Fund Management Companies - Guidance

1

Fund Management Companies –

Guidance

December 2016

2016

Fund Management Companies - Guidance

1

Contents

Part I. Delegate Oversight 2

Part II. Organisational Effectiveness 24

Part III. Directors’ Time Commitments 26

Part IV. Managerial Functions 30

Part V. Operational Issues 102

Part VI. Procedural matters 109

Fund Management Companies - Guidance

2

Adherence to guidance

1. It should be evident from the fund management company’s board minutes that

the fund management company is acting in accordance with this guidance, if

this is the case.

PART I

Delegate Oversight

Scope

1. This Part sets out the Central Bank’s guidance for boards of directors of

investment companies, UCITS management companies, alternative investment

fund managers (AIFMs) and AIF management companies incorporated and

authorised in Ireland (referred to in this Part as “relevant companies”).

2. A board of a relevant company has ultimate responsibility for all aspects of

management that are not specifically reserved to the shareholders (whether by

constitutive documents or applicable law

1

). While boards may delegate tasks

internally, it is also common in Ireland for certain tasks to be delegated

externally. The focus of this document is on the role of boards where significant

tasks are delegated externally. It is not deemed necessary at this time to issue

guidance on other aspects of a board’s work. In those regards, boards are

recommended to exercise prudent judgement having regard to, but not

necessarily confining themselves to, widely accepted standards of good

governance and to have regard to the particular challenges of the relevant

company.

3. Such delegation, and the legal responsibilities of delegates, does not reduce the

board’s ultimate responsibility. It follows that the board must, notwithstanding

1

In particular, under the Companies Act 2014 or the Irish Collective Asset-management Vehicles Act

2015

Fund Management Companies - Guidance

3

any such delegation, at all times retain and exercise overall control of the

relevant company’s management.

4. There are also limits on the extent to which delegation is legally permissible. In

particular, under European legislation as transposed, AIFMs and UCITS

management companies are under an obligation not to delegate to the extent that

they become letterbox entities

2

.

5. The responsibilities of a UCITS management company and an AIFM, as set out

in applicable legislation, differ. A UCITS management company is defined as

a company whose regular business is the management of UCITS (defined as

including investment management, fund administration and distribution). An

AIFM may carry on all these functions but is required to perform investment

management (defined as encompassing portfolio management and risk

management). In this Part, no distinction is drawn between UCITS and AIFs,

but, in the application of the guidance it sets out, account should be taken of the

specific circumstances which prevail.

6. The scope of this Part covers:

A. investment management

B. distribution

C. risk management (both operational and investment risk)

D. operation and administration

E. support and resourcing

F. boards of externally-managed investment companies

7. The main body of this Part concerns the responsibilities of relevant companies

(and, by extension, of their boards, which have ultimate management

responsibility) which are authorised in Ireland as AIFMs or UCITS

management companies. This encompasses:

• self-managed UCITS and AIFs; and

2

Regulation 23(2) of the EC (UCITS) Regulations 2011 and Regulation 21(4) of the EU (AIFM)

Regulations 2013.

Fund Management Companies - Guidance

4

• UCITS management companies and AIFMs.

8. In some cases UCITS management companies and AIFMs will have been

appointed by investment companies (i.e. UCITS or AIFs). A further section F

therefore addresses issues specific to the responsibilities retained by such

investment companies (and, by extension, their boards).

9. In this Part the term:

• “delegate” means, in the context of any relevant company or the board

of any relevant company, the fund administration company, investment

manager, risk manager and distributor;

• “depositary”, in the context of an investment fund, includes reference to

any trustee or custodian, if applicable, of that investment fund;

• “investment company” means an investment company authorised in

accordance with Part 24 of the Companies Act 2014 or the European

Communities (Undertakings for Collective Investment in Transferable

Securities) Regulations 2011 (S.I. No. 352 of 2011) or an Irish

Collective Asset-management Vehicle (‘ICAV’) registered with and

authorised by the Central Bank under the ICAV Act 2015;

• “investment fund” means a collective investment scheme whether

structured as an investment company, unit trust, common contractual

fund, investment limited partnership or otherwise

3

;

• “fund management company” means an entity regulated as an AIFM or

a UCITS management company

4

in each case incorporated or otherwise

organised, and authorised under the laws of Ireland. In the context of

section F, however, it may encompass a management company

organised and authorised in another EU member state or an AIFM

established outside the EU; and

3

Investment funds may be organised and authorised under the laws of jurisdictions other than Ireland.

The laws applicable to such an investment fund may impose on a management company additional, or

alternative, obligations to those imposed in the case of an Irish investment fund. The Central Bank has

focussed only on investment funds organised and authorised under the laws of Ireland and has assumed

that nothing in the laws of such other jurisdictions would affect the recommendations made in this Part.

Of course, the board of a management company must be satisfied that the management company has

complied with all applicable legal and regulatory requirements. It follows therefore that it should also

be satisfied that there is no conflict between the respective requirements of each relevant jurisdiction.

4

This includes any self-managed investment company which is itself regulated as an AIFM or UCITS

management company

Fund Management Companies - Guidance

5

• “investment management” means that which, in an AIFMD context,

would be encompassed by the portfolio management aspects of

investment management.

10. The provisions set out in this Part are intended to assist relevant companies by

providing an overview of the approach recommended by the Central Bank. This

Part does not purport to address every aspect of such practice in detail. The

overriding approach should be that the board should design its governance

practices so as to be appropriate and commensurate to the business of the

relevant company and, where applicable, the investment funds it manages.

General observations

Relationship between fund management company and delegates

11. Good governance requires clarity as to the allocation of responsibilities,

documented policies and procedures, structures which foster constructive

challenge, and the effective provision of appropriate information to boards. The

adoption by a board of the general approach identified in this Part will not in

itself achieve the objective of good governance. The environment and culture

in which such an approach operates are also key.

12. The relationship between a fund management company and a delegate must be

such as to enable competent and appropriate management of the fund

management company and a shared understanding as to how to achieve it. The

following features are essential to such a relationship:

• Openness: Full, frank and open dialogue between the board and the

delegates is essential. A delegate should provide all information that the

board needs in order to discharge its responsibilities. The scope of that

information should be clearly identified by the board and agreed with

the delegate;

• Engagement: Directors should be attentive to their duties as directors

and dedicate sufficient time to their discharge. The Central Bank’s

guidance on directors’ time commitments is relevant in this regard. A

Fund Management Companies - Guidance

6

delegate should recognise the directors’ duties and facilitate the

discharge by the directors of their ultimate responsibility for the

delegated tasks;

• Co-operation: A fund management company and its delegates should

recognise their common interest in a well-run fund management

company that serves the interests of investors in the funds that it

manages.

• Dialogue: A delegate should accept that directors, in order to discharge

their duties, may need to seek further information on proposals and

performance, ask probing questions and provide constructive criticism.

The relationship between the delegate and the board should be such that

directors are encouraged to do so. Nothing in the way directors are

appointed or support is provided to directors should signal any

reluctance on the part of delegates to support open board-level

challenge.

13. The relationship between the fund management company and its delegates

should be such as will support and facilitate the exercise by the board of its

ultimate responsibility for, and control over, the management of that fund

management company.

Retained tasks and delegated tasks

14. A fund management company may, notwithstanding the ultimate management

responsibility of its board, delegate in whole or in part certain specific tasks

which form part of the fund management company’s management functions.

While the tasks may be delegated, however, ultimate responsibility for those

management functions themselves cannot be delegated. Delegation is permitted

but responsibility is retained. The terms of any delegation should, therefore, be

such as will facilitate the discharge by directors of:

• their duties to the relevant fund management company (including those

relating to that company’s discharge of its obligations in respect of

investment funds it manages); and

Fund Management Companies - Guidance

7

• any other responsibilities assumed by them to other persons, for example

to shareholders (investors) pursuant to the prospectus, where it is a self-

managed investment company.

Retained tasks

15. The board should, notwithstanding any delegation of tasks, take all major

strategic and operational decisions affecting the fund management company and

any investment funds it manages

5

.

16. Examples of key responsibilities that should be retained by the board include

the following:

• issue of the prospectus, where the fund management company has

responsibility in this regard;

• review and approval of financial accounts and investment fund

documentation, where the fund management company has responsibility

in this regard;

• temporary suspension of redemptions, or other measures taken in

response to adverse financial developments, where the fund

management company has responsibility in this regard;

• approval and periodic review of the business plan or programme of

operations, as the case may be, and compliance with it;

• its own internal governance, including the appointment and retention of

directors and any staff, the capacity of directors to fulfil their roles and

conflict of interest policies;

• adoption and review of a comprehensive suite of policies and procedures

and, to the extent that reliance is placed on the policies and procedures

of delegates, periodic review of the appropriateness of such reliance;

• satisfying itself that arrangements are in place to enable compliance with

applicable legal and regulatory requirements;

5

Subject always to any matters reserved to its shareholders (in the case of decisions affecting it), or to

the shareholders (or other investors) or board (or other internal management) of any externally-managed

investment fund (in the case of decisions affecting such an investment fund). The below comments on

retained tasks should be read subject to this.

