Financial Crimes Enforcement Network

BSA Electronic Filing Requirements For Report

of Foreign Bank and Financial Accounts

(FinCEN Report 114)

Release Date March, 2015 – Version 1.4

DEPARTMENT OF THE TREASURY

Financial Crimes Enforcement Network (FinCEN)

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Form 114) ii

Table of Contents

Revision History iv

Purpose 1

Electronic Filing 1

File Organization 2

Record Layouts 4

Transmitter (1A) Record – Required 4

Filer Information (2A) Record – Required 6

Third Party Preparer (2B) Record 11

Separately Owned Financial Account (3A) Record 14

Jointly Owned Financial Account (4A) Record 16

Principal Joint Owner (4B) Record 18

No Financial Interest in Financial Account (5A) Record 20

No Financial Interest Account Owner (5B) Record 22

Consolidated Report for Corporate Filer Financial Account (6A) Record 24

Corporate Account Owner (6B) Record 26

Late Filing (7A) Record 28

File Summary (9Z) Record – Required 29

Acknowledgement Record Formats 30

Acknowledgement Transmitter (1A) Record 30

Acknowledgement Filer Information (2A) Record 31

Acknowledgement Third Party Preparer (2B) Record 31

Acknowledgement Separately Owned Financial Account (3A) Record 32

Acknowledgement Jointly Owned Financial Account (4A) Record 33

Acknowledgement Principal Joint Owner (4B) Record 33

Acknowledgement No Financial Interest in Financial Account (5A) Record 34

Acknowledgement No Financial Interest Account Owner (5B) Record 34

Acknowledgement Consolidated Report for Corporate Filer Financial Account (6A) Record 35

Acknowledgement Corporate Account Owner (6B) Record 35

Acknowledgement Late Filing (7A) Record 36

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) iii

Acknowledgement Trailer for Transmitter (9Z) Record 37

Attachment A – Error Code List 38

Attachment B – Error Correction Instructions 45

Attachment C – Electronic Filing Instructions 47

Secure Data Transfer Mode Users 65

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) iv

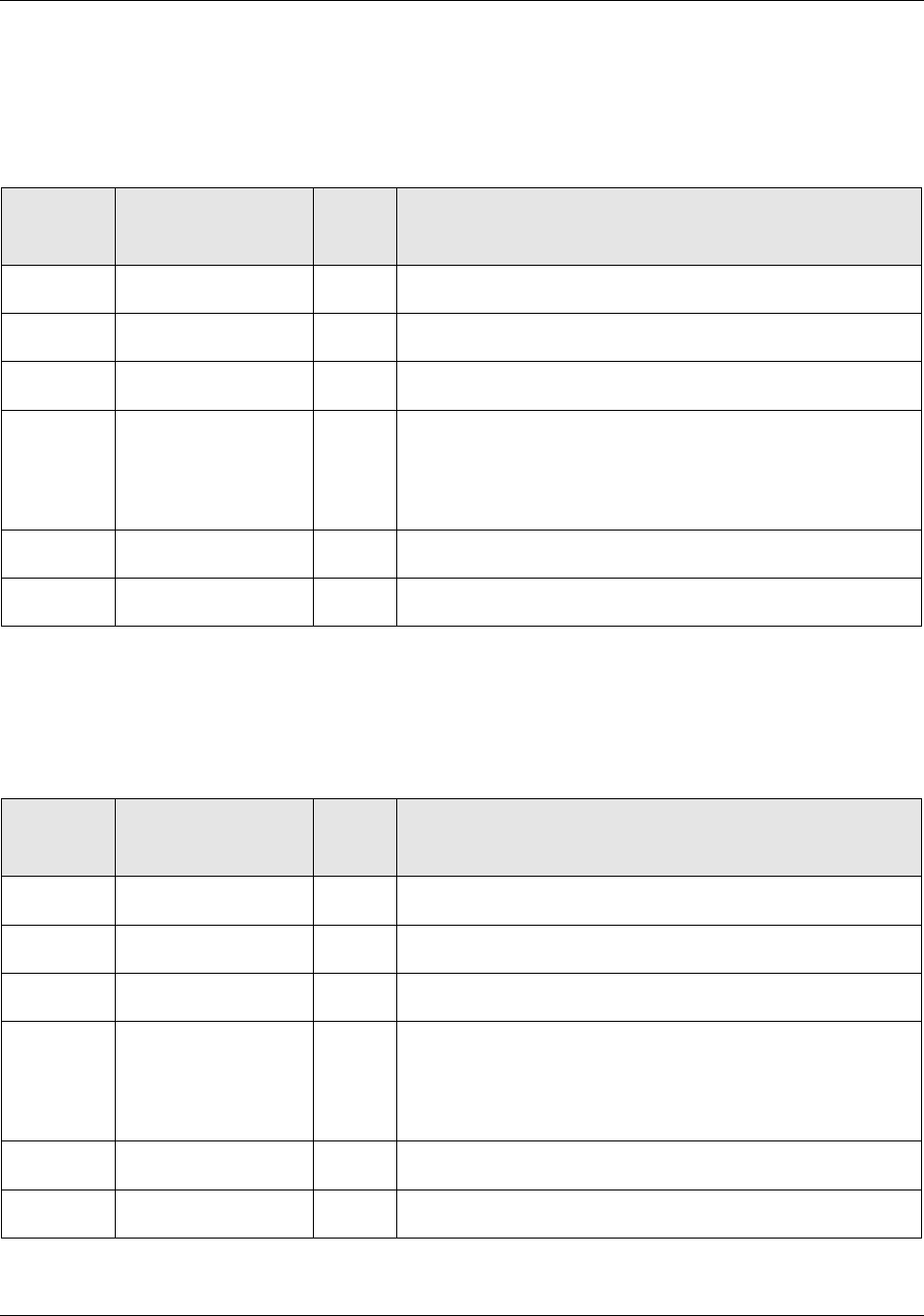

Revision History

Version

Number

Date

Reason for Change

1.0

March 2013

Initial version

1.1

July 2013

Updates FBAR FinCEN Report reference number from “TD F 90-22.1” to

“114” throughout the document.

Updates all references to “FinCEN Form 108” to “Form 114a” (Record of

Authorization to Electronically File FBAR’s).

Replaces all references to “paid preparer” with “third party preparer”.

Record Layouts:

o Increases all record’s total length from 640 to 645

o Updates Description and Remarks for “Coverage Beginning Date”

in the 1A record by replacing “Enter the earliest date of signature

(2A record, positions 584-591) recorded in the file” with “Enter the

earliest date recorded in Item 46 "Date of Signature" (2A record,

positions 625-632).”

o Updates Description and Remarks for “Coverage Ending Date” in

the 1A record by replacing “Enter the latest date of signature (2A

record, positions 584-591) recorded in the file” with “Enter the

latest date recorded in Item 46 "Date of Signature" (2A record,

positions 625-632).”

o Removes from the 1A record the “Format Indicator” field.

o Updates Description and Remarks for “Amendment Indicator

(Item 1)” in the 2A record by replacing “584-597” with “589-602”.

o Updates Description and Remarks for “Foreign Identification

Country of Issue (Item 4c)” in the 2A record by replacing

the first sentence with “Identify the country where the foreign

identification recorded for the “Foreign Identification Type (Item

4a)” was issued by entering the appropriate 2-letter code.”

o Updates item number associated with “Financial Interest” and

“Number of Financial Interest Accounts” in the 2A record from

“14” to “14a”.

o Updates Description and Remarks for “Financial Interest (Item

14a)” by making this field “REQUIRED” and removing the

statement “Otherwise, space-fill.”

o Adds “Signature Authority (Item 14b)” to the 2A record, position

584.

o Adds “Number of Signature Authority Accounts (Item 14b)” to the

2A record, positions 585-588.

o Updates Field Position(s) for all fields that follow Item 14b in the

2A record.

o Removes from the 2B record the “Preparer’s Signature (Item 50)”

field.

o Updates Field Position(s), item numbers, and Description and

Remarks for all fields that follow the “Preparer’s Signature (Item

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) v

Version

Number

Date

Reason for Change

50)” in the 2B record as a result of its removal (e.g. “Check if Self-

Employed” was formally Item 51 in field position 229 and is now

Item 50 in field position 228).

o Updates “Firm’s EIN” to “Firm’s TIN”, increases the size from 9

characters to 25 characters, and updates the Description and

Remarks to accommodate the entry of U.S. or foreign TINs.

o Adds “TIN Type (Item 54a)” to the 2B record, position 452.

o Updates Description and Remarks for “Type of Account (Item 16)”

in the 3A, 4A, 5A, and 6A records by replacing “C” with “Z” as the

code associated with the account type “Other”.

o Updates Field Name for Item 22 in the 3A, 4A, 5A, and 6A records

by replacing “ZIP/Postal Code” with “Foreign Postal Code, if

known”.

o Updates Description and Remarks for “Corporate Name – Account

Owner (Item 34) in the 6B record by replacing “Enter the corporate

name of the account owner as shown on the books of the financial

institution” with “Enter the account owner organization’s name as

shown on the books of the organization.”

o Updates Description and Remarks for “TIN Type (Item 35a)” in the

6B record by replacing “principle joint” with “account” when

referring to the account owner’s TIN entered in Item 35.

Acknowledgement Record Formats:

o Updates Description and Remarks reference to the incoming User

Field position for each record type by replacing “631-640” with

“636-645”.

Attachment A – Error Code List:

o Removes Error Codes: F89 “The submitted batch contains an

invalid format indicator in the 1A record”, G31 “Prior Report BSA

Identifier is blank”, G58 “Preparer Signature is blank”, and G59

“Preparer Signature contains an invalid code.”

o Adds Error Codes G77, G78, G79, G80, G81, and G82.

o Updates Error Codes G68 and G69 by replacing “EIN” with “TIN”

in the Error Description.

o Updates Field Position and Form Field Number associated with all

fields that follow the “Preparer’s Signature (Item 50)” in the 2B

record as a result of its removal (e.g. G60 “Check if Self-Employed

contains an invalid code” was formally associate with Item 51 in

field position 229 which is now Item 50 in field position 228).

