CONS UMER FINANCIAL PROTECTION BUREAU | S EPTEMBER 2022

Supervisory Highlights

Student Loan Servicing

Special Edition

Issue 27, Fall 2022

1 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

Table of contents

Table of contents ..............................................................................................................1

1. Introduction ................................................................................................................2

1.1 Private Student Loans ............................................................................... 2

1.2 Federal Student Loans............................................................................... 4

2. Institutional Lending .................................................................................................7

2.1 Examination Process ................................................................................. 7

2.2 Transcript Withholding Findings.............................................................. 8

3. Supervision of Federal Student Loan Transfers.................................................10

3.1 Supervisory Approach ............................................................................. 10

3.2 Findings..................................................................................................... 11

4. Recent Exam Findings ............................................................................................14

4.1 Teacher Loan Forgiveness ....................................................................... 14

4.2 Public Service Loan Forgiveness ............................................................. 16

4.3 Income-Driven Repayment ......................................................................21

5. Conclusion................................................................................................................26

2 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

1. Introduction

The student loan servicing market has shifted significantly over the past two and a half years.

The COVID-19 pandemic led to financial and operational disruptions at servicers. At the same

time, the Federal loan payment suspension brought meaningful relief to borrowers. Recently,

several Federal contractors left the market, and, as a result, nine million Federal student loan

accounts transferred from one servicer to another. Additionally, the Department of Education

(ED) introduced specific programs to broaden access to public service loan forgiveness and

forgiveness through income-driven repayment. Post-secondary schools, such as for-profit

colleges, continued to offer institutional loans that pose particular risks to consumers. During

this period, the Consumer Financial Protection Bureau (CFPB or Bureau) engaged in vigorous

oversight of the consumer protections set forth in the Dodd-Frank Wall Street Reform and

Consumer Protection Act (Consumer Financial Protection Act), in coordination with ED and

State regulators.

In light of these developments, this Supervisory Highlights Special Edition focuses on three sets

of significant supervisory findings. First, Supervision initiated work at certain institutional

lenders and found that blanket policies to withhold transcripts in connection with an extension

of credit are abusive under the Consumer Financial Protection Act. Second, Supervision

engaged in oversight of major Federal loan transfers and identified certain consumer risks

related to those transfers. Third, Supervision identified a considerable number of violations of

Federal consumer financial law by student loan servicers in administering Public Service Loan

Forgiveness (PSLF), Income-Driven Repayment (IDR), and Teacher Loan Forgiveness (TLF).

Supervision found that servicers regularly provide inaccurate information and deny payment

relief to which borrowers are entitled. ED is addressing some of these risks through program

changes like the PSLF and IDR program waivers, as well as improved vendor oversight. The

extensions to the COVID-19 payment pause for federally owned loans also has given ED some

breathing room to implement these changes. However, the findings documented in this report

impact servicers’ entire portfolios, including commercially-owned Federal Family Education

Loan Program (FFELP) loans, and CFPB encourages servicers to address the issues across their

portfolios.

1.1 Private Student Loans

Private student loans are extensions of credit made to students or parents to fund

undergraduate, graduate, and other forms of postsecondary education that are not made by ED

pursuant to Title IV of the Higher Education Act (Title IV). Banks, non-profits, nonbanks, credit

3 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

unions, state-affiliated organizations, institutions of higher education, and other private entities

hold an estimated $128 billion in these student loans, as reported to the national consumer

reporting companies. Private student loans include traditional in-school loans, tuition payment

plans, income share agreements, and loans used to refinance existing Federal or private student

loans.

1

The private student loan market is highly concentrated – the five largest private education loan

providers make up over half of outstanding volume. For the most recent academic year,

consumers took out $12.2 billion in-school private education loans, which reflects a 15 percent

year over year reduction from 2019-20, driven by recent enrollment declines. Additionally,

industry sources estimate refinancing activity in calendar year 2021 at $18 billion; demand for

private refinancing appears to have declined significantly because of the pause in Federal

student loan repayment and the recent rise in interest rates.

2

Postsecondary institutions sometimes provide loans directly to their students; this practice is

known as institutional lending.

3

Aggregate data on institutional lending are limited.

Underwriting requirements and pricing of institutional loans vary widely, ranging from low-

interest rate, subsidized loans that do not require co-signers to unsubsidized loans that accrue

interest during and after the student's enrollment and do require borrowers to meet

underwriting standards or obtain qualified co-signers. At the same time, many institutions also

extend credit for postsecondary education through products like deferred tuition or tuition

payment plans. Student loans and tuition billing plans may be managed by the institutions

themselves or by a third-party service provider that specializes in institutional lending and

financial management. Supervisory observations suggest that some institutional credit

programs have delinquency rates greater than 50 percent.

Additionally, students may withdraw from their classes before completing 60 percent of the

term, triggering the return of a prorated share of Title IV funds to Federal Student Aid (FSA),

known as “return requirements.” Institutions of higher education often charge tuition even

where students do not complete 60 percent of the term. When a student withdraws from classes

without completing 60 percent of the term, the institution often refunds the Title IV funds

1

Recently, institutions and other private actors started offering new private student loan products branded as

“income share agreements” (ISAs). At least several dozen postsecondary institutions directly offer income share

agreements (ISAs), which require consumers to pledge a given percentage of their incomes over a specified period.

The repayment process for ISAs may result in consumers realizing very large APRs or prepayment penalties that

may be illegal under the Truth In Lending Act or State usury caps.

2

Navient, July 2022 investor presentation, https://navient.com/Images/SFVegas-2022-Investor-

Presentation_tcm5-25984.pdf, at 7.

3

This category does not include Perkins loans, which were issued by schools but largely funded by Title IV Federal

funds distributed to schools.

4 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

directly to FSA and, in turn, bills students for some or all of the amount refunded to FSA, since

the school is maintaining its tuition charge for the classes. Institutions handle these debts in a

variety of ways, but many offer payment plans and other forms of credit to facilitate repayment.

In aggregate, these debts, called “Title IV returns,” can total millions of. Supervisory

observations indicate that some of these repayment plans can include terms requiring

repayment for more than four years.

1.2 Federal Student Loans

ED dominates the student loan market, owning $1.48 trillion in debt comprising 84.5 percent of

the total market, and it guarantees an additional $143 billion of FFELP and Perkins loans. All

told, loans authorized by Title IV of the Higher Education Act (Title IV) account for 93 percent

of outstanding student loan balances.

4

The Federal student loan portfolio has more than tripled in size since 2007, reflecting rising

higher education costs, increased annual and aggregate borrowing limits, and increased use of

Parent and Grad PLUS loans. Annual Grad PLUS origination volume has more than quadrupled

in that time, expanding from $2.1 billion to an estimated $11.6 billion during the 2020-21

academic year.

