Estate Tax Filing Checklist

REV 85 0051 (09/19/22) Page 1

What do I need?

Assemble in the order listed using separator sheets (unstapled, no binding, and no tabs):

1. Payment, if applicable.

2. Original Washington State Estate and Transfer Tax Return signed by the executor:

a. First three pages of the form and the completed Washington return schedules.

3. Addendum(s) signed by the executor, if applicable.

4. Copy of the led Federal Form 706, if applicable.

a. First four pages of the form and the completed 706 return schedules.

5. Copy of Death Cercate.

6. Copy of Leers of Administraon/Testamentary, if applicable.

7. Copy of Will, if applicable.

8. Copy of Trust(s), if applicable.

9. Copy of Disclaimer(s), Community Property Agreements, Separate Property Agreements, judicial binding agree-

ments, or non-judicial binding agreements, if applicable.

10. One set of all supporng documentaon in the order of the completed return schedules: appraisals, brokerage

statements or valuaon soware reports, nancial statements, Federal Forms 712, business valuaons, gi tax

returns for the last four years, other calculaons, etc. A separate set of documentaon if alternate valuaon is

elected.

Aer ling the return - what’s next?

• We will review your ling in the order received based on the postmark date. Our review process takes 9-12

months. During our review, we may request addional informaon or documentaon. When the examinaon is

complete, we’ll issue an Estate Tax Release.

• If a Federal Form 706 was led, you must submit a copy of the Internal Revenue Service’s (IRS) Estate Tax Clos-

ing Document or an account transcript showing code “421 Closed Examinaon of tax return” before the we will

issue a nal release. You may call the IRS at 866-699-4083, opon 3 to request a copy of the closing document,

or visit irs.gov for informaon on how to obtain the account transcript.

• Customers oen ask if a Department of Revenue release is needed to make distribuons or to close probate. A

department release is not required to make distribuons or to close probate; however, the personal representa-

ve is ulmately responsible for payment of any tax due. If the estate is closed and there is an adjustment that

results in a refund, a warrant will be made out in the name of the estate and it may be dicult to negoate the

warrant if the estate is closed.

Estate Tax Filing Checklist

You can now le your return online through My DOR! This opon allows you to

submit your payment and all aachments electronically along with your return.

As you complete the return, a dynamic list of suggested aachments and required

aachments will generate to help you know what you should submit with your

return to reduce future requests for informaon.

To ask about the availability of this publication in an alternate format for the visually impaired, please call

360-705-6705. Teletype (TTY) users may use the WA Relay Service by calling 711.

Estate Tax Filing Checklist

REV 85 0051 (09/19/22) Page 2

Common ling errors

• The return and/or addendums are not signed by the executor.

• Using the net estate rather than the gross estate to determine if the estate meets the ling threshold.

• Incomplete estate tax ling; all applicable Washington schedules, supporng documentaon for completed

schedules, and applicable addendums not provided.

• The documentaon provided does not support the value on date of death.

• A separate set of documentaon is not provided for the alternate valuaon date, if applicable.

• Copies of the death cercate, will, and/or trusts not provided with the return.

• Washington estate tax return or Addendums not signed by executor.

• Errors made calculang the Washington estate tax.

• Funeral expenses not reduced by 50% in a community property estate.

• Failure to adequately idenfy assets that are included as part of a marital deducon or credit shelter trust.

• Incorrect idencaon of out of state assets and/or incorrect apporonment calculaon.

• Mortgage deducons for real property taken on Schedule A rather than on the appropriate Schedule K.

• Incorrect valuaon of stocks and bonds, using closing value rather than the mean of the high and low for the

date of death or alternate valuaon date, or incorrect value for non-trading day.

• Failure to include a list of and values for household goods, furnishings, clothes, and/or vehicles.

Quesons?

• Telephone: Call us at 360-704-5906.

• E-mail: E-mail us at estates@dor.wa.gov.

• Web site: Visit dor.wa.gov/EstateTax.

• Stay connected: Sign up for Estate Tax Nocaons at dor.wa.gov/SubscribeNow.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 1

Who must le

The person required to file the return (for example, executor or personal representative) must file the Washington

State Estate and Transfer Tax Return if the decedent’s:

• Death occurred on or after Jan. 1, 2014;

• Domiciled was in the state of Washington or owned real or tangible personal property located in the state of

Washington; and

• Entire estate’s gross value exceeds the filing threshold for the year of the decedent’s death.

Date death occurred Filing threshold

01/01/16 to 10/22/16 $2,000,000

10/23/16 to current

Same as exclusion amount

When and where to le

The return is due nine months after the date of death of the decedent. The return is filed with the Department of

Revenue, Audit Division, PO Box 47474, Olympia, WA 98504-7474. If a Federal Form 706 is filed with the IRS, send

a complete copy of the 706 including the separate 706 schedules when filing the Washington estate tax return.

Whether or not a 706 is filed, all supporting documentation must be submitted with the Washington return.

When payment is due

The payment of estate tax is due nine months after the date of death of the decedent. Interest accrues on any tax

not paid within nine months of the date of death of the decedent. A check should be made out to Washington

State Department of Revenue; write the decedent’s name and Social Security number on it. The estimated or actual

payment must be the top item in the extension or return filing when mailing.

How to obtain an extension

An extension for filing the return can be obtained by sending the Application for Extension of Time to File a

Washington State Estate and Transfer Tax Return to the same address listed in above paragraph. In order to be

timely, the extension must be received prior to the nine-month due date. When an extension is requested from the

IRS, a copy of the Federal Form 4768 is required to be sent to the department. An extension for filing the return

does not extend the time to pay.

Part 1 - Decedent, executor, preparer, condenal release

Items 1-10: Enter the decedent’s information.

Items 11-12: Enter the name and location of the county court where the will or estate was administrated and court

cause number, if applicable.

Items 13-22: Enter the executor’s information. If more than one executor, enter the primary executors on the

return, check the box for multiple executor’s, and submit a list with the additional executor’s information. The

return must be signed by an executor in order to be a valid filing.

Items 23-33: Enter the preparer’s information, if applicable.

Item 34: If the executor wants to authorize the department to communicate (via telephone or mail) about the

estate with the preparer, this item must be completed. Only check the boxes that, you as the executor, are

authorizing for additional unsecured communication methods (via fax or email) and/or if you want the department

to communicate with any staff at the preparer’s company. If this item is not completed and/or the return is not

signed, the department will not be able to communicate with the preparer.

Estate Tax Filing Instrucons

Use these instructions to help you with the Washington State Estate and Transfer

Tax Return (REV 85 0050).

Section references are to the Internal Revenue Code (IRC) as it existed on

Jan. 1, 2005.

To ask about the availability of this publication in an alternate format for the visually impaired, please call

360-705-6705. Teletype (TTY) users may use the WA Relay Service by calling 711.

Print form

Print form

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 2

Part 2 - Tax computaon

Line 1: Enter the Total Gross Estate less Exclusion calculated on Part 5 - Recapitulation, Item 12 of the return.

Line 2: Enter the Tentative Total Allowable Deductions calculated on Part 5 - Recapitulation, Item 22 of the return.

Line 3: Enter the amount of the Tentative Taxable Estate (Line 1 less Line 2).

Line 4: Enter the sum of the applicable addendums for allowable adjustments to the tentative taxable estate

(add Lines 4a and 4b). Review each addendum; complete only the ones that apply to the estate. Completed

addendum(s) must be filed with the return.

4a: If the estate is eligible to take a deduction for property used for farming (farm deduction), complete and submit

Addendum # 2. Enter the amount from the addendum’s Part 3, Line 6.

4b: If the estate is eligible to take a deduction for a qualified family-owned business interest (QFOBI), complete and

submit Addendum # 3. Enter the amount from the addendum’s Part 3, Line 8.

