Annual Report on the

Interim Inspection

Program Related to Audits

of Brokers and Dealers

PCAOB Release No. 2020-001

August 20, 2020

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 1

PCAOB Release No. 2020-001 August 20, 2020

Executive Summary

The Public Company Accounting Oversight Board (PCAOB) has completed its 2019 inspections of auditors of brokers

and dealers. This Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers provides a

summary of inspection results as well as information auditors can use to improve audit quality.

There were 411 public accounting rms (rms) registered with the PCAOB that performed audits of broker-dealers

registered with the U.S. Securities and Exchange Commission (SEC) this inspection period, and we selected 66 of

these rms for inspection. Our inspections assess rms’ compliance with professional standards and applicable rules

and regulations, with a focus on risks to customers of broker-dealers.

While our 2019 inspections revealed modest improvement in the rate of deciencies, we continue to see a high rate of

deciencies in certain areas of engagement performance. We also continue to see that rms that audit more than 100

broker-dealers generally have lower percentages of deciencies compared to other rms.

We have observed similar deciencies despite limited changes to auditing and attestation standards other than

those involving related parties and the auditor’s report. The recurring deciencies described in this annual report

highlight potential areas of improvement for all rms, whether or not they were recently inspected. While some have

demonstrated progress, other rms have not taken suicient steps to address audit and attestation engagement

performance. We expect rms to take meaningful actions to address these recurring deciencies.

All rms need to evaluate how they can improve their system of quality control. A strong system of quality control

can serve to prevent engagement deciencies from occurring. Firms should take what was learned from these

66 rm inspections, including the examples of eective procedures, and consider how to proactively implement

improvements, rather than reacting as a result of a PCAOB inspection.

Auditors of brokers and dealers should focus their eorts on improving their system of quality control and their

engagement performance in all areas described in this annual report, but particularly in these areas where we

continue to observe frequent deciencies:

y Examination Engagements – We frequently observe insuicient testing of the design and operating eectiveness

of internal controls over compliance. We believe that focusing on the risks associated with a control will help

rms develop appropriate testing procedures and lead to further improvement in this area. In 2019, examination

engagements with deciencies decreased to 69% from 75%.

y Review Engagements – Inquiries are required on all review engagements, and rms should document the

results of inquiries made. Firms should also take into account evidence from nancial statement audits, including

evidence that appears to contradict assertions made in exemption reports, when planning, performing, and

evaluating the results of review engagements. In 2019, review engagements with deciencies decreased to 51%

from 54%.

y Financial Statement Audits – Revenue and nancial statement presentation and disclosure are commonly

reviewed areas during an inspection. We believe that obtaining a suicient understanding of internal control over

nancial reporting, and other risk assessment procedures, will help rms clearly identify and assess the risks of

material misstatement in these areas, and prevent deciencies from occurring in these areas of the audit. We

encourage rms to consider the details of our observations in these areas as they conduct broker-dealer audits. In

2019, nancial statement audits with deciencies decreased to 71% from 76%.

The information contained in this annual report may be helpful for other stakeholders, including management and

the audit committee (or equivalent body) of the broker-dealers, when engaging with the rms regarding audit quality

and broker-dealer nancial reporting.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 2

PCAOB Release No. 2020-001 August 20, 2020

For Additional Information

The PCAOB website includes additional information and

resources for auditors of broker-dealers, including previous

annual reports, information about outreach forums, periodic

Spotlight publications, and more. To receive periodic

updates from the PCAOB, please join our mailing list.

We Want to Hear from You

In an eort to continue to improve external

communications and provide information that is

timely, relevant, and accessible, we want to hear

your views regarding this document. Please take

two minutes to fill out our short survey.

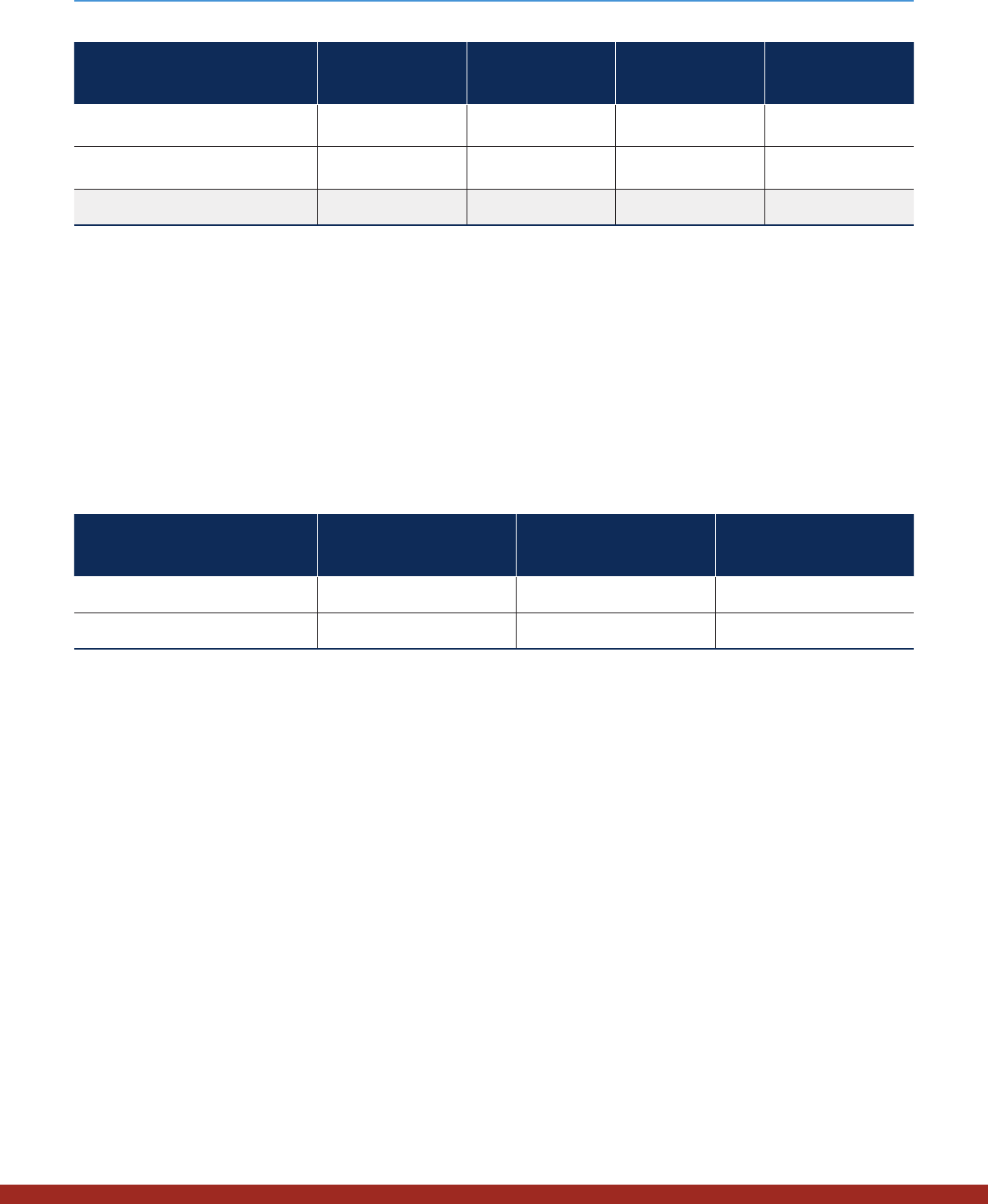

66

Firms

Inspected

y 7 With No Deficiencies

106

Audit

Engagements

y 31 With No Audit Deficiencies

y 53 With Audit and Attestation

Deficiencies

y 22 With Audit Deficiencies but

No Attestation Deficiencies

29

Examination

Engagements

y 9 With No Deficiencies

74

Review

Engagements

y 36 With No Deficiencies

Inspections By the Numbers

2019

67

Firms

Inspected

y 3 With No Deficiencies

105

Audit

Engagements

y 25 With No Audit Deficiencies

y 55 With Audit and Attestation

Deficiencies

y 25 With Audit Deficiencies but

No Attestation Deficiencies

24

Examination

Engagements

y 6 With No Deficiencies

79

Review

Engagements

y 36 With No Deficiencies

2018

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 3

PCAOB Release No. 2020-001 August 20, 2020

Contents

Executive Summary .................................................................................................................1

Overview ...................................................................................................................................4

Inspection Observations .......................................................................................................... 5

Attestation and Audit Engagements ..........................................................................................................6

Examination Engagements ........................................................................................................................................................ 6

Review Engagements .................................................................................................................................................................. 9

Auditing Financial Statements ................................................................................................................................................11

Auditing Supplemental Information Accompanying Audited Financial Statements ...................................................17

Other Instances of Non-Compliance with PCAOB Standards .................................................................19

Auditor’s Report on the Financial Statements and Supporting Schedules ....................................................................19

Auditor Communications .........................................................................................................................................................20

Engagement Documentation ..................................................................................................................................................20

Quality Control ..........................................................................................................................................21

Engagement Performance .......................................................................................................................................................21

Monitoring ...................................................................................................................................................................................22

Independence, Integrity, and Objectivity .............................................................................................................................. 22

Personnel Management ............................................................................................................................................................22

Auditor Independence ..............................................................................................................................22

PCAOB Standards Associated with Inspection Observations ..............................................24

Appendix A: Selection of Firms and Engagements for Inspections ................................... A-1

Appendix B: Comparative Results from Our Inspections under the Interim Program ..... B-1

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 4

PCAOB Release No. 2020-001 August 20, 2020

Overview

The PCAOB has registration, inspection, standard-setting, and disciplinary authority over the auditors of brokers and

dealers registered with the SEC.

This Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers provides information

on the inspections, an overview of the results of our inspections and related audit and attestation engagement

reviews, and information on steps auditors can take to improve their performance. Hereinaer, the use of the term

"broker-dealer" refers to entities that are registered with the SEC as both a broker and a dealer and to entities that are

registered as only one or the other.

Overseeing the audits of SEC-registered broker-dealers is a key component of the PCAOB’s mission to protect investors

and further the public interest in the preparation of informative, accurate, and independent audit reports. This report

serves to advance our strategic goal to drive improvement in the quality of audit services through a combination of

prevention, detection, deterrence, and remediation.

We noted that deciencies are lower in 2019 than 2018 for each type of engagement.

y Audit engagements with deciencies decreased to 71% from 76%.

y Review engagements with deciencies decreased to 51% from 54%.

y Examination engagements with deciencies decreased to 69% from 75%.

The percentages of deciencies varied by audit area reviewed. Some decreased in 2019 compared to 2018, while

others increased.

2019 Inspections Approach

Under the interim inspection program, the PCAOB assessed rms’ compliance with applicable laws, rules, and

professional standards when performing audit and attestation engagements for broker-dealers. We also evaluated

elements of rms’ systems of quality control. In 2019, we inspected 66 rms and reviewed 106 audits.

1

We reviewed

103 related attestation engagements, including 29 examination engagements and 74 review engagements.

In selecting rms to inspect and engagements for review, we primarily use risk-based selections, and consider various

characteristics of the rms and broker-dealers. Our selections also include randomly selected rms and engagements

to provide an element of unpredictability. We do not review every aspect of an audit or attestation engagement.

Rather, we generally focus our attention on areas we believe to be of greater complexity and areas of greater

signicance or with a heightened risk of material misstatement to the broker-dealer’s nancial statements.

Our selection of rms for inspection and engagements for review does not constitute representative samples of the

population of rms that audit broker-dealers or engagements. Additionally, our inspection ndings are specic to

the particular portions of the engagements reviewed. They are not an assessment of all work performed by the rms

selected for inspection or all of the procedures performed for the engagements reviewed.

Further, the populations of rms and broker-dealers are not homogeneous. Therefore, the observations related to

quality control, attestation and audit deciencies, other instances of noncompliance with PCAOB standards, and

independence ndings are not necessarily representative of the population of all rms that perform broker-dealer

audits or of all broker-dealer audit and attestation engagements.

1

The 2019 inspection of one rm and review of one audit conducted by that rm occurred in January 2020.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 5

PCAOB Release No. 2020-001 August 20, 2020

The deciencies we identied do not necessarily mean that the broker-dealer’s nancial statements, supporting

schedules, or compliance or exemption reports are not fairly presented or stated, in all material respects. It is oen not

possible for us to reach a conclusion on those points based on our inspection because we have only the information

in the broker-dealer’s lings and the information the auditor retained. We do not have direct access to the broker-

dealer’s management, underlying books and records, and other information.

Broker-Dealer Annual Reporting Pursuant to SEC Rule 17a-5

This graphic depicts certain broker-dealer annual reporting requirements and related auditor responsibilities. Further

discussion of the requirements and inspection observations appear elsewhere in this report.

Broker-Dealer claims

exemption from the Customer

Protection Rule

Broker-Dealer prepares

an Exemption Report

Independent public

accountant prepares a

Review Report

Broker-Dealer does not claim

exemption from the Customer

Protection Rule

Broker-Dealer prepares

a Compliance Report

Independent public

accountant prepares an

Examination Report

Broker-Dealer

prepares the nancial

statements and the

required supplemental

schedules

Independent public

accountant performs an audit

of the nancial statements

and required supplemental

schedules

This graphic is being provided as an example; it is not intended to, and does not, cover all instances where a broker-

dealer may be eligible to le an exemption report. Certain broker-dealers do not claim exemption from the Customer

Protection Rule (a broker-dealer nancial responsibility rule

2

), because they do not meet the exemption conditions of

paragraph (k) of that rule, and instead, prepare an exemption report pursuant to SEC and SEC sta guidance.

Inspection Observations

Inspections of selected rms under the interim inspection program included review of selected engagements and

evaluation of elements of the rms’ systems of quality control. Inspections sta communicated the following, as

applicable, to each inspected rm:

y Observations related to its system of quality control;

y Deciencies in its audits of broker-dealer nancial statements and supporting schedules, and its examination and

review attestation engagements;

2

For purposes of this Annual Report, the term “nancial responsibility rules” refers to the Securities Exchange Act of 1934 (“Exchange Act”) Rule

15c3-1, Net Capital Requirements for Brokers or Dealers (the “Net Capital Rule”); Exchange Act Rule 15c3-3, Customer Protection – Reserves and

Custody of Securities (the “Customer Protection Rule”); Exchange Act Rule 17a-13, Quarterly Security Counts to be Made by Certain Exchange

Members, Brokers and Dealers (“Quarterly Security Count Rule”); and any rule of a designated examining authority that required the broker-

dealer to send account statements to customers (“Account Statement Rule”). Paragraph (e) of the Customer Protection Rule is referred to as

the “Reserve Requirements Rule.”

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 6

PCAOB Release No. 2020-001 August 20, 2020

Throughout this report, we highlight eective procedures that describe brief scenarios and possible

procedures that may be eective to address that scenario. These eective procedures are provided as

examples and do not modify or establish auditing or attestation standards. Auditors should consider

the specic facts and circumstances of their engagements when designing audit procedures.

Attestation and Audit Engagements

This section of our report discusses certain observations from our inspections related to attestation and audit

engagements when rms did not perform—or did not suiciently perform—certain required procedures, or otherwise

comply with the applicable standards.

As further described in Appendix B, we have reclassied certain deciencies from 2018 inspections reported in the

previous Annual Report to conform to the classication of deciencies from 2019 inspections.

Examination Engagements

The auditor must plan and perform an examination of statements made by the broker-dealer in its compliance report

in accordance with AT No. 1. The examination includes obtaining evidence about whether one or more material

weaknesses existed in the broker-dealer’s internal control over compliance (ICOC) with the broker-dealer nancial

responsibility rules during, and as of the end of, the broker-dealer’s most recent scal year. The examination also

includes performing tests of the broker-dealer’s compliance with the Net Capital Rule and the Reserve Requirements

Rule as of the end of the broker-dealer’s scal year.

Deciencies in Examination Engagements

In a few instances in this report, we summarize—solely for the purpose of providing basic context

to readers—rules and standards (or aspects thereof) that, while not promulgated by the PCAOB,

are relevant to our inspection activities. Readers should not rely on our summaries as authoritative;

instead, they should refer directly to those rules and standards, along with any associated

authoritative interpretive materials.

2019 2018

Number of

Applicable

Engagements

Reviewed

Number of

Engagements with

Deciencies

Percentage Percentage

Examination Engagements 29 20 69% 75%

y Other instances of non-compliance with PCAOB standards; and

y Independence ndings.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 7

PCAOB Release No. 2020-001 August 20, 2020

The following deciencies were identied in the examination engagements:

Planning for the Examination Engagement

Firms did not obtain a suicient understanding of broker-dealer processes, including relevant controls, regarding

compliance with the nancial responsibility rules. (AT No. 1.09)

Testing of ICOC

Firms did not perform, or suiciently perform, testing of ICOC for one or more nancial responsibility rules. (AT No.

