Connecting with

the customer

How airlines

must adapt their

distribution

business model

2 Strategy&

Strategy&

Chicago

Andrew Tipping

Principal, PwC US

+1-312-346-1900

andrew.tipping

@strategyand.us.pwc.com

Dallas

Jim Bohlman

Managing Director, PwC US

+1-214-746-6500

jim.bohlman

@strategyand.us.pwc.com

Dubai

Alessandro Borgogna

Partner

+971-4-436-3000

alessandro.borgogna

@strategyand.ae.pwc.com

Aditya Agarwalla

Manager

+971-4-436-3000

aditya.agarwalla

@strategyand.ae.pwc.com

Frankfurt

Stefan Stroh

Partner

+49-69-97167-0

stefan.stroh

@strategyand.de.pwc.com

Kuala Lumpur

Edward Clayton

Partner

+60-3-2173-1188

edward.clayton

@strategyand.my.pwc.com

Sydney

Andreas Hilz

Partner

+61-2-8266-0000

andreas.hilz

@strategyand.au.pwc.com

Google

Dubai

Ivan Jakovljevic

Head of Travel, Finance, and

Government, MENA

+971-50-10-40-797

ijakov@google.com

Alessandro Borgogna is an advisor to executives in the aviation, travel, and aerospace industries with Strategy&,

part of the PwC network. He is a partner based in Dubai and leads the aviation, travel, and aerospace practice in the

Middle East. He has more than 20 years of experience across Europe and the Middle East, focusing on strategy and

business planning, performance improvement, organization design, nancial planning, and technology innovation.

Stefan Stroh is an advisor to executives in the travel, transport, logistics, and high-tech industries for Strategy&,

PwC’s strategy consulting business. He is a partner with PwC Germany, based in Frankfurt. He specializes in strategy

development, organizational transformation, and digital strategy and capability-building work for clients in Europe

and globally. He leads the travel and transport practice in Europe, the Middle East, and Africa.

Andreas Hilz is a leading practitioner on airlines, aviation, tourism, and public transport for Strategy&, PwC’s

strategy consulting business. He is a partner with PwC Australia based in Sydney, and leads PwC’s aviation practice

there. He has nearly two decades of experience in the airline and travel industry across all continents.

Aditya Agarwalla is a thought leader in the aviation, travel, and public transport industries with Strategy&. He

is based in Dubai and specializes in aviation. He has worked extensively with leading carriers in the Middle East,

Europe, South East Asia, and Australia, focusing on strategy and business planning, performance improvement, and

organizational design.

Google

Ivan Jakovljevic is the lead for travel, nance, and government for Google in the Middle East and North Africa

region. He works with leading travel organizations, nancial institutions, and government entities to create

innovative, impactful digital marketing and advertising solutions. Before joining Google, Ivan was one of the leaders

of the transport practice at Booz & Company.

About the authors

Contacts

3Strategy&

Three global trends are reshaping travel distribution business

models and threaten to weaken the connection between airlines and

their customers. These trends are: shifting customer behavior on both

retail and business sides, changing dynamics within direct and

indirect sales channels, and the rise of digital technologies. The

consumer trends involve an increasing use of online channels for

search and booking, the use of multiple devices, and the growing

popularity of social media. Meanwhile, changing dynamics within

direct and indirect sales channels — online travel agents, traditional

travel agents, and travel management companies — offer

opportunities and pitfalls for airlines.

Airlines can benefit from this only if they undertake three major

initiatives within a holistic strategy enabled by technology. They have

to transform their travel distribution model in both direct and indirect

channels. They must pursue closer partnerships with channel,

content, and technology players. Finally, they should enhance internal

capabilities (operating model, processes, skills, and technology) to

capture the opportunities of the new distribution trends and so

become centered on customers in their organizational setup. In

particular, airlines need to adeptly manage digital innovation and use

these technologies to improve areas of the business, particularly direct

channel sales, marketing, cross-selling, and dynamic pricing and

inventory management.

Executive summary

4 Strategy&

Airlines should increase their understanding of how consumer behavior

is changing in the retail and corporate sectors.

Changes in retail travel

Retail behavior varies signicantly across geographies, but four themes

prevail globally.

1. The increasing use of online channels for search and booking

2. The use of multiple devices during the research and booking process

3. The growing popularity of social media to share rst-hand

experiences — and the use of these as objective input in the travel

decision-making process

4. The increasing relevance of loyalty programs

1. Increasing use of online channels for search and booking

Within most mature markets, retail consumers typically research

airlines, online travel agents (OTAs), and metasearch websites before

making purchases online. In these countries, the online shop-to-buy

ratio is often above 90 percent. This ratio is lower, though growing, in

emerging markets because of market-specic characteristics: lower

Internet penetration (e.g., in India), lower credit card adoption rates,

issues with online payment security, and less packaging of travel

components owing to the relative lack of supplier and online travel

agent sophistication (see Exhibit 1).

