1

2023 Cook County

Employee Benets Overview

Department of Risk Management Employee Benets Division

2

TABLE OF CONTENTS

WELCOME 3

KNOW YOUR BENEFITS 4

THE BASICS

Who Is Eligible To Enroll 5

When You Can Enroll 6

How To Enroll In Benets During Annual Open Enrollment 6

Change Your Benets - Permitted During Qualifying Life Events 7

Enrollment Procedure 8

Required Documents For Dependents 8

Eective Date of Benets Coverage 10

Coordination With Other Coverage 10

Dual Coverage 10

Cost And Funding 10

Calculating Your Coverage 11

Leave Of Absence 11

Termination/COBRA 11

GUIDE TO BENEFITS

Medical Plan 12

Prescription Drug Program 14

Dental Program 15

Vision Program 17

Flexible Spending Accounts (FSAs) 19

Health Care FSA 19

Using Your FSA Funds 19

Dependent Day Care FSA 20

Commuter Benet 21

Income Protection/Life Insurance 22

Voluntary Benets 23

Deferred Compensation Retirement Plan 24

Employee Assistance Program 25

Benets Connect/Well-Being 25

HEALTH AND BENEFITS LITERACY

Denitions 26

REMINDERS AND NOTICES

Reminders 27

Notices 27

Important Benets Contact Information 28

3

E

mployees have unique needs when it comes to benets,

and Cook County oers a comprehensive program so you

can choose what is important to protect the health and

well-being of you and your family.

1

Cook County oers a competitive employee benets package and

remains committed to oering benets at the most aordable cost to

employees. The County provides some benets at no cost to you, some

you pay for, and other benet costs are shared between Cook County

and you.

The information in this guide highlights Cook County’s Employee

Benets and well-being programs, as well as important information

about your rights and responsibilities under the plans. Please take the

time to review this guide carefully. You may only make changes to your

benet elections during the annual Open Enrollment period or if you

experience a Qualifying Life Event such as a marriage, divorce or the

birth/adoption of a child.

This guide, the Employee Benets website www.cookcountyrisk.com,

and the Employee Benets team in the Department of Risk Management

are your resources to educate yourself and choose the options best

for you.

Contact Risk Management by phone at 312-603-6385 or email

at risk.mgmt@cookcountyil.gov if you have questions or need

additional assistance.

1

Every eort is made to ensure the information in this guide is accurate. In the event of a

discrepancy between the information in this guide and the ocial Plan Certicates, the

ocial Plan Certicates govern.

WELCOME

4

KNOW YOUR BENEFITS

Review your benets annually in Employee Self Service (ESS). Medical,

dental and vision enrollments are in eect unless you make changes

during the annual Open Enrollment period each year. You must enroll

in health care and dependent day care exible spending accounts

(FSAs) each year to participate–elections do not carry over from one

year to the next.

Check ESS to make sure your personal information is correct for you and

your dependents.

Name

Date of Birth

Social Security Number

Home Address

Check ESS to make sure your benets enrollment is as expected.

Medical Insurance

Dental Insurance

Vision Insurance

Health Care FSA

Dependent Day Care FSA

Group Basic Term Life

Check the Voluntary Benets webpage on

www.cookcountyvoluntarybenets.com to make sure your

enrollment is as expected.

Group Accident Insurance

Group Critical Illness Insurance

Group Hospital Indemnity Insurance

Short-Term Disability Insurance

Universal Life Insurance

Identity Theft Protection

Legal Service Plan

Check the benets plan site to manage your Group Supplemental Life

and Commuter Benets.

Group Supplemental Life (www.metlife.com/mybenets)

Commuter Benets (www.optumnancial.com)

5

WHO IS ELIGIBLE TO ENROLL

You are eligible to participate in Cook County’s group benet plans if you are:

• An employee working at least 30 hours per week on a regular, year-round basis

• Eligible for participation in Cook County’s group benet plans pursuant to the Board

of Commissioners’ Budget Resolution, a collective bargaining agreement or an

employment agreement

Dependent benets are extended to spouse, domestic partners and civil union partners. If both

the employee and spouse or partner are Cook County employees, all family members must be

covered under one enrollment. Children up to age 26 are eligible for health benets coverage as

dependents. Military veterans may be covered up to the age of 30.

Dependent Verication

When you enroll dependents in the County’s benets, you will be asked to provide information about

each of your eligible dependents, such as name, date of birth, Social Security number (SSN), and gender.

You will also be required to submit documentation of the dependent’s relationship to you. Requested

proof includes a government-issued birth certicate or marriage certicate.

You are required to provide the SSN of each of your dependents. However, if your dependent

does not have a SSN when you enroll, you should continue the enrollment and return to ESS

once you have received the SSN and enter the information.

By enrolling your dependents, you are arming that each dependent you are enrolling meets

all eligibility requirements. If at any time your covered dependent no longer meets eligibility

requirements, you agree to promptly remove that dependent from your coverage.

Coverage Tiers

If you choose to participate in a medical, dental and/or vision plan, you also must choose a

Coverage Tier. The County oers four tiers of coverage in the medical plan:

• Employee Only: Coverage for you only

• Employee Plus Spouse/Partner: Coverage for you and your spouse/partner only

• Employee Plus Child(ren): Coverage for you and your eligible child(ren), including the

eligible child(ren) of your spouse/partner

• Employee Plus Family: Coverage for you, your spouse/partner, your eligible child(ren) and

your spouse’s/partner’s eligible child(ren)

Tiers for the dental and vision plans are Employee Only, Employee +1, and Family.

You can choose a dierent coverage tier for medical, dental and vision. For example, you

might enroll in “Employee Only” coverage for medical if your spouse/partner has medical

coverage from his or her employer and “Employee Plus Spouse/Partner” for dental coverage

if your spouse’s/partner’s employer does not oer dental coverage. If enrolled, you and your

dependents must elect the same plan.

THE BASICS

6

WHEN YOU CAN ENROLL

You can enroll in County coverage within 31 days of the date you rst become eligible, during

the annual Open Enrollment period or within 31 days of a Qualifying Life Event (QLE). Benets

are eective the rst day of the month following the date you became benets eligible, except

for Group Term Life Insurance, which is eective your rst day of employment.

New Hire or Newly Eligible for Benets

As a newly hired benets-eligible employee, or if you are newly eligible for benets, you have

31 days from your date of eligibility to enroll in the County’s benet plans. Enrollment is not

mandatory. The monetary penalty for not having health coverage under the Aordable Care Act

is no longer applicable.

