Special Report Series

May 28, 2024

Dividend Forecasting

Juan Pablo Albornoz, Research Analyst, Dividend Forecasting

Dividend initiation fever:

Who is next?

Nonpayers report: Part 1

spglobal.comspglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 2

Table of contents

About us 3

S&P 500 nonpayers 4

Dividend initiation fever 4

Most likely initiations: Quantitative and qualitative analysis 4

Complete coverage 7

Fundamental approach 10

Quantitative score: Methodology 10

Pillar I: Dividend history 10

Pillar II: Buyback reliability 10

Pillar III: Buyback payout magnitude and sustainability 11

Pillar IV: Revenue growth reliability 12

Pillar V: Leverage management and EBITDA generation 12

Pillar VI: Free cash flow stability 13

Pillar VII: Free cash flow margin growth 13

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 3

About us

S&P Global Market Intelligence Dividend Forecasting serves top-tier financial

institutions with their investment decision-making and risk management through

provision of timely data, insights and commentary on dividend forecasts. Powered

by a global team of 40 dividend analysts closely maintaining precise forecasts on the

size and timing of payments based on bottom-up fundamental research as well as a

proprietary advanced analytics model, our dataset incorporates the latest company

news and market developments. We pride ourselves in an unmatched coverage that

spans over 28,000+ stocks across the globe and our analysts are always available to

engage in discussion and address users’ queries.

To learn more or to request a demo, contact dividendsupport@spglobal.com or visit

https://www.spglobal.com/marketintelligence/en/mi/products/dividend-forecasting.html.

The take

– The US market’s dividend initiation momentum has reached its highest level in the last decade after Meta

Platforms Inc.’s and Google parent Alphabet Inc.’s first-ever dividend announcements.

– With a proprietary quantitative scoring system combined with analyst qualitative analysis, S&P Global Market

Intelligence provides initiation likeliness metrics for the 96 constituents of the S&P 500 Index that do not pay

regular dividends on their common stock.

– Half of the top 25 quantitative-ranked nonpayers operate in the TMT sector.

– None of the 20 most likely companies to initiate dividends are companies that suspended dividends during the

COVID-19 pandemic.

