Federal Aviation

Administration

Memorandum

Date: August 27, 2018

To: Regional Airports Division Directors, Airport District Office Managers,

Compliance Specialists

From: Kevin Willis, Director, Director, Office of Airport Compliance

And Management Analysis, ACO-1

Subject: Compliance Guidance Letter 2018-3, Appraisal Standards for the Sale and

Disposal of Federally Obligated Airport Property

I. Introduction and Purpose

This Compliance Guidance Letter (CGL) was developed to assist and inform FAA field

offices, airport sponsors, and commercial appraisers on the appraisal process required for the sale

and leasing of federally obligated property.

1

FAA views the appraisal process as an integral and

required component to establishing an objective marketable value and protecting the federal

investment in our nation’s airports. This CGL describes the FAA-accepted appraisal process and

report documentation standards for establishing Fair Market Value (FMV) for the sale, exchange,

or leasing of federally obligated property.

Airport sponsors have a federal obligation to establish the FMV for airport property

proposed for disposal. With some limited exceptions, lease rates on airport property used for non-

aeronautical purposes must be based on FMV.

This CGL supports FAA Order 5190.6B, Airport Compliance Manual in further defining

the process for determining FMV. Although this CGL does not address the acquisition of property

under federally assisted projects, some FAA guidance related to land acquisition requirements may

be similar to FAA guidance for land disposal and leasing of non-aeronautical property applicable

1

The document was developed to address a Department of Transportation, Office of Inspector General, requirement

that the FAA Airports Division establish standards regarding appraisals for the sale and disposal of federally obligated

property. See DOT-OIG Audit on Venice Airport, AV-2011-180, September 29, 2011 and DOT-OIG Audit on Denver

Stapleton International Airport, AV2011057, February 28, 2011. It should also be used as guidance for airport

sponsors and appraisers. Field offices are encouraged to share this document with the interested parties. The document

becomes effective September 10, 2018, the revision date)

2

to this CGL. Please consult statutory authority for guidance before conducting an appraisal for

land acquisition.

2

In this CGL, you will find information on these topics:

Governing standards and authorities.

Developing a “scope of work” for procuring an appraiser.

Airport sponsor’s selection of an appraiser.

Features of an appraisal report.

Discussion of the basic valuation process.

Sample Scope of work statements for airport sponsors.

The CGL contains scope of work samples for most appraisal types that airport sponsors

may have to conduct. The CGL also cites the relevant standards and governing authorities for

conducting each type of scope of work.

How to Use this Document

Become familiar with the requirements for airport appraisals as defined in Federal law

and FAA policy beginning with the discussion in Section II. What Do I Need to Know

About Appraisals?

Use Exhibit 1: The Airport Real Property Appraisal Process in Section II as a starting

point to decide what to do about a specific property that may need an appraisal.

Review Section III. Key Authorities. If you need more information on federal

requirements for appraisals, determine if one of the Specific Scopes of Work in Section

V applies to your appraisal. The sample scopes of work are appropriate in most cases.

However, if they are not applicable to your particular appraisal, plan to use the

General Scope of Work in Exhibit 2

Adapt the letter contained in Section V to provide guidance about your particular

appraisal for the airport sponsor and then attach the appropriate Scope of Work.

Examine the definitions of appraisal concepts in the dictionary in Appendix A.

2

For acquisitions of property, sponsors should consult Uniform Relocation Assistance and Real Property Acquisition

Policies Act (42 USC 4601 et seq.) and FAA AC 150/5100-17, Land Acquisition and Relocation Assistance for

Airport Improvement Program Assisted Projects (see

http://www.faa.gov/airports/environmental/relocation_assistance/

).

3

Table of Contents

I. Introduction and Purpose

II. What Do I Need to Know About Appraisals?

Exhibit 1: The Airport Real Property Appraisal Process ……………………………………………... 4

What is an Appraisal? ………………………………………………………………………………… 5

When is an Appraisal Report Required?................................................................................................. 5

What is Fair Market Value?.................................................................................................................... 6

How Do We Know Rent on an Airport Property is at FMV?................................................................. 8

What are the Qualifications of an Appraiser?......................................................................................... 10

Appraiser’s Statement of Competency………………………………………………………………… 12

What is an Acceptable Appraisal Report?............................................................................................... 12

When Is a Review Appraisal Required?.................................................................................................. 13

How to solicit for an Appraiser and Review Appraiser………………………………………………... 15

Property Worth More than $1 million…………………………………………………………………. 15

How to Define a Scope of Work………………………………………………………………………. 15

Exhibit 2: Sample General Scope of Work Statement………………………………………………… 16

Shelf Life of an Appraisal……………………………………………………………………………… 19

Resolving Divergent Valuations between Appraisal Reports…………………………………………... 20

III. Key Authorities…………………………………………………………………………………………. 21

a. Federal Law………………………………………………………………………………………… 21

b. Airport Improvement Program Grant Assurances…………………………………………………. 21

c. FAA Order 5190.6B, Compliance Handbook……………………………………………………… 22

d. FAA Order 5100.38D, AIP Handbook……………………………………………………………... 22

e. FAA Revenue Use Policy…………………………………………………………………………... 23

f. FAA Advisory Circular Number 150/5100-17……………………………………………………... 24

g. Uniform Standards of Professional Appraisal Practice (USPAP)……………………………… …. 24

h. Fair Market Value Definitions……………………………………………………………………… 25

IV. Appraising Airport Land at Fair Market Value…………………………………………………………. 29

Appraising Aeronautical Property……………………………………………………………….………. 30

Appraising Non-aeronautical Property…………………………………………………………………... 31

Appraising Leased Airport Land………………………………………………………………….……... 31

V. Sample Scopes of Work……………………………………………………… ……………………… 33

Appraisal Scope of Work: Disposal of Existing Airport

Appraisal Scope of Work: Disposal of Non-Aeronautical Airport Land

Appraisal Scope of Work: Acquisition of On-Airport Leasehold

Appraisal Scope of Work: Concurrent/Interim Lease of On-Airport Property

Appraisal Scope of Work: Sale/Lease of Oil/Gas/Mineral Rights

Appraisal Scope of Work: Sale/Disposal of Utilities/Pipeline Easement

Appraisal Scope of Work: Disposal/Lease of Hotel

Appraisal Scope of Work: Disposal/Lease of Golf Course

Appraisal Scope of Work: Sale/Lease of Agricultural Land

VI. Sample Letter to Sponsor……………………………………………………………………………… 85

Appendix A: Real Estate Dictionary

4

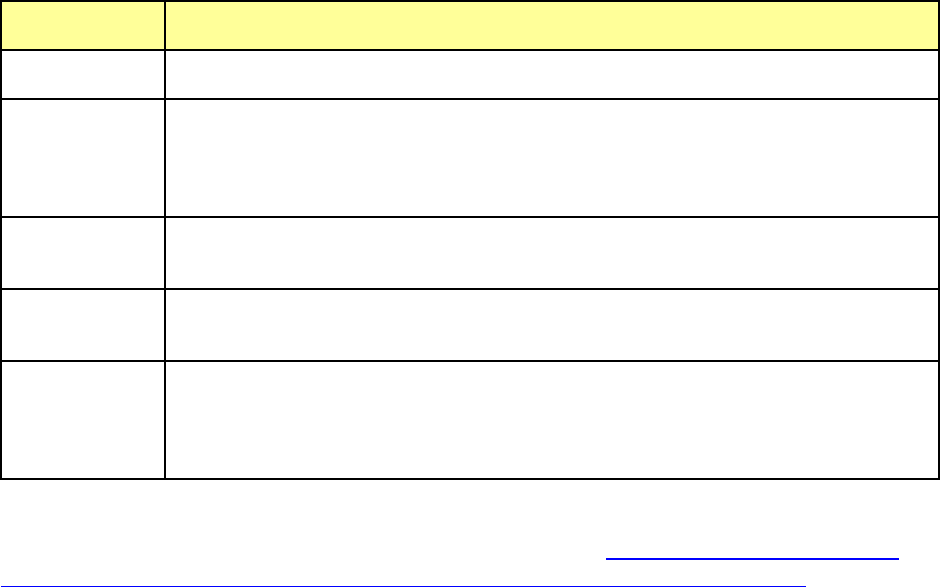

II. What Do I Need to Know about Appraisals?

Exhibit 1 provides an overview of when an appraisal of an airport property is required, the basis of

valuation, qualifications of appraisers, the type of report required, and how to provide guidance to

airport sponsors on hiring an appraiser. It does not contain all of the issues related to airport

appraisals, but is a good starting point.

