“

FinCEN Report of Foreign Bank and

Financial Accounts (FBAR)

Electronic Filing Requirements

User Guide

Financial Crimes Enforcement Network (FinCEN)

XML Schema 2.0

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) i

DEPARTMENT OF THE TREASURY

FINANCIAL CRIMES ENFORCEMENT NETWORK (FINCEN)

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) ii

0. Revision History

Version

Number

Date

Change Description

1.0

06/23/2017

Initial version

1.1

10/13/2017

Updates include:

Section 3.3 Element Requirements

ActivityAssociation:

o Updated the minOccurs value from “0” to “1”.

o Updated the Element Restrictions to make this a required element.

o Updated the Remarks to reject the submission if this element is not

recorded.

CorrectsAmendsPriorReportIndicator:

o Updated the Element Restrictions to make this a required element.

o Updated the Value Restrictions to allow a null value for this element.

Re-sequenced the ApprovalOfficialSignatureDateText element to be recorded

prior to the EFilingPriorDocumentNumber element.

ThirdPartyPreparerIndicator:

o Updated the following rejection criteria as follows: “The element is

not recorded or does not contain a value, and third party preparer is

not indicated PreparerFilingSignatureIndicator is not recorded with a

“Y” value.”

SignatureAuthorityIndicator:

o Updated element name to the following:

SignatureAuthoritiesIndicator and extended this change throughout

the User Guide.

Section 4. FinCEN FBAR XML Acknowledgement Format

Added the following schema reference to the introductory paragraph: “Please

visit

https://www.fincen.gov/sites/default/files/schema/base/EFL_BatchAcknowled

gementSchema.xsd to access the FinCEN XML 2.0 batch acknowledgement

schema file.”

Removed the “fc2” prefix from all elements in the returned FBAR XML

Acknowledgement file.

EFilingBatchXML:

o Added “StatusCode” to the Attribute(s) and updated the Example to

include the StatusCode attribute and its value (e.g. StatusCode=”A”).

o Updated the SeqNum values associated with the

EFilingActivityErrorXML elements in the Example to correctly show

the value resetting to “1” for each new Activity element.

EFilingSubmissionXML:

o Added “StatusCode” to the Attribute(s) and updated the Example to

include the StatusCode attribute and its value (e.g. StatusCode=”A”).

EFilingActivityErrorXML:

o ErrorContextText: Updated the Description, Value Restriction(s), and

Example to include additional details regarding how the value will

be recorded.

Section 4.2 Acknowledgement XML Example

Updated the Sample to reflect the changes to Section 4 mentioned above.

Attachment A – Error Descriptions

Added Error Code A26 – State code and country code mismatch when U.S.

Territory is recorded.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) iii

Removed Error Code C6 (The element is recorded for an inappropriate party

type) associated with the Part I Filer Information (Type of Filer) because it is a

duplicate of error code A2.

Removed the following error codes from the Transmitter Contact section due

to the fact the Phone Number is not applicable for this section:

o I8 – The value recorded for the element contains non-numeric

characters

o I9 – The element is recorded but without a value (i.e. the value is

null).

Revised the Error Text associated with the following elements to read “The

element is not recorded or but does not contain a value (i.e. the value is

null)”: D8, E8, F8, and G8.

Miscellaneous

Added the section "Secure Data Transfer Mode Filers" to the end of the document.

This section provides information about filing the FBAR XML batch via secure, system

to system file transfer.

1.2

7/31/2018

3.2 Batch Validation (Form & Fit) Overview

Added the following bullet to the list of general schema requirements that all

XML batch files must adhere to:

o Element names must be spelled correctly and in the correct case. Do

NOT included spaces at the beginning or ending of the element

names.

o Element values must not include leading and/or trailing spaces.

o Element values must not include non-printable characters, such as

carriage returns, line feeds, and tabs.

1.3

10/1/2019

FinCEN FBAR XML Batch Reporting Requirements

AccountMaximumValueAmountText

o Removed the following ‘accepted with warning’ validation criteria

from the remarks:

The FBAR contains a single account with a value less than

or equal to $10,000.

The FBAR contains multiple accounts with an aggregated

value less than or equal to $10,000 and “Y” is not reported

in <UnknownMaximumValueIndicator>.

PartyIdentificationTypeCode

o Updated the value restrictions by including 1 (SSN/ITIN) and 9

(Foreign TIN) as acceptable values for the Consolidated Report

Account Owner (44) party type. This is now consistent with the

FinCEN FBAR discrete entry form.

Error Descriptions (Attachment A)

Removed the following error codes as a result of the removal of the “less

than $10,000” criteria (above):

o D5: The FBAR contains a single account and the value is less than or

equal to $10,000.

o D24: The FBAR multiple accounts with an aggregated value less than

or equal to $10,000 and "Y" is not reported in

<UnknownMaximumValueIndicator>.

o E5: The amount recorded is less than or equal to $10,000.

o F5: The amount recorded is less than or equal to $10,000.

o G5: The amount recorded is less than or equal to $10,000.

Electronic Filing Instructions (Attachment C)

Who Must File an FBAR

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) iv

o Added the following sentence to the description: “This does not

prohibit filing an FBAR on an aggregated value less than or equal to

$10,000.”

Addresses

o Added the following note to the end of the section text: “NOTE: The

ISO 3166-2 country list contains the code “UM” that stands for the

United State Minor Outlying Islands. Using “UM” in country fields is

prohibited. These islands are uninhabited. As such they have no

addresses.”

Monetary amounts

o Modified the description as follows (underlined for emphasis): “If the

maximum account value of a single account or aggregate of the

maximum account values of multiple accounts exceeds $10,000, an

FBAR must be filed. An FBAR may be filed but is not required to be

filed if the person did not have more than $10,000 of maximum

value or aggregate maximum value in foreign financial accounts at

any time during the calendar year.”

1.4

08/01/2021

Changed Error Code A13 to F60 – “The namespace prefix for the element is invalid.”

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) v

Contents

0. Revision History ...................................................................................................................................................................................................................... ii

1. Introduction ............................................................................................................................................................................................................................. 1

2. FinCEN FBAR XML Schema Overview ............................................................................................................................................................................ 1

2.1. File Organization .................................................................................................................................................................................................................... 1

XML declaration (prolog) .............................................................................................................................................................................................................. 2

EFilingBatchXML .............................................................................................................................................................................................................................. 2

Activity ................................................................................................................................................................................................................................................. 2

ActivityAssociation .......................................................................................................................................................................................................................... 2

Party ...................................................................................................................................................................................................................................................... 2

Account ............................................................................................................................................................................................................................................... 3

Foreign Account Activity............................................................................................................................................................................................................... 3

Activity Narrative Information .................................................................................................................................................................................................... 3

3. FinCEN FBAR XML Batch Reporting Requirements .................................................................................................................................................. 4

3.1. Element Definition Overview ............................................................................................................................................................................................. 4

3.2. Batch Validation (Form & Fit) Overview ........................................................................................................................................................................ 5

3.3. Element Requirements ........................................................................................................................................................................................................ 5

XML declaration/prolog ................................................................................................................................................................................................................ 5

EFilingBatchXML Elements ........................................................................................................................................................................................................... 5

Activity Elements ............................................................................................................................................................................................................................. 7

ActivityAssociation Elements ...................................................................................................................................................................................................... 9

Party Elements (Activity Level) .................................................................................................................................................................................................. 10

Account Elements .......................................................................................................................................................................................................................... 30

Foreign Account Activity Elements ......................................................................................................................................................................................... 46

Activity Narrative Information Elements ............................................................................................................................................................................... 49

3.4. Party Elements by Party Type .......................................................................................................................................................................................... 50

Activity Level.................................................................................................................................................................................................................................... 50

Account level ................................................................................................................................................................................................................................... 54

4. FinCEN FBAR XML Acknowledgement Format ......................................................................................................................................................... 57

4.1. XML File Structure ............................................................................................................................................................................................................... 57

