To Buying

COMMERCIAL

REAL ESTATE

The Small

Business Owner’s Guide

Illinois Small Business Development Centers

"Experts, networks, and tools to transform your business"

Illinois Small Business Development Centers

(SBDC) provide information, confidential

business guidance, training and other

resources to early stage and existing small

businesses.

Illinois International Trade Centers (ITC)

provide information, counseling and

training to existing, new to-export

companies inte

rest

ed in pursuing

international trade opportunities.

Illinois Procurement Technical

Assistance Centers (PTAC) provide one-

on-one counseling, technical

information, marketing assistance and

training to existing businesses

that are interested in selling their

products and/or services to

local, state, or federal

government agencies.

Technology, Innovation and

Entrepreneurship Specialty

(TIES) ten SBDC location

s

help

Illinois businesses,

entrepreneurs and citizens to

succeed in a changing economy by:

developing the skills of their workers;

promoting safe and healthy workplaces;

assisting in the commercialization of new

technologies; and providing access to

modernizing technologies and practices.

Jo Daviess

Stephenson

Winnebago

Boone Mc Henry Lake

Carroll

Ogle

De Kalb

Kane

Cook

Du Page

Whiteside

Lee

Kendall

Rock Island

Henry

Bureau

Putnam

La Salle

Grundy

Will

Kankakee

Livingston

Mercer

Henderson

Warren

Knox

Stark

Marshall

Hancock

Mc Donough

Fulton

Peoria

Woodford

Tazewell

McLean

Ford

Iroquois

Adams

Schuyler

Brown

Cass

Menard

Logan

De Witt

Piatt

Champaign

Vermilion

Edgar

Douglas

Moultrie

Macon

Christian

Sangamon

Morgan

Scott

Pike

Calhoun

Greene

Macoupin

Jersey

Montgomery

Shelby

Coles

Clark

Cumberland

Madison

Bond

Fayette

Engham

Jasper

Crawford

St. Clair

Clinton

Marion

Clay

Richland

Lawrence

Monroe

Ra

ndolph

Perry

Washington

Jeerson

Wayne

Edwards

Wabash

Jackson

Franklin

Hamilton White

Williamson

Saline Gallatin

Union

Johnson

Pope

Hardin

Alexander

Pulaski

Massac

Mason

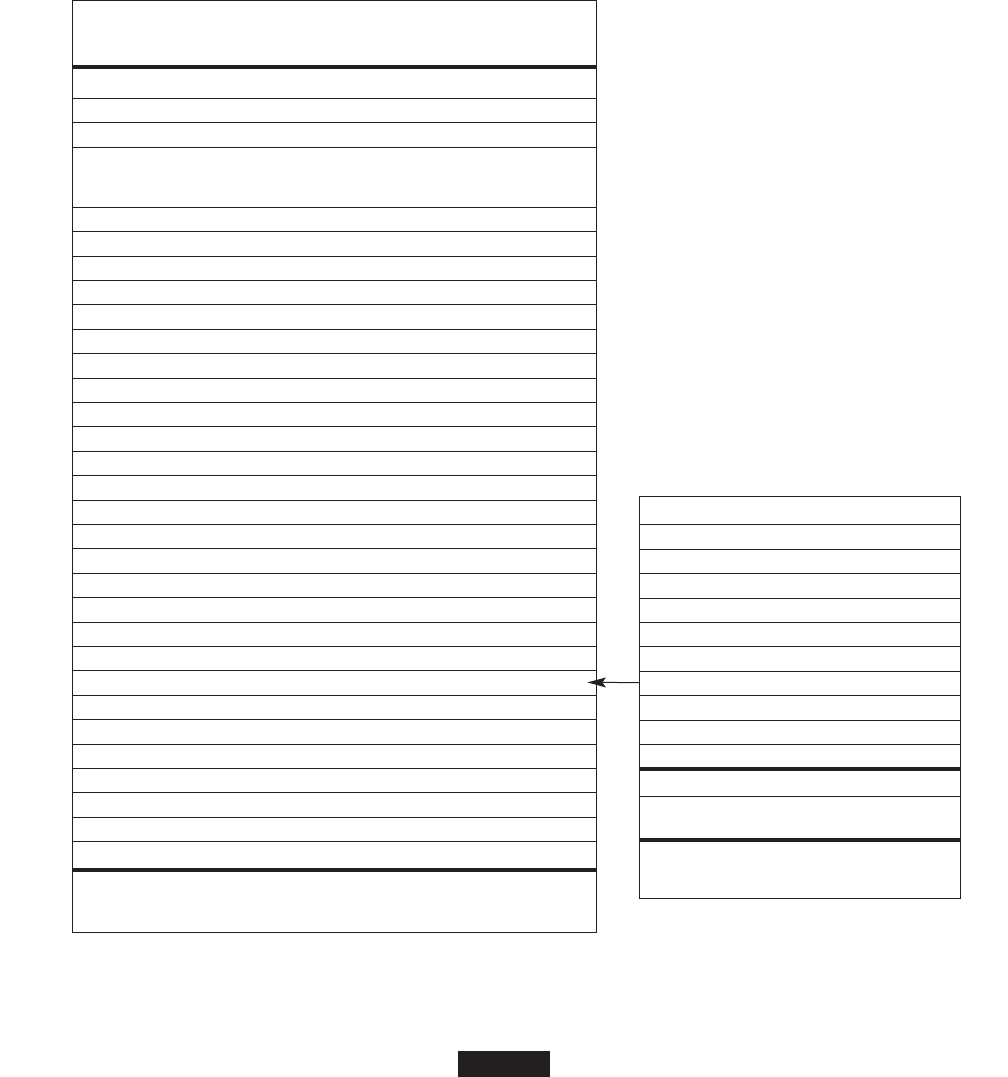

www.ilsbdc.biz

Business Center Locations

SBDC

SBDC/ITC

SBDC/ITC/PTAC

SBDC/PTAC

PTAC

Technology Services

*

See Northeast Region map on other side

for Business Center Services in that area.

*

See

Note

Below

800-252-2923

This resource is made possible through a partnership with the Illinois Department of Commerce and Economic

Opportunity, Small Business Development Center and the U.S. Small Business Administration.

*See the Northeast Region map on the last page

for the Business Center Services in that area.

See

Note

Below

If you’re sold on buying Commercial

Real Estate, here’s your plan.

