Public report

Cabinet

Cabinet 29

th

August 2023

Council 5

th

September 2023

Audit and Procurement Committee 2

nd

October 2023

Name of Cabinet Member:

Cabinet Member for Strategic Finance and Resources - Councillor R Brown

Director Approving Submission of the report:

Chief Operating Officer (Section 151 Officer)

Ward(s) affected:

City wide

Title:

2023/24 First Quarter Financial Monitoring Report (to June 2023)

Is this a key decision?

No

Executive Summary:

The purpose of this report is to advise Cabinet of the forecast outturn position for revenue and

capital expenditure and the Council’s treasury management activity as at the end of June 2023.

The net revenue forecast position after management action is for spend in 2023/24 of £12.1m over

budget. At the same point in 2022/23 there was a projected overspend of £9.5m.

The Council continues to face budget pressures within both Adults and Children’s social care which

together account for £11m of the underlying overspend. The overwhelming majority of this is caused

by the continuing high level of inflation within the economy and difficult conditions within social care

markets. Other smaller but still significant overspends are also being reported in Business

Investment and Culture, Transportation and Highways, and Streetscene and Regulatory Services.

Recent weeks have seen a number of councils with social care responsibilities report large in-year

budgetary difficulties and it is clear that there are systemic problems for the whole sector which

represent a serious threat to its financial sustainability. The Council’s position above reflects a

number of largely one-off actions that have already been taken to reduce the overspend. As the

underlying position is significantly higher than has been experienced in recent years, further

urgent action is proposed to address the pressure in order to prevent the 2024/25 position

increasing to unmanageable levels.

The Council’s capital spending is projected to be £163.6m and includes major schemes progressing

across the city. The size of the programme and the nature of the projects within it continue to be

fundamental to the Council’s role within the city. Inflationary pressures are also affecting capital

projects. The assumption is that stand-alone projects that are already in-progress will be delivered

as planned but that future projects that have not yet started may need to be re-evaluated to

determine their deliverability within previously defined financial budgets.

The materiality of the emerging financial pressures, both revenue and capital, has renewed the

imperative to maintain strict financial discipline and re-evaluate the Council’s medium-term financial

position. This will be a priority across all services as the Council develops its future budget plans in

the coming months.

Recommendations:

Cabinet is requested to:

1) Approve the Council’s first quarter revenue monitoring position and endorse the proposal

for officers to seek to identify further ongoing service options to mitigate the position in

conjunction with Cabinet Members as appropriate.

2) Approve the revised forecast capital outturn position for the year of £163.6m incorporating:

£14.0m rescheduling from 2022/23 outturn, £29.7m net increase in spending relating to

approved/technical changes, £0.4m underspend and £38.9m of net rescheduling of

expenditure into future years.

Cabinet is requested to recommend that Council:

1) Receive and note the decisions of Cabinet as outlined in recommendations 1) and 2) above.

Council is recommended to:

1) Receive and note the decisions of Cabinet as outlined in recommendations 1) and 2)

above.

The Audit and Procurement Committee is requested to:

1) Note the proposals in the report and forward any comments they wish to raise with the

Cabinet Member for Strategic Finance and Resources.

List of Appendices included:

Appendix 1 - Revenue Position: Detailed Directorate breakdown of forecast outturn position

Appendix 2 - Capital Programme: Analysis of Budget/Technical Changes

Appendix 3 - Capital Programme: Analysis of Rescheduling

Appendix 4 - Capital Programme: Analysis of Over / Under Spend

Appendix 5 - Prudential Indicators

Background papers:

None

Other useful documents

None

Has it been or will it be considered by Scrutiny?

No

Has it been or will it be considered by any other Council Committee, Advisory Panel, or

other body?

Yes - Audit and Procurement Committee, 2

nd

October 2023

Will this report go to Council?

Yes – 5

th

September 2023

Report title: 2023/24 First Quarter Financial Monitoring Report (to June 2023)

1. Context (or background)

1.1 Cabinet approved the City Council's revenue budget of £260.5m on 21st February 2023 and

a Capital Programme of £159.2m. This is the first quarterly monitoring report for 2023/24.

The purpose is to advise Cabinet of the forecast outturn position for revenue and capital

expenditure, recommending any action required, and also to report on the Council’s treasury

management activity.

1.2 The current 2023/24 revenue forecast is for net expenditure to be £12.1m over budget (after

management action). The reported forecast at the same point in 2022/23 was an overspend

of £9.5m. Capital spend is projected to be £163.6m.

1.3 It is not unusual for the revenue position to reflect a forecast overspend at this stage which

then improves over the course of the year. However, as significant management action has

already been factored in, the underlying position is significantly higher than the £12.1m

forecast. This is a significantly high figure by historical standards, and represents a serious

enough cause for concern for the Council, such that emergency in year actions should be

considered.

1.4 The overspend is caused largely by factors external to the Council and which can be expected

to be ongoing (affecting future years MTFS) if action is not taken urgently.

1.5 Following on from the £6.7m reported at the end of 2022/23 this indicates a serious financial

trend for the Council which is not sustainable over the long-term. Section 2 of the report

provides further detail on the revenue position and Section 5 sets out the Council’s proposed

approach to managing the position.

1.6 As a final backstop it should be noted that the Council maintains a strong balance sheet in-

part to protect itself from circumstances such as this, although it should be re-iterated that

reserves are a finite resource and should only be applied sparingly to mitigate ongoing

revenue overspends, and once a medium-term solution is in place.

