A Proposal for SPP Markets+

CONTENTS

INTRODUCTION: SPP AND ENERGY MARKETS ................................................................................................... 1

GOVERNANCE .................................................................................................................................................................. 5

MARKET DESIGN .......................................................................................................................................................... 20

TRANSMISSION ............................................................................................................................................................ 64

MARKET SETTLEMENTS ............................................................................................................................................. 68

MARKET MONITORING ............................................................................................................................................. 75

STAKEHOLDER RELATIONS ...................................................................................................................................... 84

IMPLEMENTATION ...................................................................................................................................................... 85

CONCLUSION ................................................................................................................................................................ 89

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 1

Utilities have the daunting task of ensuring electric reliability and affordability for their customers.

Southwest Power Pool (SPP) has proven that centralized, regional electricity markets make this

task easier and more successful. We have years of experience and a customer-centric approach to

market development. We provide more than just market development and administration services.

We provide peace of mind.

SPP is pleased to present this proposal for Markets+, a bundle of services proposed that would

centralize day-ahead and real-time unit commitment and dispatch, provide hurdle-free

transmission service across its footprint and pave the way for the reliable integration of a rapidly

growing fleet of renewable generation. We have made an earnest attempt to accurately estimate

and clearly state the anticipated costs and obligations of designing, implementing and

administering Markets+. We’ve based the market’s design on both our own experience and the

expressed wishes of you, our customer.

We look forward to continuing to work with you in developing a mutually beneficial relationship

that will bring financial benefits and enhance electric reliability for your customers for years to

come.

INTRODUCTION: SPP AND ENERGY

MARKETS

A LEGACY OF TRUSTWORTHINESS

SPP has coordinated the reliability of the bulk electric grid for more than 80 years. We were

founded in 1941, incorporated in 1994, approved by the Federal Energy Regulatory Commission

(FERC) as a regional transmission organization (RTO) in 2004 and have grown and matured

steadily throughout our history, constantly expanding our service offerings and territory to

provide greater value to a continually growing and diverse group of customers.

Even as our services, responsibilities and staff size have grown, particularly in the last two

decades, our values and commitment to serving customers have remained the same. We believe

in doing the right thing for the right reason in the right way, and we’ve managed to stay true to

those values even as we expanded our RTO footprint, extended our contract services and

welcomed our first members in the Western Interconnection.

Our annual stakeholder satisfaction surveys regularly return superbly favorable results among

our stakeholders, and our employee engagement surveys consistently show phenomenal levels

of satisfaction, motivation and effectiveness among our highly qualified, dedicated and

professional staff of more than 600 employees. All of this is proof: Our strategy is built to last.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 2

OUR VALUE PROPOSITION: EXPERIENCE AND

CUSTOMER SERVICE SET SPP APART

Our value depends on the complimentary principles of maintaining independence through

diversity and a commitment to being stakeholder-driven. We are facilitators, helping our

stakeholders work together to responsibly and economically keep the lights on today and in the

future. We don’t tell our stakeholders what to do. We facilitate dialogue among them, ensuring

every voice is heard regardless of size.

SPP’s approach to business is creating and maintaining a strong, unique culture in which our

staff and stakeholders collaborate to be as effective and efficient as possible.

We share your values. We understand equally the challenges of managing transmission in rural

areas and the importance of maintaining reliability in large population centers. The SPP RTO

serves seven of the one hundred largest cities in the U.S. and has a keen understanding of rural

America, too: after all, it’s where we call home and is the area we have primarily served for the

past 80 years.

We hire career employees and invest in them as people first and employees second. We give

back to our community. We value transparency in our actions and communications, flexibility in

our approach to customer service and response to industry trends and integrity and trust in

everything we do. We consider ourselves partners with our stakeholders and stewards of their

valuable resources.

We are proud that SPP today – having grown from 11 members in 1941 to 114 in 2022,

spanning all or parts of 15 states and soon to provide service to even more in the west – still

reflects our early principles of collaboration with an unwavering commitment to remain

customer-focused.

SPP has a proven record of creating value for the companies we serve, who are as diverse as the

services we offer. Our customers include investor-owned utilities, rural electric cooperatives,

municipalities, public power, large retail customers, alternative power and state and federal

agencies. In fact, we are the only RTO to count among its members a federal agency: Western

Area Power Administration, Upper Great Plains Region.

The relationships we’ve forged and maintained not only serve as a testament to the integrity

and strength of our business model but also as a foundation on which to build the next step in

SPP’s evolution.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 3

SPP’S HISTORY OF SUCCESSFUL MARKET DEVELOPMENT

SPP launched its first energy imbalance services (EIS) market in 2007. With it, we set a precedent

for huge returns on market-development investments. The EIS market’s total implementation

costs were approximately $33 million, and in its first year alone it paid back its participants

threefold, providing $103 million in benefits.

Our 2007 EIS market was a real-time balancing market that dispatched participating generating

resources to meet load every five minutes. Our members and market participants quickly saw

additional reliability and economic opportunity in consolidating our 16 balancing-authority

areas and expanding our market to perform day-ahead unit commitment. We began designing

and implementing what would become our Integrated Marketplace.

In 2014, we launched the Integrated Marketplace on time and under budget with the highest

degree of quality, something no other RTO in the world has accomplished. In its first year of

operation, our expanded market delivered $380 million in net savings to our members and their

customers, paying for itself in just four months.

The Western Energy Imbalance (WEIS) market launched Feb.1, 2021. The real-time balancing

market is part of SPP’s contract-based portfolio of Western Energy Services it provides

customers in the Western Interconnection. The WEIS market helps keep wholesale electricity

costs low, increases price transparency and mitigates congestion on the transmission system for

market participants. Throughout its first year of operation, it has performed well and to the

expectations of its participants, enhancing both reliability and economics and paving the way

toward even greater value as it grows in size and leads to the development of Markets+.

SPP-administered markets save money and enhance reliability. In testimony to the House

Subcommittee on Energy and Mineral Resources, then Western Area Power Administration

Administrator and CEO Mark Gabriel said of his organization’s participation in SPP’s markets,

“Our participation in energy and transmission market initiatives has delivered greater benefits

than we anticipated … In addition to experiencing financial and operational benefits exceeding

our conservative assumptions, above-average water conditions resulted in surplus generation

sales into Southwest Power Pool (SPP) that accrued more than $48 million of additional net

market revenue. These surplus sales help put downward pressure on firm power rates.”

We have a long and successful history of providing contract services to non-members of the SPP

RTO. We’ve provided tariff administration, reliability coordination, reserve sharing and planning

authority services to dozens of entities in the Eastern and Western Interconnections.

It’s on this foundation of success that we propose to build Markets+ and bring time-tested

benefits to customers in the Western Interconnection.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 4

SPP has worked for several years with utilities in the

west to understand their needs and design solutions

to ensure the highest levels of reliability while

keeping rates as low as possible for customers. SPP

understands that western utilities place high value on

having a voice in helping shape the ever-changing

energy landscape, and that the western utility

landscape represents many diverse interests that must

be balanced in every decision.

These objectives are at the heart of who SPP is and

how we do what we do. Our customer-driven

approach will ensure western customers get the

products and services they need at affordable rates

they help control. Our strength is in our ability to

facilitate effective discussions of complex issues

among diverse stakeholders while balancing impacts

to the inseparable ideals of reliability and economics.

Our industry is undergoing transformational shifts in

generation technologies, customer demands,

environmental considerations and political

expectations. SPP has more than 75 years of

experience using a relationship-based business model

to help customers meet their challenges in a way that

fits the needs of their business, customers,

stakeholders and regulators. We know you have a

choice when considering your market options, and we

believe after reviewing our proposal you’ll agree our

approach of providing a customer-driven energy

imbalance market is the right choice for you and your

customers.

THE SPP ADVANTAGE

SPP has worked for several years with utilities in the

west to understand their needs and design solutions

to ensure the highest levels of reliability while keeping rates as low as possible for

customers. SPP understands that western utilities place high value on having a voice in helping

shape the ever-changing energy landscape, and that the western utility landscape represents

many diverse interests that must be balanced in every decision.

These objectives are at the heart of who SPP is and how we do what we do. Our customer-

driven approach will ensure western customers get the products and services they need at

WHY SPP?

