[Inside Front Cover

This Page Left Intentionally Blank]

SECURITY COOPERATION BILLING HANDBOOK

Jointly Developed By

Defense Security Cooperation

University (DSCU)

Defense Finance and

Accounting Service (DFAS)

Security Cooperation

Accounting (SCA)

Current as of January 2021

Acknowledgements

Defense Security Cooperation

University (DSCU)

Defense Finance and Accounting

Service (DFAS) Security

Cooperation Accounting (SCA)

Mr. David Sobyra

Acting President

Ms. Melissa Jacobs

Director

Authors and Contributors

Mr. John O’Connor, DSCU/DC

2475 K Street

Wright-Patterson Air Force Base, Ohio 45433

Mr. Colin Nowling, DFAS SCA

8899 East 56th Street

Indianapolis, Indiana 46249

1

The Security Cooperation Billing Handbook is intended to provide insights and references on Security

Cooperation (SC) case delivery/performance transaction reporting and billing. While the U.S. Department of

Defense (DoD) is always receptive to suggestions to improve SC case financial procedures, readers of this

publication should observe that many such procedures are followed because of legal requirements contained in

U.S. public law. As a result, DoD very often has little flexibility in the financial administration and billing of the

SC case programs.

This publication does not take precedence over officially published U.S. government regulations, directives,

instructions, or manuals and is intended as a textbook and guide only. Additionally, this publication goes to press

in a time of dynamic changes in the Security Cooperation enterprise. Some changes may even occur while this

handbook is being printed.

Any requests for clarification or suggestions for improvement or content should be addressed to the

following:

Defense Security Cooperation University

(DSCU)

Defense Finance and Accounting Service

Security Cooperation Accounting

(DFAS SCA)

Mail:

2475 K Street

Wright-Patterson Air Force Base, Ohio 45433

Mail:

8899 East 56th Street

Indianapolis, Indiana 46249

POC/Email:

John O’Connor

john.b.oconnor12.civ@mail.mil

POC/Email:

Doug Flanagan

douglas.o.flanagan.ci[email protected]

Phone:

DSN 713-3256

Commercial (937) 713-3256

Phone:

DSN 699-3281

Commercial (317) 212-3281

2

Table of Contents

PART I—GENERAL OVERVIEW 6

CHAPTER 1 THE SECURITY COOPERATION BILLING SYSTEM FOR CASES 6

Purpose 6

The Security Cooperation Billing Cycle 6

Inputs to DFAS SCA 7

Payment Schedules 7

Delivery Transactions and Peformance Reporting 7

Cash Accounting 8

Foreign Military Sales Trust Fund 8

Foreign Military Sales Customer Funds 9

DFAS SCA Reports 11

Foreign Military Sales Billing Statement (DD Form 645) 11

Foreign Military Sales Delivery Listing 13

Foreign Military Sales Financial Forecast 13

Foreign Military Sales Reply Listing to Customer Requests for Adjustments 13

Holding Account Statement 14

Foreign Military Sales Accelerated Case Closure Suspense Account 14

Special Billing Arrangements (SBA) 14

Foreign Military Sales Case Closure 15

Case Closure Procedures 15

Summary 16

CHAPTER 2 DFAS SCA CUSTOMER ASSISTANCE 17

Purpose 17

Visits to DFAS SCA 17

Policy 17

Visit Requests 17

DFAS SCA Visits to Customer Site 17

DFAS SCA Automated Delivery Listing Products 17

PART II—BILLING DOCUMENTS 26

CHAPTER 3 FOREIGN MILITARY SALES BILLING STATEMENT (DD FORM 645) 26

Purpose 26

Introduction 26

General Information Regarding DD Form 645 26

Function and Content 26

Cycle 27

Explanation of Entries on the DD Form 645 28

Entries on DD Form 645 [FMR Table 8-1 and Figure 3-1] 29

Summary 36

3

CHAPTER 4 FMS DELIVERY LISTING 37

Purpose 37

General Information 37

Function and Format 37

Cycle 37

Explanation of Entries on the Foreign Military Sales Delivery Listing 37

Summary 45

CHAPTER 5 FOREIGN MILITARY SALES FINANCIAL FORECAST 46

Purpose 46

General Information Function and Format 46

Cycle 46

Explanation Of Entries On The FMS Financial Forecast 46

Summary 47

CHAPTER 6 FMS REPLY LISTING TO CUSTOMER REQUEST FOR ADJUSTMENTS 48

Function and Format 48

Cycle 48

Summary 50

CHAPTER 7 HOLDING ACCOUNT STATEMENT 52

Purpose 52

General Information 52

Function 52

Cycle 52

Explanation Of Entries On The Holding Account Statement 52

Summary 54

CHAPTER 8 ACCELERATED CASE CLOSURE SUSPENSE ACCOUNT STATEMENT 56

General Information 56

APPENDICES 59

Appendix A: Document Identifier (DOC ID) Codes 59

General Description 59

Delivery Listing Codes 59

Delivery Cost Total Codes 60

Appendix B: Routing Identifier Codes (RIC) 61

Appendix C: Price Code (Prc Cd) 67

Code Meaning 67

Appendix D: MILSTRIP Document Number (SC) 69

Appendix E: Implementing Agency (IA) Codes 71

Appendix F: Delivery Term Codes (DTCs) 73

NOTES: 75

4

Appendix G: Generic Codes Table 76

NOTES: 77

Appendix H: Transportation Bill Codes (TBC) 79

Appendix I: Transportation based on Transportation Bill Codes (TBCs) for Inventory Items Shipped by DWCF 83

Appendix J: Transportation Charges based on TBCs for Inventory Items NOT Shipped by DWCF 87

Appendix K: Types of Assistance (T/A) Codes 91

Appendix L: Julian Date Calendar 93

Appendix M: Unit of Issue Codes 95

Appendix N: Offer/Release Codes 97

Appendix O: Mode of Shipment (MOS) Codes 99

Appendix P: Adjustment Reply Codes (ARC) 101

Adjustment Reply Codes (ARC): Denial 101

Adjustment Reply Codes (ARC): Reason Request Granted and Instructions for Disposition of Any Materiel Shipped in

Error 102

Adjustment Reply Codes (ARC): Advisory Codes That Do Not Require Billing or Supply Action 103

Adjustment Reply Codes (ARC) Codes: To Request Additional Data from Country 103

Adjustment Reply Codes (ARC): USG reimbursement to Foreign Countries to Recover Transportation Costs those

Countries Incurred to Return Items to USG 104

Appendix Q: Delivery Source Codes (DSC) and Accessorial Computation Matrix 106

Delivery Source Code: Sale of Articles Under AECA Section 21 106

Delivery Source Code: Performance of DoD Services Under AECA Section 21 or 22 107

Delivery Service Codes: Unique FMSO Charges 107

Delivery Source Codes: Procurement for FMS Purchasers Under AECA Section 22 108

Delivery Source Code: Miscellaneous Charges 109

Delivery Source Code: Special Defense Acquisition Fund 109

Delivery Source Codes (DSC) Surcharge Matrix 110

Appendix R: Abbreviations And Acronyms 114

Appendix S: Glossary Of Selected Terms 119

5

[This Page Left Intentionally Blank]

6

Part I—General Overview

CHAPTER 1

The Security Cooperation Billing System for Cases

Purpose

The Arms Export Control Act (AECA Sections 21 through 24) provides the legal basis for Foreign Military

Sales (FMS) billing policies and procedures. These policies and procedures are further delininated in the DoD

Financial Management Regulation (FMR—DoD 7000.14R Volume 15 [Security Cooperation Policy]); the

Security Assistance Management Manual (SAMM - DSCA 5105.38-M Chapter 9 [Financial Policies and

Procedures]); and the United States of America Foreign Military Sales (FMS) Letter of Offer and Acceptance

(LOA) Standard Terms and Conditions (SAMM Chapter 5 Figure 4). The purpose of this chapter is to provide a

high-level description of the Defense Finance and Accounting Service Security Cooperation Accounting (DFAS

SCA) functions in the billing cycle, cash management, and reports/products provided to the SC case customers

while also describing the responsibilities of the DoD Implementing Agencies (IAs) to provide the required inputs

to DFAS SCA.