1.11)

Firms did not test, or suiciently test, important controls, in particular the following specic types of controls:

y Management review controls, in particular not obtaining a suicient understanding of the nature and extent of

management’s review, including understanding and evaluating the expectations and criteria used by management

to identify matters for investigation, as well as the nature and resolution of the investigation procedures performed;

y Controls over the accuracy and completeness of information produced by either the broker-dealer or the broker-

dealer’s service organizations upon which the design and operating eectiveness of ICOC depended; and

y Information technology controls or automated application controls.

Firms did not test controls that were important to the auditor’s conclusion about whether the broker-dealer

maintained eective ICOC as of its scal year-end.

ICOC: Management Review Controls

The auditor considered management’s review of its monthly net capital computation an

important control and one that the auditor was required to test. The auditor inquired of the

control owner regarding the nature of the review, information used, expectations, thresholds

for variances requiring investigation, and resolution of variances. In addition, the auditor inquired about the

nature of errors in applying the Net Capital Rule identied through the review during the year. The auditor

selected a sample of monthly net capital computations and inspected evidence of management’s review,

including evidence that variances exceeding the threshold were resolved. The auditor determined that the

control owner used a securities borrowed and loaned report to determine the appropriate net capital charge,

and that the control owner also veried that amounts from the report were accurately captured and included in

the computation. The auditor separately tested controls over the accuracy and completeness of the information

included in the securities borrowed and loaned report.

Firms did not test, or suiciently test, important controls over processes related to compliance with the Customer

Protection Rule, including:

y Determining credit and debit balances reported within the reserve computations pursuant to Exhibit A of the

Customer Protection Rule;

y Making timely deposits to special reserve bank accounts;

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 8

PCAOB Release No. 2020-001 August 20, 2020

y Identifying and resolving decits that required action by the broker-dealer within the required timeframe; and

y Maintaining custodial accounts free of any right, charge, security interest, lien, or claim.

Firms did not test, or suiciently test, important controls over processes related to compliance with the Quarterly

Security Count Rule, including:

y Accounting for all securities subject to the broker-dealer's control or direction, but not in its physical possession,

and verifying all such securities in that status for more than 30 days; and

y Assigning appropriate broker-dealer personnel to make or supervise the quarterly security counts.

Firms did not test, or suiciently test, important controls over processes related to compliance with the Account

Statement Rule, including producing and delivering complete and accurate account statements, either electronically

or by mail, to all customers.

ICOC: Account Statement Rule

All of a broker-dealer’s customers elect to access their customer account statement in

electronic form and decline receipt of a paper statement. A broker-dealer relied on an internally

developed application to create account statements that included securities positions, money

balances, and account activity as required by the Account Statement Rule. The auditor tested controls over

the production of the statements and controls over the accuracy and completeness of information included in

the statements. The controls tested included automated application controls, manual controls, and relevant

information technology controls. The auditor also tested controls related to electronic delivery of statements.

Account Statement Rule

Financial Industry Regulatory Authority (FINRA) Rule 2231 replaced NASD Rule 2340, Customer

Account Statements, eective May 8, 2019. FINRA Rule 2231 requires each general securities

member to send account statements to customers at least once each calendar quarter containing

a description of any securities positions, money balances, or account activity in the accounts since the prior

account statements were sent, except if carried on a Delivery versus Payment/Receive versus Payment basis and

certain requirements are met.

Performing Compliance Tests

Firms did not perform, or suiciently perform, tests of compliance with the Net Capital Rule or the Reserve

Requirements Rule as of the end of the broker-dealer’s scal year, including : (AT No. 1.21)

y Evaluating whether the amounts reported within the schedules were determined in accordance with the

applicable rules;

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 9

PCAOB Release No. 2020-001 August 20, 2020

y Testing the accuracy and completeness of the information in the schedules, including information produced by

the broker-dealer (or the broker-dealer’s service organizations) that was used by the broker-dealer to prepare its

schedules; and

y Determining whether the broker-dealer maintained a special reserve bank account for the exclusive benet of its

customers or for broker-dealers in accordance with the Reserve Requirements Rule.

Performing Compliance Tests

A broker-dealer used an internal system to allocate securities positions according to the

broker-dealer’s identied allocation pairings for determining balances in its customer reserve

computation. As part of the audit of the nancial statements, the auditor performed valuation,

conrmation, and securities position reconciliation procedures to determine whether the broker-dealer’s scal

year-end stock record was complete and accurate. As part of its compliance tests over the customer reserve,

the auditor selected a sample of securities from the stock record and re-performed the allocation to determine

whether the broker-dealer allocated the securities in accordance with its identied allocation pairings. The

auditor also reviewed the broker-dealer’s allocation pairings hierarchy and compared it to the requirements of

Exhibit A of the Customer Protection Rule.

Evaluating Results of the Examination Procedures

Firms did not suiciently evaluate results of examination procedures to determine whether individually, or in

combination with other deciencies, one or more material weaknesses in ICOC existed. (AT No. 1.25 and .26)

Obtaining a Representation Letter

Firms did not obtain written representations from management of the broker-dealer. (AT No. 1.32)

Reporting on the Examination Engagement

In examination reports, rms included statements that referred to a required assertion that broker-dealers did not

include in their compliance reports. (AT No. 1.36)

Review Engagements

In accordance with AT No. 2, the auditor must plan and perform the review of assertions made by the broker-dealer in

its exemption report. The objective of the review includes obtaining evidence about whether one or more conditions

exist that would cause one or more of the broker-dealer’s assertions not to be fairly stated, in all material respects.

The auditor should coordinate the review engagement with the audit of the nancial statements and supplemental

information, taking into account relevant evidence obtained in the audit when planning, performing, and evaluating

the results of the review engagement.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 10

PCAOB Release No. 2020-001 August 20, 2020

Deciencies in Review Engagements

The following deciencies were identied in the review engagements:

Performing the Review Engagement

Firms did not obtain a suicient understanding of the exemption

provisions identied by the broker-dealer and other rules and

regulations relevant to the broker-dealer’s assertions in its exemption

report, which was necessary to properly perform the review

engagement. (AT No. 2.05)

Firms did not make required inquiries, including inquiries about

controls in place to maintain compliance with the exemption

provisions, and those involving the nature, frequency, and results of

related monitoring activities. (AT No. 2.10)

2019 2018

Number of

Applicable

Engagements

Reviewed

Number of

Engagements with

Deciencies

Percentage Percentage

Review Engagements 74 38 51% 54%

Firms did not perform, or suiciently perform, an evaluation of

evidence obtained in the audit of the nancial statements that

contradicted the broker-dealer’s assertions regarding compliance

with the claimed exemption provision. (AT No. 2.10)

Inquiries of Management

Auditors should make the inquiries required by

AT No. 2 to identify exceptions to the exemption

provisions. The auditor inquired of the broker-

dealer’s Finance and Operations Principal

(FINOP) and the Chief Compliance Oicer regarding ndings

the broker-dealer received in a regulatory examination report

from its designated examining authority. The ndings indicated

the broker-dealer’s written supervisory procedures related

to prompt transmittal of customer funds were decient. The

auditor inquired of the FINOP regarding how those deciencies

were taken into account when preparing the statement in the

broker-dealer’s exemption report that identies each exception

to the identied exemption provision. The auditor also inspected

documentation that corroborated the FINOP’s response.

Sta Guidance

Regarding

Coordination of the

Audit and Review

Engagements

Examples of financial statement

audit procedures that may provide

information relevant to the broker-

dealer’s compliance with the

exemption provision(s) from the

Customer Protection Rule identified

in the broker-dealer’s exemption

report include:

y Testing customer trades;

y Testing of specially designated

cash accounts;

y Testing investment inventory

or transactions related to the

broker-dealer’s trading for its own

account; and

y Reading the clearing agreement

in connection with testing trade

fee or commission revenue or

expenses.

Source: Sta Guidance for Auditors of SEC-

Registered Brokers and Dealers (June 2014)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 11

PCAOB Release No. 2020-001 August 20, 2020

Firms did not suiciently evaluate results of review procedures, because they did not evaluate information that should

have caused them to believe that one or more of the broker-dealer’s assertions regarding the claimed exemption

provision were not fairly stated, in all material respects. (AT No. 2.11)

Firms did not obtain written representations from management of the broker-dealer. (AT No. 2.13)

Reporting on the Review Engagement

In review reports, rms included statements that referred to a required assertion that broker-dealers did not include in

their exemption reports, or referred to dierent exemption provisions than as specied in related exemption reports.

(AT No. 2.16)

Auditing Financial Statements

The nancial statements broker-dealers include in their annual lings with the SEC are required to be audited in

accordance with PCAOB standards. Our standards require auditors to obtain suicient appropriate audit evidence to

support the opinion expressed in the auditor’s report (i.e., as to whether the nancial statements present fairly, in all

material respects, the nancial position, results of operations, and cash ows in conformity with GAAP).