• Strong customer involvement

and transparent governance

that balances the interests of

all states and all participants

• Demonstrated customer-

driven approach to decision-

making

• Long-term cost certainty

through customer-driven

changes to service

• Efficient market operation and

flow-based internal congestion

management

• Future optionality for long-

term market evolution

• Lower up-front and on-going

costs for participating

balancing authorities thanks to

the market’s direct interaction

with embedded entities

• High utilization of legacy

metering requirements

• No long-term commitments

and low up-front and on-

going costs for market

administration

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 5

affordable rates they help control. Our strength is in our ability to facilitate effective discussions

of complex issues among diverse stakeholders while balancing impacts to the inseparable ideals

of reliability and economics.

Our industry is undergoing transformational shifts in generation technologies, customer

demands, environmental considerations and political expectations. SPP has more than 75 years

of experience using a relationship-based business model to help customers meet their

challenges in a way that fits the needs of their business, customers, stakeholders and regulators.

We know you have a choice when considering your market options, and we believe after

reviewing our proposal you’ll agree our approach of providing a customer-driven energy

imbalance market is the right choice for you and your customers.

GOVERNANCE

1.0 DEFINITIONS

Affiliate: Affiliate relationships are relationships between Markets+ market participants that

have one or more of the following attributes in common:

1. Are subsidiaries of the same company

2. One Markets+ market participant is a subsidiary of another Markets+ market participant

3. Have, through an agency agreement, turned over control of a majority of their

generation facilities to another Markets+ participant

4. Have, through an agency agreement, turned over control of a majority of their

transmission system to another Markets+ participant, except to the extent that the

facilities are turned over to an independent transmission company recognized by FERC

5. Have an exclusive marketing alliance between Markets+ participants

6. Ownership by one Markets+ participant of 10% or greater of another Markets+

participant.

Federal Energy Regulatory Commission (FERC): The Federal Energy Regulatory Commission is

an independent agency that regulates the interstate transmission of natural gas, oil and

electricity. FERC is the regulatory agency that will oversee and approve Markets+.

Markets+ Independent Panel (MIP): A five-member panel that is independent from Markets+

participants and Markets+ stakeholders. The MIP is the highest level of authority for decisions

related to the Markets+ market with the SPP board of directors providing independent

oversight.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 6

Markets+ Market Participant (MMP): An entity that has executed a Markets+ market

participant agreement as part of the Markets+ tariff and contributes generation and/or load to

the Markets+ market.

Markets+ Market Stakeholder (MMS): Category of stakeholders who has executed a

Markets+ stakeholder agreement, does not contribute generation and/or load to the Markets+

market and pays an annual fee of $5,000. A MMS has voting rights at the MPEC, the MIP

Selection Forum and is eligible for a voting seat, if appointed, on the MIP Nominating

Committee, working groups and task forces. The annual fee may be waived for eligible entities

that are nonprofit organizations under the Internal Revenue Code.

Markets+ Non-Voting Stakeholder (MNVS): General category of stakeholders who provide

input at all stakeholder meetings that do not have voting rights on working groups and task

forces and pay no annual fee.

Meeting of Markets+ Participants and Markets+ Stakeholders: A meeting of Markets+

market participants and Markets+ market stakeholders shall be held for the purpose of electing

members of the MIP and conducting other business as necessary. The MPEC chair shall preside

over these meetings.

SPP: Southwest Power Pool, Inc. or successor organization (SPP Bylaws).

Staff: The technical and administrative staff of SPP as hired by the officers to accomplish SPP’s

mission.

2.0 PARTICIPATION IN MARKETS+

2.1 QUALIFICATIONS AND PHASES

Phase One: Funded Investigation

Entities that are supportive of SPP’s development of a detailed Markets+ design, can commit a

non-refundable amount so SPP can commit resources to designing the market functions, draft

the governing documents and submit the proposal to FERC.

Phase Two: SPP Implementation

Upon FERC approval of the necessary Markets+ governing documents, SPP will begin acquiring

or modifying the necessary software, hardware and related processes if entities commit to fully

fund the cost of such efforts. Upon SPP’s creation of the Markets+ systems and processes,

entities will then be integrated into the system based on participant-specific schedules,

including milestones and activation dates.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 7

Participation in each phase described above is discreet and separate. The incremental approach

is taken to confirm an appropriate amount of participant interest and commitment is achieved,

while ensuring SPP’s costs are recovered for each phase of the effort. The terms and conditions

for each agreement will be limited to the commitments within scope of each phase.

2.2 MARKETS+ MARKET PARTICIPANT AGREEMENT

SPP will administer the Markets+ market pursuant to the Markets+ FERC-approved tariff,

including a Markets+ market participant agreement. Such agreement will contain terms and

conditions that must be met for an entity to be able to participate in Markets+.

3.0 ORGANIZATIONAL STRUCTURE

3.1 SPP BOARD OF DIRECTORS

3.1.1 AUTHORITY

SPP’s independent board of directors will provide ultimate oversight of SPP’s administration of

Markets+ subject to FERC regulatory jurisdiction. The board will give significant recognition and

deference to the Markets+ Independent Panel (MIP) decision-making role.

The SPP board of directors shall review and consider:

1. Decisions of the MIP that have a material adverse effect on SPP, including:

a. Material agreements and material changes to those agreements between SPP

and Markets+ market participants or SPP and Markets+ market stakeholders

b. Issues or concerns raised by the market monitor related to any FERC filing, rule or

process within the scope of the market monitor’s authority as established by

FERC that has been previously raised to the MIP

c. Legal and/or litigation disputes or actions involving SPP or the implementation of

Markets+

d. Financial ramifications or corporate risk to SPP

2. Markets+ budgets, any debt obligations related to Markets+ or material changes to

SPP’s staffing requirements.

3. Appeals from the MIP made pursuant to Section 3.2.1.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 8

All reviews by the SPP board of directors shall be in coordination with the MIP. Any time the SPP

board of directors takes action to review any issue due to a material adverse effect on SPP, the

board shall publish the basis for the materiality.

3.2 MARKETS+ INDEPENDENT PANEL (MIP)

3.2.1 PURPOSE AND SCOPE OF ACTIVITIES

The Markets+ Independent Panel (MIP) is the highest level of authority for decisions related to

the Markets+ market with the SPP board of directors providing independent oversight. Actions

taken by the MIP under the authorities defined in its charter will be filed with FERC, unless

appealed per this section or reviewed by the SPP board of directors pursuant to its authority.

Absent an appeal, SPP staff will be authorized to submit requisite regulatory filings to

implement the MIP’s decision.

Appeals: Any member of the MIP may request the SPP board of directors review any action or

inaction of the MIP. Only members of the MIP can appeal to the SPP board of directors. Upon

such a request by a member of the MIP, the SPP board of directors shall review the matter for

resolution in consultation with the MIP. Should the SPP board determine there is not sufficient

consensus supporting the MIP’s decision, and provided time allows, the SPP board of directors

may remand the issue to the MIP and/or the appropriate Markets+ working group for further

consideration. The MIP is responsible, through the Markets+ State Committee (MSC) and the

Markets+ Participants Executive Committee (MPEC) and designated working groups,

committees and task forces, for developing and deciding or recommending policies, procedures

or system enhancements related to the administration of the Markets+ market.

In carrying out its purpose, the MIP will:

1. Provide a forum for entities that have executed a Markets+ market participant

agreement, a Markets+ stakeholder agreement with SPP or a Markets+ non-voting

stakeholder to discuss issues related to the ongoing administration and advancement of

Markets+ development in the Western Interconnection. The MIP has the authority to set

priorities and direct the Markets+ Participant Executive Committee to investigate

potential market design and tariff revisions.

2. Approve or reject proposed amendments to the Markets+ tariff made by the Markets+

Participants Executive Committee before the filing of such amendments at FERC.

3. Consider, approve or reject market rules if such rules solely apply to the administration

of the Markets+ market and have no application to the SPP Integrated Marketplace or

any other service provided by SPP. To the extent such rules do apply to the SPP

Integrated Marketplace or any other service provided by SPP, the MIP shall be afforded

the opportunity to provide input to any other applicable SPP organizational group and

the SPP board of directors.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 9

4. Collaborate with SPP staff on the development of Markets+ tariff provisions, market

protocols, business practices and interregional agreements to promote transparency and

efficiency in the operation of the Markets+ market.

5. Evaluate and provide consultation to SPP on the Markets+ market administration budget

to the Markets+ State Committee, Markets+ market participants and Markets+

stakeholders, including modifications or adjustments of the Markets+ market

administration rate, in accordance with the Markets+ tariff.

6. Review, consider and decide whether to approve market design system or process

enhancement proposals recommended by SPP, the Markets+ State Committee, the

Markets+ Participant Executive Committee or any designated working group, committee,

or task force established by the Markets+ Participation Executive Committee.

