POLICY DOCUMENT

YOUR COVER EXPLAINED

FLAT SIZE: 210MM H 148MM W

FINISHED SIZE: 210MM H 296MM W

93014560.indd 1 19/09/2018 15:05

Thank you for insuring your pet with us

WELCOME

TO ARGOS PET INSURANCE

Argos Pet Insurance is pleased to have teamed up with Royal & Sun Alliance Insurance plc

(RSA) to provide cover for your pet. RSA is one of the largest and most experienced insurers

in the UK.

Together, Argos and RSA have a total of over 23 years experience in providing pet insurance.

Inside you will find details of:

• What is covered

• What is not covered

• What you pay towards the cost of a claim (excess)

• What you should do to make sure your pet remains protected

• How to claim

• How to complain.

WE HOPE THAT ARGOS PET INSURANCE CAN HELP YOU

LOOK AFTER YOUR PET FOR MANY YEARS TO COME.

Claims

(Home and Abroad)

Call: 0345 078 7500

Email: claims@argospetinsurance.co.uk

Customer Services

Call: 0345 078 7500

Email: help@argospetinsurance.co.uk

Renewals

Call: 0345 078 7500

Email: help@argospetinsurance.co.uk

Website argospetinsurance.co.uk

2

93014560.indd 2 19/09/2018 15:06

HELPLINES

ALL POLICIES AUTOMATICALLY INCLUDE ACCESS TO THE

FOLLOWING HELPLINES:

Argos vetfone

For help if you are worried about your pet’s

health at any time.

Telephone: 0800 197 6717 – available 24 hours a

day, 365 days a year A free 24/7 advice line manned

by qualified RCVS (Royal College of Veterinary

Surgeons) vet nurses.

Healthcare away from home

If you and your pet are away from home and your pet needs

urgent veterinary care, call this helpline.

Telephone: 0800 197 6756 – available 24 hours

a day, 365 days a year

Bereavement counselling

An understanding, confidential and professional service

where you can talk for as long as you need to about the

death or illness of your pet.

Telephone: 0800 197 6756 – available 24 hours

a day, 365 days a year.

Please quote scheme number: 72620

Pet legal

Lawyers are available to provide advice and explain legal

issues related to your pet in plain English and in a friendly

and helpful way.

Telephone: 0800 197 6756 – available 24 hours

a day, 365 days a year

Please quote scheme number: 72620

Pet minder

Helps you to locate a registered pet minder (on a National

basis) for either a few minutes or indeed weeks, in order to

look after your pet while you are away.

Telephone: 0800 197 6756 – available 24 hours

a day, 365 days a year

PETS Travel Scheme (DEFRA helpline)

If you are taking your pet abroad and need information on

how to obtain a PETS Travel Scheme Certificate using the

PETS helpline.

Telephone: 0370 241 1710

3

93014560.indd 3 19/09/2018 15:06

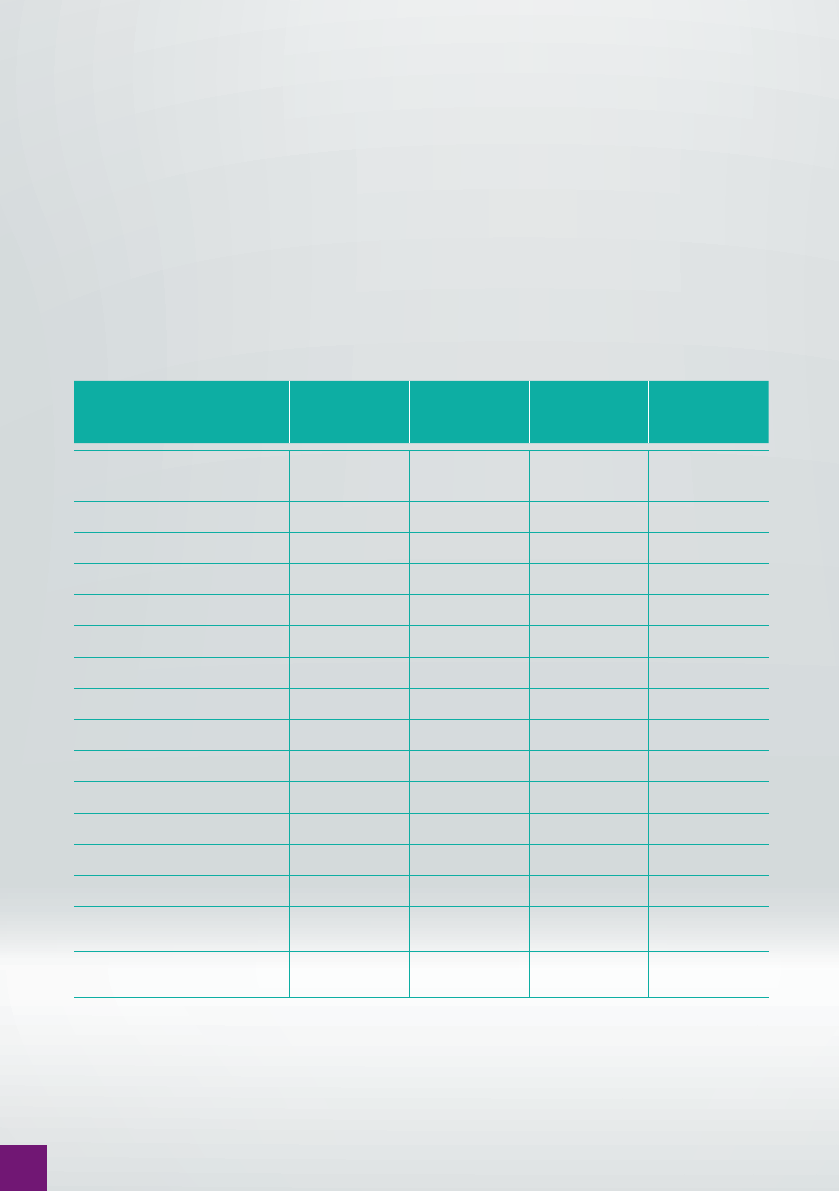

TAKE A LOOK AT THE TABLE

BELOW TO FIND OUT WHAT’S

COVERED

From vet fees to accidental damage and boarding costs your new Argos Pet Insurance covers

you for a whole host of unexpected expenses. How much you can claim depends on which

cover level you’ve chosen. So, take a look at the table below for all the details you need.

