Oceans North Conservation Society

Canadian Green Shipping Corridors

Preliminary Assessment

Final Report

02 | 19 June 2023

This report takes into account the particular instructions and requirements of our client.

It is not intended for and should not be relied upon by any third party and no

responsibility is undertaken to any third party.

Job number 289659-00

Arup International Projects Limited

8 Fitzroy Street

London

W1T 4BJ

United Kingdom

arup.com

| 02 | 19 June 2023 | Arup International Projects Limited

Contents

Acronyms 1

1. Introduction 2

2. Green shipping corridors in Canada 4

2.1 Green shipping corridors are intended to accelerate maritime

decarbonisation 4

2.2 Government and industry have already shown support for

green shipping corridors in Canada 6

3. Fuels for green shipping corridors 8

3.1 Production of low and zero emission shipping fuels 8

3.2 Mobilising the fuel supply value chain 12

4. The Total Value Case 15

4.1 A Total Value approach could illuminate the potential co-

benefits of green shipping corridors 15

4.2 Benefits that green corridors and broader maritime

decarbonisation could bring to Canada 16

4.3 Delivering the value 20

5. Case study: British Columbia, the Port of Vancouver, and the Port

of Prince Rupert 21

5.1 Regional energy and resources 21

5.2 Estimated demand for low and zero emission fuels 23

5.3 Port of Vancouver 26

5.4 Port of Prince Rupert 33

6. Case study: Nova Scotia and the Port of Halifax 40

6.1 Regional energy and resources 40

6.2 Estimated demand for low and zero emission fuels 42

6.3 Port of Halifax 44

7. Summary 50

8. References 52

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 1

Acronyms

AIS Automatic Identification System

BC British Columbia

CAD Canadian Dollars

CCS Carbon Capture and Storage

CMC Chamber of Maritime Commerce

CO

2

Carbon Dioxide

CO

2

e Carbon Dioxide Equivalent

COP Conference of the Parties

DAC Direct Air Capture

ESG Environmental, Social and Governance

GDP Gross Domestic Product

GW Giga-Watt

H

2

Hydrogen

HFO Heavy Fuel Oil

HFOe Heavy Fuel Oil (Energy) Equivalent

IMO International Maritime Organisation

ktpa Kilo-tonnes per annum

LNG Liquefied Natural Gas

MOU Memorandum of Understanding

MW Mega-Watt

NS Nova Scotia

PPA Power Purchase Agreement

R&D Research & Development

RVA Real Value Added

Ro-Ro Roll-on / Roll-off

TEU Tonne Equivalent Unit

USA United States of America

USD United States Dollars

VLSFO Very Low Sulphur Fuel Oil

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 2

1. Introduction

Accelerated action is needed to tackle greenhouse gas emissions from

shipping

Commercial shipping activity in Canada has been estimated to contribute

approximately $30 billion to the Canadian economy annually [1].

Meanwhile, vessels operating in Canadian waters produced more than more

than 13 million tonnes of CO

2

emissions in 2019 [2], or around 1.7% of

Canada’s total greenhouse gas emissions, directly contributing to global

climate change. These vessels also produce thousands of tonnes of air

pollutants that impact the health of port and coastal communities, pollute

oceans, and can themselves have a significant climate impact.

An urgent transition away from fossil fuels is required

Much of the activity to address shipping emissions has been at the

International Maritime Organisation (IMO) level. The IMO has introduced

regulations to address air pollutant emissions and has progressed with

measures to improve the energy efficiency of ships and therefore reduce

greenhouse gas emissions. At a national level, Canada has a legislated

commitment to achieve net-zero emissions by 2050 and, through the 2030

Emissions Reduction Plan, is developing a national action plan to enable the

marine sector to reduce its emissions, including engagement with

stakeholders on energy efficiency and carbon intensity requirements for

domestic vessels in-line with requirements for international vessels.

Energy efficiency measures and exhaust treatment technologies represent

some progress; however they will only contribute to marginal reductions in

emissions. A global transition is required away from fossil fuels to zero

emission alternatives if deep greenhouse gas emissions cuts are to be

achieved. Widespread uptake of these fuels will be required from the end of

this decade to follow a decarbonisation trajectory in line with Paris

Agreement goals. However, although progress is being made, availability of

these fuels is still extremely low while high costs make their use

uneconomical where they are available. Coordinated action in the short term

can help to develop and demonstrate the technical, regulatory, and

commercial viability of these fuels, laying the groundwork for subsequent

proliferation of their use across the industry.

The transition represents a significant infrastructure opportunity and Canada

is well placed to maximise the benefits

The capital investment required to decarbonise international shipping by

2050 has been estimated to be up to USD$1.6 trillion, around 87% of which

will be needed to develop the fuel production facilities and other landside

infrastructure [3]. In many cases, this infrastructure will be entirely new and

include renewable electricity generation, hydrogen electrolysers, and fuel

synthesis plants. This represents a significant opportunity for countries

around the world to achieve their environmental objectives while fuelling

economic prosperity, realising social co-benefits, and protecting themselves

from the impact of divestment from fossil fuel industries. As an existing

energy producer with a skilled workforce and substantial land and natural

resource availability, Canada is well placed to seize the opportunity to

become a producer, or even exporter, of zero emission fuels.

This report uses the term ‘zero emission fuels’ to refer to those with zero

lifecycle greenhouse gas emissions. In the context of this report, ‘low

emission fuels’ refers to fuels with lifecycle greenhouse gas intensity of

20gCO

2

e/MJ, which is approximately 80% lower than conventional

shipping fuel oils. These terms are discussed in more detail at Section 3.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 3

Green shipping corridors can accelerate maritime decarbonisation in

Canada

A variety of technical, regulatory, and commercial barriers have slowed

uptake of low and zero emission fuels in the shipping sector to date. Green

shipping corridors are a means of bringing together actors from across the

shipping and fuel value chain to work together to address these barriers. In

doing so, corridors aim to demonstrate the feasibility of using these fuels on

specific routes in the short to mid-term and therefore catalyse their uptake

more broadly. Several corridor partnerships involving Canadian Ports have

already been announced and Transport Canada has released a national green

shipping corridors framework to guide their implementation.

This report is intended to demonstrate the opportunity for Canada

Oceans North has commissioned Arup to undertake this preliminary

assessment into the potential impact that green shipping corridors - and

maritime decarbonisation more broadly - could have in Canada. Arup’s study

is supported by analysis by Lloyd’s Register Maritime Decarbonisation Hub

estimating the potential development of low and zero emission fuel uptake

from shipping using three Canadian ports under a variety of different

scenarios.

In this report, we introduce the background to green shipping corridors, the

characteristics of the emerging initiatives, and how these might be applicable

in the Canadian context. We explore the main low and zero emission marine

fuel production pathways and their feedstocks that have the potential to

support long term decarbonisation of shipping. We describe key

considerations that influence their suitability to different regions. We have

also explored how green corridor partnerships can be used to mobilise key

stakeholder groups in the fuel production value chain to drive the uptake of

these fuels.

Lloyd’s Register have estimated the potential demand evolution for low and

zero emission fuels under different scenarios at three different Canadian ports

based on vessel traffic data and forward-looking assumptions around demand

development. We have approximated the size, type, and capital cost of

energy and fuel production infrastructure required to meet demand. We have

described illustrative fuel supply typologies at the three ports, as a means of

exploring the challenges and opportunities they face in meeting this demand.

