THE HONORABLE MAXINE WATERS, CHAIRWOMAN, COMMITTEE ON FINANCIAL SERVICES

THE HONORABLE JOYCE BEATTY, CHAIR, SUBCOMMITTEE ON DIVERSITY AND INCLUSION

117

TH

CONGRESS, SECOND SESSION

DECEMBER 14, 2021

This report has not been officially adopted by the Committee on Financial Services and may not necessarily reflect

the views of its Members.

DIVERSITY AND INCLUSION: HOLDING AMERICA’S

LARGEST INVESTMENT FIRMS ACCOUNTABLE

REPORT PREPARED BY THE MAJORITY STAFF OF THE COMMITTEE ON FINANCIAL SERVICES,

U.S. HOUSE OF REPRESENTATIVES

2

Table of Contents

I. Executive Summary ................................................................................................................................ 3

II. Background ............................................................................................................................................ 7

A. Workforce Diversity .......................................................................................................................... 9

1. Executive-Level Management Diversity ........................................................................................ 12

2. Executive Leadership Diversity ..................................................................................................... 17

B. Board Diversity ................................................................................................................................. 19

C. Procurement Diversity ..................................................................................................................... 24

D. Asset Management Diversity ........................................................................................................... 30

E. Underwriting Procurement Diversity ............................................................................................. 33

F. Data Reliability ................................................................................................................................. 34

1. Practices to Support Diversity ........................................................................................................ 38

2. Practices to Support Inclusion ....................................................................................................... 41

IV. Recommendations and Legislative Proposals to Improve Diversity and Inclusion ...................... 45

Appendix I: Total Assets for Americas Largest Investment Firms ...................................................... 49

Appendix II: Methodology ....................................................................................................................... 50

Summary of Diversity Data Request .................................................................................................. 50

Limitations on Scope of Analysis ...................................................................................................... 50

Appendix III: Glossary of Terms ............................................................................................................ 51

Appendix IV: Firms with Racial Equity Commitments ........................................................................ 52

Appendix V: Firms Reporting Actual or Estimated Data ..................................................................... 54

Appendix VI: Sample Letter to Investment Firms……………………………………………………………………. 55

3

I. Executive Summary

In the 116

th

Congress, House Financial Services Committee Chairwoman Maxine Waters

established Congress’ first Subcommittee on Diversity and Inclusion to “examine and resolve the

systemic economic exclusion of women, people of color, persons with disabilities, LGBTQ+

individuals, veterans, and other members of our society who have to fight for a seat at the table.”

1

Congresswoman Joyce Beatty has served as the Chair of the Subcommittee on Diversity and

Inclusion since its inception. As part of the Subcommittee’s ongoing and important work on

diversity and inclusion issues, on March 18, 2021, Chairwoman Waters, and Subcommittee Chair

Beatty issued a letter to 31 of the largest investment firms

2

in the U.S., requesting data on their

diversity and inclusion policies and practices.

3

The firms included in this report are entrusted to manage more than $47 trillion. These

firms serve as institutional investors for pension funds, endowments, and other funds.

4

Investment

firms manage the life savings of millions of hard-working Americans and families across the

country and their decisions have widespread impacts. The lack of diversity and inclusion at these

firms raises concerns regarding equal employment opportunities, the further widening of the racial

wealth,

5

unequal distributions of capital, and the overall profitability of these firms.

The Committee requested data to promote transparency and accountability for diversity

performance, as well as to encourage economic inclusion, both internally and externally, within

the investment management industry. Chairwoman Waters and Chair Beatty asked investment

firms with assets over $400 billion (31 total) to report and comment on their diversity and inclusion

data and practices. The request included a self-assessment of data and activities ranging from 2016-

2020 and solicited a mix of quantitative and qualitative responses. The request included six

categories of quantitative data including: Workforce Diversity, Board Diversity,

Procurement/Supplier Diversity, Asset Management Diversity, Underwriting Diversity, and Data

Reliability. In addition, firms were asked questions related to internal diversity and inclusion

policies and practices.

Based on staff findings, there was little progress across most data categories between 2016

and 2019. For example, in 2016 women comprised 25% of the workforce at the executive level.

In 2019, women comprised 26.2% of the executive level workforce, meaning that there was only

an increase of 1.2 percentage points in women in executive positions from 2016 to 2019. Similarly,

people of color comprised 14.1% of the workforce at the executive level in 2016, and 16.6% of

the executive level workforce in 2019, meaning that there was only an increase of 2.4 percentage

1

Press Release, U.S. House Committee on Financial Services, Waters Statement on Historic Diversity and Inclusion

Subcommittee Hearing (Feb. 28, 2019).

2

For this report, the term “investment firms” or “investment advisers” are SEC registered persons and the entities they work for,

are regulated pursuant to the Investment Advisers Act of 1940, along with state securities authorities, are responsible for

providing investment advice and the management of investments on behalf of its clients, and are required to act as a fiduciary,

that is, to act in its clients’ best interest.

3

Press Release, U.S. House Committee on Financial Services, Waters and Beatty Request Diversity Data from the Nation’s

Largest Investment Firms (Mar. 18, 2021).

4

Willis Towers Watson, The world’s largest asset managers – 2020. (2020).

5

In this report, the racial wealth gap refers to the long-standing and significant wealth disparities between households in different

racial and ethnic groups. According to a 2021 FEDS Note from the Board of Governors of the Federal Reserve System, “White

households hold a much larger share of wealth than their population share, with Black and Hispanic households

disproportionately concentrated at low, or even negative net wealth ranges.”

4

points in people of color in executive positions over this period. Following the murder of George

Floyd in May 2020

6

, 26 of the firms that we examined in this report made public commitments to

improving racial equity either within the company or more generally (See Appendix IV).

7

Committee staff compiled a list of these commitments and categorized each statement based on

the following commitment topic: increasing workforce diversity, increasing board diversity,

implementing diversity and inclusion policies, and increasing procurement/supplier diversity.

Despite public racial equity commitments, the diversity and inclusion of investment firms

did not increase substantially between 2019 and 2020. For example, women made up 26.2% of

executives in 2019 and 27.5% of executives in 2020, an increase of 1.3 percentage points. People

of color made up 16.6% of the executive workforce in 2019, and 17.6% of the executive workforce

in 2020, only an increase of one percentage point. Importantly, only 3.0% of executives in

investment management firms were Black in 2019. In 2020, this number rose to 3.4%, less than

half a percentage point increase. Similarly, on average, only 3.0% of executives were Latinx in

2019, and this number rose less than half a quarter of a percentage point to 3.2% in 2020.

Collectively, the findings in this report highlight the serious shortcomings of the largest investment

firms in America when it comes to diversity and inclusion. While some progress has been made

over the last five years, there is more work to be done.

Key Findings

The key findings from Committee Staff are as follows:

Workforce Diversity

• Different racial and ethnic groups experience different levels of representation. Across all

employees who are people of color, Black and Latinx employees were highly represented

in administrative support roles or other non-professional level roles but were less likely to

be represented in executive/senior level or mid-level manager roles. Meanwhile, Asian

Americans were most represented in technician, professional, and first/mid-level manager

role, compared to support roles and senior level roles.

• Women are underrepresented in executive level management (27.5%).

• People of color are underrepresented in executive level management (17.3%).

• Of the firms that made 2020 racial justice commitments, six firms committed to

diversifying their workforce.

• The Chief Executive Officers (CEOs) of the 31 firms included in this report are

overwhelmingly White and male. Of the firms profiled, only one has a person of color as

the CEO and three firms have White women as their CEOs.

Board Diversity

6

For more information and history on public commitments by financial institutions’ and public companies’ commitments to

racial equity following the murder of George Floyd, see the Subcommittee on Diversity and Inclusion’s hearing, “The Legacy of

George Floyd: An Examination of Financial Services Industry Commitments to Economic and Racial Justice.”