Recommendations to enhance systems or processes materially impacting SPP’s

administration of the Markets+ market or the Markets+ market administration budget

must be approved by the MIP before beginning implementation of the enhancement.

7. Resolve any disputes regarding the establishment of a working group or task force and

the staffing of that working group or task force.

3.2.2 COMPOSITION AND QUALIFICATIONS

The MIP shall consist of five persons, one of which shall be a SPP Independent Director. The MIP

shall select its chair. The members of the MIP shall be independent of any Markets+ market

participant, Markets+ market stakeholder, or Markets+ non-voting stakeholder and shall not be

limited in the number of terms he/she may serve.

Members of the MIP shall have recent and relevant senior management expertise and

experience in one or more of the following disciplines: electric industry, including electric

transmission and generation planning, markets or general understanding of electric utility

regulation.

Members of the MIP shall comply with SPP’s standards of conduct. Under the standards of

conduct, members of the MIP shall not be an employee, director, consultant or contractor of,

and shall have no interest in any third party, or any of its affiliates as defined in SPP’s FERC-

approved tariff, which shall be deemed to include ownership (outside of a mutual fund, blind

trust or similar arrangement as permitted herein) by a panelist or his/her immediate family

members of prohibited securities.

3.2.3 TERM AND ELECTION

3.2.3.1 TERM

Four of the members of the MIP shall be elected at the Markets+ Market Participants and

Markets+ Market Stakeholder Forum to a four-year term commencing upon election and

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 10

continuing until his/her duly elected successor takes office. The initial term for non-SPP directors

will be a one, two, three or four year term to allow staggering. The ballot for the initial elected

members of the MIP will consist of a single person for each seat to be filled (slate) and each

MPEC member will cast his/her vote to approve or disapprove the entire slate.

3.2.3.2 MIP NOMINATING COMMITTEE

3.2.3.2.1 Composition

The MIP Nominating Committee will consist of 11 representatives of Markets+ market

participants and Markets+ market stakeholders, including one representative from each of the

following sectors or groups:

1. Independent power producers

2. Markets+ State Committee member

3. Public interest organizations

4. Cooperatives

5. Municipal utilities, including public utility districts and joint action agencies

6. Federal agencies

7. Investor-owned utilities

8. Competitive marketers

9. Large energy and industrial customers

10. Residential and small commercial retail customers

11. MIP representative, not up for renomination, shall serve as chair. For the initial MIP

nominations, the chair shall be the SPP Independent Director designated to serve on

the MIP.

Each sector will nominate and vote on its representative to the MIP Nominating Committee.

3.2.3.2.2 Meetings

The MIP Nominating Committee shall meet as necessary. Meetings shall be open, however, the

MIP Nominating Committee may limit attendance at a meeting by an affirmative vote of MIP

Nominating Committee members as necessary to safeguard confidentiality of sensitive

information. Unless otherwise agreed to by the MIP Nominating Committee, representatives

shall be given at least 15 business days’ written notice of the date, time, place and purpose of

each regular or special meeting. Telephone or web conference meetings may be called as

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 11

appropriate by the chair of the MIP Nominating Committee with at least one business day’s

prior notice.

3.2.3.2.3 Voting Structure

Decisions of the MIP Nominating Committee shall be by simple majority vote of the

representatives participating, whether in person or remotely by telephone, web conference or

similar technology and voting. Representatives must be participating at a meeting to vote. No

votes by proxy are permitted. The SPP staff secretary will collect and tally the ballots and

announce the results of a vote.

3.2.3.3 ELECTION PROCESS

1. At least 90 calendar days before the Markets+ Market Participants and Markets+ Market

Stakeholders Forum when election of new members of the MIP is required, the MIP

Nominating Committee shall commence the process to nominate persons equal in

number to the members of the MIP to be elected.

2. At least 45 calendar days before the Markets+ Market Participants and Markets+ Market

Stakeholders Forum, the MIP Nominating Committee shall determine the persons it

nominates for election as members of the MIP, specifying the nominee for any vacancy

to be filled. The staff secretary shall prepare the ballot accordingly and shall deliver same

to Markets+ market participants and Markets+ market stakeholders at least 30 calendar

days before the Markets+ Market Participants and Markets+ Market Stakeholders Forum.

3. For purposes of electing or removing members of the MIP only, each group of Markets+

market participants with affiliate relationships shall be considered a single market

participant.

4. Any additional nominee(s) may be added to the ballot specifying the nominee(s) to a

single seat or multiple seats if a petition is received by the staff secretary at least 15

calendar days before the Markets+ Market Participants and Markets+ Market

Stakeholders Forum and evidencing support of at least 20% of the existing Markets+

market participants and Markets+ market stakeholders.

a. If only one candidate is nominated for a seat, each Markets+ market participants

and Markets+ market stakeholders representative shall be entitled to cast a vote

by written ballot, whether in person or remotely by email or other reliable

electronic means, for or against the nominee. The votes will be calculated and will

require a simple majority. In the event a member of the MIP position is not filled,

the MIP Nominating Committee will determine a new nominee for

recommendation for election by Markets+ market participants and Markets+

market stakeholders at a special meeting of Markets+ market participants and

Markets+ market stakeholders to be held no later than the next regular MPEC

meeting.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 12

b. If multiple candidates are nominated for a seat, each Markets+ market

participants and Markets+ market stakeholders representative shall be entitled to

cast a vote by written ballot, whether in person or remotely by email or other

reliable electronic means, for only one nominee, but may vote against each

candidate. The votes will be calculated with a simple majority of votes cast

determining which nominee is elected. In the event a member of the MIP position

is not filled, the MIP Nominating Committee will determine a new nominee for

recommendation for election by Markets+ market participants and Markets+

market stakeholders at a special meeting of Markets+ market participants and

Markets+ market stakeholders to be held no later than the next regular Markets+

market participants and Markets+ market stakeholders meeting.

3.2.3.4 VACANIES

Any member of the MIP may resign by written notice to the MIP and SPP corporate secretary

noting the effective date of the resignation. The Markets+ market participants and Markets+

market stakeholders may remove an elected member of the MIP with cause by vote. Removal

proceedings may only be initiated by a petition signed by not less than 20% of the Markets+

market participants and Markets+ market stakeholders. The petition shall state the specific

grounds for removal and shall specify whether the removal vote is to be taken at a special

meeting of the Markets+ market participants and Markets+ market stakeholders or at the next

regular meeting of the Markets+ market participants and Markets+ market stakeholders. An

external member of the MIP who is the subject of removal proceedings shall be given 15

calendar days to respond to the petition in writing to the MPEC chair and SPP corporate

secretary.

If a vacancy occurs, the MIP Nominating Committee will present a nominee to the Markets+

market participants and Markets+ market stakeholders for consideration and election to fill the

vacancy for the unexpired term at a special meeting of Markets+ market participants and

Markets+ market stakeholders following 30 calendar days’ notice from the staff secretary. The

replacement member of the MIP shall take office immediately upon election.

3.2.4 MEETINGS

Meetings of the MIP are open to all interested parties and written notice of the date, time, place

and purpose of each meeting will be provided as described below. However, the MIP may limit

attendance during specific portions of a meeting by an affirmative vote of the MIP. Matters for

consideration in closed or limited sessions are limited to personnel, legal and proprietary,

confidential or security sensitive information.

At a minimum, meetings will be scheduled such that there will be an official meeting quarterly.

Annually, there will be at least one face-to-face meeting.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 13

Written notice and public posting of the date, time, place and purpose of each regular meeting

shall be given at least 15 calendar days in advance of each regular meeting. Agendas for regular

meetings will be publicly posted no less than seven days before the meeting.

Telephone conference meetings may be called by the MIP chair with prior notice of at least one

business day.

3.2.5 VOTING STRUCTURE

Decisions of the MIP shall be by simple majority vote of the members participating, whether in

person or remotely by telephone, web conference or similar technology and voting, subject to

the quorum requirements in Section 3.6. Members of the MIP must be participating at a

meeting to vote. No votes by proxy are permitted. The SPP staff secretary will collect and tally

the ballots, and announce the results of a vote.

3.3 COMMITTEES ADVISING THE MARKETS+ INDEPENDENT PANEL

3.3.1 MARKETS+ PARTICIPANTS EXECUTIVE COMMITTEE (MPEC)

The Markets+ Participants Executive Committee (MPEC) will provide a forum for Markets+

market participants, Markets+ market stakeholders and Markets+ non-voting stakeholders to

discuss issues related to the ongoing administration and advancement of market development

in the Western Interconnection.

