U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [1]

Property & Casualty Insurance Industry

PROPERTY & CASUALTY OVERVIEW

Near double-digit premium growth and a continuing trend of prior year reserve

releases were offset by increased catastrophe losses and worsening results in

personal auto. As a result, the property and casualty industry reported its first

underwriting loss since 2017, totaling $(39.0) million.

Continued strong performance in investment operations with a gain of $71.1

billion and miscellaneous income of nearly $2.0 billion offset the underwriting

loss and led to net income of $60.5 billion. Despite higher investment returns,

the investment yield declined to 2.60%, its lowest point in eleven years.

The combination of net income and unrealized capital gains of $86.8 billion

pushed policyholders’ surplus to a record high of $1.1 trillion at December 31,

2021.

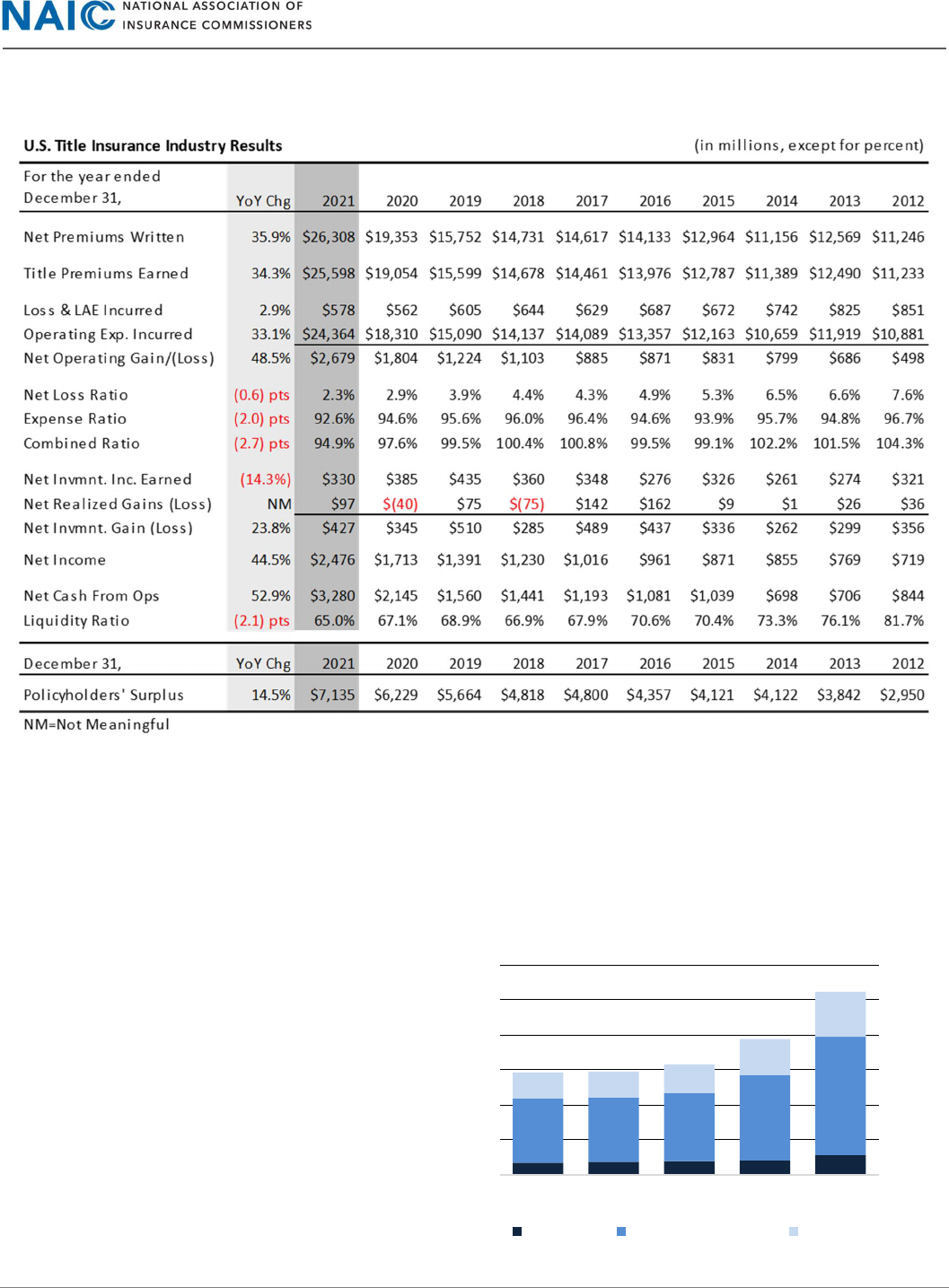

U.S. Property and Casualty Insurance Industry Results

(in millions, except for percent)

YoY Chg 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012

Net Premiums Written 9.2% 719,815 658,913 642,984 621,786 561,952 537,926 524,006 506,657 486,462

465,743

Net Premiums Earned 7.4% 693,664 646,014 630,776 603,188 549,958 533,236 515,835 497,931 476,792

457,906

Net Losses Incurred 12.8% 432,474 383,308 378,582 366,258 353,954 323,195 296,749 284,934 263,576

283,985

Loss Expenses Incurred 1.1% 70,638 69,888 69,244 64,658 65,218 61,829 60,932 58,706 56,951

56,552

Underwriting Expenses 5.3% 189,487 179,964 173,055 168,228 151,672 148,692 145,753 139,846 136,586

130,809

Underwrting Gain (Loss) NM (39) 12,100 8,373 2,907 (22,459) (1,700) 11,453 14,658 20,127 (13,762)

Net Loss Ratio 2.4 pts 72.5% 70.2% 71.0% 71.4% 76.2% 72.2% 69.3% 69.0% 67.2%

74.4%

Expense Ratio (1.0) pts 26.3% 27.3% 26.9% 27.1% 27.0% 27.6% 27.8% 27.6% 28.1%

28.1%

Combined Ratio 0.9 pts 99.6% 98.7% 98.7% 99.1% 103.9% 100.5% 97.8% 97.3% 96.0%

103.1%

1yr Rsrv Devlp/PY PHS 0.8 pts (0.0%) (0.8%) (0.8%) (1.6%) (1.4%) (0.7%) (1.2%) (1.4%) (2.7%) (2.2%)

Net Invmnt. Inc. Earned 2.6% 52,932 51,596 55,132 53,287 48,978 45,539 47,228 46,401 46,594

48,041

Net Realized Gains (Loss) 64.5% 18,200 11,064 11,260 10,885 19,833 8,747 10,285 12,006 18,823

9,032

Net Invmnt. Gain (Loss) 13.5% 71,132 62,660 66,392 64,172 68,812 54,286 57,513 58,407 65,417

57,073

Investment Yield (0.15) pts 2.60% 2.75% 3.19% 3.24% 3.08% 3.01% 3.18% 3.17% 3.34%

3.61%

Total Other Income 240.0% 3,514 1,034 1,284 1,530 (4,687) 950 1,475 (2,908) (580)

2,305

Net Income

1

(4.9%) 60,537 59,196 62,229 57,565 38,717 42,860 56,884 56,439 69,725

36,486

Return on Revenue (0.4) pts 7.9% 8.4% 8.9% 8.6% 6.3% 7.3% 9.9% 10.1% 12.9% 7.1%

December 31, YoY Chg 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012

Policyholders' Surplus

2

12.8% 1,077,866 955,136 891,214 779,921 786,016 734,026 705,948 706,740 686,135

615,809

Return on Surplus (0.5) pts 6.0% 6.4% 7.4% 7.4% 5.1% 6.0% 8.1% 8.1% 10.7% 6.1%

1. Excludes investment income from affiliates. 2. Adjusted to eliminate stacking

For the year ended

December 31,

Inside the Report

Page No.

Market Conditions ....................... 2

Premium ...................................... 3

Underwriting Operations ......... 5-9

Investment Operations .............. 10

Net Income ................................ 10

Cash Flow & Liquidity ...........10,11

Capital & Surplus ....................... 11

Reserves ...............................11,12

Reinsurance ..........................12,13

Inflation ................................13,14

Cyber.......................................... 14

Title Industry

........................

15

-

1

8

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [2]