The changing airline customer

Airlines should

increase their

understanding

of how consumer

behavior is

changing in

the retail and

corporate

sectors.

5Strategy&

Source: “Search, Shop, Buy: The New Digital Funnel,” Phocuswright, June 2015 (http://www.phocuswright.com/Special-

Projects/2014/Search-Shop-Buy-The-New-Digital-Funnel); Google, The MENA Travel Book: 2014 in review; Strategy& analysis

Exhibit 1

Travel booking and online adoption varies by region

70%

75%

95%

15%

The U.S. is a matur

e

market with high

Inter

net penetration

and online uptake.

Over 70 per

cent of

consumers r

esearch

and finalize flight

pur

chases online.

The online conver

-

sion ratio for

shop-to-book is

nearly 100 per

cent.

In Australia there is a

maturing travel

market with strong

trends in online

research and

booking. The online

shop-to-book

conversion rate is

around 95 percent,

slightly behind the

U.S. and U.K. The

online share of

revenue r

emains high

because of concen-

trated supply and

strong airline direct

channels.

Western Europe has

varied online

purchasing. Online

uptake is strong in the

U.K. and France with

ratios of shop-to-book

near the U.S. level,

but only 75 percent in

Germany because of

longer and complex

itineraries and lower

credit card usage.

In the Middle East

there is growing

Internet penetration,

with a rapid rise in the

use of mobile. Around

15 percent of all

Middle East travelers

use only mobile to

access booking sites.

In India, Internet

access and broadband

penetration lag behind

other markets.

However, there is high

online penetration in

the air travel segment

because of the

simplicity of products

and price transpar-

ency. Price is a key

driver of uptake, and

online channels are

well aligned with the

market.

88%

In China, consumers

have high online

adoption rates because

of strong economic

growth and broad

Internet penetration.

The online shop-to-book

conversion rate of

around 88 percent is

higher than that of

Germany.

6 Strategy&

Mobile is increasingly important, although most online research and

booking still typically occurs on the desktop. For example, mobile

accounted for 6 percent of airline website gross bookings in the U.S. in

2013, and is expected to grow to 17 percent by 2016.

1

Meanwhile, the

use of mobile and tablets for shopping, as opposed to buying, is

accelerating even faster in emerging markets — in which the desktop

buying wave will mostly be skipped as consumers move straight from

oine to mobile/tablets (see Exhibit 2).

2. Use of multiple devices during the research and booking process

As mobile gains traction, airlines, OTAs, and metasearch providers such as

Expedia and Hipmunk are catering to the increasing numbers of “multi-

device travelers” (those who use desktops, smartphones, and tablets) by

oering cross-platform features. These allow users to pick up and continue

their history and searches across devices and operating systems. Expedia’s

Scratchpad and Hipmunk’s Anywhere connect the same traveler across

multiple devices to provide a seamless digital experience. Airlines mostly

lag behind in catering for this.

Source: Google Consumer Barometer, 2014–15

Exhibit 2

Consumers tend to use tablets and phones, singly or in combination, to research rather than

to buy

Online shopping (research) Online booking (purchase of leisure flight)

58%

45%

49%

69%

78%

73% 73%

20%

19%

13%

18%

36% 34%

23%

17%

23% 21%

4%

U.S.UAE U.K.GermanyAustraliaChinaIndia U.S.

UAE

U.K.GermanyAustraliaChinaIndia

81%

76%

78%

97%

92%

90%

14%

14%

15%

93%

6%

6%

7%

10%

4%

3%

5%

Computer

Tablet

Sm

artphone

Other

3%

4%

2%

3%

1%

2%

1%

1%

4%

3%

3%

2%

2%

2%

7Strategy&

3. Growing popularity of social media

There is increasing use of social media to share experiences during trips,

mostly via mobile. In emerging markets in particular, where a greater

proportion of travelers tends to be young and tech savvy, social

networking is especially popular and is mostly via mobile. Seven in 10

Chinese leisure travelers shared a travel experience online in the past 12

months. Online sharing among Brazilians and Russians was also well

above more mature markets. People increasingly view this shared content

as unbiased travel information they can use to inform their own travel

decisions. For this reason, partnerships between social media platforms

and travel suppliers will become more common as a way to integrate

social media into the sales and service channel. For example, Facebook

Messenger allows KLM Dutch Airlines’ customers to check in, receive

ight updates, and change their travel itineraries from within the app.

4. Increasing relevance of loyalty programs

Customers are increasingly using loyalty programs as a means to directly

engage with airlines. The interaction has evolved beyond the traditional

use of points to earn and redeem seats. Instead, these programs have

become platforms for customers to provide the airline with their

preferences and to engage with them for a range of benets beyond seat

redemption; for example, lifestyle memberships and rewards from

everyday spending through multi-brand coalition loyalty programs.