Line 5: Enter the result of Line 3 less Line 4.

Line 6: Enter the amount of Washington State Applicable Exclusion Amount from table below:

Applicable exclusion amount table

Year of decedent’s death Applicable exclusion amount

2016 $2,079,000

2017 $2,129,000

2018 to Current $2,193,000

Line 7: Enter the result of Line 5 less Line 6. Do not enter less than zero. This is the “Washington Taxable Estate.”

Line 8: Enter the tax determined by using Table W (below) on the Washington Taxable Estate (Line 7). If the amount

is zero, skip down to the signature line, you do not need to fill out Lines 9 through 14. For additional information on

calculating the tax, see Chapter 458-57 WAC.

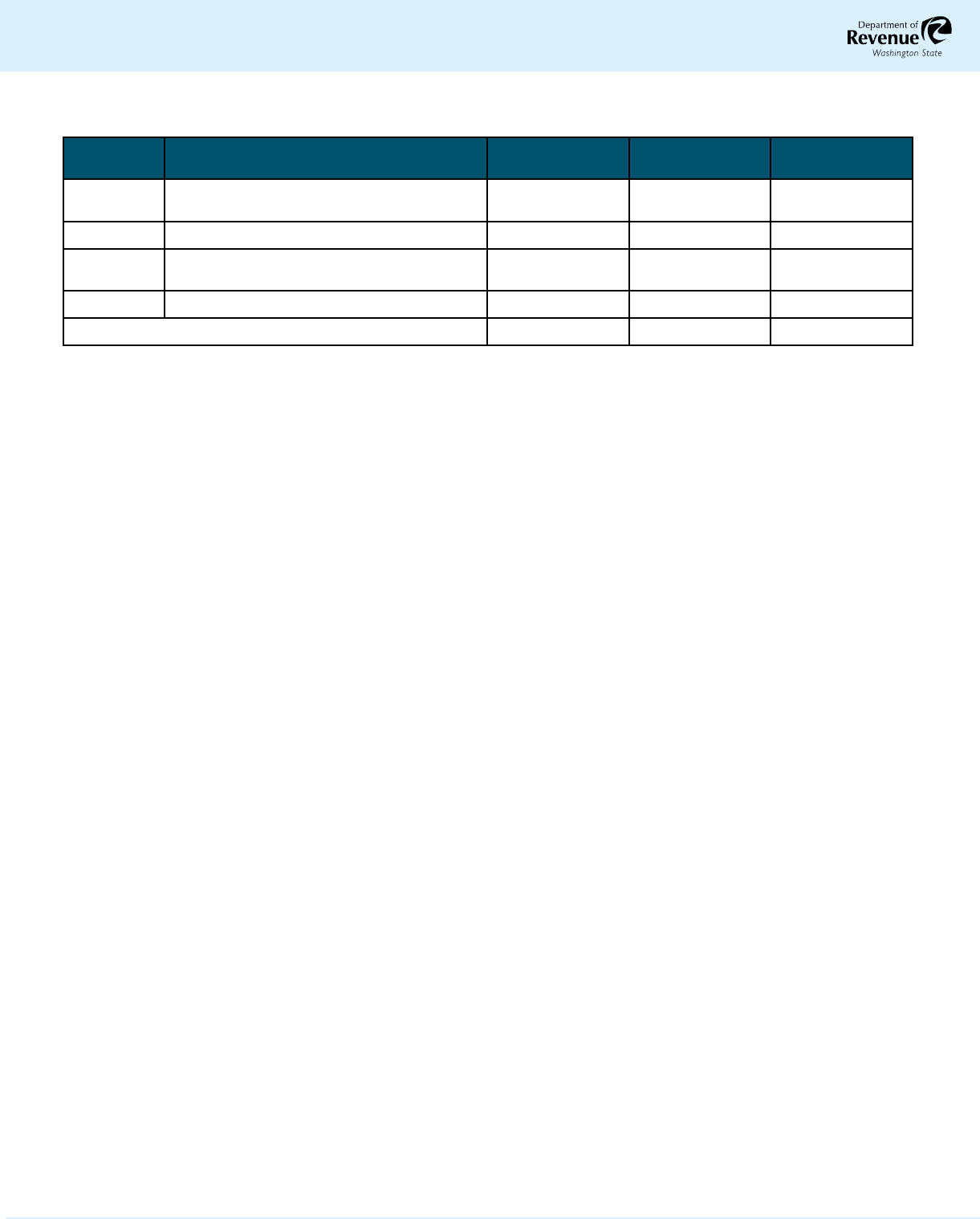

Table W (for dates of death occurring on or aer Jan. 1, 2014)

If Washington taxable estate is at

least

Rate Of Washington taxable estate value greater than

$0 to $1,000,000 10% 10% of taxable amount

$1,000,000 to $2,000,000 14% $100,000 plus 14% of the amount over $1,000,000

$2,000,000 to $3,000,000 15% $240,000 plus 15% of the amount over $2,000,000

$3,000,000 to $4,000,000 16% $390,000 plus 16% of the amount over $3,000,000

$4,000,000 to $6,000,000 18% $550,000 plus 18% of the amount over $4,000,000

$6,000,000 to $7,000,000 19% $910,000 plus 19% of the amount over $6,000,000

$7,000,000 to $9,000,000 19.5% $1,100,000 plus 19.5% of the amount over $7,000,000

$9,000,000 and up 20% $1,490,000 plus 20% of the amount over $9,000,000

Note: The amount you start with in the first column is the Washington Taxable Estate (Line 7). This is the amount

after allowable deductions, adjustments and the applicable exclusion amount. The tax is not calculated on the gross

estate.

Two examples using Table W - single person, date of death occurred in 2019

Example 1

Total gross estate: $3,000,000

Allowable deductions: $50,000

Tentative taxable estate: $2,950,000

Applicable exclusion amount: $2,193,000

Washington taxable estate: $757,000

Table W is used to compute the tax on the Washington

taxable estate of $757,000. The amount falls into the “$0

to $1,000,000” row. The tax is 10% on $757,000, for a tax

owing of $75,700.

Example 2

Total gross estate: $6,000,000

Allowable deductions: $100,000

Tentative taxable estate: $5,900,000

Applicable exclusion amount: $2,193,000

Washington taxable estate: $3,707,000

Table W is used to compute the tax on the Washington

taxable estate of $3,707,000. The amount falls into the

“$3,000,000 to $4,000,000” row. The tax is $390,000

plus 16% on $707,000 is $113,120 for a tax owing of

$503,120.

Line 9: If the estate is eligible for apportionment of out of state property, complete and submit Addendum # 4.

Enter the amount from the addendum’s Part 4, Line 6.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 3

Line 10: Enter the Washington Estate Tax Due. This amount equals Line 8 or, if apportioning for out of state

property, Line 9.

Line 11: Enter the total amount of any previous payments.

Line 12: Enter the result of Line 10 less Line 11. If Line 10 is larger than Line 11, check the “amount owing” box. If

Line 10 is smaller than Line 12, check the “refund due” box and show Line 12 as a negative amount.

Note: If any payments are paid late, interest must be calculated on the unpaid principal from the day after nine

months due date through the postmark date of the payment(s). Late payment interest will affect the amount owing

or the refund due. Payments are applied to accrued interest first, the remainder is then applied to principal.

Line 13: Enter the amount of interest. Any tax not paid by the due date will accrue interest daily on the unpaid

principal. Any overpaid principal accrues daily interest from the date of overpayment until the refund is mailed

(the department will calculate this amount upon reviewing the file). Interest rates are adjusted annually per RCW

82.32.050(2); see the DOR website for applicable rates. If you wish the department to calculate the amount, do not

complete Lines 13 and 14; a notice of the interest due will be sent upon review of the return.