2. Options considered and recommended proposal.

2.1 This is a budget monitoring report and as such there are no options.

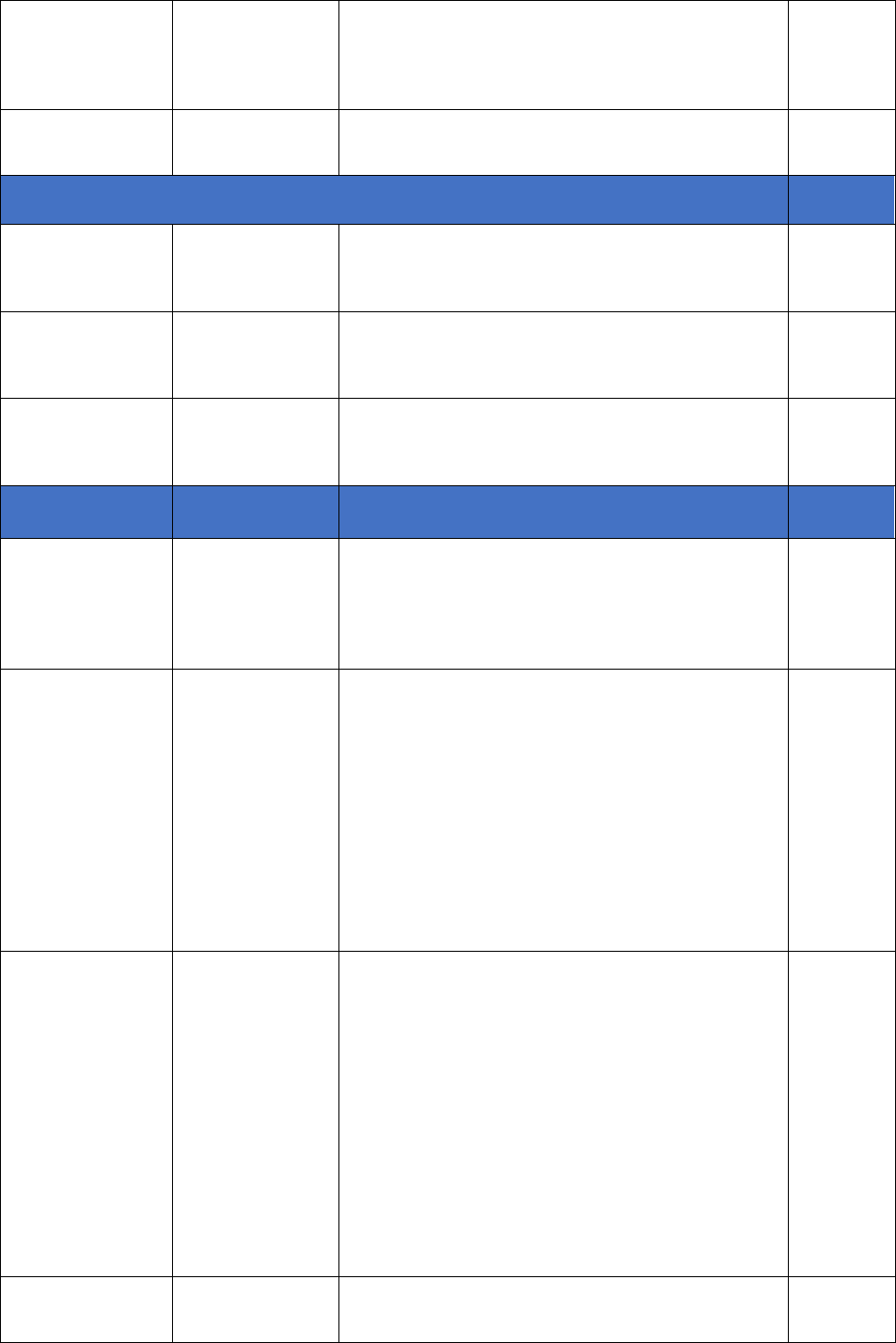

Table1 Revenue Position - The revenue forecast position is analysed by service area below.

Service Area

Revised Net

Budget

Forecast

Spend

Total Over/

(Under)

Spend

£m

£m

£m

Adult Services & Housing

113.8

120.4

6.6

Business Investment & Culture

8.1

9.1

1.1

Children & Young People's Services

93.3

97.5

4.2

Contingency & Central Budgets

(28.1)

(28.7)

(0.6)

Education and Skills

19.4

19.2

(0.2)

Finance & Corporate Services

9.3

9.2

(0.1)

Human Resources

0.7

1.2

0.5

Legal & Governance Services

7.5

7.7

0.2

People Directorate Management

1.0

1.0

0.0

Project Management & Property Services

(8.3)

(8.5)

(0.2)

Public Health

0.9

(0.6)

(1.6)

Streetscene & Regulatory Services

32.6

33.7

1.1

Transportation & Highways

10.3

11.5

1.2

Total

260.5

272.6

12.1

2.2 An explanation of the major forecast variances is provided below, the vast majority of which

are of an ongoing nature if urgent action is not taken. Further details are provided in Appendix

1 to the report.

Directorate

Adult Services & Housing £6.6m

Within Adult Services & Housing the largest element of overspend is on Adult Social Care of

£4.5m, which is due to increased activity & complexity of placements and increased package

costs (inflation). The other notable variance is a £2.0m overspend on Housing &

Homelessness due to significantly more people seeking assistance and placed in temporary

accommodation plus a 15% increase in temporary accommodation fees which is required to

ensure temporary accommodation continues to be available and mitigate the use of more

expensive Bed and Breakfast accommodation.

Children’s and Young People £4.2m

Within Children & Young People’s Services £3.2m of the total overspend relates to the cost

of looked after children’s placements. The overspend is caused by a lack of sufficiency in the

market to meet the needs of young people in care which has significantly increased the

average unit cost of those placements. There is a further overspend of £1.3m against staffing

in Help and Protection due to high levels of cases requiring additional workers and agency

staff. There are short term one-off savings that are offsetting these budget pressures across

the directorate from additional grants, and the use of earmarked reserves.

Business Investment & Culture £1.1m

Of the total Business Investment and Culture overspend, £0.8m relates to the one-off holding

costs of the Cultural Gateway building and the remainder relates to sponsorship income

shortfalls and Godiva festival costs.

Streetscene & Regulatory Services £1.1m

The Streetscene & Regulatory Services overspend includes a c£0.6m reduction in Planning

income due to delayed major applications, however planning fees will increase in October

2023 to partially mitigate this. The majority of the remaining balance relates to agency and

overtime costs relating to vacancies (Streetpride and Parks and Street Team Enforcement),

income shortfalls (Car Parks and Pest Control) and higher waste collection costs than

budgeted.

Transport & Highways £1.2m.

There are income pressures of £0.5m in Bus Lane and Parking Enforcement attributed to

temporary bus gates closures and lower than expected enforcement activity due to the impact

of sickness and not recruiting to vacancies. This is offset by higher car park usage/income.

The remaining overspend relates to the current planned cost of addressing the backlog in

highways defects at £0.35m and an under-recovery within Highways Operations as a result

of vacancies and sickness of £0.4m.

2.3 Capital

The quarter 1 2023/24 capital outturn forecast is £163.6m compared with the original

programme reported to Cabinet in February 2022 of £159.2m. Table 3 below updates the

budget at quarter 1 to take account of a £14.0m increase in the base programme (net

rescheduling from 2022/23), £29.7m of new approved/technical changes, a £0.4m

underspend and £38.9m of rescheduling now planned to be carried forward into future years.

The resources available section of Table 3 explains how the Capital Programme will be

funded in 2023/24. It shows 79.6% of the programme is funded by external grant monies,

whilst 11.6% is funded from borrowing. The programme also includes funding from capital

receipts of £12.9m.

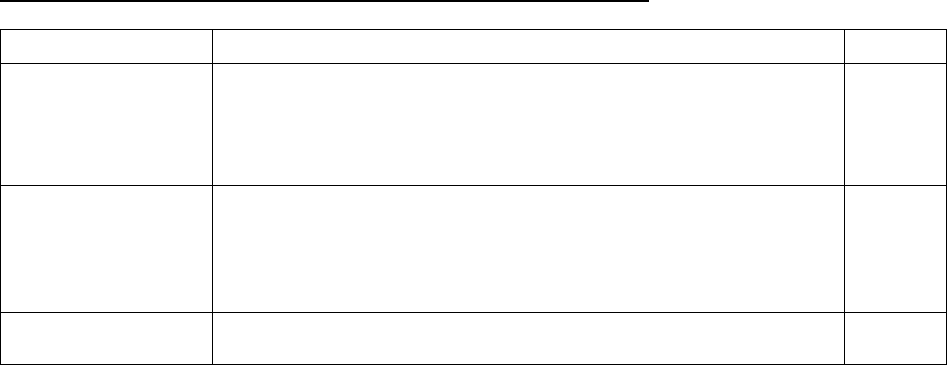

Table 3 – Movement in the Capital Budget

The inflationary pressures affecting the Council’s revenue budget are also present within

capital schemes although the pattern with which this takes affect can be different due to the

way in which expenditure is incurred. It is likely that most stand-alone projects that are already

in-progress will be delivered within existing agreed contractual sums. However, some future

projects that have not yet started may need to be re-evaluated to determine their deliverability

within previously defined financial budgets. In addition, where budgets have established to

deliver programmes of expenditure, it is likely that these programmes will need to be reduced

in size over time reflecting higher prices.

2.4 Treasury Management

Interest Rates

From the start of the quarter until May it looked like peak global monetary policy rates were

in sight as inflation continued to ease. However, a few weeks later, stronger and more

persistent inflation data, particularly in the UK, changed the picture. Inflation fell from its peak

of 11.1% reached in October 2022, but annual headline CPI in May 2023 was higher than the

consensus forecast at 8.7%.