Attachment C: General Definitions:

o Adds Joint Account definition

Attachment C: Filing Information:

o Updates the Addresses instructions by adding “or three” to the

following sentence: “For addresses in the U.S., Canada, or Mexico

enter the permanent street address, city, two or three letter

state/territory/province abbreviation or code…”

o Updates the Identifying numbers instructions by removing

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) vi

Version

Number

Date

Reason for Change

“driver’s license and state identification numbers” as common

identifying numbers, as well as replacing “industry specific

identifiers such as National Futures Association (NFA) numbers

and Securities and Central Registration Depository (CRD)

numbers” from the instructions” with “foreign TIN’s”.

o Updates the Filing by Third Party Preparer instructions by

replacing “must” with “should” when instructing the filer or

owner’s record keeping responsibilities when using a third party

preparer, as well as adding the following: “NOTE: Spouses filing a

joint FBAR also may use the Form 114a to approve/designate

which spouse will sign the report.”

Attachment C: Item Instructions:

o Includes an introduction to the Item Instructions section that

includes specific instructions to file a discrete FBAR electronically

via the BSA E-Filing System, such as accessing the electronic

discrete FBAR and completing the fields located on the home page

of the report.

o Updates the Item 2 instructions by replacing parent “corporation”

with “entity” when describing the authorized official who should

sign a consolidated FBAR.

o Updates Item 4 instructions to include a clarifying statement that

the country of issue will be recorded as a “(Two letter designation

from ISO 3166-1 Country code list)”.

o Replaces Item 8a field name from “Name suffix” to simply

“Suffix”.

o Replaces Item 9 field name from “Address” to “Mailing address”.

o Updates Item 14 instructions to correspond with the new 14a

(financial interest) and 14b (signature authority) fields.

o Updates Item 15 by removing the “reported” reference from the

end of the field title, as well as adding the sentence, “Use the end of

the year conversion rate” to the end of the instructions.

o Updates “Part III – Information on financial account(s) owned

jointly” instructions by adding the following: “Note: If jointly filing

with a spouse, both parties should complete and sign Form 114a.

Completing the Form 114a with both spouses signing the form

completes the necessary requirement that will permit one spouse to

electronically sign (PIN) a single report for both parties instead of

filing two FBARs. The Form 114a is available on the FinCEN

(under the forms tab) and BSA E-File websites. Keep this form for

your records, do not send to FinCEN.” Also, replaces “copy” in the

Part II instructions that follow the new note with “click the ‘+’ sign

on the electronic report to add additional Part III’s”.

o Updates Items 25-33 instructions by replacing the statement “Enter

‘(spouse)’ on line 26 after the last name of the joint spousal owner”

with “Enter on line 26 the last name of the joint spousal owner.”

o Includes in the field title for Item 25 the acronym “TIN” in

parenthesis.

o Updates “Part IV – Information on financial account(s) where filer

has signature authority but no financial interest in the account(s)”

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) vii

Version

Number

Date

Reason for Change

instructions by adding the following: “If additional Part IV’s are

required, click on the ‘+’ sign on the electronic report to add

copies.”

o Updates Items 34, 36, 37 instructions by replacing “organization”

with “entity” in the following sentence: “If the owner is an entity,

enter the name in Item 34 and leave Items 36 and 37 blank.”

o Updates “Part V – Information on financial account(s) where filer is

filing a consolidate report” instructions by adding the following:

“If additional Part V’s are required, click on the ‘+’ sign on the

electronic report to add copies.”

o Replaces Item 34 field name from “Corporate Name of Account

Owner” to “Organization name of account owner”. Also replaces

“corporate” with “entities” in the Item 34 instructions.

o Updates Item 44 instructions to specify “electronically” signed with

a PIN, and the “completion of the 2A record in the” batch file.

o Updates Item 44a instructions to capitalize “Third Party…” and

replace Item “60” with “59”.

o Updates Item 46 instructions to include the following: “Note: When

the FBAR is completed, return to the header/cover page to validate

the report, save a copy of the report, print a copy for your records.

Then sign with your PIN and submit the report.”

o Includes the following “Third party preparer information”

introductory note to follow the above Item 46 note: “Note:

Completion of this section is not required for spouses filing

jointly.”

o Removes Item 50 Preparer’s signature from the report entirely.

Adjusts the Item numbers associated with the fields that following

(e.g. Item 51 “Check if self-employed” becomes Item 50).’

o Adds Item 54a TIN Type to accompany Item 54 Firm’s TIN.

1.2

December 2013

Attachment A – Error Code List:

o Adds Error Code F12 “A required 2B record is missing from the

submitted file.”

o Adds Error Code G83 “Late Filing Reason Explanation is blank or a

required 7A record is missing from the submitted file.”

1.3

September 2014

Attachment C – Electronic Filing Instructions

Filing Information (Addresses):

o Removed “Note: The ISO 3166-1 country list includes entries for

all U.S. territories. Do not use these U.S. territory entries, which

match the U.S. Postal Service abbreviations required in state

fields, in any country field.” Added “Note: The ISO 3166-1

country list contains entries for all U.S. territories, including the

United States Minor Outlying Islands. Do not use these U.S.

territory entries, which may match the U.S. Postal Service

abbreviations required in state fields, in any country field.”

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) viii

Version

Number

Date

Reason for Change

1.4

March 2015

Updates to Attachment C – Electronic Filing Instructions

General Instructions (Addresses):

Removed “Note: The ISO 3166-1 country list contains entries

for all U.S. territories, including the United States Minor

Outlying Islands. Do not use these U.S. territory entries,

which may match the U.S. Postal Service abbreviations

required in state fields, in any country field.”

This change was made as the discrete (online) reports were

updated to include the following entries in Country fields:

American Samoa, (AS)

Guam, (GU)

Marshall Islands (the), (MH)

Micronesia (the Federated States of), (FM)

Northern Mariana Islands (the), (MP)

Palau, (PW)

Puerto Rico, (PR)

Virgin Islands (U.S.), (VI)

These values can now be used in Country fields to adhere to

the ISO 3166-1 standard.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Form 114) 1

Purpose

The purpose of this document is to provide the requirements and conditions for electronically

filing the FinCEN Report 114, the Report of Foreign Bank and Financial Accounts (FBAR).

Electronic filing of this report will be through the BSA E‐Filing System operated by the

Financial Crimes Enforcement Network (FinCEN). For more information on the BSA E‐Filing

System and to register, please go to http://bsaefiling.fincen.treas.gov. This document should be

used in conjunction with the “General Specifications for Electronic Filing of Bank Secrecy Act

(BSA) Reports” (General Specifications) available at http://www.fincen.gov/forms/files/e-

filing_GENspecs.pdf. It is recommended that you refer to the General Specifications first, and

then the specific information contained in this document. If the General Specifications conflict

with any specific requirement found in this document, the specific requirement should be

followed.

Electronic Filing

The BSA E‐Filing System Batch File Testing Procedures are detailed in a separate document that

can be accessed on the BSA E‐Filing System web site at http://bsaefiling.fincen.treas.gov under

Quick Links. For purposes of this document, the filer is the organization responsible for filing

the FBAR and the transmitter is the organization responsible for preparing the electronic files.

The filer and transmitter may be the same or different organizations. Filers are required to

retain a copy of the FBAR data and all original supporting documentation or business record

equivalent for five years from the date of the report. All supporting documentation must be

made available to appropriate authorities upon request.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 2

File Organization

The following data controls must be followed or the FBAR electronic file will be rejected. The

data records must be in the following sequence:

Transmitter (1A) Record – Required

There can only be one of this record type and it must be the first record on the file.

Filer Information (2A) Record – Required

There must be one of this record type for each FBAR on the file. This record type is used to

describe the filer of the FBAR and immediately precedes all records related to the FBAR. Each

FBAR on the file must begin with this record type.

Third Party Preparer (2B) Record – Conditional

There must be one of this record type for each FBAR on the file that is completed by a third

party preparer on behalf of the filer and/or owner of the foreign account(s). If the FBAR report is

not completed by a third party preparer, a 2B record should not be recorded for the FBAR.

Separately Owned Financial Account (3A) Record – Optional

This record type should be included on the file when a filer has financial interest in a separately

owned foreign financial account. Filers should record a 3A record for each account that falls into

this category. If the filer does not have financial interest in a separately owned foreign financial

account, a 3A record should not be recorded for the FBAR.

Jointly Owned Financial Account (4A) Record – Optional

This record type should be included on the file when a filer has financial interest in a jointly

owned foreign financial account. Filers should record a 4A record for each account that falls into

this category. If this record does not apply to the filer, a 4A record should not be recorded for

the FBAR.

Principal Joint Owner (4B) Record – Optional

This record type may occur only once per Jointly Owned Financial Account (4A) Record on the

file and should immediately follow the associated 4A record. If the Principal Joint Owner is

unknown or not applicable, a 4B record should not be recorded for the account.

No Financial Interest in Financial Account (5A) Record – Optional

This record type should be included on the file when a filer has signature authority but no

financial interest in a foreign financial account. Filers should record a 5A record for each

account that falls into this category. If this record does not apply to the filer, a 5A record should

not be recorded for the FBAR.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 3

No Financial Interest Account Owner (5B) Record – Optional

This record type may occur one or more times per No Financial Interest in Financial Account

(5A) Record on the file (depending on the number of account owners for a particular account)

and should immediately follow the associated 5A record. If the account owner is unknown or

not applicable, a 5B record should not be recorded for the account.

Consolidated Report for Corporate Filer Financial Account (6A) Record – Optional

This record type may be included on the file when a filer is filing a consolidated report. Filers

should record a 6A record for each account that falls into this category. If this record does not

apply to the filer, a 6A record should not be recorded for the FBAR.

Corporate Account Owner (6B) Record – Conditional

This record type may occur one or more times per Corporate Account Owner (6A) Record on

the file (depending on the number of corporate account owners for a particular account) and

should immediately follow the associated 6A record. If the account owner is unknown or not

applicable, a 6B record should not be recorded for the account.