Fund Management Companies - Guidance

8

• appointment, oversight and removal of delegates (including the basis on

which delegates may further delegate tasks);

• investment approach (see section A below);

• launches or closures of sub-funds and share classes; and

• distribution strategies including the jurisdictions into which the

investment funds are marketed.

17. The board may of course discharge these responsibilities with the benefit of

advice and recommendations from delegates. Given the nature of its

responsibilities, however, it should consider any such advice and

recommendations and reserve the right not to act on such advice and

recommendations where appropriate. Decisions on matters reserved to the

board should be minuted in precise, unequivocal and directive terms.

Delegated tasks

18. The main body of this Part deals with the oversight of tasks which are delegated.

19. The delegation of a task does not release the board from its ultimate

responsibility for the relevant management functions. The board should satisfy

itself that the manner of delegation is such that the relevant board

responsibilities can be discharged, that management roles delegated internally

can be effectively performed (see Part III on organisational effectiveness) and

that the external delegate performs the relevant task to an appropriate standard.

20. A board should exercise skill, care and diligence when identifying and

approving the appointment of a delegate for any task. It should satisfy itself as

to the capacity of the prospective delegate to undertake such task to the required

standard.

21. It should continue to exercise skill, care and diligence in its continuing oversight

of delegates. To this end the board should receive and be satisfied with periodic

reports from appropriately authorised personnel of the delegate.

Fund Management Companies - Guidance

9

22. Such reports should address compliance with relevant legal and regulatory

requirements and with relevant policies and operating procedures (including

those of the fund management company and the delegate as relevant), noting

the extent of any breaches; error reporting should be included. The board should

identify when standards fall short of the required levels and require remedial

action to be taken.

23. In addition, boards should receive and be satisfied with reports or presentations

from their delegates addressing significant developments in the delegate’s

business, including development plans or changes in organisation, business mix

or client base, outcomes of regulatory inspections and external and internal audit

reviews, and business continuity programmes.

Fund Management Companies - Guidance

10

A. Investment management

24. The board should seek a report or presentation from the investment manager

prior to the issue of the prospectus and launch of the investment fund or sub-

fund (the “relevant fund” in this Part) to inform it of the investment approach

the investment manager proposes to take. It should approve the proposed

investment approach, taken as a whole. For this purpose, the board should be

provided with information about at least the following matters:

• the investment objective and policies;

• any benchmark against which the relevant fund’s performance will be

presented to investors and/or used in the calculation of performance

fees;

• the range of assets into which it is proposed the relevant fund should

invest;

• the portfolio management team’s credentials for the task;

• the investment processes to be adopted by the portfolio management

team;

• the type of restrictions and limitations imposed on the management of

the relevant fund, additional to those specified in the prospectus, for

example those dealing with large exposures or leverage, and the related

control arrangements;

• frequency of unit dealing, the basis for pricing relevant fund units, and

any anti-dilution measures;

• the investment manager’s trading protocols, including order

management, best execution, allocation of business to brokers and

commission sharing;

• the basis on which any securities lending is undertaken, including fees,

counterparty risk and collateral management;

• the extent to which it is proposed to use financial derivative instruments,

the controls to which such use will be subject and applicable policies in

respect of collateral management, counterparty risk and leverage

management; and

Fund Management Companies - Guidance

11

• processes for the management of liquidity risks, including the potential

for liquidity mismatches between assets and liabilities, and the actions

to be taken to mitigate them.

25. Once the relevant fund has been established and launched, the board should

oversee the investment manager’s compliance with the approved investment

approach. While it is not the role of the board to take day-to-day investment

decisions that are properly within the remit of the portfolio manager, it should

put in place processes under which it monitors, and the investment manager is

accountable for, the delegated tasks.

26. The board should receive and be satisfied with comprehensive annual

presentations from the investment manager detailing developments affecting the

manager itself, the investment process and strategy, the investment team,

progress and performance (including strategy for responding to any

underperformance) and any proposed development of the investment approach.

Changes to the investment approach at any time should be subject to approval

by the board. A suitable representative of the investment manager should be

available to answer questions in advance of and at the board meeting where such

changes are being discussed.

27. The board should also receive and be satisfied with regular (at least quarterly,

unless the particular circumstances indicate otherwise) reports during the year.

These should include details of any departures from the investment approach

approved by the board or breaches of the investment manager’s internal

policies, and any remedial action taken.

28. All directors should have a good understanding of all relevant aspects of the

investment manager’s business and policies. This might require site visits

and/or meetings with senior management, in addition to the regular

presentations and reports from the personnel working directly on the account

where practicable. Such site visits are often beneficial and should be given

positive consideration.

Fund Management Companies - Guidance

12

B. Distribution

29. At the time of the launch of a new investment fund (including any sub-fund),

the board should approve the proposed distribution strategy, including:

• who will undertake the tasks associated with distribution and any

proposed delegation;

• the marketing strategy and approach;

• target markets and channels, including the competitive landscape;

• the jurisdictions into which distribution is proposed, whether

immediately or in due course;

• the control framework for compliance with any local legal, regulatory,

tax or other compliance requirements; and

• the control framework for marketing in a manner consistent with the

terms of the prospectus.

30. The board should receive and be satisfied with regular reports on distribution,

including:

• patterns of distribution, current progress and development, and

resourcing;

• sales flows in the period and current pipeline;

• any proposed new developments and initiatives; and

• any local legal, regulatory, tax or other compliance issues

31. The arrangements with any distributor should be structured so that marketing

activities are required to be consistent with the agreed distribution strategy. The

board should be entitled therefore to receive on request any marketing materials

prepared by the distributor, including fact sheets and generic presentations to

prospective investors. Boards should seek such marketing material whenever

they have reason to believe that such material includes significant elaborations

on the matters covered in the investment approach. The board should also

examine such material if there is a perceived risk that its content conflicts with

the prospectus.

Fund Management Companies - Guidance

13

C. Risk management

32. The board should adopt a risk management framework which:

• identifies the applicable risks;

• confirms the risk appetite;

• identifies any appropriate risk mitigants; and

• incorporates appropriate policies for the measurement, management and

monitoring of risk, including the implementation as appropriate of any

risk mitigants.

33. The risk appetite statement should be appropriate and proportionate to the

nature, scale and complexity of the activities of the fund management company

and the investment fund(s) under management. The risk policies should include

clear procedures (with thresholds where appropriate) for reporting to the board,

and considering breaches of any limits.

34. The board should keep the risk management framework, and its constituent

elements, under periodic review.

35. The board should agree how its responsibility for risk oversight and

management is discharged, given any delegations of tasks, and establish a

shared understanding with each delegate as to their respective roles. The board

should determine the quality, type and format of risk-related information which

it requires and put in place arrangements to receive it.

36. While the board may obtain advice and recommendations on risk issues,

including periodic review of the risk management framework, it should retain

the ultimate decision-making capability. While it may seek advice relating to

risk management and delegate tasks relating to the implementation of the

policies, it should ensure that it receives and reviews comprehensive reports

from any such delegate.

Fund Management Companies - Guidance

14

Investment risk

37. A fund management company’s risk management framework should address all

significant investment risks to which any investment fund it manages is

exposed, which may include some or all of the following:

• market risk, including major external developments which could impact

investments

• portfolio risk, including quantitative analysis

• liquidity risk, including the risk of investor redemptions requiring the

disposal of assets of limited liquidity

• country or regional risk

• credit risk

• counterparty risk

• leverage

38. Investment risk appetite should be set having regard to:

• the investment objective and strategy and product design of the

investment fund(s) under management;

• the likely nature of potential investors in the investment fund(s) and the

appropriate disclosure of risks; and

• the liquidity of the assets in which the investment fund(s) invests and

the potential for any asset/liability mismatch

39. The board should receive and be satisfied with regular reports assessing risk

levels relative to the risk appetite(s) for the investment funds under

management.

Operational risk

40. A board should satisfy itself that the business of delegates is effectively

managed and controlled, and that appropriate operational risk policies and

procedures of the delegates are in place and subject to regular review by the

delegates. It should receive and be satisfied with regular reports on the

performance of the delegate, including the following as they relate to the

investment fund under management:

Fund Management Companies - Guidance

15

• significant IT incidents

• fraud

• complaints

• outsourcing

• dealing errors

• pricing errors

• other breaches

Operational risk - Enterprise risk and business continuity

41. Boards should receive and be satisfied with reports on risks which could impact

the fund management company and the investment funds that it manages. These

would include:

• large dealing risk

• key person risk

• failure of a delegate or sub-delegate

• reputational risk

• regulatory risk

• continued capacity of systems and personnel

42. In respect of delegated tasks, a board may consider it appropriate to rely upon

business continuity programmes maintained by delegates. It should however

satisfy itself that

• those programmes are sufficient to discharge the board’s own

obligations for the relevant tasks; and

• the delegates’ programmes, taken together with any maintained by the

board (for example where tasks have been retained rather than

delegated), encompass all relevant activities of the company and the

investment funds under management.