Finally, we have applied a ‘Total Value’ framing approach to explore some

of the key financial, social, and economic co-benefits that could be realised

through effective delivery of this new infrastructure.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 4

2. Green shipping corridors in Canada

2.1 Green shipping corridors are intended to

accelerate maritime decarbonisation

Despite growing decarbonisation ambition in the shipping industry, there are

numerous barriers hampering the development and deployment of zero

emission marine fuels. Green shipping corridors are one way of helping to

address these and accelerate decarbonisation of the industry.

Approaches vary but the deployment of zero emission shipping is the common

aim among green shipping corridors

The concept of green shipping corridors first emerged in 2021 and was

brought into the spotlight by the Clydebank Declaration made at COP26 and

now signed by 24 nations, including Canada. The declaration set out a

collective aim by the signatories to establish at least six green shipping

corridors by the middle of the decade, including international and domestic

routes. The concept of green corridors was developed by research from the

Global Maritime Forum (GMF) and their partners in the ‘The Next Wave’

report [4]. This sets out the core definition of a green shipping corridor as:

“Specific shipping routes where the technological, economic and regulatory

feasibility of the operation of zero-emission ships is catalysed by a

combination of public and private actions.”

This has created a wave of green shipping corridor commitments across the

globe, with different interpretations of the definition. Additional definitions

include:

“Maritime routes that showcase low- and zero-emission lifecycle fuels and

technologies with the ambition to achieve zero greenhouse gas emissions

across all aspects of the corridor in support of sector-wide decarbonization

no later than 2050.” US State Department Green Shipping Corridors

Framework [5]

“A green shipping corridor is a maritime route between two or more ports on

which vessels running on scalable zero-emission energy sources are

demonstrated and supported.” UK Shipping Office for Reducing Emissions

(UK SHORE) [6]

“Focused action/intention by a group of companies/countries/institutes,

related to the entire Zero Emission Shipping Value Chain with the aim to

deliver a commercial product/offer throughout the value chain.” Maersk

McKinney Møller Centre [7]

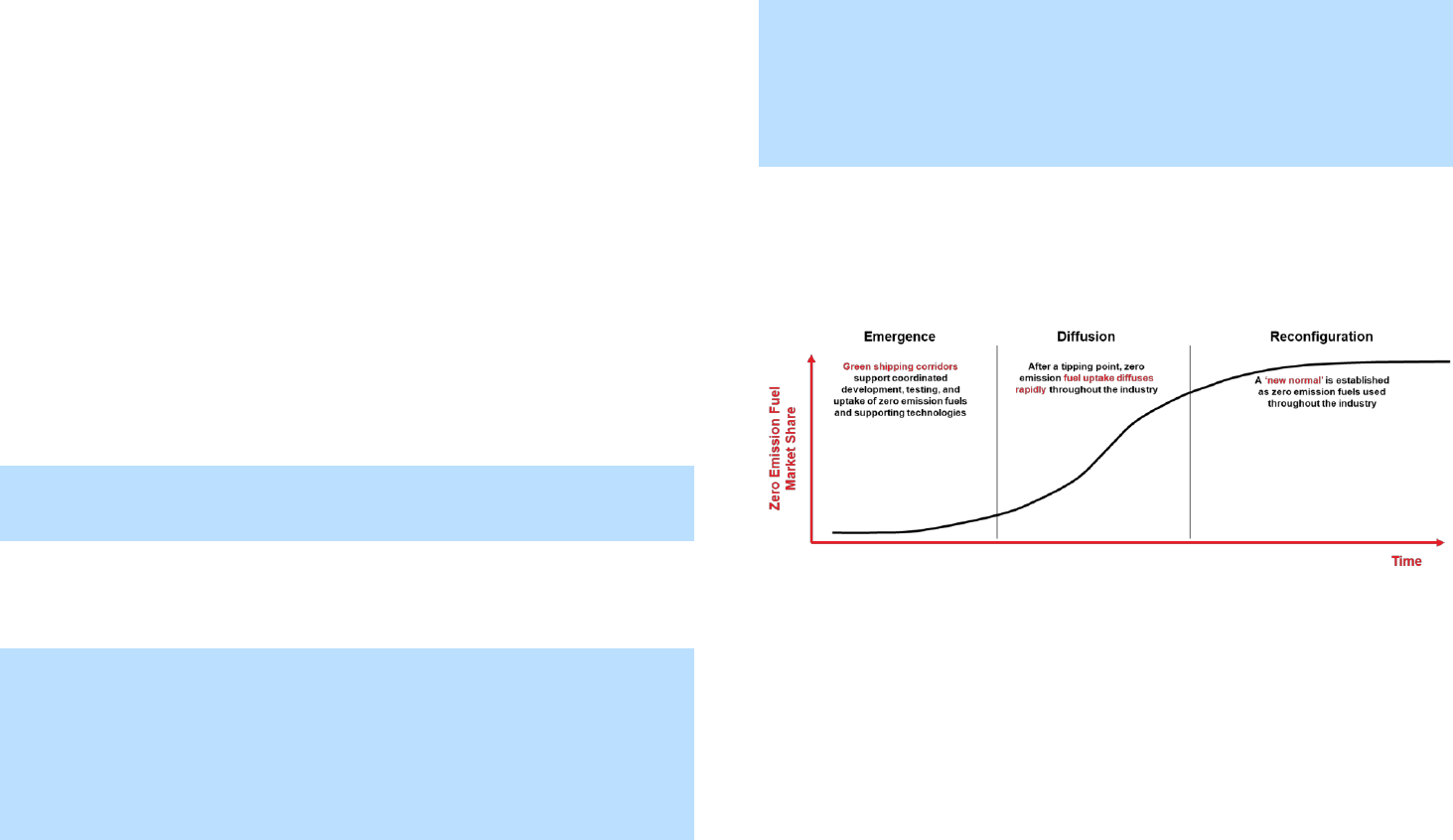

It is important to view green shipping corridors as emergence-phase initiatives

to catalyse feasibility of zero-emission shipping, working in tandem with

development of policy at a national and international level. As illustrated in

Figure 1, this dual approach can lead to rapid uptake during the subsequent

diffusion phase.

Figure 1 - Green Corridors in a transition context

(Adapted from Global Maritime Forum [8])

First mover corridors can help the shipping industry reach a ‘tipping point’ in

the uptake of zero emission fuels

At their core, green shipping corridors aim to mobilise stakeholders across the

value chain to address the barriers to zero emission fuel uptake. The focus of

these initiatives is on the initial stages of the fuel transition taking place over

the short to mid-term, while the technical and commercial readiness of the

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 5

required solutions are still developing. By fostering this development and

facilitating the first uptake of zero emission shipping fuels, these initiatives

can contribute to the industry as a whole reaching a ‘tipping point’ where

they start to rapidly scale without such focussed support and coordination. It

has been estimated [9] that this point could be crossed if 5% of the fuel used

by international shipping industry and 15% of the fuel used by domestic

shipping has zero lifecycle greenhouse gas emissions by 2030; helping to

align shipping’s decarbonisation trajectory with Paris Agreement Goals.

Governance structures, shipping routes and goals vary widely between

corridor initiatives

Dozens of green shipping corridor initiatives have been announced and are

being developed globally; several of which involve Canadian ports. This

number is expected to increase rapidly over the coming months and years as

countries move to fulfil their obligations under the Clydebank Declaration.

These initiatives all differ in how they are led, the type of routes being

examined, the overall aims and objectives, and the methodologies being

applied to their development. All the initiatives are still at an early stage, and

it is too early to measure their relative success. However, there is an

opportunity for lessons to be shared between corridor partnerships and wider

stakeholder groups as they develop.

By understanding the benefits and challenges of the different approaches,

Canadian stakeholders can ensure that green shipping corridors involving

Canadian ports contribute most effectively to realising the long-term uptake of

zero emission fuels at scale and position Canada to benefit from this

transition.

