Financial report 2022

01

Financial report 2022

|

The Vancouver Fraser Port Authority

Financial Report 2022 provides an

overview and analysis of our financial

results. The analysis throughout uses

Canadian dollars.

About this report

02

|

Vancouver Fraser Port Authority

Year in review

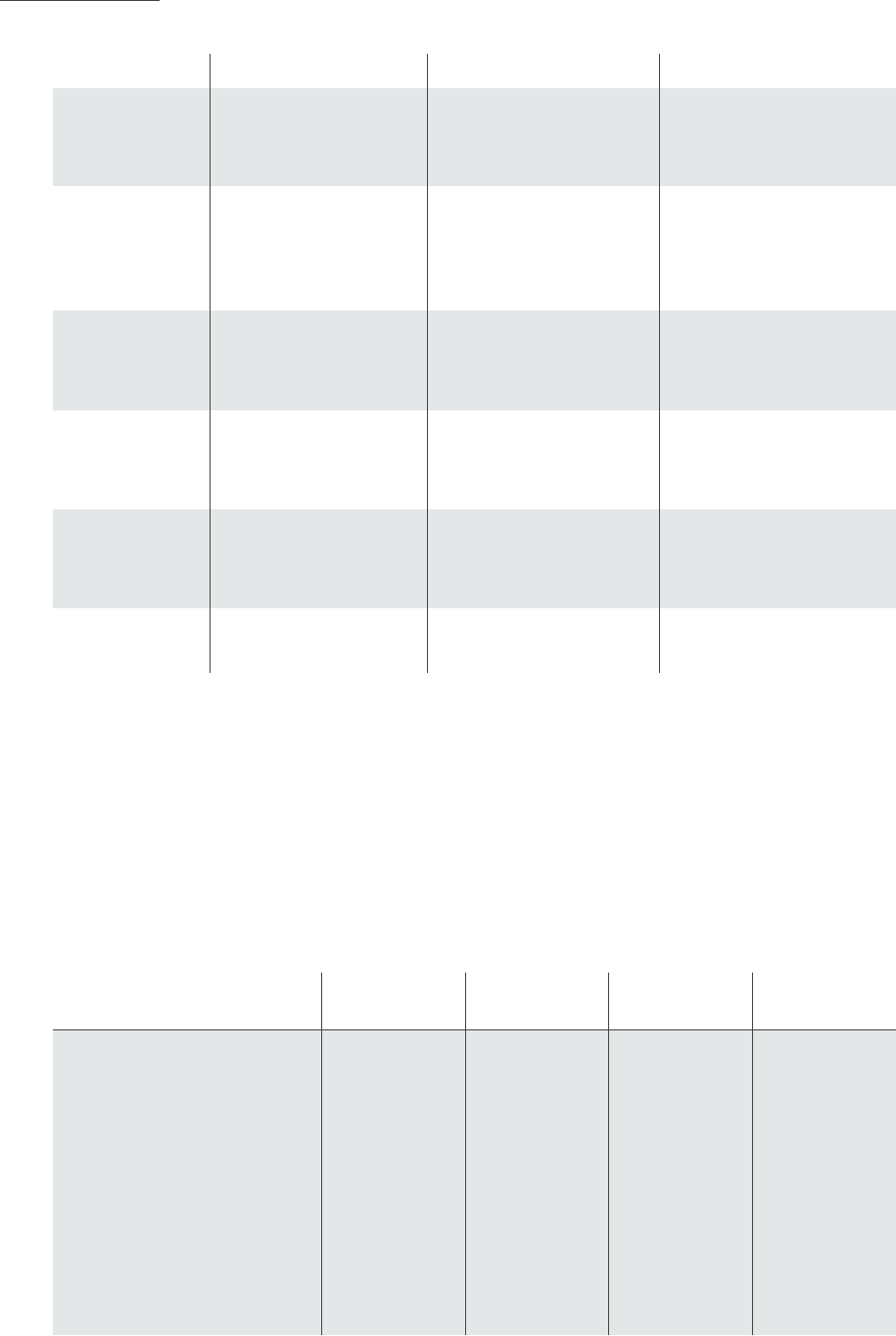

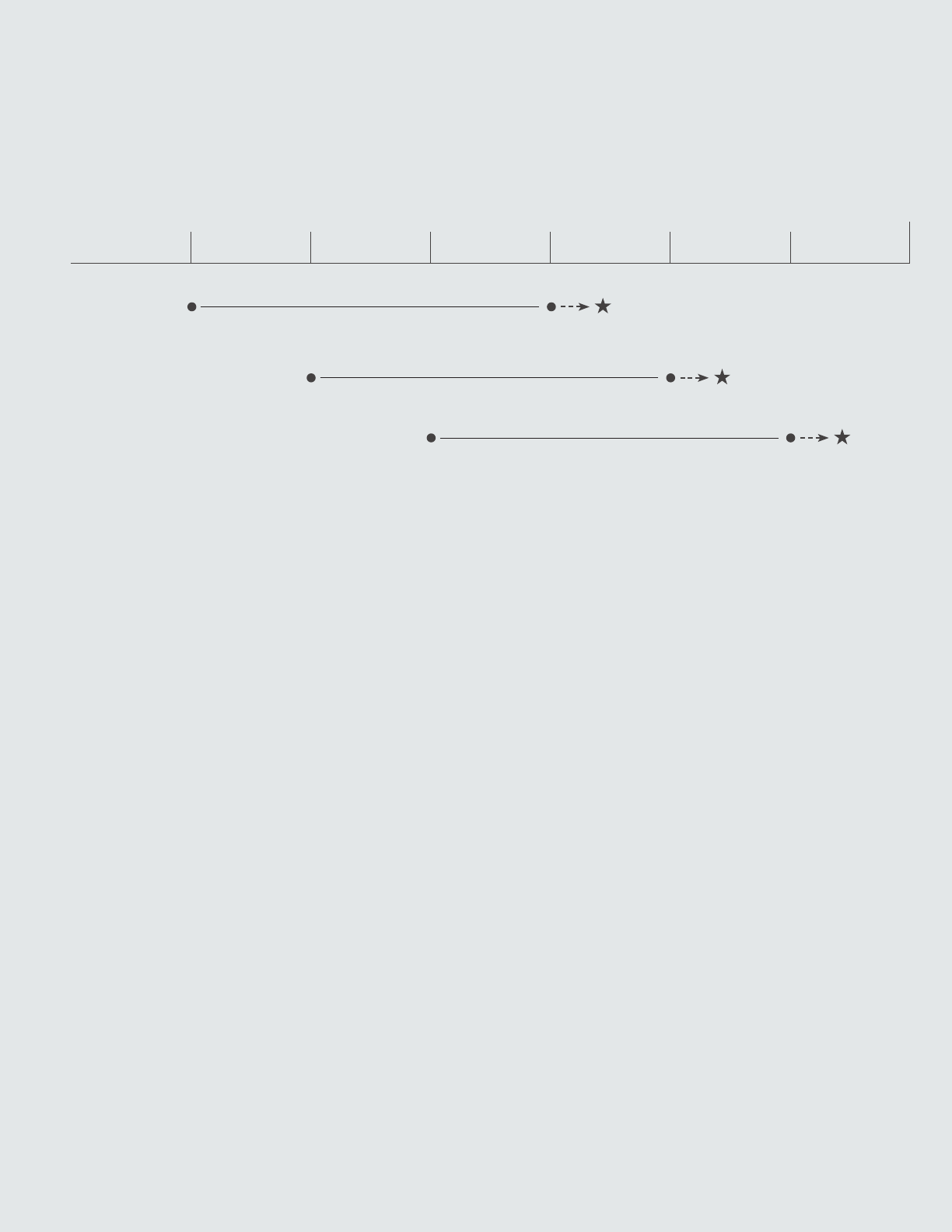

Port of Vancouver cargo volumes

Overall cargo volume in 2022 was 141 million tonnes, which was down 3% from the 2021

volume of 146 million metric tonnes.

Auto sector volume was 333,734 units, a 6% decrease compared

to 2021, mainly driven by supply-side production and distribution

issues in the first half of 2022.

Breakbulk volume was flat at 20 million metric tonnes. Lower

domestic volumes were offset by higher imports of steel products.

Autos

Breakbulk

Bulk volume was 99 million metric tonnes, a 3% decrease compared

to 2021, largely driven by a 23% decline in grain volumes. Coal, potash,

and sulphur volumes increased by 6%, 11%, and 22% respectively.

Bulk

Container volume was 4 million 20-foot equivalent units (TEUs),

a 3% decrease from the record volume seen in 2021.

Container

Cruise business returned in 2022 with 810,090 passengers

after a two-year hiatus due to Canada-wide COVID-19 pandemic

restrictions implemented by the federal government.

6

%

3

%

3

%

–

–

Cruise

Auto (units)

Breakbulk (metric tonnes)

Bulk (metric tonnes)

Containerized (metric tonnes)

Total tonnage (metric tonnes)

Containers (TEUs)

Cruise passengers

425

18,209

101,795

26,662

147,091

3,396

889

420

17,165

99,697

26,923

144,204

3,399

1,071

345

16,731

101,770

26,604

145,451

3,468

–

356

19,793

101,719

24,605

146,474

3,679

–

334

19,828

99,029

22,226

141,416

3,557

810

Operating highlights (000s) 2018 2019 2020 2021 2022

Strategic capital investments

The Vancouver Fraser Port Authority continues to invest in capital projects to support the growth of Canada’s trade and

help address supply-chain congestion, while minimizing the impact of trade on local communities and the environment.

Key projects in 2022 included:

Centerm Expansion Project and South Shore Access Project Construction at the Centerm

container terminal was substantially completed in 2022, which included expanding the terminal

footprint by 15%, reconfiguring the container yard, building a new operations facility, and local marine

habitat improvements. Once fully optimized, the terminal’s capacity will increase by 60%. Work

continued on the associated South Shore Access Project, which involves improving port road and

rail infrastructure around Centerm and other nearby terminals and providing direct access to the

Trans-Canada Highway.

