Contents

What’s New .................. 1

Future Developments ............ 1

Introduction .................. 1

What Is Fair Market Value (FMV)? ..... 2

Valuation of Various Kinds of

Property ................. 4

Substantiation of Noncash

Charitable Contributions ....... 9

Penalty .................... 12

How To Get Tax Help ............ 12

Index ..................... 15

What’s New

New actuarial tables. New actuarial tables

used to determine the present value of a chari-

table interest donated to a charitable organiza-

tion have been published. These new actuarial

tables were effective June 1, 2023. However, for

a period prior to June 1, 2023, there is a transi-

tional rule allowing filers to elect to use either

the former or the new actuarial tables. The tran-

sitional rule applies for donations with valuation

dates from May 1, 2019, through June 1, 2023.

See Actuarial tables, later.

Future Developments

For the latest information about developments

related to Pub. 561, such as legislation enacted

after it was published, go to IRS.gov/Pub561.

Introduction

This publication is designed to help donors and

appraisers determine the value of property

(other than cash) that is given to qualified or-

ganizations. It also explains what kind of infor-

mation you must have to support the charitable

contribution deduction you claim on your return.

This publication does not discuss how to fig-

ure the amount of your deduction for charitable

contributions or written records and substantia-

tion required. See Pub. 526, Charitable Contri-

butions, for this information.

Comments and suggestions. We welcome

your comments about this publication and sug-

gestions for future editions.

You can send us comments through

IRS.gov/FormComments. Or, you can write to

the Internal Revenue Service, Tax Forms and

Publications, 1111 Constitution Ave. NW,

IR-6526, Washington, DC 20224.

Although we can’t respond individually to

each comment received, we do appreciate your

feedback and will consider your comments and

suggestions as we revise our tax forms, instruc-

tions, and publications. Don’t send tax

Department

of the

Treasury

Internal

Revenue

Service

Publication 561

(Rev. February 2024)

Cat. No. 15109Q

Determining

the Value of

Donated

Property

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (Tiếng Việt)

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 8

Draft Ok to Print

AH XSL/XML

Fileid: … ons/p561/202402/a/xml/cycle09/source (Init. & Date) _______

Page 1 of 15 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Mar 11, 2024

questions, tax returns, or payments to the above

address.

Getting answers to your tax questions.

If you have a tax question not answered by this

publication or the How To Get Tax Help section

at the end of this publication, go to the IRS In-

teractive Tax Assistant page at IRS.gov/

Help/ITA where you can find topics by using the

search feature or viewing the categories listed.

Getting tax forms, instructions, and pub

lications. Go to IRS.gov/Forms to download

current and prior-year forms, instructions, and

publications.

Ordering tax forms, instructions, and

publications. Go to IRS.gov/OrderForms to or-

der current forms, instructions, and publica-

tions; call 800-829-3676 to order prior-year

forms and instructions. The IRS will process

your order for forms and publications as soon

as possible. Don’t resubmit requests you’ve al-

ready sent us. You can get forms and publica-

tions faster online.

Useful Items

You may want to see:

Publication

526 Charitable Contributions

Forms (and Instructions)

8282 Donee Information Return

8283 Noncash Charitable Contributions

8283-V Payment Voucher for Filing Fee

Under Section 170(f)(13)

See How To Get Tax Help near the end of this

publication for information about getting these

publications and forms.

What Is Fair Market

Value (FMV)?

To figure how much you may deduct for prop-

erty that you contribute, you must first deter-

mine its FMV on the date of the contribution.

This publication focuses the valuation of non-

cash property being contributed after January

1, 2019, to a charity that qualifies under section

170(c) for an income tax charitable contribution

deduction.

FMV. FMV is the price that property would sell

for on the open market. It is the price that would

be agreed on between a willing buyer and a will-

ing seller, with neither being required to act, and

both having reasonable knowledge of the rele-

vant facts. In addition to this general rule, there

are special rules used to value certain types of

property such as remainder interests, annuities,

interests for life or for a term of years, and rever-

sions, discussed below.

Example 1. If you give an item of used

clothing that is in good used condition or better

to the Salvation Army, the FMV would be the

price that typical buyers actually pay for clothing

of this age, condition, style, and use. Usually,

such items are worth far less than what you paid

for them.

526

8282

8283

8283-V

Example 2. If you donate land and restrict

its use to agricultural purposes, you must value

the land at its value for agricultural purposes,

even if it would have a higher FMV if it were not

restricted.

Factors. In making and supporting the val-

uation of property, all factors affecting value are

relevant and must be considered. These in-

clude, but are not limited to:

•

The cost or selling price of the item,

•

Sales of comparable properties,

•

Replacement cost, and

•

Opinions of professional appraisers.

These factors are discussed later. Also, see

Table 1 for a summary of questions to ask as

you consider each factor.

Date of contribution. Ordinarily, the date of a

contribution is the date on which the property is

delivered to the charity or the title transfer date,

provided you do not retain any right to or inter-

est in the property that would limit the charity's

use of the property.

Stock. If you deliver, without any condi-

tions, a properly endorsed stock certificate to a

qualified organization or to an agent of the or-

ganization, the date of the contribution is the

date of delivery. If the certificate is mailed and

received through the regular mail, it is the date

of mailing. If you deliver the certificate to a bank

or broker acting as your agent or to the issuing

corporation or its agent, for transfer into the

name of the organization, the date of the contri-

bution is the date the stock is transferred on the

books of the corporation.

Options. If you grant an option to a quali-

fied organization to buy real property, you have

not made a charitable contribution until the or-

ganization exercises the option. The amount of

the contribution is the FMV of the property on

the date the option is exercised minus the exer-

cise price.

Example. You grant an option to a local

university, which is a qualified organization, to

buy real property. Under the option, the univer-

sity could buy the property at any time during a

2-year period for $40,000. The FMV of the prop-

erty on the date the option is granted is

$50,000.

In the following tax year, the university exer-

cises the option. The FMV of the property on

the date the option is exercised is $55,000.

Therefore, you have made a charitable contribu-

tion of $15,000 ($55,000, the FMV, minus

$40,000, the exercise price) in the tax year the

option is exercised.

Determining FMV

Determining the value of donated property de-

pends upon many factors. You should consider

all the facts and circumstances connected with

the property, including any recent transactions,

in determining value. Value may also be based

on desirability, use, condition, scarcity, and mar-

ket demand for that property. Depending on the

type of property, there may be other characteris-

tics that are relevant in determining its value.

Cost or Selling Price of the

Donated Property

The cost of the property to you or the actual

selling price received by the qualified organiza-

tion may be the best indication of its FMV. How-

ever, because conditions in the market change,

the cost or selling price of property may have

less weight if the property was not bought or

sold at a time that is reasonably close to the

date of contribution.

The cost or selling price is a good indication

of the property's value if:

•

The purchase or sale took place close to

the valuation date in an open market,

•

The purchase or sale was at “arm's-length,”

•

The buyer and seller knew all relevant

facts,

•

The buyer and seller did not have to act,

and

•

The market did not change between the

date of purchase or sale and the valuation

date.