Take a moment to sit back and reflect. You’ve grown your small business

with a lot of hard work, time and dedication, and now you’re ready to take it

to the next level. Or perhaps you’re standing on the ground floor of a new

endeavor. In either scenario, you’re at an important threshold, ready to take

the crucial step of purchasing commercial real estate.

Even if you’ve bought a home or two, make no mistake about it: buying

commercial real estate takes longer and requires more research and

planning. You will need to be tenacious and organized. You’ll need the

expertise of professionals to prove that your business profits can pay for the

real estate loan – and that positive cash flow will not be interrupted.

What makes real estate “commercial?” Any property you use to grow,

expand or support your business qualifies. Some examples are:

• Retail locations • Warehouses • Office buildings

• Manufacturing facilities • Shopping centers • Hotels

• Apartment complexes with at least 4 units • Commercial condos

• Land for commercial construction

The Good News

Many business owners rent whatever space is necessary to operate, so why

is purchasing Commercial Real Estate/CRE a good idea?

• By building equity in your CRE, its value may increase because of

inflation, and because the principal balance of the loan is decreasing.

• You’ll enjoy the tax benefits of depreciation that offsets income.

• You’ll have the freedom to manage and customize your own space

without restrictions from a property owner or landlord.

If the building or facility you purchase has space that can be leased to other

businesses, that income can greatly supplement your cash flow. In addition,

tax laws benefit entrepreneurs who invest in commercial real estate because

it promotes commerce, elevates surrounding property values and could

increase employment. Additions and improvements also add value.

So let the process begin! is easy-to-follow guide will explain it in simple

terms, in logical order and in full support of the entrepreneurial spirit.

© NewGround Publications. (Phone: 800 207-3550) All rights reserved. Copying any part of this book is against the law.

This book may not be reproduced in any form, including xerography, or by any electronic or mechanical means, including information storage and retrieval systems, without prior permission in writing from the publisher. 0811

Contents

Professional Team . . . . . . . . . . . . . 4

Analysis & Appraisal . . . . . . . . . . 6

Lenders & Loans . . . . . . . . . . . . . . 8

Business Plan . . . . . . . . . . . . . . . . 12

Financial Statements . . . . . . . . . 14

® Balance Sheet . . . . . . . . . . . . 15

® APOD . . . . . . . . . . . . . . . . . . 16

® Profit & Loss/P&L . . . . . . . 17

® Cash Flow . . . . . . . . . . . . . . . 18

Purchase & Sale . . . . . . . . . . . . . . 19

Closing . . . . . . . . . . . . . . . . . . . . . 19

4

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

Find a Good Real Estate Broker

It’s preferable to work with a realtor who specializes in

commercial rather than residential real estate. A commercial

expert will not only make finding a suitable property easier,

but will also offer valuable advice, insight and experience.

Don’t just consider someone’s resumé or track record. It’s

wise to make sure that your broker is a good fit for you, since

the two of you will be working closely. Temperament,

personality and working style should be factored in, too,

before you sign a contract.

Once a real estate broker knows the size, usage, zoning and

condition of the property you’re looking for, he or she will

search the market, showing you qualifying properties. At the

Closing, the seller typically pays the commission earned by

the broker. e usual fee is 5%-10% of the sale price,

although laws vary by state, and the rate can be negotiated

before the broker agreement is signed. Brokers earn their

commission by:

• Finding real estate that fits your needs, within your

price range.

• Knowing how the real estate can be financed. Most lenders

require a 20- to 30% down payment, with the remainder

of the loan financed for 15 or 20 years (which results in

affordable monthly payments) with a three to five-year

balloon. A “balloon” means that, at the end of five years, the

remainder of the principal balance of the loan is due.

Gather Your Team

You’ve made the decision to buy commercial real estate, so how do you begin? First, realize that, although you’re

good at what you do, negotiating the worlds of real estate, law, accounting, leasing and insurance – especially when

your money is on the line – requires sharp knowledge and experienced perspective. Your “team” should include a

commercial real estate broker, an attorney, an accountant, an insurance agent, a business advisor, and a lender.

Choose your team wisely, considering not just their track records, but also their working styles. Asking iends,

business contacts and local chambers of commerce for recommendations is a good idea, but do your homework

before contracting with anyone.

• Facilitating all negotiations between buyers and sellers.

• Providing business plan documents, including current

leases (if the real estate has tenants) and the income

(“rent roll”) they provide.

• Researching the costs associated with the real estate, including

operating expenses such as utilities and tax information.

• Gathering old environmental studies and appraisals,

even though the lender will order new ones. (Some “old”

information is valuable in this process.)

e Legal Team

e Buyer’s Attorney

• Prepares formal offers.

• Reviews zoning, environmental reports, titles, survey and

licenses that will be included with the purchase.

• Looks at the lender’s commitment letter and/or term sheet,

which outline terms, conditions, rates and covenants. is

letter typically has a time limit, so returning a signed copy

to the lender is crucial.

• Holds the “good faith” deposit, a nominal amount agreed

on by the buyer and seller. e deposit can be “hard” (non-

refundable) or “so” (refundable).

• May or may not be present at the Closing. Ask the lender

to send all documents to your attorney before the Closing,

and feel comfortable that they have been reviewed and

explained to you.

5

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

e Lender’s Attorney

• Dras the loan documents to be reviewed and signed by

you. is will happen only aer the lender receives your

signed commitment letter.

• Checks for any liens on the real estate or other assets you’re

using to secure the loan. is insures that the lender has

the first lien on all collateral.

e Seller’s Attorney

• Develops the final Purchase and Sales agreement,

which must be signed prior to presenting the loan

request to the lender.

• Creates the Bill of Sale, which is signed at the Closing.

• Facilitates the transfer of any licenses or easements

with all legal documents necessary. If licenses have to be

transferred, ask for enough time in the P&S agreement.

Transfers must be final at the Closing.

• Usually does not attend the Closing. If, however, the

seller cannot be there, the seller’s attorney can attend

as a representative.

Add a Good Certified Public Accountant

Lenders will typically require a CPA (Certified

Public Accountant) to prepare your financial

statements. Your accountant will assist in analyzing

the property you’re buying by reviewing past financials.

