The IRS

Research Bulletin

Proceedings of the 2023 IRS / TPC Research Conference

Publication 1500 (Rev. 5-2024) Catalog Number 11546J Department of the Treasury Internal Revenue Service www.irs.gov

Research, Applied Analytics & Statistics

IRS Research Bulletin

Papers given at the

13th Annual Joint Research Conference

on Tax Administration

Cosponsored by the IRS and the

Urban-Brookings Tax Policy Center

June 22, 2023

Compiled and edited by Alan Plumley*

Research, Applied Analytics, and Statistics, Internal Revenue Service

*Prepared under the direction of Barry W. Johnson, IRS Chief Research and Analytics Ocer

IRS Research Bulletin

iii

Foreword

is edition of the IRS Research Bulletin (Publication ) features selected papers from the IRS-Tax Policy

Center (TPC) Research Conference held on June , , at the Brookings Institution in Washington, DC.

Conference presenters and attendees included researchers from many areas of the IRS, ocials from other

government agencies, and academic and private sector experts on tax policy, tax administration, and tax com-

pliance. Many people participated in this, our rst in-person conference in several years. Videos of the presen-

tations are archived on the Tax Policy Center website to enable additional participation.

e conference began with welcoming remarks by Wendy Edelberg, Director of the Hamilton Project at

the Brookings Institution, Eric Toder, Institute Fellow at the Urban-Brookings Tax Policy Center, and Barry

Johnson, then Deputy Chief Data and Analytics Ocer in the IRS Oce of Research, Applied Analytics and

Statistics. e remainder of the conference included sessions on taxpayer service, estimating audit aer-

shocks, understanding contemporary taxpayers, and hidden assets and networks. e keynote speaker was

Washington Post columnist Catherine Rampell, who oered her insights on contemporary tax policy and tax

administration issues.

We trust that this volume will enable IRS executives, managers, employees, stakeholders, and tax adminis-

trators elsewhere to stay abreast of the latest trends and research ndings aecting tax administration. We an-

ticipate that the research featured here will stimulate improved tax administration, additional helpful research,

and even greater cooperation among tax administration researchers worldwide.

IRS Research Bulletin

iv

Acknowledgments

is IRS-TPC Research Conference was the result of preparation over a number of months by many peo-

ple. e conference program was assembled by a committee representing research organizations through-

out the IRS. Members of the program committee included: Alan Plumley, Brett Collins, Kelly Dauberman,

and Valentina Kachanovskaya (Research, Applied Analytics, and Statistics); Anne Dayton (SB/SE Division);

Brittany Jeerson (W&I Division); and Rob McClelland (Tax Policy Center). In addition, Megan Waring, of

the Brookings Institution, and John Buhl, of the Urban Institute, oversaw numerous details to ensure that the

conference ran smoothly.

is volume was prepared by Lisa Smith (layout and graphics), Anne McDonough (editor), and Beth Kilss

(contractor), all of the IRS Statistics of Income Division. e authors of the papers are responsible for their

content, and views expressed in these papers do not necessarily represent the views of the Department of the

Treasury or the Internal Revenue Service.

We appreciate the contributions of everyone who helped make this conference a success.

Barry Johnson

IRS Chief Data and Analytics Ocer

IRS Research Bulletin

v

Contents

Foreword ........................................................................................................................................................................ iii

1. Service Is Our Surname

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

Jan Millard (IRS, RAAS), Omar Faruqi, Jonah Flateman, Jamil Mirabito, Sarah Smolenski, Michael Stavrianos,

and Lauren Szczerbinski (ASR Analytics) ...........................................................................................................................3

e Balance Due Taxpayer: How Do We Reduce IRS Cost and Taxpayer Burden for Resolving Balance

Due Accounts?

Javier Framinan, Frank Greco, Shannon Murphy, and Howard Rasey (IRS, W&I), Javier Alvarez and Angela

Colona (IRS Taxpayer Experience Oce) ..................................................................................................................... 27

Understanding Yearly Changes in Family Structure and Income and eir Impact on Tax Credits: Can

Tax Credits Be Advanced?

Elaine Maag, Nikhita Airi, Lillian Hunter (Urban-Brookings Tax Policy Center) ...............................................55

2. Estimating Audit Aershocks

Changes to Voluntary Compliance Following Random Taxpayer Audits

Allan Partington, Murat Besnek (Australian Taxation Oce) ...................................................................................73

e Long-Term Impact of Audits on Nonling Taxpayers

India Lindsay, Jess Grana, and Alexander McGlothlin (MITRE); Alan Plumley (IRS, RAAS) ...............................83

Silver Lining: Estimating the Compliance Response to Declining Audit Coverage

Alan Plumley, Daniel Rodriguez (IRS, RAAS); Jess Grana, Alexander McGlothlin ............................................... 103

3. Understanding Contemporary Taxpayers

Who Are Married-Filing-Separately Filers and Why Should We Care?

Emily Y. Lin, Navodhya Samarakoon (U.S. Department of the Treasury) ...............................................................133

Willing but Unable to Pay? e Role of Gender in Tax Compliance

Andrea Lopez-Luzuriaga (Universidad del Rosario); Carlos Scartascini (Inter-American Development

Bank) ................................................................................................................................................................................ 149

13th Annual IRS-TPC Joint Research Conference on Tax Administration

IRS Research Bulletin

vi

3. Understanding Contemporary Taxpayers (Continued)

Who Sells Cryptocurrency?

Jerey L. Hoopes (University of North Carolina at Chapel Hill); Tyler S. Menzer, Jaron H. Wilde

(University of Iowa) ........................................................................................................................................................ 165

4. Hidden Assets, Hidden Networks

Following K-1s: Considering Foreign Accounts in Context

Tomas Wind, David Bratt, Alissa Gra, Anne Herlache (IRS, RAAS) ...................................................................... 199

Application of Network Analysis To Identify Likely Ghost Preparer Networks

Joshua W. King, Andrew J. Soto, Getaneh Yismaw, Izabel Doyle, Ririko Horvath, Ashley Nowicki,

Chris Hess

(IRS, Research, Applied Analytics & Statistics), Brandon Gleason (IRS, Criminal Investigations),

Will Sundstrom, Jacob Brooks, Michael Mastrangelo, Mike Stavrianos, Daniel Hales (GCOM) ........................ 217

5. Appendix

Conference Program ...................................................................................................................................... 235

1

∇

Service Is Our Surname

Millard Faruqi Flateman Mirabito

Smolenski Stavrianos Szczerbinski

Framinan Greco Murphy Rasey

Alvarez Colona

Maag Airi Hunter

Looking Beyond Level of Service: Using

Behavioral Insights To Improve Taxpayer

Experience

Jan Millard (IRS, RAAS), Omar Faruqi, Jonah Flateman, Jamil Mirabito, Sarah Smolenski,

Michael Stavrianos, and Lauren Szczerbinski (ASR Analytics LLC)

I

n , as part of the Servicewide Future State Initiative, the IRS initiated a notice redesign eort focusing

on Collection notices issued through the Automated Collection System (ACS) (e.g., LT, LT) as well

as those issued prior to ACS entry (e.g., CP, CP, CP, CP). e redesigned notices included

changes to wording and format which collectively guide taxpayers towards desired behaviors and away from

undesired behaviors. ese “behavioral nudges” were designed based on a robust and rapidly growing body of

research from the behavioral sciences (e.g., psychology, neuroscience, behavioral economics), which examines

how individuals absorb, process, and react to information, and applies this knowledge to design practical poli-

cies and interventions with human behavior in mind.

IRS has explored the application of behavioral nudges

through other taxpayer communication channels, including recorded announcements in the Customer Voice

Portal (CVP) system.

is initiative was prompted, in part, by a study conducted by the United Kingdom’s

tax authority, which found taxpayers were much more likely to “channel shi” (i.e., abandon a telephone call in

favor of web-based self-service) aer hearing certain recorded messages containing behavioral nudges.

is paper discusses a pilot test conducted to evaluate the ecacy of a sequence of CVP message prompts

redesigned using behavioral insights to encourage callers routed to ACS Application (App ) to abandon

the call queue and shi to online service channels.

e study team used behavioral design techniques to

develop an alternative sequence of voice prompts with the taxpayer experience in mind, aiming to increase

awareness of online resources relevant to specic tax issues (e.g., establishing an online account to access

tax return information and view payment history) and provide callers with information necessary to con-

sider self-service channels to resolve their issue rather than continue to wait on hold for a Customer Service

Representative (CSR). As the IRS seeks to reduce costs, improve taxpayer compliance, and enhance the overall

taxpayer experience, redesigning CVP announcements based on research from behavioral sciences provides

an opportunity to achieve all three objectives.

e pilot results suggest using behavioral insights to design voice prompts can improve taxpayer experi-

ence. Using voice prompts to provide salient details of the benets of using online tools enables taxpayers to

opt-in to preferred service channels, thus saving both time and money. Taxpayers who called the IRS and

heard redesigned messages were more likely to abandon their call and shi to online channels compared with

callers who heard the existing messages. By informing taxpayers of the availability of relevant online alterna-

tives, phone assistors were freed up to answer calls from taxpayers who prefer or require CSR assistance to

resolve their tax issue.

1

e name of this discipline stems from the Behavioral Insights Team, an organization established in 2010 within the government of the United Kingdom to

improve government policy and services and save money using behavioral nudges. e concept of using behavioral insights to improve performance has become

pervasive throughout government. In 2015, a U.S. Executive Order encouraged all Federal departments and agencies to develop strategies for applying behavioral

science insights to programs and, where possible, rigorously test and evaluate the impact of these insights.

2

CVP is a component of the IRS Unied Contact Center Enterprise (UCCE), an IP–based technology for call distribution and management, to support taxpayers

and IRS partners who want to communicate with the IRS by phone. UCCE routes calls to applications which encompass a distinct product line or service and may

have a dedicated call queue and group of trained CSRs.