Roberts Bank Terminal 2 Project This proposed marine container terminal has been developed

under the port authority’s public interest mandate to meet Canada’s growing trade needs. In 2022,

we continued to advance environmental studies, sign additional mutual benefit agreements with

Indigenous groups, and engage with industry and the community as we progress through the federal

assessment process that began in 2013.

Highway 91/17 Upgrade Project The port authority contributed funding to this provincially led

project that will improve traffic safety and efficiency along key provincial highway routes connected

to the Roberts Bank Trade Area.

Temporary empty container storage facility Partially funded under the National Trade Corridors

Fund, we developed a temporary storage site on our existing land for empty shipping containers to help

clear supply-chain backlogs that resulted from rail service disruptions caused by the severe flooding in

November 2021, which fully cut off the Port of Vancouver from national supply chains for eight days.

Richmond Logistics Hub This project focuses on preparing underdeveloped port land to increase

capacity and improve the flow of goods through the logistics hub in Richmond. In 2022, we continued

to prepare multiple sites within the hub for future development of trade-enabling facilities.

Gateway infrastructure projects In 2022, we continued to advance multiple road and rail

infrastructure projects throughout the Lower Mainland, partly funded by the Government of Canada

through the National Trade Corridors Fund and partly funded by industry. These projects will improve

the movement of cargo in the region, help get Canadian goods to market efficiently, create well-paying

jobs, and improve safety and traffic flow for communities. Construction on the Commissioner Street

Road and Rail Realignment Project in Vancouver, and the rail component of the Burnaby Rail Corridor

Improvements Project were completed in 2022.

Vancouver Fraser Port Authority

04

|

Vancouver Fraser Port Authority

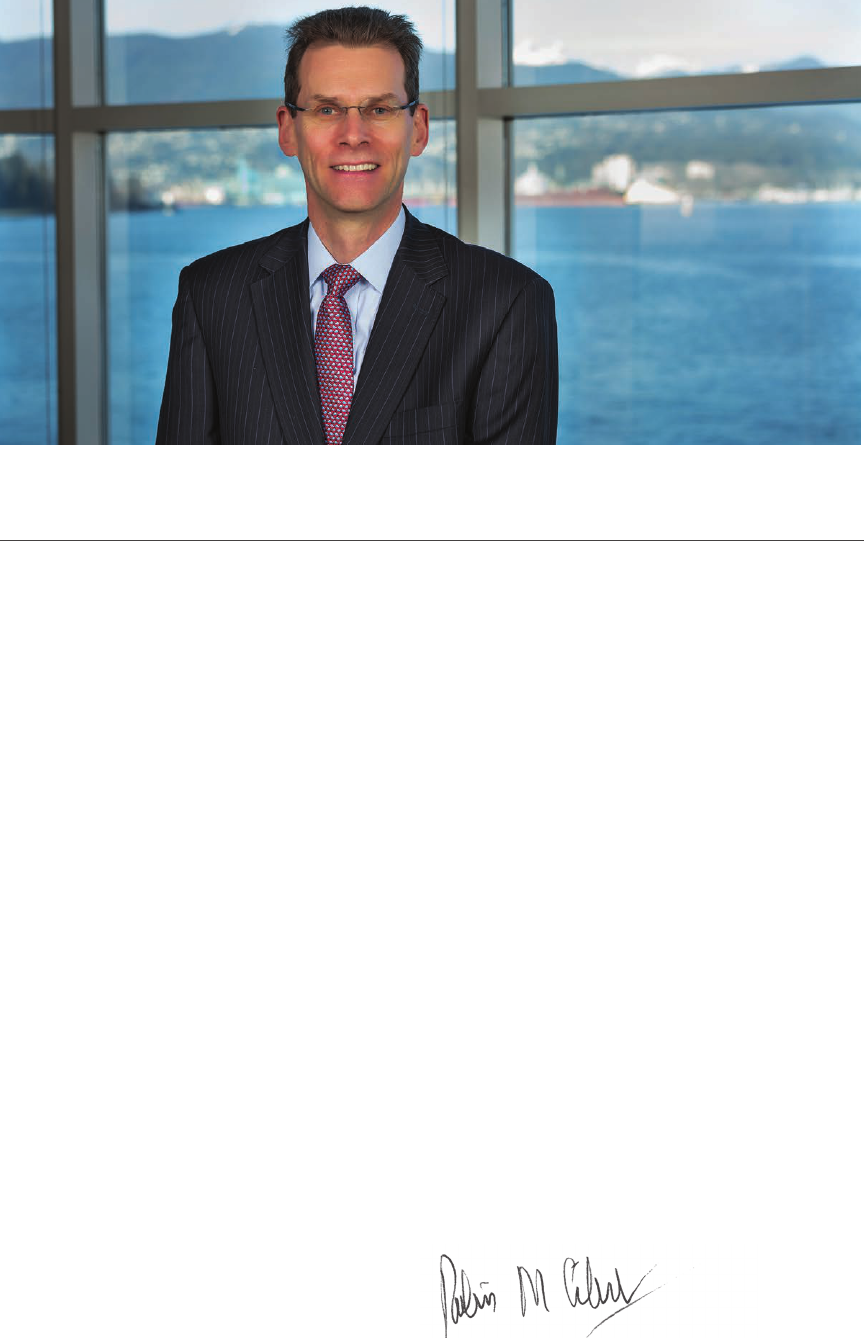

Messages

As Canada’s largest port, the Port of Vancouver is an

economic powerhouse. The Vancouver Fraser Port

Authority is federally mandated to enable trade

through the port while protecting the environment

and considering communities. In overseeing the

port’s long-term success and sustainability, the port

authority fulfills a vital role for Canada’s economy.

The port authority’s board of directors, in turn,

provides oversight and strategic guidance to the port

authority to help it deliver on its mandate. Each of us

on the board is proud to support the port authority’s

work, for the benefit of all Canadians.

I am pleased to present the Vancouver Fraser Port

Authority Financial Report 2022, which details 2022

trade volumes across the Port of Vancouver’s diverse

cargo sectors, the port authority’s financial position,

and the strategic capital investments the port

authority has made to support Canada’s long-term

trade growth.

Against a backdrop of complex trade challenges

in 2022, the steady results in this report are a

testament to the port authority’s effective stewardship

of the port, in conjunction with the exceptional work

by industry and the port’s workforce moving goods

through the port.

With Canada’s west coast ports projected to run out

of container capacity by the mid- to late 2020s, in

2022, the port authority continued to advance the

Roberts Bank Terminal 2 Project, a proposed new

container terminal in Delta, through the final stages

of the federal environmental assessment process.

The project is Canada’s opportunity to provide timely

capacity for our country’s growing trade needs;

to support the success of Canada’s Indo-Pacific

Strategy, which expands trade with a region on track

to account for 50% of the world’s GDP by 2040;

and to strengthen reliable access to goods that

Canadians use every day.

In the spring of 2023, the port authority welcomed

the Government of Canada’s approval of the project,

which is a significant step forward for the project and

towards a stronger trade future for Canada.

As we reflect on 2022, on behalf of the board

of directors, I would like to thank the full port

community for their remarkable work, in a

challenging year, that has supported these resilient

financial results. I would also like to thank Robin

Silvester, his executive leadership team, and the port

authority’s dedicated employees for their ongoing

work to advance the organization’s strategic

priorities, to enable Canada’s trade objectives, and

to benefit Canadians across the country.

Judy Rogers

Chair, Board of Directors

Message from the chair, board of directors

05

Financial report 2022

|

The trade landscape in 2022 remained complex,

including layered supply-chain challenges and

grain-sector impacts in the first half of the year, due

to Canada’s 2021 drought-affected harvest. Despite

these headwinds, one of the Port of Vancouver’s

foundational strengths—the most diversified cargo-

handling abilities of any port in North America—

continued to provide resilience in trade flows.

Lower grain volumes through mid-year were

substantially offset in the second half of the year by

a strong fourth-quarter grain rebound; the second-

highest annual container and potash volumes to date;

and record coal volumes, resulting in 141 million

metric tonnes handled through the port overall in

2022, a 3% decrease from 2021. Additionally in

2022, after a two-year hiatus due to pandemic

restrictions, Vancouver’s port community and tourism

partners welcomed the restart of cruising in Canada

for what proved to be a strong comeback season,

including a record 307 cruise ship visits, a 7% increase

compared to 2019.

The return of cruise revenues helped drive an 11.1%

increase in overall revenues and a 10.5% increase

in EBITDA, helping enable the Vancouver Fraser Port

Authority’s $233 million in capital investments in

2022, centrally infrastructure and trade-enabling

land, up from $208 million invested in 2021.

In 2022, we were pleased to have reached substantial

completion of construction on the Centerm Expansion

Project, also in the container sector, as well the

Commissioner Street Road and Rail Alignment

Project, part of a suite of nearly $1 billion in road

and rail projects that we are leading, in partnership

with government and industry, to strengthen the

region’s trade corridors.

With the coming forecasted capacity crunch at

Canada’s west coast container terminals, the port

authority continued to advance the proposed Roberts

Bank Terminal 2 (RBT2) Project, which is of vital

importance to Canada’s trade future through this

gateway. After a public comment period ended in

March 2022, we provided a final submission to the

Impact Assessment Agency of Canada to show how

topics raised through that period will be addressed.

We continued to build positive, long-lasting relationships

with Indigenous groups and were proud to have 24

RBT2-related Mutual Benefits Agreements (MBAs)

with Indigenous groups in place by the end of 2022,

and two additional MBAs signed in early 2023.

In April 2023, we welcomed the Government of

Canada’s approval of RBT2, following a rigorous

environmental assessment process that started in 2013.

With this landmark project milestone achieved, we will

now work toward obtaining other applicable approvals

and permits to advance the project and support a strong

future for Canada’s west coast container trade.

As we consider the future, the port’s enduring role

powering the Canadian economy and the port

authority’s strong financial results, investments, and

leadership at Canada’s largest port underscore the

organization’s unique position and capability to drive

long-term trade success through this gateway, in

close partnership with port industry, for the benefit

of all Canadians.