Exhibit 1: The Airport Real Property Appraisal Process

When Does an Airport Need an Appraisal?

- Establishing fair market value for airport property

- Selling or Exchanging Property worth more than $25,000

3

- Selling an entire airport with FAA approval

- Establishing rates and charges for non-aeronautical land

What is the Basis of Establishing Value?

- Market Value at the highest and best use as defined by Uniform

Standards of Professional Appraisal Practice (USPAP)

4

Qualifications of an Appraiser

- Listed on the National Registry of certified and licensed real estate

appraisers:

https://www.asc.gov/National-Registry/NationalRegistry.aspx

- Prefer airport experience and/or experience with specialized

properties (e.g., land sales, hotels or golf courses, solar panels,

water, oil and mineral rights)

- Experience preparing requests to release airport property

- Extensive knowledge and application of the USPAP

What Kind of Report is Required?

- A written Appraisal Report, as defined by USPAP

- A second Appraisal Report by another appraiser for market values

over $1 million

- A written Review Appraisal of two Appraisal Reports

How Do I Provide Guidance to a Sponsor Hiring an Appraiser?

- Sample letter to sponsor in this CGL

- Scope of Work in this CGL (either general or for specific appraisals)

3

Uncomplicated transaction is vacant marketable land without deductions or encumbrances.

4

Uniform Standards of Professional Appraisal Practice can be accessed at http://www.uspap.org/.

5

What is an Appraisal?

Title 49 CFR Part 24 Uniform Relocation Assistance (URA) and Real Property Acquisition for

Federal and Federally Assisted Programs defines an appraisal in the following way:

The term appraisal means a written statement independently and impartially

prepared by a qualified appraiser setting forth an opinion of defined value of an

adequately described property as of a specific date, supported by the presentation

and analysis of relevant market information.

FAA uses appraisals to establish the FMV of airport property, as do airport sponsors for

determining fees and rates as stated in Grant Assurance 24, Fee and Rental Structure, which states

in pertinent part:

The Airport sponsor will maintain a fee and rental structure for the facilities and

services at the airport that will make the airport as self-sustaining as possible under

the circumstances existing at the particular airport, taking into account such factors

as the volume of traffic and economy of collection.

The purpose of this self-sustaining principle is to protect the Federal investment in the nation’s

airports (see FAA Order 5190.6B, Chapter 17, which discusses the self-sustaining principle).

FAA’s Policy and Procedures Concerning the Use of Airport Revenue, February 16, 1999, (64 FR

7721) (Revenue Use Policy) interprets the self-sustaining principle to require that airports receive

FMV for the sale of airport property and for the leasing of airport property and facilities (land,

buildings, other improvements) for non-aeronautical use.

When is an Appraisal Report Required?

Two conditions are required to initiate an appraisal report:

• There is a need to establish FMV for the sale of airport property, the exchange of airport

property for off-airport property, or to establish lease rates for non-aeronautical use.

• An airport is selling property, except when the sponsor concludes that the appraisal is

uncomplicated and the property value is reasonably determined to be less than 25,000.

5

Under this exception, the sponsor must prepare a waiver valuation to document its

conclusions.

6

A letter to the local FAA office, supported with appropriate documentation of

property values and signed by an airport official knowledgeable of the airport’s property

5

Uncomplicated transaction is an exchange of vacant land marketable without deductions or encumbrances.

6

A waiver valuation is not an appraisal. URA Rule appraisal requirements and USPAP standards relating to appraisals

do not apply to a waiver valuation. Appraisal practice is provided only by appraisers, whereas valuation services are

provided by a variety of professionals and others. Valuation services pertain to all aspects of property value and

include services performed both by appraisers and by others. A waiver valuation is to be prepared by a knowledgeable

person who is aware of the general market values in the airport. The basic concept is to streamline the process.

6

values, is acceptable.

What is Fair Market Value?

FAA and Uniform Standards of Professional Appraisal Practice (USPAP) have similar definitions

for fair market value, or market value. FMV is the cash value of the property if it were sold in a

well-functioning market, assuming an arm’s-length transaction (the buyer and seller are free from

any duress), and the property is exposed to the market for a sufficient period of time for buyers to

evaluate it.

FAA Order 5190.6B, Appendix Z of the Airport Compliance Manual, defines Fair Market Value:

Fair Market Value. The highest price estimated in terms of money that a

property will bring if exposed for sale in the open market allowing a

reasonable time to find a purchaser or tenant who buys or rents with

knowledge of all the uses to which it is adapted and for which it is capable

of being used. It is also frequently referred to as the price at which a willing

seller would sell and a willing buyer buy, neither being under abnormal

pressure. FMV will fluctuate based on the economic conditions of the area.

Implicit in this definition are the consummation of a sale as of a specified date and the passing of

title from seller to buyer under the following conditions:

The buyer and seller are typically motivated.

Both parties are well informed or well advised, and each is acting in what he or she

considers his or her own best interest.

A reasonable time is allowed for exposure in the open market.

7

Payment is made in terms of cash in U. S. dollars or in terms of comparable financial

arrangements.

The price represents the normal consideration for the property sold unaffected by

special or creative financing or sales concessions granted by anyone associated with the

sale.

There is also a discussion of Fair Market Value in FAA Order 5190.6B (see Chapter 17 Self-

Sustainability).

7

Reasonable time will vary by type of property. For example, a house with similar characteristics to those in its

neighborhood may only require a few weeks or months exposure to the market to establish value, whereas a unique

industrial property may require a few years.

7

FMV is the Required Standard When an Airport Sells or Leases Non-Aeronautical Property

To maintain self-sustainability, airports must satisfy these requirements:

Maintain a rate structure, including for airport property leased or sold, that makes the

airport as self-sustaining as possible under the circumstances at the airport (Revenue

Use Policy, Section VI.C).

Obtain FMV for any land it leases or sells to the airport sponsor for other municipal

purposes, developers, non-aviation commercial interests, or other private individuals.

Charge market rent for leasing airport property for non-aeronautical use as well as

determine the market value for the disposal of property that is no longer needed for

airport purposes (AIP Grant Assurance 31, Disposal of Land; projects and systems, and

(d) military aeronautical units).

Prohibit the sale of airport property at less than FMV that diverts revenue away from

the airport in violation of Grant Assurance 25, Airport Revenue.

Retain sufficient property rights and control of any AIP-funded noise land sold,

released, or leased, so that its use and development will always be compatible with

airport operations (See FAA APP-400 guidance “Noise Land Management and

Requirements for Disposal of Noise Land or Development Land Funded with AIP”,

June 2014). The retained property rights must be enforceable and recorded in the local

public land records. The FMV appraisal of land to be disposed or leased long term will

be subject to the needed sponsor retained rights and restrictions on the land (see

appraisal scope of work).

Typical non-aeronautical uses that require FMV include leasing rates for non-aviation facilities

(i.e., ground rentals for commercial development, cargo buildings, hotels, car rental facilities, and

commercial buildings). Land for these non-aeronautical uses should be appraised based on FMV.

FMV is Not the Standard for Setting Aeronautical Rates and Charges

Rates and charges for the airfield (runways and aircraft movement areas) may not exceed the

airport’s capital and operating costs of those facilities. These rates are based on accounting

principles without reference to market conditions; an appraisal is not required to set the rates.

Airport sponsors should consult the FAA Policy Regarding Airport Rates and Charges, 78 FR

55330, September 10, 2013 (Rates and Charges Policy).

The FAA does not require that these rates be set higher than the airport’s capital and operating

costs. So, unless the airport’s objective is to set rates and charges for hangars, aviation offices, and

similar non-movement facilities at FMV, an appraisal is not required.

8

How Do We Know Rent on an Airport Property is at FMV?

The appraiser still has to make judgments about “similar” returns and what properties are

“comparable” when analyzing data on property sales and rentals. Various appraisal and real estate

research organizations periodically publish guidelines to aid appraisers in developing parameters

for rates of returns applicable to different forms of property. The appraiser will have to

specifically take account of the restrictions on the use of airport property (e.g., height restrictions

or the need to go through security) when establishing rates.

One way to think about establishing rental rates based on FMV is to answer the question: How

much would an airport tenant pay monthly to buy the property, allowing the airport sponsor to

make a rate of return on its investment (the property’s value), that is similar to what a property

owner in the local geographic area might earn on comparable properties? This concept is similar

to a mortgage payment, except market rent considers 100 percent of the property’s value and

reflects the overall investor/owner demanded rate of return on their property value. Of course, the

appraiser will not use such a formula as the sole basis of the appraisal, but this approach is a useful

way of thinking about what a market rate rental represents.