Evaluating the Results of the Review Procedures

The auditor should evaluate whether information has come to the auditor’s attention that

causes the auditor to believe that one or more of the broker-dealer’s assertions are not fairly

stated, in all material respects. A broker-dealer stated in its exemption report that it complied

with the exemption provisions of paragraph (k)(2)(ii) of the Customer Protection Rule throughout the year

without exception. During its audit of the broker-dealer’s nancial statements, the auditor obtained information

that the broker-dealer did not have an arrangement with a clearing broker-dealer at any point during the year,

and that the broker-dealer’s revenue was earned primarily from private placements. The auditor took into

account this evidence from the audit of the nancial statements and modied its review report to indicate the

broker-dealer’s assertion regarding the exemption claimed was not fairly stated in all material respects because

it did not reect the nature of the broker-dealer’s private placement services.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 12

PCAOB Release No. 2020-001 August 20, 2020

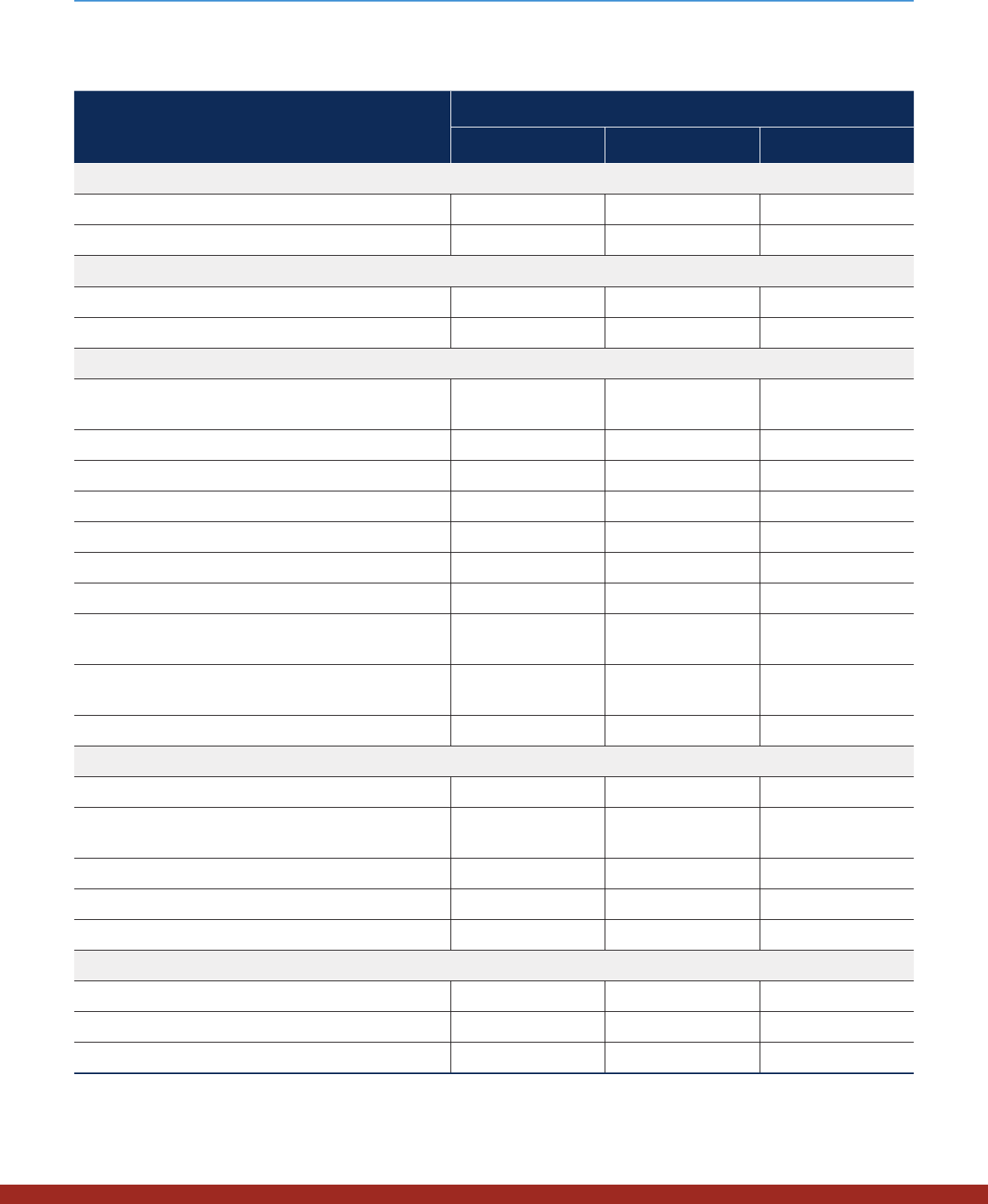

Areas of the Financial Statement Audit with Deciencies

Audit Areas

2019 2018

Number of

Applicable

Engagements

Reviewed

Number of

Engagements with

Deciencies

Percentage Percentage

Revenue 97 51 53% 60%

Financial Statement

Presentation and Disclosures

106 39 37% 27%

Identifying and Assessing Risks

of Material Misstatement

106 16 15% 23%

Related Party Relationships and

Transactions

37 10 27% 55%

Receivables and Payables 26 7 27% 21%

Consideration of an Entity's

Ability to Continue as a Going

Concern

9 6 67% 40%

Consideration of Materiality in

Planning and Performing an

Audit

106 4 4% 3%

Post-Audit Matters 7 3 43% 0%

Risks of Material Misstatement

Due To Fraud

8 3 38% 12%

The following deciencies were identied in the audits of nancial statements:

Revenue

Firms used information produced by the broker-dealer as audit evidence, but did not suiciently test the accuracy and

completeness of that information, whether by testing controls, testing the information, or a combination of both. (AS

1105.10)

Firms did not perform audit procedures to address the assessed risks of material misstatement for one or more

relevant assertions. (AS 2301.08)

Firms did not perform tests of details specically responsive to the assessed risks of fraud related to improper revenue

recognition. (AS 2301.13)

Firms did not perform suicient tests of controls, including information technology controls and automated

application controls, to support control risk assessments at less than the maximum when the nature, timing, and

extent of substantive procedures were based on that lower assessment. (AS 2301.16)

Firms did not perform suicient substantive procedures for relevant assertions. (AS 2301.36)

Firms did not obtain suicient evidence about the eectiveness of controls at the broker-dealers’ service organizations

to support the assessed level of control risk at less than the maximum and the related modication of the nature,

timing, and extent of substantive procedures. (AS 2601.14 and .15)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 13

PCAOB Release No. 2020-001 August 20, 2020

Responses to Significant Risks, Including Fraud Risks

For signicant risks, auditors should perform substantive procedures, including tests of details,

that are specically responsive to the assessed risks. A broker-dealer advises clients on mergers

and acquisitions and is compensated through a combination of retainer and success fees. The

auditor identied a fraud risk related to the occurrence of success fees for private transactions. The auditor

selected recorded success fees from private transactions throughout the year and subsequent to year-end. In

addition to vouching cash receipts and requesting conrmation of related receivables, the auditor requested

conrmation of key transaction terms, including closing date, from the broker-dealer’s customers. The auditor

also inspected closing documents to corroborate the information obtained through the conrmation process.

FASB ASC Topic 606

FASB ASC Topic 606, Revenue from Contracts with Customers, became eective for annual periods

beginning aer December 15, 2017. FASB ASC Topic 606 replaced most industry-specic revenue

recognition guidance, including broker-dealer guidance, with a ve-step model. Under the

model, an entity should:

1. Identify the contract(s) with a customer;

2. Identify the performance obligations in the contract;

3. Determine the transaction price;

4. Allocate the transaction price to the performance obligations in the contract; and

5. Recognize revenue when (or as) each performance obligation is satised.

When using substantive analytical procedures, rms did not establish that there were plausible and predictable

relationships between the data, develop expectations that were suiciently precise to identify misstatements,

determine the amount of dierence from expectations that could be accepted without further explanation, or

evaluate the reliability of the data from which their expectations were developed. (AS 2305.11 and .20)

When testing a sample, rms did not plan and design an appropriate sample, did not select sample items in such a

way that the sample could be expected to be representative of the population, and did not project the results of the

sample to the items from which the sample was selected. (AS 2315.16, .21, .24, and .26)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 14

PCAOB Release No. 2020-001 August 20, 2020

Revenue Recognition

Auditors should perform procedures to address the risks of material misstatement related to

improper revenue recognition. A broker-dealer advises clients on mergers and acquisitions.