MARKET CONDITIONS

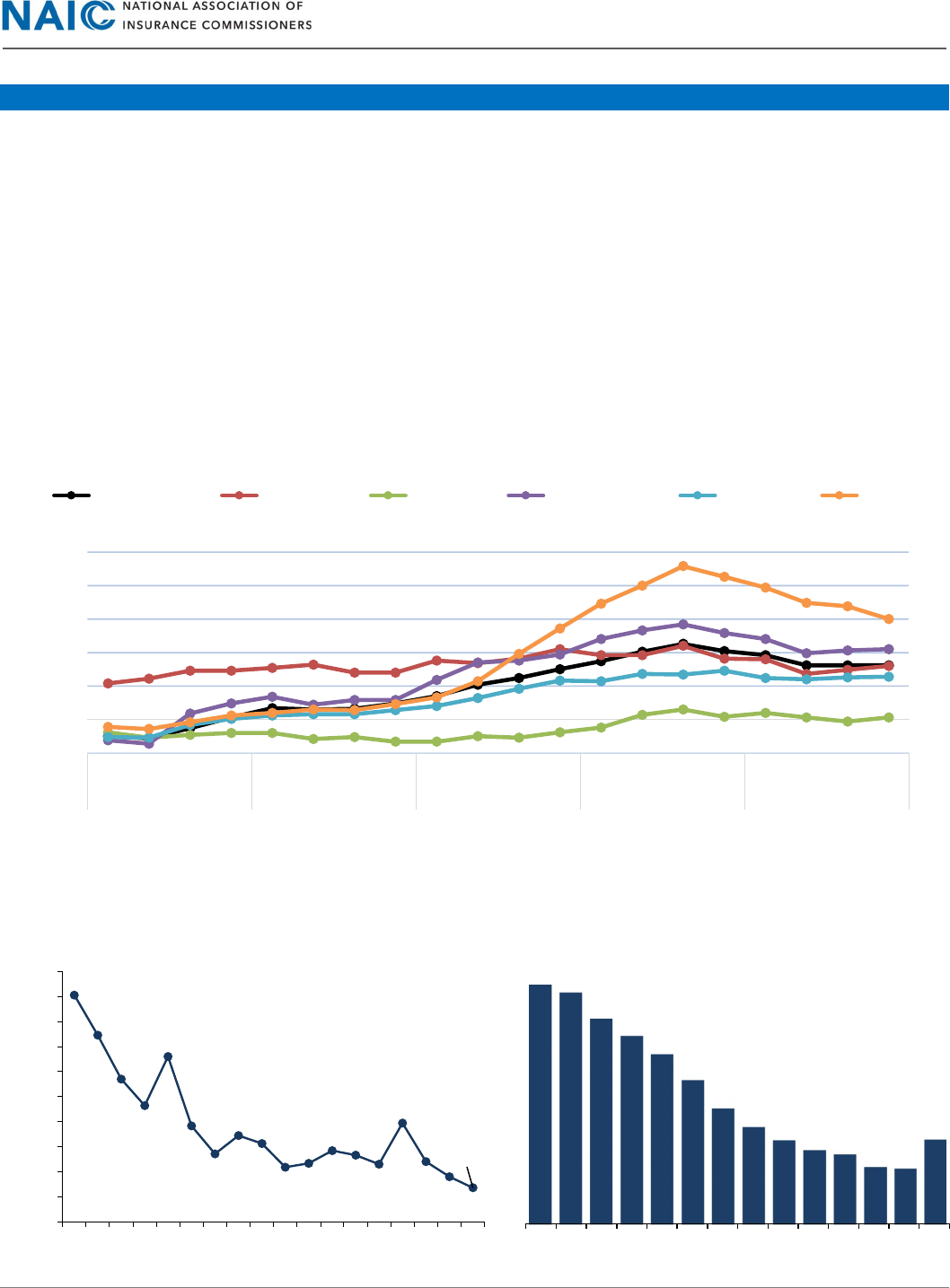

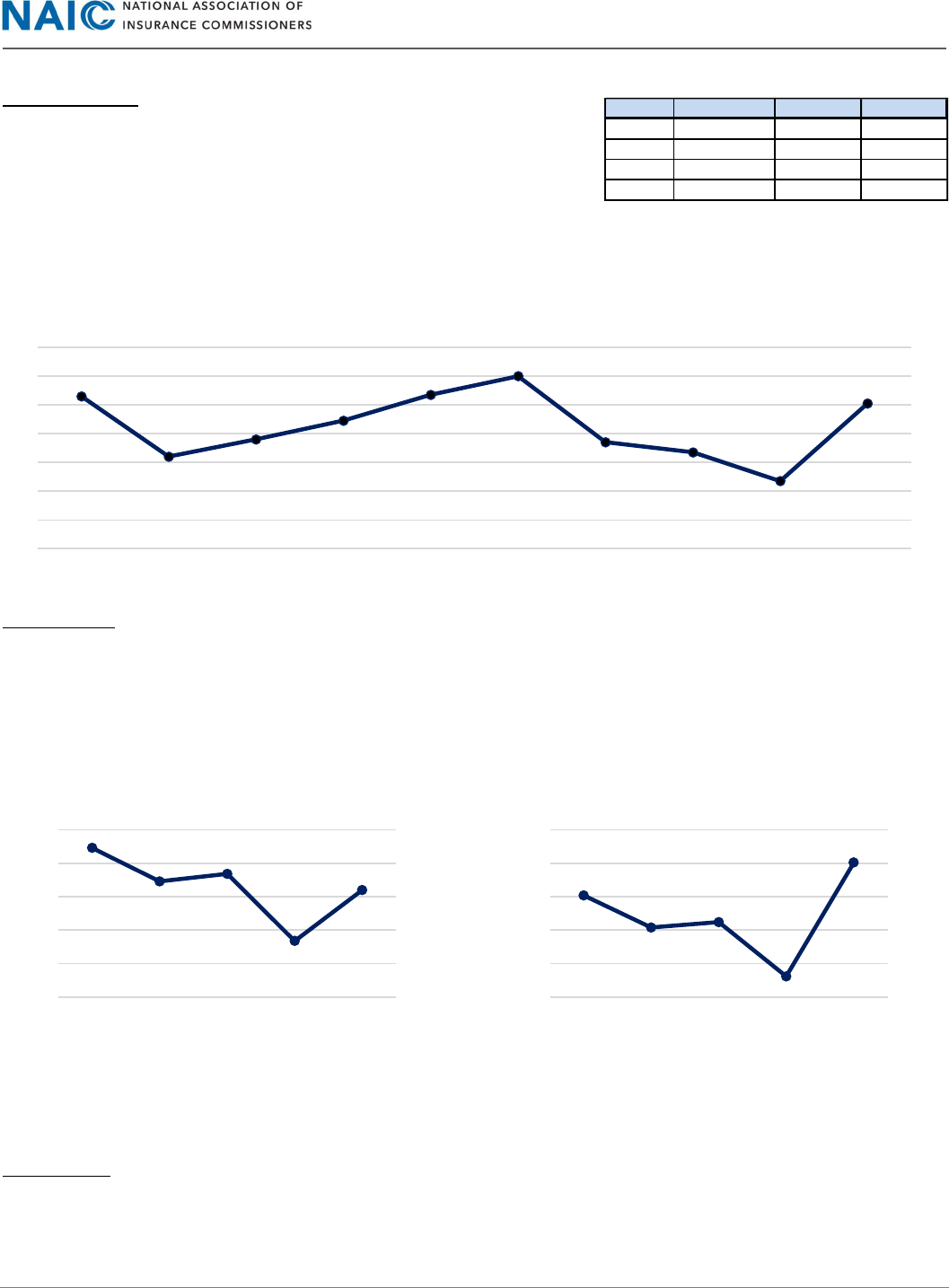

Premium Pricing

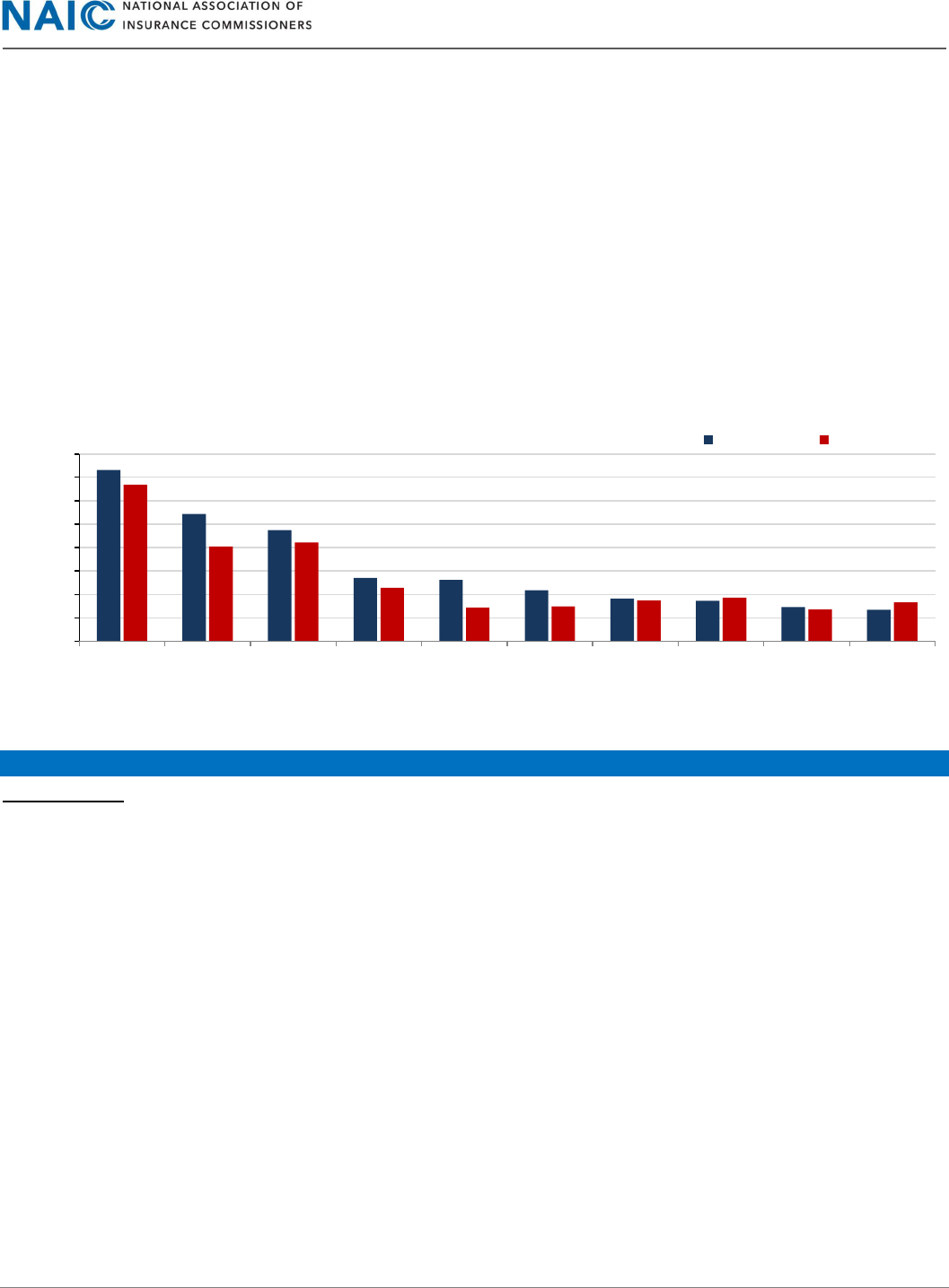

Market conditions continued to harden in most commercial products as insurers attempt to compensate for the

increased frequency and severity of natural catastrophes, the low interest rate environment in recent years, and most

recently, economic and social inflation. While existing carriers have increased rates and deductibles, improved market

conditions have also led to several new carriers entering the space in 2021, as an increase in the number of filers shows

within the chart at the bottom of this page. If this trend continues over time, it could drive rates lower as competition

increases.

According to the Council of Insurance Agents and Brokers (CIAB) fourth quarter Market Report, commercial premium

rates increased in all lines for seventeen consecutive quarters (see chart below), with the exception of workers’

compensation. Further, the CIAB indicated that commercial premium rates increased by an average of 8.1% for all lines

in Q4 2021, which included an 8.0% increase in commercial auto rates – marking 38 consecutive quarters of rate

increases within this line. The CIAB also indicated that workers’ compensation rates began increasing in the second

quarter of 2020 following 21 consecutive quarters of decreasing premium rates.

Source: The Council of Insurance Agents & Brokers, Commercial Property/Casualty Market Index – Q4/2021

Capacity

Twenty consecutive years of industry profits have contributed to an all-time high in policyholders’ surplus. As a result,

industry capacity has never been more abundant as evidenced by a net writings leverage ratio of 66.8%.

(5.0%)

-

5.0%

10.0%

15.0%

20.0%

25.0%

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q

2017 2018 2019 2020 2021

All Commercial LOBs Commercial Auto Workers' Comp Commercial Property General Liability Umbrella

66.8%

60%

65%

70%

75%

80%

85%

90%

95%

100%

105%

110%

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Net Writings Leverage

2,842

2,743

2,620

2580

2621

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21

No. of P&C Filers

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [3]

PREMIUM

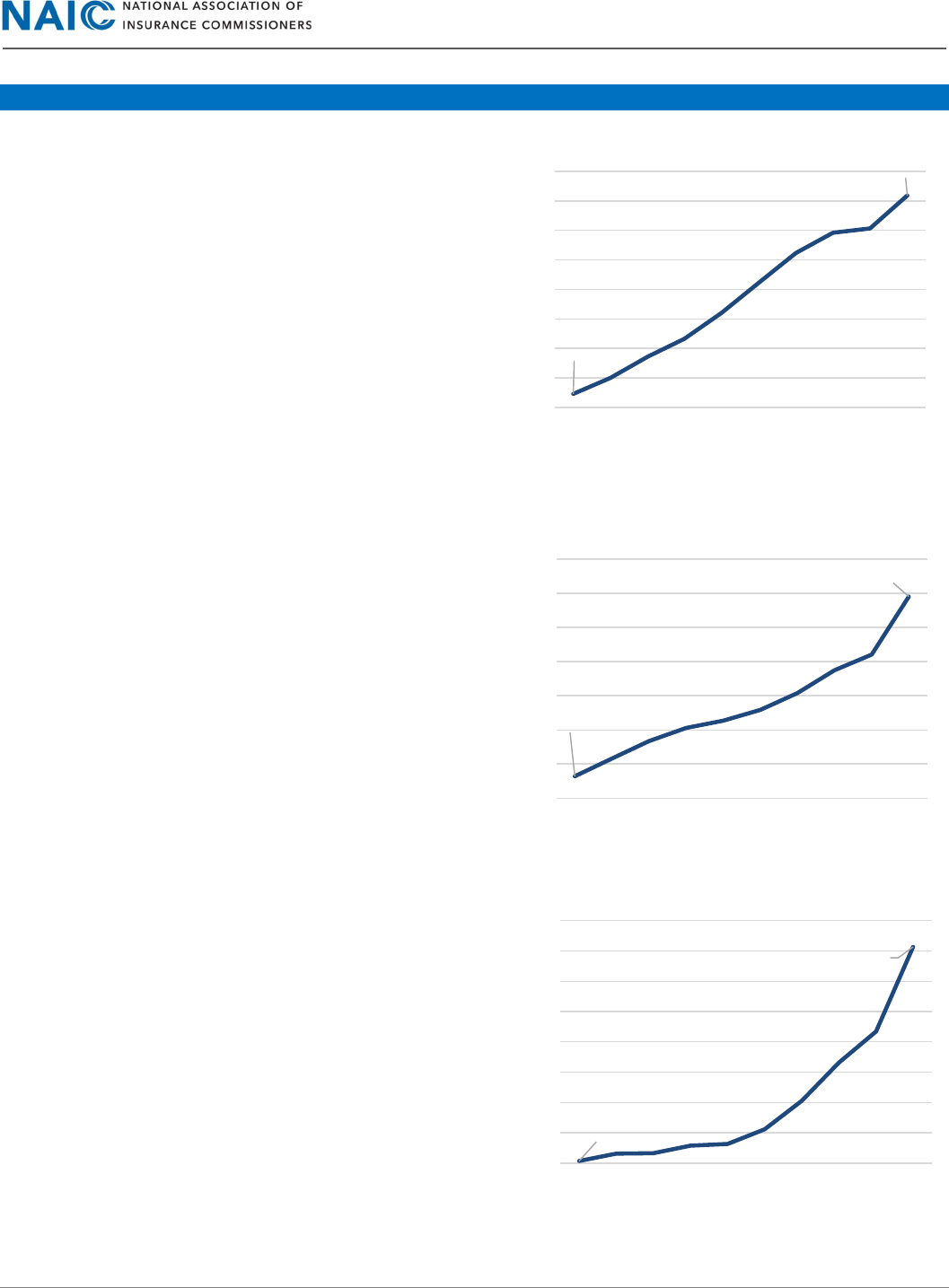

Direct premiums written (DPW) in the property and casualty

insurance industry rebounded from the prior year, which

was impacted by Covid, increasing 9.5% year-on-year (YoY)

to $797.5 billion in 2021. This represents the largest YoY

increase over the past ten years, which has averaged 4.8%.

