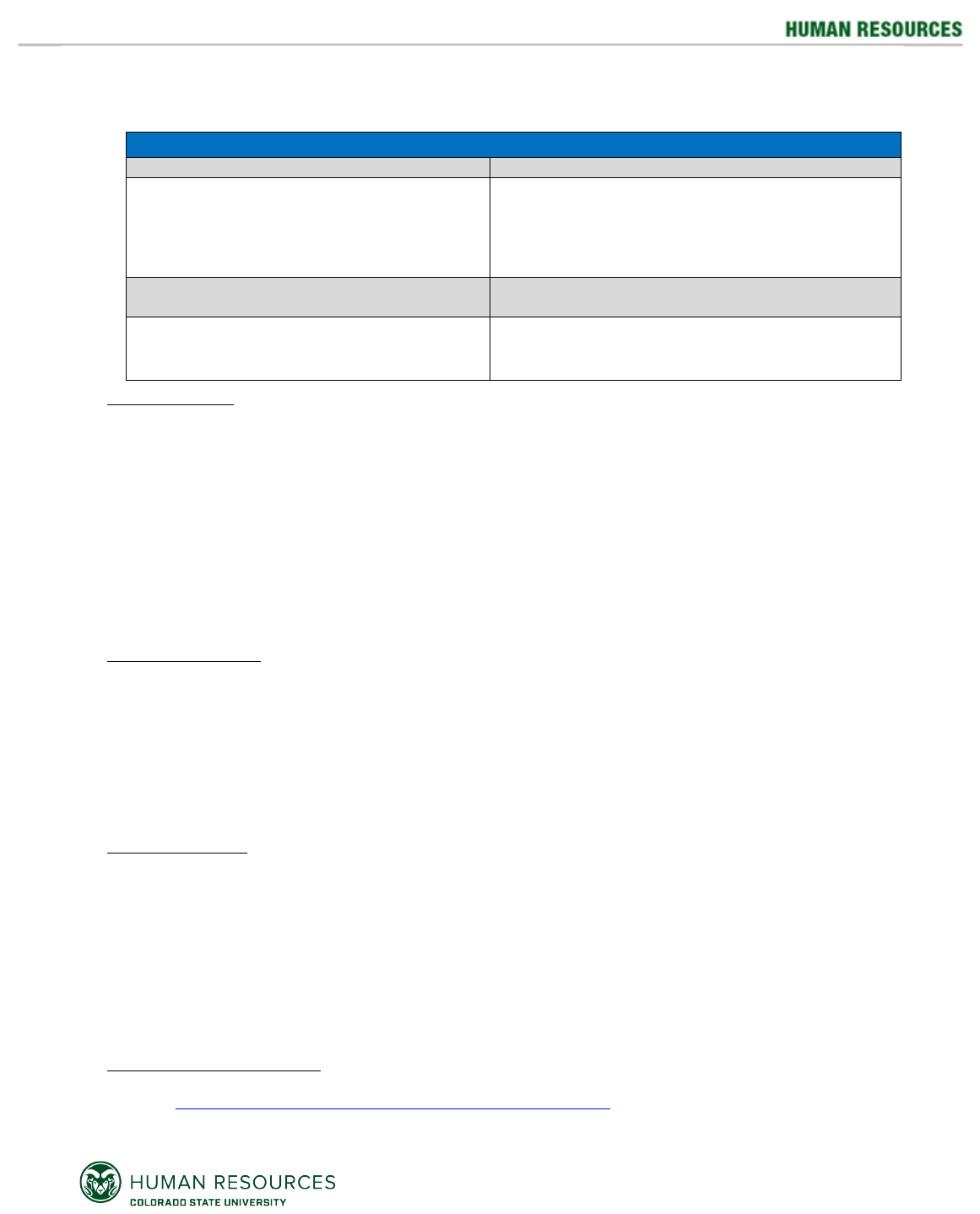

Page | 1 Table of Contents

SECTION 1: GENERAL PROVISIONS

Section 1, Page 1

Purpose ....................................................................................................................... 1-1

Authority .................................................................................................................... 1-1

Responsibilities ......................................................................................................... 1-1

Department Head .................................................................................................................................. 1-1

Office of Equal Opportunity and Diversity ........................................................................................... 1-1

Human Resources Department ............................................................................................................. 1-2

Payroll Unit of the Human Resources Department ............................................................................... 1-2

Student Employment Services .............................................................................................................. 1-3

Office of Budgets and Institutional Analysis .......................................................................................... 1-3

Risk Management and Insurance ......................................................................................................... 1-3

Classification of Employees .................................................................................... 1-3

Academic Faculty and Administrative Professionals ........................................................................... 1-3

State Classified Personnel .................................................................................................................. 1-3

Non-Student Hourly Employees ............................................................................................................ 1-3

Student Employees ................................................................................................................................ 1-3

Graduate Assistants, Graduate Research Assistant-PreDoc, Veterinary Residents ........................ 1-4

Post Doctoral Fellows, Veterinary Interns and Clinical Psychology Interns ........................................ 1-4

Volunteer Services .................................................................................................... 1-4

Agricultural Labor Furnished by Crew Leader ........................................................ 1-4

Independent Contractors ......................................................................................... 1-5

General ................................................................................................................................................ 1-5

Definition of an Independent Contractor ............................................................................................... 1-5

Performing Artists, Athletic Officials, and Consultants ........................................................................ 1-5

Nondiscrimination Policy ......................................................................................... 1-5

Discrimination Complaints ....................................................................................... 1-6

Americans with Disabilities Act (ADA) Employment Accommodation

Requests .................................................................................................................... 1-6

Employment of Minors ............................................................................................. 1-6

Immigration Reform and Control Act (IRCA) .......................................................... 1-6

Social Security Protection Act .................................................................................. 1-7

Work Provisions and Definitions ............................................................................. 1-8

Established Work Week .................................................................................................................... 1-8

Hours Worked ................................................................................................................................... 1-8

Flexible Work Arrangements ............................................................................................................... 1-8