Here is a simplified example of a market rent required on a typical airport ground lease which

requires the tenant to construct its own building and pay all operating expenses including any real

estate tax on its development and use of the property:

• Appraised Fair Market Value (FMV) - An appraiser has completed an appraisal of

airport land based on recent market land sales with highest best use for industrial

development similar to the proposed development of airport land (without access to the

ramp) and has concluded that the FMV of the land is $10 per square foot of a typical

building lot.

• Cap Rate - The appraiser determines that a local owner/investor currently would expect

to earn about 8 percent annually on a ground lease for industrial development after

vacancy and land owner management expenses are paid.

• Vacancy Rate -The appraiser finds that in the region’s property market, ground rent

leases for industrial properties have a 3 percent vacancy rate.

• Annual Management Fee Rate - The airport land owner can expect to incur another 5

percent of gross rent annually for airport management expense on the leased property.

Given the above values, what would be the estimated FMV gross rent (before deducting any

airport expenses) charged on a ground lease of airport land, ignoring (for this illustration) all other

factors or assuming they have zero impact in this case?

9

In equation form:

Gross Annual Rent @ FMV = (CAP Rate x Appraised FMV)/(1-Vacancy Rate-Annual

Management Fee Rate)

Gross Rent @ FMV = (8% x $10) / (1- .03 – .05) = $8.70 per square foot/ year (rounded).

The Gross Rent, therefore, to be received on the airport land with an FMV of $10/sq. ft. for

a market required 8% return on value is $8.70 per square foot/year before expenses.

10

What are the Qualifications of an Appraiser?

The sponsor must ensure appraisals are conducted by qualified appraisers. Each state adopted the

USPAP as the governing standards within their jurisdictions. They also developed licensure

standards, which meet or exceed the recommendations of the Appraisal Foundation. All appraisers

should be registered in a National Registry certified or licensed by a U.S. state, territory, or

possession to perform appraisals in connection with federally related real estate transactions

(https://www.asc.gov/National-Registry/NationalRegistry.aspx). Although there is variation from

state to state, the most common categories of licensing are Appraisal Trainee, Residential

Appraiser, Certified Residential Appraiser, and Certified General Appraiser.

Airport properties should be appraised by either a Certified Residential Appraiser (for residences,

usually involved in Part 150 noise issues) or a Certified General Appraiser (who may appraise any

type of property). Preference should be given to an appraiser having extensive airport valuation

experience involving the type of property being assessed at airports of similar or larger size.

All states have a provision for a Temporary Practice Permit for licensed or certified appraisers

from other states who may wish to do appraisal work outside of the state or states in which they are

licensed or certified. Such permits are intended to fulfill the appraisal needs of a state, especially

when demand exceeds the number of available qualified appraisers within the state.

The following exhibit from FAA AC 150/5100-17, Land Acquisition and Relocation Assistance for

Airport Improvement Program (AIP) Assisted Projects summarizes the desirable qualifications of

an appraiser. Airport sponsors should consult FAA AC 150/5100-17, Chapter 2. “Real Estate

Appraisal” for further information about Qualifications, Appraisal Management, and Conflict of

Interest.

11

APPRAISER AND REVIEW APPRAISER QUALIFICATIONS

The qualifications of an appraiser and review appraiser must be adequate for the proposed

appraisal assignment. The sponsor should seek to hire the best-qualified appraiser for the type

of property, the complexity of the acquisition (i.e., whole or partial taking), familiarity and

expertise in the local real estate market, and as applicable experience with acquisitions subject

to eminent domain. Also, the appraiser must not have any apparent conflict of interest in the

property to be acquired, or potentially with a current or prior client relationship with property

owners. An appraiser under consideration for an assignment should be able to submit a resume'

of qualifications citing some or all of the following qualification criteria.

Professional Designations:

American Institute of Real Estate Appraisers: Member Appraisal Institute (MAI) and

Residential Member (RM)

National Association of Independent Fee Appraisers: (IFA)

American Society of Appraisers: (ASA)

International Right-of-Way Association: (SR/WA)

American Society of Farm Managers and Rural Appraisers: (ASFRM)

National Association of Master Appraisers

Other National and local appraisal organization which grant designations upon

completion of educational and experience requirements.

Licensing and Certification under Title XI of the Financial Institutions Reform, Recovery,

and Enforcement Act of 1989 (FIRREA): State laws implementing FIRREA will require

appraisers to meet the mandated educational and experience requirements to secure either a

license or certification. State law may only require the license or certification for FIRREA

mandated transactions (i.e., typically Federally insured real estate loans), or may be required for

all appraisal activity within the state. The Appraisal Qualification Board of the Appraisal

Foundation established by FIRREA, instituted appraiser qualifications for a state license or

certification. A licensed or certified appraiser may only perform appraisals consistent with the

Uniform Standards of Professional Appraisal Practice (USPAP) as required under FIRREA.

Adherence to USPAP requires appraisers to meet specific appraisal standards and a code of

ethics in accepting and performing appraisals. The appraisal requirements contained in 49 CFR

24.103 have been determined to meet the requirements of USPAP, (Appraisal Foundation

Determination, September 1990).

Educational Background: Completion of recognized course work in professional real estate

appraisal principles, processes, and practices. Course providers may be colleges and universities,

professional appraisal organizations, and accredited business and professional schools.

Experience: Verifiable experience in the types of property to be appraised. Experience and

acceptance as an expert appraisal witness in eminent domain and other court proceedings.

Experience with the before and after appraisal process for determining just compensation and the

value of partial acquisitions such as easements.

Client References: Verifiable listing of appraisal clients.

Geographic Area of Expertise: Area where the appraiser has an established practice. Some

appraisers and appraisal firms may have a national scope, while often appraisers limit their work to

specific local areas where they have developed adequate market databases and are fully familiar

with the local markets and real estate trends.

12

Appraiser’s Statement of Competency

Under USPAP, appraisers are required to possess the necessary competence to produce

credible results in their appraisal report. An appraiser must disclose any lack of knowledge or

experience necessary to complete an assignment before accepting the assignment. This disclosure

is particularly important with regard to sub-specialties like airport property.

It is the responsibility of appraisers to determine whether or not they are competent with

regard to a particular assignment. Factors that determine competency may include:

Familiarity and experience level with regard to specific types of appraisals

Regional familiarity

The use of a particular appraisal

Use of an analytical method in developing the appraisal

If appraisers determine they are not competent to accept a particular assignment, they have

three mandatory actions.

First, the appraiser will work with another appraiser who possesses the requisite knowledge

to produce credible results. Second, they will take specific steps to educate themselves and

develop the necessary knowledge to competently complete the appraisal; and third, if these

standards cannot be met, the appraiser must withdraw from the assignment.

What is an Acceptable Appraisal Report?

The FAA will only accept an Appraisal Report that meets the essential steps outlined in

USPAP, 2016-2017 Edition. USPAP Standards Rule 2-2 requires the content of an Appraisal

Report to be consistent with the intended use of the appraisal and contain this information at a

minimum:

1. state the identity of the client and any intended users, by name or type;

2. state the intended use of the appraisal;

3. describe information sufficient to identify the real estate involved in the

appraisal, including the physical and economic property characteristics

relevant to the assignment;

4. state the real property interest appraised;

5. state the type and definition of value and cite the source of the

definition;

6. state the effective date of the appraisal and the date of the report;

7. summarize the scope of work used to develop the appraisal;

8. summarize the information analyzed, the appraisal methods and

techniques employed, and the reasoning that supports the analyses,

opinions, and conclusions; exclusion of the sales comparison approach,

cost approach, or income approach must be explained;

13

9. state the use of the real estate existing as of the date of value and the use

of the real estate reflected in the appraisal; and, when an opinion of

highest and best use was developed by the appraiser, summarize the

support and rationale for that opinion;

10. clearly and conspicuously: state all extraordinary assumptions and

hypothetical conditions; and

11. state that their use might have affected the assignment results; and

12. include a signed certification in accordance with Standards Rule 2-3.

A Restricted Appraisal Report, another option allowable under USPAP, is inappropriate and

unacceptable for FAA use.

When Is a Review Appraisal Required?

The review appraiser will ensure the appraisal process, the resulting FMV, and appraisal report

meet minimum USPAP standards and FAA requirements. Two independent Appraisal Reports

and a Review Appraisal are required for the disposal of the high value property ($1 million) or

more. In the case of large land disposals or subdivision sales, FAA AC 150/5100-17 recommends

hiring a review appraiser before hiring appraisers. This review appraiser may assist in defining

appraisal scope of work.