The Personal Lines Market represented 49.4% of total DPW

and rose 6.0% due to increases in private passenger auto

liability of 3.3%, a 7.3% increase in auto physical damage

DPW, and an 8.4% increase in homeowners DPW as insurers

continued to respond to increased catastrophe loss severity

and frequency with rate increases.

DPW in the Commercial Lines Market represented 37.4% of

total DPW and saw a 12.9% increase during 2021. The other

liability line (35.5% of commercial DPW and 13.3% of total

DPW) increased 21.8% YoY as insurers continued to seek

rate increases to remain competitive among rising concerns

over increased claim severity, partly due to social inflation.

DPW in the workers’ compensation line increased 2.4% YoY

to $52.2 billion, driven by quarter-over-quarter growth in

the second half of the year as businesses have returned to

normal. Commercial multiple peril DPW increased 7.9% and

commercial auto liability, which has experienced challenges

in recent years (discussed in more detail later), saw a 19.0%

increase in DPW.

The Combined Lines Market represented 13.2% of total

industry DPW and consists primarily of allied lines, inland

marine, and fire insurance, all of which increased by double-

digits. Overall, DPW in the combined lines increased 15.2%

YoY.

Assumed premiums written increased 13.3% YoY to $668.2

billion, of which 88.5% was affiliated assumptions. U.S.

intercompany pooling agreements comprised 58.2% of

reinsured business, followed by 27.6% affiliated non-pooled

business. Ceded premiums written amounted to $745.9

billion, a 13.1% increase compared to last year. Overall, net

premiums written (NPW) increased 9.2% to $719.8 billion.

Geographically, premiums increased in nearly all states and

territories in 2021. The table on the following page shows

the change in DPW and pure direct loss ratio (PDLR) by state.

192,901

298,085

12 13 14 15 16 17 18 19 20 21

DPW Commercial Lines ($M)

259,196

393,736

12 13 14 15 16 17 18 19 20 21

DPW Personal Lines ($M)

70,369

105,693

12 13 14 15 16 17 18 19 20 21

DPW Combined Lines ($M)

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [4]

Direct Writings & Profitability by State and Territory

(in Millions except for percent)

YoY Chg 2021 2020 YoY Chg 2021 2020 2021 2020 2021

2020

AL

9.2%

10,841

9,929

(10.6) pts

61.9%

72.5%

6,476

7,041

10,469

9,712

AK

3.1%

1,711

1,660

(3.2) pts

47.8%

51.0%

798

844

1,670

1,654

AR

9.9%

14,093

12,825

7.3 pts

61.5%

54.2%

8,332

6,785

13,548

12,519

AR

6.3%

6,415

6,036

(2.5) pts

64.5%

67.0%

4,017

3,910

6,230

5,838

CA

11.0%

96,312

86,740

2.0 pts

56.2%

54.2%

51,888

45,962

92,253

84,767

CO

10.5%

16,368

14,811

3.0 pts

63.1%

60.1%

9,876

8,691

15,649

14,458

CT

8.6%

10,016

9,226

3.8 pts

61.0%

57.2%

5,908

5,219

9,692

9,128

DE

11.8%

3,262

2,918

(8.6) pts

52.4%

61.0%

1,641

1,775

3,135

2,911

DC

9.5%

2,328

2,127

(0.1) pts

46.3%

46.4%

1,032

962

2,228

2,072

FL

12.0%

66,397

59,277

(4.2) pts

60.4%

64.6%

37,927

37,141

62,844

57,538

GA

10.5%

26,514

24,002

0.2 pts

63.2%

63.0%

16,130

14,752

25,510

23,408

HI

8.2%

2,891

2,672

1.1 pts

47.0%

46.0%

1,310

1,221

2,786

2,656

ID

11.9%

3,849

3,439

4.9 pts

62.2%

57.3%

2,282

1,903

3,667

3,322

IL

11.1%

30,485

27,432

(5.1) pts

57.8%

62.9%

16,743

16,902

28,959

26,858

IN

9.2%

13,581

12,434

2.7 pts

56.0%

53.3%

7,361

6,503

13,138

12,204

IA

14.9%

8,055

7,009

(55.1) pts

61.7%

116.8%

4,815

8,027

7,807

6,873

KS

10.6%

7,896

7,142

8.9 pts

55.4%

46.5%

4,235

3,242

7,645

6,978

KY

6.8%

8,600

8,049

15.9 pts

68.6%

52.6%

5,737

4,210

8,369

7,999

LA

5.7%

13,256

12,539

48.6 pts

166.6%

118.1%

21,362

14,656

12,819

12,414

ME

8.9%

2,771

2,544

(13.3) pts

48.0%

61.3%

1,285

1,531

2,674

2,496

MD

6.3%

13,781

12,968

0.6 pts

53.7%

53.1%

7,217

6,818

13,429

12,832

MA

8.9%

18,331

16,839

0.5 pts

48.4%

47.9%

8,560

7,889

17,684

16,468

MI

3.0%

21,331

20,713

8.4 pts

63.6%

55.3%

13,336

11,434

20,955

20,695

MN

9.6%

14,037

12,804

(3.0) pts

59.1%

62.1%

8,028

7,805

13,593

12,567

MS

9.8%

6,343

5,774

(7.3) pts

60.0%

67.4%

3,669

3,807

6,109

5,651

MO

9.1%

14,263

13,077

(4.2) pts

58.1%

62.3%

8,027

7,964

13,810

12,782

MT

13.4%

3,073

2,709

8.3 pts

64.7%

56.4%

1,887

1,489

2,915

2,641

NE

11.9%

6,073

5,427

(1.3) pts

55.3%

56.6%

3,263

3,002

5,896

5,302

NV

10.2%

7,050

6,395

2.3 pts

58.6%

56.3%

3,955

3,518

6,749

6,247

NH

8.2%

2,834

2,620

2.4 pts

45.2%

42.7%

1,245

1,110

2,756

2,598

NJ

8.4%

24,785

22,872

8.7 pts

65.8%

57.1%

15,771

12,940

23,982

22,659

NM

6.7%

4,041

3,787

7.2 pts

59.4%

52.2%

2,328

1,944

3,920

3,727

NY

9.7%

55,034

50,150

(0.1) pts

61.6%

61.7%

32,545

30,443

52,792

49,312

NC

8.9%

19,677

18,073

3.4 pts

58.4%

54.9%

11,080

9,717

18,987

17,688

ND

12.8%

2,991

2,651

17.8 pts

92.0%

74.2%

2,688

1,955

2,923

2,636

OH

8.2%

19,747

18,247

(0.3) pts

53.6%

53.9%

10,216

9,649

19,077

17,908

OK

7.5%

9,354

8,699

6.4 pts

62.4%

56.0%

5,645

4,808

9,044

8,586

OR

8.5%

8,533

7,864

(16.7) pts

59.9%

76.7%

4,951

5,929

8,259

7,735

PA

7.3%

28,340

26,422

1.3 pts

58.3%

57.0%

15,997

14,925

27,433

26,164

RI

7.4%

2,880

2,682

2.3 pts

54.9%

52.5%

1,553

1,393

2,831

2,651

SC

8.7%

12,103

11,134

(2.7) pts

55.7%

58.4%

6,518

6,375

11,697

10,911

SD

16.9%

3,049

2,609

(10.4) pts

65.2%

75.6%

1,931

1,938

2,960

2,563

TN

8.9%

14,200

13,038

(13.2) pts

59.4%

72.7%

8,133

9,245

13,688

12,723

TX

10.7%

70,749

63,931

20.2 pts

79.0%

58.8%

53,345

36,659

67,520

62,326

UT

11.0%

6,344

5,715

(7.7) pts

55.8%

63.5%

3,374

3,511

6,044

5,530

VT

(6.0%)

1,417

1,508

3.4 pts

45.1%

41.7%

625

622

1,386

1,489

VA

8.0%

16,597

15,361

2.5 pts

53.7%

51.2%

8,651

7,730

16,115

15,105

WA

9.3%

15,263

13,970

7.8 pts

62.1%

54.3%

9,121

7,453

14,699

13,732

WV

4.9%

3,141

2,994

7.4 pts

54.1%

46.7%

1,669

1,415

3,084

3,029

WI

7.2%

12,160

11,348

3.8 pts

54.1%

50.4%

6,426

5,626

11,871

11,171

WY

9.8%

1,457

1,326

(12.6) pts

46.3%

59.0%

643

763

1,388

1,295

AS

(72.3%)

0

0

(131.1) pts

(117.6%)

13.5%

(0)

0

0

0

GU

(0.4%)

316

318

6.4 pts

50.1%

43.7%

153

135

305

309

PR

5.3%

2,599

2,467

(55.1) pts

11.6%

66.7%

288

1,600

2,492

2,401

VI

(9.4%)

176

194

25.6 pts

27.3%

1.7%

51

3

186

183

MP

(1.7%)

22

22

129.0 pts

186.1%

57.1%

38

13

20

22

Totals 9.5% 797,532 728,174 2.6 pts 62.2% 59.6% 477,165 425,385 767,008 713,504

State

Direct Premiums Written

Pure Direct Loss Ratio

Losses Incurred

Premiums Earned

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [5]

