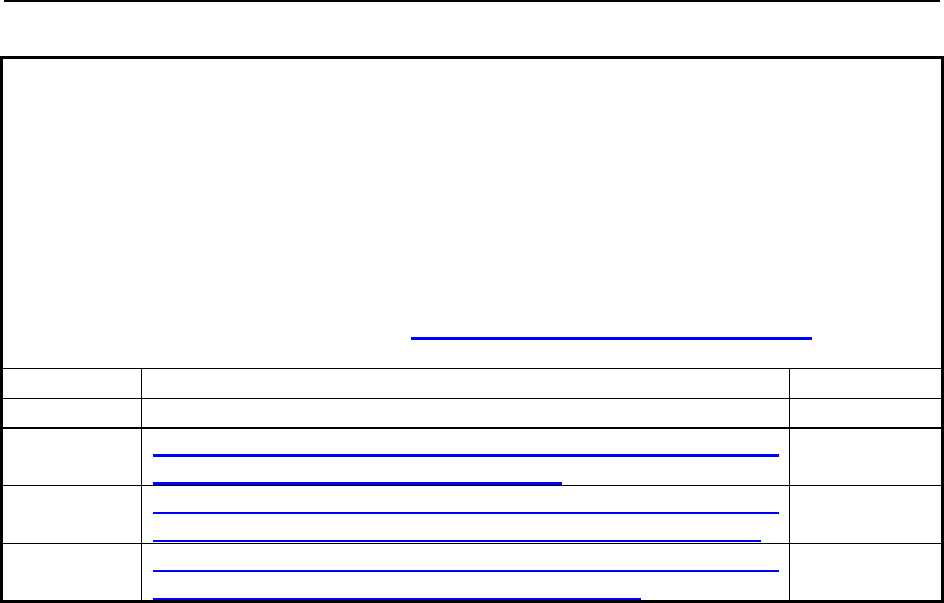

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

SUMMARY OF MAJOR CHANGES TO

DOD 7000.14-R, VOLUME 4, CHAPTER 3

“RECEIVABLES”

Changes are denoted by blue font.

Substantive revisions are denoted by a Ë preceding the section, paragraph, table

or figure that includes the revision

Hyperlinks are denoted by bold, italicized, and underlined blue font

PARA EXPLANATION OF CHANGE/REVISION PURPOSE

030211 Clarified definition of DoD Component. Update

030317

Clarified guidance regarding collection of non-Foreign

Military Sales foreign government debt.

Update

030405.C

Revised timeframe for referring delinquent individual out-

of-service debt to the Debt and Claims Management Office.

Revision

Annex 1

Clarified guidance regarding recording interest, penalties

and administrative charges as non-entity assets.

Update

3-1

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

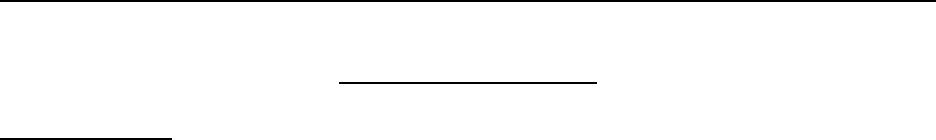

TABLE OF CONTENTS

RECEIVABLES

0301 General

Ë0302 Definitions

Ë0303 Receivables Policy and Procedures

Ë0304 Public Receivables

0305 Intragovernmental Receivables

0306 Reporting Receivables Due from the Public

0307 Reporting Receivables in the Department of Defense Audited Financial

Statements

ËAnnex 1 Interest, Penalties, and Administrative Charges

Annex 2 Breakeven Analysis

3-2

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

CHAPTER 3

RECEIVABLES

0301 GENERAL

030101. The purpose of this chapter is to issue policy for the recognition,

recording, and reporting of public and federal (hereafter referred to as intragovernmental)

accounts receivable. Additionally, this chapter addresses the recognition, recording, and, if not

collected, eventual write-off and close out of public receivables or the recording and

adjusting/correcting of intragovernmental receivables. Annexes to this chapter address

procedures for the interest, penalties, and administrative charges (Annex 1

); and breakeven

analysis (Annex 2).

030102. Receivables shall be recognized when corresponding revenue is earned

and collected when due. The Statement of Federal Financial Accounting Standards (SFFAS) 1

requires that receivables be recognized when a federal entity establishes a claim to cash or other

assets against other entities either based on legal provisions, such as a legislative requirement, a

payment due date, or goods or services provided. Further, SFFAS 1 requires that receivables

from intragovernmental receivables be reported separately from receivables from public entities.

Intragovernmental and public receivables are treated differently because of the different legal

and administrative requirements and concepts that apply to them.

0302 DEFINITIONS

030201. Accounts Receivable. Receivables arise from claims to cash or other assets

against another entity. At the time revenue is recognized and payment has not been received in

advance, a receivable shall be established. Receivables include, but are not limited to, monies due

for the sale of goods and services and monies due for indebtedness. Examples of indebtedness to

the Department of Defense (DoD) include overdue travel advances, Federal Employee Health

Benefits paid while employee is on leave without pay status, dishonored checks, fines, penalties,

interest, overpayments, fees, rent, claims, damages, and any other event resulting in a determination

that a debt is owed to the DoD.

030202. Accounts Receivable Office (ARO)

. The ARO (as used in this chapter) is

the office responsible for the recording and reporting of receivables and can also be the office

responsible for debt collection. In most, but not all cases, the ARO is located at a Defense Finance

and Accounting Service (DFAS) site.

030203. Allowance for Loss on Accounts Receivable

. A method for estimating the

amount of public accounts receivables that will not be collected in full.

030204. Close out (applies to public debt only). The ARO, in conjunction with the

DoD Component, closes out a debt when it is determined that further debt collection actions are

prohibited (e.g., a debtor is released from liability in bankruptcy) or there are no plans to take

3-3

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

any future active or passive actions to try to collect the debt. Close out may occur concurrently

with the write-off of an account receivable or at a later date, depending on the collection strategy

and the ultimate determination that the debt has been discharged. At close out, the ARO or Debt

Collection Office (DCO) may be required to report to the IRS the amount of the debt as potential

income to the debtor on IRS Form 1099C. Within DoD, the Debt Management Office (DMO),

the Debt and Claims Management Office (DCMO), and the Tax Office (TO) are responsible for

issuing the IRS Forms 1099C. Definitions for these offices are in paragraphs 030207, 030208,

and 030209.