Airlines can benet from loyalty programs because they reduce the cost to

capture customer insights, but only if airline and loyalty program

communication is well integrated. In addition, loyalty programs are

benecial because business customers prefer loyalty programs to reduce

travel costs, and they are a way of rewarding employees or redeeming

non-travel expenses. In response, many airlines now have loyalty oerings

for small and medium-sized businesses (SMEs) to create “stickiness” (i.e.,

customer loyalty) in a highly competitive market segment. Etihad, for

example, has launched Business Connect, which awards frequent yer miles

to passengers and allows the business to earn loyalty points redeemable for

ights, upgrades, or even cash.

In the corporate market, customers request the same ease of travel as in

the retail market. Many businesses (e.g., large corporations) are

demanding greater cost eciency and they are more strictly enforcing

their travel policies. Their employees are simultaneously demanding

the same ease of use they have become accustomed to for their leisure

travel. Travel management companies (TMCs) are responding to these

trends by oering solutions that blend policy management, reporting

requirements, and ease of use. For example, TMCs are developing

front-end mobile applications for approvals, requests, and schedule

alerts, and monitoring travel expenses. At the back end, TMCs are using

enhanced predictive and reporting capabilities.

There is

increasing

use of social

media to share

experiences

during trips,

mostly via

mobile.

8 Strategy&

Besides consumer behavior, a second major trend aecting airline travel

distribution models is the changing dynamics within sales channels.

Globally, direct (airlines’ websites) and indirect (OTA) online channels

are forecast to grow the fastest. However, traditional channels continue

to occupy important, protable niches (see Exhibit 3).