UNDERWRITING OPERATIONS

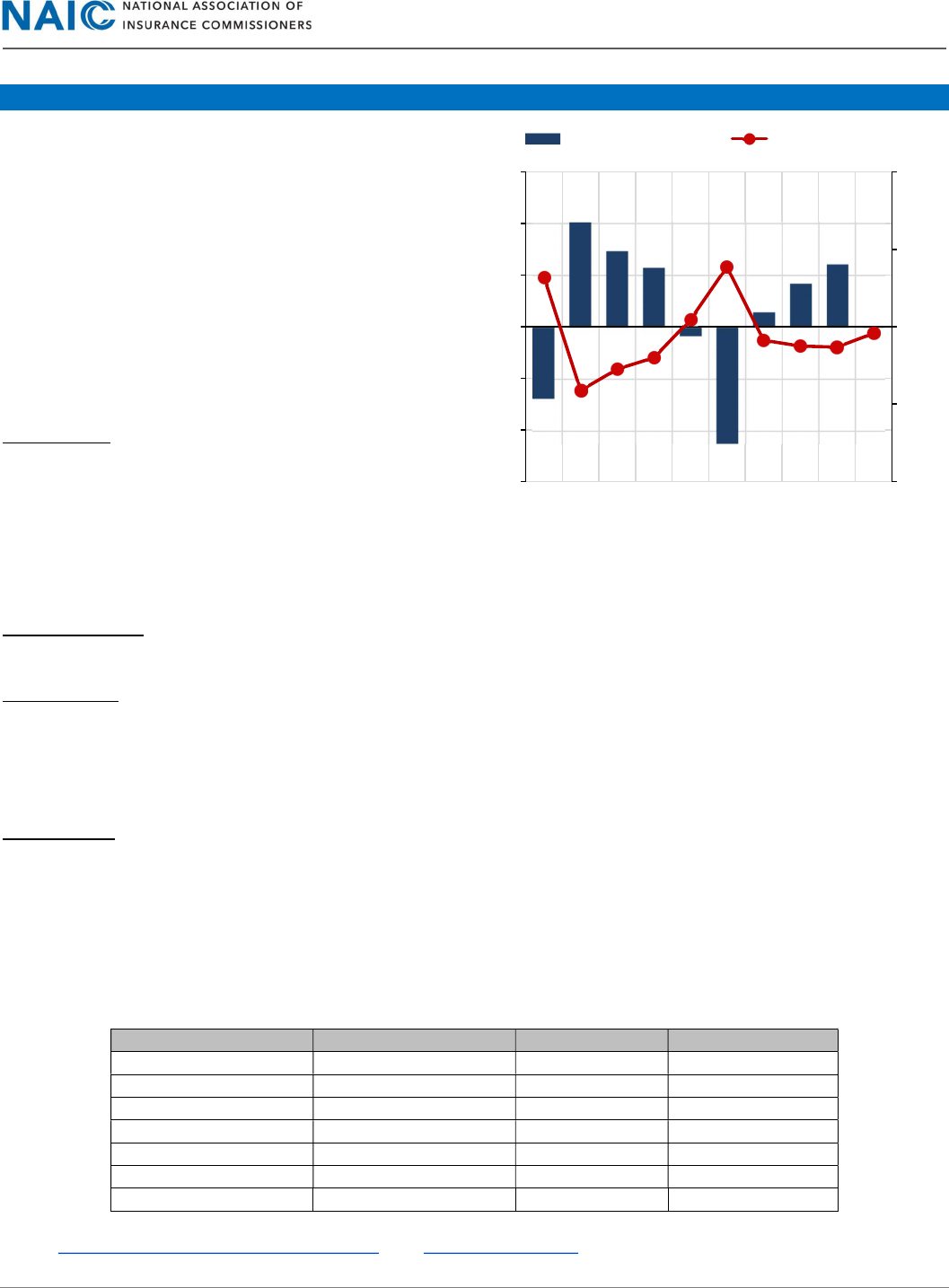

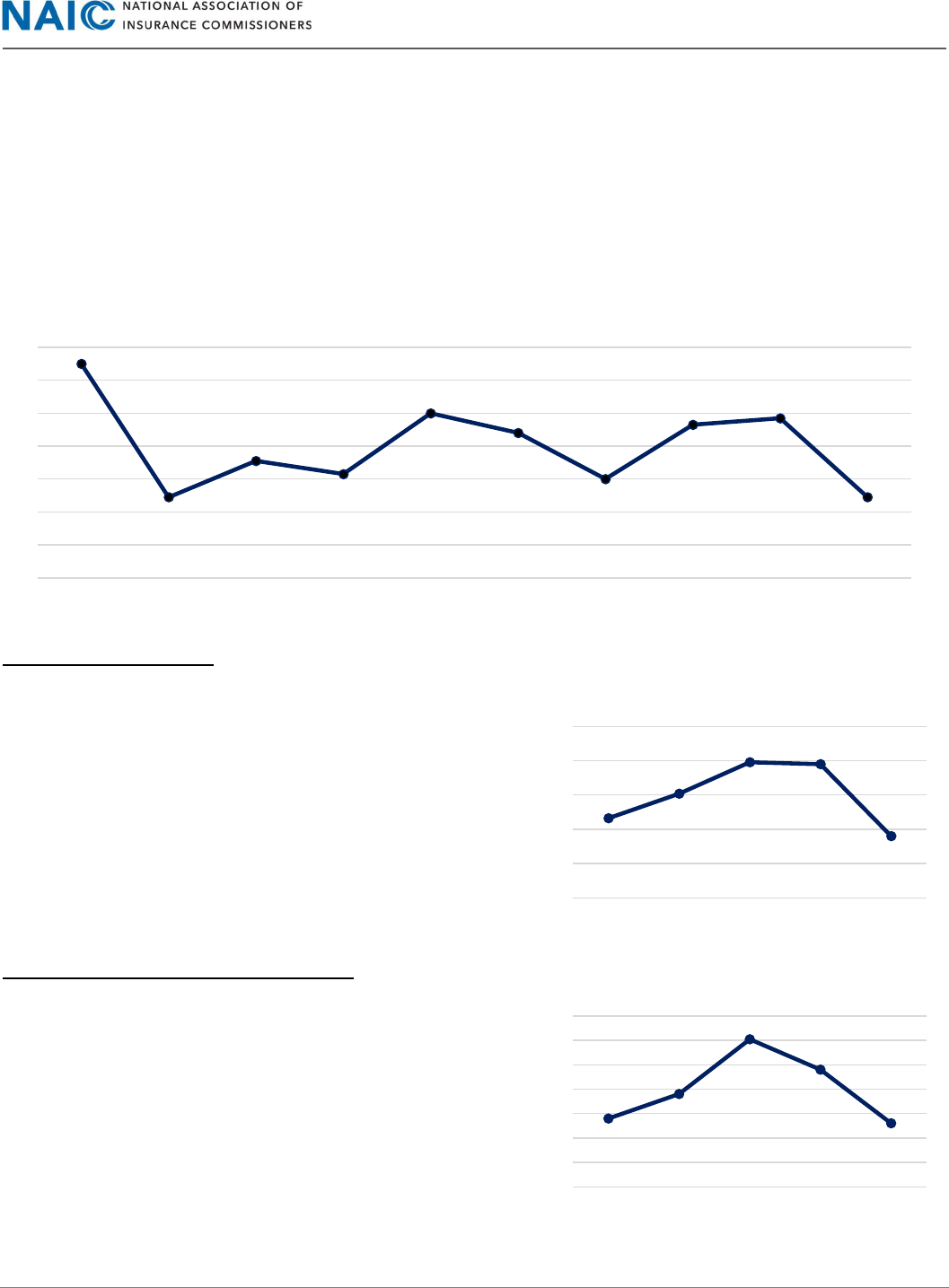

Following three consecutive years of underwriting gains,

the property and casualty insurance industry reported an

underwriting loss of $39.0 million for 2021. The

underwriting loss came despite a 7.4% increase in net

premiums earned, however, net losses and Loss

Adjustment Expense (LAE) incurred increased 11.0%

primarily due to higher catastrophe losses and worsening

results in personal auto. Although underwriting expenses

increased, the expense ratio was 1.0-point lower than

last year due to the growth in net premiums written.

Overall, the combined ratio worsened by nearly 1.0-point

to 99.6% (72.5% net loss ratio and 27.3% expense ratio).

Catastrophes

According to the National Centers for Environmental

Information, National Oceanic and Atmospheric

Administration (NOAA), there were 20 weather/climate

disaster events with total losses of more than $1 billion in the U.S. in 2021. These events included 11 severe storms, 4

tropical cyclones, 2 floods, 1 wildfire event, and 1 winter storm. Overall costs for these events were $148.0 billion. The

costliest events are discussed below.

Tropical Cyclones – Overall costs of tropical cyclones were roughly $80.2 billion. Hurricane Ida, the costliest natural

disaster in 2021, with overall losses estimated at $65.0 billion, made landfall as a category 4 storm in Louisiana.

Severe Storms – There were 11 severe storms with an overall cost of $20.8 billion in 2021. The most significant event

occurred in September in the central and southeastern regions of the U.S. Several reports indicated that dozens of

tornadoes with wind speeds of up to 190 miles per hour impacted six states, with Kentucky receiving the most damage.

The city of Mayfield was hardest hit when an EF4 tornado destroyed large parts of the city. Overall losses totaled

roughly $5 billion for this event.

Winter Storm – In February, a cold wave brought freezing temperatures and record snowfall in the central U.S.,

impacting areas as far south as Houston, Texas. Texas was primarily impacted as the state’s energy, infrastructure, and

buildings were inadequately prepared for such conditions. Snow and ice also caused widespread road closures, leaving

thousands of people stranded. This event caused roughly $24.5 billion in overall losses.

The annual average of $1 billion dollar events from 1980 to 2021 is 7.7 events. The annual average for the most recent

5 years is 17.8 events (CPI-adjusted). Since 1980 the U.S. has sustained a total of 323 events where overall costs reached

or exceeded $1 billion. The table below shows the distribution of damage from U.S. billion-dollar disasters by time

period.

Time Period Billion Dollar Disasters Events per Year Overall Cost

1980-1989 31 3.1 $195.2B

1990-1999 55 5.5 $298.4B

2000-2009 67 6.7 $558.0B

2010-2019 128 12.8 $891.5B

Last 5 yrs. (2017-2021) 89 17.8 $764.9B

Last 3 yrs. (2019-2021) 56 18.7 $306.6B

2021 20 20.0 $148.0B

Source: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters

(2022). https://www.ncei.noaa.gov/access/billions/, DOI: 10.25921/stkw-7w73

90%

95%

100%

105%

110%

($30)

($20)

($10)

$0

$10

$20

$30

12 13 14 15 16 17 18 19 20 21

U/W Income ($B) Combined Ratio

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [6]

Impact to States: The table to the right shows the deterioration in the

PDLR in the states primarily impacted by the largest natural disasters in

2021

Personal Lines Market

The personal lines market comprised half of industry premiums in 2021 and experienced a downturn in operating

results due to the increase in natural catastrophes noted above, and a deterioration in personal auto results. The

combined ratio worsened 5.5-points to 102.1%.

Personal Auto

In 2021, business activity returned to normal levels following the 2020 COVID-19 shutdowns that resulted in less driving

and auto claims activity. However, during 2021 results normalized as claims activity returned to typical frequency

compounded by inflation and supply chain issues that boosted the cost of claims. Overall, net losses incurred totaled

$95.4 billion for the private passenger auto liability line versus $81.4 billion in 2020. Private passenger auto physical

damage net losses incurred increased 35.7% YoY to $73.8 billion.

As seen in the charts above, the pure net loss ratio (PNLR) in private passenger auto liability (20.6% of total NPW in

2021) worsened 7.6-percentage points to 76.0%, while private passenger auto physical damage (14.5% of total NPW)

saw a 17.0-percentage point deterioration to 80.1%.

Homeowners

While results slightly improved, the homeowners line was unprofitable again in 2021 with a combined ratio of 103.8%,

down from 107.4% in 2020. In recent years, an increase in frequency and severity of natural catastrophes placed

pressure on homeowners profitability, with underwriting losses in four of the last five years. While many insurers have

102.6%

98.4%

99.6%

100.9%

102.7%

104.0%

99.4%

98.7%

96.7%

102.1%

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Personal Lines Combined Ratio

State

Chg. In PDLR

PDLR 2021

PDLR 2020

LA

48.6-pts

166.6%

118.1%

KY

15.9-pts.

68.6%

52.6%

TX

20.2-pts.

79.0%

58.8%

NJ

8.7-pts.

65.8%

57.1%

82.3%

77.3%

78.4%

68.4%

76.0%

2017 2018 2019 2020 2021

PNLR Private Psgr. Auto Liab.

75.2%

70.4%

71.2%

63.1%

80.1%

2017 2018 2019 2020 2021

PNLR Private Psgr. Auto Phys. Dmg

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [7]

raised premiums in response to the increase in natural disasters, inflation has been the latest headwind for the

industry, as the price of building materials, labor, and fuel has been on the rise.