The MPEC will review system or process enhancement proposals recommended by SPP, the

Markets+ State Committee, the Markets+ market participants, Market+ stakeholders, Markets+

non-voting stakeholders or any designated working group, committee or task force established

by the MPEC. The MPEC will provide to the MIP its recommendation on proposals received for

the MIP’s consideration and decision. The MPEC recommendations to the MIP are advisory and

non-binding. In its presentation to the MIP, the MPEC will report any minority views expressed

to the MPEC during its consideration. Recommendations to enhance systems or processes

materially impacting SPP’s administration of the Markets+ market or the Markets+ market

administration budget must be approved by the MIP before beginning implementation of the

enhancement.

3.3.1.1 COMPOSITION

Each Markets+ market participant and Markets+ market stakeholder shall appoint one

representative to the MPEC. Each representative designated shall be a senior level management

employee with financial decision making authority. The MPEC representatives will appoint the

chair and vice chair. Each representative of the MPEC may continue to be a representative

thereof until the Markets+ market participant appoints a successor representative. A Markets+

market participant and Markets+ market stakeholder shall be eligible to appoint only one

representative for itself.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 14

3.3.1.2 AUTHORITY

The MPEC will have authority to make recommendations to the MIP regarding:

• Proposed amendments to the Markets+ tariff

• Markets+ market protocols to support the filed tariff

• The administrative rate charged to participants of the Markets+ market

The MPEC may establish standing working groups and ad hoc task forces as needed to facilitate

its authorities as described below.

3.3.1.3 MEETINGS

Meetings of the MPEC are open to all interested parties, and written notice of the date, time,

place and purpose of each meeting will be provided as described below. However, the MPEC

may limit attendance during specific portions of a meeting by an affirmative vote of the MPEC.

Matters for consideration in closed or limited session are limited to personnel, legal and

proprietary, confidential or security sensitive information.

At a minimum, meetings will be scheduled such that there will be an official meeting quarterly.

Annually, there will be at least one face-to-face meeting.

Written notice and public posting of the date, time, place and purpose of each regular meeting

shall be given at least 15 calendar days in advance of each regular meeting. Agendas for regular

meetings will be publicly posted no less than seven days before the meeting.

Telephone conference meetings may be called by the MPEC chair with prior notice of at least

one business day.

3.3.1.4 VOTING STRUCTURE

Upon execution of the Markets+ participant agreement or execution of the Markets+ stakeholder

agreement and payment of the annual fee or fee waiver, an entity will be assigned to one of three

membership sectors: Investor-owned utilities, public power and independent. The sectors are

defined as follows:

Investor-owned utilities (IOUs): This sector includes Markets+ market participants that are public

utilities under the Federal Power Act, regulated by one or more state regulatory commission and

subject to a fiduciary responsibility to investors to earn a return on rate-based assets.

Public power: This sector includes Markets+ market participants that are publicly-owned utilities,

electric cooperatives and power marketing administrations (PMAs).

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 15

Independents: This sector includes Markets+ market participants that are not an IOU or a public

power utility and Markets+ market stakeholders.

The MPEC will vote with the result for that sector being a percent of approving vote to the total

number of participants in the sector participating and voting. Each of the three sectors represents

33 1/3% of the vote. An action is approved by the MPEC if the average of these percentages is at

least 67%.

3.3.2 MARKETS+ STATE COMMITTEE (RSC)

3.2.2.1 COMPOSITION/MEMBERSHIP

One representative from each state in which a Markets+ market participant has generation or

load participating in the Markets+ market in that state, may participate as a member of the

Markets+ State Committee (MSC). Each state representative will be appointed by the utility

regulatory commission of that state. The MSC will provide advice to the MIP, the MPEC and any

working group or task force on all matters pertinent, including but not limited to, initiative

prioritization and policy issues, to the participation in the Markets+ market of the Markets+

market participants under the Markets+ tariff. SPP staff will assist the MSC by providing

information and support relevant to the Markets+ market.

3.3.2.2 MEETINGS AND VOTING

The MSC will determine its meeting provisions and voting structure.

3.3.2.3 SUPPORT AND FUNDING

SPP will facilitate the retention of independent staffing for the MSC sufficient and stable enough

to support the MSC’s ability to develop analytical and legal analysis in order to present

independent positions related to the Markets+ market and before FERC. The MSC shall annually

submit a proposed budget to the MIP for approval. Before approval, the MIP shall seek

comment from the MPEC. The approved MSC budget costs will be allocated to the Markets+

market participants.

3.3.2.4 DATA ACCESS

The MSC will have access to performance data and data specific to policy initiatives, subject to

any confidentiality agreements.

3.4 OTHER COMMITTEES AND STAKEHOLDER GROUPS

3.4.1 MARKETS+ WORKING GROUPS

Through an affirmative vote in accordance with the voting structure set forth in Section 3.3.1.4,

the MPEC may establish standing working groups to assist with its mission. Before voting on the

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 16

establishment of a working group, the MPEC should consider potential resource and financial

impacts in excess of those contemplated.

3.4.1.1 COMPOSITION AND TERMS

Unless otherwise provided in these bylaws, each working group shall have a chair to preside

over meetings. The chair of all organizational groups shall be nominated by the MPEC for

consideration and appointment by the MIP. The term of the chair of all working groups shall be

two years. Working groups have discretion to determine the need for a vice-chair. Should a

working group establish a vice-chair position, the vice-chair shall be elected by the working

group.

Following a solicitation of nominations, working group representatives shall be recommended

by the MPEC chair to the MPEC for approval. The recommendation and approval of

representatives shall consider the various types and expertise of Markets+ market participants

(MMPs) and Markets+ market stakeholders (MMS) and their geographic locations, to achieve a

widespread and effective representation of MMPs and MMSs. Criteria and sector representation

for serving on a working group will be determined in the group’s scope and be sector based. An

appointment to a working group is for an individual, not a corporate entity.

3.4.1.2 MEETINGS

Working groups shall meet as necessary and the meetings shall be open. However, any working

group may limit attendance at a meeting by an affirmative vote of the working group. Matters

for consideration in closed or limited attendance session should be limited to personnel, legal

and proprietary, confidential or security sensitive information. Unless otherwise agreed to by the

working group, representatives shall be given at least 15 business days’ written notice of the

date, time, place and purpose of each regular or special meeting. Telephone or web conference

meetings may be called as appropriate by the chair of any working group with at least one

business day’s prior notice.

3.4.1.3 VACANCIES

Working group vacancies will be filled on an interim basis by appointment of the MPEC chair,

unless otherwise provided.

3.4.1.4 VOTING STRUCTURE

Each representative of a working group shall have one vote. A simple majority of

representatives, whether participating in person or remotely by telephone, web conference or

similar technology, or represented by proxy and voting shall be required for approval of an

action. Unless otherwise stated, a working group may determine to vote on an issue by email.

The outcome of any email vote must be recorded in the minutes for the group.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 17

The quorum for any working group shall be a majority of the representatives thereof, but not

less than three representatives, provided a lesser number may adjourn the meeting to a later

time. The quorum for a meeting must be established and maintained throughout the meeting in

order for the working group to take any binding action(s). Notwithstanding the above, any

actions taken before a quorum is lost are considered valid and binding.

3.4.1.5 STANDING COMMITTEES

3.4.5.1 Operations and Reliability Working Group (ORWG): Provides recommendations to other

working groups and the MPEC on the effects of current or proposed market designs on these

entities ability to ensure reliable operations. The ORWG will be comprised of one representative

from each Markets+ market participant that is a balancing authority or transmission provider.

3.4.1.5.2 Market Working Group (MWG): Reviews any initiative that would modify the Markets+

tariff or market protocols.

3.4.1.5.3 Seams Working Group (SWG): Coordinates with the ORWG, any RTO or ISO adjacent to

the Markets+ footprint and any bordering non-RTO or ISO balancing authority areas and

transmission providers.

3.4.2 AD HOC TASK FORCES

A temporary task force may be created by the MPEC chair. Through an affirmative vote in

accordance with the voting structure set forth in Section 3.3.1.4, the MPEC chair may establish

ad hoc task forces as necessary to fulfill its mission. Upon establishment of a task force reporting

to the MPEC, the MPEC chair shall appoint a chair of the task force to preside over meetings.

Any ad hoc task forces established by the MPEC chair shall be temporary and shall have the

scope of its activities limited to a specific purpose. Before the establishment of an ad hoc task

force, the MPEC chair should consider any potential resource and financial impacts to SPP.

