More precise measurements of variables and the

inclusion of new predictor variables may be

important in accounting for the unexplained

variance. For example, psychological factors such

as work-motivation, self-concept, and work-satis-

faction may help predict what the outcome of the

disability will be.

The emphasis of this study is on the conse-

quences of chronic disability. Results show that

severity of disability alone does not determine

the disabling consequences since current employ-

ment status and personal earning are influenced

by other social and demographic factors. The

recurring importance of industry of employment

in the statistical analyses indicates that more

concern should be given to the working environ-

ment of the disabled when ascertaining their

needs. Industries vary greatly according to work

requirements, work conditions, benefits for em-

ployees and union members, etc. The criteria for

judging severity of disability should include not

only work limitations but other factors that in-

fluence the degree to which the disabled are

dependent on those around them for economic,

social, and psychological well-being.

The prospects for future research in disability

rest on a social epidemiological understanding

of risk factors that directly contribute to the

severity of the disabling condition. Part of this

understanding will be obtained by collecting

complete social-demographic information about

the disabled through survey research, but a sig-

nificant proportion of knowledge must come from

an investigation of disabling factors in a social-

psychological perspective. It is important to gain

insight into the conditions of the disabled that

distinguish them from the general population.

A fruitful approach is the utilization of com-

parative groups with respect to differing levels

of functional limitations. By using this approach

and, more specifically, by focusing attention on

the individual with the functional limitation and

not the disabling condition itself, those charac-

teristics of the disabled that render him prone

to severe disability can be identified. Perhaps the

researcher’s necessary classification of the dis-

abled in terms of severity of disability, however,

limits him to an analysis of medical conditions

and prohibits him from discussing the disabled’s

social conditions.

Social Security Abroad

Constant-Attendance Allowances for

Non-Work-Related Disability *

Since 1961, 22 countries have adopted constant-

attendance allowances payable under the dis-

ability provisions of old-age, survivors, and

invalidity insurance programs. A total o$ 47

countries now provide these benefits, in part a

reflection of a growing effort to contain the

spiraling cost of providing long-term hospital or

nursing-home care by cash assistance designed

to keep the beneficiary at home.

Constant-attendance allowances are cash bene-

fits paid on behalf of permanently disabled

persons who require either full- or part-time care

by another person at home. Since the early part

of this century, these benefits have been almost

exclusively awarded to incapacitated workers who

qualified for a disability pension under workmen’s

compensation programs. Thus, coverage was for

permanent disability resulting from diseases or

accidents that were work-related. In the post-

World War II era and as early as the 1930’s,

however, many countries instituted constant-

attendance allowances under the provisions of old-

age, survivors, and invalidity insurance programs

for persons whose disability was not work-con-

nected.

Most wage earners and heads of families who

become disabled receive workmen’s compensation.

The constant-attendance allowance under inva-

lidity insurance programs, however, is usually

aimed at covering persons with non-work-related

disabilities, including children and the aged. In

effect, the invalidity provisions eliminate cause

as a qualifying condition for constant-attendance

allowances.

BACKGROUND

Although payments of cash allowances for

constant attendance under invalidity programs

*Prepared by Martin B. Tracy, International Staff,

05ce of Research and Statistics.

32

SOCIAL SECURITY

have been made since at least the 1930’s, many

European programs were instituted in the post-

World War II period. There were apparently

two principal reasons for its development at

that time. First, the War had increased the need

for women workers, and their subsequent en-

trance into the labor market meant that they

could no longer attend to disabled relatives or

participate in voluntary home-care service orga-

nizations. As a result, home-care services were

unable to meet growing demands. Cash benefits

helped to alleviate the lack of voluntary man-

power by enabling a beneficiary either to pay for

the services of a nurse or to help compensate a

relative who stayed home to care for the invalid.