Line 14: Enter the result of adding Lines 12 and 13.

Signature

The executor (or other person required to file, such as, the personal representative, fiduciary, or trustee) of the

estate must sign the return. An unsigned return cannot be processed. If the return is unsigned and the confidential

release section, Item 34, is completed, the department will not be authorized to contact the preparer regarding

questions on the return.

Part 3 - Elecons by the executor

Line 1 - Alternate value

Unless you elect at the time you file the return to adopt alternate valuation as authorized by IRC §2032, you must

value all property included in the gross estate on the date of the decedent’s death. Alternate valuation cannot be

applied to only a part of the property.

You may elect special use valuation (Line 2) in addition to alternate valuation.

You may not elect alternate valuation unless the election will decrease both the value of the gross estate and the

total net estate taxes due after application of all allowable credits.

You elect alternate valuation by checking “Yes” on Line 1 and filing the return. Once made, the election may not be

revoked. The election may be made on a late filed return provided it is not filed later than 1 year after the due date

(including extensions).

If you elect alternate valuation, value the property that is included in the gross estate as of the applicable dates as

follows:

1. Any property distributed, sold, exchanged, or otherwise disposed of or separated or passed from the gross

estate by any method within six months after the decedent’s death is valued on the date of distribution,

sale, exchange, or other disposition, whichever occurs first. Value this property on the date it ceases to

form a part of the gross estate; i.e., on the date the title passes as the result of its sale, exchange, or other

disposition.

2. Any property not distributed, sold, exchanged, or otherwise disposed of within the six-month period is

valued on the date six months after the date of the decedent’s death.

3. Any property, interest, or estate that is “affected by mere lapse of time” is valued as of the date of

decedent’s death or on the date of its distribution, sale, exchange, or other disposition, whichever occurs

first. However, you may change the date of death value to account for any change in value that is not due to

a “mere lapse of time” on the date of its distribution, sale, exchange, or other disposition.

The property included in the alternate valuation and valued as of six months after the date of the decedent’s death,

or as of some intermediate date (as described above) is the property included in the gross estate on the date of the

decedent’s death. Therefore, you must first determine what property constituted the gross estate at the decedent’s

death.

Interest. Interest accrued to the date of the decedent’s death on bonds, notes, and other interest-bearing

obligations is property of the gross estate on the date of death and is included in the alternate valuation.

Rent. Rent accrued to the date of the decedent’s death on leased real or personal property is property of the gross

estate on the date of death and is included in the alternate valuation.

Dividends. Outstanding dividends that were declared to stockholders of record on or before the date of the

decedent’s death are considered property of the gross estate on the date of death, and are included in the

alternate valuation. Ordinary dividends declared to stockholders of record after the date of the decedent’s death

are not property of the gross estate on the date of death and are not included in the alternate valuation. However,

if dividends are declared to stockholders of record after the date of the decedent’s death so that the shares of

stock at the later valuation date do not reasonably represent the same property at the date of the decedent’s

death, include those dividends (except dividends paid from earnings of the corporation after the date of the

decedent’s death) in the alternate valuation.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 4

As part of each Schedule A through I, you must show:

1. What property is included in the gross estate on the date of the decedent’s death;

2. What property was distributed, sold, exchanged, or otherwise disposed of within the six-month period after

the decedent’s death, and the dates of these distributions, etc.

3. In the “Description” column of each schedule, briefly explain the status or disposition governing the

alternate valuation date, such as: “Not disposed of within six months following death,” “Distributed,”

“Sold,” “Bond paid on maturity,” etc.

4. The date of death value, entered in the appropriate value column with items of principal and includible

income shown separately; and

5. The alternate value, entered in the appropriate value column with items of principal and includible income

shown separately. (In the case of any interest or estate, the value of which is affected by lapse of time,

such as patents, leaseholds, estates for the life of another, or remainder interests, the value shown under

the heading “Alternate Value” must be the adjusted value; i.e., the value as of the date of death with an

adjustment reflecting any difference in its value as of the later date not due to lapse of time.)

Distributions, sales, exchanges, and other dispositions of the property within the six-month period after the

decedent’s death must be supported by evidence. If the court issued an order of distribution during that period,

you must submit a certified copy of the order as part of the evidence. The Department of Revenue may require you

to submit additional evidence if necessary.

If the alternate valuation method is used, the values of life estates, remainders, and similar interests are figured

using the age of the recipient on the date of the decedent’s death and the value of the property on the alternate

valuation date.

The alternate valuation may be elected on Washington only filings. If alternate valuation is elected and a federal

estate return is also filed, the election must be consistent on both returns. Two sets of supporting documents must

be included with the return supporting both date of death and alternate valuation values.

Line 2 - Special use valuaon of IRC §2032A

Under IRC §2032A, you may elect to value certain farm and closely held business real property at its farm or

business use value rather than its fair market value. You may elect both special use valuation and alternate

valuation.

To elect this valuation you must check “Yes” on Line 2 and complete and submit Schedule A-1 and its required

additional statements. You must submit Schedule A-1 and its required documentation for this election to be valid.

You may make the election on a late filed return so long as it is the first return filed.

Real property may qualify for the IRC §2032A election if:

1. The decedent was a U.S. Citizen or resident at the time of death;

2. The real property is located in the United States;

3. At the decedent’s death the real property was used by the decedent or a family member for farming or in

a trade or business, or was rented for such use by either the surviving spouse or a lineal descendant of the

decedent to a family member on a net cash basis;

4. The real property was acquired from or passed from the decedent to a qualified heir of the decedent;

5. The real property was owned and used in a qualified manner by the decedent or a member of the decedent’s

family during five of the eight years before the decedent’s death;

6. There was material participation by the decedent or a member of the decedent’s family during five of the eight

years before the decedent’s death; and

7. The qualified property meets the following percentage requirements:

a. At least 50% of the adjusted value of the gross estate must consist of the adjusted value of real or personal

property that was being used as a farm or in a closely held business and that was acquired from, or passed

from, the decedent to a qualified heir of the decedent; and

b. At least 25% of the adjusted value of the gross estate must consist of the adjusted value of qualified farm or

closely held business real property.

For this purpose, adjusted value is the value of property determined without regard to its special-use value. The

value is reduced for unpaid mortgages on the property or any indebtedness against the property, if the full value of

the decedent’s interest in the property (not reduced by such mortgage or indebtedness) is included in the value of

the gross estate. The adjusted value of the qualified real and personal property used in different businesses may be

combined to meet the 50% and 25% requirements.

Qualied real property

Qualified use. The term “qualified use” means the use of the property as a farm for farming purposes or the use

of property in a trade or business other than farming. Trade or business applies only to the active conduct of a

business. It does not apply to passive investment activities or the mere passive rental of property to a person other

than a member of the decedent’s family. Also, no trade or business is present in the case of activities not engaged

in for profit.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 5

Ownership. To qualify as special-use property, the decedent or a member of the decedent’s family must have

owned and used the property in a qualified use for five of the last eight years before the decedent’s death.

Ownership may be direct or indirect through a corporation, a partnership, or a trust.

If the ownership is indirect, the business must qualify as a closely held business under IRC §6166. The ownership,

when combined with periods of direct ownership, must meet the requirements of IRC §6166 on the date of the

decedent’s death and for a period of time that equals at least five of the eight years preceding death.

If the property was leased by the decedent to a closely held business, it qualifies as long as the business entity to

which it was rented was a closely held business with respect to the decedent on the date of the decedent’s death

and for sufficient time to meet the “five in eight years” test explained above.

Structures and other real property improvements. Qualified real property includes residential buildings and other

structures and real property improvements regularly occupied or used by the owner or lessee of real property (or

by the employees of the owner or lessee) to operate the farm or business. A farm residence which the decedent

had occupied is considered to have been occupied for the purpose of operating the farm even when a family

member and not the decedent was the person materially participating in the operation of the farm.