5

Before the COVID-19 pandemic, Parent PLUS volume peaked at $12.8 billion

(in current dollars) in loans originated in the 2018-2019 academic year. Combined, these

products accounted for 26 percent of all Title IV originations in the most recent academic year.

Federal student loans suffer high default rates. As of March 2022, approximately $171 billion in

outstanding Title IV loans were in default. This represents nearly 11 percent of outstanding

balances but 19 percent of Federal student loan borrowers ‒ a figure that would surely be higher

but for the federally owned loan payment suspension. Federal ownership and management of

more than four-fifths of outstanding student loans enabled the government, at the outset of the

pandemic in March 2020, to directly assist more than 40 million borrowers through the CARES

Act and a series of executive orders.

Servicers are responsible for processing a range of different payment relief applications or

requests including PSLF, TLF, and IDR, as well as payment pauses including deferment and

4

See https://www.newyorkfed.org/microeconomics/hhdc/background.html, and

https://www.newyorkfed.org/microeconomics/topics/student-debt.

5

In comparison, annual student borrowing under the subsidized and unsubsidized Stafford loan program rose from

$49.4B in 2006-07 to a peak of $87.8B in AY2010-11 before beginning a downward trend that tracked with falling

undergraduate enrollment that was e xacerbated by the COVID pandemic. Stafford originations in AY2020-21

totaled $62.1B, down more than 29 percent from AY2010-11.

5 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

forbearance. The volume of these applications changes significantly over time based on servicer

account volume and external events such as the expected return to repayment following COVID-

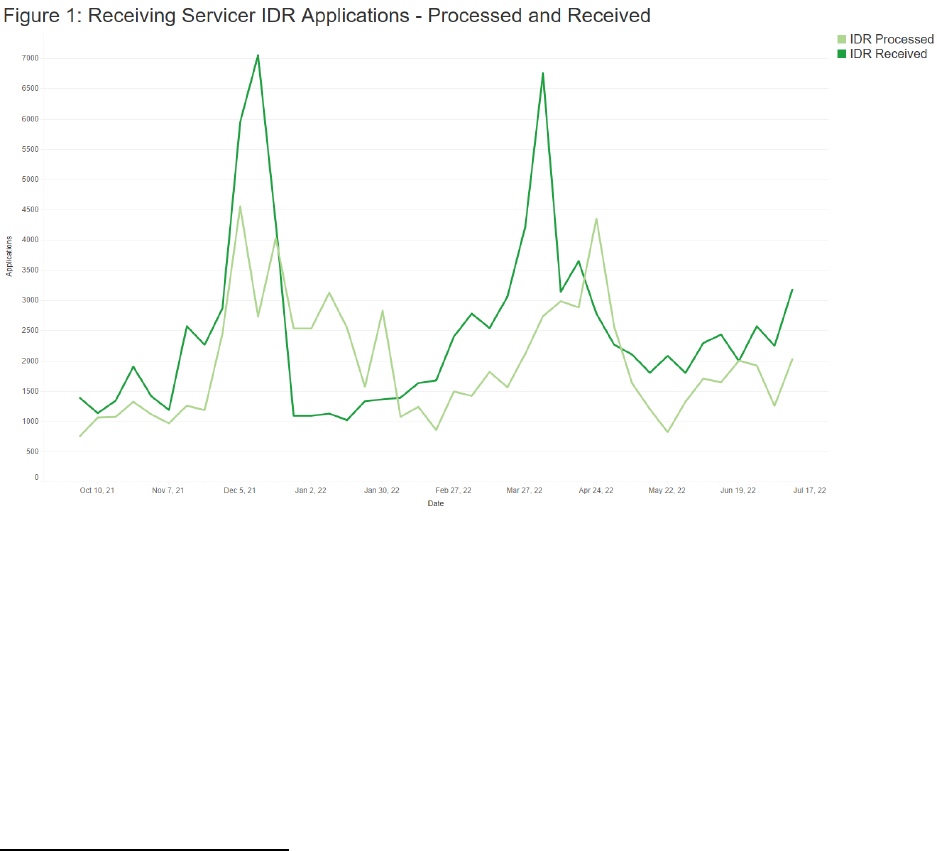

19 related forbearance. To illustrate these trends, Figure 1 shows the total incoming IDR

applications and processed applications from October 2021 through July 2022 at one servicer.

6

For example, in December 2021, many borrowers expected to start repaying their loans

imminently and thus submitted IDR applications. In light of the intermittent increases in

application volume, servicers frequently did not respond timely to borrowers’ applications.

Additionally, at any given time, servicers may have a meaningful number of unprocessed

applications because they wait to process the recertifications until closer in time to the

recertification due date.

ED contracts with several companies to service Direct and ED-owned FFELP loans. When one

of these companies decides to stop servicing loans, the accounts are transferred to another

contractor. As shown in Figure 2, the recent departures of Granite State and PHEAA/FedLoan

Servicing resulted in the transfer of millions of borrower accounts among the remaining Federal

loan servicers.

7

Where a borrower’s data has become lost or corrupted as a result of poor data management by a

particular servicer, subsequent transfers may result in servicers sending inaccurate periodic

6

Examiners collected these data in 2021 and 2022.

7

FSA provided these data and authorized publication here.

6 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

statements, borrowers losing progress toward forgiveness, and borrowers having difficulty in

rectifying past billing errors.

8

To prepare consumers for the transfers, the CFPB published

specific information for consumers, including advising them to remain vigilant toward potential

scams at a time when they are particularly vulnerable.

9

8

See generally Conduent Education Services, LLC (consent order), Administrative Proceeding (File No. 2019-BCFP-

0005), Bureau of Consumer Financial Protection.

9

https://www.consumerfinance.gov/about-us/blog/student-loans-transferring-to-new-servicer-learn-what-this-

means-for-you/.

7 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

2. Institutional Lending

Earlier this year, the CFPB announced it would begin examining the operations of institutional

lenders, such as for-profit colleges, that extend private loans directly to students.

10

The lenders

have not historically been subject to the same servicing and origination oversight as traditional

lenders. Considering these risks, the Bureau is examining these entities for compliance with the

Federal consumer financial laws.

2.1 Examination Process

Simultaneously with issuing this edition of Supervisory Highlights, the Bureau has updated its

Education Loan Examination Procedures. The Consumer Financial Protection Act provides the

Bureau with authority to supervise nonbanks that offer or provide private education loans,

including institutions of higher education.

11

To determine which institutions are subject to this

authority, the Consumer Financial Protection Act specifies that the Bureau may examine entities

that offer or provide private education loans, as defined in section 140 of the Truth in Lending

Act (TILA), 15 U.S.C. 1650. Notably, this definition is different than the definition used in

Regulation Z. However, a previous version of the Bureau’s Education Loan Examination

Procedures referenced the Regulation Z definition. The new version has now been updated to

tell examiners that the Bureau will use TILA’s statutory definition of private education loan for

the purposes of exercising the Consumer Financial Protection Act’s grant of supervisory

authority.