Late Filing (7A) Record – Conditional

This record type should be included for each late filed FBAR on the file. This record allows the

filer to provide a narrative of the circumstances that resulted in the late filing (375 maximum

per 7A; 750 character maximum per FBAR).

File Summary (9Z) Record – Required

There must be one of this record type on the file and it must be the last record.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 4

Record Layouts

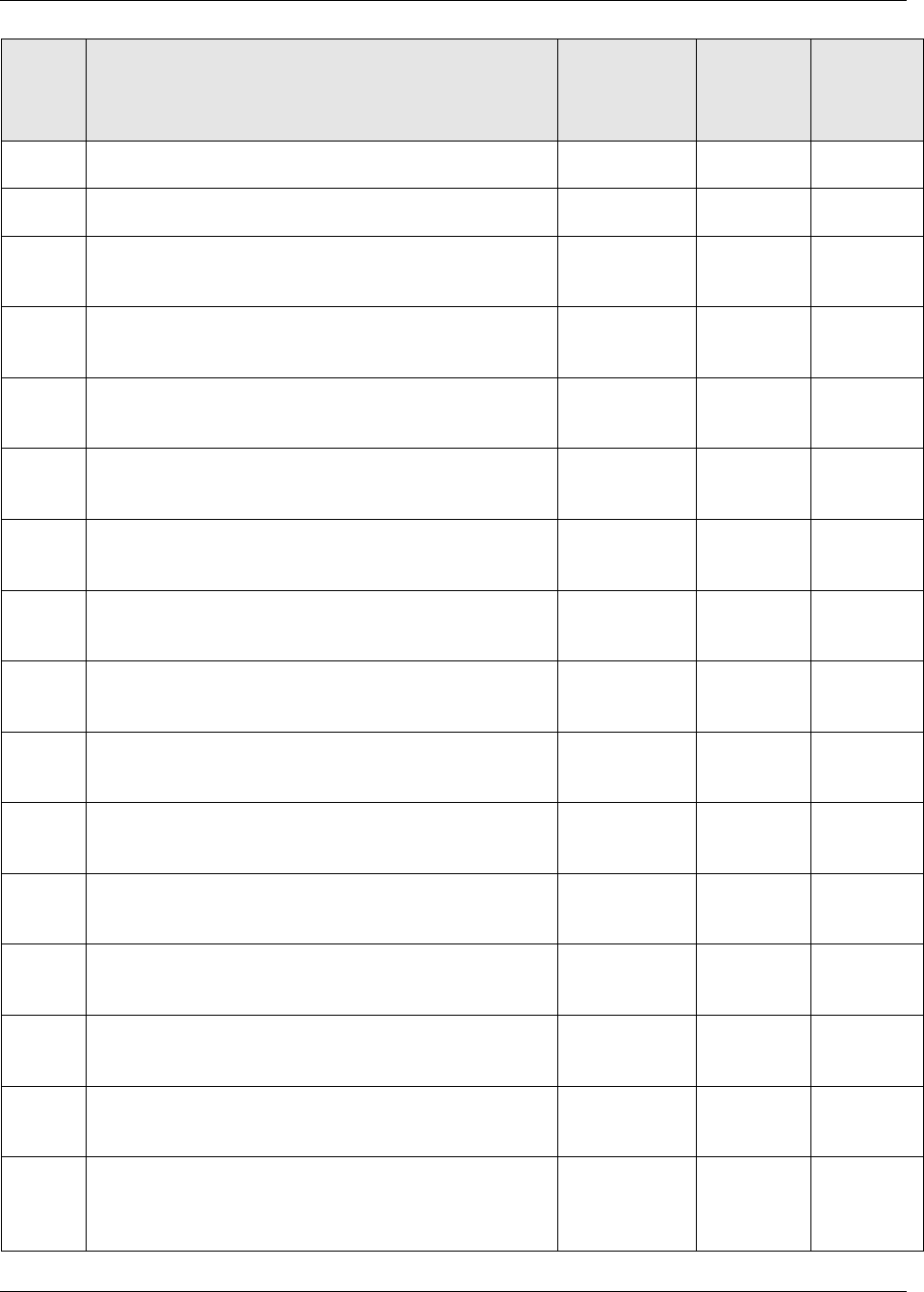

Transmitter (1A) Record – Required

The first record on each file must be the Transmitter (1A) Record, which will contain

information identifying the batch file transmitter (person or organization handling the data

accumulation and formatting). There will be only one transmitter record on each electronic file.

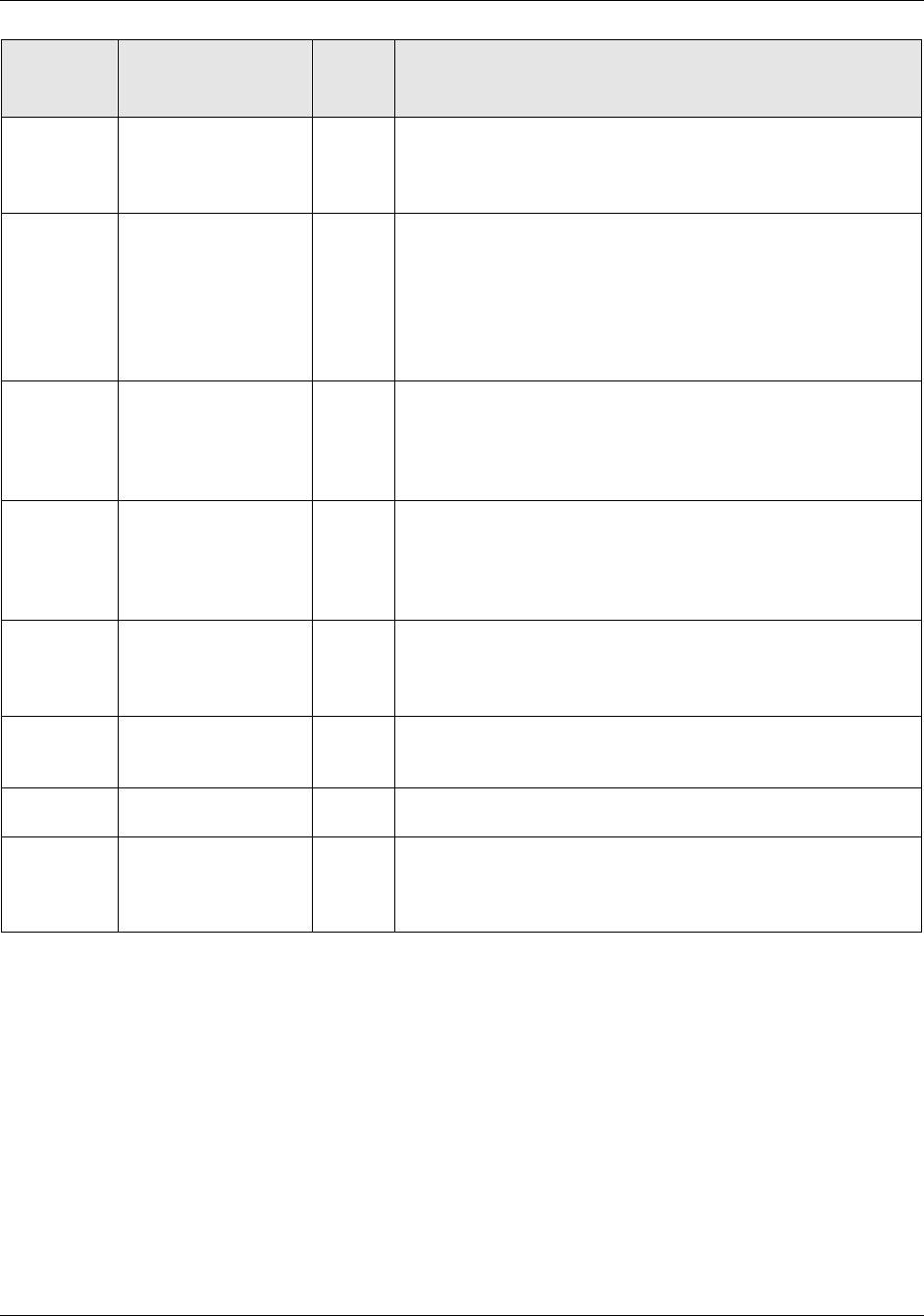

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "1A".

3-152

Transmitter Name

150

REQUIRED. Enter the name of the individual or organization

that is transmitting the reports on this file. Left justify the entry

and space-fill unused positions.

153-252

Transmitter Address

100

REQUIRED. Enter the street address of the transmitter. Left

justify the entry and space-fill unused positions.

253-302

Transmitter City

50

REQUIRED. Enter the city of the transmitter. Left justify the

entry and space-fill unused positions.

303-305

Transmitter State

3

REQUIRED (conditional). Enter the state/territory/province code

of the transmitter if “Transmitter Country” is “CA”, “MX”, or

“US”. See Attachment C (Addresses) for information about the

codes to be entered. Left justify the entry and space-fill unused

positions. Space-fill if “Transmitter Country” contains a country

code other than “CA”, “MX”, or “US”.

306-314

Transmitter ZIP

Code/Postal Code

9

REQUIRED (conditional). Enter the ZIP Code or foreign postal

code of the Transmitter. An entry is required if “Transmitter

Country” is “CA”, “MX”, or “US”. Do not include punctuation

or formatting such as hyphens, periods, and spaces within the

entry. An entry must be five or nine digits if the country is “US”.

A nine-digit entry cannot end with four zeros or four nines if the

country is “US”. Left justify the entry and space-fill unused

positions if less than nine digits. Otherwise, space-fill.

315-316

Transmitter Country

2

REQUIRED. Enter the country code of the transmitter. See

Attachment C (Addresses) for information about the codes to be

entered.

317-332

Transmitter

Telephone

16

REQUIRED. Enter the telephone number of the transmitter.

Enter as a single number string without formatting and

punctuation such as spaces, hyphens, or parenthesis. Left justify

the entry and space-fill unused positions.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 5

Field

Position(s)

Field Name

Length

Description and Remarks

333-482

Transmitter Contact

Name

150

REQUIRED. Enter the name of the person who is the official

contact for the transmitter. Left justify the entry and space-fill

unused positions.