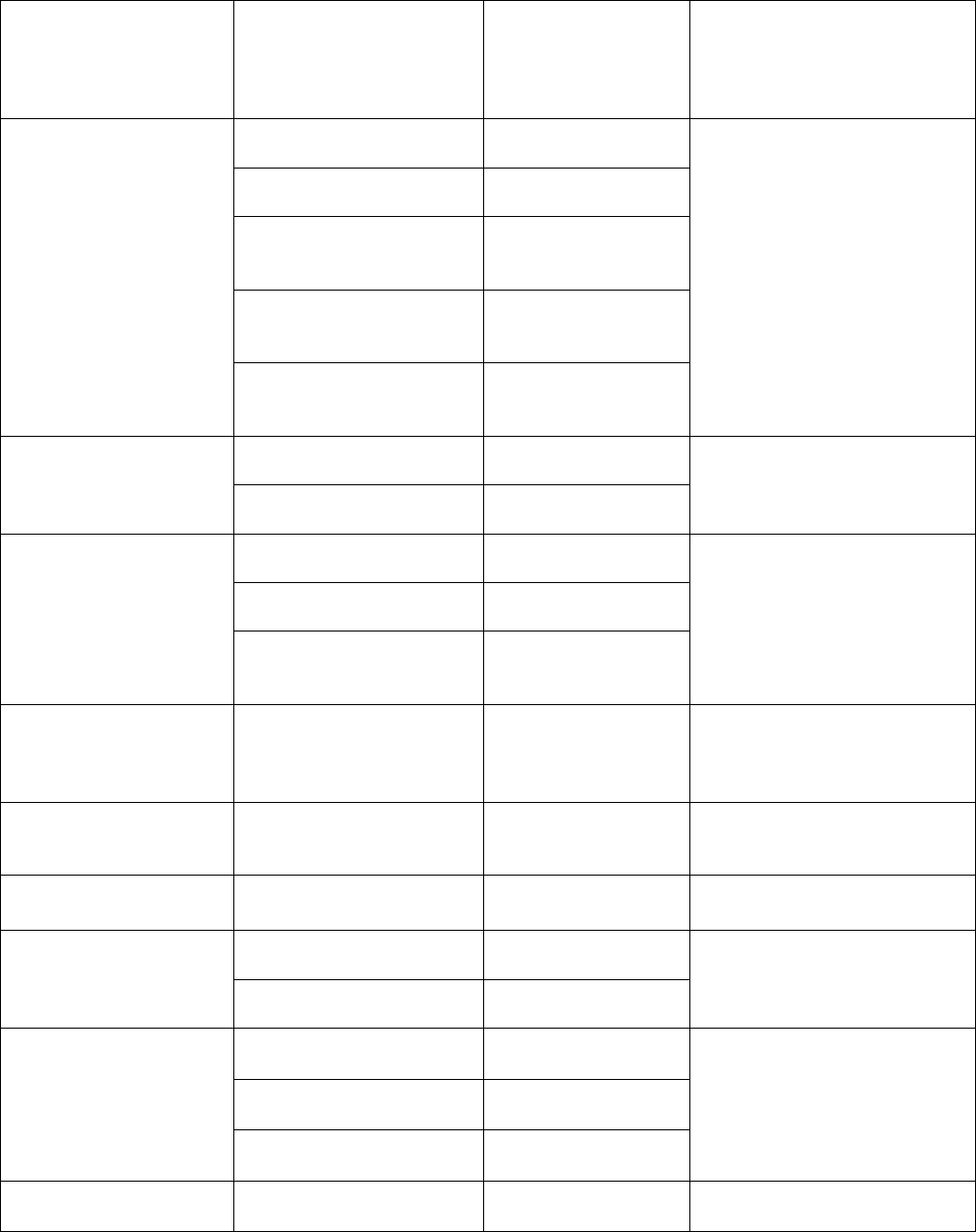

The Security Cooperation Billing Cycle

DFAS SCA issues quarterly billing statements (e.g., DD Form 645 “Foreign Military Sales Billing

Statement” along with additional attachments and information described later in this Handbook) to SC Case

customers per the billing timeline documented in SAMM Table C9.T25 (FMS Billing Timeline), and the FMR

VOL 15, Chapter 8, Section 0803 (FMS Billing Statement). That SAMM and FMR information is depicted in the

following table. The information in those billing statements and attachments is consolidated from multiple data

inputs, including the current implemented LOA data (e.g., case, line, payment-schedule data, etc.), performance /

delivery reporting data reported to DFAS SCA by the applicable IA, collected case funds, etc. DFAS SCA bills

for costs related to defense articles, services, and training that have been sold pursuant to the Arms Export Control

Act (AECA). IAs report SC deliveries and performance of case material, services, training, accrued expenditures

(work in process), and other related costs to DFAS SCA for the purposes of obtaining reimbursement or reporting

performance under an allotment of trust fund budget authority.

PERIOD ENDED ON FMS

BILLING STATEMENT

Approximate Date

DD 645

Mailed by DFAS

SCA

PAYMENT DUE AT DFAS

INDIANAPOLIS

FOR PERIOD

COVERING

December 31st January 15th March 15th April–June

March 31st April 15th June 15th July–September

June 30th July 15th September 15th October–December

September 30th October 15th December 15th January–March

7

Inputs to DFAS SCA

To prepare an accurate bill (DD Form 645) for a given FMS case, DFAS SCA must have certain information

from the IAs. When an LOA is sent to the FMS customer, a copy is also provided to DFAS SCA, and the LOA

payment schedule is entered into the Defense Integrated Financial System (DIFS) information system. After the

customer accepts the LOA and provides DFAS SCA with signed copies of the LOA and the applicable initial

deposit, DFAS SCA updates its system and prepares for case implementation and IA delivery reports. The initial

deposit accompanying most SC cases provides sufficient cash advance to cover disbursements from the time the

case is accepted until the first billing payment due date.

Payment Schedules

The purpose of the LOA payment schedule is to supplement and amplify LOA Financial Terms and

Conditions that are documented in the Section 4 of the FMS LOA Standard Terms and Conditions (SAMM

Chapter 5, Figure 4), and to provide a clear understanding between the United States government and the

purchaser as to the estimated rate and timing of the payments to be made. The payment schedules for LOA

documents are prepared (based on inputs by the Implementing Agencies) by the DSCA Case Writing Division

(CWD) during the case-development process. Payment schedules are prepared using pricing estimates and

estimated dates for when purchasers will accept the LOA, the estimated dates (e.g., when the LOA will be

implemented, requisitions will be initiated, contracts will be awarded, payments will be made to contractors,

deliveries will occur, personnel costs will be incurred, etc.) of acceptance and execution of the the applicable

LOA. DoD LOA payment schedule policy essentially fulfills dual objectives:

1. Provide the FMS purchaser with sound budgetary information

2. Increase probability of the USG receiving required funds in advance of anticipated expenditures

Payment schedules are a consolidated formal presentation to the FMS customer of the estimates of cash

requirements and potentially consist of two financial categories:

1. An initial deposit

2. Estimated quarterly billing amounts (when authorized and required).

If initial deposits are required upon acceptance of a sales agreement, the amount of the initial deposit should

be sufficient to cover all costs and contingencies (e.g., contract holdback, potential termination liability, costs of

materials and services planned to be provided, etc.) anticipated to be incurred until the first billing statement can

be rendered and monies collected. IAs are expected to closely monitor and manage the accuracy of payment

schedules on all cases to ensure that cash is available when the necessity for disbursements arises. When it is

known that the current payment schedule does not accurately reflect the financial requirements for the case, the

Implementing Agency should prepare a modification (if there is no “SCOPE” change on the case per SAMM,

Chapter 6.7—Amendments and Modifications), or an amendment (if there is “SCOPE” change on the case) to

update the payment schedule.

Delivery Transactions and Peformance Reporting

IAs must report the performance and execution (e.g., deliveries from DoD stock and procurement,

progress payments, etc.) of the SC LOAs to DFAS SCA by use of the delivery transactions. IAs shall report

accrued expenditures (work in process [WIP]) and physical deliveries to DFAS SCA within 30 days (per FMR

Volume 15, Chapter 8, Section 080203) of occurrence (i.e., date of shipment or performance) through the billing

and reporting procedures. Among other things, the delivery transactions typically document the MILSTRIP

document number, the stock or part number, quantity, mode of shipment, delivery source code, transportation bill

code, and dollar value. For many FMS case types (e.g., Cooperative Logistics Supply Support Arrangements

[CLSSA], Blanket Order, etc.), there are thousands of delivery transactions, which are received by DFAS SCA on

a monthly basis. The delivery data transmissions are batched upon receipt and are typically due to arrive at DFAS

8

SCA by the 16th calendar day of the month following the end of the month being reported. The delivery

transactions provide the basis for the detailed entries, which appear in the FMS delivery listing and further prompt

reimbursement/liquidation of transactions reported by the implementing agencies. DIFS processes delivery

transactions/performance reporting 20 times per year. There are two performance cycles in each month without a

quarterly bill, but just one performance cycle in the four months (Jan, Apr, Jul, Oct) a quarterly bill is issued.

Cash Accounting

Foreign Military Sales Trust Fund

The FMS country trust fund is credited with receipts earmarked by law and held in trust or in a fiduciary

capacity by the United States government for use in carrying out specific purposes and programs. The FMS trust

fund (accounting classification 97-11X-8242) represents the aggregation of cash received from purchaser

countries, international organizations, and the USG that are credited to open SC cases and/or country/program

accounts (e.g., funds that are excess to closed FMS-case financial requirements, funds held pending

implementation of new cases or other agreed financial arrangements, etc.).

DFAS SCA is responsible for recording transactions that impact the FMS trust fund. FMS customer cash

deposits for defense articles and services sold under Sections 21 and 22 of the AECA are normally (unless an

exception is approved) made in advance of delivery, performance, or progress payments to contractors. DD Form

645, Special Billing Arrangements (SBAs), and LOA financial instructions direct that foreign purchasers forward

payments (initial deposits on basic LOAs, amounts due with LOA amendments, or official billing statement

payments) by: (a) wire transfers (preferred method for the foreign purchaser to forward payments) to American

Bankers Association (ABA) #021030004, U.S. Treasury NYC, Agent Location Code 00003801, Beneficiary

DFAS-IN/JAX Agency, payment from (country or international organization) for Letter of Offer and Acceptance

(Identifier at the top of the first page of the LOA); or (b) checks made payable to the U.S. Treasury mailed to the

Defense Finance and Accounting Service, ATTN: Disbursing Operations-FMS Processing; Col 135D, 8899 E

56th Street, Indianapolis, IN 46249, USA, payment from (country or international organization) for Letter of

Offer and Acceptance (Identifier at the top of the first page of the LOA). Any recipient of a check from an FMS

purchaser is responsible for depositing the check into a U.S. Treasury account within 1 working day of receipt.

[FMR VOL 15, CH 4, Section 0408 (Deposit of Purchaser Cash into Treasury Accounts)]

Wire transfers should be sent to the Department of the Treasury Account at FRBNY, using the standard

Federal Reserve Funds Transfer (FRFT) format. The Federal Reserve System (FRS) will accept wire transfers

only from banks that are members of the FRS. Foreign banks must go through a U.S. correspondent bank that is a

member of FRS. DFAS SCA retrieves wire transfers daily from the Treasury Financial Communications Systems

and prepares collection vouchers from this data for crediting FMS purchasers. [FMR VOL 15, CH 4, Section

040801.A (Wire Transfers)]

All payments should properly identify the customer country making the payment, FMS case designator,

amounts being paid on each case, and the U.S. service responsible for managing the case(s).

DSCA and DFAS SCA exercises stringent controls over the FMS trust fund to ensure proper visibility and

accountability are maintained for all payments made by a customer for every FMS case. There are certain

principles of trust fund management, including the following:

• One FMS customer’s trust fund balance cannot be used to finance another customer’s programs. The

integrity of customer country and security cooperation program funds is strictly observed.

• Cash disbursements are controlled on a country/organization/program basis, although accounting for SC

transactions are maintained on an SC-case basis. In other words, cash deposits of a given

country/organization/program are used to pay U.S. government or contractors for costs associated with

any of that country’s/organization’s/program’s cases, but the accounting will be maintained and reported

on individual cases. All cash disbursements for a purchaser shall not exceed the customer’s cash deposits.

9

• Dollars received into the FMS trust fund are subject to United States Treasury accounting system controls

from the date of receipt to the date of expenditure or refund. DFAS SCA, as the accounting agency,

renders periodic reports to the United States Treasury and performs a monthly reconciliation of balances.