CAPITAL BUDGET 2023/24 MOVEMENT

Qtr 1 Reporting

£m

February 2022 Approved Programme

159.2

Net rescheduling of expenditure from 2022/23

14.0

Revised Programme

173.2

Approved / Technical Changes (see Appendix 2)

29.7

“Net” Rescheduling into future years (See Appendix 3)

Underspend (see Appendix 4)

(38.9)

(0.4)

Revised Estimated Outturn 2023-24

163.6

RESOURCES AVAILABLE:

Qtr 1 Reporting

£m

Prudential Borrowing (Specific & Gap Funding)

19.0

Grants and Contributions

130.2

Capital Receipts

12.9

Revenue Contributions and Capital Reserve

1.5

Total Resources Available

163.6

After a sharp rise in interest rate expectations, with serious implications for mortgage markets

due to higher inflation and wage data, the Bank of England’s Monetary Policy Committee

reaccelerated monetary policy tightening over the period with a 0.25% rise in May to a 0.5%

rise in June, taking Bank Rate to 5.0%. Interest rate expectations priced in further hikes in

policy rates. Arlingclose, the authority’s treasury adviser, revised its forecast to expect a

further 0.5% of monetary tightening to take Bank Rate to 5.5%. The risks, however, are that

rates could be higher; financial markets are forecasting interest rates to rise to 6.5%. Better

than expected inflation figures released on 19

th

July 2023 may now, however, dampen down

those forecasts.

Long Term (Capital) Borrowing

The net long-term borrowing requirement for the 2023/24 Capital Programme is £4.1m, taking

into account borrowing set out in Section 2.3 above (total £19.0m), less amounts to be set

aside to repay debt, including non PFI related Minimum Revenue Provision (£14.9m). In the

current interest rate climate, the Council has no immediate plans to take any further new long-

term borrowing although this will continue to be kept under review.

The Public Works Loan Board (PWLB) remains the main source of loan finance for funding

local authority capital investment. In August 2021 HM Treasury significantly revised guidance

for the PWLB lending facility with more details and 12 examples of permitted and prohibited

use of PWLB loans. Authorities that are purchasing or intending to purchase investment

assets primarily for yield will not be able to access the PWLB except to refinance existing

loans or externalise internal borrowing. Under the Treasury Management Strategy 2022/23

approved by Cabinet on 22 February 2022 it was agreed the Council will not purchase

investment assets primarily for yield.

Interest rates for local authority borrowing from the Public Works Loans Board (PWLB)

between 1

st

April and 30 June 2023 have varied within the following ranges:

PWLB Loan

Duration

(maturity loan)

Minimum

2023/24 to

Q1

Maximum

2023/24 to

Q1

As at the

End of Q1

5 year

4.34%

5.91%

5.91%

50 year

4.47%

5.43%

5.15%

The PWLB allows qualifying authorities, including the City Council, to borrow at 0.2% below

the standard rates set out above. This “certainty rate” initiative provides a small reduction in

the cost of future borrowing.

Regular monitoring continues to ensure identification of any opportunities to reschedule debt

by early repayment of more expensive existing loans replaced with less expensive new loans.

The premiums payable on early redemption usually outweigh any potential savings.

Short Term (Temporary) Borrowing and Investments

The Council’s Treasury Management Team acts daily to manage the City Council’s day-to-

day cash-flow, by borrowing or investing for short periods. By holding short term investments,

such as money in call accounts, authorities help ensure that they have an adequate source

of liquid funds. The City Council borrowed £10m in February 2023 to cover a forecasted cash

flow shortage. This was repaid in April 2023.

Returns provided by the Council’s short-term investments yielded an average interest rate of

4.87% over the last quarter. This rate of return reflects low risk investments for short to

medium durations with UK banks, Money Market Funds, Certificates of Deposits, other Local

Authorities, Registered Providers, and companies in the form of corporate bonds.

Although the level of investments varies from day to day with movements in the Council’s

cash-flow, investments held by the City Council identified as a snapshot at the reporting

stages were: -

As at 31st

March 2023

As at 30

th

June 2023

£m

£m

Banks and Building Societies

0.0

0.0

Local Authorities

0.0

41.0

Money Market Funds

42.96

36.96

Corporate Bonds

0.0

0.0

HM Treasury

0.0

0.0

Total

42.96

77.96

External Investments

In addition to the above in-house investments, a mix of Collective Investment Schemes or

“pooled funds” is used, where investment is in the form of sterling fund units and not specific

individual investments with financial institutions or organisations. The pooled funds are

generally AAA rated; are highly liquid, as cash can be withdrawn within two to four days; and

have a short average duration. These investments include Certificates of Deposit,

Commercial Paper, Corporate Bonds, Floating Rate Notes, Call Account Deposits, Property

and Equities. However, they are designed to be held for longer durations allowing any short-

term fluctuations in return due to volatility to be smoothed out. In order to manage risk these

investments are spread across several funds (CCLA, Schroders, Ninety-One Investec,

Columbia Threadneedle and M&G Investments).

Returns provided by the Council’s pooled funds yielded an average interest rate of 4.4% over

the last 12 months. At 30

June 2023 the pooled funds were valued at £26.8m (£27.4m at 31

March 2023), against an original investment of £30m (a deficit of £3.2m). All seven pooled

funds show a deficit mainly as a consequence of dropping property prices and rising interest

rates. Some of the funds are showing encouraging signs of recovery to their original capital

value. There remains an expectation that the full value for each pooled fund will be recovered

over the medium term - the period over which this type of investment should always be

managed. Current accounting rules allow any ‘losses’ to be held on the Council’s balance

sheet and not counted as a revenue loss. This override was due to change in April 2023 but

a further extension to 31

st

March 2025 has been granted by the government. These

investments will continue to be monitored closely and are likely to be redeemed when they

reach par value.

Prudential Indicators and the Prudential Code

Under the CIPFA Prudential Code for Capital Finance authorities are free to borrow, subject

to them being able to afford the revenue costs. The framework requires that authorities set

and monitor against Prudential Indicators relating to capital, treasury management and

revenue issues. These indicators are designed to ensure that borrowing for capital purposes

is affordable, sustainable and prudent. The purpose of the indicators is to support decision

making and financial management, rather than illustrate comparative performance.

The indicators, together with the relevant figures as at 30 June 2023 are included in Appendix

4 to the report. This highlights that the City Council's activities are within the amounts set as

Performance Indicators for 2023/24. Specific points to note on the ratios are:

The Upper Limit on Variable Interest Rate Exposures (indicator 9) sets a maximum

amount of net borrowing (borrowing less investments) that can be at variable interest

rates. At 30 June 2023 the value is -£66.7m (minus) compared to +£96.2m within the

Treasury Management Strategy, reflecting the fact that the Council has more variable rate

investments than variable rate borrowings at the current time.

The Upper Limit on Fixed Interest Rate Exposures (indicator 9) sets a maximum amount

of net borrowing (borrowing less investments) that can be at fixed interest rates. At 30

June 2023 the value is £204.0m compared to £480.9m within the Treasury Management

Strategy, reflecting both the level of actual borrowing and that a significant proportion of

the Council’s investment balance is at a fixed interest rate.

2.5 Commercial Investment Strategy – Loans and Shares

The Council’s Commercial Investment strategy is designed to ensure there are strong risk

management arrangements and that the level of commercial investments held in the form of

shares, commercial property and loans to external organisations, is proportionate to the size

of the Council. In doing this the strategy includes specific limits for the total cumulative

investment through loans and shares. The total combined limit for 2023/24 is £146m, against