12

The new exam manual thus instructs examiners that the Bureau may exercise its

supervisory authority over an institution that extends credit expressly for postsecondary

educational expenses so long as that credit is not made, insured, or guaranteed under Title IV of

the Higher Education Act of 1965, and is not an open-ended consumer credit plan, or secured by

real property or a dwelling.

13

10

Consumer Financial Protection Bureau to Examine Colleges’ In -House Lending Practices,

https://www.consumerfinance.gov/about-us/newsroom/consumer-financial-protection-bureau-to-examine-

colleges-in-house-lending-practices/.

11

12 U.S.C. 5514 (a)(1)(D).

12

https://www.consumerfinance.gov/compliance/supervision-examinations/education-loan-examination-

procedures/.

13

This definition does not include Regulation Z’s exceptions for tuition payment plans or very short -term credit.

Thus, institutions may offer private education loans that make them subject to the Bureau’s supervisory authority

even if Regulation Z exempts them from disclosure requirements.

8 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

The Education Loan Examination Procedures guides

examiners when reviewing institutional loans by

identifying a range of important topics including the

relationship between loan servicing or collections and

transcript withholding.

Where higher education institutions extend credit, the

dual role of lender and educator provides institutions with a range of available collection tactics

that leverage their unique relationship with students. For example, some postsecondary

institutions withhold official transcripts as a collection tactic. Institutions often withhold

transcripts from their students who are delinquent on debt owed to the institution, while also

requiring new students to provide official transcripts from schools they previously attended.

Collectively, this industry practice creates a circumstance in which a formal official transcript is

necessary for students to move from one school to another, creating a powerful mechanism to

enforce payment demands even when consumers seek to attend a competitor school.

Consumers who cannot obtain an official transcript could be locked out of future higher

education and certain job opportunities.

2.2 Transcript Withholding Findings

Examiners found that institutions engaged in abusive acts or practices by withholding official

transcripts as a blanket policy in conjunction with the extension of credit. These schools did not

release official transcripts to consumers that were delinquent or in default on their debts to the

school that arose from extensions of credit. For borrowers in default, one institution refused to

release official transcripts even after consumers entered new payment agreements; rather, the

institution waited until consumers paid their entire balances in full. In some cases, the

institution collected payments for transcripts but did not deliver those transcripts if the

consumer was delinquent on a debt.

An act or practice is abusive if it, among other things, takes unreasonable advantage of the

inability of a consumer to protect the interests of the consumer in selecting or using a consumer

financial product or service. Examiners found that institutions took unreasonable advantage of

the critical importance of official transcripts and institutions’ relationship with consumers.

Since many students will need official transcripts at some point to pursue employment or future

higher education opportunities, the consequences of withheld transcripts are often

disproportionate to the underlying debt amount. Additionally, faced with the choice between

paying a specific debt and the unknown loss associated with long-term career opportunities of a

new job or further education, consumers may be coerced into making payments on debts that

are inaccurately calculated, improperly assessed, or otherwise problematic.

Compliance Tip: Schools should evaluate

the financial services they offer or provide and

ensure they comply with all appropriate

consumer financial laws.

9 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

This heightened pressure to produce transcripts leaves consumers with little-to-no bargaining

power while academic achievement and professional advancements depend on the actions of a

single academic institution. Other consumers might simply abandon their future higher

education plans when faced with a transcript hold. At the same time, the institution does not

receive any intrinsic value from withholding transcripts. Unlike traditional collateral,

transcripts cannot be resold or auctioned to other buyers if the original debtor defaults.

Consumers do not have a reasonable opportunity to protect themselves in these circumstances.

Since most institutional debt is incurred after consumers have already selected their schools,

they may be practically limited to a single credit source. After consumers select their schools,

those schools have a monopoly over the access to an official transcript. At the point where

consumers need a transcript, they cannot simply select a different school to provide it. For these

reasons, Supervision determined that blanket policies to withhold transcripts in connection with

an extension of credit are abusive under the Consumer Financial Protection Act and directed

institutional lenders to cease this practice.

10 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

3. Supervision of Federal

Student Loan Transfers

In July of 2021, PHEAA and Granite State announced they were ending their contracts with FSA

for student loan servicing, triggering the transfer of more than nine million borrower accounts.

14

The Bureau reviewed the transfers of one or more transferee and transferor servicers, with a

focus on assessing risks and communicating these risks to supervised entities promptly so that

they could address the risks and prevent consumer harm. The Bureau coordinated closely with

FSA and State partners as they also conducted close oversight of the loan transfers.

3.1 Supervisory Approach

The Bureau’s supervisory approach included three components: pre-transfer monitoring and

engagement, real-time transaction testing during the transfers, and post-transfer review and

analysis. Throughout this process the Bureau worked closely with ED’s primary office handling

student loans, Federal Student Aid (FSA), and State supervisors including the California

Department of Financial Protection and Innovation, Colorado Attorney General’s Office,

Connecticut Department of Banking, Illinois Department of Financial and Professional

Regulation, Washington Department of Financial Institutions, and Massachusetts Division of

Banks. This coordination significantly improved oversight.

Pre-transfer monitoring and engagement included an evaluation of transfer-related policies and

procedures in accordance with the Education Loan Examination Procedures, coordination

between the Bureau and FSA in issue and risk identification, and direct engagement between

Supervision leadership and specific servicers.

A significant aspect of the oversight involved transaction testing sampled accounts on both ends

of the transfer. Within these samples, examiners identified discrepancies between relevant

servicers’ data and requested clarification to determine whether they represented transfer errors

or other consumer risks. Subsequently, the Bureau reviewed these data to identify systemic

risks to consumers from the transfers and root causes of the identified discrepancies. Through

14

https://www.pheaa.org/documents/press-releases/ph/070721.pdf;

https://nhheaf.org/pdfs/press/2021/NHHEAF_Network _Public_Announcement_07-19-21.pdf. The total volume

of transfers between entities is 14 million borrower accounts, but the transfer from Navient to Maximus of five

million accounts did not involve borrower accounts moving to a new servicing platform.

11 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

this process, the Bureau provided rapid feedback to servicers and is closely coordinating with

FSA to improve consumer outcomes and drive toward timely solutions to any errors.

Overall, the near real-time supervision of a portfolio transfer alongside FSA and State regulators

was a novel approach. Many of the findings detailed below were resolved, and the corrections

help to prevent the type of long-term consumer harm seen in prior transfers.

3.2 Findings

Based on the work described above, examiners issued interim supervisory communications to

certain entities documenting consumer risks and directing them to take action to address those

risks. Notable findings include:

• Many servicers reported that the initial set of information they received during the

transfer was insufficient to accurately service loans. In some cases, important account

information was missing or provided in an unusable format. For example, examiners

identified inaccurate information about certain consumers’ monthly payment amounts,

due dates, and payment plans. The root cause of many of these discrepancies was one

servicer’s failure to include current repayment schedules – data showing future expected

monthly payments based on consumers’ repayment plans – for many accounts in the

transfer. This error occurred for hundreds of thousands of accounts.

