EVERYTHING

T

W

Dear New Jersey Driver,

Auto insurance is required in New Jersey. As a New Jersey driver, you have

many choices when it comes to purchasing auto insurance. Each choice you

make affects the coverage you receive and the amount you pay.

As with any major purchase, you need to understand the product before you

buy it. The New Jersey Department of Banking and Insurance has prepared

this guide to help you understand auto insurance and explain how to shop

for the coverage that best suits

your needs. Whether you are

buying a new insurance policy

or renewing your current policy,

this guide will outline how to

make choices that work for you.

It is important to remember

that you have the right to change

your coverages and policy limits

at any time, even if you are not

near your renewal date.

If you need more information

about auto insurance options,

visit the Department’s web site,

www.dobi.nj.gov, or call or

write to the Department. Contact

information is located on the

back cover of this guide.

Sincerely,

Justin Zimmerman

Acting Commissioner

Where Should You Start? .............. 1

What’s in a Policy? ......................... 2

What are the

Types of Policies?

............................ 4

What are Limits

and Deductibles?

............................. 5

Do You Want an Unlimited

Right to Sue?

.................................... 8

What is the Assigned

Risk Market? ..................................... 9

What is Tier Rating?

..................... 11

What Affects the

Cost of Auto Insurance?

...............12

What is Insurance Scoring?

.........17

What Should Every

New Driver Know?

........................21

What Should You Do

if You’re in an Accident?

.............. 24

Who is At Fault?

............................ 26

What are Your Rights?

................. 28

What is Auto Insurance Fraud?

...32

Frequently Asked Questions

........33

Table of Contents

2

Coverages — Your auto insurance policy is divided into different coverages

based on the type of claim that will be paid to you or others. (A claim is a

request to an insurer for payment or reimbursement of a loss covered by the

terms of an insurance policy.) These coverages are:

Personal Injury Protection — Otherwise known as “PIP,” this is your medical

coverage for injuries you (and others) suffer in an auto accident. PIP pays if

you or other persons covered under your policy are injured in an auto accident.

It is sometimes called “no-fault” coverage because it pays your own medical

expenses no matter who caused the auto accident. PIP has two parts — (1)

coverage for the cost of treatment you receive from hospitals, doctors and

other medical providers and any medical equipment that may be needed to

treat your injuries and (2) reimbursement for certain other expenses you may

have because you are hurt, such as lost wages and the need to hire someone

to take care of your home or family. You may purchase both parts of PIP

coverage or medical treatment coverage only, depending upon your needs.

Liability — This coverage pays others for damages from an auto accident

that you cause. It also pays for a lawyer to defend you if you are sued for

damages that you cause.

There are two kinds of liability coverage: Bodily Injury and Property Damage.

Bodily Injury Liability Coverage — Pays for claims and lawsuits by

people who are injured or die as a result of an accident you cause.

(See pages 8 and 9 for lawsuit options). It compensates others for pain,

suffering and economic damages, such as lost wages. This coverage

is typically given as two separate dollar amounts: (1) an amount paid

per individual and (2) an amount paid for total injuries to all people

injured in any one accident that you cause.

Property Damage Liability Coverage — Pays for claims and lawsuits

by people whose property is damaged as a result of an auto accident

you cause.

These coverages can sometimes be purchased as a combined single

limit, which offers a maximum limit of protection per accident of

bodily injury and property damage liability combined.

What’s in a Policy?

Insurance policies use terms that may be unfamiliar to the average driver.

It is useful to understand what these terms mean so you can make better,

more informed decisions about your coverage.

Whether you are buying a new insurance policy or renewing your current

policy, you will make many decisions about what coverage you need and how

much you can pay in premium (the amount of money a company charges for

insurance coverage). Some things to consider:

Understand Your Needs

Do you rent or own your own

home? Do you have assets to

protect (including income from

a job)? Will your own health

insurance cover auto accident

injuries? How much insurance

coverage can you afford? These

are some of the questions you

should ask yourself before

choosing a specific coverage

plan.

Understand Your Options

Use this guide to learn about

the words and phrases used in

auto policies. Know the many

coverage options. Review the

different benets of each option.

(See pages 2-9).

Understand Consumer

Protections

As a New Jersey auto insurance

consumer, you have rights. (See

pages 28-31.) You have the right

to fair and equal treatment, and

you have the right to get the

information you need to make

informed decisions.

1

Where Should You Start?

Auto insurance helps protect you and your family from losses resulting

from motor vehicle accidents. It is required in New Jersey. If you drive without

insurance, you are breaking the law!

Agents, brokers and companies

must inform you of your

coverage options when

applying for a new policy, or

at any time upon your request

if you are already insured.

You have the right to know

how each choice may affect

what you pay and what your

benets would be in the event

of an accident. You always

have the right to ask about

additional options.

You can shop for auto

insurance at any time –

not just when your policy is

up for renewal, and if you

nd a better price, you can

cancel your old policy and

seek a refund of your unused

premium.

You have the right to change

your coverages and policy

limits at any time, even if

you are not near your renewal

date. If you select options that

save you money, you have

a right to a refund of your

unused premium within 60

days.

Remember...

Standard Policy — The Standard Policy provides a number of different

coverage options and the opportunity to buy additional protection. Most

New Jersey drivers choose this policy.

Things to note if you choose the Standard Policy:

• Even if you choose one of the lower PIP limits, in some instances you

will be covered for medically necessary treatment up to $250,000 for

certain permanent or signicant injuries, regardless of your selected

limit. Amounts paid under the permanent or signicant PIP provision

will be applied to and will reduce any amount payable under the

lower PIP limit chosen.

• A minimum amount of Uninsured/Underinsured Motorist coverage

is required. You can purchase higher limits if you want more coverage,

but cannot exceed your primary liability limits.

• Comprehensive and Collision coverages are available as options of

the Standard Policy. (Some insurers may provide these options in

the Basic Policy.)

Basic Policy — The Basic Policy usually costs less than a Standard Policy, but

provides limited benets. It is not for everyone, but it does provide enough

coverage to meet the minimum insurance requirements of New Jersey law.

The Basic Policy could be an option for those with few family responsibilities

and few assets to protect (including income from a job).

4

What are the Types of Policies?

There are two common types of auto insurance policies in New Jersey —

they are referred to as Standard and Basic. Both offer options as well. The

chart on page 7 compares the differences between the policies.

What is the

SAIP?

The Special Automobile Insurance Policy

(SAIP) is a new initiative to help make limited

auto insurance coverage available to drivers

who are eligible for Federal Medicaid with

hospitalization. Such drivers can obtain a

medical coverage-only policy at a cost of

$365 a year. For more information, ask your

agent or call the New Jersey Department of

Banking and Insurance at 1-800-446-7467.

Special Policy for Medicaid Recipients Only

Uninsured Motorist Coverage — Pays

you for property damage or bodily injury

if you are in an auto accident caused by

an uninsured motorist (a driver who does

not have the minimum level of insurance

required by law). Claims that you would

have made against the uninsured driver who

caused the accident are paid by your own

policy. Uninsured motorist coverage does

not pay benets to the uninsured driver.

Underinsured Motorist Coverage — Pays

you for property damage or bodily injury

if you are in an auto accident caused by a

driver who is insured, but who has less

coverage than your underinsured motorist

coverage. When damages are greater than

the limits of the other driver’s policy, the

difference is covered by your underinsured

motorist coverage.

* Claims paid under uninsured or

underinsured motorist coverage exclude

the rst $500 in damages.

Collision Coverage — Pays for damage to your vehicle as the result of a

collision with another car or other object. Collision coverage pays you for

damage that you cause to your automobile. You can also make a claim under

your own collision coverage for damage to your

car from an auto accident you did not cause.

This may take less time than making a property

damage liability claim against the driver who

caused the auto accident. Your insurer then seeks

reimbursement from the insurer of the driver

who caused the auto accident. (See page 27.)

Comprehensive Coverage — Pays for damage

to your vehicle that is not a result of a collision,

such as theft of your car, vandalism, ooding,

re or a broken windshield. However, it will pay

if you collide with an animal.

3

What’s in a Policy?

Remember...

Comprehensive (also

known as “comp” or

“Other Than Collision”)

and Collision

coverages are not

required by law, but

may be required

under the terms of an

automobile leasing or

nancing contract.

Jane purchases $100,000

in liability coverage and

$100,000 in underinsured

motorist coverage. Sam

purchases only $25,000 in

liability coverage.

Sam crashes his car

into Jane’s car, causing

$35,000 in damages.

Sam’s insurance company

pays Jane $25,000 of

the damages, while Jane’s

insurance company pays the

remaining $10,000 (*less

a $500 exclusion) from

her underinsured motorist

coverage.

What does

Underinsured Motorist

Coverage pay for?

What are Limits and Deductibles?

6

Health Care Primary — Cost savings can also be achieved by using your

own health insurance as a primary source of coverage in the case of injury

related to an auto accident. Before selecting this option, you should nd

out if your health insurance will cover auto accident injuries and how

much coverage is provided. Medicare and Medicaid cannot be used for

the Health Care Primary Option.

Extra PIP Package Coverage — These are additional benet options

provided under the Standard Policy.

Income Continuation — If you cannot work due to accident-related

injuries, this coverage pays lost wages, less Temporary Disability

Benets you may receive if your disability prevents you from working,

up to the amount you select.

Essential Services — Pays for necessary services that you normally do

yourself, such as cleaning your house, mowing your lawn, shoveling

snow or doing laundry, if you are injured in an auto accident.

Death Benet — In the case of death, family members or estates will

receive any benets not already collected under the income continuation

and essential services coverages.

Funeral Expense Benet — Pays for reasonable funeral expenses up

to the limit you select if you die as a result of an auto accident.

Comprehensive and Collision Coverages

Deductible Options — The standard deductible for Comprehensive and

Collision coverages is $750. Higher and lower deductibles are available

as options. (Remember: Higher deductibles can reduce your premium.)

Named Driver Exclusion — Prevents certain drivers on your policy from

being covered by and charged for collision and/or comprehensive coverage

on a specic automobile. This can lower your premium, but if the excluded

driver operates the automobile for any reason and is involved in an auto

accident, you are not insured for collision and/or comprehensive coverage;

which means you could be personally responsible for damage to your own

vehicle. (Remember: This exclusion is only for physical damage coverage;

insurers are permitted to rate licensed drivers in your household who are

not insured on another policy for other coverages on your policy.)

Uninsured/Underinsured Motorist Coverage

Limit — This coverage is sold together and is available up to the selected

limits of your liability coverage.

5

Limits — The maximum dollar amount the insurer will pay following an auto

accident. Limits vary with each coverage within the policy. (See chart, page 7.)

Deductibles — Payments you have to make before the insurer pays for a

covered loss. For example, a $750 deductible

means that you pay the first $750 of each

claim. Deductibles vary by company and type

of coverage. In addition to any savings you

may realize from how much coverage you buy,

you can also save money by choosing higher

deductibles. The amount you save by selecting

a higher deductible will vary by company.

(Below you’ll find limit and/or deductible

information for the coverages discussed on

pages 2 and 3.)

Bodily Injury and Property Damage Liability Coverage

Limit — Coverages can sometimes be purchased as a combined single

limit, which offers a maximum limit of protection per accident.

Personal Injury Protection (PIP)

Deductible Options — If you feel you need a high level of PIP coverage

but want to reduce your premium, you can save money by agreeing to pay

more out of pocket through a higher deductible if you are injured in an auto

accident. Your insurer will pay the medical bills over the deductible amount

you choose. No matter what deductible you choose, there is a 20 percent

co-payment for medical expenses between the deductible selected and

$5,000. That means you pay 20 percent, and your insurer pays 80 percent.

What are Limits and Deductibles?

In addition to choosing coverage options, you must choose the amount of

coverage you want to buy and the amount you are willing to pay out of

pocket in the event of an accident.

What is a Deductible?

John has a car

accident. His repair

shop estimates the

cost of repairs at

$2,000. John pays

$750 of the bill (his

deductible) and his

insurance company

pays the remainder.

Sam and Jane each have an accident that results in $10,000 of medical

expenses. Sam chose the minimum $250 deductible. He pays the $250

deductible plus $950 (20 percent of the $4,750 that is left of the rst

$5,000) and the insurer pays the remaining $8,800). Jane chose the

$2,500 PIP deductible for a 25 percent reduction in the PIP premium.

She pays the rst $2,500 as the deductible. She also pays $500 (20

percent of the $2,500 that is left of the rst $5,000) and the insurer

pays the remaining $7,000.

Example

8

Do You Want an Unlimited Right to Sue?

For the Standard Policy, you must make a choice about the rights you will

have if you are injured in an automobile accident. The Basic Policy includes

the Limited Right to Sue option.

The choice you make affects how much your

insurance will cost and what claims will be

paid in the event of an accident.

The choice you make regarding your right to

sue another driver applies to you, your spouse,

children and other relatives living with you

who are not covered under another automobile

insurance policy.

The Unlimited Right to Sue and Limited

Right to Sue options (see page 9) only cover

lawsuits for “pain and suffering” or non-

economic losses. Your medical expenses and

some economic losses for injuries in auto

accidents will be paid up to the limits of your

PIP coverage and are not affected by the choice

you make here.

WARNING:

Insurance companies or their producers or

representatives shall not be held liable for your

choice of lawsuit option (

Limited Right to Sue

or

Unlimited Right to Sue) or for your choices

regarding amounts and types of coverage.

You cannot sue an insurance company or its

producers or representatives if the Limited Right

to Sue option is imposed by law because no

choice was made on the coverage selection form.

Insurers and their producers or representatives

can lose this limitation on liability for failing

to act in accordance with the law. See N.J.S.A.

17:28-1.9 for more information.

Remember...

Choosing the

Limited Right to

Sue option will

save you money,

but will limit your

right to sue the

person who caused

an auto accident

for pain and

suffering.

You have an

important

decision to

make

regarding the

Right to Sue

7

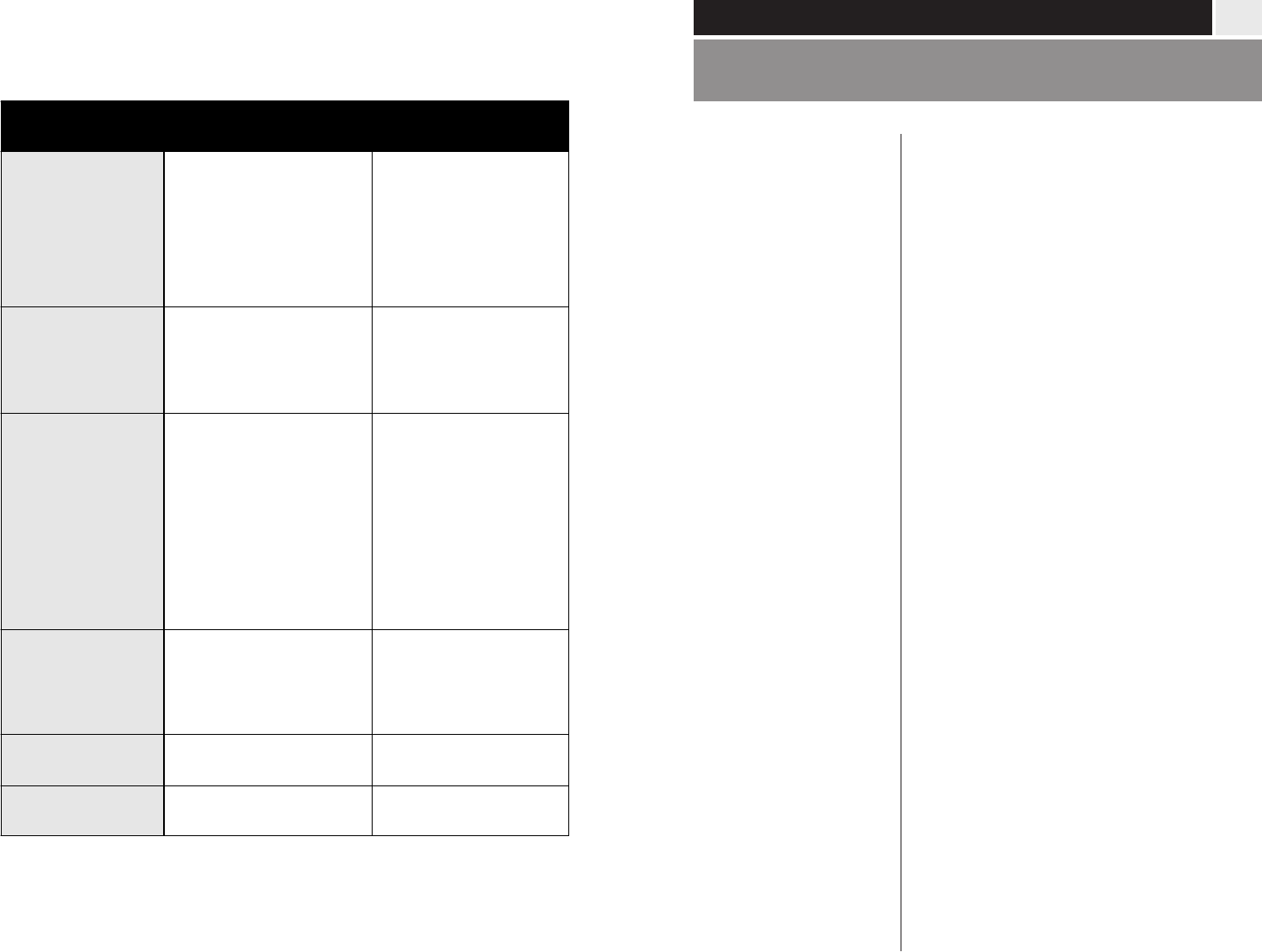

TYPE OF

COVERAGE

STANDARD

POLICY

BASIC

POLICY

BODILY

INJURY

LIABILITY

(PAGE 2)

As low as:

$25,000 per person,

$50,000 per accident

As high as:

$250,000 per person,

$500,000 per accident

Coverage is not

included, but $10,000

for all persons, per

accident, is available

as an option

PROPERTY

DAMAGE

LIABILITY

(PAGE 2)

As low as:

$25,000 per accident

As high as:

$100,000 or more

$5,000 per accident

PERSONAL

INJURY

PROTECTION

(PIP)

(PAGE 2)

As low as:

$15,000 per person

or accident

As high as:

$250,000 or more

Up to $250,000 for

certain injuries* regardless

of selected limit

$15,000 per person,

per accident

Up to $250,000 for

certain injuries*

UNINSURED/

UNDERINSURED

MOTORIST

COVERAGE

(PAGE 3)

Coverage is available up

to amounts selected for

liability coverage

None

COLLISION

(PAGE 3)

Available as an option Available as an option

(from some insurers)

COMPREHENSIVE

(PAGE 3)

Available as an option Available as an option

(from some insurers)

The chart below compares the differences between the Standard

and Basic policies and explains the amounts of coverage you may

be able to purchase from an insurer.

*permanent or signicant brain injury, spinal cord injury or disgurement or for

medically necessary treatment of other permanent or signicant injuries rendered

at a trauma center or acute care hospital immediately following an accident and

until the patient is stable, no longer requires critical care and can be transferred in

the judgment of the physician.

10

What if you have seven or more insurance eligibility points?

In accordance with New Jersey regulations for Eligible Person

Qualications, any driver who has accumulated seven or more insurance

eligibility points for the three-year period immediately preceding the

application for insurance or the three-year period ending 90 days prior to

renewal of a policy may not be considered eligible to purchase coverage

in the voluntary market. As a result, some insurers will direct them to

purchase insurance through the Personal Automobile Insurance Plan

(PAIP). It is important to note, however, that not all insurers in the

voluntary market refuse to cover drivers with seven or more insurance

eligibility points. If you have seven or more insurance eligibility points

it may be a good idea to shop around and compare your coverage and

pricing options.

The PAIP is not an insurance company; instead, it acts as an administrative

clearinghouse and assigns each driver to a company for coverage.

Therefore, this type of coverage is referred to as “assigned risk.” The state

has standardized the rates for this type of coverage and they do not vary

from company to company. The rates may also be substantially higher than

rates in the voluntary market. To nd PAIP producers in your area, call

1-800-652-2471 or visit the Department’s web site, www.dobi.nj.gov.

How do you get out of the assigned risk market?

Each year when a policy comes up for renewal or upon the purchase of

a new policy, the insurer will review a driver’s record for the preceding

three-year period. Insurance eligibility points for a violation or accident

are dropped when the incident falls outside the three-year “look back”

period. Once your point total falls below seven, you will again become

eligible to purchase insurance in the voluntary market.

What is the Assigned Risk Market?

How Do You

Get Insurance

Eligibility Points?

Insurers assign points for driver inexperience,

motor vehicle violations, suspensions and at-

fault accidents.

For example, if you are found equally or

more at fault than any other driver involved

in an accident and your insurance company

pays a claim of $1,000 or more ($500 or

more for accidents occurring before June 9,

2003), ve insurance eligibility points will

be assigned to you.

Unlimited Right To Sue — Under the No Limitation on Lawsuit Option,

you retain the right to sue the person who caused an auto accident for pain and

suffering for any injury.

Limited Right to Sue — By choosing the Limitation on Lawsuit Option, you

agree not to sue the person who caused an auto accident for your pain and

suffering unless you sustain one of the permanent injuries listed below: (Choosing

this option does not affect your ability to sue for economic damages such as

medical expenses and lost wages.)

• loss of body part

• signicant disgurement or signicant scarring

• a displaced fracture

• loss of a fetus

• permanent injury (Any injury shall be considered permanent

when the body part or organ, or both, has not healed to

function normally and will not heal to function normally

with further medical treatment based on objective medical

proof.)

• death

Do You Want an Unlimited Right to Sue?

A driver is considered eligible to purchase insurance in the voluntary market

if he or she has fewer than seven insurance eligibility points accumulated

during the preceding three years. These points are not the same as those

on your driving record maintained by the New Jersey Motor Vehicle

Commission. Insurers assign insurance eligibility points to drivers for motor

vehicle violations, suspensions and at-fault accidents. Insurers also assign

every newly licensed driver, regardless of gender or age, three insurance

eligibility points for being an inexperienced operator. (See page 21.) These

points are merely used as a guide to help the company determine whether

you are eligible for auto insurance in the voluntary market.

9

What is the Assigned Risk Market?

In New Jersey, there are two separate insurance markets — the “regular”

or voluntary market, and the “residual” or assigned risk market.

12

When you apply for auto insurance, companies consider a variety of factors

to determine the risk you represent and the likelihood that you will experience

an accident or loss. The company then groups you with policyholders with

similar risk characteristics (i.e., tiering), and assigns a rate based on the

driving and claims history of your risk group. Not all companies consider

the same factors when determining your premium (the amount you pay for

insurance coverage), but there are some common factors that impact rates:

Driving Record

If you (or a member of your household) have a driving record that includes

motor vehicle violations, suspensions and/or at-fault accidents, the price

you pay to obtain insurance might be higher. Insurance companies may

consider you (or a member of your household) to be a high-risk driver

and charge a higher rate than a driver with a “clean” record (free of

accidents and violations). Each company has underwriting guidelines to

determine what type and how many accidents and violations during a

specic period constitute a high-risk driver. (Remember: Insurers assign

insurance eligibility points for accidents and violations, and having

seven or more may make it difcult to remain in the voluntary market.)

Vehicle Type

The make, model and value of your vehicle affects the cost of your auto

insurance premium. Generally, an older vehicle will cost less to insure,

while a high performance or luxury car will cost more. The cost to insure

different makes and models of vehicles can vary among insurers, so be

sure to check with several insurers to get the best price and coverage

for your needs. Companies may offer discounts for vehicles with safety

features, so check with your insurer or producer for details, especially

when you are considering purchasing a vehicle.

Geographic Area

Where you drive and keep your vehicle also inuences your premium.

The number of claims led by policyholders in your territory will affect

the rates charged by insurance companies.

What Affects the Cost of Auto Insurance?

Auto insurance rates vary from company to company, driver to driver, car

to car, and coverage to coverage.

11

Under the tier rating system, insurers assign drivers to different tiers, or rating

levels, based on a number of risk characteristics. Tier rating systems take the

“complete picture” into account to identify a good risk, rather than simply

penalizing drivers for accidents and motor vehicle violations.

What factors determine what tier I’m in?

Insurers can consider a number of risk characteristics, including driving

record, years of driving experience, vehicle type, coverage limits, claims

and credit history when determining a driver’s tier placement. Other

factors, like age, gender and marital status, may also impact an individual’s

rate within a specic tier.

Do all companies use the same tier characteristics?

No. For example, some insurers use an “insurance score” (see page 17)

based on a driver’s credit history, while others may emphasize factors such

as driving record and claims history. Insurers are permitted to establish

their own tier rating criteria as long as they can show that they are not

arbitrary, capricious or unfairly discriminatory. Insurers also have to show

that tiers are reasonably based on loss experience — meaning that the

guidelines they use to place drivers in specic tiers are substantiated by

the losses the companies actually incur.

How many tiers can a company have?

Tier systems can vary greatly from company to company. Auto insurers

have developed a number of ways to evaluate risk; risk characteristics

considered important to one insurer don’t necessarily carry the same

weight with another. This makes it important for consumers to shop

around, as insurers’ tier systems and rates can vary considerably.

What is a “standard” tier?

A “standard” tier is a tier that represents the company’s base rates. Drivers

with favorable risk characteristics may qualify for preferred or lower-

rated tiers, while drivers with less favorable risk characteristics may be

placed in higher-rated tiers.

What is Tier Rating?

The Automobile Insurance Cost Reduction Act of 1998 (AICRA) changed the

way insurance companies do business in New Jersey by creating a tier system

to determine rates.

What Affects the Cost of Auto Insurance?

14

While some of the

factors used by

insurers to determine

risk are out of your

control (i.e., gender,

age), you do have

control over a variety

of factors that

inuence the cost of

your insurance.

Before you

purchase

auto insurance,

check out:

How Can You Lower Your Premium?

Your Collision and Comprehensive

Deductibles — In many cases, consumers

can save premium dollars by choosing higher

deductibles or eliminating coverage for older

cars that are paid in full. Remember, a higher

deductible means you will pay more out of

pocket in the event of an accident. You will

need to decide how much you can afford to

pay if an accident occurs.

Your Auto-Related Health Insurer Option

— Consumers can save premium dollars by

choosing their health care insurers as primary

in the case of auto accident-related injuries.

It is important to check with your health

care insurer before choosing the Health Care

Primary option.

Your Personal Injury Protection (PIP)

Deductible and Limits — Standard policies

usually carry a deductible of $250 and

a PIP limit of $250,000. Consumers can

save premium dollars by choosing a higher

deductible of $500, $1,000, $2,000 or $2,500

and/or choosing one of the lower PIP limits

of $15,000, $50,000, $75,000 or $150,000.

Your Lawsuit Option — Consumers can save

premium dollars by choosing the Limited Right

to Sue (Limitation on Lawsuit Option), which

limits suits for pain and suffering except in

cases of death or permanent injury.

Are You Eligible for Discounts? — It is always

a good idea to ask your insurer if any discounts

may be available to you. The following are

some of the discounts insurers may offer and

to which you may be entitled:

(For more

information

about the

coverages listed

at right, see

pages 2-9).

13

Gender and Age

Statistics show that males and young adults have a higher incidence of

accidents and claims; therefore, your gender and age can affect your rate.

Marital Status

Statistically, young married couples tend to have a lower incidence of

accidents and claims; therefore, they generally pay lower premiums than

single people.

Vehicle Use

The distance you live from work or school may affect the cost of your

insurance, as it determines your daily exposure to risk. Insurers will

calculate your premium based on the average distance you drive on an

annual basis or how far you commute to work or school. Whether you

use your vehicle for personal or business use may also impact your rate.

Policy Changes

Changes to your policy can also affect your premium. Such changes

may include:

• Adjusting your coverage

• Changing your deductibles

• Moving to a new area (territory)

• Adding or removing a vehicle from your policy

• Adding a new driver

Any time period in which you had a car that was required to be insured

but did not have auto insurance can affect your premium as well. A lapse

in coverage exceeding 30 days could place you in the assigned risk

market. By law, any vehicle registered in the state must have insurance,

so if your car is off the road or not operational and you let your insurance

lapse, it is important to surrender your license plates to the New Jersey

Motor Vehicle Commission to be sure you do not have an uninsured

registered vehicle.

Insurance Score

Some, but not all, insurers in New Jersey will use an insurance score

based on your credit history as one of the factors in determining risk.

(See page 17.)

What Affects the Cost of Auto Insurance?

What Affects the Cost of Auto Insurance?

16

The key to getting the most out of your premium dollars is to comparison

shop among insurers. Before you start shopping, consider what insurance

coverage you need, then compare how much the same coverage would cost

from several insurers.

Comparison shopping takes time, but the effort may result in a lower premium

since different companies charge different rates for identical products and

services. Some companies employ agents or brokers to sell policies, while

others sell policies directly through the mail or their web sites.

Agents, brokers and companies must inform

you of your coverage options when applying

for a new policy, or at any time upon your

request if you are already insured. You have

the right to know how each choice may affect

what you pay and what your benets would

be in the event of an accident. You always

have the right to ask about additional options.

When shopping for insurance, you should

also consider an insurer’s reputation for

nancial stability, policyholder service and

claims handling practices. Many insurers

offer information about their services on

their web sites, and companies such as A.M.

Best (www.ambest.com), Moody’s (www.

moodys.com) and Standard & Poor’s (www.

standardandpoors.com) rate the nancial

condition of insurers.

As the regulatory authority for the state’s

insurance industry, the Department cannot

recommend insurers to consumers. However,

the Department’s web site (www.dobi.

nj.gov) offers many shopping tools, as well

as a current list of insurance companies that

write policies in New Jersey.

How to Shop for Auto Insurance

Try the Department’s

online tool, the

Auto Insurance

Purchasing Planner

(www.dobi.nj.gov/

autoplanner.htm).

This interactive tool

guides you through the

coverage selections that

must be made when

purchasing an

auto policy.

You can print out

information about the

types of coverage that

are right for you and

use it when speaking to

an agent or insurance

company.

Before You Shop...

What Affects the Cost of Auto Insurance?

15

In order to accurately quote you a premium, insurers will generally request

the following information:

• Make/model/year/vehicle identication number (VIN) of vehicle(s)

• Number of average annual miles (daily miles to work or school)

• Principal owner and operator of vehicle(s) (registration information)

• Driver(s) to be insured on the policy – name, license number, age,

sex, marital status (It is important to tell your insurer about all

licensed drivers in your household, even if they are covered by other

policies)

• Accidents or moving violations of each driver during past three years

• Coverages and limits desired

• Multiple Car/Other Policies — Insuring two or more vehicles on one

policy can reduce your premium. Discounts may also apply if you have

another policy, such as homeowner’s, renter’s or life insurance, with

the same company.

• Vehicle Safety Features — Insurers must offer discounts for vehicles

that have anti-lock brakes, air bag and passive restraint systems, and

anti-theft vehicle recovery systems.

• “Good Student” — Many insurers offer discounts for young drivers

who maintain a 3.0 (“B”) or higher grade point average or for those

family members attending school away from home.

• Defensive Driving — New Jersey law requires insurers to offer

discounts for drivers who have completed a Defensive Driving course

approved by the New Jersey Motor Vehicle Commission. (To nd an

approved school near you, call 1-888-486-3339.)

What Information May an Insurer Request?

What is Insurance Scoring?

18

How is insurance scoring different in New Jersey?

The New Jersey Department of Banking and Insurance examined the

practice of insurance scoring in more than 40 states to help craft a

comprehensive approach that will protect consumers and encourage

competition. Consumer safeguards include:

CANNOT:

Use an insurance score to deny, cancel or non-renew coverage

Use an insurance score for consumers covered by the Special

Automobile Insurance Policy or Basic Policy programs

Use an insurance scoring model that considers race, ethnicity,

sex, age, religion, income, address or unpaid medical bills

Offer less favorable payment plans based on credit

MUST:

Provide written notice to applicants and existing policyholders

of the practice and factors that affect the scoring

Provide written notice and specific explanations if an

“adverse action” is taken against the applicant, in whole or

in part, because of their credit history

Consider multiple credit inquiries for home or auto loans as

one inquiry if requests were made within a 30-day period

Make exceptions for consumers whose credit has been

directly inuenced by extraordinary life events, such as

catastrophic illness, injury, death of spouse, child, or parent,

temporary loss of employment, divorce or identity theft (An

insurer may only consider credit information not affected

by the event)

Protect existing customers who have been claim and violation

free in their company for seven years

Protect consumers without a credit history

Submit their scoring model to the Department and fully

disclose the factors used in establishing the model, as well

as its statistical justication

Auto

insurance

companies

that use

insurance

scoring...

17

Some auto insurance companies in New Jersey are now using your insurance

score as one of the various factors to evaluate risks and assign rates. An

insurer may use your insurance score, based on information contained in

your consumer credit reports, in conjunction with your motor vehicle records,

loss reports and application information to determine your insurance risk at

a particular point in time.

In New Jersey, insurers are prohibited from using your insurance score

to deny, cancel or non-renew coverage.

How much do you know about your credit history?

Your credit history plays a major role in many

aspects of your life. How you manage credit is

considered when you apply for home or auto loans,

and when establishing utility, cable or telephone

services. Few landlords will rent apartments

or houses without ordering a credit report. It is

sometimes considered even when applying for

a job. Because the use of credit information is a

fact of life today, it is important to understand and

manage your credit wisely.

Why is insurance scoring being used?

A common practice in most states, insurance scoring, like other rating

criteria, is a way for insurers to differentiate between insurance risks.

Insurance scores are used by insurers to determine a consumer’s likelihood

to le claims.

What is the difference between a credit score and an insurance score?

While a credit score and an insurance score are both derived from

information contained in your credit report, they predict very different

things. A credit score is used by banks and mortgage lenders to predict the

likelihood that a person will repay a loan or some form of credit debt. An

insurance score is used by insurance companies to predict a consumer’s

likelihood to le claims.

What is Insurance Scoring?

In 2003, the use of insurance scoring was introduced to New Jersey as yet

another step in providing auto insurance consumers with more choices in

companies, products and price.

While a credit

score and an

insurance score are

both derived from

information contained

in your credit report,

they predict very

different things.

Remember...

• Make a realistic saving and spending plan and stick to your budget.

You are responsible for what you borrow. Examine your nancial

situation to make sure you are able to repay your debt.

• Check monthly statements and report inaccuracies or mistakes

immediately.

• Annually request a copy of your credit report. Review for accuracy

and correct all errors in writing. Over time, responsible use of credit

can improve a customer’s insurance score.

Know your credit history

There is a good chance your current or prospective insurance company

will consider nancial stability as part of its rating process. Insurance

scores are based on information from credit reports from the three

major credit reporting agencies (see below). It is important to review

your credit history and correct any errors. New Jersey and federal law

entitles consumers to a free report each year from each of the major credit

reporting agencies.

The federal Fair Credit Reporting Act requires an insurance company to

tell you if they have taken an “adverse action” against you, in whole or

in part, because of your credit history. If your insurance company tells

you that you have been adversely affected, they must also tell you the

name of the credit reporting agency that supplied the information so you

can get a free copy of your report and correct any errors.

What is Insurance Scoring?

20

You should review your credit

report from each credit reporting

agency at least once a year.

Get your free reports online at

www.annualcreditreport.com

or by calling

1-877-322-8228.

How Can You Get Your

Free Credit Report?

You can also contact the

agencies directly:

Equifax: 1-800-685-1111

Experian: 1-888-397-3742

TransUnion: 1-800-888-4213

Where does an insurance score come from?

Most insurance companies do not directly participate in the process

of developing a consumer’s insurance score. Insurers generally hire a

vendor to look at the information provided by major credit bureaus, and

use it to develop an insurance score for you. The vendor then gives your

score, not your credit report, to the insurer. Insurance scores vary by

company due to the information provided and the vendor formula used

to calculate the score.

What factors can affect your insurance score?

There are a number of factors that determine insurance scores. One insurer

might place more weight on a certain factor while another insurer might

not consider it at all. Following is a list of common factors:

• Major negative items — Bankruptcy, collections, foreclosures, liens,

etc.

• Past payment history — Number and frequency of late payments.

• Length of credit history — Amount of time you have been in the

credit system.

• Inquiries for credit — Number of times you’ve recently applied for

new accounts, including mortgage loans, utility accounts, credit card

accounts, etc.

• Number of open credit lines — Number of open credit cards, whether

you use them or not.

• Type of credit in use — Major credit cards, store credit cards, nance

company loans, etc.

• Outstanding debt — How much you owe compared to how much

credit is available to you.

What can you do to improve your insurance score?

• Pay bills on time. Delinquent payments and collections can have a

major negative impact on an insurance score.

• Use credit wisely. High outstanding debt can affect an insurance score.

• Apply for and open new credit accounts only as needed. Maintain

only the minimum number of credit cards and other credit accounts

necessary.

• Remember that the longevity of an account (the amount of time

you’ve had it) is considered part of your credit history.

What is Insurance Scoring?

19

What Should Every New Driver Know?

22

New Jersey

Statutes

Annotated

Event

Description

Moving

Violation

Points

Inexperienced

Driver

Assessment

Total Insurance

Eligibility

Points

39:4-50

Operating a motor

vehicle under the

influence of alcohol

or drugs

9 3

12

39:4-52

Racing on highway

5 3

8

39:4-96

Reckless driving

5 3

8

39:4-99

Exceeding

maximum speed

15-29 mph over

limit

4 3

7

39:4-128.1

Improper passing

of school bus

5 3

8

39:4-129

Leaving the scene

of an accident -

Personal Injury

8 3

11

When do parents have to add a teenager to their auto policy?

You should notify your parents’ insurer when you are ready to obtain

your driving permit. Any change in their insurance cost will either

apply when you receive a permit or license, depending on the insurance

company’s rating plan. (Remember: Failure to disclose all of the drivers

in a household to your insurer can be construed as a form of insurance

fraud - see page 32, which is subject to policy cancellation, civil ne,

or penalty under the New Jersey Insurance Fraud Prevention Act.)

Most insurers offer discounts for multiple cars, so it will most likely

cost less for a young driver to be added

to their parents’ policy than to purchase

their own. However, any driver with

a car titled and registered in their

name can purchase insurance.

Check with your agent, broker or

insurance company to understand

the factors to consider when

making such a decision.

21

What Should Every New Driver Know?

Getting the keys to your rst car (even if it belongs to your mom or dad!) is

considered a rite of passage by many teenagers. With this important step

toward adulthood comes many responsibilities — insurance being one of them.

Following are questions teenage drivers and their parents should consider

when shopping for auto insurance.

Why are insurance rates higher for teenagers?

According to the National Safety Council, young drivers as a group are

involved in more car accidents than any other driver age group. Lack of

experience, higher accident statistics and more costly accidents result

in higher insurance rates for novice drivers, especially those under 25.

But there is some good news: As long as drivers maintain good driving

records, auto insurance rates tend to decrease with age.

What are inexperience points?

Every newly licensed driver, regardless of gender or age, is assigned three

insurance eligibility points for being an inexperienced operator. (See

page 9.) For every year of experience, one inexperience point is removed.

If you start out with three insurance eligibility points, you have little

room for error if you want to remain in the voluntary market. If you

have seven or more insurance eligibility points upon renewal of your

policy, you and possibly your family may have to seek coverage in the

assigned risk market.

If you commit any of the following

motor vehicle offenses (see chart

on page 22) during the rst year of

your three-point assessment, upon

renewal you may have to purchase

insurance in the assigned risk market.

In addition, for Driving Under the

Inuence (DUI) offenses, you could

face a delay in getting your license,

suspension of your license and/or nes

and surcharges.

Remember...

Every newly licensed

driver, regardless of

gender or age, is assigned

three insurance eligibility

points for being an

inexperienced operator.

With each year of driving

experience, the driver

loses one inexperienced

operator eligibility point

until he or she is licensed

for three years.

The following tips can help you before, during and following an accident.

Before an Accident

Make sure you are sufciently insured – Read your policy carefully

to understand the types of coverage you have purchased and the

limits of your coverage. Discuss with your agent or broker what your

benets would be in the event of an accident.

Keep your insurance information (and vehicle registration)

available at all times –You will be required to present your license,

proof of insurance and registration if you are involved in an accident

or trafc stop. (Keep a disposable camera with your insurance

information – Use it to take pictures at the scene of an accident,

including any damage to vehicles and the number of people involved.)

Look for a reputable repair shop – Establish a good working

relationship with a repair facility before you need one. You can choose

your own licensed repair shop, and insurance law requires that the

insurance company attempt to reach an agreement with it regarding

the cost to repair your vehicle. If not, the insurance company is

obligated to identify other licensed shops that can make repairs at

the price determined.

At the Scene of an Accident

Stop the vehicle and remain at the scene – If possible, move out

of the way of oncoming trafc, but do not leave the area. Switch

on emergency ashers and put out ares, if possible, to alert any

oncoming trafc.

Call the police – Report the accident and if necessary, request medical

assistance.

Obtain information – If possible, write down the following:

24

What Should You Do If You’re In an Accident?

Whether you are involved in a minor fender bender or serious collision, an

auto accident is a stressful experience for any driver. It is important to try

to remain calm and know what to do.

What Should Every New Driver Know?

23

Will a parents’ auto policy cover a student away at college?

In general, young people away at college are still considered members of

their parents’ household and would be covered while driving their own

or other autos. As such, you should advise your insurer of your location

and current use of vehicles insured under the policy. If you bring your

car with you to school, you will need to notify the insurer that the car

will be garaged at another location. However, if you’ll be away at school

and won’t have access to a car, you may want to ask your insurer about

possible discounts for students living away from home and the Named

Driver Exclusion endorsement (see page 6).

How can teenage drivers save money on auto insurance?

• Shop around — Since premiums vary from company to company, it

is important to shop around.

• Enroll in driver training — Many schools offer driver training as part

of their curriculum. Check with your insurer if any discount will apply

if you complete a program that includes behind-the-wheel training as

well as classroom instruction.

• Keep your grades up — Many insurers offer “Good Student” discounts

for young drivers who maintain a 3.0 (“B”) or higher grade point

average or for those family members attending school away from home.

Check with your insurer.

• It’s all about the car — The make and model of your vehicle affects

the cost of your auto insurance premium. Generally, an older vehicle

will cost less to insure, while a high performance or luxury car will

cost more. The cost to insure different makes and models of vehicles

can vary among insurers, so be sure to check with several insurers to

get the best price and coverage for your needs. Companies may offer

discounts for vehicles with safety features, so check with your insurer

or producer for details, especially when you are considering purchasing

a vehicle.

• Choose a higher deductible — You may reduce your insurance

premium by selecting higher deductibles (see pages 5 and 6).

(Remember: A deductible is the amount you pay out of pocket in the

event of an accident.)

26

Who is At Fault?

In New Jersey, if more than one driver contributes to an accident insurance

companies will pay physical damage and other liability claims according

to the percentage of fault for each driver involved.

Who decides who is at fault in an accident?

Insurance companies determine each driver’s degree of fault in an

accident using the Comparative Negligence Act (N.J.S.A. 2A:15-5.2).

The amount, or percentage, of fault is determined on a case by case basis

depending on the circumstances surrounding the accident and is used to

determine liability for physical damage and other liability claims. Under

the law, an individual cannot recover damages if his or her percentage of

fault for the accident is greater than the individual from whom damages

are sought.

In the event of an accident, the insurer will conduct an investigation and

review all the facts provided by each party (such as police reports, driver

and witness statements, etc.). It will then assign a percentage of fault to

the parties involved in the accident based on contributing factors such as:

failing to observe and avoid another vehicle, failing to sound the horn,

apply brakes or swerve, and/or driver inattention.

If you are found to have a portion of fault for an accident, any payment

or reimbursement you may receive from the other driver’s insurer will

be reduced by that portion.

If you were considered 50 percent at fault for the

accident and had $1,000 in damage to your car, you

would be paid $500 or 50 percent by the other driver’s

insurance company. If in the same accident you were

only considered 10 percent at fault, you would receive

$900 from the other driver’s insurance company.

If you have an accident where you believe you are not at fault and have

collision coverage on your vehicle, you have the option of ling with your

own insurance coverage or directly with the person you believe is at fault.

If you are paid under your own policy minus your collision deductible,

your insurer will try to pursue reimbursement from the at-fault person. If

your insurer is successful, it will reimburse you the proportionate share

of your deductible.

For

example:

What Should You Do if You’re in an Accident?

25

• Insurance information (including company and policy number) for

each vehicle involved in the accident

• Make and model of the vehicles involved in the accident

• Time, date, location, weather and road conditions

• Direction and speed of drivers involved

• How the accident occurred

• Names, addresses and phone numbers of any witnesses to the

accident

• Names, badge numbers of police ofcers or emergency personnel,

and instructions on how to obtain a copy of the police report

After an Accident

Contact your insurance company as soon as possible – Ask your

insurer what forms or documents will be needed to support your claim.

Current regulations require your company to contact you within 10

working days after it has been notied of a loss; or, within seven working

days if it intends to inspect the damaged vehicle. This inspection must

be done at a time and place that is reasonably convenient for you. For

your own protection, you should contact your insurance company even if

you believe you were not at fault in an accident, or if there is no visible

damage or injury.

Get a copy of the police report – Make copies for your own records

and your insurance company. Review report for details, such as how

many passengers were listed in comparison to how many were present

at the accident. If you see inconsistencies, let your

insurance company know and contact the police

department that responded to the scene.

Take reasonable steps to protect your property from

further damage – For example, if you don’t cover a

broken windshield and rain damages your upholstery,

your insurer could refuse to pay for the damaged

upholstery. Save all receipts for emergency repairs

and submit with your claim.

What are Your Rights?

As a New Jersey driver, you have certain rights and responsibilities regarding

the purchase of auto insurance. Knowing these rights will allow you to get

the most from your insurance coverage.

28

You Have the Right to Purchase Insurance

You can never be denied auto insurance based on your gender, race or

ethnicity. In most circumstances, a company cannot refuse to sell you

insurance based on where you live as long as you meet the company’s

acceptance criteria*.)

If you are denied auto insurance coverage, the agent or company must state

a reason. Common reasons include:

• You do not meet any of the company’s acceptance criteria*.

• The insurer is a “membership company” that only covers certain cat-

egories of drivers.

• The Department of Banking and Insurance has permitted the insurer

to stop writing new policies.

You Have the Right to Cancel or Change Insurance

You can shop for cheaper auto insurance at any time – not just when your

policy is up for renewal. If you nd a better price, you can cancel your old

policy and seek a refund of your unused premium. However, never cancel

your old policy until a new one is in effect. A lapse in coverage will result

in higher rates in the future.

You have the right to change your cover-

ages and policy limits at any time, even

if you are not near your renewal date. If

you select lower policy limits or cancel

nonmandatory coverages to save money,

you have a right to a refund of your unused

premium within 60 days.

*Acceptance criteria are the written

standards by which a company ac-

cepts new business or renews existing

business.

27

Who is At Fault?

You le a claim with your insurer for $2,000 in damage

under collision. After applying your $750 collision

deductible, your insurer pays you $1,250. The insurer

pursues subrogation (reimbursement) from the at-fault

person’s insurance company and recovers 80 percent of the

loss. Your insurer will reimburse you 80 percent of your

deductible, or $595, for a total payment on your claim of

$1,845. If you led the claim directly with the at-fault

person’s insurance company rather than under collision,

you would be paid 80 percent of $2,000 or $1,600.

You should also be aware that your percentage of fault will be considered

when reimbursing you for other accident-related costs, such as rental car

charges. However, if you are found to be more at fault than the other

driver, (i.e., if you were 80 percent at fault and the other driver was 20

percent at fault), you would not be entitled to collect damages from the

other driver’s company.

What if you disagree with the percentage

of negligence assigned to you?

All auto insurers must have an Internal

Appeal Process in place for the review

of disputed claims. In the event that a

settlement cannot be reached through the

Internal Appeal Process, the company

must inform the claimant of their right

to contact the Department’s Office of

Insurance Claims Ombudsman to request

a review of the claim and the appeal

determination. (For contact information,

see the back cover of this guide.)

However, police report details or opinions

and extenuating circumstances exist for nearly every accident and there

are times when a dispute between the drivers involved as to how an

accident occurred cannot be resolved. In this situation, determining

the facts of the accident would be up to a court of law. It should be

remembered that ling an internal appeal or a complaint through the

Department does not negate your right to le suit to ultimately resolve

the claim dispute. Consult an attorney or your County Court Clerk for

more information on ling a lawsuit.

For

example:

Remember...

Under the law, in

order to recover

damages from

another person or his

insurance company,

an individual’s

percentage of fault

for the accident

cannot be more than

the individual from

whom damages are

sought.

What are

Acceptance

Criteria?

30

You Have the Right to Appeal

If your coverage is canceled, you can le an appeal with the New Jersey

Department of Banking and Insurance. Contact the Consumer Inquiry and

Response Center, P.O. Box 471, Trenton, NJ 08625-0471, call (609) 292-

7272 or 1-800-446-7467, or visit online at www.dobi.nj.gov/consumer.

htm. The Department cannot guarantee that your policy will be reinstated,

so you should not delay shopping for alternate coverage.

If a carrier denies you coverage and does not state a reason, or if you believe

you have been treated unfairly, you can contact the Department.

You Have the Right to a Notice of Non-renewal

Insurers can decline to renew coverage if you no longer meet any of the

company’s acceptance criteria*. This can occur when a driver’s record

includes “at-fault accident” or motor vehicle violations. Other reasons for

nonrenewal of a policy include:

• The Department has, for regulatory reasons, permitted the company

to non-renew policies.

• The insurer is using the 2-for-1 or the 2 percent rule. The 2-for-1

rule allows the insurer to non-renew one vehicle for every two new

ones it writes in each territory. The 2 percent rule allows the insurer

to non-renew up to 2 percent of policies in a territory experiencing

heavy growth. Drivers subject to non-renewal do not have clean

driving records or have a poor payment history. Insurers must state

that they have invoked these rules on the non-renewal notice.

A written non-renewal notice must

be sent at least 60 calendar days prior

to the expiration date of the existing

policy.

*Acceptance criteria are the written

standards by which a company

accepts new business or renews

existing business.

What are Your Rights?

29

You Have the Right to Choices

Agents, brokers and companies must inform you of your coverage options

when applying for a new policy, or at any time upon your request if you are

already insured. You have the right to know how each choice may affect

what you pay and what your benets would be in the event of an accident.

You always have the right to ask about additional options.

You Have the Right to a Timely Response

You have the right to a timely response when seeking an appointment

or application from an agent, broker or company. Appointments should

be scheduled so that you can obtain

coverage before your current policy

expires. However, an application is usually

not considered complete until the company

has obtained all pertinent information,

including a copy of the applicant’s driving

record from the Motor Vehicle Commission

and verication of any previous coverage.

Therefore, the overall application process

can take up to two weeks. Make sure you

give yourself enough time to shop for

coverage.

You Have the Right to the Prompt and Fair Handling of Claims

You have the right to ask about any payments made to others by your

company and charged to your policy. If you le a claim, it should be

handled promptly and fairly. If a claim is denied, you must receive a

written explanation for the denial.

You Have the Right to a Notice of Cancellation

There are specic circumstances that allow an insurance company to

cancel your policy during the policy period. This is referred to as a mid-

term cancellation. This may only occur when fraud is discovered, when

your driver’s license is suspended or when the policyholder fails to make

premium payments. A 15-day warning notice must be sent before the policy

is canceled.

What are Your Rights?

32

Frequently

Asked Questions

There are many types of fraudulent schemes and scams, all of which increase

premiums for policyholders of auto, life, health, homeowner’s and other types

of insurance. Insurance fraud can be “hard” or “soft.”

Soft fraud occurs when normally honest people knowingly misrepresent facts

on insurance applications or “pad” a claim with damages and injuries that

never occurred. Some examples:

• Understating the annual number of miles driven on an insurance

application to reduce insurance premiums.

• Reporting to your agent or company that a car is principally garaged

in New Jersey when it is garaged elsewhere.

• Adding damages to a claim to cover the cost of your deductible or

prior premiums paid.

• Omitting high-risk drivers from your application or policy.

Hard fraud occurs when an accident, injury, theft or other loss is deliberately

staged, either by a lone person or as part of an organized fraud ring. These

rings often join dishonest doctors, lawyers and repair shop owners in snaring

innocent drivers with a staged collision that appears accidental. Some

examples:

• A driver stops abruptly in front of your vehicle, causing you to rear-

end it. In addition to collecting money for vehicle damages, the “crash

dummy” also submits a claim for nonexistent injuries to collect more.

• A vehicle is found abandoned and burned before it is reported stolen

by its owner.

• A fraudster obtains insurance on a vehicle using a counterfeit title and

registration. Later, a theft claim is led on the “paper car.”

Any form of auto insurance fraud is a serious crime in New Jersey that can

lead to heavy nes and possible jail time. Protecting yourself from fraud

scams is one way to help ght this crime. If you have specic information

about individuals or entities that may be committing insurance fraud, contact

the New Jersey Ofce of Insurance Fraud Prosecutor at 1-877-55-FRAUD.

What is Auto Insurance Fraud?

Auto insurance fraud occurs when people knowingly misrepresent pertinent

facts to a company or agent to obtain a policy or collect money to which

they aren’t entitled.

What are Your Rights?

31

Your Obligations as a New Jersey Driver

New Jersey state law requires that any registered vehicle be covered by

an insurance policy. Failure to maintain coverage can lead to higher prices

for new policies, placement in the “assigned risk” pool, suspension or

revocation of your driver’s license or registration, and additional nes and

penalties.

• Always make payments for your policy on time or a

lapse in coverage may result. A driver who incurs

a lapse in coverage will end up paying far more for

coverage.

• Always provide any information your company

seeks. Insurance companies have the right to

seek information about all licensed drivers in the

household.

• If you receive a non-renewal notice, do not wait to

shop for alternate coverage. Policies can be prepared

in advance to become effective on a date several days

or weeks after the application.

A driver who mails a renewal payment before the due date cannot lose

coverage. However, insurers can charge the driver a late fee if the payment

is postmarked on time, but arrives after the payment due date.

Maintaining

your auto

insurance

coverage

requires

that you:

A driver who mails a renewal payment

before the due date cannot lose coverage

if the payment is received within three

business days of the due date or there is

evidence it is postmarked prior to the due

date. However, insurers can charge the

driver a late fee if the payment arrives

after the due date.

What if My Renewal

Payment is Late?

Frequently Asked Questions

34

Due to nancial difculties, I sent my insurance payment a few days

late and the policy was canceled. My company did not notify me that

the policy was canceled; they just sent my check back. Isn’t there a grace

period during which the company must accept the payment?

There is no “grace period” for policies that have lapsed or terminated.

Under current regulations, companies must provide notice of payment

due dates according to what type of payment is due. Renewal offers

must be mailed 30 days prior to the due date. A cancellation notice for

nonpayment of premium must be mailed at least 15 days prior to the

expiration of the policy. If you do not pay your renewal premium or the

premium due amount on a notice of cancellation by the date specied, the

company is not required to once again tell you the coverage has lapsed,

nor to offer to reinstate your policy. While insurance laws require that

an insurer must be able to provide proof that a notication was mailed to

the address where you have told them you reside, they are not required to

mail any notice “certied” or “return receipt” and are under no obligation

to ensure that these notices are received.

Why do insurers charge young males more than young females?

Insurance rates are based on statistics and probability. Historically,

statistics have shown that, while males as a group have only a slightly

higher percentage of accidents and violations than females, accidents

involving youthful male drivers cause substantially higher amounts of

damage and cost the insurance companies considerably more in claim

settlement costs than accidents involving youthful females. Therefore,

insurance companies are permitted to set rates based on the overall risk of

the policy being written.

My son has received his driver’s license and our family now has two

cars and three drivers. My son is listed as an operator of my car on our

insurance policy, but my son is not allowed to drive my car; he uses

his mother’s car. How can I remove him from the rating of my vehicle?

The Named Driver Exclusion endorsement is available for the

Comprehensive and Collision portion of Standard policies. This

endorsement allows certain licensed drivers within the household to

be excluded from the rating of comprehensive and collision costs of a

particular vehicle on the policy. If you own vehicles that your child(ren)

does not operate, this may help save premium dollars. However, it should

be remembered that if the excluded driver does, for any reason, even in

an emergency, operate that vehicle there would be no coverage afforded

for repair to the vehicle in the event of an accident. (See page 6.)

Why Was My

Policy Canceled?

33

What if I don’t pay my premium?

If you don’t pay your insurance premium, the company will cancel your

policy. Getting a policy from another insurer may be difcult or may

cost more if you let your policy lapse and go without insurance. A lapse

exceeding 30 days could place you in the assigned risk market. (See

page 9).

I sent in my insurance payment on the due date, but the company said

it was too late and still canceled my policy. Can they do that?

Whether or not a policy is terminated for a late payment depends on

what type of payment is due. Most companies will allow policyholders

to make installment payments on their premiums and may even accept

these payments received after the initial due date. This is permissible

because a policy is already in force and there may be equity (premiums

already paid) available to continue coverage for a short time. However,

if no payment is received, the company will issue a notice of cancellation

for nonpayment of premium. If this payment is not received before the

due date, the policy will terminate. Until the initial payment for a policy

renewal is paid, there is no policy in force. Therefore, when the renewal

payment is not received by the due date, the previous policy expires and

the offered policy does not become effective. Should the policyholder

wish to continue coverage with that company, the company would then

need to write a new policy for that customer.

I got a notice that said I had to make my overdue premium payment

or my policy would be canceled on the 15

th

. I

took the money to my agent on the 15

th

,

but they said it was too late and the

policy had already been canceled.

How can this be?

Because an insurance policy must

provide coverage for every full 24-hour

day that it is in force, every insurance policy

expires at 12:01 a.m., meaning one minute

after midnight on the specied date. Therefore,

any premium payment must be received before the

cancellation date in order for the policy to remain in force.

Frequently Asked Questions

The Department wants all New Jersey drivers to make informed decisions

regarding their auto insurance coverage. We are happy to assist with any

additional questions you may have about insurance.

A

Additional PIP Coverage Options, 6

appeal, 30

assigned risk market, 9-10, 13, 21, 31,

33

Auto Insurance Purchasing Planner, 16

B

Basic Policy, 4, 7 (chart), 18

Bodily Injury Liability, 2, 5, 7 (chart)

C

cancellation, 29, 33, 34

claim, 2, 5, 25, 27, 29, 32

Collision coverage, 3, 4, 6, 7 (chart),

14, 26, 34

combined single limit, 2, 5

Comparative Negligence Act, 26

Comprehensive coverage, 3, 4, 6, 7

(chart), 14, 34

credit history, 11, 13, 17-20

D

deductibles, 5-6, 14, 23, 26, 32

discounts, 14-15

F

fraud, 22, 32

H

Health Care Primary option (PIP), 5,

14

I

inexperienced operator, 9, 21

insurance eligibility points, 9-10, 12,

21

insurance score, 11, 13, 17-20

Internal Appeal Process, 27

L

lapse in coverage, 13, 28, 31

liability, 2, 4, 6

limits, 5, 7 (chart), 14

Limited Right to Sue, 8-9, 14

M

mid-term cancellation, 29

N

Named Driver Exclusion, 6, 23, 34

no-fault coverage, 2

non-renewal, 30

P

Personal Automobile Insurance Plan

(PAIP), 10

Personal Injury Protection (PIP), 2, 4,

5-6, 7 (chart), 8, 14

premium, 1, 12, 15, 28, 32, 33

Property Damage Liability, 2, 5, 7

(chart)

R

rates, 11-15

S

Standard Policy, 4, 6, 7 (chart), 34

Special Automobile Insurance Policy

(SAIP), 4, 18

subrogation, 27

T

Tier rating, 11, 12

U

Underinsured Motorist coverage, 3, 4,

6, 7 (chart)

Uninsured Motorist coverage, 3, 4, 6,

7 (chart)

Unlimited Right to Sue, 8-9

V

voluntary market, 9-10, 12, 21