Do Managers Learn from Institutional Investors Through Direct Interactions?

Rachel Xi Zhang

xi1@wharton.upenn.edu

The Wharton School

University of Pennsylvania

1 November 2020

Abstract:

Prior evidence suggests that managers learn indirectly from stock prices, which contain private

information impounded by informed investors’ trades. However, stock price is an indirect

aggregate signal, which is likely to be insufficient for managerial learning. I propose that managers

seek out direct interactions with institutional investors as a further mechanism to learn relevant

information about their firms. Using investor conferences and investor days as the medium for

direct learning, I find that managers seek more direct interactions when they have a high demand

for information concerning industry trends and supply chain dynamics, and when they expect their

current base of institutional investors to be knowledgeable. I also predict that information learned

through direct interactions will be reflected in the manager’s subsequent corporate and personal

decisions. I find that the frequency and accuracy of management forecasts increase after direct

learning. Comparing insider trades in the same firm-month, trades executed by participating

insiders within seven days after a conference earn greater positive abnormal returns, consistent

with managers’ information set expanding as a result of their direct learning.

__________

I am very grateful to the members of my dissertation committee for their support, guidance, and

insight: Chris Armstrong, Brian Bushee (Chair), Luzi Hail, and Bob Holthausen. I thank multiple

anonymous investment professionals and a CEO of a public U.S. corporation for providing helpful

institutional insight. I thank Paul Fischer, Yanju Liu (discussant), Cathy Schrand, Frank Zhou,

Christina Zhu and participants at the 2020 Deloitte Doctoral Consortium, the 2020 AAA Annual

Meeting, and the Wharton School for helpful discussions and comments. I gratefully acknowledge

the generous financial support from the Wharton School. All remaining errors are my own. The

Internet Appendix is available at this link.

- 1 -

1. Introduction

Extant literature recognizes that managers learn from external parties about different

prospects of their own firms. The feedback effects literature also suggests that managers can glean

useful information from stock prices about investment opportunities (e.g., Chen et al., 2007;

Dessaint et al., 2019; Foucault and Fresard, 2014; Jayaraman and Wu, 2019), cash flows (Bai et

al., 2016; Subrahmanyam and Titman, 2001; Zuo, 2016), and M&A synergies (e.g., Luo 2005).

However, price as an aggregate signal is likely to be insufficient for managerial learning.

In this study, I propose that institutional investors are the source of relevant information

and examine whether direct manager-investor interactions serve as a mechanism for managerial

learning. Institutional investors are important external capital providers for the firm. They are often

knowledgeable about industry trends, product-market peers, and supply chain dynamics,

especially when they are invested in these sectors.

1

All of this information can be relevant for the

manager, who might not have perfect knowledge about every decision-relevant aspect of the firm

(e.g., Ben-David et al., 2013; Hutton et al., 2012).

The notion that external capital suppliers can provide useful information to managers has

been documented in several specific settings: namely between venture capitalists and early

entrepreneurial firms (see Da Rin et al., 2013 for useful reviews) and during extreme forms of

shareholder intervention initiated by hedge fund activists (e.g., Brav et al., 2008). Yet beyond these

specific settings that involve either a subset of firms or an infrequent form of intervention, there is

little evidence on institutional investors as a source of relevant information for managerial learning,

despite the fact that they regularly interact with managers of public U.S. firms (Brown et al., 2016).

1

Prior work on institutional cross-holdings recognize that the scale of information gathering and production allows

institutions holding shares in multiple firms in the same industry to enjoy an information advantage (He and Huang,

2017; Kang et al., 2018).

- 2 -

I examine direct managerial learning from institutional investors, using public and private

meetings at investor conferences and investor days as the medium for interactions.

Investor

conferences bring together informed participants with potentially complementary information to a

well-defined physical setting and facilitate two-way information exchange.

2

Managerial learning

from investors can occur in two ways. First, while managers usually do not ask questions during

conference presentations, they can learn about investors’ opinions by seeking feedback and

soliciting questions from investors. By presenting different aspects of the firm during public

management discussions and by providing detailed answers during public questions-and-answers

sessions, managers can gather relevant feedback from investors. Second, managers can make

themselves available for private breakouts and one-on-one meetings, which allows for in-depth

discussions around more proprietary topics. Such interactions enable information exchange, and

the potential complementarities between managers and institutional investors’ information

facilitate direct managerial learning.

The empirical challenge to provide evidence of learning is that it is inherently unobservable

and thus cannot be measured directly. Researchers can, however, observe the entire content of

discussions during public meetings and the occurrence of private meetings at investor conferences.

Utilizing 56,924 transcripts gathered for Russell 3000 companies, I develop six empirical proxies

to measure the extent of interactions and to estimate the degree of information flow between

investors and managers. This is because interaction and information flow are the necessary

conditions for learning to occur. I conduct two sets of empirical analyses to provide evidence of

learning from direct interactions. First, I examine whether managers seek more direct interactions

when they have a higher demand for information that institutional investors are likely to possess.

2

For the rest of the document, I use the phrase “investor conferences” to refer to both investor conferences and investor

days broadly.

- 3 -

Second, I examine whether information learned through direct interactions is reflected in two

subsequent managerial decisions: management forecasts and insider trades.

To test my first prediction, I start by examining specific types of information demand,

namely demand for information concerning product-market peers and demand for information

about suppliers and customers. Managers often need to pay attention to the actions of their peers

in formulating product-market strategy, as well as monitor supply chain conditions (Bernard et al.,

2019; Dessaint et al., 2019; Foucault and Fresard, 2014). As a result, they are likely to have a

higher information demand when there is an increase in product-market activities among either

peer firms and connected firms on the supply chain. Therefore, I capture a manager’s demand for

peer (supply chain) information using the frequency and the magnitude of product-market

announcements made by peer firms (suppliers and customers). In a panel of 73,262 firm-quarter

observations constructed using firms covered in transcripts sample, I use a within-firm research

design and find that the six proxies of direct interactions are positively associated with measures

of managers’ information demand. This relation is robust to controlling for investors’ demand for

information and other capital market incentives for managers to provide investor access. Next, I

develop a measure that captures managers’ revealed overall uncertainty about the firm’s operations,

utilizing earnings conference calls whereby managers need to respond in real-time questions about

the firm’s recent performances and future outlooks. Consistent with my prediction, I find that

managers are more likely to seek direct interactions when they face higher uncertainty.

While these results are suggestive of managerial learning, concerns over omitted correlated

variables exist. To mitigate such concerns, I develop cross-sectional hypotheses that would be

expected under learning but are difficult to be explained by alternative theories. Specifically,

managers should have higher incentives to seek direct learning when they expect that their

- 4 -

institutional investors are knowledgeable, and specifically with regard to the types of information

that the manager demands. Therefore, I partition the sample based on managers’ expectations of

the amount of product-market and supply chain knowledge their institutional investor base is likely

to possess, whereby investor knowledge is measured using their portfolio holdings and trading

activities in the respective industries. Consistent with direct learning, I document a stronger

positive relation between demand for product-market (supply chain) information and proxies of

direct interactions when institutional investors are knowledgeable about the product-market

(supply chain industries) and find no relation when institutional investors are not.

In my second set of analyses, I investigate whether information learned through direct

interactions is reflected in subsequent managerial decisions. Because a manager’s private

information set is inherently unobservable, I focus on two decisions that can serve as a window to

the manager’s information set: the frequency and accuracy of management forecasts, as well as

the timing and profitability of insider trades. I chose these decisions because they are sensitive to

the acquisition of investors’ sector knowledge, have information content, and are ex-post verifiable

(Brochet, 2010; Hoskin et al., 1986; Lakonishok and Lee, 2001; Rogers and Stocken, 2005).