Partners &

leadership

Routes

Goals &

aims

The leadership and key partners involved in a green

shipping corridor initiative can have a major bearing on its

focus and activities. For example, government and public-

private led initiatives may focus on unlocking opportunities

for economic and social development while industry led

initiatives may seek to position their partner organisations

to develop new commercial models. The makeup of the

partnership is also important as it will affect where efforts

are focussed in the value chain, either focussing on the

supply of fuels or mobilising their demand.

A corridor may focus on vessels operating between two

ports (end-to-end), in the area around or between one or

more ports (clusters) or across an entire geographic region

(regional). The scope of the route will have an impact on

the complexity of the corridor’s implementation. In some

cases, initiatives may start by assessing routes in a whole

region, before focussing on the most promising end-to-end

routes or clusters.

Corridors focusing on incremental emissions reductions

risk deployment of efficiency measures or transition fuels

that may not support the uptake of zero carbon fuel

solutions in the longer term. Corridors may take a hybrid

approach to their aims, targeting emissions reductions over

time while focusing efforts of the multi-stakeholder

partnerships on the more challenging topic of zero carbon

fuels uptake.

Figure 2 – Review of existing green shipping corridor initiatives

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 6

2.2 Government and industry have already shown

support for green shipping corridors in Canada

The Government has indicated strong support for the decarbonisation of

shipping

In 2021, Canada passed the Net-Zero Emissions Accountability Act which

enshrines a commitment to achieving net-zero greenhouse gas emissions by

2050 across all sectors. The legislation puts in place a legally binding process

to set 5-yearly emissions reduction targets with credible plans to reach them.

The ‘2030 Emissions Reduction Plan’ [10], the first plan under the net zero

legislation that was released in March 2022, outlines Canada’s aim to cut

emissions by 40-45% below 2005 levels by 2030 and go on to achieve net-

zero emissions by 2050. The plan includes measures applied across all

economic sectors, including support for clean energy projects like wind and

solar power, the development of zero-emission fuels, a plan to decarbonise

transportation as well as a commitment to reduce methane emissions from oil

and gas production by 75%. For the maritime sector, the plan includes the

commitment to develop a ‘national action plan’ for emissions reductions in

the marine sector as well as to take direct action to reduce emissions from

government operated vessels.

At an international level, Canada has been collaborating at the International

Maritime Organisation (IMO) on lifecycle assessment guidelines for marine

fuels and regulatory measures for emission reductions. Canada, the United

States, and the United Kingdom have cosponsored a submission that

proposes increased levels of ambition in the IMO’s revised greenhouse gas

strategy. This includes proposals for shipping emission reduction targets that

align with the Paris Agreement's goal of pursuing efforts to limit global

temperature rise to 1.5°C, including to reduce total annual greenhouse gas

emissions from international shipping, on a life cycle basis, by at least 37%

by 2030 and 96% by 2040, compared to a 2008 baseline, and to zero

emissions by no later than 2050 [11]. The submission also proposes that the

revised strategy enshrine the goal that least 5% of the global fleet operating

on fuels and technologies with zero or near-zero emissions on a lifecycle

assessment basis by 2030.

Canada has joined the ‘Declaration on Zero Emissions Shipping’ [12] in

which partners agree to strengthen global efforts to achieve zero emissions

from international shipping by 2050. Canada has also confirmed support for

the Green Shipping Challenge [13], which encourages announcements that

support alignment of shipping’s decarbonisation with a trajectory to limit

global temperature rise to 1.5°C.

Delivering the required emissions reductions from domestic and international

shipping, in line with a 1.5°C decarbonisation trajectory, requires a rapid

transition to zero emission fuels over the coming years. Green shipping

corridors are an opportunity for the government to work with voluntary

industry participants to accelerate this transition through the development,

testing and use of scalable zero emission fuels and supporting technologies.

Canada has set out a framework for development of green shipping corridors

Canada is a signatory to the Clydebank Declaration [14], supporting the

establishment of at least six green shipping corridors ‘by the middle of this

decade’; including both domestic and international routes. Transport Canada

has published a ‘Canadian Green Shipping Corridors Framework’ [15] to

help guide the development of green shipping corridors and ensure consistent

implementation.

The framework recognises the challenges to Canadian shipping achieving

net-zero emissions by not later than 2050 and sets out the government’s

support for scalable solutions that can be implemented in the short term while

facilitating a path to net-zero. This could include efficiency measures,

provision of shorepower, as well as alternative zero emission fuels.

Regardless of the measure, the importance of considering the whole lifecycle

environmental impacts is reiterated.

The framework also identifies the importance of aligning local and national

actions with international efforts to ease their implementation, particularly in

the case of international corridor partnerships. Finally, it underscores the

importance of mobilising a broad range of industry stakeholders in the

implementation of green shipping corridors while ensuring the involvement

of all implicated parties such as local communities and indigenous groups.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 7

Several green shipping corridor initiatives involving Canadian ports have

already been announced

There have been at least four green shipping corridor announcements

involving Canadian ports made to date, as shown in Figure 3, demonstrating

the strength of industry support for maritime decarbonisation in Canada.

Canada has an opportunity to build on this early progress and establish itself

as a leader in maritime decarbonisation.

Figure 3 - Green shipping corridor initiatives announced in Canada to date

Canada’s abundant energy resources make it well-placed to be a supplier of

low and zero lifecycle emission marine fuels

Canada has one of the cleanest electrical systems in the world with more than

83% of output coming from non-emitting sources [16] and the government

has committed supporting clean energy projects to further reduce emissions

from power generation. The country is also a producer of oil and gas;

meaning that the sector has the financial resources, infrastructure, energy

expertise, and skilled workforce that can be leveraged to develop zero

emission fuel pathways.

The Hydrogen Strategy for Canada [17] was released in December 2020 by

the Government of Canada. It outlines opportunities for Canada to leverage

its natural resources to drive the domestic production and use of clean

hydrogen including the potential for Canada to become global producer of

low-carbon hydrogen. In 2022 the Government of Canada signed a joint

declaration of intent with the Government of the Federal Republic of

Germany on establishing a Canada-Germany Hydrogen Alliance which aims

to create a transatlantic supply chain for hydrogen before 2030.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 8

3. Fuels for green shipping corridors

3.1 Production of low and zero emission shipping

fuels

As identified above, scaling the production of low and zero emission fuels to

meet growing demand and deliver on global climate goals is a key challenge.

There are numerous possible alternative fuels, but focus is on a few core

options

There are numerous fuel options that could be considered, with no ‘silver

bullet’ applicable across all shipping segments, however the industry is

coalescing around a few core fuels that are expected to make up the majority

of the future fuel mix for deep sea shipping; methane, methanol, and

ammonia as well as drop-in fuel oils from renewable sources [18, 19, 20].

The use of molecular hydrogen and electrical energy stored in batteries are

also likely to play a key role in the decarbonisation of in-port or short sea

vessels, however their low energy density make them unsuitable for deep sea

vessels and are therefore expected to meet only a small portion of shipping’s

total energy demand.

It is critical to consider the full lifecycle greenhouse gas emissions from

marine fuels

The greenhouse gas emissions produced at the point of use of each fuel

option can be readily compared, regardless of how the fuel was produced and

distributed to the vessel. However, to reflect true climate impact, the full

lifecycle greenhouse gas emissions generated during the feedstock

generation, fuel production, distribution, and eventual use onboard must also

be considered.