Enrollment in Group Term Basic Life Insurance is automatic. You are not required to enroll in this

benet. If you wish to be enrolled in other benets, you are required to act. You are required to

enroll in the coverages listed below because enrollment is not automatic, and you will not be

defaulted into any plan. All coverage continues each year unless you make changes; however,

you must enroll each year to participate in the Health Care Flexible Spending Account (HCFSA)

and Dependent Day Care Flexible Spending Account (DCAP).

HOW TO ENROLL IN BENEFITS DURING ANNUAL OPEN ENROLLMENT

Choose your benets carefully and understand all your benet options so you can make an

informed decision for the upcoming year.

If you want to enroll in County coverage; drop County coverage; change to a dierent

medical, dental or vision option; enroll in a exible spending account; or change your

coverage tier, for example, from single to family or vice versa, you must do so during

the annual Open Enrollment period. All changes are binding from December 1 through

November 30, unless you experience a QLE. If you experience a QLE, you may add, change

or cancel coverage within 31 days of the event. Benet changes must be made within 31

days of the QLE.

See the Qualifying Life Events section for more information.

Medical, Dental and/or Vision Coverage

If you previously enrolled in coverage and do not change benet elections during a subsequent

annual Open Enrollment period, you will be assigned the same coverage for the following year.

Plan enrollment changes are eective December 1.

*You must enroll in HCFSA and DCAP each year to have coverage.

YOU MUST ENROLL WITHIN 31 DAYS*

TO HAVE COVERAGE:

YOU MAY ENROLL AT ANY TIME

THROUGHOUT THE YEAR:

• Medical coverage

• Dental coverage

• Vision coverage

• Group Supplemental Life

• Health Care and Dependent Day Care

Spending Accounts*

• Voluntary Benets

• Commuter Benets

• Deferred Compensation

7

Health Care Flexible Spending Account (HCFSA) and/or Dependent Day Care Spending Account (DCAP)

FSA enrollments do not carry over so you must re-enroll each year to participate. FSA elections

are eective January 1.

Voluntary Benet Plans

You can enroll each year during annual Open Enrollment (or as a new hire) or within 31 days

of a QLE.

Once you are enrolled, your participation will continue as long as you maintain eligibility requirements

unless you elect to drop coverage during a subsequent annual Open Enrollment period.

After You Enroll or Waive Conrmation of Enrollment

Once you submit your enrollment elections in ESS, you will be able to view your benets elections.

Review your benets elections carefully to conrm they are accurate. You can review your elections

or make changes to your benets until the deadline. All enrollments are nal as of 11:59 p.m. CST on

October 31. A conrmation of your enrollment can be printed from ESS.

CHANGE YOUR BENEFITS – PERMITTED DURING QUALIFYING LIFE EVENTS

Open Enrollment is the annual period available to make changes to your

benets. A Qualifying Life Event (QLE) is required for you to request changes

to your benets outside of the Open Enrollment period. You can enroll, add

or remove dependents; change plans; or enroll in/make changes to a exible

spending account within 31 days of any of the following events:

• Employment

• Marriage, establishment of a partnership (with government-issued

domestic partner certicate or civil union certicate)

• Birth, adoption, or obtaining legal guardianship of a child

• Loss of other coverage for you or your dependent(s) for reasons such as

legal separation, divorce, death, termination of employment or moving outside

of the service area

• A change in employment status signicantly impacting the employee

contribution rate

Changes must be completed through Employee Self Service (ESS) within 31 days of

the QLE. Appropriate dependent documentation must also be uploaded within 31

days. Government-issued newborn birth certicates must be uploaded within 45 days.

Please note: QLE additions are eective on the event date (e.g., due to marriage, birth).

A QLE that terminates participation, such as waived coverage or the removal of a

dependent from coverage (e.g., a divorce, death of a dependent, or aging out),

is eective the last day of the month in which the event occurs.

Enrollments not completed within the designated time frame will not be accepted.

The next opportunity to enroll will be the following annual Open Enrollment period

or within days of another QLE.

If you are not currently enrolled and your QLE does not include a dependent change,

please send an email to risk.mgmt@cookcountyil.gov to set up your eligibility to enroll

in ESS. Enrollments entered more than 31 days after the QLE will not be processed.

Dependent children who reach the age of 26 (30 for military veterans) are

automatically terminated from benet coverage on the last day of the month of the

26th birthday. Special rules apply to disabled dependents.

BE AWARE!

THERE’S ONLY

A 31-DAY

WINDOW TO

MAKE CHANGES!

You must make

changes to your

benets within

31 days of your

life event, or you

will have to wait

until the next

Open Enrollment

period.

Coverage begins

on the date of

the event.

8

ENROLLMENT PROCEDURE

STEP 1: Log in to Employee Self Service (ESS).

To access ESS from within the County’s network, click on the Oracle EBS icon on your

desktop or use www.ccgprod.ccounty.com and then click on the applicable button.

You may also log in to ESS from home at: www.ccgprod.cookcountyil.gov

For assistance with logging into ESS, contact your agency’s technology desk.

STEP 2: Complete your enrollment within 31 days of a QLE or during annual Open

Enrollment using ESS.

Your dependents will not have medical, vision, or dental coverage unless you SUBMIT THE

REQUIRED DOCUMENTATION BY THE DEADLINE.

STEP 3: Upload copies of documents to prove they are your legal dependents.

STEP 4: Print and retain your conrmation statement for your records. This is the only

conrmation of your enrollment.

STEP 5: Monitor your Cook County email. Risk Management will contact you via email

to notify you of any problems with your dependent enrollment or documentation.

Note: You are encouraged to submit documents right away to avoid delays in processing.

REQUIRED DOCUMENTS FOR DEPENDENTS

If you include dependents in your Cook County coverage, you must submit proof of eligibility

for each dependent. Required documents must be scanned and uploaded through ESS.