Qualified real property also includes roads, buildings, and other structures and improvements functionally related

to the qualified use.

Elements of value such as mineral rights that are not related to the farm or business use are not eligible for special-

use valuation.

Property acquired from the decedent. Property is considered to have been acquired from or to have passed from

the decedent if one of the following applies:

• The property is considered to have been acquired from or to have passed from the decedent under

IRC§1014(b) (relating to basis of property acquired from a decedent);

• The property is acquired by any person from the estate; or

• The property is acquired by any person from a trust, to the extent the property is includible in the gross

estate.

Qualified heir. A person is a qualified heir of property if he or she is a member of the decedent’s family and

acquired or received the property from the decedent. If a qualified heir disposes of any interest in qualified real

property to any member of his or her family, that person will then be treated as the qualified heir with respect to

that interest.

The term member of the family includes only:

1. An ancestor (parent, grandparent, etc.) of the individual;

2. The spouse of the individual;

3. The lineal descendant (child, stepchild, grandchild, etc.) of the individual, the individual’s spouse, or a

parent of the individual; or

4. The spouse, widow, or widower of any lineal descendant described above.

A legally adopted child of an individual is treated as a child of that individual by blood.

Material parcipaon

To elect special-use valuation, either the decedent or a member of his or her family must have materially

participated in the operation of the farm or other business for at least five of the eight years ending on the date

of the decedent’s death. The existence of material participation is a factual determination, but passively collecting

rents, salaries, draws, dividends, or other income from the farm or other business does not constitute material

participation. Neither does merely advancing capital and reviewing a crop plan and financial reports each season or

business year. In determining whether the required participation has occurred, disregard brief periods (i.e., 30 days

or less) during which there was no material participation, as long as such periods were both preceded and followed

by substantial periods (more than 120 days) during which there was uninterrupted material participation.

Retirement or disability. If, on the date of death, the time period for material participation could not be met

because the decedent had retired or was disabled, a substitute period may apply. The decedent must have retired

on Social Security or been disabled for a continuous period ending with death. A person is disabled for this purpose

if he or she was mentally or physically unable to materially participate in the operation of the farm or other

business.

The substitute time period for material participation for these decedents is a period totaling at least five years

out of the eight-year period that ended on the earlier of (1) the date the decedent began receiving social security

benefits, or (2) the date the decedent became disabled.

Surviving spouse. A surviving spouse who received qualified real property from the predeceased spouse is

considered to have materially participated if he or she was engaged in the active management of the farm or other

business. If the surviving spouse died within eight years of the first spouse’s death, you may add the period of

material participation of the predeceased spouse to the period of active management by the surviving spouse to

determine if the surviving spouse’s estate qualifies for special-use valuation.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 6

To qualify for this, the property must have been eligible for special-use valuation in the predeceased spouse’s

estate, though it does not have to have been elected by that estate.

For additional details regarding material participation, see IRC Regulations §20.2032A-3(e).

Valuaon methods

The primary method of valuing special-use value property that is used for farming purposes is the annual gross

cash rental method. If comparable gross cash rentals are not available, you can substitute comparable average

annual net share rentals. If neither of these are available, or if you so elect, you can use the method for valuing real

property in a closely held business.

Average annual gross cash rental. Generally, the special-use value of property that is used for farming purposes is

determined as follows:

1. Subtract the average annual state and local real estate taxes on actual tracts of comparable real property

from the average annual gross cash rental for that same comparable property; and

2. Divide the result in 1 by the average annual effective interest rate charged for all new Federal Land Bank

loans.

The computation of each average annual amount is based on the five most recent calendar years ending before the

date of the decedent’s death.

Gross cash rental. Generally, gross cash rental is the total amount of cash received in a calendar year for the use

of actual tracts of comparable farm real property in the same locality as the property being specially valued. You

may not use appraisals or other statements regarding rental value or area wide averages of rentals. You may not

use rents that are paid wholly or partly in kind, and the amount of rent may not be based on production. The rental

must have resulted from an arm’s-length transaction. Also, the amount of rent is not reduced by the amount of any

expenses or liabilities associated with the farm operation or the lease.

Comparable property. Comparable property must be situated in the same locality as the specially valued property

as determined by generally accepted real property valuation rules. The determination of comparability is based on

all the facts and circumstances. It is often necessary to value land in segments where there are different uses or

land characteristics included in the specially valued land. The following list contains some of the factors considered

in determining comparability.

• Similarity of soil;

• Whether the crops grown would deplete the soil in a similar manner;

• Types of soil conservation techniques that have been practiced on the two properties;

• Whether the two properties are subject to flooding;

• Slope of the land;

• For livestock operations, the carrying capacity of the land;

• For timbered land, whether the timber is comparable;

• Whether the property as a whole is unified or segmented; if segmented, the availability of the means

necessary for movement among the different sections;

• Number, types, and conditions of all buildings and other fixed improvements located on the properties and

their location as it affects efficient management, use, and value of the property; and

• Availability and type of transportation facilities in terms of costs and of proximity of the properties to local

markets.

You must specifically identify on the return the property being used as comparable property. Use the type of

descriptions used to list real property on Schedule A.

Effective interest rate. Contact the Washington State Department of Revenue for the annual interest rate.

Net share rental. You may use average annual net share rental from comparable land only if there is no

comparable land from which average annual gross cash rental can be determined. Net share rental is the difference

between the gross value of produce received by the lessor from the comparable land and the cash operating

expenses (other than real estate taxes) of growing the produce that, under the lease, are paid by the lessor. The

production of the produce must be the business purpose of the farming operation. For this purpose, produce

includes livestock.

The gross value of the produce is generally the gross amount received if the produce was disposed of in an arm’s-

length transaction within the period established by the federal Department of Agriculture for its price support

program. Otherwise, the value is the weighted average price for which the produce sold on the closest national

or regional commodities market. The value is figured for the date or dates on which the lessor received (or

constructively received) the produce.

Valuing a real property interest in closely held business. Use this method to determine the special-use valuation

for qualifying real property used in a trade or business other than farming. You may also use this method for

qualifying farm property if there is no comparable land or if you elect to use it.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 7

Under this method, the following factors are considered:

• The capitalization of income that the property can be expected to yield for farming or for closely held

business purposes over a reasonable period of time with prudent management and traditional cropping

patterns for the area, taking into account soil capacity, terrain configuration, and similar factors;

• The capitalization of the fair rental value of the land for farming or for closely held business purposes;

• The assessed land values in a state that provides a differential or use value assessment law for farmland or

closely held business;

• Comparable sales of other farm or closely held business land in the same geographical area far enough

removed from a metropolitan or resort area so that non agricultural use is not a significant factor in the

sales price; and

• Any other factor that fairly values the farm or closely held business value of the property.

Making the elecon

Include the words “IRC §2032A valuation” in the “Description” column of any return schedule if IRC §2032A

property is included in the decedent’s gross estate.

An election under IRC §2032A need not include all the property in an estate that is eligible for special use valuation,

but sufficient property to satisfy the threshold requirements of IRC §2032A(b)(1)(B) must be specially valued under

the election.

If joint or undivided interests (i.e., interests as joint tenants or tenants in common) in the same property are

received from a decedent by qualified heirs, an election with respect to one heir’s joint or undivided interest need

not include any other heir’s interest in the same property if the electing heir’s interest plus other property to be

specially valued satisfies the requirements of IRC §2032A(b)(1)(B).

If successive interests (i.e., life estates and remainder interests) are created by a decedent in otherwise qualified

property, an election under IRC §2032A is available only with respect to that property (or part) in which qualified

heirs of the decedent receive all of the successive interests, and such an election must include the interests of all of

those heirs.