3.4.2.1 COMPOSITION AND TERMS

Unless otherwise provided in these bylaws, task force representation will be appointed by the

MPEC chair after the SPP staff secretary solicits nominations for task force members. The MPEC

chair shall consider the various types and expertise of Markets+ market participants (MMPs) and

Markets+ market stakeholders (MMS) and their geographic locations, to achieve a widespread

and effective representation of the MMPs and MMS. Criteria and sector representation for

serving on a task force will be determined in the group’s scope. Except for any full

representation group, an appointment to a task force is for an individual, not a corporate entity.

3.4.2.2 MEETINGS

Task forces shall meet as necessary and the meetings shall be open. However, any task force

may limit attendance at a meeting by an affirmative vote of the task force. Matters for

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 18

consideration in closed or limited attendance session should be limited to personnel, legal and

proprietary, confidential or security sensitive information Unless otherwise agreed to by the task

force, representatives shall be given at least 15 business days’ written notice of the date, time,

place and purpose of each regular or special meeting. Telephone or web conference meetings

may be called as appropriate by the chair of any task force with at least one business day’s prior

notice.

3.4.2.3 VACANCIES

Task force vacancies will be filled on an interim basis by appointment of the MPEC chair unless

otherwise provided.

3.4.2.4 VOTING STRUCTURE

Each representative of a task force shall have one vote. A simple majority of representatives,

whether participating in person or remotely by telephone, web conference or similar technology,

or represented by proxy and voting shall be required for approval of an action. Unless otherwise

stated, a task force may determine to vote on an issue by email. The outcome of any email vote

must be recorded in the minutes for the group.

The quorum for any task force shall be a majority of the representatives thereof, but not less than

three representatives, provided a lesser number may adjourn the meeting to a later time. The

quorum for a meeting must be established and maintained throughout the meeting in order for

the task force to take any binding action(s). Notwithstanding the above, any actions taken before

a quorum is lost are considered valid and binding.

3.5 SPP STAFF INDEPENDENCE AND SUPPORT

Each working group, committee or task force reporting to the MPEC shall be assigned a SPP

staff member, who shall attend all meetings and act as secretary to the group. Staff secretaries

of all committees, working groups, and task forces shall be non-voting, independent and

impartial. The secretary shall keep minutes of pertinent discussions, business transacted,

decisions reached and actions taken at each meeting. Minutes shall be published within seven

calendar days following a meeting but in any event in advance of the next meeting and

considered final documents upon their approval by the working group, committee or task force.

SPP shall strive to provide support to all working groups, committees and task forces while

taking into account the Markets+ market administration budget and other priorities of the SPP

organization. Should it become necessary for SPP to hire additional staff or augment staffing to

maintain the expected level of support, SPP will advise the MIP and MPEC of any budgetary

impacts.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 19

3.6 ATTENDANCE, QUORUM AND PROXY

If a representative is unable to attend a meeting of the MPEC or any committee, working group

or task force, he/she may, in writing to the applicable chair, vice chair and staff secretary,

appoint a proxy representative who shall have such rights to participate and vote as the

representative specifies. The proxy representative may be another member of the MIP, MPEC or

the committee, working group or task force or another person who has the authority to act on

behalf of the representative.

The quorum for a meeting of the MIP, the MPEC, the MSC or any working group, committee or

task force shall be a majority of the representatives thereof, provided a lesser number may

adjourn the meeting to a later time. A representative participating by phone is considered to be

in attendance of the meeting for the purpose of quorum. The quorum for a meeting must be

established and maintained throughout the meeting in order for the group to take any binding

action(s). Notwithstanding the above, any actions taken before a quorum is lost are considered

valid and binding. A proxy will serve to meet the quorum requirements as follows:

• A proxy provided to another representative of the MPEC will not be recorded as

attendance at the meeting and will not serve to meet or maintain the quorum

requirements.

• A proxy provided to another person with the authority to act on behalf of the

representative will be recorded as attendance at a meeting for the purpose of meeting or

maintaining the quorum requirements.

3.7 APPEALS TO THE MPEC AND THE MIP

Should any Markets+ market participant, Markets+ market stakeholder or the MSC disagree on

an action or inaction taken or recommended by any working group or task force, such Markets+

market participant, Markets+ market stakeholder or the MSC may, upon written request to the

MPEC staff secretary, appeal and submit an alternate recommendation, including a

recommendation for inaction to the MPEC within seven days after the meeting following such

working group or task force action or inaction.

Should any Markets+ market participant, Markets+ market stakeholder or the MSC disagree on

the MPEC’s denial of any issue, such Markets+ market participant, Markets+ market stakeholder

or MSC member may, upon written request to the MIP staff secretary, appeal and submit an

alternative recommendation, including a recommendation for inaction to the MIP within seven

days after the meeting following the MPEC denial.

The MIP may take any action it deems necessary to address the appeal. This could include

affirming the action or inaction appealed, reversing the action or inaction appealed or

remanding the matter back to the appropriate group or groups.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 20

4.0 GOVERNANCE REVIEW

Upon the MPEC’s request, but no later than three years after the Markets+ market launch, the

MIP will initiate a review of the Markets+ market governance in light of accumulated experience

and changed circumstances. Examples of changed circumstances includes:

• Voting structure changes: Findings and a request by the MPEC that participation and

voting experiences suggest that changes in voting structures are needed.

• Markets+ service offering evolution and Markets+ State Committee authority: SPP

Bylaws confer on the RSC certain authorities and responsibilities within the governance

of SPP. Specifically, Section 7.2 of the SPP Bylaws gives the RSC specific authority

(pursuant to Section 205 of the Federal Power Act) over:

o Cost allocation

o Financial transmission rights

o Planning for remote resources

o Regional resource adequacy

While none of these authorities are part of the Markets+ service offering at this time, if the

market design evolves to include these features, the MIP will evaluate whether the MSC should

have similar designated authorities.

To accomplish the governance review, after a solicitation of nominations, the MIP shall appoint a

sector-based working group to develop recommendations for any governance revisions. Any

modification to Markets+ governance requires a super majority (4/5 vote) of the MIP.

MARKET DESIGN

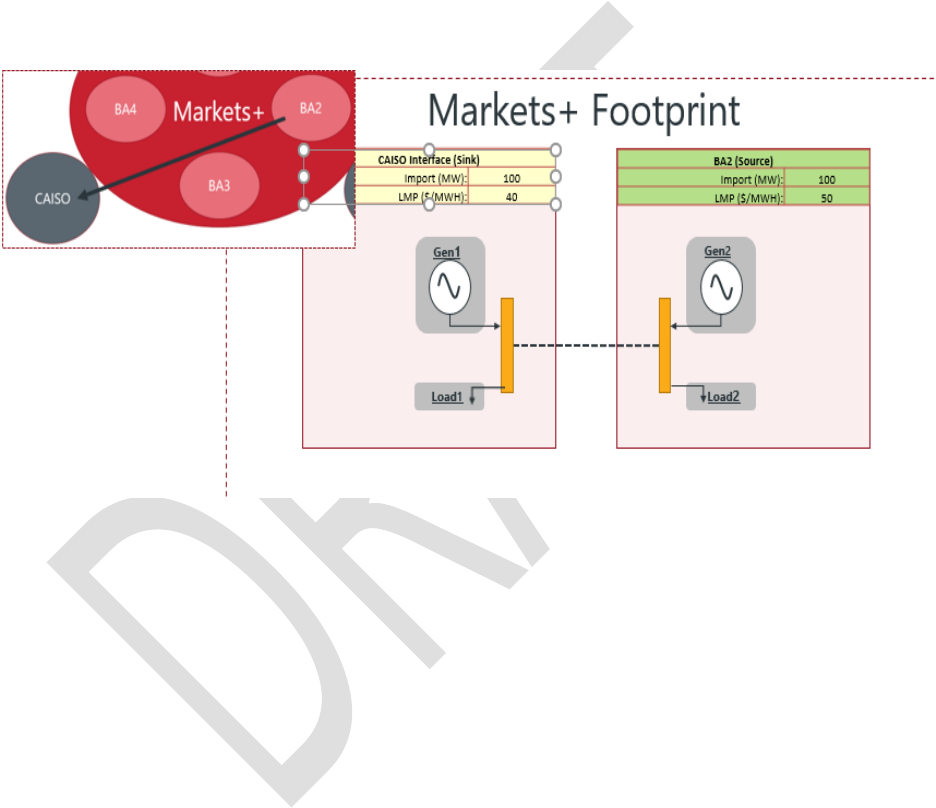

MARKETS+ OVERVIEW

As a market operator

1

, SPP collaborates with participating entities, serving as an interface

between reliability and commercial functions in the Markets+ footprint. To assist in reliable

operations and competitive wholesale electricity prices, SPP proposes to operate and administer

1

NERC Reliability Functional Model – Version 5.1; The market entity whose interrelationships with other

entities are included in the Functional Model only as an interface point of reliability functions with

commercial functions.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 21

energy and reserve markets. The responsibilities to capacity adequacy, reserves and other

reliability-based concerns do not change because of this proposed market.