483-507

Transmitter Taxpayer

Identification

Number (TIN)

25

REQUIRED. Enter the U.S. or foreign Taxpayer Identification

Number (TIN) assigned to the transmitter. U.S. TINs must be 9-

digits in length, with no formatting such as hyphens and no

consecutive string of the same number. Foreign TINs may be as

long as 25-digits, with no formatting such as spaces, hyphens, or

periods. Left justify the entry and space-fill unused positions.

508-515

Coverage Beginning

Date

8

REQUIRED. Enter the earliest date recorded in item 46 “Date of

Signature” (2A record, positions 625-632). Enter as a numeric 8-

position entry in format MMDDCCYY where MM = month, DD

= day, CC = century, and YY = year.

516-523

Coverage Ending

Date

8

REQUIRED. Enter the latest date recorded in item 46 “Date of

Signature” (2A record, positions 625-632). Enter as a numeric 8-

position entry in format MMDDCCYY where MM = month, DD

= day, CC = century, and YY = year.

524-531

Transmitter Control

Code (TCC)

8

REQUIRED. Enter your assigned 8-character Transmitter

Control Code (TCC). Do not enter a TCC assigned for testing

purposes.

532-534

Batch Sequence

Number (BSN)

3

Space-fill this field, which is reserved for BSA E-Filing use.

535-635

Filler

101

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 6

Filer Information (2A) Record – Required

This record type is used to describe the filer of the FBAR and immediately precedes all records

related to the FBAR. There must be one of this record type for each FBAR on the file. The 2A

record item numbers refer to Part I items 1-14 and Signature section items 44-46.

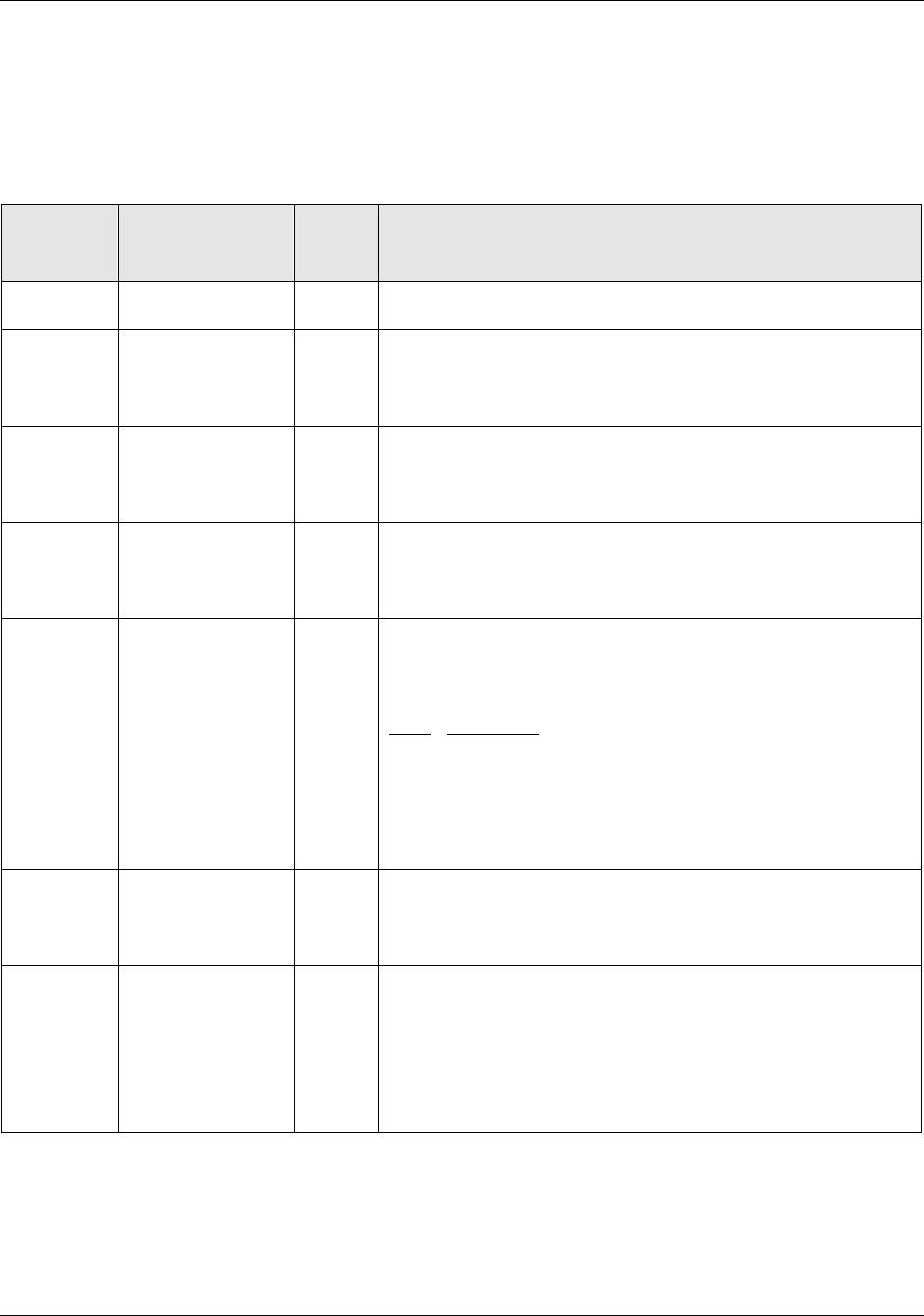

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "2A".

3-7

Sequence Number

5

REQUIRED. Enter a sequential number starting with 00001 and

increment by 1 for each Filer Information (2A) Record. Right

justify the entry and zero-fill unused positions.

8-11

Calendar Year

(Item 1)

4

REQUIRED. Enter the calendar year being reported as a numeric

4-position entry in the format CCYY where CC = century and YY =

year (e.g. 2012).

12

Amendment

Indicator (Item 1)

1

Enter "X" if the FBAR is an amendment to a prior report and

record the prior report’s BSA Identifier (if known) in positions

589-602. Otherwise, space-fill.

13

Type of Filer (Item

2)

1

REQUIRED. Enter the code that describes the type of filer. See

Attachment C (Item Instructions) for information about the codes

to be entered.

Code Description

A Individual

B Partnership

C Corporation

D Consolidated

E Fiduciary or Other

14-63

Type of Filer Other

Description (Item

2)

50

REQUIRED (conditional). If "Type of Filer (Item 2)" is "E” enter a

brief description of the type. Left justify the entry and space-fill

unused positions. Otherwise, space-fill.

64-72

U.S. TIN (Item 3)

9

REQUIRED (conditional). Enter the U.S. Taxpayer Identification

Number (TIN) for the filer. The TIN must be a valid nine-digit

entry with no formatting such as hyphens, slashes, alpha

characters, or invalid entries such as all nines, all zeros, or

“123456789”. If the filer does not have a U.S. TIN, space-fill this

entry and complete Item 4.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 7

Field

Position(s)

Field Name

Length

Description and Remarks

73

TIN Type (Item 3a)

1

REQUIRED (conditional). Enter the appropriate code to describe

the filer’s TIN type if “U.S. TIN (Item 3)” contains a valid 9-digit

TIN. Otherwise, space-fill.

Code Description

A EIN

B SSN/ITIN

74

Foreign

Identification Type

(Item 4a)

1

REQUIRED (conditional). Enter the foreign identification type

code for the filer. Space-fill if "U.S. TIN (Item 3)" contains a valid

9-digit entry.

Code Description

A Passport

B Foreign TIN

Z Other

75-124

Foreign

Identification Other

Description (Item

4a)

50

REQUIRED (conditional). If "Foreign Identification Type (Item

4a)" is "Z”, enter a description of the type. Left justify the entry

and space-fill unused positions. Otherwise, space-fill.

125-149

Foreign

Identification

Number (Item 4b)

25

REQUIRED (conditional). Enter the number from the foreign

identification used to verify the identity of the filer. Left justify

the entry and space-fill unused positions. Otherwise, space-fill.

150-151

Foreign

Identification

Country of Issue

(Item 4c)

2

REQUIRED (conditional). Identify the country where the foreign

identification recorded for the “Foreign Identification Type (Item

4a)” was issued by entering the appropriate 2-letter code. See

Attachment C (Addresses) for information about the codes to be

entered. Otherwise, space-fill.

152-159

Date of Birth (Item

5)

8

REQUIRED (conditional). Record the filer's date of birth as a

numeric 8-position entry in format MMDDCCYY where MM =

month, DD = day, CC = century, and YY = year. This field is

required when “Type of Filer (Item 2)” is “A”. Otherwise, space-

fill.

160-309

Organization/Last

Name (Item 6)

150

REQUIRED. Enter the last name (if individual) or legal name (if

entity) of the filer. Left justify the entry and space-fill unused

positions.

310-344

First Name (Item 7)

35

REQUIRED (conditional). Enter the filer's first name. Left justify

the entry and space-fill unused positions. This field is required

when “Type of Filer (Item 2)” is “A”. Otherwise, space-fill.

345-379

Middle Initial/

Name (Item 8)

35

Enter the filer's middle initial/name. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 8

Field

Position(s)

Field Name

Length

Description and Remarks

380-414

Name suffix (Item

8a)

35

Enter the filer's name suffix. Left justify the entry and space-fill

unused positions. Otherwise, space-fill.

415-514

Address (Item 9)

100

Enter the street address of the filer. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

515-564

City (Item 10)

50

Enter the city of the filer. Left justify the entry and space-fill

unused positions. Otherwise, space-fill.

565-567

State (Item 11)

3

REQUIRED (conditional). Enter the state/territory/province code

of the filer if “Country (Item 13)” is “CA”, “MX”, or “US”. See

Attachment C (Addresses) for information about the codes to be

entered. Left justify the entry and space-fill unused positions.

Space-fill if “Country (Item 13)” contains a country code other

than “CA”, “MX”, or “US”.