Commercial Lines Market

Overall, commercial lines performed better in 2021 as evidenced by a combined ratio of 96.9%, as seen in the chart

below. Increased pricing in the commercial market provided a boost to insurers’ bottom lines. However, certain liability

lines continued to face challenges, as many had combined ratios over 100 percent. The largest liability lines of business

in the commercial market are discussed in more detail below:

Other Liability-Occurrence

Various types of coverage fall within the other liability line,

including, professional, environmental, general liability, directors

and officers (D&O), and employers’ liability. Loss costs have

trended upward in recent years primarily due to adverse

development of prior accident year reserves and rising costs due to

social inflation. D&O liability saw a 13.0% increase in premium rates

according to the CIAB report, the second highest premium increase

among all commercial lines behind umbrella, likely due to higher

incurred losses which have increased 76.8% over the past five

years. Overall, the combined ratio for the other liability-occurrence

line was 99.0%, the first year since 2013 it was below 100 percent.

Commercial Multiple Peril (Liability Portion)

Commercial multiple peril covers a variety of risk exposures

including, but not limited to, fire, allied lines, difference in

conditions, and various liability coverages. The combined ratio for

the non-liability portion improved 2.9-points to 109.2% in 2021.

Results in the liability portion of commercial multiple peril

improved slightly, evidenced by a 4.4-point improvement in the

combined ratio to 101.2%. Despite the slight YoY improvement, this

line has been unprofitable for six consecutive years and nine out of

the last eleven years. Litigation trends have been largely to blame

for the trend in poor results.

105.0%

96.9%

99.1%

98.3%

102.0%

100.8%

98.0%

101.3%

101.7%

96.9%

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Commercial Lines Combined Ratio

101.6%

103.6%

108.1%

105.6%

101.2%

2017 2018 2019 2020 2021

Commercial Multi-Peril Combined Ratio

101.6%

105.2%

109.8%

109.5%

99.0%

2017 2018 2019 2020 2021

Other Liab-Occurrence Combined Ratio

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [8]

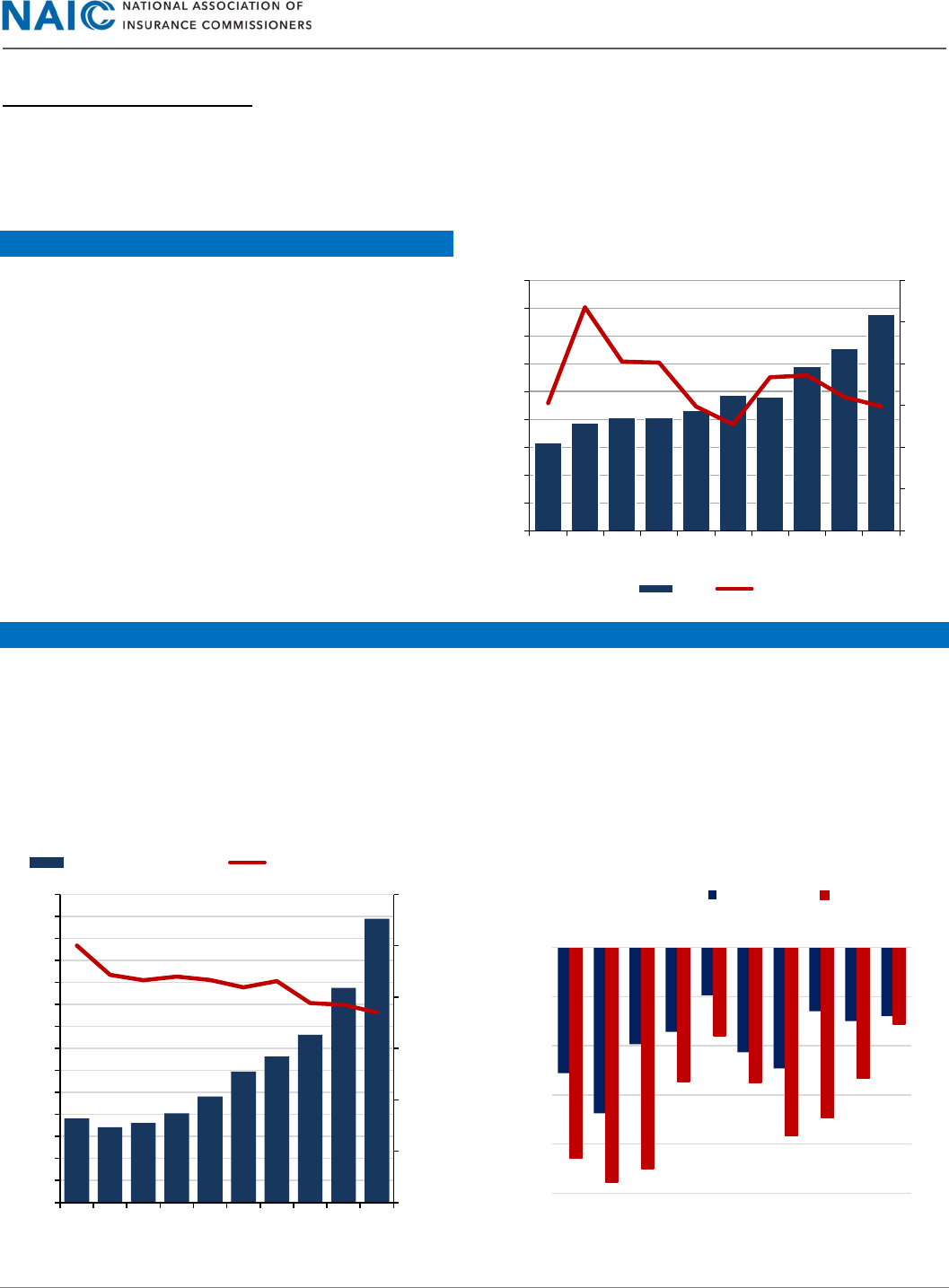

Commercial Auto Liability

A trend of underwriting losses within the commercial auto liability

space continued, a trend that began in 2011. Adverse development

of prior accident year reserves and a sharp rise in nuclear verdicts

have contributed to the negative trend. Insurers have increased

rates each quarter for 38 consecutive quarters, according to the

CIAB (see CIAB report on page 2). The combined ratio for the

current year was 101.4%, a small improvement compared to

107.1% for 2020.

Medical Professional Liability

Medical professional liability insurance protects physicians and

health care professionals from liability associated with wrongful

practices that result in bodily injury, medical expenses, and

property damage. It also covers the cost of legal fees to defend an

insured, and judgements or settlements resulting from claims and

lawsuits. This line of business has generated poor underwriting

results for eight consecutive years due to a trend of rising loss costs

and diminishing prior year reserve takedowns. For the current year,

the growth in net premiums earned increased at a greater rate than

net losses incurred, resulting in a small improvement in the

combined ratio to 108.0%.

Workers’ Compensation

Workers’ compensation is the second largest commercial line at

6.2% of total net premiums written in 2021 and has seen eight

consecutive years of underwriting profits due, in large part, to the

release of prior accident year reserves. As a result, market

conditions have been soft, as average premium pricing decreased

each quarter from 1Q-2015 to 1Q-2020 and has recently been flat

(as noted on page 2). While workers’ compensation remained

profitable in 2021, a slight deterioration was noted as the combined

ratio worsened 0.9-points to 91.9%. In addition, the accident year

loss ratio has increased each year since 2016 to 76% for the 2021

accident year. Overall, the profitable trend within this line is largely

due to prior year reserve releases.

113.5%

111.7%

114.0%

107.1%

101.4%

2017 2018 2019 2020 2021

Commercial Auto Liab Combined Ratio

101.4%

104.1%

112.2%

112.1%

108.0%

2017 2018 2019 2020 2021

Medical Prof Liab Combined Ratio

92.2%

86.2%

88.5%

91.0%

91.9%

2017

2018

2019

2020

2021

Workers' Compensation Combined

Ratio

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [9]

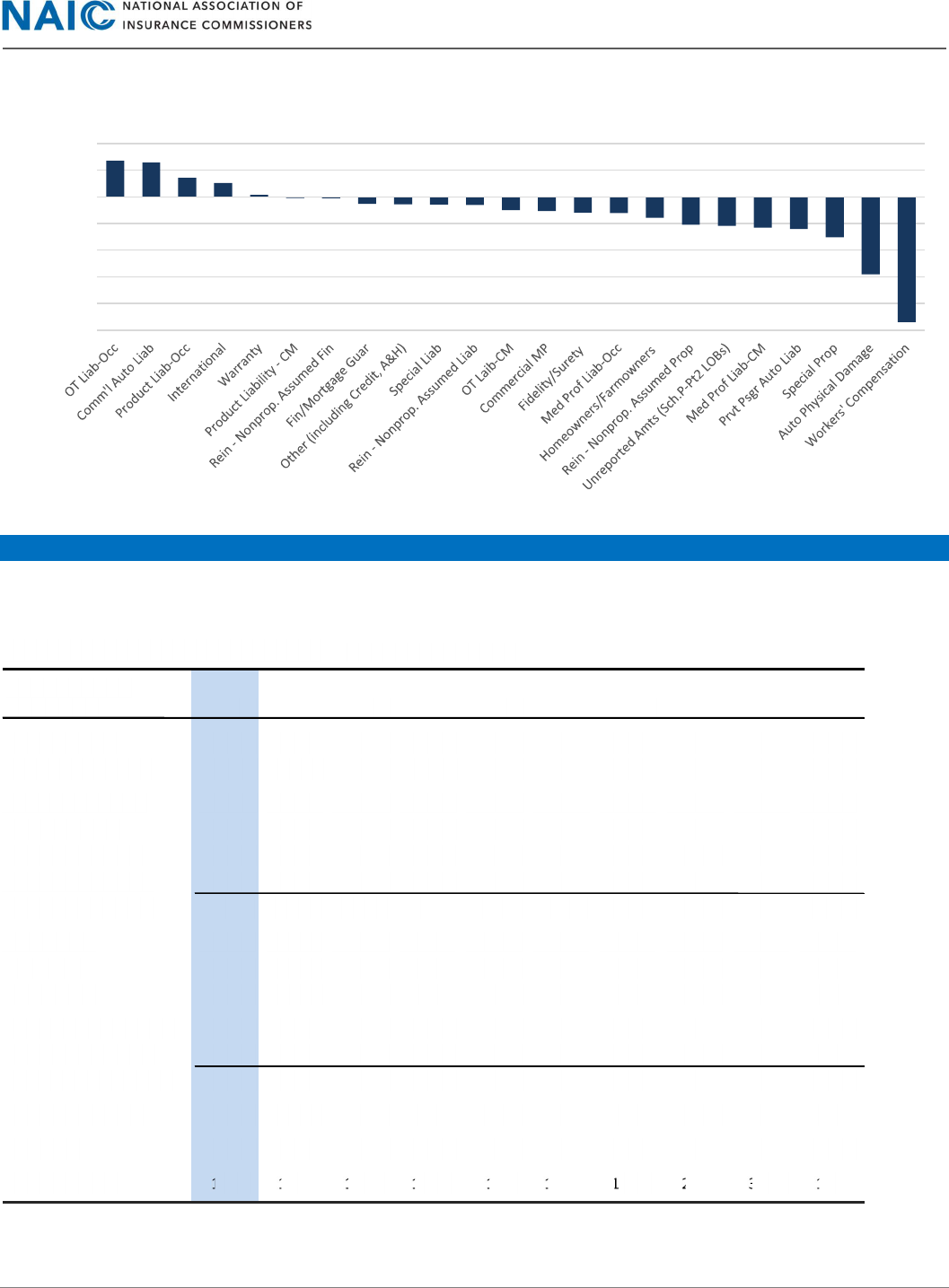

Combined Ratio by Lines of Business

Lines of Business 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012

Aggregate Write-ins 116.7% 108.7% 76.2% 81.1% 41.2% 83.5% 83.7% 125.4% 64.0% 56.3%