7

Following the release of this report, Goldman Sachs informed the Committee that it erroneously provided inaccurate

information on its racial equity commitments. The corrected information is now included in this report.

5

• Women are underrepresented on investment firm boards (28%).

• People of color are underrepresented on investment firm boards (17.5%).

• Of the firms that made 2020 racial justice commitments, only one committed to

increasing board diversity.

Procurement Diversity

• While almost two-thirds of firms reported having policies to support diverse suppliers, few

reported spending with women-owned or minority-owned firms. Of firms that responded

to the request, all reported spending 4% or less of asset manager spending with women-

owned or minority-owned firms.

• Only 14 of the 28 firms (50%) that responded to this request provided at least some

information on women-owned businesses and minority-owned businesses with which they

are doing business. The average percent spent with women-owned firms ranged from

11.63% for non-professional spending to 0.30% for underwriting. The average percent

spent with minority-owned firms ranged from 17.13% for human resources to 0.50% for

asset management subcontracting.

• Only three firms made a commitment around procurement among their 2020

commitments to racial justice.

Asset Management Diversity

• Only 9 of the 28 firms (32%) that responded to this request provided information on

women-owned asset managers with which they are doing business. Of these firms, they

spent on average 0.57% of total asset management services spend with women-owned

businesses.

• Only 9 of the 28 firms (32%) that responded to this request provided information on

minority-owned asset managers with which they are doing business. Of these firms, they

spent on average 3.96% of total asset management services spend with minority asset

managers.

Underwriting Procurement Diversity

8

• Only 6 of the 28 firms (21%) that responded to this request provided information on

women-owned and minority-owned underwriters with which they are doing business. Of

these firms, they spent on average 0.30% of total underwriting services spend with women-

owned businesses and 9.47% with minority asset managers.

Data Reliability

• Twenty-one firms (75%) indicated that the data they provided were actual numbers rather

than estimates when providing information about their workforce, board, and procurement,

8

Generally, underwriting refers to investment banking and capital markets activities tied to the process where a broker dealer or

investment adviser, and its partners, helps raise capital for a client from investors. The underwriter plans the logistics of an

offering, time the offering based on market conditions and investor sentiment, and structures the type and nature of the offering,

whether the securities offering will be a private placement, listed domestically or internationally, including whether the securities

product will target institutional investors or retail investors and the minimum investment levels.

6

including asset management and underwriting. Four firms (14%) indicated that the data

that they provided were a mixture of actual numbers and estimates. Three firms (11%) did

not provide information about whether they used actual numbers or estimates.

Policies and Practices

• Most firms reported that they have policies and positions related directly to diversity and

inclusion and that they engaged in efforts to recruit and hire diverse employees. 100% of

firms acknowledged the importance of connecting to the diverse communities they serve.

• Despite most firms being headquartered in racially diverse cities, many of the investment

firms indicated that geographic region was a barrier to recruiting diverse talent. Five firms

that are in majority people of color cities, including Newark, NJ; Baltimore, MD; and New

York City, NY said that their geography was a limitation in diversifying their staff.

Recommendations

Based on expert testimony heard at Congressional hearings on matters of diversity and

inclusion and in recognition of the challenges identified by the firms that responded to the letter,

Committee staff make the following recommendations, buttressed by proposed legislation, to the

industry to improve its diversity and inclusion outcomes. The following recommendations are

grouped by themes explored in this report:

Workforce Diversity

• Investment firms should collect disaggregated data regularly on workforce, executive and

board diversity, as well as conduct regular audits on pay and racial equity.

• Investment firms should partner with historically Black colleges and universities, minority

serving institutions and community colleges to build talent pipelines into these

organizations.

Board and Executive Leadership Diversity

• Investment firms should consider at least one diverse candidate for all executive positions

and board positions when there are openings.

Overall Procurement Diversity

• Investment firms should consider diverse suppliers whenever a procurement takes place,

especially when contracting for asset managers.

• Investment firms should develop pipeline programs for diverse asset managers to manage

increasingly larger portfolios.

7

II. Background

This report is the second in a series published by the Committee on Financial Services to

hold the financial services industry accountable regarding diversity and inclusion. The first in this

series was “Diversity and Inclusion: Holding America’s Large Banks Accountable,” published

in February 2020, and it profiled the largest banks in America.

9

As the second installment in this

series, the current report examines the current state of diversity and inclusion within America’s

largest investment firms.

Investment firms provide a wide array of services, and among them is the management of

assets. Investment managers collectively handle trillions in assets, including the investment

savings of nearly half of all U.S. households.

10

People saving for retirement, education, or to buy

a home often rely on the professional services of asset managers for advice and guidance to help

secure their financial future or meet their investing goals. In 2021, the global asset management

industry managed over $100 trillion in assets.

11

Despite the increasing diversity of the U.S. population, studies have shown that investment

firms are among the least diverse within the financial services industry, an industry which already

struggles with diversity.

12

According to the 2020 Census, the United States is now 38.4% people

of color and 61.6% White;

13

and women account for 50.8% of the population.

14

Research suggests

that by 2045, the United States will be majority people of color.

15

Comparatively, an analysis

performed by the Knight Foundation found that White men managed a stunning 98.7% of the

assets in the U.S. investment management sector (i.e., hedge funds, mutual funds, real estate funds,

and private equity funds) in 2019.

16

In January 2018, the Securities and Exchange Commission (SEC), led by its Office of

Minority and Women Inclusion (OMWI), introduced its “Diversity Assessment Report for Entities

Regulated by the SEC,” which includes broker dealers, investment advisors, mutual funds and

others who are regulated by the SEC.

17

According to the SEC, this report is designed to: “(1) help

guide a regulated entity’s self-assessment of its diversity policies and practices using the Joint

Standards; and (2) provide the regulated entity with a template for submitting diversity assessment

information to the OMWI Director at the SEC, as contemplated under the Joint Standards.”

18

9

Majority Staff, U.S. House Committee on Financial Services, Diversity and Inclusion: Holding America’s Large Banks

Accountable (Feb. 2020).

10

Capital Markets: Asset Management and Related Policy Issues, Congressional Research Service (Oct. 2019).

11

The $100 Trillion Machine: Global Asset Management 2021, Boston Consulting Group (Jul. 8, 2021).

12

See Investment management is overwhelmingly dominated by white men—and it’s costing you money, Fortune (Jul. 19, 2020).

See also, SEC Urged to Help Diversify Asset-Management Industry, The Wall Street Journal, (Jul. 16, 2020) (noting that less than

1.5% of assets are managed by women or people of color).

13

Race and Ethnicity in the United States: 2010 Census and 2020 Census, U.S. Census Bureau (Aug. 12, 2021).

14

Quick Facts: United States, U.S. Census Bureau (Jul. 2019).

15

The US will become ‘minority white’ in 2045, Census projects, Brookings Institute (Mar. 14, 2018).

16

, Knight Foundation, Diversifying Investments: A Study of Ownership Diversity and Performance in the Asset Management

Industry (Jan. 28, 2019).

17

Securities and Exchange Commission, Diversity Assessment Report for Entities Regulated by the SEC: Summary of Year One

Results (2018).

18

Securities and Exchange Commission, Standards for Assessing the Diversity Policies and Practices of Entities Regulated by the

Securities and Exchange Commission - Frequently Asked Questions (Sept. 2018).

8

However, the submission of data for the Diversity Assessment Report is voluntary, and of the

approximately 1,400 firms that were invited to complete the assessment report, only 38 responses

were received, accounting for just 5% of regulated entities invited.