XML declaration/prolog .............................................................................................................................................................................................................. 57

EFilingBatchXML ............................................................................................................................................................................................................................ 57

EFilingSubmissionXML ................................................................................................................................................................................................................. 58

EFilingActivityXML ......................................................................................................................................................................................................................... 59

EFilingActivityErrorXML ............................................................................................................................................................................................................... 59

4.2. Acknowledgement XML Example .................................................................................................................................................................................. 62

Attachment A – Error Descriptions .................................................................................................................................................................................................. 63

Attachment B – Error Correction Instructions .............................................................................................................................................................................. 79

Attachment C – Electronic Filing Instructions .............................................................................................................................................................................. 80

Secure Data Transfer Mode Filers .................................................................................................................................................................................................... 95

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 1

1. Introduction

The FinCEN XML Schema 2.0 User Guide outlines the business and validation rules to support the electronic batch

transmission of the FinCEN Report of Foreign Bank and Financial Accounts (FinCEN Report 114 – FBAR). Electronic

filing of this report will be through the Bank Secrecy Act (BSA) E‐Filing System operated by the Financial Crimes

Enforcement Network (FinCEN). BSA E-Filing users who intend to file the FinCEN FBAR batch XML should be familiar

with FinCEN regulations, Extensible Markup Language (XML) and the FinCEN XML schemas. For more information,

please go to bsaefiling.fincen.treas.gov.

2. FinCEN FBAR XML Schema Overview

Before you begin submitting your BSA data to FinCEN’s BSA E-Filing System (bsaefiling.fincen.treas.gov) via XML

batch, you must first review the required schemas to assist you with constructing and testing your XML batch file

before submitted to FinCEN for processing. These schemas define the requirements by which the FinCEN FBAR XML

batch file must be constructed, such as which elements must contain an entry, which elements can be omitted when

the data are unknown, what the appropriate values are for certain elements, and what sequence the elements should

appear in when building the batch. Please visit Please visit

https://www.fincen.gov/sites/default/files/schema/base/EFL_FBARXBatchSchema.xsd to access the FinCEN FBAR XML

2.0 schema file.

2.1. File Organization

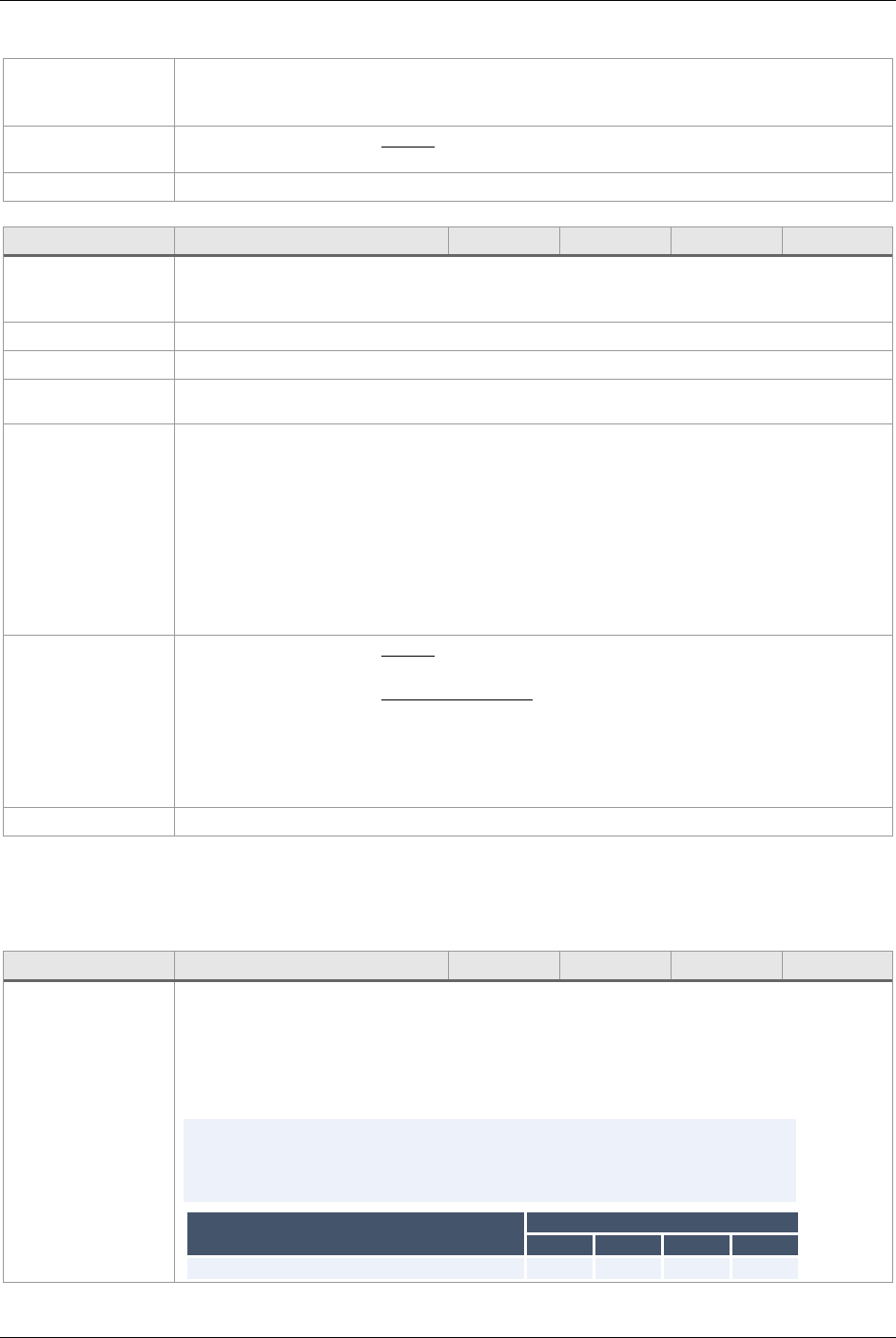

This section describes the general formatting requirements for FinCEN FBAR XML batch reporting. The diagram below

provides a visual representation of the XML batch file layout from a high level perspective. Detailed element

requirements can be found in Section 3 – FinCEN FBAR XML Batch Reporting Requirements.

Figure 1 FBAR XML Batch File Layout Overview

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 2

XML declaration (prolog)

The XML declaration specifies the XML version and character encoding used in the file. It must appear on the first line

of the file.

EFilingBatchXML

This is the root element and serves as the container for all FinCEN FBAR documents recorded in the batch. It must be

the first element recorded in the file.

The EFilingBatchXML element is parent to the following complex element(s):

Activity. This element is the container for each FinCEN FBAR document in the batch. All BSA data related to

a single FinCEN FBAR document must be recorded within the <Activity> element. The number of <Activity>

elements will depend on the number of FinCEN FBAR documents being reported in the batch.

Activity

Each FinCEN FBAR document in the batch must begin with the <Activity> element. It identifies all information related

to a single FinCEN FBAR, including (but not limited to) information about the transmitter of the batch file, foreign

account filer, and third party preparer (if applicable), as well as the foreign financial account(s) and account owner(s).

There is no limit to the number of <Activity> elements that may be recorded in the batch; however, batch files should

not exceed 60MB total.

The <Activity> element is parent to the following complex element(s):

ActivityAssociation. This element is the container for the type of filing and should be recorded when the

FinCEN FBAR corrects/amends a prior report.

Party. This element is the container for any person (individual or entity) associated with the FinCEN FBAR at

the activity level, such as the batch file transmitter, the foreign account filer, and the third party preparer and

preparing firm (if applicable).

Account. This element is the container for foreign account information associated with the filer, such as a

separately owned foreign financial account, jointly owned foreign financial account, a foreign financial

account where the filer has signature authority but no financial interest, and/or a foreign financial account

where the filer is filing a consolidated report. NOTE: The <Account> element also contains <Party> elements

in addition to those mentioned above, such as the financial institution where the account is held, and the

account owners.