Financial projections, which include new real estate costs

and mortgage payments, will be solidified. In addition to

these numbers, lenders also require both personal and

business tax returns for the past three years from anyone

who will own more than 20% of the real estate. ese

returns must be re-signed in blue ink to confirm they are

correct, and that they match the ones you filed with the IRS.

Lender oen require detailed personal financial statements.

Find an Insurance Agent or Broker

Your lender will require property and casualty

insurance on the real estate you’re purchasing, as

well as on any assets taken as collateral. You have

the option to choose your own insurance agent, so look for

one who specializes in commercial real estate. Show the

agent a copy of the commitment letter to be sure you receive

the right kind and amount of insurance, which must be

equal to the loan amount.

Buyers who will hold a 20% or more ownership in the

property are sometimes required to carry life insurance as

well – a guarantee that the loan will be paid if they should

die. If a loan has three guarantors, three insurance policies

would each cover one third of the loan amount. If the

owner/borrower dies, the lender is paid the remaining loan

amount from the insurance payout and anything in excess

goes to the borrower’s beneficiary.

Hire a Good Business Advisor

Many times, it’s wise to pay for the perspective of

a knowledgeable business consultant (also called

a commercial loan broker) who sees the financing

process with clarity and can offer solid perspective and

advice. Professional advisors have experience putting

together business plans and loan presentations, as well as

constructing financial projections. You should negotiate a

fee up front with your consultant, usually an hourly rate for

a minimum amount of hours. In addition, there is usually a

“success” fee or commission of .75% to 2% of the loan

amount. is number has nothing to do with the rates,

terms or covenants of the loan, and is paid by the borrower

at the Closing.

6

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

Even those who have bought commercial real estate in the

past would agree that each facet of the process requires

careful analysis. Here are some things to ask yourself:

• Is the property the right size?

• Is the building or land the right type?

• Are all the necessary utilities in place?

• Is there parking, a loading dock, or access for the disabled?

• Is it close to highways, airports and rail lines?

• If it’s important to be close to your market, how does the

property’s location rate?

• Is it OSHA (Occupational Safety and

Health Administration) approved?

ey set and enforce health and

safety rules for employers.

• Will the property comply with

zoning laws?

• Do any licenses need to be transferred

with the sale? For example, if you

were buying a restaurant, the license

to serve food would need to be

transferred. Research into licenses will

be done by the lender, and should also

be conducted by both the buyer’s and

seller’s attorneys. Keep in mind that

license transfers take time, so the issue

should be brought up early on, in the

offer letter (page 11) and the Purchase

& Sale Agreement (page 19).

Get Real with Your Real Estate Purchase

• Do any easements need to be transferred? An easement

allows someone access to your land. For example, an

easement for utilities allows an employee or representative

of a utility company to pass through your property for

repairs or maintenance.

• Pay attention to zoning laws for the new purpose of the

property. If you are buying an old farm that will become

an antique store, be sure zoning will allow it.

• Utilities – or the lack of them – should be considered. For

example, if you’re buying a small manufacturing facility,

be sure its power supply is up to current standards.

How Do You Arrive at a

Value for Real Estate?

Numbers can be demystified by using

several valuation methods (page 7). In

order to complete these calculations,

you must have a copy of the current

property tax bill. Ask the seller for it,

or you can go to the municipal office

that records property transactions,

which are public record. It is a good

idea to run the numbers on other

recently sold properties in the area, too.

Idea

Create two separate companies:

Operating Company

Holding Company

You may be the owner of both

companies.The Holding Company

owns the real estate and leases the

commercial space to the Operating

Company.The Operating Company

pays rent to the Holding Company.

A “triple net” lease is common which

means the Operating Company

directly pays real estate taxes, hazard

insurance and repairs/maintenance for

the Holding Company.Why do this?

There are tax benefits, plus a lawsuit

against the operating company will not

affect the real estate holding company.

You also have the ability to sell the

business but keep the real estate.

7

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

Three Appraisal Methods

Capitalization/CapRate

is method arrives at a value based on

what the real estate generates in lease and

rental revenues, minus expenses. Each property

will have a different cap rate. Investors and

lenders want higher cap rates if the property has

problems including a depreciating value.

Investors and lenders will accept lower cap rates

if the commercial property is in good condition,

in the right location, with no major problems,

and a low vacancy rate. e appraiser bases the

analysis on what an investor would expect for a

similar investment.

Comparison

is method of

determining a property’s

value compares it to properties

that are the same size and

condition, in the same vicinity.

is method is somewhat

difficult, since there are so many

types of real estate – everything

from horse stables to

skyscrapers. In this method, the

land and building are separately

valued according to square

footage.

Replacement

is appraisal method is

based on what it would cost

to reproduce the same real estate.

Costs might include things like

land preparation, utility

installation, building type and

location. Appraisers typically break

down costs per square foot. For

example, the cost per square foot

may be $50 for a storage facility

and $75 for a retail store. is

method of valuation is affected by

the age of the building(s) and the

amount depreciated over the years.

e appraiser will be aware of, and

research these numbers.

An overview of the basic computations for analyzing the value of real

estate

What it Number we’re Your

represents using as an example number

A Size of the land being purchased 9,000 sq. ft.

B Size of the building being purchased 5,000 sq. ft.

C Tax assessed value of the land $100,000

D Tax assessed value of the building $200,000

E Total tax assessment of land and buildings $300,000

F Percentage of taxes allotted to the land 33.3%

G Percentage of taxes allotted to the building 66.7%

H Purchase price of the land ($165,000) (33.3%)

I Purchase price of the building ($335,000) (66.7%)

J Total sale price $500,000 (100%)

K Purchase price value of one foot of the land (H divided by A) $18.33

L Purchase price value of one foot of the

building’s floor space (I divided by B)

$67.00

M Total area of land and building 14,000 sq. ft.

N Average purchase price of one sq. ft.

of land and building ( J divided by M)

$35.71

1

2 3

$48,000 Annual Rental Income

-

$33,000 Less Total Expenses

$15,000 Net Operating Income

x 10 Cap Rate

$150,000 Real EstateValue

8

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

Landing a Lender and a Loan

When searching for a lender, you need to find one

that not only offers commercial loans, but is open

to the type of financing you seek. ere are many

internal reasons for a lender’s decision, so it’s wise to

ask up ont whether your loan request would be

considered. Suppose you’re seeking a loan to open

a restaurant. Even if everything you bring to the

table looks good, a lender may already have too many

restaurant loans and will not be interested in yours.