Aircraft (all perils) 90.9% 107.0% 131.2% 111.5% 109.2% 113.1% 100.7% 89.1% 99.5% 98.5%

Allied Lines 104.6% 112.5% 105.0% 130.7% 182.0% 96.6% 88.1% 85.4% 85.3% 129.9%

Boiler and Machinery 71.5% 85.9% 72.8% 86.3% 76.5% 78.8% 69.9% 76.1% 72.4% 80.1%

Burglary and Theft 86.6% 113.8% 74.2% 78.1% 49.1% 46.2% 61.4% 59.9% 42.2% 58.6%

Commercial Auto Liab 101.4% 107.1% 114.0% 111.7% 113.5% 113.2% 111.3% 103.6% 107.5% 106.3%

Commercial Auto Phy Dmg 90.2% 85.3% 95.5% 97.0% 104.2% 102.0% 100.9% 103.1% 104.9% 109.1%

Commercial MP (Liab) 101.2% 105.6% 108.1% 103.6% 101.6% 105.6% 99.3% 103.5% 103.0% 94.1%

Commercial MP (Non-Liab) 109.2% 112.1% 103.1% 108.4% 111.8% 99.1% 91.9% 97.1% 94.4% 114.6%

Credi t 78.1% 108.2% 84.9% 93.6% 90.8% 92.1% 76.5% 74.7% 74.9% 91.3%

Credi t A & H 95.5% 106.5% 86.7% 84.8% 128.3% 120.9% 42.3% 45.2% 45.0% 49.5%

Earthquake 36.8% 37.2% 28.7% 44.6% 43.6% 33.9% 28.5% 34.3% 30.5% 36.7%

Excess Workers' Comp 105.2% 89.4% 113.8% 116.6% 123.6% 109.2% 112.0% 107.4% 69.3% 151.4%

Farmowners MP 97.2% 106.2% 99.3% 97.0% 105.7% 91.1% 89.9% 95.4% 94.0% 99.5%

Fidelity 65.8% 78.8% 90.6% 73.4% 74.0% 78.4% 77.2% 92.7% 92.9% 99.3%

Financial Guaranty 46.8% 246.3% 181.7% 130.5% 320.1% 177.2% 99.2% 91.3% (3.4%) 181.2%

Fire 105.9% 103.7% 95.8% 110.8% 119.2% 92.3% 85.1% 85.4% 78.5% 86.5%

Group A & H 94.8% 92.2% 97.8% 90.7% 90.5% 98.4% 100.1% 96.9% 99.9% 94.1%

Homeowners MP 103.8% 107.4% 98.6% 104.1% 107.8% 93.4% 92.1% 92.7% 90.3% 104.0%

Inland Marine 86.9% 97.5% 86.5% 86.4% 90.0% 84.0% 83.9% 83.5% 83.8% 96.2%

International 107.9% 106.7% 153.4% 145.3% 130.7% 144.3% 2.0% 116.7% 92.6% 91.5%

Medical Prof Liab 108.0% 112.1% 112.2% 104.1% 101.4% 106.4% 102.3% 104.7% 89.4% 93.3%

Mortgage Guaranty 31.5% 62.8% 32.8% 29.2% 40.4% 49.8% 58.1% 70.2% 98.0% 189.7%

Multiple Peril Crop 94.9% 100.3% 108.6% 85.0% 84.1% 81.7% 99.9% 104.9% 103.3% 104.0%

Ocean Marine 100.7% 98.0% 105.2% 100.2% 110.5% 95.8% 94.7% 91.2% 98.1% 109.2%

Other A & H 111.8% 98.4% 128.0% 149.6% 133.1% 128.6% 132.0% 126.6% 132.5% 133.0%

Other Liab - Claims-Made 93.7% 100.4% 97.6% 91.0% 98.9% 103.4% 98.6% 88.1% 97.4% 100.4%

Other Liab - Occur 99.0% 109.5% 109.8% 105.2% 101.6% 114.9% 103.3% 101.5% 96.4% 104.9%

Private Crop 122.0% 148.3% 117.5% 126.9% 107.5% 122.3% 146.2% 138.8% NA NA

Private flood 65.0% 50.6% 59.6% 55.0% 186.2% 93.1% NA NA NA NA

Products Liability 100.5% 87.9% 108.6% 122.9% 102.1% 119.8% 130.6% 134.4% 155.2% 102.2%

Prvt Psgr Auto Liab 99.8% 94.8% 101.6% 100.4% 105.5% 109.5% 107.9% 103.8% 103.5% 103.2%

Prvt Psgr Auto Phy Dmg 103.9% 89.2% 94.6% 93.6% 98.2% 101.7% 99.5% 100.3% 98.7% 100.2%

Reinsurance-Nonproportional 108.2% 101.2% 98.1% 109.1% 122.8% 78.6% 72.3% 63.2% 72.9% 79.8%

Surety 69.6% 79.4% 71.3% 70.9% 72.2% 72.4% 73.8% 69.3% 72.7% 76.8%

Warranty 87.7% 84.1% 104.8% 95.4% 90.6% 88.8% 107.9% 93.5% 104.2% 99.5%

Workers' Comp 91.9% 91.0% 88.5% 86.2% 92.2% 95.4% 95.9% 102.6% 98.8% 111.2%

NA = Not Available

Note: Federal Flood is not shown due to negative combined ratio results

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [10]

INVESTMENT OPERATIONS

Net investment income rebounded from a periodic

downturn last year driven by the pandemic. Net

investment gains increased 13.5% to $71.1 billion

versus $62.7 billion last year. Realized capital gains

jumped 64.5% to $18.2 billion, as gains on unaffiliated

common stocks more than doubled to $14.3 billion and

gains on affiliated common stocks were $800.9 million

versus losses of $1.4 billion last year. The industry

reported a $3.9 billion realized gain from bonds, down

40.1% from last year as gains from U.S. Government

bonds were down 97.3% to $83.2 million. Further, gains

on other invested assets were down 35.7% to $2.6

billion. Net investment income earned increased 2.6%

YoY to $52.9 billion. Investment income earned was

primarily derived from bonds at 50.4% of the total,

while stocks comprised 25.9%, and other invested assets

18.0%. Despite the continued solid investment results,

investment yield continued its downward trend to

2.60% versus 2.75% last year.

Bonds continued to comprise the majority of cash and

invested assets accounting for 48.6% of the total at

December 31, 2021. However, the low interest rate

environment has pressured insurers to seek investment

gains through more risky investments. The industry’s

cash and invested assets composition is shown in the

chart to the right.

NET INCOME

The property and casualty insurance industry reported

net income of $60.5 billion for the year, a 2.3%

improvement compared to last year, primarily driven by

the above-mentioned $71.1 billion in investment gains.

Return on revenue—a measure of net income to net

premiums earned, net investment income earned, and

realized capital gains (losses)—was slightly lower at 7.9%

versus 8.4% for the prior year.

CASH & LIQUIDITY

Net cash provided by operating activities increased

25.8% to $124.3 billion. Premiums collected net of

reinsurance rose 9.1% to $713.1 billion, leading to an

8.7% increase in operating cash inflows. Benefit and loss

related payments rose 8.0% to $378.7 billion and

policyholder dividends decreased 43.7% or $3.6 billion

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

$0

$10

$20

$30

$40

$50

$60

'12 '13 '14 '15 '16 '17 '18 '19 '20 '21

Investment Income ($B)

Investment Income Earned Net Realized Gains (Losses)

Investment Yield

0%

2%

4%

6%

8%

10%

12%

14%

16%

$0

$10

$20

$30

$40

$50

$60

$70

$80

'12 '13 '14 '15 '16 '17 '18 '19 '20 '21

Profitability ($B)

Net Income ROR

Bonds

48.6%

Unaffiliated Equities

21.4%

Affiliated Equities

14.1%

Other Long-term

Investments

7.5%

Cash & S-T

Investments

6.2%

Other

2.3%

Cash & Invested Assets at Dec. 31, 2021

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [11]

Cash and Liquidity, Continued…

to $4.6 billion. Overall, cash outflows were 5.9% or $36.2 billion higher than 2020.

The industry liquidity ratio improved 2.0-points to 75.2% since the prior year end. Liquid assets increased 14.8% while

adjusted liabilities increased at a lesser pace of 11.9%.

CAPITAL & SURPLUS

Industry aggregated policyholders’ surplus (adjusted for

affiliated investments) increased 12.8% to an all-time

high of $1.1 trillion at December 31, 2021 versus $955.1

billion at the prior year end.

Twenty consecutive years of industry profits have fueled

growth in surplus as this figure has increased 275.0%

since 2002. Along with net income, adjusted unrealized

gains of $86.8 billion boosted surplus for the current

year.

Return on surplus—a measure of net income to average

policyholders’ surplus—was 0.4-points lower than last

year at 6.0%.

LOSS & LAE RESERVES

Total Loss and LAE reserves increased 8.5% to $797.7 billion and was comprised of $665.2 billion unpaid losses and

$132.5 billion unpaid LAE. Reserve leverage improved 3.0-points to 74.0% compared to 77.0% at the prior year-end.

The trend of favorable prior year reserve development continued with a one-year redundancy of $7.0 billion and a

two-year redundancy of $7.8 billion. Current market conditions, which have prompted insurers to increase rates,

particularly in the commercial market, have offset concerns from recent rising economic and social inflation. However,

prolonged inflation could impact the accuracy of reserves.

($25.0)

($20.0)

($15.0)

($10.0)

($5.0)

$0.0

12 13 14 15 16 17 18 19 20 21

Prior Year Reserve Development ($B)

One-Year Two-Year

-

20%

40%

60%

80%

100%

120%

$540

$560

$580

$600

$620

$640

$660

$680

$700

$720

$740

$760

$780

$800

$820

12 13 14 15 16 17 18 19 20 21

Net Reserves ($B) Reserve Leverage

0%

2%

4%

6%

8%

10%

12%

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

$1,200

'12 '13 '14 '15 '16 '17 '18 '19 '20 '21

Policyholders' Surplus ($B)

PHS ROS

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [12]

REINSURANCE

The following table is a snapshot of the insurance industry’s professional reinsurers, or those insurers that account for

75% of the industry’s unaffiliated assumptions.

$(50,000)

$(40,000)

$(30,000)

$(20,000)

$(10,000)

$-

$10,000

$20,000

(Thousands)

PY Reserve Development by LOB in 2021

Professional Reinsurers Financial Snapshot

(in millions, except for percent)

2021

2020 2019

2018

2017

2016

2015

2014 2013 2012

Unaffiliated APW

57,973

56,827

44,083

39,369

37,342

36,487

36,432

35,869

34,514

35,883

Net Premiums Written

135,830

100,393

97,665

102,364

78,930

73,687

78,029

86,744

64,407

55,497

Net Premiums Earned

129,328

96,084

95,537

96,362

73,471

72,117

75,213

82,367

60,604

54,927

Net Losses Incurred

84,049

62,887

60,662

64,632

52,949

43,799

42,049

47,613

30,774

36,730

Loss Expenses Incurred

11,033

8,997

9,225

9,165

7,197

6,953

7,815

8,903

6,009

5,916

Underwriting Expenses

34,382

26,446

26,438

27,725

21,196

20,816

21,631

21,801

19,205

15,688

Underwriting Gain (Loss)

(165)

(2,260) (765)

(5,065)

(7,867)

528

3,697

4,096

4,619

(3,405)

Net Loss Ratio

73.5%

74.8%

73.2%

76.6%

81.9%

70.4%

66.3%

68.6%

60.7%

77.6%

Expense Ratio

25.3%

26.3%

27.1%

27.1%

26.9%

28.2%

27.7%

25.1%

29.8%

28.3%

Combined Ratio

98.8%

101.2%

100.2%

103.7%

108.7%

98.6%

94.1%

93.8%

90.6%

106.0%

Net Investment. Inc. Earned

13,417

12,966

14,720

17,021

12,587

11,794

13,087

19,503

15,699

13,846

Net Realized Gains (Loss)

3,074

5,810

3,464

2,423

2,875

2,443

2,142

3,219

10,081

521

Net Investment. Gain (Loss)

16,491

18,776

18,184

19,443

15,462

14,237

15,229

22,722

25,780

14,368

Investment Profit Ratio

12.8%

19.5%

19.0%

20.2%

21.0%

19.7%

20.2%

27.6%

42.5%

26.2%

Net Income

15,005

16,119

15,324

13,584

1,055

13,283

16,010

21,120

26,625

9,617

Return on Revenue

10.3%

14.0%

13.5%

11.7%

1.2%

15.4%

17.7%

20.1%

30.8%

13.9%

For the year ended

December 31,

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [13]

Assumed premiums written in the property and casualty industry totaled $668.2 billion, a 13.3% increase compared to

$590.0 billion in 2020. Affiliated assumptions totaled $591.6 billion and unaffiliated totaled $76.6 billion. The

professional reinsurance market consists of the reinsurers that comprise 75% of the total unaffiliated assumptions. In

2021, 25 reinsurers assumed $58.0 billion in premiums. As seen in the table on the previous page, underwriting results

within the professional reinsurance market have been negative for five consecutive years, primarily due to the increase

in frequency and severity of natural catastrophes in recent years. For the current year the underwriting loss totaled

$165 million versus $2.3 billion last year. The combined ratio improved 2.4-points to 98.8%. Strong investment returns

and total other income of $1.1 billion (mostly due to a large retroactive reinsurance gain from one reinsurer) resulted

in net income of $15.0 billion, a decrease of $1.1 billion compared to last year.