19

Additionally, unlike the other

financial regulators that collect this data annually, the SEC collects this data every other year. In

the absence of mandatory, annual reporting, the public lacks comprehensive and timely data and

reporting on the workforce, senior staff, and board leadership of investment management firms,

among other regulated entities.

To provide a deeper understanding of the diversity issues within the investment

management industry, Chairwoman Waters, and Diversity and Inclusion Subcommittee Chair

Joyce Beatty sent a letter to America’s 31 largest investment managers, which are those with $400

billion in assets under management (AUM) or greater.

20

Twenty-eight of the firms that received

this letter responded.

21

Among those who responded, some did not fully respond to each question

posed.

22

The letter requested diversity data for a 5-year period, from calendar year 2016 to 2020,

including demographic data on its board, staff, and executive leadership. The letter also requested

information on procurement, internal policies and practices meant to support greater diversity and

inclusion and challenges in pursuing diversity and inclusion in this industry. Topics included in

the request were the following:

1. Workforce diversity

2. Board diversity

3. Procurement/supplier diversity

4. Asset management diversity

5. Underwriting diversity

6. Data reliability

7. Institution’s diversity policies and practices.

23

19

Id.

20

See Appendix 1 for table with participating firms and their assets under management; Due to an administrative error, one firm

with assets above $400 billion — Geode Capital— did not receive the request. The Committee is in communication with the firm

to gather data and will update this report accordingly.

21

Id.

22

Legg Mason, Inc., and Eaton Vance Corp. did not respond. Legg Mason did not complete the data request, after being acquired

by Franklin Templeton on July 31, 2020. Eaton Vance did not complete the data request, after being acquired by Morgan Stanley

on March 1, 2021.

23

The full text of the request letter that was sent to the 31 investment firms can be found in Appendix V

9

III. Investment Firm Data & Committee Staff Findings

A. Workforce Diversity

Different racial and ethnic groups

experience different levels of representation.

Almost all firms (96.4%) provided workforce data

for 2020. In addition to overall firm workforce

data, four firms provided supplemental data from

their subsidiary firms. Staff used overall

workforce data for analyses in this report for

consistency when firms provided both overall and subsidiary data. In the case of Charles Schwab,

which only provided data on the subsidiary Charles Schwab Investment Management, staff used

the subsidiary data provided.

Across all employee groups, the representation of employees who identify as persons of

color dramatically declines the higher up the corporate ladder they climb. Black and Latinx

employees were highly represented in administrative support roles or other non-professional level

roles but were substantially less likely to be represented in executive/senior level or mid-level

manager roles (See Table 1.) Asian Americans were the most

represented person of color group overall, and were most

represented in technician, professional, and first/mid-level

manager roles, compared to support roles and senior level

roles. While the low representation of Black and Latinx

employees might be explained by an overall pipeline issue, the

low representation of Asian American employees at senior

levels might be explained by a different phenomenon. As

examined in a report by the Association of Asian American

Investment Managers (AAAIM) Asian American employees

encounter a proverbial ceiling at the mid-level manager level

which present difficulties in progressing to more senior

levels.

24

White employees were the most represented at every level of employment and had the

highest representation of executive/senior level employees (82.6%) and first/mid-level managers

(75%).

24

AAAIM, Good Workers-Not Leaders: Unconscious Biases That Stall AAPI Advancement (Sept. 2021).

Different racial and ethnic

groups experience different

levels of representation.

10

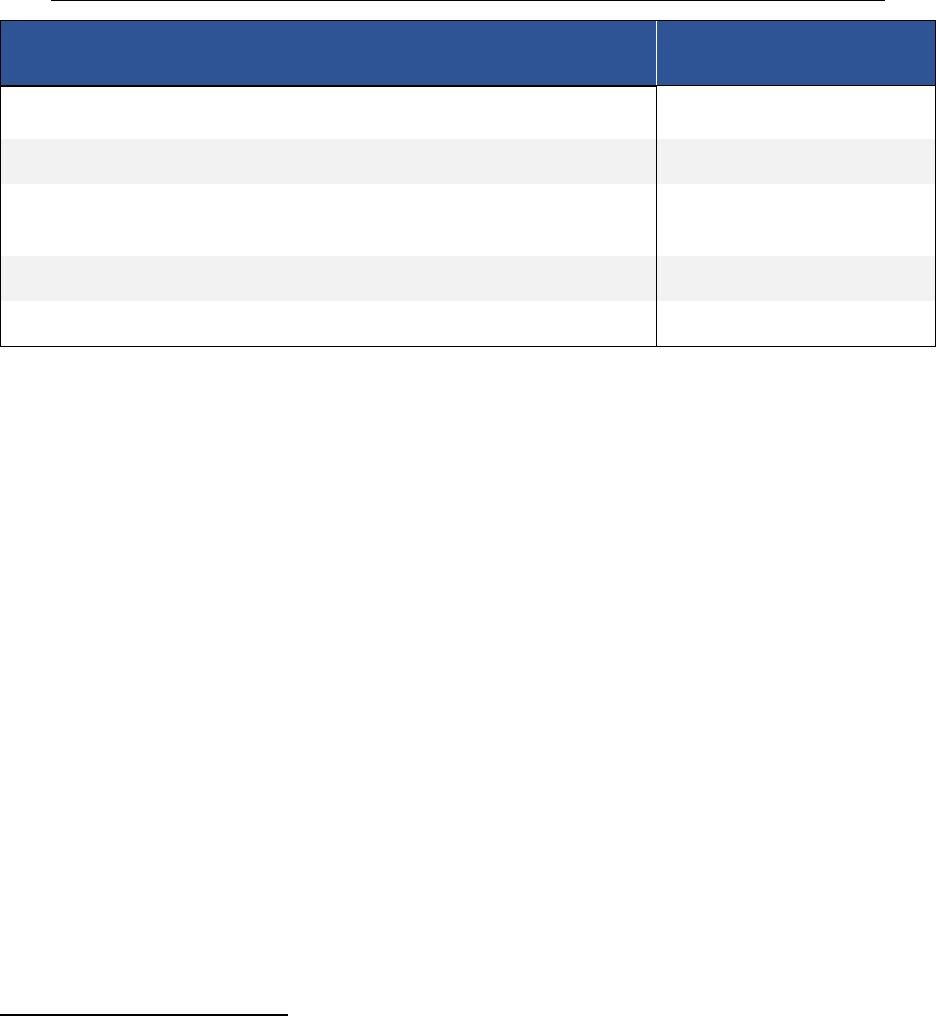

Table 1. Race and Ethnicity of Workforce at Different Employment Levels

Black or

African

American

%

Hispanic

or

Latino

%

Asian or

Pacific

Islander

%

American

Indian or

Alaska

Native %

Two or

more

races %

White %

Exe /Senior Level

3.3

3.1

9.7

0.1

0.9

82.6

First/Mid-Level

Managers

4.2

4.7

13.9

0.2

1.7

75.0

Professional Level

6.4

6.4

18

0.1

2.0

66.4

Technicians

17.2

6.0

15.9

0.1

1.7

56.1

Administrative

Support Workers

14.9

13.9

6.7

0.3

2.9

60.9

All Others

8.2

8.1

5.7

0.2

3.0

74.6

Total Workforce

7.2

7.5

14.3

0.2

2.1

68.2

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Overall workforce diversity data included those at the executive or C-suite level, first or

mid-level officials and managers, professionals, technicians, administrative support workers, and

others (i.e., those who do not fall into one of the previous categories). Despite the generally

stagnant levels of racial or ethnic diversity over the five years reviewed, there was a slight increase

in employees who identify as Asian or Pacific Islander (2.5 percentage points), and a slight

decrease of employees who identify as White (-3.3 percentage points). The percentage of women

working for investment firms that responded to the data request decreased slightly (-1.1 percentage

points) over the past five years, with a slight decrease each year since 2016. There was a

corresponding increase in men working for these firms over the past five years (1.1 percentage

points). See Table 2 for details.

