HANDLING TRUST MONIES

1. May a broker ever receive a check/negotiable instrument payable to someone other than the

broker or the broker’s real estate company? If so, when?

2. You are BIC of a residential sales company with several listings. You receive an offer from

a buyer with a due diligence fee check written to the seller-owner and a second check for the

earnest money deposit payable to your brokerage company as escrow agent. The parties,

after oral negotiations, reach an agreement and formally enter into a written contract on

Friday. The contract states that the earnest money will be paid within five days of the

Effective Date. By what day must the listing company deposit the earnest money check into

its trust account? Could the listing company deposit the earnest money check upon receipt

of the offer?

3. You are a broker who manages forty single-family residential properties. A tenant who

leased a house for ten years vacates, leaving the property in excellent condition, other than

normal wear and tear. Your owner-principal insists that you deduct $800 from the $1400

tenant security deposit to defray the cost of a new carpet. The tenant disputes the legality of

the proposed debit. A broker-friend suggests you pay the tenant security deposit to the Clerk

of Court under the disputed funds rule. May you?

INTRODUCTION

Nearly every real estate transaction involves the collection and disbursement of money in the

form of cash, checks and electronic transfers. When a real estate broker is the person designated to

handle the money, he or she becomes responsible for accounting for and safeguarding others’ funds

in accordance with Real Estate License Law and Commission rules.

Maintaining a trust/escrow account involves record-keeping and simple math, but it is not

necessarily complex, particularly for those brokers engaged primarily in sales transactions. Often

the only funds exchanged between the parties in sales transactions prior to closing are the due

diligence fee and earnest money deposit. While brokers engaged in sales transactions may be able

to avoid having a trust account, if they choose, it will be virtually impossible for a broker engaging

in any form of property management or leasing, commercial, residential, or vacation, to not have an

escrow account. Because maintenance and oversight of the trust account is one of a broker-in-

charge’s responsibilities, the money-handling procedures of Rule A.0116 and basic requirements to

create a trust account will be reviewed in this Section, but not the record-keeping requirements found

in Rule A.0117.

-1-

As evidenced by any of the Commission’s Real Estate Bulletins, trust account violations are

one of the leading causes of disciplinary actions against brokers and BICs, even if the BIC wasn’t

the one embezzling the funds. For this reason, BICs should implement policies to ensure the

handling of trust monies in accordance with the Commission’s rules.

Learning Objectives: After completing this Section, you should be able to:

! define “trust money”;

! explain how a trust account must be designated and why;

! describe the general rule for depositing trust monies;

! describe options for handling disputed funds;

! define “deficit spending”.

REAL ESTATE LICENSE LAW

ALL licensees may be subject to disciplinary proceedings for:

! “failing, within a reasonable time, to account for or to remit any monies coming into his

or her possession which belong to others” [G.S. 93A-6(a)(7)]

OR

! “commingling the money or other property of his or her principals with his or her own or

failure to maintain and deposit in a trust or escrow account in a bank as provided by

subsection (g) of this section all money received by him or her as a real estate licensee acting

in that capacity ... which relate to or concern that person or entity’s interest or investment in

real property ” [G.S. 93A-6(a)(12)].

Commingling of monies is the mixing of monies belonging to others with a broker’s personal or

business funds in one account. Commingling is illegal. A broker’s trust account must be a separate,

custodial, demand deposit account containing only monies belonging to others received by the broker

when acting as an agent in a transaction. The account must not contain the broker’s business or

personal funds and any funds in the trust account that become the broker’s monies, e.g., earnest

money deposit applied to partial commission, accrued interest, management fees, must be transferred

from the trust account to the broker’s operating account within thirty days.

[Caveat: Rule A.0117(c)(4)(c) allows a broker to keep $100 in company funds in the

trust account to pay service fees and bank charges. If service charges exceed $100

monthly, then “...the broker may deposit an amount each month sufficient to cover

the service charges.” This is the only permissible commingling.]

BIC Responsible for the Trust Account

While all licensees have accountability, responsibility for ensuring the safekeeping of trust

monies is expressly vested in the broker-in-charge. The Broker-in-Charge rule [Rule A.0110]

states in pertinent part:

The broker-in-charge shall ... assume the responsibility at his or her office for:

(4) the maintenance at such office of the trust or escrow account of the firm and the

records pertaining thereto.