ENERGY AND RESERVE MARKETS

The energy and reserve markets processes include market participant

2

participation in:

• A price-based day-ahead market (DA market) with congestion rent allocation in the DA

market

• A price-based real-time balancing market (RTBM)

• All reliability unit commitment (RUC) processes

The DA market provides market participants with the ability to submit offers to sell energy,

flexibility reserve products

3

and/or to submit bids to purchase energy. The RTBM provides

market participants with the ability to submit offers to sell energy and flexibility reserve

products. Energy and reserve markets operations will simultaneously or jointly optimize resource

offers for energy and reserve in the security constrained unit commitment (SCUC) and security

constrained economic dispatch (SCED) algorithms. The objective function of joint optimization is

the minimization of the total production costs in the DA market and the RTBM for energy and

reserve products to meet the requirements.

Procurement of operating reserve (regulation-up service, regulation-down service, spinning

reserve and supplemental reserve) will not be included in the energy and reserve markets but

will continue to occur under the existing paradigm. Market participants with resources providing

operating reserve will communicate operating reserve procurements to SPP to ensure the

energy and reserve markets do not optimize capacity set aside for those operating reserve

obligations.

The simultaneous optimization logic considers various permutations of unit commitment and

the joint dispatch of energy and flexibility reserves, resulting in a solution with the least overall

production cost subject to reliability constraints. If multiple flexibility reserve products are

defined, the simultaneous optimization logic allows product substitution of flexibility reserve if

economically efficient, i.e., the logic utilizes a higher quality product offer to fill a lower quality

product demand if and when such selection would reduce the overall production cost compared

to a situation where each product was cleared separately.

2

An entity that generates, transmits, distributes, purchases, or sells electricity within, into, out of, or

through the transmission system participating in Markets+.

3

Flexibility Products refers to energy reserve products developed to respond to uncertainties or

unexpected changes primarily due to renewable and load forecast errors. Further discussion in later

sections.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 22

SPP performs the RUC processes to ensure the physical unit commitment produced from the DA

market is sufficient to meet SPP-projected capacity needs during the operating day. Exhibit 1-1

provides an overview of the key energy and operating reserve market functions.

EXHIBIT 1-1: OVERVIEW OF KEY ENERGY AND OPERATING RESERVE MARKET FUNCTIONS

Key features of the day-ahead market include:

• A financially binding market in which all cleared supply and demand is settled with a

minimum mandatory offer quantity requirement

4

.

• Physical supply offers, virtual supply offers, physical demand bids and virtual demand

bids are accommodated.

• Import, export and through-interchange transactions are accommodated in

Markets+, resulting in energy supply or energy demand cleared at external interface

settlement locations as appropriate.

4

Specific details of minimum mandatory offer requirement will be determined in Phase 1 of Markets+

development.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 23

• DA market clearing is performed for energy and flexibility products on a least-cost,

co-optimized basis and accounts for each resource’s marginal system losses,

congestion and energy cost to minimize the overall production cost.

• All physical supply cleared for flexibility reserve products cleared are paid at the

applicable market clearing price for the flexibility reserve product.

• All cleared energy supply is paid at the settlement location

5

DA market locational

marginal price, and all cleared energy demand is charged at the settlement location

DA market locational marginal price, producing an over collection due to congestion

(congestion revenues) and marginal losses (marginal loss revenues).

• Firm

6

transmission service reservation (TSR) holders are paid DA congestion rents. DA

marginal congestion component (MCC) is collected for all load, generators, imports

and exports. The sum of this number is allocated back to TSR holders.

• Losses will settle under the host transmission service provider with any impacts of

losses reduced from Markets+ settlements to avoid double settlement of losses.

• Resources committed by SPP are assured recovery of their start-up offer, no-load

offer and actual incremental energy costs as defined in the energy offer curve,

subject to certain eligibility criteria.

• Flexibility reserve procurement costs are allocated and collected on a reserve zone

basis.

• Greenhouse gas (GHG) pricing included in the market optimization that includes the

cost to serve load in states with GHG programs, including providing the necessary

tracking and reporting associated with supply serving load in the GHG state.

Key features of the RUC processes and real-time balancing market include:

• The RUC may commit resources based on market participant offers from physical

resources that were not otherwise committed by the day-ahead market.

• The RTBM operates on a five-minute basis, calculates dispatch instructions for

energy, clears flexibility products on a least-cost, co-optimized basis and accounts for

5

Settlement locations are the location of finest granularity for calculation of settlements in Markets+. SPP

anticipates multiple types of Settlement Locations including: Resources, Load, Trading Hub, Resource Hub,

and External Interfaces.

6

The design can also contemplate allocating day-ahead congestion rents to conditional firm and

secondary network transmission service, but more discussion is needed on the appropriateness and level

of allocation for curtailment priority 6 reservations.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 24

each resource’s marginal system losses, congestion and energy cost to minimize the

overall production cost.

• Cleared flexibility reserve settlement is performed on a five-minute basis. SPP

calculates charges and credits as the difference between the RTBM flexibility reserve

megawatts (MW) cleared and the DA market flexibility reserve MW cleared amount

multiplied by the applicable flexibility reserve market clearing price.

• Resource settlement is performed on a five-minute basis. SPP calculates energy

charges and credits as the difference between the resource actual output and the

resource DA market cleared MW amount multiplied by the settlement location RTBM

locational marginal price.

• Load settlement is performed on a five-minute basis. SPP calculates energy charges

and credits as the difference between the load actual consumption and the load DA

market cleared MW amount multiplied by the settlement location RTBM locational

marginal price.

• Import, export and through-interchange transaction energy settlement is performed

on a five-minute basis. SPP calculates charges and credits as the difference between

the real-time scheduled MW amount and the DA market cleared MW amount

multiplied by the RTBM locational marginal price of the appropriate external

interface settlement location.

• Losses will settle under the host transmission service provider with any impacts of

losses reduced from Markets+ settlements to avoid double settlement of losses.

• Resources committed by SPP are assured recovery of their start-up offer, no-load

offer and actual incremental energy costs as defined in the energy offer curve subject

to certain eligibility criteria.

• Charges are imposed on market participants for failure to deploy energy as

instructed.

• Flexibility reserve procurement costs and net of penalty revenues received for

flexibility reserve availability failure are collected from market participants on a real-

time, load-ratio share basis.