Changing dynamics in sales

channels

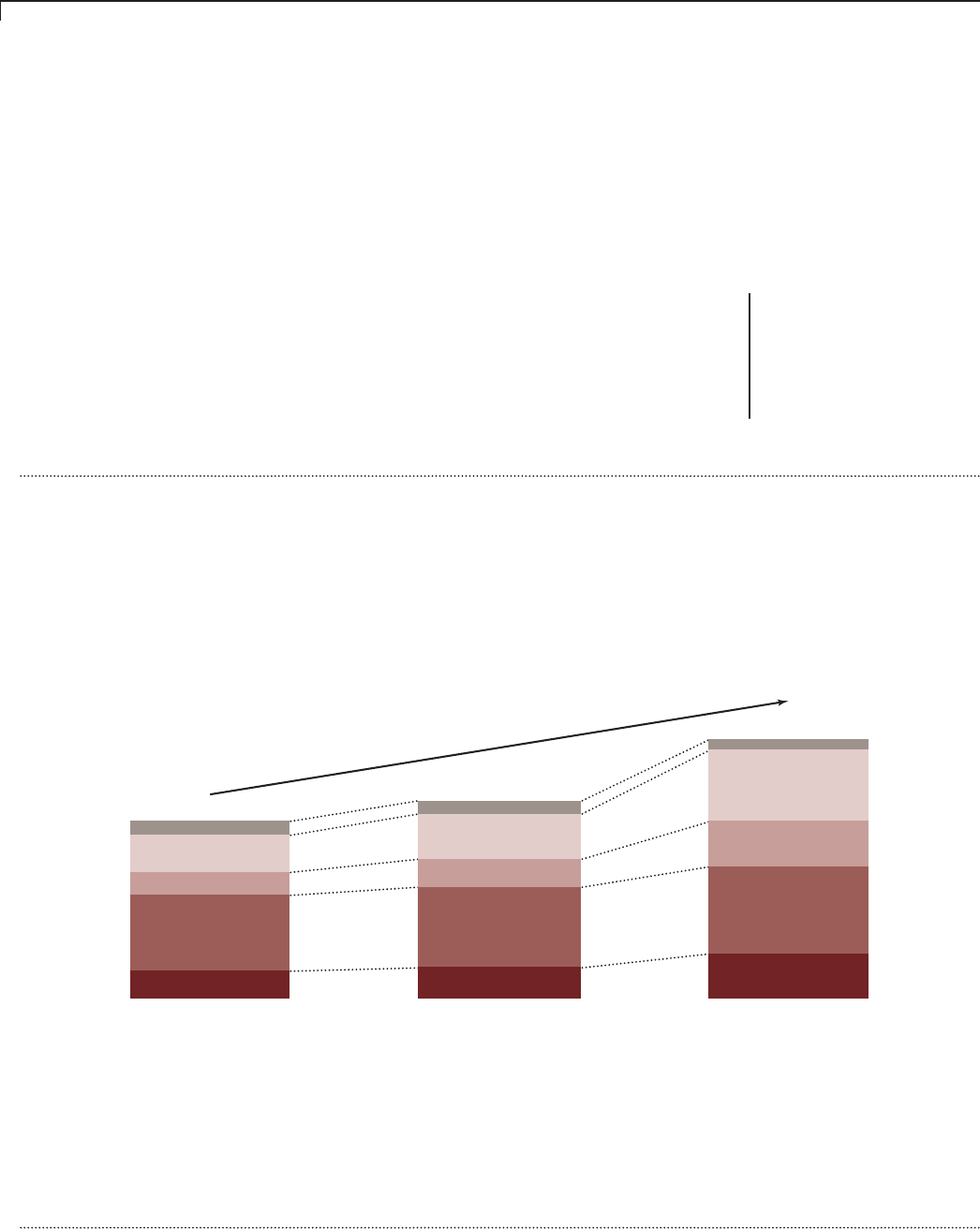

Exhibit 3

Traditional travel market sales channels are resilient

Global travel market, by channel (US$ billions, % of total, CAGR %, 2013–2020)

Note: OTA = online travel agencies, TA = travel agencies, TMC = travel management companies.

Source: TechNavio, Global Business Travel Market 2014-2018, 2014 (http://www.technavio.com/report/global-business-travel-

market-2014-2018); Global Travel Agencies Market 2015-2019, 2014 (http://www.technavio.com/report/global-travel-agencies-

market-2015-2019); Phocuswright, Global Online Travel Overview, Third Edition, 2014 (http://www.phocuswright.com/Travel-

Research/Market-Overview-Sizing/Global-Online-Travel-Overview-Third-Edition); Strategy& analysis

TM

C

TA

OT

A

Dir

ect online

Dir

ect offline

5.6%

2020

2,895

17%

34%

17%

28%

4%

2015

2,209

16%

40%

14%

23%

7%

2013

1,983

16%

43%

13%

21%

8%

CAGR

(2013–2020)

9.9%

9.5%

1.8%

7.4%

4.7%

9Strategy&

The direct online channel is expected to remain the fastest growing in

terms of sales and interaction. Leisure customers will use the airlines’

proprietary websites whereas businesses, particularly in the SME

segment, will use intranet portals to connect directly with airlines. SMEs

will also use intermediaries with global distribution systems (GDS) for

non-contracted ights. Other intermediaries, such as travel agents

(particularly the non-IATA [International Air Transport Association]

agents) are increasingly making use of technologies to bypass GDS

entirely and connect directly with airlines’ inventory systems.

For airlines, direct online sales are usually the lowest-cost channels and

an ecient way to gather customer data. Airlines can analyze this

information to identify trends and make personalized oers. The low-

cost carriers, in particular, are eectively using the direct online

channel to increase or cross-sell ancillaries and related products and

services, such as a preferred seat (aisle, bulkhead, etc.), meals,

baggage, or in-ight communication services. With the basic airline seat

becoming an increasingly commoditized product, these ancillaries will

become important to drive protability.

For consumers, the direct channel oers the most comprehensive view

of everything an airline oers. This channel also allows a more

personalized transaction, where previously set prole information can

pre-populate parts of the booking ow (such as meal selections, choice

of seats, etc.). Interestingly, a recent study found that consumers

“trusted” airline direct sales channels for booking more than they did

OTAs and metasearch, often by substantial margins.

2

Airlines have an

opportunity to build upon this trust and strengthen the relationship

further by oering solutions that personalize travel research and

booking across multiple touch points in the direct online channel.

However, airlines will achieve this only if they organize their customers’

data well enough to provide personalized content that is more valuable

to customers than the ease of comparing ight times and prices in the

indirect channels.

Airlines have

an opportunity

to build upon

this trust and

strengthen the

relationship

by oering

solutions that

personalize

travel research

and booking

across multiple

touch points in

the direct online

channel.

10 Strategy&

The future of

direct online

is more than

selling an

airline’s own

content; it is

about oering

all the content

travelers need

for their entire

journey.

The future of direct online is more than selling an airline’s own content;

it is about oering all the content travelers need for their entire journey.

If airlines fail to create this kind of seamless travel/customer

experience, they will lose direct ownership of their customers.

Consumers will turn to alternate channels (e.g., metasearch or OTA

sites), and airlines will become mere production engines.

Indirect channels’ common use of GDS makes it difficult for airlines

to differentiate their products. As a result, consumers’ buying

decisions are heavily influenced by price, which reinforces the trend

toward commoditization. However, the New Distribution Capability

(NDC) initiative by IATA is an effort to remedy this problem by

offering a new XML-based messaging standard to give travel agents

richer content via GDS. This will enable the airlines to make

customized offers via travel agents and help bridge the gap between

the commoditized information currently available to the agents and

the full content available on the airlines’ websites.