I predict that direct learning helps managers to better project future operations and,

therefore, to issue more management forecasts and more accurate forecasts. Managers are unable

to guide when they do not have enough information to forecast future operations with a sufficient

degree of accuracy (Waymire, 1985). Institutional investors’ information can be relevant because

management forecasts incorporate firm-specific, macroeconomic, and sector information (Bonsall

et al., 2013). Using a similar within-firm design, I find that, following direct interactions, managers

issue more management forecasts and more accurate earnings-per-share (EPS) forecasts. These

results suggest that information acquired from such interactions helps to improve the manager’s

- 5 -

private information about the firm’s future cashflow, and therefore, the precision of his forecasts.

The increase in management forecasts is robust to using only forecast revisions, which are unlikely

to be driven by investors demanding new information at the conference, as well as controlling for

the need to avoid Regulation Fair Disclosure (Reg FD) violations.

Moreover, trades by corporate insiders often reflect their private information about the

firm’s future cash flow (Ke et al., 2003; Piotroski and Roulstone, 2005; Seyhun, 1992). Therefore,

I predict that information learned through direct information should be reflected in the timing and

profitability of that manager’s insider trades. In a sample of 28,632 open-market insider

transactions within two months before or after a conference, I find that executives who participated

in an investor conference (i.e., participating insider) are more likely to utilize their information

advantage and trade in the seven-day post-conference window. Next, I examine insider trading

profits, which reflect the trading manager’s private information, and compare trades made with the

benefit of direct learning against those without. I focus on the narrow window of trades made in

the same month for a given firm, which controls for all possible omitted correlated variables that

do not vary within a given firm-month. I find that trades made by participating insider within the

seven-day post-conference window earn more positive abnormal returns. This comparison is made

against trades executed by (i) non-participating insiders of the same firm or (ii) participating

insiders outside of the conference window. Overall, my evidence suggests that direct learning has

expanded the private information set of participating insiders.

3

My study contributes to several streams of literature. First, I contribute to the literature on

management-investor interactions. Prior studies focus almost exclusively on the transfer of

3

A potential alternative explanation is that managers can anticipate investors’ trades to information disclosed during

direct interactions, and therefore sell (buy) before negative (positive) investor reactions. I conduct two analyses,

described in more detail in section 4.3.2, to distinguish from this alternative explanation.

- 6 -

information from managers to investors during these interactions and the associated benefits to

brokers, investors, managers and the firm (Bushee et al., 2020, 2017, 2011; Green et al., 2014a,

2014b; Solomon and Soltes, 2015). However, the literature has largely neglected the potential for

information transfers in the other direction: from investors to managers. Also, my study documents

another benefit of disclosure: that voluntary disclosure of information during direct investor

interactions (e.g., by presenting different aspects of the firm and by providing longer answers to

questions) helps managers to elicit valuable feedback. A related study is Jayaraman and Wu (2019),

which examines the use of voluntary disclosure in a different setting where managers use capital

expenditure forecasts to solicit market-feedback.

Second, my study complements the learning from price literature (e.g., Chen et al., 2007;

Edmans et al., 2017). While price serves to aggregate information in the financial market, it is

likely insufficient for managers to learn about multiple dimensions of their firms because price

contains noise, and the process of aggregation results in a loss of dimensionality (Bond et al., 2010;

Dessaint et al., 2019). Edmans et al. (2017) show that what matters for learning is information in

prices that managers do not already know, suggesting a role for informed investors’ private

information. My study complements such evidence by documenting institutional investors as a

source of relevant information for managerial learning.

Third, my study provides large-scale evidence on how institutional investors can provide

useful information to managers. Prior literature recognizes that venture capitalists and hedge fund

activists offer value-add advice to their portfolio firms (see Brav et al., 2015a; Da Rin et al., 2013

for useful reviews). However, both venture capitalists and activists are only involved with (and

therefore can only influence) a limited subset of firms. On the other hand, most public U.S. firms

regularly interact with institutional investors, and learning can happen without costly intervention.

- 7 -

As a result, managerial learning from institutional investors may be a more prevalent and

widespread phenomenon, despite very little empirical evidence so far. Moreover, my findings

contribute to the institutional cross-holding literature by documenting an associated benefit: that

institutional investors’ industry expertise and sector knowledge, arising from holding shares in

multiple firms, can be a valuable source of information for the manager.

2. Relevant Literature and Institutional Background

2.1. Managerial learning from external sources

Prior literature recognizes the notion that managers can and do learn from information

possessed by external parties about the prospects of their firms, and the sufficient condition for

managerial learning to take place is that the manager does not have perfect information about every

decision-relevant aspect. For example, Hutton et al. (2012) suggest that managers have less

accurate macroeconomic information than sell-side analysts. Ben-David et al. (2013) show that

managers are often miscalibrated in predicting stock market returns.

The feedback effects literature suggests that managers might learn from stock prices, which

aggregate information impounded by informed traders, about their own firms (e.g., Chen et al.,

2007; Jayaraman and Wu, 2019; Luo, 2005; Zuo, 2016) or about their peers (Dessaint et al., 2019;

Foucault and Fresard, 2014). However, even if one assumes that the market is strong-form efficient

and price serves as an aggregate signal of all dispersed sources of information, learning from price

alone is likely to be insufficient for managers to make corporate decisions. First, price is a noisy

signal about the firm’s prospects, and managers have limited abilities to distinguish information

from noise when using price as a signal (Dessaint et al., 2019; Morck et al., 1990). Second,

managers might require granular information that cannot necessarily be extracted from prices as

the process of aggregation results in a loss of dimensionality. Third, prices can reflect multiple

- 8 -

equilibria such that there is no one-to-one mapping between managers’ decisions and prices (Bond

et al., 2010). Last, institutional investors might not trade on some information that they possess

(Edmans et al., 2015).

4

Therefore, the information contained in price alone is likely to be

insufficient and needs to be supplemented with other sources of information, and this paper seeks

to examine direct interactions with institutional investors as a further mechanism of learning.

5

2.2. Institutional investors as a source of useful information for managerial learning

The notion that external capital suppliers can offer useful information and advice to their

portfolio companies has been documented in two specific settings, which either involve early-stage

entrepreneurial firms or is via an extreme form of shareholder intervention.

The first setting involves venture capitalists (VC). VCs are often involved in the operations

of the early-stage startups that they invest in by sitting on the board of directors, assisting with

talent recruitment and future funding raising, and offering advice to management (see Da Rin et

al. (2013) for a review). The second setting involves an infrequent and costly form of intervention

-- hedge fund activism. For instance, Brav et al. (2008) document that activist hedge funds can

propose strategic, operational, and financial remedies to their target firms.

Yet beyond these specific settings that either involves a subset of firms or an infrequent

form of intervention, institutional investors regularly interact with managers of public U.S.

corporations. I focus on institutional investors because they have superior information gathering

and processing abilities and often possess knowledge that is useful to the manager, including

industry trends, product-market knowledge, and supply chain dynamics. Prior work on

4

Edmans et al. (2015) show that when firm values are endogenous to trading, feedback effects serve as a limit to

arbitrage -- speculators profit less from selling on negative information when decision-makers can increase the value

of the underlying assets by using the information revealed through informed trading.

5

Prices might be a sufficient confirmatory signal for some decisions that require a simple “good” or “bad” signal, for

instance, whether to proceed with an acquisition (Zuo, 2005) and whether to adjust up or down capital expenditures

(Jayaraman and Wu, 2019).

- 9 -

institutional cross-holdings recognizes that institutions holding shares in multiple firms often

achieve scale in information gathering and production (e.g., He and Huang, 2017; Kang et al.,

2018). In a survey of 344 buy-side analysts, Brown et al. (2016) show that industry knowledge and

primary research are the two most important sources of information in generating stock

recommendations. Their results suggest that part of institutional investors’ information advantage

comes from gathering and analyzing information beyond company disclosure.