• Transferee and transferor servicers reported different numbers of total payments that

count toward IDR forgiveness for some consumers.

• One servicer sent statements to more than 500,000 consumers that presented

inaccurate information about the borrower’s next due date and, separately, the date

Federal student loans were set to return to repayment.

▪ One servicer placed certain accounts into transfer-related forbearances following the

transfer, instead of the more advantageous CARES Act forbearances.

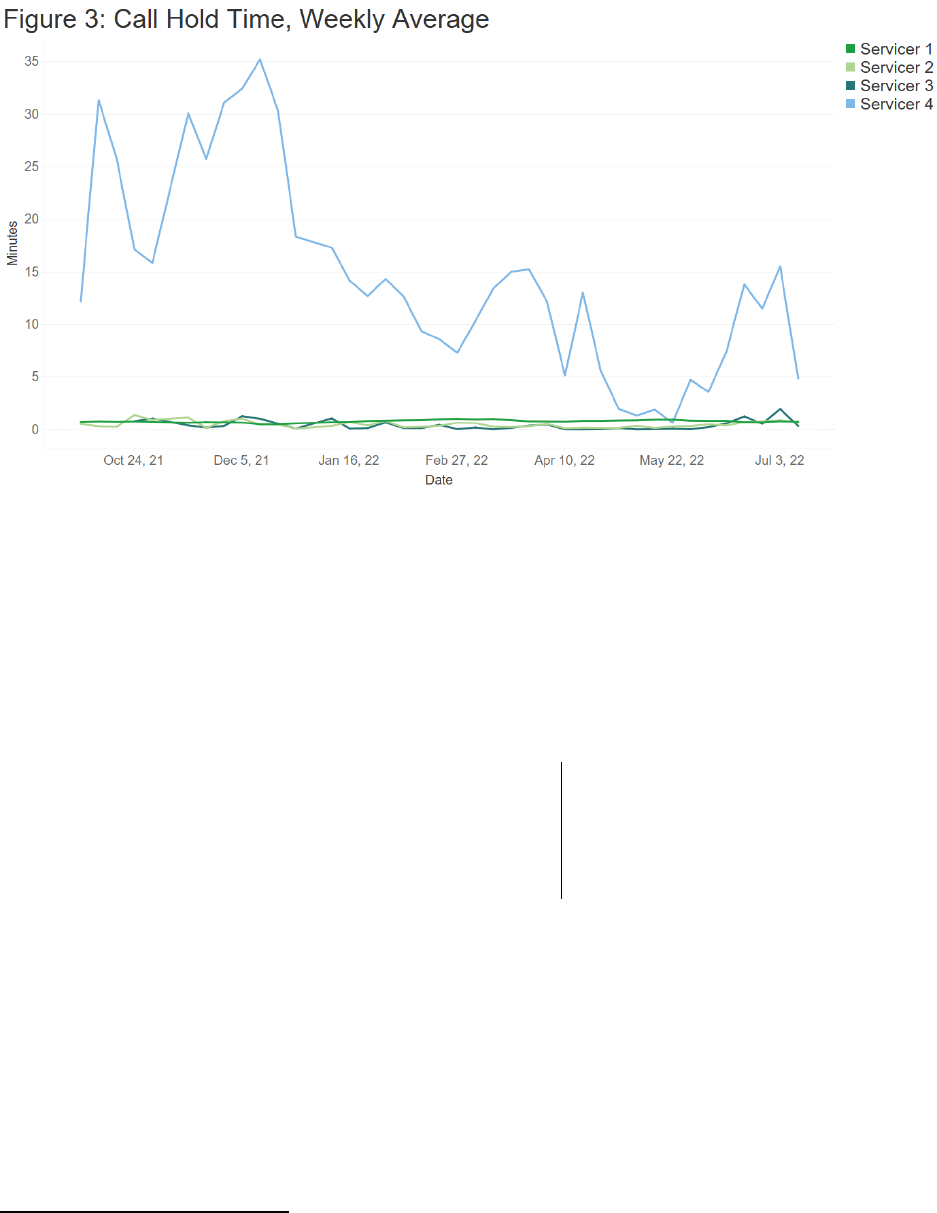

▪ Multiple servicers experienced significant operational challenges in managing the

transfers at the same time they were implementing major program changes. The

payment pauses and extensions, PSLF waiver, and transfers drove increased call volume

and applications for payment relief. Some servicers were inadequately staffed, making

them unable to effectively manage this volume. As shown in Figure 3, call wait times and

average processing time for payment relief increased significantly.

12 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

▪ Some accounts transferred with inaccurate capitalization or paid ahead status. These

errors caused the transferee servicer to misrepresent consumers’ payment amounts or

due dates.

Critically, the ongoing payment pause provides servicers and FSA with more time to correct

transfer-related errors by making manual account adjustments, transferring supplemental

account information, and correcting previous inaccurate or misleading statements.

Supervision issued Matters Requiring Attention

(MRAs) across student loan servicers in a series of

interim supervisory communications directing them

to act before the transfers concluded to correct many

of the issues discussed above.

15

Servicers are

currently working to resolve these issues.

Supervision issued MRAs directing servicers to:

• Update their systems with accurate repayment schedules and other missing

information;

• Correct misrepresentations on their websites and provide disclaimers where they did

not have complete and accurate account details;

15

Supervision issues MRAs to supervised entities that direct the entities to take certain steps to address violations or

compliance weaknesses and provide written updates on their progress to the Bureau.

Compliance Tip: Prior to a transfer,

institutions should engage in robust data

mapping exercises that include test transfers

to minimize errors.

13 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

• Correct the type of forbearance applied to transferred accounts, ensuring that CARES

Act forbearances are applied rather than less-advantageous transfer-related

forbearances for the relevant period;

• Correct credit reporting errors;

• Improve their own internal due diligence through additional audits focused on critical

date elements;

• Improve transfer-related training for call center representatives; and

• Develop and implement staffing plans to address operational challenges.

In addition, supervisory personnel coordinated closely with Federal Student Aid to ensure that

both agencies benefit from the Bureau’s work. The Bureau worked to verify compliance with

these MRAs while FSA directed complementary corrective action and tracked progress towards

the resolution of systematic errors such as the failure of one servicer to provide repayment

schedules in its initial data transfer. In some cases, FSA’s programmatic and contractual tools

were brought to bear on complex issues that did not originate with the transfers. For example,

the discrepancies revealed in IDR payment counting were not caused by the transfer itself.

Rather, oversight of the transfer process revealed a range of operational differences and data

weaknesses that predated the transfer. The recently-announced IDR waiver may address many

of these issues by standardizing the way periods of eligibility are counted and expanding the

repayment, forbearance, and deferment periods considered as eligible payments toward IDR

forgiveness. In this way, FSA aims to ensure that all consumers receive the full benefits to which

they are entitled, regardless of the servicer or transfer status. It will also provide remediation to

address certain prior misrepresentations through broadened eligibility.