Vet fees £2500 £4000 £7000

Refer to your

Policy Schedule

Treatment period 12 months 12 months Each year -

3rd party liability (dogs only) £1 million £1.5 million £2 million £100

Death from accident £250 £750 £1500 -

Death from illness £250 £750 £1500 -

Cremation fees £100 £100 £100 -

Advertising & reward £250 £750 £1000 -

Theft or straying £250 £750 £1500 -

Boarding kennel/cattery fees £150 £500 £1000 -

Holiday cancellation £250 £1500 £3000 -

Accidental damage Not covered £500 £500 £100

Travel covers

Quarantine costs £150 £500 £1500 -

Loss of Healthcare Certificate £250 £250 £250 -

Repeat tick & worming

treatment

£150 £250 £1000 -

Emergency expenses cover

abroad

£150 £250 £1000 -

Cover Levels

Silver

(up to)

Gold

(up to)

Platinum

(up to)

Excess

The amount you must

pay if you claim

4

93014560.indd 4 19/09/2018 15:06

5

INDEX IN

ALPHABETICAL ORDER

I’M LOOKING FOR HELP WITH WHERE TO LOOK PAGE

My pet has been in an accident Vet fees and death by accident 7 & 10

My pet is ill Vet fees and death by illness 7 & 10

My pet has got lost Theft & straying & advertising & reward 11

My pet has been stolen Theft & straying & advertising & reward 11

My pet has passed away Death by accident or illness 10

My pet has caused an accident Liability 9

I am on holiday and my pet is ill Travelling how to make a claim 15

I am on holiday and my pet has had an accident Travelling how to make a claim 15

I was going on holiday but my pet is ill Holiday cancellation costs 12

I’m going on holiday and taking my pet Travelling 13

I am on holiday and my pet has got lost Emergency expenses cover abroad 14

SECTION PAGE SECTION PAGE

Accidental damage 13 Holiday cancellation 12

Advertising & offering a reward 11 How we use your information 20

Bereavement help 3 Kennel fees 12

Cancelling your policy 16 Legal help for situations involving your pet 3

Cattery fees 12 Liability cover 9

Claims conditions 18 Policy conditions 15

Complaints procedure 19 Policy exclusions 17

Contact numbers 2 Quarantine costs 14

Death from accident 10 Straying 11

Death from illness 10 Theft of your pet 11

Emergency expenses abroad 14 Tick and worming repeat treatment 14

Healthcare away from home 3 Travelling in the UK or abroad 13

Healthcare certificate replacement 14 Veterinary fees cover 7

Helplines 3 Words with special meanings 6

93014560.indd 5 19/09/2018 15:06

Important information

Your policy wording and policy schedule are evidence of your insurance with Royal & Sun Alliance Insurance plc (RSA),

please check that the information is correct and the cover is exactly what you need. Then, once you’re sure you’re happy

with it, please keep your policy and schedule in a safe place.

RSA part is:

•

that we will provide the cover set out in this policy wording for the period of insurance set out on the

policy schedule.

Your part:

•

you must pay the premium as shown on the policy schedule for each period of insurance;

•

you must comply with all the conditions set out in this policy.

If your part of the contract is not met, we may turn down a claim, increase the premium or you may find that

you do not have any cover.

At renewal your premium, excess, benefits and policy terms and conditions can change and we can choose not to offer

renewal of a policy if this happens we would let you know in advance of your renewal date so that you have enough time

to make alternative arrangements.

It is particularly important that you read your policy wording and policy schedule especially the Conditions & Exclusions

pages 15 - 18.

The law applicable to this policy

This policy will be governed by the law applicable in the part of the United Kingdom, Channel Isles or Isle of Man in which

you normally live. Legal proceedings will only take place in the courts of the part of the United Kingdom, Channel Isles or

Isle of Man in which you normally live.

Words with special meanings

Some words have a special meaning in the policy. They are listed below in alphabetical order. Whenever a word with a

special meaning is used in the remainder of the policy it will be printed in bold type.

Condition: Illness, injury, accident or change in your pet’s health or behaviour.

Incident: A specific, identifiable illness, injury or accident or change in your pet’s health or behaviour.

If a vet considers a number of injuries, accidents, illnesses or changes in your pet’s health or

behaviour are connected, they will be considered to be one incident.

Period of Insurance: The time for which we provide cover as shown in your schedule and for which we have accepted

your premium.

Pet: Dog(s) or Cat(s) named on your schedule.

Treatment: Any examination, consultation, tests, x-rays, surgery, prescription medication, as provided by a

vet at the time of your visit or purchased using a prescription a vet provides, nursing, care and

physiotherapy, provided by a veterinary surgeon or an employee of a veterinary practice under a

veterinary surgeon’s instruction.

Vet/Veterinary: A Qualified Veterinary Surgeon.

We/Us/Our: Royal & Sun Alliance Insurance plc.

You/Your: The person or persons named as the policyholder on the schedule.

Your family: Your husband, wife, partner, children, parents, other relatives and any joint policyholder all who

normally live with you.

The types of cover we provide

This policy offers different types of cover levels.

Silver and Gold Cover

Argos Silver and Gold policies provide cover for up to 12 months from the start of treatment providing you renew the

policy with no break in cover for up to £2,500 (Silver) or £4,000 (Gold). Once the 12 month limit or £2,500 (Silver) or

£4,000 (Gold) has been reached, you will no longer be able to claim for that condition.

6

93014560.indd 6 19/09/2018 15:06

7

Platinum Cover

This policy provides lifetime cover. It covers treatment costs for ongoing or one off conditions, illnesses and accidents. It

gives you up to £7,000 of vet treatment each year, as long as you continue to be insured with us. Claims can continue

year after year providing we offer a renewal invitation, you accept renewal with no break in cover and your premiums

are paid. Once renewed your vet fee limit will be available to use again, we do not exclude ongoing treatments. Covered

treatments will be paid for the next policy year providing you renew your policy with no break in cover. If your limit is

reached in any one year, we will not make any more treatment payments until your policy is renewed again. Treatment

fees that vets charge increase yearly and the number of visits to the vet can increase as your pet gets older.

Veterinary fees cover

What is covered What is not covered

Applicable to all cover sections Silver, Gold and Platinum.

The cost of fees charged by a veterinary practice for

consultations, tests, X-rays, surgical procedures, drugs

and medication, nursing and hospitalisation all provided

by or given under the instruction, supervision or referral

of a vet, for an illness, injury, accident or change in your

pet’s health or behaviour.

Fees includes:

•

The cost of herbal or homeopathic medicine

and physiotherapy, acupuncture, osteopathy,

hydrotherapy and chiropractic treatment if referred

by a vet;

•

Treatment for teeth or gums if they are damaged

in an accident or if an underlying illness has caused

tooth decay or gum disease or if the teeth need to be

removed to treat an illness;

•

Costs of behavioural treatment for changes to the

mental or emotional health of your pet caused as

a direct result of an insured Illness, injury, accident

which occurs while insured by this policy.

If an incident causes more than one injury to your pet

the amount paid would be up to the amount shown on

your policy schedule for all the injuries which happened in

the same incident.

Applicable to all cover selections Silver, Gold & Platinum.

The excess, this is the first part of a claim that you have

to pay.

This is paid for each incident for Silver & Gold cover

and for each incident for each period of insurance for

Platinum cover.