2.3. Manager-investor interactions at investor conferences

Manager-investor interactions can happen through (i) public meetings at investor

conferences, (ii) private meetings following public meetings at investor conferences, and (iii)

private non-deal roadshows and in-house meetings (Solomon and Soltes, 2015). In this paper, I

focus on public and private meetings at investor conferences as the medium for manager-investor

interaction for several reasons. First, compared to in-house meetings and non-deal roadshows,

investor conferences bring together many investors with diverse backgrounds and expertise, which

in turn facilitates managerial learning. Bushee et al. (2011) examine investor conference as a

“disclosure milieu” and find that cross-sectional variations in its information content depend on

the composition of its audience. Their study highlights the role of the audience’s private

information in determining the extent of information flow during conferences. Second, the entire

content of discussion during public meetings at investor conferences is observable from conference

transcripts, which allow researchers to develop multiple empirical proxies to estimate the extent

of information flow between investors and managers. Moreover, while the occurrence of in-house

meetings or non-deal roadshows is generally unobservable for companies in the United States,

researchers can identify the occurrence of private meetings at investor conferences using

conference transcripts.

- 10 -

Public meetings at investor conferences usually start with managers making prepared

remarks on the firm’s overall strategy in the Management Discussions sessions, followed by

Questions-and-Answers (Q&A) sessions for managers to respond to questions raised by investors.

Managers are careful not to release details on recent information events because of concerns over

Reg FD (Bushee et al., 2011). Outside of public meetings, some conference organizers give

attending firms the option to meet with investors privately, through either one-to-one meetings

throughout the day or breakout sessions after the public presentation (Bushee et al., 2017).

There are a number of ways the managers can learn from investors during investor

conferences. First, investors often express their views during Q&A sessions, and managers can

encourage such discussions when they are more willing to entertain questions. Second, while

public meetings generally do not allow managers to ask a question, managers can present relevant

aspects of the firm and learn from investors’ reactions and feedback. Moreover, such management

presentations can attract investor attention, encourage participation at Q&As, and encourage

attendance at breakout sessions, all of which will, in turn, facilitate managerial learning. Finally,

private breakouts and one-on-ones sessions allow managers to ask explicit questions, and the

closed-door environment facilitates discussions around proprietary investment thesis that investors

might not be willing to share otherwise (Park and Soltes, 2018).

While investor conferences are viewed as a predominant venue for manager-investor

interaction, prior studies primarily focus on the transfer of information from managers to investors

at conferences and the associated benefits. Brokers, analysts, and investors benefit from selective

(and possibly private) access to management. Specifically, brokers and analysts that have access

to management are able to issue more informative research (Green et al., 2014b), earn higher

commission revenue (Green et al., 2014a), while equity investors can make profitable trades

- 11 -

(Bushee et al., 2018, 2017; Solomon and Soltes, 2015). At the same time, participating firms derive

capital-market benefits, including increased analyst following, institutional ownership, and

improved liquidity (Bushee et al., 2018, 2011; Green et al., 2014a). My study differs from prior

literature because I document information flowing from investors to managers at conferences.

3. Sample Construction

I collect investor conference transcripts for firms that are included in the Russell 3000

index from Factset CallStreet and Thomson StreetEvents.

6

My sample period starts in 2004

because the coverage of both datasets becomes much more comprehensive after the passage of

Reg FD and ends in 2017, the last year with valid data from various data sources. Using Russell

3000 firms allows me to select a sample of firms that are medium to large in size, included in a

major index, relatively liquid, and have good visibility among investors. Such firms, therefore, can

choose when and how often to attend conferences. This procedure yields 56,924 transcripts.

The unit of analysis in most of my empirical tests is at the firm-quarter level (except for

the insider trading analysis, which is conducted at the insider trades level).

7

I construct the firm-

quarter panel by gathering quarterly financial and market information from Compustat/CRSP from

2004 to 2017 for all firms that appear in the transcript sample. For firm-quarters during which no

transcripts are available (in other words, without any conferences), I only retain an observation if

it occurs within two years before or after a conference to avoid any bias in the data providers’

coverage that might be correlated with product-market activities or properties of management

forecasts. This approach also serves to mitigate concerns that any results are driven by systematic

6

Factset CallStreet covers more firms than Thomson StreetEvents. Therefore, I start the data-collection process with

Factset and for firms that are not covered in Factset CallStreet, I obtain transcripts from Thomson StreetEvents. To

eliminate bias introduced by Russell index re-constitution, if a firm is evered included in the Russell 3000 index, I

include it for the entire sample period (to the extent that data is available).

7

Section 4.3.2 provides details of the sampled used in the insider trading analysis.

- 12 -

changes in a firm’s policy towards attending investor conferences. This procedure results in 73,262

firm-quarter observations from the sample of 56,924 transcripts.

8

I obtain data on analyst coverage

and management forecasts from I/B/E/S, institutional investors’ holdings and trades data from

Thomson-Reuters 13F, supply chain information from Factset Revere, earnings conference call

transcripts from S&P Capital IQ, and insider trading data from Thomson Insiders. Requiring data

coverage from these additional databases results in a smaller sample in some analyses.

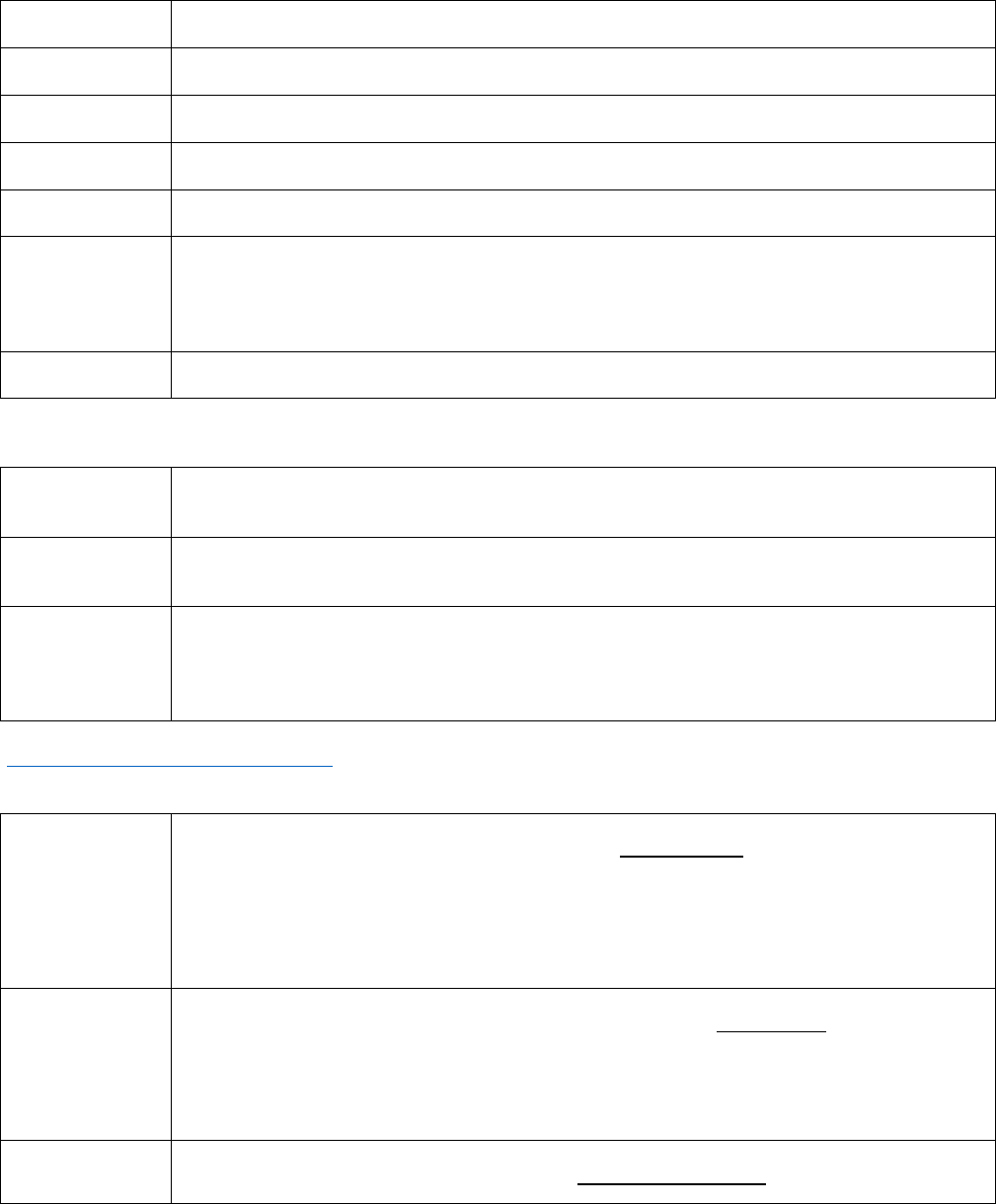

Table 1 presents the descriptive statistics of the transcript sample. Panel A (B) shows the

frequency of transcripts by year (quarter). The number of transcripts increases gradually over time.