Example. Bailey Morgan, who is not a

dealer in gems, bought an assortment of gems

for $5,000 from a promoter. The promoter

claimed that the price was “wholesale” even

though this dealer and other dealers made simi-

lar sales at similar prices to other persons who

were not dealers. The promoter said that if Bai-

ley kept the gems for more than 1 year and then

gave them to charity, Bailey could claim a chari-

table deduction of $15,000, which, according to

the promoter, would be the value of the gems at

the time of contribution. Bailey gave the gems to

a qualified charity 13 months after buying them.

The selling price for these gems had not

changed from the date of purchase to the date

Bailey donated them to charity. The best evi-

dence of FMV depends on actual transactions

and not on some artificial estimate. The $5,000

paid by Bailey and others is, therefore, the best

evidence of the maximum FMV of the gems.

Terms of the purchase or sale. The terms of

the purchase or sale should be considered in

determining FMV if they influenced the price.

These terms include any restrictions, under-

standings, or covenants limiting the use or dis-

position of the property.

Rate of increase or decrease in value. Un-

less you can show that there were unusual cir-

cumstances, it is assumed that the increase or

decrease in the value of your donated property

from your cost has been at a reasonable rate.

For time adjustments, an appraiser may con-

sider published price indexes for information on

general price trends, building costs, commodity

costs, securities, and works of art sold at auc-

tion in arm's-length sales.

Example. Corey Brown bought a painting

for $10,000. Thirteen months later, Corey gave

it to an art museum, claiming a charitable de-

duction of $15,000 on their tax return. The ap-

praisal of the painting should include informa-

tion showing that there were unusual

circumstances that justify a 50% increase in

value for the 13 months Corey held the property.

Page 2 of 15 Fileid: … ons/p561/202402/a/xml/cycle09/source 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2 Publication 561 (2-2024)

Arm's-length offer. An arm's-length offer to

buy the property close to the valuation date may

help to prove its value if the person making the

offer was willing and able to complete the trans-

action. To rely on an offer, you should be able to

show proof of the offer and the specific amount

to be paid. Offers to buy property other than the

donated item will help to determine value if the

other property is reasonably similar to the dona-

ted property.

Sales of Comparable Properties

The sales prices of properties similar to the do-

nated property are often important in determin-

ing the FMV. The weight to be given to each

sale depends on the following.

•

The degree of similarity between the prop-

erty sold and the donated property.

•

The time of the sale—whether it was close

to the valuation date.

•

The circumstances of the sale—whether it

was at arm's-length with a knowledgeable

buyer and seller, with neither having to act.

•

The conditions of the market in which the

sale was made—whether unusually infla-

ted or deflated.

The comparable sales method of valuing real

estate is explained later under Valuation of Vari-

ous Kinds of Property.

Example 1. Quinn Black, who is not a book

dealer, paid a promoter $10,000 for 500 copies

of a single edition of a modern translation of a

religious book. The promoter had claimed that

the price was considerably less than the “retail”

price and gave Quinn a statement that the

books had a total retail value of $30,000. The

promoter advised that if Quinn kept the books

for more than 1 year and then gave them to a

qualified organization, Quinn could claim a

charitable deduction for the “retail” price of

$30,000. Thirteen months later, all the books

were given to a house of worship from a list pro-

vided by the promoter. At the time of the dona-

tion, wholesale dealers were selling similar

quantities of books to the general public for

$10,000.

The FMV of the books is $10,000, the price

at which similar quantities of books were being

sold to others at the time of the contribution.

Example 2. The facts are the same as in

Example 1, except that the promoter gave

Quinn Black a second option. The promoter

said that if Quinn wanted a charitable deduction

within 1 year of the purchase, Quinn could buy

the 500 books at the “retail” price of $30,000,

paying only $10,000 in cash and giving a prom-

issory note for the remaining $20,000. The prin-

cipal and interest on the note would not be due

for 12 years. According to the promoter, Quinn

could then, within 1 year of the purchase, give

the books to a qualified organization and claim

the full $30,000 retail price as a charitable con-

tribution. Quinn purchased the books under the

second option and, 3 months later, gave them

to a house of worship, which will use the books

for religious purposes.

At the time of the gift, the promoter was sell-

ing similar lots of books for either $10,000 or

$30,000. The difference between the two prices

was solely at the discretion of the buyer. The

promoter was a willing seller for $10,000.

Therefore, the value of Quinn’s contribution of

the books is $10,000, the amount at which simi-

lar lots of books could be purchased from the

promoter by members of the general public.

Replacement Cost

The cost of buying, building, or manufacturing

property similar to the donated item may be

considered in determining FMV. However, there

must be a reasonable relationship between the

replacement cost and the FMV.

The replacement cost is the amount it would

cost to replace the donated item on the valua-

tion date. Often, there is no relationship be-

tween the replacement cost and the FMV. If the

supply of the donated property is more or less

than the demand for it, the replacement cost be-

comes less important.

To determine the replacement cost of the

donated property, find the “estimated replace-

ment cost new.” Then subtract from this figure

an amount for depreciation due to the physical

condition and obsolescence of the donated

property. You should be able to show the rela-

tionship between the depreciated replacement

cost and the FMV, as well as how you arrived at

the “estimated replacement cost new.”

Opinions of Professional

Appraisers

Generally, the weight given to a professional ap-

praiser’s opinion on matters such as the authen-

ticity of a coin or a work of art, or the most profit-

able and best use of a piece of real estate,

depends on the knowledge and competence of

the professional appraiser and the thorough-

ness with which the opinion is supported by ex-

perience and facts. For a professional apprais-

er’s opinion to deserve much weight, the facts

must support the opinion. For additional infor-

mation, see Appraisal, later.

Problems in Determining

FMV

There are a number of problems in determining

the FMV of donated property.

Unusual Market Conditions

The sale price of the property itself in an

arm's-length transaction in an open market is

often the best evidence of its value. When you

rely on sales of comparable property, the sales

must have been made in an open market. If

those sales were made in a market that was ar-

tificially supported or stimulated so as not to be

truly representative, the prices at which the

sales were made will not indicate the FMV.

For example, liquidation sale prices usually

do not indicate the FMV. Also, sales of stock un-

der unusual circumstances, such as sales of

small lots, forced sales, and sales in a restricted

market, may not represent the FMV.

Selection of Comparable Sales

Using sales of comparable property is an impor-

tant method for determining the FMV of dona-

ted property. However, the amount of weight

given to a sale depends on the degree of simi-

larity between the comparable and the donated

properties. The degree of similarity must be

close enough so that this selling price would

have been given consideration by reasonably

well-informed buyers or sellers of the property.

Example. You give a rare, old book to your

former college. The book is a third edition and is

in poor condition because of a missing back

cover. You discover that there was a sale for

$300, near the valuation date, of a first edition of

the book that was in good condition. Although

the contents are the same, the books are not at

all similar because of the different editions and

their physical condition. Little consideration

would be given to the selling price of the $300

property by knowledgeable buyers or sellers.