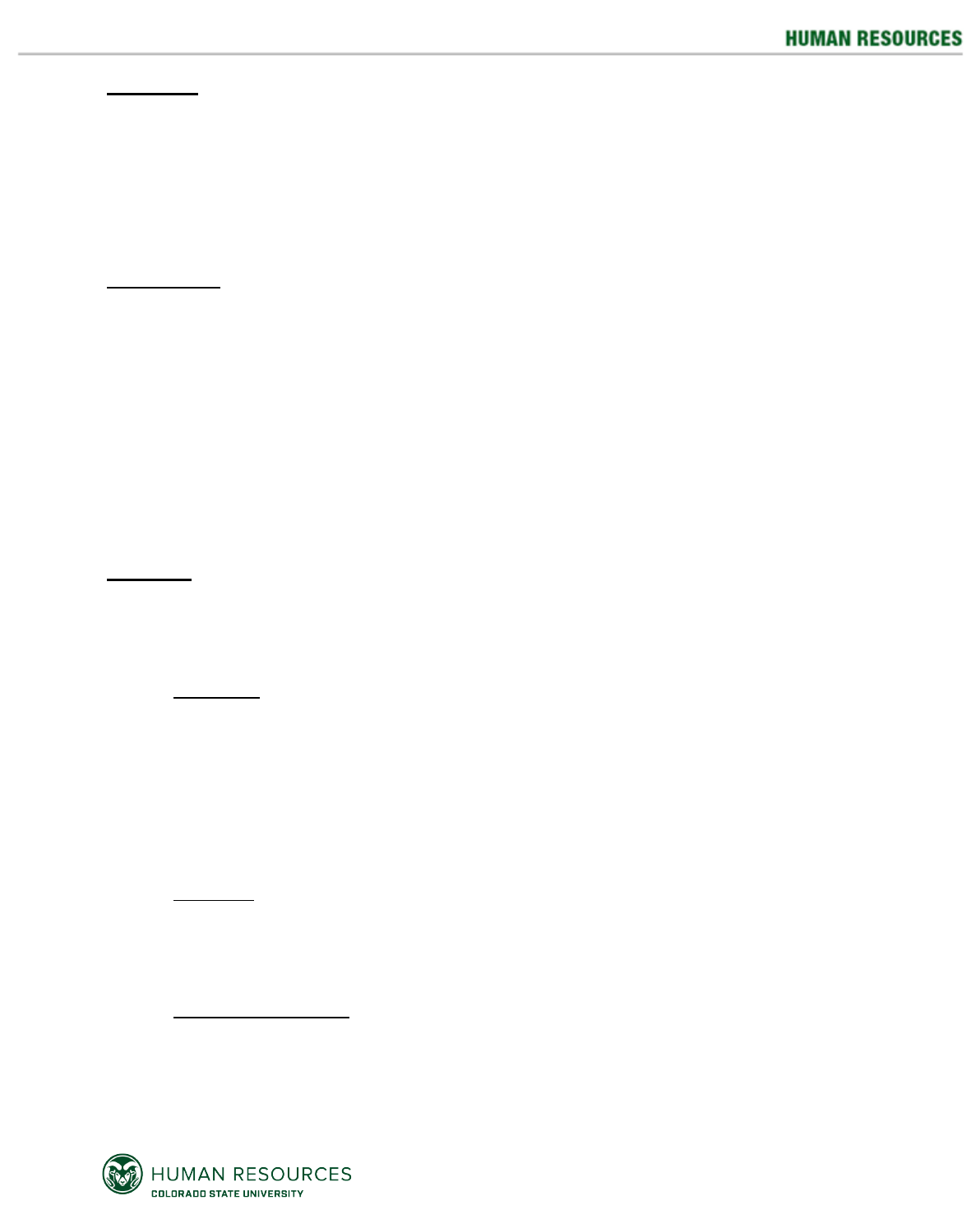

Page | 2 Table of Contents

SECTION 1: GENERAL PROVISIONS (continued)

................................................................................................................................. Section 1, Page 10

Overtime .................................................................................................................. 1-11

Overtime Definition ...................................................................................................................... 1-10

Overtime Use .............................................................................................................................. 1-10

Time off .......................................................................................................................................... 1-10

Overtime Eligibility ....................................................................................................................... 1-10

Travel Time and Overtime ........................................................................................................... 1-10

On-Call Status ............................................................................................................................. 1-11

Sleep-in-Time .............................................................................................................................. 1-11

Weekends and Periods of Paid Leave ......................................................................................... 1-11

Casual, Occasional or Sporadic Employment .............................................................................. 1-11

Accrual and Recording of Overtime ............................................................................................ 1-11

Charging Overtime When Working in Two or More Positions .................................................... 1-11

Payment of Overtime .................................................................................................................. 1-11

Compensatory Time .................................................................................................................... 1-12

When Separated from University Service ................................................................................... 1-12

Time Off for Exempt Employees ........................................................................... 1-12

Employee Privileges and Benefits ........................................................................ 1-12

CSU Benefits Plan (Cost Share) ................................................................................................. 1-12

Academic Faculty on regular, special, or temporary appointments ............................................. 1-12

Administrative Professionals on regular, special or temporary appointments ............................ 1-12

Academic Faculty and Administrative Professionals on temporary appointments ..................... 1-12

Post doctoral Fellows, Veterinary Interns and Clinical Psychology Interns ................................ 1-13

Federal Employees ....................................................................................................................... 1-13

State Classified and State Classified Hourly Employees ............................................................ 1-13

Graduate Assistants, Graduate Research Assistant-Pre-Doc ................................................... 1-13

Non-Student Hourly Employees ................................................................................................... 1-13

Student Hourly and Work Study Students .................................................................................. 1-13

University Study Privilege .......................................................................................................... 1-14

Eligible Courses .......................................................................................................................... 1-15

Ineligible Courses ....................................................................................................................... 1-15

Reciprocal Study Privilege ......................................................................................................... 1-15

Retirement Plans .......................................................................................................................... 1-16

Public Employees Retirement Association (PERA) ..................................................................... 1-16

Defined Contribution Plan (DCP) for Retirement ......................................................................... 1-16

Student Employees Retirement Plan (SERP) ............................................................................ 1-17

Tuition Scholarship Program for Spouses, Domestic Partners, and Children .......................... 1-17

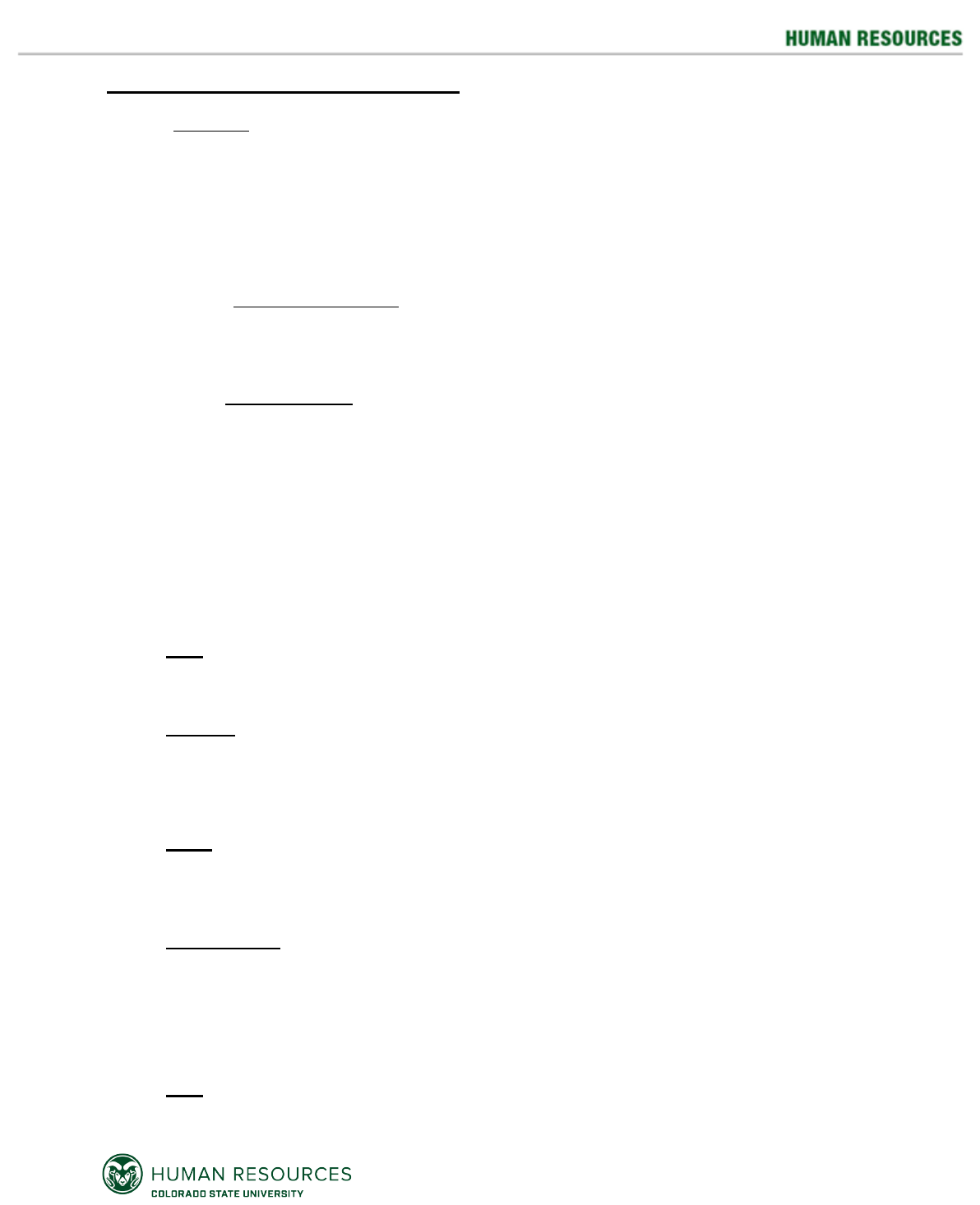

Page | 3 Table of Contents

f

SECTION 1: GENERAL PROVISIONS (continued)