14 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

4. Recent Exam Findings

The Bureau has supervised student loan servicers, including servicers responsible for handling

Direct and other ED-owned loans, since it finalized the student loan servicing larger participant

rule in 2014.

16

In many instances, examiners have identified servicers that have failed to provide

access to payment relief programs to which students are entitled. Examiners identified these

issues in both the Direct Loan and Commercial FFELP portfolios; in most cases the conduct

constitutes the same unfair, deceptive, or abusive act or practice regardless of what entity holds

the loan. The Bureau shared these findings with FSA at the time of the examinations, and in

many cases FSA’s subsequent programmatic changes including the PSLF and IDR waivers

provide meaningful remediation to injured consumers.

4.1 Teacher Loan Forgiveness

Certain Federal student loan consumers are eligible for TLF after teaching full-time for five

consecutive academic years in an elementary school, secondary school, or educational service

agency that serves low-income families. Consumers apply by submitting their TLF applications

to their servicers. These applications can be time consuming as they require consumers to

solicit their schools’ chief administrative officers to complete and sign a portion of the

application. Servicers are responsible for processing these applications and sending

applications that meet the eligibility criteria to FSA or the loan guarantor for final approval. In

that process, servicers are responsible for, among other things, ensuring applications are

complete, determining whether the consumer worked for the required period, and verifying that

borrowers’ employers are qualifying schools by cross matching the name of the employer

provided against the Teacher Cancellation Low Income (“TCLI”) Directory.

4.1.1 Unfair and abusive practices in connection with

Teacher Loan Forgiveness application denials

Examiners found that servicers engaged in unfair acts or practices when they wrongfully denied

TLF applications in three circumstances: (1) where consumers had already completed five years

of teaching, (2) where the school was a qualifying school on the TCLI list, or (3) when the

16

For a period of time beginning in 2017, servicers did not provide information to the CFPB at ED’s direction.

Recently, coordination with ED/FSA increased significantly, including entering into appropriate confidentiality

agreements. The findings documented below come from the first three exams completed after the Bureau resumed

unrestricted oversight of federally owned student loans in 2020.

15 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

consumer formatted specific dates as MM-DD-YY instead of MM-DD-YYYY, despite meeting all

other eligibility requirements.

17

These wrongful denials resulted in substantial injury to consumers because they either lost their

loan forgiveness or had their loan forgiveness delayed. Consumers who are wrongfully denied

may understand that they are not eligible for TLF and refrain from resubmitting their TLF

applications. Consumers could not reasonably avoid the injury because the servicer controlled

the application process. Finally, the injury was not outweighed by countervailing benefits to

consumers or competition.

An act or practice is abusive when a covered person takes unreasonable advantage of reasonable

reliance by the consumer on a covered person to act in the interests of the consumer. A servicer

also engaged in an abusive act or practice by denying TLF applications where consumers used a

MM-DD-YY format for their employment dates, particularly where FSA had previously

identified one such denial, directed the servicer to reconsider the application, and suggested the

servicer refrain from date format denials going forward. The denial of forgiveness was

detrimental to consumers, as described above. And the servicer may benefit from the conduct

because servicers are paid monthly and denying forgiveness may prolong the life of the loan,

generating additional revenue for the servicer.

Consumers reasonably rely on servicers to act in their interests, and this servicer encouraged

consumers to consult with their representatives to assist in managing their accounts, including

on its websites where it provided information about TLF. Further, it was reasonable for

consumers who are applying for TLF to rely on their servicer to act in the consumers’ best

interests because processing forgiveness applications is a core function for student loan

servicers, and they are entirely in control of their evaluation policies and procedures.

In response to these violations, examiners directed

the servicer to review all TLF applications denied

since 2014 to identify improperly denied applications

and remediate harmed consumers to ensure they

receive the full benefit to which they were entitled,

including any refunds for excess payments or accrued

interest.

17

If a supervisory matter is referred to the Office of Enforcement, Enforcement may cite additional violations based

on these facts or uncover additional information that could impact the conclusion as to what violations may exist.

Compliance Tip: Servicers should

routinely approve applications for payment

relief when they have all the required

information to make decisions, even if that

information is provided in a nonstandard

format or across multiple communications.

16 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

4.2 Public Service Loan Forgiveness

The PSLF program allows borrowers with eligible Direct Loans who (i) work for qualifying

employers in government or public service fields, (ii) make 120 on-time monthly qualifying

payments, (iii) while in a qualified repayment plan, to have the remainder of their loans

forgiven. Congress recognized in 2007 that the “staggering debt burdens” of higher education

were driving students away from public service.

18

By 2018, Congress came to understand that many consumers working in public service would

never receive PSLF benefits due the complexities of higher education finance and eligibility

requirements. At that time, the PSLF program had discharged loans for only 338 consumers

despite receiving 65,500 applications.

19

At a minimum, many applicants had a fundamental

misunderstanding about the program terms. In response, Congress authorized additional

funding to extend the PSLF benefits to Direct Loan borrowers who would be eligible but for

repaying under a non-qualifying repayment plan like the Extended or Graduated repayment

plans. The Temporary Expanded PSLF (TEPSLF) allowed these consumers that meet certain

additional requirements in their last year of repayment to have the balance of their loans

forgiven.

Over the following three years, PSLF and TEPSLF canceled debts for 10,354 and 3,480

consumers, respectively.

20

However, these successful applications continued to be the

exception, as more than half a million applications were rejected, including 409,000 from

borrowers who had not been in repayment on a Direct Loan for 120 months. These data are

explained in part by material misrepresentations by FFELP servicers about critical PSLF terms

and application processes.

21

18

E.g., 153 Cong. Rec. S9595 (daily ed. July 19, 2007) (statement of Senator Leahy) (“Because tuition has increased

well beyond the rate of student assistance, students today are graduating with staggering debt burdens. With the

weight of this debt on their backs, recent college graduates understandably gravitate toward higher paying jobs that

allow them to pay back their loans. Unfortunately, all too often these jobs are not in the arena of public service or

areas that serve the vital public interests of our communities and of our country. We need to be doing more to

support graduates who want to enter public service, be it as a childcare provider, a doctor or nurse in the public

health field, or a police officer or other type of first responder.”).

19

FSA Public Service Loan Forgiveness Data, https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data.

20

See FSA November 2021 Public Service Loan Forgiveness Data, https://studentaid.gov/data-center/student/loan-

forgiveness/pslf-data.

21

Supervisory Highlights, Issue 24, Summer 2021. Consent Order, EdFinancial Services, LLC, 2022-CFPB-0001

(Consumer Financial Protection Bureau March 30, 2022).

17 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

In an effort to make the PSLF program “live up to its promise,” ED announced a PSLF waiver in

October 2021.