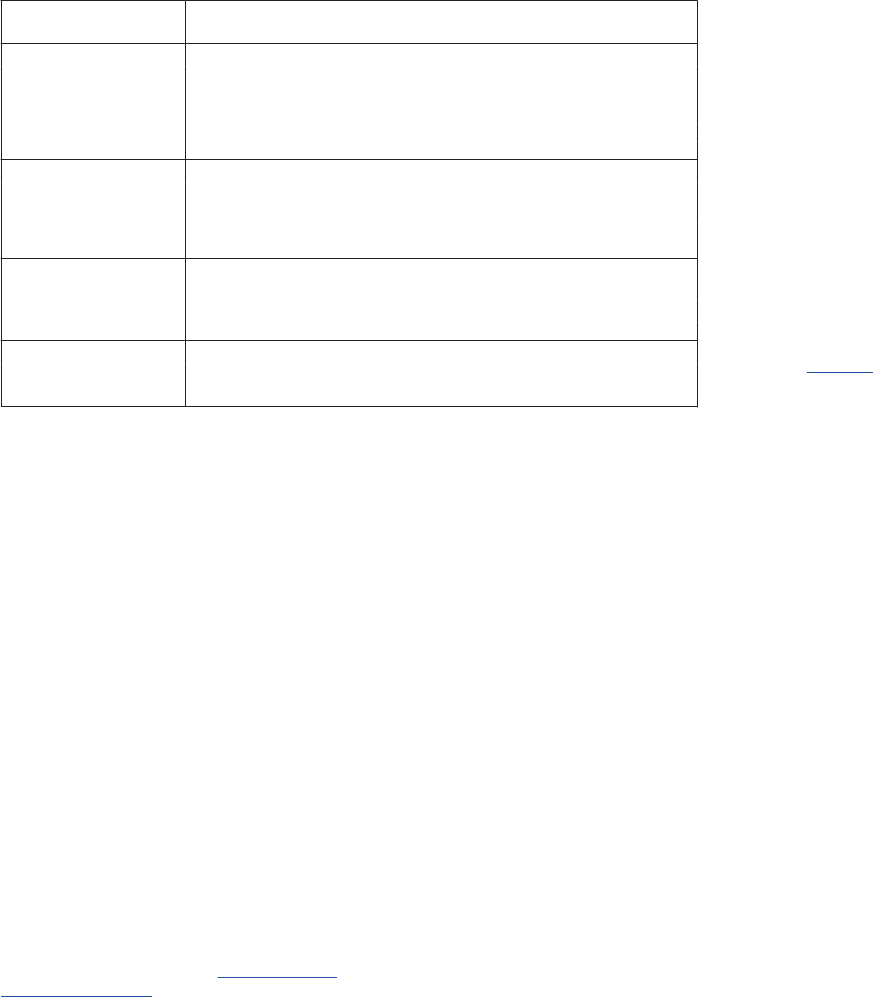

Table 1. Factors That Affect FMV

IF the factor you are

considering is... THEN you should ask these questions...

cost or selling price Was the purchase or sale of the property reasonably close to the date of contribution?

Was any increase or decrease in value, as compared to your cost, at a reasonable

rate?

Do the terms of purchase or sale limit what can be done with the property?

Was there an arm's-length offer to buy the property close to the valuation date?

sales of comparable

properties

How similar is the property sold to the property donated?

How close is the date of sale to the valuation date?

Was the sale at arm's-length?

What was the condition of the market at the time of sale?

replacement cost What would it cost to replace the donated property?

Is there a reasonable relationship between replacement cost and FMV?

Is the supply of the donated property more or less than the demand for it?

opinions of professional

appraisers

Is the professional appraiser knowledgeable and competent?

Is the opinion thorough and supported by facts and experience?

Page 3 of 15 Fileid: … ons/p561/202402/a/xml/cycle09/source 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Publication 561 (2-2024) 3

Future Events

You may not consider unexpected events hap-

pening after your donation of property in making

the valuation. You may consider only the facts

known at the time of the gift, and those that

could reasonably be expected at the time of the

gift.

Example. You give farmland to a qualified

charity. The transfer provides that your mother

will have the right to all income and full use of

the property for her life. Even though your

mother dies 1 week after the transfer, the value

of the property on the date it is given is its

present value, subject to the life interest as esti-

mated from actuarial tables. You may not take a

higher deduction because the charity received

full use and possession of the land only 1 week

after the transfer.

Using Past Events To Predict the

Future

A common error is to rely too much on past

events that do not fairly reflect the probable fu-

ture earnings and FMV.

Example. You give all your rights in a suc-

cessful patent to your favorite charity. Your re-

cords show that before the valuation date there

were three stages in the patent's history of

earnings. First, there was rapid growth in earn-

ings when the invention was introduced. Then,

there was a period of high earnings when the in-

vention was being exploited. Finally, there was a

decline in earnings when competing inventions

were introduced. The entire history of earnings

may be relevant in estimating the future earn-

ings. However, the appraiser must not rely too

much on the stage of rapid growth in earnings

or of high earnings. The market conditions at

those times do not represent the condition of

the market at the valuation date. What is most

significant is the trend of decline in earnings up

to the valuation date. For more information

about donations of patents, see Patents, later.

Valuation of Various

Kinds of Property

This section contains information on determin-

ing the FMV of ordinary kinds of donated prop-

erty. For information on appraisals, see Ap-

praisal, later.

Household Items

The FMV of used household items is usually

much lower than the price paid when new.

Household items include furniture, furnishings,

electronics, appliances, linens, and similar

items. Household items do not include paint-

ings, antiques, objects of art, jewelry, gems, and

collections like stamp and coin collections.

Such used property may have little or no market

value because it may be out of style.

You cannot take an income tax charitable

contribution deduction for household items un-

less they are in good used condition or better.

The one exception to this is a household item

that is not in good used condition or better for

which you claim an income tax charitable contri-

bution deduction of more than $500. In this

case, you must obtain a qualified appraisal valu-

ing the item and complete a Form 8283. See

Deduction over $500 for certain clothing or

household items, later.

If the property is valuable because it is old or

unique, see Art and Collectibles, later.

Used Clothing

Used clothing and other personal items are usu-

ally worth far less than the price you paid for

them. Valuation of items of clothing does not

lend itself to fixed formulas or methods.

The price that buyers of used items actually

pay in used clothing stores, such as consign-

ment or thrift shops, is an indication of the

value.

You cannot take an income tax charitable

contribution deduction for an item of clothing

unless it is in good used condition or better. An

item of clothing that is not in good used condi-

tion or better for which you claim an income tax

charitable contribution deduction of more than

$500 requires a qualified appraisal and a com-

pleted Form 8283. See Deduction over $500 for

certain clothing or household items, later.

Art and Collectibles

Your income tax charitable contribution dona-

tion of art and collectibles, for which you claim a

deduction of more than $5,000 must be suppor-

ted by a qualified appraisal and a Form 8283.

See Qualified Appraisal, later.

Art valued at $20,000 or more. If you claim a

deduction of $20,000 or more for an income tax

charitable contribution donation of art, you must

attach the qualified appraisal for the art. A pho-

tograph of a size and quality fully showing the

object, preferably a high-resolution digital im-

age, must be provided if requested.

Art valued at $50,000 or more. If you donate

an item of art that has been appraised at

$50,000 or more, you can request a Statement

of Value for that item from the IRS. You must re-

quest the statement before filing the tax return

that reports the donation. Your request must in-

clude the following.

•

A copy of a qualified appraisal of the item.

See Qualified Appraisal, later.

•

A user fee of $7,500 for one to three items

and $400 for each additional item paid

through Pay.gov. A payment confirmation

will be provided to you through the Pay.gov

portal and you should submit the payment

confirmation with your Statement of Value

request.

•

A completed Form 8283, Section B.

•

The location of the IRS territory that has

examination responsibility for your return.