11

Table 2. Total Workforce Diversity for All Investment Managers Combined 2016-2020

Female

%

Male

%

Black or

African

American

%

Hispanic

or

Latino

%

Asian or

Pacific

Islander

%

American

Indian or

Alaska

Native %

Two or

more

races %

White

%

2016

51.6

48.4

11.1

13.3

10.9

0.3

2.0

62.4

2017

51.4

48.6

11.1

13.5

11.5

0.3

2.1

61.4

2018

51.3

48.7

11.0

13.7

12.2

0.3

2.3

60.5

2019

51.0

49.0

11.0

13.9

12.7

0.3

2.3

59.6

2020

50.5

49.5

10.9

13.6

13.4

0.3

2.4

59.1

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Committee staff analysis revealed that the workforce diversity demographics of the

nation’s largest investment firms were very similar to the workforce demographics of America’s

largest banks.

25

See Figure 1. There were only slight differences such that, investment firms

seemed to have more representation of Latinx employees (14%) compared to banks (11%).

Figure 1. Comparison of the Largest Investment Firms to the Largest Banks

U.S. Largest Banks Racial Diversity U.S. Largest Investment Firm Racial Diversity

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

25

Majority Staff, U.S. House Committee on Financial Services

12

1. Executive-Level Management Diversity

Women are underrepresented in executive level

management (27.5%). Responses to the Committee’s

data request included gender, racial, and ethnic diversity

data disaggregated for executive-level management

positions. All firms that responded provided this

information for 2020, with one exception, which did not

provide this data beyond 2019. Based on the responses,

the percentage of women at the executive level range

from a low of 0.0% at Charles Schwab Investment Management to a high of 39.7% at Wellington

Management. See Table 3 for details. On average, executive management at investment firms were

comprised of 27.5% women and 72.5% men. See Figure 2. It should be noted that not all executive

management positions are fund management positions; executive management may include

leaders in accounting, human resources, risk, and information technology, for example.

Women are

underrepresented in

executive level

management (27.5%).

13

Table 3. Executive Level Gender Diversity by Firm for Most Recent Year

Firm Name

Women %

Wellington Management

39.7

T. Rowe Price

37.7

Vanguard

34.8

Northern Trust

34.7

Prudential Financial

33.7

Wells Fargo

32.9

Franklin Templeton

32.8

State Street

32.7

AMG

31.8

Invesco

31.7

Principal

31.5

BNY Mellon

31.3

Capital Group

31.0

New York Life

30.9

Nuveen*

30.7

MassMutual

29.3

JPMC

27.9

MetLife

26.5

Dimensional Fund Advisors

26.3

Goldman Sachs

24.7

Morgan Stanley

24.6

AllianceBernstein

23.8

Ameriprise

23.8

BlackRock

19.8

Federated Hermes

17.4

Fidelity

16.0

Blackstone

12.7

Charles Schwab Investment Management

0.0

Note: *Indicates data from 2019. Unless indicated via star, data is from 2020.

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data.

14

Figure 2. Average Gender Composition of Investment Firm Executives in Most Recent Year

Reported

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Gender composition at the executive level differed meaningfully between professional staff

level and administrative assistant level. At the professional staff level for all firms in 2020,

26

the

investment firms’ workforce was, on average, comprised of 43.8% women and 56.2% men. At the

administrative assistant level, on average, the investment firms’ workforce was comprised of

73.5% women and 26.5% men.

People of color are underrepresented in

executive level management (17.3%). Among firms that

responded to this inquiry, people of color at the

executive level ranged from a low of 0.0% at Federated

Hermes to a high of 30.7% at Capital Group. See Table

4 for details. On average, 82.4% of executive

management identified as White and 17.3% identified as

people of color.

27

On average, 32.7% of employees at

the professional staff level identified as people of color, and at the administrative assistant level,

the average was 39.1%. See Figure 3.

26

Nuveen provided 2019 data and this data was used in the analysis.

27

Data may not sum to 100% due to non-disclosure of race or ethnicity by employees at some investment firms.

People of color are

underrepresented in

executive level

management (17.3%).

15

Table 4. Executive Level Racial and Ethnic Diversity by Firm in Most Recent Year Reported

Firm Name

People of Color %

Capital Group

30.7

BlackRock

28.7

Goldman Sachs

23.7

MassMutual

22.4

New York Life

22.1

Nuveen

22.1

Franklin Templeton

22.0

JPMC

21.2

Prudential Financial

21.0

Vanguard

20.3

Morgan Stanley

20.3

BNY Mellon

18.8

MetLife

17.6

Ameriprise

17.5

Wells Fargo

17.1

Invesco

16.6

Northern Trust

16.5

Blackstone

15.9

T. Rowe Price

15.8

State Street

14.3

AllianceBernstein

14.3

Fidelity

14.1

Charles Schwab Investment Management

12.5

Wellington Management

11.5

AMG

11.4

Dimensional Fund Advisors

10.5

Principal

6.7

Federated Hermes

0.0

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

16

Figure 3. Average Race and Ethnicity Composition of Investment Firm Executives in Most

Recent Year Reported

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Of the firms that made 2020 racial justice commitments, six firms committed to

diversifying their workforce. Six firms (17%)

made public 2020 racial equity commitments

related to workforce diversity. Three of the

firms specifically committed to increasing

representation of Black employees. Findings

from the Committee’s request show that the

total Black employee representation

increased from 5.4% in 2019 to 5.8% in

2020 at BlackRock; and 3.6% in 2019 to 4.2% in 2020 at Wellington Management. Despite direct

goals, two firm’s Black employee representation decreased slightly from 2019 to 2020. Fidelity

Investments public statements focused on general promotion of diversity and inclusion without

tangible commitments, and the firm’s employee representation increased from 5.2% in 2019 to

5.4% in 2020. See Table 5.

Of the firms that made 2020

racial justice commitments,

six firms committed to

diversifying their workforce.

17

Table 5. 2020 Racial Equity Commitments: Workforce Diversity

Firm Name

Public Commitment

Date of

Announcement

BlackRock

Double Black representation at the senior level by

2024; and increase overall representation by 30%

28

June 22, 2020

Fidelity Investments

Stay committed to corporate value of promoting a

diverse and inclusive workforce

29

June 1, 2020

Goldman Sachs

By 2025, increase workforce to 7 percent Black

professionals representation in the Americas and the

UK; and 9 percent Hispanic/Latinx professionals in

the Americas

30

August 5, 2020

Prudential

Evaluate and improve talent practices—hiring,

promotion, performance management, development,

and compensation. Establish representation goals for

people of color at all levels, including senior-most

executives

31

August 5, 2020

State Street

Triple Black and Latinx leadership (senior vice

presidents+) and double percentage of Black and

Latinx populations over the next three years. Extend

requirement to interview a diverse slate of

candidates to positions at all levels

32

Unknown

Wellington Management

Increase Black and other underrepresented talent

into investment, management, and leadership roles

33

Unknown

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

2. Executive Leadership Diversity

The CEOs of the 31 firms included in this report

are overwhelmingly White and male. For diversity and

inclusion programs to be successful throughout corporate

America, senior leaders must signal that diversity is a

priority.

34

Diversity in the most senior ranks, and

especially in the C-suite, has proven to lead to more

profitability and better for the bottom-line.

35

Of the firms

profiled, only one has a person of color as the CEO and

three firms have White women as their CEOs. See Figure 4.

28

Larry Fink and Rob Kapito, Our Actions to Advance Racial Equity and Inclusion, BlackRock (Jun. 22, 2020).