The reinsurance market has hardened recently, particularly for loss-impacted property lines due to elevated

catastrophe loss activity. In addition, lower investment returns, and most recently, a trend of increasing loss severity

in liability lines, have caused reinsurers to increase rates.

EMERGING RISKS

Social Inflation

Social inflation is a term used to describe the potential for rising insurance claim costs resulting from increased

litigation, broader definitions of liability, more plaintiff-friendly legal decisions, and larger compensatory jury

awards. Social inflation has the potential to emerge through both traditional product liability exposures (e.g., asbestos

or opioids) as well as behavioral liability exposures (e.g., breach of privacy, sexual misconduct, or corporate

misconduct). In addition, social inflation exposures can emerge under various lines of coverage (e.g., general liability,

products liability, or workers’ compensation).

Emerging prevalence of litigation financing firms, whereby third-party capital is now being made available to finance

the pursuit of class-action and mass tort lawsuits is considered the primary driver of social inflation. Hedge fund

managers now see multibillion-dollar lawsuits as valuable investments as legal fund investment units are popping up

within hedge funds. Third party litigation finance totaled $17 billion in 2021 according to a December 2021 Swiss Re

report, U.S. Litigation Funding and Social Inflation. In addition, a recent study produced by the Insurance Information

Institute and the Casualty Actuarial Society found that social inflation increased claims for commercial auto liability by

over $20 billion between 2010 and 2019, which represented a 14% increase above projected losses.

Supporters of third-party financing believe it is a way to create equity and fairness and balance the interests between

consumers and insurance companies. Insurers claim that shock verdicts have led to reduced liability coverage and

higher pricing in the liability market and have called for government and regulatory assistance to put controls in place,

including transparency about litigation funding programs.

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

Reinsurance -

nonpro

assumed

property

Reinsurance -

nonpro

assumed

liability

Other liability

- occurrence

Home Commercial

multiple peril

Prvt Psgr auto

liab.

Fire Allied lines Workers'

compensation

Other liability

- claims-made

Unaffiliated Assumptions by Largest Lines of Business ($M)

2021 2020

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [14]

Economic Inflation

The U.S. economy has shown signs of rising inflation, with various measures spiking to their highest levels in over forty

years. Rising economic inflation in recent months has had impact on loss costs, which could impact reserve adequacy

and underwriting profitability for many lines of business. This has been more evident in property coverages as supply

chain issues have led to higher costs for building materials, replacement parts, and labor. In addition, rising inflation

has the potential to impact the value of a wide range of assets held by insurers, particularly fixed income holdings that

are not able to be held to maturity. Finally, inflation has the potential to lead to rapidly rising interest rates, which

could drive increased surrender activity, margin calls on certain derivatives, and have other significant life insurance

product impacts.

Cyber Insurance

While cyber coverage is not a new risk to the industry,

it continues to evolve as the demand continues to

skyrocket and data breaches has become more

widespread. According to the Council of Insurance

Agents and Brokers (CIAB) Q4 Market Report, cyber

was the most troubled line of business in Q4 2021 as

respondents reported an average premium increase of

34.3% compared to Q4 2020. The CIAB noted that

historical underpricing and an increase in frequency

and severity of cyberattacks have had a significant

impact on the market. In Q4 2021, 76% of respondents

reported a decrease in underwriting capacity, the

highest of any commercial line of business. Further,

carriers were reducing cyber limits and imposing more

restrictive terms and higher deductibles.

Despite reduced capacity, cyber insurance direct premium written increased 75.0% YoY to $4.8 billion in 2021, of which

65.3% consisted of stand-alone policies and 34.7% package policies. At the same time, policies in force decreased to

3.7 million from 4.0 million a year ago, while the total number of claims reported climbed to 25,667 from 22,718. Direct

losses increased 30.5% to $1.6 billion. As seen in the chart below, stand-alone coverage has become by far the most

popular coverage with businesses in recent years due to broader coverage options. The PDLR for stand-alone coverage

was 65.0% in 2021 versus 72.7% in 2020.

$746

$898

$912

$1,010

$1,462

$994

$1,114

$1,265

$1,640

$3,152

2017 2018 2019 2020 2021

Cyber Premium ($M)

Package Stand-Alone

$85

$898

$117

$251

$382

$141

$220

$342

$700

$898

2017 2018 2019 2020 2021

Cyber Paid Losses ($M)

Package Stand-Alone

Source: The Council of Insurance Agents & Brokers, Commercial

Property/Casualty Market Index

–

Q4/2021

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [15]

Title Insurance Industry

Premium

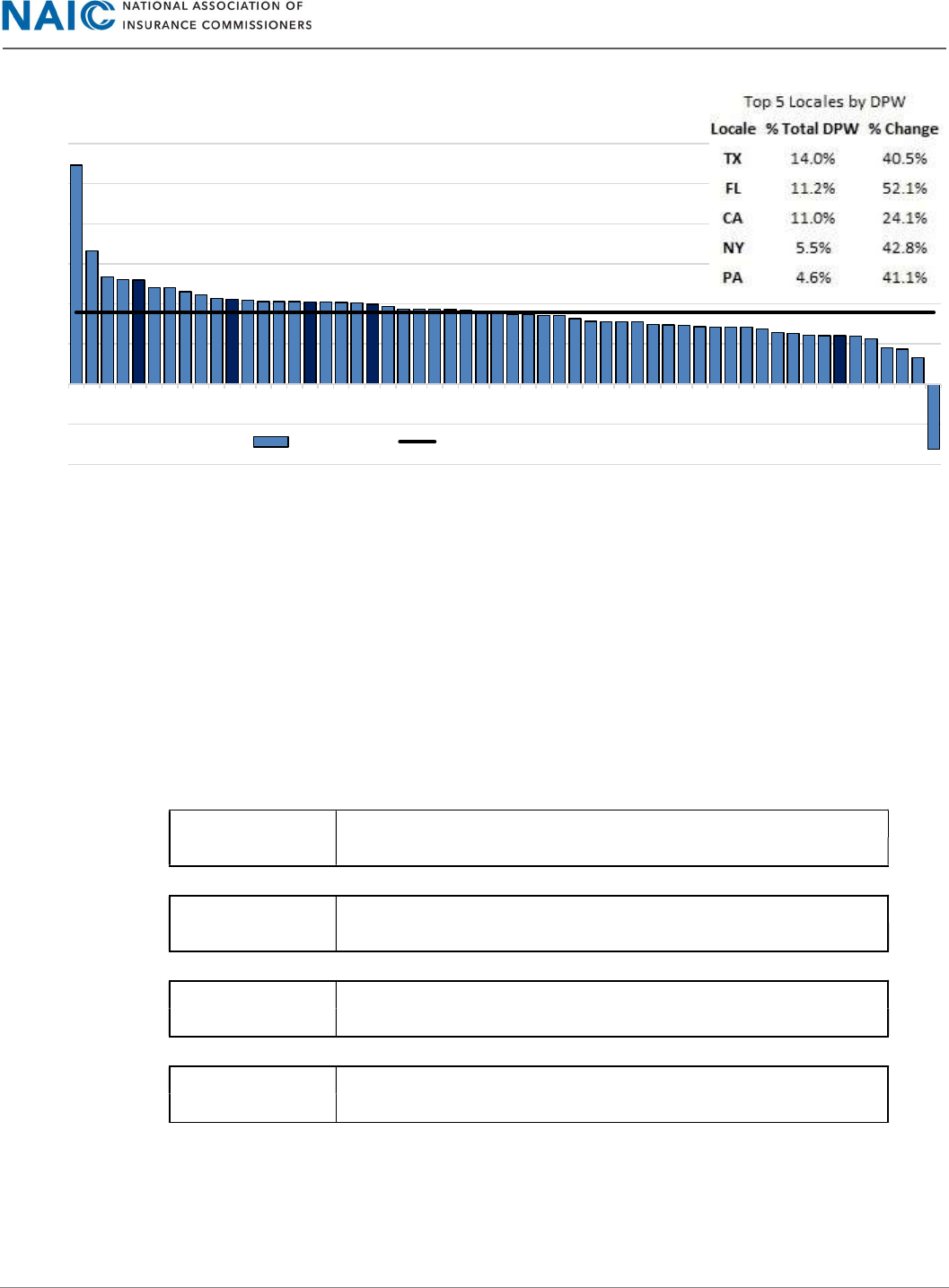

Title industry premiums written were almost entirely on a direct basis through either direct operations or agency

operations. Non-affiliated agencies represented 64.6% of Direct Premiums Written (DPW) in 2021. Overall, DPW

increased 35.9% to $26.4 billion in 2021 due to higher average revenue from both commercial and residential purchase

transactions driven by increased real estate values. Net premiums written totaled $26.3 billion, indicating that

reinsurance is rarely used by title insurers. Net retention increased 0.1 points to 99.7%.

The five largest states by DPW (TX, FL, CA, NY, and PA) saw

Florida move up one spot to second but were otherwise

unchanged from recent years. These five states represent

46.3% of the 2021 market, up 1.0 point from 2020. Four

of the five (excluding CA) saw year-on-year (YoY) DPW

growth above the average of 35.9%. Puerto Rico (109.2%),

Delaware (66.6%), Rhode Island (53.4%), Florida (52.1%)

and Wyoming (51.9%) all grew over 50% by DPW, while

Northern Mariana Islands (-35.9%) was the only decrease

and Oregon (13.2%) saw the smallest growth.

$2.8 B

$2.0 B

$2.0 B

$1.9 B

$1.7 B

$16.9 B

$12.2 B

$9.8 B

$9.2 B

$9.2 B

$6.5 B

$5.1 B

$4.1 B

$3.7 B

$3.7 B

$0

$5 B

$10 B

$15 B

$20 B

$25 B

$30 B

20212020201920182017

Direct Premiums Written: Title ($B)

Direct Ops. Non-Aff. Agency Ops. Aff. Agency Ops.

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [16]

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development March 2022 report indicated

that during 2021, there were 1.6 million new housing starts (non-seasonally adjusted), up 16.0% from 2020. Seasonally

adjusted new housing starts were up 3.9% in March 2022 vs March 2021 (4.8% without seasonal adjustment). This

growth in housing starts is concentrated in the Northeast, with some growth in the West, and decreases in the Midwest

and the South. New housing permits and starts have seen strong growth since March 2020, while new housing

completions are down 13.0% vs March 2021 and slightly above (2.8%) March 2020.