3

Calls are routed to App 75 when the caller provides a TIN and UCCE evaluates the TIN for an ACS indicator. A call enters the CVP queue once the call is routed to

the application and remains in the queue until 1) the caller hangs up, abandoning the call; 2)the CVP executes a courtesy disconnect due to extreme call volume;

or 3) the caller connects with a CSR.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

Findings from the study also point to opportunities to use behavioral methods to redesign message

prompts on other IRS phone applications. Designing eective nudges requires an understanding of the reasons

taxpayers may call the IRS to ensure voice prompts provide information most relevant to those circumstances.

As such, this paper builds on ndings from the CVP pilot and introduces an approach to attribute outcomes,

such as taxpayer phone calls, to events. is approach can inform future opportunities to tailor call queue mes-

sages to caller proles, thereby increasing the eectiveness of messages in encouraging callers to self-resolve

tax issues through online service channels. As the IRS continues to expand online service oerings available to

taxpayers, behavioral insights can be used to promote adoption by informing taxpayers of relevant tools and

explaining how to use them.

e IRS uses Level of Service (LOS) to evaluate its ability to assist callers, measuring the proportion of calls

routed and connected with a live assistor. LOS excludes calls routed to automated assistance and callers who

hang up before connecting with an assistor. By this measure, answering as many calls as possible is the optimal

outcome, while the value of issue resolution via self-service alternatives may not be considered. Using more

comprehensive metrics could help the IRS evaluate its ability to provide “top quality service” to taxpayers. For

example, CVP pilot results showed using voice message prompts to encourage channel shi can accelerate

issue resolution, both by enabling callers to self-serve online and by freeing up live assistors to handle callers

with more complex issues unable to be resolved online. is paper will discuss alternative measures to evaluate

taxpayer experience beyond LOS as the IRS continues to expand online services available to taxpayers.

Methodology and Design

Lessons learned through prior notice redesign pilots informed the approach to test the impact of designing

voice prompts to encourage callers routed to ACS App to use self-service channels rather than remain on

hold in the call queue.

Message Design

A growing body of research conducted by the IRS and other tax authorities demonstrates Behavioral Insights

can be used to improve tax administration by nudging taxpayers towards desirable actions and away from

undesirable actions. To develop improved versions of the CVP announcements, the IRS leveraged insights

derived from previous notice redesign eorts and related behavioral research input from IRS stakeholders

and additional research on the use of behavioral nudges to inuence customer contact channels, including a

study conducted by the United Kingdom’s tax authority, Her Majesty’s Revenue and Customs (HMRC).

e HMRC study is highly analogous to the CVP test as it used recorded messages to encourage callers who

could self-serve to use online service tools by applying behavioral nudging techniques. HMRC increased chan-

nel shi rates by using behavioral insights to enhance high-trac messages with the greatest potential for

improvement.

• Be denite and clear where possible, adding “if you can do this online, please hang up now.”

• Give precise instructions. Provide taxpayers with a specic digital resource rather than a general

resource like IRS.gov. Callers may have previously tried to self-serve online and may be less likely to do

so again unless provided with new or more helpful information.

• Shorten announcements. Keep messages to 30 seconds or less and ensure each message contains no

more than seven pieces of information.

• Prime individuals for lists. Use leading language to alert callers to a forthcoming list (e.g., “ere are

several kinds of income you will need to tell us about. ese are…”)

4

Her Majesty’s Revenue and Customs. Behaviour, Insight, and Research Team (BIR), 2019.

5

e HMRC paper used the following behavioral insights techniques to improve announcements for callers: denite and clear language, precise instructions for

completing tasks, shorter announcement length, list priming, and incentives for using self-service channels like online resources.

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

• Provide incentives to move away from the phone. Taxpayers who call are already tied to the telephone

response channel. Highlighting incentives can nudge callers to try digital self-service tools.

Callers entering the ACS App queue hear prerecorded announcements followed by hold music until the

call is abandoned, disconnected, or routed to a CSR. Announcements provide general information regarding

potential actions to resolve issues. Announcement themes include relevant information pertaining to making

payments or payment plans online or provide guidance for preparing account documentation prior to con-

necting with a CSR. Should the caller wish to connect with a CSR, the CSR can assist the caller with the fol-

lowing: making full payments (by assisting taxpayers with online payment applications or sending a payment

via mail); establishing payment plans; obtaining levy sources; reviewing liability disagreements; evaluating

eligibility for Currently Not Collectible (CNC) determination; and resolving inquiries related to these issues.

e study team developed a sequence of ve prototype announcements for App , which were evaluated

in the pilot . e prototype messages address specic taxpayer concerns, highlight benets of self-service tools,

and acknowledge resource constraints associated with IRS phone resources. e redesigned messages aimed

to nudge callers to abandon earlier in the sequence, freeing up space in the call queue for callers with more

complex issues. To achieve this, the order of message themes in the sequence address issues expected to be

most common among callers rst. Table summarizes themes employed by control and redesign announce-

ment sequences. e rst two announcements aim to nudge those calling to make a payment or establish or

modify a payment plan to use IRS online tools by highlighting the salient benets. e remaining messages in

the sequence reiterate the availability of online services and remind callers to have their documentation ready

if they intend to speak with a CSR.

TABLE 1. Control and Prototype Announcement Themes

Message # Control Announcements Redesigned Announcements

Message 1

Make sure you’re prepared when your call is

answered.

Have details on hand related to the cause of

balance due, your nancial situation, and any

unled returns

If you’re calling to make a payment, online is your best

option.

IRS cannot accept payments over the phone, but there

is a quick, easy, and secure option online

Message 2

Online options are available.

Go to irs.gov/payments to explore a variety of

online service options, such as accessing ac-

count information or making a payment

If you’re interested in a payment plan, OPA is the best

choice.

Benets of using OPA include reduced user fees for new

and modied plans, instant conrmation, and the ability

to explore a variety of plan options

Message 3

Go to IRS.gov and use the search feature to

nd services.

There are many services available online that

don’t require waiting

Use Online Account to view up-to-date account

information.

Assure “comfort callers” the most current information

about their account is accessible through OLA

Message 4

Payment plan options may be available if you

can’t pay now.

Visit irs.gov/payments–you may be able to pay

a portion of your balance or make payments

with credit card

While you’re waiting, check out online services.

Acknowledge the wait time and suggest checking out

new and improved features available online

Message 5

Check out safe and secure services on IRS.

gov.

You don’t have to wait–you can go to IRS.gov

to explore online services

If you choose to wait, make sure your information is

ready.

Recap online service options (before indenite hold) and

remind callers to have information ready

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

Test Methodology

To test the eectiveness of the redesigned message sequences, the pilot alternated the control and redesigned

message sequences played to callers routed to the App call queue. e pilot included callers entering the

ACS App queue by inputting a valid Taxpayer Identication Number (TIN) with an ACS indicator present

on their account. Results were tracked for days aer the nal pilot call.

Due to CVP system constraints, calls could not be randomly assigned to either redesigned or control

message sequences.

As such, the test could not be implemented as a true randomized control trial. Control

and redesigned message sequences were alternated each day during the six-week test period: July through

August , . A comparison of characteristics of the two samples veried they were similar in all key re-

spects, other than the treatment received.

To measure the eectiveness of redesigned CVP announcements, we evaluated caller behavior aer reach-

ing the App call queue and compared outcomes for callers who heard control messages with callers who

heard the redesigned messages. Metrics describing call outcomes (e.g., call abandon rate) were evaluated over

the time interval in which the taxpayer was in the application. Metrics describing channel shi and online ser-

vice access were evaluated over the days following the caller entering the CVP queue. We compared metrics

observed among the treatment group to those observed among the control group and tested the statistical

signicance of any dierences. e following outcomes were evaluated across control and redesign callers in

the pilot sample:

• Channel Shi: Callers who channel shi abandon their call before connecting with a CSR and access

IRS online resources within 30 days of the call.

• Online Resource Access: Online resource access evaluates use of Online Account (OLA), Online

Payment Agreement (OPA), or Get/View transcript applications occurring aer a pilot call.

• Average Speed to Answer (ASA): Time callers spent in queue before connecting with a CSR. Increasing

callers who channel shi should reduce the amount of time callers remaining in the queue must wait to

connect with a CSR.

• Abandoned Calls: Proportion of calls abandoned while in the queue. Increasing rates of call abandonment

among callers who can self-serve online will free up CSR capacity to assist callers with more complex

tax issues.

7

Sample Selection

e primary goal of the CVP pilot was to encourage callers able to self-service to abandon the call queue and

shi to online service channels to resolve their tax issue. erefore, the channel shi rate was the preferred

metric for determining sample size requirements. Historic channel shi rates are not available for App due

to an inability to connect associated TIN-level data for abandoned call records. For this reason, we used histor-

ic channel shi rates from a prior pilot evaluating channel shi rates among LT notice recipients.

Individuals

receiving this notice would be a subset of App callers due to their account being in ACS. Because the LT

taxpayer population received a notice of intent to levy, this population may be more apt to contact the IRS. For

this reason, we used the channel shi rate provided by HMRC as a comparison. By reviewing variance in these

two channel shi rates, we determined the sample sizes required to detect meaningful dierences in channel

shi rates across message groups. Achieving % power in identifying a % dierence using the .% channel

shi rate reported in the HMRC study required a minimum sample of , calls. A more conservative ap-

proach to identify a % dierence at % power using the channel shi rate from the LT population required

a minimum sample of roughly , calls.

6

Each call queue uses a single sequence of announcements at any given time, so all callers in the queue at the same time must hear the same announcements,

meaning the control and treatment groups could not be tested concurrently.

7

LT11 Notice Redesign Pilot Test (2019). Internal Revenue Service.

8

Data retrieved from Intelligent Contact Management/Customer Voice Portal (ICM/CVP) platform. TIN-level data later acquired via UWR 2021-099 and merged

with ICM data.

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

During the pilot, , calls were routed to ACS App .

About % of calls were exposed to at least

one control or redesigned message, meaning the caller remained on the call long enough to hear at least one

message in the announcement sequence before connecting with a CSR, receiving a courtesy disconnect (due to

high call volume), or abandoning their call while waiting in queue. Aer exclusions, the resulting population

consisted of , taxpayers and , calls.

Given the large sample size, the test was suciently powered

(%) to detect a % dierence in the channel shi rate attributable to redesigned messages.