This report refers to fuels with low or zero lifecycle greenhouse gas

emissions as ‘low and zero emission fuels’. However, it should be noted that,

depending on how the fuels are converted to energy on board, they may still

produce air pollutant emissions, some of which could themselves contribute

to climate change. Further discussion around the potential air quality impacts

of the new fuels is discussed in more detail in Section 4.

Each fuel has a range of production pathways which influence its lifecycle

greenhouse gas emissions

A fuel’s lifecycle emissions are heavily influenced by the feedstocks and

production pathway used to produce it. Each fuel option discussed in this

report has numerous production pathways – including fossil-, bio-, e- and

ccs-enabled routes – each with different feedstocks and production

technologies that will influence these lifecycle emissions. This report has

focussed on production pathways that can produce fuels with low or zero

lifecycle emissions.

The sector needs to minimise lifecycle emissions and avoid carbon lock-in

The lifespan of energy, fuel production, and port infrastructure, as well as of

ships themselves, typically spans several decades. Much of the infrastructure

being planned now and developed over the coming years will therefore still

be operating in 2050, the year in which Canada and the majority of major

economies have committed to achieving net-zero emissions. It is therefore

critical that infrastructure for the supply alternative shipping fuels is designed

to deliver, or have the ability to deliver, low or zero lifecycle emission fuels

in order to avoid ‘carbon lock-in’.

There are a number of ways of defining what constitutes a low emission fuel

There are various government and industry standards that can be applied to

define thresholds for the lifecycle emissions of hydrogen-derived fuels. These

thresholds are a key measure to ensure that government support and

investment is directed towards projects that can contribute to greenhouse gas

emissions reduction.

The Hydrogen Strategy for Canada recommended that a carbon intensity

threshold is set in Canada at which hydrogen may be termed ‘clean’ and that

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 9

it should “coordinate with efforts underway internationally” [17]. The

strategy made specific reference to the European voluntary ‘CertifHy’

scheme and its recommended threshold of 36.4gCO2e/MJ. The same

threshold is recommended in British Columbia’s provincial hydrogen

strategy [21]. The threshold is set at 60% below the carbon intensity of

hydrogen produced from natural gas without CCS.

Other standards either published or in development include:

• More recent rules published by the European Commission which set a

lower lifecycle emissions threshold of 3.38kg-CO

2

e/kg-H

2

(~28gCO

2

e/MJ) [22].

• The ‘UK Low Carbon Hydrogen Standard’ which sets an emissions

intensity threshold of 20gCO

2

e/MJ [23] below which the hydrogen can be

considered ‘low carbon’.

• The ‘U.S. Department of Energy Clean Hydrogen Production Standard

(CHPS) Draft Guidance’ [24] proposes a less stringent target of 4

kgCO

2

e/kgH

2

.

The threshold in the UK standard (20gCO

2

e/MJ) is the most stringent of

those listed above and has been selected as the preferred approach in the

absence of a standard specifically agreed for Canada. Therefore, this report

uses the term ‘low emission fuel’ to refer to fuels with lifecycle greenhouse

gas intensity below 20gCO

2

e/MJ, which is approximately 80% lower than for

conventional shipping fuel oils. Since this threshold is for hydrogen

production only, it is assumed that further processing to produce ammonia or

methanol is powered by renewable electricity only and that the source of CO

2

for methanol is net carbon zero over its lifecycle.

Green shipping corridors should focus on building supply chains for low and

zero emission fuels

Green shipping corridors are an opportunity for high-ambition partners to

drive the uptake of low and zero emission fuels in the short term. This report

has therefore considered fuel production pathways that could offer significant

reductions in lifecycle greenhouse emissions compared to conventional fuels

and are therefore able to support the decarbonisation of shipping in line with

a trajectory aligned with a 1.5°C Paris Agreement goal. A high-level

overview of the production pathways considered in this report is shown in

Figure 4.

The fuels can be grouped and defined as follows:

• CCS-enabled fuels, referring to those derived from hydrogen produced

by reforming natural gas feedstocks and capturing the resulting carbon

using a Carbon Capture and Storage (CCS) process. These fuels may also

be referred to as ‘blue’ fuels. For these fuels to meet the emissions

intensity threshold, the CCS process must have a high capture rate, the

resulting carbon permanently and securely sequestered, fugitive methane

emissions must be tightly controlled, and hydrogen used to fuel the

reformer.

• Bio-fuels, referring to those produced with carbon from biomass

feedstocks. For these fuels to be meet the emissions intensity threshold,

the biomass feedstocks must be from sustainable sources without

detrimental climate, environmental, or social impacts and with robust

certification and traceability.

• E-fuels, referring to those derived from hydrogen produced by

electrolysis. To meet the emissions intensity threshold, the electricity

used in the fuel’s production must be from low or zero carbon generation

sources. These fuels are sometimes also referred to as ‘green’ fuels. For

carbon containing e-fuels, such as methane or methanol, the carbon must

be removed from the atmosphere via biogenic processes or Direct Air

Capture (DAC).

Geographical and technological characteristics will influence the uptake of

each fuel and production pathway in the short, medium, and longer term

Each fuel and production pathway presents its own challenges and

opportunities that may affect its short- and mid-term development as well as

long-term technical, economic, and environmental viability as a full-scale

shipping fuel. As well as the fuel’s production, there are also challenges

associated with the bunkering, storage and use onboard of the fuels that will

need to be overcome.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 10

Location of production infrastructure is key to delivering cost competitive

fuels

In the absence of market influencing policy or regulations, the cost of

production of low and zero emission fuels will be higher than that of their

fossil fuel equivalents. Aside from technology costs, which are broadly

comparable regardless of location, the cost of production is highly dependent

on:

• Availability of low-cost renewable energy - The production of e-fuels

requires significant input of electrical energy for hydrogen electrolysis

and subsequent synthesis of the fuels. Electrical energy may also be

required to power desalination plants to provide water for electrolysis or,

in the case of methanol and methane, for energy intensive carbon capture

processes. To minimise lifecycle emissions of the fuels, the electricity

must be generated from low or zero emission sources such as renewables

or nuclear power. Furthermore, the electrical generation capacity used in

the production of fuels should be introduced in addition to those required

to decarbonise the electrical grid in any country or region. Since long

distance electrical transmission presents a range of challenges, including

Figure 4 - The key energy sources, feedstocks, and production processes involved in the main carbon fuels under consideration

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 11

high costs and power losses, location of the production plants in regions

with ample renewable power available at low cost is preferable.

• Proximity to the point of use - There are existing global supply chains

for methane, methanol, and ammonia, with the products transported by

pipeline, road, rail, or ship. However, transporting the fuels over greater

distances will add cost and logistical challenges; hence impacting the

commercial competitiveness of the delivered fuel. Producing fuels in

proximity to the point of delivery to the end user could be preferable

where this is balanced with the relative production cost at that location.

• Sustainable supply of carbon - The lifecycle emissions associated with

carbon containing fuels, such as methane or methanol, will heavily

depend on the source of the carbon used as a feedstock during production.

Although this could be captured from the exhaust streams of existing

fossil fuel plants, the preference should be for this carbon to be

sequestered permanently rather than released to the atmosphere when the

fuel is used. For the fuel to be considered low or zero emission on a

lifecycle basis it needs to be from sustainable biogenic sources or

extracted from the atmosphere by a DAC process. In the case of biomass,

the energy required to transport the feedstock, often by road, can have a

significant impact on the lifecycle emissions as well as the cost of the

end-product. Similarly, transporting carbon dioxide over significant

distances, by road, rail, ship, or pipeline, is equally costly and presents

infrastructure development challenges.