which there are £131.2m of existing commitments: -

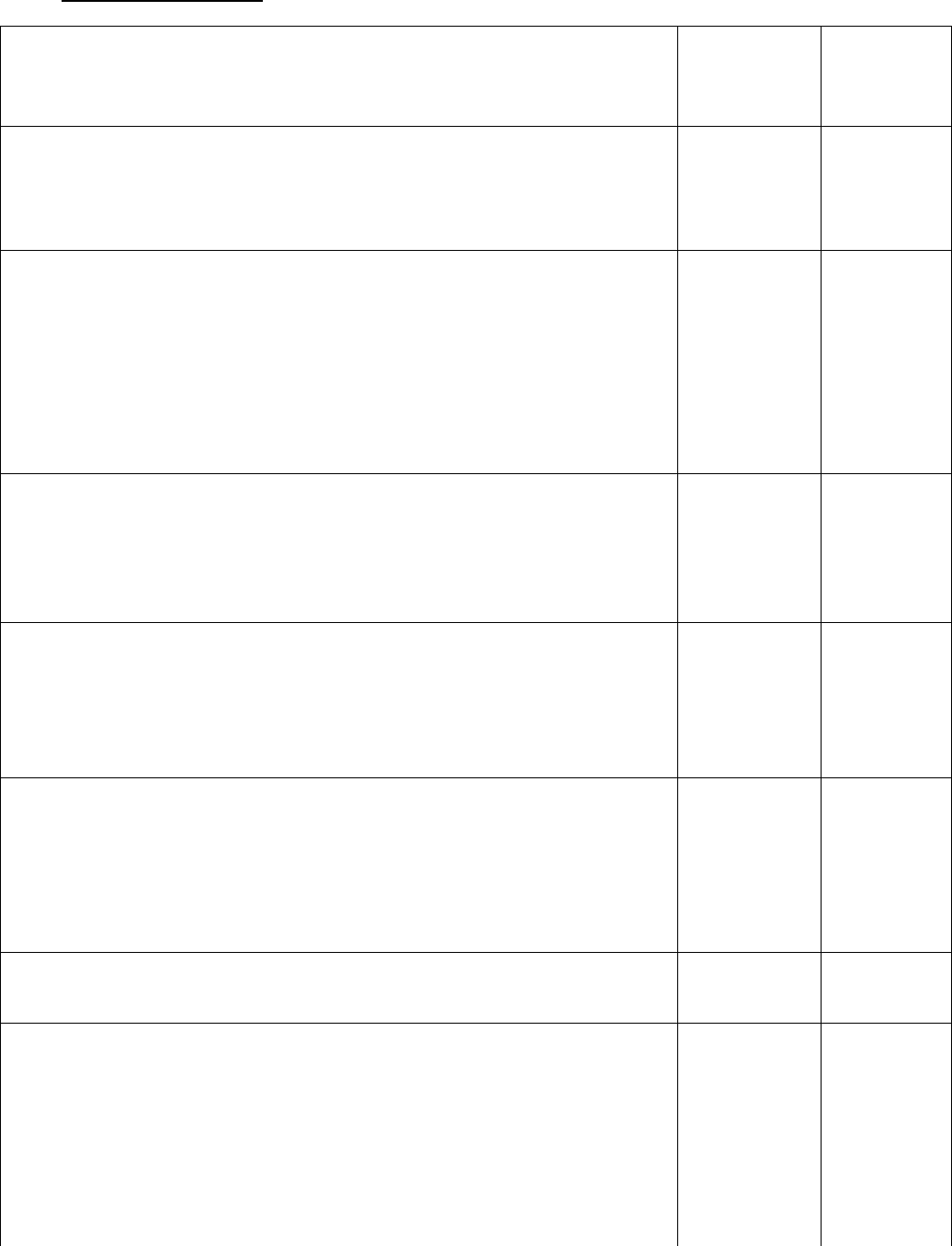

Limit

Actual 31st

March 2023

2023/24

Committed

and Planned

Total

Headroom

£m

£m

£m

£m

£m

Shares

55.0

52.1

0.0

52.1

2.9

Loans

91.0

52.5

26.6

79.1

11.9

146.0

104.6

26.6

131.2

14.8

The committed or planned total of £26.6m includes a number of loan facilities to lend which

may not necessarily be taken up, although the Council is committed to provide the funds if

requested.

3. Results of consultation undertaken

3.1 None

4. Timetable for implementing this decision.

4.1 There is no implementation timetable as this is a financial monitoring report.

5. Comments from the Chief Operating Officer (Section 151 Officer) and the Chief Legal

Officer

5.1 Financial implications

Revenue

The net quarter 1 forecast reflects an extremely serious and concerning position for the

Council. The net forecast, after significant management action is a £12.1m revenue

overspend, and incorporates a range of intractable ongoing issues and the continuation of

inflationary pressures which will have an impact beyond the current financial year. Actions

taken, and set out below, are of a largely one-off nature, meaning the underlying position

is significantly higher.

At this stage of the monitoring cycle there is a real and significant threat that the Council will

not be able to balance its revenue position by year-end without the use of reserve

contributions, and without further urgent and ongoing action, will increase the initial 2024/25

MTFS gap approved by Council in February 2023.

These circumstances are common to councils across the country with instances of financial

stress being widely reported. Alongside councils that have already been in difficult financial

circumstances due to a variety of largely local reasons, 2023 has seen an increasing number

of councils, including noticeably those with social care responsibilities, give dire warnings

about their ability to balance their 2023/24 budgetary positions and beyond. The failure of the

local government finance system to tackle issues around social care funding plus the

continued impact of inflation in excess of that anticipated in the 2023/24 budgets, have put

many councils in a perilous financial position.

The trend for cost of service delivery has generally over time reflected an upwards trajectory

reflecting prevailing inflation and market conditions. However, the unprecedented levels of

inflation in the last 2 calendar years have affected all service delivery costs such that 2022/23,

2023/24 and beyond, will reflect a very steep relative upward trend for the Council’s key

service costs.

Although the Council had budgeted for above historic levels of inflation, the pay award budget

of £6m (4%) falls short of the current employer offer, which has not yet been accepted by the

trades unions and which it is estimated would cost in the region of £9m, a minimum pressure

of £3m.

Difficulties in the external markets for both children and adults are well documented but issues

including the cost of highly complex cases and higher than planned levels of inflationary

increases in placement costs have exceeded the additional budgetary provision included

within the Council’s budget. It is difficult to accurately predict whether current forecast outturn

figures reflect a robust forecast for the year or whether further budgetary shocks will continue

in these areas.

Management Action

This difficult position carries on from that faced in 2022/23 when the Council needed to

balance its financial outturn position using £6.7m of reserves. Such a solution would be the

Council’s backstop position for 2023/24 but is one that the Council should be anxious to avoid.

The Council holds limited reserve balances and recognises that such an approach is not

sustainable in the medium term. It is therefore imperative to identify and adopt approaches

that help the Council to manage its short-term pressures, whilst at the same time supporting

the outlook for 2024/25 and medium-term financial problems.

The Council’s Leadership Team instigated a range of immediate responses and is in the

process of taking forward other actions. The following actions used to mitigate the underlying

pressures have been taken so far:

- Urgent spend restrictions have already been put in place to cease non-essential spend.

- Control the filling of vacant posts.

- Control the drawdown of reserves.

- Challenge robustly any proposals for additional spend this year.

- Budget holders reminded of their responsibility to manage services within budget.

- Areas that require more regular forecasts identified

As these are primarily one-off solutions, the Leadership Team have also requested that

Financial Management support and challenge Directors and budget managers to:

- identify options and service impact of reducing ongoing spend levels to within budget for

political decision.

- undertake a comprehensive review of service reserves.

- identify technical options to resource switch.

- undertake a comprehensive review of service and policy options.

These ‘policy’ options may require political consideration of cost reduction initiatives which

have previously been viewed as unfavourable. Directors have been asked to liaise with

relevant cabinet member portfolio holders to identify these, such that members can

collectively discuss, and ultimately decide whether they wish to implement in order to mitigate

the pressures in 2023/24, but importantly for 2024/25 and beyond.

The above gives sufficient assurance that the Chief Operating Officer does not need to take

any extra-ordinary action at this stage to respond to the financial position such as issuing a

Section 114 Notice (a self-imposed limit on making any non-statutory expenditure as result

of financial distress). However, Cabinet should be in no doubt that the underlying position for

2023/24 is incredibly challenging and that the Council will face some difficult choices in

2023/24 and to an even greater degree in 2024/25. Without further in-year support from

Government or as part of the 2024/25 Local Government Finance Settlement, the Council

faces the prospect of making some very hard in-year decisions including cutting or charging

for some valued services in order to balance its budget.