It is more concentrated in 2010 to 2013 and during the second quarter, suggesting the importance

of controlling for common time trends across years and quarters throughout my empirical analyses.

4. Research Design

To provide evidence of managers learning, I develop two sets of analyses. First, I examine

whether managers seek more direct interactions when they have a high demand for certain types

of information that they expect their current base of institutional investors to possess. Second, I

examine whether information learned through direct interactions is reflected in subsequent

decisions made by the manager, namely, the frequency and accuracy of management forecasts and

the timing and profitability of insider trades. Next, I describe my empirical analyses in detail.

4.1. Measures for managers–investors interaction

Utilizing conference transcripts, I develop six empirical proxies to measure the frequency

of interactions and to estimate the degree of information flow between investors and managers,

building on the premise that interactions and information flow are the necessary conditions for

8

For firm-quarters without any conference attendance, all proxies of direct interactions will take a value of 0. In

robustness analysis presented in the Internet Appendix, I repeat my analyses by only retaining firm-quarters with at

least one conference occurrence. My results and inferences remain unchanged.

- 13 -

learning to occur. First, I measure the frequency of interactions using the number of investor

conferences that a firm has attended during a fiscal quarter (NumInteract). Second, the degree of

information flow is a function of who is present at such meetings, and firms have control over how

much resources, in terms of managerial time, to put in a conference. I measure the number of total

corporate participants (NumExecs) and the number of times that the CEO has attended an investor

conference during a fiscal quarter (CEO). Next, as managers can attract investor attention, gather

feedback, and solicit questions by presenting different aspects of the firm, I measure the total

number of words in the management discussion session(s) of all conferences that a firm has

attended during a fiscal quarter (MDWords). Investors often express their views during Q&As, and

managers’ willingness to entertain questions can, in turn, facilitate a more active discussion.

Therefore, I calculate the average number of words in answers provided per question during the

Q&A session(s) of conferences that a firm has attended during a fiscal quarter (AnsPerQ). In

addition, firms that invest more managerial time to meet with different investors privately are more

likely to benefit from such closed-door discussions. I compute PrivateMtg, which is the number

of conferences whereby the firm offers private meetings during a fiscal quarter. To identify private

meetings, I follow the procedure described in Bushee, Jung, and Miller (2017) and search through

transcripts that mention “one-on-one” or “breakout” (and all common variants), or an indication

in the last few lines of the transcript that mentions “moving to another room” (or other wording

that would indicate the presence of a breakout session). Finally, I extract the first principal

component of the above-mentioned six measures (Direct Interaction). Principal component

analysis reduces the individual variables into a common factor that accounts for most of the

variance in the observed measures of direct interactions. It helps to reduce data dimensionality

while preserving the most important information from the data sources (Abdi and Williams, 2010).

- 14 -

Table 2 Panel A presents the descriptive statistics for the above-mentioned proxies. The

full sample consists of 73,262 firm-quarter observations. For firm-quarters without any conference

occurrence, all proxies of interactions take the value of zero. Descriptive evidence suggests that

managers interact with investors regularly, through public or private meetings at investor

conferences. The average number of manager-investor interactions is 0.678 per quarter, with 18%

of quarters have more than one interaction (NumInteract). The number of times that a CEO attends

a conference is 0.412 per quarter (CEO), and the average number of times that a firm offers private

meetings is 0.187 per quarter (PrivateMtg). On average, 1.041 corporate executives interact with

investors at conferences in a quarter (NumExecs). In the full sample (including quarters without

any interactions), the mean value of AnsPerQ (MDWords) is 66 words (2,480 words).

Conditioning on attending a conference, managers, on average, answer 144 words per question

asked, and the median is 136 words per question asked (un-tabulated). The management discussion

session usually runs slightly longer, and the mean (median) number of words per conference is

3,729 (3,228) words (un-tabulated). Table 2 Panel B presents the respective factor loadings of the

six proxies in the first principal component, Direct Interaction, and all six proxies load positively.

Direct Interaction has an eigenvalue of 4.31 and explains 72% of the variance.

4.2. Incentives for learning

Providing investor access is costly for the firm, as it occupies the managers’ time and the

firm’s resources (Kirk and Markov 2016). As a result, managers are willing to incur such costs

when they have a high demand for types of information that they expect external parties to possess,

such that the perceived net benefit of direct learning is high. In this section, I develop three distinct

and complementary empirical proxies to capture a manager’s information demand. I first examine

two specific situations whereby the manager is likely to be at an information disadvantage because

- 15 -

of changes in the firms’ external competitive and operating environment. The advantage of these

two proxies is that they focus on specific sources of information uncertainty, allowing me to

develop corresponding measures that capture investors’ supply of the relevant information in

subsequent cross-sectional analyses. However, these proxies capture a manager’s uncertainty

indirectly and rely on the assumption that the manager is indeed put into an information

disadvantage when there are changes to the firm’s external environment. Therefore, to complement

these two proxies, I develop a direct measure that captures the overall realization of a manager’s

uncertainty about the firm’s future operating prospects

4.2.1. Demand for product-market information

Managers often need to pay attention to the actions of their peers in formulating product-

market strategy (Bernard et al., 2019; Dessaint et al., 2019; Foucault and Fresard, 2014). For

example, Bernard et al. (2019) document that firms search for public disclosure of peer firms who

operate in a similar product-market space and when there are investment opportunities, suggesting

the relevance of peer information in making investment and product decisions. Consequently,

managers are likely to have higher information demand when there is an increased amount of

product-market activities among their peer firms. The intuition is that when a peer firm makes a

product-market announcement, managers want to know about the circumstances surrounding that

decision. Institutional investors can possess relevant information because they have superior

information processing abilities and enjoy scale economies in acquiring sector-related information.

Therefore, I measure the frequency and the impact of product-market announcements made

by the focal firm’s peers to capture the focal firm manager’s demand for product-market

information. For each focal firm, Demand for Prd Mkt Info is the sum of absolute announcement-

day adjusted stock returns of product-market announcements made by its peer firms during a fiscal

- 16 -

quarter, scaled by the total number of peers.

9

Using adjusted returns allows me to capture variations

in the significance of these announcements and essentially place higher weights on announcements

that are more important, thus generating greater stock market reactions. I use Hoberg-Phillips text-

based network industry classifications to define peer firms (Hoberg and Phillips, 2016, 2010).

4.2.2. Demand for supply chain information

A production network is an important form of inter-firm linkages that can transmit

production shocks from suppliers and demand shocks from customers (Acemoglu et al., 2012;

Barrot and Sauvagnat, 2016). Therefore, a firm’s suppliers and customers are important and

economically connected firms. When there is an increased level of product-market activities from

such connected firms, managers are likely to demand more information about their upstream and

downstream industries. Therefore, similar to Demand for Prd Mkt Info, I capture managers’

demand for supply chain information using the sum of the absolute adjusted announcement-day

returns of product-market announcements made by the focal firm’s direct suppliers and customers,

scaled by the total number of suppliers and customers (Demand for Supply Chain Info. I obtain

information on a firm’s suppliers and customers from Factset Revere.