ActivityAssociation

As the container for the type of filing declaration for the FinCEN FBAR, this element (when recorded) identifies the

FinCEN FBAR as a correction/amendment to a prior report. There can only be one occurrence of this element for each

<Activity> element in the batch.

Party

Each FinCEN FBAR in the batch must include at the <Activity> element level a separate <Party> element identifying

the following:

Transmitter

This is the person (individual or entity) handling the data accumulation and formatting of the batch file. Each

FinCEN FBAR <Activity> element in the batch must include a <Party> element that identifies the batch

transmitter. The batch transmitter should be identical for each FinCEN FBAR. There must be only one occurrence of

this party for each FinCEN FBAR in the batch.

Transmitter Contact

This is the official contact for the transmitter. Each FinCEN FBAR <Activity> element in the batch must include a

<Party> element that identifies the point of contact for the batch transmitter. The transmitter contact should be

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 3

identical for each FinCEN FBAR. There must be only one occurrence of this party for each FinCEN FBAR in the

batch.

Foreign Account Filer

This is the United States person that has a financial interest in or signature authority over foreign financial

accounts when the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the

calendar year. There must be only one occurrence of this party for each FinCEN FBAR in the batch.

If the FinCEN FBAR involves a third party preparer who is either self-employed or with a firm, then a separate

<Party> element must be recorded for each:

Third Party Preparer

This is the individual that has prepared the FinCEN FBAR and is filing on behalf of the filer and/or owner of the

foreign account(s). If recorded, there may be only one occurrence of this party for each FinCEN FBAR in the batch.

Third Party Preparer Firm

This is the firm associated with the third party preparer. This party type is not applicable when the third party

preparer is self-employed. If recorded, there may be only one occurrence of this party for each FinCEN FBAR in

the batch.

Account

Each FinCEN FBAR in the batch must include at least one <Account> element where one or more of the following

account types are identified; however, if the filer has financial interest or signature authority over (but no financial

interest) in 25 or more accounts, the account information may not be required. Please refer to Attachment C –

Electronic Filing Institutions for more details.

Separately Owned Financial Account

Information about a financial account owned separately by the filer. Information about the financial institution

where the account is held must be recorded as a <Party> element below the <Account> element.

Jointly Owned Financial Account

Information about a financial account owned jointly by the filer. Information about the financial institution where

the account is held is recorded as a <Party> element below the <Account>, along with a separate <Party>

element for each owner associated with the joint account.

No Financial Interest Account

Information about a financial account where filer has signature authority but no financial interest in the account.

Information about the financial institution where the account is held is recorded as a <Party> element below the

<Account>, along with a separate <Party> element for each owner associated with the joint account.

Consolidated Report Account

Information about a financial account where filer is filing a consolidated report. Information about the financial

institution where the account is held is recorded as a <Party> element below the <Account>, along with a

separate <Party> element for each owner associated with the joint account.

Foreign Account Activity

This is the container for general information about the FinCEN FBAR, such as the FinCEN FBAR calendar year, the

count of financial interest and/or signature authority accounts associated with the filer (if applicable), and if filing the

FinCEN FBAR past the annual deadline, a reason code can be recorded. There can only be one occurrence of this

element for each <Activity> element in the batch.

Activity Narrative Information

This is the container for a detailed explanation as to why the FinCEN FBAR is being filed late when the reason does

not fall into one of the predefined classifications provided by FinCEN. There can only be one occurrence of this

element for each <Activity> element in the batch.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 4

3. FinCEN FBAR XML Batch Reporting Requirements

This section describes in detail the reporting requirements for each element in the FinCEN FBAR batch.

3.1. Element Definition Overview

Each element in this user guide is defined using the following terms:

Item

Description

Element Name

This is the name that must be used when recording the element.

minOccurs/maxOccurs

This defines the number of times the element can occur for the parent element.

MinOccurs. The minimum number of times this element may be recorded for the

parent element (e.g. minOccurs=0 means this element is only required under certain

conditions while minOccurs=1 means at least one of the element must be recorded for

the parent element in the FinCEN FBAR.)

MaxOccurs. The maximum number of times this element may be recorded for the

parent element (e.g. maxOccurs=9999 means this element can occur up to 9999 times

in the same FinCEN FBAR.)

Description

This is the summary description of the element. Also included in the description is a list of

sub-elements associated with the element (if applicable) as well as any special requirements

for when (and when not) to record the element.

Attribute(s)

This specifies the attribute(s) that are required to be recorded for the element.

Note: Various elements contain the SeqNum attribute used to identify the associated

element in the batch file. The value recorded for this attribute must be numeric and unique.

It should begin with “1” and increase by 1 for all subsequent elements in the batch that

contain this attribute.

Parent Element

This identifies the element’s container element. The <Parent> element contains sub

elements and is considered a complex element.

Element Restriction(s)

This specifies the requirement level for the element; specifically, under what conditions the

element should be recorded:

Required. The element must be recorded for the <Parent> element; however, this

does not necessarily mean that a value must also be recorded for the element.

Conditionally Required means that the element should only be recorded when certain

conditions apply (if the element is labeled as conditionally required, the conditions for

recording the element are defined in the Remarks).

NOTE: If neither of the above requirement levels are specified in this field, then the element

is not required. However, a field that is not required does not mean that it is optional. All

fields require an entry when the filer has the relevant data.

Value Restriction(s)

This specifies any requirements and/or restrictions in terms of the value recorded for the

element.

Required. A value must be recorded for the element.

Conditionally Required. A value may or may not be recorded for the element

depending on whether or not certain conditions apply.

Remarks

This specifies any additional information about the element to assist with reporting;

including:

Reporting conditions that may result in a batch rejection.

Reporting conditions that may result in a batch accepted with warnings.

Example

This provides one or more examples of how to record the element.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 5

3.2. Batch Validation (Form & Fit) Overview

It is important to note that if the batch file does not adhere to the basic format described in this guide in accordance

with the FBAR XML batch schema, then the batch will fail validation and will not be accepted by FinCEN.

Here is a list of general schema requirements that your batch must adhere to in addition to the data requirements

described for each element throughout this guide:

Elements must include the prefix “fc2”.

Element names must be spelled correctly and in the correct case. Do NOT included spaces at the beginning

or ending of the element names.

Elements must have a matching closing tag (which includes a self-closing tag in the event that no value is

recorded for the element).

Elements must be in the correct sequence.

Elements must be recorded when the minOccurs=1 (or greater than 1).

Elements must not be recorded more than the maxOccurs value for the associated <Parent> element.

Element values must not exceed the maximum specified character limit.

Element values must not include leading and/or trailing spaces.

Element values must not include non-printable characters, such as carriage returns, line feeds, and tabs.

3.3. Element Requirements

The following defines each element in the FinCEN FBAR XML batch in the order in which they can be recorded.

XML declaration/prolog

The XML declaration must appear on the first line of the file.

Element Name:

?xml

minOccurs:

1

maxOccurs:

1

Description:

XML declaration/prolog. This is the XML declaration which specifies the XML version and character

encoding used in the file.

Attribute(s):

version. The version number of the XML. The value recorded must be “1.0”

encoding. The character encoding, which must be UTF-8, used for the XML. The value recorded must be

“UTF-8”

Parent Element:

n/a

Element

Restriction(s):

This declaration must be recorded.

Value Restriction(s):

The value provided must adhere to the following requirements:

<?xml version="1.0" encoding="UTF-8"?>

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The XML declaration/prolog is not recorded with the required values (see Value Restriction(s)

above) or it is not recorded on the first line of the batch file.

Example:

<?xml version="1.0" encoding="UTF-8"?>

EFilingBatchXML Elements

The <EFilingBatchXML> element is the container for the contents of the batch file, which may include one or more

FinCEN FBAR documents. It must be the first element recorded in the file (directly following the XML

declaration/prolog) and is considered the root element. An <Activity> element must be recorded for each FinCEN

IMPORTANT: If the batch file does not conform to the above requirements, it will fail schema validation and the entire batch

submission will be rejected by FinCEN.