22

The waiver significantly changed what periods of repayment were considered

eligible and opened a pathway for FFELP borrowers to receive credit toward forgiveness for the

first time, if those borrowers consolidate into Direct Loans by October 31, 2022, providing the

potential for cancelation for nearly 165,000 borrowers with a total balance of $10.0 billion. In

an effort to help identify and address servicing errors, ED announced that it would also review

denied PSLF applications for errors and give borrowers the ability to have their PSLF

determinations reconsidered.

Starting in March 2020, the CARES Act provided additional relief for consumers. During the

CARES Act payment suspension and subsequent extensions, consumers are not required to

make any payments and can request a refund for any payments they did make. These

protections were included in subsequent extensions of the repayment pause. Importantly,

regardless of whether a consumers paid anything, all months during this time will count toward

PSLF and other forgiveness programs.

During the periods covered by this report, borrowers submitted two kinds of PSLF forms:

Employer Certification Forms (ECFs) and PSLF applications. ECFs certify that borrowers

worked for qualifying employers for a specified period, while PSLF applications document their

current qualifying employment and request forgiveness of the loans when they have reached 120

qualifying payments. A combined PSLF form was made available in November 2020 for both

PSLF applications and ECFs.

23

4.2.1 Unfair practice of providing erroneous initial PSLF

eligibility determinations, qualified payment counts,

and estimated eligibility dates.

Results of ECFs and PSLF applications are communicated to consumers through letters telling

consumers whether the form was approved or denied and including counts of consumers’ total

qualifying payments (QPs) and estimated eligibility dates (EEDs) for reaching the 120 payments

required for forgiveness. Examiners identified both wrongful denials and approvals of

applications or ECFs. In many cases, the servicer corrected these errors months later, after the

22

Press Release, U.S. Department of Education Announces Transformational Changes to the Public Service Loan

Forgiveness Program, Will Put Over 550,000 Public Service Workers Closer to Loan Forgiveness (October 6, 2021).

https://www.ed.gov/news/press-releases/us-department-education-announces-transformational-changes-public-

service-loan-forgiveness-program-will-put-over-550000-public-service-workers-closer-loan-forgiveness.

23

See https://fsapartners.ed.gov/knowledge-center/library/electronic-announcements/2020-10-28/changes-public-

service-loan-forgiveness-pslf-program-and-new-single-pslf-form.https://www.pheaa.org/documents/press-

releases/ph/070721.pdf.

18 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

consumer complained or the servicer identified the issue. In the sample reviewed, examiners

found that the servicer wrongfully approved ECFs where the borrowers had ineligible

employment or had loans that were otherwise ineligible. This representation could lead

consumers to falsely believe they are accruing credit toward forgiveness and delay taking steps

like loan consolidation that could actually make them eligible. Other ECFs were wrongfully

denied when representatives erroneously determined the forms had invalid employment dates,

were missing an employer EIN, or were otherwise incomplete – when in fact they were not.

Examiners also found that a servicer engaged in an unfair act or practice by miscalculating

consumers’ total QPs or EEDs and then communicating that erroneous information to

consumers pursuing PSLF. Examiners’ sample suggests these errors were common with many

consumers receiving multiple incorrect QP or EED determinations across multiple ECF

submissions.

Wrongful approvals and denials and incorrect PSLF eligibility information resulted in a

substantial injury because the availability of PSLF can substantially impact borrowers’ careers,

financial situation, and life choices. Depending on the circumstances, consumers may have

committed to additional work with their employers for these months, instead of pursuing other

opportunities; made other major financial decisions, such as financing the purchase of a

residence or automobile; or delayed consolidation of their FFELP loans. The injury is not

reasonably avoidable because borrowers have no choice among student loan servicers, no way to

ensure the servicer properly processed these forms, and were often not aware of the processing

errors. Finally, the injury was not outweighed by countervailing benefits to consumers or

competition because there is no direct benefit to consumers or competition created by improper

approvals or denials.

4.2.2 Deceptive practice of misleading borrowers about

student loan COVID-19 payment suspension refunds

and PSLF forgiveness

Despite the PSLF-related benefits of the CARES Act payment suspension, some consumers

seeking PSLF continued to make payments on their student loans during the suspension.

Examiners found that at least one servicer engaged in a deceptive act or practice by implicitly

representing to these consumers that they must make payments during the COVID-19 payment

suspension for those months to be eligible for PSLF. During the suspension, consumers

received standard PSLF communications including denials that informed them that qualifying

payments are ones made under specific repayment programs ‒ known as REPAYE, PAYE, IBR,

and ICR. Other letters informed consumers that the estimated eligibility date is based on

making “on-time, qualifying payments every month” when in fact no monthly payments were

required for the period of the payment suspension. Taken together, these communications

19 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

created the implicit representation that consumers’ payments made between March 2020 and

the effective date of forgiveness were necessary for PSLF when in fact they were not.

Hundreds of consumers faced this situation, and in the first year of the payment suspension

approximately eight percent of all consumers that earned PSLF forgiveness had made payments

during the payment suspension but did not receive a refund of those payments upon achieving

forgiveness. Consumers rely on servicers to provide accurate information about forgiveness

programs, so they reasonably believed that those payments were necessary. These

representations were material because if consumers knew these payments were refundable, they

likely would have requested a refund as those payments were unnecessary for achieving PSLF.

4.2.3 Unfair practice of excessive delays in processing

PSLF forms

Examiners found that at least one servicer engaged in

an unfair act or practice when it excessively delayed

processing PSLF forms. In some cases, these delays

lasted nearly a year. These delays could change

borrowers’ decisions about consolidation, repayment

plan enrollment, or even employment opportunities.

For example, when FFELP loan borrowers apply for

PSLF, they are denied because those loans are

ineligible, but they are told that a consolidation could make the loan eligible. Therefore, a delay

in processing the PSLF form could cause consumers to delay consolidation and delay their

ultimate forgiveness date.

24

In addition, examiners observed that some borrowers spent

unnecessary time contacting their servicers to expedite the process or receive status updates

when these forms were delayed. Consumers plan around their debt obligations, and excessive

delays can alter consumers’ major financial decisions and cause substantial injury that is not

reasonably avoidable and not outweighed by countervailing benefits to consumers or

competition.

24

The PSLF waiver will provide meaningful remediation to this population by automatically counting periods of

FFELP repayment as eligible if the borrower consolidates their loan by the deadline and submits the PSLF form for

the relevant time period.

Compliance Tip: Servicers should

regularly monitor both the average time for

application review and outlier experiences.

Delays in processing forms can be unfair

even where they affect a subset of the

portfolio.