Robin Silvester

President and CEO

Message from the president and CEO

06

|

Vancouver Fraser Port Authority

About us

07

Financial report 2022

|

About the Vancouver Fraser Port Authority

Mission and vision

Our mission is to enable Canada’s trade objectives,

ensuring safety, environmental protection, and

consideration for local communities.

Our vision is for the Port of Vancouver to be the

world’s most sustainable port.

We believe a sustainable port delivers economic

prosperity through trade, maintains a healthy

environment, and enables thriving communities

through collective accountability, meaningful

dialogue, and shared aspirations.

The Vancouver Fraser Port Authority is the federal agency responsible for the

shared stewardship of the lands and waters that make up the Port of Vancouver,

Canada’s largest port.

As a Canada Port Authority, our mandate is to enable Canada’s trade through

the Port of Vancouver while protecting the environment and considering local

communities. Accountable to the federal minister of transport, Canada Port

Authorities manage federal lands and waters in support of national trade

objectives for the benefit of all Canadians. At the Vancouver Fraser Port

Authority, we do this by leasing the federal lands that make up the Port of

Vancouver, and by providing marine, road, and other infrastructure to support

port growth, function, and operation.

Economic prosperity through trade

Competitive business

Effective workforce

Strategic investment and asset management

Healthy environment

Healthy ecosystems

Climate action

Responsible practices

Thriving communities

Good neighbour

Community connections

Indigenous relationships

Safety and security

08

|

Vancouver Fraser Port Authority

Borrowing limit and credit rating

The Vancouver Fraser Port Authority continues to

maintain a strong AA (stable) credit rating from

Standard & Poor’s Ratings Services. This consistent

strong credit rating and stable outlook helps us

attract lenders and optimize our borrowing costs in

support of our investment in the gateway. In 2021,

our Letters Patent was updated to increase our

permitted borrowing limit from $0.51 billion to

$1.03 billion. To accommodate growing trade

through Canada’s largest port, this increase in

borrowing limit aligns with the port authority’s

strategic plan to continue to fund infrastructure

capacity expansion within the port and the

surrounding gateway.

Existing credit facilities

Committed revolving credit facilities:

Subsequent to increasing our borrowing limit, in

October 2021 the port authority increased its

committed revolving credit facilities from $0.5 billion

to $0.8 billion with three banks. All committed

revolving credit facilities mature in March 2026.

As of December 31, 2022, a total of $0.2 billion

was drawn on these three committed revolving

credit facilities.

Letter of credit: The port authority holds letters

of credit under a sub-facility to support various

commitments relating to port-related projects and

the delayed funding of our pension plan solvency

deficit. As of December 31, 2022, letters of credit

in the amount of $0.01 billion were outstanding.

Subsidiary credit facilities

Port of Vancouver Terminals Ltd.: Under one of

the bank’s committed revolving credit facilities, the

subsidiary has an outstanding uncommitted demand

non-revolving loan that matures in March 2026.

As of December 31, 2022, the outstanding balance

was $0.7 million.

09

Financial report 2022

|

2022 financial

results

Consolidated summary

10

|

Vancouver Fraser Port Authority

2022 financial results

Consolidated summary

Net income

Add: Depreciation

Add: Other expenses (income)

EBITDA

$ 106,050

37,947

5,359

149,356

$ 90,438

39,715

5,012

135,165

15,612

(1,768)

347

14,191

17.3%

(4.5%)

6.9%

10.5%

(000s)

2022 2021

Increase

(decrease) $

Increase

(decrease) %

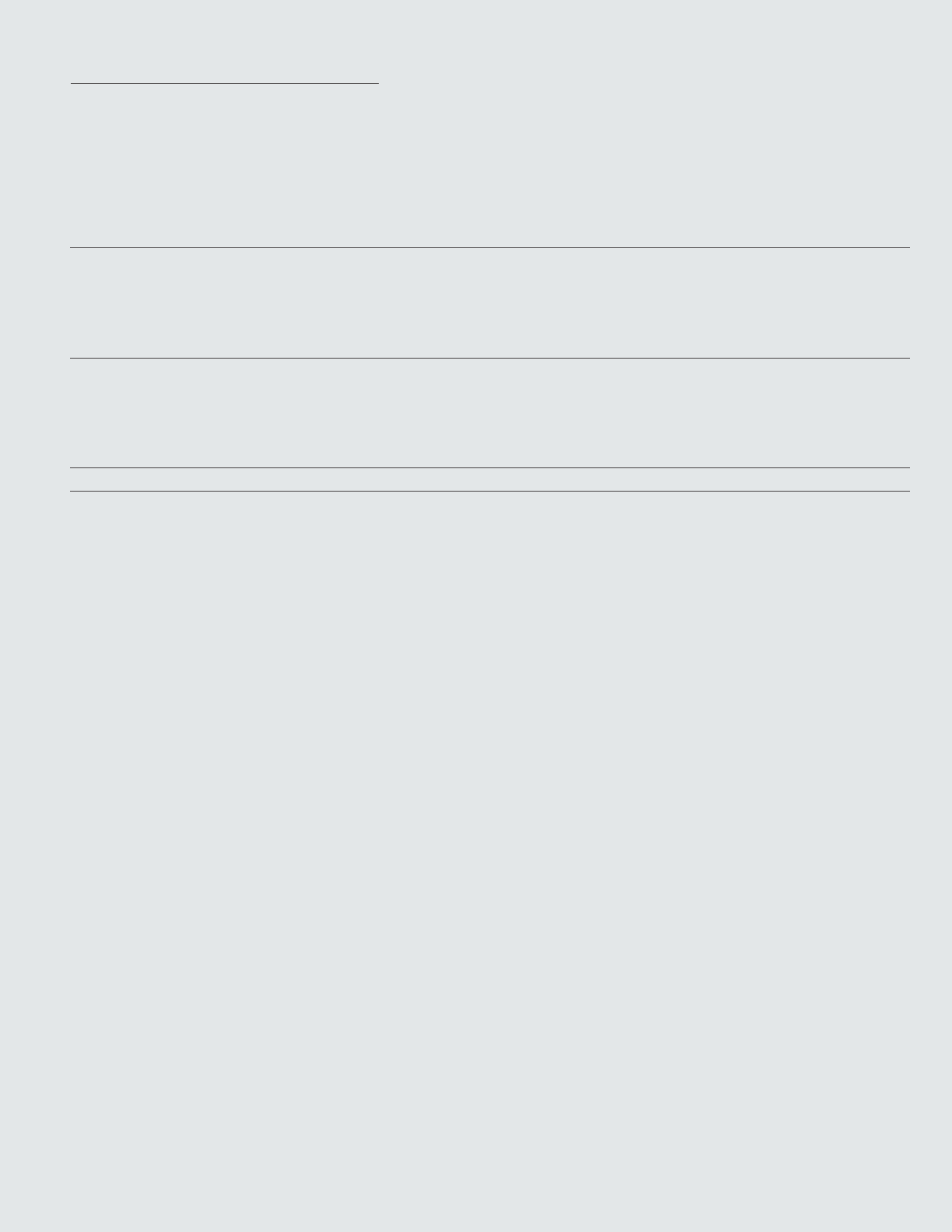

Consolidated EBITDA increased by 10.5% to $149 million in 2022, primarily due to the resumption of the

cruise season, offset by higher internal and external costs to advance the port authority’s strategic initiatives.

Net income increased by 17.3% due to the higher EBITDA.

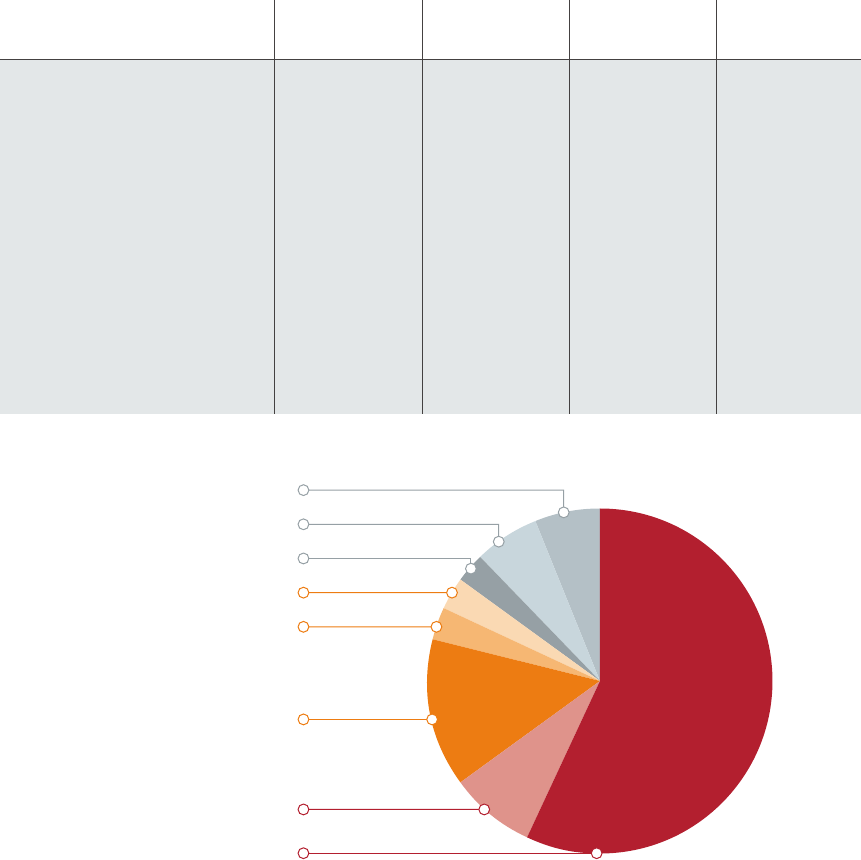

Revenue

Operating expenses

EBITDA

Capital investments

$ 274,453

$ 143,928

$ 166,260

$ 136,238

$ 301,318

$ 155,510

$ 183,668

$ 190,526

$ 274,082

$ 153,922

$ 158,511

$ 315,377

$ 274,671

$ 179,221

$ 135,165

$ 207,511

$ 305,099

$ 193,690

$ 149,356

$ 233,382

Financial highlights

(000s)

2018 2019 2020 2021 2022

Consolidated revenues

increased 11.1% to

$305.1 million in

2022, compared to

$274.7 million in 2021.