Section 1, Page 22

University Retirement Policy ..................................................................................................... 1-18

Continuation of Medical Insurance under COBRA ................................................................... 1-18

Personnel-Budget-Payroll System ................................................................... 1-19

Form Deadlines ......................................................................................................................... 1-19

General Payroll Information ............................................................................. 1-19

Payroll Documents .................................................................................................................. 1-19

Pay and Pay Periods .............................................................................................................. 1-19

Tax Withholding ...................................................................................................................... 1-20

Extended Sick Leave ................................................................................................................ 1-20

Terminal Pay ........................................................................................................................... 1-20

Time Limitations for Terminal Pay .......................................................................................... 1-20

Taxes on Terminal Pay ........................................................................................................... 1-20

Moving Expense Reimbursements ......................................................................................... 1-21

Advances ................................................................................................................................... 1-21

Overseas Pay ......................................................................................................................... 1-21

Pay Advice .............................................................................................................................. 1-21

Payroll Deductions ............................................................................................ 1-21

Overpayments and Underpayments of Salaries and Wages and Other

Amounts ............................................................................................................... 1-22

Recovery of Overpayments .................................................................................................... 1-22

Underpayment of Salaries and Wages ................................................................................. 1-22

FICA Medicare Tax ............................................................................................ 1-22

Workers’ Compensation ................................................................................... 1-23

Unemployment Insurance ................................................................................. 1-23

Social Security Number .................................................................................... 1-23

Name Change ..................................................................................................... 1-24

Family and Medical Leave Act (FMLA) ............................................................ 1-24

Inclement Weather Policy ................................................................................. 1-25

Records Policy ................................................................................................. 1-26

Outside Employment ......................................................................................... 1-26

Policy on Rights and Responsibilities Related to Creative Works ................ 1-26

Oath of Allegiance .............................................................................................. 1-26

Code of Ethical Behavior and Conflict of Interest Statements ...................... 1-26

Political Activities ............................................................................................... 1-26

Page | 4 Table of Contents

SECTION 1: GENERAL PROVISIONS (continued)

Section 1, Page 29

CSU Smoking, Vaping and Tobacco Policy…………………………………………………….1-27

Notification Procedure for Death of a Current Employee, Retiree, or Former

Employee ............................................................................................................ 1-27

Employee Liability ............................................................................................. 1-27

SECTION 2: ACADEMIC FACULTY AND ADMINISTRATIVE PROFESSIONALS

Types of Appointments ........................................................................................ 2-1

Academic Faculty ................................................................................................ 2-1

Regular Full-Time Appointments .............................................................................................. 2-1

Regular Part-Time Appointments ............................................................................................. 2-1

Special Appointments ................................................................................................................... 2-2

Temporary Appointments ......................................................................................................... 2-2

Transitional Appointments .......................................................................................................... 2-2

Other Kinds of Academic Faculty Appointments ............................................. 2-3

Department Heads ..................................................................................................................... 2-3

Joint Appointments ................................................................................................................... 2-3

Affiliate Faculty ......................................................................................................................... 2-4

Visiting Faculty ......................................................................................................................... 2-4

Emeritus Faculty ....................................................................................................................... 2-4

Administrative Professional ................................................................................ 2-5

Regular Appointment ................................................................................................................ 2-5

Special Appointments ............................................................................................................... 2-5

Temporary Appointments ......................................................................................................... 2-5

Joint Administrative Professional and Academic Faculty Appointments ...... 2-5

Maximum Employment ........................................................................................ 2-5

Work Hours ........................................................................................................... 2-6

Establishing Position .......................................................................................... 2-6

Academic Faculty ..................................................................................................................... 2-6

Administrative Professional Staff ............................................................................................. 2-6

Announcing Position ........................................................................................... 2-6

Selection of Employee ......................................................................................... 2-7

Page | 5 Table of Contents

SECTION 2: ACADEMIC FACULTY AND ADMINISTRATIVE

PROFESSIONALS (continued)

Section 2, Page 7

Appointment ...................................................................................................... 2-7

Reappointment Process ................................................................................... 2-7

Tenure ................................................................................................................ 2-7

Leave Policies .................................................................................................... 2-7

Annual Leave ........................................................................................................................... 2-8

Sick Leave ................................................................................................................................ 2-9

Holiday Leave ........................................................................................................................ 2-11

Military Leave ......................................................................................................................... 2-12

Bereavement Leave ............................................................................................................... 2-12

Injury Leave ............................................................................................................................ 2-12

FAMLI Leave .......................................................................................................................... 2-12

Parental Leave ....................................................................................................................... 2-12

Jury/Court Leave .................................................................................................................... 2-16

Administrative Leave ............................................................................................................. 2-16

Leave Without Pay ............................................................................................................... 2-16

Sabbatical and Other Leaves ................................................................................................ 2-16

Termination and Retirement ........................................................................... 2-17

Times and Methods of Salary Payments. ...................................................... 2-17

Payments to Regular Faculty .............................................................................................. 2-17

Payments to Summer Session Faculty ................................................................................ 2-17

Payments for Work of Less Than a Full Year ...................................................................... 2-17

Payments for Fractional Months of Newly Hired and Terminating Employees .................... 2-17

Supplemental Pay .......................................................................................... 2-18

Data Forms Required ...................................................................................... 2-18

Academic Faculty/Administrative Professional Biographical and Appointment Data Collection

Forms ................................................................................................................................... 2-18

Withholding Exemptions ...................................................................................................... 2-18

Deductions ........................................................................................................................... 2-19

Retirement Plan Enrollment ................................................................................................... 2-19

Direct Deposit ........................................................................................................................ 2-19

Supplemental Pay ................................................................................................................ 2-19

Sabbatical Leave ................................................................................................................... 2-19

Twelve-Month Pay to Nine-Month Faculty ........................................................................... 2-19

Faculty/Staff Study Privilege Employee Registration Form ................................................. 2-19

Sick and Annual Leave Report ............................................................................................ 2-19

Page | 6 Table of Contents

SECTION 2: ACADEMIC FACULTY AND ADMINISTRATIVE PROFESSIONALS

(continued)

Section 2, Page 20

Oath of Allegiance .................................................................................................................. 2-20

Policy on Rights and Responsibilities Related to Creative Works ......................................... 2-20

Employment Eligibility Verification I-9 ................................................................................... 2-20

Statement Concerning Employment in a Job Not Covered by Social Security ...................... 2-20

Faculty Transitional Appointment ........................................................................................... 2-20

Extended Sick Leave ................................................................................................................ 2-20

SECTION 3: STATE CLASSIFIED PERSONNEL

Statement of Administrative Goals Relating to Classified Personnel .......... 3-1

Appointing Authority Delegation .................................................................... 3-2

Classification System ...................................................................................... 3-3

Positions ................................................................................................................................... 3-3

Assignment of Duties and Responsibilities ................................................................................ 3-3

Position Classification ............................................................................................................... 3-3

Positions Within the Personnel System. ........................................................ 3-3

Regular Full-Time ..................................................................................................................... 3-3

Regular Part-Time .................................................................................................................... 3-3

State Classified Hourly ............................................................................................................. 3-3