Foreign Military Sales Customer Funds

The FMS customer is billed for United States Government requests for payments (initial deposits, quarterly

billing statements, or special billing arrangements) and, if applicable, direct commercial contract progress

payments. The customer may make payments in the form of United States dollars directly to DFAS SCA or, when

authorized, utilize foreign military financing (FMF) funds through the U.S. government. There are presently two

types of FMS financing programs authorized by the AECA, as described below:

1. DoD Guaranteed Loans. (Section 24, AECA). This kind of financing constituted the major portion of

the FMF program prior to FY 1985. Under the guaranteed loan concept, DoD (DSCA) submitted a

guarantee (against all political and credit risks of nonpayment) for principal and interest installments

defaulted by the borrower to the Federal Financing Bank (FFB—an agency of the Treasury Department).

The FFB was responsible for signing the loan agreement with the borrowing country and for disbursing

loan funds upon receipt of drawdown requests from the borrower. The FMS customer will normally be

required to make semi-annual payments of interest and (once the grace period expires) principal. Current

loan repayments should be sent directly to the FFB; however, repayments of arrearages on FFB loan

installments should be sent to DFAS SCA, since the FFB has already been paid by DFAS SCA under

provisions of the guarantee noted above.This form of financing was terminated at the end of FY 1984.

2. DoD Direct Credit. (Section 23, AECA). With the exception of a few direct credits in the early 1970s,

this form of financing commenced in FY 1985. The source of funding to finance this program is

appropriated by Congress through annual Foreign Operations legislation. Direct Credit can be provided

either in the form of grants (non-repayable) or loans (repayable). A discussion of these funding categories

is provided below:

o FMF Grants. FMS grant funds are availed upon apportionment of country-level funds. If a

country is authorized to use FMF funds to finance direct commercial purchase, a grant agreement

certifying compliance with various requirements must be implemented prior to the utilization of

funds for commercial contacts. If countries cannot use FMF for direct commercial purchases, no

agreement is required. In this latter instance, DFAS SCA can unilaterally disburse funds for

LOAs financed with FMF in accordance with billing procedures for that country.

o FMF Loans. FMF loan funds are availed upon implementation of a bilateral loan agreement,

signed by the USG and the borrower. Generally, loan repayment terms are a total of 12 years (7

of which are principal); interest rates are determined by the Department of the Treasury. The

FMS customer will normally be required to make semi-annual payments of interest and, once the

grace period expires, principal. FMF loan repayments should be sent directly to DFAS SCA.

Once an FMF loan or grant has been established, all requests for disbursement of those funds must be

submitted by the borrower to DFAS SCA for processing/approval. For commercial contract disbursements, the

requests must be accompanied by relevant invoices, bills of lading, various certificates, and other documentation

as prescribed in the Annexes and Attachments to the loan agreement. Regarding FMS cases, the customer also

issues a disbursement request for LOA initial deposits or DD Form 645 billing requirements.

Whenever an FMS case has multiple financing, FMF funds are considered to be applied first and cash funds

second. If the case is closed and excess funds exist, the excess cash funds would be considered available to the

FMS customer absent arrearages or funding shortfalls on other cash cases. Excess FMF funds, however, cannot be

refunded to the FMS customer. The FMF funds can be used to pay down arrearages on FMF loan installments;

DFAS SCA will normally not initiate this action and must have DSCA authorization prior to doing so.

10

Cross-Leveling is an accounting technique by which DFAS SCA transfers excess funds (i.e., cash receipts)

from one FMS case to another FMS case. This transfer permits the FMS purchaser to minimize payments due on

a billing by fully utilizing all funds previously paid on FMS cases. For example, if DFAS SCA has collected

excess funds on a case, or a case has been closed and there are excess funds, these funds may be transferred to

other open cases, thereby reducing the amount due on the bill.

There are two methods through which cross-leveling of excess funds may be accomplished. In the first

method, the customer conducts a cash analysis and, in a letter (usually with a payment), requests DFAS SCA

make specific cash transfers among designated FMS cases. The second method authorizes DFAS SCA to

automatically cross-level based on case needs.

In order for DFAS SCA to perform cross-leveling automatically on a recurring basis, a written Memorandum

of Agreement (MOA) must be accomplished between DFAS SCA and the FMS customer. In order to initiate this

action, the customer should advise DFAS SCA of an interest in entering into a cross-leveling arrangement and

specify the name and office of the individual to sign a Memorandum of Agreement (MOA) on behalf of the FMS

customer. DFAS SCA will prepare the agreement in duplicate, sign, and forward it for the customer’s signature.

Upon receipt of the signed agreement, DFAS SCA will begin cross-leveling on the next succeeding billing

statement.

In order to provide the FMS customer with a complete record of cross-leveling transactions, the transfer of

excess cash is processed to the country holding account and then withdrawn from the holding account to be

applied to a case requiring payment. For example, consider the situation where FMS case ABC is in a $10,000

overpayment surplus status but case ABD is underpaid by $10,000. Under cross-leveling, DFAS SCA could

transfer, via the Holding Account, $10,000 from case ABC to ABD. The basic procedure is to record such

transfers (as the $10,000 amount above) as a withdrawal (i.e., debit) transaction to the cash position of the FMS

case with a surplus (case ABC) and as a deposit (i.e., credit) to the Holding Account. Simultaneously, $10,000 is

recorded as a deposit to the underpaid case (ABD) and a withdrawal is recorded against the Holding Account. In

other words, the $10,000 is “washed through” the Holding Account for control and reporting purposes.

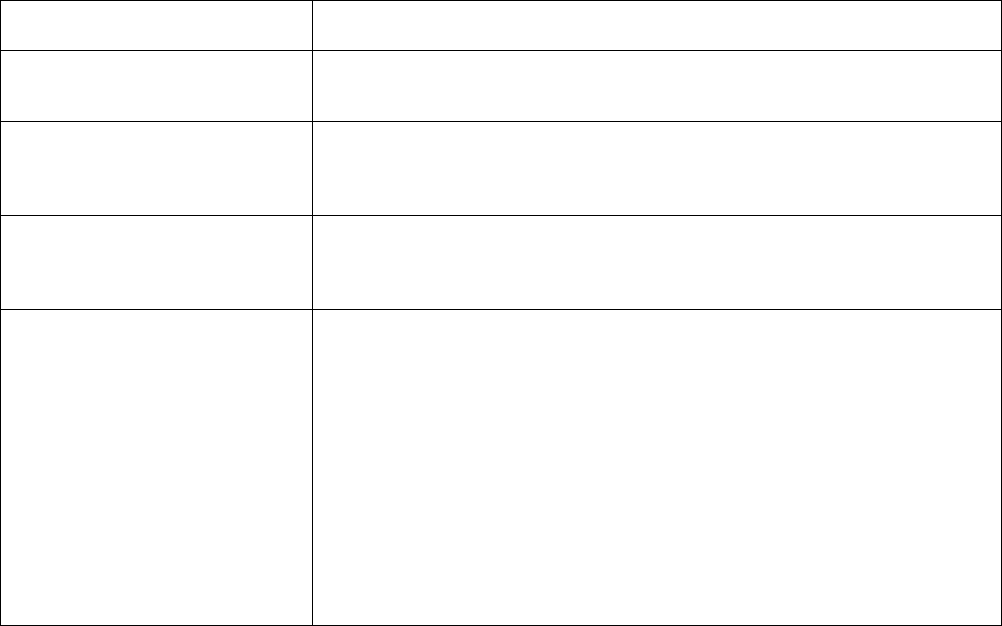

See Figure 1-1 below for a sample Cross-Leveling Memorandum of Agreement (MOA). DFAS SCA will

also honor individual FMS cross-leveling in lieu of blanket authorizations based on letter or message requests

from an authorized representative of the FMS customer.

11

Figure 1-1: Sample Cross Leveling Memorandum of Agreement

DFAS SCA Reports

The basic FMS billing document is the DD Form 645, which is prepared at the end of each calendar quarter.

The DD Form 645 serves as both a billing document and a statement of account. Numerous attachments, as

applicable, accompany the DD Form 645, to include the “FMS Delivery Listing,” the “FMS Financial Forecast,”

the “FMS Reply Listing to Customer Requests for Adjustments,” the “Holding Account Statement,” and the

“Accelerated Case Closure Suspense Account Statement.” Each of those document types are discussed in

significant detail in Part II (Billing Documents) chapters 3 through 8 of this Security Cooperation Billing

Handbook. Following, though, is an executive summary of each of those documents.

Foreign Military Sales Billing Statement (DD Form 645)

DoD billings to Security Cooperation case customers are issued by DFAS SCA. A computer-produced DD

Form 645 and/or Special Billing Arangement (SBA)—official claim for payment by the U.S. government—is

used in billing the Security Cooperation case customer. In addition, it furnishes an accounting to the Security

Cooperation purchaser for all costs incurred under each LOA agreement.

12

Detail on the face of the billing statement segregates the cost elements in a manner parallel to the

presentation of line item detail on the LOA. Physical performance of services or delivery of materiel is shown

against the item number of the LOA. Administrative charges, accessorial costs, and work in process are separately

listed at the case level.

Billing statements are prepared and forwarded to the FMS purchaser on a quarterly basis (i.e., for quarters

ending in March, June, September, and December). The billing cycle [FMR VOL 15 Chapter 8 Section 080301

(FMS Billing Statement) and SAMM C9.T25], which is depicted in the following table.

PERIOD ENDED ON FMS

BILLING STATEMENT

Approximate Date

DD 645

Mailed by DFAS

SCA

PAYMENT DUE AT DFAS

INDIANAPOLIS

FOR PERIOD

COVERING

December 31st January 15th March 15th April-June

March 31st April 15th June 15th July-September

June 30th July 15th September 15th October-December

September 30th October 15th December 15th January-March

For example, the 31 December (period ending) bill reflects physical deliveries and cash collections recorded

for the SC case through the December “cut-off” for entries into the DFAS SCA FMS accounting system. It also

contains a forecast of estimated advance cash requirements for the work estimated to be conducted from 1 April

through 30 June. This period’s bill is mailed on or about January 15, with a due date for payment of March 15.

The March, June, and September statements follow the same basic time frames. The FMS Delivery Listing will

only include delivery data received in DFAS SCA by the end of each quarter of the period ending.