If you choose to pay a voluntary excess in addition to the

cover excess, this will be included in the total veterinary

excess on your schedule.

Vet fees payable for any changes in your pets health or

behaviour you or your vet notice within the first 10 days

of the first period of insurance of your policy unless

previously agreed by us.

Vet fees payable for the death or injury to your pet as a

result of an accident within the first 48 hours of the first

period of insurance of your policy.

Any treatments that are or relate to:

Procedures which are not to treat an illness or injury, or

that are preventative; pregnancy, giving birth or rearing

puppies or kittens.

Treatment for teeth or gums if they’re damaged due to

tooth decay, dental or gum disease.

Routine examinations, vaccinations, homeopathic

vaccinations, flea treatments or wormers (except under

travel cover where the cost of repeating tick and worming

treatment is covered) grooming, spaying or castration.

Any behaviour training or treatment for changes to the

mental or emotional health of your pet that is not caused as

a direct result of an illness, injury, accident which is covered

by this policy and occurs while insured by this policy.

Non-essential hospitalisation and/or house calls unless

the vet declares that to move your pet would seriously

endanger its health.

Supplements and probiotics, these are products you can

purchase over the counter or online without prescription.

They are made from foods or biological products. Joint

supplements, nutraceuticals, vitamin and mineral

supplements, and organ supplements are all examples of

these products.

For costs charged by a vet to fill or provide a prescription.

Cryptorchidism (retained testicle(s)).

The cost of prosthesis, including any veterinary

treatment needed to fit the prosthesis, other than the

cost of hip, knee and/or elbow replacement(s).

93014560.indd 7 19/09/2018 15:06

8

What is covered What is not covered

Stem-cell or gene therapy.

Any claim as a result of a ‘notifiable’ disease, e.g. Rabies.

Putting your pet to sleep unless it was necessary for

humane reasons or to stop incurable suffering.

Silver and Gold

Vet fees cover is provided for up to 12 months from the

start of treatment for an incident for up to £2,500

(Silver) and £4,000 (Gold).

Cover for an incident also includes 5 sessions of

hydrotherapy within a 12 month treatment period.

Any treatment exceeding 12 months after the incident.

The cost of food.

Platinum

Vet fees cover provides up to £7,000 for each period of

insurance. Cover includes 10 sessions of hydrotherapy in

each period of insurance.

Cover includes food recommended by a vet to treat each

condition for up to 4 weeks in each period of insurance.

Any treatment exceeding £7,000 for each period of

insurance.

Veterinary fees – How to make a claim

Once treatment starts you should telephone the claims helpline 0345 078 7500 or contact us by email on

claims@argospetinsurance.co.uk and report the possible claim. You will then be sent a claim form or you can

download a claim form via www.argospetinsurance.co.uk parts of this form will need to be completed by your vet,

please make sure that the form is signed by you and your vet and that you tell us if you want us to make payment to you

or straight to your vet. We can arrange to pay most vets directly. Please ask your vet if they are happy to do this, and if

we are able to, we will take care of the rest.

Please send us your claim form within 90 days of the first treatment for each new incident. If your vet tells you that

your pet will need treatment over a few visits you do not need to send each invoice to us separately, you can send them

all to us with one completed claim form within the 90 day period.

You need to keep all invoices and receipts that your vet gives you in connection with your claim and send these along

with a complete medical history for your pet to us. This must be a record of all visits your pet has made to a vet and this

information can be obtained from each vet practice your pet has attended.

If your pet needs ongoing treatment, you can send in further claims including updated medical records showing the

treatment your pet has received, invoices and receipts, every 3 to 6 months. If any information we have asked for is not

provided it will delay your claim.

We will need you to agree that your current, previous or referral vet may release information or records regarding the

medical history, including test results for any pet insured with us. If your pet is referred to another vet, we need copies of

any reports the referral vet completes.

We may ask your vet, to provide an opinion on whether conditions are connected, and the date changes in the health or

behaviour of your pet started. While we are providing help we may need to release information about your pet insurance

policy to any vet who has treated your pet or is about to treat your pet.

We do not cover the cost of obtaining receipts, invoices or reports required as part of the claim.

If there is any amount other than the excess that we cannot pay because the costs are not covered by your policy, we will

tell you.

You must settle with your vet, any amount not covered by the policy.

We don’t pay vet invoices that are 12 months older than the last date of treatment.

We don’t pay the cost charged by a vet to fill or provide a prescription.

Please also see the claim conditions on page 18.

93014560.indd 8 19/09/2018 15:06

9

Do not forget that if your pet needs to be treated by a referral vet, your usual vet will let you know which referral vet

from our preferred referral vet network you should go to. If a referral vet from outside our network is chosen, you will

need to pay £200 of the referral vet bill yourself. This amount is in addition to your policy excess.

If your pet needs emergency treatment for a situation that if not resolved immediately will lead to a loss of life or cause

a serious threat to the present or ongoing health of your pet you can visit any vet and you will not have to pay the

additional £200 excess.

Details of the vets in our preferred referral network can be found on Argospetinsurance.co.uk. If you need help or advice

about which vet to visit, please contact the Pet Claims Helpline on 0345 078 7500 before an appointment is made.

A referral is what happens when your usual vet advises you that there is a need to go to another vet for a certain

procedure, for example a surgery or treatment. This may occur if a condition or treatment needed is outside of your

usual vet’s area of expertise. You might be asked to visit a different veterinary centre/hospital/practice, or another

branch of your existing practice. After a referral visit and any required treatment takes place it is normal for future visits

to be with your usual vet.

Third party liability cover (Dogs only)

What is covered

What is not covered

Damages and costs to others which you become legally

liable to pay if your dog causes:

Death or injury to a person; or

Loss or damage to their property.

If someone who is not a member of your family is

looking after your dog when the injury or damage

happens, we will still pay as long as you:

•

asked them to look after your dog;

•

did not agree to pay them to look after your dog;

•

and the death, injury, loss or damage was not to

them or their property.

The most we will pay for any claim or series of claims

arising from any one event during the period of

insurance is up to £1,000,000 (Silver), £1,500,000 (Gold)

or £2,000,000 (Platinum) depending on the cover you

have selected, plus defence costs agreed by us in writing.

The excess, this is the first part of a claim that you have

to pay.

This is paid for each incident for Silver & Gold cover

and for each incident for each period of insurance for

Platinum cover.

Anything owned by or the legal responsibility of your

family, your domestic employees who normally live

with you or anyone looking after your dog with your

permission.

Liability arising from:

•

any employment, trade, profession or business of

any of your family or anyone looking after your dog

with your permission;

•

the use of your dog for trade, profession or business;

•

any of your family, your domestic employees who

normally live with you or anyone looking after your

dog with your permission passing on any disease

or virus;

•

injury, death, disease or illness to any of your family,

your domestic employees who normally live with

you, anyone employed under contract of service

by you or anyone looking after your dog with your

permission;

Liability accepted by any of your family under any

agreement, unless the liability would exist without

the agreement.