29

Abby Johnson, “I, too, am heartbroken and angry that racial discrimination and inequality continue to plague our society,”

LinkedIn (Jun. 1, 2020).

30

Goldman Sachs, Update on Inclusion and Diversity at Goldman Sachs, Including New Aspirational Goals, (Aug. 5 2020)

31

Prudential, Prudential deepens commitment to advance racial equity (Aug. 2020)

32

State Street, 10 State Street Actions, Addressing Racism and Inequality (Assessed Nov. 18, 2021)

33

Brendan Swords, Jean Hynes and Steve Klar, “The path forward,” Wellington Management. Accessed (Oct. 22, 2021).

34

Center for Creative Leadership, Leading Effectively Staff, 5 Powerful Ways to Take REAL Action on DEI (Diversity, Equity &

Inclusion) (Jul. 10, 2021).

35

Companies with more female executives make more money—here’s why, CNBC (Mar. 2, 2018).

The CEOs of the

31 firms included

in this report are

overwhelmingly

White and male.

18

Figure 4. Firm Executive Leadership and Demographics as of 10/01/2021

Note: This figure represents demographics of the CEOs of each firm’s parent company.

Source: U.S. House Financial Services Committee Staff Analysis of Public Data on CEO Leadership.

19

B. Board Diversity

Most investment firms provided us with complete

information about the gender, racial, and ethnic composition of their

boards in 2020, with the exceptions of Dimensional Fund Advisors,

Franklin Templeton, Nuveen, and Charles Schwab Investment

Management. Nuveen provided this data for 2016-2019 but did not

provide any information for the year 2020. One firm did not provide

any information on the diversity of their board for any year. Two

firms only provided information on the genders of their board

members for the year 2020 but did not provide information on race or ethnicity. Dimensional Fund

Advisors indicated that they do not track board diversity.

Women are underrepresented on investment firm

boards (28%). Based on the data provided by firms in

response to this inquiry, Charles Schwab Investment

Management had the lowest percentage of women on its

board with 0.0%, and MassMutual had the highest

percentage of women on its board at 45.5%. See Table 6

for details. On average, among firms that responded to

this inquiry, their boards were comprised of 72% men

and 28% women. See Figure 5. All firms, except one, had at least one woman either in executive

management or on the board in 2020.

Women are

underrepresented

on investment firm

boards (28%).

20

Table 6. Investment Firm Board Gender Diversity in 2020

Firm Name

Women %

MassMutual

45.5

Principal

41.7

JPMorgan Chase

40.0

Goldman Sachs

36.4

State Street

36.4

T. Rowe Price

36.4

Capital Group

33.3

MetLife

33.3

Morgan Stanley

33.3

BlackRock

31.3

Prudential Financial

30.8

Wellington Management

30.8

Franklin Templeton

30.0

Vanguard

30.0

BNY Mellon

27.3

New York Life

27.3

Wells Fargo

25.0

Blackstone

23.1

Northern Trust

23.1

Ameriprise

22.2

Invesco

22.2

AMG

20.0

AllianceBernstein

16.7

Federated Hermes

16.7

Fidelity

16.7

Charles Schwab Investment Management

0.0

Dimensional Fund Advisors

Did Not Provide

Nuveen

Did Not Provide

Note: Firms in red did not provide complete information about their board diversity.

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

21

Figure 5. Gender Composition of Investment Firm Boards in 2020

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

People of color are underrepresented on investment firm boards (17.5%). Based on the data

provided by firms in response to this inquiry, representation of people of color on firm boards

ranged from 0.0% to 38.5%. As described above, four

firms – Charles Schwab Investment Management,

Dimensional Fund Advisors, Franklin Templeton, and

Nuveen – did not report racial or ethnic board diversity.

See Table 8 for details. Of firms that provided information,

Federated Hermes, Fidelity, and Invesco had the lowest

percentage of board directors who identify as people of

color, with 0.0% of their boards comprised of people of

color. Northern Trust and Prudential had the highest percentage of people of color on their boards

with 38.5% of their boards comprised of individuals identifying as a person of color. On average,

the boards of the investment firms that provided us with data were comprised of 83.5% of people

who identify as White and 17.5% of people who identify as people of color. See Figure 6.

People of color are

underrepresented

on investment firm

boards (17.5%).

22

Table 7. Investment Firm Board People of Color Diversity in 2020

Firm Name

People of Color %

Prudential Financial

38.5

Northern Trust

38.5

BNY Mellon

36.4

MassMutual

27.3

T. Rowe Price

27.3

AllianceBernstein

25.0

Principal

25.0

Wells Fargo

25.0

Morgan Stanley

20.0

AMG

20.0

Goldman Sachs

18.2

New York Life

18.2

MetLife

16.7

Wellington Management

15.4

BlackRock

12.5

Ameriprise

11.1

JPMorgan Chase

10.0

Vanguard

10.0

Capital Group

9.5

State Street

9.1

Blackstone

7.7

Federated Hermes

0.0

Fidelity

0.0

Invesco

0.0

Charles Schwab Investment Management

Did Not Provide

Dimensional Fund Advisors

Did Not Provide

Franklin Templeton

Did Not Provide

Nuveen

Did Not Provide

Note: Firms in red did not provide complete information about their board diversity.

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

23

Figure 6. Average Racial and Ethnic Composition of Investment Firm Boards in 2020

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Of the firms that made 2020 racial justice commitments, one committed to increasing board

diversity. Notably, this report highlights the

commitments of firms to greater diversity

following the murder of George Floyd.

While firms committed to workforce

diversity and senior level workforce

diversity, very few made commitments to

increasing board diversity. Although

AllianceBernstein, Blackstone, and BNY

Mellon did not make public racial equity commitments in 2020 related to board diversity, these

firms increased Black leadership in 2020 with the addition of one Black board member per firm.

Table 8. 2020 Racial Equity Commitments: Board Diversity

Firm Name

Public Commitment

Date of Announcement

State Street

Work with board to add Black and

Latinx directors within 18 months

and to expand its diversity efforts

36

Unknown

36

State Street, Addressing Racism and Inequality (Assessed Nov. 18, 2020)

Of the firms that made 2020

racial justice commitments, one

committed to increasing board

diversity. (See Appendix IV)

24

C. Procurement Diversity

Businesses spend billions of dollars every year on goods and services, including in

professional services, information technology, and legal services. These services are important to

focus on as they are “high-margin” services and can create wealth for families and job creation

opportunities.

37

Firms with more diverse suppliers can benefit from improved supplier

competitiveness, innovation, heightened perception of impact, attract and retain top and diverse

talent, and have a positive social impact.

38

However, less than 1% of global financial assets under

management are managed by minority- or women- owned firms.

39

Investors have increasingly

focused on women-led funds through emerging manager programs or informal practices designed

to increase the number of diverse-led funds in their portfolios.

40

While almost two-thirds of firms reported having policies to support diverse suppliers, few

reported spending with women-owned or

minority-owned firms. Of the firms that

responded to the request, all reported

spending 4% or less of asset manager

spending with women-owned or minority-

owned firms. To better understand

investment management firms’ efforts to

promote diverse suppliers, Chairwoman

Waters and Chair Beatty asked thirteen

questions related to each firm’s procurement spending and related policies to support greater

supplier diversity. Among firms that responded to this inquiry efforts to promote diverse suppliers

increased from 43% in 2016 to 60% in 2020. While all firms reported having practices and policies

related to diverse suppliers, quantifiable data that captures the impact of these practices and

policies can help the public understand a firm’s commitment and its institutionalization of supplier

diversity. See Table 9.

37

Supplier diversity needs to focus on industries of today and tomorrow, Crain’s Chicago Business (Dec. 18, 2020).

38

Accenture, Five reasons why you should prioritize supplier diversity as part of your sourcing strategy (2020).