4.2.3. Managerial uncertainty

Next, I develop a proxy that directly measures a manager’s revealed uncertainty with

respect to the firm’s future operating prospects, exploiting a situation whereby the manager has to

respond on-the-spot to questions raised by investors during the Q&A sessions of an earnings

conference call. Unlike the previous two measures (which focus on specific scenarios that are

likely to give rise to higher managerial uncertainty), this measure directly captures the ex-post

realization of a manager’s overall uncertainty, encompassing all potential sources.

9

The purpose of scaling is to make sure this measure captures the frequency and the magnitude of peer activities on

a per-peer-firm basis, and does not merely reflect a firm having more product-market peers.

- 17 -

An earnings conference call is an important disclosure event that often involves real-time

information exchange between investors and managers (Gow et al., 2019). Compared to other

forms of written disclosure that are carefully prepared and reviewed beforehand, the Q&A sessions

represent a situation of real-time and dynamic information exchange that is more likely to reveal

a manager’s uncertainty about the firm’s future operations. Therefore, I calculate Managerial

Uncertainty, which is the proportion of answers that contains at least one uncertain word during

the Q&A sessions of the earnings conference call for a given fiscal quarter. An uncertain word is

defined using the Loughran and McDonald sentiment wordlist (Loughran and Mcdonald, 2011).

4.2.4. Empirical specification

I estimate the following OLS model to investigate the relation between managers’ information

demand and direct interactions:

where denotes firm, denotes quarter,

denotes firm dummies,

denotes calendar-year-

quarter dummies and

denotes fiscal quarter dummies. Manager Information Demand is either

Demand for Prd Mkt Info, Demand for Supply Chain Info, or Managerial Uncertainty. Direct

Interactions measure the frequency of manager-investor interactions, as well as the degrees of

information exchange between investors and managers using the six empirical proxies described

in section (4.1): NumInteract, CEO, NumExecs, MDWords, AnsPerQ, PrivateMtg, and the first

principal component, Direct Interaction.

One concern is that managers might attend more conferences (i.e., provide more investor

access) when investors are demanding information. Therefore, in the vector of control variables

(X), I include proxies for investors’ demand for information and previously identified capital-

market incentives that motivate a manager to increase investor access (i.e., these are incentives for

- 18 -

a manager to “teach,” instead of to learn). Larger firms (Size), firms with more institutional

investors (Inst. Ownership), and analyst following (Analyst) are likely to have greater visibility

among equity investors. I control for the firm’s financing (Financing) and M&A activities (M&A),

as managers have strong disclosure incentives around these activities (Lang and Lundholm, 2000).

I control for profitability, growth, and potential uncertainty over the firm’s undervaluation,

including firm age (Firm Age), the book-to-price ratio (BM Ratio), leverage ratio (Leverage), an

indicator for loss-reporting firms (Loss), whether the firm operates in a high-technology industry

(High Tech), adjusted returns (Ret), return volatility (Ret Vol), R&D expenditure (R&D) and

intangible assets (Intangibles) (Bushee et al., 2011; Green et al., 2014a; Kirk and Markov, 2016;

Koh and Reeb, 2015). Investors might demand more information when the firm has a complex

business model or is undergoing changes to its operations; I control for the number of segments

(Segments) and an indicator for restructuring (Restructuring). To mitigate concerns that activities

of firms operating within the same product-markets are correlated, and therefore an increase in

direct interactions is driven by investor demanding for more information, I control for the firm’s

own product-market activities using the number of product-market announcements (AnnFreq) and

the sum of absolute market-adjusted announcement-day returns (AnnAR).

I estimate equation (IC1) with individual firm dummies to rule out concerns that certain

types of firms are more likely to attend investor conferences. I include a separate dummy for each

calendar-year-quarter combination to control for time-variant macroeconomic trends that could

both affect general product-market activities and the occurrence of investor conferences. I include

separate dummies for each of the four fiscal quarters to address concerns that seasonality in the

product market might be correlated with firms’ propensity to attend conferences over different

fiscal periods of the year.

- 19 -

4.2.5. Results and discussions

Table 2 presents descriptive statistics for the variables used in the subsequent empirical

analysis using a firm-quarter as the unit of analysis. The full sample consists of 73,262 firm-quarter

observations. Further requiring data coverage from various databases result in a reduction in

sample size for some of the variables. The firms in my sample are relatively large, with an average

(median) asset size of $5,630 million ($1,313 million), and have eight covering analysts on average.

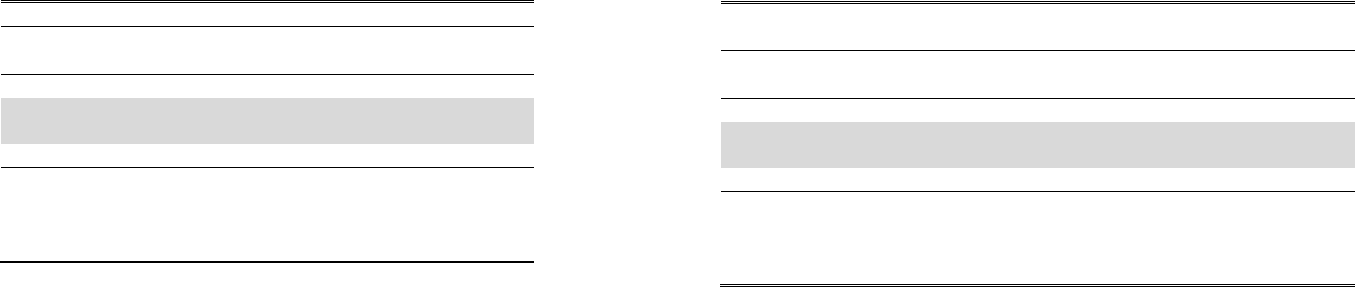

Table 3 presents the results of this analysis. Panel A investigates the association between

managers’ demand for product-market information and direct interactions, controlling for the

firm’s own product-market activities. The coefficient on Demand for Prd Mkt Infois positive

across all six proxies of direct interactions, as well as their first principal component, Direct

Interaction. It is significant under 1% (10%) significance level for three (four) out of the six

proxies, as well as for the principal component, Direct Interaction, consistent with my hypothesis

that managers seek more direct interactions with investors when there is greater need to gather

information about their peer firms. In column (7), the point estimate on Demand for Prd Mkt Info

is 1.216, which suggests that one standard deviation increase in Demand for Prd Mkt Info is

associated with a 0.029 (1.216*0.024/1.009) standard deviation increase in Direct Interaction,

ceteris paribus. The coefficients on the control variables have the expected signs: larger and more

mature firms, firms with more institutional investors, higher analyst coverage, and more product-

market activities are more likely to provide investor access.

Panel B examines the association between managers’ demand for supply chain information

and direct interactions. The reduction in sample size in Panel B (and subsequently in Panel C) is

because of requiring coverage from Factset Revere (Capital IQ transcripts) for the computation of

Demand for Supply Chain Info (Managerial Uncertainty). The coefficients on Demand for Supply

- 20 -

Chain Info are positive across all proxies and are significant under 5% under four out of six, as

well as for the first principal component, Direct Interaction. Compared to Demand for Prd Mkt

Info, the economic significance of Demand for Supply Chain Info is smaller. The point estimate of

0.665 in column (7) translates to one standard deviation increase in Demand for Supply Chain Info

is associated with a 0.018 (0.665*0.027/1.009) standard deviation increase in Direct Interaction,

ceteris paribus. Consistently, the results suggest that managers seek more direct interactions when

they have a higher demand for information regarding their supply chain industries.

Panel C presents the analysis from investigating the association between the managers’

overall uncertainty and direct interactions. The coefficients on Managerial Uncertainty are

consistently positive and significant under 10% across five out of the six empirical proxies of direct

interactions, consistent with the notion that managers seek more direct interactions when they face

higher uncertainty. The economic magnitude is comparable to that of Connected Firm Activities,

with one standard deviation increase in Managerial Uncertainty is associated with 0.013

(0.068*0.202/1.009) standard deviation increase in Direct Interaction, ceteris paribus.