Pilot Analysis Groups

To analyze the results of the pilot, callers were assigned to one of three groups based on the number of calls

made during the pilot test period:

• Group 1 includes taxpayers who were routed to App 75, remained on the line to hear at least the rst

announcement in the message sequence, and did not call again within the pilot period.

• Group 2 includes individuals who called more than once during the pilot, but only during one call

attempt were they on the line to hear at least one message in the sequence. All other call attempts were

abandoned or disconnected prior to hearing the rst announcement in the message sequence.

• Group 3 includes callers who heard at least one message in the sequence, called back at least once more

and again heard at least one message in the sequence. Repeat callers may: have called back aer a 2-hour

courtesy disconnect; not have had time to remain on hold; be seeking assistance aer attempting to use

self-service options; be following up with a CSR; or be listening to queue messages again.

Table summarizes the number of callers in each group who heard control and redesigned messages.

TABLE 2. Pilot Callers per Prototype by Analysis Group

Group Message Sequence Pilot Callers

Group 1

Control 30,580

Redesign 31,146

Group 2

Control 3,606

Redesign 3,437

Group 3

Control 7,884

Redesign 8,449

Results and Discussion

Increase Channel Shi

e primary goal for the CVP pilot was to redesign voice prompt messages to nudge taxpayers able to self-

serve to abandon their call while in the queue and shi to IRS online channels. e primary metric used to

evaluate channel shi was the rate at which taxpayers abandoned their call aer hearing at least one voice

prompt and accessed an IRS online application to address their issue.

e channel shi rate considers a va-

riety of actions that do not require CSR support and can be performed using IRS self-service tools, such as

making a one-time payment, establishing or modifying a payment plan, conrming payment history, checking

9

Table 25 lists exclusionary criteria and the number of calls and callers removed from the study for meeting one or more of the exclusionary criteria.

10

See Table 27 in the Appendix for a list of exclusionary criteria, and the resulting number of calls and number of callers removed from the study.

11

Channel shi actions include self-service payments, accessing OPA, requesting a return transcript, or accessing Online Account within 30 days of the abandoned

call. Self-service payments are identied using the rst and second positions of the EFT number associated with the payment transaction.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

account balance, and viewing a transcript. Abandoning the call queue to accomplish any of these tasks using

IRS online resources would be considered a successful outcome for the redesigned messages.

Callers exposed to at least one message in the redesigned sequence appeared more likely to channel shi

than callers who heard the control messages. Table shows the channel shi rate aggregated across the three

pilot call groups. Across groups, redesigned messages increased the channel shi rate by about % relative to

the control messages.

TABLE 3. Channel Shift Rate

Prototype Channel Shift Rate

Relative Uplift

(Percentage Change)

Control 12.51%

Redesign 14.11% + 12.83% ***

***p-value < 0.001.

Table summarizes dierences in the channel shi rate for control and redesign callers by analysis group.

Redesigned messages increased the channel shi rate by over % relative to the control messages for Group

callers and improved the channel shi rate by nearly % for Group callers. Redesigned messages increased

the channel shi rate by % relative to the existing messages for Group callers.

TABLE 4. Channel Shift Rate by Group

Group Prototype Channel Shift Rate

Relative Uplift

(Percentage Change)

Group 1

Control

15.29%

Redesign

17.47% + 14.24%***

Group 2

Control

19.52%

Redesign

21.62% + 10.73%*

Group 3

Control

6.43%

Redesign

7.45% + 15.93%***

*p-value < 0.05; ***p-value < 0.001.

Table shows the days between call and channel shi action for pilot callers who channel shi. While

the channel shi rate considered self-service actions within days of a call, between and % of channel

shiers complete their channel shi actions in the rst days following their call. Most callers who channel

shi do so on the same day as their call. Across groups, a larger proportion of callers who heard the redesigned

messages channel on the day of their call compared with callers who heard the existing messages. About %

of Group callers who heard redesigned messages channel shi on the same day as their pilot call, while %

of callers who heard the control messages channel shied on the same day as the call. About % of Group

callers who heard redesigned messages and channel shied did so on the same day as the call, while nearly %

of callers who heard control messages did so. Group comprises repeat callers where outcomes are calculated

at the call level.

Just over % of callers who heard the redesigned messages and channel shied did so on the

same day, whereas % of callers who channel shied aer hearing control messages did so on the same day

as their call.

12

is analysis assumes if a Group 3 caller called twice and channel shied aer each call, both actions would be included in the analysis. However, if they called

twice and only channel shied aer the second call regardless of whether it occurred in the same 30-day window, this action would only be counted once.

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

TABLE 5. Days Between Call and Channel Shift

Days to

Channel Shift

Group 1 Group 2 Group 3

Control Redesign Control Redesign Control Redesign

Same Day 67.84% 70.43% 61.65% 65.41% 58.94% 64.32%

1–7 Days 15.27% 14.28% 19.18% 16.02% 24.12% 20.55%

8–30 Days 16.89% 15.29% 19.18% 18.57% 16.94% 15.14%

Actions taken by channel-shi callers include self-service payments, accessing IRS OLA, using OPA, and

actions such as viewing a return transcript. Table summarizes the rst self-service action taken by callers

who channel shi. OPA access appears to be the most common self-service outcome following call abandon-

ment. About % of control and % of redesign callers who channel shi access OPA. e higher rate of OPA

access among redesign callers can perhaps be attributed to the reminder of increased costs associated with

establishing a payment plan over the phone.

TABLE 6. First Self-Service Action-Channel Shift Callers

Prototype

Channel Shift

Callers

Self-Service

Payment*

OPA Access OLA

Get / View

Transcript

Control 6,550 28.21% 31.21% 25.01% 15.57%

Redesign 7,645 28.82% 37.59% 20.30% 13.29%

* Self-service payments include Direct Pay, and other forms of electronic payment such ACH Debit, credit card, e-le debit. See Table 24 in the Appendix for a summary of

Direct Pay application use by App 75 callers.

Individual Message Success

To examine the ecacy of individual messages in encouraging App callers to channel shi, we evaluated

outcomes for each group by last message heard prior to call abandonment.

Callers who abandoned the queue before the nal message in the sequence most oen did so aer hearing

the second message. Across groups, a larger proportion of callers who heard the redesigned messages aban-

doned aer the second message compared with callers who heard the control messages. e second message

in the redesign sequence highlights the salient benets of OPA, such as reduced user fees for setting up a pay-

ment plan through OPA as opposed to over the phone. As shown in Table , a larger proportion of callers who

heard the redesigned messages abandoned before the h message in the sequence compared with callers who

heard the control messages.

TABLE 7. Callers Who Abandon in Queue–Distribution of Last Message Heard

Group Prototype

Last Message Heard

1 2 3 4 5

Group 1

Control 4.29% 9.32% 5.08% 2.81% 78.50%

Redesign 6.36% 13.94% 4.19% 5.14% 70.37%

Group 2

Control 5.25% 10.23% 5.93% 2.57% 76.02%

Redesign 6.45% 14.37% 4.81% 5.26% 69.10%

Group 3

Control 3.66% 8.15% 4.58% 2.77% 80.84%

Redesign 5.70% 12.09% 4.26% 4.97% 72.99%

Because announcements are designed to encourage callers to shi to online service channels, we expect

taxpayers who abandon their call during the announcement sequence to exhibit higher rates of self-service

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

than those who abandon during the indenite hold. Table shows the channel shi rate for taxpayers who

abandoned their call by the last message in the sequence they heard. Among callers who abandon, callers who

heard redesigned messages were more likely to channel shi aer most of the announcements in the sequence.

e proportion of Group callers who abandon and subsequently channel shi aer hearing messages in

the control sequence is lower than the channel shi rate for callers who heard redesigned messages for all but

the fourth message in the sequence. Group callers, who called multiple times during the pilot, may prefer

to speak with a CSR and therefore may be less likely to channel shi, as shown below. Among Group callers

who channel shi aer abandoning their call, it is possible callers may have called multiple times to listen to

the voice prompts if information presented by the messages was missed initially.

TABLE 8. Proportion of Abandon Callers Who Channel Shift by Last Message Heard

Group Prototype

Last Message Heard

1 2 3 4 5

Group 1

Control 31.20% 36.19% 37.52% 40.80% 38.19%

Redesign 45.41% 45.22% 39.06% 40.41% 40.26%

Group 2

Control 35.11% 40.44% 45.28% 42.48% 38.90%

Redesign 48.25% 47.24% 48.24% 49.46% 39.39%

Group 3

Control 7.67% 9.67% 8.49% 10.89% 13.43%

Redesign 12.73% 11.04% 11.59% 10.51% 15.13%

Increase Use of Online Services

Redesigned messages are aimed to increase callers’ use of IRS online services, which include self-service pay-

ments, use of OPA for establishing or modifying payment plans, requests for prior return transcripts, and OLA

access.

Callers across groups appear more likely to access IRS online resources when exposed to the redesigned

message compared with callers exposed to control messages. Table shows the proportion of callers accessing

IRS online services within the days following their pilot call. Group callers realized over an % improve-

ment in the online service access rate relative to the existing messages. About % of Group callers who heard

redesigned messages accessed IRS online services in the days following their phone call, compared with

roughly % of callers who heard control messages. About % of callers in Group who heard the control

messages accessed IRS online resources compared with roughly % of callers who heard the redesigned mes-

sages. e redesigned messages achieved more than a % improvement in the rate of online service access

relative to the existing messages. Results are signicant for each group.

14

If a Group 3 caller called twice within a 30-day period and channel shied aer each call, both channel shi actions are included in this analysis. However, if they

called twice and only channel shied aer the second call, regardless of whether if occurred in the same 30-day window, this entry would only be counted once.

15

e CVP announcement sequence is only played once before an indenite hold with music. If a taxpayer misses a certain component of the announcement

sequence, they will have to call again to hear the announcements again.