39

See Government Accountability Office, Key Practices Could Provide More Options for Federal Entities and Opportunities for

Minority-and Women-Owned Asset Managers, (Sept. 2017). Submitted to AMAC July 16, 2020. Report to Congress on the

Investment Management Industry.

40

The Call to Act: Women in Alternative Investment, 6

th

ed., Klynveld Peat Marwick Goerdeler (KPMG) (Feb. 2019).

While almost two-thirds of firms

reported having policies to

support diverse suppliers, few

reported spending with women-

owned or minority-owned firms.

25

Table 9. Efforts to Promote Diverse Suppliers

Diversity Practice

Total Investment

Firms with

Practice

The firm has a supplier diversity policy.

19 (61%)

The firm participates in conferences, workshops, and other events to attract minorities

and women and to inform them of employment and promotion opportunities.

23 (74%)

The firm publicizes its procurement opportunities in media primarily serving minorities

and women.

19 (61%)

The firm maintains a list of qualified minority-owned and women-owned businesses that

may compete for upcoming contracting opportunities.

22 (71%)

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Only 14 of the 28 firms (50%) that responded to this request provided at least some

information on women-owned businesses and minority-owned businesses with which they are

doing business. The Committee’s data

request included annual procurement

spend

41

for the years 2016-2020 with

women-owned, minority-owned, or

minority women-owned businesses

compared to the total procurement

spend with all vendors and suppliers

for the following professional service

categories: legal, consulting,

information technology, human

relations, other procurement, non-professional, subcontracted asset management, and

underwriting. The focus of the following section is 2020, the most recent year for which data was

collected.

41

Spend, procurement spend or direct spend is money spent for goods and services at a business or corporation.

Only 14 of the 28 firms (50%) that

responded to this request provided

at least some information on

women-owned businesses and

minority-owned businesses with

which they are doing business.

26

There was significant variation in the amount and types of quantitative data that each firm

provided. See Table 10 for details on which firms did and did not provide information. Fidelity,

New York Life, and Principal

reported overall spend, overall

spend with women-owned firms,

and overall spend with minority-

owned firms for 2020 but did not

break information down by

category of professional service.

AllianceBernstein reported the

total spend for each category

without any diversity

information. One firm only

provided the amount spent with

White male-owned firms for a

number of categories, while

stating that information is not

tracked for total spend. Several

firms reported that they did not

track most of the information

requested by the Committee, and

some firms reported that several categories were not applicable to them, for example underwriting

is done by diverse broker dealers for investment banking activities, such as assisting a company,

or an adviser helping a financial product being listed on an exchange. Wells Fargo provided data

on procurement for the overall firm and separately for its asset management subsidiary, Wells

Fargo Asset Management. As Wells Fargo is the only firm that provided this information, we were

not able to compare it to other firms’ subsidiary data.

There was significant variation in the percent of total money spent by investment firms

with women-owned and minority-owned firms. In certain instances, averages were driven by a

single firm’s commitment to diversity. For example, among 14 firms reporting legal spending with

minority-owned businesses, 13 of these firms reported less than 1% spending with minority-owned

businesses. However, Northern Trust reported that 50.8% of their legal spending is spent with

minority-owned businesses and 72.0% of their consulting spending is with women-owned

businesses, so although eight firms reported less than 1% of consulting spending with women-

owned businesses, two firms reported less than 1.3% with this group, and one firm reported 8.7%

of consulting spending with women-owned businesses, Northern Trust’s leadership in spending

with diverse suppliers and procurement elevated the average consulting spending with women-

owned businesses to 9.0%.

THE STATE OF DIVERSE OWNERSHIP FOR

MUTUAL FUNDS: WE IDENTIFY 136 WOMEN-

OWNED AND 120 MINORITY-OWNED FIRMS,

MANAGING $430 BILLION AND $191 BILLION

IN AUM. FOR WOMEN, THE 136 FIRMS

REPRESENT 9.9% OF FIRMS AND 0.8% OF

TOTAL INDUSTRY AUM, RESPECTIVELY.

27

Table 10. Investment Firms Reporting or Not Reporting Quantifiable Diverse Procurement and

Supplier Information

Firms that

reported

quantifiable

information

Legal

Spend

Consulting

Spend

IT

Spend

HR

Spend

Other

Procurement

Spend

Non-

Professional

Spend

Asset

Management

Subcontracting

Underwriting

Fees

AllianceBern-

stein

Ameriprise

BlackRock

Blackstone

BNY Mellon

Dimensional

Fund

Capital Group

Fidelity

Goldman Sachs

Invesco

JPMC

MassMutual

MetLife

Northern Trust

Prudential

State Street

T. Rowe Price

Vanguard

Wellington

Management

Wells Fargo

28

Firms that did

not report

quantifiable

information

Legal

Spend

Consulting

Spend

IT

Spend

HR

Spend

Other

Procurement

Spend

Non-

Professional

Spend

Asset

Management

Subcontracting

Underwriting

Fees

Affiliated

Managers*

AllianceBern-

stein

Blackstone*

BNY Mellon†

Capital Group*

Charles Schwab

Investment

Management*

Dimensional

Fund Advisors†

Federated

Hermes

Fidelity*

Franklin

Templeton*

Invesco*

MassMutual

MetLife*

Morgan Stanley

New York Life

Nuveen

Principal*

Prudential

State Street*

T. Rowe Price

Vanguard

Wellington

Management†

Wells Fargo

29

Notes: Firms in red did not provide information. * indicates that an investment firm self-reported that this category

was not tracked. † indicates that an investment firm indicated that this category was not applicable to them.

Ameriprise only reported total underwriting fees without any diversity information for this category. Prudential

included non-professional spend in other procurement. MassMutual included consulting spend in other

procurement.

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Based on responses received, the average amount of money spent with women-owned

firms ranges from 11.63% for non-professional spending to 0.30% for underwriting. The average

amount of money spent with minority-owned firms ranges from 17.13% for human resources to

0.50% for asset management subcontracting. See Table 11 for details.

Table 11. Average Percentage of Money Spent on Procurement or Suppliers with Women-

Owned or Minority-Owned Firms in 2020

Women-Owned %

Minority-Owned %

Legal

3.46

5.28

Consulting

8.98

2.78

Information Technology

4.85

11.10

Human Resources

7.73

17.13

Other Procurement

5.86

7.16

Non-Professional

11.63

1.24

Asset Management Subcontracting

0.57

0.50

Underwriting

0.30

9.47

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Only three firms made a

commitment around procurement

among their 2020 commitments to

racial justice. Despite a few firms

making commitments to increase

workforce diversity, even fewer firms

made public commitments regarding

procurement following the murder of

George Floyd. See Table 12.

Only three firms made a

commitment around procurement

among their 2020 commitments to

racial justice.

30

Table 12. 2020 Racial Equity Commitments: Supplier Diversity

Firm Name

Public Commitment

Date of

Announcement

BlackRock

Committed to increasing partnerships with minority

business enterprises, including minority brokers for

trading, external managers in our solutions and fund of

funds businesses, and third-party vendors

42

June 22, 2020

State Street

Increase our spend with diverse suppliers over the next

three years. Hold ourselves accountable for

strengthening Black- and Latinx-owned businesses.

Unknown

Fidelity

Proactively procure goods and services from diverse

businesses

June 11, 2020

Source: U.S. House Financial Services Committee Staff Analysis of Public Racial Equity Statements

D. Asset Management Diversity

There was little variation in asset management subcontracting. Nine firms did not report

quantitative information on the amount of money spent with women-owned and minority-owned

asset managers. Of those firms that reported quantitative information, none committed more than

4.0% of their asset management subcontracting to women-owned or minority-owned managers.