Second, as national health systems became

more developed after the War, provisions for

determining eligibility were adopted that usually

alIowed the family physician to decide entitle-

ment based on national guidelines. The cash pay-

ments made available under this approach allowed

disabled persons to pay the medical fees required

for home-nursing care or to pay relatives for

attending them. In the early stages of develop-

ment, the national health systems of Europe

sometimes did not provide cash allowances for

constant attendance because of the administrative

complexities involved. Some systems could not

cope with determining the extent of disability

necessary for entitlement to the benefit.

Since the early 1960’s, spiraling costs for insti-

tutionalized care, combined with an increase in

the number of permanently disabled persons, has

moved 22 more nations to establish this type of

allowance under their invalidity insurance pro-

visions. By adding the allowance to the invalidity

pensions, virtually all persons in covered em-

ployment are potentially entitled to constant-

attendance allowances, regardless of the cause

of incapacity, if the disability requires constant

care.

In addition to the invalidity insurance pro-

grams’ provisions for constant-attendance allow-

ances, three other main programs provide some

form of care to the disabled of all age groups:

(1) Workmen’s compensation programs award

cash allowances to the permanently disabled for

work-related incapacity;

(2)

home-help services

primarily provide domestic services to the tempo-

rarily as well as permanently disabled; and (3)

nursing homes offer institutionalized care, prin-

UULMTIN, NOVEMBER 1974

cipally for the aged with or without physical

handicaps.

Workmen’s Compensation

Traditionally, most provisions for constant-

attendance cash benefits have been covered under

workmen’s compensation. Of the 127 countries

with workmen’s compensation programs,

‘76

or

about 60 percent provide constant-attendance

allowances. All of the European countries as

well as Australia and Japan have such allowances.

In the United States, the workmen’s compensation

programs of Hawaii, Nevada, and Washington

pay a supplement for constant care to persons

permanently disabled from work-related acci-

dents or illnesses.

In most of the countries that provide the

allowance under workmen’s compensation, the

benefit increases the pension amount to at least

100 percent of former income. In many instances,

particularly in Europe and the former French

colonies, the trend has been to exceed the lOO-

percent replacement rate by as much as 40 per-

cent in an apparent effort to offset increasing

nursing-care costs and to induce the greater use

of home care.

Home-Help Services

A major source of constant-attendance care

is found in home services organizations. Since

the 1940’s, most industrialized countries have

provided programs to assist disabled aged and

handicapped persons by aiding them with domes-

tic chores such as cleaning, cooking, laundry, and

shopping. The intent has been to keep the patient

independent in his own home and out of institu-

tions. The types of services provided by home-help

programs and their financing vary greatly be-

tween communities as well as from country to

country. Services may be performed on a volun-

tary basis through charitable organizations or

provided as municipal projects, partly funded by

national assistance. In Sweden, for example, the

Government funds one-third of the cost to the

municipality in providing domestic home care

a5

to the handicapped and aged. In the United

States, home-help services are available under

both private and national programs.

At times, home-help services take the form

of a cash benefit. In the Scandinavian countries,

beneficiaries receive a means-tested benefit so that

they can hire an attendant when nurses, who

are usually provided free to the indigent, are not

otherwise available.

Aside from the Scandinavian programs, the

success of most home-help services has been hin-

dered by the general absence of provisions for

nursing care. Many women who once stayed home

to care for incapacitated relatives are now at

work and no longer available. The need for domi-

ciliary nursing care has, moreover, grown steadily

as the proportion of aged people in the general

population has increased. Correspondingly, the

traditional means of providing care have declined.

Nursing Homes

A third approach to constant care has been the

expansion of public nursing homes. Many coun-

tries have either built publicly financed facilities,

encouraged private development and expansion,

or both. A number of national health systems

subsidize private nursing homes to defray the

added expense of caring for the permanently dis-

abled. The use of nursing-home facilities is not,

however, generally viewed as a practical means

of caring for the severely handicapped. Too many

people must be accommodated and the cost of

institutionalization is too high.