43. Such reliance should be the subject of periodic review.

Fund Management Companies - Guidance

16

D. Investment operations and administration

44. When appointing a delegate to take on operational and administrative tasks, a

board should establish in particular that the delegate has:

• operational resilience (the ability to provide an uninterrupted service to

the required standard even in adverse circumstances);

• robust risk management policies and procedures;

• sufficient capacity and flexibility to manage varying levels of business

including potential variations in the fund management company’s

requirements over time; and

• suitable procedures for maintaining confidentiality and security of

information.

45. The board should receive and be satisfied with regular reports on operational

matters, including but not limited to:

• depositary reports, where the board considers that they are necessary for

the discharge by the fund management company of its responsibilities;

• fund administrator reports;

• performance, including appropriate error and breach reporting;

• oversight by delegates of any outsourcing arrangements they put in

place, and performance of sub-delegates;

• operation of anti-money laundering policies;

• IT systems issues, including significant changes and developments of

relevance to the board;

• resourcing of the provision of services to the fund management

company.

46. The board should adopt and keep up to date an appropriate valuation policy. It

should receive and be satisfied with regular reports on exceptional valuation

items, such as stale prices and fair valued securities, and appropriate error

reporting. The board should receive reports covering material and non-material

pricing errors which identify patterns in causation and satisfy itself that those

Fund Management Companies - Guidance

17

errors have been mitigated. In the case of illiquid assets, it should satisfy itself

as to the process by which values are set.

47. The board should approve and keep under review a budget for payments over

and above the investment management fee which may be charged to the

investment fund and receive periodic reports.

Fund Management Companies - Guidance

18

E. Support and resourcing

48. Fund management companies need to have sufficient resources at their disposal

to enable them to carry out their functions properly, taking into account the

nature, scale and complexity of their business. It is the responsibility of the

board to determine in the light of its particular circumstances the appropriate

resourcing of these functions and to satisfy itself that responsibilities for

undertaking delegated tasks are allocated accordingly.

49. The matters on which the board will require support and resources (in addition

to the support of the official company secretary, the duties of which are

prescribed by law) may include, without limitation, the following:

• proactive monitoring of developments between board meetings,

assessing which if any require the immediate attention of the board, and

arranging any necessary action;

• management of board meetings including adequate planning and

preparation, preparing the agenda, managing the attendees, actioning of

board decisions, briefing of directors on developments and preparation

where appropriate of executive summaries for directors;

• management of other meetings and visits of directors which may include

training sessions, due diligence visits, board evaluation meetings or

planning and strategy sessions;

• management of documents, including meeting minutes, business plan,

policies, procedures, offering documents, material contracts, registers

and correspondence;

• preparation of reports, summaries and other material relevant to the

board’s considerations and decisions;

• timely preparation of half-yearly and audited annual financial accounts;

• managing an annual calendar, so that all matters required to be

considered by the directors through the year are dealt with in an orderly

fashion, and facilitating the timely preparation and circulation of papers

to the board to enable directors to give proper prior consideration to all

relevant matters;

Fund Management Companies - Guidance

19

• regular review of the fund management company’s suite of policies and

procedures, and preparing any required revised drafts for consideration

and approval by the board, including collecting relevant information

from delegates, monitoring regulatory and other external developments

and evaluating the need for changes.

50. There is a variety of potential resourcing models for the necessary support

including, without limitation, models based on employees of, and/or secondees

to, the fund management company and/or services provided by external

delegates. The appropriateness of any proposed model will depend on the

circumstances of, and any legal and regulatory requirements applicable to, the

relevant fund management company. The board should satisfy itself that the

model selected is appropriate in the relevant circumstances.

51. Individual directors may be designated as having particular managerial

functions. Such designation should not, however, be taken to affect the board’s

overall collective responsibility for the function, and procedures should be

adopted so that matters continue to be escalated for consideration by the full

board where appropriate. When designating an individual director for such a

managerial function, boards should be satisfied that:

• the individual has the requisite skills and experience for the role;

• sufficient support and resources are available to the individual to enable

the role to be discharged; and

• the designation does not compromise the ability of the individual, or the

board as a whole, to satisfy any applicable independence requirement.

52. Where a board engages support in discharging its functions, it should retain

control at all times, and the respective responsibilities of the provider of that

support and of the board should be clearly documented so as to facilitate the

exercise by the board of its ultimate responsibility for, and control over, the

management functions to which that support relates.

Fund Management Companies - Guidance

20

53. A director or directors may on occasion consider it necessary to obtain

independent advice on issues relating to the board’s functions and

responsibilities. It is desirable for a director’s contract to enable the director to

do so.

Fund Management Companies - Guidance

21

F. Boards of externally-managed investment companies

54. The fund management company is responsible for ensuring that it and its

investment funds under management comply with regulatory obligations. The

board of an externally-managed investment company should ensure that it

supports the ability of the fund management company to comply with all

regulatory obligations. But it also needs to satisfy itself that the delegation to

the fund management company is working effectively for investors.

55. Externally-managed investment companies are not regulated as fund

management companies. Nevertheless the board of an externally-managed

investment company retains ultimate responsibility for its management

6

,

including the appointment and oversight of the fund management company,

which is its principal delegate.

56. The relationship between an externally-managed investment company and its

fund management company may be structured in a number of different ways.

The two entities should agree in the light of their particular circumstances the

appropriate and proportionate approach to the recommendations in this section.

57. The board of the externally-managed investment company retains responsibility

for issuing the prospectus. It should expect to receive information about the

investment approach of the fund management company, as outlined in section

A of this Part. It also retains responsibility for publishing audited financial

statements (a responsibility shared with the fund management company in the

case of an investment company authorised as an AIF).

58. The board of the externally-managed investment company should satisfy itself

that its relationship with the fund management company is such that the relevant

board responsibilities are discharged, and that the fund management company

performs the relevant tasks it is required to undertake to an appropriate standard.

It should receive and be satisfied with regular and appropriately detailed reports

6

Other than in respect of matters reserved to the shareholders

Fund Management Companies - Guidance

22

from a senior representative of the fund management company in this regard.

It should further consider and identify any conflicts of interest that may arise

and should satisfy itself that such conflicts are being appropriately managed. In

general, it should hold the fund management company to the same standards of

accountability as the preceding sections of this Part recommend that a fund

management company should set for its delegates. It should also receive and

be satisfied with regular, direct reports from the depositary. It does not,

however, need to replicate the detailed oversight of delegates by the fund

management company.

59. The board of the externally-managed investment company should expect to

receive and be satisfied with regular reports from the fund management

company describing:

• its performance (whether directly or through delegates) of the

investment management tasks outlined in section A of this Part;

• significant developments in the distribution of the investment fund,

including any significant legal, regulatory, tax or other compliance

issues;

• its performance (whether directly or delegated) of the risk management

tasks outlined in section C of this Part;

• its performance (whether directly or delegated) of the operational and

administrative tasks outlined in section D of this Part;

• the extent of its delegation of any of the tasks and its control framework

for oversight of its delegates’ performance.

60. The board should also consider whether it should, in addition to reports from

the fund management company, require periodic direct reports from (including,

if appropriate, attendance at board meetings by) the delegates of the fund

management company.

61. A fund management company may include reports received from its delegates

in its reports to the board of an externally-managed investment company.

However, a fund management company’s report should not consist solely of the

Fund Management Companies - Guidance

23

transmission of reports received from its delegates. The fund management

company’s report should include commentary from the fund management

company on how it has performed its role.

62. Some AIF “management companies” may appoint external AIFMs. These AIF

“management companies” are not regulated as AIFMs but retain responsibility

for the AIFs under management and the oversight of the AIFM. The board of

the AIF management company also retains responsibility for issuing the

prospectus (unless the AIF is itself an investment company) and for publishing

audited financial statements (unless the AIF is itself an investment company),

the latter responsibility being shared with the AIFM.

63. In such cases, the board of the AIF management company should apply the same

approach to the oversight of the AIFM as described above in the case of an

investment company.

64. For avoidance of any doubt, this section (F) is limited to externally-managed

investment companies and to AIF management companies with external

AIFMs, and does not apply to other forms of investment fund or fund

management company.

Fund Management Companies - Guidance

24

PART II

Organisational Effectiveness

7

1. One of the independent directors of a fund management company, which could

be the Chair if he or she is independent, should undertake an organisational

effectiveness role. The purpose of this role is to ensure that there is an

independent director within the fund management company who has the

specific task of keeping the effectiveness of the organisational arrangements of

the company under ongoing review, with his or her reports being submitted to

the board for discussion and decision.

2. The independent director who undertakes this task will be on alert for

organisational issues and will escalate these to the board. They will be change

leaders who bring proposals to improve effectiveness to the board. They will

champion these proposals and will drive through the change agenda to ensure

that agreed actions are implemented.

3. Having a person with responsibility for reviewing organisational effectiveness

should ensure that a fund management company does not continue to adhere to

agreed organisational arrangements when these are no longer appropriate

because, for example, the fund management company has grown and

developed, because market practice has moved on or because one of the

arrangements suffers from an unanticipated conflict of interests.