As stated in the previous paragraph, in addition to identifying deliveries (or performance of services) made

on the FMS purchaser’s behalf, the DD Form 645 also reflects the estimated forecasted costs that relate to a given

FMS case. These estimated forecasted costs equate to a number of factors, including anticipated progress

payments/advances, contractor holdbacks, termination liability reserve, accrued and future deliveries, pro rata

share of non-recurring charges, contract administration costs, and administrative/ accessorial costs, as applicable.

Previous schedule of payment amounts on requisition-type cases may be replaced by military department

reporting of open requisition values on hand or anticipated.

Essentially, the DD Form 645 provides current period (i.e., the calendar quarter preceding the period ending

date) delivery costs as well as cumulative delivery costs for all prior periods and work-in-process costs for the

period subsequent to the period ending date. The bill normally requests funds to cover the planned deliveries for

the forecast quarter (the calendar quarter subsequent to DFAS SCA payment due date). This concept is illustrated

in Figure 1-2 (The “Four Periods of the DD 645” Example). Refer to Chapter 3 of this Handbook for additional

details on the Foreign Military Sales Billing Statement (DD Form 645).

13

Figure 1-2: The “Four Periods” of the DD 645 Example

Foreign Military Sales Delivery Listing

This is a listing of the performance reporting of articles, services, Supply Discrepancy Reports (SDRs), etc.,

which have been reported to DFAS SCA by the IAs. An FMS Delivery Listing will be provided if deliveries have

been received in DFAS SCA during the Current Quarter Period (column 9) of the DD Form 645.

The FMS Delivery Listing provides delivery information by case and by LOA line-item number. Detailed

information regarding articles/services transactions, administrative/accessorial transactions, and a summary of

delivery costs for each item number’s (i.e., LOA line number) reported transaction(s) is provided. Refer to

Chapter 4 of this Handbook for additional details on the Foreign Military Sales Delivery Listing Statement.

Foreign Military Sales Financial Forecast

This is a listing that reflects future forecast amounts of payments due, by quarter, for the FMS case. It

essentially portrays the same information as the LOA’s payment schedule. Refer to Chapter 5 of this Handbook

for additional details on the Foreign Military Sales Financial Forecast.

Foreign Military Sales Reply Listing to Customer Requests for Adjustments

This is a listing that reflects all transactions relating to the final disposition/action taken with respect to any

customer requests for adjustments requested by Supply Discrepancy Reports (SDRs) that the FMS customer

submits, and it may also contain other internal USG billing transactions, which also require an Adjustment Reply

Code (ARC) and are being billed the FMS customer. Close review should be made to ascertain that the

adjustment does or will satisfy a SDR requirement in the event the SDR number is not present.

In the event a customer review of the DD Form 645 and/or the supporting FMS Delivery Lists identifies the

necessity for an adjustment, the FMS customer should submit a formal request for adjustment. Requests for

billing and supply adjustments for materiel and service performance should be submitted to the IA. FMS

customers should submit all requests for billing and supply adjustments on a Standard Form (SF) 364 per the

LOA Standard Terms and Conditions, Section 5.4 [SAMM Chapter 5 Figure 4—C5.F4], clearly indicating the

specific adjustment or billing action requested. The form, instructions for completion, and definitions are

prescribed in DLM 4000.25, Defense Logistics Management System (DLMS) Volume 2 (Supply Standards and

Procedures), “Chapter 17 (Supply Discrepancy Reporting),” and the related Appendices 2 and 3. After resolution

14

of SDRs applicable to materiel and services, Implementing Agencies (IAs) report the action being taken to DFAS

SCA. DFAS SCA will prepare a consolidated listing of the actions taken in response to the SDRs, and this listing

will be mailed with the DD Form 645 to the country involved. All responses to SDRs are listed separately for

each country, Service, Case, and Item Number. The Reply Listing is prepared in the same basic sequence as the

billing statement and FMS Delivery Listing. All SDRs appearing on the FMS Delivery Listing are included in the

Reply Listing. Refer to Chapter 6 of this Handbook for additional details on the Foreign Military Sales Reply

Listing to Customer Requests for Adjustments Statement.

Holding Account Statement

As a convenience to the FMS purchaser, procedures are available for the establishment of purchaser holding

account(s). The holding account(s) is/are sub-account(s) of funds not identified to a specific FMS case, reserved

for identified cases (but not yet deposited in those cases) and/or funds not required when a case is closed. The

FMS customer may request DFAS SCA to “draw upon” their holding account for transfers to specific cases as the

need arises. The holding account balances are not included in the totals of the DD Form 645. A separate statement

is provided to the country showing deposits and withdrawals to the holding account and is considered an offline

statement. Refer to Chapter 7 of this Handbook for additional details on the Holding Account Statement.

For those FMS customers receiving holding account statements, the combination of the DD Form 645 FMS

Billing Statement(s) and holding account statement will reflect the total FMS Trust Fund activity for the

accounting period for that international country/organization.

The FMS customer needs to advise DFAS SCA of its requests relative to the controls over holding account

transactions. For example, DFAS SCA needs to know if the customer will allow automatic use of the funds for

other open FMS cases, if the customer requests automatic refunds, or if the customer wants to request refunds on

a case-by-case basis. Please note that funds temporarily held for new case implementation are not available for

cross-leveling or refund. DFAS SCA will state the total reserved balance for each account. Refer to Chapter 7 of

this Handbook for additional details on the Holding Account Statement.

Foreign Military Sales Accelerated Case Closure Suspense Account

This is a country-level account that shows FMS cases of participating countries where all ordered goods and

services have been provided (i.e., Logistically/Supply and Services Complete—SSC) and only final financial

reporting is necessary. It depicts the country, IA, case, and closure date with the previous quarters unliquidated

obligations (ULO) and current quarters activity. The “CUR QTR BAL” column documents the balance at the end

of the reporting period. Refer to Chapter 8 of this Handbook for additional details on the Foreign Military Sales

Accelerated Case Closure Suspense Account Statement.

Special Billing Arrangements (SBA)

There are two official forms of FMS billing: the quarterly DD Form 645, Foreign Military Sales, Billing

Statement issued by DFAS, and the DSCA issued Special Billing Arrangement (SBA) statements, referred to as

Special Bill Letters (SBL). A Special Bill Letter supersedes the DD 645 Billing Statement and serves as the

official claim for payment issued to the FMS purchaser. The purpose of the SBA is to improve cash management

for eligible FMS partners. This is done by more accurately projecting cash requirements, including reserves for

termination liability, as agreed in the LOA. The SBA does not supersede the need for accurate LOA payment

schedules; however, LOA payment schedules will not be adjusted to reflect revised payments requested in the

Special Bill. The payment schedule on the basic LOA is imperative for partner nation budgeting and must be as

accurate as possible. FMS partners eligible for Dependable Undertaking may submit a request for an SBA to the

DSCA Principal Director for Business Operations for consideration. DSCA (Directorate of Business Operations

[DBO] Country Financial Management Division [CFM]) will negotiate the SBA with the FMS partner as

appropriate and will coordinate all prospective agreements with DSCA (Office of the General Counsel [OGC]),

15

the applicable Integrated Regional Team, and DSCA (Directorate of Business Operations [DBO] Financial Policy

& Analysis Division [FPA]) prior to presenting the SBA to the Principal Director for approval. SBAs must

specify the frequency at which billing will occur. This can be on a monthly, quarterly, or semi-annual basis

depending on the USG and FMS partner requirements defined and agreed to in the SBA. After an SBA is

established, DSCA will, on the date and at the frequency specified in the SBA, provide the FMS partner an SBL

requesting payment. The SBL is the official billing document that supersedes the quarterly DD 645 billing

statement when an SBA is established. The amount due and payable in the SBL supersedes Column 14 (“Amount

Due and Payable”) of the DD 645 Billing Statement. See SAMM Table C9.T27 for an example of the SBL

calculation. [SAMM C9.10.2]

Foreign Military Sales Case Closure

A logical follow-on event to a case that has been completely delivered and billed is case closure. FMS

customers are encouraged to request status from the IA on undelivered/unbilled items prior to case closure. A

Security Cooperation case is considered closed when all material has been delivered and/or all services have been

performed, the IA has certified the final delivered cost, all financial transactions (including all collections) have

been completed, and the customer has received a Final Statement of Account (i.e., a Final DD Form 645). DFAS

SCA is the final determining organization for case closures; however, an IA may consider their records as

logistically closed at the time a closure certificate is released to DFAS SCA. After processing, DFAS SCA

confirms closure data to the IAs to ensure that records are logistically and financially complete. Two broad

categories (both of which are discussed in greater detail in the following paragraphs) of closure exist: Accelerated

Case Closure Procedures (ACCP) and non-ACCP.

Case Closure Procedures

[SAMM C16.4]

Once a case is Supply/Services Complete (SSC), and the requisite verification steps for SSC reconciliation

are complete, the case is eligible to be submitted for closure. Case closure is the final phase of the SC Case life

cycle and is extremely important to the USG and purchaser. Reconciliation for closure involves extensive

communication between various logistics, financial, and contract organizations (including the FMS Purchaser) to

ensure associated closure transactions are completed. It is imperative that case and line reconciliation be initiated

upon implementation of the LOA to make the closure process described herein timely and easier. By reconciling

during case execution, case closure becomes an event instead of a process. A case is submitted for closure once it

is reconciled according to procedures for the appropriate closure method.

Closed cases are identified by an asterisk on the DD Form 645 (Billing Statement) and a separate case-level

DD Form 645 (Final Statement of Account) is printed for distribution to appropriate parties. Once a case appears

with the closed case asterisk, it will be dropped from future DD 645 forms unless the IA or DFAS SCA has cause

to reopen the case.

Closure Types: Accelerated Case Closure Procedures (ACCP) and non-ACCP.

ACCP applies to all countries/programs that have cases financed with Foreign Military Financing (FMF)

funds, or those countries that elect to participate. For cases closed with ACCP, all commitments and obligations

must be completed; however expenditures do not have to be finalized prior to closure. The non-ACCP category

exists to accommodate those countries whose FMS programs are completely financed with national funds (cash)

and have elected to not participate in ACCP. In addition, Building Partner Capacity (BPC) programs that use

various funding where the period of funds availability expires/cancels must utilize non-ACCP. A brief synopsis of

ACCP and non-ACCP criteria follows:

• ACCP: This type of closure allows a case to be closed after SSC, even if there are outstanding

Unliquidated Obligations (ULOs) on the case. Purchaser funds are placed in a country-level Case

Closure Suspense Account (CCSA) pending final resolution of the ULOs. This program is voluntary,

16

except for those countries that have Foreign Military Financing (FMF)-funded cases, which requires

mandatory participation in ACCP for all FMS cases regardless of the funding source. Most

countries/international organizations participate or are automatically (if they receive FMF) included in

the ACCP process. The DSCA (Business Operations Directorate, Financial Policy, and Analysis

Division) maintains the master list of countries and international organizations that participate in ACCP.