Revenue

11.1

%

Consolidated earnings before

interest, taxes, depreciation,

and amortization (EBITDA)

increased 10.5% to

$149.4 million in 2022.

EBITDA

10.5

%

12.5

%

Capital investment

Capital investments relating

to property and equipment

totalled $233.4 million

for 2022, compared to

$207.5 million in 2021.

Management discussion and analysis

11

Financial report 2022

|

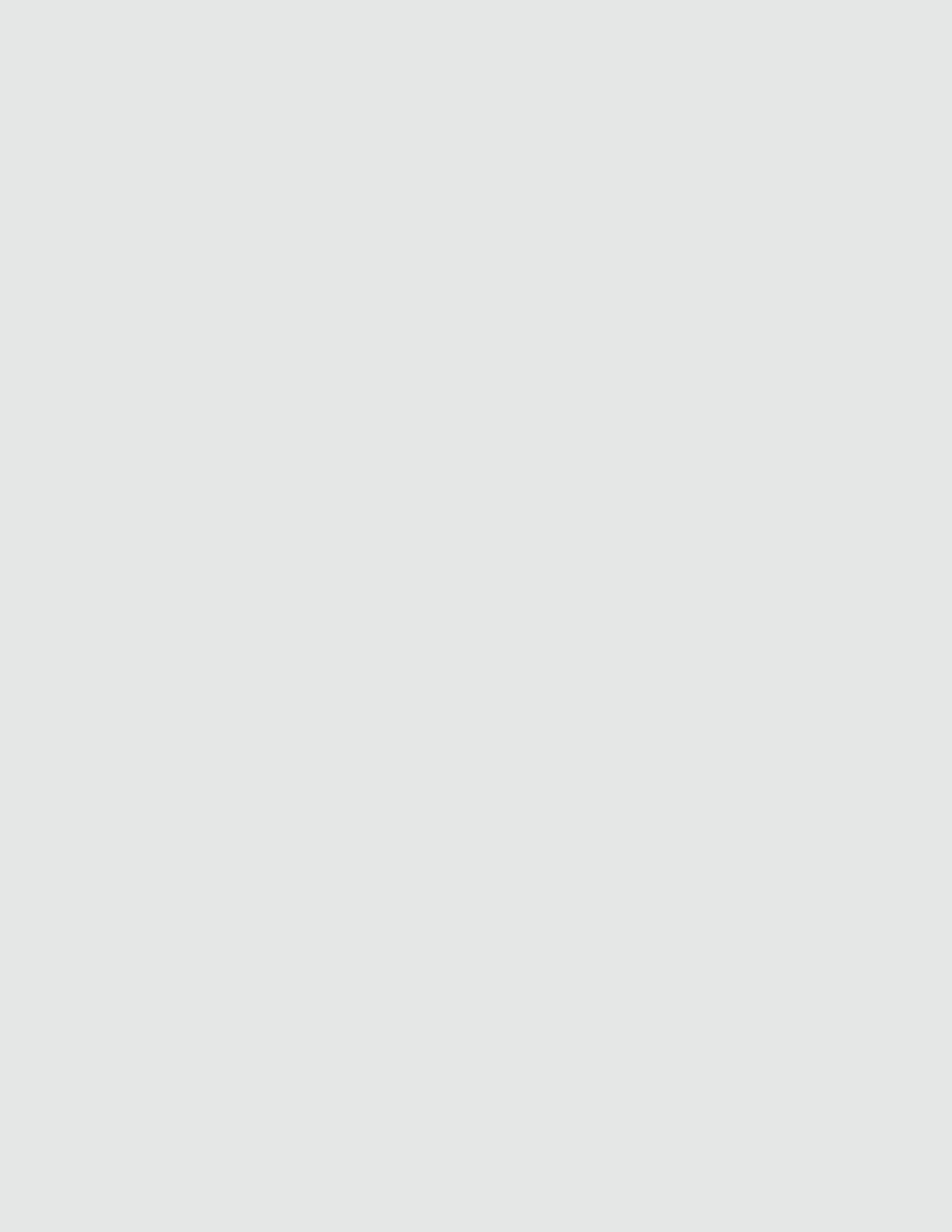

Operating revenue comprises rent, fees, and

other income. Operating revenue for 2022 was

$305.1 million, which is 11.1% higher than 2021.

Overall, fixed rent accounts for more than half of our

operating revenues, providing protection against

fluctuations in trade volumes. In 2022, rental revenue

increased by 8.1% over the prior year, mainly from an

increase in fixed rent.

Fee revenue includes wharfage, cruise fees, harbour

dues, Gateway Infrastructure Fees, and berthage.

This revenue recovers ongoing operating costs

and investments made to support trade activities

at the port.

The following table summarizes the key drivers,

methodology, and purpose of each of these fees.

Operating revenue

Below is a further breakout of operating revenue.

Fixed rent

Variable rent

Rental revenue

Wharfage

Cruise

Harbour dues

Gateway Infrastructure Fee

Berthage

Log revenues

Fee revenues

Other revenue

Operating revenue

$ 173,271

23,495

196,766

43,265

17,484

10,560

8,104

8,713

10

88,136

20,197

305,099

$ 156,325

25,744

182,069

46,606

–

10,372

9,404

8,025

11

74,418

18,184

274,671

16,946

(2,249)

14,697

(3,341)

17,484

188

(1,300)

688

(1)

13,718

2,013

30,428

10.8%

(8.7%)

8.1%

(7.2%)

–

1.8%

(13.8%)

8.6%

(9.1%)

18.4%

11.1%

11.1%

(000s)

2022 2021

Increase

(decrease) $

Increase

(decrease) %

Fixed rent 57%

Variable rent 8%

Wharfage 14%

Harbour dues 3%

Gateway infrastructure

fee 3%

Berthage 3%

Cruise 6%

Other revenue 6%

12

|

Vancouver Fraser Port Authority

2022 financial results

Operating expenses

The port authority’s significant expense items are noted in the following table.

Salaries and employee benefits

Depreciation

Other operating and administrative

expenses

Professional fees and consulting

services

Dredging

Payments in lieu of taxes

Maintenance and repairs

Federal stipend

Operating expenses

(000s)

$ 64,681

37,947

35,025

18,583

14,898

8,557

5,875

8,124

193,690

2022

$ 60,887

39,715

29,823

19,824

10,860

7,201

3,395

7,516

179,221

2021

3,794

(1,768)

5,202

(1,241)

4,038

1,356

2,480

608

14,469

Increase

(decrease) $

6.2%

(4.5% )

17.4%

(6.3% )

37.2%

18.8%

73.0%

8.1%

8.1%

Increase

(decrease) %

Overall, fee revenue in 2022 increased by

$13.7 million from an increase in cruise, partially

offset by a decrease in wharfage and Gateway

Infrastructure Fees. There was no cruise season

in 2021, as the federal government had prohibited

cruise ships in Canadian waters due to the

COVID-19 pandemic. Wharfage fees decreased by

$3.3 million from lower volumes during the year.

Other revenue increased by 11.1% in 2022, primarily

due to higher interest revenue on cash balances

from higher rates.

Fee revenue

Wharfage

Harbour dues

Berthage

Cruise fees

Gateway

Infrastructure

Fee

Truck Licensing

System program

charges

Calculation key driver

Rate x unit

Rate x gross registered

tonne

Rate x overall ship length

x time at berth

Passenger fee = rate x

number of passengers

Service and facilities fee =

rate x overall ship length x

time at berth

Rate x unit

Licence fee based on

number of trucks

Details of calculation

Unit rate applied is per

thousand foot board measure

(MFBM), tonne, or 20-foot

equivalent unit (TEU)

Charged on first five calls;

discounts for participating

in the EcoAction Program

Unit rate applied is based on

location and duration of stay

Rates vary for days of the

week and duration of stay

Unit rate applied is per

MFBM, tonne, or TEU

Annual fee depends on the

number of approved trucks

Purpose of fee

To recover investments and

costs associated with the

provision of port infrastructure

and services to handle cargo

To recover investments and

costs associated with harbour

operations, as well as harbour

safety, security, and cleanliness

To recover investments and

costs associated with the

wharf apron, berth dredging,

and maintenance

To recover investments and

costs associated with the

provision of cruise terminal

facilities, berths, and

infrastructure

To recover investments and

costs related to infrastructure

improvements in three trade

areas

To recover investments and

costs related to the Truck

Licensing System program

13

Financial report 2022

|

The port authority’s operating expenses increased

by 8.1% over the previous year. This change was

primarily due to salaries and employee benefits, other

operating and administrative expenses, and higher

dredging volumes.

Salaries and employee benefits increased by

$3.8 million due to inflationary salary increases, an

increase in head count to advance the port authority’s

strategic initiatives and operational needs, and

increases in salaries and bonuses.

Other operating and administrative expenses increased

by $5.2 million, mainly from an increase in cruise-

related costs and higher information system costs.

To provide safe and unimpeded access to terminals

and to allow vessels to navigate through the Fraser

River channel, the port authority carries out an annual

maintenance dredging program to remove sediment

and sand. The recovered sand is then sold and used

for preload in local construction projects. The volume

of sand removal and sales can vary from year to year.

Compared to 2021, net dredging expenses in 2022

increased by $4.0 million, due to higher dredging

activity resulting from higher fuel costs, a larger

freshet, and related increased sand and gravel in

the channel.

Repair and maintenance increased by $2.5 million,

primarily due to increased cruise-related

maintenance and repairs, and other revenue-

generating tenant services.

The port authority is exempt from income taxes, but

it is obligated to pay an annual federal stipend to the

minister of transport under the Canada Marine Act

of $8.1 million in 2022. The stipend is calculated by

reference to gross revenues at rates varying between

2% and 6%, depending on the gross amount determined.

Other expenses (income)

The port authority’s significant non-operating items are noted in the following table.

The port authority’s other expenses increased by

$0.3 million over the previous year, primarily due to the

loss on disposal of assets offset by non-recurring costs in 2021.