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 4

S&P 500 nonpayers

Dividend initiation fever

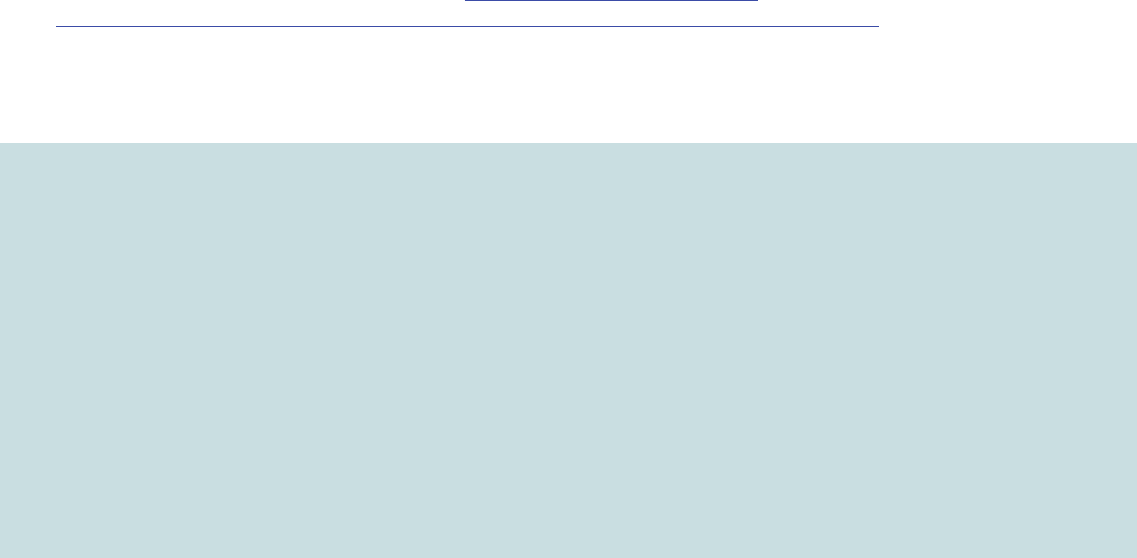

The dividend initiation momentum

in the US market has reached its

highest level since at least Apple

Inc.’s reinstatement in 2012. Since

2023, and particularly in the

beginning of 2024, many large-cap

companies initiated or reinstated

dividends. Some of these companies

are Meta Platforms Inc., The

Walt Disney Co., T-Mobile US Inc.,

Salesforce Inc. and most recently

Alphabet Inc. An estimated US$15.2

billion of new dividends is expected

for 2024 (US$17.7 considering Google

on an annualized basis as only three

payments are expected in 2024).

Regarding Google’s initiation, we

addressed the likelihood of it in a

previous report — “Google dividends:

To initiate or not?” — published

before Alphabet’s announcement.

Most likely initiations: Quantitative and qualitative analysis

Which S&P 500 constituents are the most likely to initiate dividends? According to

our data, only 96 constituents do not pay regular dividends on their common stock. To

address the initiation question, we analyzed these nonpayers from fundamental and

qualitative standpoints.

Our fundamental evaluation is summarized in the “overall score.” This score reflects

the dividend initiation fundamental financial likeliness for each of these companies.

The score ranges from 0 to 1, representing the lowest and highest possible grades,

respectively. The score is not a probability of initiation — it intends to provide a

quantitative score of the company’s financial robustness. It relies on seven pillars that

we consider key for the dividend initiation thesis.

8.6

10.7

6.7

7.0

5.8

1.9

2.2

4.5

5.2

1.5

3.5

4.0

6.3

15.2

0

20

40

60

80

100

120

140

160

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

Amount Initiations or reinstatements

US market dividend initiations or reinstatements (US$B)

© 2024 S&P Global.

Source: S&P Global Market Intelligence.

Apple reinstated dividends in 2012. Its annualized dividend would have triggered 2012's new or reinstated

dividends to reach US$15.7 billion.

As of May 21, 2024.

e = estimated.