One way to pay a smaller down payment is through

an SBA/Small Business Administration guaranteed

loan offered by most lenders (page 9). You may also

consider your state’s department of economic

Applying for a Commercial Loan

In order to apply for a commercial loan, you will be required

to pay a down payment (page 11) and to submit a complete

business plan (page 12). Your business plan includes the

loan request and projected financial statements, usually for

the next 12 months. is shows the lender that you have the

money to pay the real estate loan, while maintaining

profitability and positive cash flow.

Show how much money you have and where it is coming

from. If there are investors, you must provide detailed

information about the money they are investing. Indicate

how much money you are requesting from the lender, and

how it will be used (such as renovating, upgrading or

customizing the property). Include itemized expenses,

backed up with written estimates, contracts or other

documents that show amounts.

How Will e Loan Be Used?

Lenders want every dollar of their loan accounted for.

Uses include the purchase of inventory, furniture, fixtures,

equipment, machines, repairs and improvements, and

working capital (money for the business’ day-to-day

activities). Your business’ income must cover your expenses.

You need more money if your expenses are more than your

income. Use of funds must be fully documented (page 15).

You are usually allowed to use the commercial loan money

to pay for legal fees, environmental remediation, zoning fees,

building plans and permits.

development, which offers business loan programs

with low interest rates and/or property tax breaks.

In addition to your loan presentation, you may

also be asked to fill out the lender’s own loan

application. If a loan guarantee from the Small

Business Administration is required, you must

also complete an SBA application.

Your loan presentation will be reviewed along

with your personal and business credit. Regardless

of their decision, lenders will usually not return

your submission; so make at least one complete

copy to keep for yourself.

9

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

SBA

Perspective

The

The 7(a) Program

• Terms up to 25 years, and a variable

interest rate that is tied to a

certain level over the prime rate.

• The actual real estate loan comes

from a commercial lender. The

SBA guarantees the loan. If the

borrower does not repay the loan,

the SBA will reimburse the lender

up to the amount of their

guarantee.

• Loans/guaranty can be used for

working capital, machinery and

equipment, furniture and fixtures,

as well as land and building

(purchase/renovation/new

construction).

What They Have In Common

• Terms of any SBA loan will not change, even if the lender is taken over or sold. No changes can take place

without your consent.The borrower and their attorney should review the lender’s loan agreement before the

Closing since the lender could include many things.Changes may be done later by the lender first and then the

borrower is notified.

• There is no balloon. A balloon loan has a long term, or amortization, but a shorter maturity. For example, let’s

say the loan has a 20-year term with a 5-year balloon. At the 5-year mark, the entire balance of the loan is due,

or must be refinanced. Usually, non-SBA commercial mortgages are balloon loans.

The 504 Program

• You occupy 51% of a building’s floor plan. If, however, you are building

a structure, you must occupy 60% immediately.

• Terms up to 20 years.

• The borrower must put down 10% (may be more in some cases) of

the total loan amount.

• 50% of the loan is funded by the lender, who determines the interest

rate on their portion, and holds the first mortgage.

• 40% of the loan is funded by an economic development company,

certified by the SBA.The interest for this portion is set by the

Treasury’s 10-year bond market.The economic development

company then sells a bond, guaranteed by the SBA, into the bond

market.When the bond is sold, the EDC repays the bank its 40%, and

then holds the second mortgage.

• You can find economic development companies in your area by

checking with your state’s economic development office, the State

Treasurer or the Secretary of State, or the SBA.

The Small Business Administration/SBA

offers loan guarantee programs for buyers

of commercial real estate.

10

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

When The Lender Says “Yes!”

If your lender is interested in financing your commercial

real estate, you will receive a Term Sheet and/or a

Commitment Letter.

e Term Sheet

A Term Sheet will sometimes be generated, although it is

not a requirement or an approval. It specifies the borrower,

guarantor, loan amount, term or length of the repayment

period, interest rate, prepayment structure, prepayment

penalties, collateral being put up, fees being charged, as well

as any covenants or stipulations agreed to by both parties

(such as the lender not allowing you to borrow from

another lender).

You must review the Term Sheet very closely, preferably with

your business advisor and/or your attorney. If you agree with

everything it specifies, sign and return to the lender.

e Commitment Letter

is letter is based on the Term Sheet (if provided) and

outlines every detail of the agreement, including the amount

of insurance. Your attorney, advisor and accountant should

review the commitment letter very carefully. Pay attention

to the “suspense date.” is is usually 10 to 30 days aer it is

issued, and it is the deadline for signing the letter. Should

you require more time, it is acceptable to ask the lender for

it. But remember that if the suspense date is not honored,

the lender’s commitment expires and you will need to

reapply for financing.

Once the lender receives the signed letter, money may be

requested from you for the appraisal, environmental

inspections and other administration costs. At this point,

the lender can still change the terms and conditions of the

funding, but not without your written approval.

If your loan isn’t approved:

Receiving a rejection letter from a lender is not good news,

but it’s very important to understand why. A short, cordial

conversation may give you valuable advice and feedback you

can use to revise your loan request. Oen, a rejection does

not reflect shortcomings in your loan request. e lender

may simply have too much money out in commercial loans

in your particular category. You may submit your request to

another lender who would be more receptive to your type

of loan.

e Value of an Appraisal

Developing an opinion of the value of property is called

an appraisal. Since no two properties are identical in nature

or location, it is important to have an appraisal done by a

professional. Your lender, not you, will select an appraiser

from their list of qualified and approved professionals.

As the borrower, you pay the lender for the appraisal.

In the past, when assets were overvalued or decreased in

value without being revaluated, lenders have had serious

problems. In an economy that goes up and down, lenders

don’t want to see your real estate drop in value, so they

usually require a 20- to 30% down payment (10% for SBA

guaranteed loans), and then finance the remainder of the

property’s appraised value. Lenders base their maximum

loan amount on either the sale price of the property, or on

the appraisal value, whichever is lower.

If additional collateral (like the borrower’s home) is needed

to secure the loan or to back up a personal guarantee, the

lender will use 80% of the collateral’s appraised value less any

liens or mortgages.