Given the prevalence of GDS in the industry, airlines are likely to seize

on any opportunity to integrate or enhance their ancillary

merchandising capability with the GDS. For example, in its partnership

with Travelport, Air Canada allows Travelport Agencia™ users access to

all of Air Canada’s à-la-carte fare and Flight Pass products, as well as

product attributes. This includes its cheapest category, Tango fares,

which are not available on any other GDS. Interestingly, one major

global carrier recently introduced a fee on all bookings made via GDS, a

fee not levied on bookings made via the direct channels. Although this

policy has led to some short-term pressure on sales, it is expected that

other carriers will follow in a move to reduce GDS costs unless other

ways can be found to reduce distribution costs to the airlines. If more

carriers were to adopt such a strategy more consumers would favor

direct channels over indirect channels as they would oer lower fares.

11Strategy&

Online travel agencies will continue to grow organically by moving into

less-mature markets, capitalizing on their brand, ease of use, and

scalability. Moreover, they will maintain their dominance in the hotel

sub-vertical over airlines given the fragmented and complex nature of

hotel accommodation. OTAs will also expand through acquisitions.

There have been a few recent examples of this type of activity:

• Expedia invested in Orbitz (to build a multibrand portfolio), Travelocity

(to expand market share), Wotif (to acquire Asia-Pacic hotel market

share), Trivago (to have a metasearch capability in the EU), and

Homeaway (to enter the vacation and rental market as a form of

indirect competition with the online accommodation channel Airbnb).

• Priceline invested in Open Table (to strengthen its restaurant

oering), Ctrip (to gain a foothold in Chinese OTAs), and Kayak (to

have a metasearch capability); and the company launched

Bookingsuite (a booking and property management system for hotel

owners built through the acquisitions of Buuteeq and PriceMatch).

OTAs have other advantages over their competitors. A recent study found

that during the research stage, in most countries, consumers favored

OTAs as the sites with the best prices over metasearch or suppliers’

websites (though, consumers perceive that it is safer to book with the

supplier than an OTA). Consumers rated OTAs the highest in terms of

both price availability and breadth of options for ights and hotels.

12 Strategy&

Traditional travel agencies (TTAs) will continue to lose market share at

the global level, but they will stay relevant by focusing on oerings with a

strong service angle, specialized oerings, and selling third-party

ancillaries. This is particularly the case for luxury and cruise travel, a

market in which travelers want expertise and a “real person” to look after

their specic requirements. Similarly, they will remain relevant in

emerging markets such as China, India, and the Middle East, in which

many rst-time middle class travelers prefer agent-organized groups and

a personal relationship with an agent. One other niche is travel retail

service to older travelers who are less technology adept or willing to use

modern channels.

Travel management companies (TMCs) are expected to remain

dominant in the business travel market. However, more consolidation can

be expected with the big four — American Express, BCD, Carlson

Wagonlit, and HRG — remaining dominant. TMCs are also taking

advantage of new technologies to expand their oering and stay relevant

in light of changing customer preferences. For example, they are:

• exploiting big data to perform travel policy checks and perform

expense management

• promoting traveler eciency through mobile apps

• integrating and reselling corporate self-booking tools

• expanding dynamic pricing capabilities to maintain margins

For airlines, the TMC channel provides important access to highly

protable corporate customers. Suppliers can exploit the increasing usage

of corporate self-booking tools and dynamic pricing to win more business.

13Strategy&

Disruptive distribution models are adding more complexity to this

distribution landscape and are expected to be the most likely catalysts

for change. These models are based on emerging technologies that

savvy customers are quick to embrace. For example:

• TripAdvisor is blurring the lines between the classic OTA and

destination content providers. It oers a reservation platform, an

application to secure advance payments made when booking a

homestay, and has announced partnerships with Marriott, Hyatt, and

Priceline for its instant hotel booking platform.

• Apple Passbook currently manages a customer’s itinerary and may

soon integrate with iPay, ADP’s mobile payment platform.

• Google’s new search product “Destinations on Google” helps discover

and plan the next vacation through Google Search on a smartphone.

It integrates information about places with Google Flights and Hotel

search, and presents available ight and hotel prices instantly.

• Other Google Search products, including Google Flights and Hotel

Ads, move users more quickly from intent to action. For example,

Google Flights uses an algorithm that trades o price, duration,

stop-overs, and even amenities such as baggage fees.

• Airbnb has disrupted the industry by building a marketplace where

individual property owners can oer accommodations directly to a

wide online audience.

14 Strategy&

A wave of new digital technologies continues to provide strategic

opportunities in the field of airline distribution.

Marketing

The lines are blurring between sales channels and marketing platforms

(e.g., OTAs). Search engines, social media, crowd sourcing, and mobile

are redening the consumer journey, particularly in the “discover” and

“research” phases. Consumers can now book directly from travel

metasearch portals that were once strictly for research. Moreover, as

the consumer journey becomes more digital and complex, there are

more opportunities for suppliers to market across multiple touch points.