030205. Current Nondelinquent Receivables. Nondelinquent debts are categorized

as current and noncurrent assets. The portion of a non-delinquent debt that is scheduled to be

collected in the next 12 months is recorded as current; the portion of a non-delinquent debt

scheduled for collection after 12 months is recorded as non-current. The importance is to inform

the DoD and the Department of the Treasury (Treasury) of the expected cash flow/liquidity of the

asset (i.e. current vs. noncurrent asset).

030206. Currently Not Collectible (CNC). At the time of write-off, the DMO,

DCMO, or other Debt Collection Office (DCO) shall classify the debt as CNC when it intends to

continue cost-effective debt collection action. Debts will be reported as CNC until collected or

closed out.

030207. Debt and Claims Management Office (DCMO). The DFAS Office that

services referred individual out-of-service debt.

030208. Debt Collection Office (DCO). The DCO is responsible for debt collection

and serving due process. This includes the DMO, DCMO, Foreign Government Debt Management

Office (FGDMO), and all other debt collection activities. The ARO can also be the DCO.

030209. Debt Management Office (DMO). The DFAS Office that services referred

vendor/contractor debt.

030210. Delinquent Receivables

. Delinquent accounts receivable are receivables

that have not been paid by the date specified in the initial written demand for payment (i.e., invoice,

demand letter, or other applicable agreement or instrument (including a post-delinquency

repayment agreement)) unless other satisfactory payment arrangements have been made.

Delinquency starts one day after the payment due date or other agreed upon date, depending on the

agreement or instrument. If an installment agreement is provided and the payment is not made by

the due date, then the entire balance of the receivable becomes delinquent from the original

payment due date or other agreed upon date. If the payment is not made according to the agreed

upon installment, then the full amount of the account and related interest and penalties, if any, are

reported as delinquent.

Ë 030211. DoD Component. Refers to the Offices of the Secretary of Defense, the

Military Departments, the Chairman of the Joint Chiefs of Staff, the Combatant Commands, the

3-4

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

Office of Inspector General of the Department of Defense, the Defense Agencies, the DoD Field

Activities, and all other organizational entities in DoD.

030212. Entity Receivables. As defined by the SFFAS 1, entity receivables are

amounts that a federal entity claims for payment from other federal or nonfederal entities and

that the federal entity is authorized by law to include in its obligation authority or to offset its

expenditures and liabilities upon collection.

030213. Foreign Government Debt Management Office (FGDMO). The DFAS

Office that services referred non-Foreign Military Sales foreign government debt.

030214. Intragovernmental Receivables. Intragovernmental receivables are claims

of a federal entity against other federal entities. Intragovernmental receivables are either within

DoD (e.g., a Service (Army)) or outside DoD (e.g., General Services Administration).

030215. Noncurrent Nondelinquent Receivables. Noncurrent nondelinquent accounts

receivable are nondelinquent receivables that will not become due within 12 months after the

receivable is established.

030216. Nondelinquent Receivables. Nondelinquent accounts receivable are

receivables that have not been billed or are not due under the contract or billing document

pertaining to the receivable. This also includes rescheduled receivables and receivables under an

installment agreement.

030217. Nonentity Receivables. As defined by the SFFAS 1, these are receivables

that the DoD collects on behalf of the U.S. Government or other entities, and the DoD is not

authorized to use. Nonentity receivables are reported separately from receivables available to

the DoD (entity receivables). Nonentity receivables include governmental receipts and

collections arising from the sovereign and regulatory powers unique to the federal government,

(e.g., interest, penalties, income tax receipts, customs duties, court fines, and certain license

fees). The DoD accounts receivable in canceled accounts are also nonentity receivables, because

collections received after an appropriation cancels are deposited in the Treasury’s Account 3200,

“Collections of Receivables from Canceled Accounts.” Nonentity receivables are to be recorded as

a receivable and a custodial liability.

030218. Public/Nonfederal Receivables. Public/nonfederal receivables are claims

of the DoD or an entity within the federal government against nonfederal entities. The term

“public/nonfederal entities” encompasses domestic and foreign persons and organizations

outside the U.S. Government, including Nonappropriated Fund Instrumentalities (NAFI) (for

purposes of processing receivables under this chapter) and Foreign Military Sales (FMS).

Examples are: salary/travel overpayments; overpayments to contractors/vendors due to duplicate

and erroneous billings; incorrectly computed invoices; non-FMS foreign government fuel

purchases; contract default; amounts due for items rejected or returned; and amounts due on

payments for contractual services such as rent, insurance, and transportation purchased, where

such contracts are canceled and adjustments are made for the unused portion.

3-5

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

030219. Reimbursements

. Reimbursements are amounts earned and collected for

materials sold or services furnished as a result of a reimbursable agreement.

030220. Rescheduled Receivables. Rescheduled receivables are receivables that

have been subject to rescheduling, forbearance, reamortization, or any other form of extending

the future of the original payment(s) or payment due dates.

030221. Treasury Report on Receivables (TROR)

. The TROR is a quarterly report

of receivables prepared in compliance with the Treasury guidance. It provides a means for

collecting data on the status and condition of the total receivable portfolio from public sources.

030222. Write-off of Receivables. Write-off is an accounting action that results in

removing the nonfederal (public) receivable from the DoD Component’s financial accounting

records/financial statements. Write-offs are classified as either CNC or closed out by the DCO.

Receivables that are classified as CNC, must be maintained in an inactive administrative file and

reported on the Treasury Report on Receivables (TROR) until the receivable is closed-out.

0303 RECEIVABLES POLICY AND PROCEDURES

030301. General. When payment is not received in advance or at the time revenue

is recognized, a receivable shall be established. Receivables shall be recorded when earned from

the sale of goods and services or when a receivable is recognized. Accounting records for

receivables shall be maintained so that all transactions affecting the receivables are included in

the reporting period of occurrence. There shall be immediate recording of events not previously

recorded due to error or oversight; due dates for such items shall be established in the first

notification to the debtor. If the exact amount of a receivable is unknown, a reasonable estimate

shall be made.