Finance costs

Investment income

Loss (gain) on disposal of assets

Other expenses (income)

Other expenses

1,195

93

3,507

(4,448)

347

$ 2,508

(1,168)

4,005

14

5,359

$ 1,313

(1,261)

498

4,462

5,012

91.0%

(7.4%)

n/a

(99.7%)

6.9%

(000s)

2022 2021

Increase

(decrease) $

Increase

(decrease) %

Maintenance & repairs 2%

Federal stipend and payment in lieu of taxes 9%

Professional fees and consulting services 10%

Net dredging expenses 8%

Other operating and administrative expenses 18%

Depreciation 20%

Salaries and employee benefits 33%

14

|

Vancouver Fraser Port Authority

Audited

summary

financial

statements

15

Financial report 2022

|

16

|

Vancouver Fraser Port Authority

Independent auditor’s report

To the Directors of the Vancouver Fraser Port Authority and

the Minister of Transport, Government of Canada

Our opinion

In our opinion, the accompanying summary consolidated financial

statements of Vancouver Fraser Port Authority and its subsidiaries

(together, the VFPA) are consistent, in all material respects, with

the audited consolidated financial statements, on the basis

described in note 2 to the summary consolidated financial

statements.

The summary consolidated financial statements

The VFPA’s summary consolidated financial statements derived

from the audited consolidated financial statements for the year

ended December 31, 2022 comprise:

· the summary consolidated statement of financial position as at

December 31, 2022;

· the summary consolidated statement of comprehensive income

for the year then ended;

· the summary consolidated statement of changes in equity for

the year then ended;

· the summary consolidated statement of cash flows for the year

then ended; and

· the related notes to the summary consolidated financial

statements.

The summary consolidated financial statements do not contain

all the disclosures required by International Financial Reporting

Standards as issued by the International Accounting Standards

Board (IFRS). Reading the summary consolidated financial

statements and the auditor’s report thereon, therefore, is not a

substitute for reading the audited consolidated financial

statements and the auditor’s report thereon.

The audited consolidated financial statements and our

report thereon

We expressed an unmodified audit opinion on the audited

consolidated financial statements in our report dated

March 31, 2023. That report also includes an Emphasis of

matter paragraph that draws attention to note 2(r) in the

audited consolidated financial statements, which describes

the restatement of certain comparative information.

Management’s responsibility for the summary

consolidated financial statements

Management is responsible for the preparation of the summary

consolidated financial statements on the basis described in note 2

to the summary consolidated financial statements.

Auditor’s responsibility

Our responsibility is to express an opinion on whether the

summary consolidated financial statements are consistent, in

all material respects, with the audited consolidated financial

statements based on our procedures, which were conducted

in accordance with Canadian Auditing Standard (CAS) 810,

Engagements to Report on Summary Financial Statements.

Chartered Professional Accountants

Vancouver, British Columbia

March 31, 2023

17

Financial report 2022

|

Summary consolidated statement of financial position

(expressed in thousands of Canadian dollars)

2022 2021

(Restated –

note 2(s))

Assets

Current assets

Cash and cash equivalents $ 80,874 $ 80,445

Accounts receivable and other assets 53,325 55,884

134,199 136,329

Non-current assets

Long-term receivables and other assets 66,717 72,886

Deferred charges 3,090 1,872

Intangible assets 157,500 137,145

Property and equipment 2,324,530 2,151,678

Total assets $ 2,686,036 $ 2,499,910

Liabilities and shareholders’ equity

Current liabilities

Accounts payable and accrued liabilities $ 102,654 $ 109,553

Provisions 6,451 7,999

Deferred revenue 21,309 16,609

Borrowings (note 4) 701 801

131,115 134,962

Non-current liabilities

Other employee benefits 1,615 1,648

Net benefit liability 2,951 4,981

Provisions 12,316 10,650

Deferred revenue 72,868 74,779

Borrowings (note 4) 199,656 114 , 94 2

Other long-term liabilities 10,919 11, 6 0 5

Total liabilities 431,440 353,567

Shareholders’ equity

Contributed capital 150,259 150,259

Retained earnings 2,104,337 1,996,084

Total shareholders’ equity 2,254,596 2,146,343

Total liabilities and shareholders’ equity $ 2,686,036 $ 2,499,910

Commitments and contingent liabilities (notes 5 and 6)

Bruce Chan, Director

Summary consolidated statement of financial position

Vancouver Fraser Port Authority

As at December 31, 2022

The accompanying notes are an integral part of these summary consolidated financial statements.

Approved on behalf of the board of directors

Robin Silvester, President and CEO

|

Vancouver Fraser Port Authority

18

Summary consolidated statement of comprehensive income

(expressed in thousands of Canadian dollars)

2022 2021

Revenue

Rental revenue $ 196,766 $ 182,069

Fee revenue 88,136 74,418

Other revenue 20,197 18,184

305,099 274,671

Expenses

Wages, salaries, and benefits 64,681 60,887

Depreciation and amortization 37,947 39,715

Other operating and administrative expenses 35,025 29,823

Professional fees and consulting services 18,583 19,824

Dredging expenses 14,898 10,860

Repairs and maintenance 5,875 3,395

Payments in lieu of taxes 8,557 7,201

Federal stipend 8,124 7,516

193,690 179,221

Income from operations 111,409 95,450

Other expense (income)

Finance costs 2,508 1,313

Loss on disposal of assets 4,005 498

Investment income (1,168) (1,261)

Other loss 14 4,462

5,359 5,012

Net income 106,050 90,438

Other comprehensive income

Item that will not be reclassified to net income

Actuarial gains in defined benefit pension plans 2,203 5,305

Total comprehensive income $ 108,253 $ 95 ,74 3

Summary consolidated statement of comprehensive income

Vancouver Fraser Port Authority

For the year ended December 31, 2022

The accompanying notes are an integral part of these summary consolidated financial statements.

19

Financial report 2022

|

Summary consolidated statement of changes in equity

(expressed in thousands of Canadian dollars) Contributed Retained

capital earnings Total

Balance – December 31, 2020 $ 150,259 $ 1,900,341 $ 2,050,600

Net income — 90,438 90,438

Other comprehensive income

Actuarial gains in defined benefit pension plans — 5,305 5,305

Balance – December 31, 2021 150,259 1,996,084 2,146,343

Net income — 106,050 106,050

Other comprehensive income

Actuarial gains in defined benefit pension plans — 2,203 2,203

Balance – December 31, 2022 $ 150,259 $ 2,104,337 $ 2,254,596

Summary consolidated statement of changes in equity

Vancouver Fraser Port Authority

For the year ended December 31, 2022

The accompanying notes are an integral part of these summary consolidated financial statements.

|

Vancouver Fraser Port Authority

20

Summary consolidated statement of cash flow

The accompanying notes are an integral part of these summary consolidated financial statements.

(expressed in thousands of Canadian dollars)

2022 2021

(Restated –

note 2(s))

Cash provided by (used in)

Operating activities

Net income $ 106,050 $ 90,438

Adjustments to reconcile net income to net cash from operations:

Depreciation and amortization 37,947 39,715

Loss on disposal of assets 4,005 498

Provisions (1,754) 568

Net employee benefits 138 6

Other 558 84

146,944 131,309

Changes in non-cash operating working capital:

Accounts receivable and other assets (2,916) (3,514)

Accounts payable and accrued liabilities 5,065 (35,741)

Deferred revenue 5,500 30,486

Long-term lease receivable and lease liability (5,660) (3,908)

148,933 118 , 6 3 2

Investing activities

Acquisitions and construction of property and equipment (224,379) (201,226)

Acquisitions of intangible assets (34,374) (65,139)

Deposits – (1,840)

Government funding for property and equipment, and intangible assets 19,324 58,642

Other third-party funding for intangible assets 5,363 3 ,974

Net change in long-term receivables 951 865

Principal repayment on lease financing assets – 23

Proceeds from disposal of property and equipment – 144

Other 193 205

(232,922) (204,352)

Financing activities

Repayments of short-term borrowings (100) (100)

Proceeds from long-term borrowings 94,714 104,955

Repayments of long-term borrowings (10,000) (10,000)

Payments of lease liabilities (196) (197)

84,418 94,658

Increase in cash and cash equivalents 429 8,938

Cash and cash equivalents, beginning of year 80,445 71,507

Cash and cash equivalents, end of year $ 80,874 $ 80,445

Supplemental cash flow information

Interest paid 4,649 890

Investment income received 1,269 1,414

Summary consolidated statement of cash flows

Vancouver Fraser Port Authority

For the year ended December 31, 2022

21

Financial report 2022

|

Notes to the summary consolidated financial statements

1. Nature of operations

The Vancouver Fraser Port Authority (VFPA) is a non-share capital, financially self-sufficient authority established on January 1, 2008

by the Government of Canada pursuant to the Canada Marine Act (Act). The address of the VFPA’s registered office is

100 – 999 Canada Place, Vancouver, British Columbia. The VFPA is the federal agency responsible for the stewardship of

the Port of Vancouver. Consistent with all Canada Port Authorities, the VFPA is accountable to the federal minister of transport

and operates pursuant to the Act with a mandate to enable Canada’s trade through the Port of Vancouver, while protecting the

environment, and considering local communities. The VFPA has control over the use of port land and water, which includes more

than 16,000 hectares of water, over 1,000 hectares of land, and approximately 350 kilometres of shoreline. Located on the

southwest coast of British Columbia, Canada, the Port of Vancouver extends from Roberts Bank and the Fraser River up to and

including Burrard Inlet, bordering 16 Lower Mainland municipalities, one Treaty First Nation, and borders and intersects the asserted

and established territories of several Coast Salish First Nations.

The VFPA and its wholly owned subsidiaries, Canada Place Corporation (CPC), Port of Vancouver Ventures Ltd. (PoVV), Port of

Vancouver Holdings Ltd. (PoVH), Port of Vancouver Enterprises Ltd. (PoVE), Port of Vancouver Terminals Ltd. (PoVT), Marine Safety

Holdings Ltd. (MSH), 1359792 B.C. Ltd., and 1381641 B.C. Ltd. are exempt from income taxes as the VFPA, on a consolidated basis,

pays a gross revenue charge (federal stipend) as required per the Letters Patent under the authority of the Act.