Methods of Filling Positions ............................................................................ 3-4

Establishing a Position .................................................................................... 3-4

Appointment Process ...................................................................................... 3-4

Comparative Analysis ....................................................................................... 3-4

Probationary Period ......................................................................................... 3-5

Trial Service Period .......................................................................................... 3-5

Early Certification ............................................................................................. 3-5

Promotions ........................................................................................................ 3-6

Reinstatement ................................................................................................... 3-6

Separation ......................................................................................................... 3-6

Resignation ............................................................................................................................... 3-6

Retirement ................................................................................................................................ 3-6

Lay-off/Job Abolishment ............................................................................................................. 3-6

Administrative Separation for Physical Inability ........................................................................ 3-7

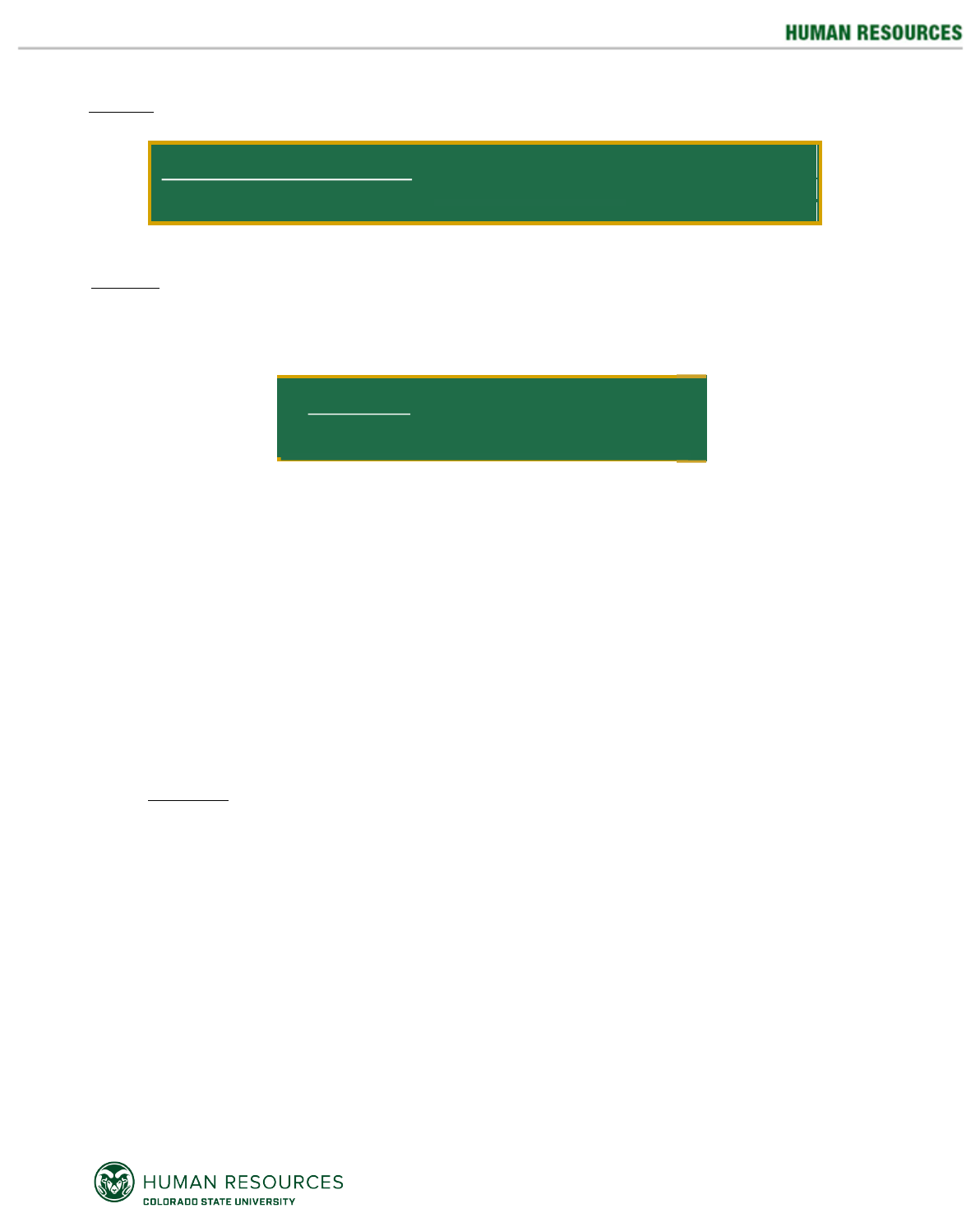

Page | 7 Table of Contents

SECTION 3: STATE CLASSIFIED PERSONNEL (continued)

Section 3, Page 7

Dismissal .................................................................................................................................. 3-7

Compensation of State Classified Employees ............................................... 3-8

New Hires ................................................................................................................................. 3-8

Transfers ................................................................................................................................... 3-8

Reinstatements ......................................................................................................................... 3-8

Demotions ................................................................................................................................. 3-9

Promotions ................................................................................................................................ 3-9

System Maintenance Studies ..................................................................................................... 3-9

In-Range Salary Movements .................................................................................................... 3-9

Supplemental Pay ..................................................................................................................... 3-9

Merit Pay ................................................................................................................................. 3-10

Overtime Payment .................................................................................................................... 3-10

Shift Differential Pay ............................................................................................................... 3-10

Shift Differential Overtime ....................................................................................................... 3-11

Call Back Pay ......................................................................................................................... 3-11

On-Call Pay ............................................................................................................................ 3-11

Positions Brought into State Personnel System ..................................................................... 3-12

Payment to State Classified Personnel .......................................................... 3-12

Pay Schedule .......................................................................................................................... 3-12

Regular Full Month’s Pay ........................................................................................................ 3-12

Partial Month’s Pay- Full-time Employees ............................................................................... 3-12

Permanent Part-time Employees Who Work a Regular Part-time Schedule .......................... 3-12

Permanent Part-time Employees Who Work an Irregular or Intermittent Schedule ............... 3-12

Processing Excess Hours, Shift Differential and Overtime ......................... 3-13

Processing Hours Worked by State Classified Hourly Employees ............ 3-13

Overtime Pay Examples ................................................................................. 3-14

Performance Planning and Evaluation ......................................................... 3-15

Leave Policies ................................................................................................. 3-15

Annual Leave ............................................................................................................................ 3-16

Sick Leave ................................................................................................................................ 3-17

Holiday Leave ........................................................................................................................... 3-19

Military Leaves .......................................................................................................................... 3-20

Bereavement Leave .................................................................................................................. 3-20

Page | 8 Table of Contents

SECTION 3: STATE CLASSIFIED PERSONNEL (continued)

Section 3, Page 21

FAMLI Leave ............................................................................................................................. 3-20

Parental Leave .......................................................................................................................... 3-20

Jury Leave ................................................................................................................................. 3-23

Administrative Leave ................................................................................................................ 3-23

Leave Without Pay .................................................................................................................. 3-24

Short-Term Disability (STD) Leave .......................................................................................... 3-25

Victim Protection ..................................................................................................................... 3-25

Volunteer Firefighter Leave ....................................................................................................... 3-25

Injury Leave .............................................................................................................................. 3-25

Family Medical Leave Act ..................................................................................................... 3-25

Leave Sharing Bank ................................................................................................................. 3-26

Prolonged Illness .................................................................................................................... 3-27

Administrative Suspensions .......................................................................... 3-27

Corrective and Disciplinary Actions .............................................................. 3-27

Grievance and Appeal Process ..................................................................... 3-28

Grievance Process ................................................................................................................. 3-28

Job Evaluation and Examination Action Review Process ...................................................... 3-29

External Appeal Process ........................................................................................................ 3-29

Personnel Actions and Forms Required ....................................................... 3-30