Liability covered by any other policy unless all the cover

under that policy has been used up.

Fines, penalties or breach of quarantine restrictions or

import or export regulations.

Third party liability – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

You will then be given instructions on what to do with any letter, claim, writ or summons.

93014560.indd 9 19/09/2018 15:06

10

Death from illness

What is covered What is not covered

If your pet dies from illness or is put to sleep by a vet as

a result of illness we will pay you an amount that should

you choose to, will allow you to buy a similar pet of the

same breed, sex and age as your pet at the time you

became its owner.

We will also pay up to £100 for the cost of cremation if

your pet dies or is put to sleep by a vet as a result of the

illness.

We will not pay if your pet dies from an illness that you or

your vet notice within the first 10 days of the first period

of insurance of your policy.

Any claim for:

•

dogs aged 9 years and above;

•

cats aged 11 years and above.

The most we will pay for any one claim is the purchase/

donation price shown on your schedule, up to £250

(Silver), £750 (Gold) or £1,500 (Platinum) depending on

the cover you have selected.

We will not pay more than the policy limits shown even if

you paid more than this for your pet.

Death from illness – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

You must obtain a veterinary certificate at your own expense stating the date and cause of death.

If your pet was put to sleep, you must obtain a veterinary certificate stating that this was necessary for humane reasons

or to stop incurable suffering.

Death from accident

What is covered

What is not covered

If your pet dies from an accident or is put to sleep by a

vet as a result of an accident we will pay you an amount

that should you choose to, will allow you to buy a similar

pet of the same breed, sex and age as your pet at the

time you became its owner.

We will also pay up to £100 for the cost of cremation if

your pet dies or is put to sleep by a vet as a result of an

accident.

Death as a result of an accident arising within the first 48

hours of the first period of insurance of your policy.

The most we will pay for any one claim is the purchase/

donation price shown on your schedule, up to £250

(Silver), £750 (Gold) or £1,500 (Platinum) depending on

the cover you have selected.

We will not pay more than the policy limits shown even if

you paid more than this for your pet.

Death from accident – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

You must obtain a veterinary certificate at your own expense, stating the date and cause of death.

If your pet was put to sleep, you must obtain a veterinary certificate stating that this was necessary for humane reasons

or to stop incurable suffering.

93014560.indd 10 19/09/2018 15:06

11

Advertising and reward

What is covered What is not covered

A refund of the cost of local advertising and for offering

a suitable reward for the recovery of your pet if it is lost

or stolen.

Any reward you have not agreed with us before it

is offered.

The most we will pay for any one claim is up to £250

(Silver), £750 (Gold) or £1,000 (Platinum) depending on

the cover you have selected.

Advertising and reward – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

You should report the loss to your vet and local rescue centres as we may ask for confirmation that you have done so.

We will need to give our approval before you pay any amounts or offer any reward.

In the case of a reward, you must not pay the finder yourself. Please provide us with the details of the finder and we will

arrange for the payment to be made directly to them.

Theft and straying

What is covered What is not covered

If your pet is permanently lost or stolen and not

recovered despite the use of advertising and reward cover

we will pay you an amount that should you choose to, will

allow you to buy a similar pet of the same breed, sex and

age as your pet at the time you became its owner.

Any claim less than 45 days after the date your pet was

lost or stolen.

The most we will pay for any one claim is the purchase/

donation price shown on your schedule, up to £250

(Silver), £750 (Gold) or £1,500 (Platinum) depending on

the cover you have selected.

We will not pay more than the policy limits shown even if

you paid more than this for your pet.

Theft and straying – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

You must also report the loss of your pet to your local rescue centres and veterinary practices and provide confirmation

that you have made these enquiries to our claims department.

You must report the loss of your dog to the Police and the dog warden within 24 hours of discovery and provide their

reference number to our claims department.

If there is no recovery of your pet after 45 days, you will then need to complete a claim form and provide the information

detailed above.

93014560.indd 11 19/09/2018 15:06

12

Boarding kennel & cattery fees

What is covered What is not covered

A refund of boarding kennel or cattery fees if you or a

member of your family has to go into hospital on medical

advice for a period of more than 4 days in a row.

Any stay in hospital, you were aware of before the policy

cover started, or any medical condition you knew about

before the policy cover started that might require a stay

in hospital.

A refund of boarding kennel or cattery fees if your pet

is unable to live at your main UK home because it has

become uninhabitable. We will need to agree with you

that your home is uninhabitable.

Any kennel or cattery fees you pay without agreeing

payment with us first.

The most we will pay in any one period of insurance

is up to £150 (Silver), £500 (Gold) or £1,000 (Platinum)

depending on the cover you have selected.

Boarding kennel & cattery fees – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

You should obtain, at your own expense, receipted bills detailing dates and fees paid.

You must also obtain, at your own expense, confirmation of the period you or your family members were in hospital and

any additional information requested by us.

If you claim under this policy for something which is also covered by another insurance policy you must provide us with

full details of the other insurance policy. We will only pay our share of the claim.

Holiday cancellation costs

What is covered What is not covered

A refund of the cost of cancelling or cutting short your

holiday, that you cannot recover elsewhere, if your pet

needs life saving emergency treatment within 7 days of

you going away on holiday.

Any surgery that in your vet’s opinion is non life-saving.

Emergency life saving surgery for any changes in your

pets health or behaviour which you or your vet notice

before this policy started.

Any refund for any holiday booked less than 28 days

before you go away.

The most we will pay in any one period of insurance is

up to £250 (Silver), £1,500 (Gold) or £3,000 (Platinum)

depending on the cover you have selected.

Holiday cancellation costs – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

You should obtain, at your own expense, the booking invoice and cancellation invoice from your travel agent or tour

operator. This should detail the amount for the charges you are unable to recover elsewhere and the date of cancellation.

93014560.indd 12 19/09/2018 15:06

13

Accidental damage

What is covered What is not covered

We will pay if your pet causes accidental damage to

personal property.

The excess, this is the first part of a claim that you have

to pay.

Damage to personal property owned by you or in

your control.

Damage to any personal property belonging to any

person entrusted with the care, control and custody of

your pet.

Any damage occurring whilst your pet is left alone or

where you or any person entrusted with its care, control

and custody are not in a position to control its behaviour.

The most we will pay is up to £500 for any one claim

(Gold and Platinum cover only) depending on the cover

you have selected.

Accidental damage – How to make a claim

Contact the claims helpline on 0345 078 7500 as soon as you become aware of any possible claim.

A claim form will be sent to you which should be completed detailing the exact circumstances of the claim, including the

description of the damaged personal property and its purchase price if known.

The amount paid will take into account the age and condition of the personal property.

Travelling

This section extends your vet fees cover outside of the United Kingdom and provides additional covers A-D.

What is covered What is not covered

Travel with your pet to a member country of the

PETS Travel Scheme in accordance with the European

Economic Community regulations.

