Financial Statements

for

MURRAY STATE UNIVERSITY

A COMPONENT UNIT OF THE

COMMONWEALTH OF KENTUCKY

For the Year Ended June 30, 2019

with Report of Independent Auditors

CONTENTS

Pages

ReportofIndependentAuditors.........................................................................................................................................1‐2

Management’sDiscussionandAnalysis..........................................................................................................................3‐22

FinancialStatements

StatementsofNetPosition–MurrayStateUniversity.............................................................................................23‐24

StatementsofFinancialPosition–MurrayStateUniversityFoundation,Inc...........................................................25

StatementsofRevenues,ExpensesandChangesinNetPosition–

MurrayStateUniversity............................26‐27

StatementsofActivities–MurrayStateUniversityFoundation,Inc.....................................................................28‐29

StatementofCashFlows–MurrayStateUniversity................................................................................................30‐31

NotestoFinancialStatements......................................................................................................................................32‐75

SupplementaryInformation.........................................................................................................................................76‐83

ReportonInternalControloverFinancialReportingand

onComplianceandOtherMattersBasedonanAuditof

FinancialStatementsPerformedinAccordancewithGovernmentAuditingStandards.............................................84‐85

ScheduleofFindingsandResponses..............................................................................................................................86‐87

Lexington

■

Louisville

■

Raleigh deandorton.com

ReportofIndependentAuditors

BoardofRegents

MurrayStateUniversity

Murray,Kentucky

SecretaryofFinanceandAdministration

CabinetoftheCommonwealthofKentucky

ReportontheFinancialStatements

Wehaveauditedtheaccompanyingfinancialstatementsofthebusiness‐typeactivitiesandthediscretelypresented

componentunitofMurrayStateUniversity(theUnive

rsity),acomponentunitoftheCommonwealthofKentucky,

as of and for the years ended June 30, 2019 and 2018, and the related notes to the financial statements, which

collectivelycomprisetheUniversityʹsbasicfinancialstatementsaslistedinthetableofcontents.

ManagementʹsResponsibilityfortheFinanc

ialStatements

Managementisresponsibleforthe preparationandfairpresentation ofthesefinancial statementsinaccordance

with accounting principles generally accepted in the United States of America; this includes the design,

implementation,andmaintenanceofinternalcontrolrelevanttothepreparationandfairpresentationoffinancial

statementsthatarefreefro

mmaterialmisstatement,whetherduetofraudorerror.

Auditor’sResponsibility

Ourresponsibilityistoexpressanopiniononthesefinancialstatementsbasedonouraudits.Weconductedour

auditsinaccordancewithauditingstandardsgenerallyacceptedintheUnitedStatesofAmericaandthestandards

applicabletofinancialauditscontainedinGo

vernmentAuditingStandards,issuedbytheComptrollerGeneralofthe

UnitedStates.Thosestandardsrequirethatweplanandperformtheaudittoobtainreasonableassuranceabout

whetherthefinancialstatementsarefreefrommaterialmisstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the

fin

ancialstatements.Theproceduresselecteddependontheauditor’sjudgment,includingtheassessmentofthe

risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk

assessments,theauditorconsidersinternalcontrolrelevanttotheentity’spreparationandfairpresentationofthe

fin

ancialstatementsinordertodesignauditproceduresthatareappropriateinthecircumstances,butnotforthe

purposeofexpressinganopinionontheeffectivenessoftheentity’sinternalcontrol.Accordingly,weexpressno

such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the

reason

ableness of significant accounting estimates made by management, as well as evaluating the overall

presentationofthefinancialstatements.

Webelievethattheauditevidencewehaveobtainedissufficientandappropriatetoprovideabasisforouraudit

opinion.

BoardofRegents

MurrayStateUniversity

ReportofIndependentAuditors,continued

2

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial

positionofthebusiness‐typeactivitiesandthediscretelypresentedcomponentunitofMurrayStateUniversityas

ofJune 30,

2019 and 2018, and the changes inits financialposition and itscash flows thereof for theyears then

endedinaccordancewithaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica.

OtherMatter

RequiredSupplementaryInformation

AccountingprinciplesgenerallyacceptedintheUnitedStatesofAmericarequirethat

themanagement’sdiscussion

andanalysisonpages3‐22andthepensionandOPEBinformationonpages76‐83bepresentedtosupplement

thebasicfinancialstatements.Suchinformation,althoughnotapartofthebasicfinancialstatements,isrequired

bytheGovernmentalAccountingStandardsBoardwhoconsidersittobe

anessentialpartoffinancialreporting

forplacingthebasicfinancialstatementsinanappropriateoperational,economic,orhistoricalcontext.Wehave

applied certain limited procedures to the required supplementary information in accordance with auditing

standardsgenerallyacceptedintheUnitedStatesofAmerica,whichconsistedofinquiriesofmanagement

about

the methods of preparing the information and comparing the information for consistency with management’s

responsestoourinquiries,thebasicfinancialstatements,andotherknowledgeweobtainedduringourauditofthe

basicfinancialstatements.Wedonotexpressanopinionorprovideanyassuranceontheinformationbecausethe

limitedproceduresdonotprovideuswithsufficientevidencetoexpressanopinionorprovideanyassurance.

OtherReportingRequiredby GovernmentAuditingStandards

InaccordancewithGovernmentAuditingStandards,wehavealsoissuedour reportdatedOctober 2,2019 onour

considerationoftheUniversity’sinternalcontroloverfinancial

reportingandonourtestsofitscompliancewith

certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of that

reportistodescribe thescopeofourtestingofinternalcontrolover financialreportingandcomplianceandthe

results of that testing, and not

to provide an opinion on the internal control over financial reporting or on

compliance.ThatreportisanintegralpartofanauditperformedinaccordancewithGovernmentAuditingStandards

inconsideringtheUniversityʹsinternalcontroloverfinancialreportingandcompliance.

October2,2019

Lexington,Kentucky

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis

June30,2019

3

Introduction

ThefollowingManagement’sDiscussionandAnalysis(MD&A)providesanoverviewofthefinancialpositionand

activities of Murray State University (University) for the year ended June 30, 2019.

This discussion has been

preparedbymanagementandshouldbereadinconjunctionwiththefinancialstatementsandthenotesthereto,

which follow this section.The financial statements and related notes and this discussion and analysis are the

responsibilityofmanagement.

TheUniversityisacomprehensivepublicinstitutionofhigherlearning

locatedinwesternKentuckyandprimarily

servesstudentsinKentucky,Illinois,Missouri,TennesseeandIndiana.Foundedin1922,theUniversityhasstudy

centersinfourothercitieswhereitoffersadiverserangeofdegreeprogramsfromassociatetodoctorallevels,is

composedoffouracademiccollegesandtwoschools.

TheUniversitycontributestotheregionandstatethrough

relatedresearchandpublicserviceprograms.TheUniversityisachartermemberoftheOhioValleyConference

andaDivisionImemberofthe NCAA.TheUniversityservesasaresidential,regionaluniversityofferingcore

programs in the liberal arts, humanities, sciences

and selected high‐quality professional programs for

approximately9,500students.Forthe2019‐20academicyear,tuitionandfeesincreasedby$42persemesterfor

fulltimeresidentundergraduatestudents.TuitionandfeesattheUniversitycontinuestobelessthanthenational

average.

MurrayStateUniversityconsistentlyranksamong

thenation’stoppublicuniversitiesandhasbeenrecognizedfor

thequalityandvalueofitsacademicprograms.Onceagain,U.S.News&WorldReport’sBestCollegeshasrecognized

theUniversityamongthetopschoolsinthecountry.TheUniversity’sstreakoftoprankingswasextendedto29

consecutiveyearswith

thereleaseofthe2020U.S.NewsBestCollegeslist.MurrayStatewasranked24

th

inthe“Best

Regional Universities in the South” category and is the highest‐ranked regional public university in Kentucky.

Murray State also ranked 11

th

among peer institutions in the “Top Public Regional Universities in the South”

category.

InadditiontotheU.S.News&WorldReport’srankings,theUniversityisrankeda“MilitaryFriendlySchool”by

VictoryMediaandthe2019WashingtonMonthlycollegeguideandrankingslistedMurrayStateasabestvalue

for

studentsseekingacollegedegree,andthetop‐rankedpublicuniversityinKentucky.Forbesmagazinenamedthe

UniversityasoneofAmerica’sTopCollegesin2019.Thismarksthe12thstraightyearinwhichMurrayStatehas

garneredthisaccolade.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

4

FinancialHighlights

The University’s financial net position dramaticallychanged in 2015 with the implementation of GASB

StatementNo.68‐AccountingandFinancialReportingforPensions—an

amendmentofGASBStatementNo.27,

andagainin2018withtheimplementationofGASBStatementNo.75–AccountingandFinancialReporting

forPostemploymentBenefitsotherthanPensions(OPEB).TheeffectsofimplementingGASBStatementNos.

68and75aresummarizedinthefollowingtable.Itisimportantto

notethattheimplementationofthese

standardshasnoeffectonpastorcurrentcashorcashequivalents.

2019 2018 2017

Beginningnet position,nopension/OPEBadj ustment 336,973,0 98$ 332,252,009$ 300,800,699$

Changeinnet position,nopension/OPEBadj ustment 5,227,09 8 4,721,089 31,451,310

Endingnetpositionbeforepension/OPEBadj ustment 342,200,196 336,973,098 332,252,009

Pensionb eginningadj ustment (290,776,657) (266,031,237) (244,041,269)

Pensionrevenue/(expense)adj ust ment 13,691,790 8,816,578 (21,989,968)

OPE Bpriorperiodbalanceadj ustment — (32 ,141,103) —

OPE Brevenue/(expense)adj ustment

(839,266) (1,420,895) —

Totalpension/OPEBadj ustment s (277,924,133) (290,776,657) (266,031,237)

Netpositionaft er pension/OPEBadjustment s 64,276,0 63$ 46,196,441$ 66,220,772$

Infiscalyear2019,theUniversityhadassetsof$440.3million,deferredoutflowsof$42.4million,liabilities

of$313.6millionanddeferredinflowsof$104.8million.Netposition,whichrepresentstheUniversity’s

residualinterestinassetsand deferredoutflowsafter liabilitiesanddeferred inflowsare deducted,was

$64.3million

or13%oftotalassetsanddeferredoutflows.Netpositionincreasedby$18.0millionfrom

fiscal year 2018 to 2019. This increase in net position was the result of a $12.8 million net decrease in

pension/OPEB related activity.Additionally, there is a $4.6 million increase in liabilities other than

pension/OPEB

primarilyduetoincreasesinaccountspayableof$4.7millionandadecreaseinlong‐term

debtof($4.6million).Deferredoutflowsandinflowsareitemspreviouslyreportedasassetsorliabilities

respectively that are required to be reported separately from assets or liabilities by GASB Standard 65.

Deferred inflows increased

$4.4 million to reflect future receipts related to a new dining operations

arrangementinDecember2018.

Fiscaloperationswereinaccordancewiththeannualoperatingbudgetofapproximately $159.0 million.

TheUniversitycontinuedtobeastrongemployerfortheregionandemployed3,524individuals,including

578 faculty and

927 staff members and 2,019 students.These totals include 1,266 regular and full‐time

facultyandstaff.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

5

Total originally enacted operating state appropriations for fiscal year 2019 decreased by .5% $229,800,

decreasingto$45.6million,thisincludesgeneralappropriationsof$43.0million,$2million

newfunding

forBreathittVeterinaryCenterandperformancefundingpoolallocationsof$557,800.

The University invests approximately 96% of its endowment funds with the Murray State University

Foundation,Inc.(Foundation).Thevalueofthesefundsisasfollows:

HistoricalValue $18.1million

MarketValue $21.7million

Thesefunds

experiencedanunrealizedgainof$138,412infiscalyear2019.Thisallowedformostprogram

spendingtoremainconstantduringtheyear.TheFoundationoperatedwitha4.0%caponendowment

spendingforthefiscalyear2019.

J.H.RichmondResidenceHallwascompletedandreopenedforoccupancyin

August2019with279beds.

TheUniversityinvestedinasignificantnumberofassetpreservationcampusenhancementprojectsin2019.

Total expenditures for these projects were $11.6 million, excluding J.H. Richmond Residence Hall

renovationsandrepairs.

In July 2015, significant moisture issues, air pressurization issues, and the discovery

of hidden water

damageswereidentifiedintheBiologyBuilding.TheUniversityiscontinuingtoworkwithconstruction

companies,architects,designfirmsandconsultantstoidentifythesourceoftheproblem.Duringfiscalyear

2019, the University engaged an architect and engineering firm to recommend appropriate repairs and

preparebid

documents.FinalbiddocumentsforrepairsshouldbeissuedinFall2019withworkbeginning

betweenFall2019andSpring2020.Finalcompletiondatehasnotbeendetermined.

TheUniversityexperiencedlargechangesinthepensionliabilityinfiscalyear2019,overalladjustments

relatedto pensions/OPEB were a ($51.2

million)reductionto liabilitiesanda($6.1 million)reduction to

operatingexpenses.TheUniversity’sportionofthereducedliabilityreportedbytheTeachers’Retirement

System (TRS) of Kentucky, resulted in a ($55.3 million)reduction tothe TRS portion of thenet pension

liability and a ($7.9 million) reduction to expenses. However,

these results were partially offset by an

increasetotheKentuckyEmployeesRetirementSystem(KERS)liability,whichincreasedtheUniversity’s

liability $6.2 million and increased expenses $2.4 million. Additionally, the University’s liabilities were

furtherreducedbytheadjustmentsrelatedtoOPEBpaidtotheretirementsystems.Thisresultedina

$2.1

milliondecreaseinliabilitiesand($.6million)decreaseinexpenses.

TheUniversity’sdiningserviceswereoutsourcedtoSodexoOperations,LLCeffectiveDecember2018.The

agreementisthroughJune2029andencompassesallcampusdiningservicesaswellassignificantcapital

investmentsmadebySodexo.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

6

TheUniversityexperienceda5.5%declineinenrollmentinfiscalyear2019.Theimpactofthedecreasewas

addressedbyaplannedreductioninexpendituresinfiscal

year2019andabudgetedcontingency.

PerformanceFunding

Theenacted2017‐18CommonwealthofKentuckybudgetincludedimplementationoftheperformancefunding

modelandincludedaperformancepool.Thepoolwasfundedwith5%ofthenetadjustedappropriationsofeach

ofthe four‐yearinstitutionsandKentuckyCommunity and

TechnicalCollegeSystem(KCTCS),which totaled

$31million.MurrayStateUniversitycontributed$2,293,200tothepoolandreceived$2,231,000inthe2017‐18

budgetbackfromthefundingpool.

Theenacted2018‐19CommonwealthofKentuckybudgetincludedaperformancefundingpoolof$38.7million

forallfour‐yearinstitutions

andKentuckyCommunityandTechnicalCollegeSystem(KCTCS).MurrayState

Universityreceived$557,800fromtheaboveperformancepool.

Thethreebasiccomponentsofthefundingmodelinclude:

StudentSuccess:35%ofthemodeltiesthedistributionofallocablefundingdirectlytodegreeproduction

andprogressiontowardadegreeorcredential;

CourseCompletion:35%ofthemodeltiesthedistributionofresourcestothenumberofcredithours

awardedateachcampus;

OperationalSupport:30%ofthemodeltiesthedistributionofresourcestocampusservicesand

infrastructurethatsupportstudentlearningandsuccess.

UsingtheFinancialStatements

TheUniversity’sfinancialstatementsconsistofStatementsofNetPosition,StatementsofRevenues,Expensesand

Changes in Net Position, Statements of Cash Flows and Notes to the Financial Statements.These financial

statementsandaccompanyingnotesarepreparedinaccordance

withtheappropriateGovernmentalAccounting

StandardsBoard(GASB)pronouncements.

These financial statements provide an entity‐wide perspective and focus on the financial condition, results of

operationsandcashflowsoftheUniversityasawhole.

FinancialstatementshavealsobeenincludedfortheMSUFoundation,acomponentunit,inaccordance

withthe

requirementsofGASBStatementNo.39,DeterminingWhetherCertainOrganizationsareComponentUnits.Financial

statementsforthisentityconsistofStatementsofFinancialPositionandStatementsofActivities.Thesestatements

arepreparedinaccordancewiththeappropriateFinancialAccountingStandardsBoard(FASB)pronouncements.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

7

StatementsofNetPosition

TheStatementofNetPositionpresentsafinancialpictureoftheUniversity’sfinancialconditionattheendofthe

2019and2018fiscalyears

byreportingassets(currentandnoncurrent),deferredoutflowsofresources,liabilities

(currentandnoncurrent),deferredinflowsofresources,andnet position.Netposition,thedifferencebetween

total assets plus deferred outflows less total liabilities and deferred inflows, are an important indicator of the

currentfinancialcondition,whilethechangein

netpositionisanindicatorofwhethertheoverall financialposition

hasimprovedordeclinedduringtheyear.

Assets

Total assets at the end of the fiscal year 2019 were $440.3 million, of which capital assets, net of depreciation,

represented the largest portion.Capital assets totaled approximately$239.7 millionor 54% of total assetsand

wereprimarilycomprisedofUniversity‐ownedland,buildings,equipment,andlibraryholdings.Cashand

cash

equivalentsamountedto$156.4millionor36%oftotalassets.Totalassetsincreasedby$9.9millionduringthe

2019fiscalyear.Thisdecreaseingrosstotalassetsisdueprimarilytothefollowingitems:

$6.0million‐Increaseinnetcapitalassets.Primarilydueto$12.7millioninnew

additionstoconstruction‐

in‐progress(CIP), largelyrelated to renovationandrepairs toJ. H. RichmondResidence Hall combined

with a $1.6 million increase in non‐building improvements offset by $9.1 million in current year

depreciation.

$13.2million‐Increaseincashandcashequivalents.Thisincreasewastheresult

ofa$2.3millionincrease

inoperatingcashexplainedbytimingoftransactionsaswellasanadditional$3.1millioninprojectfunding

relatedtotheoutsourcingofdiningservices.Investmentincomeincreasedby$2.9millionduetoimproved

marketconditionsandunspentinsuranceproceedsincreasedby$1.5millionrelatedto

theJ.H.Richmond

ResidenceHallincident.IncreasesinEducation&General(E&G)netpositionpriortothepensionexpense

(non‐cash)adjustmenttotaled$1million,andanincreaseinrestrictednetpositionof$2.5million.

($9.0million)‐Decreaseinaccountsreceivable,net.Thisdecreaseistheresultof

a($10million)decrease

in an insurance receivable related to the J. H. Richmond Residence Hall incident offset by a $1 million

increaserelatedtotheeffectsofoutsourcingdiningservices.

Totalassetsdecreasedby$3.2millionduringthe2018fiscalyearduetothefollowing:

($16.6 million)‐

Decrease in net capital assets.Primarily due to ($12 million) decrease in current year

depreciation combined with the ($9.5 million) decrease due to the J. H. Richmond impairment.This

combined($21.5million)decreasewasoffsetby$3.6millionincreaseinequipment,$2.1millionofwhich

was related to equipping the new

Engineering and Physics building as well as $0.3 million in land

purchases,$0.4 non‐buildingimprovements with theremaining$0.6increaserelatedto thereductionin

construction‐in‐progress and related increase in buildings for the capitalization of Breathitt Veterinary

Center,H.C.FranklinHallandtheEngineeringandPhysicsbuilding.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

8

$3.4million‐Increaseincashandcashequivalents.Thisincreasewastheresultofa$1.7millionincrease

in operating cash explained by increases in E&G net

position prior to the pension expense (non‐cash)

adjustment, and an increase of $1.4 million in Auxiliary cash explained by an increase in Auxiliary net

positionpriortothepensionexpense(non‐cash)adjustmentaswellasanincreaseinrestrictednetposition

of$0.7million.Theseincreaseswereoffset

byanincreaseincollectionexpensesof$0.4million.

$10.1million‐Increaseinaccountsreceivable,net.Thisincreaseistheresultofa$10.5millionincreasein

an insurance receivable related to the J. H. Richmond Residence Hall incident offset by a ($0.4 million)

decreaserelatedtotheeffects

ofthedeclineinenrollment.

DeferredOutflowsofResources

AnewsectionoftheStatementofNetPositionwasaddedin2014incompliancewithGASBStatementNo.65‐

ItemsPreviouslyReportedasAssetsandLiabilities.Thisstatementrequiredthatthedeferredbondrefundingloss,

previouslyreportedaspartofthe“Long‐termdebt”lines,bereportedinsteadas

adeferredoutflowofresources

in fiscal year 2014.GASB statement 65 also required that we restate this deferred outflow for all prior years

reported withinthese financial statements.Deferred outflows consisted of bond refunding lossfrom the 2011

refundingofhousinganddiningbondSeriesM,N,O,P,

andQwhichtotaled$1.6millionforfiscalyear2019,$1.7

millionforfiscalyear2018and$1.7millionfor2017.Alsoincludedisabondrefundinglossfromtherefunding

of2007generalreceiptsbondsSeriesAwhichtotaled$0.7millionforfiscalyear2019,$0.7millionand$0.8million

forfiscalyears2018and2017respectively.Deferredoutflowsalsoconsistedof$40.1millionforfiscalyear2019,

$51.3and$53.8millionforfiscalyears2018and2017respectively,relatedtoreportingrequirementsspecifiedin

GASBStatementsNo.68‐AccountingandFinancialReportingforPensions—anamendmentofGASB

StatementNo.

27andNo.75‐AccountingandFinancialReportingforPostemploymentBenefitsotherthanPensions.

Liabilities

Totalliabilitiesattheendofthefiscalyear2019were$313.6million,adecreaseof($51.2million).Thischangewas

duetothefollowing:

($51.2million)–Netdecreaseinpension/OPEBliability.GASBStatementNo.68‐AccountingandFinancial

Reporting for Pensions — an amendment of GASB Statement

No. 27 required the reporting of the pension

liabilityforthefirsttimeinfiscalyear2015.GASBStatementNo.75–AccountingandFinancialReportsfor

PostemploymentBenefitsOtherthanPensions(OPEB)requiresthereportingoftherelatedliabilityforthefirst

time in fiscal year 2019.This represents

the University’s proportionate share of the net pension/OPEB

liabilityfortheKentuckystateretirementplanstowhichtheUniversitymakescontributions.Theliability

relatedtopensionsdecreased($49.1million),whiletheliabilityrelatedtoOPEBdecreasedby($2.1million).

$4.8million–Increaseinaccountspayable.Thisincreaseis

duetoaccountspayablesrelatedtorenovation

andconstructionprojectsincludingJ.H.RichmondResidenceHall,Chick‐fil‐A,andEinsteinBros.Bagels.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

9

($4.6million)–Decreaseinlong‐termdebt.Thisdecreaseistheresultofthe2019principalpaymentson

bondsandmasterleases.

Totalliabilitiesatthe

endofthe2018fiscalyearwere$364.8million,adecreaseof($52.1million).Thischangewas

duetothefollowing:

($43.8million)–Netdecreaseinpension/OPEBliability.GASBStatementNo.68‐AccountingandFinancial

Reporting for Pensions — an amendment of GASB Statement No. 27 required the

reporting of the pension

liabilityforthefirsttimeinfiscalyear2015.GASBStatementNo.75–AccountingandFinancialReportsfor

PostemploymentBenefitsOtherthanPensions(OPEB)requiresthereportingoftherelatedliabilityforthefirst

time in fiscal year 2018.This represents the University’s proportionate share

of the net pension/OPEB

liabilityfortheKentuckystateretirementplanstowhichtheUniversitymakescontributions.Theliability

relatedto pensionsdecreased($81.6million),whiletheliabilityrelatedtoOPEBincreasedby$37.8million.

($3.2million)‐Decreaseinaccountspayable.Thisdecreaseisattributedtothenet($3

million)decreasein

PlantaccountspayablerelatedtotheBreathittVeterinaryCenter,H.C.FranklinHallandtheEngineering

andPhysicsbuilding,andoffsetbya($0.2million)decreaseinrestrictedaccountspayableattributableto

timingdifferencesinroutinepayables.

($0.4 million) – Decrease in unearned revenue.This decrease is

the result of reductions in E&G ($0.2

million)andRestricted($0.2million)unearnedrevenues.

($4.7million)‐Decreaseinlong‐termdebt.Thisdecreaseis theresultofthe2018principalpaymentson

bondsandmasterleases.

DeferredInflowsofResources

AnewsectionoftheStatementofNetPositionaddedin2014incompliancewithGASBStatementNo.65–Items

PreviouslyReportedasAssetsandLiabilities.Thisstatementrequiresthatcertainitemsarenolongertobereported

asaliability.Thisconsistedof$100.4millioninfiscalyear

2019,$73.2millionand$7millioninfiscalyears2018

and2017respectively,fordeferredinflowsofresourcesrelatedtopensions/OPEBasspecifiedinGASBStatement

Nos. 68 and 75. An additional $4.4 million was record in fiscal year 2019 related to the outsourcing of dining

services.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

10

NetPosition

Netposition,whichrepresenttotalequity,oftheUniversityweredividedintothreemajorcategories,definedas

follows:

o Investedincapitalassets,netofrelateddebt‐Thiscategoryrepresentstheinstitution’sequityinproperty,

buildings, equipment, library holdings and other plant assets owned by the University, less related

depreciationandoutstandingbalancesofborrowingsusedtofinancethepurchaseorconstructionofthose

assets.

o Restricted‐This category represents those assets which are subject to externally imposed restrictions

governingtheiruseandincludesclassificationsofnonexpendableandexpendable.

Restrictednonexpendablenetposition‐Restrictednonexpendablenetpositionconsistsolelyof

permanent endowments owned by the University.The corpus, as specified by the donor, is

investedinperpetuityandmaynotbeexpended.

Restrictedexpendablenetposition‐Restrictedexpendablenetpositionconsistofthoseassetsthat

may be expended by the University, but must be spent for purposes as defined by the donors

and/orexternalentitiesthathaveplacedtimeorpurposerestrictionsontheuseoftheassets.

o Unrestricted‐This category represents the net position held by the University that has no formal

restrictions.Although unrestricted net position is not subject to externally imposed stipulations,

substantiallyalloftheunrestrictednetpositionhasbeendesignatedforvariousprogramsandinitiatives,

capitalprojectsandworkingcapitalrequirements.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

11

CondensedStatementsofNetPosition

June30,2019 June30, 2018 June30, 2017

Currentasset s 108,932,836$ 116,557,371$ 103,706,220$

Noncurr entasset s 91,658,940 80,169,828 79,651,477

Capitalassets 239,660,043 233,647,333 250,242,436

440,251,819 430,374,532 433,600,133

DeferredOutflows 42,40 2,028 53,839,367 56,508,116

Currentlia bilit ies 27 ,08 6 ,95 5 22,447,918 26,072,558

Noncurr entlia bilities 28 6,51 8 ,165 342,364,235 390,780,206

313,605,120 364,812,153 416,852,764

DeferredInflows 104,772,664 73,205,305 7,034,713

Investedincapita l

asset s, 170,681,775 159,215,284 173,041,810

net ofrelateddebt

Res t r ict edfor

Nonexpendable 22,517,317 22,285,087 21,973,233

Expendab le

Scholar ships,research,

instr uctionandother 7,183,574 6,979,462 6,271,792

Loans 3,646,465 3,469,792 4,081,721

Capital 14,567,160 17,812,615 2,667,171

Deb t ser vice 365,424 287,315 236,717

Unrestricted (154,685,652) (163,853,114) (142,051,672)

64,27 6,063$ 46,196,441$ 66,220,772$

Totalliabili ties

Ne tPosition

Totalnetposition

Asse ts

Totalassets

Liabilities

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

12

StatementsofRevenues,ExpensesandChangesinNetPosition

The Statements of Revenues, Expenses and Changes in Net Position, which are generally referred to as the

activitiesstatement

orincomestatement,presenttherevenuesearnedandexpensesincurredandincomeorloss

fromoperationsforthecurrentandpriorfiscalyears.Activitiesarereportedaseitheroperatingornon‐operating.

ChangesintotalnetpositionaspresentedontheStatementsofNetPositionarebasedontheactivitypresented

intheStatementsofRevenues,ExpensesandChangesinNetPosition.

The financial statements are prepared on the accrual basis of accounting, whereby revenues and assets are

recognizedwhen the serviceis provided and expenses and liabilities are recognized whenothers provide the

service,regardlessof when cash isexchanged.

Apublicuniversity’sdependencyon stateappropriations will

resultinreportedoperatinglosses.TheGovernmentalAccountingStandardsBoardrequiresstateappropriations

tobeclassifiedasnon‐operatingrevenues.Theutilizationoflong‐livedcapitalassetsisreflectedinthefinancial

statementsasdepreciation,whichexpensesthecostsofanasset

overitsexpectedusefullife.

Revenues

Totaloperatingrevenues,whichexcludestateappropriations,forfiscalyear2019were$110.3million,

includingstudenttuitionandfees,netofrelateddiscountsandallowances,of$60.5million,operating

restrictedgrantsandcontractsrevenuesof$6.9million,sales,servicesandotherrevenuesof$16.0

million,andauxiliaryservicesnetrevenues

of$26.9million.

Duringfiscalyear2019,operatingrevenuesdecreasedby($8.8million).Thisdecreasefromtheprioryear

iscomprisedprimarilyof($7.7million)inactualnettuition,offsetbyincreasesof$0.2millioningrants

andcontractsrevenue,$3.6millioninsales,services,andotherrevenuesand

($4.9million)decreasein

auxiliaryservices,specificallyhousing,diningandbookstore,largelyduetotheoutsourcingofdiningin

December2018.

TheUniversityreceived$45.3millioninstateappropriationsforoperations,includingperformancepool

funding,forfiscalyear2019,and$45.8millionforfiscalyear2018.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

13

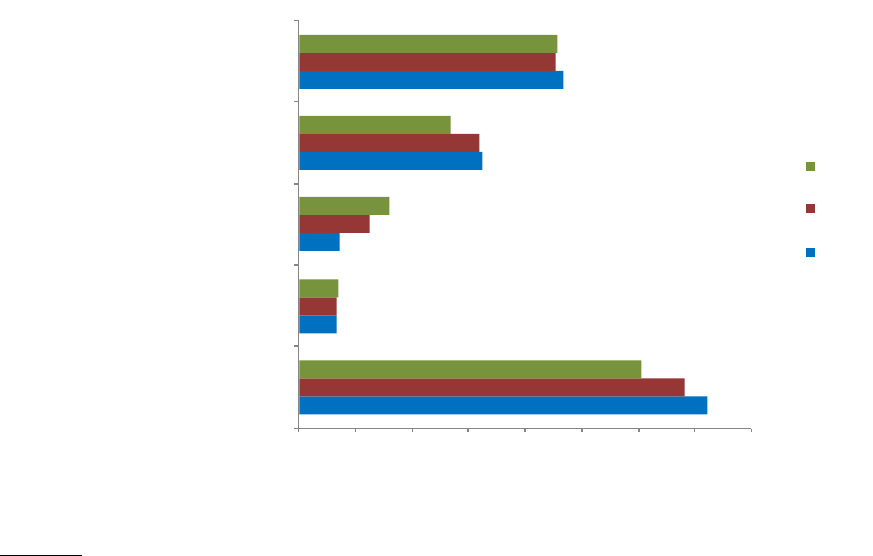

Thecomparativesourcesoftotaloperatingrevenuesandnonoperatingstateappropriationrevenuesarereflected

inthefollowingchart:

OperatingRevenuesandStateAppropriations

(InThousands)

$72,054

$6,787

$7,306

$32,474

$46,825

$68,175

$6,651

$12,454

$31,779

$45,344

$60,456

$6,887

$16,015

$26,928

$45,572

$— $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,00 0

Studenttuition&fees,net

Grants&contracts

Other

Auxiliary

Stateappropriations

2019

2018

2017

Expenses

Totaloperatingexpensesforfiscalyear2019were$168.9million.AcademicAffairs,whichincludeinstruction,

research,librariesandacademicsupport,representthelargestportionoftheoperatingexpensestotaling$73.4

millionor43%.StudentAffairs,whichincludestudentservices,financialaidandauxiliaryservices,was$49.5

millionor29%and

otherexpenseswhichincludepublicservice,institutionalsupport,depreciationandoperation

andmaintenanceandstatepensionexpenseamountedto$46.0millionor28%.DepreciationandPensionexpense

forallareasoftheUniversity,arereportedasanoperatingexpenseandwasnotallocatedtoeachprogramgroup,

exceptforauxiliaryenterprises.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

14

OperatingexpensesdecreasedfortheyearendedJune30,2019,by($17.6million).Theprimaryreasonsforthe

decreaseinoperatingexpensesareasfollows:

($5.5million)

‐DecreaseinoveralloperatingexpensesastheresultoftheUniversity’sproportionateshare

ofexpensesrelatedtoKentuckystatepensionplans.TheUniversity’sproportionateexpenseswere$12.6

millionin2019,$10.2millionin2018and$4.6 millionin2017fortheKERSanda$21.2millioncreditto

expensein

2019,$13.2millioncredittoexpensesin2018and$18millionchargetoexpensesin2017forthe

TRS.

($0.5million)–DecreaseinoveralloperatingexpensesastheresultoftheUniversity’sproportionateshare

of expenses related to Kentucky state OPEB plans. The University’s proportionate expenses were $1.0

millionin2019and$1.2millionin2018KERSand$0.3millionin2019and$0.6millionin2018fortheTRS.

($3.8million)‐DecreaseinoperationandmaintenanceofplantexpenseastheresultoftheNewBVCand

EngineeringandPhysicsbuildingsbeingplacedinservicein

2018.Whenthisoccurs,severalexpensesheld

asconstruction‐in‐progressarereleasedasplantexpensesrelatedtotheconstructionofthebuildingbut

notcapitalizedaspartofthebuilding.

($3.7 million)‐Decrease in overall operation spending, not including operations and maintenance

mentionedabove.Thisincludesa($3.6

million)decreaseinoverallsalariesandbenefitsanda($0.1million)

decreaseinotheroverallexpenditures.

($4.0million)–Decreaseinauxiliaryenterprisesprimarilyduetotheoutsourcingofdiningservices.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

15

Operatingexpensesbytypearereflectedinthefollowingchart:

UniversityOperatingExpenses

YearEndedJune30,2019

St udent

Affairs 29%

Academic

Affairs 43%

Other 28%

The net loss from operations for the year ended June 30, 2019, was ($58.7 million) including pension/OPEB

adjustments.Nonoperatingrevenues,netofexpenses,of$73.1million,insurancereimbursementsof$3.4million,

andcapitalgiftsof$0.1millionresultedinanincreaseinnetpositionof$18.1millionfortheyear

endedJune30,

2019.Thisincreaseinnetpositionisprimarilytheresultof$6.0millionrelatedtopension/OPEB,$4.0million

relatedtotheoutsourcingofdiningservices,$3.8millionrelatedtoadecreaseinoperationandmaintenanceof

plantexpensesrelatedand$3.7decreaseinoveralloperationspendingcombined

withanincreaseininvestment

income.

The net loss from operations for the year ended June 30, 2018, was ($67.6 million) including pension/OPEB

adjustments.Nonoperatingrevenues,netofexpenses,of$70.8million,statecapitalappropriationsof$4.4million

related to the Breathitt Veterinary Center and the Engineering and Physics building

projects, insurance

reimbursementrelatedtotheimpairmentofJ.H.RichmondResidenceHallandsurroundingbuildingswhich

wereimpactedof$3.9million,otherinsurancereimbursementsof$1.1million,andcapitalgiftsof$0.4million

resultedinanincreaseinnetpositionof$12.1millionfortheyearendedJune30,2018.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

16

CondensedStatementsofRevenues,Expe nses,andChangesinNetPosition

2019 2018 2017

Operatingre venues

Studenttuitionandfees,net 60,456,045$ 68,175,108$ 72,053,962$

Gra ntsandcontr acts 6,886,581 6,650,616 6,787,113

Other 16,015,020 12,453,726 7,306,302

Auxiliary,net 26,928,253 31,779,351 32,473,936

Totaloperatingr ev enues 110,285,899 119,058,801 118,621,313

Operatingexpe nses

Instr uction 61,064,980 62,572,485 62,523,230

Othereducationalandgener al 77,435,333 89,344,602 105,309,128

Depr eciation 9,154,634 9,330,382 8,585,227

Auxiliaryenter prises 18,599,020 22,608,719 22,570,810

Auxiliarydepr eciation 2,693,821 2,757,883 2,872,348

Totaloperating expenses 168,947,788 186,614,071 201,860,743

Operatingloss (58,661,889) (67,555,270) (83,239,430)

Nonoperatingrevenues

Stateappr opr iations 45,572,300 45,344,100 46,824,500

Othernonoperat ingrevenues 27,485,929 25,496,375 23,916,782

Totalnonoper at ingrevenues 73,058,229 70,840,475 70,741,282

Otherrevenues

Statecapitalappropr iationsandot her 3,683,282 8,831,567 21,959,490

Increaseinnetassets 18,079,622 12,116,772 9,461,342

Netposition,beginningofy ear 46,196,441 66,220,772 56,759,430

Res tat ementof2018b eginningnet positionfor

OPEBliab ility — (32,141,103) —

Netposition,beginningofyear 46,196,441 34,079,669 56,759,430

Netposition,endofyear 64,276,063$ 46,196,441$ 66,220,772$

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

17

StatementsofCashFlows

TheStatementsofCash Flows provideasummaryofthesourcesandusesofcashby definedcategories.The

principal purposes of the Statements

of Cash Flows are to provide information about the University’s cash

receipts and payments during theyearsand to helpassessthe University’s ability to generate future netcash

flowsandmeetobligationsastheybecomedue,aswellasitsneedforexternalfinancing.

FortheyearendedJune

30,2019:

ThenetcashusedinoperatingactivitiesreflectsthenetcashusedforgeneraloperationsoftheUniversity,which

increasedby$11.3millionduringfiscalyear2019.Thisincreaseincashwasprimarilyduetoincreasesincash

providedbysalesandservicesofeducationandotherrevenuesactivitiesby$13.4

millionwhichincludesstate

pensionsupportanddecreasesincashusedbypaymentstosupplierstotaling$3.0millioncombinedwitha($3.5

million)decreaseincashusedbyauxiliariesforpaymentsforsalaries,wagesandfringesaswellas($1.6million)

decreasepaymentsto suppliers,primarilyresultingfrom theoutsourcing

ofdining services during fiscalyear

2019.

Thecashflowsfromnoncapitalfinancingactivitiesincreasedby$5.0millionduringfiscalyear2019.Thischange

wasprimarilyduetoanincreaseof$3.9millionfordeferredrevenuesrelatedtotheoutsourcingofdiningservices

and$1.1millionincreaseingrantsand

contracts.

The net cash flows used in capital and related financing activities represent cash used for the acquisition,

constructionandrenovationofcapitalassets,changedfrom($6.1million)usedduringfiscalyear2018to($17.3

million)usedduringfiscalyear2019, a $11.2millionchange.Part of thisdecreaseis

dueto$5.8millionmore

cash used in the construction costs attributable to J.H. Richmond Hall. Additionally, the Breathitt Veterinary

Center,andEngineeringandPhysicsbuildingwerecompletedornearingcompletioninfiscalyear2018therefore,

reducedspendingonthesefacilitiesoccurredduringfiscalyear2019.Alsocontributingtothedecrease

wasa$3

millionreceiptofinsuranceproceedsforJ.H.RichmondResidenceHallreceivedinfiscalyear2018.

Thecashflowsprovidedbyinvestingactivitiesrepresentthecashactivitiesofinvestments,whichincreasedby

$2.9millionfor2019.Thisincreasewasprimarilytheresultofanincreaseininvestment

earnings,$2.9whichis

attributedtoanincreaseininterestearnedon cashaccountsheldby theTreasurerof theCommonwealthand

wasduetofavorablemarketperformance.

FortheyearendedJune30,2018:

ThenetcashusedinoperatingactivitiesreflectsthenetcashusedforgeneraloperationsoftheUniversity,which

decreasedby($10.9million)duringfiscal2018.Thisdecreaseincashusedwasprimarilyduetoincreasesincash

usedbypaymentstosuppliersandforsalaries,wagesandfringes,anddecreases

incashfromnettuitionand

fees,andsalesandotherrevenues.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

18

Thecashflowsfromnoncapitalfinancingactivitiesincreasedby$323,000duringfiscalyear2018.Thischange

was primarily due to an increase of $1.4 million for grants and

contract revenue, $227,000 for Endowment

proceedsand$209,000forgiftsotherthancapital,offsetbya($520,000)decreaseinstateappropriationsforfiscal

year2018anda($961,000)decreaseinstateappropriationreturnsofprioryeardeductions.

The net cash flows used in capital and related financing activities represent cash

used for the acquisition,

construction and renovation of capital assets, changed from ($16.2 million) used during 2017 to ($6.1million)

usedduring2018,a$10millionchange.Partofthisdecreaseisdueto$23.1millionlesscashusedinthepurchase

of capital assets, attributable to decreased spending on the

Breathitt Veterinary Center, and Engineering and

Physicsbuildingbothofwhichwerecompletedornearingcompletionin2018.Alsocontributingtotheincrease

was a $3 million receipt of insurance proceeds for J.H. Richmond Hall. These were offset by a ($16.8 million)

decrease in state capital appropriations for the final

construction of the Breathitt Veterinary Center and the

EngineeringandPhysicsbuilding.

Thecashflowsprovidedbyinvestingactivitiesrepresentthecashactivitiesofinvestments,whichincreasedby

$1.1millionfor 2018.This increasewas primarily the result of anincreasein investmentreceipts, $900,000 of

which is attributed to

an increase in interest earned on local bank accounts as well as cash accounts held in

Frankfort.

CondensedStatementsofCashFlows

2019 2018 2017

Cash

p

rovided/(used)b

y

:

O

p

eratin

g

act ivities (50,285,029)$ (61,621,713)$ (50,689,875)$

Nonca

p

italfinancin

g

act ivities 74,117,599 69,112,066 68,789,385

Ca

p

it a landrelatedfinancin

g

act ivities (15,574,361) (6,105,745) (16,174,554)

Investin

g

act ivities 4,961,649 2,052,005 949,730

Netincr easeincash 13,219,858 3,436,613 2,874,686

Cashandcashequivalents,beginning

of

y

ear 143,192,525 139,755,912 136,881,226

Cashandcashe

q

uivalents,endof

y

ear 156,412,383$ 143,192,525$ 139,755,912$

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

19

CapitalAssetsandDebtAdministration

TheUniversityhada$15.0millionincreaseincapitalassets,beforeaccumulateddepreciation,duringthefiscal

yearendedJune30,2019.This change

isprimarilyduetoa$12.5millionincreaseinconstruction‐in‐progress

relatedtoJ.H.RichmondResidenceHall.

CapitalassetsasofJune30,2019,andchangesduringtheyearareasfollows:

Balance Balance NetChange

June30, 2019 June30,2018 2018‐19

Land 10,442,742$ 10,176,698$ 266,044$

Constructioninpr ogr ess 18,831,090 6,264,350 12,566,740

Museumandcollectibles 694,737 694,737 ‐

Buildings 372,556,320 372,149,804 406,516

Non‐buildingimpr ovements 18,507,858 17,172,063 1,335,795

Equipment 35,864,174 35,280,560 583,614

Softw ar e 1,932,019 1,932,019 —

Libra ryholdings 10,681,965 10,744,204 (62,239)

Livestock 137,749 151,749 (14,000)

Accumulateddepreciation (229,988,611) (220,918,851) (9,069,760)

Tot al 239,660,043$ 233,647,333$ 6,012,710$

DebtasofJune30,2019,andchangesduringtheyearareasfollows:

Balance Balance NetChange

June 30,2019 June30,2018 2018‐19

General receiptsb onds 64,400,000$ 68,290,000$ (3,890,000)$

Bonddiscount (46,219) (50,841) 4,622

Bondpremium 1,826,529 1,947,291 (120,762)

CityofMur ray 6,995,000 7,390,000 (395,000)

Tot al 73,175,310$ 77,576,450$ (4,401,140)$

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

20

InfrastructureAssets

InfrastructureassetsaredefinedbyGASBNo.34aslong‐livedassetsthatarenormallystationaryinnatureand

normallycanbepreservedforasignificantly

greaternumberofyearsthanmostcapitalassets.Thesetypesof

assets will typically be permanent nonbuilding additions that service the entire campus.The University has

adoptedthemodifiedapproachofaccountingforitsinfrastructureassets.Thisapproachrequiresthatanasset

managementsystembeestablishedandmaintained.Suchasystem

wouldassessanddisclosethatalleligible

infrastructureassetsarebeingpreservedapproximatelyat(orabove)aconditionlevelestablished.Todate,the

Universityhasnotidentifiedanyassetsthatshouldbeclassifiedasinfrastructure.

AdditionalinformationforCapitalAssetsandDebtcanbefoundinNotes7and11,

respectively,tothefinancial

statements.

EconomicFactorsAffectingFuturePeriods

Infiscalyear2019,Kentucky’sGeneralFundreceiptsrosefortheninthconsecutiveyear.Final2019General

Fundrevenueswere$11,392.7million,or5.1%,morethan2018collections.FinalGeneralFundrevenues

were$194.5millionor1.7%more

thantheofficialrevenueestimatewhichhadprojected3.3%growth.

Thenationaloutlookoverthenextthreefiscalquarterscallsforareturntothelong‐termGrossDomestic

Product(GDP)growthtrendandamaterialslowinginemploymentgains.RealGDPgrowthisexpected

to be 2% over the

next three quarters.Additionally, interest rates are expected to remain low and the

Federal Reserve has signaled a “dovish” policy for the near term.Recent gains in wealth, wages, and

employment have been coupled with increased consumer confidence, supporting continued growth in

consumerexpenditures.

Theabovewasreportedinthe

2019annualeditionofCommonwealthofKentuckyQuarterlyEconomic&

RevenueReport.

TheUniversityissuedgeneralreceiptsbondsinJuly2019totaling$4.3millionfortherefundingofSeries

2009Ageneralreceiptsbondsoriginallyobtainedforthecomp letionofJ.H.RichmondResidenceHalland

variousotherprojectsunder

$600,000.

TheUniversitycontinuestomanageongoingassetpreservationissues.Thesearebeingaddressedthrough

a combination of an annual budget allocation of university funds designated to deferred maintenance

projects,one‐timefundingandtheuseofreservesasappropriate.Withagingbuildingsandinfrastructure,

assetpreservationwillcontinue

tobeafundingpriorityfortheUniversity.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

21

The University will be requesting bond financing authorization for up to $11 million from the General

Assemblyintheir2020sessionaspartofthe2020‐22Budget

oftheCommonwealth.Inaddition,arequest

forupto $22millioninmatching fundswill berequested.This$33millionwillbe designatedfor asset

preservation.

The2020‐22bienniumcapitalbudgetrequestwillalsoinclude$16millionbondfinancingauthorizationfor

aconstruction/renovationofResidencehallsandupto

$66millionofthirdfinancingauthorizationforthe

construction/renovationofresidencehalls.

The University is currently developing an updated campus master plan, including residence halls and

athleticfacilities.Theseplansareexpectedtobecompletedinthewinter2020.

The University continues to provide health insurance to employees through

a self‐funded program. As

reflectedinnationaltrends,thecostsofhealthclaimscontinuetobeamajorexpensefortheUniversity.

DetailsoffundingamountsfortheplancanbefoundinNote9.TheUniversityimplementedastronger

utilization management package, with additionalcontrols onspecialtydrugs to

help manage pharmacy

costs.TheSegalCompany(SibsonConsulting)providesguidanceforallhealthandwellnessprograms.

The Board of Regents authorized the exploration of outsourcing options and the issuance of necessary

requestforproposals(RFP)thatmaybeinthebestinterestoftheUniversityinJune2019.

AnRFPwas

releasedinSeptember2019relatedtotheoutsourcingoffacilitiesmanagementcustodial,groundsand/or

maintenancefunctions.TheRFPwillbefollowedbyareviewofvendorresponsesandcampusvisitsand

presentations,resultinginanevaluationofthefacilitiesmanagementoutsourcingoptions.

Earlyheadcountenrollmentsfor

Fall2019arepromising,with first‐time freshmenenrollmentsup7.6%,

first‐timetransferenrollmentsup11.6%,andfirst‐timegraduateenrollmentup12.5%.Totalenrollmentis

projected to be up 1.1%, with freshmen to sophomore retention rate for baccalaureate‐degree seeking

studentsof79%.

TheUniversityisworking

todevelopastrongeronlineacademicprogrampresenceandplanstobegina

pilot project with the assistanceof a third‐party to assist with the marketing and management of select

graduateprograms.TheUniversity’sfacultywillcontinuetoteachtheseprogramsandwillmaintainall

responsibilitiesandoversight of

coursecontent.Enrollmentsareexpected togrow abovecurrentlevels

andnetrevenueswillassistwithacademicprogramenhancementandotherinstitutionalpriorities

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

Management’sDiscussionandAnalysis,continued

June30,2019

22

Duringthe2019KentuckySpecialLegislationSession,HouseBill1(HB1)wasapprovedbythelegislatureand

approvedbytheGovernor,tobeeffectiveforfiscalyear

2020.HB1providedanemployercontributionrate

freezeof49.47%endingonJune30,2020.Thisratewasplannedtobe83.43%onJuly1,2019.Inaddition,the

legislation provides options for “quasi” agencies, which includes five comprehensive universities and the

communitycollegesystemwithinthestateofKentucky.These

optionsprovideforalumpsumora30‐year

financingoptionforeachagencytopaytheirportion,asdefinedbytheKentuckyRetirementSystem,ofthe

KERSunfundedpensionandOPEBliabilities.ThelegislationalsoallowstheseagenciestoremainintheKERS

andacceptincreasingemployeecontribution

ratesthatcurrentlyhavenodefinedmaximum.MurrayState

Universityisinthe processofanalyzingwhichoptionismostsustainableforthelong‐rangeoperationsofthe

University.

TheUniversitiesstateperformancefundingmodelcapsthemaximumexposureoflossat1%ofappropriations

for fiscal year 2019.

This cap isa maximum of 2% for fiscalyear 2020 and current legislation requires the

elimination of a cap for fiscal years 2021 and after.The University is actively working with legislative

representativestoreinstatethelegislatively2%mandatedcapforfiscalyears2021andafter.Thiswillprovide

a

morestableallocationfromtheperformancefundingpoolandallowalluniversitiestheabilitytodevelop

long‐rangefinancialplans.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

StatementsofNetPosition

June30,2019and2018

Seeaccompanyingnotes.

23

2019 2018

Assets

CurrentAssets

Cashandcashequiv alents 93,721,297$ 92,230,046$

Accountsreceivable,net 9,775,707 18,727,240

Interestreceivable — 197,854

Inventor ies 2,742,521 3,141,909

Loanstostudent s,net 490,043 582,137

Prepa idexpenses 2,203,268 1,678,185

To ta lCurrentAssets

108,932,836 116,557,371

NoncurrentAsset s

Res tr ict edcashandcash equiv alents 62,691,086 50,962,479

Res tr ict edinv estments 26,723,042 26,555,267

Loanstostudent s,net 2,244,812 2,652,082

Capitalassets 469,648,654 454,566,184

Accumulateddepr eciat ion (229,988,611) (220,918,851)

To ta lNoncurrentAssets

331,318,983 313,817,161

To ta lAssets

440,251,819 430,374,532

DeferredOutflows ofRe sources

Bondrefundingloss 2,256,251 2,491,793

Defer r edoutflowsrelatedtopension/OPEBcont ributions 40,145,777 51,347,574

To ta lDeferredOutflowsofRe sources

42,402,028 53,839,367

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

StatementsofNetPosition

June30,2019and2018

Seeaccompanyingnotes.

24

2019 2018

Liabilities

CurrentLiabilities

Accountspayab le 11,431,746$ 6,646,037$

Accruedpay r oll 6,277,097 6,775,768

Self‐insuredhealt hliabilit y 716,162 624,291

Interestpayab le 777,860 814,646

Unearnedr evenue 2,920,163 2,850,441

Deposit s‐currentpor tion 302,787 275,595

Long‐termdebt‐cur rentpor t ion 4,661,140 4,461,140

To talCurrentLiabilities

27,086,955 22,447,918

NoncurrentLiabilities

Deposits 329,700 330,000

Long‐termdeb t 68,514,170 73,115,310

Netpension/OPEBliability,stat epen sionplans 217,674,295 268,918,925

To tal

NoncurrentLiabilities

286,518,165 342,364,235

To talLiabilities

313,605,120 364,812,153

DeferredInflowsofResource s

Defer r edinflows relatedtodiningcontr act 4,377,049 —

Defer r edinflows relatedtonetpension/OPEBliab ility 100,395,615 73,205,305

To ta lDeferredInflowsofResources

104,772,664 73,205,305

NetPosition

Netinvest mentincapitalassets 170,681,775 159,215,284

Res t rictedfor:

Nonexpendable:

Endow ment 22,517,317 22,285,087

Expen da b le:

Scholar ships,resear ch,instr uct ionandother 7,183,574 6,979,462

Loans 3,646,465 3,469,792

Capitalpr oj ects 14,567,160 17,812,615

Deb t service 365,424 287,315

Unr estr icted (154,685,652) (163,853,114)

To talNe tPosition

64,276,063$ 46,196,441$

MURRAYSTATEUNIVERSITYFOUNDATION,INC.

StatementsofFinancialPosition

June30,2019and2018

Seeaccompanyingnotes.

25

2019 2018

Cashandcas h equiv alents 3,091,087$ 1,503,097$

Account s r eceivable 176,764 2,765,584

Invest ment s 124,657,562 118,849,706

Realestateheldforinv estment 2,552,957 2,552,957

Prep aidandotherasset s 59,350 67,464

Contributionsreceivable,net 1,075,782 740,133

Proper tyandequipment,net 6,440,741 6,563,619

To ta lAssets 138,054,243$ 133,042,560$

Asse ts

2019 2018

Liabilities

Account s payable 128,367$ 114,648$

DuetoMurrayStateUniversity(MSU) 319,944 249,045

Accruedexpenses 59,122 57,729

Deferredrevenue 57,438 60,610

Assetsheldforother s 27,628,298 27,501,731

Capitalleaseobligation 74 ,28 3 130,284

Annuitiesandtrustspay able 5,208,773 5,378,187

Otherliabilit ies 328 ,20 3 338,459

To ta lLiabilities 33,804,428 33,830,693

Ne tAssets

Withoutdonorrest rictions 21,400,371 20,638,045

Withdonorrestr ictions 82,849,444 78,573,822

To ta lNetAssets

104,249,815 99,211,867

To ta lLiabilitiesandNetAssets 138,054,243$ 133,042,560$

LiabilitiesAndNe tAssets

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

StatementsofRevenues,Expenses,andChangesinNetPosition

YearsendedJune30,2019and2018

26

2019 2018

OperatingRevenues

Tuitionandfees 101,710,114$ 111,009,473$

Less:Dis count s andallowances (41,254,069) (42,834,365)

Nettuitionandfees 60,456,045 68,175,108

Federalgrantsandcontr acts 5,857,082 5,358,956

St ategrantsandcontr acts 640,649 924,241

Priva tegrantsandcontr acts 388,850 367,419

Totalgrantsandcont racts 6,886,581 6,650,616

Salesandser vicesofeducationalactivities 6,793,655 5,548,567

Otheroperatingrevenues 9,221,365 6,905,159

Totalsales,ser vices,

andotherrevenues 16,015,020 12,453,726

Auxilia ry enterpr ises 27,384,197 32,268,637

Less:Dis count s andallowan ces (4 5 5 ,94 4 ) (489,286)

Netauxiliary rev enue 26,928,253 31,779,351

To ta lOperatingRevenues 110,285,899 119,058,801

OperatingExpenses

Instr uction 61,064,980 62,572,485

Resear ch 2,258,101 2,472,027

Pub licser vice 5,977,242 6,731,676

Libr ar ies 3,391,475 3,527,421

Academicsuppor t 6,699,859 6,399,346

Studentser vices 15,537,491 16,467,202

In stit utionalsuppor t 18,292,223 18,453,802

Operationandmaintenanceofplant 19,956,224 23,777,931

Studentfinancialaid 12,649,543 12,735,820

Depreciation 9,154,634 9,330,382

St atepensionexpenseGASB68 (8,595,091) (3,008,564)

St atepensionexpense‐OPEBGASB75 1,268,266 1,787,941

Auxilia ry enterpr ises 18,599,020 22,608,719

Auxilia ry depreciation 2,693,821 2,757,883

To talOperatingExpens es 168,947,788 186,614,071

OperatingLoss (58,661,889) (67,555,270)

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

StatementsofRevenues,Expenses,andChangesinNetPosition,continued

YearsendedJune30,2019and2018

Seeaccompanyingnotes.

27

EndedJune30,

2019 2018

NonoperatingRe venues (Expense s)

Sta teappropr iations 45,572,300$ 45,344,100$

Res t rictedstudentfees(revenuesarepledgedas

security fortheCityofMurraydebtagr eement ) 595,887 620,681

Federalgrantsandcontr acts 13,719,413 12,878,368

Sta tegrantsandcontr acts 8,958,465 8,663,326

Localandpriv a tegrantsandcontr acts 634,072 602,347

Gift s 1,382,794 1,369,510

Investmentincome 5,363,133 3,191,632

Interestoncapital asset

‐relateddeb t (2,540,805) (1,630,671)

Lossondeletionanddisposalof capita lassets (507,629) (79,417)

Bondamor tization (119,401) (119,401)

NonoperatingRevenues(Expenses),Ne t 73,058,229 70,840,475

IncomeBeforeOtherRevenues,Expe ns es

Ga insandLo sse s 14,396,340 3,285,205

StateCapitalAppropriatio ns 131,988 4,378,656

GainontheInsuranceProc eedsfromtheImpairment

ofJ.H.Ri chmondResidenc eHall 3,057,744 2,845,855

Othe r

InsurancePro ceeds 359,653 1,194,604

CapitalGifts 127,916 403,899

AdditionstoPermanentEndowments 5,981 8,553

ChangeinNe tPosition 18,079,622 12,116,772

Net Position - Beginning of Year

46,196,441 66,220,772

Restatement of beginning net position for OPEB liability

— (32,141,103)

NetPosition‐BeginningofYear(adjusted) 46,196,441 34,079,669

NetPosition‐EndofYear 64,276,063$ 46,196,441$

MURRAYSTATEUNIVERSITYFOUNDATION,INC.

StatementsofActivities

YearendedJune30,2019

Seeaccompanyingnotes.

28

WithoutDo no

r

WithDonor

Restrictions Restrictions Totals

Revenues,Gains/(Lo sses)AndOtherSupport

Contributions 3,500$ 3,722,551$ 3,726,051$

Revenues fromoperationsofthe

FrancesE.MillerMemorialGolfCourse 414,298 — 414,298

Feesandrentalincome 45,605 37,920 83,525

Investmentreturn,net 1,588,327 3,502,129 5,090,456

Other (31,692) 22,9 87 (8,705)

Changeinvalueofan n uitiespayable — 31,829 31,829

Netasset sreleasedfromrestr ictions 3,174,935

(3,174,935) —

To talRevenues,Gains/(Losse s)AndOthe rSupport 5,194,973 4,142,481 9,337,454

Expens es:

Progr amser vicesexpenses:

Supportpr ovidedtoMSU,includingscholar ships 3,191,890 — 3,191,890

FrancesE.Miller MemorialGolfCourse 605,142 — 605,142

TotalProgramServ icesExpenese 3,797,032 — 3,797,032

Suppor tingser vicesexpenses:

Mana gem ent andgener al 466,387 — 466,387

Fundr aising 36,08 7 — 36,0 87

TotalSupporting

Servi cesExpenese 502,47 4 — 502,474

To talExpe nses 4,299,506 — 4,299,506

TransfersbetweenFoundationfundgroups (133,141) 133,141 —

ChangeinNetAssets 762,32 6 4,275,622 5,037,948

NetAssets‐ BeginningofYear 20,638,045 78,573,8 22 99,211,867

Ne tAssets‐EndofYea r 21,400,371$ 82,849 ,444$ 104,249,815$

MURRAYSTATEUNIVERSITYFOUNDATION,INC.

StatementsofActivities

YearendedJune30,2018

Seeaccompanyingnotes.

29

WithoutDonor WithDono

r

Restrictions Restrictions Totals

Revenues,Gains/(Losse s)AndOtherSupport

Contributions —$ 5,419,900$ 5,41 9,900$

Revenues fromoperationsofthe

FrancesE.Miller MemorialGolfCourse 420,310 — 420,31 0

Feesandrentalincome 518,666 41,258 559,924

Investmentreturn,net 2,520,794 4,715,573 7,236,367

Other 9,082 42,536 51,618

Changeinvalueofan n uities pa yable — (164,342) (164,342)

Netasset sreleasedfromrest r ictions 2,879,078 (2,879,078) —

To talRevenues,Gains/(Lo sse s)AndOtherSupport 6,347,930 7,175,847 13,523,777

Expens es :

Programser vicesexpenses:

Supportprov idedtoMSU,includingscholarships 3,506,665 — 3,506,665

FrancesE.MillerMemorialGolfCourse 598,570 — 598,570

TotalPr ogramServicesExpenese 4,105,235 — 4,105,235

Suppor tingser vicesexpenses:

Management andgener al 391,682 — 391,68 2

Fundrais in g 22,542 — 22,542

TotalSupportin gServ ic es

Expenese 414,224 — 414,224

To talExpe nses 4,519,459 — 4,51 9,459

Transfe rsbetweenFoundationfundgroups 2,168,056 (2,168,056) —

ChangeinNetAssets 3,996,527 5,007,791 9,00 4,318

NetAssets‐BeginningofYear 16,641 ,518 73,566,031 90,207,549

NetAssets‐EndofYe ar 20,638 ,045$ 78,573,822$ 99,211,867$

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

StatementsofCashFlows

YearsendedJune30,2019and2018

Seeaccompanyingnotes.

30

2019 2018

CashFlowsFromOperatingActivities

Tuit ionandfees 59,213,135$ 66,266,582$

Gr ant sandcont r acts 6 ,400,296 6,549,597

Pa ymentsforsalar ies,wagesandfringes (102,330,390) (104,057,020)

Pa ymentstosupplier s (32,048,633) (35,143,546)

Pa ymentsforstudentfinancia laid (12,649,543) (12,735,820)

Loansissuedtoemployees (10,600) (26,546)

Collectionsof loan stoemployees 23,205 11,437

Loansissuedtostudents (63,378) (373,440)

Collectionsof loan sto

students 562,742 593,965

Salesandser vicesof educat ionalact ivities 18,288,760 7,880,793

Otheroperatingrevenues 3,694,436 639,481

Auxiliaryrevenues:

Diningservices 5,881,056 11,677,672

Housin

g

14,493,491 14,428,979

Bookstore 4,775,953 5,097,721

Contracteddiningservcies 761,618 —

Other 185,699 175,357

Auxiliarypaym ents:

Pa ymentsforsalar ies,wagesandfr inges (4,132,449) (7,661,947)

Pa ymentstosuppliers (13,330,427) (14,944,978)

NetCashUsedinOpera tingActi vi ties (50,285,029) (61,621,713)

CashFlowsFromNoncapita lFinancingActivities

St ateappr opriations 45,572,300 45,344,100

Endow ment proceedsforw ardedto

MSUFoundationforinvest ment (9,137) 390,535

Gr ant sandcontr acts 23,311,950

22,144,041

Endow ment income 446,681 241,888

Gift sforotherthancapitalpurposes 889,356 992,437

Agencyt ransactions 13,400 (935)

Defer r edinflowscontrac teddiningserv ices 3,893,049 —

NetCashProvidedbyNonca pitalFinancing Activities 74,117,599 69,112,066

CashFlowsFromCapitalandRelatedFinancingActivities

Rest rictedstudentfeespledgedfordebtserv ice 595,887 620,681

Insuranceproceeds‐J.H.Richm ondResidenceHall 3,057,744

2,999,000

Insuranceproceeds‐other 3 59,653 91,496

St atecapitalappr opriations 132,852 4,376,453

Purchasesof ca pita lasset s (13,014,563) (7,240,859)

Capitalgifts 109,090 341,491

Pri n ci pa lpaidoncapita ldebtandleases (4,285,000) (4,581,619)

Interestpa i doncapita ldebtandleases (2,530,024) (2,712,388)

NetCashUsedinCapitalandRelatedFinancingActi v ites (15,574,361) (6,105,745)

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

StatementsofCashFlows

YearsendedJune30,2019and2018

31

2019 2018

CashFlowsFromInvestingActivities

Proceeds fromsalesandmaturitiesofinvestments (4,850)$ 8,512$

Purc h asesofinvestments (9,395) (3,156)

Investmentreceipts 4,975,894 2,046,649

NetCashPro videdbyInvestingActivities

4,961,649 2,052,005

NetIncreaseinCashandCashEquivale nts

13,219,858 3,436,613

CashandCashEquivale nts‐BeginningofYea r

143,192,525 139,755,912

CashandCashEquivale nts‐End

ofYear

156,412,383$ 143,192,525$

ReconciliationofCashandCashEquivalents

totheStatementofNetPosition

Cashandcas h equivalents 93,721,297$ 92,230,046$

Rest rict edcash andcas h equivalents 62,691,086 50,962,479

To ta lCashandCashEquivalents

156,412,383$ 143,192,525$

ReconciliationofOpe ra tingLossto

Ne tCashUsedinOperatingActi vities

Operatingloss (58,661,889)$ (67,555,270)$

Adjustments

toreconcileoperatingloss to

net cash usedin operatingactivities:

Depr ecia t ionexpense 11,848,455 12,088,265

Baddebtexpense 377,840 319,939

Netpens i on(gain)/expense,proportionateshare (12,852,524) (7,395,683)

Netin‐kindexpenses 217,628 244,938

Changesinassetsandlia bilities:

Accountsandloan s receivable,net 9,450,897 625,439

Invent or ies 399,388 230,599

Prep aidexpenses (525,083) 192,013

Accountspayable (215,291) (87,969)

Self‐in suredhealt hliabilit y 91,871

49,338

Accruedpay roll (498,671) 53,947

Deposits 13,492 (74,319)

Unearnedr evenue 68,858 (312,950)

NetCashUsedinOperatingActivities

(50,285,029)$ (61,621,713)$

SupplementalDisclosureofCashFlowInformation

Gift sof ca pitalassets 18,826$ 62,408$

Accountspayableincurr edforcapitalassetpur chases 5,966,334 819,003

Changesinfairvalueofinvest ment s 138,412 705,241

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

NotestotheFinancialStatements

32

1. SummaryofSignificantAccountingPolicies

ChangeinAccountingPrinciple

Effective July 1, 2017, Murray State University (University) was required to adopt Governmental

Accounting Standards Board (GASB) Statement No. 75,ʺAccounting and Financial Reporting for

PostemploymentBenefitsOtherThanPensions(OPEB)ʺ(Statement75).Statement75replacestherequirements

ofStatementsNo.45,“AccountingandFinancialReportingbyEmployersforPostemployment

BenefitsOtherThan

Pensions, as amended, and No.57, “OPEB Measurements by Agent Employers and Agent Multiple‐Employer

Plans”, for OPEB. GASB 75 isapplicable for government agenciesthat provide definedbenefit OPEB to

recognize their long‐term obligation for OPEB as a liability to more comprehensively and comparably

measure

the annual cost. The University participates in the Kentucky Employees Retirement System

(KERS)OPEBplanadministeredbytheBoardofTrusteesoftheKentuckyRetirementSystemsaswellas

theTeachers’ Retirement System(TRS)ofKentucky.These arecostsharing,multipleemployerdefined

benefitOPEBplans,whichcoveralleligiblefull

‐timeemployeesandprovideshealthinsurancebenefits.

Cost‐sharinggovernmentalemployers,suchastheUniversity,arerequiredtoreportanetOPEBliability,

OPEBexpenseandOPEB‐relatedassetsandliabilitiesbasedontheirproportionateshareofthecollective

amountsforallgovernmentagenciesintheplan.Forthesepurposes’

amountshavebeendeterminedon

thesamebasisastheyarereportedbyKERSandTRS.TheKERSandTRSfinancialstatementsareprepared

usingtheaccrualbasisofaccountingwithbenefitsbeingrecognizedwhendueandpayableinaccordance

withtermsoftheplan.Investmentsarereportedatfairvalue.

Allgovernmentsparticipatinginthedefined

benefit OPEB plan also are required to disclose various information in the footnotes to the financial

statements–seeNote14.

StatementNo.75requiredretrospectiveapplication.ThebeginningnetpositionfortheyearendedJune

30, 2018 was adjusted to reflect the retrospective

application. The adjustment resulted in a $32,141,103

reductioninbeginningnetpositionforfiscalyear2018.

NatureofOperations

The University is a state‐supported institution of higher education located in Murray, Kentucky, and is

accredited by the Southern Association of Colleges and Schools.The University awards graduate and

undergraduate degrees from five colleges and two schools and serves a student population of

approximately 9,500.The University is a component

unit of the Commonwealth of Kentucky and is

includedinthegeneral‐purposefinancialstatementsoftheCommonwealth.

ReportingEntity

InaccordancewiththeprovisionsofGASB,certainorganizationsaretobereportedascomponentunitsof

a primary government based on the nature and significance of that organization’s relationship to the

primary government.Application of this statement results in including Murray State University

Foundation, Inc. (the Foundation) as a discretely

presented component unit of the University.The

Foundationisaprivatenonprofitorganizationthatreportsundergenerallyacceptedaccountingprinciples

setforthbyFinancialAccountingStandardsBoard(FASB)standards.Assuch,certainrevenuerecognition

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

NotestotheFinancialStatements

33

criteriaandpresentationfeatures aredifferentfromGASBrevenue recognitioncriteriaandpresentation

features.NomodificationshavebeenmadetotheFoundation’sfinancialinformationintheUniversity’s

financialreportforthesedifferences.

BasisofAccountingandFinancialStatementPresentation

TheUniversitypreparesitsfinancialstatementsasabusinesstypeactivityinconformitywithapplicable

pronouncementsoftheGASB.

Forfinancialreportingpurposes,theUniversityisconsideredaspecialpurposegovernmentengagedonly

inbusinesstypeactivities.Accordingly,theUniversity’sfinancialstatementshavebeenpresentedusing

theeconomicresourcesmeasurementfocus

andtheaccrualbasisofaccounting.Undertheaccrualbasis,

revenuesarerecognizedwhenearned,andexpensesarerecordedwhenanobligationhasbeenincurred.

Allsignificantintra‐agencytransactionshavebeeneliminated.

CashandCashEquivalents

TheUniversityconsidersallhighlyliquidinvestmentsthatareimmediatelyavailabletotheUniversityto

becashequivalents.FundsheldbytheCommonwealthofKentuckyareconsideredcashequivalents.

RestrictedCash,CashEquivalentsandInvestments

Cash, cash equivalents and investments that are externally restricted are classified as restricted assets.

These assets are used to make debt service payments, maintain sinking or reserve funds, purchase or

constructcapitalorothernoncurrentassetsorforotherrestrictedpurposes.

Investments

TheUniversityaccountsforitsinvestments atfairvalue.Fair valueisdeterminedusingquotedmarket

prices.Changesinunrealizedgain(loss)onthecarryingvalueofinvestmentsarereportedasacomponent

ofinvestmentincomeinthestatementsofrevenues,expenses,andchangesinnetposition.

Assetsheldbythe

FoundationrepresentthosegiftsanddonationsmadedirectlytotheUniversity,which

areheldbytheFoundationforinvestmentpurposes.Thenetappreciationandincomeofdonorrestricted

endowmentsareavailabletotheUniversityforexpendituretotheextentpermittedbyKentuckylawand

thespendingpolicy oftheFoundation.

Therecognitionofgifts, donations and endowmentpledgesare

accounted for by the University in accordance with GASB Statement No. 33, Accounting and Financial

Reporting forNon‐exchange Transactions(GASB No.33) andare recognizedwhen allapplicableeligibility

requirementsaremet.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

NotestotheFinancialStatements

34

AccountsReceivable

Accountsreceivableconsistsoftuitionandfeecharges,otheroperationalactivitiesandauxiliaryenterprise

servicesandamountsduefromcomponentunits.Accountsreceivablealsoincludeamountsduefromthe

federal government, state and local governments or private sources, for nonexchange type agreements

definedinaccordancewithGASBNo.33orin

connectionwithreimbursementofallowableexpenditures

madepursuanttotheUniversity’sgrantsandcontracts.Accountsreceivablearerecordednetofestimated

uncollectibleamounts.

Inventories

Inventoriesarestatedatthelowerofcost(first‐in,first‐outmethod)ormarketexceptinthecaseofFacilities

Managementinventorieswhichuseanaveragecostmethodtodeterminevalue.

CapitalAssets

All capital assets, as defined by University policy, are recorded at cost at the date of acquisition or, if

donated,atfair value atthedateof donation.Depreciationis computedusing the straight‐line method

overtheestimatedusefullifeoftheassetandisnotallocatedtofunctionalexpense

categories.Assetsunder

capitalleasesareamortizedovertheestimatedusefullifeoftheassetortheleaseterm,whicheverisshorter.

Routinerepairsandmaintenancearechargedtooperatingexpenseintheyearinwhichtheexpensewas

incurred.

Thefollowingestimatedusefullivesarebeingusedbythe

University:

Estimated

Asset Life

Buildin

g

s 40

y

ears

Nonbuildingimprovements 8‐20years

Equipment 5‐15years

Libraryholdings 10years

Livestock 12years

Software 8years

TheUniversitycapitalizesinterestcostsasacomponentofconstructioninprogress,basedoninterestcosts

ofborrowingspecificallyfortheproject,netofinterestearnedoninvestmentsacquiredwiththeproceeds

ofborrowing.Totalinterestcapitalizedwas$243and$1,037,348fortheyearsendedJune30,2019and2018,

respectively.

The University owns historical collections housed throughout the campus that it does not capitalize,

includingartifactsinWratherMuseum.ThesecollectionsadheretotheUniversity’spolicyto(a)maintain

themforpublicexhibition,educationorresearch;(b)protect,keepunencumbered,careforandpreserve

them and (c) require proceeds from

their sale to be used to acquire other collection items.Generally

acceptedaccountingprinciplespermitcollectionsmaintainedinthismannertobechargedtooperationsat

timeofacquisitionratherthancapitalized.

MURRAYSTATEUNIVERSITY

AComponentUnitoftheCommonwealthofKentucky

NotestotheFinancialStatements

35

CompensatedAbsences

ForemployeesparticipatingintheTeachers’RetirementSystem(TRS),vacationpayisaccruedatyearend

forfinancialstatementpurposes.Theliabilityandexpenseincurredareincludedatyearendwithaccrued

payroll,andasacomponentofcompensationandbenefitexpense.Sickleavebenefitsareexpectedtobe

realized as

paid time off or used to purchase service credits upon retirement.These are recognized as

expensewhenthetimeoffoccursorwhenservicecreditpaymentsareincurred.Noliabilityisaccruedfor

such benefits employees have earned while participating in the TRS plan, but not yet realized.For

employees

participatinginoptionalretirementplans(ORP),sicktimeisaccruedasitisearned.

UnearnedRevenue

Unearnedrevenueincludesamountsfortuitionandfees,internationalprogramfeesandcertainauxiliary

activities,includingcontracteddiningservices,receivedpriortotheendofthefiscalyearbutrelatedtothe

subsequent accounting period.Unearned revenues also include amounts received from state capital

appropriations and grant and contract sponsors for

which eligibility requirements have not been fully

satisfiedorthathavenotyetbeenearned.Suchamountsarerecognizedintheperiodtowhichtheservice

relatesorthegrant/contractrequirementshavebeenmet.

DeferredOutflowofResourcesandDeferredInflowofResources

Inadditionto assets,financialstatementsmayreportaseparatesectionfordeferredoutflowsofresources.

Deferred outflows of resources consist of the consumption of net position that is applicable to a future

reportingperiodandsowillnotberecognizedasanoutflowofresourcesuntilthen.Deferredoutflowsof

resourcesrelatedtorefundinglong‐termdebtandcertainpension/OPEBcontributionsarereportedinthe

statementofnetposition.Thedeferredbondrefundingamountresultsfromthedifferenceinthecarrying

value of refunded debt and its reacquisition price, and is amortized over the shorter of the life of the

refundedorrefundingdebt.Thedeferredoutflowforpension/OPEBcontributionsrepresentcontributions

made to the plan between the measurement date, which was the end of fiscal year 2018, of the

pension/OPEBobligationsandtheendoffiscalyear2019.

In addition to liabilities, financial statements may report a separate section for

deferred inflows of

resources.Deferredinflowsof resourcesconsist of the acquisitionofnet positionthat is applicableto a