11

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

To protect themselves against a drop in the property’s value,

lenders oen require more than a first mortgage on a

commercial property, such as a personal guarantee secured

by a mortgage on their personal property, in addition to the

current mortgages on the property. ey may take a lien on

all of the company’s assets, including Furniture, Fixtures,

Equipment and Machinery (FFEM). Lenders might also

want your Accounts Receivable and Inventory as collateral

too but try to avoid this, because if you apply for a line of

credit, they would be used to secure the line. A commercial

real estate mortgage without an SBA guarantee is usually

written with a 15-year term and a 5-year balloon (every five

years, the lender may roll the remaining balance over for an

additional five years with a different interest rate). Lenders

may also “call” the loan (require full repayment of the

remaining loan principal) on the balloon’s maturity date.

e Down Payment

e amount of money you have to “put down as a deposit”

on a property (10% - 40% depending on the type of loan) is

based on either the appraised value of the real estate or the

sale price, whichever amount is lower, since lenders will

finance the smaller amount. If the property cannot be

transferred because the title isn’t clear or because it doesn’t

pass an environmental inspection, the deposit is refunded to

the buyer.

What Is Discounted Collateral?

Commercial mortgages may be discounted

from 20- to 40%, as shown:

Appraisal of borrower’s home . . . . . . . $100,000

Lender discounts appraisal 20% . . . . –$20,000

Lender’s discounted value . . . . . . . . . . . $80,000

Mortgage/Loan amount . . . . . . . . . . . –$50,000

Usable equity . . . . . . . . . . . . . . . . . . . . . . . $30,000

If financing is secured and the property passes all

inspections, but the buyer backs out, the seller may keep

the deposit, unless another arrangement has been specified

in the Purchase & Sales Agreement (page 19).

Environmental Inspection

Lenders also require an environmental inspection, which the

buyer pays. Keep in mind that the seller or seller’s broker

must be notified in advance of these inspections. A Phase

One environmental study must also be ordered by the lender

and paid for by the buyer. If any environmental issues are

uncovered, the seller must correct them, or the lender can

withdraw approval for financing.

Making an Offer

Once you know that you have an interested lender in place,

it’s time to make an Offer to the seller. e Offer doesn’t just

include the sale price, but also more specific terms – which is

why it must be prepared by your attorney, then reviewed by

your business advisor and accountant before bringing it to

the seller.

If the seller accepts your Offer, he or she will return a signed

copy to you. is will serve as the basis for the Purchase &

Sales Agreement (page 19), which is developed by the

seller’s attorney.

e Door Is Open for a Closing

Once the Commitment Letter is signed by you and

returned, the lender’s attorney will go to work developing

the Closing documents (page 19) and confirming that all

legal requirements have been satisfied, and that all permits

and licenses can be transferred to the new property owners.

e lender’s attorney’s fees are your responsibility and are

paid at the Closing.

12

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

Here’s the Plan

In order to secure a loan for a piece of commercial real

estate, you will haveto complete and submit a business

plan – even if your business is already established.

Lenders need to make sure that the revenue your

business generates will be sufficient to meet the

monthly mortgage payments. In addition, you must

understand where themoney will be coming from, and

how it will affect your Balance Sheet (page 15) and

Profit & Loss Statement (page 17).

A business plan looks at every facet, every aspect, and

every dimension of yourbusiness. Writing your plan is

an invaluable exercise for creating clarity and helping

you foresee problem areas. A well executed business

plan will give a lender everything needed to make an

easier, quicker decisiononyourloan – and to offer it at

the best rates and terms.

e components of a business plan are:

• Summary or Cover Letter

Be sure to answer all of the following questions:

® How much money are you requesting?

® What is the loan’s purpose?

® How will it be repaid?

® What collateral are you offering?

® What terms are you requesting?

® What products or services will you offer?

® What experience do the business owners have?

® What markets will you be involved in?

® Who is your biggest competition?

® Why are you a better choice?

• Business Description

is detailed description must include the legal name

of the business, the location address, your taxpayer

identification number (TIN), names of owners with

percentage breakdown of ownership, legal structure,

purpose, rationale for financing, short-term goals for

the first year, long-term goals, industry information,

history and schedules for operation.

• Professional Team

Include names, addresses, phone numbers and email

addresses for all the members of your team, as outlined

on pages 4 and 5. Team members include your broker,

attorney, accountant, banker, insurance agent and

business consultants.

• Property History

Answer questions like: Why is the property being sold?

What other purposes was this property used for in the

past?

The Foundation for Your Success

is a Business Plan

13

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

• e Management Team

e resumé and background of anyone who owns 20% or

more of the business will need to be submitted. Your

lender wants to feel comfortable that the people who own

the property are competent and responsible. Don’t hesitate

to explain each person’s qualities and experience.

• Operations/Suppliers

Tell your lender about the day-to-day running of the

business. Explain what facilities and equipment are

necessary to produce and distribute its products and

services. Include a copy of any leases, existing or new.

Provide a list of suppliers and explain what they will be

supplying and at what terms.

• Marketing

Show your lender that you understand your market by

creating a profile of your customer base, including its

geographical scope and size. Explain your products and

services in relation to your market, how you will distribute

and how you will promote. Include copies of any

copyrights, patents and licenses.

• Competition

Develop a list of your closest competitors and explain their

strengths and weaknesses. How will you differentiate your

business from theirs? What reasons will customers have

to switch to your business? Estimate the percentage of the

market owned by each of your competitors, and explain how

you are going to take customers and sales away from them.

• Location

Explain why you chose this location. Your description of

the property should include topics like zoning and traffic

patterns. Talk about the general vicinity, the kinds of

businesses there and the general economic temperature of

the area. If renovations will be necessary, show all costs and

a timetable for completion. Include copies of all the quotes

you have received for renovation work.

• Leases

If there are any new or existing leases that must be honored

by you, the new buyer, you must include copies of them in

your business plan. Any proposed leases that may take

effect aer the Closing must also be included.

• Licenses

Any licenses or permits that will be transferred

to the new owner(s) with the sale of the property must

be included.

• Appraisals and Environmental Reports

Make copies of all reports, whether old or new. Lenders

welcome an abundance of data on property value,

and environmental reports are crucial to minimizing

their liability.

• Financial Statements

Your business plan must include several financial

statements (pages 14-18).

14

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

In order to feel confident that your business can repay the real

estate loan, your lender will require one to three years of past

financial documents and projections.

Lenders will “crunch” the numbers in the five documents

highlighted on this page, using them to make the decision

on whether to approve your loan request. With the

exception of your tax returns, each of the four financial

statements is further explained in pages 15 through 18.