That list is documented in the SAMM Table C4.T2 (Security Cooperation [SC] Customer and Regional

Codes and FMS Eligibility Table), and also in the SAMM Appendix 7 (Reconcilliation and Closure

Guide [RCG]), Chapter 3 Table A7.C3.T1 (Master ACCP Participating Country Table [sorted by

country code]). For ACCP, purchaser funds are placed in the applicable country-level case closure

suspense account pending final resolution of the ULOs.

• Non-ACCP: Non-ACC procedures are used to accommodate those countries that have not elected to

participate in the ACCP process and whose FMS programs are completely financed with national funds

(vice with FMF). While ACCP case closure always has a higher priority, non-ACCP cases with no

supporting contracts should be closed as quickly as possible. BPC program cases are also closed under

non-ACCP procedures.

• Reopening and Reinstating Activity on Cases: Reopening a closed case is performed on an exception

basis only. Reinstating activity applies to a case not yet closed, but which is in the financial

reconciliation/closure process or, at a minimum, is not currently active from a logistical perspective.

Cases may be reopened or reinstated for additional processing (e.g., disbursements or SDRs). [SAMM

C16.4.16.]

Summary

The FMS Billing System provides a mechanism of complying with the AECA. Through the LOA and its

included Payment Schedule, the FMS customer is able to determine the required initial deposit and programmed

estimated quarterly financial requirements.

DFAS SCA, through its FMS Trust Fund–accounting and related cash-accounting procedures, is able to

collect and track country monies by case. The basic FMS billing document is the DD Form 645, which is prepared

at the end of each calendar quarter. The DD Form 645 serves as both a billing document and a statement of

account. The “FMS Delivery Listing,” the “Foreign Military Sales Forecast,” the “FMS Reply Listing to

Customer Requests for Adjustment,” the “Holding Account Statement,” and the “Accelerated Case Closure

Suspense Account” are all documents that can be included with the DD Form 645 when applicable.

Case closure is accomplished once all necessary logistical and financial actions have been completed on the

part of both the U.S. government and the foreign purchaser.

17

CHAPTER 2

DFAS SCA Customer Assistance

Purpose

There are certain initiatives Security Cooperation customers may take that can facilitate their understanding

of the financial documents received from DFAS SCA. These initiatives consist of writing or calling DFAS SCA

points of contact and arranging visits. This chapter provides the information necessary to arrange for a visit to the

Center, or a visit by DFAS SCA to a customer site.

Visits to DFAS SCA

Policy

FMS customers are encouraged to visit DFAS SCA when appropriate. A visit may be warranted for any

number of reasons, including the following:

• To resolve problems or misunderstandings

• To discuss the realignment/redistribution of billing products sent to country addresses

• To meet with your country manager and other DFAS SCA officials for orientation purposes

Visits, of course, are most productive when DFAS SCA is afforded sufficient advance notification and time

for preparation. Please attempt to furnish advance agenda items on specific problem/subject areas to DFAS SCA

for research.

Visit Requests

In order for DFAS SCA to make the proper preparations for a visit, to include building/parking clearances,

etc., the following information should be provided to DFAS SCA via the Foreign Visit System (FVS) 30 days in

advance of the intended visit: [SAMM C3.4]

• Name, rank, and position of visitor(s). Equivalent rank should be

furnished if military rank does not apply

• Desired visit dates

• Lodging and protocol requirements

• Topics to be discussed

DFAS SCA Visits to Customer Site

Based on resource availability, DFAS SCA is available to send a representative to a country’s

embassy/mission in Washington, D.C. In circumstances where extensive/extraordinary services or assistance are

needed, it may be necessary to have the associated costs directly funded through a “services line” on an FMS

case. All requests for in-country visits will be reviewed on a case-by-case basis.

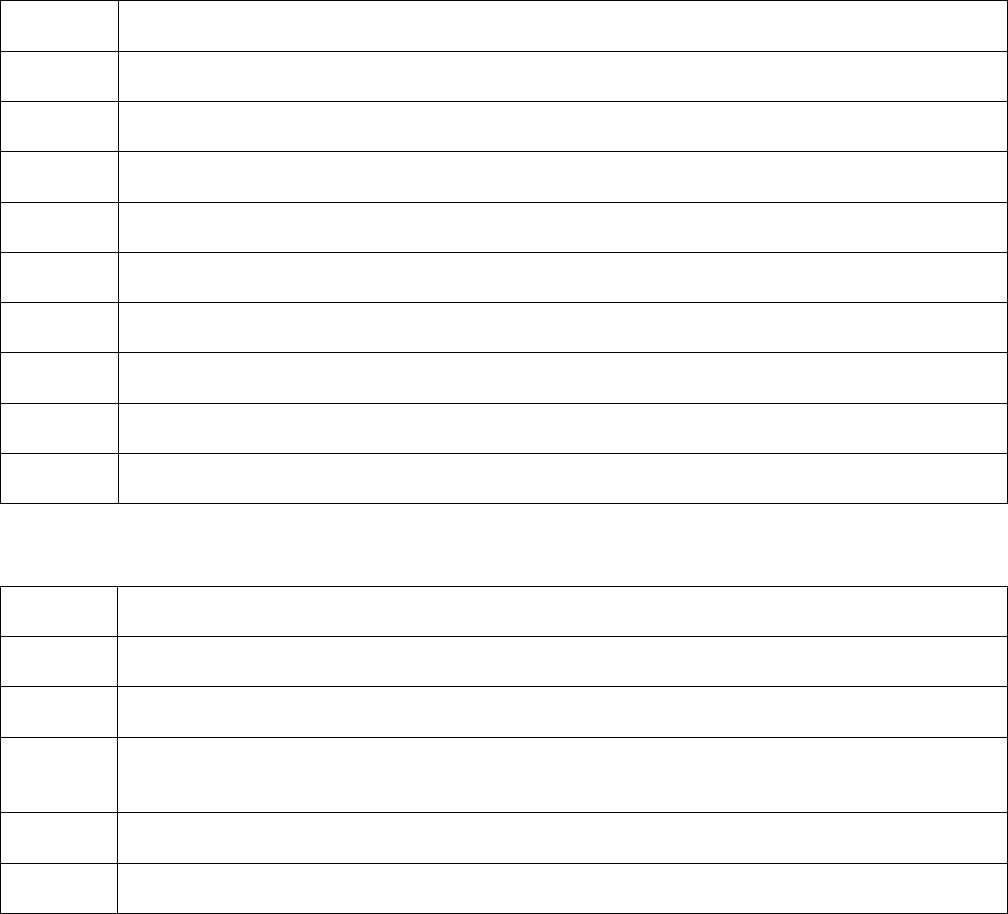

DFAS SCA Automated Delivery Listing Products

The customer may also request that DFAS SCA provide additional data to support the FMS Delivery

Listings. Specific data formats prepared by DFAS SCA based upon Delivery Transactions are shown in Figures 2-

1 through 2-6 for the following transactions:

18

• Articles/Service Transaction (Figure 2-1)

• Training Transaction (Figure 2-2)

• Administrative Transaction (Figure 2-3)

• Accessorial/Additional Cost Transaction (Figure 2-4)

• Articles/ Services Transaction (Figure 2-5)

• Administrative/Accessorial Cost Transactions (Figure 2-6)

Figure 2-1: Data Tape Format for Articles/Service Transaction

1

The majority of data in this transaction is perpetuated from the Delivery Transaction report.

2

Document identifier code will be FKA for debits, FKB for credits, and FKG for reply to customer requests for

adjustments. FKG cards may contain either debit or credit values and are financial information relating to the

original FKA/FKB transaction.

3

A credit value is indicated by a CR or “-” after the value.

4

Numeric year and month in which processed at DFAS SCADFAS SCA.

5

Second position of original code.

Data Tape Format for Articles/Service Transaction

1

Transaction Position Field Contents

1-3 Document Identifier Code

2

4-6 Routing Identifier Code

7 Price Code

8-22 Stock or Part Number/SDR Response

23-24 Unit of Issue

25-29 Quantity Shipped

3

30-43 Document Number

44 Suffix Code

45-50 Supplemental Address

51 Mode of Shipment

52-53 Adjustment Reply Code

54-57 Accounting Date

4

58 Transportation Bill Code

5

59-60 Delivery Source Code

19

Figure 2-2: Data Tape Format for Training Transaction

Data Tape Format for Training Transaction

TransactionPosition Field Contents

1-3 Document Identifier Code (FKA, FKB)

4-6 Routing Identifier Code

7 Price Code

7

8-22 Course Number or Brief Description

23-24 Unit of Issue

8

25-29 Quantity

30-43 Document Number

9

44 Suffix Code or Blank

45-50 Supplemental Address

10

51-53 Blank or Zero

54-57 Accounting Date

58 Normally Blank

59-60 Delivery Source Code

61-64 Course Commencement Date or Blank

6

For items which exceed $99,999.99 in unit price, the extended value and unit price fields contain dollars only.

7

Normally “A.”

8

Normally “XX.”

9

Normally contains zeros in cc 33-35 and ITO date and/or number in cc 36-43.

10

Normally contains zeros in cc 46-47.

61-64 Date Shipped

65-73

Extended Value

3,4

74-80 Unit Price

6

81-83 Item Number

84 Cost Identification Code

85 In-Country Service

21

Figure 2-3: Data Tape Format for Administrative Transaction

Data Tape Format for Administrative Transaction

TransactionPosition Field Contents

1-3 Document Identifier Code

13

4-6 Routing Identifier Code

14

7 Blank

8-19 Contains constant “ADM COST,” left-justified

20-29 Value to which cost applies, if applicable

30 U.S. IA Code

31-32 FMS Country Code

33-44 Blank

45 FMS Country Service

46-47 Blank

48-50 FMS Case Designator

51 Blank

52-53 Adjustment Reply Code, if applicable

54-57 Accounting Date

58-60 Generic Code (L6A)

61-64 Blank

65-73 Value of Administrative Cost

74-80 Percentage rate used, if applicable

81-83 Item Number

84 Cost Identification Code

85 In-Country Service

13

FKC for debits, FKD for credits.