568-576

ZIP/Postal Code

(Item 12)

9

REQUIRED (conditional). Enter the ZIP Code or foreign postal

code of the filer. An entry is required if “Country (Item 13)” is

“CA”, “MX”, or “US”. Do not include punctuation or formatting

such as hyphens, periods, and spaces within the entry. An entry

must be five or nine digits if “Country (Item 13)” is “US”. A nine-

digit entry cannot end with four zeros or four nines if “Country

(Item 13)” is “US”. Left justify the entry and space-fill unused

positions if less than nine digits. Otherwise, space-fill.

577-578

Country (Item 13)

2

REQUIRED. Enter the country code of the filer. See Attachment C

(Addresses) for information about the codes to be entered.

579

Financial Interest

(Item 14a)

1

REQUIRED. Indicate whether or not the filer has a financial

interest in 25 or more foreign financial accounts by selecting the

appropriate code. See Attachment C (Item Instructions) for

additional information about this field.

Code Description

A Yes

B No

580-583

Number of

Financial Interest

Accounts (Item

14a)

4

REQUIRED (conditional). If "Financial Interest (Item 14)" contains

"A", enter the total number of foreign financial accounts. Right

justify the entry and zero-fill unused positions. Otherwise, space-

fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 9

Field

Position(s)

Field Name

Length

Description and Remarks

584

Signature

Authority (Item

14b)

1

REQUIRED. Indicate whether or not the filer has signature

authority over but no financial interest in 25 or more foreign

financial accounts by selecting the appropriate code. See

Attachment C (Item Instructions) for additional information about

this field.

Code Description

A Yes

B No

585-588

Number of

Signature

Authority Accounts

(Item 14b)

4

REQUIRED (conditional). If "Signature Authority (Item 14b)"

contains "A", enter the total number of foreign financial accounts.

Right justify the entry and zero-fill unused positions. Otherwise,

space-fill.

589-602

Prior Report BSA

Identifier

14

If “Amendment Indicator (Item 1)” is “X”, enter the 14 digit BSA

Identifier (or Document Control Number) previously assigned by

FinCEN to the FBAR to be corrected or amended. Otherwise,

space-fill.

603

Filer Signature

(Item 44)

1

REQUIRED (conditional). Enter "X" to authorize this report for

submission to FinCEN's BSA E-Filing System as the filer. If the

report is completed by a third party preparer on behalf of the filer,

space-fill this field and enter “X” in “Third Party Preparer (Item

44a)”.

604

Third Party

Preparer (Item 44a)

1

REQUIRED (conditional). If this FBAR is completed by a third

party preparer, enter “X” and identify the preparer in the Third

Party Preparer Information (2B) Record. Otherwise, space-fill.

605-624

Filer Title (Item 45)

20

Enter the filer’s title when the individual that is filing the FBAR

has signature authority over the account(s) or is authorized to file

on behalf of a legal entity, such as a corporation, which is shown

as the filer. Let justify the entry and space fill unused positions.

Space-fill this item if the filer is reporting as an individual because

of a personal financial interest in the account(s).

625-632

Date of Signature

(Item 46)

8

REQUIRED. Enter the date of signature (i.e. the date this report

has been authorized for submission to FinCEN's BSA E-Filing

System). Enter as a numeric 8-position entry in format

MMDDCCYY where MM = month, DD = day, CC = century, and

YY = year.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 10

Field

Position(s)

Field Name

Length

Description and Remarks

633

Late Filing Reason

Code

1

If this FBAR is a late filing, enter the appropriate reason code for

the late filing. If “Z” (Other) is selected, enter a description of the

late filing reason in the Late Filing (7A) Record. Otherwise, space-

fill.

Code Description

A Forgot to file

B Did not know that I had to file

C Thought account balance was below reporting threshold

D Did not know that my account qualified as foreign

E Account statement not received in time

F Account statement lost (replacement requested)

G Late receiving missing required account information

H Unable to obtain joint spouse signature in time

I Unable to access BSA E-Filing System

Z Other

634-635

Filler

2

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 11

Third Party Preparer (2B) Record

This record type is used to describe the third party preparer of the FBAR. There can only be one

of this record type for each FBAR on the file. The 2B record item numbers refer to Third Party

Preparer Use Only section items 47-59. This is not a required record and should only be

recorded when applicable.

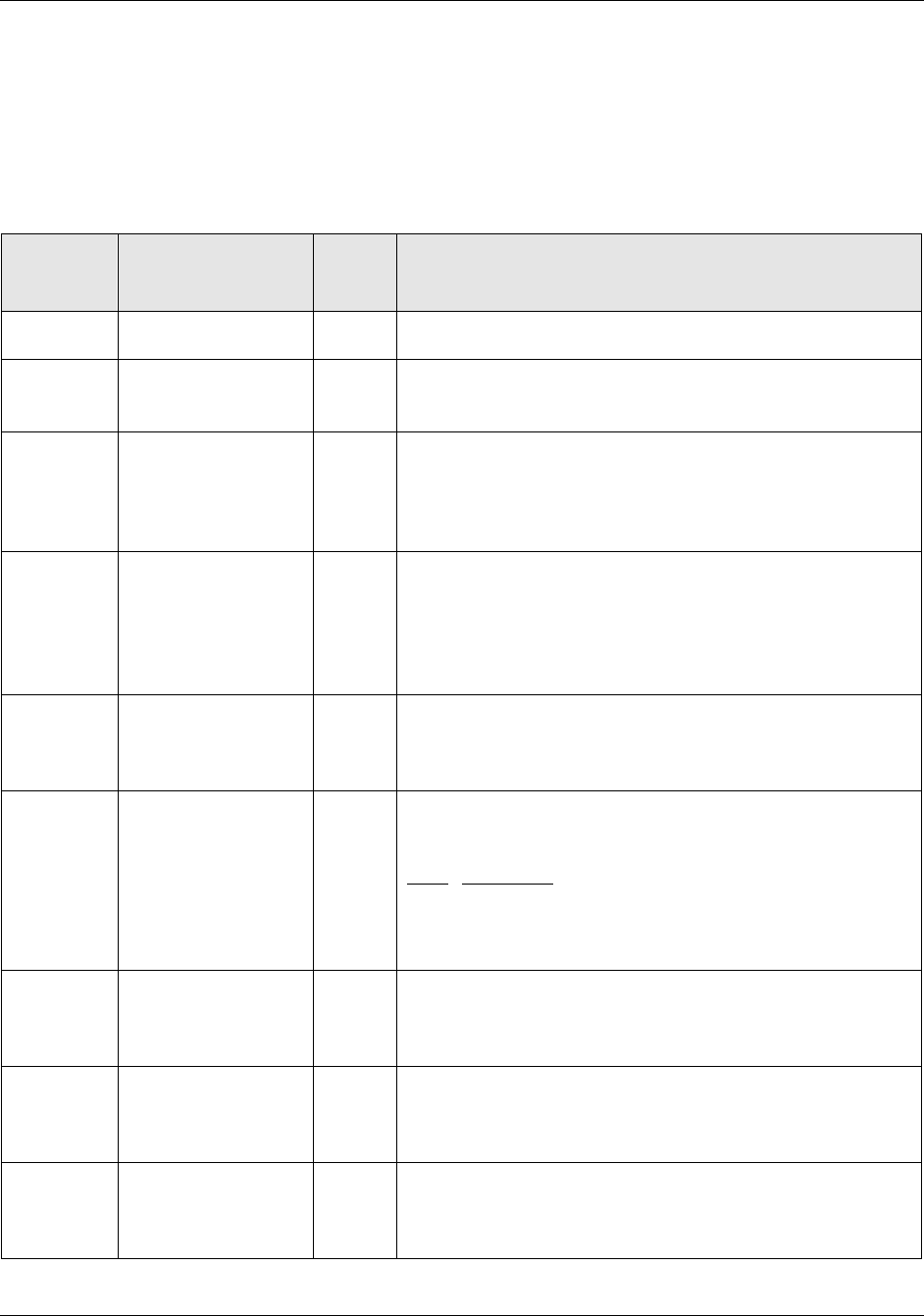

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "2B".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8-157

Preparer's Last Name

(Item 47)

150

REQUIRED. Enter the last name of the preparation firm

employee or of the self-employed preparer that prepared the

FBAR. Left justify the entry and space-fill unused positions.

158-192

Preparer's First Name

(Item 48)

35

REQUIRED. Enter the first name of the preparation firm

employee or of the self-employed preparer that prepared the

FBAR. Left justify the entry and space-fill unused positions.

193-227

Preparer's Middle

Initial/Name (Item 49)

35

Enter the middle initial/name of the preparation firm employee

or of the self-employed preparer that prepared the FBAR. Left

justify the entry and space-fill unused positions. Otherwise,

space-fill.

228

Check if Self-

Employed (Item 50)

1

If the preparer is self-employed, enter “X” in this field and

space-fill “Firm’s Name (Item 53)” and “Firm’s EIN (Item 54)”.

Otherwise, space-fill.

229-253

Preparer's Taxpayer

Identification

Number (TIN) (Item

51)

25

REQUIRED. Enter the preparer’s U.S. or foreign Taxpayer

Identification Number (TIN). A U.S. TIN must be a valid nine-

digit entry with no formatting such as hyphens, slashes, alpha

characters, or invalid entries such as all nines, all zeros, or

“123456789”. A foreign TIN may be as long as 25-digits, with no

formatting such as spaces, hyphens, or periods. Left justify the

entry and space-fill unused positions.

254

TIN Type (Item 51a)

1

REQUIRED. Enter the appropriate code to describe the

preparer’s TIN type.

Code Description

B SSN/ITIN

C Foreign

D PTIN

255-270

Contact Phone

Number (Item 52)

16

REQUIRED. Enter the preparer’s contact telephone number as a

single number string without formatting such as hyphens,

spaces, or parenthesis. Left justify and space-fill the entry.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 12

Field

Position(s)

Field Name

Length

Description and Remarks

271-276

Extension (Item 52a)

6

Enter the preparer’s contact telephone number extension as a

single number string without formatting such as hyphens,

spaces, or parenthesis. Left justify and space-fill the entry.

Otherwise, space-fill.