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

TABLE 9. IRS Online Service Access Rate

a

Group Prototype IRS Online Service Access Relative Uplift

Group 1

Control 29.24%

Redesign 31.65% + 8.25% ***

Group 2

Control 30.70%

Redesign 33.02% + 7.57%*

Group 3

b

Control 14.63%

Redesign 16.74% + 14.45%***

*p-value < 0.05; ***p-value < 0.001.

a

Online resources accessed within 30 days of call.

b

For repeat callers in Group 3, 30-day outcomes are shown only for the call where the online action occurred most recently after. If a caller in Group 3 called twice and

accessed online services after the second call, their action would be counted once and be associated with the outcomes of the second call. If they called another time

and accessed online services again after the call, but still within the 30-day window of the rst and second calls, the action would be associated with the outcomes of the

third call for a total number of two access outcomes for the individual.

Most callers who use IRS resources following their call appear to access online services on the day of their

call or within the rst seven days. Table shows callers who used IRS online tools aer their pilot call typically

accessed those resources on the same day as their call. About % of callers who heard redesigned messages

and roughly % of callers who heard control messages used IRS online resources on the same day as the call.

A smaller proportion of callers who accessed online services did so within seven days of their call.

TABLE 10. Days Between Call and First IRS Online Service Action

Days to Channel Shift Control Redesigned

Same Day 70.24% 73.28%

1 – 7 Days 13.46% 11.96%

8 – 30 Days 16.17% 14.65%

Many App callers seeking to make a payment or establish or modify a payment plan have the option to

use IRS online tools, such as OPA and IRS Direct Pay, to accomplish the task.

Individual taxpayers can estab-

lish or modify a payment plan, change the due date of their payments, change their bank account information,

and change their monthly installment amount using OPA. Table shows the OPA access rate for OPA-eligible

pilot callers.

OPA access is dened as taxpayer entry into the OPA application. Pilot callers who heard the re-

designed messages appear to access OPA at a higher rate than callers who heard the control messages. Among

the three groups, Group callers realized the largest improvement in the OPA access rate relative to callers

hearing the control messages (%). Callers who heard redesigned messages in Group and Group saw %

and % improvements in the OPA access rate, respectively, relative to callers exposed to control messages. All

group-level results are signicant.

16

All analyses in this section observe outcomes in the 30 days following each call.

17

IRS Direct Pay is identied by EFT numbers with the rst position in 2, the second position in 2 (ACH Debit), and the third position in 2 (IRS Debit); OPA Rate

includes taxpayers who access the OPA app and had an associated IA or pending IA transaction.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

TABLE 11. OPA Rate by Group

Group Prototype OPA-Eligible Callers OPA Access Relative Uplift

Group 1

Control 24,641 14.74%

Redesign 25,066 18.63% + 26.36%***

Group 2

Control 3,062 16.13%

Redesign 2,890 19.45% + 20.54%***

Group 3

Control 14,575 7.90%

Redesign 16,000 11.19% + 41.75%***

***p-value < 0.001.

Redesigned Messages Can Increase Taxpayer Savings by Encouraging Use of OPA. Taxpayers who use OPA

to set up a payment plan or modify a payment plan rather than doing so over the phone with a CSR will save

between and per payment plan. Over the course of the six-week pilot, , taxpayers who heard the

redesigned messages and taxpayers who heard the control messages abandoned their call and set up a

payment plan through OPA. e second message in the redesigned sequence encourages callers interested in

establishing or modifying a payment plan to use OPA, highlighting potential cost savings from lower user fees

charged by OPA compared with an over the phone.

To estimate yearly taxpayer savings resulting from the redesign messages, we will only consider taxpayers

who either abandoned or were disconnected, since the callers who connected would likely have received ad-

ditional information from the CSR. Among callers who abandoned their call or disconnected, additional

callers in the redesign group established a payment plan in the month aer their call. If each of these pilot tax-

payers saved between – per call, over the course of a month the redesign pilot population would have

saved a total of ,–,. If the redesigned messages were scaled to the entire App population, we

estimate taxpayers could save between ,–, in one month, or ,,–,, in one year.

Table shows the rate of self-service payments for callers who heard redesigned messages and callers

who heard the control messages.

Across pilot groups, self-service payment rate was generally comparable for

callers who heard redesigned and control messages. e redesigned messages appear to have had a positive

eect on the self-service payment rate for callers in Group who abandoned their calls. Among callers who

connect with a CSR, self-service payments are still a possible outcome. e IRS cannot process payments over

the phone, and therefore CSRs may guide callers interested in making a payment to do so through an IRS pay-

ment application.

18

OPA allows individuals and businesses with an outstanding balance in aggregate assessed tax, penalties, and interest, to request a payment plan. Individual

taxpayers are eligible to use OPA to full pay or set up a short-term plan if their outstanding balance is less than $100,000. To use OPA to set up an IA, the total

balance must be less than $50,000.

19

is analysis estimates taxpayer savings through OPA if the redesign message sequence were implemented on App 75. It assumes callers who provided their TIN

(i.e., callers in the analysis group) behave similar to callers who did not provide their TIN, but this may not be the case. Callers in the analysis group were not a

random subset of 68.7% of the population, but rather may include a self-selected subset choosing to provide their TIN. It is dicult to predict whether callers

who did not provide a TIN would react to the redesign messages similarly as the TIN callers and, if not, the rate with which they diered. Some proportion of

call records without TIN information may be a result of routing processes which limit the IRS’s ability to associate TIN information with call records, rather

than the taxpayer’s decision to provide a TIN (e.g., if calls do not pass-through TIN Entry, TIN information is not captured in the Integrated Customer Contact

Environment database).

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

TABLE 12. Self-Service Payment Rate by Group

Group Call Outcome Prototype Payment Rate Relative Uplift

Group 1

Connected

Control 13.91% -

Redesign 13.66% - 1.81%

Abandoned

Control 14.90% -

Redesign 15.13% + 1.55%

Group 2

Connected

Control 14.22% -

Redesign 14.30% + 0.56%

Abandoned

Control 13.84% -

Redesign 16.38% + 18.33%*

Group 3a Both

Control 6.68% -

Redesign 6.86% + 2.78%

*p-value < 0.05.

a

Outcomes for Group 3 callers were not broken out by connected versus abandoned because it would be unclear whether the action could be attributed to the an-

nouncement sequence or direction from a CSR if they both connected and abandoned their calls.

Improve Call Resource Allocation

In Calendar Year (CY) , more than . million phone calls reached App and .% connected with a

CSR. Monthly call characteristics showed the abandon rate for App callers generally uctuated between

% and %. e average abandon rate and ASA tend to be correlated, with longer wait times leading to

higher abandon rates.

e redesigned CVP announcement sequence was developed to nudge callers who could self-serve to

resolve their issues online, reducing wait times for callers who require CSR support or cannot self-serve. e

abandon rate measures the proportion of callers who abandon the call by hanging up aer the start of the an-

nouncement sequence. Table shows App callers who heard the redesigned messages were more likely to

abandon their call while in queue than callers who heard the control messages.

TABLE 13. Abandon Rate

Prototype Abandon Rate Relative Uplift

Control 44.76%

Redesign 46.70% + 4.33%***

***p-value < 0.001.

Table shows the abandon rate for each analysis group. Group callers who heard the redesigned mes-

sages saw close to a % increase in the abandon rate compared with callers who heard the control messages.

Group and Group callers who heard redesigned messages realized a nearly % increase in the abandon rate

compared with callers who heard the control messages. Group and Group results suggest redesigned mes-

sages increased the rate of callers abandoning while in queue relative to the control messages.

20

is analysis is restricted to taxpayers with an outstanding balance at the time of their call.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

TABLE 14. Abandon Rate by Group

Group Prototype Abandon Rate Relative Uplift

Group 1

Control 40.52%

Redesign 42.37% + 4.57%***

Group 2 Control 49.61%

Redesign 51.41% + 3.63%

Group 3

Control 50.93%

Redesign 52.76% + 3.59%***

***p-value < 0.001.

Table shows the ASA for all App callers as measured by average time in the call queue in minutes.

Among callers who connected with a CSR, redesign callers spent, on average, roughly three fewer minutes in

the call queue relative to callers who heard the control messages. Redesigned messages nudged callers able to

self-service to abandon their call at a higher rate than the control messages, which helped free up space in the

queue for callers with issues requiring CSR support.

TABLE 15. ASA—Connected Callers

Prototype ASA (mm:ss)

Control 87:22

Redesign 85:49 - 3:17***

***p-value < 0.001.

Table shows the ASA for connected callers in each analysis group. Group callers who heard redesigned

messages waited, on average, two minutes less in the queue than callers who heard the control messages.

Group callers who heard redesigned message spent nearly ve and a half minutes less, on average, in the

queue than callers who heard control messages. For Group callers, there was no signicant dierence in the

amount of time spent in the queue for callers who heard redesigned or control messages.

TABLE 16. ASA by Group—Connected Callers

Group Prototype ASA (mm:ss)

Group 1

Control 88:00

Redesign 85:56 –2:04***

Group 2

Control 89:56

Redesign 84:31 –5:27***

Group 3

Control 85:34

Redesign 85:48 + 0:14

***p-value < 0.001.

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

Redesigned Messages Reduce Queue Time for Callers Who Speak with a CSR. Callers who can resolve their

tax issues online and choose to abandon their call sooner can reduce resource utilization of IRS call-systems

and shorten the wait time for other callers to reach a CSR. To evaluate the redesigned messages’ ability to im-

prove call center resource allocation, the pilot tracked callers who abandoned prior to speaking with a CSR and

observed the actions taken aer the point of abandonment. In general, callers who heard at least one redesign

message and abandoned their call, did so earlier in the message sequence than callers who heard the control

messages. By the end of the ve-message announcement sequence, a larger proportion of redesign callers had

abandoned (e.g., roughly % for Group callers) the queue compared with control callers (e.g., roughly %

for Group callers). Further, redesign callers generally spent less time waiting in queue compared with callers

who heard control messages. Among callers who abandoned, callers who heard redesigned messages spent, on

average, to fewer minutes waiting in the call queue compared to callers who heard the control messages.

Callers in Groups and who heard the redesigned messages and remained on the line to connect with a CSR

also experienced shorter wait times–roughly to fewer minutes than callers who heard the control messages.

Recommendations for Future Research

Deeper Understanding of Taxpayer Reasons for Calling Can Inform Improvements to

Message Design

Understanding taxpayers’ reasons for calling the IRS may inform further improvements to voice messages.