2. Basis of presentation and significant accounting policies

a) Basis of presentation

The VFPA has prepared the summary consolidated financial statements using the following criteria:

· The summary consolidated financial statements include a statement for each statement included in the audited consolidated

financial statements and certain note disclosures, which are presented in thousands of Canadian dollars unless otherwise

indicated

· Information in the summary consolidated financial statements agrees with the related information in the completed set of

audited consolidated financial statements

· Major subtotals, totals, and comparative information from the audited consolidated financial statements are included

· The summary consolidated financial statements contain the information from the audited consolidated financial statements

dealing with matters having a pervasive or otherwise significant effect on the summary consolidated financial statements

b) Audited financial statements

· The audited consolidated financial statements were prepared in accordance with International Financial Reporting Standards

(IFRS) as issued by the International Accounting Standards Board (IASB) and interpretations issued by the International

Financial Reporting Interpretations Committee (IFRIC)

· The audited consolidated financial statements and summary consolidated financial statements were approved and authorized

for issue by the VFPA board of directors on March 31, 2023

c) Consolidation

These summary consolidated financial statements consolidate the accounts of the VFPA and its wholly owned subsidiaries.

Subsidiaries are all entities over which the VFPA has control. The VFPA controls an entity when it has power to govern the financial

and operating policies of the entity; it is exposed to, or has rights to variable returns from performance of the entity, and has the

ability to affect those returns through its control over the entity. Subsidiaries are fully consolidated from the date that VFPA

obtains control and continues to be consolidated until the date that such control ceases to exist.

All intercompany balances and transactions are eliminated on consolidation. The financial statements of subsidiaries are prepared

for the same reporting period as the VFPA, using consistent accounting policies.

Notes to the summary consolidated financial statements

Vancouver Fraser Port Authority

December 31, 2022

(figures in the tables are expressed in thousands of Canadian dollars)

|

Vancouver Fraser Port Authority

22

Notes to the summary consolidated financial statements

d) Cash and cash equivalents

Cash and cash equivalents include cash on deposit with banks, short-term deposits with maturities of 90 days or less, and

demand deposits with restrictions from third party contracts when acquired that are readily convertible to known amounts of

cash and which are subject to an insignificant risk of changes in value.

e) Trade and other receivables

Trade and other receivables are recognized initially at fair value and subsequently measured at amortized cost using the effective

interest method, less provision for impairment.

f) Financial instruments

A financial instrument is any contract that gives rise to a financial asset or a financial liability.

i) Financial assets

Financial assets are classified as measured at either amortized cost, fair value through other comprehensive income (OCI),

or fair value through profit or loss. The classification is based on the contractual cash flow characteristics of the financial

assets and the VFPA’s business model for managing those financial assets.

Recognition and measurement

At amortized cost

The VFPA’s financial assets measured at amortized cost include cash and cash equivalents, accounts receivable, and other

assets and long-term receivables, and other assets. With the exception of trade receivables that do not contain a significant

financing component, these financial assets are recognized initially at fair value plus directly attributable transaction costs,

if any. After initial recognition, they are measured at amortized cost when they are held for collecting contractual cash flows,

where those cash flows solely represent payments of principal and interest using the effective interest method less any

impairment as described below. The effective interest method calculates the amortized cost of a financial asset and allocates

the finance income over the term of the financial asset using an effective interest rate. The effective interest rate is the rate

that discounts estimated future cash receipts through the expected life of the financial asset, or a shorter period when

appropriate, to the gross carrying amount of the financial asset.

Derecognition

Financial assets are derecognized when the rights to receive cash flows from the financial assets have expired or have

been transferred, and the VFPA has transferred substantially all the risks and rewards of ownership. Gains or losses are

recognized in net income when the financial asset is derecognized or impaired.

The VFPA does not have any financial assets classified as fair value through OCI or fair value through profit or loss.

Impairment of financial assets

The VFPA recognizes a loss allowance for expected credit losses (ECLs) on financial assets measured at amortized cost.

At the end of each year, the loss allowance for the financial assets, except for trade receivables without a significant financing

component, is measured at an amount equal to the lifetime ECL if the credit risk on that financial asset has increased

significantly since initial recognition. If it is determined that the credit risk on a financial asset has not increased significantly,

the VFPA measures the loss allowance for that financial asset at an amount equal to the 12-month ECL.

For trade receivables without a significant financing component, the VFPA applies a simplified approach and uses a provisions

matrix, which is based on the VFPA’s historical credit loss experience and forward-looking information, to estimate and

recognize the lifetime ECL. Any subsequent changes in the lifetime ECL will be recognized immediately in the summary

consolidated statement of comprehensive income.

2. Basis of presentation and significant accounting policies

(Continued)

23

Financial report 2022

|

2. Basis of presentation and significant accounting policies (Continued)

ii) Financial liabilities

Financial liabilities are classified as measured at amortized cost or fair value through profit or loss.

Financial assets and financial liabilities are presented on a net basis when the VFPA has a legally enforceable right to offset

the recognized amounts and intends to settle on a net basis or to realize the asset and settle the liability simultaneously.

Recognition and measurement

At amortized cost

The VFPA’s financial liabilities measured at amortized cost include accounts payable and accrued liabilities, provisions, other

long-term liabilities, borrowings and other non-derivative financial liabilities, and are recognized on the date at which the VFPA

becomes a party to the contractual arrangement. Financial liabilities are designated as held-for trading on initial recognition

or it is a derivative and are measured at fair value and the net gains and losses including interest expense are recognized

in profit and loss. Financial liabilities are recognized initially at fair value including discounts and premiums, plus directly

attributable transaction costs, such as issue expenses, if any. Subsequently, these financial liabilities are measured at

amortized cost using the effective interest method.

Derecognition

Financial liabilities are derecognized when the contractual obligations are discharged, cancelled, or expire. Gains or losses are

recognized in net income when the financial liability is derecognized.

The VFPA does not have any financial liabilities classified as fair value through profit or loss.

g) Intangible assets

i) Gateway infrastructure

The VFPA incurs costs associated with the development of gateway infrastructure assets such as overpasses and road

expansions to support trade. Costs can include construction, engineering, project management and other direct project costs

less any third-party contributions.

The VFPA does not control or maintain all assets on completion but receives fees to recover its costs incurred. As the VFPA

has the ability to set those fees, the gateway investment costs are recognized as intangible assets when capitalization criteria

are met. Accordingly, these assets are recorded as a finite lived intangible asset and are amortized over the period that fees

are collected.

ii) Computer software

Computer software costs are capitalized as intangible assets if they are identifiable, separable or arise from contractual or

legal rights and are amortized over their estimated useful lives of five years or less. Costs associated with maintaining

computer software programs are recognized as an expense when incurred.

h) Property and equipment

Property and equipment are initially recorded at cost less accumulated amortization and impairment losses, if any. Costs that are

directly attributable to the acquisition of the asset are capitalized and include land survey costs, materials, contractor expenses,

internal labour, borrowing costs on qualifying assets, and site restoration or removal costs. Costs continue to be capitalized until

the asset is available for use with subsequent costs capitalized only when it is probable that future economic benefits associated

with the item will flow to the VFPA.

The VFPA capitalizes interest during construction of a qualifying asset using the weighted average cost of debt incurred on the

VFPA’s borrowings. Qualifying assets are considered those that take a substantial period of time to construct.

At December 31, 2022, property and equipment net book value of $2.3 billion included $1.7 billion of federal property and

$0.6 billion of other property.

When parts of an item of property and equipment have different estimated useful lives, they are accounted for as separate items

(major components) of property and equipment.

|

Vancouver Fraser Port Authority

24

Notes to the summary consolidated financial statements

2. Basis of presentation and significant accounting policies (Continued)

Depreciation commences when the asset is available for use and is recognized on a straight-line basis over the estimated useful

lives of each part of an item of property and equipment in the summary consolidated statement of comprehensive income. Land,

habitat bank assets, and construction-in-progress are not depreciated.

Estimating the appropriate useful lives of assets requires judgment and is generally based on estimates of life characteristics of

similar assets. The assets’ residual values, method of depreciation, and estimated useful lives are reviewed at minimum annually,

and adjusted on a prospective basis if appropriate.

An item of property and equipment is derecognized on disposal or when no future economic benefits are expected from its use.

Gains or losses on disposal or retirement of the property and equipment are determined by comparing the net disposal proceeds

with the carrying amount of the assets and are recognized in the summary consolidated statement of comprehensive income.

The ranges of estimated useful lives for each class of property and equipment are as follows:

Dredging 4 to 40 years

Berthing structures, buildings, roads and surfaces 10 to 75 years

Utilities 10 to 50 years

Machinery and equipment 3 to 25 years

Office furniture and equipment 3 to 10 years

Leasehold improvements and right-of-use assets Term of lease

i) Leases

Where the VFPA is a lessee, at the inception of a contract, the VFPA determines if it has the right to control the asset and

accordingly recognizes a right-of-use asset with a corresponding lease liability. The right-of-use asset is initially measured at cost,

which includes the initial lease liability, any lease payments made at or before commencement date less any lease incentives

received, any initial direct costs, and restoration costs. It is depreciated on a straight-line basis over the shorter of the lease term

and its estimated useful life. The lease liability is initially measured at the present value of the future unavoidable lease payments

under the contract, discounted using the interest rate implicit in the lease contract. Where the implicit rate cannot be readily

determined, the VFPA uses the incremental borrowing rate of the legal entity entering into the lease contract. Subsequently, the

lease liability is measured at amortized cost, using the effective interest method. Transaction costs related to the leases are

classified as deferred charges and are amortized over the lease term. If the lease is less than 12 months or has a lower dollar

value, the lease is expensed on a straight-line basis over the lease term.