277-426

Firm's Name (Item

53)

150

Enter the name of the preparing firm. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

427-451

Firm's TIN (Item 54)

25

Enter the preparing firm's U.S. or foreign Taxpayer

Identification Number (TIN). A U.S. TIN must be a valid nine-

digit entry with no formatting such as hyphens, slashes, alpha

characters, and cannot be all nines, all zeros, or “123456789”. A

foreign TIN may be as long as 25-digits, with no formatting such

as spaces, hyphens, or periods. Left justify the entry and space-

fill unused positions. Otherwise, space-fill.

452

TIN Type (Item 54a)

1

REQUIRED (conditional). If "Firm's TIN (Item 54)" contains an

entry, enter the appropriate code to describe the firm's TIN type.

Otherwise, space-fill.

Code Description

A EIN

C Foreign

453-552

Address (Item 55)

100

Enter the street address or equivalent of the preparing firm or

the preparer. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

553-602

City (Item 56)

50

Enter the preparer’s city. Left justify the entry and space-fill

unused positions. Otherwise, space-fill.

603-605

State (Item 57)

3

REQUIRED (conditional). Enter the preparer’s

state/territory/province code if “Country (Item 59)” is “CA”,

“MX”, or “US”. See Attachment C (Addresses) for information

about the codes to be entered. Left justify the entry and space-fill

unused positions. Space-fill if “Country (Item 59)” contains a

country code other than “CA”, “MX”, or “US”.

606-614

ZIP/Postal Code (Item

58)

9

REQUIRED (conditional). Enter the preparer’s ZIP Code or

foreign postal code. An entry is required if “Country (Item 59)”

is “CA”, “MX”, or “US”. Do not include punctuation or

formatting such as hyphens, periods, and spaces within the

entry. An entry must be five or nine digits if “Country (Item 59)”

is “US”. A nine-digit entry cannot end with four zeros or four

nines if “Country (Item 59)” is “US”. Left justify the entry and

space-fill unused positions if less than nine digits. Otherwise,

space-fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 13

Field

Position(s)

Field Name

Length

Description and Remarks

615-616

Country (Item 59)

2

REQUIRED. Enter the preparer’s country code. See Attachment

C (Addresses) for information about the codes to be entered.

617-635

Filler

19

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 14

Separately Owned Financial Account (3A) Record

This record type is used to describe a separately owned foreign financial account where the filer

has financial interest in the account. There can be more than one of these record types for each

FBAR on the file. The 3A record item numbers refer to Part II items 15-23. This is not a required

record and should only be recorded when applicable.

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "3A".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8-22

Maximum Account

Value (Item 15)

15

REQUIRED (conditional). Enter the maximum value of the

account in U.S. dollars during the calendar year being reported.

Right justify the entry and zero-fill unused positions. Space-fill if

“Maximum Account Value Unknown (Item 15a)” contains “X”.

23

Maximum Account

Value Unknown

(Item 15a)

1

Enter “X” if the maximum account value is unknown.

Otherwise, space-fill.

24

Type of Account

(Item 16)

1

REQUIRED. Enter the appropriate code to describe the type of

account.

Code Description

A Bank

B Securities

Z Other

25-74

Type of Account -

Other Description

(Item 16)

50

REQUIRED (conditional). If "Type of Account (Item 16)" is "Z",

enter a brief description of the type. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

75-224

Financial Institution

Name (Item 17)

150

REQUIRED. Enter the name of the financial institution where

the account is held. Left justify the entry and space-fill unused

positions.

225-264

Account Number

(Item 18)

40

REQUIRED. Enter the account number used by the financial

institution to designate the account. Left justify the entry and

space-fill unused positions.

265-364

Address (Item 19)

100

Enter the street address of the financial institution where the

account is held. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 15

Field

Position(s)

Field Name

Length

Description and Remarks

365-414

City (Item 20)

50

Enter the city of the financial institution where the account is

held. Left justify the entry and space-fill unused positions.

Otherwise, space-fill.

415-417

State (Item 21)

3

Enter the state/territory/province code of the financial institution

where the account is held if “Country (Item 23)” is “CA” or

“MX”. See Attachment C (Addresses) for information about the

codes to be entered. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

418-426

Foreign Postal Code –

if known (Item 22)

9

Enter the foreign postal code of the financial institution where

the account is held. Do not include punctuation or formatting

such as hyphens, periods, and spaces within the entry. Left

justify the entry and space-fill unused positions if less than nine

digits. Otherwise, space-fill.

427-428

Country (Item 23)

2

REQUIRED. Enter the foreign country code of the financial

institution where the account is held. See Attachment C

(Addresses) for information about the codes to be entered.

429-635

Filler

207

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 16

Jointly Owned Financial Account (4A) Record

This record type is used to describe a jointly owned foreign financial account where the filer has

financial interest in the account. There can be more than one of this record type for each FBAR

on the file. The 4A record item numbers refer to Part III items 15-24. A 4A record must be

recorded when one or more of items 15-33 are completed in Part III.

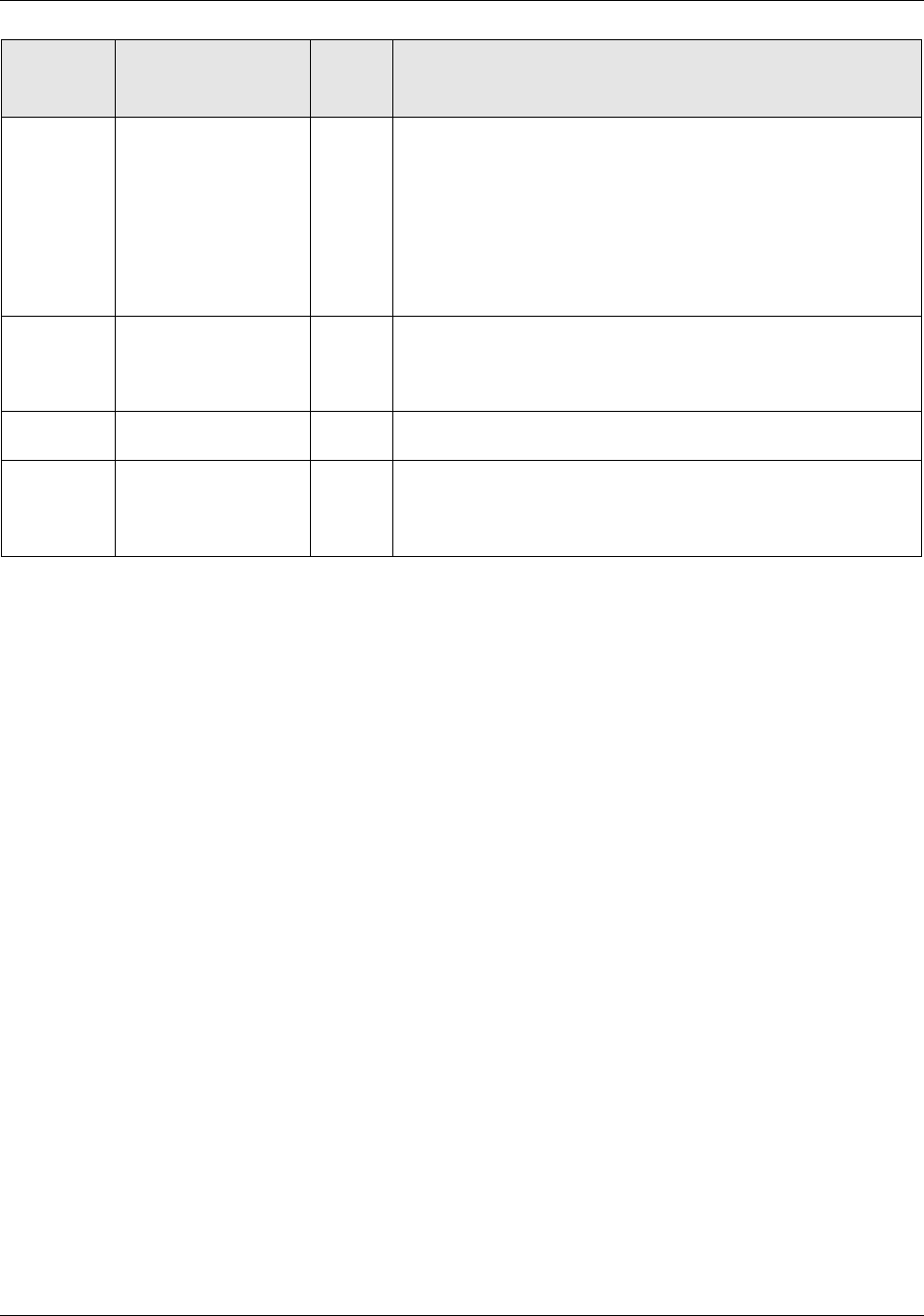

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "4A".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8

Account Information

Unknown or Not

Applicable

1

Enter "X" if all account information (Items 15-24) in Part III is

unknown or not applicable. Otherwise, space-fill.

9-23

Maximum Account

Value (Item 15)

15

REQUIRED (conditional). Enter the maximum value of the

account in U.S. dollars during the calendar year being reported.

Right justify the entry and zero-fill unused positions. Space-fill if

“Maximum Account Value Unknown (Item 15a)” contains “X”.

24

Maximum Account

Value Unknown

(Item 15a)

1

Enter “X” if the maximum account value is unknown.

Otherwise, space-fill.

25

Type of Account

(Item 16)

1

REQUIRED. Enter the appropriate code to describe the type of

account.

Code Description

A Bank

B Securities

Z Other

26-75

Type of Account -

Other Description

(Item 16)

50

REQUIRED (conditional). If "Type of Account (Item 16)" is “Z”,

enter a brief description of the type. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

76-225

Financial Institution

Name (Item 17)

150

REQUIRED. Enter the name of the financial institution where

the account is held. Left justify the entry and space-fill unused

positions.

226-265

Account Number

(Item 18)

40

REQUIRED. Enter the account number used by the financial

institution to designate the account. Left justify the entry and

space-fill unused positions.

266-365

Address (Item 19)

100

Enter the street address of the financial institution where the

account is held. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 17

Field

Position(s)

Field Name

Length

Description and Remarks

366-415

City (Item 20)

50

Enter the city of the financial institution where the account is

held. Left justify the entry and space-fill unused positions.