This is a Government scheme that allows you to take

your pet temporarily to any member country of the PETS

Travel Scheme and come back to the UK without putting

your pet into quarantine.

(Silver) a maximum of 90 days cover is provided during

the period of insurance.

For (Gold) or (Platinum) cover there is no limit to the

number of days during the period of insurance

depending on the cover you have selected.

Non compliance with the PETS Travel Scheme.

Countries that are non-EU members of the PETS Travel

Scheme as defined by DEFRA.

Travelling – How to make a claim

In the event that your pet requires veterinary treatment whilst temporarily in a member country of the PETS Travel

Scheme, payment for the treatment must be made by you to the vet whilst you are there.

When you return home call the claims helpline 0345 078 7500 or contact us by email on

claims@argospetinsurance.co.uk immediately and report the claim.

You will be sent a claim form to complete and return to us with all the paid veterinary receipts.

Settlement will then be made to you after the deduction of the part of the claim that you must pay in sterling at the

current rate of exchange.

93014560.indd 13 19/09/2018 15:06

14

Travel covers

(These are all subject to full compliance with the PETS Travel Scheme)

A. Quarantine costs

What is covered What is not covered

Quarantine costs and costs you have to pay to get a

replacement health certificate for your pet should a

microchip of ISO Standard 11784 or Annex A to ISO

Standard 11785 fail.

Any claims not supported with all relevant receipts and

documentary evidence that your pet was microchipped

before your journey with a microchip of ISO Standard

11784 or Annex A to ISO Standard 11785.

Any costs where it can be shown that the microchip was

not functioning before your departure.

Quarantine costs if, despite compliance with the relevant

regulations, your pet is placed in quarantine due to illness.

Any costs where it can be shown that your pet was

suffering from a condition before your departure.

The most we will pay is up to £150 (Silver), £500 (Gold)

or £1,500 (Platinum) for each trip depending on the cover

you have selected.

B. Loss of healthcare certificate

What is covered What is not covered

The cost of a replacement of the official PETS Travel Scheme

certificate, should the original become lost during a trip.

Claims that are not supported by all relevant receipts and

evidence of amounts you have paid.

Quarantine costs as a result of the loss of the

health certificate.

Claims where the loss of the certificate was not reported

to the issuing vet within 24 hours of discovery.

Claims where it can be shown that the health certificate

was lost before departure.

The most we will pay is a total of up to £250 for each trip.

C. Repeat tick and worming treatment

What is covered What is not covered

A refund of costs you pay to arrange a repeat of the

tick and worming treatment if your return to the UK is

delayed by your carrier.

Any claims which cannot be supported by evidence that

the initial tick and worming treatment was carried out.

The most we will pay is in total for each trip is up to £150

(Silver), £250 (Gold) or £1,000 (Platinum) for each trip

depending on the cover you have selected.

D. Emergency expenses cover abroad

What is covered What is not covered

The most we will pay in total for each trip is up to £150

(Silver), £250 (Gold) or £1,000 (Platinum) this amount

includes the following limits:

A refund of costs you have paid for accommodation

and the journey home, if your pet needs emergency

vet treatment which results in you missing your

return journey.

Any claim not supported by all relevant receipts and

evidence of amounts you have paid.

•

93014560.indd 14 19/09/2018 15:06

15

D. Emergency expenses cover abroad continued

What is covered What is not covered

The most we will pay in total for each trip is up to £100

(Silver), £200 (Gold) or £300 (Platinum) depending on

the cover you have selected.

A refund of the costs you have paid for

accommodation and transport while you try to find

your lost pet before you are due to return to the UK.

Any claim where you have not notified the Police as soon

as you become aware that your pet is missing.

Any claim not supported by a written Police report.

The most we will pay in total for each trip is up to £150

(Silver), £250 (Gold) or £300 (Platinum) depending on the

cover you have selected.

A refund of costs you have paid for accommodation

and transport for 4 more days while you remain

abroad to try to find your lost pet.

Any claim where you have not notified the Police as soon

as you become aware that your pet is missing.

Any claim not supported by a written Police report.

The most we will pay in total for each trip is up to £150

(Silver), £250 (Gold) or £300 (Platinum) depending on the

cover you have selected.

Travel covers A-D – How to make a claim

You will need to pay the cost of any amounts yourself.

When you return home call the claims helpline 0345 078 7500 or contact us by email on

claims@argospetinsurance.co.uk immediately and report the claim.

You will be sent a claim form to complete and return to us with all the paid receipts, evidence of amounts you have paid

and required reports. We will not pay a claim if you are not able to supply supporting evidence.

Settlement will then be made to you in sterling at the current rate of exchange.

Policy Conditions

These are the conditions you and your family will need to keep to as your part of this contract. If you do not,

a claim may be rejected or payment could be reduced. In some circumstances your policy might be invalid.

Conditions applicable to the whole policy

You must:

•

tell us as soon as you are aware that information about you or your pet shown on your schedule is going to change

or has changed;

•

take all reasonable precautions to prevent accidents, injury or damage.

Vaccinations and Care of your pet

You must take care of your pet at all times and pay to have treatment recommended by a Vet to prevent illness

or injury.

It is your duty as the owner of your pet to manage your pet’s weight by taking advice and making yourself aware of

the acceptable weight range for your pet at the various stages of its life, you must take steps to prevent or reduce the

increased health risk that being obese or underweight can bring. If you need help or advice contact Argos vetfone on

0800 197 6717 or ask your vet.

You must have your dog vaccinated against distemper, hepatitis, leptospirosis and parvovirus; have your cat vaccinated

against infectious enteritis, cat flu and feline leukaemia. If your pet is not vaccinated, we will not pay any claims that result

from any of the above illnesses, unless the vaccination has failed.

•

•

93014560.indd 15 19/09/2018 15:06

16

Fraud

If dishonesty, exaggeration or false documentation is used by you and your family or anyone acting on behalf of you or

your family to obtain or support:

•

a claims payment under your policy; or

•

cover for which you do not qualify; or

•

cover at a reduced premium;

all benefits under this policy will be lost, the policy may be invalid, you may not be entitled to a refund of premium and

legal action may be taken against you.

Transferring your interest in the policy

You cannot transfer your interest in this policy to anyone else without our written permission.

Renewing your policy

At least 21 days before each policy renewal date we will tell you the premium and terms and conditions that will apply for

the following year. If you wish to change or cancel the cover then please tell us before the renewal date.

If you pay by Direct Debit we will renew the policy automatically and continue collecting premiums unless you notify us

that you wish to cancel the policy. For payments by credit or debit card, you must submit a further payment if you wish to

renew the policy.

You will have 14 days to cancel the policy after the renewal date and receive a refund of any premiums paid,

as described in “Your right to cancel the policy within the statutory period” below.