IMPORTANT: FinCEN strongly encourages that filers first test their XML batch files for schema compliance using the schemas

available at www.fincen.gov/base. Your batch file should pass schema validation before you attempt to submit to FinCEN;

otherwise, it will be at risk of being rejected.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 6

FBAR document within the EFilingBatchXML element. Once all FinCEN FBAR <Activity> elements are recorded, the

batch file must include a closing tag for the element (e.g. </EFilingBatchXML>) which should be the last line of data

recorded in the file. There must only be one occurrence of this element in the file.

Element Name:

EFilingBatchXML

minOccurs:

1

maxOccurs:

1

Description:

FinCEN FBAR XML batch (header). This is the container for the contents of the batch file.

This element is parent to the following sub-elements:

FormTypeCode

Activity *

NOTE: The elements marked with an asterisk (*) in the table above contain sub-elements.

Attribute(s):

ActivityCount. The total count of all <Activity> elements recorded in the batch file.

PartyCount. The total count of <Party> elements where the <ActivityPartyTypeCode> element is equal

to “41” (Financial institution where account is held) recorded in the batch file.

AccountCount. The total count of all <Account> elements recorded in the batch file.

JointlyOwnedOwnerCount. The total count of <Party> elements where the <ActivityPartyTypeCode>

element is equal to “42” (Principle joint owner).

NoFIOwnerCount. The total count of <Party> elements where the <ActivityPartyTypeCode> element is

equal to “43” (No financial interest account owner).

ConsolidatedOwnerCount. The total count of <Party> elements where the <ActivityPartyTypeCode>

element is equal to “44” (Consolidated report account owner).

xsi:schemaLocation. The location of the FBARX batch schema, which is

www.fincen.gov/base/EFL_FBARXBatchSchema.xsd.

xmlns:xsi. The namespace definition location, which is http://www.w3.org/2001/XMLSchema-instance.

xmlns:fc2. The name prefix that must be specified for each element in the file (e.g.

<fc2:EFilingBatchXML>). The value for this attribute should be www.fincen.gov/base.

Parent Element:

n/a

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

n/a

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or is incorrectly formatted.

One or more of the attributes are missing, incorrectly formatted, or contain an invalid value.

The reported attribute count does not match the actual count.

Example:

<?xml version="1.0" encoding="UTF-8"?>

<fc2:EFilingBatchXML ActivityCount="55" PartyCount="102" AccountCount="102" JointlyOwnedOwnerCount="27"

NoFIOwnerCount="36" ConsolidatedOwnerCount="10"

xsi:schemaLocation="www.fincen.gov/base/EFL_FBARXBatchSchema.xsd"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xmlns:fc2="www.fincen.gov/base">

<fc2:FormTypeCode>FBARX</fc2:FormTypeCode>

<fc2:Activity SeqNum="1">

…

</fc2:Activity>

</fc2:EFilingBatchXML>

Element Name:

FormTypeCode

minOccurs:

1

maxOccurs:

1

Description:

Form type (code). This element identifies the type of form being reported in the batch.

Attribute(s):

n/a

Parent Element:

EFilingBatchXML

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

The value provided must equal:

FBARX

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 7

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or is incorrectly formatted.

The value recorded for the element is not equal to FBARX.

Example:

<fc2:FormTypeCode>FBARX</fc2:FormTypeCode>

Activity Elements

The <Activity> element is the container for the FinCEN FBAR document. The first <Activity> element in the batch file

must directly follow the <FormTypeCode> element. Once all sub-elements related to the FinCEN FBAR are recorded,

the batch file must include a closing tag for the element (e.g. </Activity>) before any subsequent FinCEN FBAR

<Activity> elements are recorded. The <Parent> element <EFilingBatchXML> element must contain at least 1

occurrence of this element. There is no maximum occurrence value set for this element; however, the total size of the

batch file must not exceed 60MB.

Element Name:

Activity

minOccurs:

1

maxOccurs:

unbounded

Description:

FinCEN FBAR activity (header). This is the container for the FinCEN FBAR document contents, which

includes information about the transmitter, reporting financial institution, transaction location(s),

person(s) involved in the transaction(s), and specific activity data related to the currency transaction

report, such as the date of the transaction(s), the total cash-in/out amount(s), etc.

This element is parent to the following sub-elements:

ApprovalOfficialSignatureDateText

EFilingPriorDocumentNumber

PreparerFilingSignatureIndicator

ThirdPartyPreparerIndicator

ActivityAssociation *

Party *

Account *

ForeignAccountActivity *

ActivityNarrativeInformation *

NOTE: The elements marked with an asterisk (*) in the table above contain sub-elements.

Attribute(s):

SeqNum. The value recorded for this attribute must be numeric and unique. It should begin with “1”

and increase by 1 for all subsequent elements in the batch that contain this attribute.

Parent Element:

EFilingBatchXML

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

n/a

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

The element is missing a “SeqNum” attribute.

The element contains a “SeqNum” attribute with a duplicate or invalid value.

Example:

<fc2:Activity SeqNum="1">

<fc2:ApprovalOfficialSignatureDateText>20171022</fc2:ApprovalOfficialSignatureDateText>

<fc2:EFilingPriorDocumentNumber>31000000000001</fc2:EFilingPriorDocumentNumber>

…

</fc2:Activity>

Element Name:

ApprovalOfficialSignatureDateText

minOccurs:

1

maxOccurs:

1

IMPORTANT: If the batch file does not conform to the above requirements, it will fail schema validation and the entire batch

submission will be rejected by FinCEN.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 8

Description:

Date of signature (text). This element identifies the date in which the FinCEN FBAR is approved for

electronic submission through FinCEN’s BSA E-Filing System either by the filer or by a third party

preparer on behalf of the filer

Attribute(s):

n/a

Parent Element:

Activity

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

The value provided must adhere to the following requirements:

8 numeric characters in the format YYYYMMDD where YYYY = year, MM = month, and DD =

day. Single digit days or months must be prefaced by a zero.

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

The element is recorded but without a value (i.e. the value is null).

The value recorded for the element is not a valid date in the format YYYYMMDD.

The batch submission will be accepted with warning if any of the following conditions are true:

The value recorded for the element is a date greater than the current date.

Example:

<fc2:ApprovalOfficialSignatureDateText>20170310</fc2:ApprovalOfficialSignatureDateText>

Element Name:

EFilingPriorDocumentNumber

minOccurs:

0

maxOccurs:

1

Description:

Prior report BSA Identifier (text). This element identifies the BSA Identifier (BSA ID) of the previously-

filed FinCEN FBAR when filing a correction/amendment to that report.

Attribute(s):

n/a

Parent Element:

Activity

Element

Restriction(s):

Conditionally Required. Record this element when:

<CorrectsAmendsPriorReportIndicator> contains a “Y” value.

Value Restriction(s):

The value provided must adhere to the following requirements:

14-digit numeric BSA ID (if the BSA ID is known).

Equal to “00000000000000” (if the BSA ID is unknown).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element is recorded but without a value (i.e. the value is null).

The value recorded for the element contains non-numeric characters.

The batch submission will be accepted with warning if any of the following conditions are true:

The element is not recorded and <CorrectsAmendsPriorReportIndicator> contains a “Y” value.

The element is recorded (with a valid value) and <CorrectsAmendsPriorReportIndicator> is

not recorded or contains a null value.

Example(s):

<fc2:EFilingPriorDocumentNumber>31000000000001</fc2:EFilingPriorDocumentNumber>

Element Name:

PreparerFilingSignatureIndicator

minOccurs:

0

maxOccurs:

1

Description:

Filer signature (indicator). This element declares that this FinCEN FBAR was prepared by the foreign

account filer and it is authorized for submission to FinCEN's BSA E-Filing System.