In the Internet Appendix, I present alternative specifications that address concerns raised

by (i) the decline in the number of conferences during the financial crisis in 2007 and 2008 and (ii)

implications from inter-firm information transfer. My results and inferences remain unchanged.

4.2.6. Cross-sectional analyses

The previous two sections focus on the manager’s information demand when it is driven

by a specific source of uncertainty, either related to (i) the product market that the firm operates in

or (ii) the firm’s upstream and downstream industries. Consequently, we would expect that the

extent of the manager’s propensity to resolve their information uncertainty through direct learning

from institutional investors depends on their expectation of how knowledgeable their investors are

- 21 -

in these specific areas. Therefore, in the section, I develop explicit proxies to capture investors’

supply of information about the firm’s product market as well as its supply chain industries.

First, when the source of information uncertainty arises from product-market peers, I

partition the sample based on managers’ expectations of the amount of product-market knowledge

that their current institutional investor base is likely to possess.

10

I estimate institutional investors’

product-market knowledge using their dollar investments (Prd Mkt Hldgs) and dollar trading

activities (Prd Mkt Trades) in the focal firm’s product-market peer firms:

where is the set of all institutional investors that hold at least 1% of the total common shares

outstanding in the focal firm , is the set of all product-market peer firms of the focal firm .

Product-market peer groups are defined using Hoberg-Phillips text-based industry classification.

11

is the total number of product-market peer firms. Dollar Holdings (Dollar Trades) is investor

’s dollar holdings (quarterly dollar trades) in firm , averaged over all 13F reports made over the

trailing 12 months ending before the start of the fiscal quarter, .

Correspondingly, when managers demand more sector-related information about upstream

and downstream industries, I develop measures to capture the investors’ knowledge for supply

chain industries using the following formulae:

10

Because managers do not know which investors will attend a conference beforehand, using the current investor

base captures the manager’s expectation of investor attendance.

11

I focus on institutional investors that hold more than 1% the firm’s shares because these investors are more likely

to interact with managers during an investor conference. I do not restrict holding size in peer firms.

- 22 -

where is the set of all SIC 4-digit industries whereby the focal firm has at least one direct

supplier or one customer. is the set of all institutional investors that hold at least 1% of the total

common shares outstanding in the focal firm . Industry Dollar Holdings (Industry Dollar Trades)

is the dollar holdings (quarterly dollar trades) in industry by investor , averaged over all 13 F

reports made over the trailing 12 months ending before fiscal quarter .

is the number of direct

suppliers and customers in industry .

I hypothesize that the positive association between managers’ demand for product-market

(supply chain) information and direct interactions is stronger when managers expect their

institutional investors to be knowledgeable about the product market (supply chain industries).

Table 4 panel A (Panel B) examines the relation between Demand for Prd Mkt Info (Demand for

Supply Chain Info) and direct interactions, dividing the sample in Table 3 Panel A (Panel B) based

on the median value of investors’ product-market knowledge (supply chain industry knowledge).

12

Requiring coverage in Thomson-Reuters 13F to compute investors’ portfolio holdings and trades

results in a reduction in the size of the respective sample (see Table 2 for descriptive statistics).

Consistent with my predictions, I find that the relation between Demand for Prd Mkt Info (Demand

for Supply Chain Info) and direct interactions is positive and significant only when investors are

more knowledgeable about product-market firms (supply chain industries). Further, the economic

magnitude of Demand for Prd Mkt Info in the high sub-sample is about two times larger than that

in the full sample in Table 3, with one standard deviation increase in Demand for Prd Mkt Info is

12

For parsimony purposes, I only present the results using the component score, Direct Interaction, as the dependent

variable. However, my inferences remain unchanged if using individual proxies (NumInteract, CEO, NumExecs,

AnsPerQ, MDWords, PrivateMtg).

- 23 -

associated with around 0.05 standard deviation increase in Direct Interaction.

13

The F-statistics

comparing the coefficients on Demand for Prd Mkt Info across the two subsamples is 3.878 (p-

value: 0.049) when using Prd Mkt Trades as the proxy for investors’ product-market knowledge

and 4.531 (p-value: 0.033) when using Prd Mkt Hldgs. For Demand for Supply Chain Info, the F-

statistics between the two sub-sample is 2.473 (p-value: 0.116) when using Supply Chain Trades

to capture investors’ supply chain information, and 2.885 (p-value: 0.090) for Supply Chain Hldgs.

4.2.7. Alternative specifications using conference-quarter only

The sample in my main analyses includes any firm-quarters as long as they occur within

two years of a conference for a given firm. This design choice captures variations in a manager’s

decision to attend an investor conference, which is an important element of a manager’s decision

set because conference attendance is costly in terms of firm resources and managerial time.

However, one possible concern is that broker-hosted conferences are primarily by-invitation.

While big firms are invited to most conferences (and therefore, their managers have the choice to

attend or decline), smaller firms might not have control over when and to which conference they

are invited. While I restrict my sample to a group of relatively liquid firms with good visibility

among investors (i.e., the Russell 3000 universe), this might remain a concern among the smaller

firms in my sample. Therefore, in the Internet Appendix, I repeat the analyses in Table 3 to Table

5 using the smaller sample of firm-quarters with at least one conference and focus on variations in

the amount of managerial time invested and the degrees of information exchange between

investors and managers, conditioning on attendance. My results and inferences remain unchanged.

4.3. Consequences of learning

13

The calculation of standardized coefficient is based on the respective standard deviation of Demand for Prd Mkt

Info and Direct Interaction in the sub-sample.

- 24 -

In the following sections, I investigate whether and how information learned through direct

interactions is reflected in the manager’s subsequent decisions. While I cannot directly observe

how a manager’s private information set has changed after direct learning, I instead focus on two

managerial decisions that are likely to be sensitive to the acquisition of investors’ information and

therefore serve as a window into the manager’s information set. Specifically, I examine managers’

ability to issue more and more accurate management forecasts, as well as their insider trading

profits. I focus on these two decisions because (i) they both rely on the manager’s private

information about the firm’s future operating prospects, which could benefit from institutional

investors’ macroeconomic and sector knowledge, (ii) both decisions have an information content,

as suggested by the respective market reactions to the issuance of management forecasts and the

disclosure of insider trades (Brochet, 2010; Hoskin et al., 1986; Lakonishok and Lee, 2001; Rogers

and Stocken, 2005), (iii) managers’ private information reflected in these decisions can be verified

ex-post, using the accuracy of management forecasts and the abnormal returns associated with

insider trades, (iv) managers make both decisions regularly throughout the year, even in the

absence of direct learning, which facilitates the design of empirical tests to examine the effect of

learning, and (v) prior evidence suggests that managers’ personal and corporate decisions are

coordinated when the source of underlying information is common (Jenter, 2005).

4.3.1. Frequency and accuracy of management forecasts

Managers’ ability to issue accurate earnings guidance depends on whether they can

accurately forecast firms’ future operations (Waymire, 1985). As management forecasts

incorporate both firm-specific and sector information (Bonsall et al., 2013), institutional investors’

information can be relevant to managers. Institutional investors’ information can complement the

manager’s knowledge about macroeconomic and sector trends, fill in the “mosaic” around his

- 25 -

private information set, and help him to make more accurate predictions about the firm’s future

operating environment. Therefore, I investigate the effect of direct learning on the frequency and

accuracy of management forecasts.

14

The OLS empirical specification is:

where denotes firm, denotes quarter,

denotes firm dummies,

denotes calendar-year-

quarter dummies and

denotes fiscal quarter dummies. Direct Interactions measures the

frequency of manager-investor interactions and the degrees of information exchange using

empirical proxies discussed in section (4.1): NumInteract, CEO, NumExecs, MDWords, AnsPerQ,

PrivateMtg, and their first principal component, Direct Interaction.