• Availability of carbon sequestration facilities - In the case of CCS-

enabled fuels, where hydrogen is separated from fossil fuel feedstocks,

there is an additional requirement for long term sequestration of the

carbon; a process that relies on suitable geological conditions, often in

depleted natural gas or oil fields. Situating CCS-enabled fuel production

facilities in proximity to the source of natural gas as well as sequestration

locations will remove the need to transport these products and hence

reduce production costs.

The location of the fuel production plant in relation to the energy source,

feedstock, point of use and carbon sequestration location is therefore key to

minimising production costs and making these fuels commercially viable.

The availability of these key resources in a region will influence which fuel

and production pathways would make the most economic sense – a topic

which is explored in more detail later in this report.

Liquefied Natural Gas

Liquefied Natural Gas (LNG) – a gaseous mixture of hydrocarbons

predominantly made up of methane – has seen uptake as a marine fuel in

recent years as a means of complying with new regulations on air

pollutant emissions as well as to reduce the carbon intensity of vessels.

More than 10% of the global fleet, either operating or on order, are now

capable of operating on LNG fuel [60] and bunkering availability is

increasing around the world. However, LNG has not been considered in

this report for the following reasons:

• LNG is a fossil fuel that is only able to offer limited greenhouse gas

emissions reductions of up to just 23% [61] on a lifecycle basis in

comparison to fossil fuels. Widespread uptake of LNG as a shipping

fuel does not enable a decarbonisation trajectory for the shipping

sector that is aligned with the Paris Agreement goals and achieving

net zero greenhouse gas emissions by 2050.

• Since methane is itself a highly potent greenhouse gas - 86 times more

potent that carbon over a 20 year time frame - tight controls of

fugitive emissions are required through the supply chain from

production to use in ship engines. Unless fugitive emissions are

tightly controlled, the use of LNG fuel could have a detrimental effect

on the overall climate impact of shipping.

• The purpose of green shipping corridor initiatives is to accelerate

development of supply chains for zero emission fuels that are

currently immature.

The potential role of LNG in meeting existing emission reduction targets

has been covered in more detail in a number of industry papers [61, 62,

63]. For the purpose of this report, natural gas has been considered as

possible feedstock in the production of CCS-enabled fuels.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 12

3.2 Mobilising the fuel supply value chain

There are a number of commercial, regulatory, and technical barriers to the

production, supply, and use of low and zero emission fuels at scale. A green

shipping corridor initiative is an opportunity for an engaged group of

stakeholders, from across the supply and demand side of the marine fuel

value chain, to collaborate on means of addressing these. This could include

development of new commercial approaches, agreeing safety standards for

bunkering of new fuels or collaborating on technology demonstration

projects.

Figure 5 outlines the key groups of value chain actors involved in the supply

of low carbon marine fuel value. Each of these groups can play a key role in

the supply of fuels to green shipping corridors and, in the longer term, to

shipping as a whole. This section explores these roles and the ways in which

the stakeholders can work together to accelerate low and zero emission fuel

uptake.

Close collaboration between energy, feedstock and fuel producers can

minimise fuel production costs

As discussed above, the cost of energy and material feedstocks is one of the

key price drivers for many low and zero emission fuels. Close collaboration

or integration between feedstock and fuel producers is important to support

commercial viability by minimising and stabilising costs. For CCS-enabled

fuels, natural gas could be procured from the open market however more

niche renewable feedstocks may require dedicated production or collection

facilities local to the fuel production facility.

For electricity supply, agreements between energy companies and fuel

producers should therefore prioritise minimising and stabilising costs to

support viability of the fuels. Stabilisation can be achieved through specific

power purchase agreements (PPAs) which might be delivered virtually from

a remote renewable electricity production facility, or physically using a direct

wire connection.

Figure 5 – Key stakeholder groups involved in production, supply and use of low and zero carbon marine fuels

Demand

Supply

Energy Providers

Feedstock Producers

Fuel Producers

Vessel Operators

Ports

Cargo Owners

Bunker Suppliers

Investors

Government & Regulators

Production

Distribution & Supply

End Use

Local Communities, Indigenous Groups & Wider Society

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 13

Fuel offtake agreements will help to stabilise prices and de-risk

infrastructure investments

Producers of low carbon fuels will include start-ups developing new

production infrastructure as well as established organisations adapting

existing facilities. In either case, making significant investment in new

infrastructure can represent a significant risk. Establishing offtake

agreements with bunkering services or vessel operators can offer longer-term

stability of pricing for both the producer and the user, increasing the certainty

required to invest in costly new infrastructure. For this reason, first mover

fuel producers are likely to seek partnerships with upstream suppliers (which

may be exposed to a similar risk from economy-wide decarbonisation), ports

and bunkering services and vessel operators.

Bunker suppliers are involved in the distribution of marine fuels from

production facilities or import/export hubs to in-port storage facilities or

directly to the vessel via truck, bunker vessel, or fixed infrastructure.

Alternative marine fuels such as hydrogen, ammonia, and methanol each

present distinct challenges to their safe and efficient storage, distribution and

transfer that will require new infrastructure and equipment to safely deliver

the fuels to vessels; this may include storage facilities, pipelines, landside

vehicles, and bunker vessels. It is likely that the fuel producers may

undertake some or all of the bunker supply activities.

Ports sit at the intersection of the supply and demand of marine fuels

Ports will play a vital facilitating role in the transition of shipping to zero

emission fuels. As a minimum, ports can be expected to facilitate port visits

from vessels using alternative fuels. However, there is an opportunity to

support movement of fuels into their site and facilitate bunkering activities,

requiring the appropriate knowledge and procedures to manage this safely.

Development of fuel storage facilities within the port boundary will require

significant investment. It should be noted that bunkering of several different

fuels in a single port, each with distinct handling requirements, is likely to be

commonplace in the future.

Sharing the cost of the fuels across the supply chain

Increased operational costs associated with the high cost of low carbon

marine fuels will be faced by vessel owners and operators. They will

additionally require significant capital investment for new or upgraded ships

and supporting technologies. Collaborating with other value chain actors on

offtake agreements, port fee incentives, or premium cargo rates can help to

mitigate this. Significant technical and regulatory challenges remain to the

uptake of some fuel's onboard vessels and collaboration with regulators,

shipbuilders, and equipment suppliers will be required to overcome them.

Cargo owners bridge the gap between the shipping industry and consumer

ambition

Cargo owners will play a key role in the development of green shipping

corridors. Ambitious decarbonisation targets have been set by cargo owners

in response to government and consumer pressures and this is driving these

businesses to seek low carbon shipping options. For example, the Cargo

Owners for Zero Emission Vessels (coZEV) network, which includes major

retailers like Amazon and Ikea, is working to accelerate maritime

decarbonisation by sending demand signals for zero emission shipping

services and supporting green shipping corridor development [25].

Governments will play a central role in the decarbonisation of shipping at

local, regional, national, and international levels

The nature of the marine fuel production value chain will require

involvement from a range of government departments. By setting top-level,

Paris-aligned decarbonisation policies for the energy and transport sectors,

governments can ensure the shipping industry is clear on the targets that need

to be achieved. Governments may also seek to regulate the greenhouse gas

intensity of fuels used by domestic shipping, in a similar approach to the

existing Clean Fuel Regulations [26] put in place in Canada to help drive

development and uptake of low emission fuels in transportation sector.