The broker-dealer’s contracts with its customers are nonstandard but generally include success

fees and compensation for other services. The broker-dealer asserted that its contracts contain multiple

performance obligations. The auditor tested management's assertion by inspecting a sample of contracts, and

assessing the nature of the promises based on the contract terms. The auditor determined that each selected

contract included a success fee (a percentage of the merger or acquisition price) and xed fees for providing a

fairness opinion in connection with the sale. The auditor tested that management determined the transaction

price, allocated the transaction price to the performance obligations, and recognized revenue when (or as) the

separate performance obligations were satised in accordance with FASB ASC Topic 606.

Financial Statement Presentation and Disclosures

Firms did not suiciently evaluate or test:

y The classication of fair value of securities as Level 1, Level 2, or Level 3 as set forth in FASB ASC Topic 820, Fair

Value Measurement; (AS 2502.15)

y Revenue presentation and disclosure, as nancial statements appeared to include:

o Presentation of revenues on a net basis that was not in conformity with FASB ASC Topic 940, Financial Services –

Brokers and Dealers,

o Incomplete revenue recognition policy disclosures under FASB ASC Topic 235, Notes to Financial Statements,

and

o Incomplete qualitative and quantitative disclosures of information regarding revenue from contracts with

customers under FASB ASC Topic 606. (AS 2810.30)

y Statement of cash ows presentation and disclosure, as nancial statements appeared not to have been presented

in conformity with FASB ASC Topic 230, Statement of Cash Flows and excluded required disclosures regarding the

related change in accounting principle under FASB ASC Topic 250, Accounting Changes and Error Corrections. (AS

2810.30)

Deciencies related to the evaluation and disclosure of related parties and going concern are described on pages 15

and 16, respectively.

Identifying and Assessing Risks of Material Misstatement

Insuicient risk assessment procedures contributed to deciencies in areas of the nancial statement audit described

in this report.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 15

PCAOB Release No. 2020-001 August 20, 2020

Firms did not:

y Obtain a suicient understanding of the selection and application of

accounting principles relating to the broker-dealers’ implementation

of FASB ASC Topic 606. (AS 2110.12)

y Obtain a suicient understanding of the broker-dealers’ internal

control over nancial reporting, including the broker-dealers’

information systems and business processes and control activities,

to identify and assess the risks of material misstatement and design

further audit procedures. (AS 2110.18 and .28)

y Perform suicient procedures to identify and assess the risks

of material misstatement because rms did not, among other

deciencies, identify and assess the risks of material misstatement at

the assertion level for one or more signicant accounts. (AS 2110.59)

y Identify improper revenue recognition as a fraud risk, or did not

evaluate which types of revenue, revenue transactions, or assertions

may give rise to such risks. (AS 2110.68)

y Evaluate the design of the broker-dealers’ controls intended to

address fraud or other signicant risks, and determine whether those

controls had been implemented. (AS 2110.72)

Related Party Relationships and Transactions

Firms did not suiciently:

y Address the identied and assessed risks of material misstatement

because rms performed insuicient testing of allocated revenues

and expenses that related to formal agreements between broker-

dealers and their parents or ailiates, including not suiciently testing

whether the data used to determine the allocated revenues and

expenses was accurate and complete. (AS 2410.11)

y Test the accuracy and completeness of the broker-dealers’

identication of related parties and relationships and transactions

with related parties because rms did not take into account

information gathered during the audit. (AS 2410.14)

y Evaluate disclosures, as nancial statements omitted disclosures

necessary to understand related party relationships and the eects of

related party transactions as set forth in FASB ASC Topic 850, Related

Party Disclosures. (AS 2410.17)

Risk Assessment

As part of their risk assessment

procedures, auditors should obtain

an understanding of the broker-

dealer and its environment, and

its internal control over financial

reporting. Eectively performed risk

assessment procedures enable the

auditor to identify and assess the

risks of material misstatement at

the financial statement level and the

assertion level, including the risk of

material misstatement due to fraud.

The identification and assessment

of risks of material misstatement

should include risks associated with

related parties and relationships and

transactions with related parties.

Factors that auditors should evaluate

in determining which risks are

significant risks include whether the

risk is related to significant economic

developments.

Source: PCAOB AS 2110: Identifying and

Assessing Risks of Material Misstatement

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 16

PCAOB Release No. 2020-001 August 20, 2020

Receivables and Payables

Firms did not:

y Suiciently test the accuracy and completeness of information produced by the broker-dealer used as audit

evidence, whether by testing controls, testing the information, or a combination of both. (AS 1105.10)

y Perform suicient procedures that provided a reasonable basis for extending audit conclusions from an interim

date to the period end. (AS 2301.08 and .45)

y Appropriately design sampling procedures to respond to the risks of material misstatement, which resulted in an

insuicient extent of substantive testing. (AS 2301.08; AS 2315.16)

y Perform suicient tests of controls, including information technology controls, to support control risk assessments

at less than the maximum and the related modications to the nature, timing, and extent of substantive

procedures. (AS 2301.16)

y Perform, or suiciently perform, substantive procedures for relevant assertions, including instances of the use of

negative conrmations when the combined assessed level of inherent and control risk was not low and instances

where the evidence obtained through alternative procedures was not suicient. (AS 2301.36; AS 2310.20 and .33)

Confirmation Procedures

When the auditor has not received replies to positive conrmation requests, the auditor should

apply alternative procedures to the nonresponses to obtain the evidence necessary to reduce

audit risk to an acceptably low level. A broker-dealer recorded receivables from customers in

its nancial statements. The auditor assessed the risk of material misstatement and sent positive conrmation

requests to a sample of customers. The auditor performed alternative procedures for the nonresponses to the

conrmation requests, which included inspecting the customer statements used in the conrmation process,

performing tests of detail of customer activity that aected the receivable balance (e.g., securities purchases

and sales, cash deposits and withdrawals, and dividends and interest), and performing tests of detail of

customer activity in the period subsequent to the nancial statement date.

Consideration of an Entity's Ability to Continue as a Going Concern

Firms did not suiciently evaluate:

y Conditions and events identied through audit procedures that indicated there could be substantial doubt about

broker-dealers’ abilities to continue as a going concern. (AS 2415.03 and .06)

y Management’s plans for dealing with the conditions and events that indicated that there could be substantial

doubt because they did not obtain suicient information to consider whether the plans would have a mitigating

eect, and if so, whether the plans could be eectively implemented. (AS 2415.07)

y Disclosures, as nancial statements omitted disclosures regarding conditions and events that indicated there

could be substantial doubt, broker-dealer managements’ evaluations of their signicance, and any mitigating

factors as set forth in FASB ASC Topic 205, Presentation of Financial Statements, when substantial doubt was

alleviated based primarily on consideration of managements’ plans. (AS 2415.11)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 17

PCAOB Release No. 2020-001 August 20, 2020

Consideration of Materiality in Planning and Performing an Audit

Firms did not establish materiality levels for the nancial statements as a whole or did not establish tolerable

misstatement at an amount less than planning materiality. (AS 2105.06 and .08)

Post-Audit Matters

In auditors’ reports on revised broker-dealer nancial statements, rms did not refer to the reasons the nancial

statements were revised, including instances associated with broker-dealers’ implementation of ASC Topic 606. (AS

2905.06)

Risks of Material Misstatement Due to Fraud

Firms did not suiciently examine journal entries and other adjustments to address the risk of management override

of controls. (AS 2401.58)

Auditing Supplemental Information Accompanying Audited Financial Statements

The supporting schedules broker-dealers are required to include in their annual lings with the SEC are required to

be audited in accordance with PCAOB standards. AS 2701 requires auditors to obtain suicient appropriate audit

evidence to support the auditor’s opinion regarding whether the supplemental information is fairly stated, in all

material respects, in relation to the nancial statements as a whole.

Supplemental Information

The supplemental information required by Exchange Act Rule 17a-5(d)(2)(ii) consists of

supporting schedules that present the net capital computation under the Net Capital Rule,

the reserve requirement computations under Exhibit A of the Customer Protection Rule, and

information relating to the requirement for possession or control of customer securities under the Customer

Protection Rule. The reserve requirement computations include the customer reserve computation and the

Proprietary Securities Account of a Broker-Dealer (PAB) account reserve computation.