At the end of each period of insurance we have the right to amend the premium, excess and/or policy benefits, terms and

conditions. Cats and dogs, like humans, are more prone to illness and ailments as they get older. Your price will increase at

renewal, because of this likelihood and also when a claim has been paid.

Change of Insurers

It may be that the Insurance company underwriting your cover could change at renewal time – if so you will be informed

of this change not less than 21 days before your current policy renews and provided with details of any changes in your

policy cover.

If you pay by Direct Debit then your policy may be automatically renewed with the new insurer. If you do not want your

policy to be renewed then please let them know before the renewal date.

Cancelling the policy

This policy is an annual contract.

Your right to cancel the policy within the statutory period

If, having examined your policy documentation, you decide not to proceed with the insurance you will have 14 days to

cancel it starting on the day you receive the policy documentation.

We will refund any premiums already paid, except when you have already made a claim under your policy.

Your right to cancel the policy outside the statutory period

You may cancel this policy at any time.

Monthly payment

If you pay by monthly instalments and you cancel this insurance because your pet has died, has been stolen or strays

and you make a claim for this we will not deduct outstanding instalments for the remainder of the current period of

insurance from any claim payment.

If you pay by monthly instalments and you cancel this insurance for any other reason other than those stated above and

you make a claim, we will deduct outstanding instalments for the remainder of the current period of insurance from any

claim payment.

Annual payment

If you pay the full annual premium and you cancel this insurance and you have not made a claim we will refund part of

the premium already paid for the remainder of the current period of insurance.

93014560.indd 16 19/09/2018 15:06

17

If you pay the full annual premium and you cancel this insurance because your pet has died, has been stolen or strays,

and you make a claim for this we will refund part of the premium already paid for the remainder of the current period of

insurance.

If you pay the full annual premium and you cancel this insurance for any other reason other than those stated above

and you make a claim, we will not refund part of the premium already paid for the remainder of the current period of

insurance.

Cancelling monthly premium payments

Your policy has a normal period of insurance of 12 months and your legal contract with us is for this period. You may

have asked and we may have agreed for your annual premium to be paid on a monthly basis.

We have the right to terminate the policy in the event that there is a default in instalment payments.

If you want to cancel payment by monthly instalment but not your policy, we can tell you how much you will have to

pay for the rest of the period of insurance. If this amount is not paid by the date given in our reply to you, then all cover

under your policy will be cancelled from this date.

If you need to cancel your policy for any of the reasons given above, please contact us on 0345 078 7500.

Our right to cancel

We can cancel this policy by giving you at least 14 days notice at your last known address. We will only do so for the following

reasons, and not before, where possible, making contact with you to seek an opportunity to agree a solution with you.

•

failure to provide us with information we have requested that is directly relevant to the cover provided under this

policy or any claim;

•

the use or threat of violence or aggressive behaviour against our staff, contractors or property;

•

the use of foul or abusive language;

•

nuisance or disruptive behaviour.

You will be entitled to a refund of part of any unexpired premium, providing no claims had been made for the current

period of insurance.

Policy exclusions

We will not pay claims for any pet:

•

not named on the schedule;

•

which is less than 8 weeks of age at the policy cover start date;

•

which no longer belongs to you;

•

where you and any joint policyholder are not the sole owner(s);

•

which should be registered under the Dangerous Dogs Act 1991 and The Dangerous Dogs (Northern Ireland) Order

1991 or any subsequent amendments.

We will not pay claims for any changes that you or your vet notices in your pets health or behaviour before this policy

started, or any illness or injury that develop from these changes.

Any incident outside the territorial limits of the United Kingdom, Northern Ireland, Isle of Man, Channel Islands, Eire and

the member countries of the PETS Travel Scheme (non-EU listed countries as defined by DEFRA are excluded).

Slaughter, by order from any Government, Local Authority or any person having jurisdiction in the matter, except in the

case of destruction for humane reasons to stop incurable suffering.

The cost and compensation for putting your pet to sleep, under a court order of the Contagious Diseases Act or following

its destruction for the protection of livestock.

Infringement of United Kingdom animal health and importation legislation.

Malicious or wilful injury or gross negligence to your pet which is caused by you or members of your family.

Medication that has not been recommended by a vet.

Any claim when your premium has not been paid.

War risks. Any loss, damage, liability, cost or expense of any kind caused directly or indirectly by war, invasion or revolution.

93014560.indd 17 19/09/2018 15:06

18

Claims conditions

These are the claims conditions you and your family will need to keep to as your part of this contract. If you do not, a

claim may be rejected or payment could be reduced. In some circumstances your policy might be invalid.

You must not settle, reject, negotiate or offer to pay any claim you have made or intend to make under this policy without

our written permission.

We have the right, if we choose, in your name but at our expense to:

•

take over the defence or settlement of any claim;

•

start legal action to get compensation from anyone else;

•

start legal action to get back from anyone else any payments that have already been made.

You must help us to take legal action against anyone or help us defend any legal action if we ask you to.

Referral Vet Visits

If your pet needs to be treated by a referral vet, your usual vet will let you know which referral vet from our preferred

referral vet network you should go to.

If a referral vet from outside our network is chosen, you will need to pay £200 of the referral vet bill yourself. This

amount is in addition to your policy excess.

If your pet needs emergency treatment for a situation that if not resolved immediately will lead to a loss of life or cause

a serious threat to the present or ongoing health of your pet you can visit any vet and you will not have to pay the

additional £200 excess.

Details of the vets in our preferred referral network can be found on Argospetinsurance.co.uk. If you need help or advice

about which vet to visit, please contact the Pet Claims Helpline on 0345 078 7500 before an appointment is made.

Late submissions

We don’t pay vet invoices that are 12 months older than the last date of treatment.

Other insurance

If you claim under this policy for something which is also covered by another insurance policy you must provide us with

full details of the other insurance policy. We will only pay our share of the claim.

Financial Sanctions

We won’t provide any cover or be liable to provide any payment or other benefit under this policy where doing so would

breach any prohibition or restriction imposed by law or regulation. If any such prohibition or restriction takes effect during

the period of insurance we may cancel this policy immediately by giving you written notice at your last known address. If

we cancel the policy no refund of premium will be made.

93014560.indd 18 19/09/2018 15:06

19

Complaints Procedure

Our Commitment to Customer Service

Argos Pet insurance is provided by Royal & Sun Alliance Insurance plc (RSA). Both Argos and RSA are committed to going

the extra mile for our customers. If you believe that we have not delivered the service you expected, we want to hear

from you so that we can try to put things right. We take all complaints seriously and following the steps below will help us

understand your concerns and give you a fair response.

Step 1

If your complaint relates to your policy then please contact the sales and service number shown in your schedule. If your

complaint relates to a claim then please call the claims helpline number shown in your policy booklet.

We aim to resolve your concerns by close of the next business day. Experience tells us that most difficulties can be sorted

out within this time.