030302. Advance Payment

. An advance payment is required for orders from the

public, including state and local governments except for fuel, as the sale of petroleum

products to the public is covered by a fuel purchasing agreement. The order must be

accompanied by an advance equivalent to the actual or estimated cost of goods and services,

except for cross servicing agreements with foreign governments, NAFI, patient charges at

medical treatment facilities, natural disasters, immediate wartime requirements, or any

exemptions authorized by law. An advance payment from foreign governments for FMS is held

and recorded in the FMS Trust Fund. Written requests for an exception to the requirement for an

advance shall be submitted to the Office of the Under Secretary of Defense (Comptroller) and

must be approved in advance of the order being accepted by the performing activity.

030303. Sales of Goods and Services. Intragovernmental materials sold or services

furnished shall be authorized and documented in a support agreement between the provider and

ordering entity. The cost of the materials or services is first initiated by the activity providing

the materials or performing the services (performer). The activity receiving the materials or

3-6

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

services (ordering entity or customer) pays the performing activity. Uncollected amounts earned

from reimbursable sales are recorded as accounts receivable.

030304. Recording of Receivables. In accordance with paragraph 030301,

receivables will be recorded in the applicable accounting system during the month the receivable

occurs. DCOs shall ensure that the appropriate ARO is advised that a receivable is to be

established in the applicable accounting system. DCOs will provide the ARO with signed copies

of indebtedness notices and other appropriate documentation to support entries in the accounting

system and will provide the status of the debt which includes: beginning debt balance, collections,

adjustments, current ending balance and notice of discontinuance of collection efforts.

030305. Collection of Receivables. The collection of receivables shall be

aggressively pursued for amounts due from DoD Components, federal agencies, and the public.

The due date for a receivable normally is 30 days from the date of invoice, demand letter, or

notice of payment due, unless a specific due date is established by statute, contract provision, or

notice of indebtedness. Collection actions shall be initiated when payment becomes due. Funds

shall be collected in the appropriation that earned the funds, unless otherwise specified by law.

030306. Allowance Account and Aging

A. An allowance for uncollectible accounts receivable due from the public

shall be estimated and recorded per section 030405 below.

B. No allowance for uncollectible accounts shall be recorded for

intragovernmental receivables, non-loan interest, penalties, and administrative charges.

C. The AROs (on behalf of the DoD Components) shall age both

nondelinquent and delinquent accounts receivable.

D. Aging of receivables (delinquency) starts one day after the due date for

both public and intragovernmental (within and outside DoD) receivables.

030307. Interest Receivable. Interest is accrued when an amount due is not

received by the established due date. An interest receivable shall be recorded for the amount of

interest income earned but not received for an accounting period. An interest receivable shall be

recorded as it is earned on investments in interest-bearing securities. Interest also shall be

recognized on outstanding accounts receivable against persons and entities in accordance with

(IAW) provisions in Title 31, United States Code (U.S.C.), 3717, Interest and Penalty Claims.

Until the interest payment requirement is officially waived by the government entity or the

related debt is closed out, interest will accrue. Note, however, that debts owed by any federal

agency (including NAFI) are exempt from interest, penalty, and administrative charges. See

Annex 1. Interest receivable is considered a nonentity receivable.

3-7

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

030308. Payment Application. When a debt is paid in partial or installment

payments, amounts received shall be applied first to outstanding penalties, second to administrative

charges, third to interest, and last to principal, per Federal Claims Collection Standards, Title 31,

Code of Federal Regulations (CFR) §901.9 (f).

030309. General Ledger Accounting. Information on receivables shall be developed,

maintained, and reported using the United States Standard General Ledger (USSGL) accounts

depicted in Volume 1, Chapter 7

of this regulation. The first four digits of the accounts

receivable general ledger account shall conform to the USSGL chart of accounts. USSGL

accounting transactions for collections and receivables are at: http://www.fms.treas.gov/ussgl/

.

030310. Internal Controls. The basic standards for internal controls prescribed in

DoD Directive 5010.38, “Management Control Program,” shall be adhered to in establishing and

collecting receivables.

A. Major categories of receivables shall be maintained to facilitate clear and

full disclosure of accounts receivable, e.g., disclose the debtor, the amount, the age, and the type of

debt. Subsidiary records shall be reconciled to the control accounts on at least a monthly basis.

B. Proper internal controls require the separation of duties; e.g., a technician

responsible for creating cash or check due transactions cannot also be responsible for collecting

cash or checks.

030311. Erroneous Accounts Receivables. During the triannual review as required

in Volume 3, Chapter 8, receivables shall be reviewed for completeness, accuracy, and

supportability. Abnormal or erroneous accounts receivable shall be promptly researched and

resolved.

030312. Invalid Accounts Receivables. If at any time it is determined that a debt

was never owed and should not have been classified as an accounts receivable, the entries that

established the accounts receivable will be reversed.

030313. Unsubstantiated Accounts Receivables.

If at any time a billing DoD

Component does not have or cannot produce the evidence necessary to establish an account

receivable and has not been able to obtain the voluntary repayment of the debt, the entries that

established the accounts receivable will be reversed.

030314. Canceled Appropriations.

AROs shall retain all outstanding receivables in

the residual records even though an appropriation cancels. When the appropriation cancels, the

receivable becomes a nonentity receivable. Appropriation cancellation does not relieve the DoD of

the responsibility to pursue collection or recovery. Collections received after an appropriation

cancels shall be deposited in the Treasury’s Account 3200, “Collections of Receivables from

Canceled Accounts.”

3-8

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

030315. Nonappropriated Fund Instrumentalities (NAFI) Receivables.

Receivables from NAFIs shall be recorded as transactions with the public. They shall be

included in the quarterly TROR. With the exception of individual debt, NAFI delinquent debt

shall not be referred to the DMO or to the Treasury for collection assistance.

030316. Foreign Military Sales (FMS) Receivables. Receivables from the FMS

Trust Fund (appropriation 11X8242) shall be recorded as transactions with the public, and they

shall be included in the TROR. Other Security Assistance receivables, e.g., the Foreign Military

Financing Program, Grants, and Funds Appropriated to the President (11*1082), shall be

recorded and reported as intragovernmental receivables. The FMS delinquent accounts

receivable shall not be referred to the DMO or to the Treasury for collection assistance. See

Volume 15, Chapter 5 of this regulation for guidance on FMS receivables.

Ë 030317. Non-FMS Foreign Government Receivables. The ARO or FGDMO will

initiate initial billings for non-FMS foreign government accounts receivable. The ARO should

refer delinquent non-FMS foreign government accounts receivable, excluding fuel, to the

FGDMO for additional billing and collection action when local efforts do not result in payment.