If your request lacks essential information, you

will be notified and given 30 days to provide the

missing information.

Send your request to:

Internal Revenue Service/Appeals

Attn: Art Appraisal Services

Request for Statement of Value

1111 Constitution Ave. NW, Room 3615

Washington, DC 20224–0002

Refunds. You can withdraw your request

for a Statement of Value at any time before it is

issued. However, the IRS will not refund the

user fee if you do.

If the IRS declines to issue a Statement of

Value in the interest of efficient tax administra-

tion, the IRS will refund the user fee.

Art. Because many kinds of art may be the

subject of a charitable donation, it is not possi-

ble to discuss all of the possible types in this

publication. Most common are paintings, sculp-

tures, watercolors, prints, drawings, ceramics,

antiques, decorative arts, textiles, carpets, sil-

ver, rare manuscripts, and historical memora-

bilia.

Authenticity. The professional appraiser

should use reasonable due diligence to deter-

mine or confirm the authenticity of a donated art

work. This due diligence may include verifying

whether the art work is included in the relevant

catalogue raisonné (a scholarly listing of all

known works by a specific artist), has an as-

signed foundation number when relevant, is in-

cluded in a comprehensive on-line archive, or

whether the art work has an accompanying cer-

tificate of authenticity from a recognized author-

ity or expert on the artist.

Physical condition. The physical condi-

tion and extent of restoration are both relevant

in determining the valuation of art and antiques.

These factors should be addressed in the ap-

praisal. An antique in damaged condition lack-

ing the "original brasses," may be worth much

less than a similar piece in excellent condition.

Collectibles. Because many kinds of collecti-

bles may be the subject of a charitable dona-

tion, it is not possible to discuss all of the possi-

ble types in this publication. Most common are

rare books, autographs, sports memorabilia,

dolls, manuscripts, stamps, coins, guns, gems,

jewelry, music and entertainment memorabilia,

comics, toys, and natural history items.

Reference material. Publications availa-

ble to help you determine the value of many

kinds of collections include catalogs, dealers'

price lists, and specialized hobby periodicals.

When using one of these price guides, you

must use the current edition at the date of con-

tribution.

These sources are not always reliable

indicators of FMV and should be sup-

ported by other evidence.

For example, a dealer may sell an item for

much less than is shown on a price list, particu-

larly after the item has remained unsold for a

long time. The price an item sold for in an auc-

tion may have been the result of a rigged sale or

a mere bidding duel. The appraiser must ana-

lyze the reference material, and recognize and

make adjustments for misleading entries. If you

are claiming an income tax charitable contribu-

tion deduction for the donation of a collection

CAUTION

!

Page 4 of 15 Fileid: … ons/p561/202402/a/xml/cycle09/source 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

4 Publication 561 (2-2024)

valued at more than $5,000, you must obtain a

qualified appraisal and complete a Form 8283.

Gems and jewelry. Gems and jewelry are

of such a specialized nature that it is almost al-

ways necessary to get an appraisal by a speci-

alized jewelry appraiser. The appraisal should

describe, among other things, the style of the

jewelry, the cut and setting of the gem, and

whether it is now in fashion. The stone's color-

ing, weight, cut, brilliance, and flaws should be

reported and analyzed. Sentimental personal

value has no effect on FMV. But if the jewelry

was owned by a famous person, its value might

increase. GIA certificates and color photos

should be included in jewelry appraisals.

Stamp collections. Most libraries have

catalogs or other books that report the publish-

er's estimate of values. Generally, two price lev-

els are shown for each stamp: the price post-

marked and the price not postmarked. Contact

an appraiser for assistance with properly valu-

ing stamp collections.

Coin collections. Many catalogs and other

reference materials show the writer's or publish-

er's opinion of the value of coins on or near the

date of the publication. Like many other collec-

tors' items, the value of a coin depends on the

demand for it, its age, and its rarity. Another im-

portant factor is the coin's condition. For exam-

ple, there is a great difference in the value of a

coin that is in mint condition and a similar coin

that is only in good condition.

Use caution when consulting price guides

for coins as only a trained grader can distin-

guish the difference between various Mint State

grades and circulated grades including ex-

tremely fine, very fine, fine, very good, good,

fair, or poor. The difference in value between

one grade and another could be vast.

Books. The value of books is usually deter-

mined by selecting comparable sales and ad-

justing the prices according to the differences

between the comparable sales and the item be-

ing evaluated. This can be difficult to do and,

except for a collection of little value, should be

done by a specialized appraiser.

Modest value of collection. If the collec-

tion you are donating is of modest value, not re-

quiring a written appraisal, the following infor-

mation may help you in determining the FMV.

A book that is very old, or very rare, is not

necessarily valuable. There are many books

that are very old or rare, but that have little or no

market value.

Condition of book. The condition of a

book may have a great influence on its value.

Collectors are interested in items that are in

fine, or at least good, condition. When a book

has a missing page, a loose binding, tears, or

stains, or is otherwise in poor condition, its

value is greatly lowered.

Other factors. Some other factors in the

valuation of a book are the kind of binding

(leather, cloth, paper), page edges, and illustra-

tions (drawings and photographs). Collectors

usually want first editions of books. However,

because of changes or additions, other editions

are sometimes worth as much as, or more than,

the first edition.

Manuscripts, autographs, diaries, and

similar items. When these items are hand-

written, or at least signed by famous people,

they are often in demand and are valuable.

However, the noteworthiness of an author is not

the only determining factor; the writings of un-

known or obscure authors may also be of value

if they are of unusual historical or literary impor-

tance. Determining the value of such material is

difficult. For example, there may be a great dif-

ference in value between two diaries that were

kept by a famous person—one kept during

childhood and the other during a later period in

their life. The appraiser determines a value in

these cases by applying knowledge and judg-

ment to such factors as comparable sales and

market conditions.

Cars, Boats, and Aircraft

If you donate a car, a boat, or an aircraft to a

charitable organization, its FMV must be deter-

mined.

Certain commercial firms and trade organi-

zations publish monthly or seasonal guides for

different regions of the country, containing com-

plete dealer sale prices or dealer average pri-

ces for recent model years. Prices are reported

for each make, model, and year. These guides

also provide estimates for adjusting for unusual

equipment, unusual mileage, and physical con-

dition. The prices are not “official,” and these

publications are not considered an appraisal of

any specific donated property. But they do pro-

vide clues for making an appraisal and suggest

relative prices for comparison with current sales

and offerings in your area.

These publications are sometimes available

from public libraries or at a bank, credit union,

or finance company. You can also find pricing

information about used cars on the Internet.

An acceptable measure of the FMV of a do-

nated car, boat, or airplane is an amount not in

excess of the price listed in a used vehicle pric-

ing guide for a private party sale, not the dealer

retail value, of a similar vehicle. However, the

FMV may be less than that amount if the vehicle

has engine trouble, body damage, high mile-

age, or any type of excessive wear. The FMV of

a donated vehicle is the same as the price listed

in a used vehicle pricing guide for a private

party sale only if the guide lists a sales price for

a vehicle that is the same make, model, and

year, sold in the same area, in the same condi-

tion, with the same or similar options or acces-

sories, and with the same or similar warranties

as the donated vehicle.