State Classified Biographical and Appointment Data Collection Forms ................................. 3-30

Withholding Exemptions (Employee Self-Service) ................................................................. 3-31

Deductions .............................................................................................................................. 3-31

Sick and Annual Leave Report ............................................................................................... 3-31

Faculty/Staff Study Privilege Employee Registration Form .................................................... 3-31

Position Description Questionnaire (PDQ) ............................................................................. 3-31

Trial Service Appraisal ............................................................................................................ 3-32

Employment Eligibility Verification Form (I-9) .......................................................................... 3-32

Statement Concerning Employment Not Covered by Social Security (SSA-1945) ................ 3-32

State Classified Compensatory Time Agreement .................................................................. 3-32

Performance Planning and Appraisal ..................................................................................... 3-32

Hourly Time Entry in TimeClock Plus ...................................................................................... 3-32

Colorado State University TimeClock Plus and Overtime Form (30-5-70) ............................. 3-32

Overtime Approval and Recording ......................................................................................... 3-33

Policy on Rights and Responsibilities Related to Creative Works ......................................... 3-33

Extended Sick Leave ................................................................................................................ 3-33

Page | 9 Table of Contents

SECTION 3: STATE CLASSIFIED PERSONNEL (continued)

Section 3, Page 31

Supplemental Pay ................................................................................................................... 3-33

Corrective Action Form ........................................................................................................... 3-33

Grievance Form ...................................................................................................................... 3-33

SECTION 4: NON-STUDENT HOURLY EMPLOYEES

Employment Policy .......................................................................................... 4-1

Compensation of Non-Student Hourly Employees ....................................... 4-1

Leaves and Other Benefits .............................................................................. 4-1

Payments to Non-Student Hourly Employees ............................................... 4-1

Data Forms Required ....................................................................................... 4-2

Non-Student Hourly Initial Employment Form .......................................................................... 4-2

Direct Deposit ........................................................................................................................... 4-2

Withholding Exemptions (Employee Self-Service) ................................................................... 4-2

Hourly Time Entry in TimeClock Plus ......................................................................................... 4-2

Overtime Approval and Recording ........................................................................................... 4-2

Employment Eligibility Verification Form (I-9) ............................................................................ 4-2

PERA Member Information Form/PERA Exclusion Form ........................................................ 4-3

Statement Concerning Employment Not Covered by Social Security (SSA-1945) .................. 4-3

SECTION 5: STUDENT EMPLOYEES

Definition of a Student Employee ................................................................... 5-1

Employment Policy & Eligibility ...................................................................... 5-1

Types of Student Employment ........................................................................ 5-2

Compensation/Payroll ..................................................................................... 5-4

Performance ...................................................................................................... 5-5

SERP/Medicare ................................................................................................. 5-5

Page | 10 Table of Contents

SECTION 5: STUDENT EMPLOYEES (continued)

Section 5, Page 4

Leaves and Other Benefits .............................................................................. 5-5

Student Employee Responsibilities ................................................................ 5-5

Students of Concern ........................................................................................ 5-6

Hiring Process .................................................................................................. 5-6

Work-Study Postings .................................................................................................................. 5-6

Background Checks ................................................................................................................... 5-6

Form 1-9/SSA 1945 (Equifax) .................................................................................................. 5-6

Work-Study MOU/CR ................................................................................................................ 5-6

Oracle Approval Requests ........................................................................................................ 5-6

Terminations ............................................................................................................................. 5-7

SECTION 6: GRADUATE ASSISTANT, VETERINARY RESIDENT,

FELLOWSHIP

GRANT TRAINEE

Graduate Assistants .......................................................................................... 6-1

Graduate School Policy ............................................................................................................ 6-1

Leaves and Other Benefits ....................................................................................................... 6-1

Compensation ........................................................................................................................... 6-1

Hourly Work and Payment .......................................................................................................... 6-1

Veterinary Residents ........................................................................................ 6-2

Leaves and Other Benefits ....................................................................................................... 6-2

Fellowship Grant Trainees ............................................................................... 6-3

Leaves and Other Benefits ....................................................................................................... 6-3

Personnel Actions and Data Forms Required ............................................... 6-3

Graduate Assistant Appointment/Certification form (GAAC form) - Used for GA’s .................. 6-3

Initial Employment Form……………………………………………………………………………..6-3

Direct Deposit ........................................................................................................................... 6-4

Withholding Exemptions (Employee Self-Service) ................................................................... 6-4

Employment Eligibility Verification Form (I-9) ............................................................................ 6-4

Policy on Rights and Responsibilities Related to Creative Works ........................................... 6-4

Oath of Allegiance .................................................................................................................... 6-4

SECTION 7: POST DOCTORAL FELLOW, VETERINARY INTERN, CLINICAL

PSYCHOLOGY

INTERN

Post doctoral Fellows ....................................................................................... 7-1

Page | 11 Table of Contents

SECTION 7: POST DOCTORAL FELLOW, VETERINARY INTERN, CLINICAL

PSYCHOLOGY INTERN (continued)

Section 7, Page 1

Veterinary Interns ............................................................................................. 7-1

Clinical Psychology Interns ............................................................................. 7-1

Leaves and Other Benefits ............................................................................... 7-1

Data Forms Required ........................................................................................ 7-1

Other Salaried Employee, Initial Employment Forms-Used for PD’s, VI’s, and CPI’s .............. 7-2

Direct Deposit ........................................................................................................................... 7-2

Withholding Exemptions ........................................................................................................... 7-2

Employment Eligibility Verification Form (I-9) ............................................................................ 7-2

Statement Concerning Employment in a Job Not Covered by Social Security ........................ 7-2

Policy on Rights and Responsibilities Related to Creative Works ........................................... 7-2

Oath of Allegiance .................................................................................................................... 7-3

Retirement Plan Enrollment ........................................................................................................ 7-3

Faculty/Staff Study Privilege Employee Registration Form ...................................................... 7-3

Leave/Termination Action Sheet .............................................................................................. 7-3

SECTION 10: HUMAN RESOURCES SYSTEM USER GUIDE

Contact HRIS, Human Resources, for a copy of

this section.

General Provisions, Page 1

Purpose

The purpose of this Human Resources Manual is to:

1.

Provide the personnel and payroll policies and procedures affecting the various categories of

University

employees.

2.

Outline the employee classifications, regulations and benefits.

3.

Establish requirements and instructions for submission of Human Resources System data.

4.

Outline the conditions, methods and schedules of employee pay.

5.

Provide format and instructions for the time and effort reporting system.

6.

Outline provisions and procedures of the workers' compensation insurance coverage.

Authority

The classifications, rates of pay, leave policies, insurance benefits and retirement, as well as the basic

records and

procedures are prescribed by State regulations and by the Governing Board. The personnel

policies and procedures

are issued in compliance with the rules and regulations of the Colorado State

Personnel System. Basic payroll policies

and procedures are contained in the University Fiscal Rules.

If through administrative error any part of the manual is in conflict with State law, rules of the State Personnel

System,

or policies of the Governing Board of the University, such other authority prevails.

Responsibilities

1.

Department Head

The department head is responsible for compliance with policies and procedures set forth in this manual

and for

prompt and accurate submission of required data. The department head or other immediate

supervisor is

responsible for accurate recording of time worked by employees and for certification and

submission of required

time sheets and Time and Effort Reports.

2.

Office of Equal Opportunity

Colorado State University is committed to providing an environment that is free from discrimination and harassment

based on race, age, creed, color, religion, national origin or ancestry, sex, gender, disability, veteran status, genetic

information, sexual orientation, gender identity or expression, or pregnancy and will not discharge or in any other

manner discriminate against employees or applicants because they have inquired about, discussed, or disclosed

their own pay or the pay of another employee or applicant. Colorado State University is an equal opportunity/equal

access/affirmative action employer fully committed to achieving a diverse workforce and complies with all Federal

and Colorado State laws, regulations, and executive orders regarding non-discrimination and affirmative action.