Emirates, for example, uses Instagram posts that tout premium

products and encourage consumers to imagine dream destinations.

Finding the right touch points between social media and direct sales

channels will be important for airlines.

New digital technologies also allow airlines to reach consumers in real

time during their research phase. Airlines can further personalize the

travel experience. TAM, for example, used Facebook proles to

personalize inight magazines placed on the seat of each passenger to

celebrate the 35th anniversary of its São Paulo to Milan route. Each

cover bore a dierent passenger’s photo and name, in accordance with

the seat assignments, and content was geared toward each individual’s

interests and life experiences. Airlines need to improve their specic

destination content and inspirational media if they are to stay relevant

in the search/inspiration part of a consumer’s travel booking journey.

Direct channel

Airlines have a powerful array of digital platforms at their disposal that can

help enhance direct revenue channels, while reducing reliance on indirect

channels (e.g., GDS, consolidators, and tour operators). On their websites,

airlines can change the search paradigms available to consumers from

More digital opportunities

15Strategy&

route-based searches to interest-based, theme-based, and map-based

search experiences. By improving their landing pages to engage users and

capture those directed from search engine pages, metasearch pages, and

others, airlines can make the most of the direct channel.

Cross-selling and up-selling

Emerging technologies also provide a platform for airlines to improve

their merchandising capabilities, and to sell additional travel-related

products and services (e.g., hotel stays) across both direct and

indirect channels with and without GDS connections. This is because

passengers are an airline’s greatest asset as they can be sold additional

airline and non-airline products. These new technologies offer greater

flexibility to set up and manage business rules, as well as high-margin

ancillary products and more varied fare options. Here again, airlines

can personalize offers based on frequent flyer information — such as

status, flyer profile, past behavior, and so forth (see Exhibit 4).

Exhibit 4

Airlines will benet from merchandising and personalization capabilities

Note: GDS = global distribution systems, ATPCo = airline tariff publishing company.

Source: Strategy&

Standard

Enhanced merchandising

(no personalization)

Enhanced merchandising

(with personalization)

Bags

Fare

up-sell

Other

ancillary

Seats

- Flat charges as filed in ATPCo, e.g.,

fixed fee for extra legroom, no

differentiation on frequent flyer

status

- Flat fee based on number of

checked bags. Differentiation based

on destination but unable to charge

based on booking class/frequent

flyer status.

- Difficult to display “fare families,”

combination fare/simplified rules

- Limited ability to offer items not

supported by ATPCo

- Able to apply different business

rules to the ATPCo filed fares, e.g.,

by type of seat (aisle vs. window),

flight, aircraft, booking class, etc.

- Able to apply different business

rules to ATPCo filed fares

- Fully supported on condition airline

has access to an ancillary platform

that can feed requisite data into the

system

- Able to offer ancillaries, e.g., special

lounge, priority boarding, stopover

tour packages, “meet and greet”

- Able to vary offer based on

passenger frequent flyer status,

e.g., waive extra legroom charges,

offer upgrades

- Able to vary based on passenger

profile/preference as primary

criteria. Secondary criteria include

destination, class, and fare.

- Manage fare rules to protect

inventory for high-status flyers

- Personalized offers and integration

with frequent flyer programs so

passengers can buy ancillaries with

money, points, or both

16 Strategy&

Dynamic pricing

The ability to analyze big data increasingly allows airlines to predict

with a high degree of certainty when a known passenger will be ying

next, to where, and what his or her travel preferences are. For example,

airlines can use the customer data gathered in airlines’ direct channels

— e.g., customer segment, seasonality of ight, and ight timing — to

make better and more targeted oers to customers. Furthermore,

airlines can integrate this tailored pricing with marketing and

promotions in real time to optimize bidding. Fully realized, dynamic

pricing could usher in a new era of ne-tuned channel distribution

strategies.

Loyalty

Loyalty programs are the main tool for airlines to collect a wide range

of customer data. Supported by technology and increasing online

penetration, loyalty programs can be the backbone of airlines’

customer data centers. Coupled with analytical tools, these programs

allow airlines to remain closely engaged with their customers,

allowing them to build personalized offers, tailor a marketing

campaign to specific profiles, and drive the sale of ancillary products

and services. Moreover, with airline partnerships on the rise,

harmonized loyalty programs could become a key differentiator in the

marketplace.