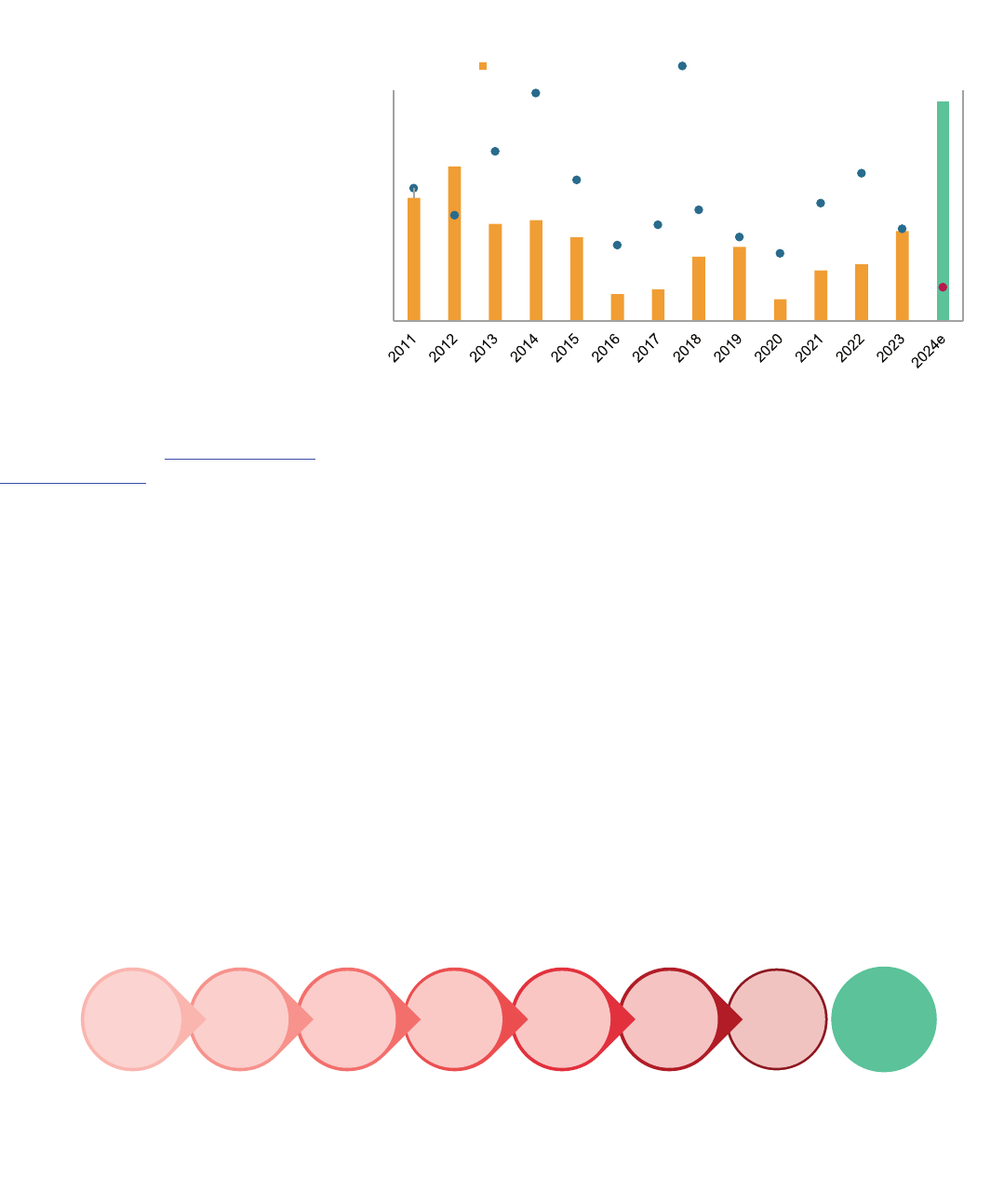

Dividend initiation fever

S&P Global Market Intelligence Dividend Forecasting's quantitative score pillars

© 2024 S&P Global.

Source: S&P Global Market Intelligence.

As of May 22, 2024.

Overall

score

VII.

FCF

margin

growth

VI.

FCF

stability

V.

Debt

IV.

Sales

growth

III.

Buyback

payout

II.

Buyback

reliability

I.

Dividend

history

management

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 5

Each pillar has four possible

classifications: “Low,” “Medium,”

“High” and “Very High.” While the

methodology is analyzed in depth in

the following section, the pillars

1

try

to address four key questions:

1. What is the capital return policy

of the company? — Pillars I, II

and III

2. How reliable is the topline

performance of the company? —

Pillar IV

3. How does the company manage

its leverage and EBITDA

generation? — Pillar V

4. How reliable is the company’s free

cash flow (FCF) generation over

time to support a dividend initiation

thesis? — Pillars VI and VII

The table below exhibits the top 20 companies that are most likely to initiate dividends

exclusively based on their quantitative scores.

1. Methodology note: Each pillar is equally weighted in the overall score. “Very High,” “High” and “Medium” scores translate into 3 points, 2 points and 1 point,

respectively, while “Low” scores provide no points. The total sum of the scores has a maximum level of 21, which is then normalized to [0,1] for communication

purposes only.

S&P Global Market Intelligence Dividend Forecasting's quantitative

scoring grades

© 2024 S&P Global.

Source: S&P Global Market Intelligence.

As of May 22, 2024.