For example, if a surviving spouse receives a life estate in otherwise qualified property and the spouse’s brother

receives a remainder interest in fee, no part of the property may be valued pursuant to an election under IRC

§2032A.

Where successive interests in specially valued property are created, remainder interests are treated as being

received by qualified heirs only if the remainder interests are not contingent on surviving a non-family member or

are not subject to divestment in favor of a non-family member.

Protecve elecon

You may make a protective election to specially value qualified real property. Under this election, whether or not

you may ultimately use special use valuation depends upon values as finally determined (or agreed to following

examination of the return) meeting the requirements of IRC §2032A.

To make a protective election, check “Yes” on line 2 and complete Schedule A-1 according to its instructions for

“Protective Election.”

If you make a protective election, you should complete the return by valuing all property at its fair market value.

Do not use special use valuation. Usually, this will result in higher estate tax liabilities than will be ultimately

determined if special use valuation is allowed. The protective election does not extend the time to pay the taxes

shown on the return.

If it is found that the estate qualifies for special use valuation based on the values as finally determined (or agreed

to following examination of the return), you must file an amended return (with a complete IRC §2032A election)

within 60 days after the date of this determination. Complete the amended return using special use values under

the rules of IRC §2032A, and complete Schedule A-1 and submit all of the required statements.

Addional informaon

For definitions and additional information, see IRC §2032A and the related regulations.

Line 3 - Installment payments

If the gross estate includes an interest in a closely held business, you may be able to elect to pay part of the estate

tax in installments.

The maximum amount that can be paid in installments is that part of the estate tax that is attributable to the

closely held business. In general, that amount is the amount of tax that bears the same ratio to the total estate tax

that the value of the closely held business included in the gross estate bears to the total gross estate.

Percentage requirements. To qualify for installment payments, the value of the interest in the closely held

business that is included in the gross estate must be more than 35% of the adjusted gross estate (the gross estate

less expenses, indebtedness, taxes, and losses).

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 8

Interests in two or more closely held businesses are treated as an interest in a single business if at least 20% of

the total value of each business is included in the gross estate. For this purpose, include any interest held by the

surviving spouse that represents the surviving spouse’s interest in a business held jointly with the decedent as

community property or as joint tenants, tenants by the entirety, or tenants in common.

Value. The value used for meeting the percentage requirements is the same value used for determining the gross

estate. Therefore, if the estate is valued under alternate valuation or special use valuation, you must use those

values to meet the percentage requirements.

Transfers before death. Generally, gifts made before death are not included in the gross estate. However, the

estate must meet the 35% requirement by both including and excluding in the gross estate any gifts made by the

decedent within three years of death.

Passive assets. In determining the value of a closely held business and whether the 35% requirement is met, do

not include the value of any passive assets held by the business. A “passive asset” is any asset not used in carrying

on a trade or business. Stock in another corporation is a passive asset unless the stock is treated as held by the

decedent because of the election to treat holding company stock as business company stock, as discussed below.

If a corporation owns at least 20% in value of the voting stock of another corporation, or the other corporation

had no more than 45 shareholders and at least 80% of the value of the assets of each corporation is attributable

to assets used in carrying on a trade or business, then these corporations will be treated as a single corporation,

and the stock will not be treated as a passive asset. Stock held in the other corporation is not taken into account in

determining the 80% requirement.

Interest in closely held business. For purposes of the installment payment election, an interest in a closely held

business means:

• Ownership of a trade or business carried on as a proprietorship;

• An interest as a partner in a partnership carrying on a trade or business if 20% or more of the total capital

interest was included in the gross estate of the decedent or the partnership had no more than 45 partners;

or

• Stock in a corporation carrying on a trade or business if 20% or more in value of the voting stock of the

corporation is included in the gross estate of the decedent or the corporation had no more than 45

shareholders.

The partnership or corporation must be carrying on a trade or business at the time of the decedent’s death.

In determining the number of partners or shareholders, a partnership or stock interest is treated as owned by

one partner or shareholder if it is community property or held by a husband and wife as joint tenants, tenants in

common or as tenants by the entirety.

Property owned directly or indirectly by or for a corporation, partnership, estate, or trust is treated as owned

proportionately by or for its shareholders, partners, or beneficiaries. For trusts, only beneficiaries with current

interests are considered.

The interest in a closely held farm business includes the interest in the residential buildings and related

improvements occupied regularly by the owners, lessees, and employees operating the farm.

Holding company stock. The executor may elect to treat as business company stock the portion of any holding

company stock that represents direct ownership (or indirect ownership through one or more other holding

companies) in a business company. A “holding company” is a corporation holding stock in another corporation. A

“business company” is a corporation carrying on a trade or business.

In general this election applies only to stock that is not readily tradable. However, the election can be made if

the business company stock is readily tradable, as long as all of the stock of each holding company is not readily

tradable.

For purposes of the 20% voting stock requirement, stock is treated as voting stock to the extent the holding

company owns voting stock in the business company.

If the executor makes this election, the first installment payment is due when the estate tax return is filed. The five-

year deferral for payment of the tax, as discussed below under time for payment, does not apply.

Time for payment. Under the installment method, the executor may elect to defer payment of the qualified estate

tax, but not interest, for up to five years from the original payment due date. After the first installment of tax is

paid, you must pay the remaining installments annually by the date one year after the due date of the preceding

installment. There can be no more than ten installment payments.

Interest on the unpaid portion of the tax is not deferred and must be paid annually. In years in which installments

of principal are paid, interest must be paid at the same time as and as a part of each installment payment of the

tax.

For information on the acceleration of payment when an interest in the closely held business is disposed of, see IRC

§6166(g).

Important: Only interest actually accrued and paid on installment payments can be deducted as an administrative

expense of the estate.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 9

Making the election. If you check this line to make a protective election, you should submit a notice of protective

election as described in IRC Regulations §20.6166-1(d). If you check this line to make a final election, you should

submit the notice of election described in IRC Regulations §20.6166-1(b). In computing the adjusted gross estate

under IRC §6166(b)(6) to determine whether an election may be made under IRC §6166, the net amount of any real

estate in a closely held business must be used.

Line 4 - Reversionary or remainder interests

For details of this election, see IRC §6163 and the related regulations.

Part 4 - General informaon

Line 1 - Marital status

Enter the marital status of the decedent at the time of death by checking the appropriate box. If the decedent was

married at the time of death, complete Lines 2 through 4. If the decedent had one or more prior marriages, submit

a list providing the name and SSN of each former spouse, the date(s) the marriage ended, and specify whether the

marriage ended by annulment, divorce decree, or death of spouse.

Lines 2-4 - Surviving spouse

Complete Lines 2 and 3 even if the surviving spouse did not receive any benefits from the estate. If there was no

surviving spouse on the date of decedent’s death, enter “None” in Line 2 and leave Lines 3 and 4 blank. The value

entered in Line 4 need not be exact. See the instructions for “Amount” under Line 5, below.

Line 5 - Beneciaries

Name. Enter the name of each individual, trust, or estate who received (or will receive) benefits of $5,000 or more

from the estate directly as an heir, next-of-kin, devisee, or legatee; or indirectly (for example, as beneficiary of an

annuity or insurance policy, shareholder of a corporation, or partner of a partnership that is an heir, etc.).

Identifying number. Enter the SSN of each individual beneficiary listed. If the number is unknown, or the individual

has no number, indicate “unknown” or “none.” For trusts and other estates, enter the FEIN.

Relationship. For each individual beneficiary enter the relationship (if known) to the decedent by reason of blood,

marriage, or adoption. For trust or estate beneficiaries, indicate TRUST or ESTATE.