Proper documentation must be included in the referral. The accounts receivable is established

and maintained at the field site. Once collection is received from the foreign entity, the field

sites are reimbursed to satisfy their accounts receivable. Refer to Volume 6A, Chapter 12 for

further information on non-FMS foreign government receivables, excluding fuel. Defense

Energy Support Center (DESC) debts greater than 60 days should be sent to the Retail

Management Division of DESC for research and possible collection. This applies to all DESC

aged receivables except delinquent debt that is associated with companies that have filed for

bankruptcy or are suspected of fraud. Bankruptcy and possible fraud related debts should be

forwarded to the appropriate DFAS Debt Management Office.

030318. Retention of Documentation. AROs and DCOs will maintain

documentation to support actions taken on each accounts receivable. This includes, but is not

limited to, documents supporting:

A. establishing the receivable

B. due process requirements

C. research and resolution of abnormal or erroneous balances

D. reversal of entries establishing the receivable

E. termination, write-off and close-out of receivable

F. bankruptcy

G. installment payment plan

3-9

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

030319. Obligations. Obligations for receivables shall be established as required in

Volume 3, Chapter 8, paragraph 080301.A of this regulation. For any receivables deemed

delinquent and not obligated, the obligation shall be established in the appropriation that created

the receivable.

030320. Undistributed Collection Balances. Undistributed collection balances shall

be analyzed and reconciled monthly to ensure all collected amounts are properly credited to the

proper appropriation fund balance with the Treasury and applicable accounts receivable

accounts.

0304 PUBLIC RECEIVABLES

030401. General. Receivables due from the public are claims of the DoD, or an

entity within the federal government, against nonfederal entities, to include public entities,

domestic and foreign persons and organizations outside the U.S. Government. Public receivables

are created from the sales of goods or services when an advance is not first received (advance

payment exceptions are in paragraph 030302) or from refunds due to the DoD.

030402. Debt Collection Policies. The DoD policies for credit management and

debt collection are delineated in other volumes of this regulation as listed below.

A. Policies and procedures for collection of debt from individuals are in

Volume 5, Chapters 28 through 32 of this regulation.

B. Policies and procedures for loss of funds cases are in Volume 5, Chapter 6

of this regulation.

C. Policies and procedures for salary offset to collect debts owed to the federal

government by military members or civilian employees are in Volumes 7A, 7B, 7C, and 8 of this

regulation. Volumes 7A, 7B, 7C, and 8 of this regulation also address collection of child support,

alimony, or commercial debts from the pay of military members or civilian employees through

garnishment or involuntary offset.

D. Policies and procedures for collection of commercial or contractor debt,

excluding fuel, are in Volume 10, Chapter 18

of this regulation. Additionally, the Federal

Acquisition Regulation (FAR

), Part 32.6, “Contract Debt,” prescribes policies and procedures for

ascertaining and collecting contract debts, charging interest on the debts, deferring collections, and

compromising and terminating certain debts.

E. Policies for collection of debts from foreign countries, excluding fuel, are in

Volume 6A, Chapter 12

of this regulation.

030403. Management of Receivables from the Sale of Goods and Services to the

Public

3-10

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

A. Upon receipt of a collection voucher, the ARO shall record the collection in

the accounting system and report the collection to the Treasury. If an abnormal balance results

from recording the collection, the ARO shall research and resolve the abnormal balance.

B. The ARO shall refer delinquent accounts receivable for further collection

action as required by debt collection policy referenced in section 0303 and 0304 of this chapter.

C. The ARO shall report public receivables in accordance with TROR

instructions located at the Treasury website http://www.fms.treas.gov/debt/dmrpts.html.

030404. Management of Refunds Receivable. Refunds receivable are funds due to

the DoD. There is not a separate account for refunds receivable in the USSGL. Refunds receivable

are treated as accounts receivable.

A. Examples of refunds receivable are:

1. Salary overpayments.

2. Overpayments to commercial concerns due to erroneous billings,

incorrectly computed invoices, or contract default.

3. Amounts due for items rejected or returned.

4. Amounts of recovery due on payments for contractual services,

such as rent, insurance, and transportation purchased, where such contracts are canceled and

adjustments made for the unused portion.

B. Non-DCO agencies (e.g., contracting offices, fundholders) will notify the

DCO that a debt exists. For contracting offices, guidance is contained in the FAR, Part 32,

Contract Financing. The DCOs shall ensure the appropriate ARO is advised that a receivable is to

be established in the applicable accounting system. Such notification shall be made in the same

accounting cycle that the debt is recognized.

C. Upon receipt of a collection voucher, the ARO shall ensure that the

collection is recorded in the accounting system and reported to the Treasury. If an abnormal

balance results from recording the collection, then the ARO will research and resolve the abnormal

balance.

D. The DCO shall refer delinquent accounts receivable for further collection

action as required by debt collection policy references in section 0304 of this chapter.

E. The ARO shall report public refunds receivable in accordance with TROR

instructions located at the Treasury website http://www.fms.treas.gov/debt/dmrpts.html.

3-11

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

030405. Management of Collection Actions. Accounts receivable shall be aged to

allow for the management of collection actions.

A. The due date for a receivable is normally 30 days from the date of invoice,

demand letter, or notice of payment due unless a specific due date is established by statute, contract

provision, or notice of indebtedness. The initial demand for payment, invoice, or demand letter

shall include a complete explanation of the debtor’s rights, responsibilities, and additional charges

(i.e., interest, penalties and administrative charges) that may be levied.

B. Uncollected public vendor debt of less than $600 and individual

out-of-service debt of less than $225 shall be collected or written off and closed out within

one year of delinquency in accordance with section 030406. This debt shall not be referred for

further collection action unless mandated by public law.

Ë C. Delinquent individual out-of-service debt of $225 or more shall be

referred to the DCMO for further collection action no later than 60 days after the payment due

date. Multiple debts to the same individual totaling $225 or more shall be consolidated and

referred to DCMO as one debt package.

D. Delinquent vendor debt of $600 or more shall be referred to the DMO for

further collection action no later than 60 days after the payment due date. Multiple debts to the

same vendor totaling $600 or more shall be consolidated and referred to the DMO as one debt

package.

E. The DCMO or DMO will refer delinquent public receivables over

180 days old to the Treasury for further collection action IAW 31 U.S.C. 3711, subsection (g),

and the TROR instructions referenced in section 030402C of this chapter. Only those activities

with specific authority will refer these aged debts to the Treasury.