9

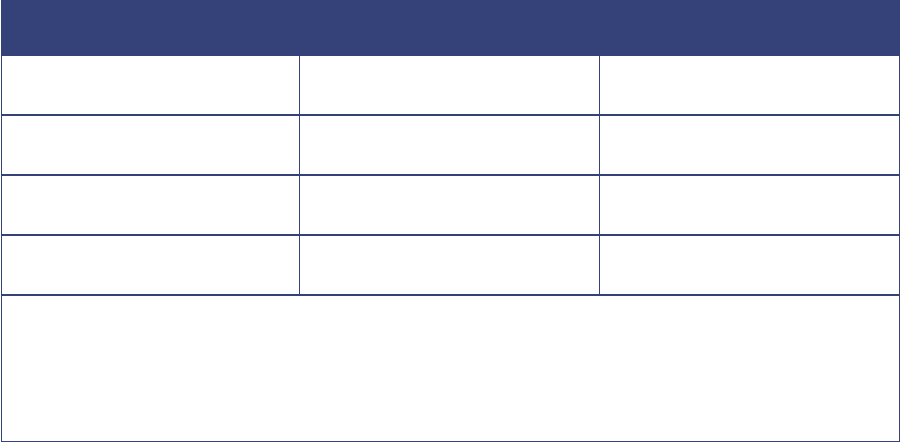

DEPENDENT BEING ENROLLED DOCUMENT(S) REQUIRED

Spouse Government-issued marriage certicate

Child (0-25yrs.) Government-issued birth certicate with

employee’s name listed as parent

Adult Military Dependent Child (Age 26-30)

Illinois Resident

Government-issued certied birth

certicate, proof of Illinois residency, DD

Form 214 indicating discharge other than

dishonorable discharge

Adopted Child At time of placement:

A copy of legal adoption documentation

showing placement in employee’s home

prior to adoption, or one of the following:

• Interim order with judge’s signature and

the circuit court le stamp

• Petition for adoption with the circuit

court le stamp

• Pre-adoptive notarized placement

agreement establishing the employee’s

obligation to provide support for the

child in anticipation of adoption

• Placement papers signed by the court

Within 31 days of nalized adoption:

• Final order of adoption issued

through court, or

• Final adoption certicate issued

through court

Legal Guardianship of Dependent

(Court Appointed)

Certied guardianship documents signed by

judge and stamped by circuit court placing

the child in the home (date of placement)

Civil Union Partner Government-issued civil union certicate

Domestic Partner Government-issued domestic

partnership certicate

What Happens If I Do Not Enroll?

If you do not enroll within 31 days following your hire date or the date you become

eligible for benets, you will not have medical, dental and/or vision coverage through

the County. Additionally, you will not be able to contribute to exible spending accounts.

You will have to wait until the next Open Enrollment or until you experience a QLE.

10

EFFECTIVE DATE OF BENEFITS COVERAGE

New Hire: 1st day of the month following date of hire

Qualifying Life Event:

• Event date when adding coverage (e.g., due to marriage, birth)

• Last day of the month in which the event date occurs when removing coverage

or dependents from coverage

Open Enrollment: December 1 (FSA OE changes begin January 1)

COORDINATION WITH OTHER COVERAGE

If you are eligible for benets coverage elsewhere, for example, through a spouse’s/partner’s

or other employer’s plan, you should compare the County’s coverage and costs to the other

coverage. You may decide to enroll in some plans oered through the County and some from

the other source.

However, if you are enrolling in coverage from two sources, be sure you understand how

benets are paid when you are covered by two group medical plans or group dental plans.

In many instances, you may pay for coverage from two group plans, but you will not receive

double benets or even be reimbursed for 100% of your costs as a result of what is called

“coordination of benets.”

DUAL COVERAGE

Dual coverage is prohibited on all County benet plans for employees and dependents if both

individuals work for Cook County in a benet-eligible position. If a dual-coverage enrollment is

made, the Employee Benets Division will update the enrollment based on a pre-dened order

of benets determination so that each individual is only enrolled in coverage under one record.

Both parties involved in the dual-coverage enrollment will be notied of the change.