Attribute(s):

n/a

Parent Element:

Activity

Element

Restriction(s):

Conditionally Required. Record this element when:

The FinCEN FBAR was prepared by the foreign account filer and is authorized for submission

to FinCEN's BSA E-Filing System. If the FinCEN FBAR was completed by a third party preparer

on behalf of the filer, record the <ThirdPartyPreparerIndicator> element with a “Y” value and

do not record the <PreparerFilingSignatureIndicator> element.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate that this report was prepared by the foreign account filer and is authorized by

the filer for submission)

Remarks:

The batch submission will be rejected if any of the following conditions are true:

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 9

The element start tag and/or end tag is incorrectly formatted.

The element is not recorded or does not contain a value and third party preparer is not

indicated.

The element contains a value not equal to “Y” or null.

The batch submission will be accepted with warning if any of the following conditions are true:

Filer Signature and Third Party Preparer are both indicated.

Example:

<fc2:PreparerFilingSignatureIndicator>Y</fc2:PreparerFilingSignatureIndicator>

Element Name:

ThirdPartyPreparerIndicator

minOccurs:

0

maxOccurs:

1

Description:

Third party preparer (indicator). This element declares that this FinCEN FBAR was prepared by third

party preparer on behalf of the foreign account filer and it is authorized for submission to FinCEN's BSA

E-Filing System.

Attribute(s):

n/a

Parent Element:

Activity

Element

Restriction(s):

Conditionally Required. Record this element when:

The FinCEN FBAR was prepared by third party preparer on behalf of the foreign account filer

and is authorized for submission to FinCEN's BSA E-Filing System. If the FinCEN FBAR was

completed by foreign account filer, record the <PreparerFilingSignatureIndicator> element

with a “Y” value and do not record the <ThirdPartyPreparerIndicator> element.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate that this report was prepared by a third party preparer on behalf of the foreign

account filer and is authorized for submission)

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element is not recorded or does not contain a value and PreparerFilingSignatureIndicator

is not recorded with a “Y” value.

The element contains a value not equal to “Y” or null.

The batch submission will be accepted with warning if any of the following conditions are true:

Filer Signature and Third Party Preparer are both indicated.

Example:

<fc2:ThirdPartyPreparerIndicator>Y</fc2:ThirdPartyPreparerIndicator>

Element Name:

ActivityAssociation

See ActivityAssociation Elements section for details.

Element Name:

Party

See Party Elements section for details.

Element Name:

Account

See Account Elements section for details.

Element Name:

ForeignAccountActivity

See ForeignAccountActivity Elements section for details.

Element Name:

ActivityNarrativeInformation

See ActivityNarrativeInformation Elements section for details.

ActivityAssociation Elements

The <ActivityAssociation> element is the container for information about the type of filing associated with the FinCEN

FBAR. Once all sub-elements related to the <ActivityAssociation> element are recorded, the batch file must include a

closing tag for the element (e.g. </ActivityAssociation>). There must be one occurrence of this element for each

FinCEN FBAR <Activity> element recorded in the batch.

IMPORTANT: If the batch file does not conform to the above requirements, it will fail schema validation and the entire batch

submission will be rejected by FinCEN.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 10

Element Name:

ActivityAssociation

minOccurs:

1

maxOccurs:

1

Description:

FinCEN FBAR activity filing type association (header). This is the container that identifies the FinCEN

FBAR as a correction/amendment to a prior report.

This element is parent to the following sub-element:

CorrectsAmendsPriorReportIndicator

Attribute(s):

SeqNum

Parent Element:

Activity

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

n/a

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag are incorrectly formatted.

The element is missing a “SeqNum” attribute.

The element contains a “SeqNum” attribute with a duplicate or invalid value.

Example:

<fc2:ActivityAssociation SeqNum="2">

<fc2:CorrectsAmendsPriorReportIndicator>Y</fc2:CorrectsAmendsPriorReportIndicator>

</fc2:ActivityAssociation>

Element Name:

CorrectsAmendsPriorReportIndicator

minOccurs:

1

maxOccurs:

1

Description:

Correct/amend prior report (indicator). This element declares that the FinCEN FBAR corrects or amends

a previously-filed report.

Attribute(s):

n/a

Parent Element:

ActivityAssociation

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate correct/amend prior report).

Null (if the FBAR is not a correction/amendment to a prior report).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

Example:

<fc2:CorrectsAmendsPriorReportIndicator>Y</fc2:CorrectsAmendsPriorReportIndicator>

Party Elements (Activity Level)

The <Party> element is the container for information about the individual or entity associated with the FinCEN FBAR.

At the report activity level, the <Party> element is used to identify the transmitter [of the batch file], the transmitter

contact, the foreign account filer, the third party preparer, and the third party preparer firm. At a minimum, each

FinCEN FBAR <Activity> element must contain a separate <Party> element identifying each of the following party

types: Transmitter (not to exceed one occurrence), Transmitter Official Contact (not to exceed one occurrence), and

Foreign Account Filer (not to exceed one occurrence). If the FinCEN FBAR includes a third party preparer and third

party preparer firm (when the third party preparer is not self-employed), a separate <Party> element must be

recorded for each party type at the <Activity> element level. Once all sub-elements related to the <Party> element

are recorded for the <Activity> element, the batch file must include a closing tag for the party (e.g. </Party>).

In this section, all sub-elements associated with the <Party> element are defined; however, when and when not to

record each element is dependent upon the party type (e.g. transmitter, foreign account filer, third party preparer,

etc.) being identified for the <Party> element. It is noted within each element’s description which party type the

element can be recorded for and under what conditions the element should be recorded within the Element

IMPORTANT: If the batch file does not conform to the above requirements, it will fail schema validation and the entire batch

submission will be rejected by FinCEN.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 11

Restriction(s). For a complete summary of required party elements by party type, refer to Section 3.4 – Party Elements

(Activity Level) by Party Type.

Element Name:

Party

minOccurs:

3

maxOccurs:

5

Description:

Party (header). This is the container for information about the individual or entity associated with the

FinCEN FBAR; specifically, the transmitter [of the batch file], the transmitter contact, the foreign account

filer, the third party preparer (if recorded), and the third party preparer firm (if a third party preparer is

recorded and is not self-employed).