1. Exceptions to the requirement to refer debt to the Treasury include

debts or claims that: (a) are in litigation or foreclosure; (b) will be disposed of under an asset sales

program within 1 year after becoming eligible for sale, or later than 1 year if consistent with an

asset sales program; (c) have been referred to a private collection contractor for collection for a

period of time approved by the Secretary of the Treasury, (d) will be collected under internal offset,

if such offset is sufficient to collect the claim with 3 years after the date the debt or claim is first

delinquent (e) are foreign government debts, (f) are state and local government debts, or (g) are

NAFI debts.

2. The Treasury, after due process, returns uncollected public

receivables to the sender (length of time varies based upon collection actions taken by the

Treasury).

3. Treasury-referred debts that are returned due to failure to collect

that are $100,000 to $500,000 must be referred to the Treasury for concurrence to terminate

3-12

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

collection action. Debts $500,000 or more must be referred to the DOJ. Debts returned that are

less than $100,000 can be terminated for further collection action by the DMO upon

coordination with the appropriate fundholders.

030406. Establishment of Allowance for Loss on Accounts Receivable

. The ARO

shall record an allowance for loss on accounts receivable, which shall provide for reducing gross

receivables by the amount of the estimated loss to their net realizable value.

A. The SFFAS 1

states that losses on receivables should be recognized when

it is more likely than not that the receivables will not be totally collected; the phrase “more likely

than not” means more than a 50 percent chance of loss.

B. The allowance for loss on accounts receivable shall be reestimated at

least annually. The methodology will be based on the history of bad debt expense, except for

debts greater than $100,000. See paragraph 030406.D for guidance on debts greater than

$100,000. The allowance will be based on percentages determined from the last three years of bad

debt expense. The percentages used by each DoD Component will be determined using historical

bad debt expense for each delinquent age category greater than 90 days old. The determined

percentages will be applied to the total amount in each age category. The resultant allowance will

be used for the new fiscal year. In those instances when one DoD Component sub-allocates funds

to another DoD Component, the office executing the funds will be responsible for establishing the

allowance for loss on accounts receivable. The Office of the Under Secretary of Defense

(Comptroller) may approve exceptions when abnormal circumstance skews the 3 year average.

C. The write-off of receivables must be processed through the allowance for

loss on accounts receivable account. If the allowance account has been depleted as a result of

write-off activity, then it must be immediately reestimated and re-established.

D. Each debt greater than $100,000 must be analyzed to determine the loss

allowance. Loss estimation for each account shall be based on: (a) the debtor’s ability to pay,

(b) the debtor’s payment record and willingness to pay, and (c) the probable recovery of

amounts from secondary sources, including liens, garnishments, cross collections and other

applicable collection tools. Agencies with a low number of debts or a large number of small

dollar debts may lower the threshold. However, consistent methodology must be used from

year-to-year. The allowance amount calculated using guidance in this paragraph will be added

to the allowance amount calculated using the guidance in paragraph 030406.B. The total of the

two calculations will be the total amount for allowance for loss on accounts receivable.

3-13

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

030407. Write-off and Close out of Public Accounts Receivable. General

provisions for the collection, write-off and close out of public accounts receivable are established

in OMB Circular A-129, “Policies for Federal Credit Programs and Non-Tax Receivables.”

Write-off is mandatory for public delinquent debt that has not been collected within two years of

delinquency unless documented and justified to OMB in consultation with the Treasury. See

paragraph 030404.B for vendor debts under $600 and individual out-of-service debts

under $225.

A. Write-off. The DMO shall provide the ARO with documentation to

support write-off of the receivable and also shall provide the history of all research and debt

collection efforts. When received, the ARO shall immediately provide the documentation to the

fundholder for concurrence for write-off and notify the DMO that the request for concurrence

was sent. If the fundholder concurs, the ARO will write-off the debt, record an obligation if one

has not already been recorded and notify the DMO. If the fundholder nonconcurs or does not

respond the following applies:

1. The fund holder shall respond within 30 days of request for

write-off. If a response is not received within 30 days, the ARO shall write off the debt and

record an obligation if one has not already been recorded.

2. If nonconcurring, the fundholder shall provide the ARO with

additional written evidence to enable the collection of the debt. The ARO shall only make one

additional attempt to collect (i.e., issue one additional demand letter).

3. If payment is not received after following procedures outlined

above, the ARO shall write off the debt and record an obligation if one has not already been

recorded. The ARO will notify the fund holder and the DMO that the debt was written off.

B. Currently not collectable (CNC).

1. Once the debt is written off, it must either be classified as CNC or

closed out. Debts in CNC status are reported on the TROR and are still eligible for Treasury's

cross-servicing and offset programs.

2. Public debt shall be classified as CNC only if the criteria listed

below are met:

a. The vendor debt is $600 or more or the individual

out-of-service debt is $225 or more.

b. All debt collection actions referenced in sections 0303 and

0304 of this chapter have been pursued.

c. It is cost effective to continue collection efforts.

3-14

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

3. CNC debt shall be continuously reviewed and, as required,

reclassified and closed-out.

4. When the Treasury is able to collect on a CNC or closed out

receivable and remits funds to the DMO, ARO or DoD Component, reverse the write-off,

reestablish the receivable and record the collection against the receivable.

C. Close-out of Indebtedness. Debt write-off and close out may occur at the

same time, or close out may follow write-off by a substantial period of time. When it has been

determined that the debt is not collectible (e.g., returned from the Treasury uncollected or further

collection action would not be economically feasible), the DMO shall notify the fund holder for

concurrence to close out the debt. If the fund holder nonconcurs or does not reply, the following

applies.

1. The fund holder shall respond within 30 days of request for

close-out. If a response is not received within 30 days, then the debt shall be closed out.

2. If nonconcurring, the fund holder shall provide the DMO with

additional written evidence to enable the collection of the debt. The DMO shall only make one

additional attempt to collect (i.e., issue one additional demand letter).

3. If payment is not received after following procedures outlined

above, then the debt shall be closed out and the fund holder notified.

4. Once a debt has been closed out, it cannot be reactivated, and the

federal government cannot take any further administrative or legal action to collect the debt. The

federal government, however, can accept voluntary repayment of the debt at any time. Once the

fund holder has decided to close out the debt, the DMO and DCMO have primary responsibility

for close out actions and 1099C IRS reporting for all referred debts. Close out for foreign

government debts will be accomplished by the FGDMO IAW Volume 6A, Chapter12.