Low (0)

Medium (1)

High (2)

Very High (3)

S&P 500 nonpayers: Top 20 companies ranked by quantitative score

Company Ticker

Analyst

sentiment

Overall

score

Dividend

history

Buyback

history

Buyback

payout

Sales

growth

Leverage

management

FCF

stability

FCF margin

growth

IDEXX Laboratories Inc. IDXX

0.86

Cadence Design Systems Inc. CDNS

0.81

Lululemon Athletica Inc. LULU

0.81

Adobe Inc. ADBE

0.76

Synopsys Inc. SNPS

0.76

Autodesk Inc. ADSK

0.76

ANSYS Inc. ANSS

0.76

VeriSign Inc. VRSN

0.76

F5 Inc. FFIV

0.76

Chipotle Mexican Grill Inc. CMG

0.71

PayPal Holdings Inc. PYPL

0.71

O'Reilly Automotive Inc. ORLY

0.71

Edwards Lifesciences Corp. EW

0.71

Fortinet Inc. FTNT

0.71

Fair Isaac Corp. FICO

0.71

Mettler-Toledo International Inc. MTD

0.71

Akamai Technologies Inc. AKAM

0.71

Fiserv Inc. FI

0.67

Keysight Technologies Inc. KEYS

0.67

NVR Inc. NVR

0.67

Data compiled May 22, 2024.

Analyst sentiment score: capital allocation policies and management commentaries' qualitative analysis groups dividends into unlikely (red), neutral (yellow) or likely (green) initiations.

Quantitative scores depicted by pie charts, where a full pie chart represents a “Very High” score, downgrading into “High,” “Medium” or “Low” scores.

Source: S&P Global Market Intelligence.

© 2024 S&P Global.

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 6

As depicted in the previous table, we combine the quantitative fundamental analysis

with qualitative analysis. The latter consists of the study of the capital allocation

policies that managements comment on in their earnings calls or investor presentations,

with special emphasis on their capital allocation priorities and commentaries regarding

shareholder returns. Without this analysis, some companies like Berkshire Hathaway

Inc. (score of 0.52) could be included in the list above despite Berkshire’s management’s

explicit commentaries about not considering a dividend initiation.

Similarly, the qualitative analysis comprises business-related capital needs that

might deprive a company from increasing shareholder returns. One example relates

to Chipotle Mexican Grill Inc.’s situation. The company’s management emphasizes

reinvesting in the business to continue expanding its restaurant footprint, with over 285

new restaurants expected to be inaugurated in 2024 in North America. The cash needed

to fund the expansion might deprive Chipotle’s management from initiating despite its

solid fundamentals (score of 0.71).

Moreover, our qualitative analysis

considers the situation of some

companies that used to pay

dividends until the pandemic (which

translates into a “High” score in Pillar

I) which currently state that they do

not expect to reinstate dividends

until deleveraging is successful. One

example is American Airlines Group

Inc.’s situation.

The analyst sentiment score is

divided into three categories:

unlikely, neutral and likely,

depicted by red, yellow and green,

respectively. Our final top 20

selection contains seven companies

with “likely” sentiment scores and

above-average quantitative scores

(over 0.47), the 12 highest-ranked

companies by quantitative score with

“neutral” sentiment scores and one

outlier — Amazon.com Inc.

S&P Global Market Intelligence Dividend Forecasting analysts' qualitative

sentiment scores

© 2024 S&P Global.

Source: S&P Global Market Intelligence.

As of May 22, 2024.

Neutral

LikelyUnlikely

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 7

The table above displays our selection of the top 20 companies that are most likely to

initiate dividends, assessed from both a fundamental quantitative perspective and a

qualitative capital allocation analysis standpoint.

More than half of these companies (11) operate in the TMT

2

sector. Predominant names

include Adobe Inc., Akamai Technologies Inc., Netflix Inc., ServiceNow Inc. and Arista

Networks Inc. We will focus on the TMT sector specifically in the second edition of

this Special Report Series, which examines non-dividend-paying companies within the

S&P 500 Index. No single company in our final top 20 used to be a dividend payer that

suspended distributions during the pandemic, such as Aptiv PLC, Expedia Group Inc.,

The Boeing Co., American Airlines, Royal Caribbean Cruises Ltd., Carnival Corp. & PLC

and Western Digital Corp. Moreover, except for Expedia and American Airlines, the

remaining companies have negative analyst sentiment scores and most of them return

below-average quantitative scores.

Complete coverage

In the previous section, we outlined our selection of the top 20 S&P 500 constituents

that are most likely to initiate dividends based on both quantitative analysis (score)

and qualitative analysis. The first table included the top 20 ranked companies by

quantitative score only, regardless of the analyst sentiment score. The overall scores

(and their breakdowns) and analyst sentiment scores for the remaining 76 constituents

can be found below.