Insight into taxpayers’ possible motivations for choosing to wait in the queue to speak with a CSR can help

identify how queue messages may be rened to assist taxpayers with specic issues by informing them of self-

service resources most relevant to their circumstance or oer guidance for how to prepare information for

speaking with a CSR while waiting on hold. We analyzed taxpayer journeys over the days prior to their pilot

call, and using event groups (e.g., notices issued, online authentication events, account transactions), identi-

ed specic events and actions within each group to calculate common pathways leading to a call.

Evaluating notices issued to taxpayers within days of their pilot call suggests the type of notice or num-

ber of notices issued could inuence taxpayers’ willingness to channel shi. Table summarizes channel shi

rates for callers sent one of the notices issued most frequently to taxpayers prior to their pilot call. Channel

shi rates for pilot calls attributable to the CP, the rst notication of a balance due, were highest for both

redesigned and control messages. Among those notice types issued most frequently to pilot taxpayers, the

CP, which noties taxpayers their refund has been applied to pay an outstanding tax debt, saw lower chan-

nel shi rates for both control and redesigned messages. Taxpayers may opt to remain in the queue to connect

with a CSR in response to notices or other circumstances which may not by addressed specically by either

the control or redesigned messages. Taxpayers who were sent multiple notices within days prior to calling

may prefer to wait to speak with a CSR –in particular, in instances where the notices issued appear to present

conicting information (e.g., notices with dierent balance due amounts).

21

CY 2019 data retrieved from Enterprise Telephone Data Aspect Application Activity Report.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

TABLE 17. Channel Shift Rate for Most Commonly Issued Notices Prior to Pilot Call

Notice Type Prototype Channel Shift Rate

CP504, Final/3rd Balance Due

Control 14.8%

Redesign 15.6%

CP14, Balance Due

Control 16.5%

Redesign 20.1%

CP90, Final Notice – Levy, Right to CDP Hearing

Control 13.8%

Redesign 15.5%

LT11, Final Notice – Notice of Intent to Levy

Control 13.1%

Redesign 16.7%

CP49 – Refund Applied to Other Tax Liability

Control 12.5%

Redesign 14.1%

Multiple Notices

Control 14.1%

Redesign 15.5%

Over ,, or % of pilot taxpayers were sent at least one notice in the days prior to their pilot call.

e CP was the most common notice issued to pilot taxpayers. More than , CP notices resulted

in a pilot phone call. Some taxpayers were issued multiple notices in succession; for example, pilot taxpayers

issued the CP had over other distinct notice types issued, in addition to a CP within days prior

to call. About , pilot taxpayers issued a CP were sent a CP notice prior to the CP, both within the

same -day window prior to call. On average these CPs were issued just days aer the CP. e stan-

dard interval between Balance Due notices is at typically days, this scenario may have motivated additional

taxpayers to call with concerns or seeking clarication.

TABLE 18. Call Outcomes for Pilot Callers Issued More than 1 Notice 30 Days

Prior to Call

# Notices Issued Prototype

Call Outcome

Connected Abandoned

Two Notices

Control 51.8% 47.0%

Redesign 49.4% 48.7%

Three Notices

Control 55.6% 43.6%

Redesign 54.2% 44.2%

Four or More Notices

Control 58.0% 40.2%

Redesign 52.8% 45.1%

Over , pilot taxpayers were issued more than one notice within the days prior to calling the IRS

and , of these taxpayers received multiple notices within seven days of making a phone call. Taxpayers

may be issued more than one notice of the same type if the notice presents information specic to a given tax

year. For example, over , taxpayers were sent multiple CPC notices (Annual Reminder of Balance Due)

if they had outstanding tax debt for more than one prior tax year. Taxpayers who were issued multiple notices

prior to calling appeared to show less tendency to abandon. Regardless of whether callers heard redesigned or

control messages, the connected call rate increased by .–. percentage points for callers issued three notices

compared with callers issued two notices in the days prior. While concern or confusion stemming from

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

conicting information across notices issued in close proximity may not be feasible to address via information

in a voice prompt, redesigning queue messages to encourage callers who can self-serve to use online services

can reduce wait time for callers requiring CSR assistance. Further exploration of the eect of notices issued in

close proximity on phone calls may help IRS to identify changes to underlying business processes which could

improve taxpayer experience.

Call outcomes following specic events suggest taxpayers may be more inclined to stay in the queue if cur-

rent messages do not adequately address the specic issue motivating the call. Table summarizes events im-

mediately preceding pilot calls eectively acknowledged by the redesigned messages which experienced high-

er abandon rates. Calls attributable to notices requesting payment, such as Balance Due or Annual Reminder

notices, or delivery of Collection Due Process notice (determined by return receipt) saw higher abandon rates

among callers who heard the redesigned messages. Redesigned messages highlighted the availability and ben-

et of self-service payment tools relative to continuing to wait on hold to speak with a CSR.

TABLE

a

(Higher Abandon Rates with

Redesign Messages)

Description Prototype

Call Outcome

Connected Abandoned

CP501/CP504, Subsequent Balance Due

Control 58.7% 40.5%

Redesign 54.6% 44.1%

CP14 – Balance Due

Control 62.7% 36.4%

Redesign 50.3% 48.5%

CP90/CP91 (Notice of Intent to Levy, Right

to CDP Hearing)

Control 42.0% 53.9%

Redesign 37.1% 57.6%

Additional Tax Assessment

Control 61.3% 38.1%

Redesign 56.5% 42.1%

Payment

Control 56.2% 42.2%

Redesign 53.4% 44.9%

Certied Mail Return Receipt Signed

Control 53.5% 44.1%

Redesign 47.8% 50.2%

CP71C/LT39, Annual Balance Due

Reminder

Control 56.0% 41.7%

Redesign 51.0% 47.6%

a

Table 20 shows outcomes for Group 1 callers only.

Table summarizes events immediately preceding pilot calls where the abandon rate is comparable for

callers who heard the control and redesigned messages. e circumstances surrounding some of these events

may not be acknowledged specically by either the existing or redesigned messages. For example, taxpayers

who accessed IRS online tools (e.g., OPA) and proceeded to call the IRS, remained on hold to connect with a

CSR more oen than they abandoned their call in the queue. Most taxpayers called within ve days aer going

online. Taxpayers who attempt to self-serve using online tools but are unable to resolve their issue may call the

IRS and wait in the queue to connect with a CSR for assistance. Further exploration of challenges encountered

by taxpayers attempting to use online tools could help identify opportunities to improve user experience and

help users in resolving issues on the rst attempt.

Some circumstances or events preceding a phone call may be best addressed by speaking with a CSR. For

example, issues related to changes to the Advanced Child Credit for Tax Year as part of the American

Rescue Plan Act or a Bureau of Fiscal Service (BFS) Levy implemented with the Federal Payment Levy Program

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

may require CSR guidance to resolve. ese circumstances may not be practical to address via call queue voice

messages due to limited potential for self-service resolution.

TABLE

a

–Comparable Abandon Rates for

Redesigned and Control Messages

Description Prototype

Call Outcome

Connected Abandoned

Advanced Child Credit

Control 57.6% 42.0%

Redesign 59.2% 39.1%

IRS Online Service Access

(Get/View Transcript)

Control 58.5% 40.2%

Redesign 58.5% 40.0%

OLA Access

Control 66.1% 32.7%

Redesign 66.0% 32.5%

OPA Access

Control 68.9% 30.3%

Redesign 66.8% 32.5%

BFS Levy Program

Control 58.2% 40.4%

Redesign 56.6% 41.7%

a

Table 21 shows outcomes for Group 1 callers only.

Future research may explore analyzing call transcripts and pursuing opportunities to collect information

from CSRs about the nature of handled calls. Research in these areas could help provide deeper understanding

of taxpayer motivations for calling the IRS and common issues taxpayers may be facing when they choose to

stay and connect with a CSR. Future research eorts may also explore the construction of taxpayer proles

via event clusters and applications of attribution modeling, ese proles could determine the events driving

calls and demand for CSR support, which can inform strategies for further improving taxpayer interactions

with the IRS.

Level of Service Measures May Understate the Caller Experience

e IRS uses LOS to evaluate its ability to answer taxpayer questions and assist taxpayers in meeting their tax

obligations.

LOS is a budget-level measure required by the Congressional Budget Justication and Annual

Performance Report and Plan. It is dened as the success rate of taxpayers calling the Accounts Management

(AM) oce of the IRS in connecting with a CSR. While inbound calls to AM applications inform the LOS

estimate and calls to ACS applications may not directly, consideration should be given to the potential eect of

applying lessons learned through redesigning App messages to improve the existing AM App messages.

e LOS formula is shown below:

=

(

+

)

( + + + + )

LOS alone may be limited in its ability to evaluate taxpayer access to assistance from the IRS. LOS mea-

sures the proportion of calls answered, but may not fully capture other aspects of the customer experience. For

example, a taxpayer may connect with a CSR, but LOS does not capture whether the taxpayer resolved their

22

is analysis did not consider or evaluate demographic information (e.g., age, income level) which may have aected a callers’ ability to channel shi.

23

National Taxpayer Advocate. (2018). Measuring the Taxpayer Experience—e IRS Level of Service Measure Fails to Adequately Show the Experience of Taxpayers

Seeking Assistance Over the Phone. NTA Blog.

24

App 10 is an AM application similar to ACS App 75. Callers routed to App 10 are individual taxpayers with a balance due.

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

issue during the call or if additional contact with the IRS was necessary. As the Taxpayer Advocate Service

(TAS) notes, “[a]chieving a high LOS does not mean much if the IRS is unable to answer taxpayers’ questions

over the phone or guide them to an appropriate resolution of their issues.” Further, an additional aspect of cus-

tomer experience not captured by LOS is wait time. TAS found time spent waiting on the phone was a primary

factor in customers’ satisfaction with telephone service.

Channel shi measures the rate at which callers abandon the call queue and shi to use online self-service

tools to resolve their tax issue. According to the LOS formula shown above, an increase in the number of chan-

nel shi callers would increase the number of abandoned calls in the denominator, resulting in a lower LOS.