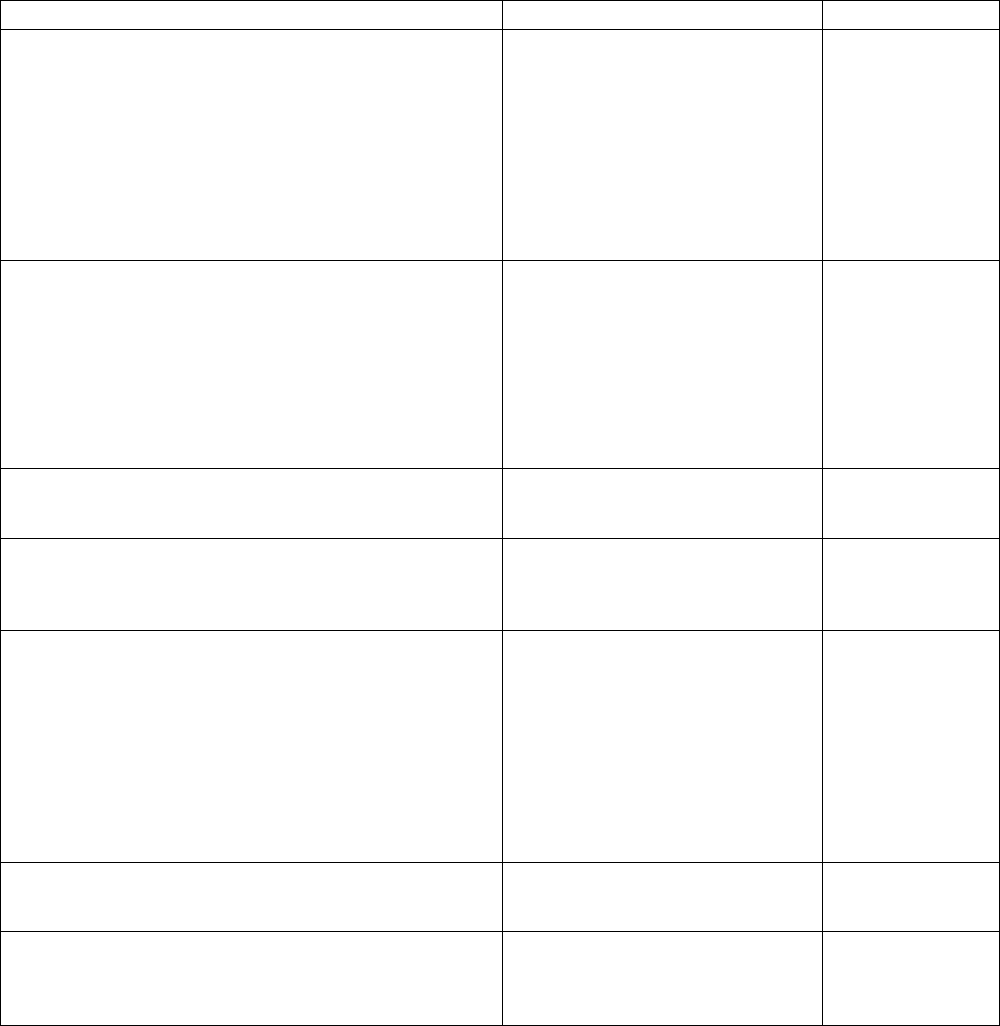

FAA AC 150/5100-17, Figure 2-2 Appraisal Report Requirements provides a description of the

appraisal process, report content, and statutory authority, which are summarized in the following

table.

14

Appraisal Report Requirements

Appraisal Process

Detailed Report Content

49 CFR 24

Define the Appraisal Problem

Identify and Locate the Real Estate

Identify the Property Rights to be Valued

Establish Date(s) of Value Estimate

Identify the Use of the Appraisal

Define Value to be Estimated

Identify Limiting Conditions and Limitations

Parcel Number as shown on

Exhibit "A"

Project Influences Disregarded

E

xisting Ownership: fee,

easement, tenant

Options/contracts

Date of Value, Date of Inspection

Statement of Owner

Accompaniment

Statement of Limiting Conditions

49 CFR

24.103(a)

49 CFR

24.103(a)(1)

Preliminary Analysis and Data Collection

General: Specific: Market

(Supply & Demand):

Geographic Subject Applicable Sub-market

Social Site & Imps. Competing Supply

Economic Costs/Income Sales/Listings

Govt. Interest Rates Vacancies/Absorption

Environ. Use/Ownership Demand Studies

Area, Zoning, Utilities,

Improvements

I

dentification of Special Features

Identification of Adverse

Influences

Market Analysis

Neighborhood Analysis

5 Year Sales History of Property

Encumbrances

49 CFR

24.103(a)(2), (4)

Highest and Best Use Analysis

As Vacant and Available

As Improved

Support and Analysis Presented

49 CFR

24.103(a)(2)

Land/Site Value Estimate

Sales Comparison, Subdivision

Approach,

Income Capitalization (Land

Residual)

49 CFR

24.103(a)(3)

Application of the Three Approaches to Value

S

ales Comparison, Income, Cost Approaches

(As Applicable)

Comparable Sales Verified

Adjustments Explained

Data and Analysis Presented for

Each Sale

Income & Expense Data

Verified

Capitalization Rate Support

Provided

Cost Source, Depreciation

Supported

49 CFR

24.103(a)(3)

Reconciliation

Reasoning presented, relative

strengths and weaknesses of the

approaches discussed

49 CFR

24.103(a)(5), (6)

Report of Defined Value

Appraisal Report

Appraisers Certification

Before & After Analysis (Partial

Acquisitions)

49 CFR

24.103(a)(5)(6)

15

How to Solicit for an Appraiser and Review Appraiser

Airport sponsors can use FAA AC 150/5100-14 as a guide for soliciting and procuring an

appraiser; however, there is no requirement to do so. When hiring appraisers, airport sponsors

should rely on the applicable legal authority and local procedures governing procurement. FAA

requires that the appraisers and review appraiser be from different appraisal organizations.

Property worth more than $1 million

When an airport property is worth more than gross value of $1 million, FAA requires a sponsor to

engage two independent appraisers and a review appraiser. One regular appraisal and a review

appraisal are sufficient for gross values under $1 million. If the two appraisal reports of the

property show divergent fair market values, it is the responsibility of the review appraiser to

determine the FMV based on the information in the two appraisal reports and the review

appraiser’s own views of the market at that time.

How to Define a Scope of Work

The sponsor’s appraisal assignment (solicitation) must contain a scope of work statement to ensure

an appraisal report acceptable to the FAA. Exhibit 2 provides a sample general scope of work

statement to use in procuring a qualified appraiser. The scope of work should be commensurate

with the complexity of the appraisal problem and at a minimum include the following:

a. Purpose and/or function

8

of the appraisal (e.g., appraise fair market value).

b. Requirement that the appraiser must perform an appraisal and develop an Appraisal

Report, as defined under USPAP.

c. Description of the sponsor as the client and any other intended user, each of which must

receive a written Appraisal Report. The FAA is always considered an intended user of

the appraisal report.

d. Definition of the estate being appraised, e.g., fee simple, easement, or leased fee.

e. Assumptions and limiting conditions affecting the appraisal.

f. Data search requirements and parameters.

g. Identification of the technology requirements, including approaches to value, to be used

to analyze the data.

h. Other specifications required to adequately appraise the property and meet FAA and

other regulatory requirements.

8

“Purpose” is sometimes called “Type” and “Function” is sometimes called “Definition of Value.”

16

Exhibit 2: Sample General Scope of Work Statement

The property to be appraised is roughly X acres of land located at ________________________.

Attached are the legal description and a copy of the plat of the property (and, if applicable, a

copy of the proposed lease). The sponsor currently owns (or had owned or leased) this property

in fee and the real property will be conveyed or leased subject to the identified retained real

property rights and encumbrances (see Assumptions and Limiting Conditions).

This appraisal of the property is subject to the following scope of work, intended use, intended

user, definition of market value, certifications and statement of assumptions, and limiting

conditions. The appraiser may expand the scope of work to include any additional research or

analysis determined necessary for a credible appraisal of the fair market value of the subject

property and to meet the identified standards and requirements.

SCOPE OF WORK: The appraiser will provide an appraisal and appraisal report in accordance

with Uniform Standards of Professional Appraisal Practice (USPAP) and FAA requirements.