Amount. Enter the amount actually distributed (or to be distributed) to each beneficiary including transfers

during the decedent’s life from Schedule G required to be included in the gross estate. The value to be entered

need not be exact. A reasonable estimate is sufficient. Where precise values cannot readily be determined, as with

certain future interests, a reasonable approximation should be entered. The total of these distributions should

approximate the amount of gross estate reduced by funeral and administrative expenses, debts and mortgages,

bequests to surviving spouse, charitable bequests, and any federal and state estate taxes paid (or payable) relating

to the benefits received by the beneficiaries listed on Lines 2-5.

All distributions of less than $5,000 to specific beneficiaries should be included with distributions to

unascertainable beneficiaries on the line provided.

Line 6 - RCW 83.100.047 / IRC §2044 property

If you answered “Yes,” these assets must be shown on Schedule F and the date of death value attested to by

completing Addendum # 1 - Qualified Terminable Interest Property. RCW 83.100.047 and/or IRC §2044 property

is property for which a previous QTIP election was made, or for which a similar gift tax election (IRC §2523) was

made. For more information, see the instructions for Schedule F and Addendum # 1.

Lines 8a and 8b - Insurance not included in gross estate

If you answered “Yes” on either line 8a or 8b, you must complete and submit Schedule D and include a Federal

Form 712, Life Insurance Statement, for each policy and an explanation of why the policy or its proceeds are not

includible in the gross estate.

Lines 10a and 10b - Partnership Interests and Stock in Closely Held Corporaon

If you answered “Yes” on line 10a, you must include full details for partnerships and unincorporated businesses on

Schedule F (Schedule E if the partnership interest is jointly owned). You must include full details for the stock of

inactive or close corporations on Schedule B.

Value these interests using the rules of IRC Regulations §20.2031-2 (stocks) or §20.2031-3 (other business

interests).

A “close corporation” is a corporation whose shares are owned by a limited number of shareholders. Often, one

family holds the entire stock issue. As a result, little, if any, trading of the stock takes place. There is, therefore, no

established market for the stock, and those sales that do occur are at irregular intervals and seldom reflect all the

elements of a representative transaction as defined by the term “fair market value” (FMV).

Lines 12a through 12e - Trusts

If you answered “Yes” on either 12a or 12b, you must submit a copy of the trust instrument for each trust.

You must complete Schedule G if you answered “Yes” on 12a and Schedule F if you answered “Yes” on 12b.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 10

Part 5 - Recapitulaon

Gross estate

Items 1 through 10 - You must make an entry in each of Items 1 through 9. If the gross estate does not contain

any assets of the type specified by a given item, enter zero for that item. Entering zero for any of items 1 through

9 is a statement by the executor, made under penalties of perjury, that the gross estate does not contain any

includible assets covered by that item.

Do not enter any amounts in the “Alternate value” column unless you elected alternate valuation on Line 1 of Part

3 - Elections by the Executor.

Which schedules to submit for Items 1 through 9. You must submit:

• Schedule F to the return and answer its quesons even if you report no assets on it;

• Schedules A, B, and C if the gross estate includes any real estate; stocks and bonds; or mortgages, notes, and

cash, respecvely;

• Schedule D if the gross estate includes any life insurance or if you answered “Yes” on Lines 8a or 8b of Part 4;

• Schedule E if the gross estate contains any jointly owned property or if you answered “Yes” on Line 9 of Part 4;

• Schedule G if the decedent made any of the lifeme transfers to be listed on that schedule or if you answered

“Yes” on Line 11 of Part 4;

• Schedule H if you answered “Yes” on Line 13 of Part 4; and

• Schedule I if you answered “Yes” on Line 15 of Part 4.

Exclusion

Item 11 - Conservaon easement exclusion. You must complete and submit Schedule U (along with any required

documentation) to claim this exclusion.

Deducons

Items 13 through 21. You must submit the appropriate schedules for the deductions you claim.

Item 17. If Item 16 is less than or equal to the value (at the time of the decedent’s death) of the property subject

to claims, enter the amount from Item 16 on Item 17.

If the amount on Item 16 is more than the value of the property subject to claims, enter the greater of (a) the value

of the property subject to claims, or (b) the amount actually paid at the time the return is filed.

In no event should you enter more on Item 17 than the amount on Item 16. See IRC §2053 and the related

Regulations for more information.

Instrucons for Schedule A - Real estate

If the total gross estate contains any real estate, you must complete Schedule A and file it with the return. On

schedule A, list real estate the decedent owned or had contracted to purchase. Number each parcel in the left-hand

column.

Describe the real estate in enough detail so that the department can easily locate it for valuation. For each parcel

of real estate, report the location or area and, if the parcel is improved, describe the improvements. For city or

town property, report the street and number, ward, subdivision, block and lot, etc. For rural property, report the

township, range, landmarks, etc. Provide the parcel number if available.

If any item of real estate is subject to a mortgage for which the decedent’s estate is liable, that is, if the

indebtedness may be charged against other property of the estate that is not subject to that mortgage, or if the

decedent was personally liable for that mortgage, you must report the full value of the property in the value

column. Enter the amount of the mortgage under “Description” on this schedule. The unpaid amount of the

mortgage may be deducted on Schedule K.

If the decedent’s estate is NOT liable for the amount of the mortgage, report only the value of the equity of

redemption (or value of the property less the indebtedness) in the value column as part of the gross estate. Do not

enter any amount less than zero. Do not deduct the amount of indebtedness on Schedule K.

Also list on Schedule A real property the decedent contracted to purchase. Report the full value of the property and

not the equity in the value column. Deduct the unpaid part of the purchase price on Schedule K.

Report the value of real estate without reducing it for homestead or other exemption, or the value of dower,

curtesy, or a statutory estate created instead of dower or curtesy.

Explain how the reported values were determined and submit copies of any appraisals.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 11

On Schedule A, list real estate the decedent owned or had contracted to purchase. Number each parcel in the left-

hand columns.

Schedule A - Examples

In this example, alternate valuation is not elected: The date of death is January 1, 2014.

Item

number

Description

Alternate

valuation date

Alternate

value

Value at

date of

death

1 House and lot, 1921 William Street NW, Tacoma,

Washington (lot 6, square 481). Rent of $3,900 due at

end of each quarter, February 1, May 1, August 1, and

November 1. Value based on appraisal, copy of which is

attached. 208,000

Rent due on item 1 for quarter ending November 1, 2013,

but not collected at date of death.

3,900

Rent accrued on item 1 for November and December 2013.

2,600

2 House and lot, 304 Jefferson Street, Seattle, Washington

(lot 18, square 40). Rent of $900 payable monthly. Value

based on appraisal, copy of which is attached. 196,000

Rent due on item 2 for December 2013, but not collected

at date of death. 900

In this example, alternate valuation is elected: The date of death is January 1, 2014.

Item

number

Description

Alternate

valuation

date

Alternate

value

Value at

date of

death

1 House and lot, 1921 William Street NW, Tacoma,

Washington (lot 6, square 481). Rent of $3,900 due at

end of each quarter, February 1, May 1, August 1, and

November 1. Value based on appraisal, copy of which is

attached. Not disposed of within 6 months following death.

7/1/14 196,000 208,000

Rent due on item 1 for quarter ending November 1, 2013,

but not collected until February 1, 2014. 2/1/14 3,900 3,900

Rent accrued on item 1 for November and December 2013,

collected on February 1, 2014. 2/1/14 2,600 2,600

2 House and lot, 304 Jefferson Street, Seattle, Washington

(lot 18, square 40). Rent of $900 payable monthly. Value

based on appraisal, copy of which is attached. Property

exchanged for farm on May 1, 2014. 5/1/14 190,000 196,000

Rent due on item 2 for December 2013, but not collected

until February 1, 2014. 2/1/14 900 900

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 12

Instrucons for Schedule B - Stocks and bonds

If the total gross estate contains any stocks or bonds, you must complete Schedule B and file it with the return.