Example. You donate a used car in poor

condition to a local high school for use by stu-

dents studying car repair. A used car guide

shows the dealer retail value for this type of car

in poor condition is $1,600. However, the guide

shows the price for a private party sale of the

car is only $750. The FMV of the car is consid-

ered to be no more than $750.

Boats. Except for inexpensive small boats, the

valuation of boats should be based on an ap-

praisal by a marine surveyor because the physi-

cal condition is so critical to the value.

More information. Your deduction for a dona-

ted car, boat, or airplane is generally limited to

the gross proceeds from its sale by the qualified

organization. This rule applies if the claimed

value of the donated vehicle is more than $500.

In certain cases, you can deduct the vehicle's

FMV. For details, see Pub. 526.

Inventory

If you donate any inventory item to a charitable

organization, the amount of your deductible

contribution is generally the FMV of the item,

minus any gain you would have realized if you

had sold the item at its FMV on the date of the

gift. For more information, see Pub. 526.

Patents

To determine the FMV of a patent, you must

take into account, among other factors:

•

Whether the patented technology has

been made obsolete by other technology;

•

Any restrictions on the donee's use of, or

ability to transfer, the patented technology;

and

•

The length of time remaining before the

patent expires.

However, your deduction for a donation of a

patent or other intellectual property is its FMV,

minus any gain you would have realized if you

had sold the property at its FMV on the date of

the gift. Generally, this means your deduction is

the lesser of the property's FMV or its basis. For

details, see Pub. 526.

Stocks and Bonds

The value of stocks and bonds is the FMV of a

share or bond on the valuation date. See Date

of contribution, earlier, under What Is Fair Mar-

ket Value (FMV)?

Selling prices on valuation date. If there is

an active public market for the contributed

stocks or bonds on a stock exchange, in an

over-the-counter market, or elsewhere, the FMV

of each share or bond is the average price be-

tween the highest and lowest quoted selling pri-

ces on the valuation date. For example, if the

highest selling price for a share was $11 and

the lowest $9, the average price is $10. You get

the average price by adding $11 and $9 and di-

viding the sum by 2.

No sales on valuation date. If there were

no sales on the valuation date, but there were

sales within a reasonable period before and af-

ter the valuation date, you determine FMV by

taking the average price between the highest

and lowest sales prices on the nearest date be-

fore and on the nearest date after the valuation

date. Then you weight these averages in in-

verse order by the respective number of trading

days between the selling dates and the valua-

tion date.

Example. On the day you gave stock to a

qualified organization, there were no sales of

the stock. Sales of the stock nearest the valua-

tion date took place 2 trading days before the

valuation date at an average selling price of $10

and 3 trading days after the valuation date at an

Page 5 of 15 Fileid: … ons/p561/202402/a/xml/cycle09/source 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Publication 561 (2-2024) 5

average selling price of $15. The FMV on the

valuation date was $12, figured as follows.

[(3 x $10) + (2 x $15)] ÷ 5 = $12

Listings on more than one stock ex

change. Stocks or bonds listed on more than

one stock exchange are valued based on the

prices of the exchange on which they are princi-

pally dealt. This applies if these prices are pub-

lished in a generally available listing or publica-

tion of general circulation. If this is not

applicable, and the stocks or bonds are repor-

ted on a composite listing of combined ex-

changes in a publication of general circulation,

use the composite list. See also Unavailable pri-

ces, later.

Bid and asked prices on valuation date. If

there were no sales within a reasonable period

before and after the valuation date, the FMV is

the average price between the bona fide bid

and asked prices on the valuation date.

Example. Although there were no sales of

Blue Corporation stock on the valuation date,

bona fide bid and asked prices were available

on that date of $14 and $16, respectively. The

FMV is $15, the average price between the bid

and asked prices.

No prices on valuation date. If there

were no prices available on the valuation date,

you determine FMV by taking the average pri-

ces between the bona fide bid and asked prices

on the closest trading date before and after the

valuation date. Both dates must be within a rea-

sonable period. Then you weight these aver-

ages in inverse order by the respective number

of trading days between the bid and asked

dates and the valuation date.

Example. On the day you gave stock to a

qualified organization, no prices were available.

Bona fide bid and asked prices 3 days before

the valuation date were $10 and 2 days after the

valuation date were $15. The FMV on the valua-

tion date is $13, figured as follows.

[(2 x $10)

+ (3 x $15)] ÷ 5 = $13

Prices only before or after valuation date,

but not both. If no selling prices or bona fide

bid and asked prices are available on a date

within a reasonable period before the valuation

date, but are available on a date within a rea-

sonable period after the valuation date, or vice

versa, then the average price between the high-

est and lowest of such available prices may be

treated as the value.

Large blocks of stock. When a large block of

stock is put on the market, it may lower the sell-

ing price of the stock if the supply is greater

than the demand. On the other hand, market

forces may exist that will afford higher prices for

large blocks of stock. Because of the many fac-

tors to be considered, determining the value of

large blocks of stock usually requires the help of

experts specializing in underwriting large quan-

tities of securities or in trading in the securities

of the industry of which the particular company

is a part.

Unavailable prices. If selling prices (or bid

and asked prices) are not available, you should

work with a professional appraiser to determine

the FMV of the bond or stock on the valuation

date because the analysis requires considera-

tion of factors similar to those used to value an

Interest in a Business below.

Restricted securities. Some classes of stock

cannot be traded publicly because of restric-

tions imposed by the Securities and Exchange

Commission, or by the corporate charter or a

trust agreement. These restricted securities

usually trade at a discount in relation to freely

traded securities.

You should work with a professional be-

cause the analysis requires consideration of

factors similar to those used to value an Interest

in a Business, below.

Real Estate

Because each piece of real estate is unique and

its valuation is complicated, a detailed appraisal

by a professional appraiser is necessary.

The appraiser must be thoroughly trained in

the application of appraisal principles and

theory. In some instances, the opinions of

equally qualified appraisers may carry unequal

weight, such as when one appraiser has a bet-

ter knowledge of local conditions.

The appraisal report must contain a com-

plete description of the property, such as street

address, legal description, and lot and block

number, as well as physical features, condition,

and dimensions. The use to which the property

is put, zoning and permitted uses, and its poten-

tial use for other higher and better uses are also

relevant.

In general, there are three main approaches

to the valuation of real estate. An appraisal may

require the combined use of two or three meth-

ods rather than one method only.

1. Comparable Sales

The comparable sales method compares the

donated property with several similar properties

that have been sold. The selling prices, after ad-

justments for differences in date of sale, size,

condition, and location, would then indicate the

estimated FMV of the donated property.

If the comparable sales method is used to

determine the value of unimproved real property

(land without significant buildings, structures, or

any other improvements that add to its value),

the appraiser should consider the following fac-

tors when comparing the potential comparable

property and the donated property.

•

Location, size, and zoning or use restric-

tions.

•

Accessibility and road frontage, and availa-

ble utilities and water rights.

•

Riparian rights (right of access to and use

of the water by owners of land on the bank

of a river) and existing easements,

rights-of-way, leases, etc.

•

Soil characteristics, vegetative cover, and

status of mineral rights.

•

Other factors affecting value.

For each comparable sale, the appraisal

must include the names of the buyer and seller,

the deed book and page number, the date of

sale and selling price, a property description,

the amount and terms of mortgages, property

surveys, the assessed value, the tax rate, and

the assessor's appraised FMV.