4. Some non-exhaustive examples of the types of matters which the independent

director undertaking the organisational effectiveness role will be involved in

are: monitoring the adequacy of a fund management company’s internal

resources to its day-to-day managerial roles; reviewing the organisational

structure of the fund management company and considering whether it remains

fit for purpose; considering the conflicts of interest affecting the fund

Fund Management Companies - Guidance

25

management company and its investment funds under management and

initiating action, such as escalation to the board, where these are having or are

likely in the near future to have an adverse impact; reviewing the board

composition and reporting on this to the board; organising periodic board

effectiveness evaluations and overseeing how well the decision taken by the

fund management company and the arrangements for the supervision of

delegates are working in the interests of investors.

Fund Management Companies - Guidance

26

PART III

Directors’ Time Commitments

1. The Central Bank considers that a reasonable number of working hours

available for each individual is approximately 2000 per year. This is based on

a 9 hour day and 230 working days per annum. This ‘total’ time allocation

should be considered by individuals when taking on new directorship roles and

should include all professional commitments including other directorships and

employments held. Directors should satisfy themselves, and their boards, that

they have sufficient time to fully discharge their duties.

2. Directors and boards should agree a minimum time allocation for board meeting

attendance; this should include all necessary preparation, review of documents

and also, where appropriate, travel time. The agreed minimum time allocation

should be documented in the director’s letter of appointment in line with

paragraphs 5 and 6 of this Part.

3. Sufficient time should be set aside as a buffer for directors to deal with ad hoc

issues that arise from time to time. This should be in addition to the normal time

allocated to each director role.

4. Additional time should be allocated where a director carries out a Chairperson

role. This time allocation should be agreed with each board and be

commensurate with any additional work that this role requires.

5. A designated person role for managerial functions should be considered

separately to the role of director. A separate time commitment should be

allocated for each such designated person role and should be commensurate

with any additional work that this role requires, including remuneration

received. The time allocated should take into account, inter alia, the on-going

oversight role, daily availability, report review and onsite visits to delegates.

Fund Management Companies - Guidance

27

6. A separate letter of appointment should issue in respect of a designated person

role for managerial functions. This should include a written contract setting out

the job specifications, the time expectations and the fee arrangements for the

role. The separate letters of appointment should be subject to annual review by

the board and made available to the Central Bank upon request.

7. Individuals with multiple directorships should consider the conflicts which may

arise when sitting on a number of boards and the corporate interconnectivity

that is created. Conflicts which may occur between individuals with full-time

positions in a service provider to the board should also be considered and the

most appropriate action taken.

8. In addition to the number of directorships, individuals should consider the

additional time required to deal with the number of underlying sub funds within

one investment fund. The type and complexity of individual investment funds

and sub-funds should also be considered carefully by individuals when

assessing both the required time commitment and the necessary expertise

needed at board level to oversee the investment fund.

9. Individuals should also take into account the number of different client

relationships they have entered into when assessing time commitments.

10. Directors should be fully aware of the regulatory and legal obligations of

differing types of boards and legal structures prior to any board appointments.

11. Membership of board committees should also be regarded as a separate role and

should be included in any assessment of director time commitment and

availability.

12. The ultimate responsibility for compliance with all regulatory obligations rests

with the boards and the individual directors. Extensive director commitments

without sufficient awareness and consideration of the corresponding impact

may lead to significant governance risk.

Fund Management Companies - Guidance

28

Central Bank engagement

13. The Central Bank will directly engage with those individuals with high numbers

of directorships combined with high aggregate levels of annual professional

time commitments to ensure their legal obligations and responsibilities as board

members are being met and will monitor directors’ commitments so as to avoid

any potential risk that governance standards may be weakened.

14. The Central Bank intends to treat high levels of directorships combined with

high aggregate levels of annual professional time commitments as a risk

indicator. Where any risk indicator is triggered, additional supervisory attention

is appropriate under the Central Banks risk-based approach to supervision.

Accordingly, in the rare case of the proposed appointment of directors who

already hold in excess of a defined number of directorships (including

directorships outside of the investment fund industry and directorships within

the funds industry outside Ireland) and a defined number of annual hours

representing aggregate professional time commitments the Central Bank will:

• Request a letter from each board which will set out the proposed time

commitment for that director in accordance with paragraph 4.5 of the

IFIA Code;

• Withdraw from corporate Qualifying Investor AIF which propose such

a director, the option of the 24 hour authorisation time-frame. In each

such case the Central Bank will be considering additional enquiries

which will not be capable of being completed within that timeframe.

15. Previously authorised investment funds which continue to have individual

directors who hold more than the defined numbers of directorships and

aggregate hours representing annual professional time commitments after 1st

January 2016 will be given priority consideration for inclusion in Central Bank

thematic reviews where board effectiveness is being tested in any respect.

16. The Central Bank is initially setting that risk indicator in terms of a joint test of

(a) having more than 20 directorships and (b) having an aggregate professional

time commitment in excess of 2000 hours. These numbers may be reviewed

Fund Management Companies - Guidance

29

from time to time, having regard to the typical burden on directors and changes

in the environment impacting on regulatory risk. The fact that directors hold

less than the referenced numbers of directorships and annual hours of

professional time commitments does not, of course, obviate the need for the

whole of this guidance to be had regard to and the publication of this risk

indicator should not be read in that way.

PART IV

Managerial Functions

Fund Management Companies - Guidance

30

Purpose of this guidance

1. The purpose of this guidance is to set out the Central Bank’s expectations

regarding how persons who conduct managerial functions (“Designated

Persons”) should carry out their roles.

The role of Designated Persons

2. The Central Bank has identified six key managerial functions for fund

management companies – Capital and Financial Management; Operational Risk

Management; Fund Risk Management; Investment Management; Distribution;

and Regulatory Compliance. The Central Bank requires fund management

companies to identify an individual, known as a Designated Person, who will

be responsible for monitoring and overseeing the managerial function assigned

to him or her. It is possible for a Designated Person to oversee more than one

managerial function. Furthermore, the same Designated Person may carry out

the managerial functions of (i) fund risk management and (ii) operational risk

management. However, he or she may not perform the investment management

managerial function and either the fund risk management managerial function

or the operational risk management managerial function.

3. Designated Persons should receive separate letters of appointment from fund

management companies. The letter of appointment should include inter alia the

time commitment involved and the rate of payment. Where a director acts as a

Designated Person, he or she should receive two letters of appointment – one

for the role of director and one for the role of Designated Person.

4. Designated Persons are a fund management company’s line of management that

lies between the board of directors and delegates. They ensure that the

strategies, policies and directions issued by the board are acted upon and

complied with. Designated Persons monitor and oversee compliance by a fund

management company with its regulatory obligations. They report to the fund

management company’s board on a regular basis and escalate issues to the board

Fund Management Companies - Guidance

31

where pre-defined parameters are exceeded or where the Designated Person

judges that immediate escalation is warranted.

5. It is clear that the board of directors is not involved in managing a fund

management company on a day-to-day basis. This task is delegated to the

Designated Persons by the board of directors. If a fund management company

delegated tasks to third parties and did not have Designated Persons in place,

then the fund management company would have no-one within the fund

management company responsible for its management on a day-to-day basis. It

would be entirely dependent on the delegates to manage the tasks delegated to

them without sufficient managerial oversight by the fund management company

on a day-to-day basis. A fund management company that operated on this basis

could be one which had delegated to the extent that it might be a letterbox entity

within the meaning of the relevant legislation.

6. Designated Persons will not necessarily be the persons who are carrying out all

of the tasks which fall within their scope of responsibility. For example, the

Designated Person - Capital and Financial Management will not be the person

who prepares the accounts for the fund management company and the

investment funds under management. The Designated Person will likely

manage fund management employees or oversee delegates who carry out these

tasks. In managing those employees or overseeing those delegates, the

designated person will review their work on an on-going basis to ensure that it

is being carried out properly and that the policies and directions issued by the

board are acted upon and that regulatory obligations are being complied with.

7. Fund management companies are under regulatory obligations to act in the best

interests of the investors in the investment funds under management. This

obligation applies to any Designated Persons engaged by a fund management

company. Designated Persons should be mindful of this obligation when

carrying out their roles, particularly where the fund management company is

part of a larger group of companies or where the Designated Person is also

engaged by another entity within that group. The letter of appointment or other

Fund Management Companies - Guidance

32

contractual arrangements between a fund management company and a

Designated Person should specifically provide that the Designated Person must

put the best interests of investors in the investment funds under management

ahead of any other interests.

8. Designated Persons can be directors or employees of the fund management

company. Alternatively, they can be seconded to the fund management

company, on a full or part-time basis, from another firm such as the investment

manager or a firm which specialises in the provision of Designated Persons.

9. The organisational and structural arrangements put in place by a fund

management company should not create any obstacles to the supervision of that

fund management company and the investment funds under its management by

the Central Bank.