14

Code of activity for reported materiel/services to which administrative costs apply.

22

Figure 2-4: Data Tape Format for Accessorial/Additional Cost Transaction

Data Tape Format for Accessorial/Additional Cost Transaction

Transaction Position Field Contents

1-3 Document Identifier Code

15

4-6 Routing Identifier Code

16

7 Blank

8-19 Phrase identifying type of cost

17

20-29 Value to which cost applies, if applicable

30 U.S. IA Code

31-32 FMS Country Code

33-44 Blank

45 FMS Country Service

46-47 Blank

48-50 FMS Case Designator

51 Blank

52-53 Adjustment Reply Code, if applicable

54-57 Accounting Date

58-60

Generic Code for type of cost as prescribed by the Security

Assistance Management Manual (SAMM)

61-64 Blank

65-73 Value of Accessorial Cost

74-80 Percentage rate used, if applicable

81-83 Item Number

84 Cost Identification Code

85 In-Country Service

15

FKE for debits, FKF for credits.

16

Code of activity for reported materiel/services to which accessorial costs apply.

17

E.g., “CONUS T,” “OSEAS T,” “P POST,” “PCH,” “STAGING,” “MEDICAL,” etc.

23

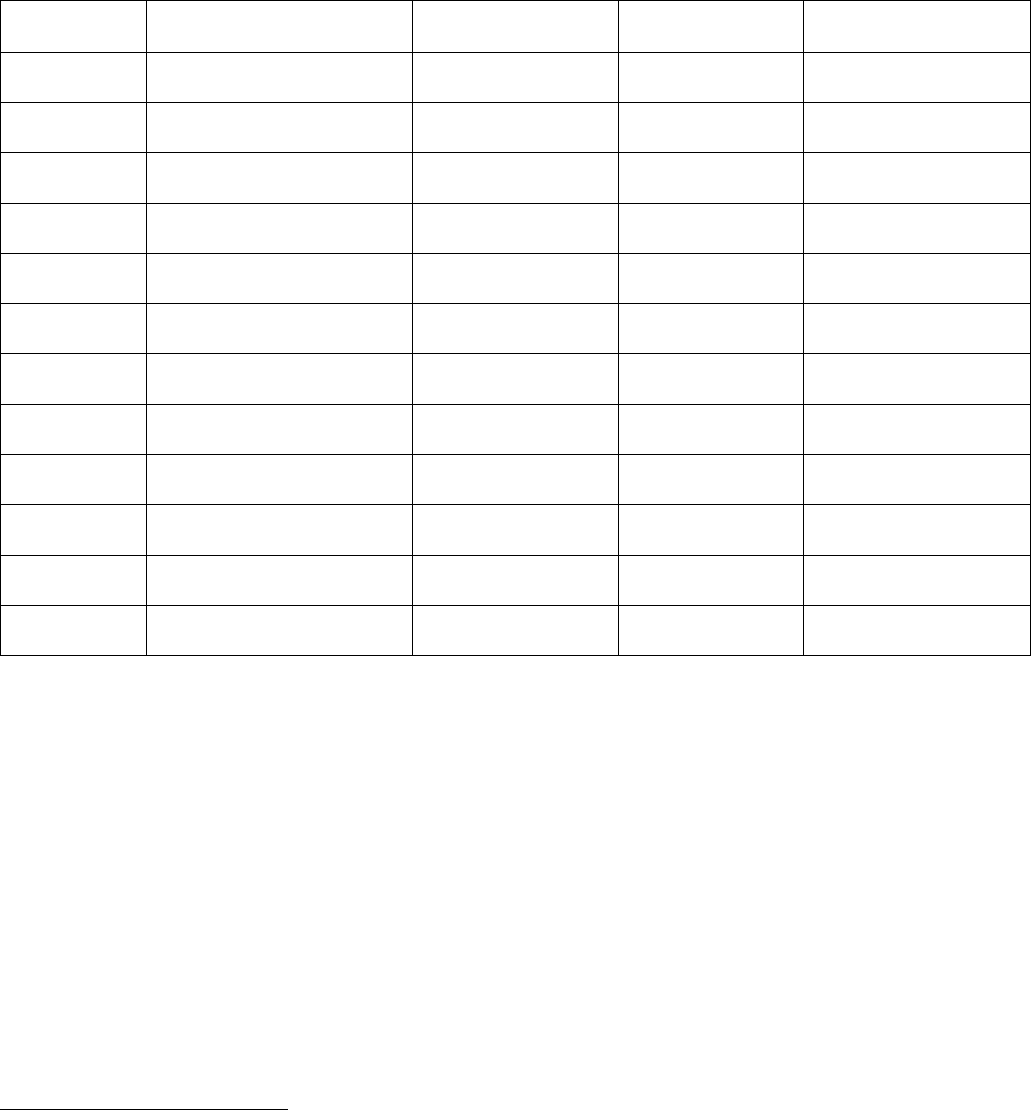

Figure 2-5: Data CD Format for Articles/Service Transaction

Data CD Format for Articles/Service Transaction

18

Transaction Position

Field Contents

1-3

Document Identifier Code

4-6

Routing Identifier Code

7

Price Code

8-22

Stock or Part Number/SDR Response

23-24

Unit of Issue

25-30

Quantity Shipped

31

Blank

32-45

Document Number

46

Suffix Code

47-52

Supplemental Address

53

Mode of Shipment

54-55

Adjustment Reply Code

56-59

Accounting Date (numeric year and month in which processed at

DFAS SCADFAS SCA)

60

Transportation Bill Code (second position of original code)

61-62

Delivery Source Code

63-66

Date Shipped

67-79

Extended Value

19,20

80-88

Unit Price

19,20,21

89-91

Item Number

92

Cost Identification Code

22

93

In-Country Service

18

The majority of data in this transaction is perpetuated from the Delivery Transaction report.

19

The sign positions are “0” for positive and “-“ for negative quantities.

20

For items that exceed $9,999,999.99 in the extended value field, the extended value is expressed as rounded

whole dollars only (no cents).

21

For items that exceed $99,999.99 in the unit price field, the extended value and unit price fields contain dollars

only.

22

This field always contains an “A” (above-the-line costs, articles, and services).

24

Figure 2-6: Data CD Format for Administrative and Accessorial Transactions

Data CD Format for Administrative and Accessorial Transactions

18

Transaction Position Field Contents

1-3

Document Identifier Code (DIC)

4-6

Routing Identifier Code of activity which reported materiel/services

to which administrative/accessorial costs apply

7

Blank

8-19

Cost Description

20-31

Extended Value Total

19,20,21

32

U.S. IA Code

33-34

FMS Country Code

35

Type Cost 5

36-46

Blank

47

FMS Country Service

48-49

Blank

50-52

FMS Case Designator

53

Blank

54-55

Adjustment Reply Code, if applicable

56-59

Accounting Date

60-62

Generic Code (L6A)

63-66

Blank

67-77

Value of Administrative/Accessorial Cost

20,21

78-85

Percentage rate used, if applicable

21

86-88

Blank

89-91

Item Number

92

Cost Identification Code

93

In-Country Service

If the DIC is FKC or FKD, “ADMIN-COSTS” should appear this space. If DIC is FKE or

FKF, the generic description of the accessorial charges (i.e., CONUS TRANS, PCH, P Post,

etc) should appear in this space.

25

[This Page Left Intentionally Blank]

26

Part II—Billing Documents

CHAPTER 3

Foreign Military Sales Billing Statement (DD Form 645)

Purpose

The purpose of this chapter is to introduce the reader to the format of, and the types of information contained

in, the Foreign Military Sales (FMS) Billing Statement, DD Form 645.

Introduction

The FMS Billing Statement, DD Form 645, and attachments (which are described in detail in the subsequent

chapters of this Handbook), are produced by DFAS SCA on a quarterly basis. The Defense Integrated Financial

System (DIFS) billing subsystem is where those transactions are compiled and the DD Form 645 is created.

Customized print packets are generated by DFAS SCA for specific customer addressees (utilizing the

Country Address/Distribution file which can be revised upon a county’s formal request to DFAS by an authorized

country POC). Each country’s packets contain only the reports or portions of the reports in the number and sort

sequence required by a specific country addressee. The select and variable sort sequence parameters used are Bill

Code, IA Code, In-Country Service Code, and Report Type. The proper mailing label is also printed for each

packet. All report copies printed are originals and the special form required for the DD Form 645 is formatted

within the computer system.

General Information Regarding DD Form 645

Function and Content

The DD Form 645, prepared by DFAS SCA, represents the official claim for payment by the U.S.

government referred to in the United States of America Letter of Offer and Acceptance (LOA). In addition, it

furnishes accounting records to the FMS Purchaser for all costs incurred under each LOA. Details on the DD

Form 645 segregate the cost elements in a manner parallel to the presentation of line item number detail on the

LOA with physical performance of services or delivery of materiel being shown for each of the LOA’s item

number(s) (i.e., LOA Line number[s]). Administrative surcharges, accessorial costs, and a forecast of future

performance/deliveries are also provided, but at case, as opposed to line-item number level.

27

Cycle

The DD Form 645 is prepared and forwarded to the FMS Purchaser on a quarterly basis in accordance with

the billing timeline documented in SAMM Table C9.T25 (FMS Billing Timeline), and the FMR VOL 15, Chapter

8, Section 0803 (FMS Billing Statement), which is depicted in the following table.

PERIOD ENDED

ON FMS

BILLING

STATEMENT

Approximate

Date DD 645

Mailed by DFAS

SCA

PAYMENT DUE

AT DFAS

INDIANAPOLIS

FOR PERIOD

COVERING

December 31st January 15th March 15th April–June

March 31st April 15th June 15th July–September

June 30th July 15th September 15th October–December

September 30th October 15th December 15th January–March

Types of Statements

The DD Form 645 has two basic variations:

1. Billing Statement. The Billing Statement variation serves as a bill and statement of account for all open

FMS cases and those cases which are closed during that quarterly period. Block 2, in the first instance,

states, “This is a Billing Statement based on cash (financial) requirements. Payment is due by: _____.”