In this sense, LOS would not capture the benet to taxpayers who choose to abandon the call queue to use IRS

online tools to self-serve.

Using a combination of metrics may oer a more comprehensive assessment of level of LOS provided

to taxpayers and eort required to resolve taxpayer issues. Additional metrics which could be considered to

evaluate service include:

ASA quanties the amount of time callers spend waiting to connect with a CSR. As shown by CVP pilot

results, ASA was shorter for callers in the redesign group due primarily to the higher rate of callers deciding

to channel shi and abandon their calls to use self-service tools. ose who were able to self-serve abandoned

and did so online, reducing the average time spent in queue for callers who were either unable to or preferred

to speak with a CSR. As mentioned in the Taxpayer Advocate Service Annual Report to Congress, time

spent waiting to connect with a CSR is a primary factor in satisfaction with telephone service. Strategies which

help to reduce wait times can improve taxpayers’ phone experience and should contribute positively to the

IRS’s service performance measure.

Level of Access (LOA) measures the proportion of calls received during business hours which were con-

nected with a CSR. In response to observed LOS limitations, Treasury Inspector General for Tax Administration

(TIGTA) and TAS proposed alternative success metrics. TIGTA noted the Social Security Administration

(SSA) and tax agencies in several states use LOA and describe it as a more accurate measure of callers who

receive assistance from IRS. IRS agreed to add LOA as a supplementary metric for evaluating phone line per-

formance. e formula for LOA is shown below.

=

(

+

)

(

+ + + +

)

−

LOA is similar to LOS but excludes calls made to IRS outside of business hours () from the denominator.

LOA does not capture taxpayer satisfaction from self-servicing online. Like LOS, an increase in abandon rates

due to callers channel shiing would likely have a negative eect on this customer service measure.

First Contact Resolution (FCR) measures the proportion of taxpayer engagements successfully resolv-

ing a taxpayer issue and resulting in no follow-up high-touch engagements, e.g., phone calls or Taxpayer

Assistance Center (TAC) visits. FCR represents the rate of calls resolved on the rst attempt without the need

for the customer to be transferred or called back. FCR was strongly tied to customer satisfaction in a

survey of customer satisfaction on the AM line.

e formula for FCR is shown below.

=

# ℎ

FCR quanties the proportion of callers who contact the IRS for assistance and do not contact the IRS

again following their initial contact. Evaluating FCR for inbound calls assesses whether callers who connect

with a CSR successfully resolve their issues on the rst attempt. FCR, as dened above, does not consider tax-

payer interaction with IRS through other channels, such as TAC visits or online engagement.

25

National Taxpayer Advocate. (2022). Annual Report to Congress. National Taxpayer Advocate. 36-37.

26

National Taxpayer Advocate. (2021). Annual Report to Congress. National Taxpayer Advocate. 66-80.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

e IRS Customer Experience Visualization Tool provides performance metrics, such as the First Touch

Resolution (FTR). FTR is similar to FCR but includes TAC visits in the equation. FTR quanties the propor-

tion of taxpayers who call the IRS or visit a TAC and do not call or visit a TAC again in the days aer their

engagement. e equation for FTR is shown below.

=

# ℎ

#

Like FCR, FTR does not consider taxpayers who abandon phone calls to use self-service tools and do

not follow up with IRS in the subsequent days. FTR or FCR, as currently dened, would not be aected

by improvements in the channel shi rate achievable through eorts such as the CVP message redesign pilot.

FTR may be a useful indicator to monitor the ecacy of service provided to taxpayers who pursue high-touch

engagements with IRS, such as phone calls or TAC visits.

Taxpayer Eort (TE) applies weights to taxpayer interactions (i.e., online resource access, phone calls,

TAC visits, TAS engagements, and inbound correspondence), to estimate TE exerted in issue resolution. To

capture taxpayer interactions in a digital age, IRS must leverage available data to track taxpayer interactions via

online resources. e equation below illustrates how weights are applied to IRS interactions to estimate TE .

= (1 ∗ ) + (2 ∗ ) + (3 ∗ ) + (4 ∗ ) + (4 ∗ )

Table shows estimated TE for pilot callers in the days following their rst pilot call. Callers in Groups

and who heard redesigned messages showed slightly lower estimated TE compared with callers who heard

control messages. Callers in the redesign group abandoned calls in favor of self-service channels a higher rate

than callers in the control group, likely contributing to the lower eort estimated.

TABLE 21. Estimated TE within 30 Days of First Call

Group Prototype Average TE Relative Uplift

Group 1

Control 3.35

Redesign 3.27 -2.34%**

Group 2

Control 2.19

Redesign 2.19 -0.10%

Group 3

Control 3.85

Redesign 3.67 -4.62%**

**p-value < 0.01.

Eort to Serve (ETS) measures the eort required by IRS to resolve taxpayer issues. is metric applies

weights to inbound mail, inbound phone calls connected with a CSR, and TAC visits to estimate level of eort.

e formula for ETS is shown below.

= (17 ∗ ) + (41 ∗ ) + (67 ∗ )

Table shows the estimated ETS applied to CVP calls in the days following the rst pilot call. e aver-

age ETS for callers in Groups and who heard redesigned messages appears slightly lower than the estimated

average ETS for callers who heard the control messages. Redesign callers were more likely to abandon calls

27

IRS, W&I, Accounts Management Toll-Free Customer Satisfaction Survey FY 2020 Semiannual Report 8-9 (July 30, 2020). 37% of respondents reported “other”

to improve their experience and 35% said that resolving their issue would improve their experience.

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

and self-serve online, likely contributing to the lesser average ETS compared with callers who heard control

messages.

Table shows the estimated ETS applied to CVP calls in the days following the rst pilot call. e aver-

age ETS for callers in Groups and who heard redesigned messages appears slightly lower than the estimated

average ETS for callers who heard the control messages. Redesign callers were more likely to abandon calls

and self-serve online, likely contributing to the lesser average ETS compared with callers who heard control

messages.

TABLE 22. Estimated ETS Within 30 Days of First Call

Group Prototype Average ETS Relative Uplift

Group 1

Control 30.8

Redesign 29.7 -3.42%***

Group 2

Control 17.9

Redesign 17.3 -3.44%

Group 3

Control 38.3

Redesign 36.3 -5.26%***

***p-value < 0.001.

Measures such as ASA, LOA, FCR, TE, and ETS provide additional insight into IRS service performance

and eort required to resolve taxpayer issues. As discussed in this paper, abandoned calls may not always

signal shortcomings in service (i.e., callers who abandon the call queue to shi to use self-service tools) and

connected call rates may not fully reect taxpayers’ phone experience (e.g., amount of wait time or number of

touches required for resolution). Choosing to abandon the call queue and shi to self-service tools can save

taxpayers time otherwise spent waiting in queue and in some cases, can save money due to lower user fees as-

sociated with self-service platforms like OPA. Improving awareness of digital resources and self-service tools

relevant to specic situations enables taxpayers to elect the option best suited to their preferences and needs

in resolving outstanding tax issues. e CVP pilot showed the potential benet of incorporating behavioral

nudges to enhance call queue messages and increase use of web-based channels for specic needs, helping re-

duce demand on phones and reduce wait time for taxpayers who need to speak with a CSR. Looking forward,

using a combination of service indicator measures can oer the IRS a more comprehensive view of the level

and quality of service provided to taxpayers. Further, a comprehensive set of service metrics could help capture

the impact of IRS eorts to apply behavioral research to improve taxpayer experience.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

Appendix

TABLE 23. Acronym List

Acronym

ACS Automated Collection System

AMS Account Management Services

ARDI Account Receivable Dollar Inventory

ASA Average Speed to Answer

ATTS Automated Time Tracking System

BMF Business Master File

BOD Business Operating Division

CDP Collection Due Process

CDW Compliance Data Warehouse

CNC Currently Not Collectable

CSR Customer Service Representative

CVP Customer Voice Portal

DNIS Dialed Number Identication Service

EIN Employer Identication Number

ETS Eort to Serve

FCR First Contact Resolution

FTR First Touch Resolution

HMRC Her Majesty’s Revenue and Customs

ICCE Integrated Customer Contact Environment

ICM Indirect Channel Management

IMF Individual Master File

IRS Internal Revenue Service

IRTF Individual Returns Transaction File

IVR Interactive Voice Response

OIC Oer in Compromise

OLA Online Account

OLS IRS Oce of Online Services

OPA Online Payment Application

PSA Public Service Announcement

RAAS Research, Applied Analytics, and Statistics

RCT Randomized Control Trial

SSA Social Security Administration

TAC Taxpayer Assistance Center

TBRM Topic Based Routing Menu

TDA Taxpayer Delinquent Account

TE Taxpayer Eort

TERC Total Enforcement Revenue Collected

TIGTA Treasury Inspector General for Tax Administration

TIN Taxpayer Identication Number

TRIS Telephone Routing Interactive System

TTS Text to Speech

UCCE Unied Contact Center Enterprise

URL Uniform Resource Locator

UWR Unied Work Request

Looking Beyond Level of Service: Using Behavioral Insights To Improve Taxpayer Experience

To provide clear guidance and nudge taxpayers to use online resources where possible, the IRS rede-

signed the ACS App call queue announcements. Table describes Behavioral Insights techniques from the

HMRC study and prior notice redesigns used in redesigning ACS App announcements.

TABLE 24. Techniques Used in ACS App 75 Announcement Redesigns

Audience Awareness

• Clearly dene the target caller for each announcement and only provide relevant information.

Focus on addressing common inquires and a single high-level topic.

• Consider callers’ perspective, prior journey, and potential frustration, including the inertia and

sunk cost associated with reaching the queue.

Clarity and Simplicity

• Simplify language using plain, unambiguous English and an active voice.

• Provide no more than seven pieces of information and make them count.

• Give clear, brief next steps with precise instructions.

• Prime people for lists by hinting at their impending presentation.

• Harmonize language and keyword usage with the proposed self-service website.

Behavioral Nudges

• Give callers an incentive (e.g., loss aversion) to go online. Make incentive announcements

truthful and helpful, not promotional or assertive.

• Provide reassurance the self-service tool provides achievable benets, including averting

losses.

• Emphasize and positively frame the self-service’s immediacy, convenience, simplicity,

completeness, and security.