The comparable selling prices must be ad-

justed to account for differences between the

sale property and the donated property. Be-

cause differences of opinion may arise between

appraisers as to the degree of comparability

and the amount of the adjustment considered

necessary for comparison purposes, an ap-

praiser should document each item of adjust-

ment.

Only comparable sales having the least ad-

justments in terms of items and/or total dollar

adjustments should be considered as compara-

ble to the donated property.

2. Capitalization of Income

This method capitalizes the net income from the

property at a rate that represents a fair return on

the particular investment at the particular time,

considering the risks involved. The key ele-

ments are the determination of the income to be

capitalized and the rate of capitalization.

3. Replacement Cost New or

Reproduction Cost Minus

Observed Depreciation

This method, used alone, usually does not re-

sult in a determination of FMV. Instead, it gener-

ally tends to set the upper limit of value, particu-

larly in periods of rising costs, because it is

reasonable to assume that an informed buyer

will not pay more for the real estate than it would

cost to reproduce a similar property. Of course,

this reasoning does not apply if a similar prop-

erty cannot be created because of location, un-

usual construction, or some other reason. Gen-

erally, this method serves to support the value

determined from other methods. When the re-

placement cost method is applied to improved

realty, the land and improvements are valued

separately.

The replacement cost of a building is figured

by considering the materials, the quality of

workmanship, and the number of square feet or

cubic feet in the building. This cost represents

the total cost of labor and material, overhead,

and profit. After the replacement cost has been

figured, consideration must be given to the fol-

lowing factors.

•

Physical deterioration—the wear and tear

on the building itself.

•

Functional obsolescence—usually in older

buildings with, for example, inadequate

lighting, plumbing, or heating; small rooms;

or a poor floor plan.

•

Economic obsolescence—outside forces

causing the whole area to become less de-

sirable.

Page 6 of 15 Fileid: … ons/p561/202402/a/xml/cycle09/source 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

6 Publication 561 (2-2024)

Interest in a Business

The FMV of any interest in a closely held busi-

ness (whether a sole proprietorship or a busi-

ness taxed as a corporation or partnership) is

the amount that a willing buyer would pay for the

interest to a willing seller after consideration of

all relevant factors. Because of the many factors

to be considered in determining the FMV of an

interest in a closely held business, the help of

experts is usually required. Such a determina-

tion requires the consideration of all available fi-

nancial data, as well as all relevant factors af-

fecting FMV. The following factors, although not

all-inclusive, may be helpful.

•

The business's net worth and prospective

earning power.

•

The nature and history of the business.

•

The economic outlook of the industry in

which the business operates.

•

The business's position in the industry, its

competitors, and its management.

•

The FMV of assets of the business includ-

ing goodwill, if applicable.

•

The value of interests in businesses en-

gaged in the same or similar industries.

You should keep complete financial and

other information on which the valuation is

based. This includes copies of reports of exami-

nations of the business made by accountants,

engineers, or any technical experts on or close

to the valuation date.

Annuities, Interests for Life

or Terms of Years,

Remainders, and Reversions

The FMV of these kinds of property is their

present value, except in the case of annuities

under contracts issued by companies regularly

engaged in their sale. The valuation of these

commercial annuity contracts and of insurance

policies is discussed later under Certain Life In-

surance and Annuity Contracts.

To determine present value, you must know

the applicable interest rate and use actuarial ta-

bles.

Interest rate. The applicable interest rate var-

ies. It is announced monthly in a news release

and published in the Internal Revenue Bulletin

as a Revenue Ruling. The interest rate to use is

under the heading “Rate Under Section 7520”

for a given month and year. For a transfer involv-

ing a charitable interest, you may elect to use

the interest rate for the month of the donation or

the interest rate for either of the 2 preceding

months. You must use the same interest rate to

determine the present value of all interests in

that property. You must attach a statement to

the return to take the election. You can call the

IRS office at 800-829-1040 to obtain this rate.

Actuarial tables. You need to refer to actua-

rial tables to determine the present value of a

charitable interest in the form of an annuity, any

interest for life or a term of years, or remainder

interest donated to a charitable organization.

Use the actuarial tables set forth by regula-

tion for these types of interests. These tables

are referenced by and explained in IRS Pub.

1457, Actuarial Valuations, Version 4A; Pub.

1458, Actuarial Valuations, Version 4B; and

Pub. 1459, Actuarial Valuations, Version 4C.

These publications provide examples showing

the use of actuarial factors and contain links to

the tables of factors to be used in determining

the present value of an annuity, an interest for

life or a term of years, or a remainder or rever-

sionary interest.

Pub. 1457 explains the use of actuarial fac-

tors for computing the present value of a re-

mainder interest in a charitable remainder annu-

ity trust and a pooled income fund, as well as

factors for annuities, life estates, term certain

estates, and other remainder interests. Pub.

1458 explains the use of the factors for valuing

the remainder interest in a charitable remainder

unitrust. Pub. 1459 explains the use of factors to

determine the present value of a remainder in-

terest in depreciable property. You can down-

load Pubs. 1457, 1458, and 1459 from https://

www.irs.gov/retirement-plans/actuarial-tables.

Formulas for actuarial factors for transfers to

pooled income funds may also be found in Reg-

ulations section 1.642(c)-6(e)(6), factors for

transfers to charitable remainder unitrusts in

Regulations section 1.664-4(e), and factors for

other transfers in Regulations section

20.2031-7(d)(6).

Note. The tables referenced by Versions

4A, 4B, and 4C of the publications are effective

for transfers on or after June 1, 2023. These ta-

bles use a more recent mortality basis than ear-

lier tables. The earlier versions of the publica-

tions, Versions 3A, 3B, and 3C, are also

available: these versions—and the actuarial ta-

bles they reference—are applicable for transfers

after April 30, 2009, and before June 1, 2023.

However, there is a transition rule under which

you may elect to use the later tables (those ref-

erenced in Versions 4A, 4B, and 4C) for valuing

interests transferred from May 1, 2019, through

June 1, 2023. However, you must be consistent

in using factors derived under the same mortal-

ity basis with respect to each interest (income,

remainder, annuity, etc.) in the same property,

and with respect to all transfers occurring on

that valuation date. All of these publications and

tables can be accessed from https://

www.irs.gov/retirement-plans/actuarial-tables.

Special factors. If you need a special factor

for an actual transaction, you can request a let-

ter ruling. Be sure to include the date of birth of

each person the duration of whose life may af-

fect the value of the interest. Also include cop-

ies of the relevant instruments. The IRS charges

a user fee for providing special factors.

For more information about requesting a rul-

ing, see Revenue Procedure 2024-1 (or annual

update).

For information on the circumstances under

which a charitable deduction may be allowed for

the donation of a partial interest in property not

in trust, see Partial Interest in Property Not in

Trust, later.

Certain Life Insurance and

Annuity Contracts

The value of an annuity contract or a life insur-

ance policy issued by a company regularly en-

gaged in the sale of such contracts or policies is

the amount that company would charge for a

comparable contract.

But if the donee of a life insurance policy

may reasonably be expected to cash the policy

rather than hold it as an investment, then the

FMV is the cash surrender value rather than the

replacement cost.

If an annuity is payable under a combination

annuity contract and life insurance policy (for

example, a retirement income policy with a

death benefit) and there was no insurance ele-

ment when it was transferred to the charity, the

policy is treated as an annuity contract.