-2-

BASIC DEFINITIONS AND REQUIREMENTS

What is “Trust Money”?

1) ANY funds belonging to others

2) received by a real estate licensee

3) acting as an agent in a fiduciary capacity related to a real estate transaction.

Examples of Trust Money include (but not limited to):

• earnest money deposits • tenant security deposits

• rent payments • HOA dues

• final settlement funds • advance rental deposits

• sales and use tax • funds used to maintain owners’ properties.

Must a Company Maintain a Trust or Escrow Account?

No, if a company/sole proprietorship never holds monies belonging to others while acting

as a licensee in a real estate transaction, then the company is not required to have a trust or escrow

account.

As noted at the outset, companies involved only in sales transactions may be able to avoid

having an escrow account by requesting that any deposits be held by an attorney or title company;

however, companies engaged in property management or vacation rentals must have at least one

trust/escrow account. If a broker receives and holds monies belonging to others then s/he must have

a trust account and it must be maintained in compliance with Rules A.0116, A.0117, and A.0118.

If a Company Holds Trust Monies, How Many Accounts are Required?

Only one account is required, except brokers who are managing owner association funds are

required to have a separate trust account for each association. Monies belonging to one association

may not be commingled with monies belonging to any other association nor with any other trust

funds. [See Rule A.0118.]

A company/broker may choose to have as many escrow accounts as it wishes, but all must

be maintained in compliance with Commission rules. Thus, a real estate company that engages in

both sales and property management may have one escrow account for monies related to sales

transactions, another escrow account for rent monies received, and a third escrow account for the

tenant security deposits. All three accounts could be at the same bank, but each would have its own

account number. Similarly, a company engaged in commercial property management may choose

to have separate trust accounts for each office building or retail space it manages.

What is a “Trust Account”?

The Commission views the terms “trust account” and “escrow account” as synonymous. The

two terms will be used interchangeably in this section. While the rules generally use the term “trust

account,” brokers may find it easier to open the account with a bank if you call it an “escrow”

account.

-3-

The three primary features of a trust/escrow account are that it is:

1) separate, containing only monies belonging to others,

2) custodial, i.e., the account is in the name of the broker or real estate company (e.g., Jones

Realty, Escrow Account) and no one who has funds in the account has access to it,

and

3) available on demand, that is, the funds may be withdrawn at any time without prior

notice.

RULE A.0116 - HANDLING OF TRUST MONEY

Proper Account Designation

The rule first requires that “... all monies received by a broker acting in his or her fiduciary

capacity (hereinafter “trust money”) shall be deposited in a trust or escrow account as defined in Rule

.0117(b) of this Section...” Rule A.0117(b) requires that:

1) the account be a demand deposit account in a bank as defined by License Law

and

2) the account be designated as a trust or escrow account with the words “trust account” or

“escrow account” appearing on all bank statements, deposit tickets and checks.

The “escrow account” designation lets the world know that even though the account is in the name

of the company or broker, the funds in the account don’t belong to the company or broker. So long

as the broker properly designates the account as a “trust” or “escrow” account and keeps accurate

records that identify each owner of the funds and/or depositor (buyer, seller, lessor, lessee, etc.), the

depositors are protected from the funds being “frozen” or attached if the broker becomes insolvent,

incapacitated, dies, has tax liens, or becomes involved in a lawsuit.

Insured Deposits

Proper account designation also ensures that all deposits in the account are fully insured by

either the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union

Administration (NCUA - the federal agency that supervises federal credit unions) up to $250,000

per individual for whom funds are held. Although the account is in the broker or company’s name,

the FDIC/NCUA will know by the trust or escrow designation that the monies in the account don’t

belong to the account holder and thus all funds will be fully insured, subject to the $250,000

individual cap. For example, a broker’s trust account may contain $500,000.00 total, but all funds

are fully insured so long as no one individual’s interest in the account exceeds $250,000.00.

What Is an Acceptable “Bank”?

Since January 1, 2012, License Law [G.S.93A-6(g)] has defined a “bank” as:

1) a federally insured depository institution

2) lawfully doing business in North Carolina,

3) that will make the broker’s account records available to the Commission upon request.

-4-

License Law no longer requires brokers to open their brokerage trust accounts “in an insured

bank or savings and loan in North Carolina;” rather, the federally insured depository institution must

be authorized to do business in North Carolina and agree to make its records available to the

Commission upon request.