Government also has a central role in the development of enabling

regulations and provision of any direct grant funding to support bridging the

cost gap in the short to medium term. Creating decarbonisation policies with

clear targets and embedding them across taxation, development planning and

regulations sends opportunities signals to the market. This will need to take

place at a local, regional, national, and international level and work across the

value chain.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 14

The substantial investment opportunity needs to be unlocked

Decarbonisation of the global shipping industry by 2050 has been estimated

to require investment of up to USD$1.6 trillion [3]. This presents new

opportunities for the investor community around ship building and retrofits,

energy and fuel production infrastructure as well as associated supply chains.

Internalising the wider value opportunities means investors moving outside

the traditional, narrow lending criteria which views uncertainty as risk, rather

than a steppingstone to a bigger opportunity.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 15

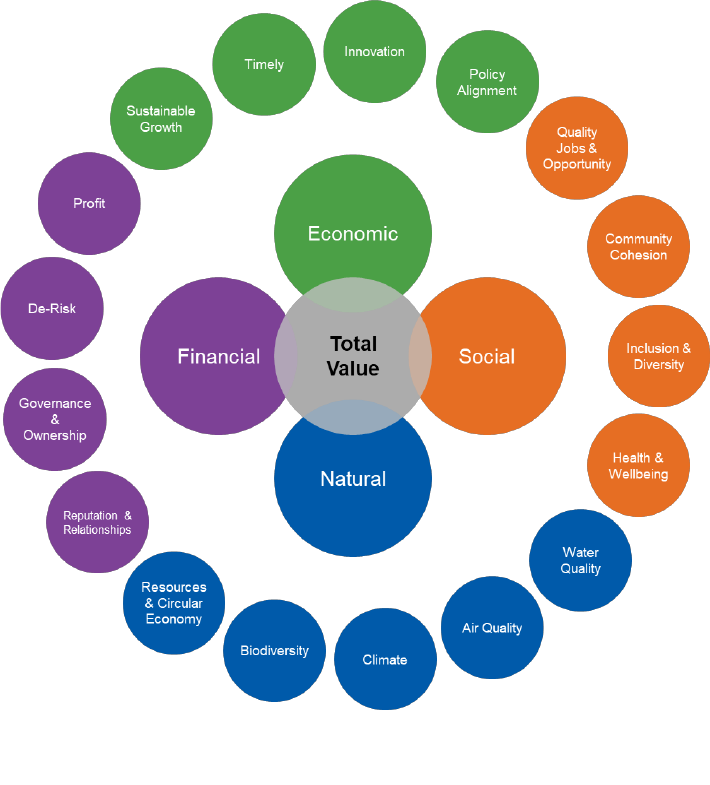

4. The Total Value Case

4.1 A Total Value approach could illuminate the

potential co-benefits of green shipping

corridors

Substantial capital and operational investment is required in new

infrastructure to supply low and zero emission fuels to first mover green

shipping corridors. These projects could have significant positive impacts

on Canada’s economy, at both national and local levels, as well as on the

natural environment and communities living nearby. Considering the

‘Total Value’ case for green shipping corridors and supporting fuel supply

projects can help to shape, capture, and leverage their wider value and

therefore improve their investment case.

The Total Value of infrastructure is the “perception of worth, or benefit,

that accrues to stakeholders, communities and other beneficiaries over

time” [27]. It is the sum of the financial, economic, social, and natural

value delivered by the project. A Total Value assessment should identify

the positive value outcomes that could be realised, helping to embed these

as objectives from an early stage of the project. However, it should also

identify and explore the risk of negative value outcomes, such that they

can be mitigated and minimised wherever possible.

This section explores how a Total Value framing approach can be applied

to green shipping corridor projects in Canada, the areas that value could be

delivered in, as well as some of the potential risks and negative outcomes

that should be mitigated. A ‘Total Value story from 2040’ has been

developed for each of the case studies in sections 6 and 7 to illustrate the

value outcomes that could be delivered and the approaches to realising

them.

Figure 6 – Total value for green shipping corridors

(Adapted from Arup [27])

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 16

4.2 Benefits that green corridors and broader maritime

decarbonisation could bring to Canada

Figure 6 shows a range of areas where green shipping corridors and their

associated fuel production infrastructure could – if shaped and implemented in

the right way – deliver broad value to diverse stakeholders. Although

presented separately, many of the value areas are inter-linked or overlapping,

underlining the importance of considering the full value profile together. Each

individual project will have a greater or lesser impact on each value category

and there may be additional categories to be considered that are not shown

here. Each of these value categories is described in more detail below.

Economic value

Economic value is the value delivered to the public purse, for example by

supporting jobs, facilitating trade, or increasing tax revenue.

Shipping has been estimated to directly contribute CAD$3 billion to Canada’s

GDP [1] while the energy sector makes up a further 9% of the economy, or

CAD$175billion [28]. However, both of these sectors will undergo significant

change in the coming decades as the world transitions to a net-zero economy

meaning that continuing in business-as-usual will not be an option. Green

shipping corridors present opportunities to address risks associated with this

transition, realise first mover advantages, create green jobs, and support

sustained economic growth in these sectors while delivering on policy

ambitions.

These economic value considerations could be grouped under the following

four categories:

Delivery of new zero emission fuel production infrastructure

can help to minimise climate transition risk in Canada’s

energy and transport sectors; future proofing jobs in these

sectors and enabling sustained economic activity and as the

world transitions to net zero emissions. More broadly,

shipping decarbonisation will help to secure a long-term

future for competitive international trade.

There are already numerous low and zero emission fuel

infrastructure projects underway globally, but production

still needs to scale significantly in the coming decades to

meet global climate targets. Entering the market at an early

stage can help to realise first mover advantages and lock-in

economic benefits over the long term. Uncertainties in the

rate that demand will scale presents risks which can be

mitigated through the green shipping corridor model.

Participation in green shipping corridors and other first

mover projects can support development and demonstration

of innovative technologies across the fuel production chain.

Fostering this innovation in Canada can help to maximise

the economic potential of the maritime fuel transition while

supporting a broader technology and innovation sector.

Projects should align with stakeholders’ strategies and

broader policy while delivering value for money. In Canada,

supporting green shipping corridors will help the

government deliver on its international commitments and

national emissions reductions targets. There are also

opportunities to consider how energy policy aligns with the

decarbonisation of road transport, rail, shipping, aviation,

and other fuel consuming sectors can help identify demand

aggregation opportunities, unlocking economies of scale and

maximising economic benefit.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 17

Social value

Social value is the value delivered to individuals, local communities and wider

society that ultimately improves quality of life.

While maritime industries can bring significant benefits to port and coastal

communities, in terms of employment and economic growth, these same

communities also often experience the worst of the negative impacts of

shipping such as air, water, and noise pollution. Maritime activity can have a

particularly acute impact on low-income communities, who may live in the

most polluted areas, as well as Indigenous people who have a strong ancestral

connection to the sea and coastal lands.

Green shipping corridors, and the longer-term decarbonisation of shipping,

presents an opportunity to reduce pollution and pursue broader social benefits.

These may include the generation of new employment opportunities, skills

development for existing workers, improved health and wellbeing, enhanced

community cohesion, and increasing inclusion of Indigenous groups.

These social value considerations could be grouped under the following four

categories:

The creation of well paid, inclusive, and meaningful jobs in

innovative industries - such as zero emission fuel production -

can provide more and better employment opportunities for

local communities with the net effect of an improved quality of

life. Providing training and improving skills will provide

broader opportunities over the long term and contribute to

realising economic benefits.

Port communities often have a strong connection to the port’s

activities with the port forming part of local identity. Ensuring

the future success of the port and positioning it as a front

runner can enhance this connection and provide positive

community uplift benefits.

Developing new energy and fuel infrastructure is an

opportunity to ensure Indigenous communities are included and

the full benefits are shared equally. Early and comprehensive

engagement and involvement with community groups,

particularly indigenous communities, is key to project success

and to advancing reconciliation and self-determination.