The appraiser must at a minimum:

• Inspect the neighborhood and local area noting utility and transportation infrastructure to

the extent required for the highest and best use of the property.

• Adequately describe the physical characteristics of the property being appraised

including known and observed encumbrances, title information, location, zoning

(current, proposed, and probability of rezoning), present use, stage of development,

concurrency with local and regional land use plans, an analysis and supported

determination of highest and best use, and adequate sales history of the property (e.g.,

when acquired and amount paid).

• Adequately describe and analyze all relevant market data and activity as of the date of

value.

• Inspect research, analyze, and verify comparable sales with public sources and with a

party to the transaction, buyer, seller or broker, or attorney.

• Appraise the current fair market value of the property, as defined below. If the property

is to be appraised based on a date in the past, the “retrospective appraisal” specification

must be met by the appraiser (see Assumptions and Limiting Conditions).

• Analyze current or proposed leases, if any, and prepare an estimate of the leased fee

value of the property. Explain any variance between the leased fee and the fee simple

market value of the property.

• Report the appraiser’s analysis, opinions, and conclusions in the appraisal report. The

appraisal report must include the plat or a sketch of the property and provide the location

and dimensions of any improvements. The appraisal report must include adequate

photographs of the subject property and of the comparable sales and provide location

maps of the property and comparable sales.

17

Exhibit 2: Sample General Scope of Work Statement continued

• The land must be appraised at an economic highest and best use as described in the

Uniform Appraisal Standards for Federal Land Acquisitions at paragraph A-14, Analysis

of highest and best use (see http://www.usdoj.gov/enrd/land-ack/yb2001.pdf ). As

applicable, the appraiser in estimating the market value of the airport land shall consider

the development potential of airport land parcels considering the location of airport land

and any potential plottage (for combining it) with adjoining development land.

INTENDED USE: The intended use of this appraisal is to provide an appraised current fair

market value (or as of the date of value specified for a retrospective appraised fair market value)

of the fee simple and leased fee interest, as is applicable.

INTENDED USER: The intended user of this appraisal report is the sponsor and the FAA. The

sponsor and FAA will rely on the appraisal and appraisal report to document the current fair

market value of the real property.

DEFINITION OF MARKET VALUE: The market value is the most probable price which a

property should bring in a competitive and open market under all conditions requisite to a fair

sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not

affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a

specified date and the passing of title from seller to buyer under these conditions:

• Buyer and seller are typically motivated,

• Both parties are well informed or well advised, and each acting in what he or she

considers his or her own best interest,

• A reasonable time is allowed for exposure in the open market,

• Payment is made in terms of cash in U. S. dollars or in terms of comparable financial

arrangements.

• The price represents the normal consideration for the property sold unaffected by special

or creative financing or sales concessions granted by anyone associated with the sale.

18

Exhibit 2: Sample General Scope of Work Statement continued

CERTIFICATION: The appraiser must provide a certification consistent with USPAP

requirements. Changes to the certifications are not permitted. However, additional

certifications that do not constitute material alterations to this appraisal report, such as those

required by law or those related to the appraiser’s continuing education or membership in an

appraisal organization are permitted.

ASSUMPTIONS AND LIMITING CONDITIONS: The appraiser must state all relevant

assumptions and limiting conditions necessary. In addition, the sponsor may provide other

assumptions and conditions that may be required for the particular appraisal assignment, such

as:

• The data search requirements and parameters that may be required for the

assignment.

• The (sponsor) will advise and provide the appraiser the legal description of the

airports retained property rights (recorded or to be recorded), e.g., easements, deed

restrictions, or other restrictions and encumbrances on the property to protect and

enhan

ce airport operations and to acknowledge and protect overflight of the property.

The appraiser must appraise the market value of the property subject to the airport

retention of the described property rights.

• Identification of the technology requirements, including approaches to value to be

used to analyze the data.

•

Needed soil studies, potential zoning changes, etc.

• As applicable, any information on property contamination to be provided and

considered by the appraiser in making the appraisal.

• Retrospective Appraisal Requirements: If a value for a date or event in the past is

required (e.g., as of past lease date or disposal date) the following specification must

be inserted into the scope of work: The date of value for this appraisal is (specific

date in the past). In conformance to USPAP,

9

market data subsequent to this

effective date may be considered in developing a retrospective value as a

confirmation of trends that would reasonably be considered by a buyer or seller as of

the date of value. For this retrospective appraisal, the appraiser will determine a

logical cut-off date after which market data cannot be used to reflect the relevant

market as of the date of value.

9

Statement of Appraisal Standards #3, Retrospective Value Opinions, Uniform Standards of Appraisal Practice,

Appraisal Foundation

19

Scopes of work adapted to specific types of property are provided later in this document, in

Section V. Sample Scopes of Work.

Shelf Life of an Appraisal

Appraisals are essentially a snapshot of value that is taken at a particular time. This short shelf-life

is why the date of valuation is so important in determining the validity of an appraisal. The market

for all types of real estate is subject to change overtime. Values can increase or decrease,

depending on a myriad of external factors.

Appraisals can be prospective, retrospective or contemporary:

Prospective: Appraisals that anticipate the construction of some type of improvement

require prospective values that designate some point in the future when the

improvement will either be completed and/or stabilized, and that value may be several

years beyond the date the appraisal is actually delivered.

Retrospective: retrospective appraisals require appraisers to determine the value based

on some preceding event, such as a date of death for purposes of settling an estate, or a

preceding date that may be tied to a condemnation or other event.

Contemporary: Appraisals for conditions on or about the date of valuation are

contemporary.

FAA and State agencies prefer contemporary appraisals over retrospective or prospective

appraisals. However, on occasion, there is a need to use prospective and retrospective appraisals to

resolve compliance problems. ACO-100 and APP-400 should be consulted before making a

decision. For contemporary appraisals, it is generally recognized that an older appraisal is less

reliable than a newer appraisal.

What is an appropriate amount of time before an appraisal needs to be updated to

incorporate any potential changes that may have occurred in the marketplace?

10

In general, for FAA review of sale or lease of properties, if a matter has not gone to contract one

year from the date of submission of the appraisal, then a new appraisal report is needed. USPAP

specifies that each time an appraiser produces a report, it is considered a completely new appraisal

assignment and must be treated as such by the appraiser to remain in compliance with the

standards. The new report is not required to have the same level of effort as the original report. In

a slow moving market, with little or no activity, the appraiser’s level of effort should be more

10

Within the appraisal profession, there is no defined time. Certain government agencies such as the Federal Housing

Administration (FHA) specify that an original appraisal report can only be updated one time using the Appraisal

Update Report (AUR). An appraisal with no AUR has a 150-day validity period (120-day validity period for the

original appraisal plus 30-day extension period as permitted by HUD). An appraisal with an AUR has a 240-day

validity period. Typically, banks and other institutional lenders consider six months to be the optimum timeframe for

appraisals pertaining to commercial property, but will often times have properties appraised every several years for

purposes of collateral management. Other government agencies at the federal and state level address this problem on a

case-by-case basis often times with a chief appraiser in the department having the authority to update appraisals.

20

modest than when several relevant property sales need to be taken into account. The same

advice would apply to any review appraisals. When market activity is minimal, the level of effort

of the review appraiser would be less than when many new properties have to be considered in the

new appraisal report.

Regardless of the nomenclature used, when a client seeks a more current value or analysis of a

property that was previously appraised, this analysis is not an extension of the previously

completed assignment. It is a new assignment. In cases where the delay in accepting the appraisal

is due to FAA review and approval beyond the one-year period, ACO should be contacted.

Resolving Divergent Valuations between Appraisal Reports

In all cases, the sale of airport property or the leasing of non-aeronautical property must be based

on a fair market value determination. In some instances, however, there may be a dispute over the

market value of the property. At the request of the FAA, the sponsor’s review appraiser may make

a determination of the subject property’s FMV, taking account of credible and verifiable valuation

information in appraisal reports and other factors the review appraiser deems appropriate.

Additionally, the sale price or lease rate offered by the sponsor and ultimately accepted to meet

applicable Federal obligations must always reflect the existing fair market value of the property.