D. Tax Reporting. All closed-out uncollected public vendor and contractor

debt will be forwarded to the DFAS-Columbus, DFAS Tax Office Standards & Compliance,

Finance Mission Area, Attn: DFAS-JJFD/CO, PO Box 182317, Columbus, Ohio 43218-2317

for tracking, consolidation, and reporting. In accordance with 26 U.S.C 6050P, the Tax Office

will issue a 1099C if the consolidation of individual closed debts is greater than or equal to $600

for the calendar year. Data elements required by the Tax Office for consolidating and reporting

the closed debts include:

1. Tax Identificatio

n

Number

2. Contractor Name

3. Contractor Address

4. Countr

y

Code

5. Date Account Close

d

6. Princi

p

al

7. Interest

3-15

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

8. Administrative Char

g

es and Penalties

9. Debt Reason Descri

p

tio

n

10. Bankru

p

tc

y

0305 INTRAGOVERNMENTAL RECEIVABLES

030501. Receivables due from DoD Components or other federal entities are

intragovernmental receivables and should be reported separately from receivables due from

public entities.

030502. DoD Performing Entity Responsibilities. The performing entity shall ensure

the obligations and accrued expenditures incurred for completed performance are promptly

recorded as earned orders (filled customer orders), and shall ensure the earned orders are promptly

charged and collected from the ordering entity. The performing entity shall:

A. Receive a customer’s order, which shall be verified against the agreement

serving as the basis for the order, such as a Department of Defense (DD) Form 448, “Military

Interdepartmental Purchase Request (MIPR).” The amount of the order shall be recorded as an

unfilled customer order.

B. Reverse the unfilled customer order and record a filled customer order (i.e.,

earnings) uncollected upon receiving documentation showing that goods or services were provided.

The responsible technician shall record the receivable and charge the customer. If an abnormal

balance results from reversing the unfilled customer order, research the abnormal balance and

promptly resolve the issue.

C. Reverse the filled customer order uncollected (i.e., earnings) and record a

filled customer order collected upon receipt of a collection voucher. If an abnormal balance results

from reversing the filled customer order uncollected, research the abnormal balance and promptly

resolve the issue.

D. Ensure that collection vouchers are recorded in the accounting system and

reported to the Treasury in the accounting month the collection was received.

E. Review unearned and earned orders and determine that recorded orders are

supported with an order or contract.

F. Research any abnormal unfilled customer order balances; such balances

indicate that an order may not be recorded. Research any abnormal filled customer orders

uncollected balances; such balances indicate that collections may have been incorrectly recorded.

Promptly resolve these abnormal balances.

G. For orders not filled from inventory (e.g., supply issues from materiel

systems); obtain the accounts payable transaction history. Review obligations and accrued

expenditures recorded and determine whether the accruals are supported with a reimbursable

3-16

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

agreement or a document evidencing that a payment is due. Unsupported obligations and accrued

expenditures should be thoroughly researched, and the necessary corrective actions should be

taken. Copies of all reimbursable orders should be available to ensure that all obligations and

accrued expenditures are recorded correctly. Balance the receivables and collections (earnings)

relating to the reimbursable program of the performing activity with the accrued expenditures paid

and unpaid of the same performing activity.

H. Obtain the billing transaction history from the ARO. (Billing transaction

histories shall be provided within 30 days.) Ensure that billings are against the correct order and,

consequently, billed against the correct obligation. Request copies of documents supporting that a

payment is due; reconcile these documents with the related accounts receivable. Any discrepancies

should be resolved by adjusting the accounts receivable to the appropriate amounts.

I. Upon receiving a request for supporting documentation, provide a copy of

an agreement, contract, and/or proof of performance or delivery within 30 days of request.

J. If a charge is disputed or rejected, review supporting files promptly. The

intragovernmental dispute process is outlined in paragraph 030505A.

K. Research unmatched disbursements and negative unliquidated obligations as

required by Volume 3, Chapter 11, section 1107 of this regulation.

L. Unless authorized by law to perform nonreimbursable work, DoD

performing activities will not perform reimbursable work for another Federal Agency that is

90 days or more in arrears in payment of previous reimbursable billings. This restriction can be

waived by the Office of the Under Secretary of Defense if in the national interest to do so.

030503. DoD Ordering Activity Responsibilities

A. The ordering activity shall review all charges from the performing activity

to ensure that amounts due are in agreement with the reimbursable orders and are supported with a

copy of the order or contract and evidence of performance.

B. Transportation charges that cannot be matched to an accounts payable

transaction, or that cannot be charged back, shall be charged against an alternate line of accounting.

Charges against an alternate line of accounting shall be researched and charged to the proper line of

accounting upon completion of research.

C. If the bill is supported, but the order or obligation is not recorded in

accounting, record the order or obligation immediately.

030504. Management of Collection Actions. Accounts receivable shall be aged.

Aging allows for the management of collection actions. Delinquency date starts one day after the

due date.

3-17

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

A. Charges arising from transactions within the DoD and with other federal

departments and agencies shall be recorded as accounts receivable in the accounting month

earned.

B. Bills arising from transactions which contain a National Stock Number

within the DoD will be collected through the Military Standard Billing System (MILBILLS)

interfund billing procedures when supported by the supply and accounting systems. The

provider will not accept a MIPR if interfund can be used. Manual billing (i.e., the XP fund code)

will not be used unless approved by the Deputy Chief Financial Officer. For intragovernmental

interfund disputes, follow the dispute process outlined in DoD Manual 4000.25-7, Chapter 4.

C. For noninterfund intragovernmental (within DoD) receivables,

reimbursement will be via Defense Cash Accountability System (DCAS), IPAC, or for-self

reimbursement (e.g., within Disbursing Station Symbol Number (DSSN) transfer of funds). The

buyer cannot chargeback or reject the charge (other than IPAC) unless authorized by the dispute

process as outlined in paragraph 030505A. The buyer generally should perform an IPAC reject

within 30 days. Only valid reasons for reject/adjustment are:

1. Billing for more than the agreed amount.

2. Duplicate/erroneous billing.

3. Lack of supporting documentation.

4. MIPR has expired and/or appropriation has expired.

D. For intragovernmental (outside DoD) receivables, IPAC is the preferred

method of billing/collection.