Partial Interest in Property

Not in Trust

Generally, no deduction is allowed for a charita-

ble contribution, not made in trust, of less than

your entire interest in property. However, this

does not apply to a transfer of less than your

entire interest if it is a transfer of:

•

A remainder interest in your personal resi-

dence or farm,

•

An undivided part of your entire interest in

property, or

•

A qualified conservation contribution.

Remainder Interest in Real

Property

The amount of the deduction for a donation of a

remainder interest in real property is the FMV of

the remainder interest at the time of the contri-

bution, determined as the present value of that

remainder interest. To determine the present

value of the remainder interest, you must know

the FMV of the property as a whole (from which

the remainder interest is donated) on the date

of the contribution. Multiply the FMV of the

whole property by the appropriate remainder

factor. Examples in Pubs. 1457, 1458 and 1459

show how to use these factors and contain links

to these tables.

If the underlying property of which the re-

mainder interest being donated is depreciable

property, you must make an adjustment for de-

preciation or depletion using the factors in Table

C, as referenced by and explained in Pub. 1459,

Actuarial Valuations, Version 4C. See Annuities,

Interests for Life or Terms of Years, Remainders,

and Reversions, earlier. You can download Pub.

1459 from https://www.irs.gov/retirement-plans/

actuarial-tables.

For this purpose, the term “depreciable

property” means any property subject to wear

and tear or obsolescence, even if not used in a

trade or business or for the production of in-

come.

If the remainder interest is an interest in real

property that includes both depreciable and

nondepreciable elements, for example, a house

and land, the FMV of the underlying real prop-

erty must be allocated between each kind of

property at the time of the contribution. You

must use distinct actuarial factors that apply

separately to the depreciable portion and to the

nondepreciable portion, in order to determine

the present value of the entire remainder

Page 7 of 15 Fileid: … ons/p561/202402/a/xml/cycle09/source 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Publication 561 (2-2024) 7

interest. The example provided in Pub. 1459 ex-

plains how to get both kinds of remainder fac-

tors and apply them separately to the two ele-

ments of the underlying property value. The

sum of the present value of the remainder inter-

est in the nondepreciable element of the under-

lying property, plus the present value of the re-

mainder interest in the depreciable element of

the underlying property, is the present value of

the entire remainder interest in the property.

For more information, see Regulations sec-

tion 1.170A-12.

Undivided Part of Your Entire

Interest

A contribution of an undivided part of your entire

interest in property must consist of a part of

each and every substantial interest or right you

own in the property. It must extend over the en-

tire term of your interest in the property. For ex-

ample, you are entitled to the income from cer-

tain property for your life (life estate) and you

contribute 20% of that life estate to a qualified

organization. You can claim a deduction for the

contribution if you do not have any other interest

in the property.

If the only interest you own in real property is

a remainder interest in a personal residence or

farm and you give your entire remainder interest

to a qualifying charity under section 170(c), see

Annuities, Interests for Life or Terms of Years,

Remainders, and Reversions above, for infor-

mation on how to value that remainder interest.

Note. No income tax deduction is available

if you give part of your remainder interest in any

kind of property. See Partial Interest in Property

Not in Trust, above.

Qualified Conservation

Contribution

A qualified conservation contribution is a contri-

bution of a qualified real property interest to a

qualified organization to be used only for con-

servation purposes as defined in section 170(h)

(4).

Qualified organization. For purposes of a

qualified conservation contribution, a qualified

organization is:

•

A governmental unit;

•

A publicly supported charitable, religious,

scientific, literary, educational, etc., organi-

zation; or

•

An organization that is controlled by, and

operated for the exclusive benefit of, a gov-

ernmental unit or a publicly supported

charity.

The organization must also have a commitment

to protect the conservation purposes of the don-

ation and must have the resources to enforce

the restrictions.

Note. A qualified organization is a certain

group of charities than a charity that qualifies

under section 170(c) for an income tax charita-

ble deduction.

Conservation purposes. Your contribution

must be made only for one of the following con-

servation purposes.

•

Preserving land areas for outdoor recrea-

tion by, or for the education of, the general

public.

•

Protecting a relatively natural habitat of

fish, wildlife, or plants, or a similar ecosys-

tem.

•

Preserving open space, including farmland

and forest land, if it yields a significant pub-

lic benefit. It must be either for the scenic

enjoyment of the general public or under a

clearly defined federal, state, or local gov-

ernmental conservation policy.

•

Preserving a historically important land

area or a certified historic structure. There

must be some visual public access to the

property. Factors used in determining the

type and amount of public access required

include the historical significance of the

property, the remoteness or accessibility of

the site, and the extent to which intrusions

on the privacy of individuals living on the

property would be unreasonable.

Certified historic structures. A certified his-

toric structure is a building that is listed individu-

ally in the National Register of Historic Places

(National Register building), or a building that is

located in a registered historic district and has

been certified by the Secretary of the Interior as

contributing to the historic significance of that

district (historically significant building). If the in-

dividual listing in the National Register of His-

toric Places consists of a more than one build-

ing (for example, a house, a garage, a mill

complex, etc.) the Secretary of the Interior may

have to certify which of the multiple buildings

qualify as certified historic structures.

A registered historic district is any district lis-

ted in the National Register of Historic Places. A

state or local historic district may also qualify as

a registered historic district if the district and the

enabling statutes are certified by the Secretary

of the Interior. You can claim a deduction for a

qualified conservation contribution of a National

Register building. This contribution can take the

form of a qualified real property interest that is

an easement or other restriction on all or part of

the exterior or interior of the building.

You can claim a deduction for a qualified

conservation contribution of a historically signifi-

cant building. This can take the form of a contri-

bution of a qualified real property interest that is

an easement or other restriction on all or part of

the interior of the building. However, you cannot

claim a deduction for a contribution of a quali-

fied real property interest that is an easement or

other restriction on the exterior of a building un-

less the easement or other restriction meets

each of the following three conditions.

1. The restriction must preserve the entire

exterior of the building and must prohibit

any change to the exterior of the building

(including its front , sides, rear, and height)

that is inconsistent with its historical char-

acter.

2. You and the organization receiving the

contribution must enter into a written

agreement certifying, under penalty of per-

jury, that the organization:

a. Is a qualified organization with a pur-

pose of environmental protection,

land conservation, open space pres-

ervation, or historic preservation; and

b. Has the resources to manage and en-

force the restriction and a commit-

ment to do so.

3. You must include with your return:

a. Form 8283, completed as specified in

the instructions to Form 8283;

b. A signed qualified appraisal, per-

formed by a qualified appraiser;

c. Photographs of the building's entire

exterior;

d. A description of all restrictions on de-

velopment of the building, such as

zoning laws and restrictive covenants;

and

e. The National Park Service project

number (NPS #), if applicable. See

the Form 8283 instructions for more

information.

If you claim a deduction of more than

$10,000 for an easement or other restriction on

the exterior of a historically significant building,

your deduction will not be allowed unless you

pay a $500 filing fee. See Form 8283-V and its

instructions.

If you claimed the rehabilitation credit for a

National Register or historically significant build-

ing for any of the 5 years before the year of the

qualified conservation contribution, your chari-

table deduction is reduced. For more informa-

tion, see Form 3468, Investment Credit, and

section 170(f)(14).

Qualified real property interest. This is any

of the following interests in real property.