I examine the following disclosure outcomes. First, I investigate whether managers can

issue more forecasts after learning, using the number of management forecasts (Forecasts).

Because an increase in management forecasts can be driven by investors demanding the manager

to release more information about the firm at the conference, I subsequently examine management

forecasts that are revisions to an earlier forecast (Revisions). This is because if the increase in

forecasts is driven by investors demanding new information about previously un-guided periods,

it will manifest in the issuance of new forecasts instead of forecast revisions. Last, I examine

forecast accuracy using the absolute error for EPS guidance, scaled by one-quarter lagged share

price, and averaged across all EPS forecasts in a given fiscal quarter (FcastError).

14

The maintained assumption here is that managers are, on average, motivated to produce accurate earnings forecasts

because accurate earnings forecasts are perceived positively by investors, analysts and the board of directors (Lee et

al., 2012; Williams, 1996; Yang, 2012; Zhang, 2012). However, managers may be incentivized to provide biased

earnings forecasts under certain circumstances. In an alternative theory, managers provide more pessimistic forecasts

to avoid negative earnings surprises after direct interactions, and to the extent that lower forecasts are more accurate,

one would observe both an increase in the number of forecast revisions and a decline in forecast errors. In the Internet

Appendix, I rule out this alternative explanation by showing that the (more accurate) EPS forecasts issued by managers

following direct learning are not associated with a higher likelihood of eventual meeting or beating analyst consensus.

- 26 -

The vector of control variables, X, includes time-varying firm characteristics identified in

prior studies to be associated with forecast properties. I control for firm size (Size) as larger firms

tend to issue more and more accurate forecasts (Ajinkya et al., 2005). Firms that report losses may

have more difficulty forecasting future earnings, so I include an indicator for whether the firm

reported a loss (Loss) and returns on assets (ROA). I control for the extent of external monitoring

(Inst. Ownership), the external information environment (Analyst), and liquidity (Bid-ask Spread,

Turnover). Higher earnings volatility (Earnings Vol) and changes in the firm’s business operations

(Restructuring, M&A) decrease managers’ ability to predict the firm’s future operations (Waymire,

1985). I include growth opportunities (BM Ratio), whether the firm operates in a high-technology

industry (High Tech), and research and development expenses (R&D) to control for the fact that

growth and high-tech firms might face more difficulty in forecasting future earnings, following

Bamber et al. (2010) and Yang (2012). To mitigate concerns that new forecasts are issued because

the manager has (intentionally or inadvertently) disclosed new information during a conference, I

include the number of 8k filings that pertain to Reg FD (i.e., item 7.01) (RegFDDiscl.). Because I

include both annual and quarterly forecasts in my sample, I control for the percentage of annual

forecasts (PctAnnFcast). I control for forecast horizon (Horizon), calculated as the number of days

between the forecast date and the actual date, when using FcastError as the outcome variable

because earlier forecasts tend to be less accurate (Baginski and Hassell, 1997). Last, I include all

other determinants of managers’ incentives to seek direct learning in equation (IC1).

Table 5 presents the results of this analysis.

15

Panel A investigates the relation between

direct learning and the frequency of management forecasts (Forecasts). The coefficients on Direct

Interactions are positive and statistically significant under 5% across all seven proxies of direct

15

Compared to the full sample in Table 3, requiring data coverage from I/B/E/S to compute various disclosure

variables results in a reduction in the sample size.

- 27 -

interactions, consistent with my predictions that information acquired through direct learning

manifest in managers’ ability to issue future guidance. The point estimate on column (7) is 0.009,

which translates to one standard deviation increase in Direct Interaction is associated with a 0.9%

(

) increase in the number of management forecasts, ceteris paribus. Panel B

restricts to management forecasts that are revisions to an earlier forecast (Revisions). The

coefficients on the proxies of direct learning remain positive and statistically significant under 1%,

and the economic magnitude is larger. One standard deviation increase in Direct Interaction is

associated with a 1.9% (

) increase in the number of forecast revisions. Panel C

presents the result using management forecast error (FcastError) as the dependent variable. This

analysis essentially restricts to firm-quarters with an EPS forecast, and therefore result in a

reduction in the size of the sample. The coefficients on Direct Interactions are negative across all

six proxies and are significant under 5% (10%) in two (five) out of six, and are also negative and

significant under 5% for Direct Interaction. The point estimate for Direct Interaction is -3.017,

which translates to one standard deviation increase in Direct Interaction is associated with 0.01 (-

3.017*1.009/322.7) standard deviation decrease in EPS forecasts errors (FcastError), ceteris

paribus. The results are consistent with my prediction that direct learning expands managers’

private information set about the firm’s future performance, and is in turn, reflected in the lower

error of their EPS forecasts.

4.3.2. Timing and profitability of insider trades

Prior literature recognizes that trades by insiders both reflect their superior information on

the firm’s future operation as well as their contrarian belief that the security of their firms differs

from its fundamental value (Ke et al., 2003; Piotroski and Roulstone, 2005; Seyhun, 1992, 1986;

- 28 -

Sias and Whidbee, 2010).

16

Direct learning improves managers’ information set in both aspects.

Institutional investors’ knowledge can complement the manager’s information set or fill in the

“mosaic” around his private information, which in turn helps him to forecast the firm’s future

operations. Moreover, institutional investors have first-hand knowledge about their trades, general

investor sentiments, and the market’s perception of the firm’s performance, all of which can help

managers assess whether their firms’ stocks are over- or under-valued.

To investigate whether and how information through direct interactions is reflected in the

timing and the profitability of managers’ insider trades, I collect insider transactions made by

corporate officers using Form 4 data from the Thomson Reuters Insider Filing database. Thomson

Reuters collects corporate insider transaction information that is subject to the disclosure

requirements under Section 16 of the Securities Exchange Act of 1934. My empirical analysis

focuses on the close window around an investor conference and examines how a manager’s private

information changes after direct learning at the conference. My regression sample includes 28,632

reported open-market stock purchases and sales made by corporate officers within two months

before or after the date of a conference that a firm has attended. Following prior literature, I require

non-missing data on the trade price, the number of shares traded, and the transaction date. I restrict

the sample to only opportunistic trades using Cohen et al. (2012)’s trade-level classification.

17

16

For instance, Piotroski and Roulstone (2005) document that insider trades are positively associated with future

earnings performance (which reflects their superior information), BM ratio and inversely related to recent returns

(which reflects trading against potential mis valuation). Ke et al. (2003) show that insiders possess and trade upon

knowledge of economically significant forthcoming disclosures. Sias and Whidbee (2010) show insider trades are

partly motivated by their perception that their securities are overvalued (undervalued) following a period of

institutional net buys (sells). Insider trades predict future stock returns, as insider trading activity is positively

correlated with changes in future real activities, and insiders are more likely to buy (sell) follows periods of stock

depreciation (appreciation) (Seyhun, 1992, 1986).

17

A routine trade is one for which the insider has made three trades in the same month in each of the three previous

years. All other trades are opportunistic. A trade-level classification is more appropriate because I focus on the narrow

window around a conference. However, my results remain unchanged using the person-level classification.

- 29 -

I examine both the timing and the profitability of insider trades made by executives who

participated in a conference (i.e., participating insiders) as the information acquired through direct

learning, if any, will likely result in participating insiders having an information advantage over

non-participating insiders from the same firm.

First, if a manager who participated in the conference was able to acquire information from

institutional investors that is relevant for him in predicting the firm’s future performance, we

should expect that manager to utilize this information advantage in a short-window after the

conference. Specifically, I examine if participating insiders are more likely to trade in the seven-

day window after a conference, using the following equation:

where denotes firm, denotes executive and k denotes trade. 1(Trade

POST

) is an indicator variable

that takes the value of one if the trade is placed within seven days after an investor conference, and

zero otherwise. Participating insider is an indicator that takes the value of one if the trade is placed

by an insider who has participated in an investor conference prior to the transaction date of the

trade on behalf of firm , and zero otherwise.