2. Final Statement of Account. Each FMS case reflecting a closed status on the quarterly Billing Statement

will be accompanied by a Final Statement, the latter of which may be conveniently detached by the FMS

Purchaser and filed in any locally maintained case files. A closed case is depicted by an asterisk (*) at the

beginning of the case designator in Column 6 of the Billing Statement and Final Statement. Block 2, in

this second variation, states, “This is a Final Statement of Account.”

a. Once a Final Statement has been submitted for an FMS case, no subsequent adjustment of such

billings (upward or downward) is authorized, except under the following instances (Note: This

information appears in the “Explanatory Notes” at the bottom of a Final Statement):

i. Discovery of latent errors, such as obvious errors in addition or multiplication,

unauthorized deviations from DoD policy, or computer errors in establishing unit prices.

ii. To provide charges/credits for Supply Discrepancy Reports (SDR) submitted by the

purchaser in accordance with terms and conditions of the LOA.

iii. Discovery by the United States that it has shipped an item or rendered a service for a case

but has failed to submit a bill.

iv. Discovery by the United States that the final price paid to a U.S. contractor for an item

provided in accordance with Section 22 of the Arms Export Control Act is different from

the final amount billed for that item.

28

Explanation of Entries on the DD Form 645

Following is an explanation of how to interpret and understand entries on the DD Form 645 Foreign Military

Sales (FMS) Billing Statement using Figure 3-1 (“DD Form 645 Billing Statement Example for BN-D-YCY

LOA”) below as as an example billing statement document. The form field numbers are identified in the

descriptions above to assist in correlating the information with the example form.

Figure 3-1 – DD Form 645 FMS Billing Statement Example

29

Entries on DD Form 645 [FMR Table 8-1 and Figure 3-1]

Foreign Military Sales

Billing Statement

Upper Left-Hand Corner. Title of DD Form 645.

United States Of

America

Department Of

Defense/Air Force

Upper Right-Hand Corner. Identifies the U.S. Department of

Defense Component acting as the Implementing Agency (IA) for the

cases shown on the statement. In this example, the U.S. Air Force is

the IA.

1. To: Bandarian Army

Data Field #1. Identifies the FMS Purchaser Service who is the

recipient of the statement. Reflects full country/activity name

followed by Military Service within country or special paying office.

In this example, the example has the Bandaria Army.

2. This Is A Billing

Statement Based On

Cash Requirements.

Payment Is Due By: 21

SEP 15

Data Field #2. Identifies the statement as a “Billing Statement based

on cash requirements” or a “Final Statement of Account,” whichever

is applicable. If the statement is a Billing Statement, this block also

indicates the date payment is due. The due date is about 60 days after

the preparation date in Block 5 but, in any event, will be the 15th day

of the last month of the quarter. The format is YEAR MONTH

DAY with the year being the first two numbers to identify the year.

In the billing form example, the “21 SEP 15” indicates the next

Bandria payment for this LOA is due 2021, September 15th.

3. Statement Number

21-06DB

Data Field #3. Statement number is assigned mechanically and is

composed of the numeric year and month representing the period

ended followed by an alphabetic management code assigned by

DFAS SCA. The management code (also referred to as the “bill

code”) is used to sort cases for distribution and normally identifies

the paying office. The foreign customer can request and obtain

billing sorted in some other manner. In this example, the statement

number is “21-06DB” with “21” indicating the calendar year 2021;

“06” indicating the sixth month (June); and “DB” standing for the

applicable management (USAF) and/or paying office (Bandaria

Army) bill code.

4. For Period Ended

21 JUN 30

Data Field #4. Contains the last calendar day of the month for which

the statement is prepared. It is normally the last day of the month at

the end of each calendar quarter, e.g., 2021, June 30th, in this

example.

5. Date Prepared

21 JUL 15

Data Field #5. Reflects the actual date on which the statement was

prepared/mailed, e.g., 2021, July 15th, in this example.

30

Case Identification And Delivery Status

23

Middle-Left Portion. Descriptor for

Columns 6 through 9.

1. Case & Item Number:

YCY

001

002

003

004

005

006

007

008

009

010

011

012

013

014

700

701

702

989

L6A

L00

WIP

Case

Total

Data Field #6. Consists of the following

information:

a. Identifies the FMS case designator

(YCY in this illustration), and the item

number (i.e., LOA Line numbers)

identification (e.g., 001, 002) from the

LOA. Immediately below and slightly to

the right of each item number in

Column 7, is the abbreviated/short title

of articles/services taken from the

Military Articles and Services List

(MASL, as documented in the Defense

Security Assistance Management

System [DSAMS] that the LOA was

developed in). As an example, in the

Figure 3-1, Item Number 001 is

identified as “HUMDINGER

MISSILES.”

b. Additionally, this column contains

identification of “ADMINISTRATIVE

FEE” (Generic Code L6A),

“ACCESSORIAL COSTS”s (Generic

Code L00), “WORK IN PROCESS”

(WIP), which is defined in Block 10,

related to the case as well as the “CASE

TOTAL.”

c. As noted earlier, an asterisk (*)

preceding the case designator indicates

a completed case (closed). A case which

has been closed since the previous

Billing Statement was issued will

appear on the current Billing Statement

with an asterisk. Concurrently, a Final

Statement of Account is prepared

mechanically for the case and presented

following the billing statement. Once a

case is closed, that case will not appear

on a subsequent DD Form 645 unless

the case is re-opened.

23

NOTE: In illustrating columns 6 through 14, Case Designator YCY from Figure 3-1 is used.

31

7.Total Value Ordered: 103,986,740.00

HUMDINGER MISSILES 78,683,170.00

LAUNCHERS 619,300.00

SPARE PARTS 2,017,000.00

TRAINING MISSILES 488,840.00

TECHNICAL DATA PKG 181,800.00

CONTAINERS 3,017,692.00

SUPPORT EQUIPMENT 1,563,480.00

CONTRACTOR SPT 2,163,402.00

PARTS/SPT EQUIP 2,021,000.00

AF TECH ORDERS 12,372.00

AIRLIFT, AMC 1,636,316.00

R&R OTHER 1,008,500.00

R&R MISSILES 631,250.00

WARRANTY 2,694,188.00

TECH ASSISTANCE 657,000.00

SITE SURVEYS 73,338.00

OTHER SERVICES 2,514,403.00

TRAINING 260,000.00

ADMINISTRATIVE FEE 3,508,507.00

ACCESSORIAL COSTS 235,182.00

CASE TOTAL 103,986,740.00

Data Field #7. Contains the dollar value

of articles/services associated with each

item number, along with the generic

description from DSAMS of each item

number, and the value of the entire case.

These dollar values come from the

current implemented version of the

applicable Letter of Offer and

Acceptance (LOA).

32

8. Cumulative Delivery Cost End Prior Period

TECHNICAL DATA PKG 181,800.00

SUPPORT EQUIPMENT 143,319.00

CONTRACTOR SPT 198,311.85

PARTS/SPT EQUIP 185,258.33

AF TECH ORDERS 1,790.68

R&R OTHER 92,445.83

R&R MISSILES 57,864.58

TECH ASSISTANCE 54,750.00

SITE SURVEYS 61,115.00

OTHER SERVICES 209,533.58

TRAINING 59,583.33

ADMINISTRATIVE FEE 43,602.03

ACCESSORIAL COSTS 21,558.35

CASE TOTAL 1,310,932.58

Data Field #8. Dollar value of

cumulative delivery costs as of the

end of the prior statement period (e.g.,

deliveries cumulative from the

implementation of the basic version of

the LOA through March 31, 2021, in

this BN-D-YCY example). No value

is shown in this column for progress

payments applicable to undelivered

items. Listing on the table on the left,

only includes the line items that have

had reported deliveries.

9. Current Period Delivery Cost

(ATTACHMENT 1)

SUPPORT EQUIPMENT 78,173.00

CONTRACTOR SPT 108,170.10

PARTS/SPT EQUIP 101,050.00

AF TECH ORDERS 976.74

R&R MISSILES 31,562.50

TECH ASSISTANCE 32,850.00

SITE SURVEYS 12,223.00

Data Field #9. Dollar value of

delivery costs reported since the end

of the prior statement period (i.e.,

those delivery transactions received in

and accepted by DFAS SCA during

the current period [April through June

2021 in this example]). Values shown

in this column are supported in

(transaction) detail by the FMS

Delivery Listing (identified in the

Column 9 heading as Attachment 1).

In Chapter 4, the FMS Delivery

Listing documents the transactions

which account for the $78,173 amount

shown for Line 007 in Column 9. No

value is shown in this column for

work in process applicable to items,

services, and training that have not yet

33

OTHER SERVICES 125,720.15

TRAINING 32,500.00

ADMINISTRATIVE FEE 20,077.77

ACCESSORIAL COSTS 11,759.10

CASE TOTAL 605,487.35

been reported to DFAS SCA as

delivered by the Implementing

Agencies (IAs).

Financial Status

Middle-Right Portion. Descriptor for

Columns 10 through 14.

10.Cumulative Delivery Cost & Work in Process

TECHNICAL DATA PKG 181,800.00

SUPPORT EQUIPMENT 221,492.00

CONTRACTOR SPT 306,481.95

PARTS/SPT EQUIP 288,308.33

AF TECH ORDERS 2,767.42

R&R OTHER 142,870.83

R&R MISSILES 89,427.08

TECH ASSISTANCE 87,600.00

SITE SURVEYS 73,338.00

OTHER SERVICES 335,253.73

TRAINING 92,083.33

ADMINISTRATIVE FEE 63,679.79

ACCESSORIAL COSTS 33,317.45

WORK IN PROCESS 23,786,978.07

CASE TOTAL 25,703,398.00

Data Field #10. This column contains

the cumulative totals of values shown

in Columns 8 and 9, plus work in

process applicable to undelivered

items.

The value in Column 10 for Work In

Process (WIP) represents accrued

costs incurred on behalf of the FMS

Purchaser that are not yet supported

by physical or constructive deliveries.

These costs include contractor

holdbacks on work in process made to

contractors, potential termination

liabilities, and any other applicable

authorized charges (e.g., Government

Furnished Material—GFM from

inventory, etc.).