2. TMT: Technology, media and entertainment and telecommunications. S&P Global Market Intelligence uses GICS for sector definition. GICS sectors included in

our definition of ”TMT” are “media and entertainment,” “semiconductors and semiconductor equipment,” “software and services,” ”technology hardware and

equipment” and ”telecom services.”

S&P 500 nonpayers: Top 20 companies that are most likely to initiate dividends

Company Ticker

Analyst

sentiment

Overall

score

Dividend

history

Buyback

history

Buyback

payout

Sales

growth

Leverage

management

FCF

stability

FCF margin

growth

IDEXX Laboratories Inc. IDXX

0.86

Cadence Design Systems Inc. CDNS

0.81

Lululemon Athletica Inc. LULU

0.81

Adobe Inc. ADBE

0.76

Autodesk Inc. ADSK

0.76

VeriSign Inc. VRSN

0.76

F5 Inc. FFIV

0.76

PayPal Holdings Inc. PYPL

0.71

O'Reilly Automotive Inc. ORLY

0.71

Fortinet Inc. FTNT

0.71

Fair Isaac Corp. FICO

0.71

Mettler-Toledo International Inc. MTD

0.71

Akamai Technologies Inc. AKAM

0.71

Keysight Technologies Inc. KEYS

0.67

Netflix Inc. USA NFLX

0.62

ServiceNow Inc. NOW

0.62

Arista Networks Inc. ANET

0.62

Amazon.com Inc. AMZN

0.52

Match Group Inc. MTCH

0.52

Regeneron Pharmaceuticals Inc. REGN

0.52

Data compiled May 22, 2024.

Analyst sentiment score: capital allocation policies and management commentaries' qualitative analysis groups dividends into unlikely (red), neutral (yellow) or likely (green) initiations.

Quantitative scores depicted by pie charts, where a full pie chart represents a “Very High” score, downgrading into “High,” “Medium” or “Low” scores.

Source: S&P Global Market Intelligence.

© 2024 S&P Global.

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 8

S&P 500 nonpayers: Bottom 76 companies ranked by quantitative score (part 1)

Company Ticker

Analyst

sentiment

Overall

score

Dividend

history

Buyback

history

Buyback

payout

Sales

growth

Leverage

management

FCF

stability

FCF margin

growth

Netflix Inc. USA NFLX

0.62

ServiceNow Inc. NOW

0.62

Arista Networks Inc. ANET

0.62

DexCom Inc. DXCM

0.62

IQVIA Holdings Inc. IQV

0.62

Ulta Beauty Inc. ULTA

0.62

Incyte Corp. INCY

0.62

Qorvo Inc. QRVO

0.62

Bio-Rad Laboratories Inc. BIO

0.57

Monster Beverage Corp. MNST

0.57

AutoZone Inc. AZO

0.57

Centene Corp. CNC

0.57

Charter Communications Inc. CHTR

0.57

Gartner Inc. IT

0.57

Align Technology Inc. ALGN

0.57

Aptiv PLC APTV

0.57

Expedia Group Inc. EXPE

0.57

Etsy Inc. ETSY

0.57

Take-Two Interactive Software Inc. TTWO

0.52

MGM Resorts International MGM

0.52

Amazon.com Inc. AMZN

0.52

Berkshire Hathaway Inc. BRK.A

0.52

CoStar Group Inc. CSGP

0.52

Builders FirstSource Inc. BLDR

0.52

Molina Healthcare Inc. MOH

0.52

Match Group Inc. MTCH

0.52

Regeneron Pharmaceuticals Inc. REGN

0.52

Advanced Micro Devices Inc. AMD

0.48

Airbnb Inc. ABNB

0.48

Copart Inc. CPRT

0.48

CBRE Group Inc. CBRE

0.48

Corpay Inc. CPAY

0.48

Caesars Entertainment Inc. CZR

0.48

PTC Inc. PTC

0.43

Enphase Energy Inc. ENPH

0.43

Trimble Inc. TRMB

0.43

EPAM Systems Inc. EPAM

0.43

Henry Schein Inc. HSIC

0.43

Data compiled May 22, 2024.

Analyst sentiment score: capital allocation policies and management commentaries' qualitative analysis groups dividends into unlikely (red), neutral (yellow) or likely (green) initiations.

Quantitative scores depicted by pie charts, where a full pie chart represents a “Very High” score, downgrading into “High,” “Medium” or “Low” scores.

Source: S&P Global Market Intelligence.

© 2024 S&P Global.

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 9

S&P 500 nonpayers: Bottom 76 companies ranked by quantitative score (part 2)

Company Ticker

Analyst

sentiment

Overall

score

Dividend

history

Buyback

history

Buyback

payout

Sales

growth

Leverage

management

FCF

stability

FCF margin

growth

Vertex Pharmaceuticals Inc. VRTX 0.43

Live Nation Entertainment Inc. LYV 0.43

Waters Corp. WAT 0.38

Arch Capital Group Ltd. ACGL 0.38

Axon Enterprise Inc. AXON 0.38

Tyler Technologies Inc. TYL 0.38

Hologic Inc. HOLX 0.38

DaVita Inc. DVA 0.38

Mohawk Industries Inc. MHK 0.38

TransDigm Group Inc. TDG 0.38

Palo Alto Networks Inc. PANW 0.33

Intuitive Surgical Inc. ISRG 0.33

The Boeing Co. BA 0.33

Teledyne Technologies Inc. TDY 0.33

Zebra Technologies Corp. ZBRA 0.33

Uber Technologies Inc. UBER 0.29

Boston Scientific Corp. BSX 0.29

ON Semiconductor Corp. ON 0.29

Dollar Tree Inc. DLTR 0.29

Warner Bros. Discovery Inc. WBD 0.29

Charles River Laboratories International Inc. CRL 0.29

Dayforce Inc. DAY 0.29

American Airlines Group Inc. AAL 0.29

Tesla Inc. TSLA 0.24

CarMax Inc. KMX 0.24

Generac Holdings Inc. GNRC 0.24

Insulet Corp. PODD 0.24

Royal Caribbean Cruises Ltd. RCL 0.19

Illumina Inc. ILMN 0.19

Carnival Corp. & PLC CCL 0.19

The Cooper Companies Inc. COO 0.19

Biogen Inc. BIIB 0.14

First Solar Inc. FSLR 0.14

Western Digital Corp. WDC 0.10

Moderna Inc. MRNA 0.05

United Airlines Holdings Inc. UAL 0.05

Catalent Inc. CTLT 0.05

Norwegian Cruise Line Holdings Ltd. NCLH 0.05

Data compiled May 22, 2024.

Analyst sentiment score: capital allocation policies and management commentaries' qualitative analysis groups dividends into unlikely (red), neutral (yellow) or likely (green) initiations.

Quantitative scores depicted by pie charts, where a full pie chart represents a “Very High” score, downgrading into “High,” “Medium” or “Low” scores.

Source: S&P Global Market Intelligence.

© 2024 S&P Global.

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 10

Fundamental approach

Quantitative score: Methodology

Which companies are more likely to initiate or reinstate dividends from a fundamental

standpoint? To address this question, we provide a quantitative score replicable for

every single company based on seven pillars.

Pillar I: Dividend history

Has the company ever paid dividends? If so, when did it suspend its dividend policy?

According to our data, 96 companies within the S&P 500 do not pay regular dividends

on their common stock. Nonetheless, 12 of these did distribute cash to their

shareholders on a regular basis within the last decade. TransDigm Group Inc. pays one

special dividend a year. The remaining 11 suspended their dividends sometime in the

last decade. Most of these suspensions (eight) occurred during or after the pandemic,

particularly within the travel and leisure industries (Boeing, American Airlines, Carnival

and Royal Caribbean Cruises, among others). From a capital allocation perspective, we

consider that companies that used to pay dividends in the past might be more likely to

reinstate than companies that never engaged in regular cash distributions.