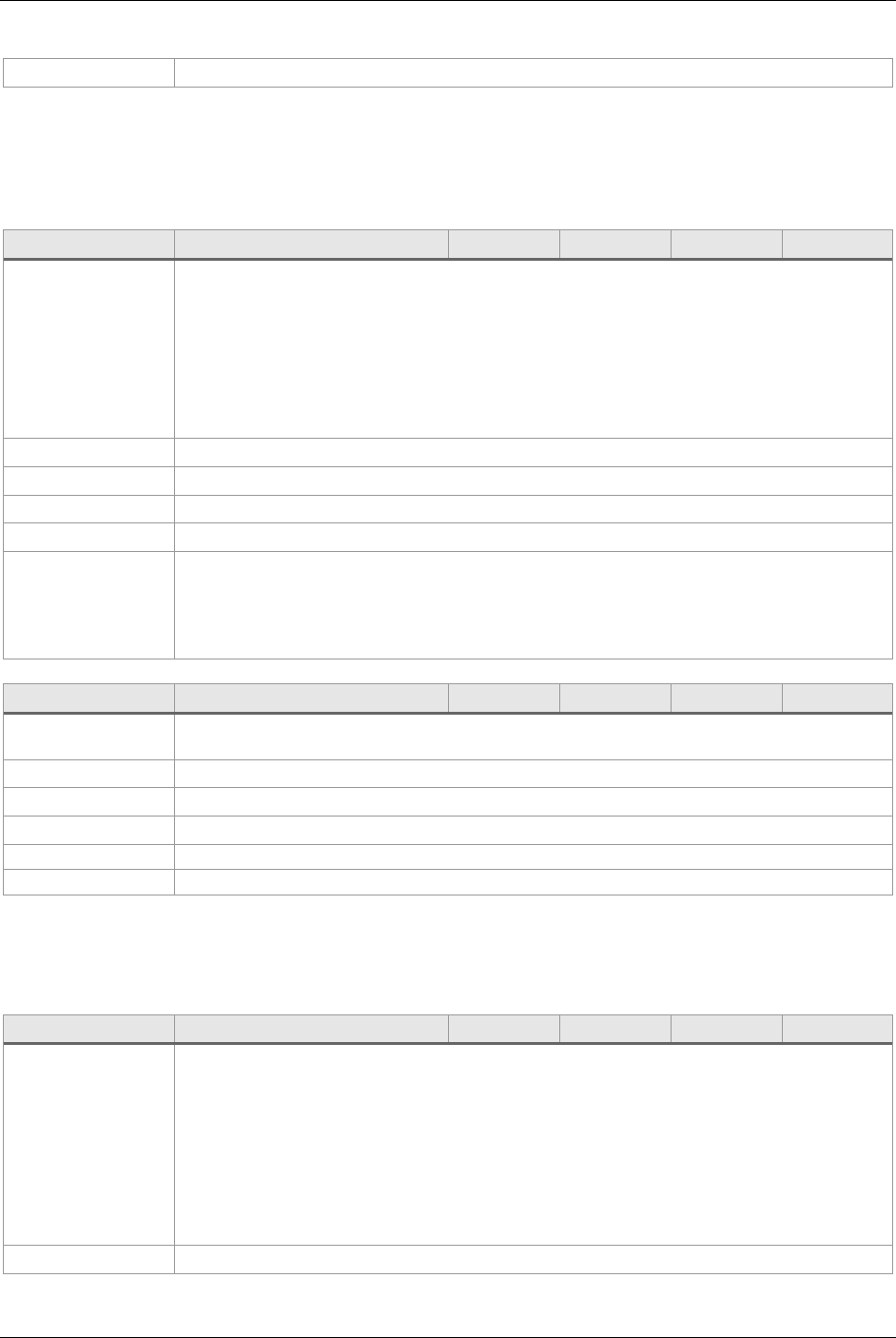

The following table describes all possible sub-elements for the Party element and the party type that

each element can be recorded for:

Party element name

ActivityPartyTypeCode

35

37

15

57

56

ActivityPartyTypeCode

●

●

●

●

●

FilerFinancialInterest25ForeignAccountIndicator

●

FilerTypeConsolidatedIndicator

●

FilerTypeCorporationIndicator

●

FilerTypeFiduciaryOtherIndicator

●

FilerTypeIndividualIndicator

●

FilerTypeOtherText

●

FilerTypePartnershipIndicator

●

IndividualBirthDateText

●

SelfEmployedIndicator

●

SignatureAuthoritiesIndicator

●

PartyName *

●

●

●

●

●

Address *

●

●

●

PhoneNumber *

●

●

PartyIdentification *

●

●

●

●

NOTE: The elements marked with an asterisk (*) in the table above contain sub-elements.

Attribute(s):

SeqNum

Parent Element:

Activity

Element

Restriction(s):

Required. Record a separate instance of this element for each FinCEN FBAR in the batch in order to

identify each of the following party types:

Transmitter (no more than one).

Transmitter contact (no more than one).

Foreign account filer (no more than one).

Conditionally Required. Record a separate instance of this element for each FinCEN FBAR in the batch in

order to identify each of the following party types (when applicable):

Third party preparer (no more than one).

Third party preparer firm (no more than one).

Value Restriction(s):

n/a

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

The element is missing a “SeqNum” attribute.

The element contains a “SeqNum” attribute with a duplicate or invalid value.

The FinCEN FBAR <Activity> element does not contain a <Party> element for each of the

following required party types or it exceeds the maximum occurrence for the party type:

o Required party types:

Transmitter (no more than one).

Transmitter contact (no more than one).

Foreign account filer (no more than one).

Activity party type code definitions

35 = Transmitter | 37 = Transmitter Contact | 15 = Foreign Account Filer

57 = Third Party Preparer | 56 = Third Party Preparer Firm

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 12

o Conditionally required party types:

Third party preparer (no more than one when a third party prepared the

FinCEN FBAR on behalf of the filer, in which case the

<ThirdPartyPreparerIndicator> element must be recorded with a “Y”

value and the <PreparerFilingSignatureIndicator> element should not be

recorded).

Third party preparer firm (no more than one when a third party prepared

the FinCEN FBAR on behalf of the filer and the third party preparer is not

self-employed, in which case the <SelfEmployedIndicator> element

should not be recorded).

Example:

Transmitter party:

<fc2:Party SeqNum="6">

<fc2:ActivityPartyTypeCode>35</fc2:ActivityPartyTypeCode>

<fc2:PartyName SeqNum="7">

...

</fc2:PartyName>

<fc2:Address SeqNum="8">

...

</fc2:Address>

<fc2:PhoneNumber SeqNum="9">

...

</fc2:PhoneNumber>

<fc2:PartyIdentification SeqNum="10">

...

</fc2:PartyIdentification>

</fc2:Party>

Transmitter Contact:

<fc2:Party SeqNum="11">

<fc2:ActivityPartyTypeCode>37</fc2:ActivityPartyTypeCode>

<fc2:PartyName SeqNum="12">

...

</fc2:PartyName>

</fc2:Party>

Foreign Account Filer:

<fc2:Party SeqNum="13">

<fc2:ActivityPartyTypeCode>15</fc2:ActivityPartyTypeCode>

<fc2:FilerFinancialInterest25ForeignAccountIndicator>N</fc2:FilerFinancialInterest25ForeignAccountIndicat

or>

<fc2:FilerTypeIndividualIndicator>Y</fc2:FilerTypeIndividualIndicator>

<fc2:IndividualBirthDateText>19850330</fc2:IndividualBirthDateText>

<fc2:SignatureAuthoritiesIndicator>Y</fc2: SignatureAuthoritiesIndicator>

<fc2:PartyName SeqNum="14">

...

</fc2:PartyName>

<fc2:Address SeqNum="15">

...

</fc2:Address>

<fc2:PartyIdentification SeqNum="16">

...

</fc2:PartyIdentification>

</fc2:Party>

Third Party Preparer:

<fc2:Party SeqNum="17">

<fc2:ActivityPartyTypeCode>57</fc2:ActivityPartyTypeCode>

<fc2:PartyName SeqNum="18">

...

</fc2:PartyName>

<fc2:Address SeqNum="19">

...

</fc2:Address>

<fc2:PhoneNumber SeqNum="20">

...

</fc2:PhoneNumber>

<fc2:PartyIdentification SeqNum="21">

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 13

...

</fc2:PartyIdentification>

</fc2:Party>

Third Party Preparer Firm:

<fc2:Party SeqNum="22">

<fc2:ActivityPartyTypeCode>56</fc2:ActivityPartyTypeCode>

<fc2:PartyName SeqNum="23">

...

</fc2:PartyName>

<fc2:PartyIdentification SeqNum="24">

...

</fc2:PartyIdentification>

</fc2:Party>

Element Name:

ActivityPartyTypeCode

minOccurs:

1

maxOccurs:

1

Description:

Party type (code). This element identifies the type of party (i.e. transmitter, foreign account filer, etc.)

associated with the FinCEN FBAR.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

The value provided must adhere to the following requirements:

Identify the party type by recording the appropriate code from the list below:

Code

Description

35

Transmitter

37

Transmitter Contact

15

Foreign Account Filer

57

Third Party Preparer

56

Third Party Preparer Firm

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted

The element does not contain a value equal to one of the approved codes listed above.

Example:

<fc2:ActivityPartyTypeCode>15</fc2:ActivityPartyTypeCode>

Element Name:

FilerFinancialInterest25ForeignAccountIndicator

minOccurs:

0

maxOccurs:

1

Description:

Financial Interest (indicator). This element declares whether or not the filer has a financial interest in 25

or more foreign financial accounts. If “Y” (Yes) is indicated, then the total number of financial interest

accounts must be recorded with the element <ForeignAccountHeldQuantityText> (under parent

element <ForeignAccountActivity>). See Attachment C – Electronic Filing Instructions for more

information regarding how to complete the FinCEN FBAR when the filer has financial interest in 25 or

more accounts.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Required. Record this element when:

The party type is associated with the foreign account filer (15).