21

I. Key Authorities

This section focuses on key authorities for the sale and disposal of airport property. For issues that

involve acquisition of property, the reader should consult the FAA website on Acquiring Land for

Airports and Relocation assistance, which at the time of this writing was available at the following

site:

a. Federal Law

49 United States Code (U.S.C.) § 47101(a) (13) Fee and Rental Structure

49 United States Code (U.S.C.) § 47107(b) Use of Airport Revenue

49 United States Code (U.S.C.) § 47107(c) Acquiring Land

b. Airport Improvement Program Grant Assurances

5. Preserving Rights and Powers

24. Fee and Rental Structure

25. Airport Revenues

31. Disposal of land

1. Self-Sustainability Principle

Federal law and FAA policy, including the Revenue Use Policy, require airport

sponsors maintain a fee and rental structure that makes the airport as financially

self-sustaining as possible under the specific circumstances at the airport. As

stated in Title 49 U.S.C. § 47101(a) (13), “airports should be as self-sustaining as

possible under the circumstances existing at each airport particular airport and in

establishing new fees, rates, and charges.”

Airport sponsors also have a responsibility to ensure the airport maintains a rate and fee

schedule that conforms to the grant assurances and is consistent with the FAA’s Rates and

Charges Policy. FAA’s Revenue Use Policy requires federally obligated airports to charge

market rent for leasing airport property for non-aeronautical use and dispose of airport

property at fair market value. The self-sustainability Principle recognizes that each airport

situation is different as well as the circumstances that may affect an airport’s ability to

pursue self-sustainability. The primary goal is to maintain the utility of the federal

investment in the airport.

22

c. FAA Order 5190.6B, Airport Compliance Manual

The Airport Compliance Manual provides guidance to FAA personnel on interpreting and

administering the various continuing commitments airport sponsors make to the U.S. Government

when they accept grants of federal funds or federal property for airport purposes.

Chapter 17. Self-Sustainability discusses the airport sponsor’s responsibility to be as self-

sustaining as possible. Each airport sponsor is required under Grant Assurance 24 to maintain a fee

and rental structure, which covers the airport’s aggregate operational costs to the greatest practical

extent. Fair market pricing or value of airport facilities can be determined by reference to

negotiated fees charged for similar uses of the airport or by appraisal of comparable properties.

However, in view of the various restrictions on the use of property on an airport (i.e., limits on the

use of airport property and height restrictions) appraisers may often need to account for such

restrictions when comparing on-airport with off-airport commercial non-aeronautical properties in

making fair market value determinations. Failure to receive fair market value under airport

circumstances where it is required may be viewed as revenue diversion by the federal or state

agency providing the grant and may result in the requirement to repay the grant, financial

penalties, and the loss of an airport’s eligibility to receive future grants.

d. FAA Order 5100.38D, AIP Handbook

The AIP Handbook at paragraph 5-68 describes the land disposal requirements under 49 U.S.C.,

§ 47107(c) (2), Grant Assurance 31. The sponsor is required to promptly dispose of AIP-funded

land when the land is no longer needed for eligible current or planned airport purposes.

The federal share portion of the proceeds on the sale of noise land or land for airport purposes

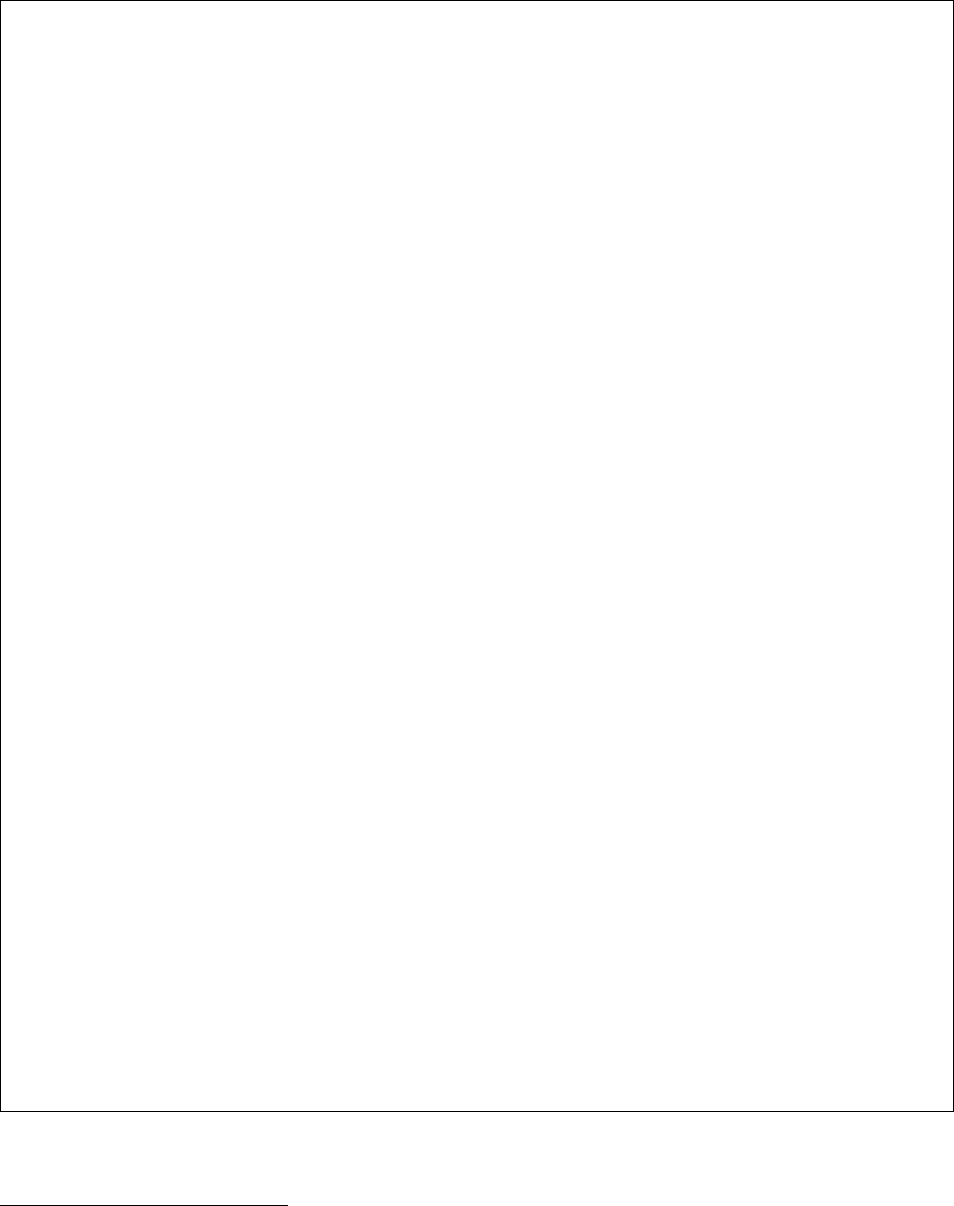

must be reinvested in eligible airport projects and programs. Table 1 provides the order of

reinvestment preferences described in Grant Assurance 31.

23

Table 1. Order of Preference Applying Sale Proceeds of AIP-Funded Land per 49 USC §

47107(c)(4)

Order Order of preference to apply the federal share of the fair market value

1 Reinvestment in an approved noise compatibility project.

2

Reinvestment in an approved project that is eligible for funding under 49 U.S.C.,

§ 47117(e). The only projects in this section of the law are those eligible for noise

and environmental set-aside funding. A complete list of projects eligible for noise

and environmental set-aside funding is in the AIP Handbook, FAA Order 5100.38.

3

Reinvestment in all other approved airport development projects at the airport that

are eligible under 49 U.S.C., § 47114, 47115, or 47117.

4

Transfer to a sponsor of another public airport for a noise compatibility project at the

other airport.

5

Payment to the Secretary of Transportation for deposit in the Airport and Airway

Trust Fund. (Send the FAA Airports District Office a check as directed by the FAA

Office of Operational Services - FAA Accounts Payable Branch (AMZ-110) for

deposit in the Airport and Airway Trust Fund.)

APP-400 and ACO-100 maintain current guidance on the FAA Airports District Office and sponsor

requirements for tracking and disposal of AIP-acquired land. See

“Noise Land Management and

Requirements for Disposal of Noise Land or Development Land Funded with AIP.”

e. FAA Revenue Use Policy

The FAA’s Revenue Use Policy outlines the use of airport revenue and maintenance of a self-

sustaining rate structure by federally assisted airports:

• The applicability of the policy.

• Statutory requirements for the use of airport revenue.

• Permitted and prohibited uses of airport revenue.

• Policies regarding the requirement for a self-sustaining rate structure, among others.

This policy echoes the principle of self-sustainability maximization and use of fair market value as

described in FAA Order 5190.6B.

Each federally assisted airport sponsor is required by statute and grant assurances to have an

airport fee and rental structure that will make the airport as self-sustaining as possible under the

particular airport circumstances in order to minimize the airport’s reliance on Federal funds and

local tax revenues. The FAA has generally interpreted the self-sustaining assurance to require

airport sponsors to charge FMV commercial rates for non-aeronautical uses of airport property.

Although FMV is not necessarily applicable to aeronautical uses, user charges are also subject to

the standard of reasonableness (Revenue Use Policy).

24

f. FAA Advisory Circular Number 150/5100-17, Land Acquisition and Relocation

Assistance for Airport Improvement Program (AIP) Assisted Projects - Real Property

Appraisal – Sections 2-3, 2-4, 2-5, 2-8, 2-9

Even though this Advisory Circular addresses the appraisal of land acquisitions for AIP projects, it

does contain helpful information that addresses the appraisal process.

g. Uniform Standards of Professional Appraisal Practice

The USPAP comprises the generally recognized ethical and performance standards for the

appraisal profession in the U.S. USPAP was created by the Appraisal Standards Board of The

Appraisal Foundation, and it is updated every year. USPAP is considered the primary set of

standards for appraisal analysis and reporting applicable to real property, personal property,

intangibles, and business valuation in the U.S. and its territories.

In 1989, Congress enacted the Financial Institutions Reform, Recovery, and Enforcement Act

of 1989 (FIRREA) that established the legislative and regulatory framework to ensure real

estate appraisals are performed in writing, in accordance with uniform standards, and by

competent individuals subject to effective supervision. State laws implementing FIRREA

require appraisers to meet the mandated educational and experience requirements to secure

either a license or certification. The Appraisal Qualification Board of the Appraisal

Foundation established by FIRREA, instituted appraiser qualifications for a state license or

certification. A licensed or certified appraiser may only perform appraisals consistent with

FIRREA. Appraisers are also required to meet specific appraisal standards and a code of

ethics in accepting and performing appraisals to adhere to USPAP. States and professional

associations enforce compliance with USPAP.

Although USPAP provides a minimum set of quality control standards for appraisals in the U.S., it

does not attempt to prescribe specific methods for conducting them. Rather, USPAP requires

appraisers to familiarize themselves with and correctly utilize acceptable appraisal methods. This

standard means the methods must conform to the intended user requirements and qualified airport

or similar industry appraiser practices. USPAP outlines these practices in its Scope of Work Rule

(Uniform Standards of Professional Appraisal Practice, 2016-2017 Edition, page U-14.), which

include these three appraiser requirements:

1. Identify the problem to be solved.

2. Determine and perform the scope of work necessary to develop credible assignment

results.

3. Disclose the scope of work in the appraisal report.

At the onset of an assignment, an appraiser is obligated to gather certain specified preliminary data

and information about the project, such as the nature of the property to be appraised, the basis of

value (e.g., market, investment, impaired, unimpaired), the interests appraised (e.g., fee, partial),

important assumptions or hypothetical conditions, and the effective date of the valuation. Based

25

on this data and information, along with other key information, the appraiser relies on a peer-

reviewed methodology to formulate an acceptable work plan.

h. Fair Market Value Definitions

This section presents definitions of and other guidance related to fair market value. The sources

include the FAA, various regulatory bodies, appraisal standards, and other legal authorities.

FAA’s Definition of FMV in Order 5190.6B states:

The highest price estimated in terms of money that a property will bring if exposed for sale in the

open market allowing a reasonable time to find a purchaser or tenant who buys or rents with

knowledge of all the uses to which it is adapted and for which it is capable of being used. It is

also frequently referred to as the price at which a willing seller would sell and a willing buyer

buy, neither being under abnormal pressure. FMV will fluctuate based on the economic

conditions of the area (FAA 5190.6B, Appendix Z).

The same order provides additional clarity on the application of FMV and exceptions for the

realization of FMV in airport-related transactions:

Paragraph 17.12. Fair Market Value. Fair market fees for use of the airport are

required for non-aeronautical use of the airport and are optional for non-airfield

aeronautical use. Fair market pricing of airport facilities can be determined by

reference to negotiated fees charged for similar uses of the airport or by appraisal

of comparable properties. However, in view of the various restrictions on use of

property on an airport (i.e., limits on the use of airport property, height restrictions,

etc.,) appraisers will need to account for such restrictions when comparing on-

airport with off-airport commercial non-aeronautical properties in making fair

market value determinations (FAA Order 5190.6B, Chapter 17).

Paragraph 17.13. Exceptions to the Self-sustaining Rule (Leasing only): While

the general rule requires market rates for non-aeronautical uses of the airport,

several limited exceptions to the general rule have been defined by congressional

direction and agency policy based on longstanding airport practices and public

benefit. These limited exceptions relate to leasing only and not the disposal of

property: (a) property for community purposes and (b) not-for-profit aviation

organizations, (c) transit projects and systems, and (d) military aeronautical units.

Applying an exception should not threaten the airport’s compliance with the

Revenue Use and Self-Sustaining Airport Policies (FAA Order 5190.6B, Chapter

17).

The Appraisal Institute’s The Dictionary of Real Estate Appraisal, 5th Edition, includes the

following entry for “market value”:

26

The most probable price that the specified property interest should sell for in a

competitive market after a reasonable exposure time, as of a specified date, in cash,

or in terms equivalent to cash, under all conditions requisite to a fair sale, with the

buyer and seller each acting prudently, knowledgeably, for self-interest, and

assuming neither is under duress.

This source also cites the definition of “market value” used by agencies that regulate federally

insured financial institutions in the U.S.:

The most probable price which a property should bring in a competitive and open

market under all conditions requisite to a fair sale, the buyer and seller each acting

prudently and knowledgeably, and assuming the price is not affected by undue

stimulus.

Implicit in this definition are the consummation of a sale as of a specified date and the passing of

title from seller to buyer under these conditions:

Buyer and seller are typically motivated;

Both parties are well informed or well advised, and acting in what they consider their

best interests;

A reasonable time is allowed for exposure in the open market;

Payment is made in terms of cash in U.S. dollars or in terms of financial arrangements

comparable thereto; and,

The price represents the normal consideration for the property sold unaffected by

special or creative financing or sales concessions granted by anyone associated with the

sale. (12 C.F.R. Part 34.42(g); 55 Federal Register 34696, August 24, 1990, as amended

at 57 Federal Register 12202, April 9, 1992; 59 Federal Register 29499, June 7, 1994)

Financial Accounting Standards Board (FASB) Statement of Financial Accounting Concepts No.

7, Using Cash Flow Information and Present Value in Accounting Measurements, defines the fair

value of an asset (liability) as:

The amount at which that asset (or liability) could be bought (or incurred) or sold

(or settled) in a current transaction between willing parties, that is, other than in a

forced or liquidation sale.

Although Generally Accepted Accounting Principles (GAAP) may not prescribe the method for

measuring the fair value of an item, it expresses a preference for the use of observable market

prices to make that determination. In the absence of observable market prices, GAAP requires fair

value to be based on the best information available in the circumstances.

West's Encyclopedia of American Law, edition 2, defines fair market value as the amount

for which real property would be sold in a voluntary transaction between a buyer and seller,

neither of whom is under any obligation to buy or sell.”

27

The customary test of FMV in real estate transactions is the price that a buyer is willing, but is

not under any duty, to pay for a particular property to an owner who is willing, but not obligated,

to sell. Various factors can have an effect on the FMV of real estate, including the uses to which

the property has been adapted and the demand for similar property.

Fair market value can also be referred to as “fair cash value” or “fair value”.

The Internal Revenue Service (Publication 561) defines fair market value as:

Fair market value (FMV) is the price that property would sell for on the open

market. It is the price that would be agreed on between a willing buyer and a willing

seller, with neither being required to act, and both having reasonable knowledge of

the relevant facts. If you put a restriction on the use of property you donate, the

FMV must reflect that restriction.

The International Valuation Standards include the following definition of “market value”:

The estimated amount for which a property should exchange on the date of

valuation between a willing buyer and a willing seller in an arm’s-length transaction

after proper marketing wherein the parties had each acted knowledgeably,

prudently, and without compulsion (International Valuation Standards, Eighth

Edition).

In 2012, the State of Florida developed a set of guidelines for determining the value of airport

property, which reads:

Market value can be defined as the most probable price, as of a specified date, in

cash, or in terms equivalent to cash, or in other precisely revealed terms, for which

the specified property rights should sell after reasonable exposure in a competitive

market under all conditions requisite to a fair sale, with the buyer and seller each

acting prudently, knowledgeably, and for self-interest, and assuming that neither is

under undue duress.(Guidelines for Determining Market Value & Market Rent of

Airport Property, The Center for Urban Transportation Research, University of

South Florida, April 2012.)