If the loan you are seeking is exclusively for real estate,

it may be structured in two different ways. First, the

operating company can make the loan to the real estate

holding company you’ve set up as a separate entity and

second, the loan could be structured to name the operating

company and the holding company as equal co-borrowers.

Tax Returns

Anyone who will hold a 20% or more interest in either

the operating company or the real estate holding company

must submit tax returns from the last three years. Does the

property have its own legal identity? For example, the seller’s

real estate holding company may own the property (see Idea

on page 6). If rental income will be necessary to pay the

monthly loan, the seller needs to provide the past three years

of tax returns.

The Balance Sheet {

PAGE 15

}

is is a snapshot of your business, a moment frozen in

time. You will need to provide Balance Sheets for the past

three years. If you’ve been in business for less than three

years, submit your fiscal-year-end statements for the time

you’ve been in business. You will also need to create an

“aer” Balance Sheet, showing the day aer the loan closes

(page 15). Use the most current Balance Sheet for the

“before-the-loan” version. e loan itself will be reflected

on the liability side, while use of the loan proceeds (such

as an increase in fixed assets or working capital) will be

reported on the asset side or reduced in Accounts Payable

on the liability side.

The Financial Statements

The APOD Report {

PAGE 16

}

An Annual Property Operating Data (APOD) is one of the

most popular reports in real estate investing because it gives

you a quick evaluation of property performance for the first

year of ownership. e APOD shows you what a property

will take in, and also what it will cost. It concisely reveals

income, operating expenses, net operating income, debt

service, and cash flow, making it a good "first glimpse" of the

investment opportunity.

The Profit & Loss Statement/P&L {

PAGE 17

}

e P&L, also called the Income Statement or Income &

Expense Statement, is a company report card, showing the

performance of a business over a period of time. e seller

provides a P&L for the previous year, only as it pertains to

the real estate that will be purchased, as well as interim

statements that are less than 30 days old. is allows you,

the buyer, to build your financial projections. Based on the

seller’s information, you, the buyer, need to provide the

lender with a projected P&L statement for one year, broken

down month by month. It should show expenses paid

by the operating company for the real estate – not just the

loan itself, but also things like interest, property taxes and

hazard insurance.

The Cash Flow Statement {

PAGE 18

}

Simply put, this statement shows how much money “flows”

into the business, and how much “flows” out. Breaking down

the year month by month, it shows how much money is le

at the end of each month to carry into the following month.

Be sure to include the assumptions you used to construct

your projections. Ask your lender how many years of cash

flow projections are required, and whether to show them

monthly or quarterly.

15

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

e balance sheet is a

snapshot of the business,

like a moment frozen in time,

and the numbers change

daily. It shows what you own,

and what you owe.

e two sets of numbers

shown here reflect the

changes that result from

financing. From these two

versions, your lender will see

how the loan will be used.

e most current set of

numbers reflects the day

before the loan, and the

second set of numbers reflects

the day aer the loan.

The Balance Sheet

A M O M E N T F R O Z E N I N T I M E

Balance Sheet

Before After

Financing Financing

ITEM AMOUNT CHANGE AMOUNT NOTE

Cash $59,750 $(23,000) $36,750

A/R, Inventory, Prepaid Expenses $46,600 0 $46,600

Deposit $8,000 $(8,000) $0

Total $114,350 $(31,000) $83,350

FFEM/Furniture Fixtures $85,000 0 $85,000

Equipment Machinery

Real Estate $0 $200,000 $200,000

Total Assets $199,350 $169,000 $368,350

Current Liabilities $43,350 0 $43,350

Loan Amount $0 $180,000 $180,000

Total Liabilities $43,350 $180,000 $223,350

Stock $10,000 0 $10,000

Retained Earnings $146,000 $(11,000) $135,000

Equity/Capital/Net Worth $156,000 $169,000 $145,000

Total Liabilities & Equity $199,350 $368,350

Breakdown: Current Liabilities

Accounts Payable . . . . . . . . $23,650

Accrued Expenses . . . . . . . . . . . $700

Line of Credit Payments . . $19,000

Total . . . . . . . . . . . . . . . . . . . . $43,350

Breakdown: Loan Amount

Loan Amount . . . . . . . . . . $200,000

10% Down Payment: . . . ($20,000)

Loan Balance . . . . . . . . . . . $180,000

Breakdown: Retained Earnings

Before . . . . . . . . . . . . . . . . . . $146,000

Closing . . . . . . . . . . . . . . . . ($11,000)

Aer . . . . . . . . . . . . . . . . . . . $135,000

Breakdown: Cash

10% down . . . . . . . . $12,000

Closing Costs . . . . . $11,000

Total . . . . . . . . . . . . . $23,000

. . . . . . . . . . . . . . . . . . . . . . . . . .

Cash before . . . . . . . $59,750

Plus deposit . . . . . . . . $8,000

Total . . . . . . . . . . . . . $67,750

Less down . . . . . . ($20,000)

Less Closing . . . . ($11,000

)

Cash Aer . . . . . . . . $36,750

Breakdown: A/R, Inventory, PP Exp

A/R . . . . . . . . . . . . . . $36,000

Inventory . . . . . . . . . $10,000

Prepaid Expenses . . . .

$600

Total . . . . . . . . . . . . . $46,600

These

numbers

must be

the same

$20K (10% down on

$200K loan) less

$8K deposit

6%, 20 yrs

($1290/month,

$15,480/year)

$3000 legal, $2500

appraisals, $1500

environmental study,

$4000 loan points

Note: Retained Earnings would drop to

$123K if both the Down Payment/$12K

and Closing/$11K were deducted

Notes

16

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

An APOD Report, which stands for Annual Operating Property Data, shows you clearly and concisely what

a property willtake in (Income) and what the property will cost (Expenses) during the first year of ownership.

Keep in mind that this report summarizes yearly, not monthly figures. It is a good first glimpse of the

investment, helping you to evaluate how it is expected to “perform”. Your accountant or business advisor can

assist in the preparation of your APOD report.

The APOD Report

Y O U R “ S N A P S H O T ” O F I N C O M E A N D E X P E N S E S

Property: Industry Park

Type: Commercial Building | Land: 40,000 sq. ft. | Building: 25,000 sq. ft.