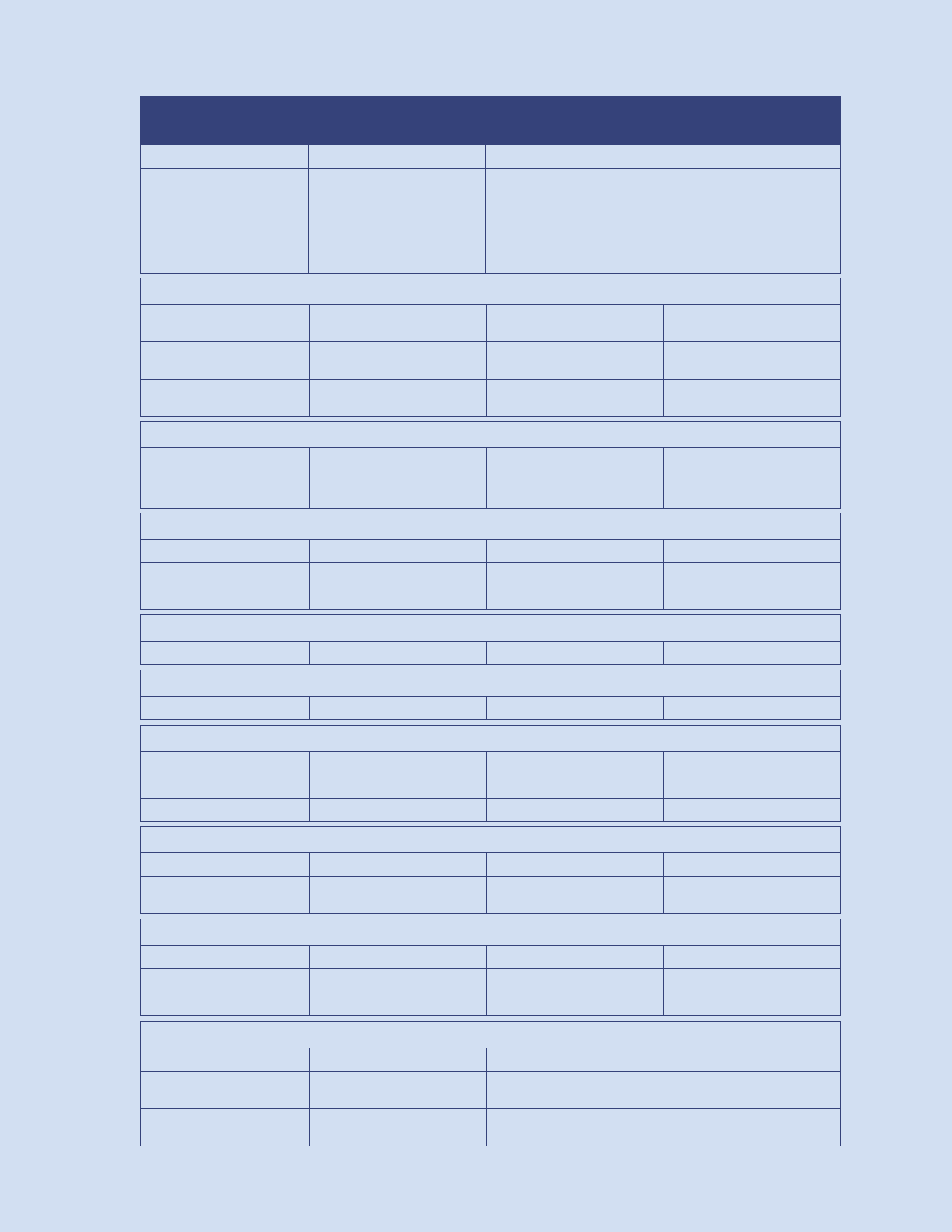

COST AND FUNDING

Contributing to Your Plans

You and the County share the cost for medical coverage, with the County paying the majority of

the costs as shown in the chart below.

For full time employees, your cost is based on the plan and coverage tier you choose and your

annual salary (based on 1.0 FTE) as shown in the chart on the following page:

Cook County pays the

full cost…

• Basic Life Insurance

• Dental Insurance

• Vision Insurance

You pay the full cost…

• Commuter Benets

• Deferred

Compensation

• Flexible Spending

Accounts

• Supplemental Life

Insurance

• Voluntary Benets

You and Cook County

share the cost…

• Medical (including

prescription drug)

11

CALCULATING YOUR COVERAGE

This chart shows your cost as a percentage of pre-tax standard salary based on plan selected

and family members you elect to cover.

HMO PPO

Employee Only 1.75% 2.75%

Employee + Spouse 2.50% 3.50%

Employee + Children 2.25% 3.25%

Employee + Family 3.00% 4.00%

Employees working less than 30 hours/week may contribute at a dierent rate.

Employees on an approved leave of absence remain responsible for their regular payroll

contributions when billed.

Employees on a personal leave of absence are responsible for paying the full County cost for

continued coverage.

LEAVE OF ABSENCE

Part-time Employees and Employees on a Personal Leave of Absence

Part-time employees and employees on a Personal Leave of Absence (PLOA) are required to

notify Risk Management in writing that they wish to enroll in benets or continue coverage

within 31 days of the status change. Once the enrollment or PLOA continuation is processed, Risk

Management will issue and mail a monthly invoice to the employee for payment of insurance.

These employees are required to pay the full County cost of coverage.

Health Insurance Statements

The Department of Revenue issues and mails statements to employees for the payment of

health insurance deductions when they are not able to be deducted from a regular paycheck or

if no paycheck is issued.

Employees on an unpaid leave status must pay their account balances in full or return to work by

the date provided or coverage will be terminated. Employees back at work whose balances are

not paid in full will have their accounts turned over to a collection agency.

TERMINATION / COBRA

Coverage for employee health benets ends on the last day of the month following the

employment termination date.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees and/or their

dependents to continue certain insurance benets after termination of employment or when a

dependent’s status changes, resulting in loss of coverage. Medical, dental and vision plans can

be continued for up to 18 months under COBRA, or longer in certain circumstances.

Once the COBRA enrollment is processed, Risk Management will issue and mail a monthly

invoice to the employee for the full County cost plus an administrative fee. Employees have 60

days to apply for coverage retroactive to the benets termination date.

12

GUIDE TO BENEFITS

HMO PPO

No deductibles or coinsurance.

Employees are responsible for copays.

There are deductibles, coinsurance

and copays.

Must select a primary care physician.

There is no out-of-network coverage

except in an emergency.

Covers in-network and out-of-network

doctors. Selection of a primary care

physician is strongly encouraged but

not required.

Oers nancial savings for services

obtained in the Domestic tier of coverage.

Requires a referral from your primary

care physician to see a specialist.

Can visit a specialist without a referral.

Pre-certication is required for

certain services.

MEDICAL PLAN

Cook County oers two medical plan options to choose from when selecting coverage for

you and your family. Each medical plan includes a prescription drug benet. Your medical plan

choices are HMO or PPO.

www.bcbsil.com/cookcounty

BlueAdvantage HMO

Group #B03351

1-800-892-2803

Blue Cross Blue Shield PPO

Group #291116

1-800-960-8809

13

Feature HMO Plan

Cook County

Domestic Tier

PPO Plan

In-Network

PPO Plan

Out-of-Network

Annual deductible $0

$350 individual

$700 family

$700 individual

$1,400 family

Out-of-Pocket (OOP) maximum

$1,600 individual

$3,200 family

$2,000 individual

$4,000 family

$4,000 individual

$8,000 family

NOTE: You are responsible for the full cost of any charges that exceed the Schedule of Maximum Allowances (SMA),

sometimes referred to as “R&C” or “reasonable and customary” amount.

Benets HMO Plan

Cook County

Domestic Tier

PPO Plan

In-Network

PPO Plan

Out-of-Network

Primary Care

Primary care visit to treat an

injury or illness

$15 copay/visit $25 copay+10% coinsurance/visit 40% coinsurance/visit

Specialist visit $20 copay/visit $35 copay+10% coinsurance/visit 40% coinsurance/visit

Other practitioner office visit $15 copay/visit $25 copay+10% coinsurance/visit 40% coinsurance/visit

Preventative care/screening/

immunization

$0 copay/visit $0 $0

Outpatient Services

Diagnostic test (x-ray, blood work)

and imaging (CT/PET scans, MRIs)

$0 0% coinsurance

10%

coinsurance

40% of the maximum allowance

Facility fee (e.g., ambulatory

surgery center)

$100 copay/visit 0% coinsurance

10%

coinsurance

40% of the maximum allowance

Physician/surgeon fees $0 10% coinsurance 40% coinsurance

Maternity prenatal/postnatal care

$15 copay/visit

First prenatal visit only

$25 copay/visit+10% coinsurance

First prenatal visit only

40% coinsurance

Mental/behavioral health

outpatient services

$15 copy/visit $25 copay/visit+10% coinsurance 40% coinsurance

Substance use disorder

outpatient services

$15 copy/visit $25 copay/visit+10% coinsurance 40% coinsurance

Emergency Care

Emergency room services $100 $100

Emergency medical transportation $0 Ground transportation only 10% coinsurance

Urgent care

$15 copay/visit

Must be affiliated with chosen

medical group or referral required

$25 copay/visit+10% coinsurance $25 copay+40% coinsurance

Inpatient Benets

Facility fee (e.g., hospital room) $100 copay/visit 0% coinsurance 10% coinsurance 40% coinsurance