Fund Management Companies - Guidance

33

Capacity of Designated Persons

10. In order to assess whether work is being carried out properly, that instructions

are being followed and that no issues are arising, Designated Persons should

normally have experience and expertise in the managerial function they are

managing or, otherwise, evidence as would satisfy a reasonable person as to

their capability. For example and by way of analogy, the Central Bank would

not expect a MiFID firm to appoint a Head of Risk where that person had no

knowledge or experience in the field of risk management. A Designated Person

should have enough knowledge in the area they are managing to interrogate the

information being provided to them and constructively challenge their

employees or delegates.

11. Designated persons should understand the managerial function they have

responsibility for and should be up-to-date on latest developments in order to

perform their role effectively. They should be familiar with their managerial

function and with the investment funds under management. They should be

able to address queries raised, for example by boards or the Central Bank, in a

fashion which demonstrates reasonable knowledge of the operations of the fund

management company and those investment funds and any issues affecting

them.

12. Designated Persons should be sufficiently senior in their role such that their

challenge of delegates carries weight and authority and they are the appropriate

individuals to meet with the Central Bank as part of the Central Bank’s

supervisory engagement process. For example, if a Designated Person occupied

a role within the fund management company’s organisation which was more

junior than the delegates he or she was monitoring and overseeing, he or she

may be unable to challenge delegates effectively.

13. Designated Persons should have enough time available to them to carry out their

roles thoroughly and to a high standard.

Fund Management Companies - Guidance

34

Documenting the delegation of tasks

14. Where a fund management company delegates the performance of tasks, each

delegate should know precisely what is being delegated to them. This should

be documented in written contractual arrangements in a manner determined by

the fund management company. It is not enough to assume that because a

delegate is authorised, it will discharge the regulatory obligations placed on the

fund management company. The delegate may not be subject to equivalent

regulatory obligations. Where it is, it may not be carrying out these tasks to the

same standard as required by the fund management company’s regulatory

obligations. For example, an AIFM should not assume that because it has

delegated investment management to an authorised entity, the investment

manager is carrying out all of the liquidity management obligations placed on

the AIFM by Regulation 18 of the EU (AIFM) Regulations 2013. The written

contractual arrangement between the fund management company and the

investment manager should include one or more contractual provisions which

will ensure that the investment manager carries out its tasks in a manner

consistent with the EU (AIFM) Regulations 2013 and EC (UCITS) Regulations

2011, as applicable, and the parameters instructed by the fund management

company.

Policies and procedures

15. Fund management companies are required to maintain a number of documented

policies and procedures. In many instances, the fund management company

will rely on the policies and procedures of its delegates or its group to satisfy its

own regulatory obligations. Where this is the case, it is not appropriate for the

fund management company to rely on the fact that its delegate is an authorised

entity subject to its own regulatory obligations concerning policies and

procedures. The fund management company must maintain its own written

policies and procedures in each instance where this is required by regulation –

it cannot rely on the delegate’s written policies and procedures to satisfy the

fund management company’s obligation to have its own written policies and

procedures. Where a fund management company intends to rely on the

Fund Management Companies - Guidance

35

substance of its delegates’ policies and procedures, the fund management

company’s policies and procedures should document:

• that this is the case;

• how the fund management company has satisfied itself that relying on

its delegates’ policies and procedures will ensure that it is complying

with its regulatory obligations i.e. how the fund management company

has mapped its regulatory obligations against those of its delegates;

• how the fund management company will test that the delegates’ policies

and procedures are being complied with;

• the frequency with which the fund management company will review its

policies and procedures;

• the role of the relevant Designated Person.

16. A fund management company should also follow this approach where it

proposes to rely on its group policies and procedures.

Allocation of regulatory obligations to managerial functions

17. Each fund management company should review the regulatory obligations

placed on it and should identify precisely under which managerial function each

regulatory obligation falls. This systematic approach of allocating regulatory

obligations to managerial functions will ensure that a fund management

company has identified each regulatory obligation and that there is a Designated

Person with responsibility for overseeing each such regulatory obligation. It

will ensure that no obligations are unmonitored. It also helps Designated

Persons to understand the expectations placed on them so that they can allocate

and price their time accordingly.

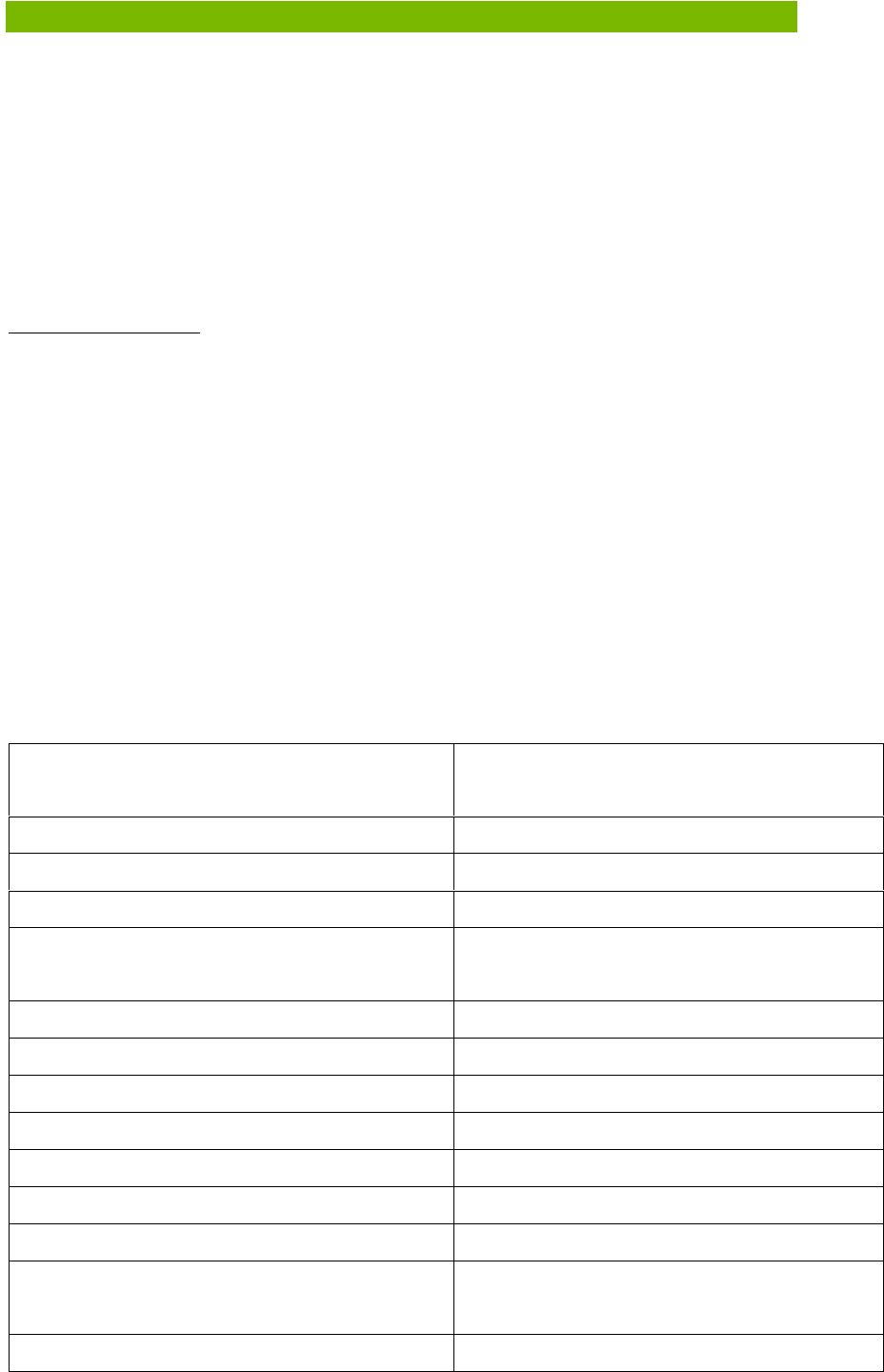

18. Annexes I and II set out a framework of how the Central Bank believes the

regulatory obligations set out in the EU (AIFM) Regulations 2013 and EC

(UCITS) Regulations 2011 (including Level 2 measures) respectively could be

allocated to each managerial function. Fund management companies may

decide that, for that company, particular regulatory obligations should be

Fund Management Companies - Guidance

36

attributed differently. The precise allocation of regulatory obligations amongst

managerial functions is not as important as ensuring that the exercise is

undertaken and that each specific regulatory obligation is individually attributed

to a specific managerial function. Annexes I and II contain requirements

stemming from the EU (AIFM) Regulations 2013 and EC (UCITS) Regulations

2011 (including Level 2 measures). The fund management company must also

take account of other regulatory obligations (e.g. Central Bank UCITS

Regulations, AIF Rulebook, EMIR, MiFID, MAD, etc.) and may wish to

perform a similar allocation on an obligation by obligation basis for those other

regulatory obligations.

Coordination with boards

Delegate Oversight Guidance

19. The Central Bank’s Delegate Oversight Guidance identifies six distinct areas

where boards should direct specific attention in the oversight of delegates.