Reducing air pollution from shipping will avoid negative health

impacts on port and coastal communities but can also have

indirect positive effects such as encouraging increased outdoor

recreational and community activities. However, there are also

health and safety challenges that must be addressed in the

transition to these new fuels.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 18

Natural value

Natural value is the value delivered for the environment.

Vessels operating in Canadian waters produced more than more than

13 million tonnes of CO

2

emissions in 2019 [2] as well as hundreds of

thousands of tonnes of air pollutants that impact the health of port and coastal

communities, pollute oceans and can themselves have a significant climate

impact. There are also risks associated with accidental fuel oil spills as well as

ongoing loss habitats and natural resource depletion.

Green shipping corridors are an opportunity to collaborate across the energy,

fuel, and shipping value chains to address these environmental impacts while

exploring opportunities to deliver net benefits to biodiversity and support the

development of circular economy principles in any new projects.

These natural value considerations could be grouped under the following

categories:

Combustion of fossil fuels contributes to ongoing

environmental damage through processes such as ocean

acidification and eutrophication. The transition to alternative

fuels can help to slow these processes. However, care must still

be taken when handling these new fuels to avoid accidental

leaks or spills, particularly in areas with vulnerable ecologies.

Poor air quality in ports and coastal areas caused by shipping

contributes to negative health impacts and causes millions of

premature deaths globally every year. Reducing combustion of

carbon-based fuels will reduce emissions of particulate matter

and associated health impacts. However, adverse impacts of

combustion of alternative fuels must be understood and

managed.

The importance and urgency of reducing greenhouse gas

emissions in order to protect people and the planet has never

been clearer. Climate impacts will be felt at a local level,

impacting coastal communities as well as stakeholders across

the port and shipping sectors. Transitioning to low and zero

emission shipping fuels will address greenhouse gas emissions

and hence help to prevent the worst climate outcomes.

The need to produce develop new energy and fuel production

infrastructure at scale, which can occupy large areas of land or

seabed, must be balanced with the need to protect sensitive

environmental areas and enhance biodiversity. Maximising the

use of brownfield sites and repurposing existing infrastructure

wherever possible can help to achieve this aim and deliver the

fuel transition with as little environmental impact as possible.

Many of the fuel production pathways explored in this report

require significant quantities of feedstocks, from biomass to

fresh water, and also produce waste streams, such as oxygen or

carbon dioxide. Effective use of these resources should be

prioritised to avoid adverse environmental impacts. Meanwhile,

any opportunities to use waste products from other industries or

provide by-products for secondary use should be explored.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 19

Financial value

Financial value is the direct financial benefit delivered to stakeholders through

the delivery and operation of new infrastructure.

Decarbonisation of the global shipping industry will require significant

investment in land side energy and fuel production infrastructure [3]. Green

shipping corridors can help to attract this investment to Canada where

available natural resources, a skilled workforce and available land can be

leveraged to produce cost competitive zero emission shipping fuels. The

development of this infrastructure raises opportunities to explore how its

financial benefit can be distributed among a broader range of stakeholders

such as local communities and indigenous groups.

These financial value considerations could be grouped under the following

categories:

The shipping industry consumes billions of dollars’ worth of

fuel every year; there is a significant opportunity for

stakeholders across the shipping and fuel supply value chain to

realise new revenue streams and profit from the transition away

from fossil fuels. This could include energy companies, fuel

producers, bunker suppliers, ports and first mover shipping

companies. Exploring different ownership structures may raise

the potential for greater public or community wealth building.

Although there is inherent risk in first mover projects involving

innovative and emerging technologies, by mobilising supply

and demand simultaneously, green shipping corridor initiatives

are an opportunity for stakeholders de-risk investments in new

fuel infrastructure. This infrastructure is also an opportunity for

investors to de-risk existing portfolios by reducing exposure to

legacy fossil fuel infrastructure and potential of stranded assets.

Considering how to structure the ownership of new

infrastructure alongside the broader value aims of a project can

help to ensure the intended outcomes are achieved and benefits

maximised. These projects provide an opportunity to increase

ownership stakes in projects for public bodies, local groups,

and indigenous communities.

Good governance in new infrastructure projects is crucial to

ensuring value is delivered across all areas and to all

stakeholders. Work should be done to ensure stakeholders,

including investors, have strong Environmental, Social and

Governance (ESG) performance and values that align with the

broader aims of the project.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 20

4.3 Delivering the value

As explored in the preceding section, there are a broad range of positive value

outcomes that could be delivered for Canada through green shipping corridors

and longer-term maritime decarbonisation. However, the type of value that

can be delivered - and the benefactors of it - depends as much on the approach

taken to implementing the infrastructure projects as it does to the type of

infrastructure delivered.

Considering the impact at a local, national, and global scale

As identified in the Canadian Green Shipping Corridor Framework, actions to

tackle emissions at a local level can support positive outcomes at a national or

global scale. This is applicable across the Total Value framework, where

supplying zero emission shipping fuels in Canada could also realise economic,

social, and financial benefits at a global scale. Figure 7 sets out example

benefits that could be delivered by at a local, national, and global scale.

Applying a place-based approach

A place-based approach recognises that a one-size-fits-all attitude to project

delivery will not capture the importance of local context and how this shapes

the uniqueness of place. The impact of creating green shipping corridors on

the local communities will be unique to Halifax, Vancouver, Prince Rupert,

and indeed any port in Canada. Ensuring that evidence-based knowledge of

local need and context feeds into decision-making processes within the project

allows for sustainable and relevant long-term value creation.

Identifying the target value outcomes from a project and embedding them in

its delivery

Undertaking a value assessment at the start of any project can enable

stakeholders to identify the potential value that could be delivered and embed

this as specific objectives in the project’s delivery. The objectives should be

revisited at all key stages of the project to ensure they are delivered. This

approach can help to make sure all stakeholders are aligned on the outcomes

and working together towards them.

Figure 7 – Example benefits that could be realised at a local, national and global

scale

Local

National

Global

A new fuel production

facility creates new, well-

paying jobs; positively

contributing to the local

economy.

Canada positions itself as

a global leader in low

carbon marine fuels and

associated technologies,

generating new export

opportunities.

The shipping industry’s

operations on with zero

carbon fuels enable it to

continue facilitating

global trade in a net-zero

economy.

A new port fuel project

creates a vacant terminal

that is redeveloped into a

waterfront public park,

increasing the wellbeing

of local communities.

A renewable energy

project undertakes

comprehensive and early

engagement with

indigenous groups,

supports reconciliation

and promotes increased

economic inclusion.

Social value

considerations are

embedded in the project’s

procurement strategy,

delivering value

throughout the supply

chain with a potential

global impact.

Use of zero emission fuels

improves air quality

around the port, reducing

negative health outcomes

for local communities.

Reduced combustion of

fossil fuels reduces

impacts of ocean

acidification and

eutrophication.

Supply of zero emission

fuels reduces greenhouse

gas emissions from

shipping and helps to

avoid the worst impacts of

climate change globally.

Facilitating the supply and

export of a range of new

fuels creates new revenue

streams for the port.

The development of zero

emission fuel supply

chains drives innovation

across the country,

attracting investment

across a number of sectors

and regions.

Shipping lines are able to

demonstrate enhanced

sustainability to access

preferential capital and

insurance rates.