Only 9 of the 28 firms (32%) that responded to this request provided information on

women-owned asset managers with which they are doing business. Of these firms, they spent on

average 0.57% of total asset management services spend with women-owned businesses.

Comprehensive data on diverse asset

managers from the SEC is not

available, as the regulator does not

capture this information for those it

regulates. However, a 2019 report

found that there are 136 women-

owned and 120 minority-owned

firms.

43

For women, the 136 firms

represent nearly 10% of all asset

management firms, but just 0.8% of total industry assets under management (AUM).

42

Fink and Kapito, Our Actions to Advance Racial Equity and Inclusion (Jun. 22. 2020).

43

Bella Private Markets, 2018 Diverse Asset Management Firm Assessment (Jan. 2019).

Only 9 of the 28 firms (32%) that

responded to this request provided

information on women-owned asset

managers with which they are doing

business.

31

Only 9 of the 28 firms (32%) that responded to this request provided information on

minority-owned asset managers with which they are doing business. Of these firms, they spent on

average 0.50% of total asset

management services spend with

minority asset managers. For

minority-owned firms, 120

represents around 9% of all firms

and they manage just 0.4% of total

AUM. In line with this,

investment management firms

who reported quantitative data for this

report spent an average of 0.50% of asset management spend with minority-owned businesses. If

these firms experienced parity in the contracting space to their representation in the industry, it

would be expected that much more would be spent with women- and minority-owned asset

managers. See Figures 7 and 8.

Figure 7. Comparison Between Minority-Owned Asset Management Firms and Total Percent

Spend with Minority-Owned Asset Management Firms

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data and Bella Private

Markets

Only 9 of the 28 firms (32%) that

responded to this request provided

information on minority-owned

asset managers with which they are

doing business.

32

Figure 8. Comparison Between Women-Owned Asset Management Firms and Percent Spend

with Women-Owned Asset Management Firms

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data and Bella Private

Markets

33

E. Underwriting Procurement Diversity

If a company is interested in going public, raising additional capital, or merging with

another company, they hire an investment bank to initiate the underwriting process.

44

Underwriting

is a multi-stage process in which an investment bank that is registered as a broker dealer and/or

investment adviser, and its partners, help raise capital from investors for a client. Essentially,

underwriters act as an intermediary between companies and the investing public.

45

On the sell-

side, the underwriter plans the offering and structures the type and nature of the offering. On the

buy-side, investment advisers run and manage the day-to-day operations of a fund or funds and

choose whether or not to buy the investment vehicle that is part of the capital raising process.

Underwriting is lucrative for Wall Street, because firms charge up to 7% to take a small business

public.

46

Investment managers play an important role in capital formation and wealth creation and

have the ability to distribute opportunities to other service providers or sub-advisers so that others

can participate in this process.

Many business operations of an

investment adviser can be

contracted out, including but not

limited to auditing, accounting,

custodial services, valuation, and

the solicitation of investors.

Only 6 of the 28 firms

(21%) that responded to this request provided information on women-owned and minority-owned

underwriters with which they are doing business. Of these firms, they spent on average 0.30% of

total underwriting services spend with women-owned businesses and 9.47% with minority asset

managers. See Figures 9 and 10.

44

Desjardins Online Brokerage, The Underwriting Process (Assessed Nov. 1, 2021).

45

Id.

46

See Commissioner Robert J. Jackson, Jr., The Middle Market IPO Tax (April 25, 2018), available at https://

www.sec.gov/news/speech/jackson-middle-market-ipo-tax; Commissioner Robert J. Jackson, Jr., Unfair Exchange: The State of

America’s Stock Markets (September 19, 2018) available at https://www.sec.gov/news/speech/jackson-unfair-exchange-state-

americas-stock-markets.

Only 6 of the 28 firms (21%) that

responded to this request provided

information on women-owned and

minority-owned underwriters with

which they are doing business.

34

Figure 9. Underwriting Spend with Women-Owned Businesses

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

Figure 10. Underwriting Spend with Minority-Owned Businesses

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Data

F. Data Reliability

To understand the accuracy of provided data, committee staff requested that firms provide

information on data reliability. Specifically, we requested information on data sources, whether

data was actual data or estimated, estimation methods, and concerns about reliability. In Table 13

35

below, we show which firms provided actual information, a mixture of actual and estimated

information, or no information on data reliability.

21 firms (75%) indicated that the data they provided were actual numbers rather than

estimates when providing information about their workforce, board, and procurement, including

asset management and underwriting. Four firms (14%) indicated that the data that they provided

were a mixture of actual numbers

and estimates. Three firms (11%)

did not provide information about

whether they used actual numbers

or estimates.

Some firms’ use of close

estimates allowed them to provide

more complete information.

Ameriprise, BlackRock, and

Northern Trust were all able to

provide at least some quantitative information in all requested categories using estimates.

However, other firms were able to provide quantitative information in all categories using actual

numbers. For example, Goldman Sachs and JPMorgan Chase and were able to provide at least

some quantitative information in all categories. See Appendix V.

G. Diversity Practices and Policies

Most firms reported that they have policies and positions related directly to diversity and

inclusion and that they engaged in efforts to recruit and hire diverse employees. 100% of firms

acknowledged the importance of connecting to the diverse communities they serve.

47

In response to the murder of George Floyd and similar instances of social injustice, 22

firms (78%) made public commitments related to diversity practices and policies. These

commitments centered around

pledges to improve internal

practices and policies. In analyzing

these commitments, the majority

of these firms made tangible

commitments that the company

would take to improve diversity

and inclusion either in the

community or within the firm. For

example, T. Rowe price committed $2 million to organizations working to fight racial justice.

47

Though 28 firms responded to the data request, three firms included data from their subsidiary firms (i.e., Morgan Stanley,

Morgan Stanley Investment Management; Prudential, Prudential (PGIM); and Affiliated Managers- AMG Funds LLC, Affiliated

Managers - AMG Inc). Staff analyzed data for each firm and its subsidiary. Therefore, calculations in this section sum to 31

responses instead of 28.

21 firms (75%) indicated that the data

they provided were actual numbers

rather than estimates when providing

information about their workforce,

board, and procurement, including

asset management and underwriting.

Most firms reported that they have

policies and positions related directly

to diversity and inclusion and that they

engaged in efforts to recruit and hire

diverse employees.

36

Additionally, Morgan Stanley made several commitments, such as hiring a new Head of Global

Internal Audit and Global Head of Diversity and Inclusion; creating a new Institute of Inclusion;

donating $5 million to the NAACP Defense Fund; and matching dollar for dollar U.S. employee

contributions to the Fund. While some firms made strong commitments, roughly half of firms

made broad statements regarding the promotion of diversity and inclusion. A few firms made broad

commitments to creating a diverse environment, with no mention of racial equity or executive

action or investment to advance these statements. See Table 13.

37

Table 13. 2020 Racial Equity Commitments: Practices and Policies

Firm Name

Type of Commitment

Date of

Announcement

AllianceBernstein

Committed to host open-forum discussions on race in the workplace

48

Unknown

Ameriprise

Financial

Committed to cultivating an environment that supports conversations

about diversity and inclusion

49

June 2, 2020

Bank of New

York Mellon

General recommitment to promote diversity and inclusion at the firm

50

May 30, 2020

BlackRock

Committed to a new speaker series on racial inclusion; requiring a new

mandatory “racial equity” course for all BlackRock employees;

Embedding accountability and improving tracking and measurement of

diversity metrics; Developing and launching products focused on racial

equity and social justice; Continue to disclose data on the diversity of

BlackRock’s workforce

51

June 22

,

2020

Blackstone

Group

Recommitted to creating a diverse and inclusive workplace

52

June 01, 2020

Capital Group

Committed to increasing our contributions to organizations promoting

social justice and racial equity by $2 million

53

June 10, 2020

Federated

Hermes

Committed to respecting the community and condemning racism,

broadly

54

June 3, 2020

Fidelity

Investments

Recommitted to fair and equitable treatment for every associate, and to

creating a safe and respectful workforce;

55

committed to establishment

of the Matching Gifts to Support Racial Equity

June 1, 2020

Goldman Sachs

Continue long-term relationships with Historically Black Colleges and

Universities (HBCUs) to recruit new hires

56

August 5, 2020

Invesco

Committed to donating to the NAACP Legal Defense and Education

Fund. Joined with the Atlanta Committee for Progress

57

June 1, 2020

J.P. Morgan

Chase

Committed to fighting against racism and discrimination, broadly

58

Unknown

MassMutual

Committed to hosting company discussion around race

59

June 2, 2020

48

Seth Bernstein, Fostering Connections During Unsettling Times AllianceBernstein. (Accessed Oct. 22, 2021).