Purchase Price $200,000

Acquisition Fees (appraisal, etc.) $5,000

Loan fees (two points) $3,920

Legal fees $2,080

Total Cost $211,000

Less: Down Payment (10% of $200,000) ($20,000)

Mortgage Amount $191,000

ANN UAL INCO M E:

Rental Income $13,500

Less Vacancy Factor (5%) ($675)

Total Income $12,825

ANN UAL EXPE NSES :

BOTH OPERATING HOLDING

COMPANIES COMPANY ONLY COMPANY ONLY

Taxes $9,000 $9,000 $0

Insurance $4,000 $4,000 $0

Maintenance. $4,500 $4,500 $0

Repairs $1,000 $1,000 $0

Utilities $10,800 $10,800 $0

Legal & Accounting Fees $2,500 $0 $2,500

Licenses $500 $500 $0

Supplies $250 $0 $250

Landscaping $900 $900 $0

Snow removal $400 $400 $0

Miscellaneous $350 $350 $0

Condo fee $2,400 $2,400 $0

Alarm $600 $600 $0

Total Annual Expenses $37,200 $34,450 $2,750

Net Income To t al Income-Total Expenses

($24,375) ($21,625) $10,075

Less: Mortgage Payments ($16,428)($16,428)

Cash Flow Net Income-Mortgage ($40,803) ($6,353)

Before After

depreciation depreciation

Square feet 23,500 23,500

Cash flow $(40,803) $(40,803)

Depreciation $0 $4,103

Cash Flow – Depreciation $0 $(36,700)

Cost per sq. ft. $(1.74) $(1.56)

(Cash Flow/Square feet)

Simplified APOD Data Example

Cost Per Square Foot

Rent 1500 sq. ft.

@ $9.00 per sq. ft.

The Holding Company is short this amount

for the mortgage payments.

Annual amount (or $529 monthly) paid

by the Operating Company,

see Related Expenses on P&L (page 17)

Loan is for 20 yrs

at 6% is $1369

per month or

$16,428 per year

Mortgage payments by the Holding Company,

not the Operating Company

Operating Company

and Holding

Company explained

on page 6 “Idea”

Figures are based on

a “triple net lease”

which sends related

expenses to the

Operating Company

$200K for land & building

($40K) land only

= $160K building only

÷39 years allowed by IRS

$4,103 depreciation

Range of

negative

numbers

since it is

an expense.

See APOD

Cash/Flow

number

25,000 sq. ft.

1,500 rental

23,500 sq. ft.

17

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

The Profit & Loss Statement

B E F O R E A N D A F T E R F I N A N C I N G

Profit & Loss Statement

Before and After the loan/financing for the Operating Company

B

EFORE AFTER % OF SALES

Sales/Income $328,790 $328,790 100%

Less: purchases/cost of goods sold ($94,856) ($94,856) (29%)

Gross Profit $233,934 $233,934 71%

EXPENSES: BEFORE AFTER % OF SALES

Accounting $2,000 $2,000 0.61%

Advertising $6,575 $6,575 2.00%

Automobile $3,000 $3,000 0.91%

Bank Charges $120 $120 0.04%

Commissions $6,575 $6,575 2.00%

Credit Card Merchant Fees $3,289 $3,289 1.00%

Dues & Subscriptions $500 $500 0.15%

General insuarance $2,780 $5,000 1.52%

Group insurance $6,000 $6,000 1.82%

Internet $1,176 $1,176 0.36%

License taxes $300 $300 0.09%

Line of credit interest $1,140 $1,140 0.35%

Miscellaneous $1,440 $1,144 0.35%

Office supplies $1,500 $1,500 0.46%

Miscellaneous $300 $300 0.09%

Payroll $112,296 $112,296 34.15%

Payroll taxes $13,476 $13,476 4.10%

Postage $522 $522 0.16%

Real Estate Taxes $0 $8,000 2.43%

Rent and Related Expenses $30,000 $39,903 12.14%

Repairs & Maintenance $2,700 $2,700 0.82%

Security system $900 0 0%

Shipping supplies $1,644 $1,644 0.50%

Telephone $4,560 $4,560 1.39%

Travel $4,000 $4,000 1.22%

Utilities $1,104 $1,104 0.34%

Total Expenses ($207,897) ($216,900) (66%)

Net Profit/Loss $26,037 $17,034 5%

Gross Profit less Total Expenses

RE LATED EX PENSES

License/permits $500

Real Estate taxes $9,000

Hazard insurance $4,000

Maintenance $4,500

Repairs $1,000

Utilities $10,800

Snow removal $400

Other $350

Condo Fee $2,400

Alarm system $600

Total Expenses $33,550

Payments to Holding Company $6,353

(See Cash Flow amount on pg.16)

Total Rent & Related Expenses $39,903

(or $9976 per quarter shown on pg.18)

e Profit and Loss statement (also called P&L, Operating Statement, or Earnings Statement) is the "report

card" for a business and is developed monthly, quarterly or annually. When buying real estate, you need to

develop and review the P&Ls for "Before" and "Aer" financing(seethe statement below). A P&L is developed

for the OperatingCompany only (see Idea on page 6). e Holding Company doesn't need a P&L since their

only income is the rent (paid by the Operating Company) and their only outflow of cash is the commercial

mortgage/loan payment.

The P

&

L vs. APOD

You may notice that this projected

P&L is similar to the APOD

(page 16). What’s the difference?

e P&L is created for the

Operating Company that occupies

the real estate, and it shows the

rent payment and related

operating/business expenses.

e APOD is created for real

estate only and used primarily by

an “investment buyer.”

18

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

Cash is thefuelthatruns your business,soyou must be acutelyawareof how it is“flowing.” is statement covers

themoneycominginandgoingout – and howmuch“stays” inthecompany for daily expensesand emergencies.

It willshow youthe maximum loanpayment the business can afford– a crucialnumber. Keep in mind that your

business may produce a profit, but still not have a positive cash flow. Shown here is a Cash Flow Statement aer

financing. e seller will provide a Cash Flow Statement before you buy or finance a business.