These areas are aligned with the key managerial functions for fund management

companies. Accordingly, fund management companies should ensure that

Designated Persons for the corresponding managerial function are responsible

for monitoring and oversight of the approaches and strategies approved by the

Board. This means that the Designated Person – Investment Management

should monitor and oversee compliance with the investment approach, the

Designated Person – Distribution should monitor and oversee compliance with

the distribution strategy and so on.

Reporting from Designated Persons to the board

20. Designated Persons should be satisfied with or be responsible for the production

of management information, or equivalent, for the board (or board sub-

committee as appropriate), so that the conduct of the Designated Person’s work

receives both appropriate monitoring by the board on a regular basis and on an

exceptional basis where issues arise.

Fund Management Companies - Guidance

37

Escalation to the board

21. Designated Persons should propose and agree with the board appropriate

thresholds and key performance indicators which trigger immediate escalation

from delegates and Designated Persons to the board. In addition, Designated

Persons should immediately escalate matters to the board where they judge that

this is warranted.

Performance of managerial functions

22. Designated Persons are responsible for performing the managerial functions

assigned to them. A large part of performing this role involves close monitoring

and oversight of employees and/or delegates. Fund management companies

should consider and agree with the Designated Person how it expects the

Designated Person to carry out this monitoring and oversight.

Performance of managerial functions - Monitoring and oversight of regulatory

obligations

Matters of fact

23. Some regulatory obligations are rules where compliance is a matter of fact. For

example, an internally managed AIFM must have initial capital of at least

€300,000 and an external AIFM must have initial capital of at least €125,000.

Compliance with this rule is objectively verifiable – either the AIFM has the

requisite capital or it does not.

24. Where a regulatory obligation – matter of fact falls within a Designated Persons’

remit, he or she should ensure that it is evident from the reporting he or she

receives that the fund management company is complying with the rule.

Matters of judgement

25. There are a number of regulatory obligations where compliance is not a simple

objective matter and where a fund management company is required to exercise

judgement. For example, an AIFM must ensure a high standard of security

Fund Management Companies - Guidance

38

during the electronic data processing and integrity and confidentiality of

information.

26. Where a regulatory obligation – matter of judgement falls within a Designated

Persons’ remit, he or she should receive sufficient reporting and have sufficient

expertise to assess whether the judgement made is reasonable. This assessment

should be documented so that the rationale for it can be explained if it is queried

at a later time.

Matters requiring design

27. The regulatory frameworks set out a number of obligations for fund

management companies to have policies and procedures (‘P&Ps’) in relation to

a certain matter, have a particular organisational structure or establish a limit.

Appropriate P&Ps, structures and limits must be (i) designed, (ii) implemented

and complied with on an on-going basis and (iii) reviewed periodically.

Designated Persons should have a role in each of these three tasks proportionate

to being a key representative of the fund management company in meeting the

obligation.

(i) Design

28. Designated Persons, using their expertise, should advise on the design process

and should assist with the creation of the structure or preparation of the P&P or

the setting of the limit that is appropriate for the fund management company

and investment funds under management given nature, scale and complexity

considerations subject to the approval of the board. Boards should provide

input, should constructively challenge proposals where they see fit and should

approve structures, limits and P&Ps.

29. A fund management company may receive assistance from its delegates or

engage third parties to aid the design process. However, it will be ultimately

the board of the fund management company’s responsibility to ensure that it has

designed appropriate structures or limits or P&Ps and the Designated Persons

should provide assistance and advice in relation to this process.

Fund Management Companies - Guidance

39

30. The Designated Person should ensure that the fund management company

documents why the proposed structure, limit or P&P was reasonable and

appropriate.

(ii) Implemented and complied with

31. Once designed, the structure must be established, the P&P must be put into

action or the limit must be imposed and complied with on an on-going basis. It

is part of the Designated Person’s role to monitor and oversee this subject

always to the higher level of monitoring and oversight by the board itself, any

sub-committee and the person responsible for assessing organisational

effectiveness.

(iii) Reviewed periodically

32. Designated Persons should keep structures, limits and P&Ps under on-going

review to determine whether they remain appropriate. For example, increased

market volatility may mean that current leverage limits are not appropriate and

so a fund management company may wish to consider whether decreasing a

leverage limit is appropriate in the new environment. Designated Persons

should advise the board where they believe a change should be considered and

should make a proposal to the board for its review, consideration and approval.

Changes to structures, limits and P&Ps should be a matter for the board, and in

some cases unitholders, to decide upon.

Frequency of monitoring and oversight

33. Fund management companies should, among other things, review each of the

regulatory obligations attributed to each managerial function and consider the

frequency of interaction appropriate. The frequency of monitoring and

oversight, including the frequency of receipt of information from delegates,

should be determined based on the activities of the investment funds under

management. This includes but is not limited to:

• the complexity of the investment strategy;

• the markets in which the investment fund operates;

• the types of investment instruments utilised;

Fund Management Companies - Guidance

40

• the underlying investment activities (as positions are bought and sold);

• the frequency of investor subscriptions/redemptions;

• the utilisation, valuation and security of margin and/or collateral;

• the number of and functions provided by fund service providers; and

• the use of efficient portfolio management techniques.

34. For example, a proposal whereby the Designated Person – Investment

Management received monthly reporting in relation to an investment fund that

deals and trades in complex securities on a daily basis might not be viewed

favourably whereas a proposal to receive reporting on a monthly basis for an

investment fund that pursues a long-term buy and hold strategy may be

acceptable.

35. In addition to regularly scheduled monitoring and oversight, more frequent

review should occur on an ad hoc basis where circumstances demand this, for

example where breaches are occurring or where market volatility has increased.

36. Designated Persons should monitor the tasks for which they are responsible on

a day-to-day basis. This does not necessarily mean that monitoring and

oversight has to take place daily – although this might be the case. As described

above, the frequency of monitoring and oversight will be driven by the activities

of the fund management company and its investment funds under management.

Furthermore, the Designated Persons should have the capability to review

delegates on a continuous basis and should be available on a day-to-day basis.

Reporting from delegates to Designated Persons

37. It is important that the reporting received by Designated Persons provides them

with the information necessary to oversee and monitor compliance by the fund

management company with its regulatory obligations, limits, P&Ps and any

directions issues by the board. Accordingly, fund management companies

should create a monitoring and oversight framework that allows Designated

Persons to receive the information necessary to carry out their roles. Designated

Persons should assist in this process.

Fund Management Companies - Guidance

41

38. Fund management companies should be able to demonstrate compliance with

limits and P&Ps at all times. Accordingly, Designated Persons should ensure

the monitoring and reporting framework designed allows the fund management

company to comply with this obligation.

39. Designated Persons should have expertise in their managerial functions such

that they can review the information received and interrogate it to identify actual

or potential issues. Receiving reports which only identify exceptions would not

be sufficient in this regard. A summary of relevant information concerning each

investment fund under management would be more appropriate. This should

summarise the activity in the investment fund over the period, any breaches

which occurred or any flags raised and underlying trends.

Meetings between Designated Persons and delegates

40. Designated Persons should hold regular meetings with delegates. These could

be in the form of sub-committee meetings, conference calls, physical meetings

or a combination of these. Designated Persons should also perform on-site visits

of delegates.

41. These meetings could be less frequent than the regular reporting frequency but

more frequent than the board meeting schedule. For example, an arrangement

whereby the Designated Person – Investment Management for an investment

fund with activity on a weekly basis had regular reporting on a weekly basis,

meetings with delegates on a monthly basis and attended quarterly board

meetings might be appropriate.

Approach to information received from delegates

42. Designated persons should approach information received from delegates with

healthy scepticism. They should not necessarily accept such information at face

Fund Management Companies - Guidance

42

value and should interrogate information received. Designated persons should

constructively challenge employees and delegates and should follow up on

issues raised to ensure that they are concluded satisfactorily.

43. Designated persons may be relying on confirmations from employees or

delegates that tasks are being carried out properly. There is a risk to the fund

management company that a confirmation is incorrect i.e. that a designated

person has received a confirmation that a task is operating normally when that

is not the case. A designated person might receive an incorrect confirmation

because the employee or delegate has made a mistake or does not have the

expertise necessary to interpret information and provide an accurate

confirmation or is deliberately attempting to misinform the designated person.

44. Fund management companies should consider instances where this risk might

arise and how it could be mitigated. There may be someone better placed to

provide a confirmation or it may be possible to receive a secondary confirmation

from another independent source. For example, a fund management company

may seek confirmations from both its investment manager and its legal advisers

concerning the contents of a new prospectus or from the fund administrator and

external auditor concerning the contents of annual reports.

45. Designated Persons should record their engagement on reports received. Where

a Designated Person enquires further into information received from a delegate,

a record of this engagement should be retained. Evidence of constructive

challenge by Designated Persons and interrogation by Designated Persons of

the information received by them might point towards a fund management

company which is well managed and that takes compliance with its regulatory

obligations seriously.