Physician/surgeon fee $0 10% coinsurance 40% coinsurance

Mental/behavioral health

inpatient services

$100 copay/admission 0% coinsurance 10% coinsurance 40% coinsurance

Substance use disorder

inpatient services

$100 copay/admission 0% coinsurance 10% coinsurance 40% coinsurance

Delivery and all maternity

inpatient services

$100 copay/admission 0% coinsurance 10% coinsurance 40% coinsurance

Extended Care

Home health care $0 10% coinsurance 40% coinsurance

Skilled nursing care $100 copay/admission 10% coinsurance 40% coinsurance

Hospice service $0 10% coinsurance 40% coinsurance

NOTE: Effective 12/1/21, The County PPO plan will incorporate a Cook County Health tier (“Domestic Tier”) wherein covered members will have lower

out-of-pocket costs when choosing to access health care within CCH faciities. Facility charges will be 0% after the annual plan deductible is met.

Hospital-based facility services not obtained at CCH will be paid based on their network status (in or out of network rate.)

SUMMARY OF HEALTH BENEFITS

14

30-DAY SUPPLY AT RETAIL 90 -DAY SUPPLY *

Generic $15 $30

Formulary brand on the drug list $30 $60

Non-formulary brand not on

the drug list

$50 $100

PRESCRIPTION DRUG PROGRAM

When you enroll in a medical plan, you automatically receive prescription drug coverage

through CVS Health. Prescriptions can be purchased through your local pharmacy or mail order.

CVS Health pharmacy is included in all Target stores that oer pharmacy services. Prescription

copays range from $15 to $100 depending on your prescription.

You will save money by purchasing generic drugs rather than brand-name drugs.

Maintenance Choice Program

The Maintenance Choice Program is mandatory. After two lls, all maintenance medications

must be lled in a 90-day supply through mail order or at a CVS Pharmacy.

*If you choose to buy a formulary brand (on the drug list) or non-formulary brand (not on the drug

list) when a generic substitute is available, you will pay the generic copay, plus the dierence in

cost between the generic and the full retail formulary brand or non-formulary brand drug cost.

You must ask your doctor to write a 90-day supply prescription and get it lled at your

CVS Pharmacy.

Generic Step Therapy Program

The Generic Step Therapy Program requires members to use up to two generic alternatives in

certain drug classes before a brand will be covered.

www.caremark.com

1-866-409-8522

15

DENTAL PROGRAM

Dental coverage is provided to employees and enrolled dependents at no charge. Regular

visits to the dentist can do more than just brighten your smile; they can also be important to

your overall health.

County employees have a choice of two dental plans:

• Guardian Dental HMO provides access to services performed at participating dental

HMO practices

• Guardian Dental PPO allows you to seek dental care from dentists who are in or out of

the PPO network, with greater coverage in-network

www.guardiananytime.com/cookcounty

Dental HMO: 1-866-494-4542

Dental PPO: 1-866-302-4542

See the Summary of Dental Plans on page 16

16

Item/Procedure

Dental HMO Copayment

(Member Pays)

Dental PPO

In-Network Out-of-Network

Benefit Period Maximum None $1,500

Deductible None

$25 per Individual

$100 per Family

(4 individual maximums)

Deductible does not apply to

preventive and orthodontic

services

$50 per Individual

$200 per Family

(4 individual maximums)

Deductible does not apply to

preventive and orthodontic

services

Preventative

Dental Exams

(2 exams per benefit period)

$0 100% of the maximum allowance 80% of the maximum allowance

Profylaxis

(2 exams per benefit period)

$0 100% of the maximum allowance 80% of the maximum allowance

Fluoride Treatment

(2 exams per benefit period)

Once every 24 months 100% of the maximum allowance 80% of the maximum allowance

Primary Services

Dental X-Rays $0 80% of the maximum allowance 60% of the maximum allowance

Space Maintainers

(eligible members up to age 19)

$63-$96 80% of the maximum allowance 60% of the maximum allowance

Oral Surgery

Routine Extractions $18-$20 80% of the maximum allowance 60% of the maximum allowance

Removal of Impacted Teeth

(soft tissue and partial bone)

$$50-$65 80% of the maximum allowance 60% of the maximum allowance

Restorative

Amalgams and Anterior Resins $17-$44 80% of the maximum allowance 60% of the maximum allowance

Posterior Resins $53-$105 80% of the maximum allowance 60% of the maximum allowance

Crowns and Fixed Bridges $256-$300 per unit 50% of the maximum allowance 50% of the maximum allowance

Periodontics

Scaling and Root Planing $37/quadrant 80% of the maximum allowance 60% of the maximum allowance

Gingivectomy $111/quadrant 80% of the maximum allowance 60% of the maximum allowance

Osseous Surgery $206/quadrant 80% of the maximum allowance 60% of the maximum allowance

Prosthetics

Full or Partial Dentures $383-$396 50% of the maximum allowance 50% of the maximum allowance

Denture Reline $40-$72 50% of the maximum allowance 50% of the maximum allowance

Endosseous Implants Not covered 50% of the maximum allowance 50% of the maximum allowance

Emergency Services

Palliative Emergency Treatment $0 80% of the maximum allowance 80% of the maximum allowance

Endodontics

Root Canal Therapy $109-$162 80% of the maximum allowance 60% of the maximum allowance

Orthodontics

Adults (19 or older) Not covered 50% of the maximum allowance

Dependent Children (up to age 19)

$3,233-$3,356 not including

x-rays or orthodontic records

50% of the maximum allowance

Lifetime Maximum

One full course of treatment for

dependent children under age 19

$1,250

SUMMARY OF DENTAL PLANS

17

See the Summary of Vision Plans on page 18

VISION PROGRAM

Vision coverage is provided at no charge to employees and enrolled dependents. Eye exams

are an important part of your overall health.

The vision plan is administered by Davis Vision and covers routine eye exams, as well as

prescription eyeglasses and contact lenses. The amount you pay for your vision care depends on

the type of services or eyewear you choose.

Coverage is only available if you use an in-network provider. To locate a Davis Vision

provider, visit:

www.davisvision.com

1-800-381-6420

18

Vision Care

Services

In-Network

Member Cost

Out-of-Network

Reimbursement

Exam with dilation as necessary $0 copay N/A

Frames

$0 copay; $100 allowance, plus 20% discount on balance

N/A

Benefits specific to Davis Vision, $150 allowance at Visionworks,

or Davis Vision “Exclusive Collection” covered in full

Standard Plastic Lenses

Single Vision $0 copay N/A

Bifocal $0 copay N/A

Trifocal $0 copay N/A

Lenticular $0 copay N/A

Contact Lens Fit & Follow-up (contact lens fit and follow-up visits are available once a comprehensive eye exam has been completed)

Standard Contact Lens Fit & Follow-up $0 copay, covered in full N/A

Specialty Contact Lens Fit & Follow-up $0 copay, up to $50 allowance plus 15% discount on any overage N/A

Frequency

Examination Once every 12 months

Lenses or Contact Lenses Once every 12 months

Frames Once every 24 months

Contact Lens Fit (contact lens allowance includes materials only)

Conventional and Disposable $0 copay, $100 allowance, 15% of balance over $100 N/A

Medically Necessary $0 copay, covered in full (prior approval required) N/A

Laser Vision Correction

Laser Vision Coverage 40-50% off the national average price of tradional LASIK N/A

Lens Options (paid by the member in addition to the price of the lenses)

Standard Progressive Lenses $0 N/A

Premium Progressive Lenses $40 N/A

Ultra-Progressive Lenses $90 N/A

High-Index Lenses $60 N/A

Plastic Photosensitive Lenses (Transitions) $70 N/A

Scratch Protection Plan:

Single Vision/Multifocal Lenses

$20/$40 N/A

UV Treatment $12 N/A

Tint (Solid and Gradient) $0 N/A

Standard Polycarbonate–Adults $35 N/A

Standard Polycarbonate–Kids Under 19 $0 N/A

Standard Anti-Reflective Coating $40 N/A

Premium Anti-Reflective Coating $55 N/A

Ultra-Anti-Reflective Coating $69 N/A

Polarized $75 N/A

Other Add-Ons and Services

$20 discount (where applicable) balance from insured frame

purchase: 30% discount on additional pairs of eyeglasses

N/A

VISION PLAN SUMMARY

19

FLEXIBLE SPENDING ACCOUNTS (FSAs)

Health Care and Dependent Day Care Flexible Spending Accounts are administered

by Optum Financial.

You can save money when you use pre-tax dollars from a Health Care Flexible Spending Account

(HCFSA) or Dependent Day Care Flexible Spending Account (DCAP) to pay eligible health care

expenses and dependent day care expenses. Your decision to participate in these voluntary

accounts should be based on your needs and personal situation.

What is a Flexible Spending Account?

A Flexible Spending Account (FSA) is a tax-advantaged account that allows you to use pre-tax

dollars to pay for qualied medical or dependent day care expenses.

When you contribute to an FSA:

• You decide how much to contribute. You elect an annual contribution in which deductions

are taken in equal amounts for the number of remaining pay periods in the plan year

• These contributions can be used for eligible expenses incurred in the calendar year

(January 1 through December 31), as well as eligible expenses incurred January 1 through

March 15 of the following calendar year. Although the plan year ends December 31, there

is a grace period until March 15 to incur claims with any unused funds, and you must

submit outstanding claims for reimbursement by March 31

• You save on taxes since your contributions are deducted from your pay before federal

income tax, state income tax, and Social Security taxes are calculated. You are not taxed on

the money you use from your account for eligible expenses

• You cannot change your elections after your enrollment period unless you experience a QLE

• Any money not used will be forfeited. Therefore, it is important to estimate your

contribution amounts wisely

• You must enroll during the annual Open Enrollment period for FSA participation for

the next year. If you do not enroll, you will not have an account

HEALTH CARE FSA

The Health Care FSA allows an annual contribution of $250 to $2,850 in pre-tax money to pay

for eligible out-of-pocket health care expenses, including physician oce copays, health plan

deductibles, prescription drugs, and dental and vision expenses. You also can use funds for your

spouse or federal tax dependents. For a complete list of eligible expenses, visit:

www.optumnancial.com

USING YOUR FSA FUNDS

Debit Card

Optum Financial will provide you with a debit card you can use to pay for eligible expenses

when you incur them.

SAVE YOUR

RECEIPTS!

Supporting

documentation of

the expenses and

payment may be

required for your debit

card transactions:

• Explanation

of Benets

• Itemized receipt

from your provider

Credit card statements

and cancelled

checks do not meet

the requirements

for acceptable

documentation.

By federal law, any

funds remaining

in these accounts

at the end of the

grace period cannot

be rolled over or

refunded.

20

FSA Claim Deadlines

You have until March 15, 2023 to use your remaining FSA balance for plan

year 2022. Any balance remaining after March 15, 2023 will be forfeited.

All claims for 2022 must be submitted by March 31, 2023.

DEPENDENT DAY CARE FSA

The Dependent Day Care Flexible Spending Account allows an annual contribu-

tion of $250 to $5,000 and lets you save pre-tax money for reimbursement of eli-

gible dependent day care or elder care expenses. Note: the Dependent Day Care

FSA is not for the payment of your dependents’ eligible health care expenses.

This is an account for eligible expenses including childcare or certain elder care

expenses if you have children under age 13 who attend a licensed day care center,

before or after school care, or summer day camp; or if you provide care for a

dependent who is mentally or physically incapable of caring for himself or herself.

These plans are governed by IRS regulation. If you are unclear on the eligibility of

an expense, visit the eligible expense list at www.optumnancial.com.

Unlike the Health Care FSA, you may only receive reimbursements for services

already incurred, and only up to the available funds in your account. An expense

is incurred when a service is received—not when a bill is paid. Even though your

service provider may require payment at the beginning of the service period,

you cannot request reimbursement until after the service is provided.

To reimburse yourself from your Dependent Day Care FSA, you must pay for the care

and then submit the appropriate supporting documentation and Reimbursement

Claim Form. All reimbursement requests must include a completed and signed

Provider Certication form.

If you do not have a Provider Certication form, submit an itemized statement

from the provider that includes:

• Start and end dates of service

• Dependent’s name and date of birth

• Itemization of charges

• Provider’s name, address and tax ID or Social Security number

The form can be located at:

www.optumnancial.com

Submit a Claim

You can also submit a claim using a smart phone or online. You can choose to

have eligible reimbursements either deposited directly into your bank account or

a check mailed to your home address.

These plans are governed by IRS regulation. If you are questioning the eligibility

of an expense, visit the eligible expense list at www.optumnancial.com.

21

COMMUTER BENEFIT

Regardless of how you get to work, the Commuter Benets Program lets you pay for your

eligible transit expenses and, now eligible on a pilot basis, work-related parking expenses

through automatic, pre-tax payroll deductions. Ordering is handled directly through Optum

Financial either online or over the phone. You can request that funds be deposited into your

Ventra account or onto an EdenRed Commuter card, or that a monthly transit pass to be mailed

to your home.

You can enroll, change your product or funding amount, or cancel at any time. Orders must be

submitted by the 10th of the month for the following month. Just visit www.optumnancial.com

or call 1-844-284-6267. Representatives are available 24 hours per day, seven days per week.

1-844-284-6267

www.optumnancial.com

22

PROTECT YOUR FUTURE INCOME FOR YOU AND YOUR LOVED ONES

The County provides basic term life insurance at no cost to you. You have an opportunity

to buy more coverage through the County’s group insurance policy. You may contact the

insurance providers at any time to learn more.

Group Term Basic Life Insurance: Totally County paid, this coverage is equal to one times

salary rounded to the next highest thousand for a full-time employee. This plan provides a

benet in the event of death of an employee. Coverage can be converted or ported to an

individual policy upon separation from employment. The maximum benet is $750,000.

Supplemental Group Term Life Insurance: You may purchase additional group term

coverage equal to one, two or three times salary, upon employment. During Open

Enrollment periods, current participants can increase their coverage within plan, and new

enrollments require Evidence of Insurability. Enrollment at other times or increases in

amounts require Evidence of Insurability. Payment is made through convenient payroll

deduction at reasonable group rates based on age. Coverage can be converted or ported to

an individual policy upon separation from employment.

Please note: Proof of good health may be required if you are increasing the amount of

insurance to 4X-5X your annual earnings, up to $500,000.

23

VOLUNTARY BENEFITS

Cook County oers voluntary benets options through Mercer, administered by Benet Harbor.

These plans are a benecial tool to help protect your nancial security. Employees are encouraged

to review all plans available prior to making benets selections, considering your family’s needs.

Payment for these voluntary benets is conveniently available through payroll deduction.

The following plans are available:

Group Accident Insurance

• Accident Insurance pays a lump sum benet directly to you

(unless otherwise assigned) for injuries caused by a covered

accident

Group Critical Illness Insurance

• Critical Illness Insurance pays a lump sum benet upon

diagnosis of a covered critical illness, such as a heart attack,

stroke, or internal cancer

Group Hospital Indemnity Insurance

• If you have a covered illness or injury, which results in

hospitalization, Hospital Indemnity Insurance pays out a lump

sum regardless of the cost of care

Short-Term Disability Insurance

• An injury or sickness may slow you down, but it won’t slow

down your monthly bills. Short-Term Disability Insurance

provides a monthly benet if you are disabled from an o-the-

job injury and cannot work

Universal Life Insurance

• A death not only leaves behind loved ones but also potentially

overwhelming nancial obligations. Universal Life Insurance

provides your beneciary a lump-sum cash benet in the

event of your death

Identity Theft Protection

• IDShield provides identity theft protection and identity

restoration services for you and your family

Legal Service Plan

• LegalShield provides you with direct access to a dedicated law

rm who will answer your personal legal questions and help

resolve life’s legal matters

Employees should carefully consider which of the optional products the County oers meet their

needs for life insurance, disability insurance, medical and dental care, and supplemental insurance.

Detailed information about these products is available online at

www.cookcountyvoluntarybenets.com or by calling 1-800-698-2849. The Department

of Risk Management does not provide advice regarding these insurance products.

24

DEFERRED COMPENSATION RETIREMENT PLAN

The 457 Deferred Compensation Plan program is a supplemental retirement plan that can help

boost your retirement income. Added benets to contributing to the deferred compensation plan

include tax-deferred contributions—possible tax-free earnings/gains.** Starting small can have

a great impact on your retirement savings in the long run. Contact your designated Retirement

Specialist today to get started!

Minimum payroll deduction to

start account

$25 per pay period

Contribution limits if you are

under the age of 50

$20,500 for 2023*

Contribution limits if you are

over age 50

Over age 50 catch-up: $6,500 in addition to

the $20,500*

Pre-retirement catch-up provision available

Please contact your local Retirement Specialist

for more information.

Age at which you must begin

taking distributions

70½ is the Required Minimum Distribution age in which

distributions are required in-service or once termed.

Please contact Nationwide for further information.

Penalty for early withdrawals Distributions before 70½ are not permitted.

Taxation All distributions are subject to federal and state

income tax. Please consult your tax preparer for

additional information.

Who can participate? All full-time and part-time Cook County Government

and Forest Preserve District employees.

www.cookcountydc.com

1-855-457-2665

*Contribution limits are subject to change annually due to IRS regulations.

**Please speak to your Retirement Specialists regarding these provisions.

25

EMPLOYEE ASSISTANCE PROGRAM

The Cook County Employee Assistance Program (EAP) is available to help you with balancing the

demands of family, work and personal needs. The EAP is administered by Magellan Health and is

staed by licensed professionals available to help you at no cost, 24 hours/7 days a week.

The EAP program is here to help you and your household members along the journey of life–no

situation is too big or too small. Services include telephonic goal-oriented coaching, counseling,

online programs and digital self-care tools.

Counseling is available for the entire family–individuals, couples and teens (with parental consent

and in accordance with applicable law and clinical appropriateness).

Virtual therapy is available in four modalities: text message exchange over a week, live phone,

live video or live chat. There are ve EAP visits available at no cost–per individual, per issue. If

additional services are needed, the appropriate health benets plan applies.

All services are condential and can be accessed over the phone at 1-800-327-5048 or online

at www.MagellanAscend.com.

WELL-BEING

Wellness Wednesday Email Communications: Based on the ve core elements of well-being:

1) having a sense of purpose, 2) physical health, 3) nancial health, 4) community engagement,

and 5) maintaining social connections, weekly emails help you explore real-world strategies

designed to help you manage your physical, nancial, and mental health.

Employee Benets Quarterly Newsletter: Keeps you up to date on important information about

your benets and upcoming events. Published in the spring, summer, fall and winter.