The Office of Equal Opportunity is located in 101 Student Services.

The Title IX Coordinator is the Executive Director of the Office of Support and Safety Assessment, 123 Student

Services Building, Fort Collins, CO 80523 -2026, (970) 491-7407. The Section 504 and ADA Coordinator is the

Executive Director of Human Resources and Equal Opportunity, Office of Equal Opportunity, 101 Student Services

Building, Fort Collins, CO 80523-0160, (970) 491-5836.

The following are key programs and activities of the Office of Equal Opportunity:

1.

Monitor and support University compliance with federal and state laws and CSU policies

prohibiting

discrimination and harassment.

2.

Develop and implement the University's affirmative action program.

3.

Oversee the University's search and selection process for all Academic Faculty and Administrative

Professionals.

4.

Work in conjunction with the Human Resources Department in the hiring process used for State

Classified

employees to ensure compliance with affirmative action and nondiscrimination

requirements.

5.

Conduct investigations and resolve complaints of discrimination and harassment in accordance

with

University procedures.

6.

Serve as a resource and provide assistance to units, departments and University constituencies

regarding

matters related to equal opportunity, affirmative action, access and nondiscrimination.

7.

Provide education and training to faculty, staff and students on matters related to equal

opportunity,

discrimination and harassment.

Section 1: General Provisions

General Provisions, Page 2

Section 1: General Provisions

6. Serve as a resource and provide assistance to units, departments and University constituencies

regarding

matter related to equal opportunity, affirmative action, access and nondiscrimination.

7. Provide education and training to faculty, staff and students on matters related to equal

opportunity,

discrimination and harassment.

8. Coordinate University compliance with the Americans with Disabilities Act and Title IX of the

Education

Amendments of 1972.

9. Collaborate with the Vice President for Diversity to cultivate awareness, appreciation and

engagement with

diversity and its relevance in a University environment.

3. Human Resources Department

The Human Resources Department has the following responsibilities:

1.

Maintaining a personnel policy that is directed toward equity to employees, preservation of

employee

rights, and optimum employee morale and job satisfaction, to the extent possible within

the capability

and resources of the University as a public institution.

2.

Maintaining, or recommending to the administration as appropriate, policies and practices which

ensure

compliance with laws and regulations.

3.

Counseling supervisors and employees on matters involving employment relationships.

4.

In cooperation with the University Office of Equal Opportunity, assuring that personnel policies and

practices are supportive of the commitment of the University to affirmative action and equal

opportunity.

5.

Providing training programs designed to enhance opportunities for and performance by

employees.

6.

With recommendations from the University Benefits Committee (UBC), developing and maintaining

employee benefit programs for Academic Faculty and Administrative Professionals. Administering

employee benefit programs established by the State Personnel Director and the Public Employees

Retirement Association (PERA).

7.

In cooperation with the State Department of Personnel and Administration, administering programs

for

state classified employees with respect to recruitment, testing, and employment classification.

8.

Determining exemption of positions from state classification in accordance with statutory

provisions and

established guidelines.

9.

Serving as the delegated appointing authority in all actions affecting the University’s employees

covered by the State Personnel System requiring such power. (Refer to Section 3 of the Human

Resources Manual for additional information).

10.

Processing and recording of personnel actions, transactions of data of all University personnel

except

for student hourly employees.

11.

Publishing administrative and informational manuals which provide guidance on personnel matters

to

University departments and employees.

12.

Serving as technical liaison to the Classified Personnel Council.

13.

Administering the unemployment compensation insurance program.

4. Payroll Unit of the Human Resources Department

The Payroll Unit has the following responsibilities:

1.

Verification of payroll data to see that all employees are paid accurately and in a timely manner.

2.

Process Expense Transfers and Payroll Journal Entries.

3.

Input and/or Verification of additional types of pay. (Supplemental pay, uniform allowances, tips,

overtime, shift

differential, etc.)

4.

Entry of W-4's and Payment Disposition Data.

5.

Input and/or verification of payroll deduction items, including insurance benefit programs, tax-deferred

investments, taxes and various other deductions. Also, collect and remit cash payments

for benefit programs

not otherwise covered.

6.

Payments of all monies withheld through the payroll system to the appropriate agency including:

Federal, State

and local taxes, Medicare, PERA, benefit programs, retirement accounts,

employee and student receivables,

parking permits, athletic ticket accounts, University Club, etc.

General Provisions, Page 3

Section 1: General Provisions

7.

Prepare and submit Federal, State and other required reports associated with payroll processing.

8.

Calculate, withhold and remit monies ordered by court systems for garnishments, tax levies and

child support.

These include Department of Social Services; Federal, State and local court

systems throughout the U.S.A.,

Guam, Virgin Islands, Puerto Rico and the District of Columbia.

9.

Prepare and submit W-2 forms and maintain records for prior years.

10.

Certify all PERA data for prospective retirees and maintain PERA records.

11.

Load and monitor back salary, tax adjustments and overpayments due to late paperwork

submission.

12.

Handle stop payments, prepare and process special checks and hand drawn checks concerning

payroll.

13.

Distribution of Certification Reports and maintenance of certification data in the Personnel/Payroll

System.

14.

Maintaining or recommending to the administration as appropriate, policies and practices which

ensure

compliance with Federal, State and local tax laws.

5. Student Employment Services

Student Employment Services is responsible for basic student employment data including job

classification codes,

pay rates, student employee wage structure and the Student Employee Retirement

Plan eligibility (SERP). The

Benefits Unit of the Human Resources Department is responsible for

retirement plan administration.

6. Office of Budgets and Institutional Analysis

The Office of Budgets and Institutional Analysis is responsible for providing, as of July 1, the staffing

pattern for

continuing faculty and classified employees.

9. Risk Management and Insurance Office

The Risk Management and Insurance Office is responsible for processing employee claims for

workers'

compensation benefits. Information about this insurance and the required forms/reports can be

obtained directly from

the website.

Classification of Employees

Employees of Colorado State University are categorized as:

1.

Academic Faculty and Administrative Professionals

These employees are appointed by the Governing Board or President of the University as applicable,

upon

recommendation of University officials. See Section 2 of the Human Resources Manual for details.

2.

State Classified Personnel

State classified personnel are appointed by the Executive Director and Chief Human Resource Officer

of the Human

Resources Department. These employees are classified according to and are governed by

State Personnel Rules

and Regulations and University policies. See Section 3 of the Human Resources Manual for details.

3.

Non-Student Hourly Employees

Non-student hourly employees are employed in jobs where the work usually is of short duration or

intermittent in

nature. These employees are paid by hourly rates. Personnel and payroll data are entered

by the department and

electronically transferred to the Personnel/Payroll System. See Section 4 of the Human Resources Manual.

4.

Student Employees

Student employees perform duties assisting in an academic program, routine general labor and general

office duties.

These employees are treated as hourly personnel for payroll purposes. Students may be

hired as student hourly or

work-study employees. Special eligibility criteria and maximum hours of work

apply. Processing is handled by

Student Employment Services, a section of the Student Financial

Services. See Section 5 of the Human Resources

Manual for details.

General Provisions, Page 4

Section 1: General Provisions

5.

Graduate Assistants, Graduate Research Assistant-PreDoc

Graduate assistants assist with academic programs and research but are students first and foremost.

Graduate

research assistant predoc (GRAPD) are graduate level fellows being paid/sponsored on certain types

of Federal

training grants and continue to hold the title, fellowship grant trainee pre-doctoral scholar, with the awarding entity

(e.g., federal, state, public or private department, unit foundation, etc.). See Section 6 of the Human Resources

Manual for details.