1. Your entire interest in real estate other

than a mineral interest (subsurface oil,

gas, or other minerals, and the right of ac-

cess to these minerals).

2. A remainder interest.

3. A restriction (granted in perpetuity) on the

use that may be made of the real property;

also commonly known as an easement, a

restrictive covenant, an equitable servi-

tude, or a perpetual conservation restric-

tion, depending upon terminology applica-

ble where the real property is located. See

Regulations section 1.170A-14(b)(2) for

further information.

Valuation. A qualified real property interest

described in (1) consists of the following.

•

Your entire interest in real property with you

retaining a qualified mineral interest, or

your entire interest in the real property

when someone else owns the qualified

mineral interest and the probability of sur-

face mining occurring is so remote as to be

negligible. A qualified mineral interest

gives you the right to access subsurface

oil, gas, or other minerals. You determine

the FMV of the real property absent the

qualified mineral interest in the same man-

ner that you determine the FMV of real es-

tate. See Real Estate, earlier.

Page 8 of 15 Fileid: … ons/p561/202402/a/xml/cycle09/source 12:07 - 11-Mar-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

8 Publication 561 (2-2024)

•

A remainder interest in real property. You

determine the FMV of a remainder interest

in real property as directed earlier under

Remainder Interest in Real Property.

•

A conservation restriction (granted in per-

petuity) on the use which may be made of

real property.

The value of the charitable contribution of a

perpetual conservation restriction (conservation

easement) is the FMV of the easement at the

time of the contribution. In determining the FMV

of a conservation easement, if there is a sub-

stantial record of arm's-length sales of conser-

vation easements on other properties that are

the same as or very similar to the donated con-

servation easement, you must take into account

the selling price of these easements. If there are

no comparable sales, the FMV of the conserva-

tion easement is generally determined indirectly

as the difference between the FMVs of the

property before and after the grant of the con-

servation easement. The FMV of the property

before the grant of the conservation easement

must take into account not only the current use

of the property but also an objective assess-

ment of how immediate or remote the likelihood

is that the property, without the easement,

would be developed. In determining whether

the property could be developed, you must also

consider any zoning, conservation, or historical

preservation laws that would already restrict the

property's potential highest and best use.

Finally, if a potential highest and best use is

being considered that would require a change

in zoning or other restrictions on the property,

you must address whether it is reasonably prob-

able that such a change would be permitted.

Granting a conservation easement may in-

crease, rather than reduce, the value of prop-

erty, and in such a situation no deduction would

be allowed.

Example. You own 10 acres of farmland.

Similar land in the area has an FMV of $2,000

an acre. However, land in the general area that

is restricted solely to farm use has an FMV of

$1,500 an acre. Your county wants to preserve

open space and prevent further development in

your area.

You grant to the county an enforceable open

space easement in perpetuity on 8 of the 10

acres, restricting its use to farmland. The value

of this easement is $4,000, determined as fol-

lows.

FMV of the property before

granting easement:

$2,000 × 10 acres ................ $20,000

FMV of the property after

granting easement:

$1,500 × 8 acres ......... $12,000

$2,000 × 2 acres ......... 4,000 16,000

Value of easement .......... $4,000

If you later transfer in fee your remaining in-

terest in the 8 acres to another qualified organi-

zation, the FMV of your remaining interest is the

FMV of the 8 acres reduced by the FMV of the

easement granted to the first organization.

Disallowance of deductions for certain con-

servation contributions by pass-through

entities. Subject to three exceptions, if the

amount of the pass-through entity’s contribution

of qualified real property interest exceeds 2.5

times the sum of each member’s relevant basis

in such pass-through entity, each member of

such pass-through entity cannot claim a deduc-

tion for the charitable conservation contribution.

For the purpose of this disallowance rule,

the pass-through entity must calculate the sum

of the relevant basis of all members of the

pass-through entity and report it on the Form

8283. Relevant basis is, with respect to any

member, the portion of the member’s modified

basis in its interest in the pass-through entity

that is allocable to the portion of the real prop-

erty with respect to which the qualified conser-

vation contribution is made. Modified basis, with

respect to any member, is the adjusted basis in

the member’s interest in the pass-through entity

as determined (I) immediately before the con-

servation contribution, (II) without regard to the

member’s share of any liabilities of the

pass-through entity, and (III) by the entity after

taking into account the adjustments described

in subclauses (I) and (II). The pass-through en-

tity must determine such member's modified

basis.

More information. For more information

about qualified conservation contributions, see

Pub. 526.

Substantiation of

Noncash Charitable

Contributions

What you need to substantiate your deduction

depends upon the property being donated and

the claimed value of this property. There are

three types of documents that may be required

in order to substantiate your contribution.

•

Contemporaneous Written Acknowledg-

ment (CWA).

•

Form 8283.

•

An appraisal, which in some cases must

be a “qualified appraisal,” completed by a

“qualified appraiser.”

CWA. You must get a CWA from the charity to

which you contributed property on or before the

earlier of the date on which you file a return re-

porting the donation or the due date (including

extensions) for filing such return.

CWA must include the following:

1. The name of the organization;

2. The amount of any monetary contribution;

3. A description (but not the FMV) of any

contribution of property;

4. A statement that no goods or services

were provided by the organization in return

for the contribution, if that was the case;

5. If the organization did provide goods or

services in return for the contribution, a

description and good faith estimate of the

FMV of the goods or services; and

6. If the organization only provided intangible

religious benefits (described later in this

publication) in return for the contribution, a

statement so providing.

See Pub. 1771 for examples of CWAs.

Form 8283. You must file a Form 8283 if the

amount of your deduction for each noncash

contribution is more than $500, and when you

donate certain publicly traded securities for

which market quotations are readily available;

certain intellectual property, like a patent; a ve-

hicle for which you obtained a CWA meeting the

requirements of section 170(f)(12)(B) (including

a car, boat, or airplane) for which your deduc-

tion is limited to the gross proceeds from its

sale; and inventory and other similar property

described in section 1221(a)(1). You must also

file a Form 8283 if you have a group of similar

items for which a total deduction of over $500 is

claimed. See Form 8283 below.

Similar items of property are items of the

same general category or type, such as coin

collections, paintings, books, clothing, jewelry,

nonpublicly traded stock, land, or buildings.

Example. You claimed a deduction of $600

for inventory, $7,000 for publicly traded securi-

ties (quotations published daily), and $6,000 for

a collection of 15 books ($400 each).

Appraisal. Many, but not all, charitable contri-

butions require a qualified appraisal completed

by a qualified appraiser. See Qualified Ap-

praiser and Qualified Appraisal, later.

A qualified appraisal is not required for the

donation of:

•

Certain publicly traded securities for which

market quotations are readily available;

•

Certain intellectual property, like a patent;

•

A vehicle for which you obtained a CWA

meeting the requirements of section 170(f)

(12)(B) (including a car, boat, or airplane)

for which your deduction is limited to the

gross proceeds from its sale;

•

Inventory and other similar property descri-

bed in section 1221(a)(1); and

•

Noncash property valued at less than

$5,000 unless the property is an item of

clothing or a household item that is not in

good used condition for which you are

claiming a value of more than $500.

The appraiser's opinion is never more valid

than the facts on which it is based; without

these facts, it is simply a guess.

Even when a qualified appraisal by a quali-