17Strategy&

Staying on customers’ radar

To become a benefactor, not a victim, of evolving customer behavior on both

retail and business sides, of the changing dynamics within sales channels,

and of the rise of digital technologies, airlines need a holistic travel

distribution strategy that is underpinned by the smart application of

technology. Such a strategy has three main focus areas:

• Transform the travel distribution business model

• Pursue deeper partnerships with channel, content, and technology

players

• Enhance internal capabilities (operating model, processes, skills, and

technology) to engage eectively with customers to capture the

opportunities of the new distribution trends

Transform the travel distribution business model

Airlines need to redefine their travel distribution business model for

direct and indirect channels by first identifying the key challenges

(e.g., load factor, yield, and cost of sales) by cabin, by country, and by

channel, and then clearly understanding the travel distribution

environment in each country. Armed with this information, they can

address gaps in revenue performance and set priorities across direct

and indirect channels as well as loyalty programs, in order to use

distribution as a targeted tool to overcome weaknesses in their

commercial performance.

In any case, airlines need to focus on making the direct channel very

attractive for both business and leisure customers. In the leisure segment,

airlines need to showcase their products and services, and exploit big

data capabilities to deliver personalized and seamless service across

multiple platforms and devices. In the SME segment, airlines need to

deploy direct connect portals to bypass the GDS and showcase tailored

products and fares. Low-cost carriers are usually more advanced in this

regard. Therefore traditional carriers that have not yet prioritized their

direct online channel suciently, or have been hampered by the diculty

of connecting legacy IT systems to state-of-the-art websites, will benet

from improving the value of their online game.

18 Strategy&

In the various indirect channels, airlines should assume that GDS will

remain integral for the foreseeable future given the fragmented

nature of intermediaries, the access GDS provides to inventories

across multiple suppliers, and the significant investment in GDS many

travel players in the industry have made. Thus, airlines should partner

with GDS and develop technology solutions that improve their

merchandising and personalization capability to cross-sell/up-sell

through GDS-enabled indirect channels, and thereby avoid product

commoditization. In the managed travel segment for large corporate

clients, airlines should partner with travel management companies to

deploy corporate self-booking tools. Airlines can use these tools in

conjunction with any preferred carrier/tariff agreements with its

corporate clients to encourage a preference for the airline and to help

enforce corporate travel policies.

Airlines should also use loyalty programs, in both the leisure and business

segments, as a distribution tool for targeted oers and as a means of

getting to know customers’ travel needs exceptionally well. They can use

loyalty programs also to avoid commoditization by keeping customers

engaged and loyal. Loyalty programs usually work across channels in

inuencing customer behavior and create “stickiness,” but the ability to

connect and engage is highest in direct channels.

Pursue deeper partnerships

Traditional commercial arrangements between airlines and channel

players often lack opportunities to exploit synergies and align strategic

objectives. In the future, airlines will need to craft partnerships that

dierentiate them and help them maintain pricing power and develop a

stronger bond with retail and corporate customers. New distribution

models will involve strategic partnerships with channel, content, and

technology players that purposefully identify and leverage synergies

and align objectives. Distribution players can benet from those

partnerships by taking advantage of the airlines’ brand awareness and

quality in certain markets, as well as access to the airlines’ customer

base, especially those who are loyal customers.

19Strategy&

For example, airlines can form equity partnerships with traditional

travel agencies to target niche markets and customer segments in

markets such as the Middle East, which remains a high-touch/high-

yield leisure market. In other markets such as Germany, Japan, and

India, tour operators provide access to a large volume of customers

who prefer package travel.

When possible, the airlines should link agents with the airlines’ inventory

system using direct connect technologies. In addition to reducing GDS costs,

this will help bypass low-yield consolidators and allow an airline to showcase

its products and services to dierentiate itself. These solutions are also being

oered by the GDSs themselves; for example, one large technology player in

the travel industry has developed a direct connect platform that allows an

airline to connect directly with an agent via a portal.

Meanwhile, equity partnerships with TMCs give airlines access to

profitable corporate customers. The self-booking tools help enforce

corporate travel policies, and dynamic pricing capabilities help

establish the airline as a company’s preferred choice. In addition,

airlines can partner with technology providers to stay abreast of

evolving trends and be responsive to new technologies. For example,

airlines can leverage technology partnerships to enhance their

merchandising capabilities as IATA progresses with its NDC initiative.

Through its dedicated ground and travel services business, dnata,

Emirates has pursued strategic investments across specialized travel

agencies and TMCs. The acquisition of Travel Republic and Gold

Medal Travel Group (the latter also offering it access to the OTA

Netflights.com, and the travel brand Pure Luxury) has strengthened

Emirates’ position in key markets and segments.

Airlines can also partner with OTAs to gain access to high-growth

customer segments across multiple geographies. Since 2011, AirAsia

and Expedia have operated a joint venture aimed at improving

AirAsia’s distribution reach on Expedia’s storefronts. Of course,

airlines should carefully plan any partnership decision and base it

upon the intent to solve strategic travel distribution issues. The

partnership should also be beneficial to both parties.