6.

Post doctoral Fellows, Post doctoral Fellowship Grant Trainees, Veterinary Residents, Veterinary

Interns and Clinical

Psychology Interns

Post doctoral fellows typically have recently completed their PhD and are engaged to work primarily on

research

projects. Post doctoral fellowship grant trainees are post graduate level doctoral fellows who

are paid/sponsored on

certain types of Federal training grants, and thus are post doctoral fellows.

Veterinary residents are post-graduate veterinarians (some of whom have completed internships) who

are enrolled in

a 2-3 year combined graduate and residency program resulting in an advanced degree

(MS or PhD), which may

ultimately prepare them for advanced board certification in a recognized

specialty. Veterinary residents are licensed

to practice Veterinary Medicine in Colorado.

Veterinary internships are formalized through the Veterinary Teaching Hospital and the interns are

DVM’s or

equivalent completing a 1 year program that results in receipt of a certificate of completion in a

specialty area (small

animal medicine or surgery, large animal medicine or surgery, or combination).

Clinical psychology internships are formalized through the University Counseling Center (USC) and the interns are

pre PhD in Counseling or Clinical psychology who are typically completing the last requirement of their PhD program,

the internship, which results in receipt of a certificate of completion. See Section 7 of the Human Resources Manual

for details.

Every individual performing work for the University (except for independent contractors as defined in the appropriate

section below) must be employed in one of the employee categories above.

Volunteer Services

Generally, the use of volunteer services without compensation by individuals performing functions for which

compensation normally would be paid is discouraged. The volunteer would not be covered by workers' compensation. In

some cases, involving injury to a volunteer, the "employer" has been held liable for medical costs.

However, this is not intended to apply to University students who perform services to the University as part

of their

educational experience, nor to affiliate faculty, guest speakers and lecturers, performers and artists,

members of advisory

committees and boards, 4-H club volunteer fund raisers, boosters and the like.

Questions concerning interpretation of this policy in specific cases should be referred to the Executive Director and Chief

Human Resource Officer of the Human Resources Department.

Agricultural Labor Furnished by Crew Leader

Generally, individuals providing agricultural labor to the University are employees hired as non-student

hourly personnel

subject to withholding of payroll taxes, Medicare and Public Employee's Retirement

Association contributions. However,

a special provision in the Internal Revenue Code of 1986 states that if a crew leader (1) furnished agricultural labor to the

University, (2) pays the workers either on his own behalf

or

on the behalf of the University, and (3) is not designated as

the University's employee in any written

statements between himself and the University, then the laborers are

employees of the crew leader rather

than the University. The crew leader is an independent contractor under these

circumstances. It is the

responsibility of the crew leader to collect, pay over and report payroll taxes of the laborers.

Crew leaders

may be paid, as any other independent contractor, through the Accounts Payable Section or they may be

paid from special operations imprest bank accounts. If payment from an imprest account is contemplated,

please refer

to Financial Policy and Procedure Instruction Manual, Number 15.00 "Special Operations

Imprest Bank Account."

General Provisions, Page 5

Section 1: General Provisions

Independent Contractors

1.

General

Careful distinction must be made between work which should be accomplished by employees on the

University

payroll or by individuals or firms on a personal services contract (verbal, letter or formal).

Since there are numerous

employer-employee obligations as well as independent contractor liabilities,

the individual's status should be carefully

considered, and cases of doubt resolved in favor of the

employee classification. An erroneous classification as an

independent contractor can result in serious

penalty to the University for failure to deduct withholding taxes. In some

circumstances, the University

contracting officer should require a certificate of insurance coverage to not only relieve

the University of

liability, but to further establish a valid independent contractor relationship.

Work may be undertaken as an independent contractor only when the individual or firm is as defined

below and is not

an employee of the University, unless specific exception is provided by the Executive

Director and Chief Human

Resource Officer of the Human Resources Department.

2.

Definition of an Independent Contractor

An independent contractor, for the purposes of this manual, is defined as an individual or firm who

performs personal

services and who:

1.

Retains the right to decide the way in which final results are achieved and the details of when,

where

and how the work is to be done, and also

2.

Receives no benefits, directly or indirectly, that accrue to University employees. For example, the

individual(s) is not covered by the University for workers’ compensation covering personal injury,

for

public liability covering injury to others, or for unemployment compensation.

3.

The above factors are controlling.

In addition, an independent contractor generally:

1.

Provides own tools and materials.

2.

Has a place of business and a business listing in a directory where the services are offered to the

public.

3.

Agrees to perform specific services for a fixed price.

4.

Is free to work for any one or more clients during any given interval.

3. Performing Artists, Athletic Officials and Consultants

Employment of performing artists, athletic event officials and consultants is covered in the Purchasing

Manual.

Nondiscrimination Policy

Colorado State University does not discriminate on the basis of race, age, creed, color, religion, national origin or

ancestry, sex, gender, disability, veteran status, genetic information, sexual orientation, gender identity or expression, or

pregnancy and will not discharge or in any other manner discriminate against employees or applicants because they

have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. The University

complies with the Titles VI and VII of the Civil Rights Act of 1964, as amended, related Executive Orders 11246 and

11375, Title IX of the Education Amendments Act of 1972, Sections 503 and 504 of the Rehabilitation Act of 1973,

Section 402 of the Vietnam Era Veterans’ Readjustment Assistance Act of 1974, as amended, the Age Discrimination in

Employment Act of 1967, as amended, The Pregnancy Discrimination Act of 1978, Americans with Disabilities Act of

1990, the Civil Rights Act of 1991, the ADA Amendments Act of 2008, the Genetic Information Nondiscrimination Act of

2008, and all civil rights laws of the State of Colorado. Accordingly, equal access and opportunity in treatment,

employment, admissions, programs and activities shall be extended to all persons. The University shall promote equal

opportunity and treatment in employment through a positive and continuing affirmative action program for ethnic

minorities, women, persons with disabilities, and veterans. The Office of Equal Opportunity is located in 101 Student

Services Building.

The Title IX Coordinator is the Executive Director of the Office of Support and Safety Assessment, 123 Student Services

Building, Fort Collins, CO 80523 -2026, (970) 491-7407. The Section 504 and ADA Coordinator is the Executive Director

of Human Resources and Equal Opportunity, Office of Equal Opportunity, 101 Student Services Building, Fort Collins,

CO 80523-0160, (970) 491-5836.

General Provisions, Page 6

Section 1: General Provisions

Pay Transparency Nondiscrimination Provision

The contractor will not discharge or in any other manner discriminate against employees or applicants because they

have inquired about, discussed, or disclosed their own pay or the pay of another employee or applicant. However,

employees who have access to the compensation information of other employees or applicants as a part of their

essential job functions cannot disclose the pay of other employees or applicants to individuals who do not otherwise

have access to compensation information, unless the disclosure is (a) in response to a formal complaint or charge, (b) in

furtherance of an investigation, proceeding, hearing, or action, including an investigation conducted by the employer, or

(c) consistent with the contractor’s legal duty to furnish information.

Discrimination and harassment are not tolerated. Incidences of discrimination and harassment should be reported to the

Office of Equal Opportunity at 970-491-5836 or [email protected].

Discrimination Complaints

University employees have the right to file a complaint with the Office of Equal Opportunity when they

believe there has

been a violation of the Nondiscrimination Policy. The same right is available through State

and Federal agencies for

discriminatory acts based on race, age, color, religion, national origin, gender,

sexual orientation, veteran status or

disability.

Americans with Disabilities Act (ADA) Employment Accommodation Requests

An employee with a disability as defined by the ADA may be entitled to employment accommodations under

that act.

The Office of Equal Opportunity is responsible for determining whether an individual qualifies for

protection under the

ADA. Any employee who believes that he/she has a qualifying disability must submit a

request for determination to that

office.