1. Include the use of IPAC as the preferred method of

billing/collection on the MIPR acceptance.

2. Follow the intragovernmental (outside DoD) dispute process as

outlined in paragraph 030505B if the IPAC transaction is rejected.

E. Rejected charges shall require the reestablishment of a receivable and

adjustments to an appropriation’s fund balance with the Treasury.

F. Accounting entries for reimbursable billings and collections, and accounts

receivable corrections and adjustments can be found at the Treasury website

http://www.fms.treas.gov/ussgl/.

3-18

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

030505. Noninterfund Dispute Process

A. Intragovernmental Debt Within the DoD

1. The performer’s ARO is responsible for managing

intragovernmental debt. Intragovernmental debt cannot be reduced, i.e., an allowance for

doubtful accounts is not allowed. Additionally, intragovernmental debt cannot be referred to a

debt collection activity.

2. The full settlement of intragovernmental accounts receivable

disputed charges shall take no longer than 180 days from the date of the charge.

3. For receivables of $2,500 or less, the buyer shall accept the charge.

These charges will not be disputed.

4. For receivables greater than $2,500 that are disputed:

a. The buyer will work with the seller during the first 60 days

from the date of the charge to resolve the dispute. The buyer or seller may request assistance

from the accounting service provider. If the dispute cannot be resolved, the buyer, along with

assistance from DFAS, will assemble a dispute package and send it to the seller. At a minimum,

the dispute package should include copies of: MIPR or equivalent, MIPR acceptance or

equivalent, voucher payment, bill, correspondence, shipment or delivery evidence, and a

narrative explaining the basis of the dispute.

b. During 61-90 days from the date of the charge, the seller will

review the buyer’s dispute package and will provide a written response of concurrence or

nonconcurrence.

(1) If the seller concurs, the seller will reverse the

charge.

(2) If no response is received from the seller, the buyer

may chargeback without recourse.

(3) If the seller nonconcurs, the buyer will elevate the

dispute package to their Resource Manager/Comptroller.

c. During 91-120 days from the date of the charge, the

buyer’s Resource Manager/Comptroller will contact the seller’s Resource Manager/Comptroller

to resolve the dispute. If the dispute cannot be resolved, the buyer’s Resource

Manager/Comptroller will elevate the dispute package to their Service Secretary, Combatant

Command Commander, or Defense Agency Director.

3-19

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

d. During 121-150 days from the date of the charge, the

buyer’s Service Secretary, Combatant Command Commander, or Defense Agency Director, will

contact the seller’s Service Secretary, Combatant Command Commander, or Defense Agency

Director, to resolve the dispute. The dispute must be resolved within 180 days.

5. If the resolution to the dispute is that the buyer does not have to

pay the bill, then the seller must make an adjustment to revenue (earnings) to liquidate the debt.

The seller will decrease revenue and increase direct obligations and expenses. An abnormal

balance will result in reversal of prior year funds when earnings are reversed.

B. Intragovernmental Debt Outside the DoD. Disputes between government

agencies (e.g., between the DoD and the General Services Administration) will start when the

IPAC transaction is rejected by the buyer. For disputed receivables of $2500 or less, the seller

must make an adjustment to revenue (earnings) to liquidate the debt. The seller will decrease

revenue and increase direct obligations and expenses. For disputed receivables of more than

$2500, the following applies.

1. During the 1-60 days from the date of the reject, the seller is to work

with the buyer to resolve the dispute. The seller or buyer may request DFAS assistance.

2. If there is no resolution, during 61-90 days from the date of the

reject, the seller will assemble a dispute package and forward it to the seller’s Resource

Manager/Comptroller. The seller may request DFAS assistance. At a minimum, the dispute

package will include: MIPR or equivalent, MIPR acceptance or equivalent, voucher payment,

bill, correspondence, and shipment or delivery evidence.

3. If there is no resolution, during 91-120 days from the date of the

reject, the seller’s Resource Manager/Comptroller will contact the buyer’s Agency Director to

resolve the dispute. If there is no resolution, the seller’s Resource Manager/Comptroller will

elevate to their Service Secretary, Combatant Command Commander, or Defense Agency Director.

4. If there is no resolution, during 121-150 days from the date of the

reject, the seller’s Service Secretary, Combatant Command Commander, or Defense Agency

Director will contact the buyer’s Agency Comptroller to resolve the dispute. The seller’s

Service Secretary, Combatant Command Commander, or Defense Agency Director will provide

a detailed explanation along with all supporting documentation of why they believe the bill is

valid. The dispute will be resolved within 180 days.

C. NAFI Billing, Collection and Dispute Processes.

DoD Instruction 1015.15

requires certain categories of NAFIs to reimburse appropriated funds

(APF) for sales of goods and services to the NAFI.

3-20

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

1. Contractual Agreements. The applicable APF office will prepare a

contractual agreement with the NAFI. This could be in the form of a memorandum of

understanding, Inter-Service Support Agreement, etc. The agreement will be signed by the APF

and NAFI authorized representative. At a minimum, this agreement must have:

a. Fixed price for goods and services or methodology for

determining price, e.g., utilities, or both. The agreement can be for a specific sale or for a

specified period of time.

b. Bill due date will be 30 days from date of the bill.

2. Due Process. If bill is not paid by due date, a demand letter will be

sent to the NAFI. The NAFI has 30 days from the date of the demand letter to provide payment

or provide reasons for non payment. The validity of the dispute will be determined by the APF

representative. If dispute is valid, the APF representative will immediately resolve. If dispute is

determined not to be valid, or there is no response, the APF representative will elevate demand

for payment as follows:

a. Within 31-60 days after the due date, the Installation

Comptroller will send the demand for payment with supporting documentation to the NAFI

Headquarters Comptroller (NHC).

b. Within 61-90 days after the due date, the NHC will make

payment or dispute the bill. The validity of the dispute will be determined by the Installation

APF Comptroller. If dispute is determined not to be valid, or there is no response, the

Installation APF Comptroller will elevate the demand for payment with supporting

documentation to the Installation Major Command.

c. Within 91-120 days after the due date, the Installation

Major Command will instruct that payment be made or dispute the bill. If the Installation Major

Command cannot resolve the dispute, or there is no response, the Installation APF Comptroller

will elevate the demand for payment with supporting documentation to the Service Comptroller.

d. Within 121-150 days after the due date, the Service

Comptroller will instruct payment or resolve the dispute.