Step 2

In the unlikely event that your concerns have not been resolved within this time, your complaint will be referred to our

Customer Relations Team who will arrange for an investigation on behalf of our Chief Executive. Their contact details are

as follows:

Post: Argos Pet Insurance

Customer Relations Team

P O Box 255

Wymondham

NR18 8DP

Email: crt.halif[email protected]

Our promise to you

We will:

•

Acknowledge all complaints promptly

•

Investigate quickly and thoroughly

•

Keep you informed of progress

•

Do everything possible to resolve your complaint

•

Use the information from your complaint to proactively improve our service in the future.

Once we have reviewed your complaint we will issue our final decision in writing within 8 weeks of the date we received

your complaint.

If you are still not happy

If you are still unhappy after our review, or you have not received a written offer of resolution within 8 weeks of the date

we received your complaint, you may be eligible to refer your case to the Financial Ombudsman Service (FOS). The FOS is

an independent body that arbitrates on complaints. They can be contacted at:

Post: Financial Ombudsman Service

Exchange Tower

Harbour Exchange Square

London E14 9SR

Telephone: 08000 234 567 (for landline users) 0300 1239 123 (for mobile users)

Email: [email protected]g.uk

Website: www.financial-ombudsman.org.uk

You have six months from the date of our final response to refer your complaints to the FOS. This does not affect your

right to take legal action, however, the FOS will not adjudicate on any case where litigation has commenced.

Thank you for your feedback

We value your feedback and at the heart of our brand we remain dedicated to treating our customers as individuals and

giving them the best possible service at all times. If we have fallen short of this promise, we apologise and aim to do

everything possible to put things right.

93014560.indd 19 19/09/2018 15:06

How we use your information

Your privacy is important to us and we are committed to keeping it protected. We have created this Customer

Privacy Notice which will explain how we use the information we collect about you and how you can exercise your

data protection rights. This privacy notice will help you understand the following:

Who are we?

We are Royal & Sun Alliance Insurance plc (RSA), we provide commercial and consumer insurance products and

services under a number of brands, such as MoreTh>n. We also provide insurance services in partnership with Argos

Limited who are an appointed representative of Home Retail Group Insurance Services Limited (HIS).

Why do we collect and use your personal information?

As an insurer, we need your personal information to understand the level of insurance cover you require. We’ll use

this information (e.g. your name, address, telephone number and email address) to communicate with you and if you

have agreed, to send you news and offers related to our products and services.

We need to use your information to create a quote for you, allowing you to buy insurance products from us. When

buying a product from us, you’ll also need to provide us with details about the items you wish to be covered by the

insurance (e.g. car make and model, your home).

We may need to check information you have submitted with external companies/organisations (e.g. the DVLA, the

Motor Insurance Database, credit reference agencies and criminal conviction checks.) When buying certain products,

sometimes we will ask for special categories of personal data (e.g. driving offences for motor insurance, medical

records in case of injury).

Once you become a customer, we’ll need to take your payment details to set up your cover. This could be direct debit,

credit or debit card information. To service your policy, we might contact you via our website, emails, telephone calls

or post. When using these services we might record additional information, such as passwords, online identifiers and

call recordings.

For some of our products, we may collect information through smart sensors to assess your insurance needs (e.g.

a black box installed in your vehicle when you buy a telematics driving product, which collects and uses geo-location

and driving behaviour data).

If you need to claim against your insurance policy, we will need to collect information about the incident and this may

be shared with other selected companies to help process the claim. If other people are involved in the incident, we

may also need to collect additional information about them which can include special categories of personal data (e.g.

injury and health data).

In submitting an application to us, you may provide us with equivalent or substantially similar information relating

to other proposed beneficiaries under the policy. You agree that you will bring this Privacy Notice to the attention of

each beneficiary at the earliest possible opportunity.

Data protection laws require us to meet certain conditions before we are allowed to use your personal information

in the manner described in this Privacy Notice. To use your personal information, we will rely on one or more of the

following grounds:

•

Performance of contract: We need to use your personal information in order to provide you with the policy

(which is a contract of insurance between you and us), and perform our obligations under it (such as making

payments to you in respect of a claim made under the policy).

•

Consent: In certain circumstances, we may need your consent unless authorised by law in order to use personal

information about you which is classed as “special categories of personal data”.

For marketing, you will always be given a choice over the use of your data.

•

Necessity to establish, exercise or defend legal claim: If you, or we, bring a legal claim (e.g. a court action)

against the other, we may use your information in either establishing our position, or defending ourselves in

relation to that legal claim.

•

Compliance with a legal obligation: Where laws or regulations may require us to use your personal

information in certain ways.

•

Legitimate Interests: We will also process your personal information where this processing is in our “legitimate

interests”. When relying on this condition, we are required to carry out a balancing test of our interests in using

your personal information (for example, carrying out market research), against the interests you have as a citizen

20

93014560.indd 20 19/09/2018 15:06

and the rights you have under data protection laws. The outcome of this balancing test will determine whether

we can use your personal information in the ways described in this Privacy Notice. We will always act reasonably

and give full and proper consideration to your interests in carrying out this balancing test.

Where else do we collect information about you?

Where possible, we’ll collect your personal information directly from you. However, on occasion we may receive

details about you from other people or companies. For example, this might happen if:

•

It was given to us by someone who applied for an insurance product on your behalf (e.g. an insurance broker, a

family member) where you have given them the permission to do so; or

•

It was supplied to us when you purchased an insurance product or service that is provided by us in partnership

with other companies; or

•

It was lawfully collected from other sources (e.g. Motor Insurance Database, Claims and Underwriting Exchange

or fraud prevention databases) to validate the information you have provided to us.

We request those third parties to comply with data protection laws and to be transparent about any such

disclosures. If you would like some further information, please contact us.

Will we share your personal information with anyone else?

We do not disclose your information outside of RSA except:

•

Where we need to check the information you gave to us before we can offer you an insurance product (e.g.

reference agencies);

•

Where we are required or permitted to do so by law or relevant regulatory authority (e.g. financial crime

screening, fraud detection/prevention);

•

Where we provide insurance services in partnership with other companies (e.g. building societies, large

retailers);

•

In the event that we are bought or we sell any business or assets, in which case we will disclose your personal

information to the prospective buyer of such business or assets;

•

As required to enforce or apply this Privacy Notice, or the contract of insurance itself;

•

Within our group for administrative purposes;

•

As required in order to give effect to contractual arrangements we have in place with any insurance broker and/

or intermediary through which you have arranged this policy;

•

With healthcare providers in the context of any relevant claim being made against your policy;

•

If we appoint a third party to process and settle claims under the policy on our behalf, in which case we will make

your personal information available to them for the purposes of processing and settling such claims;

•

With our third party service providers (including hosting/storage providers, research agencies, technology

suppliers etc.);

•

With our reinsurers (and brokers of reinsurers) in connection with the normal operation of our business;

Sometimes your personal information may be sent to other parties outside of the European Economic Area (EEA)

in connection with the purposes set out above. We will take all reasonable steps to ensure that your personal

information is treated securely and in accordance with this Privacy Notice, and in doing so may rely on certain

“transfer mechanisms” such as the EU-US Privacy Shield, and the standard contractual clauses approved by the

European Commission. If you would like further information please contact us.