Deciencies in Auditing Supporting Schedules

2019 2018

Number of

Applicable Audits

Reviewed

Number of Audits

with Deciencies

Percentage Percentage

Net Capital Rule 65 20 31% 29%

Customer Protection Rule 33 14 42% 36%

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 18

PCAOB Release No. 2020-001 August 20, 2020

In particular, when compared to the prior year, we observed an increase in decient procedures for determining

whether the broker-dealer prepared stock record allocation adjustments pursuant to Exhibit A of the Customer

Protection Rule.

The following deciencies were identied in the audit procedures related to supporting schedules:

Performing Audit Procedures on Supplemental Information

Firms did not perform, or suiciently perform, procedures to evaluate whether the following aspects of net capital

computations were determined in compliance with the Net Capital Rule: (AS 2701.04)

y Adjustments to net worth, specically the addition of discretionary and subordinated liabilities;

y Allowable assets and assets not readily convertible into cash, including commissions and concessions receivable;

y Haircuts for securities positions and undue concentration charges; or

y Operational charges and other deductions, including failed security transactions.

Securities Haircuts

A broker-dealer held long positions in government securities in inventory, and used a report

from an internal application that included issuer, maturity, and fair value information for

each security to determine the haircuts on those securities to report in its computation of

net capital. The auditor tested the completeness of the haircut report by reconciling the

government securities included on the report to the broker-dealer’s securities inventory, which was tested

during the nancial statement audit. The auditor tested the accuracy of the haircut report by selecting a

sample of government securities from the report and comparing the maturity dates to the securities inventory,

recalculating the days to maturity, obtaining the applicable haircut percentages from the Net Capital Rule, and

recalculating the haircuts per the report for the securities selected.

Firms did not perform, or suiciently perform, procedures to test whether the information in the customer and PAB

reserve computations was complete, accurate, and compliant with relevant regulatory requirements. This includes

whether the notication obtained from the banks applicable to the special reserve bank account for the exclusive

benet of customers met the requirements of the Reserve Requirements Rule, and procedures related to stock record

allocation adjustments. (AS 2701.04)

Firms did not perform, or suiciently perform, procedures to test the completeness and accuracy of information

related to the possession or control requirements of the Customer Protection Rule, including excess margin

computations, segregation decit reporting, and segregation instructions. (AS 2701.04)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 19

PCAOB Release No. 2020-001 August 20, 2020

Possession or Control

A broker-dealer reported no reportable items in the possession or control schedule included

in its nancial statements. The auditor tested the completeness and accuracy of the broker-

dealer’s stock record and customer balances during the nancial statement audit. To test the

schedule, the auditor obtained a decit report generated by the broker-dealer’s internal system.

The auditor tested that the system was programmed to properly calculate decits pursuant to the Customer

Protection Rule, and tested the relevant information technology controls over the system. The auditor tested

completeness of the decit report by reviewing the report logic to determine that it was congured to properly

report all decits. The auditor tested the accuracy of the report by selecting securities decits from the stock

record and the decit report and inspecting evidence that these securities were subject to segregation, both

instructed and accomplished.

Firms did not determine that supporting schedules included information inconsistent with the nancial statements or

the most recent FOCUS report. (AS 2701.04)

Obtaining a Representation Letter

Firms did not obtain written representations from management of the broker-dealer. (AS 2701.05)

Other Instances of Non-Compliance with PCAOB Standards

This section of our report discusses certain deciencies we identied that relate to other instances of non-compliance

with PCAOB standards. These deciencies do not relate directly to the suiciency or appropriateness of evidence

rms obtained to support their audit opinions or attestation reports.

Auditor’s Report on the Financial Statements and Supporting Schedules

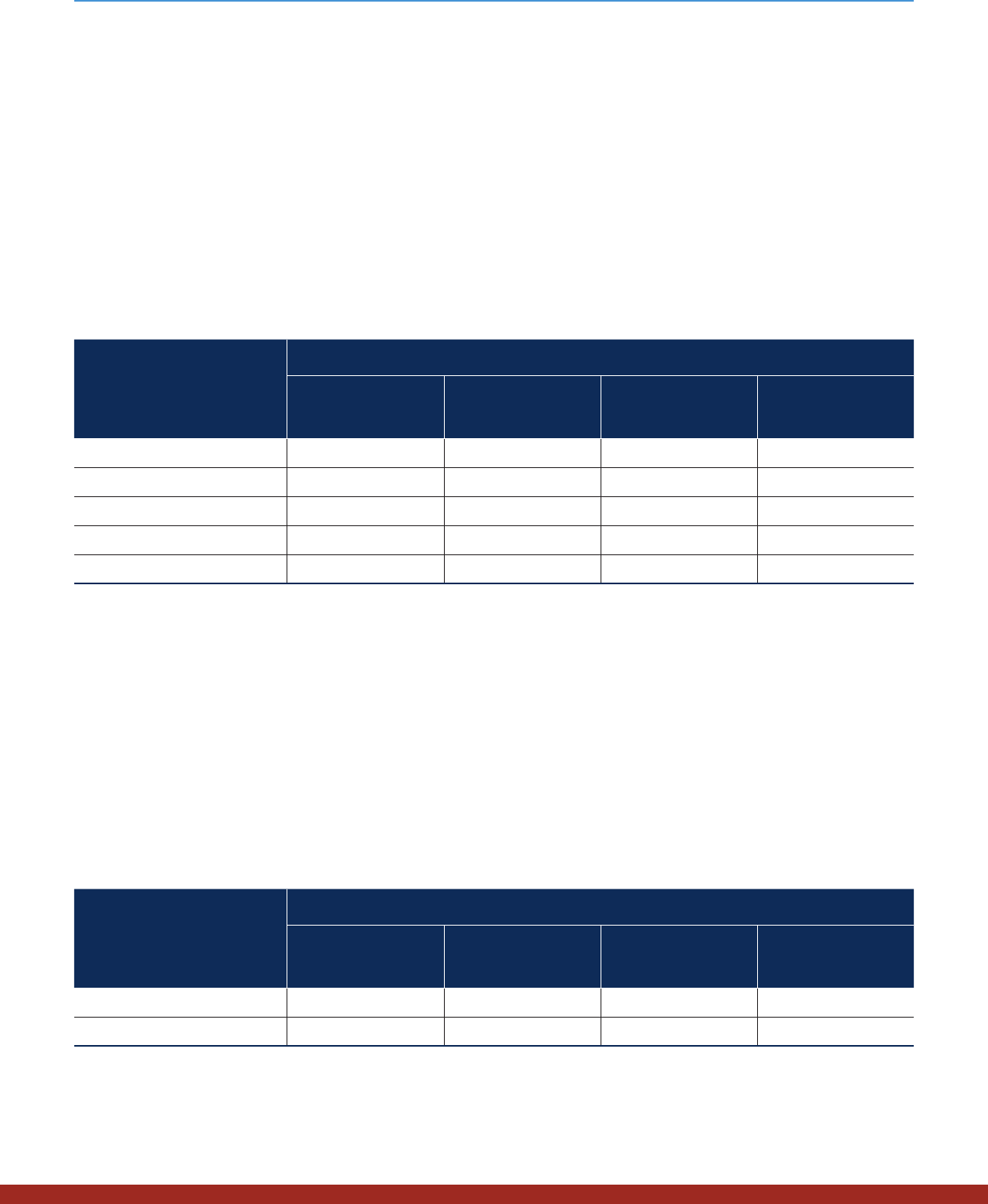

Deciencies in the Auditor’s Report

2019 2018

Number of

Applicable Audits

Reviewed

Number of Audits

with Deciencies

Percentage Percentage

Auditor’s Report on the

Financial Statements and

Supporting Schedules

106 15 14% 18%

Certain auditors’ reports on broker-dealer nancial statements and supporting schedules were not presented in

accordance with PCAOB standards. The most frequently occurring deciency related to the identication of the

supplemental information. (AS 2701.10) In certain instances, auditors’ reports on broker-dealer nancial statements

reected the requirements of AS 3101 prior to its amendment, even though the amended standard was eective.