Otherwise, space-fill.

416-418

State (Item 21)

3

Enter the state/territory/province code of the financial institution

where the account is held if “Country (Item 23)” is “CA” or

“MX”. See Attachment C (Addresses) for information about the

codes to be entered. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

419-427

Foreign Postal Code –

if known (Item 22)

9

Enter the foreign postal code of the financial institution where

the account is held. Do not include punctuation or formatting

such as hyphens, periods, and spaces within the entry. Left

justify the entry and space-fill unused positions if less than nine

digits. Otherwise, space-fill.

428-429

Country (Item 23)

2

REQUIRED. Enter the foreign country code of the financial

institution where the account is held. See Attachment C

(Addresses) for information about the codes to be entered.

430-432

Number of Joint

Owners (Item 24)

3

REQUIRED. Enter the number of joint owners for the account. If

the exact number is not known, provide an estimate. In

determining the number of joint owners, the filer is not counted.

Right justify the entry and zero-fill unused positions.

433-635

Filler

203

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 18

Principal Joint Owner (4B) Record

This record type is used to describe the principal joint owner (excluding the filer) of a foreign

financial account where the filer has financial interest in or signature authority over the account.

Only one 4B record may directly follow a 4A record. The 4B record item numbers refer to Part

III items 25-33. This is not a required record and should only be recorded when applicable.

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "4B".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8-32

Taxpayer

Identification

Number (TIN) -

Principal Joint Owner

(Item 25)

25

Enter the U.S. or foreign Taxpayer Identification Number (TIN)

of the principal joint owner. U.S. TINs must be 9-digits in length,

with no formatting such as hyphens and no consecutive string of

the same number. Foreign TINs may be as long as 25-digits, with

no formatting such as spaces, hyphens, or periods. Left justify

the entry and space-fill unused positions. Otherwise, space-fill.

33

TIN Type (Item 25a)

1

REQUIRED (conditional). Enter the appropriate code to describe

the principle joint owner’s TIN type. Otherwise, space-fill.

Code Description

A EIN

B SSN/ITIN

C Foreign

34-183

Organization/Last

Name - Principal

Joint Owner (Item 26)

150

Enter the last name (if individual) or legal name (if entity) of the

principal joint owner. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

184-218

First Name - Principal

Joint Owner (Item 27)

35

Enter the principal joint owner’s first name (if individual). Left

justify the entry and space-fill unused positions. Otherwise,

space-fill.

219-253

Middle Initial/Name -

Principal Joint Owner

(Item 28)

35

Enter the principal joint owner’s middle initial/name. Left justify

the entry and space-fill unused positions. Otherwise, space-fill.

254-288

Name suffix (Item

28a)

35

Enter the principal joint owner's name suffix. Left justify the

entry and space-fill unused positions. Otherwise, space-fill.

289-388

Address - Principal

Joint Owner (Item 29)

100

Enter the street address of the principal joint owner. Left justify

the entry and space-fill unused positions. Otherwise, space-fill.

389-438

City - Principal Joint

Owner (Item 30)

50

Enter the city of the principal joint owner. Left justify the entry

and space-fill unused positions. Otherwise, space-fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 19

Field

Position(s)

Field Name

Length

Description and Remarks

439-441

State - Principal Joint

Owner (Item 31)

3

Enter the state/territory/province code of the principal joint

owner if “Country (Item 33)” is “CA”, “MX”, or “US”. See

Attachment C (Addresses) for information about the codes to be

entered. Left justify the entry and space-fill unused positions.

Otherwise, space-fill.

442-450

ZIP/Postal Code -

Principal Joint Owner

(Item 32)

9

Enter the ZIP Code or foreign postal code of the principal joint

owner. Do not include punctuation or formatting such as

hyphens, periods, and spaces within the entry. An entry must be

five or nine digits if “Country (Item 33)” is “US”. A nine-digit

entry cannot end with four zeros or four nines if “Country (Item

33)” is “US”. Left justify the entry and space-fill unused

positions if less than nine digits. Otherwise, space-fill.

451-452

Country - Principal

Joint Owner (Item 33)

2

Enter the country code of the principal joint owner. See

Attachment C (Addresses) for information about the codes to be

entered. Otherwise, space-fill.

453-635

Filler

183

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 20

No Financial Interest in Financial Account (5A) Record

This record type is used to describe a foreign financial account where the filer has signature

authority but no financial interest in the account. There can be more than one of this record type

for each FBAR on the file. The 5A record item numbers refer to Part IV items 15-23. A 5A record

must be recorded when one or more of items 15-43 are completed in Part IV.

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "5A".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8

Account Information

Unknown or Not

Applicable

1

Enter "X" if all account information (Items 15-23) in Part IV is

unknown or not applicable. See the instructions for Part IV in

Attachment C for guidance on when the account information is

not applicable. Otherwise, space-fill.

9-23

Maximum Account

Value (Item 15)

15

REQUIRED (conditional). Enter the maximum value of the

account in U.S. dollars during the calendar year being reported.

Right justify the entry and zero-fill unused positions. Space-fill

if “Maximum Account Value Unknown (Item 15a)” contains

“X”.

24

Maximum Account

Value Unknown

(Item 15a)

1

Enter “X” if the maximum account value is unknown.

Otherwise, space-fill.

25

Type of Account

(Item 16)

1

REQUIRED. Enter the appropriate code to describe the type of

account.

Code Description

A Bank

B Securities

Z Other

26-75

Type of Account -

Other Description

(Item 16)

50

REQUIRED (conditional). If "Type of Account (Item 16)" is "Z",

enter a brief description of the type. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

76-225

Financial Institution

Name (Item 17)

150

REQUIRED. Enter the name of the financial institution where

the account is held. Left justify the entry and space-fill unused

positions.

226-265

Account Number

(Item 18)

40

REQUIRED. Enter the account number used by the financial

institution to designate the account. Left justify the entry and

space-fill unused positions.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 21

Field

Position(s)

Field Name

Length

Description and Remarks

266-365

Address (Item 19)

100

Enter the street address of the financial institution where the

account is held. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

366-415

City (Item 20)

50

Enter the city of the financial institution where the account is

held. Left justify the entry and space-fill unused positions.

Otherwise, space-fill.

416-418

State (Item 21)

3

Enter the state/territory/province code of the financial

institution where the account is held if “Country (Item 23)” is

“CA” or “MX”. See Attachment C (Addresses) for information

about the codes to be entered. Left justify the entry and space-

fill unused positions. Otherwise, space-fill.

419-427

Foreign Postal Code –

if known (Item 22)

9

Enter the foreign postal code of the financial institution where

the account is held. Do not include punctuation or formatting

such as hyphens, periods, and spaces within the entry. Left

justify the entry and space-fill unused positions if less than nine

digits. Otherwise, space-fill.

428-429

Country (Item 23)

2

REQUIRED. Enter the foreign country code of the financial

institution where the account is held. See Attachment C

(Addresses) for information about the codes to be entered.

430-635

Filler

206

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 22

No Financial Interest Account Owner (5B) Record

This record type is used to describe the account owner of a foreign financial account where the

filer has signature authority but no financial interest in the account. There can be more than one

of this record type for each 5A record on the file. The 5B record item numbers refer to Part IV

items 34-43. This is not a required record and should only be recorded when applicable.

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "5B".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8-157

Organization/Last

Name - Account

Owner (Item 34)

150

Enter the last name (if individual) or legal name (if entity) of the

account owner. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

158-182

Taxpayer

Identification

Number (TIN) -

Account Owner (Item

35)

25

Enter the U.S. or foreign Taxpayer Identification Number (TIN)

of the account owner. U.S. TINs must be 9-digits in length, with

no formatting such as hyphens and no consecutive string of the

same number. Foreign TINs may be as long as 25-digits, with no

formatting such as spaces, hyphens, or periods. Left justify the

entry and space-fill unused positions. Otherwise, space-fill.

183

TIN Type (Item 35a)

1

REQUIRED (conditional). Enter the appropriate code to

describe the account owner’s TIN type. Otherwise, space-fill.

Code Description

A EIN

B SSN/ITIN

C Foreign

184-218

First Name - Account

Owner (Item 36)

35

Enter the first name (if individual) of the account owner. Left

justify the entry and space-fill unused positions. Otherwise,

space-fill.

219-253

Middle Initial/Name -

Account Owner (Item

37)

35

Enter the middle initial/name (if individual) of the account

owner. Left justify the entry and space-fill unused positions.

Otherwise, space-fill.

254-288

Name suffix (Item

37a)

35

Enter the principal joint owner's name suffix. Left justify the

entry and space-fill unused positions. Otherwise, space-fill.

289-388

Address - Account

Owner (Item 38)

100

Enter the street address of the account owner. Left justify the

entry and space-fill unused positions. Otherwise, space-fill.

389-438

City - Account Owner

(Item 39)

50

Enter the city of the account owner. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 23

Field

Position(s)

Field Name

Length

Description and Remarks

439-441

State - Account

Owner (Item 40)

3

Enter the state/territory/province code of the account owner if

“Country (Item 42)” is “CA”, “MX”, or “US”. See Attachment C

(Addresses) for information about the codes to be entered. Left

justify the entry and space-fill unused positions. Otherwise,

space-fill.

442-450

ZIP/Postal Code -

Account Owner (Item

41)

9

Enter the ZIP Code or foreign postal code of the account owner.

Do not include punctuation or formatting such as hyphens,

periods, and spaces within the entry. An entry must be five or

nine digits if “Country (Item 42)” is “US”. A nine-digit entry

cannot end with four zeros or four nines if “Country (Item 42)”

is “US”. Left justify the entry and space-fill unused positions if

less than nine digits. Otherwise, space-fill.

451-452

Country - Account

Owner (Item 42)

2

Enter the country code of the account owner. See Attachment C

(Addresses) for information about the codes to be entered.

Otherwise, space-fill.

453-472

Filer Title - Account

Owner (Item 43)

20

Enter the filer's title for the position which gives him/her

authority over the account. Left justify the entry and space-fill

unused positions.