CONSTANT-ATTENDANCE ALLOWANCES

UNDER INVALIDITY PROVISIONS

Many disabled persons are excluded from the

benefits and facilities provided by workmen’s

compensation programs. Others need medical at-

tention not provided by home-care agencies. Still

others do not want or cannot afford care in a

nursing home. The role of the constant-attendance

cash allowance under the invalidity program has

been to fill these gaps with low-cost assistance.

Forty-seven countries have adopted this ap-

proach-all the industrialized and Western Euro-

pean countries except Canada, West Germany,

and the United States. The benefit is normally

used to hire a professional or nonprofessional

nurse or to reimburse family members for their

costs incurred in caring for a relative. In some

cases, the benefit may be paid directly to rela-

tives attending the disabled person. As one intent

of the assistance is to help the disabled person

remain at home, the allowance is terminated if

the beneficiary is institutionalized,

Qualifying Conditions

The constant-attendance allowance in most

countries is a supplement to regular benefits pay-

able under the invalidity provisions of social

insurance programs. Individuals who are entitled

under invalidity provisions usually continue

to

receive the allowance when the invalidity pension

is converted to an old-age benefit at retirement

age. Initial entitlement to benefits is also possible

under the old-age pension provisions, and in some

cases it is restricted to persons of retirement age.

Usually the qualifying conditions for an inva-

lidity pension require at least a tyo-thirds loss

of working capacity and a specified period of

contributions from covered employment to the

social security fund. In addition, the constant-

attendance supplement requires a permanent in-

capacity to such an extent that the disabled person

needs help with eating, dressing, and bodily func-

tions for at least 12 hours a day.

In some countries, these conditions are met only

in cases of loo-percent or total permanent dis-

ability. In others, particularly in Scandinavia,

constant-attendance allowances are payable for

lesser degrees of disability based on residency and

the severity of disablement. In these programs,

a permanently disabled person who needs only

part-time care may qualify for the special allow-

ance. The criteria used under these systems are

determined on an individual basis by the disabled

person’s personal physician.

A variation of this approach has recently been

adopted in Belgium There a test that required

loo-percent disability has been replaced by a

case-by-case test of each individual’s particular

circumstances. Need is determined by the patient’s

SOCIAL SECURITY

own physician, based on Government guidelines.

The criterion of a new program in Australia,

on the other hand, specifies that an aged person

must require professional nursing care to the

extent that would justify admission to a nursing

home otherwise.

Under most invalidity insurance programs,

benefits are payable for permanent disability

as a result of any cause-illness, accident, in-

firmity, or disease. By way of contrast, entitle-

ment under workmen’s compensation programs

is almost always restricted to work-related injury

or illness. A recent accident insurance program

in New Zealand that covers all contingencies is

the major exception of this po1icy.l Under this

program, about 90 percent of the workers receive

24-hour-a-day accident coverage. The remaining

10 percent (apprentices and part-time workers)

are covered for work-related injuries, including

those that occur while traveling to and from

the job.

In some countries, age may be a qualifying

condition for entitlement to constant-attendance

allowances under invalidity insurance. In Aus-

tralia, for example, the allowance is paid if the

beneficiary is aged 65 or over. In other countries,

age is a factor only in establishing the benefit

amount. In France and the United Kingdom rates

vary according to age groups. In most programs,

however, the allowance is awarded without age

restrictions. In those countries where entitlement

is based on employment, special provisions may

be made for covering children.

Another important qualifying characteristic of

most constant-attendance allowances is the appli-

cation of a means test. Under such a test, benefits

may be payable only if the beneficiary’s income,

including any disability benefits, is below a speci-

fied level. In certain countries-France, for ex-

ample-the income of the family as well as the

beneficiary is calculated in the means test. This

method is used in the French test for allowances

payable to families with disabled children. In

other countries, as in Scandinavia, the means test

is applied only when a nursing shortage requires

cash benefits for the recruitment of a relative or

others to attend the beneficiary.

’ See Elizabeth K. Kirkpatrick, “No-Fault Accident

Compensation in New Zealand,” EfociaZ Recur@ Bulletin,

September 1973, pages 25-29.