Value Restriction(s):

The value provided must adhere to the following requirements:

Indicate whether or not the filer has a financial interest in 25 or more foreign financial

accounts by entering one of the appropriate code from the list below:

Code

Description

Y

Yes (the filer has financial interest in 25 or more financial accounts)

N

No (the filer does not have financial interest in 25 or more financial accounts)

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 14

The element contains a value not equal to “Y” or “N”.

The element is recorded for a party type other than foreign account filer (15).

Example:

<fc2:FilerFinancialInterest25ForeignAccountIndicator>N</fc2:FilerFinancialInterest25ForeignAccountIndicator>

Element Name:

FilerTypeConsolidatedIndicator

minOccurs:

0

maxOccurs:

1

Description:

Consolidated report (indicator). This element declares that the filer is filing the FinCEN FBAR as a

consolidated report.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Record this element when:

The party type is associated with the foreign account filer (15) and the filer is an entity, and

the FinCEN FBAR is being filed as a consolidated report; otherwise, do not record this

element. NOTE: Only one filer type should be indicated for a single report.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate consolidated report).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

The element is recorded for a party type other than foreign account filer (15).

The batch submission will be accepted with warning if any of the following conditions are true:

The type of filer is not specified for the foreign account filer.

More than one type of filer is specified for the foreign account filer.

Example:

<fc2:FilerTypeConsolidatedIndicator>Y</fc2:FilerTypeConsolidatedIndicator>

Element Name:

FilerTypeCorporationIndicator

minOccurs:

0

maxOccurs:

1

Description:

Corporation filer type (indicator). This element declares that the foreign account filer type is classified as

corporation.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Record this element when:

The party type is associated with the foreign account filer (15) the filer is an entity, and the

filer type is corporation; otherwise, do not record this element. NOTE: Only one filer type

should be indicated for a single report.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate the filer type is classified as a corporation).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

The element is recorded for a party type other than foreign account filer (15).

The batch submission will be accepted with warning if any of the following conditions are true:

The type of filer is not specified for the foreign account filer.

More than one type of filer is specified for the foreign account filer.

Example:

<fc2:FilerTypeCorporationIndicator>Y</fc2:FilerTypeCorporationIndicator>

Element Name:

FilerTypeFiduciaryOtherIndicator

minOccurs:

0

maxOccurs:

1

Description:

Fiduciary or other filer type (indicator). This element declares that the foreign account filer type is not

classified as individual, partnership, corporation, or consolidated report.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Record this element when:

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 15

The party type is associated with the foreign account filer (15), the filer is an entity, and filer

type is not classified as individual, partnership, corporation, or consolidation; otherwise, do

not record this element. NOTE: Only one filer type should be indicated for a single report.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate the filer type is classified as fiduciary or other).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

The element is recorded for a party type other than foreign account filer (15).

The batch submission will be accepted with warning if any of the following conditions are true:

The type of filer is not specified for the foreign account filer.

More than one type of filer is specified for the foreign account filer.

Example:

<fc2:FilerTypeFiduciaryOtherIndicator>Y</fc2:FilerTypeFiduciaryOtherIndicator>

Element Name:

FilerTypeIndividualIndicator

minOccurs:

0

maxOccurs:

1

Description:

Individual filer type (indicator). This element declares that the foreign account filer type is classified as

individual.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Record this element when:

The party type is associated with the foreign account filer (15) and the filer is an individual;

otherwise, do not record this element. NOTE: Only one filer type should be indicated for a

single report.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate the filer is classified as individual).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

The element is recorded for a party type other than foreign account filer (15).

The batch submission will be accepted with warning if any of the following conditions are true:

The type of filer is not specified for the foreign account filer.

More than one type of filer is specified for the foreign account filer.

Example:

<fc2:FilerTypeIndividualIndicator>Y</fc2:FilerTypeIndividualIndicator>

Element Name:

FilerTypeOtherText

minOccurs:

0

maxOccurs:

1

Description:

Filer type other description (text). This element identifies the foreign account filer type when the filer

type cannot be classified as individual, partnership, corporation, or consolidated report.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Conditionally Required. Record this element when:

The party type is associated with the foreign account filer (15) and the

<FilerTypeFiduciaryOtherIndicator> element contains a “Y” value; otherwise, do not record

this element.

Value Restriction(s):

The value provided must adhere to the following requirements:

1-50 characters

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

The element is recorded for a party type other than foreign account filer (15).

The batch submission will be accepted with warning if any of the following conditions are true:

The element is not recorded or does not contain a value and other is indicated.

The element is recorded with a value and other is not indicated.

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 16

Example:

<fc2:FilerTypeOtherText>Other filer type description</fc2:FilerTypeOtherText>

Element Name:

FilerTypePartnershipIndicator

minOccurs:

0

maxOccurs:

1

Description:

Partnership filer type (indicator). This element declares that the foreign account filer type is classified as

partnership.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Record this element when:

The party type is associated with the foreign account filer (15), the filer is an entity, and filer

type is partnership; otherwise, do not record this element. NOTE: Only one filer type should

be indicated for a single report.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate the filer is described as a partnership).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

The element is recorded for a party type other than foreign account filer (15).

The batch submission will be accepted with warning if any of the following conditions are true:

The type of filer is not specified for the foreign account filer.

More than one type of filer is specified for the foreign account filer.

Example:

<fc2:FilerTypePartnershipIndicator>Y</fc2:FilerTypePartnershipIndicator>

Element Name:

IndividualBirthDateText

minOccurs:

0

maxOccurs:

1

Description:

Individual date of birth (text). This element identifies the date of birth of the foreign account filer when

the type of filer is classified as individual.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Conditionally Required. Record this element when:

The party type is associated with the foreign account filer (15) and the

<FilerTypeIndividualIndicator> element contains a “Y” value; otherwise, do not record this

element.

Value Restriction(s):

The value provided must adhere to the following requirements:

8 numeric characters in the format YYYYMMDD where YYYY = year, MM = month, and DD =

day. Single digit days or months must be prefaced by a zero.

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded for an individual filer or the start tag and/or end tag is incorrectly

formatted.

The element is recorded but without a value (i.e. the value is null) for an individual filer.

The value recorded for the element is not a valid date in the format YYYYMMDD.

The element is recorded for a party type other than foreign account filer (15).

The batch submission will be accepted with warning if any of the following conditions are true:

The date of birth is less than January 1, 1900 or greater than December 31 of the year entered

for the report calendar year (<ReportCalendarYearText>).

Example:

<fc2:IndividualBirthDateText>19741125</fc2:IndividualBirthDateText>

Element Name:

SelfEmployedIndicator

minOccurs:

0

maxOccurs:

1

Description:

Third party preparer self-employed (indicator). This element declares that the third party preparer is a

self-employed individual.

Attribute(s):

n/a

Parent Element:

Party

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 17

Element

Restriction(s):

Record this element when:

The party type is associated with the third party preparer (57) and the third party preparer is a

self-employed individual; otherwise, do not record this element.

Value Restriction(s):

The value provided must adhere to the following requirements:

Y (to indicate that the third party preparer is a self-employed individual).

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or null.

The element is recorded for a party type other than third party preparer (57).

Example:

<fc2:SelfEmployedIndicator>Y</fc2:SelfEmployedIndicator>

Element Name:

SignatureAuthoritiesIndicator

minOccurs:

0

maxOccurs:

1

Description:

Signature authority (indicator). This element declares whether or not the filer has signature authority

over but not financial interest in 25 or more foreign financial accounts. If yes to signature authority, then

the total number of signature authority accounts must be recorded with element

<SignatureAuthoritiesQuantityText> (under parent element <ForeignAccountActivity>). See Attachment

C – Electronic Filing Instructions for more information regarding how to complete the FinCEN FBAR

when the filer has signature authority over (but no financial interest in) 25 or more accounts.