HOWEVER, brokers managing properties physically located in North Carolina that are used

for residential leasing, whether long-term or vacation rentals, must still open at least one trust

account in an insured bank or savings and loan in North Carolina to comply with North Carolina

1) residential landlord-tenant law requiring residential tenant security deposits

and

2) vacation rental laws requiring all monies paid in advance

to be deposited into a trust or escrow account in an insured bank or savings and loan in North

Carolina. Thus, a non-resident broker managing residential property for others in North Carolina,

could deposit rents from long-term rentals into his properly designated brokerage trust account

opened in an insured bank in his home state authorized to do business in NC, but would need to open

a brokerage escrow account in an insured bank or savings and loan in North Carolina for both the

residential tenant security deposits and all advance funds received for the vacation rentals. There

are no corollary state laws governing commercial tenancies, so brokers managing commercial

property must only comply with License Law and Commission rules.

When MUST Trust Monies be Deposited in the Trust Account?

When does the clock start to tick for the deposit of trust monies? The opening paragraph of

Rule A.0116 requires that monies belonging to others be deposited into a trust account “...no later

than three banking days following the broker’s receipt of such monies ...” except as provided in

subparagraph (b). The Rule A.0116(b) exceptions are:

! All monies received by provisional brokers must be delivered upon receipt to his/her BIC.

! All monies received by a non-resident commercial broker must be delivered to the North

Carolina affiliated/supervising broker for deposit in the resident broker’s trust account.

! Checks/negotiable instruments for earnest money and tenant security deposits payable to

the broker/company may be held and safeguarded by a broker during contract/lease

negotiations, but must be deposited in a trust account not later than three banking days

following acceptance of the offer to purchase or lease agreement. If the deposit is tendered

in cash, then it must be deposited no later than three banking days following receipt, even if

no contract has been signed.

May a broker ever accept a check/negotiable instrument payable to someone other than the

broker/company?

Generally, NO. There are only two instances when the rule permits a broker to accept a check for

delivery to a payee other than the broker/company. As discussed in the revised rules section (Sec.

3), the two exceptions found in Rule A.0116(b)(4), are:

-5-

1) a check payable to an owner for a due diligence fee or option fee,

or

2) a check payable to a third party escrow agent in a sales transaction.

Prior to July 1, 2015, the only check payable to someone other than the broker that a broker could

accept was a check to an owner for a due diligence fee or option fee. A broker may now hold and

safeguard both due diligence fee checks and checks to third party escrow agents during negotiations,

but shall not retain the check/instrument for more than three business days after acceptance of the

option or sales contract. The rule further dictates what a broker must do with these checks so long

as they are in the broker’s possession, namely:

... While the instrument is in the custody of the broker, the broker shall, according to

the instructions of the buyer, either deliver it to the named payee or return it to the

buyer....

The extension of the due diligence fee procedure to earnest money deposit checks payable to third

party escrow agents was discussed at length in Section 3. Brokers are referred to that discussion on

pages 47-49.

General Rules

1. Don’t accept checks payable to someone other than the broker/company unless it’s a check:

A) payable to an owner for a due diligence fee or option fee

or

B) payable to a third party escrow agent in a sales transaction.

With either exception, the broker may hold and safeguard the checks for delivery to the respective

payees as directed by the buyer within three business days of contract formation.

2. Deposit all monies belonging to others into a brokerage trust account no later than

three banking days of receipt, except non-cash tenant security deposits and earnest

money deposits, which may be held and safeguarded pending contract formation, but

must be deposited within three banking days of contract formation.

Example 1: One of your agents prepares an offer on behalf of a buyer-client who writes one

check for the due diligence fee to the owner and a second check to the listing company for

the earnest money deposit. Can your buyer-agent receive and hold these checks or must they

be delivered to the listing company? What if the buyer gives your agent $1500 cash to hold

for the earnest money deposit — may your agent accept it?

May the buyer agent accept and hold the two checks payable to the owner and listing company?

Yes, but the broker must safeguard those checks for delivery to the named payees upon

contract formation. If the buyer demands their return while still in the buyer agent’s possession, the

broker must return the checks to the buyer.

May the broker accept a $1500 cash earnest money deposit?

No, unless the company has a trust account. If the buyer uses the $1500 cash to obtain a

money order payable to the listing company, then the buyer agent may hold and safeguard the money

order (i.e., negotiable instrument) pending contract formation.

-6-

Example 2: You are BIC of a residential sales company with several listings. You receive

an offer from a buyer with a due diligence fee check written to the seller-owner and a second

check for the earnest money deposit payable to your brokerage company as escrow agent.

The parties, after oral negotiations, reach an agreement and formally enter into a written

contract on Friday. The contract states that the earnest money will be paid within five days

of the Effective Date.

Could the listing company deposit the earnest money check upon receipt of the offer?

Absolutely; unless specifically instructed by the buyer or buyer agent not to deposit the

earnest money check, the listing firm may deposit the check immediately. The rule permits the

listing company/payee to hold the check, but it doesn’t require it to wait until contract formation to

deposit the earnest money check.

By what day must the listing company deposit the earnest money check into its trust account?

Assuming the listing company didn’t deposit the earnest money check upon receipt, then its

three banking day clock starts to tick upon contract formation. Thus, the listing company must

deposit the check into its trust account no later than Wednesday of the following week, assuming no

bank holiday on Monday or Tuesday.

The fact that the contract permitted the earnest money deposit to be paid within five days of

contract formation doesn’t alter the broker’s deposit clock because the check already is in the

broker/escrow agent’s possession at the time of contract formation. Assume that the buyer doesn’t

write the earnest money check until the following Wednesday and delivers it to his buyer agent who

delivers it to the listing company’s office on Thursday. Has the buyer timely performed? By what

day must the listing company deposit the earnest money into its trust account?

When to Disburse Monies from the Trust Account

Under Rule A.0116(e), a broker holding an earnest money deposit in its trust account may

only transfer it to the settlement agent no more than ten (10) days prior to settlement. The broker

is prohibited from disbursing the earnest money deposit prior to settlement for any purpose other

than transfer to the settlement agent without the parties’ written consent.

How to Handle Disputed Funds

What should a broker do if the parties disagree about who is entitled to the earnest money?

May the broker use his own judgment and release the deposit to the party the broker believes is

entitled to it? No.

Historically, a broker only had two options in the event of a dispute regarding the disposition

of monies in the broker’s trust account. The rule required the broker to hold the money in his or her

trust account until:

1. the parties reached an agreement in writing,

or

2. a court of competent jurisdiction ordered the broker to release the money.

-7-

Since 2005, the rule also acknowledges that, after giving the parties proper notice,

“..Alternatively, the broker may deposit the disputed monies with the appropriate

Clerk of Superior Court in accordance with the provisions of G.S. 93A-12....”

The statute, printed at the end of this Section, became effective October 1, 2005. Briefly, it allows

a broker to pay disputed funds other than disputed residential tenant security deposits to the Clerk

of Superior Court of the county where the property is located after notifying the parties in writing

at least ninety days in advance that:

! the broker intends to disburse the disputed funds to the Clerk of Court 90 days later unless

the parties agree in writing how to disburse the funds;

! after the broker pays the funds to the Clerk of Court, the parties will have one year within

which to initiate an action with the Clerk to determine entitlement to the funds; and

! if neither party initiates a legal proceeding within the one year period, the Clerk of Court

will escheat the funds to the State Treasurer.

The 90 day notice letter must be either personally delivered to each party or mailed first class mail

to each party. No other form of delivery is permitted under the statute.

Rule A.0116(d) also acknowledges that a party may “abandon” the dispute. It reads in part:

...If it appears that one of the parties has abandoned his or her claim to the funds, the broker

may disburse the money to the other claimant according to the written agreement. Before

doing so, however, the broker must first make a reasonable effort to notify the absent party

and provide that party with an opportunity to renew his or her claim to the funds.

The “... according to the written agreement...” mentioned in the rule refers to the parties’ contract.

Thus, in a residential sale transaction where the buyer timely delivers notice of termination, the

standard NCAR/NCBA Offer to Purchase and Contract form provides that the buyer should receive

the earnest money deposit.

What if the Parties Refuse to sign a Release Form?

Understand that the rule only requires the parties’ signatures in the event of a dispute! If

there is no dispute regarding the release of monies, then while it may be wise for the broker to obtain

the parties’ signatures, if either or both parties are unwilling to sign a release form, the broker may

release the money in accordance with the terms of the contract and should document that he or she

verified there was no dispute.

If a buyer disappears after entering into a contract and all efforts to communicate with the

buyer fail, and the seller wishes to terminate the contract, the broker holding the earnest money

should send a letter to the buyer’s last known address informing the buyer that the earnest money

will be released to the seller if the buyer does not dispute the release by a specified deadline. Then,

if the buyer doesn’t respond by the deadline stated in the letter, the broker may disburse the earnest

money to the seller. If the buyer asserts a claim to the money prior to disbursement, then the broker

must treat it as a disputed deposit.

-8-

What about Disputed Residential or Commercial Tenant Security

Deposits?

Does the disputed funds rule and procedure apply to residential tenant security deposits?

NO. State law requires residential landlords to provide at least an interim accounting and disburse

residential tenant security deposits within 30 days after the termination of the tenancy (45 days in

vacation rentals). Rules can’t contradict state law. Thus, residential tenant security deposits are not

subject to the requirement to keep disputed funds in a brokerage trust account until the dispute is

resolved or abandoned because state law requires an accounting and disbursement to the tenant or

landlord, as appropriate, within 30 days of the termination of the tenancy (45 days in vacation

rentals).

Does the disputed funds rule and procedure apply to commercial tenant security deposits?

YES! Remember, state laws only address residential tenant security deposits. There are no state

laws governing commercial tenant security deposits; rather, the disposition of those deposits depends

on the lease terms. In the event of a dispute between a commercial lessor and tenant, a broker

holding the tenant security deposit would be required to hold the tenant security deposit in his/her

trust account pending resolution of the dispute or the broker utilizes the G.S. 93A-12/Clerk of Court

procedure. That procedure is available to commercial brokers over disputed commercial tenant

security deposits, but is not available to brokers managing residential rental property.

What should a broker do if a landlord and residential tenant dispute the allocation of a

tenant security deposit? The broker should follow the lawful instructions of the landlord. The

tenant would then need to pursue the matter in small claims court.

In the third opening scenario where the owner wants his property manager to deduct $800

from the ten-year tenant’s security deposit to help pay for new carpet, what should the broker do?

Does the owner’s instruction comply with State law? No. The broker should inform the owner that

state law doesn’t allow deductions for normal wear and tear, but only for damage caused by the

tenant and where there is none, the tenant is entitled to a refund of the entire deposit.

ADDITIONAL RULE A.0116 CONSIDERATIONS

Interest-Bearing Trust Accounts

Brokers may have interest-bearing trust accounts where the interest belongs to the broker,

so long as they comply with the requirements in Rule A.0116(c) namely:

1. the broker first obtains written authorization from the persons for whom he holds the

funds to deposit the funds into an interest-bearing account;

2. the authorization must clearly specify how and to whom the interest will be disbursed; and

3. the written authorization must be printed in a manner that will draw attention to the

authorization and distinguish it from other provisions of the instrument (for example,

italics, boldface type, underlining, a blank _________ to be filled in with the name of

the party to whom the interest will be paid, or some similar means).

-9-

Brokers earning interest on their brokerage trust accounts must transfer the accumulated interest from

their trust account to their operating account each month upon receipt of the bank statement

indicating the amount of interest credited to avoid commingling monies that belong to the broker

with monies belonging to others.

As mentioned at the outset, License Law expressly prohibits commingling monies, that is:

mixing monies belonging to others (i.e., trust funds) with a broker’s personal or business funds in

one account. This is illegal.

Brokers Managing Their own Properties

A broker who sells or manages his or her own properties generally is not permitted to deposit

earnest money or rents or tenant security deposits into the company’s brokerage trust account.

Typically, the broker must open a separate trust account for security deposits and earnest monies

collected in connection with the leasing or sale of properties in which the broker has an ownership

interest.

Example: Betty Broker owns four residential rental properties in her individual name.

She engages in residential sales and property management under her company,

Sunshine Properties LLC, that has a firm license and of which she is the only

member/manager.

1. Must Betty keep the tenant security deposits from her 4 tenants in a trust account?

Yes, unless she posts a bond, because all owners of residential property in NC must deposit

tenant security deposits in a trust or escrow account in an insured bank or savings and loan

in North Carolina or post a bond.

2. May she put the tenant security deposits from her tenants into her brokerage property

management trust account?

No, she can’t deposit rents or security deposits into any brokerage trust account that contains

monies belonging to others.

3. What are Betty’s options?

She may...

A) open an escrow account in her individual name for her tenant security deposits,

or

B) enter into a property management agreement between herself and Sunshine Properties to

at least hold the tenant security deposits, but Sunshine would be required to open a separate

trust account for the deposit of any rents or security deposits from Betty’s properties.

or

(c) ask an attorney or broker friend if they will hold her tenant security deposits in their trust

account if it is in an insured bank or savings and loan in North Carolina.

Bottom Line: There must be a complete separation between the owner of the property and the holder

of the escrow account. This generally means that either the account holder or the property owner

is a corporation and the other player is a person or entity other than the corporation. When in doubt,

hold funds in which you have an interest in a separate escrow account from your brokerage escrow

account.

-10-

Deficit Spending

A broker may never disburse from his trust account more monies than he or she is holding

for a client. This is referred to as deficit spending. A broker who deficit spends uses funds

belonging to others to pay someone else’s expenses. It may be more likely to occur in property

management, than in sales transactions.

Example: If an owner’s property needs a repair that will cost $1,500 and the monthly rent

proceeds for the property are $1,000, then the broker should direct the landlord to send the

broker $500 for deposit into the broker’s trust account. Once the owner’s funds have

cleared, the broker could then issue a check to the repair company for $1,500. Alternatively,

the broker could pay $1,000 towards the bill immediately, and pay the balance of $500 when

the next month’s rent is paid, if acceptable to the vendor.

Don’t Steal

The final paragraph of Rule A.0116 imposes an affirmative obligation on all licensees to

safeguard and protect the monies and property of others coming into the broker’s possession.

Brokers are expressly prohibited from:

! converting the money or property of others to his or her own use,

! applying such money or property to a purpose other than that it was intended for, or

! permitting or assisting any other person in the conversion or misapplication of such money

or property.

Summary

One of the primary functions of the Real Estate License Law is to protect consumers by

protecting their monies. Brokers who handle monies belonging to others are in a position of trust

and must act with a high level of honesty and integrity at all times. The Real Estate Commission is

dedicated to educating brokers regarding their duties and enforcing the rules pertaining to trust

monies.

If a broker has created a clear audit trail, it will make it easier to find and correct mistakes

and to detect fraud. It also demonstrates to the Commission that the broker has tried to comply with

the Commission trust account rules. The Commission is usually more lenient with brokers who

make an “honest mistake” while trying to comply with the Commission’s rules than with brokers

who disregard the Commission’s rules. The Commission also tends to be more lenient with brokers

who report embezzlement within their firms than if we discover the theft through an investigation

or spot audit.

Remember, the truth always has a way of coming out. It’s usually just a matter of time.