• Appeal to social norms with a focus on descriptive norms and the minority frame.

• Encourage callers who can self-serve to go online while they remain on hold for a CSR.

Attention Management

• Limit announcement length to 30 seconds with sequenced announcements separated by 30

second intervals and a brief pause prior to the start of each announcement.

• Repeat the core announcement and action (i.e., URL) at the end of the announcement while

avoiding verbatim repetition.

• Craft announcements in a conversational style and consider beginning with a question.

• Do not repeat the same announcement on the same call.

• Employ a clear, friendly, upbeat, and slowly paced human voice.

Millard, Faruqi, Flateman, Mirabito, Smolenski, Stavrianos, and Szczerbinski

Redesigned and Control Message Announcements

TABLE 25. Redesigned App 75 Messages

Announcement Prototype Announcement Language

#8548 Are you calling to make a one-time payment? We cannot process payments over the phone. Visit

irs.gov/payments to securely make a payment from your bank account, credit card, or debit card.

Explore payment plan options if you cannot pay your balance in full. Again, visit irs.gov/payments.

#8549 Are you calling to set up a payment plan? The fee to set up a plan over the phone can be as much

as $225, compared to just $31 if you use the Online Payment Agreement tool at irs.gov/OPA. If

owe less than $50,000 you can save time and money by visiting irs.gov/OPA to apply for a payment