Employment of Minors

The Colorado Youth Employment Opportunity Act of 1971 and the child labor provisions of the Fair Labor

Standards Act

outline specific requirements concerning times, hours and categories of work permitted for

minors between the ages of

14 and 17. Departments contemplating employing a minor should refer to the

Human Resources Summary of Child

Labor Laws in Appendix 7 of the Human Resources Manual.

Immigration Reform and Control Act (IRCA)

The Immigration Reform and Control Act of 1986 (IRCA) requires all employers, under penalty of fine and/or

imprisonment, to hire only U.S. citizens and aliens lawfully authorized to work in the United States and to

maintain

documentation indicating compliance. Enforcement of this new law rests with the Department of

Homeland Security

(DHS). An Employment Eligibility Verification (Form I-9) must be used in documenting

compliance. Every employee

hired on or after June 1, 1987, must have a completed I-9 Form on file within

three days of commencing work. See

"CLASSIFICATION OF EMPLOYEES" and "INDEPENDENT CONTRACTORS" in Section 1 of this Human Resources

Manual.

The DHS requires employers to certify examination, via Form I-9, of work authorization documents,

acceptable to the

DHS, as a prerequisite to employment of anyone hired on or after June 1, 1987.

Employers are responsible for updating

and/or re-verifying employment eligibility of employees whose

employment eligibility documents carry an expiration date.

Questions pertaining to foreign passports, alien

registration cards and VISAs should be directed to the Office of

International Services.

Those employed for less than three workdays must provide identity and work authorization by the end of the first

workday. CSU has adopted an electronic system in which to complete the Form I-9 and SSA 1945. This system must

be used for all Form I-9 completions, unless otherwise expressed by Human Resources.

I-9 Forms must be kept on file with the Human Resources Department for three years after the date of hire or for one

year after the date the employment is terminated, whichever is later.

To assure compliance with the IRCA, no appointment will be approved until a properly completed Employment Eligibility

Verification Form has been completed. Departments must follow the established University process outlined below:

General Provisions, Page 7

Section 1: General Provisions

1. Complete a Form I-9 for every employee within three days of hire or upon expiration of an existing Form I-9, as

prescribed by law.

2. Review certain documentation to ensure that the individual employee is authorized to work in the United States.

The documentation the employee presents shall be used as long as the documents satisfy the requirements

listed on the Form I-9.

a.

If the documents presented appear valid on their face, and if they meet the requirements listed for the

form, the review of the documents is sufficient, and no further action is necessary.

b.

If the documents presented appear to have been tampered with or do not appear to be “authentic”, the

matter should be referred to the Executive Director and Chief Human Resource Officer of the Human

Resources Department for resolution.

3. If separate information is received regarding an individual’s immigration status, the University may be obligated to

review and respond to that information as deemed appropriate, based upon the circumstances. These cases

should be referred to the Executive Director and Chief Human Resource Officer of the Human Resources

Department.

For more information on completion of the Form I-9, please refer to the USCIS, Handbook for Employers: Guidance for

Completing the Form I-9 (Employment Eligibility Verification Form).

NOTE: Departments should contact the Executive Director and Chief Human Resource Officer of the

Human Resources

Department, Office of Equal Opportunity or Office of General Counsel before taking any

employment action related to

the I-9 process which might deviate from the process outlined above.

Social Security Protection Act

The Social Security Protection Act of 2004 requires state and local government employers like Colorado

State

University, who do not participate in the Social Security program, to disclose the effect of the Windfall

Elimination

Provision (WEP) and the Government Pension Offset (GPO) to employees hired on or after

January 1, 2005. Under the

provisions of the GPO and the WEP, Social Security benefit calculations are

based on a modified formula when a

worker is entitled to a pension from a job where the worker did not pay

Social Security tax. As a result, these workers

may receive a lower Social Security benefit than if they were

not entitled to the public pension. Starting in calendar year

2005, new employees who are required to be

covered by a retirement plan (PERA, DCP or SERP) must be advised of

the potential reduction of future

Social Security benefits.

Form SSA-1945, Statement Concerning Your Employment in a Job Not Covered by Social Security, is completed in an

electronic system adopted by Human Resources. Completion of this online document is mandated to meet the

requirements of the law. The SSA-1945 explains the potential

effects of two provisions in the Social Security law (GPO

and WEP). This form is completed online during the onboarding process. A copy of the form is available online at the

Social Security website.

For employees hired on or after January 1, 2005, departments are required to:

1.

Prior to the start of employment, direct the employee to fill out the Form SSA-1945 in the electronic

system if the position is eligible to participate in a retirement plan. This includes:

a.

Academic Faculty

b.

Administrative Professionals

c.

State Classified regular and hourly employees

d.

Post doctoral Fellows

e.

Clinical Psychology Interns and Veterinary Interns

f.

Non-Student Hourly employees

g.

Certain student employees not qualified for exemption from retirement plan participation

2.

Have these new employees complete the electronic process which attests to the fact that they

are aware of a possible

reduction in their future Social Security benefit entitlement.

3.

As per the provisions of the law, the Human Resources Department is required to maintain the Form

SSA-1945 and to forward a copy to the appropriate pension paying agency (PERA).

General Provisions, Page 8

Section 1: General Provisions

Questions about this procedure should be directed to the Records Unit. Additional information about the

GPO and WEP is available on the Social Security website.

Work Provisions and Definitions

1.

Established Work Week

An established work week is any regularly recurring period of 168 hours - seven consecutive 24-hour

periods -

designated as a period of work for an employee. The established work week for all University

departments shall be

168 consecutive hours beginning 12:01 a.m. each Saturday. Deviations from this

established work week must be

approved in writing by the Executive Director and Chief Human

Resource Officer of the Human Resources

Department.

Generally, administrative offices are open from 7:45 a.m. to 4:45 p.m. or 8:00 a.m. to 5:00 p.m., Monday

through

Friday, during the academic year, and from 7:30 a.m. to 4:30 p.m. during the summer.

However, many units have operating hours that deviate from these times based upon client service or

other

operational considerations that dictate different schedules.

The nature of the educational endeavor makes it impractical to establish specific work hours for

Academic Faculty

and Administrative Professionals with assignments in the areas of teaching, research,

and administration of these

areas of institutional responsibility.

2.

Hours Worked

Hours worked is the time for which an employee is entitled to compensation. For employees eligible for

overtime,

compensation must be paid for the time the employee is required to be on duty on the

employer's premises, or at a

prescribed work place, and for the time the employee is "suffered or

permitted" to work, whether or not requested to

do so. Thus, hours worked can include time spent in

idleness and in incidental activities as well as in productive

labor.

Scheduled meal periods are discretionary, are not counted as work time and must be at least 20

minutes. However, if

the employee is materially interrupted or not completely free from duties, the meal

period is counted as work time.

Work breaks are discretionary. If granted, breaks of up to 20 minutes are considered work time. Breaks

shall not be

used to offset other work time nor to substitute for paid leave, shall not be taken at the

beginning or end of the

workday, nor shall be used to extend meal periods.

NOTE: Work-Study Rules and Regulations for student employees are located on the Student Employment

Services

website.

3.

Flexible Work Arrangements

The University values its employees’ well-being and strives to promote a positive work-life integration. Flexible work

arrangements, such as flextime schedules, compressed workweeks, part-time arrangements, telecommuting, job

sharing, sabbaticals, and phased retirement can help employees balance work and personal life demands while, at

the same time, enabling employees to meet their needs and perform well the duties of their position. Flexible work

arrangements are encouraged whenever, in the discretion of the department or unit head, they will promote the

productivity and efficiency of the work unit and enhance employees’ work-life integration.

Types of Flexible Work Arrangements:

1. Flextime Schedules: A work schedule that allows an employee to vary their start and end times around