Capital

The Council’s Capital Programme continues to include a range of strategically important

schemes across the city. This continues to be a large mostly grant funded programme

continuing the trend of recent years. The programme includes major scheme expenditure on

secondary schools’ expansion, Very Light Rail, the Air Quality programme, disabled facilities

grant (DfG), the A45 Overbridge Eastern Green, City Centre South and support to the

Friargate Hotel development.

Legal implications

None

6. Other implications

6.1 How will this contribute to the One Coventry Plan

(https://www.coventry.gov.uk/strategies-plans-policies/one-coventry-plan)

The Council monitors the quality and level of service provided to the citizens of Coventry and

the key objectives of the One Coventry Plan. As far as possible it will try to deliver better value

for money and maintain services in line with its corporate priorities balanced against the need

to manage with fewer resources.

6.2 How is risk being managed?

The need to deliver a stable and balanced financial position in the short and medium term is

a key corporate risk for the local authority and is reflected in the corporate risk register. A

recent reassessment indicates that the Council now faces a greatly increased level of risk in

this area, described in section 5. Good financial discipline through budgetary monitoring

continues to be paramount in managing this risk and this report is a key part of the process.

A range of urgent actions has been set out in response to the Council’s financial position. It

is vital that Council officers and members are aware of the current financial challenge and

activity across the second quarter of the year including the measures outlined will provide

some indication of the direction of travel for the remainder of the year. This in turn will dictate

the extent to which the bottom line can be moved significantly closer to a balanced position.

6.3 What is the impact on the organisation?

It remains important for the Council to ensure that strict budget management continues to the

year-end. The Council may be forced to make some difficult policy choices over the coming

months especially in areas that do not have a strict statutory basis, and which involve material

levels of discretionary and flexible expenditure.

6.4 Equalities / EIA

No current policy changes have been proposed but the possibility remains that the Council

may need to consider changes to existing services through the year. If this is the case, the

Council’s equality impact process will be used to evaluate the potential equalities impact of

any proposed changes.

6.5 Implications for (or impact on) Climate Change and the environment

No impact at this stage although climate change and the environmental impact of the

Council’s decisions are likely to feature more strongly in the future.

6.6 Implications for partner organisations?

No impact.

Report author:

Name and job title:

Tina Pinks

Finance Manager Corporate Finance

Service Area:

Finance

Tel and email contact:

02476 972312

tina.pinks@coventry.gov.uk

Enquiries should be directed to the above person.

Contributor/approver

name

Title

Service Area

Date doc

sent out

Date response

received or

approved

Contributors:

Michelle Salmon

Governance

Services Officer

Law and

Governance

27/7/23

28/7/23

Sunny Singh Heer

Lead Accountant

Capital

Finance

13/7/23

21/07/23

Michael Rennie

Lead Accountant

Finance

13/7/23

21/07/23

Claire Maddocks

Lead Accountant

Finance

13/7/23

13/7/23

Names of approvers for

submission:

(officers and members)

Barry Hastie

Chief Operating

Officer (Section 151

Officer)

Finance

2/8/23

5/8/23

Sarah Harriott

Corporate

Governance Lawyer

Law and

Governance

31/7/23

2/8/23

Councillor R Brown

Cabinet Member for

Strategic Finance

and Resources

-

This report is published on the council's website: www.coventry.gov.uk/councilmeetings

Appendix 1

Revenue Position: Detailed Directorate Breakdown of Forecasted Outturn Position

Budget variations have been analysed between those that are subject to a centralised forecast and

those that are managed at service level (termed “Budget Holder Forecasts” for the purposes of this

report). The Centralised budget areas relate to salary costs – the Council applies strict control over

recruitment such that managers are not able to recruit to vacant posts without first going through

rigorous processes. In this sense managers have to work within the existing establishment structure

and salary budgets are not controlled at this local level. The Centralised salaries and Overheads

under-spend shown below is principally the effect of unfilled vacancies.

Service Area

Revised

Net

Budget

Forecast

Spend

Centralised

Variance

Budget

Holder

Variance

Total

Variance

£m

£m

£m

£m

£m

Adult Services & Housing

113.8

120.4

(1.6)

8.2

6.6

Business Investment & Culture

8.1

9.1

0.1

1.0

1.1

Children & Young People's

Services

93.3

97.5

(1.2)

5.4

4.2

Contingency & Central Budgets

(28.1)

(28.7)

0.0

(0.6)

(0.6)

Education and Skills

19.4

19.2

(0.6)

0.4

(0.2)

Finance & Corporate Services

9.3

9.2

(0.5)

0.4

(0.1)

Human Resources

0.7

1.2

0.1

0.4

0.5

Legal & Governance Services

7.5

7.7

(0.3)

0.5

0.2

People Directorate Management

1.0

1.0

(0.1)

0.1

0.0

Project Management & Property

Services

(8.3)

(8.5)

(0.3)

0.1

(0.2)

Public Health

0.9

(0.6)

(0.1)

(1.4)

(1.6)

Streetscene & Regulatory Services

32.6

33.7

(0.8)

1.9

1.1

Transportation & Highways

10.3

11.5

(0.3)

1.5

1.2

Total

260.5

272.6

(5.6)

17.7

12.1

Budget Holder Forecasts

Service Area

Reporting

Area

Explanation

Budget

Holder

Variance

£m

Adult Social Care

Strategic

Commissioning

(Adults)

£0.4m underspend relates to New Homes for Old

PFI due to additional client fee income. A further

underspend relates to lower than anticipated

transport costs to day opportunities.

(0.5)

Adult Social Care

Housing and

Homelessness

There are a number of reasons why the service is

currently forecasting a significant overspend. The

number of people seeking assistance with housing

issues and subsequently the number being placed

in Temporary Accommodation has increased

significantly during 2023. Alongside this the cost of

TA with private providers has increased by 15%

from the 1st April (the first increase since the rates

were set in 2019). A number of mitigations

including purchasing additional TA, working with a

Registered provider to provide us with an additional

50 flats for TA and new contracts with private

providers are being progressed. The increases in

TA is a national issue with the highest number of

2.1

households in TA in England being reported in

December 2022.

Adult Social Care

Adult Social Care

Director

Overspends relate to an increase in bad debt

provision of £0.4m and additional spend on joint

health initiatives to improve the provision across

Health and Social Care.

0.6

Adult Social Care

Enablement &

Therapy

Services

Overspends on equipment purchases due to high

inflation which have been offset by centralised

underspends in salaries due to vacancies.

0.2

Adult Social Care

Internally

Provided

Services

Overspends on other pay and overtime which have

been partly offset by centralised underspends in

salaries due to vacancies.

0.4

Adult Social Care

Community

Purchasing

Mental Health

Demand for mental health services continues to

increase, this impacts on provision of statutory

services to meet essential need.

1.3

Adult Social Care

Partnerships and

Social Care

Operational

Overspends relating to additional agency costs

which have been offset by centralised underspends

due to staff vacancies.

0.3

Adult Social Care

Localities and

Social Care

Operational

Overspends relating to additional agency costs

which have been offset by centralised underspends

due to staff vacancies.

0.3

Adult Social Care

Community

Purchasing

Other

see above - Community purchasing spend is

managed at an overall level and increased

complexity of demand is being seen across all

areas alongside increases to package costs driven

by high levels of inflation. Activity throughout the

year has also increased.

2.5

Adult Social Care

Mental Health

Operational

There remains significant pressures in Deprivation

of Liberty Assessment demand leading to

additional assessment costs (£0.3m). Additional

agency costs have been partly offset by

underspends on centralised salaries due to

vacancies.

0.7

Adult Social Care

Other Variances

Less than 100K

0.3

Adult Social Care

8.2

Business

Investment and

Culture

Sports, Culture,

Destination &

Bus

Relationships

Overspend mainly relates to Ikea collection

centre/City Centre Cultural Gateway (CCCG)

project with no revenue budget this year but still

incurs costs for rates, electricity, security costs,

BIDs. Final rate charge to be confirmed once VOA

completed evaluation. (For information- other

service areas: Sports and St Mary's forecast at Q1

shows a breakeven position. Godiva final position

is normally clearer two weeks after the event when

all relevant costs are confirmed, general ticket

sales is significantly higher than last year although

premium places generated a loss as ticket sales for

premium is much lower than target.)

0.6

Business

Investment and

Culture

Employment &

Adult Education

BH variance £481k mainly due to overspend in

Employment because of reduced grant income

offset underspend in Centralised variance from

vacancies, overall employment skills variation is

close to nil.

0.4

Business Investment and Culture

1.0

Children and

Young People's

Services

Children's

Services

Management

Team

Financial strategy planned underspend.

(1.2)

Children and

Young People's

Services

Commissioning,

QA and

Performance

"Safeguarding training income is £100k below the

budgeted target and the Professional Support

Service saving target of £39k has not been met.

There are also overspends due to agency spend

for Independent Reviewing Officers', Child

Protection Chairs and Local Authority Designated

Officers, due to pressures caused by vacancies

and increasing caseloads.

The position is offset partly by underspends in

CAMHS and the Coventry Safeguarding Children &

Adults Multi-Agency Boards."

0.2

Children and

Young People's

Services

Help &

Protection

"There is an overall budgetary pressure in Help and

Protection, which includes the following:

£1.3m pressure in the Area Teams linked to staff

costs, with high levels of cases requiring additional

workers and agency staff.

£0.3m pressure in Section 17 spend linked to a

high number of households being housed in

temporary accommodation. There is an additional

£0.1m pressure in NRPF (No recourse to public

funds). This is unavoidable due to statutory

responsibilities to financially support children and

families who reside in Coventry without legal status

to access benefits.

There are short-term one-off savings which are

currently offsetting the budget pressures from

additional grants and the use of earmarked

reserves. "

2.8

Children and

Young People's

Services

LAC & Care

Leavers

"There is a £3.2m overspend on looked after

children’s (LAC) placements. This figure takes into

account our expected increase in income from

central government for unaccompanied asylum-

seeking children which ensures these children do

not contribute to the budgetary pressure. All of the

overspend relates to external residential and is

linked to unit cost. This is mainly linked to

increasing unit costs for placements due to a lack

of sufficiency in the market to meet the needs of

young people in care. This is despite a decrease in

number of looked after children and placement mix

being in line with targets.

There is a further budget pressure of £400k due to

staffing challenges within LAC permanency service

and the need for agency staff to ensure that care

proceedings continue to be progressed. This is an

improving position as measures taken are now

starting to have a positive impact. The project team

is being phased out in line with paper approved at

CSLT-Business and will end fully in October. There

are some continued pressures in LAC permanency

around unbudgeted costs around therapy and

assessments.

3.6

There is an overspend of £312k in internal fostering

due to high number of staff on maternity leave and

agency cover being provided.

LAC transport has an overspend of £190k and this

is as a result of placement arrangements where

transport needs to be provided for child to continue

in current education provision. Work is on-going to

improve sufficiency of local placements which will

start to address this pressure.

There is an overspend of £193k on Adoption

Central England that relates to an increase in

Interagency fees and pay increases. Work is being

undertaken to address this and finance sit on

working group to explore budgetary needs of ACE

moving forwards.

There is a further budgetary pressure of £240k

within the Children’s disability service. This

overspend relates to increased costs for short

breaks & direct payments, DFG shortfalls and

intensive support for some children to enable them

to remain living at home, as an alternative to living

in residential care. We are currently in the process

of retendering our short breaks contracts to ensure

‘best value’ and reduce high cost support spend.

These pressures are offset in part by underspends

across the service."

Children and Young People's Services

5.4

Corporate &

Contingency

Corporate

Finance

There is a forecast overspend for pay inflation

contingencies (£2.6m) reflecting the latest local

government employers’ pay offer. This is more

than offset by favourable variances for other

contingency budgets (£1.4m), anticipated controls

to reduce discretionary expenditure (£1m), a

delayed need to replace DSG funded education

expenditure (£0.6m) and other minor underspends.

Corporate & Contingency

(0.6)

Education and

Skills

Customer and

Business

Services

A budget holder underspend of £185k mainly as a

result of the release of funding previously held in

reserve.

(0.2)

Education and

Skills

Transformation

Programme

Office

A budget holder underspend of £143k as a result of

the release of funding previously held in reserve.

(0.2)

Education and

Skills

SEND &

Specialist

Services

SEN Transport is forecasting an overspend of

£0.3M. Demand for all SEN services has sharply

increased this academic year, because of an

unanticipated rise in the population, need and

complexity; especially in the early years at the point

of admission to reception and transfer to secondary

phase. In response the LA has commissioned and

delivered an additional 65 specialist placements

0.6

within and outside of the city. Contract costs

following e-auctions has increased and in-house

salary costs reflect inflationary increase. The

remainder of the budget holder over spend relates

to staffing in Educational Psychology, but this is

offset by an equivalent under spend against

centralised staffing costs.

Education and

Skills

Libraries, Advice,

Health &

Information

Services

The forecast Budget Holder overspend of £157K

comprises a £64K net under-recovery of income on

the Schools’ Library Service, an under-recovery of

£75K on other income targets, unfunded salary

pressure of £126K, an overspend on casual posts

and overtime of £17K offset by a £75K spending

reduction on the media fund and several other

smaller spending reductions. The under-recovery

of income across the service is an on-going

pressure that has steadily worsened over the last

few years (particularly around buy in from schools).

The Service is currently investigating opportunities

for new and alternative income streams. This may

reduce the pressure but will not remove it

completely, and impact in the current year will be

reduced due to timing. Salary pressure is due to

regrading of staff (£44K higher in the current year

due to backdating). There are currently a large

volume of vacant posts within the service which is

resulting in the use of over-time and casual staff in

order to keep libraries open

0.2

Education and Skills

0.4

Finance &

Corporate

Services

Revenues and

Benefits

The pressure is primarily attributable to the cost of

temporary staffing as a result of increased levels of

work being received, cover for a higher than normal

level of staff absence and increased underlying

work levels in council tax.

0.5

Finance &

Corporate

Services

Other Variances

Less than 100K

(0.1)

Finance & Corporate Services

0.4

Human

Resources

HR - People &

Culture

The People and Culture service is forecasting a

£118K overspend. This mainly relates to pressures

within the Resourcing Team including an un-met

savings target, agency covering sickness,

increased costs for subscriptions and DBS costs. In

addition, there are growing pressures on training

and development budgets

0.1

Human

Resources

Employment

Services

Employment Services has a forecast over-spend of

£112K. This relates to a reduction in income from

external organisations. It has not been possible to

reduce costs further as a range of legislation and

regulatory changes has created an increase in

overall workload

0.1

Human

Resources

ICT & Digital

Digital Services is forecasting a Budget Holder

overspend of £183K. This relates to a shortfall on

schools’ income of £433K due to reduced buy in as

schools convert to academies and academies join

larger MATs offset by a one off release of £250K

reserves. A range of spending reductions are

expected to offset the significant pressures of

£188K email filtering costs. Spending reductions

0.2

include a short-term lower level of Microsoft

Enterprise licence consumption charges, short-

term reduction in “out of hours” service costs and

other changes which are in the process of being

worked on.

Human Resources

0.4

Legal &

Governance

Services

Legal Services

"Recruitment of staff (particularly lawyers) into

vacant positions remains a challenging situation

within the service despite numerous attempts made

to advertise vacancies. As a consequence, there is

a significant amount of expenditure (circa £600k)

on agency staff which is offset in part by vacancies

within the Legal Services team. The service is also

managing additional workload in the children’s

social care sector which has made it difficult to end

locum contracts.

An action plan is in place to address the

recruitment and retention issues within the team

with the expectation that this will show reductions

in subsequent quarters."

0.7

Legal &

Governance

Services

Other Variances

Less than 100K

(0.2)

Legal & Governance Services

0.5

People

Directorate

Management

People Directorate Management

0.1

Project

Management and

Property Services

Commercial

Property and

Development

£1.3m BH variance mainly due to £546k from CPM

rental operation and £767k from CCS (City Centre

South) project relates to red line area and new

acquisitions due to a mix of income reduction and

cost increase for void properties/sites. (Detailed

breakdown for CPM rental operation £546k: 1.

£370k: 4 Agency costs including a service charge

accountant, backfill for legal expert post and

covering two vacant posts (although there's

underspend in centralised variance £121k, it's

offset by saving target of £80k). 2. (£45k) extra

income generated by the service charge

accountant; 3.£104k Contributions to service

charges and sinking funds for void units 4. £146k

Public lighting, feeder pillars and voids 5. (£74k)

Binley Crt/240 Jardine/Riley Sq Binley Crt/240

Jardine/Riley Sq - recharge to tenants of utility

costs 6. £45k Professional fees costs to help

service achieve income target). Note that £1m

further saving target isn't in the ledger yet, so

corresponding A60 saving position will be updated

once the £1m saving target is actioned, potentially

underachieving by £300k, but could be offset by

more income generated from R&M service.

1.3

Project

Management and

Property Services

Facilities &

Property

Services

(£521k) BH variance due to 1. R&M (£123k)

income overachieved based on the current order

book for the profit to be generated from margin on

jobs (for labour, materials and subcontractors) and

additional income from project work expected. 2.

(0.5)

(£407k) Corporate property building potential

underspend due to forecasted drop in utilities costs

after offsetting a pressure on Fairfax around £175k.

Note that the position may still change due to

volatility in the market.

Project

Management and

Property Services

PMPS

Management &

Support

BH Variance (£700k) due to PMPS Property

service draw down merit funding £750k, offset

saving target of £50k.

(0.7)

Project Management and Property Services

0.1

Public Health

Public Health

Staffing &

Overheads

A budget holder underspend of £330k, mainly as a

result of the release of funding previously held in

reserve.

(0.3)

Public Health

Public Health -

Migration

A budget holder underspend of £900k as a result of

additional grant flexibility and the release of funding

previously held in reserve.

(0.9)

Public Health

Other Variances

Less than 100K

(0.2)

Public Health

(1.4)

Streetscene &

Regulatory

Services

Planning

Services

There has been an overall reduction in planning

applications since COVID which reflects the

national trend. (Affecting Majors in particular.) This

is partly mitigated by an increase in fees which is

expected to be implemented around the start of

September 2023.

0.2

Streetscene &

Regulatory

Services

Streetpride &

Parks

The net variation across Streetpride and Parks is

c£259k overspend and primarily relates to a)

service reviews (Streetpride & Parks) with

vacancies(part offset by u/spends on centralised

variance) being covered by agency/overtime whilst

new structures are being implemented, along with

some shortfalls in income (i.e. car parks), b) set up

costs and non-achievement of savings targets

relating to Coventry Funeral Services c) Pressures

in Urban Forestry relating to Tree Surveys,

associated remedial works and inflationary

increases and cd Traveller Incursion Costs. Some

s106 (c£100k) will also be applied.

1.1

Streetscene &

Regulatory

Services

Waste & Fleet

Services

Commercial Waste is currently under review and is

forecasting a deficit in excess of £0.5m. A decision

has been made for a third party to provide

resources to deliver the Waste Collection service

alongside CCC staff at a cost of c£522k (partly

offset by centralised salary savings on Waste

Admin), the WTS no longer has any external

customers and although disposal costs have been

reduced there is still a deficit of c£156k. Partly

offsetting this is an underspend on Waste Disposal

costs of (c£314k) due to lower than expected

tonnages, anticipated savings of (c£272k) relating

to SRL going live in Sept/October and additional

income/savings on capital finance costs of c£270k

from the EV programme.

0.4

Streetscene &

Regulatory

Services

Environmental

Services

There are vacancies in Street Team Enforcement

which are being covered by Agency/Overtime

0.1

payments c£95k and a shortfall in Pest Control

income c£37k.

Streetscene &

Regulatory

Services

Other Variances

Less than 100K

0.1

Streetscene & Regulatory Services

1.9

Transportation &

Highways

Parking

There are income pressures in Bus Lane and

Parking Enforcement due to temporary bus gates

closures, activity levels remaining lower than

expected due to the impact of staff vacancies and

sickness. These are offset by higher-than-expected

car park usage and income.

0.6

Transportation &

Highways

Highways

Pressure is largely due to the anticipated costs to

be incurred to address highways defects (£350k)

and under-recovery within Highways Operations as

a result of vacancies and sickness (£400k).

0.8

Transportation &

Highways

TH Management

& Support

Variance is largely due to unachieved historic

MTFS targets

0.1

Transportation & Highways

1.5

Ringfenced

Funding

SEND &

Specialist

Services

Dedicated Schools Grant Variance: The LA makes

provision for children with high needs in the early

years and new to City through a funded support

plan, September activity saw an 85% increase

against forecast demand. 50% of the forecast

demand for external placements has been realised,

with the average cost increasing during the year by

£6k. In response to the system pressures across

Coventry's special schools, top-up values have

been inflated to secure sustainability and provision

for specialist SEMH has been reviewed in

response to increasing needs.

0.4

Ringfenced

Funding

Schools

Dedicated Schools Grant Variance: The majority of

this under spend relates to the Council's High

Needs holding pot. This is budget that has been

earmarked to support the Council's overall SEND

Strategy and fund known provision cost pressures

that will arise in future years.

(2.5)

Ringfenced

Funding

Financial

Strategy

Technical adjustment to remove total Dedicated

Schools Grant Variance from the General Fund

position.

2.1

Ringfenced Funding

0.0

Total Non-Controllable Variances

17.7

Appendix 2

Capital Programme Approved / Technical Changes

SCHEME

EXPLANATION

£m

Highways

Investment

Budget 2023 announced £200 million for highways maintenance for the

financial year 2023-2024. Based on the West Midlands Local Authority

apportionment this is a further £0.6m funding for Coventry's Highway

Investment programme.

0.6

Eastern Green -

A45 Overbridge

The awarded £15.6m from Homes England for the delivery of the A45

Overbridge at Eastern Green has now been fully drawn down and passported

over to the developer. As Coventry City Council are the accountable body for

the delivery of the scheme, there is a legal agreement that the process moving

forward will entail the developer re-imbursing CCC all invoiced amounts prior to

CCC paying these funds over to the contractor. This ensures no financial risk

to CCC.

8.0

On street

Residential

ChargePoints

Phase 8

Report taken to Cabinet 14th February 2023 - Electric Vehicle Charging

Infrastructure. Bids were submitted to Office for Zero Emissions Vehicles,

which resulted in successful securing £2.8 for On street Residential charge

points phase 8.

2.8

Routes to Stations

Successful bid in securing £1.6m from Sustrans to deliver the National Cycling

Network across England, through a series of schemes to make the Network

safer and more accessible to everyone, to encourage active travel. The

awarded funding will deliver cycling network for Warwick University to Charter

Avenue and Kenilworth Road to Spencer Park.

1.6

Public Realm -

Palmer Lane De-

culverting

Report taken to Cabinet 11th July 2023 - Palmer Lane Regeneration. Approval

of additional funding of £318k for the delivery of the Palmer Lane project taking

the total budget for the delivery of the scheme to £2.4m. Along with noting the

grant acceptance of £534k received from Historic Coventry Trust in March

2023 under delegated authority contained in paragraph 2.3.2 (c) of Part 3F

(Financial Procedure Rules) of the Council Constitution.