Fund Management Companies - Guidance

43

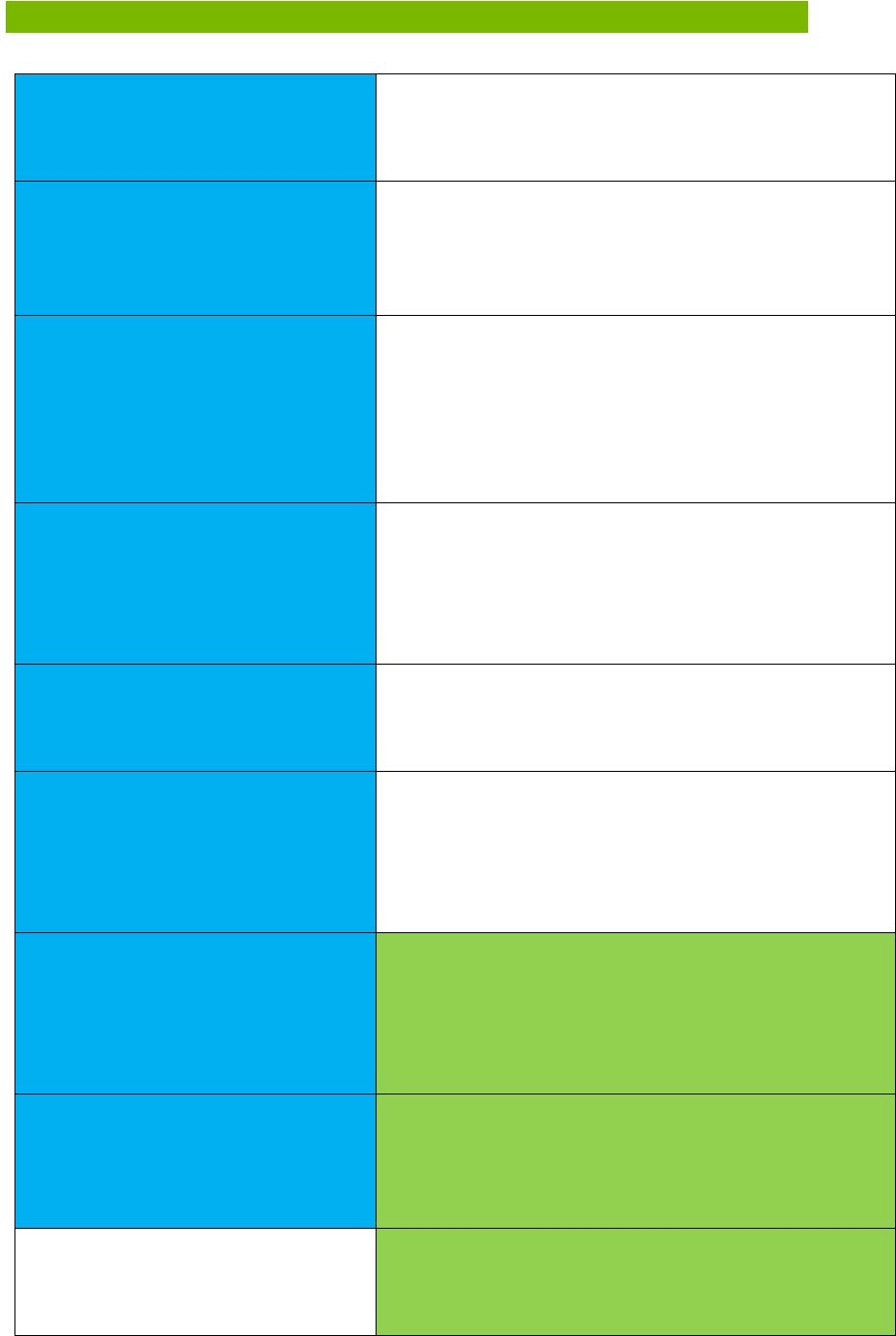

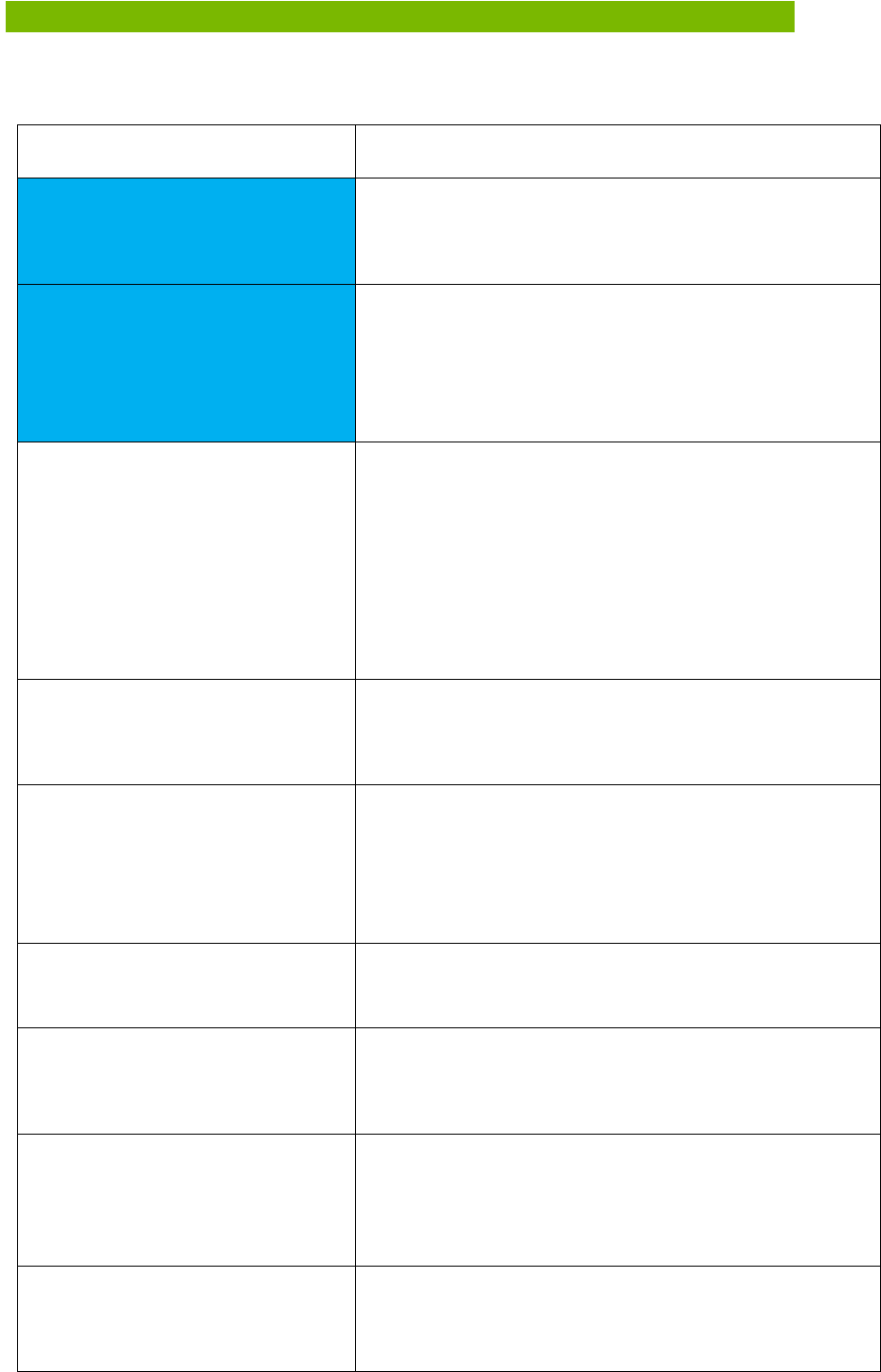

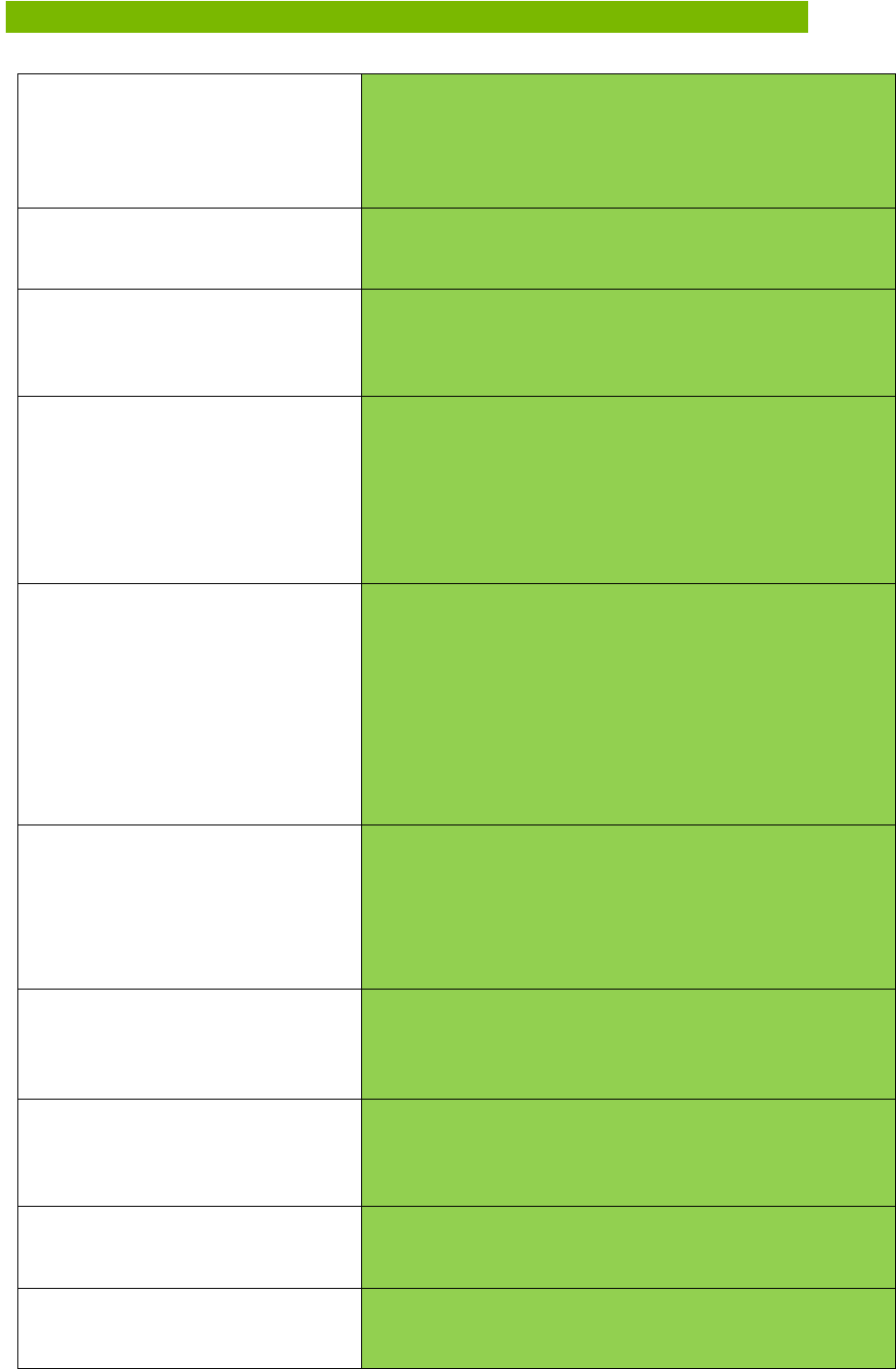

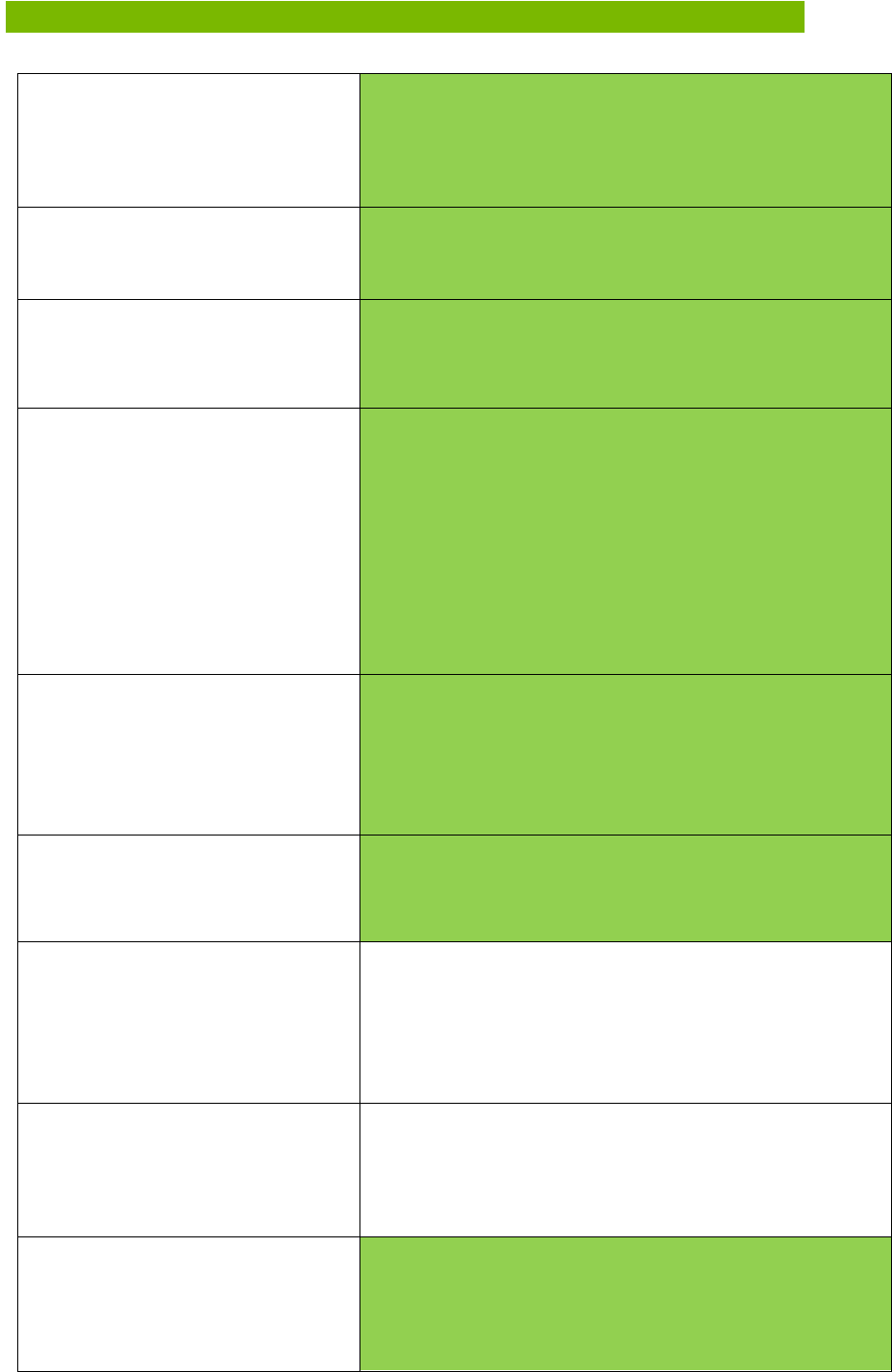

ANNEX I – Obligations on AIFMs

This Annex lists obligations placed on AIFMs by Level 1 and Level 2 of the AIFMD.

Further obligations are placed on AIFMs by other legislation and rulebooks (e.g. the

AIF Rulebook). AIFMs should also consider which Designated Person should be

responsible for monitoring and overseeing compliance with those obligations.

Obligations highlighted in green apply to each AIF under management. Obligations

highlighted in blue will only apply if the AIFM or the AIFs under management engage

in certain activities (e.g. if they acquire control of non-listed companies).

Fund Management Companies - Guidance

44

Capital and Financial Management

Legislative Provision

Managerial obligation

AIF annual reports

Reg. 23(1) AIFM Regulations

The AIFM must make available an annual report for

each AIF it manages and each of the AIFs it markets in

the Union within 6 months of year end.

Article 106(2) Level 2

The AIFM must assess changes in the information

referred to in Reg. 24 of the AIFM Regulations during

the financial year in accordance with Art 106(1) of

Level 2.

Article 107(4) Level 2

The AIFM must provide general information in the

annual report relating to the financial and non-financial

criteria of the remuneration policies and practices for

relevant categories of staff to enable investors to assess

the incentives created. The AIFM must disclose at least

the information necessary to provide an understanding

of the risk profile of an AIF and the measures it adopts

