Page 1 (Rev. 05-16-2016)

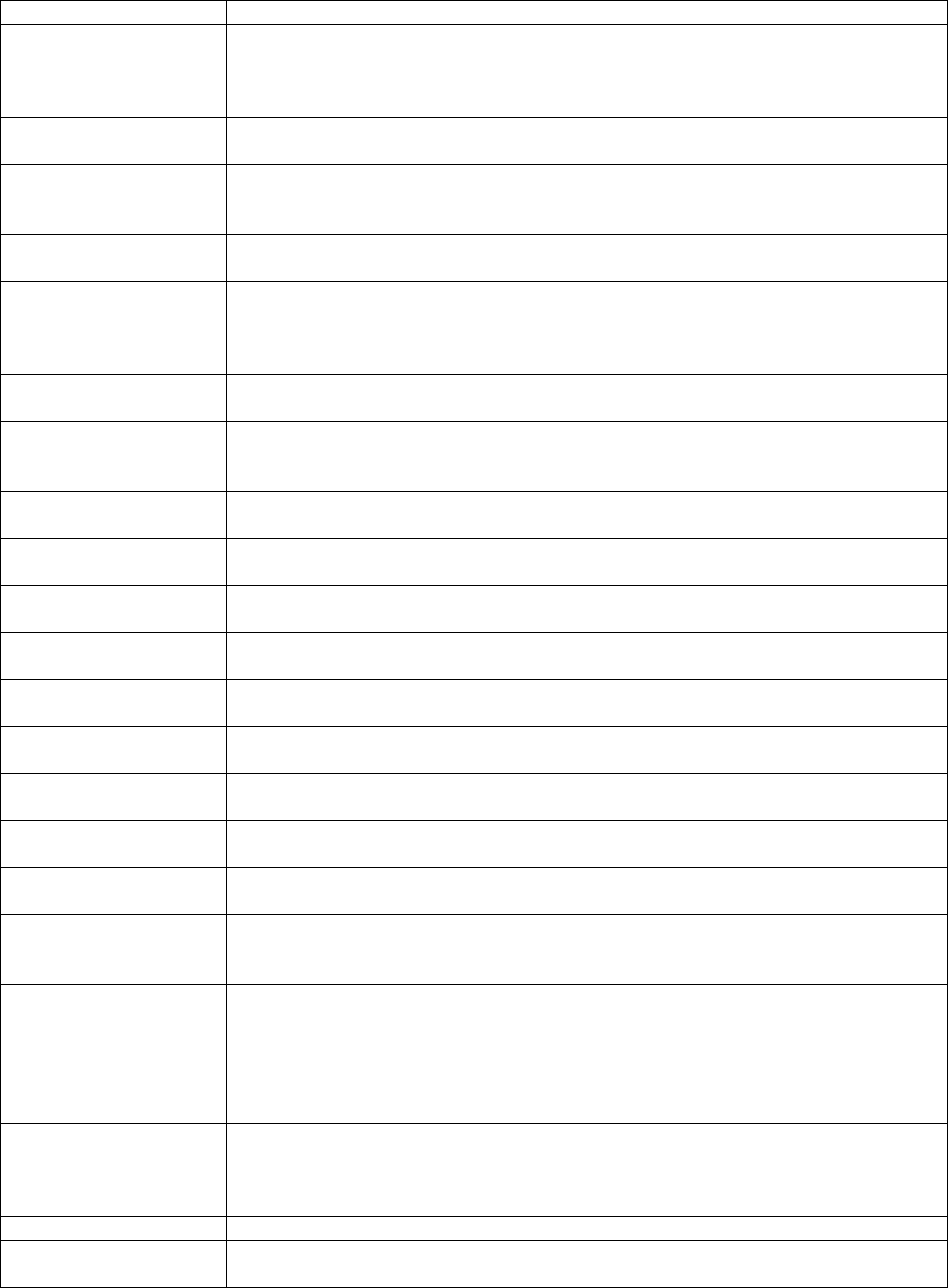

Type of Coverage Codes

Type of Coverage is divided into the following mutually exclusive categories:

Auto

Fire, Allied Lines and Commercial Multi-Peril (CMP)

Homeowner’s

Life and Annuity

Accident and Health

Liability

Miscellaneous

Each of the major categories (except for Miscellaneous) is further divided into first- and second-level coverages

that describe a more specific area of coverage within the primary category.

Each complaint may involve only one category. Within a category, a complaint may contain only one first-level

coverage and up to three second-level coverages (where available).