0306 REPORTING RECEIVABLES DUE FROM THE PUBLIC

The DoD Components are required to submit a quarterly TROR. Full instructions for

completing the TROR are located within the Treasury’s Financial Management Service website

at http://www.fms.treas.gov/debt/dmrpts.html.

3-21

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

0307 REPORTING RECEIVABLES IN THE DEPARTMENT OF DEFENSE FINANCIAL

STATEMENTS

030701. Accounts receivable are reported on the quarterly financial statements.

Instructions for the reporting of receivables in the quarterly financial statements are contained in

Volume 6B

, “Form and Content of the Department of Defense Audited Financial Statements,” of

this regulation. Receivable amounts are depicted in the Balance Sheet and are disclosed in the

Notes to the Financial Statements. Public accounts receivable balances reported on the annual

financial statements must be reconciled with the Federal Agencies’ Centralized Trial-balance

System accounts receivable from the public balances (attribute nonfederal).

030702. Accounts receivable balances due from the public reported on the quarterly

financial statements also will be reconciled with receivables reported on TROR.

030703. The consolidated quarterly financial statements eliminate intragovernmental

accounts receivable balances in accordance with Volume 6B of this regulation.

3-22

DoD Financial Management Regulation Volume 4, Chapter 3

October2008

3-23

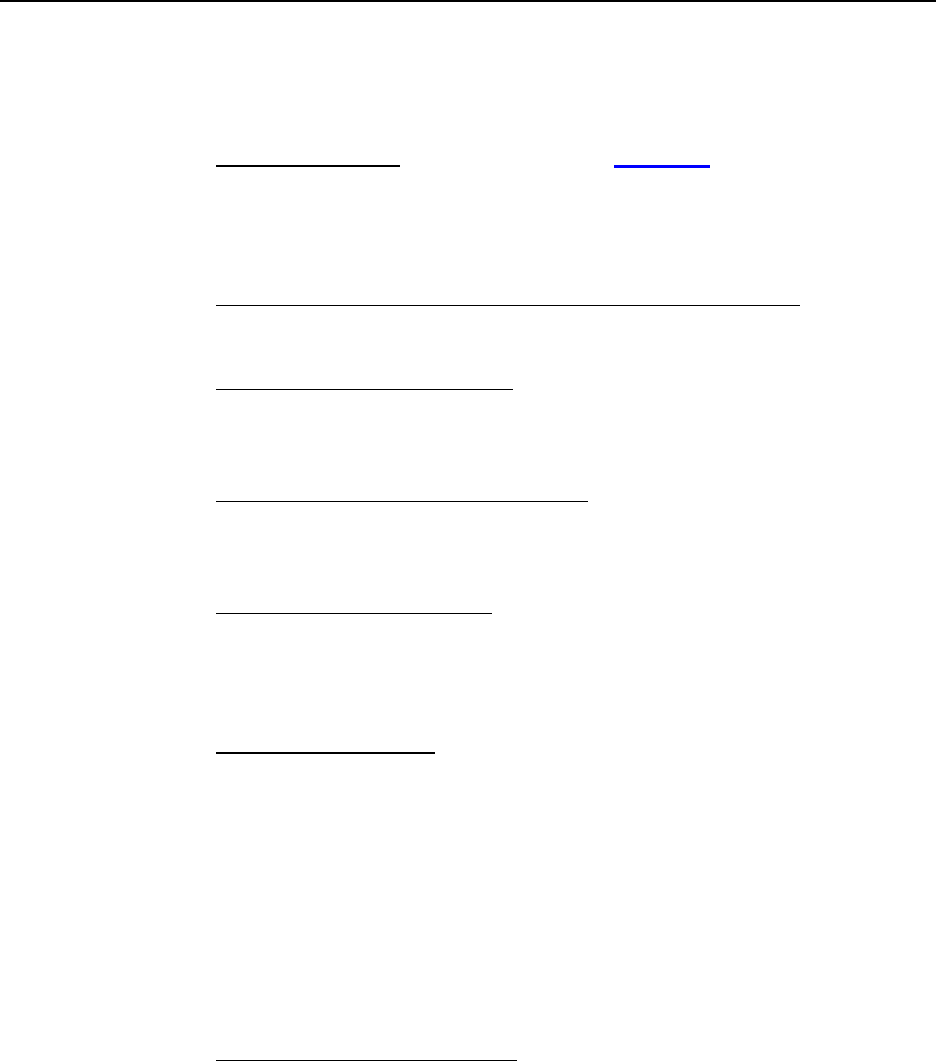

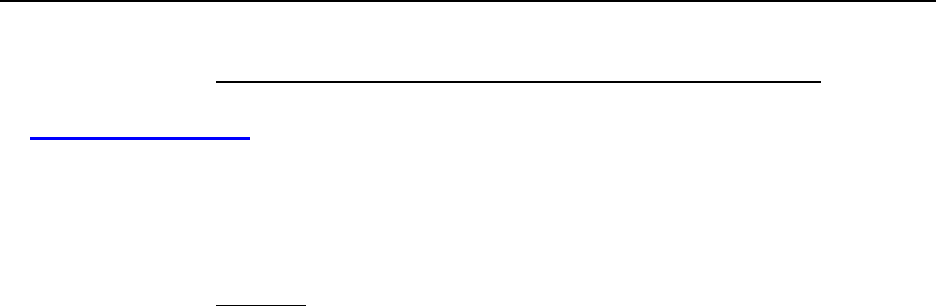

AGED ACCOUNTS RECEIVABLE GROUPS

CATEGORY INTRAGOVERNMENTAL NONFEDERAL

Nondelinquent

Current

Noncurrent

Delinquent

1 to 30 days

31 to 60 days

61 to 90 days

91 to 180 days

181 days to 1 year

Greater than 1 year and less than or equal to 2 years

Greater than 2 years and less than or equal to 6 years

Greater than 6 years and less than or equal to 10 years

Greater than 10 years

Subtotal

Less Supported Undistributed Collections

Less Eliminations

Less Other

Total

Note: The total of the columns should equal the gross amounts reported in the Accounts Receivable

schedule in Note 5. This will require that the receivables due internally within each Component and

supported undistributed collections be eliminated from this schedule. Infrequently, other items may

need to be deducted from the subtotal. These items require disclosure in the note narrative.

Figure 3-1