On Schedule B, list the stocks and bonds included in the decedent’s gross estate. Number each item in the left-

hand column. Bonds that are exempt from federal income tax are not exempt from estate tax unless specifically

exempted by an estate tax provision of the IRC. Therefore, you should list these bonds on Schedule B.

Public housing bonds includible in the gross estate must be included at their full value.

List interest and dividends on each stock or bond separately. Indicate as a separate item dividends that have

not been collected at death, but which are payable to the decedent or the estate because the decedent was a

stockholder of record on the date of death. However, if the stock is being traded on an exchange and is selling

ex-dividend on the date of the decedent’s death, do not include the amount of the dividend as a separate item.

Instead, add it to the ex-dividend quotation in determining the fair market value of the stock on the date of

the decedent’s death. Dividends declared on shares of stock before the death of the decedent but payable to

stockholders of record on a date after the decedent’s death are not includible in the gross estate for estate tax

purposes.

If you have the detailed description and values explained below in a brokerage or other financial statement for the

applicable valuation date, you may list the account information versus listing each individual stock and bond on the

schedule.

Descripon

Stocks

For stocks, indicate:

• Number of shares;

• Whether common or preferred;

• Issue;

• Par value where needed for identification;

• Price per share;

• Exact name of corporation;

• Principal exchange upon which sold, if listed on an

exchange;

• Nine-digit CUSIP number (defined below); and

• Ticker symbol, if applicable.

Bonds

For bonds, indicate:

• Quantity and denomination;

• Name of obligor;

• Date of maturity;

• Interest rate;

• Interest due date;

• Principal exchange, if listed on an exchange;

• Nine-digit CUSIP number; and

• Ticker symbol if applicable.

If the stock or bond is unlisted, show the company’s principal business office.

If the gross estate includes any interest in a trust, partnership, or closely held entity, provide the federal employer

identification number (FEIN) of the entity in the “Description” or separate column on Schedules B, E, F, G, M, and O,

where applicable. You must also provide the FEIN of the estate (if any) in the “Description” or separate column on

the above-noted schedules, where applicable.

The Committee on Uniform Security Identification Procedure (CUSIP) number is a nine-digit number that is assigned

to all stocks and bonds traded on major exchanges and many unlisted securities. Historically, the CUSIP number was

printed on the face of the stock certificate. The CUSIP number may be obtained through the company’s transfer

agent.

Valuaon

List the fair market value (FMV) of the stocks or bonds. The FMV of a stock or bond (whether listed or unlisted) is

the mean between the highest and lowest selling prices quoted on the valuation date. If only the closing selling

prices are available, then the FMV is the mean between the quoted closing selling price on the valuation date and

on the trading day before the valuation date.

If there were no sales on the valuation date, figure the FMV as follows.

1. Find the mean between the highest and lowest selling prices on the nearest trading date before and the

nearest trading date after the valuation date. Both trading dates must be reasonably close to the valuation

date.

2. Prorate the difference between the mean prices to the valuation date.

3. Add or subtract (whichever applies) the prorated part of the difference to or from the mean price figured for

the nearest trading date before the valuation date.

If no actual sales were made reasonably close to the valuation date, make the same computation using the mean

between the bona fide bid and asked prices instead of sales prices. If actual sales prices or bona fide bid and asked

prices are available within a reasonable period of time before the valuation date but not after the valuation date,

or vice versa, use the mean between the highest and lowest sales prices or bid and asked prices as the FMV.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 13

For example, assume that sales of stock nearest the valuation date (June 15) occurred two trading days before

(June 13) and three trading days after (June 18). On those days, the mean sale prices per share were $10 and

$15, respectively. Therefore, the price of $12 is considered the FMV of a share of stock on the valuation date. If,

however, on June 13 and 18, the mean sale prices per share were $15 and $10, respectively, the FMV of a share of

stock on the valuation date is $13.

If only closing prices for bonds are available, see IRC Regulations §20.2031-2(b).

Apply the rules in IRC §2031 to determine the value of inactive stock and stock in close corporations. Send with the

schedule complete financial and other data used to determine value, including balance sheets (particularly the one

nearest to the valuation date) and statements of the net earnings or operating results and dividends paid for each

of the five years immediately before the valuation date.

Securities reported as of no value, nominal value, or obsolete should be listed last. Include the address of the

company and the state and date of the incorporation. Submit copies of correspondence or statements used to

determine the “no value.”

If the security was listed on more than one stock exchange, use either the records of the exchange where the

security is principally traded or the composite listing of combined exchanges, if available, in a publication of general

circulation. In valuing listed stocks and bonds, you should carefully check accurate records to obtain values for the

applicable valuation date.

If you get quotations from brokers, or evidence of the sale of securities from the officers of the issuing companies,

submit to the schedule copies of the documents furnishing these quotations or evidence of sale.

Instrucons for Schedule C - Mortgages, notes, and cash

Complete Schedule C and file it with your return if the

total gross estate contains any:

• Mortgages;

• Notes; or

• Cash.

List on Schedule C:

• Mortgages and notes payable to the decedent at the

time of death; and

• Cash the decedent had at the date of death.

Do not list on Schedule C:

• Mortgages and notes payable by the decedent. (If

these are deductible, list them on Schedule K.)

List these items on Schedule C:

1. Mortgages;

2. Promissory notes;

3. Contracts by decedent to sell land;

4. Cash in possession; and

5. Cash in banks, savings and loan associations,

brokerage accounts and other types of financial

organizations.

What to enter in the “descripon” column:

For mortgages payable to the decedent, list:

• Face value;

• Unpaid balance;

• Date of mortgage;

• Date of maturity;

• Name of maker;

• Property mortgaged;

• Interest dates; and

• Interest rate.

Example to enter in “Descripon” column:

“Bond and mortgage of $50,000, unpaid balance:

$24,000; dated: January 1, 1983; John Doe to Richard

Roe; premises: 22 Clinton Street, Newark, NJ; due:

January 1, 2008; interest payable at 10% a year--January

1 and July 1”

For promissory notes, list in the same way as mortgages.

For contracts by the decedent to sell land, list:

• Name of purchaser;

• Contract date;

• Property description;

• Sale price;

• Initial payment;

• Amounts of installment payment;

• Unpaid balance of principal; and

• Interest rate.

For cash in possession, list such cash separately from

bank deposits.

For cash in banks, savings and loan associations,

brokerage accounts and other types of financial

organizations, list:

• Name and address of each financial organization;

• Amount in each account;

• Serial or account number;

• Nature of account - checking, savings, time deposit,

etc.; and

• Unpaid interest accrued from date of last interest

payment to the date of death.

Important: Copies of financial statements, if not

submitted with the filing, may be requested by the

department during examination.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 14

Instrucons for Schedule D - Insurance on decedent’s life

If there was any insurance on the decedent’s life, whether or not included in the gross estate, you must complete

Schedule D and file it with the return.

Insurance you must include on Schedule D. Under IRC §2042 you must include in the gross estate:

• Insurance on the decedent’s life receivable by or for the benefit of the estate; and

• Insurance on the decedent’s life receivable by beneficiaries other than the estate, as described below.

The term “insurance” refers to life insurance of every description, including death benefits paid by fraternal

beneficiary societies operating under the lodge system, and death benefits paid under no-fault automobile

insurance policies if the no-fault insurer was unconditionally bound to pay the benefit in the event of the insured’s

death.

Insurance in favor of the estate

Include on Schedule D the full amount of the proceeds of insurance on the life of the decedent receivable by

the executor or otherwise payable to or for the benefit of the estate. Insurance in favor of the estate includes

insurance used to pay the estate tax, and any other taxes, debts, or charges that are enforceable against the estate.