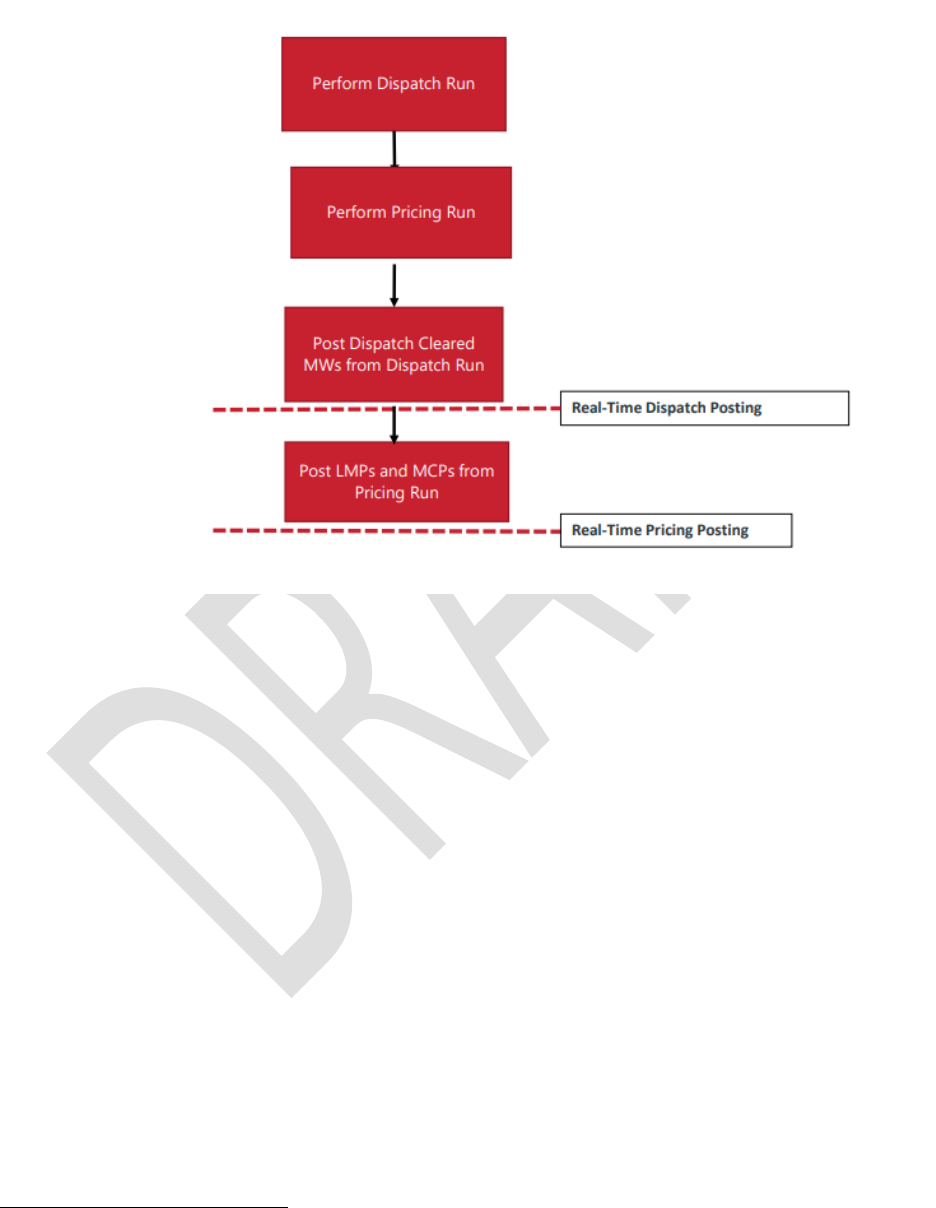

Exhibit 1-2 provides a timeline-based illustration of the sequencing and interaction of the key

energy and operating reserve market functions for a representative operating day (1/31).

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 25

Exhibit 1-2: Energy and Reserve Markets Processes Timeline

CONGESTION RENT ALLOCATION

Unlike a full RTO/ISO, Markets+ will not include financial transmission rights (FTRs) or the

associated allocations, auctions and other processes that support those instruments. Instead,

Markets+ will develop a more straightforward congestion rent allocation approach that

leverages the existing OATT framework to ensure entities who secure OATT rights to physically

deliver power across constrained paths can receive the maximum economic value and the

economic value of long-term OATT rights continues to be recovered by the transmission

customers who invest in those rights (and fund the underlying facilities). Achieving these

objectives will provide confidence to transmission customers that they will continue to receive

the economic value of their existing rights, while also preserving incentives for continued

investment in long-term OATT service in the future. These outcomes support the broader goal

of preserving third-party revenues recovered by transmission service providers (TSPs) through

sales of long-term OATT service and minimize the risk of cost shifts onto the native load

customers of TSPs that join Markets+.

SPP’s proposed congestion rent allocation approach is based on transmission rights rather than

transmission schedules. This approach ensures transmission customers will receive the economic

value of their rights without the need to self-schedule their own resources or loads using their

own transmission reservations. Instead, it provides a powerful incentive for the transmission

customer to allow the market to make the most efficient use of the transmission as part of its

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 26

broader economic optimization, while providing assurance that the resulting congestion value

will be allocated to the appropriate customer(s).

FINANCIAL SETTLEMENTS

Markets+ incorporates full net-settlement of market activity for each operating day. Post-

operating day activities begin on the day immediately following the operating day. SPP will

issue scheduled settlement statements for each operating day to market participants. Settlement

invoices are issued to market participants on a weekly basis.

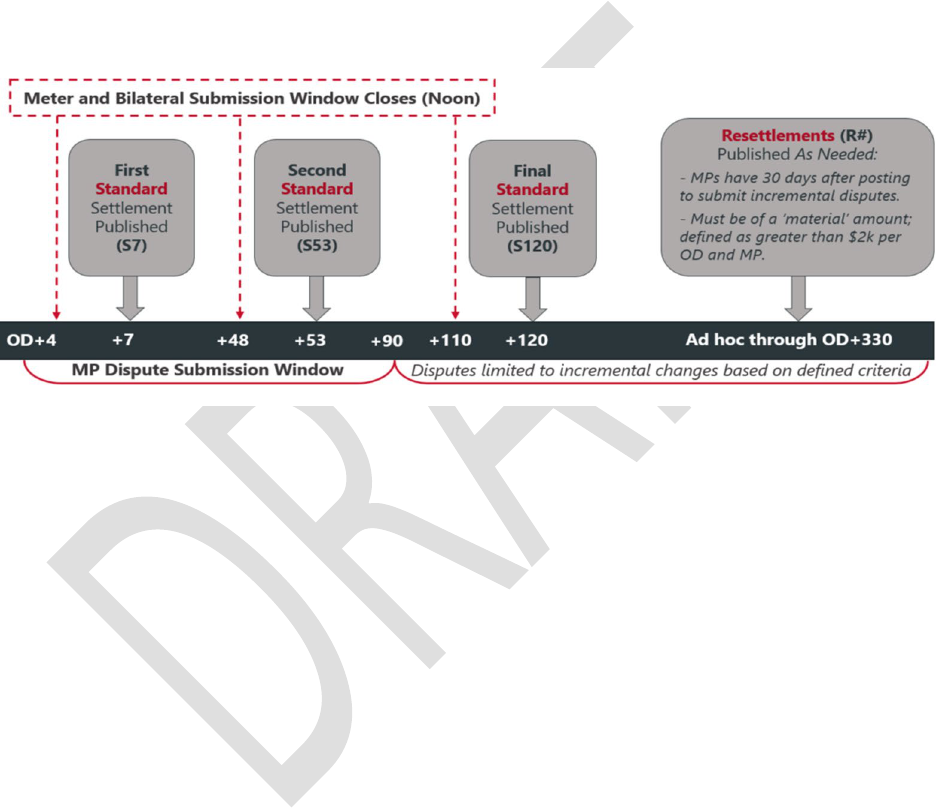

Exhibit 1-3 provides a representative overall timeline of post-operating day activities.

Exhibit 1-3: Post Operating Day Activities Timeline

OVERVIEW MARKET PARTICIPANT RESPONSIBILITIES

To participate in Markets+, an entity must be a balancing authority or receive balancing

authority services from a balancing authority participating in Markets+, i.e., a participating

balancing authority. An entity participating in Markets+ will have the opportunity to fully

participate In Markets+ (i.e., register assets, submit offers, financially settle with SPP, make

available transmission capabilities when appropriate, etc.). SPP will develop a more specific list of

market participant opportunities and requirements in the next detailed design phase, but the

guiding principle is entities can directly participate in Markets+ if willing and would not be

required to participate through an intermediary.

SPP anticipates significant coordination and collaboration between the participating balancing

authorities and the market operator. SPP proposes that a taskforce or stakeholder group be

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 27

established during the next phase of detailed market design to determine what, if any,

additional requirements and responsibilities are required for participating balancing authorities.

METERING REQUIREMENTS

Participants in Markets+ must designate an entity, including but not limited to itself, to provide

revenue-quality meter data to SPP for use in Markets+ settlement processes.

SPP proposes stakeholders determine the detailed, technical meter protocols

7

in the next phase

of detailed market design based on the regional preferences and standards of the anticipated

Markets+ footprint. SPP strongly encourages a two-part technical metering requirement for

Markets+. Any existing metering equipment at the time a participant integrates into Markets+ is

acceptable if the participant is capable of providing at least hourly kilowatt-hour-interval data

information. Any new or replacement metering equipment must satisfy the technical

requirements to be determined in the next phase of detailed market design. SPP finds this two-

phased metering approach to be successful in market launches, striking a balance between

uniformity in metering equipment and reducing unnecessary barriers to participant entry.

Stakeholders will determine the identification of the entity responsible for enforcing Markets+

technical meter protocols in the next phase of detailed market design.

REGISTRATION REQUIREMENTS

SPP requires participants in Markets+ to register their loads and resources within

8

a

participating balancing authority. SPP uses registration data for operation and settlement of

Markets+, determining responsibilities and identifying discrete entities.