(AS 3101.05-.10) In other instances, auditors’ reports omitted or did not properly present one or more of the required

elements listed below:

y A required element from the opinion on the nancial statement section of the auditor’s report; (AS 3101.08)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 20

PCAOB Release No. 2020-001 August 20, 2020

y A statement that the auditor believes that the audit provides a reasonable basis for the auditor’s opinion; (AS

3101.09)

y Tenure for the rm; and (AS 3101.10)

y A required element from the auditor’s report on supplemental information. (AS 2701.10)

In addition, certain auditors’ reports on broker-dealer nancial statements and supporting schedules included report

dates prior to the completion of the audit procedures performed by the rms. (AS 3110.01; AS 2701.12)

Auditor Communications

Deciencies in Auditor Communications

The following deciencies were identied relating to communications required to be made to the broker-dealer’s

audit committee (or equivalent body):

Communications with Audit Committees (or Equivalent Body)

Firms did not document oral communications made to the audit committee (or equivalent body). (AS 1301.25)

Communications about Control Deficiencies

Firms did not communicate in writing to management and the audit committee (or equivalent body) identied

signicant deciencies and material weaknesses. (AS 1305.04)

Engagement Documentation

Deciencies in Documentation

2019 2018

Number of

Applicable Audits

Reviewed

Number of Audits

with Deciencies

Percentage Percentage

Auditor Communications 106 5 5% 12%

2019 2018

Number of

Applicable

Engagements

Reviewed

Number of

Engagements with

Deciencies

Percentage Percentage

Audit Documentation 106 26 25% 25%

Review Documentation 74 8 11% 16%

Firms did not properly complete an engagement completion document, assemble a complete and nal set of audit

and review documentation (“engagement le”) by the documentation completion date, and properly document

additions to the engagement le aer the report release date. (AS 1215.13, .15, and .16)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 21

PCAOB Release No. 2020-001 August 20, 2020

Quality Control

This section of our report includes observations of rms’ systems of quality control. Our standards require rms

to have a system of quality control that provides reasonable assurance that personnel comply with applicable

professional and rm standards. Observations from our oversight activities have shown that rms’ improvements in

quality control systems can enhance the quality of audits.

Consistent with what we have historically emphasized, a rm’s system of quality control, among other things, should

provide reasonable assurance that for broker-dealer audit and attestation engagements:

y Firms assign engagement partners with knowledge and experience in broker-dealer accounting and regulatory

requirements and PCAOB audit and attestation standards;

y Firms assign engagement quality reviewers that meet the qualications required by PCAOB standards and

establish policies and procedures that cover the execution of engagement quality reviews pursuant to PCAOB

standards;

y Auditors participating in audit and attestation engagements exercise due professional care, including professional

skepticism; and

y Engagement teams identify and document all signicant ndings and issues related to the audit and attestation

engagements.

The results of our 2019 inspections indicate, however, that there is room for improvement. Our observations indicate

that rms’ systems of quality control did not appear to provide reasonable assurance that rm personnel will comply

with applicable professional standards in the areas of: 1) engagement performance; 2) monitoring; 3) independence,

integrity, and objectivity; and 4) personnel management, which are required elements of a system of quality control.

We explore each of these topics further below.

Engagement Performance

Our sta made the following observations related to engagement performance:

y Policies and procedures did not provide reasonable assurance that a complete and nal set of audit and

attestation documentation was assembled for retention as of the documentation completion date, and any

documentation subsequent to the report release date indicated the date the information was added, the name of

the person who prepared the additional documentation, and the reasons for adding it, in accordance with AS 1215.

(QC 20.17)

y Policies and procedures did not provide reasonable assurance that engagement partners reviewed and supervised

audit and attestation engagements with due professional care in accordance with AS 1201, which contributed to

not identifying deciencies in those engagements. (QC 20.18)

y Engagement quality reviews were not performed (AS 1220.01) or did not include a suicient evaluation of the

engagement team’s signicant judgments and the related conclusions reached that formed the overall conclusion

in the engagement report. Based on deciencies identied in audit and attestation engagements, it appears

engagement quality reviewers did not suiciently evaluate the engagement team’s assessment of, and audit

responses to, signicant risks, including fraud risks, and did not suiciently review the nancial statements,

documents containing management’s assertions, and related engagement reports. (AS 1220.09, .10, and .18A) In

addition, it appears engagement quality reviewers did not perform their review with due professional care, which

contributed to not identifying deciencies in engagement areas requiring review. (AS 1220.12 and .18B)

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 22

PCAOB Release No. 2020-001 August 20, 2020

Audit and Attestation Engagements with Deciencies in the Engagement Quality Review Area

2019 2018

Number of

Applicable

Engagements

Reviewed

Number of

Engagements with

Deciencies

Percentage Percentage

Audit Engagements 80 54 68% 65%

Review Engagements 38 27 71% 43%

Examination Engagements 21 2 10% 26%

Monitoring

Procedures for internal inspections did not provide reasonable assurance that rms would detect signicant audit

and attestation deciencies through their monitoring activities. (QC 30.04-.07)

Independence, Integrity, and Objectivity

Policies and procedures did not provide reasonable assurance that the rms would maintain their independence,

particularly related to the general standard of independence and the nancial relationship requirements of Rule 2-01

of SEC Regulation S-X. (QC 20.09)

Personnel Management

Policies and procedures did not provide reasonable assurance that engagement personnel assigned to broker-dealer

engagements complied with the rms’ education requirements. (QC 20.13)

Engagement Quality Review

Engagement quality reviewers should evaluate audit responses to signicant risks identied by

the engagement team, including fraud risks. The engagement team assessed a fraud risk related

to the improper timing of underwriting revenue recognition. The engagement quality reviewer

evaluated the engagement team’s judgments and conclusions regarding the identied fraud risk by reviewing

the substantive testing of underwriting revenue and holding discussions with the engagement team.

Auditor Independence

SEC rules require auditors of broker-dealers to comply with SEC independence requirements. This section of our

report discusses related ndings from our inspections.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 23

PCAOB Release No. 2020-001 August 20, 2020

2019 2018

Number of

Applicable Audits

Reviewed

Number of Audits

with Findings

Percentage Percentage

Auditor Independence 29 5 17% 5%

Independence Findings

Firms assisted in the preparation of broker-dealer nancial statements and supplemental information, which impaired

their independence. Assistance by the auditor with the preparation of nancial statements and supplemental

information being audited is not a permissible service as prescribed by Rule 2-01(c)(4)(i) of SEC Regulation S-X.

Firms included indemnication clauses in engagement letters, which impaired their independence based on the

general standard of independence as prescribed by Rule 2-01(b) of SEC Regulation S-X.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | 24

PCAOB Release No. 2020-001 August 20, 2020

PCAOB Standards Associated with Inspection Observations

QC 20 System of Quality Control for a CPA Firm’s Accounting and Auditing Practice

QC 30 Monitoring a CPA Firm’s Accounting and Auditing Practice

AS 1105 Audit Evidence

AS 1201 Supervision of the Audit Engagement

AS 1215 Audit Documentation

AS 1220 Engagement Quality Review

AS 1301 Communications with Audit Committees

AS 1305 Communications About Control Deciencies in an Audit of Financial Statements

AS 2105 Consideration of Materiality in Planning and Performing an Audit

AS 2110 Identifying and Assessing Risks of Material Misstatement

AS 2301 The Auditor’s Responses to the Risks of Material Misstatement

AS 2305 Substantive Analytical Procedures

AS 2310 The Conrmation Process

AS 2315 Audit Sampling

AS 2401 Consideration of Fraud in a Financial Statement Audit

AS 2410 Related Parties

AS 2415 Consideration of an Entity’s Ability to Continue as a Going Concern

AS 2502 Auditing Fair Value Measurements and Disclosures

AS 2601 Consideration of an Entity’s Use of a Service Organization

AS 2701 Auditing Supplemental Information Accompanying Audited Financial Statements

AS 2810 Evaluating Audit Results

AS 2905 Subsequent Discovery of Facts Existing at the Date of the Auditor's Report

AS 3101 The Auditor’s Report on an Audit of Financial Statements When the Auditor Expresses an Unqualied Opinion

AS 3110 Dating of the Independent Auditor’s Report

AT No. 1 Examination Engagements Regarding Compliance Reports of Brokers and Dealers

AT No. 2 Review Engagements Regarding Exemption Reports of Brokers and Dealers

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | A-1

PCAOB Release No. 2020-001 August 20, 2020

Appendix A: Selection of Firms and Engagements for

Inspections

The following information provides an overview of the rms that have been subject to our inspection procedures.

Because our inspection process evolves over time, it can, and oen does, focus on a dierent mix of rms and

engagements from year to year. We selected 66 rms for inspection during 2019.

3

These inspections covered 106

audits of nancial statements and 103 attestation engagements of broker-dealers that had nancial statement periods

ended during the period April 1, 2018 through March 31, 2019. These selections were made from the population of

rms and broker-dealer audits depicted in the following table.

Number of Broker-Dealer Audits Per Firm Number of Firms Number of Broker-Dealer Audits

1 123 123

2 to 20 245 1,287

21 to 50 27 822

51 to 100 12 810

More than 100 4 579

Total 411 3,621

The rms and the audit and attestation engagements were generally selected based on characteristics of the rms

and the broker-dealers. The rm characteristics included, among others:

y The number of broker-dealer audits performed;

y Whether the rm conducted examination engagements;

y Whether the rm also issued audit reports for issuers;

y Previous inspection results;

y History of the rm or rm personnel in auditing broker-dealers; and

y The existence of disciplinary actions against the rm or engagement partner by the SEC, PCAOB, or other

regulatory authorities.