The manner in which the policy is drawn is immaterial as long as there is an obligation, legally binding on the

beneficiary, to use the proceeds to pay taxes, debts, or charges. You must include the full amount even though the

premiums or other consideration may have been paid by a person other than the decedent.

Insurance receivable by beneciaries other than the estate

Include on Schedule D the proceeds of all insurance on the life of the decedent not receivable by or for the benefit

of the decedent’s estate if the decedent possessed at death any of the incidents of ownership, exercisable either

alone or in conjunction with any person.

Incidents of ownership in a policy include:

• The right of the insured or estate to its economic benefits;

• The power to change the beneficiary;

• The power to surrender or cancel the policy;

• The power to assign the policy or to revoke an assignment;

• The power to pledge the policy for a loan;

• The power to obtain from the insurer a loan against the surrender value of the policy; and

• A reversionary interest if the value of the reversionary interest was more than 5% of the value of the policy

immediately before the decedent died. (An interest in an insurance policy is considered a reversionary interest

if, for example, the proceeds become payable to the insured’s estate or payable as the insured directs if the

beneficiary dies before the insured).

Life insurance not includible in the gross estate under IRC §2042 may be includible under some other section

of the IRC. For example, a life insurance policy could be transferred by the decedent in such a way that it would

be includible in the gross estate under IRC §2036, §2037, or §2038. (See the instructions to Schedule G for a

description of these sections of the IRC)

Compleng the schedule

You must list every policy of insurance on the life of the decedent, whether or not it is included in the gross estate.

Under “Description” list:

• Name of the insurance company; and

• Number of the policy.

For every policy of life insurance listed on the schedule, you must request a statement on Federal Form 712, Life

Insurance Statement, from the company that issued the policy. Include a copy of the Federal Form 712 with the

filing.

If the policy proceeds are paid in one sum, enter the net proceeds received (from Federal Form 712, Line 24) in the

value (and alternate value) columns of Schedule D. If the policy proceeds are not paid in one sum, enter the value

of the proceeds as of the date of the decedent’s death (from Federal Form 712, Line 25).

If part or all of the policy proceeds are not included in the gross estate, you must explain why they were not

included.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 15

Instrucons for Schedule E - Jointly owned property

You must complete Schedule E and file it with the return if the decedent owned any joint property at the time of

death, whether or not the decedent’s interest is includible in the gross estate.

Enter on this schedule all property of whatever kind or character, whether real estate, personal property, or

bank accounts, in which the decedent held at the time of death an interest either as a joint tenant with right to

survivorship or as a tenant by the entirety.

Do not list on this schedule property that the decedent held as a tenant in common, but report the value of the

interest on Schedule A if real estate, or on the appropriate schedule if personal property. Similarly, community

property held by the decedent and spouse should be reported on the appropriate Schedules A through I. The

decedent’s interest in a partnership should not be entered on this schedule unless the partnership interest itself

is jointly owned. Solely owned partnership interests should be reported on Schedule F - Other miscellaneous

property.

Part 1 - Qualied joint interests held by decedent and spouse

Under IRC §2040(b)(2), a joint interest is a qualified joint interest if the decedent and the surviving spouse held the

interest as:

• Tenants by the entirety; or

• Joint tenants with right of survivorship if the decedent and the decedent’s spouse are the only joint tenants.

Interests that meet either of the two requirements above should be entered in Part 1. Joint interests that do not

meet either of the two requirements above should be entered in Part 2.

Under “Description,” describe the property as required in the instructions for Schedules A, B, C, and F for the type

of property involved. For example, jointly held stocks and bonds should be described using the rules given in the

instructions to Schedule B.

Under “Alternate value” and “Value at date of death,” enter the full value of the property.

Note: You cannot claim the special treatment under IRC §2040(b) for property held jointly by a decedent and a

surviving spouse who is not a U.S. Citizen. You must report these joint interests on Part 2 of Schedule E, not Part 1.

Part 2 - All other joint interests

All joint interests that were not entered in Part 1 must be entered in Part 2.

For each item of property, enter the appropriate letter A, B, C, etc., from Line 2a to indicate the name and address

of the surviving co-tenant.

Under “Description,” describe the property as required in the instructions for Schedules A, B, C, and F for the type

of property involved.

In the “Percentage includible” column, enter the percentage of the total value of the property that you intend to

include in the gross estate.

Generally, you must include the full value of the jointly owned property in the gross estate. However, the full

value should not be included if you can show that a part of the property originally belonged to the other tenant

or tenants and was never received or acquired by the other tenant or tenants from the decedent for less than

adequate and full consideration in money or money’s worth, or unless you can show that any part of the property

was acquired with consideration originally belonging to the surviving joint tenant or tenants. In this case, you may

exclude from the value of the property an amount proportionate to the consideration furnished by the other tenant

or tenants. Relinquishing or promising to relinquish dower, curtesy, or statutory estate created instead of dower

or curtesy, or other marital rights in the decedent’s property or estate is not consideration in money or money’s

worth. See the Schedule A instructions for the value to show for real property that is subject to a mortgage.

If the property was acquired by the decedent and another person or persons by gift, bequest, devise, or inheritance

as joint tenants, and their interests are not otherwise specified by law, include only that part of the value of the

property that is figured by dividing the full value of the property by the number of joint tenants.

If you believe that less than the full value of the entire property is includible in the gross estate for tax purposes,

you must establish the right to include the smaller value by submitting proof of the extent, origin, and nature of the

decedent’s interest and the interest(s) of the decedent’s co-tenant or co-tenants.

In the “Includible alternate value” and “Includible value at date of death” columns, you should enter only the

values that you believe are includible in the gross estate.

Estate Tax Filing Instructions

REV 85 0050 Instructions (11/29/2022) Page 16

Instrucons for Schedule F - Other miscellaneous property not reportable under

any other schedule

You must answer the quesons at the top of Schedule F and submit it, even if no values are reported on the schedule.

On Schedule F, list all items that must be included in the gross estate that are not reported on any other schedule,

including:

• Debts due the decedent (other than notes and

mortgages included on Schedule C);

• Interests in businesses;

• Insurance on the life of another (obtain and submit

Federal Form 712, Life Insurance Statement, for each

policy) (see note below regarding single premium or

paid-up policies);

• RCW 83.100.047 and/or IRC §2044 property

(complete Addendum # 1 and see Decedent who was

a surviving spouse below);

• Claims (including the value of the decedent’s interest

in a claim for refund of income taxes or the amount

of the refund actually received);

• Rights;

• Royalties;

• Leaseholds;

• Judgments;

• Reversionary or remainder interests;

• Shares in trust funds (submit a copy of the trust

instrument);

• Household goods, furnishings, and personal effects,

including wearing apparel;

• Farm products and growing crops;

• Livestock;

• Farm machinery; and

• Automobiles.

If the decedent owned any interest in a partnership or unincorporated business, a business appraisal is the

preferred method of determining the true fair market value. A business appraisal will capture the value of all assets

owned by the business including intangibles and goodwill, not just the book value.

If a business appraisal is not provided, care should be taken to account for the value of the intangible assets owned

by the business, including goodwill. Submit a statement of assets and liabilities for the valuation date and for the

five years before the valuation date. Also submit statements of the net earnings for the same five years. In general,

furnish the same information and follow the method used to value a closely held corporation. See the instructions

for Schedule B.

All partnership interests should be reported on Schedule F unless the partnership interest, itself, is jointly owned.

Jointly owned partnership interests should be reported on Schedule E.

If real estate is owned by the sole proprietorship, it should be reported on Schedule F and not on Schedule A.

Describe the real estate with the same detail required for Schedule A.

Note for single premium or paid-up policies: In certain situations, for example, where the surrender value of the

policy exceeds its replacement cost the true economic value of the policy will be greater than the amount shown