Participants must register all resources in a participating balancing authority on a nodal basis.

Participants may register resources located at the same physical and electrically equivalent

injection point on the transmission system individually or as an aggregate. SPP proposes that

resources interconnected to the transmission system with a maximum output below a de

minimis threshold, e.g., 100 KW, not be required to register in Markets+. SPP proposes behind-

the-meter generation

9

of substantial capacity be required to register in Markets+. SPP proposes

that the specific size requirement for behind-the-meter generation be determined in the next

phase of detailed market design but would expect the size to be between five to 10 MW.

7

The detailed, technical meter protocols will include requirements for timing standards, measurement

quantities, accuracy, testing, and technology-specific requirements for different meter types.

8

This includes load and resources pseudo-tied into a Participating Balancing Authority, but does not

include load and resources pseudo-tied out of a Participating Balancing Authority.

9

A generating unit or multiple generating units on the customer’s side of the retail meter that serve all or part of the

retail Load with electric energy.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 28

Participants must register all load, either individually at each point of withdraw from the

transmission system or in aggregate, grouping multiple withdraw points into a single aggregate

location of financial settlement. Each participant must identify any nonconforming

10

load or load

associated with demand response participating in Markets+.

MARKET OPERATOR RESPONSIBILITIES

LOAD AND RESOURCE FORECASTING

SPP will develop short-term and midterm load forecasts for each balancing authority in the

Markets+ footprint. SPP will develop the short-term load forecast on a rolling five-minute basis

for the next three hours to use as an input for the real-time balancing market and short-term,

15-minute granularity reliability unit commitment. SPP will develop the midterm load forecast

on a rolling hourly basis for the next seven operating days to use as an input for all hourly unit

commitment processes.

SPP produces and updates hourly wind and solar-powered generation forecasts on a rolling 48-

hour bases to use as an input for all hourly unit commitment processes.

The individual wind and solar-powered generation forecasts may be available to individual

market participants and their designated agents, subject to any confidentiality protections. SPP

proposes to make available to all participants the aggregate summations of the solar and wind-

powered generation forecasts, with historical data available shortly after real-time for a

determined period of time.

MARKET SYSTEM AVAILABILITY

SPP can provide a highly reliable and secure Markets+ solution.

SPP maintains a tier III

11

data center, and requires software to adhere to SPP security policies to

meet cybersecurity requirements to ensure reliability and security. Physical security of SPP’s data

center is a priority. Data centers are strictly monitored, and have 24/7 security guards. SPP

conducts regular security assessments and has a team dedicated to cybersecurity.

Both of SPP’s geographically separate data centers are fully equipped with redundant circuits,

telecommunications and networking. As is typical for systems and applications used by SPP,

applications used for Markets+ will be housed in both data centers, with one serving as primary

10

Non-conforming load is more process driven and needs to be separated from the load forecast

application because it does not follow a predictable pattern and introduces error to the load forecast

produced by SPP for Markets+ processes.

11

As rated by the Uptime Institute.

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 29

and the other as secondary. Should an issue occur in the primary data center, processing can be

moved to utilize the secondary data center while the primary is restored to full function, after

which processing would return to the primary data center.

MARKETS+ MARKET DESIGN KEY FEATURES

MARKET PRODUCTS

ENERGY

Energy is the primary product for Markets+ and will be cleared in order to balance generation

with expected obligations. For Markets+, energy is defined as an amount of electricity that is bid

or offered, produced, purchased, consumed, sold or transmitted over a period of time, which is

measured or calculated in megawatt hours (MWh). Financially binding clearings of energy will

occur on an hourly granularity in the DA market and five-minute granularity in RT market.

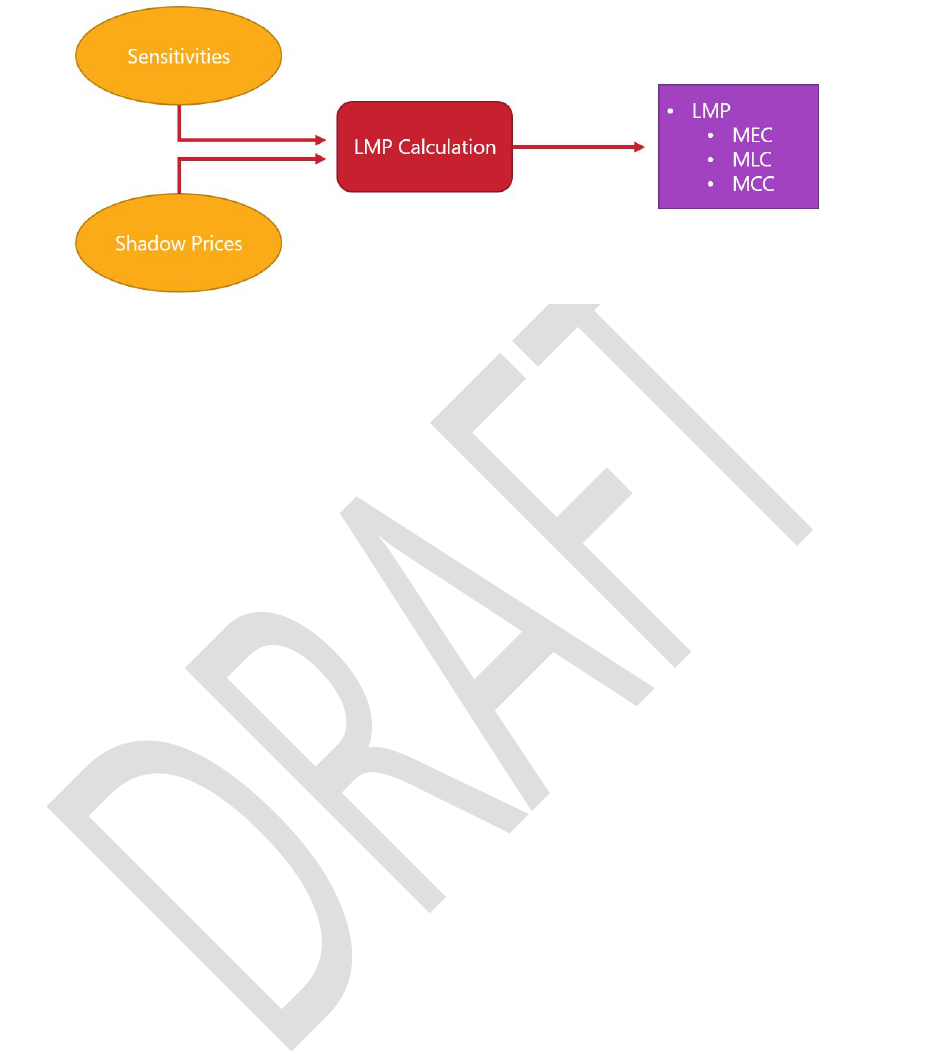

Energy will be settled at the corresponding settlement location’s locational marginal price (LMP).

As the market operator, SPP will issue energy deployment instructions to dispatchable resources

in the Markets+ footprint.

Before implementation, participants should decide the course of action when the market cannot

balance both supply and demand, along with the distinct roles and responsibilities of the market

operator and the balancing authority operator in those circumstances. It is common to have a

high penalty value that guides the market software to treat the power balance as one of the

most important constraints (see the Price Formation section). The design needs to specify

whether an administrative pricing associated with power balance will lead to high prices during

scarcity.

FLEXIBILITY RESERVES

Organized energy markets use flexibility reserve products to respond to uncertainties or

unexpected changes primarily due to renewable and load forecast errors. These products

increase the security of the grid and allow for fewer shortages and pricing

excursions. Incorporating flexibility reserve products both value and put a price on the

increasingly important attribute of flexibility under both normal and stressed conditions. One or

more flexibility products may exist that target different periods, depending on regional

preference and system need.

A short-term flexibility product targets periods in the intrahour range (e.g., 10 to 30 minutes).

Depending on the volatility and forecast uncertainties in this time range, a flexibility product

helps minimize price volatility resulting from transient error (i.e., temporary scarcity resulting

from the RT market looking at too narrow a window of time absent the product) and reduces

the risk of the RT market not meeting other future obligations. For this horizon, online

Southwest Power Pool, Inc. Name of Current Section (Optional)

Report Name Publication DATE/Version NUMBER 30

dispatchable resources would be the primary resources considered for clearing, but offline

faster-starting resources could also clear if desired.

A longer-term flexibility product could target periods beyond real-time (e.g., one hour or

greater). Depending on the potential uncertainties over this longer horizon, a flexibility product