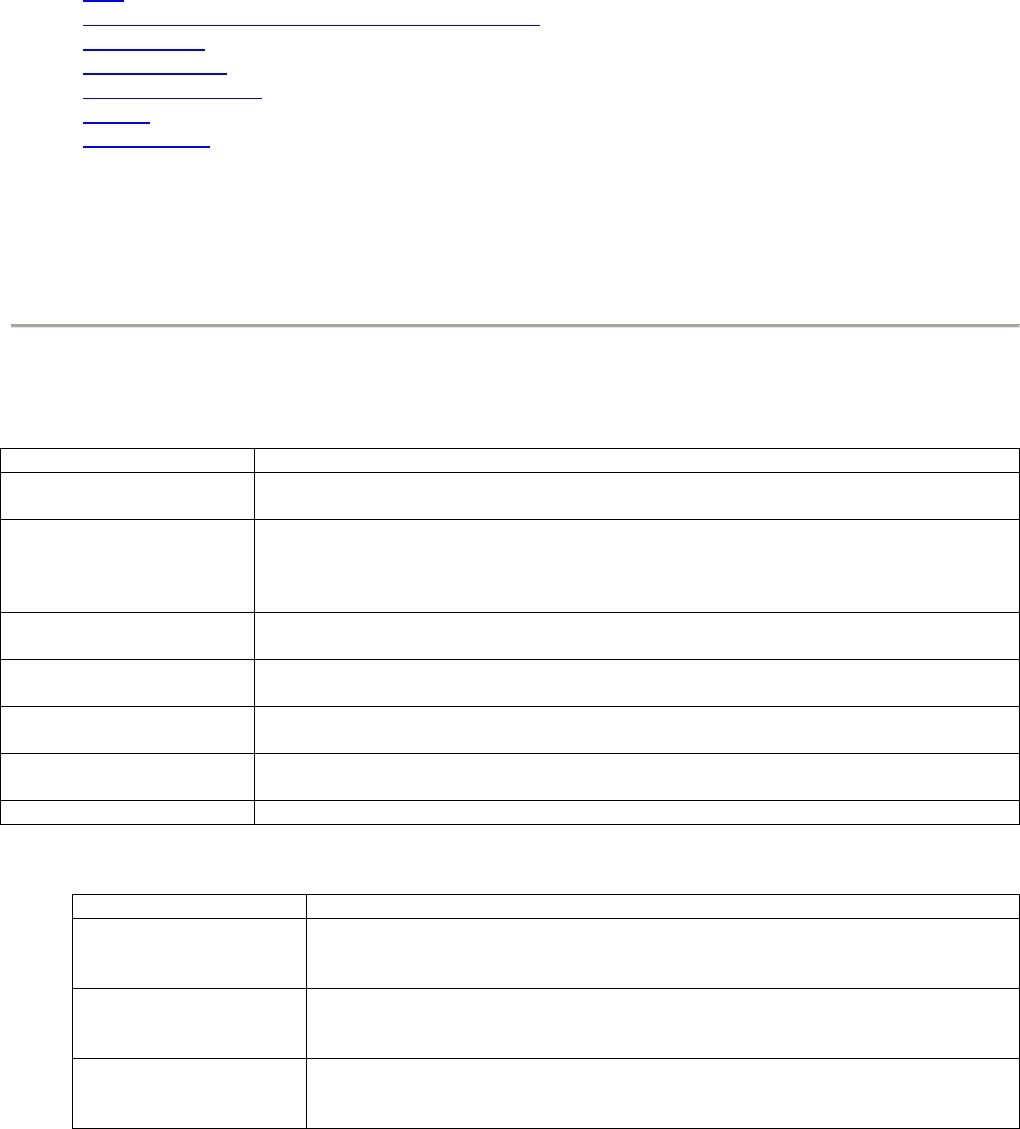

Auto

Level 1 Coverages

Title

Description

Commercial

Provides coverage for liability, physical damage, and other exposures for

automobiles owned or leased by businesses, partnerships, or organizations.

Group Private Passenger

Personal automobile coverage for liability, physical damage, and other exposures

for automobiles owned or leased by individuals or families. The individual or family

obtains the coverage with an association/group in which the individual or family is a

member/enrollee/certificate holder.

Individual Private

Passenger

Personal automobile coverage for liability, physical damage, and other exposures

for automobiles owned or leased by individuals or families.

Motor Home/Recreational

Vehicles

Individual coverage for an automotive vehicle built on a truck or bus chassis and

equipped as a self-contained traveling home.

Motorcycle

Individual coverage for any two-wheel automotive vehicle having one or more

saddles and sometimes a sidecar with a third supporting wheel.

Motorsports

Services specialty cars, race teams, special events, and related commercial

business insurance.

Rental

Automobile insurance coverage for rented vehicles.

Level 2 Coverages

Title

Description

Collision

Insurance coverage available to provide protection against physical contact of

an automobile with another inanimate object resulting in damage to the

insured’s car.

Collision Damage

Waiver

A provision in many auto rental contracts charging an extra fee to the person

renting a vehicle, and in exchange the rental company waives its right to

recover physical damage losses from the renter.

Comprehensive

Automobile insurance providing protection in case of physical damage

suffered by the insured’s car, other than collision or theft. Example: Fire,

Flood.

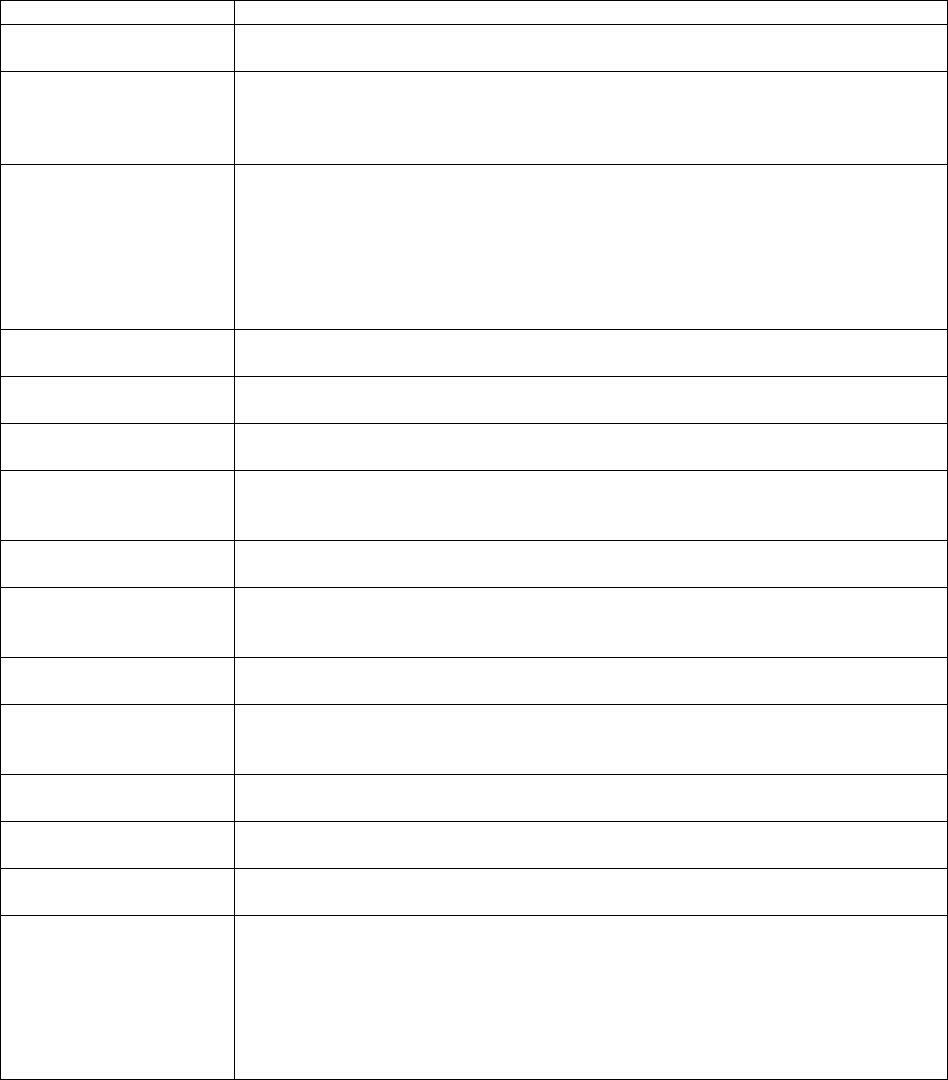

Page 2 (Rev. 05-16-2016)

Title

Description

Liability

Policyholder's legal liability resulting from injuries to other persons or damage

to their property.

Medical Payments

Coverage, available in various liability insurance policies, in which the insurer

agrees to reimburse the insured and others, without regard to the insured's

liability, for medical or funeral expenses as the result of bodily injury or death

by accident under specified conditions.

No-Fault/Personal

Injury Protection

No-Fault - Forms of insurance by which a person's financial losses

resulting from an automobile accident are paid by their own insurers

regardless of who was at fault.

Personal Injury (PIP) - A form of insurance issued in some states with

minimum coverage limits, or thresholds, set by state law. Injured parties

cannot sue the responsible party until the specific threshold of expenses

are met.

Other

Other secondary level types that do not fit clearly into any specific category in

the secondary level.

Personal Effects

Coverage

Coverage that protects personal effects of the renter while in the rental car.

Personal Passenger

Protection

Covers accidental death and medical expenses for the renter if involved in an

accident.

Physical Damage

Provides coverage to vehicles owned, leased, or operated by a covered

person due to collision or under comprehensive coverage for non-collision

hazards, such as fire, theft, or falling objects.

Physical Damage

Waiver

Responsibility for any damage to a rented vehicle is waived, provided the

rental agreement is not violated.

Policy Proof of Interest

Insurance covering peculiar conditions of risk concerning anticipated freight.

Example: If a company goes to pick up freight which ends up being destroyed

by some hazard, they suffer losses such as shipping fees.

Rental Reimbursement

Automobile coverage that pays the cost of a vehicle rental during a period the

insured vehicle requires covered repair.

Residual Market/JUA

Related

Policies issued on behalf of the Wisconsin Automobile Insurance Plan (WAIP)

whether issued by assignment or on behalf of the WAIP under a servicing

carrier agreement.

Supplemental Liability

Insurance

Protects the renter against third-party auto liability at-fault claims for up to a

specified limit if involved in an accident.

Surplus Lines

Coverage obtained in an unlicensed insurance company because of its

unavailability in the licensed market.

Towing

An endorsement to an automobile policy that pays specified amounts for

towing and related labor cost.

Uninsured

Motorists/Underinsured

Motorists

Uninsured Motorists - Protection covers the policyholder, family

members, and passengers if injured by a hit-and-run motorist or a driver

who carries no liability insurance.

Underinsured Motorists - Protection covers the policyholder and family

members if injured by a motorist who carries liability limits less than

his/her proportionate share of the total liability. Also provides coverage if

the other driver's insurance is with a financially irresponsible insurer.

Page 3 (Rev. 05-16-2016)

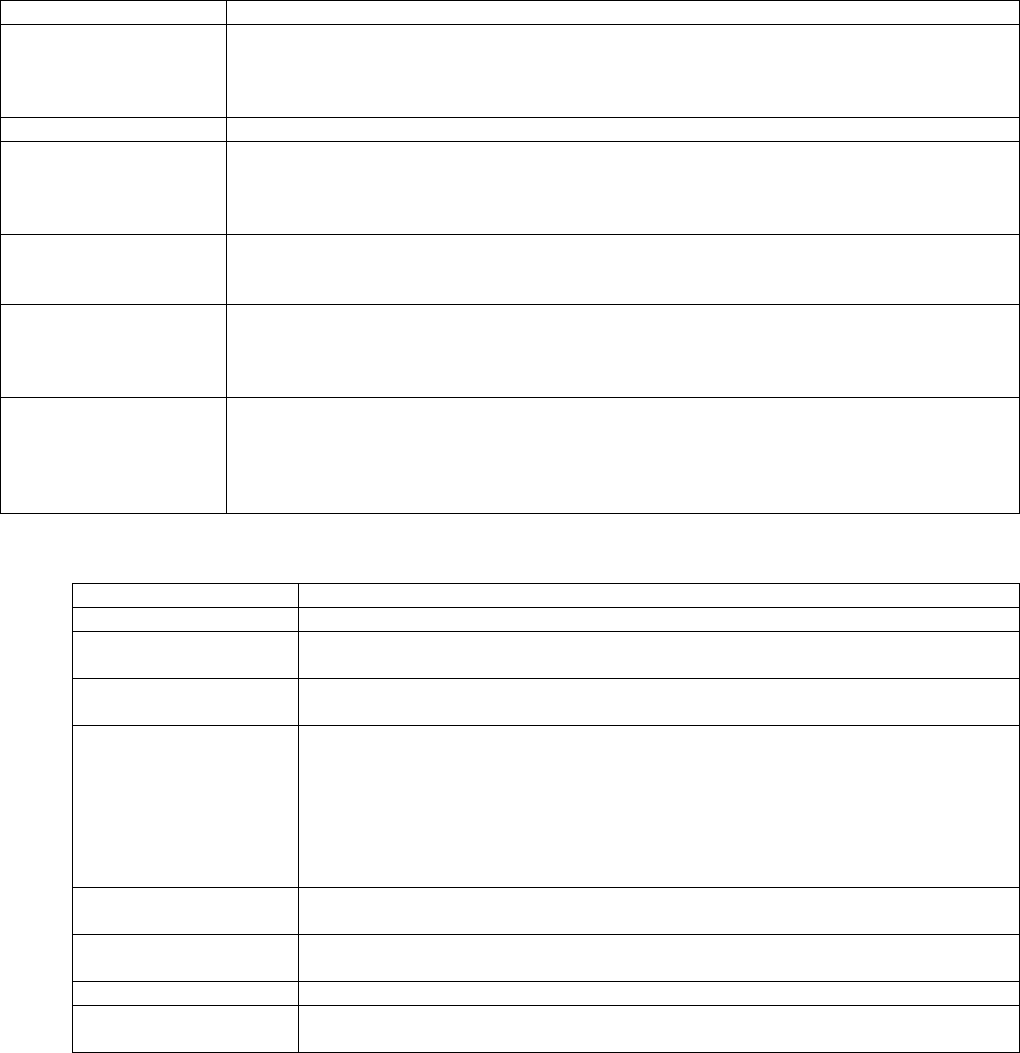

Fire, Allied Lines, and Commercial Multi-Peril

Level 1 Coverages

Title

Description

Builder's Risk

A property insurance policy that provides direct damage coverage on buildings or

structures while they are under construction. It also covers foundations, fixtures,

machinery, and equipment used to service the building, and materials and supplies

used in the course of construction.

Commercial MP

Commercial package policies which include liability, fire, and allied lines coverage.

Credit Property

Insurance against loss of or damage to personal property, covering a creditor's security

interest in the property, when the insurance is written as part of a loan or other credit

transaction. Can include GAP insurance as it relates to the difference between loss

payments and loan indebtedness.

Crop/Hail

Growing crops are subject to numerous perils--bad weather, hail, fire, flood, insects,

and disease. Policies may cover one or more of these perils reducing proportionally as

harvesting progresses and terminates when the harvest is complete.

Dwelling Fire

Covers buildings and the personal property inside. Designed to insure one- to four-

family dwellings, whether owner-occupied or tenant-occupied, and can be used to

insure mobile homes. Policies do not include theft, liability, or medical payments

coverage.

Fire, Allied Lines

Insurance covering the peril of fire damage to property, as well as extended coverage,

which includes perils other than fire, such as windstorm, hail, explosion, riot, etc., along

with resultant damage caused by smoke and water. Allied lines provide further

coverage against perils such as sprinkler leakage, rain and non-fire-related water

damage, and earthquake.

Level 2 Coverages

Title

Description

Fire-Real Property

Coverage of insured's real property against the peril of fire.

Liability

The portion of insurance that covers the insured for negligence against another

person or another person's property.

Other

Other secondary level types that do not fit clearly into any specific category in

the secondary level.

Personal Property

Property that is not attached to real property. Property other than real estate,

or property that is movable or separable from real estate; for property

insurance purposes, tangible property, which is often called "contents.”

Personal property may be used for business purposes and therefore may be

covered by a commercial policy, while personal property not used for business

purposes is generally covered only by personal lines policies (such as

homeowner’s or renter’s insurance).

Residual Market/JUA

Related

Policies issued by the Wisconsin Insurance Plan.

Surplus Lines

Coverage obtained in an unlicensed insurance company because of its

unavailability in the licensed market.

Theft

Covers theft of the insured's property.

Windstorm

Covers windstorms including hurricanes, cyclones, and high wind; perils not

normally covered under standard policies.

Page 4 (Rev. 05-16-2016)

Homeowner’s

Level 1 Coverages

Title

Description

Condo/Town

Coverage protecting the insured’s personal property and loss of use. Coverage may

include protection against fire, lightning, vandalism, malicious mischief, wind, hail,

explosion, riot, civil commotion, vehicles, aircraft, smoke, falling objects, weight of

ice/sleet/snow, and volcanic eruption.

Farm Owner/Ranch

Owner

A contract which combines personal and business multiple-line insurance; coverage for

the entire farm and ranch operations, may include the dwelling.

Group Homeowner’s

Homeowner’s insurance containing a benefit package policy that combines property

and liability coverage of property and individuals. Coverage obtained by a group

member/enrollee/certificate-holder through a master contract issued to the

association/group in which the individual or family belongs.

Homeowner’s

Coverage for homes, including dwelling coverage. Protects owners and tenants

against losses or damage to their residential property and provides protection against

liability claims by others suffering injury or damages while on such property.

Mobile Homeowner

Coverage for mobile homes, which are classified as portable units that are built to be

towed on their own chassis with frame and wheels but are permanently affixed to the

real estate and are designed for year-round living.

Renter’s/Tenant’s

Coverage for the contents of a renter’s home/apartment and liability. Tenant policies

reflect homeowner’s insurance, except they do not cover the structure. Covers inside

structure changes such as carpeting, kitchen appliances, and built-in bookshelves.

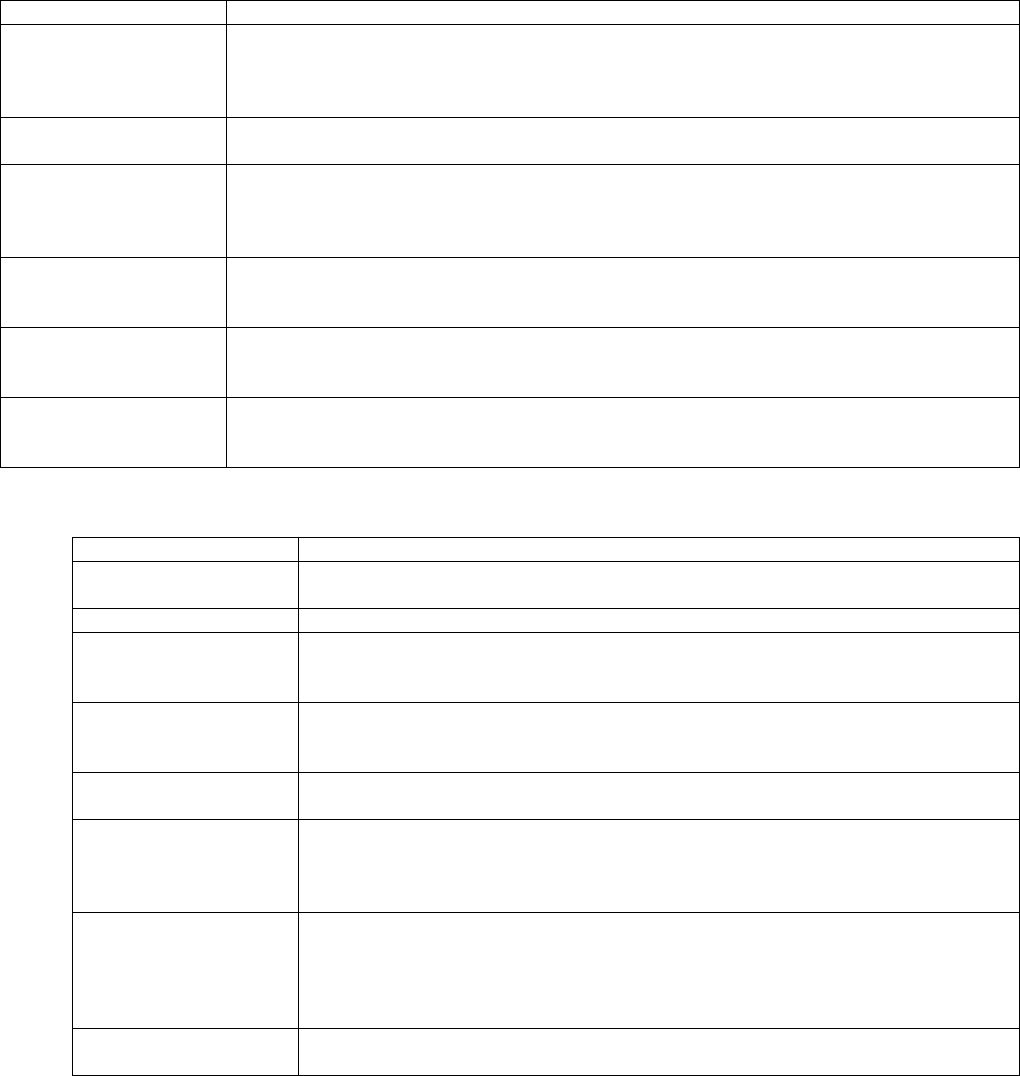

Level 2 Coverages

Title

Description

Earthquake

Covers direct damage resulting from earthquake or volcanic eruptions.

Excluded are losses resulting from fire, explosion, flood, or tidal wave.

Fire-Real Property

Coverage of insured's real estate property against the peril of fire.

Flood

Coverage made available to residents of a community on a subsidized and

non-subsidized premium rate basis once the governing body of the community

qualifies that community for coverage.

In-home/Incidental

Business

Coverage provided under an endorsement that reduces the risk of operating a

small service or retail business from home. Provides comprehensive coverage

for business personal property and business general liability exposures.

Liability

The portion of insurance that covers the insured for negligence against another

person or another person's property.

Loss of Use

If your home is destroyed by an insured peril or it becomes uninhabitable

because of an insured peril, your standard homeowner’s policy provides you

coverage for setting up a temporary living situation. "Loss of Use" will cover

any additional expenses caused by you having to move out of your home.

Medical Payments

Coverage provided under the homeowner’s policy. The insurance includes

medical expenses of persons who sustain bodily injury at an insured's

premises without regard to negligence. Medical expenses include first aid,

surgery, x-rays, dental services, prosthetic devices, transportation by

ambulance, and funeral services.

Other

Other secondary level types that do not fit clearly into any specific category in

the secondary level.

Page 5 (Rev. 05-16-2016)

Title

Description

Personal Property

Property that is not attached to real property. Property other than real estate or

property that is movable or separable from real estate; for property insurance

purposes, tangible property, which is often called "contents." Personal property

may be used for business purposes and therefore may be covered by a

commercial policy, while personal property not used for business purposes is

generally covered only by personal lines policies (such as homeowner’s or

renter’s insurance).

Replacement Cost

Sum needed to replace an insured’s damaged or destroyed property with one

of a like kind and quality, equivalent to actual cash value, minus physical

depreciation (fair wear and tear) and obsolescence.

Residual Market/JUA

Related

Policies issued by the Wisconsin Insurance Plan.

Single Interest

Insurance protecting the interest of only one of the parties having an insurable

interest in certain property, as that protecting a mortgagee but not the

mortgagor, or protecting the seller but not the buyer of merchandise.

Surplus Lines

Coverage obtained in an unlicensed insurance company because of its

unavailability in the licensed market.

Theft

Covers theft of the insured's property.

Windstorm

Covers windstorms including hurricanes, cyclones, and high wind; perils not

normally covered under standard policies.

Life and Annuity

Level 1 Coverages

Title

Description

Accelerated Benefits

Prepayment of a specified percentage of life insurance death benefits prior to death to

cover the cost of treatment for life threatening disease or confinement to a nursing

home. Generally used in case of a terminal illness. Also known as living benefits.

Credit Life

A type of decreasing term insurance usually issued to a creditor to cover the life of a

debtor for an outstanding loan.

Group Annuities

Annuities purchased by a group member/enrollee/certificateholder through a master

contract issued to the association/group to which the individual belongs. These

annuities pay a benefit at regular intervals for the life of the annuitant or for a specified

period, usually beginning at retirement.

Group Life

Life insurance coverage obtained by group member/enrollee/certificate-holder through

a master contract issued to the association/group to which the individual belongs,

usually paying face value benefits upon the death of the covered individual.

Individual Annuities

A policy that pays a benefit at regular intervals for the life of the annuitant or for a

specified period usually beginning at retirement.

Individual Life

Insurance covering the life of an individual with the face value usually payable at the

death of the insured person.

Level 2 Coverages

Title

Description

Accidental Death &

Dismemberment

A form of accident insurance which indemnifies or pays a stated benefit to the

insured or his/her beneficiary in the event of bodily injury or death due to

accidental means (other than natural causes).

Association

Pool (Association or Syndicate). An organization of insurers or reinsurers

through which life insurance and annuities are written/purchased with the

premiums, losses, and expenses shared in agreed amounts among the

insurers belonging to the pool.

Page 6 (Rev. 05-16-2016)

Title

Description

Equity Indexed

Equity index futures typically have dividend rates lower than money market

returns, and futures’ prices tend to be higher than spot index values.

Fixed

Guarantees a specific payment amount in the future.

Other

Other secondary level types that do not fit clearly into any specific category in

the secondary level.

Premium Waiver

An agreement attached to a policy which exempts from coverage certain

disabilities or injuries that otherwise would be covered by the policy.

Pre-Need Funeral

Life insurance policy or annuity contract sold to pay for the insured’s funeral.

Premiums can be single pay or multi-pay. A funeral goods and services

statement must accompany the application for a policy. Also known as funeral

policy or preneed policy.

Single Premium

A single premium contract is paid at the inception of the policy and the policy

becomes fully paid.

Term

Life insurance in effect for a specified limited period. If an insured dies within

that period, the beneficiary receives payment. If the insured survives the

specified limited period, the beneficiary receives nothing.

Universal

Adjustable life insurance under which premiums flex, protection adjusts, and

the insurance company discloses expenses and other charges to the

purchaser.

Variable

A policy allowing premium payments to vary within certain limits at the option

of the policyholder.

Whole Life

A policy remaining in full force and effect for the life of the insured with

premium payments being made for the specified period. Also known as

Ordinary Life.

Accident and Health

Level 1 Coverages

Title

Description

Credit Accident &

Health

Insurance usually issued to a creditor to provide indemnity for payments or debt

becoming due on a specific loan or other credit transaction should the debtor become

disabled.

Group

Insurance that is issued against sickness or injury where the group is the policyholder

and the individual insured is the certificateholder.

Individual

Insurance that is issued to an individual insuring one against sickness or injury.

Stop Loss

Insurance purchased by employers in order to limit their exposure under self-funded

health insurance plans. Stop-loss insurance takes effect after a minimum amount has

been paid in claims. There are two types: specific attachment point which means the

stop-loss insurance takes effect when claims for an individual employee exceeds the

agreed-upon amount and aggregate attachment point which means that the stop-loss

insurance takes effect when claims for the employer’s total group exceeds the agreed-

upon amount.

Page 7 (Rev. 05-16-2016)

Level 2 Coverages

Title

Description

Accident Only

Health insurance pertaining to only accident coverage.

Autism/PDD

Coverage provided for treatment of autism/pervasive developmental disorder

(PDD) in covered children under the age of 19. Autism means a developmental

disability significantly affecting verbal and nonverbal communication and social

interaction, generally evident before age 3, that adversely affects a child’s

performance. PDD (also known as autism spectrum disorder) refers to a

category of five neurological disorders, autistic disorder, pervasive

developmental disorder - not otherwise specified, Asperger’s disorder, Rett’s

disorder, and childhood disintegrative disorder, as specified within the current

edition of the diagnostic and statistical manual of mental disorders DSM-IV or

subsequent edition of the American Psychiatric Association.

Bronze

Coverage provided by a health plan has an AV (the percentage paid by a

health plan of the percentage of the total allowed costs of benefits) of 60

percent.

Cancer/Dread Disease

A type of medical expense policy that is designated to cover only those

medical expenses incurred by an insured only for specific catastrophic

illnesses, such as cancer.

Catastrophic

Health plans that meet all the requirements of a qualified health plan but that

don’t cover any benefits other than three primary care visits per year before

the plan’s deductible is met.

Child Only

Coverage provided by a child-only plan at the same level of coverage as any

qualified health plan offered through an exchange to individuals who, as of the

beginning of the plan year, have not attained the age of 21.

Chiropractic

Covers care provided by a chiropractor. Normally, not seen as regular health

maintenance but as a term recovery plan.

COBRA

In the United States, a statute which requires that employers sponsoring group

health plans offer continuation of coverage under the group plan to employees

and their dependents who have lost coverage because of the occurrence of a

"qualifying event." Qualifying events include reduction in work hours, many

types of termination of employment, death, and divorce.

Dental

Includes dental coverage in health plans and dental service plans. Dental

service plans are dental services provided at the expense of the plan by

participating dentists or other health care personnel.

Disability Income

Provides benefits in case of the insured's inability to perform all or part of

his/her occupational duties because of an accident or illness.

Exchange

Coverage provided by a plan issued through a governmental agency or non-

profit entity that meets the applicable standards of Title 45 of the Federal

Register and makes qualified health plans (QHPs) available to qualified

individuals and/or qualified employers.

Gold

Coverage provided by a gold health plan has an AV (the percentage paid by a

health plan of the percentage of the total allowed costs of benefits) of 80

percent.

Grandfathered

Coverage provided by a group health plan, or a group or individual health

insurance issuer, in which an individual was enrolled on March 23, 2010, for as

long as it maintains that status under the rules of section §147.140 of Title 45.

Health Only

Insurance covering sickness only. This can include an HMO (health

maintenance organization) or a PPO (preferred providers organization), which

provides basic health care services to enrollees on a prepaid basis except for

enrollees' responsibility for co-payments, deductibles.

Page 8 (Rev. 05-16-2016)

Title

Description

HIPAA

Guarantees that employers are not able to impose preexisting condition

limitations in the insurance they offer to new employees who had continuous

insurance coverage for at least the 12 months prior with their previous

employer.

HMO

An organization that provides comprehensive health care services for

subscribing members in a particular geographic area.

Home Health Care

Health care provided in the home of the patient, usually by a private nurse or a

state-licensed home health care agency. Services are usually limited to part-

time or intermittent nursing care and physical or occupational rehabilitation.

Hospital Indemnity

Provides a predetermined flat benefit for each day of hospitalization regardless

of expenses incurred.

Large Group

Coverage provided by a health insurance market under which individuals

obtain health insurance coverage (directly or through any arrangement) on

behalf of themselves (and their dependents) through a group health plan

maintained by a large employer, unless otherwise provided under state law.

Limited Benefits

A health insurance policy with limited benefit payments where all benefits have

been paid to the beneficiary.

Long-Term Care

Designed to provide coverage for not less than 12 consecutive months for

necessary medical services provided in a setting other than an acute care unit

of a hospital.

LSHO

Limited service health organization – a managed care plan that offers specific

limited services, such as dental or vision, by participating providers.

Medicare Advantage/

Part C

A plan offered by a private company that contracts with Medicare to provide

Part A and Part B benefits to Medicare beneficiaries.

Medicare Prescription

Drug/Part D

A plan offered by a private company that contracts with Medicare to provide

coverage for prescription drugs.

Medicare Select

A plan that supplements Medicare and requires enrollees to use network

hospitals and physicians.

Medicare Supplement

Medigap

A plan that supplements Medicare by paying Medicare cost-sharing.

Medicare Supplement

Plan F

A plan that supplements Medicare and is called the high-deductible plan.

Medicare Supplement

Plan K

A plan that supplements Medicare and requires 50% cost-sharing until out-of-

pocket maximums are met.

Medicare Supplement

Plan L

A plan that supplements Medicare and requires 25% cost-sharing until out-of-

pocket maximums are met.

Medicare Supplement

Plans Other/Unknown

Other state’s Medicare supplement or otherwise not identified.

Medicare Supplement

Plans Pre

Standardized

A plan that supplements Medicare and was issued prior to January 1, 1990.

Mental Health

Coverage for professional mental health services including psychologist, crisis

centers, rehabilitative therapy, etc. An emotional or organic mental impairment

(usually excluding senility, retardation or other developmental disabilities, and

substance addiction); a psychoneurotic or personality disorder; any psychiatric

disease identified in a medical manual (American Psychiatric Association's

Diagnostic and Statistical Manual).

Multi State

Coverage provided by a health plan that is offered under a contract between

the U.S. Office of Personnel Management (OPM) and the Multi State Plan

Program (MSPP) issuer pursuant to section 1334 of the Affordable Care Act

and that meets the requirements of Title 45.

Nursing Home

A policy that covers institutional care in a nursing home.

Occupational Accident

An accident arising out of and in the course of employment and covered by

worker’s compensation laws.

Page 9 (Rev. 05-16-2016)

Title

Description

Other

Other secondary level types that do not fit clearly into any specific category in

the secondary level.

PPO

A health benefit plan with contracts between the sponsor and health care

providers to treat plan members. A PPO can be a group of health care

providers who contract with an insurer to treat policyholders according to a

predetermined fee schedule. PPO contracts typically provide discounts from

standard fees, incentives for plan enrollees to use the contracting providers,

and other managed care cost containment methods.

Pharmacy Benefits

Coverage for expenses for charges made by a pharmacy, for medically

necessary prescription drugs or related supplies ordered by a physician.

Platinum

Coverage provided by a platinum health plan has an AV (the percentage paid

by a health plan of the percentage of the total allowed costs of benefits) of 90

percent.

Pre-existing Condition

An illness or disability that existed before the effective date of a health or life

insurance policy. Such a condition can result in cancellation of a policy or

exclusion from coverage.

Self-Funded/ERISA

Self-funded – An employer insurance plan that makes financial preparations to

meet pure risks by appropriating sufficient funds in advance to meet estimated

claim losses, including enough to cover possible losses that were more than

those estimated. Non-governmental self-funded plans may be subject to the

Employee Retirement Income Security Act of 1974 (ERISA).

Short-Term Limited

Duration Policy

A policy that is less than one year in duration and that is not guaranteed

renewable.

Silver

Coverage provided by a silver health plan has an AV (the percentage paid by a

health plan of the percentage of the total allowed costs of benefits) of 70

percent.

Small Group

Coverage provided by a health insurance market under which individuals

obtain health insurance coverage (directly or through any arrangement) on

behalf of themselves (and their dependents) through a group health plan

maintained by a small employer.

Stand Alone Dental

Coverage provided by a limited scope dental benefits plan through an

exchange or in conjunction with a qualified health plan.

Student Health

Coverage provided by a type of individual health insurance coverage that is

provided pursuant to a written agreement between an institution of higher

education (as defined in the Higher Education Act of 1965) and a health

insurance issuer, and provided to students enrolled in that institution of higher

education and their dependents.

Unemployment

Federal legislation allows qualified nonprofit organizations to self-insure their

unemployment compensation obligation. Some insurers provide coverage for

this obligation on a stop-loss or excess-of-loss basis.

Vision

Health insurance coverage for eye examinations and eyeglass or contact lens

prescriptions.

Liability

Level 1 Coverages

Title

Description

Directors and Officers

Reimburses for loss because of wrongful acts by directors and/or officers while acting

in their respective capacities. It covers defense costs, charges, and expenses as well

as the actual settlements from litigation.

Page 10 (Rev. 05-16-2016)

Title

Description

General

Coverage that pertains, for the most part, to claims arising out of the insured's liability

for injuries or damage caused by ownership of property, manufacturing operations,

contracting operations, sale or distribution of products, the operation of machinery, and

professional services. Covers all types of liability insurance other than employers,

automobile, or product liability.

Products

Covers liability of an insurer due to personal injury, death, emotional harm,

consequential economic damage or property damage arising from the use or operation

of a product manufactured and/or sold by the insured.

Professional/E&O

Coverage pertaining to claims arising from the insured's liability for injuries or damage

caused by acts or errors and omissions (E&O) of the insured while performing duties of

his/her profession.

Umbrella

Excess liability coverage above the limits of basic liability insurance policy such as the

owners, landlords, and tenants liability policy. The umbrella policy fills gaps in

coverage under basic liability policies.

Level 2 Coverages

Title

Description

Employment Policies

Professional liability insurance covering wrongful termination, discrimination, or

sexual harassment toward the insured's employees or former employees.

Many policies include coverage for claims by applicants for employment. Some

policies provide very specific coverage, such as for claims brought under the

Americans with Disabilities Act or the Civil Rights Act.

Excess Loss

Method whereby an insurer pays the amount of each claim for each risk up to

a limit determined in advance and the reinsurer pays the amount of the claim

above the limit up to a specified sum.

Medical Malpractice

First Level Coverage Code of 0615 – Professional/E&O

Occurrence - Protects the insured for claims stemming from alleged

incidents that take place during the policy period, even if the policy has

expired or been canceled. Occurrence coverage is the most

comprehensive kind of malpractice insurance.

Claims-made - Coverage is limited to claims or incidents which take place

on or after the retroactive date designated in the policy and are first

reported by the insured during the policy period. An alleged incident before

the retroactive date is not covered regardless when the claim is made. It

may also be necessary to secure "tail coverage" for protection against

claims submitted after coverage has expired.

Other

Other secondary level types that do not fit clearly into any specific category in

the secondary level.

Pollution

Coverage for liability to third parties arising from contamination of air, water, or

land due to the sudden and accidental release of hazardous materials from the

insured site. The policy usually covers the costs of cleanup and may include

coverage for releases from underground storage tanks. Intentional acts are

specifically excluded.

Surplus Lines

Coverage obtained in an unlicensed insurance company because of its

unavailability in the licensed market.

Page 11 (Rev. 05-16-2016)

Miscellaneous (no Level 2 Coverages available)

Level 1 Coverages

Title

Description

Aircraft

Coverage on an all-risk basis whether the airplane is on the ground or in the air. Air

cargo covers legal liability for damage, destruction or other loss of a customer’s

property while being shipped.

Bail Bonds

Monetary guarantee that an individual released from jail will be present in court at the

appointed time. If the individual is not present in court at the appointed time, the

monetary value of the bond is forfeited to the court.

Boiler Machinery

Coverage for loss arising out of the operation of pressure, mechanical and electrical

equipment. It covers loss of the boiler and machinery itself, damages to other property,

legal fees, and business interruption losses. The insurance covers business property,

other property involved, and legal fees.

Credit Unemployment

Credit insurance that provides a monthly or lump sum benefit during an unpaid leave of

absence from employment resulting from specified causes, such as illness of a close

relative and adoption or birth of a child. This insurance is sometimes referred to as

Credit Family Leave.

Extended Warranty

and Service Contracts

A policy providing repair or replacement service or indemnification for such service for

the operational failure of covered property. Examples: homeowner warranty, electronic

devices warranty, etc.

Federal Crop

Protection against natural disasters which may strike crops. Premiums reflect actual

losses incurred by farmers.

Federal Flood

Coverage made available to residents of a community on a subsidized and non-

subsidized premium rate basis once the governing body of the community qualifies that

community for coverage under the National Flood Insurance Act. Resident includes

business and non-business operation with coverage written on structures and their

contents.

Federal Programs

Programs provided or administered by the federal government including Medicare,

Medicaid and the National Flood Insurance Program.

Fidelity and Surety

Fidelity - Insurance guaranteeing the "honesty" of persons holding positions of

public or private trusts. The insurer accepts the responsibility of the employee to

the employer for faithful performance of the duties of employment.

Surety - Insurance guaranteeing the performance of contracts, other than

insurance policies, or guaranteeing and executing all bonds, undertakings, and

contracts of suretyship. One party becomes responsible to a third party for the act

or negligence of a second party.

In Home/Incidental

Business

Coverage provided under stand-alone policy that reduces the risk of operating a small

service or retail business from home. Provides comprehensive coverage for business

personal property and business general liability exposures.

Inland Marine

A broad form of insurance, generally covering articles in transit as well as bridges,

tunnels, and other means of transportation and communication. Besides goods in

transit (generally excepting trans-ocean), it includes numerous "floater" policies, such

as those covering personal effects, personal property, jewelry, furs, fine arts, and other

items of value.

Mortgage Guaranty

Insurance against financial loss by lenders by reason of non payment of principal,

interest, or other sums agreed to be paid upon the terms of any note, bond or other

evidence of indebtedness secured by a mortgage, deed of trust, or other instrument

constituting a lien on real estate.

Ocean Marine

Insurance for sea-going vessels and their cargoes, including liabilities connected with

them. This covers ships or hulls, goods or cargoes, earnings (i.e., passage money,

commissions, profit), and liability incurred by the owner or by any party interested in or

responsible for insurable property for reasons of maritime perils while in transport.

Other

Does not clearly fit in any other category in this level.

Page 12 (Rev. 05-16-2016)

Title

Description

Private Mortgage

Insurance

Insurance written by a private company protecting the mortgage lender against loss

occasioned by a mortgage default.

Surplus Lines

Coverage obtained in an unlicensed insurance company because of its unavailability in

the licensed market. This code under the Miscellaneous coverage type should not be

used where the coverage is under Auto, Fire, Homeowner’s or Liability. For those lines

of insurance, use the “Surplus Lines” code under the particular line.

Title

Insurance against the loss of the title or against expenses due to a defective title,

damage suffered by reasons of liens, encumbrances upon, defects in, or the

unmarketability of a title to such real property. Coverage may extend to heirs in case of

death or to the insurers of a corporate owner of property.

Travel

Coverage for expenses associated with cancellation of travel, delays encountered

during travel and/or medical expenses incurred while traveling.

Watercraft

Coverage for damages resulting from the operation of motor boats too large to qualify

for insurance under ordinary homeowner’s and small business policies. Coverage

exists whether the boats are leased or owned by another party who operates them in

the benefit of the business exposing them to liability. This covers the actual boat,

engine, propellers, and permanently attached equipment in and out of water while

boating, launching, towing and storing.

Wisconsin Worker's

Compensation Ins

Pool

Worker’s compensation insurance policies issued on behalf of the Wisconsin Worker’s

Compensation Insurance Pool.

Worker's

Compensation

Insurance against the legal liability of any employer for the death of, disablement of, or

injury to an employee.