Blue Cross Blue Shield of Illinois – Well onTarget: Designed to give you the support you need to

make healthy choices. With Well onTarget, you have access to a convenient, secure website with

personalized tools and resources such as digital self-management programs, health and wellness

content, and tools and trackers.

MyHealth Connection Facebook Community: Focuses on providing preventive care tips and

information. Prevention can reduce risk factors that lead to chronic disease or slow the progression of

a disease. It’s a way to help Cook County employees enjoy longer, healthier and more productive lives.

Health Fair: The annual Employee Health Fair includes a combination of on-site and virtual

programs. Flu shots are provided annually at Open Enrollment on-site events and at CVS Health

locations for employees and for enrolled dependents through the health plan.

26

HEALTH AND BENEFITS LITERACY

DEFINITIONS

The language of health insurance can be hard to understand. Yet it is important

to have a basic knowledge of the industry’s terminology. Here are some of the

most common nancial insurance terms to help you make sense of it all–so

you can make smart decisions that will benet you and your family.

Balance Bill – The dierence between the amount charged by an out-of-

network provider for a covered health service and the amount your health

plan (insurance) pays.

Coinsurance – A percentage of the cost of covered health services you pay.

This often starts after the deductible is satised.

Copayment – A xed dollar amount you pay for covered health services

such as a physician visit.

Deductible – A xed, annual amount you pay for covered health services

before the health plan (insurance) starts to pay. For certain services, such

as in-network preventive care, you are not required to rst satisfy

the deductible.

Dual Coverage – The same person is enrolled under more than one of Cook

County’s employee benets. Dual coverage is prohibited for employees and

dependents on all County plans.

In-Network – A group of doctors, hospitals, pharmacies, and other providers

who contract with the health plan and provide services at negotiated rates.

Out-of-Network – A group of doctors, hospitals, pharmacies, and other

providers who do not contract with the health plans and do not provide

services at negotiated rates. You pay more out of pocket and have fewer

protections. Out-of-network providers may balance bill you for these costs.

Out-of-Pocket Maximum – The maximum annual out-of-pocket amount you

pay before the health plan (insurance) pays 100% of covered health services.

For out-of-network services, providers may balance bill even after the out-of-

network, out-of-pocket maximum is reached.

Premium – The amount you pay for health insurance.

Pre-Tax Contributions – Pre-tax contributions include the premium costs

for the medical coverage you elect, as well as any contributions you

choose to make to a Health Care Flexible Spending Account (HCFSA),

Dependent Care Flexible Spending Account (DCAP), Commuter Benet, and

Deferred Compensation Plan up to Federal tax limits. Pre-tax contributions

are deducted from your pay before federal and state income taxes and

Medicare taxes are calculated, reducing your taxable income (and the

current taxes you pay).

USE IN-NETWORK

PROVIDERS TO

SAVE MONEY

While it may be a

personal preference

to use out-of-network

providers, there are

some protections you

lose by doing so.

1. The health plans do

not contract with

out-of-network

providers, which

means they don’t

check into providers’

history such as their

medical license,

education, training,

work history,

malpractice claims,

board certication,

health outcomes, etc.

2. Out-of-network

providers may

balance bill you,

which means

billing you for the

dierence between

the amount they

charge you for a

covered service and

the amount your

insurance pays.

3. Overall, you pay

more out of pocket

for out-of-network

services.

27

REMINDERS

Consequences of Fraudulent Enrollment

Any kind of fraud on the County’s benet plans may result in adverse consequences

to an employee and dependent, for example:

• Failure to notify the Department of Risk Management of an event that would

cause coverage to end, e.g., divorce

• Misrepresentation by the employee or dependent regarding the initial

eligibility, for example, the dependent’s age, or that the dependent is not a legal

dependent of the employee

• Any attempt to assign or transfer coverage to someone else (e.g., letting

another person use your Plan ID card)

The employee may be required to pay for any claims and all administrative costs

that were incurred fraudulently. This may result in coverage being terminated for

the employee and action by the County to collect any money paid. The County may

also discipline the employee, up to and including termination.

NOTICES

Important notices regarding Cook County Employment Benets may be found at:

www.cookcountyil.gov/service/compliance

These notices include:

• Health Insurance Marketplace Coverage

• Cook County’s Group Health Plan Notice of Privacy Practices

• COBRA Election Notices

• Women’s Health and Cancer Rights Act of 1998

• 1095 Tax Reform Request

• Notice to Enrollees of Mental Health Parity and Addiction Equity Act

Exemption for 2021

REMINDERS & NOTICES

IMPORTANT BENEFITS CONTACT INFORMATION

MEDICAL PLANS

Blue Cross Blue Shield

of Illinois

www.bcbsil.com/cookcounty

BlueAdvantage HMO

Group #B03351

1-800-892-2803

Blue Cross Blue Shield PPO

Group #291116

1-800-960-8809

PHARMACY BENEFIT PLAN

CVS Pharmacy

www.caremark.com

1-866-409-8522

GROUP TERM LIFE AND SUPPLEMENTAL

LIFE INSURANCE

MetLife

www.metlife.com/mybenets

Group/Customer #227860

1-866-492-6983

DENTAL PLANS

Guardian

www.guardiananytime.com/cookcounty

Group #397485

Dental HMO: 1-866-494-4542

Dental PPO: 1-866-302-4542

VISION PLAN

Davis Vision

www.davisvision.com/member

1-800-381-6420

FLEXIBLE SPENDING ACCOUNTS AND

COMMUTER BENEFITS

Optum Financial

www.optumnancial.com

1-844-284-6267

COOK COUNTY

VOLUNTARY BENEFITS

Mercer

www.CookCountyVoluntaryBenets.com

1-800-698-2849

DEFERRED COMPENSATION

Nationwide

www.cookcountydc.com

1-855-457-2665

EMPLOYEE ASSISTANCE

PROGRAM

Magellan

www.MagellanAscend.com

1-800-327-5048

JOIN THE FACEBOOK GROUP MYHEALTH CONNECTIONS

MyHealthConnections

www.facebook.com/groups/Myhealthconnections

Cook County Department of Risk Management

Employee Benets Division

118 N. Clark Street, Suite 1072 • Chicago, IL 60602

Phone: (312) 603-6385 • Fax (866) 729-3040

www.cookcountyrisk.com • Email: risk.mgmt@cookcountyil.gov