473-635

Filler

163

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 24

Consolidated Report for Corporate Filer Financial Account (6A)

Record

This record type is used to describe a foreign financial account where the filer is filing a

consolidated report. There can be more than one of these record types for each FBAR on the file.

The 6A record item number refers to Part V, Item 15-23. A 6A record must be recorded when

one or more of items 15-42 are completed in Part V.

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "6A".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8

Account Information

Unknown or Not

Applicable

1

Enter "X" if all account information (Items 15-23) in Part V are

unknown or not applicable. See the instructions for Part V in

Attachment C for guidance on when the account information is

not applicable. Otherwise, space-fill.

9-23

Maximum Account

Value (Item 15)

15

REQUIRED (conditional). Enter the maximum value of the

account in U.S. dollars during the calendar year being reported.

Right justify the entry and zero-fill unused positions. Space-fill if

“Maximum Account Value Unknown (Item 15a)” contains “X”.

24

Maximum Account

Value Unknown

(Item 15a)

1

Enter “X” if the maximum account value is unknown.

Otherwise, space-fill.

25

Type of Account

(Item 16)

1

REQUIRED. Enter the appropriate code to describe the type of

account.

Code Description

A Bank

B Securities

Z Other

26-75

Type of Account -

Other Description

(Item 16)

50

REQUIRED (conditional). If "Type of Account (Item 16)" is "Z",

enter a brief description of the type. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

76-225

Financial Institution

Name (Item 17)

150

REQUIRED. Enter the name of the financial institution where

the account is held. Left justify the entry and space-fill unused

positions.

226-265

Account Number

(Item 18)

40

REQUIRED. Enter the account number used by the financial

institution to designate the account. Left justify the entry and

space-fill unused positions.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 25

Field

Position(s)

Field Name

Length

Description and Remarks

266-365

Address (Item 19)

100

Enter the street address of the financial institution where the

account is held. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

366-415

City (Item 20)

50

Enter the city of the financial institution where the account is

held. Left justify the entry and space-fill unused positions.

Otherwise, space-fill.

416-418

State (Item 21)

3

Enter the state/territory/province code of the financial institution

where the account is held if “Country (Item 23)” is “CA” or

“MX”. See Attachment C (Addresses) for information about the

codes to be entered. Left justify the entry and space-fill unused

positions. Otherwise, space-fill.

419-427

Foreign Postal Code –

if known (Item 22)

9

Enter the foreign postal code of the financial institution where

the account is held. Do not include punctuation or formatting

such as hyphens, periods, and spaces within the entry. Left

justify the entry and space-fill unused positions if less than nine

digits. Otherwise, space-fill.

428-429

Country (Item 23)

2

REQUIRED. Enter the foreign country code of the financial

institution where the account is held. See Attachment C

(Addresses) for information about the codes to be entered.

430-635

Filler

206

Space-filled.

636-345

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 26

Corporate Account Owner (6B) Record

This record type is used to describe the corporate account owner of a foreign financial account

where the filer is filing a consolidated report. There can be more than one of this record type for

each 6A record on the file. The 6B record item numbers refer to Part V items 34-42. This is not a

required record and should only be recorded when applicable.

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "6B".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8-157

Corporate Name -

Account Owner (Item

34)

150

Enter the account owner organization’s name as shown on the

books of the organization. Left justify the entry and space-fill

unused positions. Otherwise, space-fill.

158-182

Taxpayer

Identification

Number (TIN) -

Account Owner (Item

35)

25

Enter the U.S. or foreign Taxpayer Identification Number (TIN)

of the account owner. U.S. TINs must be 9-digits in length, with

no formatting such as hyphens and no consecutive string of the

same number. Foreign TINs may be as long as 25-digits, with no

formatting such as spaces, hyphens, or periods. Left justify the

entry and space-fill unused positions. Otherwise, space-fill.

183

TIN Type (Item 35a)

1

REQUIRED (conditional). Enter the appropriate code to describe

the account owner’s TIN type. Otherwise, space-fill.

Code Description

A EIN

B SSN/ITIN

C Foreign

184-283

Address - Account

Owner (Item 38)

100

Enter the street address of the account owner. Left justify the

entry and space-fill unused positions. Otherwise, space-fill.

284-333

City - Account Owner

(Item 39)

50

Enter the city of the account owner. Left justify the entry and

space-fill unused positions. Otherwise, space-fill.

334-336

State - Account

Owner (Item 40)

3

Enter the state/territory/province code of the account owner if

“Country (Item 42)” is “CA”, “MX”, or “US”. See Attachment C

(Addresses) for information about the codes to be entered. Left

justify the entry and space-fill unused positions. Otherwise,

space-fill.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 27

Field

Position(s)

Field Name

Length

Description and Remarks

337-345

ZIP/Postal Code -

Account Owner (Item

41)

9

Enter the ZIP Code or foreign postal code of the account owner.

Do not include punctuation or formatting such as hyphens,

periods, and spaces within the entry. An entry must be five or

nine digits if “Country (Item 42)” is “US”. A nine-digit entry

cannot end with four zeros or four nines if “Country (Item 42)”

is “US”. Left justify the entry and space-fill unused positions if

less than nine digits. Otherwise, space-fill.

346-347

Country - Account

Owner (Item 42)

2

Enter the country code of the account owner. See Attachment C

(Addresses) for information about the codes to be entered.

Otherwise, space-fill.

348-635

Filler

288

Space-filled.

636-645

User Field

10

Use this field for any descriptive information you may require;

otherwise, space-fill. This information will be returned in the

acknowledgement file.

Financial Crimes Enforcement Network

BSA Electronic Filing Requirements for the Report of Foreign Bank and Financial Accounts

(FBAR) (FinCEN Report 114) 28

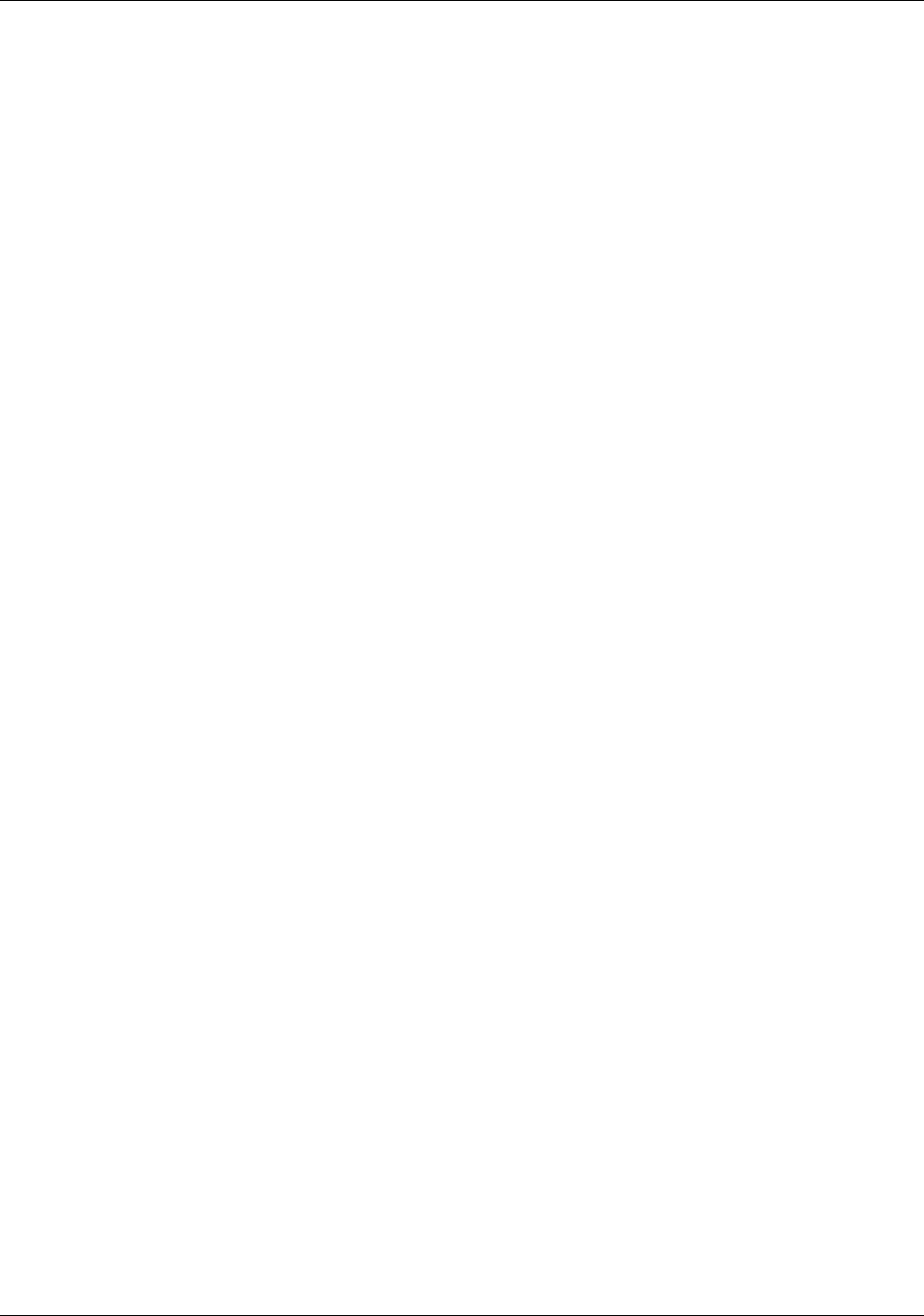

Late Filing (7A) Record

There can be one or two of this record type for each late filed FBAR within the batch file. If the

Filer Information (2A) Record contains “Z” (Other) for the “Late Filing Reason Code” then at

least one 7A record must be recorded for the FBAR. Explanations for late filing are limited to

750 characters, allowing for a maximum of two 7A records per FBAR. The Late Filing (7A)

Record should contain the following data elements. This is not a required record and should

only be included when applicable.

Field

Position(s)

Field Name

Length

Description and Remarks

1-2

Record Type

2

REQUIRED. Enter "7A".

3-7

Sequence Number

5

REQUIRED. Enter the sequence number from the associated

Filer Information (2A) Record.

8-382

Late Filing Reason

Explanation

375