Pillar II: Buyback reliability

Does the company regularly engage in shareholder returns? How long dated is its

buyback policy?

The popularity of share repurchases increases every year as more companies adopt

them as a key capital allocation use beyond reinvesting to support organic growth, M&A

and even dividend payments. We consider that companies with a long track record of

shareholder returns via buybacks are more likely to evaluate a dividend payment as

another use of capital, against companies that — due to financial or managerial reasons

— do not regularly deploy cash into buying back their common stock.

Score breakdown: Pillar I

– Very High: Companies that already engage in special dividend payments every year.

– High: Companies that used to pay dividends and suspended them during or after the pandemic.

– Medium: Companies that suspended dividends before the pandemic.

– Low: Companies that did not pay regular dividends on their common stock in the last decade or suspended

them within the last-12-months (LTM).

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 11

Our findings show that 28 companies meet the highest criteria (28%), while another 23

(24%) repurchased their stock every year in the last five years and in the LTM. Thirty-

one companies did not buy back their stock in the LTM or exhibited negative FCF in the

same period.

Pillar III: Buyback payout magnitude and sustainability

While regularly returning cash to shareholders via buybacks could support an initiation

thesis, the magnitude matters.

In a similar fashion to the dividend analysis, we divide the sample into four groups

depending on the size of the repurchase the company engages in. We consider the

buyback FCF payout to determine these scores.

Only 21 companies meet the highest criteria for both buyback reliability and magnitude,

such as Adobe, Fiserv Inc., Chipotle and Synopsys Inc.

Score breakdown: Pillar II

– Very High: Companies that engaged in buybacks in the LTM and every year in the last 10 years.

– High: Companies that engaged in buybacks in the LTM and every year in the last five years.

– Medium: Companies that repurchased their common stock in the LTM.

– Low: Companies without buybacks in the LTM or with negative FCF in the LTM.

Score breakdown: Pillar III

– Very High: Companies with cumulative payouts at or above 65% and positive FCF in the last three years.

– High: Companies with cumulative payouts of between 35% and 65% in the last three years and positive FCF in

the same period.

– Medium: Companies with cumulative payouts of below 35% in the last three years or negative FCF in some of

the last three years.

– Low: Companies that did not engage in buybacks in the last three years or had negative FCF every year in the period.

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 12

Pillar IV: Revenue growth reliability

How stable or volatile is the company’s revenue growth over time?

Companies with low volatility in their topline performance might feel more confident to

initiate dividends, as dividends represent a commitment to their shareholder base with

lower flexibility and less discretion compared with share repurchases. Consequently,

to account for sales performance in our fundamental quantitative scoring, we analyzed

how many years of consecutive revenue growth the company exhibits in the last decade.

Almost half of the S&P 500 non-dividend-paying companies show Very High or High

criteria regarding topline performance.

Pillar V: Leverage management and EBITDA generation

How prudent is the company toward leverage management and how reliable is its

EBITDA generation over time?

Dividend sustainability is strongly related to leverage management and EBITDA

generation. Companies suffering from an operational standpoint and/or that are highly

indebted tend to struggle with their dividend policies. Similarly, companies with these

types of issues are less likely to deploy cash to their shareholders via dividends and

instead tend to focus on deleveraging and supporting organic growth.

Out of 96 companies, 38 meet the highest criteria, while 36 show balance sheet

weakness and are classified as Low.

Score breakdown: Pillar IV

– Very High: Companies with at least 10 years of consecutive positive revenue growth.

– High: Companies with at least five years of consecutive positive sales growth.

– Medium: Companies with at least three years of revenue growth and sales growth in the LTM.

– Low: Companies with less than three years of consecutive topline growth.

Score breakdown: Pillar V

– Very High: Companies with net leverage below 2.5x and positive EBITDA in at least nine of the last 10 fiscal years.

– High: Companies with net leverage below 2.5x and positive EBITDA in at least four of the last five fiscal years.

– Medium: Companies with net leverage below 2.5x and positive EBITDA in the LTM or the last fiscal year.