49

Jim Cracchiolo, A message from Jim Cracchiolo, Chairman and Chief Executive Officer, Ameriprise (Jun. 2020)

50

Thomas Gibbons, Through Diversity and Inclusion Comes Understanding and Strength, BNY Mellon (May. 2020)

51

BlackRock, Our Actions to Advance Racial Equity and Inclusion (Jun. 22, 2020).

52

Blackstone, Steve Schwarzman and Jon Gray’s statement on racial injustices (Jun. 2020)

53

Tim Armour, We Must Do Better, Capital Group (Jun. 10, 2020)

54

J. Christopher Donahue and Saker Nusseibeh, Peaceful Protest is a Cornerstone of Democracy, Federated Hermes (Jun. 3,

2020).

55

Abby Johnson, I, too, am heartbroken and angry that racial discrimination and inequality continue to plague our society,

LinkedIn (Jun. 1 2020).

56

Goldman Sachs, Update on Inclusion and Diversity at Goldman Sachs, Including New Aspirational Goals, (Aug. 5 2020).

57

Marty Flanagan, Pledging our support to address social injustice LinkedIn (Jun. 1, 2020).

58

Jamie Dimon and Brian Lamb, Message from Jamie Dimon and Brian Lamb JP Morgan Chase (Accessed Oct. 22, 2021).

59

Roger Crandall, My Letter Mass Mutual Employees LinkedIn (Jun. 2, 2020).

38

Firm Name

Type of Commitment

Date of

Announcement

MetLife

Investment

Committed to strengthening advocacy for all people, broadly

60

June 1, 2020

Morgan Stanley

Committed to introducing a new Head of Global Internal Audit and

Global Head of Diversity and Inclusion; creating a new Institute of

Inclusion; donating $5 million to the NAACP Defense Fund; match

dollar for dollar U.S. employee contributions to the Fund; a new fifth

value to our core values: Committing to Diversity and Inclusion

61

June 5, 2020

New York Life

Investments

Recommitment to having conversations around race in the workplace

62

Unknown

Northern Trust

Committed to provide $20 million over 5 years to expand access to

resources that address food, housing, healthcare, and education

63

June 15, 2020

Nuveen

Launched program to raise awareness of social injustice among

employees

64

June 30, 2020

Prudential

Implement several programs that focus on building pathways for Black

Americans to achieve financial security; mandate anti-racism and other

inclusion training for all U.S. employees; and create greater

transparency of diversity data.

June 19, 2020

State Street

Systematically review governance models within key management

committees to ensure inclusion and diverse representation. Enlist entire

workforce in learning opportunities and conversations around anti-

racism and equity.

Unknown

T. Rowe Price

Committed $2 million to organizations working to fight racial injustice

65

June 18, 2020

Vanguard Group

Announced a $100,000 donation to the Thurgood Marshall College

Fund’s COVID-19 HBCU Emergency Fund

66

June 26, 2020

Wellington

Management

Committed to expand diversity and inclusion training for managers and

leaders; launch programs that foster open conversations and better

education about the realities of Black colleagues

67

Unknown

Note: This chart provides an example of each firms’ commitments, rather than an exhaustive list

Source: U.S. House Financial Services Committee Staff Analysis of Public Racial Equity Statements

1. Practices to Support Diversity

Of the firms that responded to this request for information, 74% indicated that they have

policies and positions related directly to diversity and inclusion in 2016. This average increased to

60

MetLife, https://twitter.com/MetLife/status/1267500880640835585 Twitter (Jun. 1, 2020).

61

James Gorman Committing to Diversity and Inclusion LinkedIn (Jun. 5, 2020).

62

Ted Mathas Uniting Against Racism New York Life (Jun. 2020).

63

Northern Trust, Northern Trust Commits US$20 Million to Reduce Opportunity Gap (Jun. 15, 2020).

64

TIAA, TIAA launches programs to raise awareness of racial injustice and support communities in need through the "Be the

Change" initiative.

65

T. Rowe Price, PRESS RELEASE: T. Rowe Price Commits $2 Million to Support Organizations in the Fight Against Racial

Injustice (Jun. 18, 2020).

66

Vanguard, Vanguard Announces Support of Historically Black Colleges and Universities Impacted By Global Pandemic (Jun.

26, 2020).

67

Wellington Management

39

87% in 2020. Based on findings from the Committee on Financial Services 2020 Diversity and

Inclusion Banking Report,

68

the five most common diversity and inclusion workplace strategies

shown in Table 15 were identified. In this data request, investment firms were asked to indicate

whether they utilize each of the following strategies and were given the opportunity to describe

any additional diversity and inclusion practices. The two most implemented practices and policies

were: (1) connecting with diverse communities; and (2) recruiting diverse talent.

Table 14. Top Five Common Investment Firm Diversity Practices and Policies in 2020

Diversity and Inclusion Practice

Total Asset Manager

Firms with Practice

Connecting with diverse communities

31 (100%)

Recruiting diverse talent

31 (100%)

Monitoring and evaluating performance under its diversity policies and

practices on an ongoing basis.

30 (97%)

Collecting gender pay equity data and efforts to close the gender pay gap

29 (94%)

Using enhanced interview tactics

27 (87%)

Source: U.S. House Financial Services Committee Staff Analysis of Investment Firm Diversity Data.

Connecting with Diverse Communities. All firms that responded to the diversity and

inclusion survey items acknowledged the importance of connecting to the diverse

communities that they serve. Some firms reported working with outside organizations

dedicated to the advancement of women and people of color to enhance the diversity efforts

of their organizations. Some firms mentioned external partnerships with affinity groups for

the purpose of creating a pipeline program to recruit diverse talent. For example,

MassMutual stated that they worked with external racial equity and justice organizations

to “address the racial wealth gap and income disparities by providing access to capital and

resources to Black-owned businesses and by supporting agencies with increased

recruitment, marketing, and business development opportunities for our Black and African

American agents.” Additionally, a few firms mentioned donating, or pledging to donate,

funds to organizations focused on racial equity or social justice. For example, both

Vanguard and T. Rowe Price donated money to support racial equity organizations

including, the Equal Justice Initiative, NAACP Legal Defense Fund, Leadership

Conference Education Fund, and Asian Americans Advancing Justice.

Recruiting Diverse Talent. Of the firms that responded to the diversity and inclusion

survey items, 83% indicated that they engaged in efforts to recruit and hire diverse

employees in 2016. This average increased to 100% in 2020. Most firms engaged in efforts

to recruit diverse talent through a variety of methods such as partnerships with external

68

Id.

40

minority and women organizations (100%) as well as Historically Black Colleges and

Universities (HBCUs), Minority-Serving Institutions (MSIs) and Women Serving

Institutions (94%). Many firms (94%) indicated that they communicate employment

opportunities through media predominately serving people of color and women.

Additionally, 94% of firms indicated participation in conferences, workshops, and other