Where the VFPA is a lessor, on initial identification of a lease contract, the VFPA determines whether the contract is a finance

lease or an operating lease. A lease is classified as a financing lease if substantially all of the risks and rewards of owning the

asset are transferred to the customer; otherwise, it is classified as an operating lease. Lease payments received by the VFPA

under operating leases are recognized as lease revenue within rental revenue on a straight-line basis over the lease term.

Where the VFPA is an intermediate lessor, it accounts for its interest in the head lease and the sublease separately. If the

sublease is classified as a finance lease, the right-of-use asset relating to the head lease is derecognized and a finance lease

receivable in the sublease is recognized.

j) Impairment of non-financial assets

At the end of each year, the VFPA reviews the carrying amount of its non-financial assets including property and equipment and

intangible assets to determine whether there is any indication of impairment. When an indication of impairment exists, the

recoverable amount of the non-financial asset is estimated. For the purposes of assessing impairment, non-financial assets are

grouped at the smallest group of assets that generate cash inflows from continuing use that are largely independent of the cash

inflows of other assets or cash generating units (CGU).

The recoverable amount of an asset or CGU is the higher of its fair value less costs to sell and its value in use. Value in use is

based on the estimated future cash flows, discounted to their present value using a discount rate that reflects current market

assessments of the time value of money and the risks specific to the asset or CGU.

An impairment loss is recognized if the carrying amount of an asset or CGU exceeds its recoverable amount. Impairment losses

are recognized in net income.

25

Financial report 2022

|

2. Basis of presentation and significant accounting policies (Continued)

k) Provisions

Provisions include those for environmental restoration, leased site restoration, local channel dredging contributions, and legal

claims. A provision is recognized when the VFPA has a present legal or constructive obligation as a result of a past event, it is

probable that an outflow of resources will be required to settle the obligation, and the amount can be reliably estimated.

Provisions are measured at the present value of the expenditures expected to be required to settle the obligation using a rate that

reflects current market assessments of the time value of money and the risks specific to the liability. Changes in the provision are

recognized within other operating and administrative expenses in the summary consolidated statement of comprehensive income and

the unwinding of the discount is recognized within finance costs in the summary consolidated statement of comprehensive income.

l) Payments in lieu of taxes

Payments in lieu of taxes (PILT) are estimated by the VFPA in accordance with the Payments in Lieu of Taxes Act. Accruals are

re-evaluated each year and changes, if any, are made in the current period’s summary consolidated financial statements based

on the best available information, including the results, if any, of appraisals by an independent consulting firm. PILT are paid on

all unoccupied land and all submerged lands in the Burrard Inlet, Fraser River, and Roberts Bank, except for Indian Arm and the

navigation channels.

m)

Employee future benefits

The VFPA maintains defined contribution, defined benefit, and other benefit plans for its employees. The VFPA’s contributions

to the defined contribution pension plans are expensed as the related services are provided. The VFPA also maintains other

non-funded benefits for eligible employees. The VFPA accrues in its accounts annually the estimated liabilities for severance pay,

annual leave, and overtime compensatory leave, which are payable to its employees in subsequent years.

For the defined benefit pension plans, the asset or liability recognized in the summary consolidated statement of financial position

in respect of defined benefit pension plans is the present value of the defined benefit obligation at the end of the year less the

fair value of plan assets. The defined benefit obligation is calculated annually by independent actuaries using the projected unit

credit method. The present value of the defined benefit obligation is determined by discounting the estimated future cash outflows

using interest rates at the end of each year on high-quality corporate bonds that are denominated in the currency in which the

benefits will be paid and that have terms to maturity approximating to the terms of the related pension obligation. The measurement

date for the defined benefit pension plans is December 31.

Actuarial gains or losses arising from experience adjustments and changes in actuarial assumptions are recognized in other

comprehensive income or loss.

Past service costs are recognized in net income immediately, unless the changes to the pension plans are conditional on the

employees remaining in service for a specified period of time (the vesting period). In this circumstance, the past service costs are

recognized in accumulated other comprehensive income and amortized on a straight-line basis over the vesting period in the

summary consolidated statement of comprehensive income.

n) Revenue recognition

The VFPA recognizes revenue when it transfers control over a promised good or service, a performance obligation under the

contract, to a customer and where the VFPA is entitled to consideration resulting from completion of the performance obligation.

Depending on the terms of the contract with the customer, revenue recognition can occur at a point in time or over time. When a

performance obligation is satisfied, revenue is measured at the transaction price that is allocated to that performance obligation.

i) Rental revenue

The VFPA leases property to customers, primarily for shipping terminals or other supply chain support services. Fixed lease

revenue is recognized on a straight-line basis over the term of the lease. Contingent based lease revenue is recognized

periodically, based on lessee’s cargo volumes, or other revenue as stipulated in the respective agreements. Cash received

in advance is deferred and recognized as revenue when the revenue recognition criteria are met.

|

Vancouver Fraser Port Authority

26

Notes to the summary consolidated financial statements

2. Basis of presentation and significant accounting policies (Continued)

ii) Fee revenue

The VFPA provides port services to customers, primarily for access to the harbour and shipping terminals. Revenue for port

services is recognized at a point in time, based on a vessel’s arrival or departure.

iii) Other revenue

The VFPA provides various other customer services and earns interest on cash held in banks. This revenue is recognized in

the period the services are provided or the period in which interest is earned.

o) River dredgeate and dredging

Costs of removing river dredgeate to maintain navigable waterways to a standard of depth are expensed. However, costs of river

dredgeate removed from the waterway for maintenance, placed on the VFPA property, and which provides betterment to that

property, are capitalized. Effective January 1, 2022, the VFPA adopted amendment to International Accounting Standards (IAS)

16 – Property, Plant and Equipment. This standard requires the net proceeds from selling any items produced while bringing an

item of property, plant, and equipment to the condition necessary for it to be capable of operating in the manner intended by

management together with the cost of producing these items, to be recognized in profit and loss. The adoption of the amendments

did not have a significant impact on the summary consolidated financial statements.

Dredging costs that deepen navigable waterways to establish a new standard of depth for future economic benefit are capitalized.

Proceeds from the sale of river dredgeate derived from maintenance are recorded as revenue.

p) Federal stipend

Under the Act, the VFPA is obligated to pay annually to the federal minister of transport a charge to maintain its Letters Patent in

good standing. The charge is calculated by reference to gross revenue at rates on a sliding scale varying between 2% and 6%

depending on the gross amount.

q) Government grants and contributions

The VFPA recognizes government grants and contributions, including non-monetary grants at fair value, when there is reasonable

assurance that any conditions attached to them will be met and the grants will be received. Government grants and contributions

related to capital assets are deducted from the carrying amount of the related asset and recognized in net income over the estimated

useful life of the related asset as a reduced depreciation expense in the summary consolidated statement of comprehensive income.

r) Non-monetary transactions

Non-monetary transactions are measured at the fair value of the asset surrendered or the asset received, whichever can be more

reliably measured, unless the transaction lacks commercial substance or the fair value cannot be reliably established. The

commercial substance requirement is met when the future cash flows are expected to change significantly because of the

transaction. When the fair value of a non-monetary transaction cannot be accurately measured or the transaction lacks

commercial substance, it is recorded at the carrying amount of the asset given up adjusted by the fair value of any monetary

consideration received or given.

27

Financial report 2022

|

2. Basis of presentation and significant accounting policies (Continued)

s) Restatement of comparative figures

During the year, the VFPA retroactively restated its financial statements for the adoption of the IFRS Interpretation Committee agenda

decision on IAS 7 – Statement of cash flows and for presentation of borrowings as a result of a review of the existing revolving

credit facility agreements (together, the credit agreements). On the adoption of IFRIC decisions for IAS 7 –

Statement of cash flows

,

restricted cash that met the definition of demand deposits with restrictions arising from a third-party contract was reclassified to cash

and cash equivalents from accounts receivable and other assets and long-term receivables and other assets (December 31, 2022

– $10.9 million). With respect to the VFPA’s borrowings, the VFPA determined that under certain terms of the credit agreements the

lending financial institutions are obligated to renew any outstanding borrowing amounts up to the March 2026 maturity date of the

facilities at VFPA’s full discretion so long as the VFPA borrowings remain in compliance with terms of the credit agreements. As a

result, the borrowings have been retroactively restated from current liabilities to long-term liabilities and the summary consolidated

statement of cash flows has been restated to present proceeds on borrowing and repayments on a gross basis. The impact to the

VFPA’s opening summary consolidated statement of financial position (January 1, 2021) was a reclassification of $20 million from

current liabilities to long-term liabilities and $5.4 million from accounts receivable and other assets to cash and cash equivalents.

The financial impact from adoption of IFRIC decisions on IAS 7 – Statement of cash flows and clarification of the credit

agreements at December 31, 2021 is as follows:

Consolidated statements of financial position

Consolidated statements of cash flows

As previously

r

eported

A

djustment

A

s restated

Operating activities

Accounts receivable and other assets

$

(

5,741)

$

2

,227

$

(

3,514)

Investing activities

Net change on long-term receivables

6

45

2

20

8

65

Financing activities

Proceeds from issuance of short-term borrowings

9

4,955

(

94,955)

–

P

roceeds from long-term borrowings – 104,955 104,955

Repayment of long-term borrowings

–

(

10,000)

(

10,000)

Cash and cash equivalents – Beginning of year $ 64,192 $ 7,315 $ 71,507

Cash and cash equivalents – End of year

$

7

0,683

$

9

,762

$

8

0,445

As previously

r

eported

A

djustment

A

s restated

Assets:

Current assets

Cash and cash equivalents $ 70,683 $ 9,762 $ 80,445

Accounts receivable and other assets

6

3,502

(

7,618)

5

5,884

Long term assets

Long-term receivables and other assets

7

5,030

(

2,144)

7

2,886

Liabilities

Current liabilities

Borrowings 115,743 (114,942) 801

Non-current liabilities

Borrowings – 114,942 114,942

|

Vancouver Fraser Port Authority

28

Notes to the summary consolidated financial statements

3. Critical accounting judgments and estimates

The preparation of the VFPA’s summary consolidated financial statements requires management to make judgments in the

application of accounting policies, and estimates and assumptions that affect the reported amounts of assets, liabilities, income

and expenses, as well as the disclosure of contingent assets and liabilities at the date of the summary consolidated financial

statements. Actual results may differ from those judgments, estimates, and assumptions.