– Low: Companies with net leverage above 2.5x or negative EBITDA in the LTM or the last fiscal year.

spglobal.com/marketintelligence

Dividend initiation fever: Who is next? | 13

Pillar VI: Free cash flow stability

How reliable is the company’s FCF generation over time?

Dividends represent a commitment to deploy a share of the FCF generated to

shareholders on a regular basis. Companies with volatile FCF generation are less likely

to be able to meet such expectations.

Pillar VII: Free cash flow margin growth

A reliable positive FCF over time, combined with FCF margin growth, increases the

odds of a dividend initiation.

Companies might exhibit positive FCF over time but not necessarily grow the FCF as a

share of sales (i.e., FCF margin) in the same period. To address how regularly companies

grow their FCF margins, we analyze four periods: LTM/year over year, three years, five

years and 10 years.

Score breakdown: Pillar VI

– Very High: Companies with positive FCF in the LTM, last fiscal year and at least nine of the last 10 years.

– High: Companies with positive FCF in the LTM, last fiscal year and at least four of the last 10 years.

– Medium: Companies with positive FCF in the last two years but less than four of the last five years.

– Low: Companies showing negative FCF in the LTM, last fiscal year or sometime within the last two years.

Score breakdown: Pillar VII

– Very High: Positive FCF margin in the LTM and growth in all four periods of analysis (LTM/year over year, three years,

five years and 10 years).

– High: Positive FCF margin in the LTM and growth in three out of four periods of analysis.

– Medium: Positive FCF margin in the LTM and margin growth in two of the four periods of analysis.

– Low: Negative FCF margin in the LTM or positive margin growth in only one of the four periods of analysis.

spglobal.com/marketintelligence

Copyright © 2024 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved.

These materials have been prepared solely for information purposes based upon information generally available to the public and

from sources believed to be reliable. No content (including index data, ratings, credit-related analyses and data, research, model,

software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced

or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of S&P

Global Market Intelligence or its affiliates (collectively S&P Global). The Content shall not be used for any unlawful or unauthorized

purposes. S&P Global and any third-party providers (collectively S&P Global Parties) do not guarantee the accuracy, completeness,

timeliness or availability of the Content. S&P Global Parties are not responsible for any errors or omissions, regardless of the cause,

for the results obtained from the use of the Content. THE CONTENT IS PROVIDED ON “AS IS” BASIS. S&P GLOBAL PARTIES DISCLAIM

ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY

OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE

CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE

CONFIGURATION. In no event shall S&P Global Parties be liable to any party for any direct, indirect, incidental, exemplary,

compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost

income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if

advised of the possibility of such damages.

S&P Global Market Intelligence’s opinions, quotes and credit-related and other analyses are statements of opinion as of the

date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any

investment decisions, and do not address the suitability of any security. S&P Global Market Intelligence may provide index data.

Direct investment in an index is not possible. Exposure to an asset class represented by an index is available through investable

instruments based on that index. S&P Global Market Intelligence assumes no obligation to update the Content following publication

in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user,

its management, employees, advisors and/or clients when making investment and other business decisions. S&P Global keeps

certain activities of its divisions separate from each other to preserve the independence and objectivity of their respective activities.

As a result, certain divisions of S&P Global may have information that is not available to other S&P Global divisions. S&P Global has

established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with

each analytical process.

S&P Global may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or

from obligors. S&P Global reserves the right to disseminate its opinions and analyses. S&P Global’s public ratings and analyses are

made available on its websites, www.standardandpoors.com (free of charge) and www.ratingsdirect.com (subscription), and may be

distributed through other means, including via S&P Global publications and third-party redistributors. Additional information about

our ratings fees is available at www.standardandpoors.com/usratingsfees.

CONTACTS

Americas: +1 800 447 2273

Japan: +81 3 6262 1887

Asia Pacific: +60 4 291 3600

Europe, Middle East, Africa: +44 (0) 134 432 8300

DividendSupport@spglobal.com

www.spglobal.com/marketintelligence

www.spglobal.com/en/enterprise/about/contact-us.html

spglobal.com/marketintelligencespglobal.com/marketintelligence