Economic

Social

Natural

Financial

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 21

5. Case study: British Columbia, the Port of Vancouver, and the Port of Prince Rupert

This report uses two Canadian case studies to illustrate the potential impact

that green shipping corridors and the longer term decarbonisation of shipping

could have in Canada. These case studies examines the Port of Vancouver

and Port of Prince Rupert in British Columbia. These explores the region’s

energy and resource setting, the local context of each port, and how these

factors can influence the feasibility of different fuel production pathways.

Using an estimate of the potential future low and zero emission fuel,

produced by the Lloyd’s Register Maritime Decarbonisation Hub, an

example fuel production and supply typology is developed for each port to

illustrate the type, scale and cost of the infrastructure required to meet

potential future demand for low and zero emission shipping fuels. The cost

estimates provide an order of magnitude indication of the investment required

to deliver the infrastructure for each typology and are based on assumptions

and benchmarks taken from publicly available sources and similar projects.

A Total Value story has been developed for each of the illustrative fuel

supply typologies to demonstrate possible value outcomes that could be

delivered for each location, including some of the approaches taken to doing

so. Considering the ‘Total Value’ case can help to shape, capture, and

leverage the wider value of the corridor and therefore improve their

investment case.

5.1 Regional energy and resources

British Columbia has a high renewable energy mix with excess generation

capacity

In British Columbia, hydroelectric power generates about 87% of the

region’s electricity followed by Biomass (5%) which primarily uses waste

from the province's large forestry sector [29]. A further 4% of electricity is

generated from wind power and the remaining 4% is generated from

combustion of natural gas generation. This high renewable energy mix means

that the province has one of the lowest carbon intensity grids in the world, as

shown in Figure 8.

Figure 8 – Carbon intensity of electricity in British Columbia compared to a selection

of global economies in 2020

Data source: British Columbia [29], all other countries [30]

Most of the hydroelectric generation plants are situated on the Peace River in

the northeast and the Columbia River in the southeast of British Columbia. A

major, 1,100 MW hydroelectric project called Site C is currently being built

on the Peace River and is anticipated to be finished in 2025 aiming to provide

additional low-cost renewable energy.

There is a currently an energy and capacity surplus in British Columbia

which is forecast to persist until around 2030 [31]. Given the large quantities

of renewable energy in the grid, the province has the opportunity to produce

low carbon fuels such as hydrogen and its derivatives.

0

100

200

300

400

500

600

Carbon intensity of electricity

(gCO2/kWh)

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 22

The province has significant natural gas resources

British Columbia is a major producer and supplier of natural gas; accounting

for 35% of total Canada’s total natural gas production in 2020 [29]. An

established pipeline network supports the distribution of natural gas within

the province as well as its export elsewhere in Canada and to the US. The

Province has recently released a New Energy Framework that sets

requirements for new LNG facilities to set out plans to reduce production

emissions to net zero by 2030. The framework commits to putting in place a

regulatory cap on production emissions from the oil and gas industry to

ensure British Columbia meets its 2030 emissions-reduction target for the

sector. The utilization of renewable energy to lower the greenhouse gas

emissions from the production and liquefaction of natural gas, would help to

minimise the lifecycle emissions where the gas is used as a feedstock in

production of CCS-enabled hydrogen and its derivatives.

Some parts of the electricity grid are constrained

There is a push to electrify buildings and vehicles to curb climate-warming

emissions. However, in the northwest of British Columbia there is limited

grid capacity and lower security of supply which has impacted the rate of

decarbonisation in the area. These constraints could impact the viability of

any e-fuel production facility in the area, including Prince Rupert. However,

the commitment in the New Energy Framework to accelerate the industrial

electrification with renewable electricity could help to alleviate this concern.

There is government support for transport electrification and hydrogen

production

Despite British Columbia having a low carbon electricity grid and surplus

generation capacity, around 70% of the region’s total energy demand is met

through fossil fuels such as gasoline and domestic natural gas. In 2021, BC

Hydro, the electric utility that generates most of the region’s electricity,

launched a 5-year ‘Electrification Plan’ [32], which includes plans to invest

CAD$260 million to promote energy studies, energy incentives and other

programs to encourage customers to switch to electricity. This plan covers

customers across industry, transportation, and homes and buildings. For the

Transportation sector, BC Hydro are providing incentive support around

customer specific electrification roadmaps, studies, fleet conversations and

demo projects. There is potentially an opportunity to further extend this

programme to support e-fuel production for vessels that cannot be directly

electrified.

The province’s government has published Hydrogen Strategy [21] to support

its aim to reach net zero emission by 2050 and ambition to become a world

leading hydrogen economy. The strategy outlines government’s actions to

accelerate the development of British Columbia’s hydrogen sector,

identifying potential for green and CCS-Enabled hydrogen production given

the clean grid, natural gas reserves, and significant CCS potentials with

favourable geology. This hydrogen can be used directly in fuel cells or

combustion engines of some marine vessels or used in the production of e-

fuels such as methane, methanol, or ammonia to fuel larger ocean going

vessels.

Favourable geology creates a potential market for carbon sequestration

The geological formations that provide the province’s abundant natural gas

reserves also present a significant opportunity for the geological storage of

carbon dioxide. Neighbouring Alberta has already committed $1.24 billion of

funding for two commercial-scale carbon capture, utilisation and storage

projects in the region where carbon will be collected from industrial activities

and injected into secure geological formations. The potential for significant

long-term sequestration of captured carbon, as well as the availability of

natural gas with low production emissions, could lend itself to production of

CCS-enabled hydrogen and derivatives such as ammonia at commercially

competitive cost.

There is also the potential to develop further economic activity around the

capture, handling, and storage of carbon, potentially importing captured

carbon from other regions or countries, or becoming a leading region in the

technology development required to develop this industry. For example, local

company Carbon Engineering is already operating a pilot Direct Air Capture

(DAC) plant in Squamish which has the potential to produce feedstock to

produce low emission e-fuels.

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 23

5.2 Estimated demand for low and zero emission fuels

The Lloyd’s Register Maritime Decarbonisation Hub conducted an analysis

of vessel traffic operating on the West Coast of Canada during a baseline

year of 2021 to estimate zero emission demand under different scenarios. The

applied methodology for this analysis is described in full at Appendix B.

Port of Vancouver

The analysis identified 3,300 vessels that entered the region covering the

western coastline of Canada and the US, extending to the southern point of

Oregon. Of these, 830 vessels entered the Strait of Georgia and Vancouver

area. However, as shown in Figure 9, many of these vessels spend a

significant proportion of the year operating internationally and therefore have

greater options to bunker elsewhere. To account for this, the analysis assumes

that vessels would be unlikely to bunker in the port if less than 20% of their

total port calls are in Vancouver or they spend more than 50% of the year

outside the region; these vessels are therefore considered out of scope and

excluded from the estimate of fuel demand. Applying these thresholds to the

first mover segments - bulk carriers, container ships and Ro-Ro vessels -

Lloyd’s Register identified 144 vessels as being in-scope. The estimated total

annual fuel demand of the in-scope fleet is in the region of 820 thousand

tonnes per annum (ktpa) of HFO equivalent fuel (HFO

e

), of which around

Figure 9 - Heatmap of global activity of vessels that ever called in Vancouver during 2021

(Source: Lloyd’s Register Maritime Decarbonisation Hub)

449bulk carriers

130 containerships

119 open hatch cargo ships

78 vehicle carriers

54 other

Oceans North Conservation Society

Canadian Green Shipping Corridors Preliminary Assessment

| 02 | 19 June 2023 | Arup International Projects Limited

Final Report

Page 24

230ktpa is estimated to be attributable to Vancouver based on the time the

vessels spend in the region.

The analysis applies a number of assumptions to project the uptake of zero

emission fuels to 2030 including estimates for transport demand growth,