The Cash Flow Statement

W H AT C O M E S I N A N D W H AT G O E S O U T

Cash Flow

After Financing for the Operating Company

1

ST QTR 2ND QTR 3RD QTR 4TH QTR TOTAL

CASH IN:

Sales & Accounts Receivable $84,288 $44,261 $65,553 $134,691 $328,793

CASH OUT:

Expenses

Accounting $500 $750 $250 $500 $2,000

Advertising $1,330 $648 $1,768 $2,829 $6,575

Automobile $750 $750 $750 $750 $3,000

Bank charges $30 $30 $30 $30 $120

Commissions $1,330 $648 $1,768 $2,829 $6,575

Credit Card Merchant Fees $665 $325 $884 $1,415 $3,289

Dues & subscriptions $0 $500 $0 $0 $500

General insurance $278 $834 $834 $834 $2,780

Group insurance $1,500 $1,500 $1,500 $1,500 $6,000

Interest on line of credit $190 $285 $285 $285 $1,045

Internet $294 $294 $294 $294 $1,176

Miscellaneous $360 $360 $360 $360 $1,440

Office supplies $375 $375 $375 $375 $1,500

Miscellaneous $75 $75 $75 $75 $300

Payroll $28,074 $28,074 $28,074 $28,074 $112,296

Payroll taxes $3,369 $3,369 $3,369 $3,369 $13,476

Postage $138 $138 $138 $138 $552

Rent and Related Expenses $9,976 $9,976 $9,976 $9,976 $39,303

Repairs & maintenance $675 $675 $675 $675 $2,700

Shipping supplies $333 $162 $442 $707 $1,644

Taxes and license fees $0 $300 $0 $0 $300

Telephone $1,140 $1,140 $1,140 $1,140 $4,560

Travel $1,000 $1,000 $1,000 $1,000 $4,000

Utilities $276 $276 $276 $276 $1,104

Total Expenses ($52,658) ($52,484) ($54,263) ($57,431) ($216,835)

Purchases ($14,941) ($10,888) ($22,005) ($41,047) ($88,881)

Only product costs including raw materials and direct labor

TOTAL CASH OUT ($67,599) ($63,372) ($76,268) ($98,478) ($305,716)

Total Expenses plus Purchases

BEGINNING CASH $36,750 $53,439 $34,329 $23,614

Use Ending Cash from previous quarter for Beginning Cash in next quarter

CASH CHANGE $16,689 ($19,111) ($10,715) $36,213

Cash in less Total Cash Out

ENDING CASH $53,439 $34,329 $23,614 $59,827

Beginning Cash and Cash Change

Cash amount after

financing on pg.15

19

T O B U Y I N G C O M M E R C I A L REAL E S T A TES M A L L B U S I N E S S O W N E R ’ S G U I D E

e Purchase & Sales Agreement/P&S is a contract

between the buyer and seller for the sale of real estate, and

spells out very specific terms and conditions. It is developed

by the seller’s attorney or real estate broker.

Sometimes, before the P&S is signed, the buyer will make an

Offer, which is draed by his or her attorney. is Offer is

not required but, if both parties sign it, it may be used instead

of the P&S, or the P&S may be based upon the Offer.

Whether there is a P&S or a written Offer in place, the

seller usually responds to the buyer’s offer with adjustments

and this is called the Counter Offer. A negotiation period

is common before both parties agree on every detail.

Time Is As Important As Money

e seller usually grants a 60 to 90 day period from the

signing of the P&S to the Closing. is gives the buyer time

to prepare documents, complete inspections and provide for

transfers. It’s preferable to ask for a 90 to 120 day period,

since it may take time to get the appraisal and environmental

assessment completed. e P&S should allow for an

extension, to accommodate any delays or problems.

Transparency Is a Must

A “real estate disclosure statement” is a declaration by the

seller of everything known about the property. It does not

eliminate the need for inspections, nor does it act as a

warranty. Buyers need to ask about any defects, problems or

issues, preferably before the appraisal and environmental

inspection are done. Due Diligence involves investigating the

property before signing contracts and includes a recent

survey, environmental study, title search, physical inspection,

zoning permit/review, and operating cost analysis. Any and

all problems must be addressed and corrected by the seller

before the lender will approve financing.

Get a Safety Net in Place

Protect yourself bymaking sure there isa financingcontingency

in place. is states that if the buyer is unable to finance the

real estate, the seller must return the deposit – deducting

any out-of-pocket expenses that were incurred – and the

P&S becomes null and void.

Agreeing on the

Purchase & Sales

The Closing Is

Just The Beginning

e end of the process is the Closing, which the lender will

schedule. e buyer/borrower, any guarantors, the seller,

the lending officer and the lender’s attorney will attend the

Closing. All legal documents necessary for the Closing will

be required, including personal guarantees, the mortgage

and note, the loan agreement (as outlined in the

commitment letter), the appraisal and the environmental

study. When these documents are finalized, they should be

carefully reviewed by your attorney before you sign them for

the Closing. At the Closing (which your attorney does not

need to attend), there will be numerous documents for both

the seller and buyer to sign, but the real estate will not

officially transfer to you until the lender’s attorney records to

deed and files the mortgage and/or liens with the

appropriate state and local government agencies. Only aer

the lender is officially notified that this has taken place –

putting the lender in the appropriate legal position – does

the money transfer to the seller.

If your loan becomes past due, your lender’s attorneys

may draw up a forbearance agreement, which outlines what

the lender will do in order to clear the delinquency. e legal

fees for creating this are the buyer’s responsibility, plus a

lending fee of the outstanding loan principal which must be

paid at the time the agreement is signed.

Some of the liens that the lender’s attorney files include:

• A first mortgage on the property in question

• 1st Uniform Commercial Code (UCC) liens on

furniture, fixtures, equipment and machinery

• An equity mortgage, which secures a personal

guarantee, such as a second mortgage on the principal

buyer’s real estate

• Mortgages on other property, which may be owned

personally or by the company

• Other assets (like a Certificate of Deposit), which may

need to be offered as collateral

Printed by the Authority of the State of Illinois. W.O. 12-021 100 9/11 IOCI 12-261

www.ilsbdc.biz

The Illinois SBDC is funded in part through a

cooperative agreement with the U.S. Small Business

Administration and the Illinois Department of

Commerce and Economic Opportunity.

Mc Henry

Lake

De Kalb

Kane

Cook

Du Page

Kendall

Grundy

Will

Kankakee

Northeast Region

"Chicagoland"

Business Center Locations

SBDC

SBDC/ITC

SBDC/ITC/PTAC

SBDC/PTAC

PTAC

Technology Services