20 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

4.2.4 Deceptive practice of misrepresenting PSLF eligibility

to borrowers who may qualify for TEPSLF

Before ED announced the PSLF waiver, examiners found that certain servicers engaged in

deceptive acts or practices when they explicitly or implicitly misrepresented that borrowers were

only eligible for PSLF if they made payments under an IDR plan, when in fact those borrowers

may be eligible for TEPSLF. One servicer’s training materials specifically advised

representatives not to initiate a conversation regarding TEPSLF. Examiners identified calls

where representatives told borrowers that there was nothing they could do to make years of

payments under graduated or extended payment plans eligible for PSLF. In response to a direct

question from a consumer about her nearly 12 years of payments, one representative explained

that they “count for paying down your loan, but it doesn’t count for PSLF.”

This false information that borrowers could only obtain PSLF through qualifying payments

under an IDR plan, when TEPSLF was available, was likely to mislead borrowers. Based on this

false information, consumers considered other options besides PSLF like paying their loans

down with lump sum payments. These misrepresentations also caused certain consumers to

refrain from applying for IDR because they understood that they had not made any eligible

payments while enrolled in graduated or extended plans.

4.2.5 Remediation for PSLF-related UDAAPs

Broadly, the PSLF violations identified relate to erroneous ECF and PSLF application

determinations or servicers deceiving borrowers by providing incomplete or inaccurate

information to consumers about the program terms. At present, the PSLF waiver can address

many of the most significant consumer injuries by crediting certain past periods that were

previously ineligible, assuming that consumers receive the benefits of the waiver as designed. In

addition, Supervision directed the servicer to

complete reviews of PSLF determinations and to

identify consumers impacted by the violations. The

servicer will audit the work and report on the

remediation-related findings to the Bureau. Where

consumers continue to face financial injuries from

these violations, the servicer will provide monetary

remediation. In addition, the servicer will notify

consumers who were not otherwise updated on the

status of their PSLF applications that certain

information they received was incorrect, and it will

provide those consumers with updated information.

• Compliance Tip: Entities should review

Bulletin 2022-03, Servicer Responsibilities

in Public Service Loan Forgiveness

Communications, which details compliance

expectations in light of the PSLF waiver. As

explained in the Bulletin, “After the PSLF

Waiver closes, direct payments to borrowers

may be the primary means of remediating

relevant UDAAPs.”

21 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

4.3 Income-Driven Repayment

Federal student loan borrowers are eligible for a number of repayment plans that base monthly

payments on their income and family size. Over the years, the number of IDR programs has

expanded, and today several types of IDR plans are available depending on loan type and

student loan history. Most recently, ED implemented the Revised Pay As You Earn (REPAYE)

for certain Direct student loan borrowers. For most eligible borrowers, REPAYE results in the

lowest monthly payment of any available IDR plan.

25

By the end of 2020, more than 12 percent

of all Direct Loan borrowers in repayment were enrolled in REPAYE.

26

Enrollment in these plans requires consumers to initially apply and then recertify annually to

ensure payments continue to reflect consumers’ current income and family size. Consumers

supply their adjusted gross income (AGI) by providing their tax returns or alternative

documentation of income (ADOI). ADOI requires consumers to submit paper forms and

specified documentation (such as paystubs) for each source of taxable income. The servicer then

uses this information to calculate the consumer’s AGI and resulting IDR payment. When

computing the IDR payment, servicers must also consider consumers’ spouses’ Federal student

loan debt.

27

Consumers might not timely recertify their IDR plans for various reasons including, but not

limited to, they may not have understood that recertification was necessary, or they may have

encountered barriers in the recertification process. Likewise, some borrowers may have

experienced a boost in income making the standard repayment amounts manageable.

Regardless, many consumers who fall out of an IDR plan seek to reenroll at some point in the

future. This creates a gap period between IDR enrollments. Unlike other IDR plans, REPAYE

requires consumers to submit documentation to demonstrate their income during the gap

period before they can be approved to return. Servicers use this documentation to determine

whether consumers paid less during the gap period than they would have under REPAYE. If so,

25

Under the program’s terms, consumers are generally entitled to make monthly payments equal to 10 percent of

their discretionary income. After repaying for 20 years (on undergraduate loans) or 25 years (for borrowers who

received any Federal loans to finance graduate school), any remaining balance on the loans are forgiven.

26

An additional 5 percent of consumers were enrolled in the Alternative repayment plan – the plan in which

borrowers are placed in if they do not recertify their income or enroll in another repayment plan.

https://studentaid.gov/data-center/student/portfolio

27

See https://studentaid.gov/sa/repay-loans/understand/plans/income-driven#apply (“If you do not meet the

conditions for documenting your income using AGI—you have not filed a federal income tax retur n in the past two

years, or the income on your most recent federal income tax return is significantly different from your current

income—you must provide alternative documentation of income.”).

22 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

servicers calculate catch-up payment amounts that get added to consumers’ monthly income-

derived payments.

During the COVID-19 payment suspension, ED did not require consumers to recertify their

incomes. Consumers’ payment amounts and duration of IDR enrollments were essentially

paused in March of 2020. Recently, ED authorized servicers to accept consumers’ oral

representation of their incomes over the phone for the purposes of calculating an IDR payment

amount. ED will not require consumers that provide their incomes this way to provide any

further documentation demonstrating the accuracy of that amount.

In April 2022, ED announced it was taking steps to bring more borrowers closer to IDR

forgiveness.

28

ED is conducting a one-time payment count adjustment to count certain periods

in non-IDR repayment plans and long-term forbearance.

29

This waiver can help address past

calculation inaccuracies, forbearance steering, and misrepresentations about the program

terms. While the revision will be applied automatically for all Direct Loans and ED-held FFELP

loans, Commercial FFELP loan borrowers can only become eligible if they apply to consolidate

their Commercial FFELP loans into a Direct Consolidation Loan within the waiver timeframe.

FSA estimates the changes will result in immediate debt cancellation for more than 40,000

borrowers, and more than 3.6 million borrowers will receive at least three years of credit toward

IDR forgiveness.

30

The pool of borrowers who may potentially benefit from IDR forgiveness is

large. As of March 2022, one third of Direct Loan borrowers in repayment were enrolled in an

IDR plan.

31

4.3.1 Unfair act or practice of improper processing of

income-driven repayment requests

Examiners found that servicers engaged in unfair acts or practices when they improperly

processed consumers’ IDR requests resulting in erroneous denials or inflated IDR payment

amounts. Servicers made a variety of errors in the processing of applications: (1) erroneously

28

https://www.ed.gov/news/press-releases/department-education-announces-actions-fix-longstanding-failures-

student-loan-programs.

29

ED also announced that it was issuing new guidance to student loan servicers to ensure accurate and uniform

payment counting, that it would track payments on a modernized data system, and that it would seek to display IDR

payment counts on StudentAid.gov that borrowers could access on their own. See

https://studentaid.gov/announcements-events/idr-account-adjustment.

30

https://www.ed.gov/news/press-releases/department-education-announces-actions-fix-longstanding-failures-

student-loan-programs.