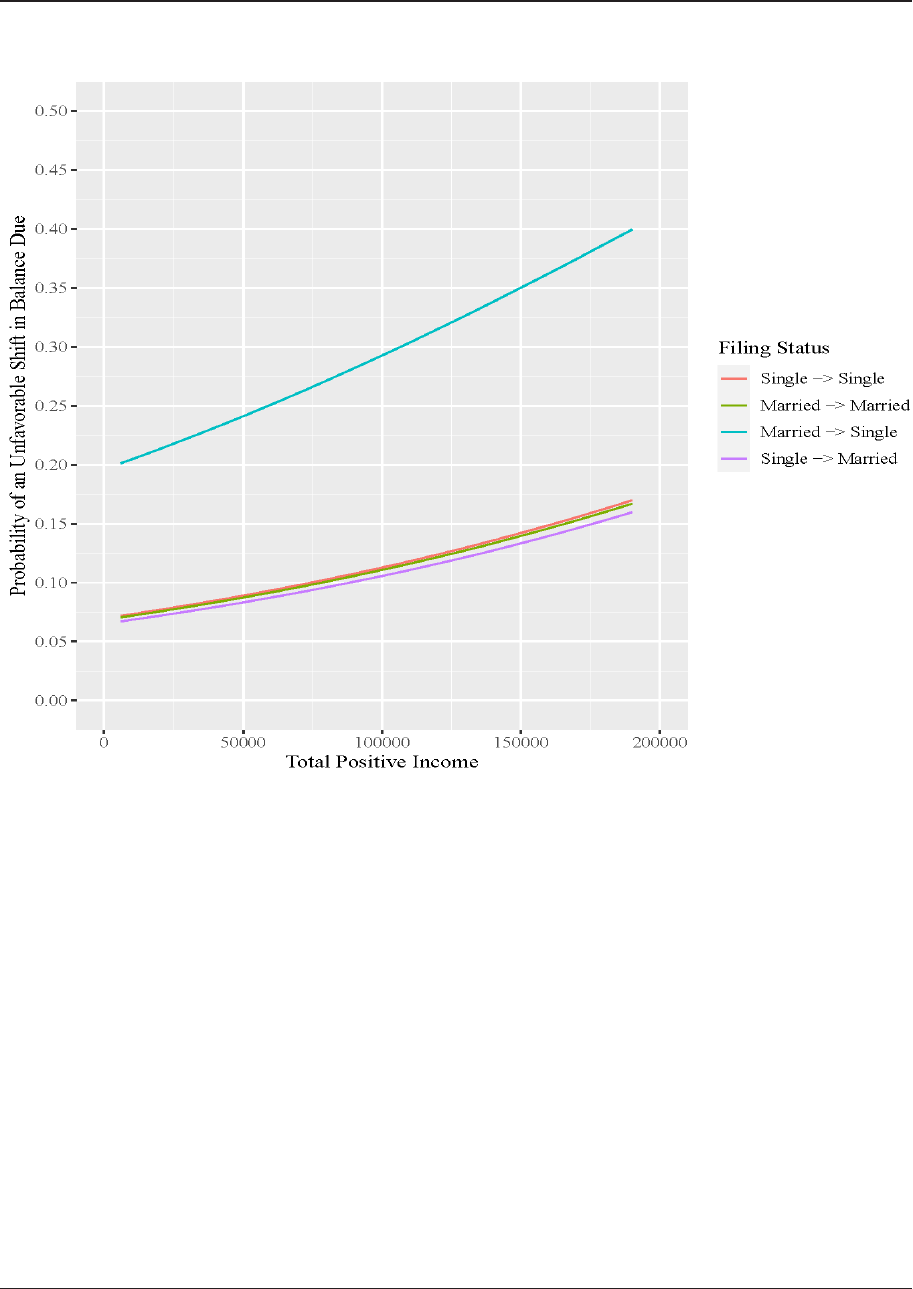

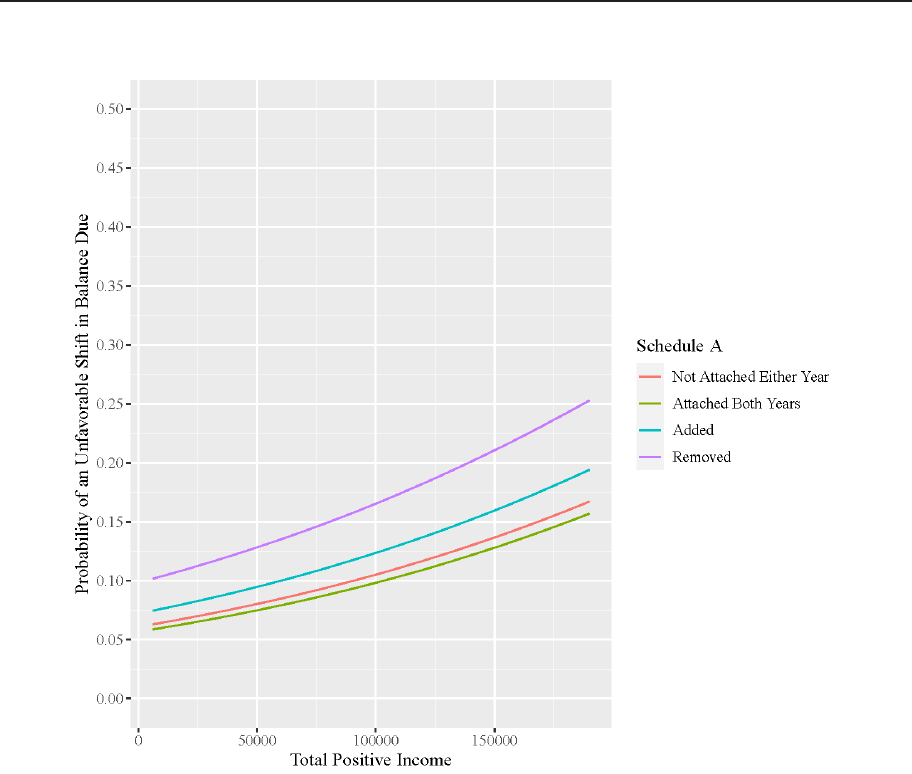

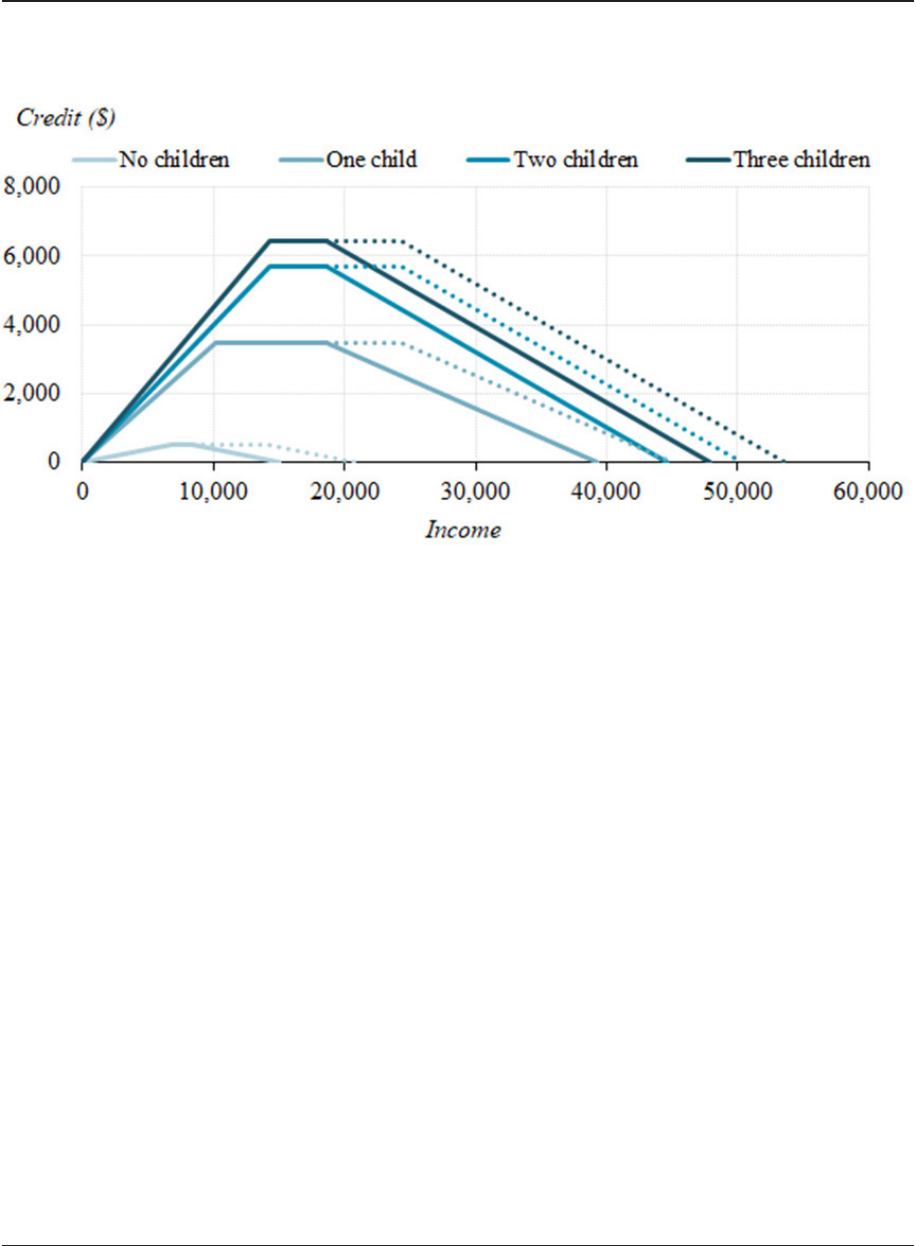

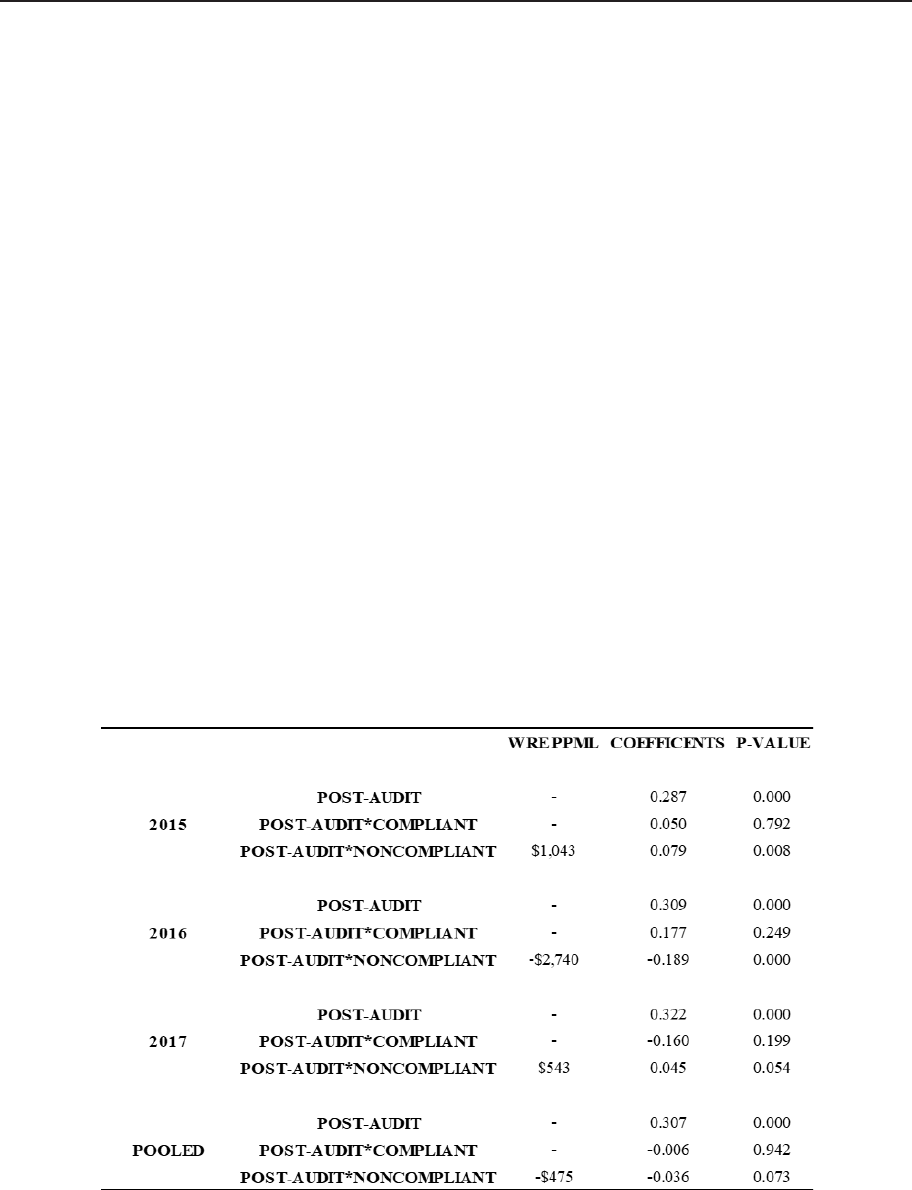

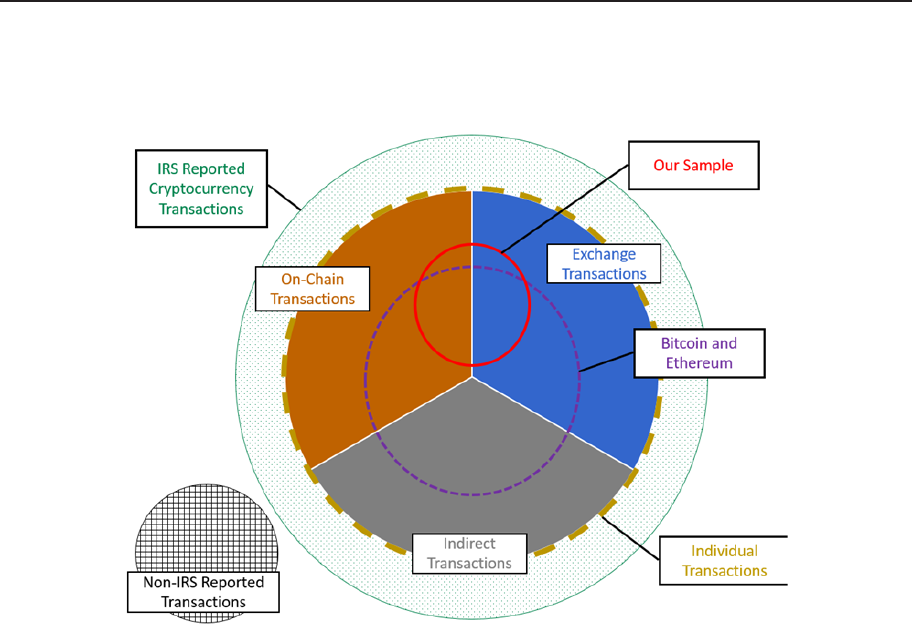

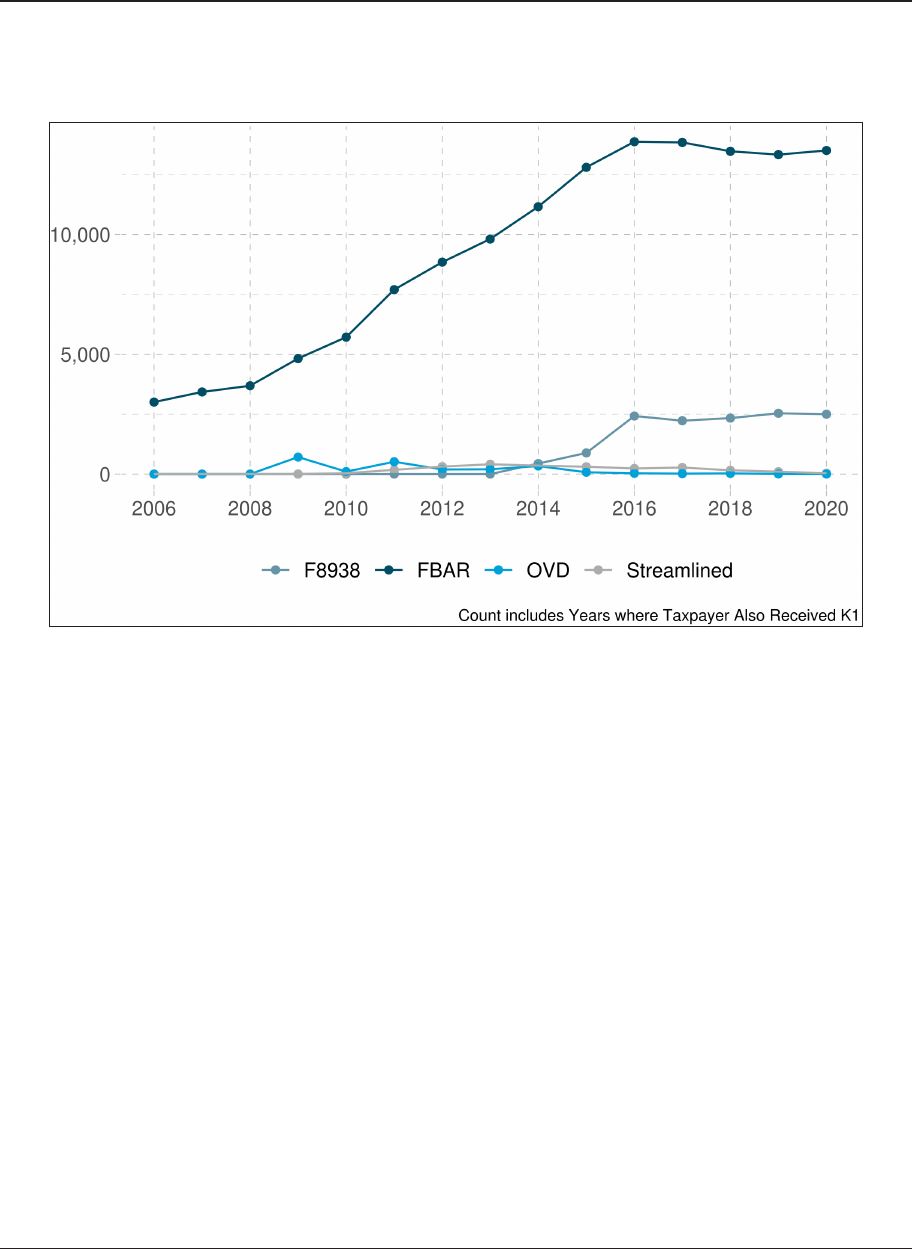

plan. You can choose from a variety of plan options and get instant conrmation if you qualify. Are