-11-

-12-

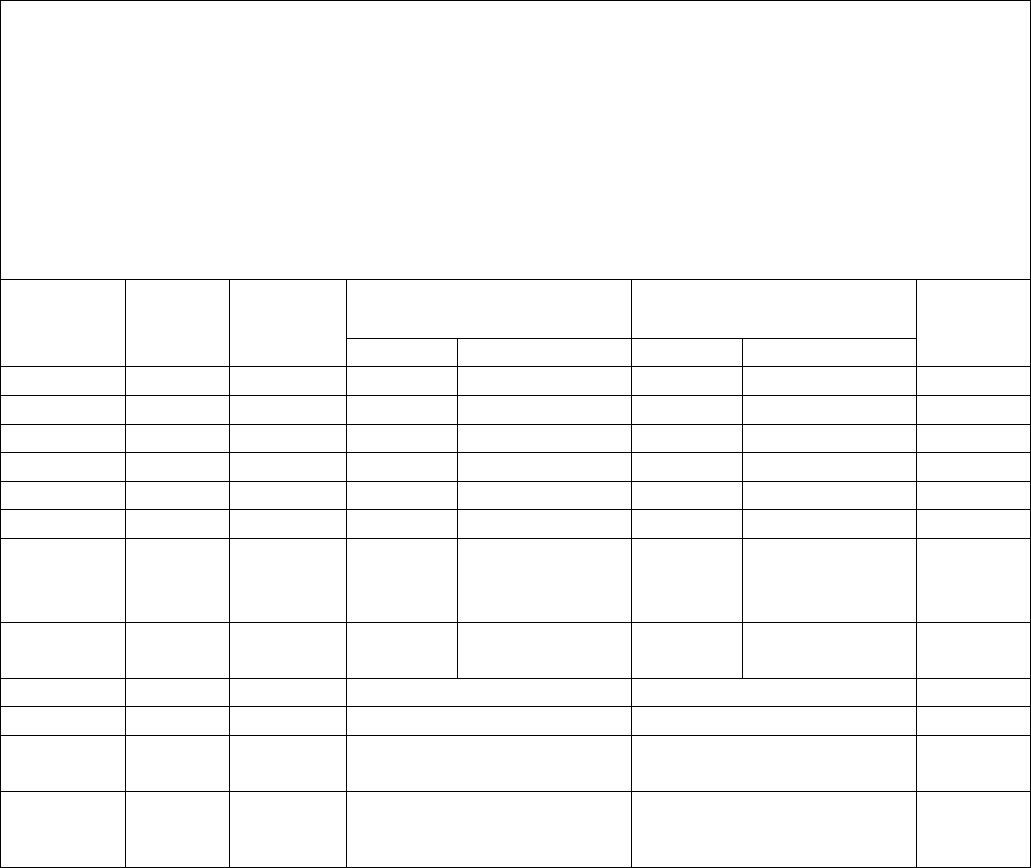

Checklist for Recording Requirements in Sales Transactions

BICs and their trust account bookkeepers should find this checklist useful to guide them in properly

recording entries in the trust account books and records for sales transactions. To use the checklist,

read down the columns.

For example, deposit tickets must identify the date, amount, remitter, parties involved, purpose of

the funds deposited, property address and a total of the bank deposit. Bank deposits recorded on a

property ledger must identify the date and amount of the funds deposited, the remitter, the purpose of

the funds deposited and a running balance of the property ledger. A sales transaction property ledger

must also identify the buyer, seller and property address.

CHECKLIST

FOR RECORDING SALES TRANSACTIONS

IN TRUST ACCOUNT RECORDS

Deposit

Tickets*

Checks**

Property Ledgers

Journal

Trial

Balance

Deposits

Disbursements

Deposits

Disbursements

Date

Amount

Check #

Remitter

Purpose

Payee

Reference

to Deposit

Ticket

Running

Balance

Buyer

Seller

Property

Address

Total

*or Supplemental deposit worksheets

**or Supplemental disbursements worksheets

-13-

Checklist for Recording Requirements in Lease Transactions

BICs and their trust account bookkeepers should find this checklist useful to guide them in properly

recording entries in the trust account books and records for lease transactions. To use the checklist,

read down the columns.

For example, a deposit ticket must identify the date, amount, remitter, purpose of the funds

deposited, the tenant, the property address and a total of the bank deposit. Bank deposits recorded on a

property ledger must identify the date and amount of the funds deposited, the remitter, purpose of the

funds deposited and a running balance of the property ledger should be recorded. A property ledger

must also identify the tenant, landlord and property address.

CHECKLIST

FOR RECORDING LEASE TRANSACTIONS

IN TRUST ACCOUNT RECORDS

Deposit

Tickets*

Canceled

Checks**

Property Ledgers

Journal

Trial

Balance

Deposits

Disbursements

Deposits

Disbursements

Date

Amount

Check #

Remitter

Purpose

Payee

Reference to

Deposit

Ticket

Running

Balance

Tenant

Landlord

Property

Address

Total

*or Supplemental deposit worksheets

**or Supplemental disbursements worksheets

Resources

The Commission offers licensees a variety of resources for expanding their trust account

knowledge and skills. These resources include the Basic Trust Account Course, various articles in

the Commission’s Real Estate Bulletin, and the trust account rules and Trust Account Guidelines are

available on the Commission Web site (www.ncrec.gov). The Trust Account Guidelines include

illustrations of a trust account journal, deposit tickets, a supplemental deposit worksheet, ledgers,

a trust account check, supplemental check worksheet, a bank reconciliation, and a trial balance.

Additionally, the Commission’s staff is available to answer questions by telephone during regular

business hours.

Commission Rule

21 NCAC 58A .0116: Handling of Trust Money

(a) Except as provided in Paragraph (b) of this Rule, all monies received by a broker acting in his

or her fiduciary capacity (hereinafter "trust money") shall be deposited in a trust or escrow account

as defined in Rule .0117(b) of this Section no later than three banking days following the broker's

receipt of such monies.

(b) Exceptions to the requirements of Paragraph (a):

(1) All monies received by a provisional broker shall be delivered upon receipt to the broker

with whom he or she is affiliated.