31

https://studentaid.gov/sites/default/files/fsawg/datacenter/library/DLPortfoliobyRepaymentPlan.xls

23 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

concluding that the ADOI documentation was not sufficient,

32

resulting in denials;

(2) improperly considering spousal income that should have been excluded, resulting in denials;

(3) improperly calculating AGI by including bonuses as part of consumers’ biweekly income,

resulting in higher IDR payments; (4) failing to consider consumers’ spouses’ student loan debt,

resulting in higher IDR payments; and (5) failing to process an application because it would not

result in a reduction in IDR payments, when in fact it would. These practices caused or likely

caused substantial injury in the form of financial loss through higher student loan payments and

the time and resources consumers spent addressing servicer errors. Consumers could not

reasonably avoid the injury because they cannot ensure that their servicers are properly

administering the IDR program and would reasonably expect the servicer to properly handle

routine IDR recertification requests. The injury was not outweighed by countervailing benefits

to consumers or competition resulting from the practice, as servicers should be able to process

IDR requests in accordance with ED guidelines.

4.3.2 Unfair practice of failing to sufficiently inform

consumers about the need to provide certain income

documentation when reentering the REPAYE payment

plan

Consumers enroll in REPAYE by submitting a form with income documentation; they must

recertify annually. Consumers who fail to recertify on time are removed from REPAYE and

placed into the “Alternative repayment plan” which has monthly payments that are generally

significantly higher than those under the REPAYE plan.

33

Many consumers attempt to reenroll

in REPAYE creating a gap period that can range from one month to multiple years. Consumers

who apply to reenroll in REPAYE must provide income documentation for the gap period. At

one servicer, during a two-year period only 12 percent of applicants attempting to reenter

REPAYE for the first time provided the required gap period income documentation. Among the

88 percent that were initially denied for this reason, 74 percent were delinquent six months later

compared to only 23 percent of consumers who had been successfully reenrolled in REPAYE.

32

For example, denying an IDR application b ecause there is no pay frequency listed on a paystub when in fact the

paystub showed the frequency, or the borrower wrote the frequency on the paystub.

33

Specifically, the monthly payment under this plan is the fixed amount necessary to repay the loan in the lesser of 10

years or whatever is left on the consumer’s 20- or 25-year REPAYE repayment period.

24 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

Examiners found that servicers engaged in an unfair

act or practice when they failed to sufficiently inform

consumers about the need to provide additional

income documentation for prior gap periods when

reentering the REPAYE repayment plan. By failing to

sufficiently inform consumers about the need for

income documentation for gap periods, servicers

likely caused the failure of many consumers to

successfully reenter REPAYE with their first

applications because consumers were unaware of this requirement. This caused or was likely to

cause substantial injury because consumers are deprived of the benefits of the REPAYE program

(which often offers the lowest repayment amount among IDR plans). Consumers could not

reasonably avoid the injury because their servicers did not inform them of the requirement to

include income documentation during the gap period.

4.3.3 Deceptive practice of providing inaccurate denial

letters to consumers who applied for IDR

recertification

Starting in March of 2020, the CARES Act and subsequent executive orders suspended

payments on all ED-owned student loans and temporarily set interest rates to zero percent.

These executive orders also extended the “anniversary date” for consumers to recertify income

for their IDR plans to after the end of the payment suspension.

Examiners found that servicers engaged in a deceptive act or practice by providing consumers

with a misleading denial reason after they submitted an IDR recertification application.

Servicers told consumers that they were denied because the executive orders suspending

payments had delayed their anniversary date, which made their applications premature. In fact,

servicers denied the applications because the consumers’ income had increased, in some cases

rendering the consumer no longer eligible for an income-driven payment amount under their

IDR program because their income-based payment exceeded the standard repayment amount.

34

These denial letters were likely to mislead consumers and affect important decisions related to

their repayment elections. For example, a consumer who knew their application was rejected

because of an increase in income (instead of the extension of the anniversary date) would know

to refile if their income had actually decreased. And even if consumers did not have a decrease

34

In other instances, the payment increased but the consumer was still eligible for the income-based payment plan.

Servicers’ policy was to deny applications before the anniversary date that resulted in increased payments.

Compliance Tip: Entities should monitor

consumer outcome data to identify potential

unfair, deceptive, or abusive acts or practices.

Delinquency rates and frequent denials on

applications for payment relief may suggest

the company is not meeting its obligations

under the Consumer Financial Protection

Act.

25 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

in income, having information indicating that their IDR application was denied because of a

payment increase would assist them in financial planning for future payments.

4.3.4 Deceptive practice of misrepresenting eligibility of

Parent PLUS loans for income-driven repayment and

PSLF

Parent PLUS loans allow parents to fund educational costs for dependent students. Parent PLUS

loans are eligible for one IDR plan, ICR, if the loans are first consolidated into Direct

Consolidation loans. Generally, to benefit from PSLF, borrowers with Parent PLUS Loans must

consolidate their loans into Direct Consolidation loans and make qualifying payments under an

ICR plan.

Examiners found that servicers engaged in deceptive acts or practices when they represented to

consumers with parent PLUS loans that they were not eligible for IDR or PSLF. In fact, parent

PLUS loans may be eligible for IDR and PSLF if they are consolidated into a Direct

Consolidation Loan. These representations were likely to cause reasonable borrowers

considering IDR or PSLF for Parent PLUS loans to forgo taking any future steps to pursue those

programs. Examiners directed servicers to improve policies and procedures, enhance training,

and improve monitoring to prevent future violations.

26 SUPERVISORY HIGHLIGHTS, ISSUE 27 (FALL 2022)

5. Conclusion

The Bureau will continue to supervise student loan servicers and lenders within its supervisory

jurisdiction – regardless of the institution type. Supervisory Highlights can aid these entities in

their efforts to comply with Federal consumer financial law and manage compliance risks. This

report shares information regarding general supervisory findings, observations related to the

recent transfer of millions of federally owned student loan accounts, and violations of the

Consumer Financial Protection Act’s prohibition on unfair, deceptive, and abusive acts or

practices.

The Bureau recommends that market participants – student loan servicers, originators, and

loan holders – review these findings and implement changes within their own operations to

ensure that these risks are thoroughly addressed. The Bureau expects institutions to

incorporate measures to avoid these violations and similar consumer risks into internal

monitoring and audit practices. Robust compliance programs seek to eliminate the problematic

practices described in Supervisory Highlights while ensuring that consumers receive complete

remediation for any past errors. Evidence of strong compliance programs that take these steps

is a factor in the Bureau’s risk-based supervision program and tool choice decisions, including

decisions on whether or not to open follow-up enforcement investigations. The Bureau expects

institutions to self-identify violations and compliance risks, proactively provide complete

remediation to all affected consumers, and report those actions to Supervision. Regardless,

where the Bureau identifies violations of Federal consumer financial law, it intends to continue

to exercise all of its authorities to ensure that servicers and loan holders make consumers whole.