Next, information acquired through direct interactions should reflect in the profitability of

participating insider trades when compared to other trades executed at the same firm and during

the same narrowly-defined window, but without direct learning. Specifically, I examine if trades

placed by participating insiders in the seven-day window after a conference (i.e., participating

insider trades) generate higher abnormal positive returns when compared to (i) trades made by

insiders of the same firm but who did not participate in a conference and (ii) trades made by

- 30 -

participating insiders but outside of the conference window (collectively, non-participating insider

trades).

18

The empirical specification is as follows:

where denotes firm, denotes executive, and denotes trade. ParInsiderTrade

POST

takes the

value of one if executive placed a trade within the seven-day window after attending an

investor conference on behalf of firm , and zero otherwise. Consistent with prior literature (Bowen

et al., 2018; Ravina and Sapienza, 2009), I measure the profitability of insider trades as the

(unrealized) capital gains after purchases and losses avoided after sales. The dependent variable is

either Alpha30 or BHAR30. Alpha30 measures the average risk-adjusted returns for each insider

transaction calculated over the 30 days following a transaction and relative to the Fama and French

(1993) three-factor models, multiplied by -1 for sales. BHAR30 measures the market-adjusted buy

and hold return over 30 days following a transaction, multiplied by -1 for sales.

I estimate both equation (IT1) and (IT2) using only within-firm variations by including

either firm-quarter or firm-month fixed effects. This specification focuses exclusively on

variations within a firm- quarter (e.g., a fixed effect for 3M Co. in Q1 2012) or a firm-month (e.g.,

a fixed effect for 3M Co. in January 2012) and subsumes all time-varying firm characteristics that

do not vary during a given firm-quarter or firm-month (e.g., the number of product-market

announcements made by Abbott Laboratories). To the extent that there is a potential omitted

variable that does not vary within a firm-quarter or firm-month, then this specification controls for

that variable. This design choice is important because it essentially restricts the comparison to

trades made by executives from the same firm and within the same short window (quarter or

month). It controls for many time-varying factors that might be associated with conference

18

In the Internet Appendix, I separately examine these two groups of non-participating insider trades and find

participating insider trades have a significant information advantage over both groups.

- 31 -

attendance (e.g., firm performance, operating and financing changes, product-market decisions,

and growth opportunities, etc.) and the timing and profitability of insider transactions. While the

firm-month specification is the most robust in ruling out omitted firm-level characteristics, its

limitation is that it relies on having meaningful variations in ParInsiderTrade

POST

for a given firm-

month, which is less of a concern in the firm-quarter specification. In the vector of controls, X, I

include a dummy variable for whether the executive is a CEO to mitigate concerns that the CEO

is both more likely to attend an investor conference and has more precise firm-specific information.

I control for the information content of the conference (from investors’ perspective) using

conference-window abnormal returns (Conf Abn Ret) and abnormal trading volumes (Conf Abn

Turnover), following Bushee et al. (2011). The coefficient of interest is

, which measures

whether participating insiders’ trades generate higher abnormal returns, thus reflecting superior

private information, when compared to non-participating insider trades.

Panel A of Table 6 provides descriptive statistics of the sample. On average, 13.3% (14.6%)

of the trades are executed in the seven-day window after (before) the conference, and the

percentage of participating insider trades is around 3% (3%) after (before) a conference. The mean

(median) size of transaction is $1,696,843 ($143,610). Panel B of Table 6 presents the results from

equation (IT1). The coefficient

is positive and significant across all columns. The results

suggest that in the same firm-month and compared to executives who did not attend a conference,

participating insiders are 6.7% more likely to utilize their information advantage after direct

learning and trade in the seven-day post-conference window.

Table 7 Panel A presents the results for equation (IT2). Columns (1) and (2) present the

results using 30-day trading alpha, and columns (3) and (4) use 30-day buy-and-hold returns. The

coefficients on ParInsiderTrade

POST

are significantly positive across all specifications. Compared

- 32 -

to non-participating insider trades, participating insider trades in the same firm-month generate an

incremental alpha of 2.8 basis point per month. The results are consistent with managers’

information set expanding as a result of their direct learning. The coefficients on the information

content of the conference (from investors’ perspective) are positive, and it is significant for Conf

Abn Turnover, suggesting that information flow between investors and managers is reciprocal in

nature. The coefficients on CEO are generally negative and significant in some specifications. This

is consistent with prior findings that CEOs do not earn higher trading profits than other top

executives (Wang et al., 2012).

4.3.2.1. Distinguish between anticipated disclosure versus direct learning

An alternative explanation that managers can trade profitably around direct interactions

with investors is that managers can anticipate investors’ reaction to information that is disclosed

by the manager during such meetings (i.e., anticipated disclosure). Managers can sell (buy) before

direct interactions if they anticipate investors to react negatively (positively) to what they are

planning to talk about, especially when managers are responding to questions raised during Q&As

or during private meetings as these responses are less likely to be scripted. For instance, Bowen et

al. (2018) examine private meetings between managers and outside investors and analysts for firms

listed on China’s Shenzhen Stock Exchange. They find that insiders are able to trade profitably in

the twenty-day window before or after a private meeting, consistent with both anticipated

disclosure and learning (and they do not distinguish between these two explanations). Bushee et

al. (2020) show that managers opportunistically issue voluntary disclosure to hype up stock prices

and sell their shares at inflated prices prior to a conference

While I acknowledge that anticipated disclosure is a possible mechanism for managers to

trade profitably around direct interactions, my analyses attempt to isolate the effect of learning by

- 33 -

examining the differential information advantage by participating insiders over non-participating

insiders and focusing on trades after a conference. Moreover, I conduct two additional analyses to

provide more comfort that my results are not driven by anticipated disclosure. First, I restrict the

sample to a subset of conferences for which at least two executives from the sample firm have

attended. It is less likely that a single participating executive can anticipate investors’ overall

reactions when multiple executives have interacted with investors during an investor conference.

Moreover, strategic disclosure (i.e., managers disclose information to investors that would move

stock prices in a certain way) becomes costlier because it would require coordination among top

executives to disclose material information, which is a violation of Reg FD. Table 7 presents the

results of this analysis. The coefficients on ParInsiderTrade

POST

remain positive and significant.

Next, anticipated disclosure would predict that participating insiders can make profitable

trades via front-running (i.e., trading before the conference), while direct learning would only

predict that participating insiders’ information advantage occurs after the conference. To

distinguish between these two theories, I carry out a falsification test by examining (i) whether

participating insiders are more likely to trade in the seven-day window before a conference and (ii)

whether trades that are executed in the seven-day pre-conference window earn more positive

abnormal returns. I modify equation (IT1) and (IT2) accordingly. Table 8 Panel A modifies

equation (IT1) by using 1(Trade

PRE

) as the outcome variable, which is an indicator variable that

takes the value of one if a trade is placed within the seven-day pre-conference window, and zero

otherwise. The coefficients on Participating Insider are significantly negative. This result,

combined with the results in Table 7, suggest that participating insiders are less likely to trade in

the pre-conference window, but rather, wait after they have acquired relevant information from

investors after a conference. Table 8 Panel B modifies equation (IT2) using ParInsiderTrade

PRE

,

- 34 -

which is an indicator variable that takes the value of one if a trade is placed by an executive in the

seven-window before attending an investor conference, and zero otherwise. The coefficients on

ParInsiderTrade

PRE

are positive but are not significant. This result suggests that participating

insiders do not have an information advantage over non-participating insiders before the

conference, which does not support the alternative explanation of anticipated disclosure.

4.3.2.2. Cross-sectional analysis: nature of information learned

The above analyses focus on whether managers can learn something useful from direct

interactions with investors. However, it is not clear what is the nature of the information learned.

On the one hand, investors can pass along sector- and industry-related knowledge that helps

managers to better predict their firms’ future competitive landscape and operating environment.

On the other hand, managers can infer how investors might trade on their firms’ stocks after the

conference.

19