(2) All monies received by a non-resident commercial broker shall be delivered as required

by Rule .1808 of this Subchapter.

(3) Earnest money or tenant security deposits paid by means other than currency and received

by a broker in connection with a pending offer to purchase or lease shall be deposited in a

trust or escrow account no later than three days following acceptance of the offer to purchase

or lease; the date of acceptance of the offer or lease shall be set forth in the purchase or lease

agreement.

(4) A broker may accept custody of a check or other negotiable instrument made payable to

the seller of real property as payment for an option or due diligence fee, or to the designated

escrow agent in a sales transaction, but only for the purpose of delivering the instrument to

the seller or designated escrow agent. While the instrument is in the custody of the broker,

the broker shall, according to the instructions of the buyer, either deliver it to the named

payee or return it to the buyer. The broker shall safeguard the instrument and be responsible

to the parties on the instrument for its safe delivery as required by this Rule. A broker shall

not retain an instrument for more than three business days after the acceptance of the option

or other sales contract.

(c) Prior to depositing trust money into a trust or escrow account that bears interest, the broker

having custody over the money shall first secure written authorization from all parties having an

interest in the money. Such authorization shall specify and set forth in a conspicuous manner how

and to whom the interest shall be disbursed.

-14-

(d) In the event of a dispute between buyer and seller or landlord and tenant over the return or

forfeiture of any deposit other than a residential tenant security deposit held by the broker, the broker

shall retain the deposit in a trust or escrow account until the broker has obtained a written release

from the parties consenting to its disposition or until disbursement is ordered by a court of competent

jurisdiction. Alternatively, the broker may deposit the disputed monies with the appropriate Clerk

of Superior Court in accordance with the provisions of G.S. 93A-12. If it appears that one of the

parties has abandoned his or her claim to the funds, the broker may disburse the money to the other

claimant according to the written agreement. Before doing so, however, the broker must first make

a reasonable effort to notify the absent party and provide that party with an opportunity to renew his

or her claim to the funds. Tenant security deposits shall be disposed of in accordance with G.S. 42-

50 through 56 and G.S. 42A-18.

(e) A broker may transfer an earnest money deposit from his or her trust or escrow account to the

closing attorney or other settlement agent no more than 10 days prior to the anticipated settlement

date. A broker shall not disburse prior to settlement any earnest money in his or her possession for

any other purpose without the written consent of the parties.

(f) A broker shall not disburse trust money to or on behalf of a client in an amount exceeding the

balance of trust money belonging to the client and held in the trust account.

(g) Every broker shall safeguard any money or property of others that comes into the broker's

possession in a manner consistent with the Real Estate License Law and Commission rules. A broker

shall not convert the money or property of others to his or her own use, apply such money or property

to a purpose other than that it was intended for, or permit or assist any other person in the conversion

or misapplication of such money or property.

License Law

§ 93A-12. Disputed monies.

(a) A real estate broker licensed under this Chapter or an attorney licensed to practice law in this

State may deposit with the clerk of court in accordance with this section monies, other than a

residential security deposit, the ownership of which are in dispute and that the real estate broker or

attorney received while acting in a fiduciary capacity.

(b) The disputed monies shall be deposited with the clerk of court in the county in which the

property for which the disputed monies are being held is located. At the time of depositing the

disputed monies, the real estate broker or attorney shall certify to the clerk of court that the persons

who are claiming ownership of the disputed monies have been notified in accordance with

subsection (c) of this section that the disputed monies are to be deposited with the clerk of court and

that the persons may initiate a special proceeding with the clerk of court to recover the disputed

monies.

(c) Notice to the persons who are claiming ownership to the disputed monies required under

subsection (b) of this section shall be provided by delivering a copy of the notice to the person or by

mailing it to the person by first-class mail, postpaid, properly addressed to the person at the person’s

last known address.

-15-

(d) A real estate broker or attorney shall not deposit disputed monies with the clerk of court until

90 days following notification of the persons claiming ownership of the disputed monies.

(e) Upon the filing of a special proceeding to recover the disputed monies, the clerk shall determine

the rightful ownership of the monies and distribute the disputed monies accordingly. If no special

proceeding is filed with the clerk of court within one year of the disputed monies being deposited

with the clerk of court, the disputed monies shall be deemed unclaimed and shall be delivered by the

clerk of court to the State Treasurer in accordance with the provisions of Article 4 of Chapter 116B

of the General Statutes.

-16-