Benefits

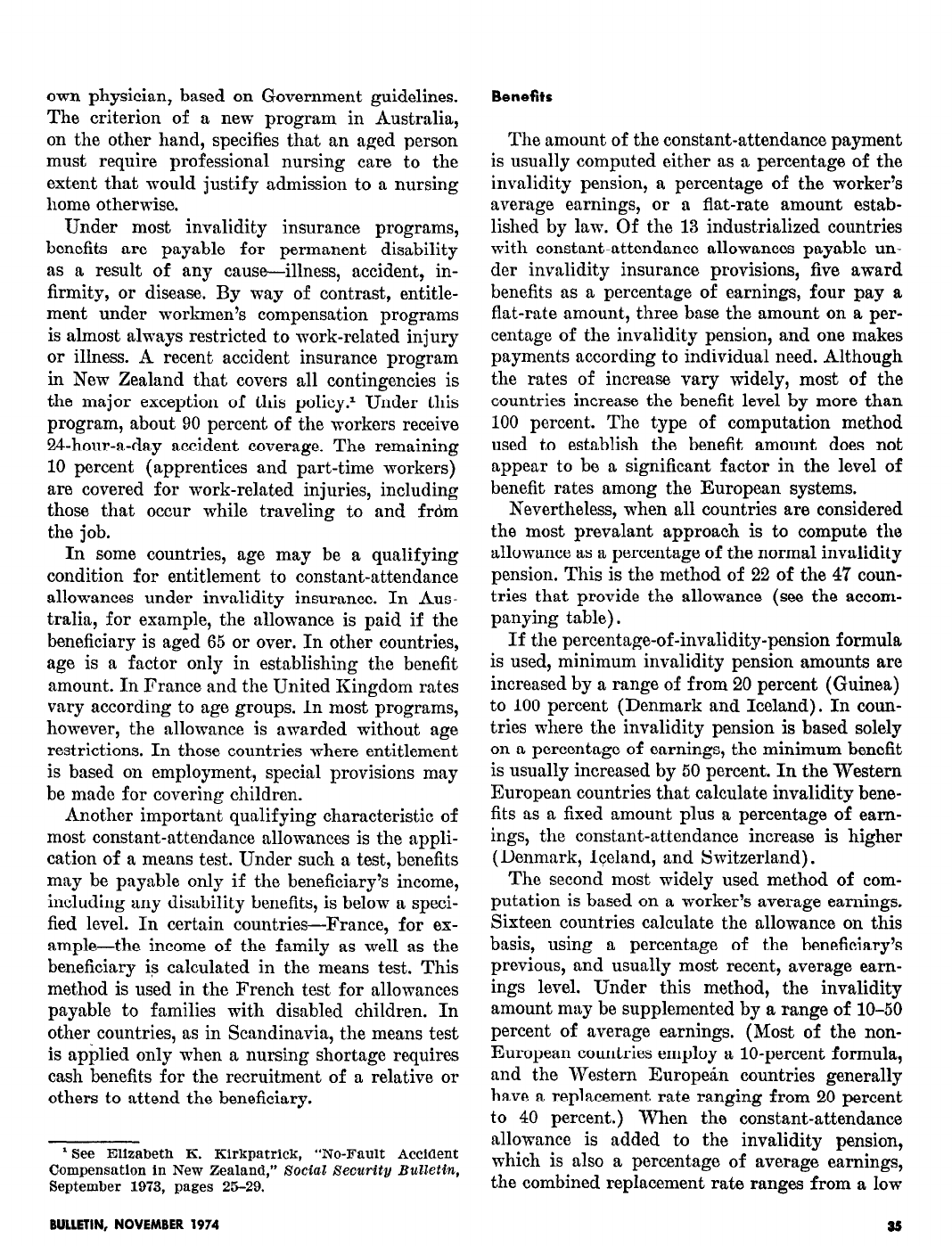

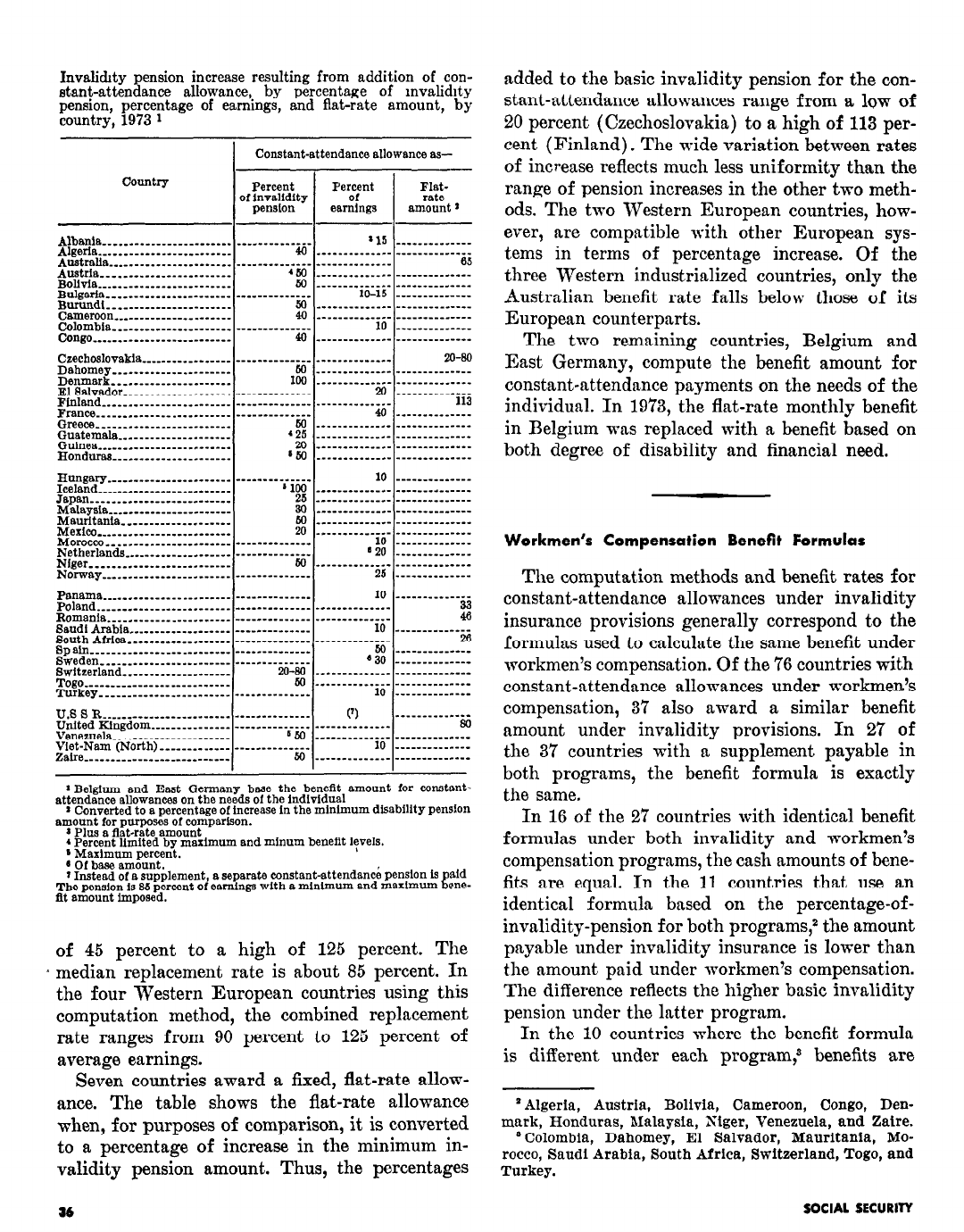

The amount of the constant-attendance payment

is usually computed either as a percentage of the

invalidity pension, a percentage of the worker’s

average earnings, or a flat-rate amount estab-

lished by law. Of the 13 industrialized countries

with constant-attendance allowances payable un-

der invalidity insurance provisions, five award

benefits as a percentage of earnings, four pay a

flat-rate amount, three base the amount on a per-

centage of the invalidity pension, and one makes

payments according to individual need. Although

the rates of increase vary widely, most of the

countries increase the benefit level by more than

100 percent. The type of computation method

used to establish the benefit amount does not

appear to be a significant factor in the level of

benefit rates among the European systems.