Estimates and assumptions are reviewed on an ongoing basis. Revisions to estimates are recognized in the period in which the

estimates are revised and in any future periods affected. The estimates and assumptions that have a significant risk of causing

a material adjustment to the carrying amounts of assets and liabilities within the next financial year are as follows:

a) Property and equipment and intangible assets

The VFPA makes judgments as to whether certain costs are directly attributable to property and equipment and intangible

assets warrant capitalization. The VFPA also makes judgments in terms of assessing whether a capital project is more likely than

not to proceed, such as Roberts Bank Terminal 2. This can include assessments with respect to required approvals and permits.

The Roberts Bank Terminal 2 project is currently awaiting a decision on a federal environmental assessment approval, which is

expected to be made during the next financial year. Additional approvals and permits will also be required to advance the project.

Management has made the assessment that it is more likely than not to receive these approvals and permits.

If the required approvals and permits are not obtained, a decrease in the carrying value of the VFPA’s property and equipment

could range up to 13%.

The VFPA assesses whether there are any indications that items of property and equipment and intangible assets may be

impaired. If indications of impairment exist, the recoverable amount calculations require the use of estimates including, but not

limited to, discount rates and future cash flows.

The VFPA also estimates the useful lives of its assets and residual values, which will impact the amount of depreciation or

amortization recorded in the period.

b) Employee future benefits

The present value of the pension obligations depends on a number of factors that are determined on an actuarial basis using a

number of assumptions. The assumptions used in determining the net cost (income) for pensions include discount rate, inflation

rate, salary growth rate, mortality rate, and medical cost trend rate. Any changes in these assumptions will impact the carrying

amount of pension obligations. The VFPA determines the appropriate discount rate at the end of each year. In determining the

appropriate discount rate, the VFPA considers the interest rates of high-quality corporate bonds that are denominated in the

currency in which the benefits will be paid and that have terms to maturity approximating the terms of the related pension obligation.

Other key assumptions for pension obligations are based in part on current market conditions.

c) Environmental liabilities

The VFPA has contingent liabilities and provisions for environmental restoration requirements at a number of its properties.

The nature, extent, timing, and cost of clean-up of these properties are based on management’s best estimates, with input from

third-party specialists, where applicable. Provisions recognized in the VFPA’s summary consolidated statement of financial

position are discounted using an appropriate risk-free rate.

The VFPA’s environmental staff keeps track of contaminated or possibly contaminated properties during the year and are part

of the team conducting due diligence on all property acquisitions. At the end of each year, each property is assessed for possible

environmental provisions in accordance with IAS 37 – Provisions, contingent liabilities and contingent assets. The provision does

not include restoration costs on leased properties where tenants are obligated to incur the costs and have sufficient financial

capacity to fulfill their lease obligations. Uncertainty exists over actual environmental restoration costs to be incurred due to the

estimates involved in performing the assessment.

29

Financial report 2022

|

4. Borrowings

2022 2021

(Restated –

note 2(s))

Revolving credit facilities $ 199,656 $ 114 , 942

Demand loan 701 801

200,357 115 ,74 3

Less: Current portion (701) (801)

$ 199,656 $ 114 , 942

a) Revolving credit facilities

The VFPA has available three revolving credit facilities totalling $800 million (2021 – $800 million) with the Toronto-Dominion

Bank, Royal Bank of Canada, and Canadian Imperial Bank of Commerce that may be drawn in either Canadian or United States

dollars. The revolving credit facilities are unsecured and bear interest at the banks’ prime rate less a spread or bankers’

acceptance rates and have a five-year term expiring in March 2026. The VFPA pays average fees of 0.39% per annum on

bankers’ acceptances and letters of credit issued and average standby fees of 0.10% per annum on the unused, authorized

portion of the facility. Outstanding amounts may be repaid at any time without penalty and can be renewed at the VFPA’s

discretion up to the facility maturity as long as the VFPA is in compliant with terms of the credit agreements. As at

December 31, 2022, the VFPA had a total of $200 million (2021 – $115 million) drawn against the revolving credit facilities

by way of short-term bankers’ acceptances.

As at December 31, 2022, the VFPA has a total of $11.3 million (2021 – $10.4 million) in letters of credit outstanding.

b) Demand loan

PoVT has an unsecured demand loan outstanding for $0.7 million with the Toronto-Dominion Bank that bears interest at the

Canadian prime rate less 0.85% per annum. Minimum quarterly principal repayments of $25,000 are required, and amounts

outstanding may be repaid at any time without penalty and must be fully repaid by March 2026.

5. Commitments

As at December 31, 2022, the VFPA has operating commitments of $23.8 million (2021 – $17.5 million) and capital commitments

of $169.3 million (2021 – $239.8 million).

6. Contingent liabilities

The VFPA has entered into several long-term agreements with arm’s length parties that require future payments to be made when

certain events have occurred. The VFPA also has monetary disputes with arm’s length parties in the ordinary course of its operations.

The estimated future payments that can be reasonably estimated are approximately $35.7 million and will be accrued as liabilities in

the summary consolidated financial statements if certain events occur in the future.

|

Vancouver Fraser Port Authority

30

Notes to the summary consolidated financial statements

7. Gateway Infrastructure Program

The Gateway Infrastructure Program (GIP) is a $717 million investment in supply-chain improvements for 17 projects beyond

traditional port activities and lands, where the majority of the projects were substantially completed in 2018. Funding for the projects

was provided by the federal and provincial governments, other partners and the VFPA and industry for the areas noted below. The

VFPA and industry contributed $167 million towards the project funding, of which a Gateway Infrastructure Fee was implemented

on January 1, 2011 in order to recover 90% of the funding. The fees collected and expenditures made towards these projects has

been summarized below.

a) VFPA and industry funding details

Industry-

T

otal VFPA

f

unded

V

FPA

and industry portion portion

c

ontributions

(

90%)

(

10%)

North Shore trade area

$

5

9,000

$

5

3,100

$

5

,900

South Shore trade area

5

8,000

5

2,200

5

,800

Roberts Bank rail corridor

5

0,000

4

5,000

5

,000

$ 167,000 $ 150,300 $ 16,700

b) Gateway Infrastructure Fee collected and total project expenditures

Current year Total to date

North Shore South Shore

Roberts Bank

North Shore

South Shore

Roberts Bank

trade area trade area rail corridor Total trade area trade area rail corridor Total

Gateway infrastructure

fee (revenue)

$

3

,850

$

2

,487

$

1

,767

$

8

,104

$

3

2,068

$

3

6,627

$

2

5,870

$

9

4,565

Gateway infrastructure

program (expenditures)

–

–

–

–

3

6,654

5

5,601

4

0,822

1

33,077

Less: industry funded

portion (90%) – – – – (32,989) (50,041) (36,740) (119,770)

VFPA portion (10%)

$

–

$

–

$

–

$

–

$

3

,665

$

5

,560

$

4

,082

$

1

3,307

31

Financial report 2022

|

Appendix: Port authority compensation disclosure 2022

Director and corporate governance

Governance

The governing directors of the Vancouver Fraser Port Authority are appointed by the following four bodies:

· Federal government appoints eight members, seven of whom are recommended by port users

· Province of British Columbia appoints one member

· Prairie provinces Alberta, Saskatchewan, and Manitoba collectively appoint one member

· Sixteen municipalities that border the port authority’s jurisdiction collectively appoint one member

Once appointed to the board, members have a fiduciary obligation to represent the best interests of the port authority. The 11 members

of the board of directors offer a broad range of experience and expertise.

Board members are appointed for terms of up to three years and are eligible for reappointment, but cannot serve more than nine

consecutive years on the board.

The board of directors meets six times per year, usually for one full day. Members also attend a two-day retreat to discuss strategic issues.

Mandate of the board of directors

The board’s role is one of governance and oversight of the port authority. The board operates by delegating to management certain authorities,

such as spending, and by reserving certain powers for itself. The board’s governance role involves reviewing and approving the port authority’s:

· Corporate vision, mission, values, and goals

· Strategic planning process and direction

· Land use plan

· Business and annual operating and capital plans

· Goals and objectives for corporate performance

· Material risks

The board also reviews and approves:

· A board succession planning process

· The hiring, compensation, and planning succession of the president and CEO

Ethics and diversity

The code of conduct for directors and officers of the port authority establishes clear rules regarding conflicts of interest, inside

information, outside employment, and more, and board members must disclose any potential or real conflicts of interest.

The nominating committee, which recommends candidates for seven of the board positions, has adopted a policy where they endeavour

to achieve gender parity and to reflect Canada’s diversity.

Board members’ biographies

The following biographies are for board members as of May 17, 2022:

Judy Rogers

Judy has been a board member and served as chair of several provincial Crown corporations and not-for-profit organizations. She held

the role of city manager of the City of Vancouver from 1999 to 2008.

Chair of the board: Attended six of six meetings in 2022, plus all the committee meetings

Tenure: Since December 14, 2017

Appointed by the federal government on the recommendation of the nominating committee

Appendix: Port authority compensation disclosure 2022

|

Vancouver Fraser Port Authority

32

James Belsheim

James is the former president of Neptune Bulk Terminals Canada Ltd. and held senior positions in the B.C. forest industry. He holds or

has held several chair roles in the non-profit and industry sectors, including the United Way of Lower Mainland, the Marine Transportation

Advisory Council, and the BC Chamber of Commerce.

Member of the board: Attended six of six board meetings in 2022, plus committee meetings, as required

Member of the governance and external relations committee

Member of the human resources, compensation and safety committee

Tenure: Since December 11, 2020

Appointed by the federal government on the recommendation of the nominating committee

Bruce Chan

Bruce serves on several boards and spent nearly 20 years in a variety of senior positions with international marine transportation firm

Teekay Corporation. Prior to that, he was with Ernst & Young, LLC in Vancouver.

Member of the board: Attended six of six meetings in 2022, plus committee meetings, as required

Chair of the audit and risk management committee