to avoid or manage conflicts of interest.

Capital

Reg. 10(1)-(3) AIFM Regulations

An internally managed AIFM must have initial capital

of at least €300,000 and an external AIFM must have at

least €125,000. It must also have own funds where a

threshold of €250 million in assets under management

is exceeded.

Article 14(2) Level 2

The AIFM must recalculate additional own funds

requirement at end of each financial year. AIFM must

have procedures to monitor on an ongoing basis the

value of portfolios of AIFs managed and shall adjust

additional own funds where the value of AIF portfolios

managed increases significantly.

Reg. 10(7) AIFM Regulations

The AIFM must have professional indemnity insurance

or additional own funds to cover potential professional

liability risks.

Reg. 10(8) AIFM Regulations

The AIFM’s own funds including additional own funds

must be invested in liquid assets or assets readily

convertible to cash.

Fund Management Companies - Guidance

45

Article 15(5) Level 2

Where professional indemnity risk is covered through

professional indemnity insurance the AIFM must

review the professional indemnity insurance policy and

its compliance with Article 15 provisions at least once

a year.

Organisational requirements

Reg. 19(2) AIFM Regulations

The AIFM must have sound administrative and

accounting procedures.

Article 51(4) Level 2

The AIFM must have accounting policies and

procedures and valuation rules to enable them to deliver

in a timely manner financial reports and which comply

with Article 59 of Level 2.

Reg. 19(2) AIFM Regulations

The AIFM must have control and safeguard

arrangements for electronic data processing and

mechanism to ensure that each transaction involving an

AIF can be reconstructed.