Which decisions made about you will be automated?

Before we can offer you an insurance product or service, we may need to conduct the following activities, which

involve automated (computer based) decision-making:

•

Pricing and Underwriting – this process calculates the insurance risks based on the information that you have

supplied. This will be used to calculate the premium you will have to pay.

•

Credit Referencing – using the information given, calculations are performed to evaluate your credit rating. This

rating will help us to evaluate your ability to pay for the quoted products and services.

21

93014560.indd 21 19/09/2018 15:06

•

Smart Sensor Data Analytics – an insurance product that collects your information using smart sensors (e.g.

in car black box) to calculate your insurance risk (e.g. driving score). This may then be used to determine your

policy rewards (e.g. cash back for safe driving) and to calculate your policy renewal premium.

•

Automated Claims – some small claims may qualify for automated processing, which will check the

information you provide, resulting in a settlement or rejection of your claim.

The results of these automated decision-making processes may limit the products and services we can offer you.

If you do not agree with the result, you have the right to request that we perform a manual reassessment using the

same information that you originally provided. If you wish to do so please contact us.

For how long will we keep your information?

Your personal information will be retained under one or more of the following criteria:

•

Where the personal information is used to provide you with the correct insurance cover, which will be kept as

long as it is required to fulfil the conditions of the insurance contract.

•

Where the use of your personal information for a specific purpose is based on your consent, it will be kept for as

long as we continue to have your consent (e.g. we would stop contacting you for marketing purposes once you

have asked us to).

•

Where, for a limited period of time, we are using some of your information to improve the products or services

we provide.

•

For as long as your information is required to allow us to conduct fraud and/or criminal checks and investigations.

Will you be contacted for marketing purposes?

If you have agreed, we might contact you by post, email, phone and text message to let you know about offers and

services we think you’ll like. The messages may be personalised using information you have previously provided us.

You can ask us to stop contacting you for marketing purposes at any point.

We will only contact you for marketing purposes if we collected your information directly, except when authorised

and instructed by the third-party acting on your behalf.

We may use the information which we collect about you to show you relevant advertising on third-party websites

(e.g. Facebook, and Google). This could involve showing you an advertising message where through the use of cookies,

we know you have browsed our products and services. If you don’t want to be shown targeted advertising messages

from us, you can change the advertising setting on some third-party sites and some browsers to block our adverts.

Your information is incorrect what should you do?

If you hold a product or service with us and think that the information we hold about you is incorrect or incomplete,

please contact us and we will be happy to update it for you.

What are your rights over the information that is held by RSA?

We understand that your personal information is important to you, therefore you may request the following from us to:

1. Provide you with details about the personal information we hold about you, as well as a copy of the information

itself in a commonly used format. [Request Ref: DSR 1]

2. Request your personal information be deleted where you believe it is no longer required. Please note however,

we may not be able to comply with this request in full where, for example, you are still insured with us and the

information is required to fulfil the conditions of the insurance contract. [Request Ref: DSR 2]

3. Request the electronic version of the personal information you have supplied to us, so it can be provided to

another company. We would provide the information in a commonly used electronic format. [Request Ref: DSR 3]

4. Request to restrict the use of your information by us, under the following circumstances [Request Ref: DSR 4]:

a. If you believe that the information we hold about you is inaccurate, or;

b. If you believe that our processing activities are unlawful and you do not want your information to be deleted.

c. Where we no longer need to use your information for the purposes set out in this Privacy Notice, but it is

required for the establishment, exercise or defence of a legal claim.

d. Where you have made an objection to us (in accordance with section 5 below), pending the outcome of any

assessment we make regarding your objection.

22

93014560.indd 22 19/09/2018 15:06

5. Object to the processing of your data under the following circumstances [Request Ref: DSR 5]:

a. Where we believe it is in the public interest to use your information in a particular way, but you disagree.

b. Where we have told you we are using your data for our legitimate business interests and you believe we

shouldn’t be (e.g. you were in the background of a promotional video but you did not agree to be in it.)

In each case under section 5 above, we will stop using your information unless we can reasonably demonstrate

legitimate grounds for continuing to use it in the manner you are objecting to.

If you would like to request any of the above, please contact us and submit a written request, including the request

reference (e.g. DSR 1), as this will speed up your request. To ensure that we do not disclose your personal information

to someone who is not entitled to it, when you are making the request we may ask you to provide us with:

•

Your name;

•

Address(es);

•

Date of birth;

•

Any policy IDs or reference numbers that you have along with a copy of your photo identification.

All requests are free of charge, although for requests for the provision of personal information we hold about you

(DSR1) we reserve the right to charge a reasonable administrative fee where, we believe an excessive number of

requests are being made. Wherever possible, we will respond within one month from receipt of the request, but if we

don’t, we will notify you of anticipated timelines ahead of the one month deadline.

Please note that simply submitting a request doesn’t necessarily mean we will be able to fulfil it in full on every

occasion – we are sometimes bound by law which can prevent us fulfilling some requests in their entirety, but when

this is the case we will explain this to you in our response.

Our Privacy Notice.

If you have any queries regarding our privacy notice please contact us and we will be happy to discuss any query

with you. Our privacy notice will be updated from time to time so please check it each time you submit personal

information to us or renew your insurance policy.

How you can contact us about this Privacy Notice?

If you have any questions or comments about this privacy notice please contact:

The Data Protection Officer

RSA

Bowling Mill

Dean Clough Industrial Park

Halifax

HX3 5WA

You may also email us at [email protected]sagroup.com.

How you can lodge a complaint?

If you wish to raise a complaint on how we have handled your personal information, please send an email to

[email protected]oup.com or write to us using the address provided. Our Data Protection Officer will investigate

your complaint and will give you additional information about how it will be handled. We aim to respond in a

reasonable time, normally 30 days.

If you are not satisfied with our response or believe we are processing your personal information not in compliance

with UK Data Protection law, you can lodge a complaint to the Information Commissioner’s Office, whose contact

details are;

Information Commissioner’s Office

Wycliffe House

Water Lane

Wilmslow

Cheshire

SK9 5AF

23

93014560.indd 23 19/09/2018 15:06

Argos Pet Insurance is underwritten and administered by Royal & Sun Alliance Insurance plc (No. 93792). Registered in England and Wales

at St. Mark’s Court, Chart Way, Horsham, West Sussex, RH12 1XL. Authorised by the Prudential Regulation Authority and regulated by the

Financial Conduct Authority and the Prudential Regulation Authority.

Calls may be recorded and monitored. 453487H (11/18)

93014560.indd 24 19/09/2018 15:06