34

11. Forecasted Requirements (Note A)

10,277,127.00

Data Field #11. Contains the

forecasted requirements for the case,

i.e., the value of potential costs to be

incurred during the calendar quarter

following the payment due date of the

current statement. This value appears

on the “Case Total” line only and may

be derived from one of two different

sources:

1. The quarterly deposit

identified in the payment

schedule for the case, which

has a due date that coincides

with the payment due date of

the current statement. In this

example, the $10,277,127.00

figure comes from the

payment schedule of the

current implemented version

(Modification 1) of the BN-

D-YCY LOA.

2. For all requisition type cases,

the Defense Component may

provide DFAS SCA with a

“Committed Values for

Requisition Cases” report.

This report (when provided)

would reflect the current

value of on-hand, unfilled

requisitions for each

applicable case. That report

will be submitted to DFAS

SCA by automated means.

These inputs will be

submitted to DFAS SCA by

the 15th day of the last month

of each calendar quarter,

reflecting the most recent

status for each case. The

committed value will be used

as the forecasted requirements

in Column 11 for the case in

lieu of the quarterly deposit in

the payment schedule when

the committed value is less

than the payment schedule

quarterly deposit. Forecasted

amounts may be adjusted by

35

DFAS SCA based on

documented information.

The Column 11 heading makes

reference to “Note A,” which is one of

the “EXPLANATORY NOTES” at

the bottom of the certification page of

the actual DD-645 Billing Statements.

While it is not included in the Figure

3-1 example above, the exact wording

of the “Note A” reference is as

follows: “THE TERMS OF THE U.S.

PUBLIC LAW, THE ARMS

EXPORT CONTROL ACT,

REQUIRE THE DEPARTMENT OF

DEFENSE TO COLLECT

PAYMENTS FROM FOREIGN

PURCHASERS IN ADVANCE OF

THE TIME THAT DOD INCURS

COSTS ON THE PURCHASER’S

BEHALF. THEREFORE, THIS

BILLING STATEMENT

REQUESTS PAYMENT OF

MONIES THAT ARE

ANTICIPATED TO BE EXPENDED

BETWEEN THE TIME THIS

BRANCH CHIEF: BILLING

STATEMENT IS PAID AND THE

FOLLOWING BILLING

STATEMENT IS PAID.”

12. Total Financial Requirements

35,980.525.00

Data Field #12. A value appears in

this column on the “Case Total” line

only. It represents the cumulative total

of the Column 10 (“CUMULATIVE

DELIVERY COSTS & WORK IN

PROCESS”) and Column 11

(“FORECASTED

REQUIREMENTS”) values for the

case.

13.Cumulative Payments Received

25,703,398.00

Data Field #13. A value appears in

this column on the “Case Total” line

only. It represents the total amount of

payments received (as of the report

date documented in Block 5 (“DATE

PREPARED”) by DFAS SCA in

behalf of the FMS customer for each

applicable case.

36

14. Amount Due And Payable

10,277,127.00

Data Field #14. A value appears in

this column on the “Case Total” line

only. It represents a calculation—

Column 12 value minus Column 13

value—and is the additional payment

due from the customer. If the

calculation is less than $1 or is a

negative amount due, no amount will

be shown.

Summary

The DD Form 645 is prepared and distributed to the FMS Purchaser on a quarterly basis. This document has

two variations: a “Billing Statement” and a “Final Statement of Account” for each closed case.

37

Chapter 4

FMS Delivery Listing

Purpose

In this chapter, the FMS Delivery Listing (which is an attachment to the DD Form 645) is addressed. The

discussion centers on how to read the Delivery Listing and how such listing relates to the DD Form 645.

General Information

Function and Format

An FMS Delivery Listing (see Figures 4-1 through 4-2 below for examples) is prepared in support of entries

in Column 9, “Current Period Delivery Costs,” for each of the DD Form 645 documents and Item Numbers (i.e.,

LOA Line Numbers) that have deliveries reported by the IAs to DFAS SCA in the just completed reporting

period. The document identifies items physically or constructively delivered and services performed that are

received and accepted by DFAS SCA during the reporting period. It is cross-referenced to specific document

numbers and allows FMS customers to validate receipt of the materiel or services. This FMS Delivery Listing

also includes DFAS SCA’s computations of authorized charges applied by that organization in accordance with

established pricing policy. Those performance-reporting items rejected back to an IA must be researched by them

for determination of errors, correction and/or re-input in subsequent reporting. The FMS delivery list is in item

number (i.e., LOA line number) sequence, and then the sorting sequence in each FMS Delivery Listing document

is by Delivery Source Code (DSC)which is subtotaled by DSC, and then by Accounting Date (ACTG DATE).

Transactions on the report are categorized by the “ARTICLE/SERVICES TRANSACTIONS” (i.e., the “Above-

the-Line” transactions), and then the “ADMINISTRATIVE/ACCESSORIAL TRANSACTIONS” (i.e., the

“Below-the-Line” transactions).

Cycle

The FMS Delivery Listing, being an attachment to the DD Form 645, is prepared and distributed on the same

quarterly basis as the DD Form 645 (Foreign Military Sales Billing Statement).

Explanation of Entries on the Foreign Military Sales Delivery Listing

The FMS Delivery Listing essentially consists of four sections or groupings of information:

1. Header Information includes the identification of country, service, statement number, case, item

number, dates (period ended, and date prepared), and the U.S. Department/Agency.

2. Articles/Services Transactions provides a listing of each “Above-the-Line” transaction reported (during

the current billing reporting period) by the IA to DFAS SCA for the CASE and Item Number identified in

the report’s Header information.

3. Administrative/Accessorial Transactions provides a consolidated listing of

administrative/accessorial costs (i.e., the ‘Below-the-Line’ transactions) by generic code and the

accounting date/month.

4. Summary of Delivery Costs documents the “ARTICLES/SERVICE COSTS” (categorized by “FKA,”

“FKB,” and “NET TOTAL”), “ADMINISTRATIVE COSTS” (categorized by “FKC,” “FKD,” and “NET

TOTAL”), and “ACCESSORIAL COSTS” (which includes categorization by “FKE,” “FKF,” and each

individual applicable transportation segments).

38

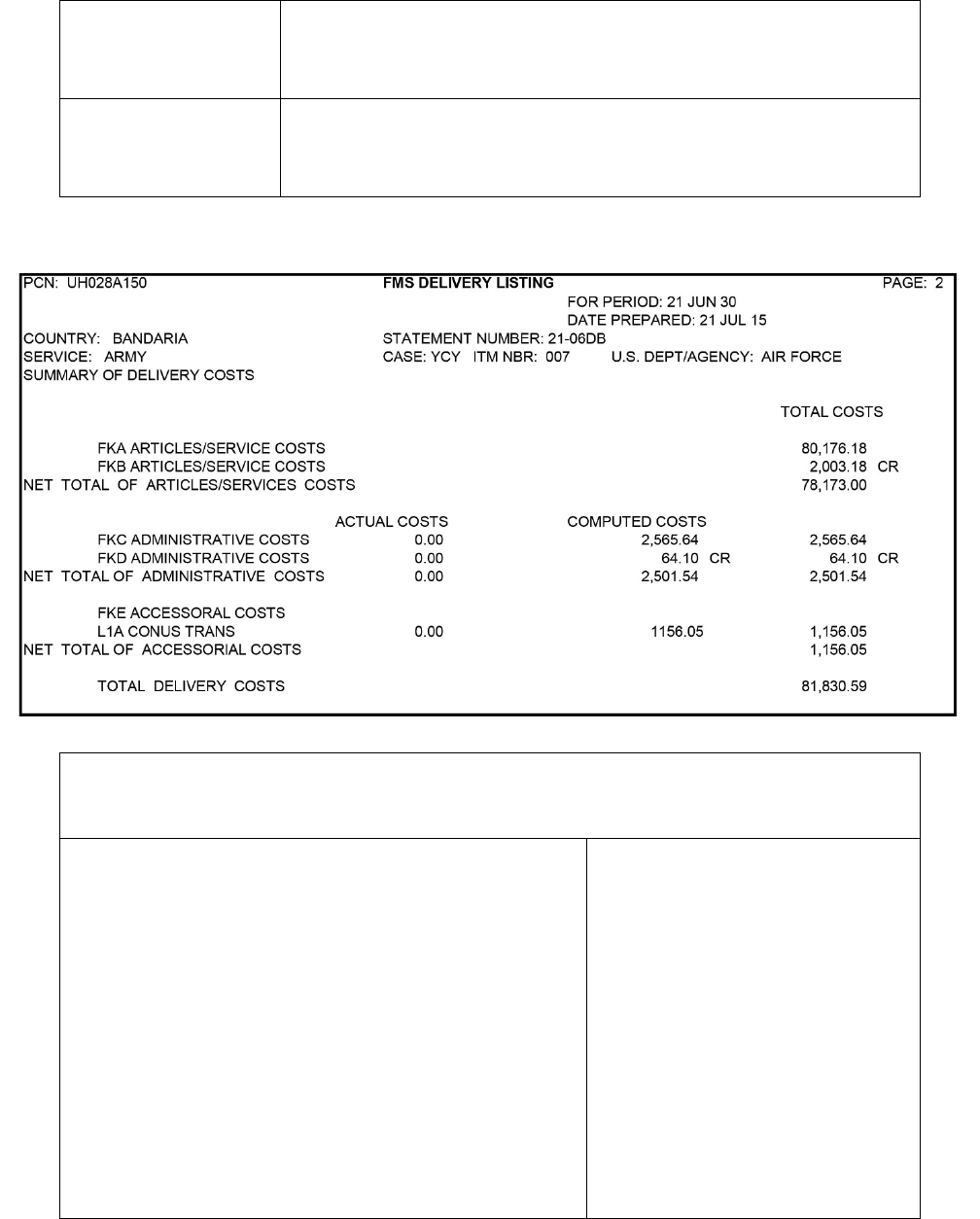

Figure 4-1: FMS Delivery Listing Example

The sections of the FMS Delivery List and associated data fields are discussed below

[Reference: Figure 4-1]

Header Information

Country: Bandaria

Service: Army

Top Left-Hand Portion. Identifies the FMS

recipient country and Service within that

country that received the applicable materials,

services, and training listed on the report.

FMS Delivery Listing Statement Number:

21-06DB

Case: YCY ITM NBR: 007

Top Center Portion. Identifies the type of

listing, the statement number, and the case and

item (i.e., LOA Line) number. In this example

(“21-06DB,” the report is for the 2021 June

transactions reported by the U.S. Air Force to

DFAS SCA for their support to the Bandaria