Nevertheless, when all countries are considered

the most prevalant approach is to compute the

allowance as a percentage of the normal invalidity

pension. This is the method of 22 of the 47 coun-

tries that provide the allowance (see the accom-

panying table).

If the percentage-of-invalidity-pension formula

is used, minimum invalidity pension amounts are

increased by a range of from 20 percent (Guinea)

to 100 percent (Denmark and Iceland). In coun-

tries where the invalidity pension is based solely

on a percentage of earnings, the minimum benefit

is usually increased by 50 percent. In the Western

European countries that calculate invalidity bene-

fits as a fixed amount plus a percentage of earn-

ings, the constant-attendance increase is higher

(Denmark, Iceland, and Switzerland).

The second most widely used method of com-

putation is based on a worker’s average earnings.

Sixteen countries calculate the allowance on this

basis, using a percentage of the beneficiary’s

previous, and usually most recent, average earn-

ings level. Under this method, the invalidity

amount may be supplemented by a range of

lo-50

percent of average earnings. (Most of the non-

European countries employ a lo-percent formula,

and the IVestern European countries generally

have a replacement rate ranging from 20 percent

to 40 percent.) When the constant-attendance

allowance is added to the invalidity pension,

which is also a percentage of average earnings,

the combined replacement rate ranges from a low

BULLETIN, NOVEMBER 1974

es

Invalidity pension increase resulting from addition of con-

stant-attendance allowance,. by percentage of mvalidrty

pension, percentage of earnings, and flat-rate amount, by

country, 1973 1

Constant-attendance allowance as-

Albania--....-...-------------- ---------‘-40-

‘15 --_______-----

Algeria ____________ ___________ __

__-__________- -__________-_-

Au&alla _______________________ __________ iw- ______________

65

Austria.-.........-............