A related measure, market rent, is also relevant since airport land is more often than not,

leased long term rather than sold, “Market rent is defined as the rental income that a

property would most probably command in the open market; indicated by the current rents

paid and asked for comparable space as of the date of the appraisal” (Guidelines for

Determining Market Value & Market Rent of Airport Property, The Center for Urban

Transportation Research, University of South Florida, April 2012).

28

It is important to observe that the following elements are common to each of these definitions:

Market value assesses when the parties are typically motivated, generally well

informed, acting in their best interest, and not under duress.

Market value assesses when the property is exposed on the market for a reasonable

length of time.

Payment is in cash or its equivalent.

29

IV. Appraising Airport Land at FMV

The methodology used by appraisers to determine the FMV of airport land include the sales

comparison approach, cost approach, or income approach. All have advantages and disadvantages:

The sales comparison approach is based on the sales of comparable properties. It

hinges on the principle of substitution, assuming that a prudent person will pay no more

for property than it would cost to purchase a comparable property. In order to

determine the value of the property, an up-to-date database of recent real estate

transactions (including the description and prices of the properties that have sold) has to

be maintained. The current market price of comparable properties is adjusted for

differences in physical characteristics (location, size, condition, amenities, etc.,) and

market conditions to provide the estimate of the property value in question. Choosing

comparable land and facilities at airports of similar size is the key for the accurate

evaluation of property. The major factors that make airports suitable for comparison

include the population and demographics of the community, proximity to other modes

of transportation (highways, rail, public transportation, etc.), number and types of based

aircraft, types of commercial activity at the airport, level of air service (number of

enplanements), availability and quality of NAVAIDS and instrument approaches,

runway length, and Air Traffic Control services. To be comparable for the valuation

purposes, the property at a different airport has to be capable of accommodating the

same type of activity.

The cost approach (replacement or reproduction) focuses on what it would cost to

construct the property. This approach includes costs for building and site

improvements, with consideration for depreciation of both physical and external

character. The cost (or rental rate payable) of underlying land must be considered as

well. The use of the cost approach for the valuation of the property is based on a

fundamental presumption that the property can be replaced or reproduced. The cost

approach is considered most reliable when used to assess the value of newer structures,

and less reliable to assess older properties.

The income approach links the value of property to the income that it’s likely to

produce. This method is preferred when evaluating income-producing rental and

commercial property, or when the property can be most valuable as a rental property.

The income potential can be estimated by researching the current rents paid for

comparable (i.e., having the same highest and best use) property. The result is a net

operating income for a single year that can be converted into an indicated property

value through the overall capitalization process (the net income produced by the

property divided by the capitalization rate). It can also be projected over a stated

holding period and discounted to present value at an appropriate yield or discount rate.

These rates are market-determined rates of return that would attract individuals to

invest in the property, considering all the risks and benefits that could be realized. As a

general rule, the rates for non-aeronautical airport development are typically lower than

30

for aeronautical airport development projects. Along with the basic special purpose

characteristics of the buildings and the sponsor’s Grant Assurance limitations, the

typical higher costs for aeronautical improvements often reflects the higher risk

associated with aviation operations. The array of potential aeronautical tenants is

relatively limited when compared to other the non-aeronautical real estate marketplace,

and the process of getting aviation-related property into revenue production can be

slower.

There are some disadvantages of the three methods. The sales comparison approach requires

substantial market data that is not always available. The cost approach is considered most reliable

when used to assess the value of newer structures, and less reliable to assess older properties.

The income approach has limited use when the property is tailored for a specific aeronautical user

that it rarely leases at a rental rate that reflects its construction costs. No “absolute” approach to

property valuation exists. In some areas where there are a high number of airports and a resulting

large pool of comparable transactions, the sales comparison (market data) approach is popular and

practical.

The value of property is directly related to its use. There are two distinct types of airport property,

aeronautical and non-aeronautical, and the valuation process is slightly different for each property

type.

Appraising Aeronautical Property

FAA defines aeronautical property as all property comprising the land, airspace, improvements,

and facilities used or intended to be used for any operational purposes related to, in support of, or

complementary to the flight of aircraft to or from the airfield. It is highly recommended for

determining FMV rates that aeronautical property is compared to other aeronautical property

serving the same function at similar airports throughout the region or state.

The following are the major factors that should be used to identify comparable properties for

determining FMV of aeronautical airport property:

Size of the metropolitan area and population

Surrounding demographic profile and economic character

Location of the airport

Runway(s) length and orientation

Airport classification, size, and function

Number of operations and other activity statistic

Number of based aircraft

Fixed-base operators and the services provided

Age and quality of facilities

NAVAIDS and Air Traffic Control facilities

Airport cost structure and fees (landing, fuel flowage, aircraft parking, hangar use)

Fuel sales

Amenities at the airport

31

Location on the airport

Size of the property parcel in question

Property function

highest and best use of property

Appraising Non-aeronautical Property

Non-aeronautical property is the airport property that is not needed or used for supporting or

complementing the aviation functions of the airport. Airport property that is not used for

aeronautical activity, in many respects, is no different than similar property located in the local

area around the airport. In the case of non-aeronautical property, airports compete with industrial

parks, commercial, and retail real estate, located in the local community around the airport.

Therefore, market value or market rent of non-aeronautical property can be determined by

comparisons to other properties with similar use, located in the local area around the airport (i.e.,

in the local community).

These major factors should be used to identify comparable properties in the local community for

appraising of non-aeronautical property:

Zoning designation and land use (legal encumbrances)

Size of parcel

highest and best use of property

Property function

Roadway and utility services access

Other amenities

Construction method and longevity

(Guidelines for Determining Market Value & Market Rent of Airport Property, The Center

for Urban Transportation Research, University of South Florida, April 2012.)

Appraising Leased Airport Land

The value of airport leased land may also depend on multiple factors including the location on the

airport, permitted use, and possibly the length of the lease term. The typical airport ground lease

term is within the range of 20 to 30 years, with renewal options and the reversion of all

improvements (or removal) at lease termination.

The most common method to appraise market rent owed on airport land is to analyze similar,

currently rented properties with the same highest and best use. This technique is similar to the

process applied in the sales comparison approach, only the market data analyzed relates to the

particulars of a lease transaction. Another method applied to appraise market rent is to estimate

the market value of the property, and apply an appropriate rate of return to that value. In other

words, if a property’s value is considered to be $1 million, and the market-derived rate of return is

10 percent, then the annual rental rate net of expenses is $100,000. (See the example on page 8 for

a further discussion of this method.)

32

An appraiser may also consider the inherent risks and limitations associated with land designated

for aeronautical use. Funding development projects on ground leases at public-use airports involve

additional risks for lenders due to specific restrictions on the use of property located on or around

the airport. In traditional real estate development pertaining to fee simple owned land, the lender

has the ability to place a lien on both the improvements and owner’s land as collateral against the

default of the borrower. Public airports are typically unable to provide this type of security to the

lender. Grant Assurance 5, Preserving Rights and Powers, prohibits an airport sponsor from

entering into any agreement that would deprive the airport sponsor from performing the terms,

conditions, and assurances under the grant agreement with the FAA. Generally, airport sponsors

are prohibited from subordinating the sponsor’s fee simple interest in airport property by

mortgage, easement, or other encumbrance without prior FAA approval.

33

V. Sample Scopes of Work

This section contains sample Scopes of Work (SOW) for specific types of appraisals. The

applicable Appraisal SOW should be given to the airport sponsor when FAA requires an appraisal

to determine Fair Market Value. If you do not find the specific type of appraisal you are interested

in, use the General Scope of Work contained in Exhibit 2.

These specific Scopes of Work are contained in this section:

• Appraisal Scope of Work: Disposal of Existing Airport – Page 34

• Appraisal Scope of Work: Disposal of Non-Aeronautical Airport Land – Page 40

• Appraisal Scope of Work: Acquisition of On-Airport Leasehold – Page 46

• Appraisal Scope of Work: Concurrent/Interim Lease of On-Airport Property – Page 52

• Appraisal Scope of Work: Sale/Lease of Oil/Gas/Mineral Rights – Page 58

• Appraisal Scope of Work: Sale/Disposal of Utilities/Pipeline Easement – Page 63

• Appraisal Scope of Work: Disposal/Lease of Hotel – Page 69

• Appraisal Scope of Work: Disposal/Lease of Golf Course – Page 74

• Appraisal Scope of Work: Sale/Lease of Agricultural Land – Page 79

34