0.9

New Union Street

Car Park

Report taken to Cabinet Member for Jobs, Regeneration and Climate Change

on 15th June 2023. The Proposed Demolition of New Union St Multi Storey Car

Park and Construction of a Surface Car Park on the Site.

1.0

Social Housing

Decarbonisation

Fund Wave 2

Coventry City Council have been successful in a consortium bid with Citizen

Housing to improve the energy efficiency of over 2,000 homes in Coventry over

the next two and half years. This Government grant funding (c. £23.8 million)

together with Citizen’s own investment will total circa £60m and deliver energy

efficiency measures to just over 2,000 social housing properties in and around

the Coventry area. The housing association worked with Coventry City Council

to submit the bid to the Department of Energy Security and Net Zero (formally

known as the Department for Business Energy and Industrial Strategy – BEIS).

The £23.8m grant will see energy efficient works carried out on properties in

the city to improve the Energy Performance to an EPC rating of a C. Works on

the homes will predominately improve the fabric and ventilation of a property

including, cavity / external wall insulation, increased loft insulation and

improving ventilation to reduce the potential for mould growth. This funding is

part of the second wave of Social Housing Decarbonisation Funding, which

was submitted following joint success with Coventry City Council in the first

wave of the bid where funding was secured to improve 95 homes across the

city last year.

9.4

Coventry UK

Shared Prosperity

Fund (UKSPF)

Approval at Cabinet on 14th February 2023, capital allocation for the

refurbishment works for the job shop relocation plus grant to business and

preparing residents for workspaces

1.2

City Centre South

15th November 2022 Cabinet Approved £5.250m additional resources

4.1

Miscellaneous

Schemes below £250k threshold

0.1

TOTAL APPROVED / TECHNICAL CHANGES

29.7

Appendix 3

Capital Programme: Analysis of Rescheduling

SCHEME

EXPLANATION

£m

Very Light Rail

Spend has slowed down because we are still working with DfT to

understand and agree the process for drawing down the phase 2 to 4

allocation. As yet, Coventry only secured phase 1 spend in 2023 (£6.4m

was confirmed in Feb 23 and the remaining phase 1 balance of £2.5m

was confirmed in July 23). Consequently, CCC took a decision to limit

the amount of spend at risk and the programme was slowed down.

CCC are confident we will spend the reprofiled forecast within the

current predicted timescales.

(6.2)

Foleshill

Transport

Package

Delays in the consultation on Foleshill along with a more detailed

approval process than anticipated at WMCA in achieving business case

sign off has resulted in the programme slipping.

(2.8)

Coventry South

Package

The previous forecast was based on a programme to deliver extensive

improvements at Asda roundabout as an early phase within the

programme. Further transport modelling assessments have

demonstrated that a further round of option appraisal is needed to

identify the best scheme to achieve all identified objectives at this

junction, and the outcome of this will be reported back in due course.

The current spend profile reflects the revised programme for design

development of the Asda Roundabout scheme, with the Abbey Road

junction improvement being the first element of the package to be

delivered during 2023/24.

(3.3)

Schools Basic

Need

Forecasts for 23/24 have been realigned to reflect the 22/23

rescheduling. There was £3m more spent in 22/23 which has reduced

the forecasts accordingly

1.4

Woodlands

School

Project delayed due to planning pre-commencement conditions issues

and change of requirement by SSMAT in relation to the temporary

accommodation to rehouse pupils out of building scheduled for

demolition

(10.3)

Schools

Condition

Additional funding received in 20/21 of £1m was carried forward to

21/22, we then received a further £1m grant from DFE, taking into

account these additional funds being carried forward into 22/23 and not

all funds being spent, this has increased the 23/24 available funds to be

able to fund additional works on schools this year.

0.9

Disabled

Facilities Grants

When the budget was set for 23/24 it included funds for a new home for

children with disabilities, this should have reduced the main DFG

forecast line but was put in as an additional line so overstated the base

budget for the main DFG programme by £1m, this has now been

adjusted at Qtr1 to reflect the correct 23/24 forecast

(0.9)

City Centre South

It was previously assumed that the demolition would complete during

2023/24. This date has moved as a result of changes to the

development programme whilst waiting for the CPO to be confirmed

and the relevant legal agreements with the developer to be finalised.

The developer is now anticipating they will begin demolition in April

2024. The demolition is currently forecast to be in one phase and take

up to 12 months.

(17.4)

Miscellaneous

Schemes below £250k rescheduling

(0.3)

TOTAL RESCHEDULING

(38.9)

Appendix 4

Capital Programme: Analysis of Over / Under Spend

SCHEME

EXPLANATION

£m

Sustainable

Warmth

Competition

The underspend is a result of low uptake from residents for

the off-gas section of the Sustainable warmth competition. The

remaining element of the grant has been returned to Midland

Net Zero Hub (MNZH).

(0.2)

Miscellaneous

Schemes below £250k threshold

(0.2)

TOTAL

UNDERSPEND

(0.4)

Appendix 5

Prudential Indicators

Indicator

per Treasury

Management

Strategy

2023/24

As at 30 June

2023

Ratio of Financing Costs to Net Revenue Stream (Indicator 1), This is an

indicator of affordability and highlights the revenue implications of existing and

proposed capital expenditure by identifying the proportion of the revenue

budget required to meet borrowing costs.

14.98%

14.73%

Gross Borrowing should not, except in the short term, exceed the total of the

Capital Financing Requirement (CFR) at 31

st

March 2023 plus the estimates of

any additional CFR in the next 3 years (Indicator 2), illustrating that, over the

medium term, net borrowing (borrowing less investments) will only be for

capital purposes. The CFR is defined as the Council's underlying need to borrow,

after taking account of other resources available to fund the capital programme

and is the amount of capital expenditure that has not yet been financed by

capital receipts, capital grants or contributions from revenue.

Estimate /

limit of

£546.2m

£317.0m

Gross

borrowing

within the

limit.

Authorised Limit for External Debt (Indicator 5), This statutory limit sets the

maximum level of external borrowing on a gross basis (i.e. excluding

investments) for the Council. Borrowing at this level could be afforded in the

short term but is not sustainable. The Authorised limit has been set on the

estimated debt with sufficient headroom over and above this to allow for

unexpected cash movements.

£534.8m

£317.0m

is less than

the

authorised

limit.

Operational Boundary for External Debt (Indicator 6), This indicator refers to

the means by which the Council manages its external debt to ensure it remains

within the statutory Authorised Limit. It differs from the authorised limit as it is

based on the most likely scenario in terms of capital spend and financing during

the year. It is not a limit and actual borrowing could vary around this boundary

for short times during the year.

£514.8m

£317.0m

is less than

the

operational

boundary.

Upper Limit on Fixed Rate Interest Rate Exposures (Indicator 9), These

indicators allow the Council to manage the extent to which it is exposed to

changes in interest rates.

The Upper Limit for variable rate exposure has been set to ensure that the

Council is not exposed to interest rate rises which could impact negatively on

the overall financial position.

£480.9m

£204.0m

Upper Limit on Variable Rate Interest Rate Exposures (Indicator 9), as above

highlighting interest rate exposure risk.

£96.2m

-£66.7m

Maturity Structure Limits (Indicator 10), This indicator highlights the existence

of any large concentrations of fixed rate debt needing to be replaced at times of

uncertainty over interest rates and is designed to protect against excessive

exposures to interest rate changes in any one period, thereby managing the

effects of refinancing risks.

The maturity of borrowing is determined by reference to the earliest date on

which the lender can require payment.

< 12 months

0% to 50%

8%

12 months – 24 months

0% to 20%

12%

24 months – 5 years

0% to 30%

7%

5 years – 10 years

0% to 30%

12%

10 years +

40% to 100%

61%

Investments Longer than 364 Days (Indicator 11), This indicator sets an upper

limit for the level of investment that may be fixed for a period greater than 364

days. This limit is set to contain exposure to credit and liquidity risk.

£30m

£0.0m