_____________- -___-____---_-

Bolivia _____ ____ __________ _ _____

50 __-___________ -------___---_

LuIl&xal-:::-::::::~::- ~:~‘-~~

-w-v----------

10-15 ----_____----_

Cameroon ___________ L:...::.-

al __--_________- --_______----_

40 _-___________- -___-_____---_

~.Wogy~bla ______________________

--__ -_-- __----

10 --__-__-__---_

__________-____-__-------

40 - _ _ _ _ _ - _ _ - _ _ - - - _ - _ _ _ _ _ _ _ - - - -

Czechoslovakia _________________ --__ -- _-----__

-------- _.-_ --

20-30

morns{- __ _ _ _ - _ _ _ _ _ _ - _ - - -- - --

w _ _ _ _ _ _ _ _ _ _ _ _ - - - _ _ _ _ _ _ _ _ _ _ _ _ _

________________--____

1Llo ____________-- -_ ____ ______ --

El Salvador ____________________ -___----______

20 _ _ _ _ _ _ _ - _ _ - - - _

Ffnland ________________________ ____--________ _----________-

113

p&3 -‘:---.‘------ .~~~.~~~~~~

----------* ---

40 - _ - - _ _ _ _ _ _ - - _ _

__ ____-_____________--__

w _ - _ _ _. _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ _ - - _ _

ylahlae151a ________ __ _ _____-_-__

425 _____________- __________-_--

______.___________.______

!a - - - - _ - - _ _ - _ _ - - - - - - - _ - _ _ _ - - - -

Honduras ___.__________________

8 w _~~~~~-~~~__.- --------------

Hungary ________________.______ ----.----- ---_

10 ---q-_q-W-----

Iceland _________________________

‘loo _*---_-----_.- q--q-_-.------

Japan ____ ___.__________________

25 _ _ ___ _ __ _ __ _ _ _ _ __ _ __ _ _ __ _ _ _ _

M*l*ySi* ____-_--_-______--_-___

30 - _ - _ _ - _ _ _ - _ _ _ - - _ _ _ - - _ _ _ _ - - _ _

fx;lrrfB

_____________._____-

_ __._.__-_-______.------

iti :::::::::::::: ::::::::::::::

Morocw ________________.______ -----------w-e

10 - _ ___ _ _______ _

Netherlands _____________.-___-- -----------G-

‘20 --~~~~~~__----

Niger _______.____________------

-.--*--e-w-_-- ------em-w----

Norway _____.__________________ ---------- ---_

25 __ ________ _ ___

Il.8 8 R ______-

_________________ ----.---------

(‘1

--______m_.---

United Elngdom _______________ -____----- in -.------------

30

Venezuela _____-__-_______ --____

__--______----

________e_.-SW

;E;iezxrn

(North) ________ _____ --____--_-__-_

10 -___-__-_ _ _--_

_______---___-_---_------

w _________________________-__

IBelgium and East Clermsny base the benefit amount for constent-

attendance allowances on the needs of the individual

s Converted to a percentage of increase In the mlnlmum disebillty pension

amount for purposes of comparlzon.

* Plus * flat-rate amount

4 Percent llmited by maximum and minum beneflt levels.

1 Maximum percent.

e Of base amount.

r Instead of B supplement, s separate constant-sttendsnce pension 1s

aid

The pension Is 86 percent of earning8 with a minlmum and maximum

fl

ene-

flt amount imposed.

of 45 percent to a high of 125 percent. The

* median replacement rate is about 85 percent. In

the four Western European countries using this

computation method, the combined replacement

rate ranges from 90 percent to 125 percent of

average earnings.

Seven countries award a fixed, flat-rate allow-

ance. The table shows the flat-rate allowance

when, for purposes of comparison, it is converted

to a percentage of increase in the minimum in-

validity pension amount. Thus, the percentages

added to the basic invalidity pension for the con-

stant-attendance allowances range from a low of

20 percent (Czechoslovakia) to a high of 113 per-

cent (Finland). The wide variation between rates

of increase reflects much less uniformity than the

range of pension increases in the other two meth-

ods. The two Western European countries, how-

ever, are compatible with other European sys-

tems in terms of percentage increase. Of the

three Western industrialized countries, only the

Australian benefit rate falls below those of its

European counterparts.

The two remaining countries, Belgium and

East Germany, compute the benefit amount for

constant-attendance payments on the needs of the

individual. In 1973, the flat-rate monthly benefit

in Belgium was replaced with a benefit based on

both degree of disability and financial need.

Workmen’s Compensation Benefit Formulas

The computation methods and benefit rates for

constant-attendance allowances under invalidity

insurance provisions generally correspond to the

formulas used to calculate the same benefit under

workmen’s compensation. Of the 76 countries with

constant-attendance allowances under workmen’s

compensation, 37 also award a similar benefit

amount under invalidity provisions. In 27 of

the 37 countries with a supplement payable in

both programs, the benefit formula is exactly

the same.

In 16 of the 27 countries with identical benefit

formulas under both invalidity and workmen’s

compensation programs, the cash amounts of bene-

fits are equal. In the 11 countries that use an

identical formula based on the percentage-of-

invalidity-pension for both programs,2 the amount

payable under invalidity insurance is lower than

the amount paid under workmen’s compensation.

The difference reflects the higher basic invalidity

pension under the latter program.

In the 10 countries where the benefit formula

is different under each program: benefits are

* Algeria, Austria, Bolivia, Cameroon, Congo, Den-

mark, Honduras, Malaysia, Xiger, Venezuela, and Zaire.

a Colombia, Dahomey, El Salvador, Mauritania, Mo-

rocco, Saudi Arabia, South Africa, Switzerland, Togo, and

Turkey.

R6

SOCIAL SECURITY

lower under invalidity insurance because a lower

percentage is generally used to compute the al-

lowance. In most of these countries, the work-

men’s compensation benefit formula for constant

care is from two to five times as great as that

used to calculate the invalidity benefit.

FUNDING

Funds for constant-attendance allowances un-

der invalidity programs are drawn from the pay-

roll contributions that finance regular invalidity

pensions. There is usually no separate fund set

aside, although revenues may be earmarked to

cover the cost of the provision. Even though the

programs are providing benefits to a growing

number of persons, the total amount makes up a

relatively small portion of total invalidity pay-

ments. In some countries with universal systems,

such as Sweden and the United Kinkdom, benefits

are noncontributory and completely financed from

general revenue.

NEW PROGRAMS

Australia, France, and the United Kingdom

are the most recent countries to implement new

programs of cash benefits for the permanently

disabled who are cared for at home. In March

1973, Australia established a flat-rate benefit

amount of $2 (Australian) a day (about $3.00

US.), payable to persons who care for an aged

relative in the home. The relative must be at

least aged 65 and require regular and continuing

professional nursing care. As the program is

designed to encourage more families to keep their

aged relatives out of nursing homes, payments

are terminated if the patient is institutionalized.

France, which previously established a con-

stant-attendance allowance to the permanently

disabled under both invalidity and workmen’s

compensation programs, added in 1971 a means-

tested payment for handicapped children and

adults aged 20-65 who are cared for at home.

The program seeks to assist those persons who

have somehow missed coverage under other pro-

grams. The program differs from other attend-

ance allowances in that the necessity for a full-

time attendant is not a qualifying condition, but

severe disability (80 percent incapacity for adults)

is required. The program is, however, similar to

others in that benefits are terminated upon in-

stitutionalization. It is anticipated that about

100,000 children and 250,000 adults will qualify

for the benefit.

In 1970, the United Kingdom for the first

time adopted a constant-attendance supplement

for severely handicapped persons whose disabili-

ties are not employment-related. Originally legis-

lated for people over age 2 who need attention

24 hours a day, a 1973 change in the law makes

a reduced benefit payable for persons needing

constant care either all day or all night. The

benefit amount as of October 1973 is a flat-rate

payment of $6.20 a week (about $14.25 U.S.). It

is not means-tested. Since the United Kingdom

does not have a disability program as such (in-

valids receive a cash sickness benefit if they had

an employment record, or, if they have no such

‘record, welfare benefits), the benefit is adminis-

tered by an autonomous board. In 1973, more

than 10,000 persons received the benefit. It is

estimated that there may be as many as 175,000

more persons potentially entitled.

Recent Publications*

GENERAL

FINK, ARTHUR E. The Field of Social Work (Sixth

ed.). New Pork:

Holt, Rinehart and Winston, Inc.,

1974. 401 pp. No price.

Provides an overall view of social welfare and social

work from experts in various programs. New chapters

cover social policy and social planning and research in

social work.

HILLS, WILLIAM G., SCUIUOCK, VOYLE G., VISILLIQ

HAROLD D., and WEST, JAMES A., editors.

ConductW

the People’s Rusineaa: The Framework and Fulzctiolcs

of Publia Administration. Norman: The

University

of

Oklahoma Press, 1973. 491 pp. $19.95 (cloth), $7.60

(paper).

Designed for practicing administrators, the 02 ar-

(Continued

on page .JS)

*Prepared by the Publications Staff, Of&e of Re-

search and Statistics. Orders for items listed should be

directed to publishers and booksellers ; Federal publica-

tions for which prices are listed should be ordered from

the Superintendent of Documents, U.S. Government Print-

ing Offlee, Washington, D.C. 29492.

BULLETIN, NOVEMBER 1974

37