$ amounts

per policy

# Policies

Net

Premiums

Earned

Direct

Losses

Paid

Direct

Allocated

LAE Paid

Direct

Losses and

LAE

incurred

Direct

Known

Claim

Reserves

Direct

2021

2,174,237 $1,294

$33

$23

$49

$66

2020

1,889,654 $1,102

$35

$25

$61

$71

Non-affiliated Agents

2021

15,879,032 $1,040

$8

$7

$19

$24

2020

12,878,232 $927

$10

$10

$20

$30

Affiliated Agents

2021

7,446,772 $843

$8

$7

$12

$18

2020

6,438,910 $781

$8

$8

$16

$19

Overall

2021

25,500,041 $1,004

$10

$9

$19

$26

2020

21,206,796 $898

$12

$11

$23

$30

-40.0%

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

120.0%

PR

DE

RI

FL

WY

IA

CT

AR

OK

NY

TN

ME

VT

AL

PA

NC

MD

SC

TX

NJ

MS

OT

ID

VA

MT

GA

SD

VI

AZ

IL

NE

WV

MI

KY

OH

MA

UT

MO

MN

NV

DC

NM

NH

IN

HI

ND

LA

WI

CA

WA

KS

GU

AK

CO

OR

MP

YoY DPW Change by State

YoY change Average

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [17]

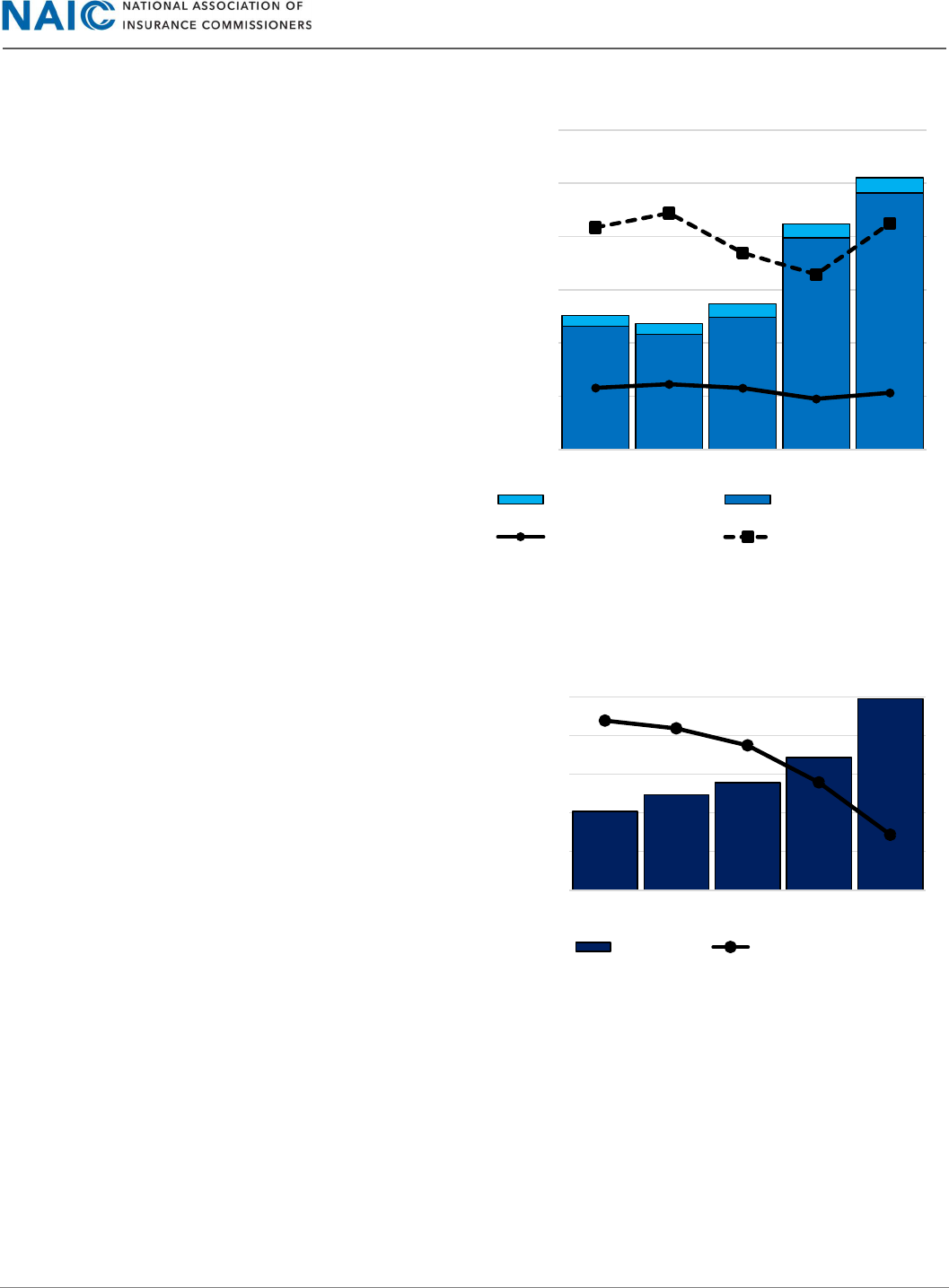

During 2021, 25.5 million policies were issued, a 20.2%

increase over 2020. Residential policies increased 21.1%

to 24.1 million while non-residential policies increased

7.4% to 1.4 million. Residential policies accounted for

$21.4 million (81.1%) of the $26.4 million in DPW, or an

average of $887 per residential policy. Non-residential

policies averaged $3,540 per policy. This was an average

YoY increase of 11.7% per residential policy and 29.1% per

non-residential policy.

Collectively, the industry recorded $1,004 per policy in

premiums earned, direct losses and allocated LAE incurred

of $19 per policy, and $18 per policy in taxes, licenses, and

fees. These values were similar to 2020’s results of $898 in

net premiums earned, $23 in expenses paid, and $15 in

taxes per policy. While polices issued directly had a net

premium earned per policy ($1294) that was 24.5% higher

than those issued by non-affiliated agencies ($1040) or

53.6% higher than those from affiliated agencies ($843),

the expenses paid and incurred ($106) were 210.7% ($34)

and 302.8% ($26) higher, respectively.

Profitability

Net income for the industry totaled $2.5 billion, a 44.6%

increase over 2020 and the fourth year in a row of double-

digit net income growth driven by strong operating

performance. Operating income increased 22.2% to $27.6

billion. Net operating gains increased 48.5% compared to

2020 to $2.7 billion, more than double the operating gains

in 2019. Premiums earned grew faster than expenses in

three of past five years, assisted by a decrease in 2021 in

losses and LAE expenses incurred. The title industry

recorded net operating gains for ten years in a row, with

YoY growth increasing each year. This was the fifth

consecutive year in which operating gains have increased

as a percentage of operating income.

Net investment gains increased 23.8% over 2020 to $427 million, above both the five- and ten-year averages and equal

to the three-year average. Net investment income earned decreased from $385 million to $330 million, a five-year low

while net realized gains increased to $97 million, the second highest in five years. This was the first time in the past ten

years that net investment gains fell below 20% of net income, continuing the trend of operating income dominating

net income that started in 2018.

The combined ratio improved 2.7 points over 2020 to 94.9%, the third year in a row below 100%. Improvements

happened in both the net loss ratio (down 0.6 points to 2.3%) and the expense ratio (down 2.0 points to 92.6%). This

was the fifth year in a row the combined ratio improved.

11.6 M

10.8 M

12.4 M

19.9 M

24.1 M

1.0 M

1.0 M

1.3 M

1.3 M

1.4 M

$964

$1,023

$961

$794

$887

$3,476

$3,701

$3,078

$2,741

$3,541

-

5.0 M

10.0 M

15.0 M

20.0 M

25.0 M

30.0 M

2017 2018 2019 2020 2021

Policy Count and Average DPW / Policy

Non-Residential Policies Residential Policies

Avg Residential DPW Avg Non-Residential DPW

$1,015 M

$1,230 M

$1,391 M

$1,713 M

$2,476 M

100.8%

100.4%

99.5%

97.6%

94.9%

$0 M

$500 M

$1,000 M

$1,500 M

$2,000 M

$2,500 M

2017 2018 2019 2020 2021

Five Years of Net Income ($M) and the

Combined Ratio

Net Income Combined Ratio

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [18]

Capital & Surplus

Policyholder Surplus (PHS) increased 14.5% since 2020 to

$7.1 billion as of December 31, 2021, more than double the

PHS as of December 31, 2012. The 2021 increase was

dominated by net income, offset by $1.7 billion in dividends

paid. Net unrealized capital gains, the second largest

contributor to the gain, decreased 23.0% to $179.2 million,

but still exceeded the sum of all other non-dividend PHS

deductions by $53.3 million. Return on surplus increased

8.3 points to 37.1%, the highest since 2014.

Cash & Liquidity

Net cash from operations increased for the seventh

consecutive year to $3.3 billion or 52.9% over 2020. This

was the largest YoY increase in the previous ten years.

Premiums collected net of reinsurance were up 36.2%,

which drove cash from operations inflows up 34.7%.

Commissions, expenses paid, and aggregate write-ins for

deductions (95.3% of all operation outflows) increased

32.7% while federal and foreign income taxes paid, the

second largest at 2.7% of cash from operations outflows,

increased 67.2%.

Net cash from investments totaled -$925.3 million, driven by increased investments in bonds (up $529.9 million) and

stocks (up $557.6 million). Other invested assets decreased $88.3 million in 2021, largely offsetting the $104.9 million

gain seen in 2020. Net cash from financing and miscellaneous sources totaled -$1.8 billion, largely driven by the $1.7

billion in dividends mentioned above.

The net change in cash was $569.6 million, an increase of 155.4% over 2020 to $2.5 billion in cash, cash equivalents,

and short-term investments as of December 31, 2021. The industry’s liquidity ratio improved 2.1 points to 65.0%, the

third year in a row of improvement. Liquid assets increased 19.7% over 2020, while adjusted liabilities only increased

15.9%.

$1,193

$1,441

$1,560

$2,145

$3,280

$34

($214)

($170)

($437)

($925)

($1,201)

($1,003)

($1,067)

($1,486)

($1,785)

$25

$225

$323

$223

$570

68.6%

66.9%

68.9%

67.1%

65.0%

($2,000)M

($1,000)M

$0 M

$1,000 M

$2,000 M

$3,000 M

$4,000 M

2017 2018 2019 2020 2021

Cash Flows ($M) and Liquidity Ratio

Cash From Operations Cash from Investments Cash from Finance Net Cash Liquidity Ratio

$4,818 M $4,909 M $5,664 M $6,229 M $7,135 M

21.1%

25.1%

24.6%

27.5%

34.7%

$0.0 B

$1.0 B

$2.0 B

$3.0 B

$4.0 B

$5.0 B

$6.0 B

$7.0 B

$8.0 B

2017 2018 2019 2020 2021

PHS and Return on Surplus

PHS Return on Surplus

U.S. Property & Casualty and Title Insurance Industries – 2021 Full Year Results

© 2022 National Association of Insurance Commissioners [19]

NAIC Financial Regulatory Services

Financial Analysis and Examination Department

Contributors:

Brian Briggs, Senior Financial Analyst

816-783-8925

Topher Hughes, Financial Analyst

816-783-8125

Contacts:

Bruce Jenson, Assistant Director - Solvency Monitoring

816-783-8348

Andy Daleo, Senior Financial Analysis Manager

816-783-8141

Rodney Good, Property/Casualty & Title Financial Analysis Manager

816-783-8430

DISCLAIMER: The NAIC 2021 Annual Report on the U.S. Property & Casualty and Title Insurance Industries is a limited scope analysis based on

the aggregated information filed to the NAIC’s Financial Data Repository as of December 31, 2021, and written by the Financial Regulatory

Services Department staff. This report does not constitute the official opinion or views of the NAIC membership or any particular state insurance

department.