The selection of the rms’ broker-dealer engagements was based on various characteristics, including:

y Whether the broker-dealer led a compliance report with the SEC pursuant to Exchange Act Rule 17a-5;

y Whether the broker-dealer was a subsidiary of an issuer and its signicance to the issuer’s consolidated nancial

statements;

y Changes in auditors and certain circumstances related to the changes;

y Financial metrics;

3

See footnote 1 on page 4.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | A-2

PCAOB Release No. 2020-001 August 20, 2020

Number of Broker-Dealer Audits Per Firm Number of Firms Inspected Number of Audits Reviewed

1 10 10

2 to 20 32 33

21 to 50 14 19

51 to 100 6 12

More than 100 4 32

Total 66 106

Firms Number of Firms Inspected Number of Audits Reviewed

Also Audited Issuers 37 73

Did Not Audit Issuers 29 33

Total 66 106

Firms Number of Firms Inspected Number of Audits Reviewed

Audited Broker-Dealers That Filed

Compliance Reports

21 58

Only Audited Broker-Dealers That Filed

Exemption Reports

45 48

Total 66 106

y Existence of disciplinary actions against the broker-dealer by the SEC, FINRA, or other regulatory authorities; and

y Engagement partner’s workload, experience in auditing broker-dealers, and previous inspection results.

We also selected a number of engagements randomly.

Selection of Firms for Inspection and Audit and Attestation Engagements for

Review in 2019

The following tables present information about the rms inspected in 2019 and the number of audits and attestation

engagements reviewed during those inspections. The tables provide the number of broker-dealer audits performed

by the inspected rms, as determined at the time of the inspection, whether or not the rms also audited issuers, and

whether the rms audited broker-dealers that led a compliance report or only audited broker-dealers that led an

exemption report.

At the time of the 2019 inspections, of the 37 rms that also audited issuers, four audited more than 100 issuers and

33 audited 100 or fewer issuers.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | A-3

PCAOB Release No. 2020-001 August 20, 2020

Broker-Dealers Number of Audits Reviewed

Range of Minimum Net

Capital Requirements

(Thousands)

Range of Actual Net Capital

Reported at Fiscal Year End

(Thousands)

Did Not Claim Exemption 33 $30 - $3,000,000 $250 - $17,000,000

Claimed Exemption 73 $5 - $1,600 $9 - $180,000

Total 106 $5 - $3,000,000 $9 - $17,000,000

Broker-Dealers Filed

Number of Attestations

Covered

Range of Minimum Net

Capital Requirements

(Thousands)

Range of Actual Net Capital

Reported at Fiscal Year End

(Thousands)

Compliance Report 29 $250 - $3,000,000 $250 - $17,000,000

Exemption Report 74 $5 - $1,600 $9 - $180,000

The following tables present the number of audits and attestation engagements reviewed during the inspections in

2019, the ranges of minimum net capital requirements and actual net capital reported for the broker-dealers that

led either a compliance report or an exemption report, stratied by whether the broker-dealer did or did not claim

an exemption, and whether the broker-dealer led a compliance report or an exemption report (on the basis of either

one or more exemptions claimed or applicable SEC and SEC sta guidance).

Three of the 106 audits reviewed during the inspections had a related attestation engagement that was not reviewed

during the inspection.

Selection of Firms for Inspections and Audit and Attestation Engagements for

Reviews since Inception of the Interim Program in 2011

The following table presents the number of rms inspected, the number of audits reviewed during the inspections,

and the number of attestation engagements covered by the inspections, stratied by the number of broker-dealer

audits per rm.

Number of Broker-Dealer Audits

Per Firm

Number of Firms

Inspected

Number of Audits

Reviewed

Number of

Examinations

Covered

Number of Reviews

Covered

1 77 78 5 44

2 to 20 253 329 34 188

21 to 50 41 125 11 54

51 to 100 17 70 8 43

More than 100 7 239 72 94

Total 370 841 130 423

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | A-4

PCAOB Release No. 2020-001 August 20, 2020

The sum of the number of rms inspected does not total to 370 because 25 rms that were inspected more than once

since the inception of the interim inspection program are reported in multiple stratications due to changes in the

number of broker-dealer audits performed by those rms. In addition, one rm that audited one broker-dealer was

inspected more than once.

The following table presents the number of rms inspected, the number of audits reviewed during the inspections,

and the number of attestation engagements covered by the inspections, stratied by whether or not the rms also

audited issuers.

Firms

Number of Firms

Inspected

Number of Audits

Reviewed

Number of

Examinations

Covered

Number of Reviews

Covered

Also Audited Issuers 159 546 115 266

Did Not Audit Issuers 217 295 15 157

Total 370 841 130 423

The sum of the number of rms inspected does not total to 370 because six rms that were inspected more than once

since the inception of the interim inspection program are reported in both stratications due to a change over time in

whether the rms also audited issuers.

The following table presents the ranges of minimum net capital requirements and actual net capital reported for

the broker-dealers whose engagements were covered in the inspections that led either a compliance report or

an exemption report, stratied by whether the broker-dealer did or did not claim exemption from the Customer

Protection Rule.

Broker-Dealers

Number of Audits

Reviewed

Range of Minimum Net

Capital Requirements

(Thousands)

Range of Actual Net

Capital Reported at Fiscal

Year End (Thousands)

Did Not Claim Exemption 207 $5 - $3,000,000 $250 - $17,000,000

Claimed Exemption 634 $5 - $82,000 $6 - $2,250,000

The requirement for broker-dealer audits to be performed in accordance with PCAOB standards, and the requirement

for broker-dealers to le compliance or exemption reports, was eective for broker-dealer annual reports with scal

years ended on or aer June 1, 2014. The following table presents the number of rms where inspections addressed

whether engagements were conducted in accordance with PCAOB standards. The table also presents the number

of audits reviewed during the inspections, and the number of attestation engagements covered by the inspections,

stratied by whether the rms audited broker-dealers that led compliance reports or only audited broker-dealers

that led exemption reports.

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | A-5

PCAOB Release No. 2020-001 August 20, 2020

Firms

Number of Firms

Inspected

Number of Audits

Reviewed

Number of

Examinations

Covered

Number of Reviews

Covered

Audited Broker-Dealers That

Filed Compliance Reports

64 292 130 158

Only Audited Broker-Dealers

That Filed Exemption Reports

221 268 N/A 265

Total 276 560 130 423

The number of rms inspected does not total to 276 because nine rms that were inspected more than once are

included in both stratications due to a change over time in whether the rms also audited broker-dealers that

led compliance reports. In addition, two of the rms inspected that only audited one broker-dealer and those

broker-dealers did not le either a compliance or an exemption report are not included in this table. Certain audits

reviewed during the inspections also (1) did not have a related attestation engagement, (2) had a related attestation

engagement not covered during the inspection, or (3) had more than one related attestation engagement covered

during the inspection.

The following table presents the ranges of minimum net capital requirements and actual net capital reported for

the broker-dealers whose engagements were covered in the inspections that led either a compliance report or an

exemption report, stratied by the type of report led.

Broker-Dealers Filed

Number of Audits

Reviewed

Range of Minimum Net

Capital Requirements

(Thousands)

Range of Actual Net

Capital Reported at Fiscal

Year End (Thousands)

Compliance Report 130 $100 - $3,000,000 $250 - $17,000,000

Exemption Report 423 $5 - $82,000 $6 - $300,000

Annual Report on the Interim Inspection Program Related to Audits of Brokers and Dealers | B-1

PCAOB Release No. 2020-001 August 20, 2020

Appendix B: Comparative Results from Our Inspections

under the Interim Program

Since the inception of the interim inspection program in 2011, the PCAOB has performed 542 inspections of 370 of the

rms that conducted audits of broker-dealers. The 542 inspections covered portions of 841 audits, of which 562 were

required to be performed in accordance with PCAOB standards, and 279 were required to be performed in accordance

with generally accepted auditing standards. These audits had nancial statement periods ended December 31, 2010

through March 31, 2019.

The inspections covered 553 attestation engagements that were required to be performed in accordance with PCAOB

standards. These attestation engagements had nancial statement periods ended June 30, 2014 through March 31,

2019.

Deficiency Classification

We have reclassied certain deciencies from 2018 and 2017 inspections reported in the previous annual report to