20 Strategy&

Enhance internal capabilities

Only those airlines with sucient capabilities within this new world of airline

travel distribution will be able to seize these opportunities. The others will

experience increasing challenges and will nd it harder to retain meaningful

interaction with their customers outside of the immediate day of travel, and

will struggle to maintain sustainable prot margins.

As mentioned before, a range of partnership opportunities exists. However,

airlines will need to build, enhance, and retain a signicant spectrum of

capabilities if they do not want to hand over the key to their customer base to

online distribution partners. A capable airline will therefore need the right

level of investment in the following capabilities:

• Customer knowledge: Integration of all pieces of customer data into a

holistic view of the customer, allowing personalized oers, products,

and distribution services

• Commercial capabilities: Ability to transform customer insights into

the appropriate customer products and services — and market them

successfully

• Digital channel capabilities: Market leading digital oerings, across all

direct channels, that link product sales and information with far-

reaching access to relevant travel information and preferred social

media channels — all characterized by ease of use

• Loyalty oering: Attractive, value-adding loyalty oerings that keep

customers engaged so that they alter their booking and travel

behavior in favor of the airline

• Technology environment: A technology landscape that enables the

eective use of direct channels without major constraints — which

means moving away from the wrong enterprise architecture and old,

or inadequate, technology platforms and applications

21Strategy&

Of equal importance, however, are the right operating model,

organizational setup, and culture. These allow the airline to deploy its

capabilities in a holistic, customer-centric, and eective manner. This

would be in contrast to too many airlines that have created silos of

functional excellence in various parts of the airline that lead to no

noticeable benets for the customer. Success depends upon a:

• Customer-centric organization: Historically, marketing, sales,

distribution, pricing, data analytics, strategy, IT, and loyalty

programs have been separate functions. Often, especially in the case

of loyalty programs, they have been dierent business entities. A

closely aligned operating model that is centered on the customer can

break functional silos and enable a holistic and well-informed view of

the customer as an individual.

• Coherent customer strategy: Successful customer-centric businesses

operate around a coherent customer-centric strategy that is known to

all parts of the organization. This ensures that all of an airline’s

employees understand their specic contribution to “knowing the

customer.”

• Customer-oriented service culture: Organizations that have managed

to remain on the forefront of customer service excellence over

extended periods of time possess an inherent desire to delight the

customer. For airlines to be visible to their customers, this means that

they will use the above-mentioned capabilities to generate customer

insights that they will translate into action every day.

22 Strategy&

Conclusion

Airlines need to identify the key opportunities and challenges from

the new distribution environment, as well as the scope of their own

internal capabilities, and put a plan in place to close any gaps and

strengthen their travel distribution models. They can benefit from the

disruption of travel distribution only if they build these capabilities

and execute them in a holistic way with a smart usage of leading

technology. In most cases, this will require strong partnerships with

channel, content, and technology suppliers. Those airlines that master

the new environment will be closer to their customers and will sell

more in less competitive, direct channels than ever before. Such

proximity to the customer will minimize the risk of dropping off the

customers’ radar and losing them to the emerging travel distribution

disruptors. Instead, the emerging and new travel distribution players

will seek partnerships with airlines that succeed at this challenge,

while diminishing the other airlines to pure transport providers.

23Strategy&

Endnotes

1

“U.S. Online Travel Overview, Fourteenth Edition,” Phocuswright,

December 2014 (http://www.phocuswright.com/Travel-Research/Market-

Overview-Sizing/U-S-Online-Travel-Overview-Fourteenth-Edition).

2

“Search, Shop, Buy: The New Digital Funnel,” Phocuswright, June 2015,

page 38 (http://www.phocuswright.com/Special-Projects/2014/Search-

Shop-Buy-The-New-Digital-Funnel).

Strategy& is a global team

of practical strategists

committed to helping you

seize essential advantage.

We do that by working

alongside you to solve your

toughest problems and

helping you capture your

greatest opportunities.

These are complex and

high-stakes undertakings

— often game-changing

transformations. We bring

100 years of strategy

consulting experience

and the unrivaled industry

and functional capabilities

of the PwC network to the

task. Whether you’re

charting your corporate

strategy, transforming a

function or business unit, or

building critical capabilities,

we’ll help you create the

value you’re looking for

with speed, confidence,

and impact.

We are part of the PwC

network of firms in 157

countries with more than

208,000 people committed

to delivering quality in

assurance, tax, and advisory

services. Tell us what

matters to you and find out

more by visiting us at

strategyand.pwc.com/me.

© 2016 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further

details. Mentions of Strategy& refer to the global team of practical strategists that is integrated within the PwC network of firms. For more about Strategy&, see www.strategyand.pwc.com.

No reproduction is permitted in whole or part without written permission of PwC. Disclaimer: This content is for general purposes only, and should not be used as a substitute for consultation with

professional advisors.

www.strategyand.pwc.com