Attribute(s):

n/a

Parent Element:

Party

Element

Restriction(s):

Required. Record this element when:

The party type is associated with the foreign account filer (15).

Value Restriction(s):

The value provided must adhere to the following requirements:

Indicate whether or not the filer has signature authority over (but no financial interest in) 25

or more foreign financial accounts by entering one of the appropriate code from the list

below:

Code

Description

Y

Yes (the filer has signature authority over (but no financial interest) in 25 or more

financial accounts)

N

No (the filer does not have signature authority over (but no financial interest) in 25 or

more financial accounts)

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “Y” or “N”.

The element is recorded for a party type other than foreign account filer (15).

Example:

<fc2:SignatureAuthoritiesIndicator>Y</fc2:SignatureAuthoritiesIndicator>

PartyName Elements

For additional guidance related to name reporting requirements, please refer to the General Instructions (Name

Editing Instructions) located in Attachment C at the end of this guide.

Element Name:

PartyName

minOccurs:

1

maxOccurs:

1

Description:

Party name (header). This is the container for information about the legal name of the party; specifically,

the transmitter [of the batch file], the transmitter contact, the foreign account filer, the third party

preparer (if recorded), and the third party preparer firm (if a third party preparer is recorded and is not

self-employed).

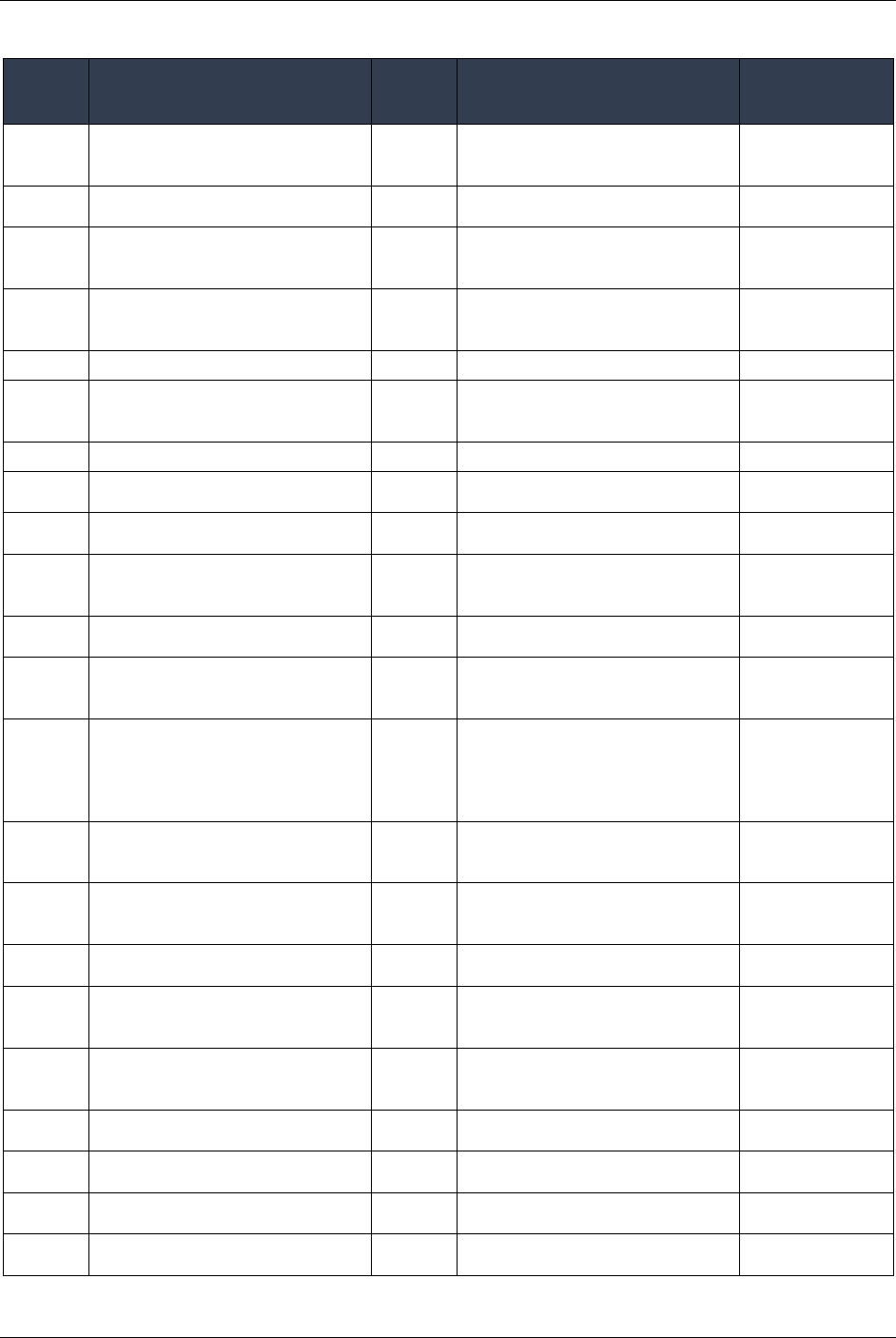

The following table describes all possible sub-elements for the PartyName element and the party type

that each element can be recorded for:

Activity party type code definitions

35 = Transmitter | 37 = Transmitter Contact | 15 = Foreign Account Filer

57 = Third Party Preparer | 56 = Third Party Preparer Firm

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 18

Element name

Activity party type code

35

37

15

57

56

PartyName

●

●

●

●

●

PartyNameTypeCode

●

●

●

●

●

RawEntityIndividualLastName

●

●

RawIndividualFirstName

●

●

RawIndividualMiddleName

●

●

RawIndividualNameSuffixText

●

RawIndividualTitleText

●

RawPartyFullName

●

●

●

Attribute(s):

SeqNum

Parent Element:

Party

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

n/a

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

The element is missing a “SeqNum” attribute.

The element contains a “SeqNum” attribute with a duplicate or invalid value.

The element exceeds the maximum occurrence threshold.

Example:

Foreign account filer (15) party type:

<fc2:PartyName SeqNum="12">

<fc2:PartyNameTypeCode>L</fc2:PartyNameTypeCode>

<fc2:RawEntityIndividualLastName>Smith</fc2:RawEntityIndividualLastName>

<fc2:RawIndividualFirstName>John</fc2:RawIndividualFirstName>

<fc2:RawIndividualMiddleName>J</fc2:RawIndividualMiddleName>

</fc2:PartyName>

Third party prepare firm (56) party type:

<fc2:PartyName SeqNum="19">

<fc2:PartyNameTypeCode>L</fc2:PartyNameTypeCode>

<fc2:RawPartyFullName>Preparing Firm Inc.</fc2:RawPartyFullName>

</fc2:PartyName>

Element Name:

PartyNameTypeCode

minOccurs:

1

maxOccurs:

1

Description:

Party name type (code). This element identifies the type of name recorded for the party as the legal

name.

Attribute(s):

n/a

Parent Element:

PartyName

Element

Restriction(s):

Required. This element must be recorded.

Value Restriction(s):

The value provided must equal:

L (to indicate legal name)

Remarks:

The batch submission will be rejected if any of the following conditions are true:

The element is not recorded or the start tag and/or end tag is incorrectly formatted.

The element contains a value not equal to “L”.

Example:

<fc2:PartyNameTypeCode>L</fc2:PartyNameTypeCode>

Element Name:

RawEntityIndividualLastName

minOccurs:

0

maxOccurs:

1

Description:

Entity name or Individual last name (text). This element identifies the legal name of the entity or last

name of the individual.

Attribute(s):

n/a

Parent Element:

PartyName

Financial Crimes Enforcement Network

FinCEN FBAR XML Schema User Guide (1.4 | August 2021) 19

Element

Restriction(s):

Conditionally Required. Record this element when: