HOUSING OPPORTUNITIES FOR PERSONS WITH AIDS (HOPWA)

Rental Assistance

Guidebook

OFFICE OF HIV/AIDS HOUSING JANUARY 2013

HOPWA

Housing Opportunities

for Persons With AIDS

Acknowledgements

This guidance material was prepared by ICF International in partnership with Collaborative Solutions, Inc.

for the U.S. Department of Housing and Urban Development’s Office of HIV/AIDS Housing. The Office of

HIV/AIDS Housing would like to thank Victory Programs, Inc. for their work to finalize this guidebook for

publication.

All materials in this work are in the public domain and may be reproduced or copied without permission

from U.S. Department of Housing and Urban Development. Citation of the source is appreciated. This

publication may not be reproduced or distributed for a fee without the specific written authorization of the

Office of HIV/AIDS Housing, Office of Community Planning and Development, U.S. Department of

Housing and Urban Development.

U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT

WASHINGTON, DC 20410-7000

www.h

ud

.

go

v

espanol.hud.gov

OFFICE OF COMMUNITY PLANNING

AND

DEVELOPMENT

Dear Colleagues:

The Office of HIV/AIDS Housing is pleased to present the Housing Opportunities for

Persons With AIDS (HOPWA) Rental Assistance Guidebook. This publication provides

HOPWA grantees and project sponsors with the tools and reference materials for operating

programs that use rental assistance payments to provide housing support to beneficiaries. The

guidebook will also be useful as you assess the results of your current rental housing programs

and consider changes, if needed. It outlines additional steps to help identify current community

needs and develop an updated comprehensive housing strategy in providing supportive housing

for low-income persons living with HIV/AIDS and their families with HOPWA and other

leveraged resources. The guidebook also supports your efforts to maintain quality programs and

to strengthen partnerships in coordinating the delivery of housing assistance and support services

to help end homelessness and reduce risks of homelessness for vulnerable households.

The Office appreciates your commitment to effectively managing and carrying out

HOPWA program activities. This guidebook is part of a range of HOPWA training materials and

related Office of Community Planning and Development (CPD) resources available to you at

https://www.onecpd.info/. The Office continues to encourage HOPWA grantees, projec

t

sponsors, and recipient organizations to make use of these resources to increase the knowledge

and skills necessary to manage these public resources, provide clients with appropriate housing

and support, and to ensure continued program successes.

If you have any questions or comments about this guidebook, please contact the Office of

HIV/AIDS Housing at HOP[email protected] or contact your local HUD Community Planning and

Development field office.

Thank you for your work on behalf of HOPWA beneficiaries in your community.

Sincerely,

David Vos

Director

Office of HIV/AIDS Housing

HOPWA Rental Assistance Guidebook i

HOPWA RENTAL ASSISTANCE GUIDEBOOK

Table of Contents

Introduction ................................................................................................................................................. 1

Purpose of the Guidebook ................................................................................................................... 1

Target Audience .................................................................................................................................. 1

Level of Knowledge Required .............................................................................................................. 1

How the Guidebook is Organized ........................................................................................................ 2

Using the Guidebook ........................................................................................................................... 3

Additional Resources ........................................................................................................................... 4

Chapter 1: Strategic Planning for Rental Assistance ............................................................................. 6

What This Chapter is About ................................................................................................................. 6

Step 1: Develop an Inventory of Current Housing and Services ......................................................... 6

Step 2: Collect and Analyze Information on Housing and Needs........................................................ 7

Collecting Information on HIV/AIDS Housing and Service Needs ............................................ 8

Analyzing Housing Data .......................................................................................................... 10

Step 3: Develop a Strategic Plan ....................................................................................................... 13

Step 4: Implementation Planning ....................................................................................................... 15

Chapter 2: HOPWA Rental Assistance Program Design ..................................................................... 16

What This Chapter is About ............................................................................................................... 16

Providing Rental Assistance .............................................................................................................. 17

Tenant-Based Rental Assistance ............................................................................................ 17

Project-Based Rental Assistance ............................................................................................ 18

Master Leasing ........................................................................................................................ 19

Designing a Rental Assistance Program ........................................................................................... 19

Program Management ............................................................................................................. 20

Property Management ............................................................................................................. 20

Supportive Services Delivery ................................................................................................... 21

Assigning Responsibilities ....................................................................................................... 21

Attachment 2-1: Short-Term Rent, Mortgage, and Utility (STRMU) Assistance Fact Sheet ............. 24

Attachment 2-2: Property Management and Supportive Services: Roles and Responsibilities and

Areas o

f Overlap ................................................................................................................................ 28

Attachment 2-3: Key Principles for Coordinating Property Management and Supportive Services in

Suppor

tive Housing ........................................................................................................................... 29

Chapter 3: Services In Support of Housing Stability ........................................................................... 33

What This Chapter is About ............................................................................................................... 33

HOPWA Rental Assistance Guidebook ii

Designing a Supportive Service Plan ................................................................................................ 34

Supportive Service Plan Components ..................................................................................... 34

Core Supportive Services ........................................................................................................ 35

Case Management ............................................................................................................................ 36

Case Management for the HOPWA Rental Assistance Program ........................................... 36

The Importance of a Housing Focus ....................................................................................... 37

Client Housing and Services Needs Assessment and Individual Housing and Services Plan ......... 37

Assessment of Housing and Services Needs ......................................................................... 37

Developing an Individual Housing and Services Plan ............................................................. 39

Staffing and Supervising .................................................................................................................... 41

Staffing Levels ......................................................................................................................... 42

Staff Supervision ..................................................................................................................... 42

Additional Service Considerations ..................................................................................................... 43

Attachment 3-1: Sample Services Plan for a Supportive Housing Development .............................. 45

Attachment 3-2: Sample Supportive Services Planning Worksheet..................................................61

Attachment 3-3: Sample Housing Assessment Template .................................................................64

Attachme

nt 3-4: Sample Quarterly Assessment and Stability Plan...................................................72

Chapter 4: Program Operations – Rental Subsidy ............................................................................... 82

What This Chapter is About ............................................................................................................... 82

Determining Rent Standard and Rent Reasonableness ................................................................... 82

Rent Standard.......................................................................................................................... 83

Rent Reasonableness ............................................................................................................. 85

Determining Resident Income ........................................................................................................... 87

CPD Income Eligibility Calculator ............................................................................................ 87

Determining Annual Income .................................................................................................... 88

Determining Adjusted Income ................................................................................................. 88

Calculating Resident Rent Contribution and Maximum Rental Subsidy ........................................... 90

Administering the HOPWA Rental Subsidy ....................................................................................... 92

Final Rent and Utilities Calculations ........................................................................................ 92

Payment Process .................................................................................................................... 93

Offering Additional Options: Shared Housing .................................................................................... 94

Eligibility ................................................................................................................................... 94

Maximum Rent......................................................................................................................... 94

Rent Reasonableness ............................................................................................................. 95

Budgeting for a TBRA Program ......................................................................................................... 95

Attachment 4-1: Rent Reasonableness Checklist and Certification .................................................. 98

Attachment 4-2: HOPWA Income and Resident Rent Calculation Worksheet .................................. 99

HOPWA Rental Assistance Guidebook iii

Attachment 4-3: Guidance on Earned Income Disregard ................................................................106

Attachment 4-4: Zero Income Affidavit ............................................................................................112

Attachment 4-5: Sample Income and Resident Rent Calculation Worksheet – Completed ...........113

Attachment 4-6: Shared Housing Rent Calculation Worksheet.......................................................117

Chapter 5: Program Operations – Policies and Procedures ............................................................. 120

What This Chapter is About ............................................................................................................. 120

Confidentiality .................................................................................................................................. 120

Other Federal and State Guidance on Confidentiality ........................................................... 121

Collecting and Maintaining Client Information ....................................................................... 121

Key Policies and Procedures for Rental Assistance Programs ....................................................... 122

Client Eligibility....................................................................................................................... 123

Client Intake ........................................................................................................................... 123

Client Participation Agreement .............................................................................................. 124

Termination of Rental Assistance .......................................................................................... 124

Program (House) Rules ......................................................................................................... 125

Emergencies and Grievances ............................................................................................... 125

Housing Search Process ....................................................................................................... 126

Move-in Prerequisites ............................................................................................................ 126

Housing Suitability ................................................................................................................. 127

Occupancy Standards ........................................................................................................... 127

Tenant Lease Requirements ................................................................................................. 128

Rental Program Landlord Contract ........................................................................................ 130

HOPWA Habitability Standards ....................................................................................................... 130

Lead-Based Paint .................................................................................................................. 131

Fire Safety ............................................................................................................................. 133

Financial Management .................................................................................................................... 133

Environmental Considerations ......................................................................................................... 134

Attachment 5-1: Covered Entity Charts ........................................................................................... 137

Attachment 5-2: Sample HOPWA Information Release Form ......................................................... 147

Attachment 5-3: Sample Rental Assistance Landlord Contract ...................................................... 148

Attachment 5-4: Sample HOPWA Habitability Standards Form ...................................................... 152

Attachment 5-5: Summary of Federal Financial Management Requirements ................................ 153

Chapter 6: HOPWA Grant Management Requirements ...................................................................... 154

What This Chapter is About ............................................................................................................. 154

Oversight of Project Sponsors ......................................................................................................... 155

Grantee – Sponsor Agreements ............................................................................................ 155

HOPWA Rental Assistance Guidebook iv

Monitoring Activities ............................................................................................................... 156

Financial Management: Personnel and Non-Personnel Costs ........................................................ 157

Personnel Costs .................................................................................................................... 158

Non-Personnel Costs ............................................................................................................ 159

Financial Management: Documenting Costs ................................................................................... 159

Documentation of Rental Assistance Support ....................................................................... 159

Documentation of Personnel Costs Directly Related to Rental Assistance .......................... 161

Documentation of Personnel Costs for HOPWA Administration ........................................... 162

Documentation of Non-Personnel Costs ............................................................................... 162

Performance Measurement and Reporting ..................................................................................... 162

CAPER and APR Reporting .................................................................................................. 163

Integrated Disbursement and Information System ................................................................ 164

The Importance of Reporting ................................................................................................. 164

Attachment 6-1: Guide for Review of HOPWA Project Sponsor or Subrecipient Management ...... 166

Attachment 6-2: Sample Client File Contents Checklist .................................................................. 182

HOPWA Rental Assistance Guidebook 1

INTRODUCTION

PURPOSE OF THE GUIDEBOOK

The Housing Opportunities for Persons with AIDS (HOPWA) program is administered by the Office of

HIV/AIDS Housing (OHH) at the U.S. Department of Housing and Urban Development (HUD). OHH is a

division of the Office of Community Planning and Development (CPD), which provides grants

management oversight through 44 area and state field offices. Since the program’s inception in 1992,

HOPWA has helped thousands of Americans with HIV/AIDS avoid homelessness by addressing their

housing needs in coordination with access to medical care and other supportive services.

The deficit of affordable housing in many communities is significant and impacts low-income residents

across the country. For low-income persons with HIV/AIDS, the challenge of finding affordable housing is

compounded by the need to cope with their medical and related issues; stable housing is the cornerstone

of HIV/AIDS treatment, allowing persons with HIV/AIDS to access comprehensive healthcare and adhere

to complex HIV/AIDS drug therapies.

1

While

Homeless Continuums of Care (CoCs) focus on the housing and service needs of homeless

populations, the development of a range of housing options specifically for those with HIV/AIDS is

warranted in order to ensure that the needs of this vulnerable group are effectively addressed. Research

has consistently shown that stable housing is a key factor in successful health outcomes for persons with

HIV/AIDS and tends to reduce risky behaviors and prevent the spread of HIV.

2

HOPWA rental assistance programs are one way of addressing the need for stable housing for persons

living with HIV/AIDS. Though rental assistance programs exist in many communities, few of these

programs target and coordinate service delivery on the comprehensive needs of low-income persons

living with HIV/AIDS. This guidebook provides HOPWA grantees and project sponsors with the tools and

resources needed to design new rental assistance programs or refine existing rental assistance programs

in coordination with HIV care and treatment so that they effectively and efficiently meet the needs of

HOPWA program beneficiaries. Specifically, this guidebook does the following:

• Describes HOPWA requirements as they relate to rental assistance programs

• Provides examples of tools and resources designed to help grantees implement effective

progr

ams

• Assists grantees and project sponsors in administering rental assistance programs and

coordinating care to better address the needs of low-income persons living with HIV/AIDS

TARGET AUDIENCE

The primary audience for this guidebook is HOPWA grantees and project sponsors providing direct

housing assistance with HOPWA funds and other key stakeholders involved in establishing and/or

implementing rental assistance programs for persons living with HIV/AIDS.

LEVEL OF KNOWLEDGE REQUIRED

This guidebook assumes a basic understanding of the HOPWA program requirements. It will focus on

HOPWA requirements only as they pertain to establishing or refining rental assistance programs receiving

1

U.S. Department of Housing and Urban Development: Implementation Plan for the for the National HIV/AIDS

Strategy (February 2011). See: https://www.onecpd.info/resource/1942/huds-implementation-plan-for-the-national-

hiv-aids-strategy/.

2

Kidder, D. P., Wolitski, R. J., Royal, S., Aidala, A., Courtenay-Quirk, C., Holtgrave, D. R., Harre, D., Sumartojo, E.,

Staff, R. (2007). Access to housing as a structural intervention for homeless and unstably housed people living with

HIV: rationale, methods, and implementation of the housing and health study. AIDS and Behavior, 11, S149-S161.

Introduction

HOPWA Rental Assistance Guidebook 2

HOPWA funding. While the guidebook is designed as a resource to be used when developing and

administering a rental assistance program for persons living with HIV/AIDS, it is not a stand-alone

document. Rather, it should be used in coordination with HUD staff and other grantees and project

sponsors who are an important resource for ideas, approaches, and sample program documents.

For readers looking for a more in-depth review of the HOPWA program and its rules and regulations,

please see: www.onecpd.info. Additional HOPWA resources are also listed in this guidebook on pages 4

and 5.

HOW THE GUIDEBOOK IS ORGANIZED

This guidebook is organized into six chapters that describe the HOPWA program requirements and

considerations that need to be taken into account when designing a HOPWA-funded rental assistance

program. To make it easier to develop or refine an existing HOPWA rental assistance program, these

chapters provide examples, tables, lists, and other tools designed to address common challenges and

help implement successful rental assistance programs.

Chapter 1: Strategic Planning for Rental Assistance offers a discussion on strategic planning for

HOPWA rental assistance within the framework of an overall HIV/AIDS housing strategy. This chapter

describes four fundamental steps in developing a community’s HIV/AIDS housing strategy. The first step

is to develop an inventory of current housing and services available to HOPWA-eligible persons. The

second step is to collect and analyze data on housing and service needs of HOPWA-eligible persons.

The third step is to develop a strategic plan. The final step in this process is to implement the strategic

plan.

Chapter 2: HOPWA Rental Assistance Program Design describes three types of rental assistance—

Tenant-Based Rental Assistance (TBRA), Project-Based Rental Assistance (PBRA), and Master

Leasing—and the advantages and disadvantages of each approach. It also provides an overview of the

fundamental components to consider when designing a rental assistance program: program

management; property management; and supportive service delivery.

Chapter 3: Services in Support of Housing Stability provides an overview of HOPWA requirements

and additional guidance related to providing supportive services. This chapter provides guidance and

information on designing a Supportive Services Plan and delivering case management. Additionally, this

chapter details the process of assessing a client’s housing and services needs and using that information

to develop an Individual Housing and Services Plan for the client. Finally, the chapter discusses staffing,

supervising, and additional service considerations to take into account when dealing with the unique

needs of HOPWA clients.

Chapter 4: Program Operations – Rental Subsidy discusses a number of key concepts that program

staff must consider for each client when administering a HOPWA rental assistance program. The chapter

begins by outlining the process by which the maximum rental subsidy is determined, including the

process of determining the rent standard and rent reasonableness and determining and adjusting annual

income. It then discusses how to administer the rental subsidy, including how to calculate final rent and

utilities. This chapter also outlines the requirements for eligibility, setting the rent standard, and

determining rent reasonableness for shared housing options. The chapter ends with an overview of the

factors to be considered when budgeting for TBRA programs.

Chapter 5: Program Operations – Policies and Procedures outlines policies and procedures designed

to enhance effective operation of a rental assistance program. This chapter highlights the importance of

having procedures in place to protect the confidentiality of HOPWA participants. It also discusses the

process of developing written policies and procedures for program staff and program participants to help

ensure consistent and fair program practices and compliance with HOPWA regulations. Finally, this

chapter also identifies the requirements that each leased unit must meet under the HOPWA Habitability

Standards as well as financial management and environmental review considerations to be taken into

account during the planning process.

Introduction

HOPWA Rental Assistance Guidebook 3

Chapter 6: HOPWA Grant Management Requirements reviews factors HOPWA grantees and project

sponsors must consider to successfully meet grant management requirements of the HOPWA program.

This chapter discusses the grantee – sponsor relationship, starting with the written agreements that set

the stage for productive and effective monitoring. It addresses monitoring methods, including remote

reviews and onsite visits. This chapter will also help grantees and sponsors understand what costs are

reimbursable and how to classify them, as well as what kind of documentation is needed for personnel

and non-personnel costs. Finally, the chapter provides an overview of performance management and

reporting requirements.

USING THE GUIDEBOOK

This guidebook is meant to serve as a resource when developing a new or refining an existing rental

assis

tance program using HOPWA funds. There are different ways to use this guidebook depending on

where the grantee or project sponsor is in the process of establishing or implementing a rental assistance

program. Below are some examples of how this guidebook can be used:

• If the grantee is just beginning to think about using HOPWA funds to provide rental housing

assistance, this guidebook can be used as a tool to help decide which form of rental

assistance is the right choice for the program. A discussion of the advantages and

disadvantages of each approach is explored in Chapter 2: HOPWA Rental Assistance

Program Design.

• Once a grantee is ready to begin designing a rental assistance program using their HOPWA

funds, Chapters 2 – 6 can provide a framework for developing a checklist of the activities that

need to be considered. Grantees at this stage in the process should also pay special

attention to Chapter 1: Strategic Planning for Rental Assistance, which discusses how to

begin by outlining a community plan.

• This guidebook is also helpful for grantees that already have a rental assistance program in

place by helping grantees and project sponsors explore ways to determine the effectiveness

of existing activities and determine where improvements can be made to enhance their

program.

Introduction

HOPWA Rental Assistance Guidebook 4

ADDITIONAL RESOURCES

As noted above, this guidebook is not a stand-alone document. Rather, it should be used in coordination

with existing HOPWA guidance and rental assistance resources. Below are a list of additional resources

to aid grantees and project sponsors in designing or refining rental assistance programs using HOPWA

funds:

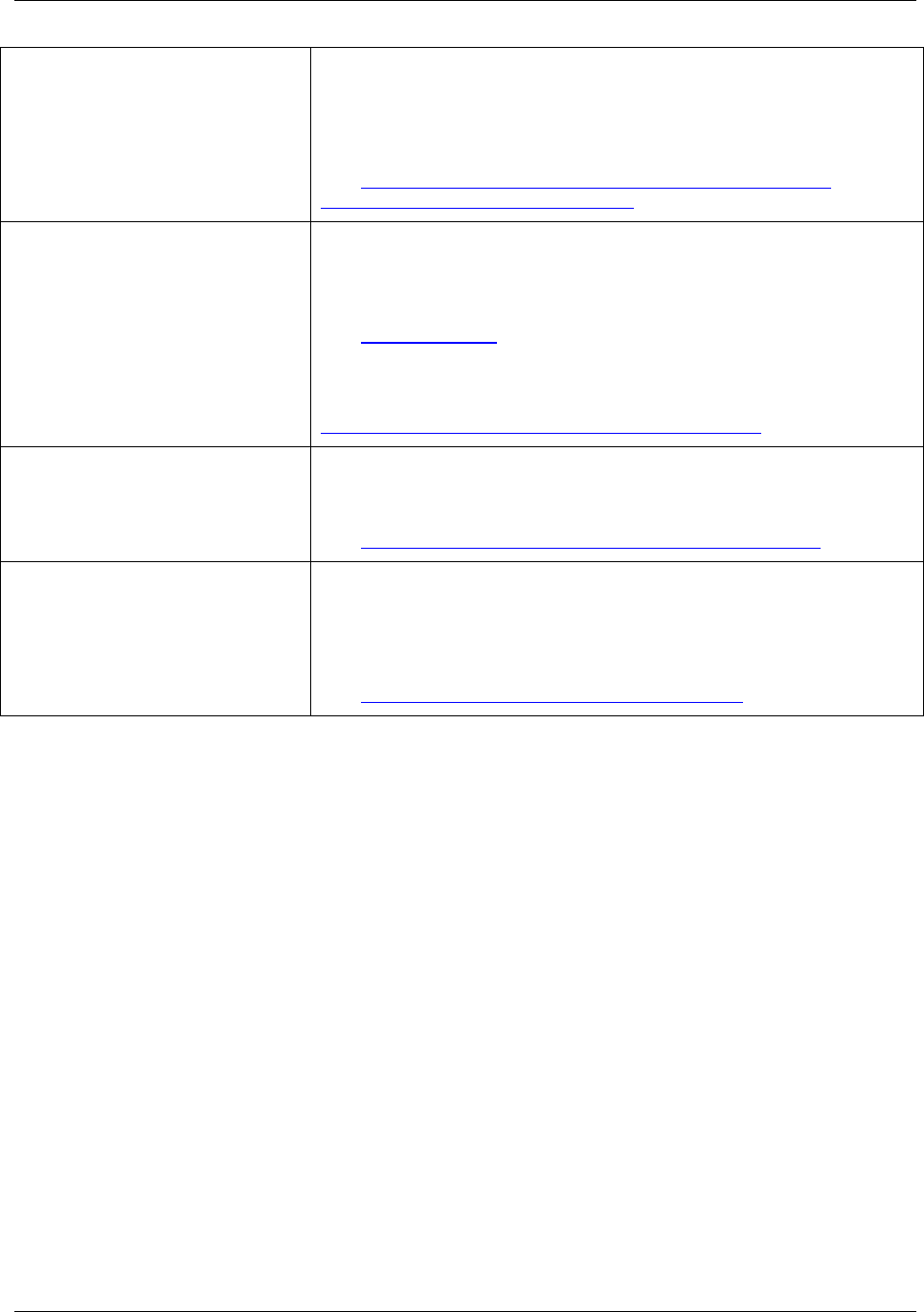

Additional Resources

Resource Description

HOPWA Program Regulation

(24 Part 574)

The HOPWA program regulation provides in-depth information about the

HOPWA program.

See: http://tinyurl.com/hopwaregs

Federal Regulation Search: www.ecfr.gov

HOPWA Grantee Oversight

Resource Guide

The HOPWA Grantee Oversight Resource Guide provides grantees and

project sponsors with an understanding of the various Federal laws and

regulations that govern the use of HOPWA resources, while providing

guidance and tools to conduct compliance reviews and identify corrective

actions, as needed.

See: www.onecpd.info/resource/1003/hopwa-grantee-oversight-resource-

guide/

HOPWA Financial Management

Online Training & Manual

The HOPWA Financial Management online training is a new approach to

training that allows grantees, project sponsors, and other community

partners to access vital information remotely. It is designed to provide

important information about the regulations and practices of the HOPWA

program and to benefit a variety of staff. The training covers many topics

including: HOPWA financial management standards; management of

personnel and non-personnel costs; HOPWA rental assistance and

reporting; auditing; and oversight of project sponsors.

See the HOPWA Financial Management Online Training Webinar:

www.onecpd.info/resource/1922/hopwa-financial-management-

online-

training-overview-webinar/

See the HOPWA Financial Management Online Training:

www.onecpd.info/resource/1238/hopwa-financial-management-online-

training/

See the HOPWA Financial Management Training Manual:

www.onecpd.info/resource/1920/hopwa-financial-management-training-

manual/

Using IDIS Online for the HOPWA

Program

The user guide, Using IDIS Online for the HOPWA Program, provides

both HOPWA formula and HOPWA competitive Grantees with the tools

necessary to successfully use the IDIS pathways for HOPWA including

the enhancements made in October 2011. IDIS Online is a web

application that provides financial disbursement, tracking and

performance reporting for CPD grant programs.

See: www.onecpd.info/resource/1018/using-idis-online-for-hopwa/

See webinar for Formula Grantees:

www.onecpd.info/resource/2058/hopwa-webinar-series-using-idis-for-the-

hopwa-formula-grant-program/

See webinar for Competitive Grantees:

www.onecpd.info/resource/2059/hopwa-webinar-series-using-idis-hopwa-

competitive-grant-program/

Introduction

HOPWA Rental Assistance Guidebook 5

HOPWA Guide for Conducting

Voluntary Consumer Satisfaction

Surveys

The HOPWA Guide for Conducting Voluntary Consumer Satisfaction

Surveys is designed to help HOPWA grantees and project sponsors to

voluntarily and confidentially hear from clients in assessing quality and in

identifying needs. Consumer survey templates are available in English

and Spanish.

See: www.onecpd.info/resource/2014/hopwa-guide-for-conducting-

voluntary-consumer-satisfaction-surveys/

Community Planning and

Development Grantee Monitoring

Handbook

This handbook is intended for grantees, project sponsors, and service

providers seeking guidance on HUD program monitoring. The handbook

establishes standards and provides guidance for monitoring many

Community Planning and Development (CPD) programs.

See: www.hud.gov/cpd

Refer to the CPD Monitoring Handbook available in the Library under the

“Non-Program Materials” heading

See the Handbook directly here:

www.hud.gov/offices/cpd/library/monitoring/handbook.cfm

Housing Choice Voucher Program

Guidebook

The Housing Choice Voucher Program guidebook is a resource typically

recommended to HOPWA grantees, which provides guidance regarding

the administration of tenant-based subsidy programs.

See: www.hud.gov/offices/pih/programs/hcv/forms/guidebook.cfm

Community Planning and

Development eCon Planning

Suite

In May 2012, HUD introduced the eCon Planning Suite, including

the Consolidated Plan template in IDIS Online and the CPD

Maps website. These tools were developed to support grantees and the

public to better assess their needs and make strategic decisions

regarding CPD funding in their communities.

See: www.hud.gov/offices/cpd/about/conplan/index.cfm

HOPWA Rental Assistance Guidebook 6

CHAPTER 1: STRATEGIC PLANNING FOR RENTAL

ASSISTANCE

WHAT THIS CHAPTER IS ABOUT

In order to successfully address the housing and supportive services needs of persons living with

HIV/AIDS and determine whether it makes sense to use HOPWA funds for rental assistance, it is critical

to assess the unique needs of this population as well as the availability of affordable housing and

supportive services already available in the community. HOPWA projects are incorporated in area

Consolidated Plans involving needs assessments, market analysis, public consultations, and coordination

with leverage resources. Grantees can also work with Homeless Continuums of Care (CoCs), Ryan

White Planning Councils, and plan in conjunction with other community groups to develop an overall

HIV/AIDS housing strategy to address these needs using HOPWA rental assistance. This chapter covers

strategic planning for HOPWA rental assistance within the framework of an overall HIV/AIDS housing

strategy, including information on the following:

• Performing a community needs assessment

• Identifying housing and service gaps

• Setting community goals in line with HOPWA program objectives

In orde

r to decide how HOPWA or other funding for affordable housing should be allocated, it is important

to have full knowledge of the current supply of affordable housing and associated supports that are

available. Equally important is a complete understanding of the housing and service needs of persons

living with HIV/AIDS. Given this kind of information, grantees and collaborative groups within communities

can engage in strategic planning designed to produce an effective HOPWA system of care of HIV/AIDS

housing and supports.

There are four fundamental steps in developing a community’s HIV/AIDS housing strategy described in

this chapter:

Step 1: Develop an inventory of current housing and services available to HOPWA-eligible persons

Step 2: Collect and analyze data on housing and service needs of HOPWA-eligible persons

Step 3: Develop a strategic plan

Step 4: Implementation Planning

STEP 1: DEVELOP AN INVENTORY OF CURRENT HOUSING AND SERVICES

The HOPWA program offers a variety of housing and support service resources that can play a central

role

in the development of an HIV/AIDS housing system of care. In most communities, however, HOPWA

resources alone are not sufficient to build a comprehensive system of care. Other affordable housing

resources should be included when planning a housing response, including many of those discussed later

in this section. By researching and seeking out additional housing resources, the system of housing and

care in a community for persons with HIV/AIDS can be greatly enhanced. Further, communities that

successfully leverage additional affordable housing will be able to serve greater numbers and may more

easily direct HOPWA funds to meet strategic housing needs.

A thorough inventory of affordable housing and housing supports available to HOPWA-eligible individuals

is the first step in determining what gaps exist in a community. Such an inventory can be used to compare

existing resources with what is needed in the community. Many communities develop and maintain such

an inventory on an ongoing basis as a resource to connect clients quickly with available housing.

Particularly useful are resources for housing low-income persons that are not designated specifically for

persons with HIV/AIDS. Capacity, eligibility, and waiting lists are important considerations in determining

the availability of resources for HOPWA-eligible individuals.

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 7

A thorough understanding of the full system of care that is available for persons living with HIV/AIDS is

essential. It is especially important to understand how multiple systems work together to form the full

system of care. For example, the HOPWA program, Ryan White, the Homeless Continuum of Care, and

mainstream housing programs

3

form a system of care for housing persons living with HIV/AIDS.

See Table 1.1 for a list of housing types and programs that should be included in a community-wide

inventory.

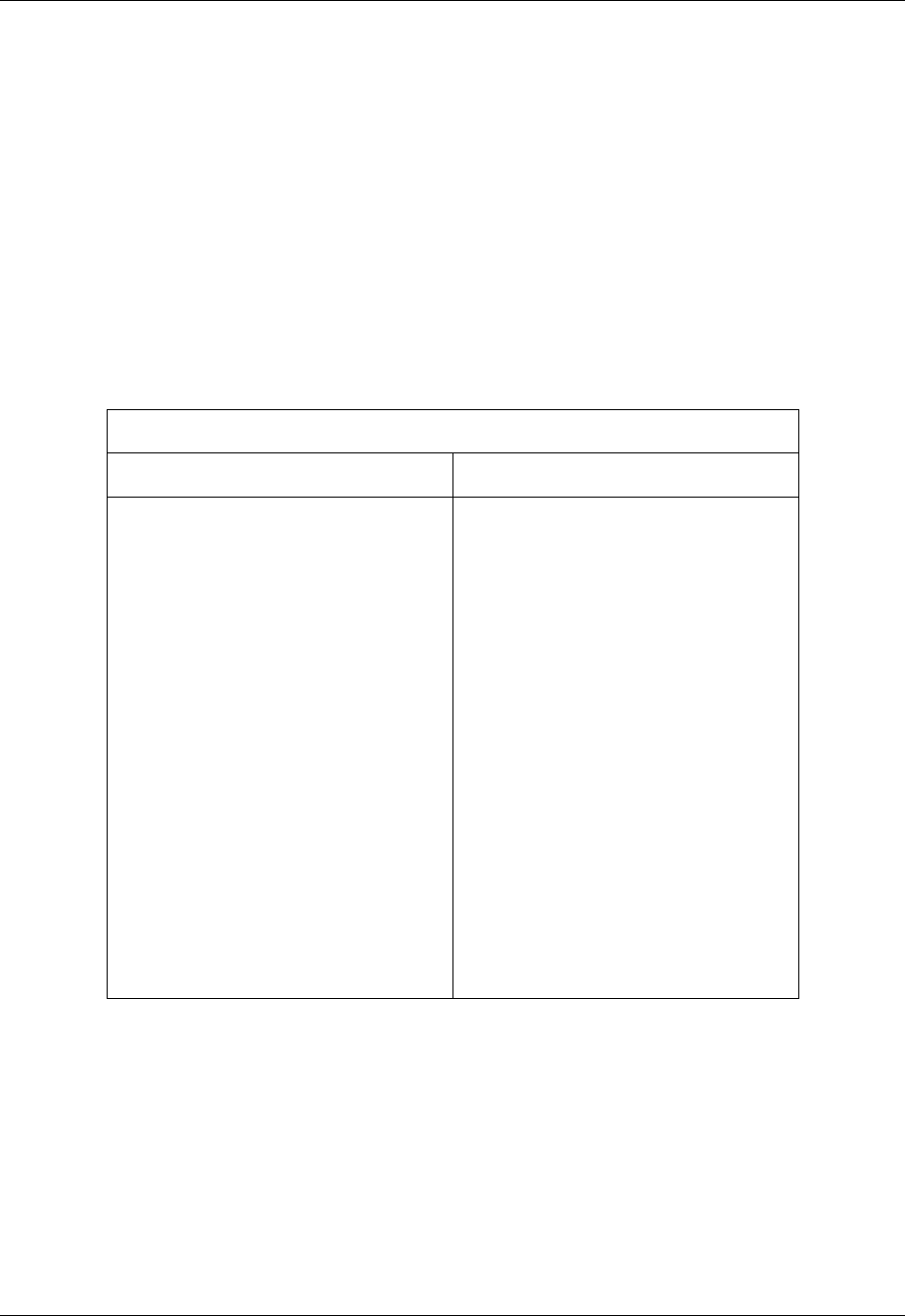

Table 1.1: What to Include in a Community-wide Inventory

of Af

fordable Housing and Housing Supports

• Emergency housing and shelters

• Rapid-rehousing of homeless persons and

families

• Transitional housing, halfway houses, and

other time-limited supportive housing,

including those that combine housing and

treatment for mental illness or substance

abuse

• Short-term homelessness prevention

assistance

• Community residences that provide a high

level of care for people who have limited

ability to live independently, and nursing

homes or institutional settings for those in

need of intensive medical care

• Permanent housing, including affordable

rental housing and low-income home

ownership programs

• Supportive services including transportation

and s

ervices designed to facilitate housing

placement and stability

• Public housing units and Housing Choice

Vouch

ers (Section 8)

• Section 811 for persons with disabilities or

202 for senior citizens

• Homeless Continuum of Care (CoC)

programs under the HEARTH Act—Shelter

Plus Care (S+C), Supportive Housing

Program (SHP), and Single Room

Occupancy Program (SRO)

• Emergency Solutions Grant Program

(ESG), previously known as Emergency

Shelter Grants Program

• HOME-funded rental units and HOME

Tenant-Based Rental Assistance

• Rural housing provided through United

States Department of Agriculture (USDA) or

the Rural Housing and Economic

Development (RHED) programs

• Other statewide or local rental assistance

or ho

using programs

• Short-term housing assistance under the

Ryan White Program

Note, for more information about the HUD homeless and housing programs described in Table 1.1,

please visit: www.onecpd.info/resource/1780/introduction-and-overview-of-hud-homeless-programs/ to

view the presentation “Overview of HUD Homeless and Housing Programs.”

Some suggestions for finding information on local programs include reviewing existing housing inventory

count information collected annually by the Continuum of Care programs, talking with state and city

grantee staff to obtain lists of affordable housing programs funded through non-HOPWA Federal sources

such as HOME, and gathering information from area community based organizations through a housing

needs assessment.

STEP 2: COLLECT AND ANALYZE INFORMATION ON HOUSING AND NEEDS

After taking into consideration all of the information related to current housing resources and the existing

system of care for persons with HIV/AIDS, the next step in planning a community’s housing response is to

collect and analyze targeted information on housing and service needs.

3

For more information on accessing mainstream resources, visit HUD’s One CPD Resource Exchange website at:

www.onecpd.info and use the “Resource Library.”

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 8

HOPWA grantees and project sponsors that provide housing and supportive services to persons living

with HIV/AIDS generally have a good understanding of what the housing needs are among their target

population. Communities can expand and clarify this knowledge by quantitatively documenting the

housing need across the full continuum, from emergency shelter to transitional and permanent housing,

and considering the supports needed to promote housing stability. Ways to collect and analyze housing

and service needs information are described in this section.

Collecting Information on HIV/AIDS Housing and Service Needs

Depending upon the scope of planning in which the grantee decides to engage, collecting information on

HIV/AID

S housing and service needs may involve the use of existing data, the collection of new data, or

both.

Using Existing Data

The use of existing data available through community data sources or agency records is often the most

cost-effective. Existing data can provide a quick picture of the housing and service needs in a community

without much cost. There are several sources for existing data that should be considered, including the

following:

• Consolidated Plan. Each HOPWA formula grantee is required to complete HUD’s five-year

Consolidated Plan. This plan outlines how HOPWA funds will be prioritized in the area and

identifies housing gaps and housing targets. Even if a jurisdiction does not receive HOPWA

funding, the Consolidated Plan is a good document to review as it indicates how the area is

prioritizing other affordable housing funds.

The Consolidated Plan

The Consolidated Plan is a five-year planning document required

by HUD for each of their four formula programs including the

Community Development Block Grant (CDBG), Emergency

Solutions Grant (ESG), HOME, and HOPWA programs.

Information collected through an HIV/AIDS housing plan is often

integrated into the Consolidated Plan to help prioritize the use of

HOPWA funding. Many cities, counties, and states have posted

their Consolidated Plan online.

To access local Consolidated Plans and reports, please visit:

www.hud.gov/offices/cpd/about/conplan/local/index.cfm.

In May 2012, HUD introduced the eCon Planning Suite, including

the Consolidated Plan template in IDIS Online and the CPD

Maps website. These tools were developed to support grantees

and the public to better assess their needs and make strategic

decisions regarding CPD funding in their communities.

For more on the eCon Planning Suite, please visit:

www.hud.gov/offices/cpd/about/conplan/index.cfm.

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 9

• Homeless Continuum of Care. A lo

cal Homeless Continuum of Care (CoC) is another good

source of existing data. All CoCs are required to utilize the Homeless Management

Information Systems (HMIS) to track client-level data on homeless individuals and families

that can be useful during a planning process. Moreover, CoCs are required to update a

Housing Inventory Chart (HIC) annually in the last 10 calendar days of January. The HIC is a

comprehensive list of emergency, transitional, and permanent housing units available for

homeless individuals and families in the community. The HIC and HMIS inform continuums

conducting housing gaps’ analyses, which compare the need for housing to available housing

resources.

• Ryan White Plan. Ryan

White Consortiums are a good source of data on the service and

medical needs of persons living with HIV/AIDS. Many consortiums conduct annual consumer

surveys to better understand service needs and utilization, as well as issues related to

housing.

• HIV/AIDS data. State and national HIV/AIDS data is available through each state’s

department of health. National data can be accessed through the Center for Disease Control

and Prevention (www.cdc.gov/hiv). Additionally, the Department of Health and Human

Services maintains AIDS.gov (www.aids.gov) as a one-stop resource for all information

related to the Federal government’s response to the HIV/AIDS epidemic.

• Searchable Bibliography of Peer-Reviewed Journal Articles related to HIV/AIDS and

Housing. This database of over 400 recent articles can be searched by key word and filtered

by Topic, Population and/or Region. Search results can be ordered by title, first author and

year of publication. Details for each article include: abstract, full citation and web links to the

full text for articles available open source.

See: www.hivhousingsummit.org/2011/frmSearchAbstracts.aspx.

• HUD USER. The U.S. Department of Housing and Urban Development (HUD) has put

together a variety of housing data on HUD USER (www.huduser.org). Such data sets include

Common Core Indicators

A common core indicator on housing status was developed for all

Federa

l HIV prevention, treatment, and care programs. The

indicator measures the percentage of persons diagnosed with HIV

receiving HIV services who were homeless or unstably housed in

the last 12 months*.

*The Department of Housing and Urban Development’s Homeless

Information Management System (HMIS) provides guidance for

classifying housing status in four categories—with first three

constituting poor housing status:

(1) literally homeless (e.g., lack a regular nighttime residence,

staying in an emergency shelter), following the McKinney-Vento

Homeless Assistance Act (42 U.S.C. 11302, Sec. 103) definition of

homelessness, as amended by the Homeless Emergency

Assistance and Rapid Transition to Housing (HEARTH) Act of 2009

(P.L. 111-22, div. B, Sec. 1003);

(2) imminently losing housing (e.g., being evicted or being

discharged from an institution with no housing options identified);

(3) unstably housed and at-risk of losing housing (e.g., temporarily

doubled up with others, moving frequently for economic reasons),

and

(4) stably housed.

See: www.onecpd.info/resource/1220/final-hmis-data-standards/.

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 10

the American Housing Survey, Fair Market Rents, Income Limits, and Worst Case Housing

Needs reports.

• U.S. Census. The U.S. Census is the most comprehensive data source for general statistics

related to the country. On American Fact Finder, data can be queried for a variety of areas

including states, counties, and census tracts. These data can provide detailed information on

an area’s population, income, and housing costs, which can be compared with similar

information for the HIV/AIDS population in that area to help demonstrate the housing needs

of HOPWA-eligible individuals. Census data can be found at: www.census.gov. The

American Fact Finder is located at: http://factfinder2.census.gov/.

• Agency data. Often overlooked is the existing data that HOPWA grantees and project

sponsors already have within their agencies. Agency data collected through agency

databases or contained in files is a valuable source for client-level information that can be

used to examine housing and service needs for the entire area. Data of interest may include

median income levels, average amounts paid for rent/utilities, rent burden based on the

percentage of client income paid for rent and utilities, and other housing related information.

To find local HIV testing and services, including HOPWA funded programs, please visit:

locator.aids.gov/.

• Waiting lists. Waiting lists maintained by local housing providers, AIDS service

organizations, and other local agencies may provide data that can be used to measure local

needs for housing and services.

Collecting New Data

A second option is collecting targeted data on housing and service needs of HOPWA-eligible individuals

through surveys, focus groups, and/or interviews. This option is more expensive and time-consuming

than an examination of existing data, but it can yield very useful information that is designed to answer

the specific housing questions posed. Typical methods for collecting this type of data include the

following:

• Self-administered questionnaires or direct interviews of consumers, providers, or others to

colle

ct basic client demographics and specific information about housing status, housing and

supportive service needs, housing stability, housing burden, and other identified issues of

interest

• Focus groups of consumers, providers, and other community groups to collect additional

information on housing and service needs and identify important qualitative elements for

consideration

• Individual stakeholder interviews with HIV/AIDS service providers, as well as mainstream

providers in systems such as mental health, substance abuse, public housing, Homeless

Continuum of Care, and other community service providers to help inform the planning

process

Analyzing Housing Data

A careful and thorough analysis of existing and new data collected can help a community more fully

understand the housing and service needs of persons living with HIV/AIDS and to shape programs to

meet those needs. At a minimum, housing cost burden, affordability gap, and housing stability data

should be analyzed, as described in this section.

Housing Cost Burden

HUD has determined that spending no more than 30% of household income on housing related costs

(i.e., rent and utilities) is affordable. As this percentage increases so, too, does the likelihood that some

people, especially those with HIV/AIDS, may experience a housing crisis. Housing burden is calculated

by taking the monthly amount a household pays for rent and utilities divided by the monthly income.

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 11

Households that pay more than 50% of household income on housing are considered “extremely cost

burdened” by HUD. These households devote too much of their budgets to housing, leaving too little for

other necessities such as food and healthcare.

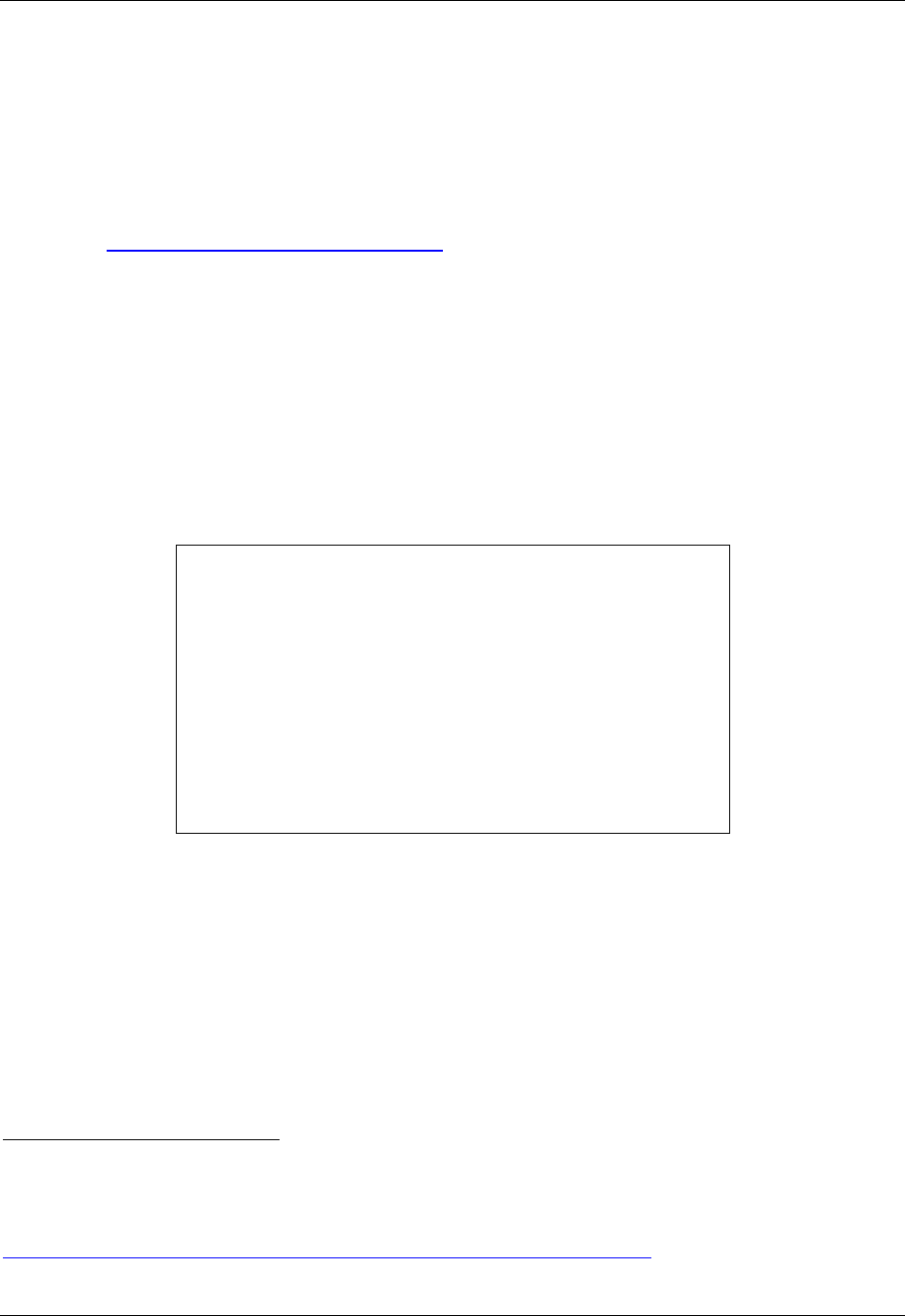

Calculating the Housing Cost Burden

Example:

If a household pays $600 in rent and $250 for utilities per month and the

household earns $1,500 per month, then the housing cost burden would

be calculated as follows:

Housing Cost Burden =

(Rent + Utilities)/Gross Monthly Income

Rent $600

Utilities $250

Total Rent and Utilities $850

Gross Monthly Income $1,500

Housing Cost Burden = $850/$1,500 = 57%

With a cost burden of 57%, this household would be considered extremely

cost burdened.

Information on a client’s housing burden can be useful both in performing client assessments and in

planning for a rental assistance program. When used as a regular part of client assessments, the level of

housing burden, based on client-reported income, rent, and utility levels, can provide important

information about the client’s current housing stability. For instance, a client requesting Short-Term Rent,

Mortgage, and Utility (STRMU) assistance but having a housing burden of 50% or more may be

determined to be a better candidate for long-term rental assistance rather than short-term emergency

assistance, as the high housing burden will likely mean the client will continue to have difficulty paying

rent at that level.

Housing burden information on a broader community level can help project the overall need for a rental

assistance program. A community analysis may be conducted, through client surveys or using other

assessment methods, to determine the percentage of target population households with extreme housing

cost burden. If a community’s analysis concludes, for example, that 60% of households with a member

living with HIV/AIDS are extremely cost-burdened, the community may decide that more HOPWA

resources should be directed toward long-term rental assistance than to short-term assistance.

Information on local housing costs and the “affordability gap,” as discussed in the next section, should

also be taken into consideration when planning a rental assistance program.

Affordability Gap

In addition to housing burden, examining the affordability gap for a specific population such as persons

living with HIV/AIDS is another way to determine the relative affordability of housing in a local area.

Understanding the affordability trends will allow grantees to target necessary housing and supportive

service programs to ensure clients have access and are able to maintain care.

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 12

The affordability gap is the difference between the average rent payment that households making up the

target population can afford and the median market rent or the Fair Market Rent (FMR). To determine

how targeted households are faring in terms of housing affordability, grantees can compare the FMR for

their area against 30% of the Area Median Income (AMI) for their clients. If the amount the household is

paying for rent and utilities exceeds the FMR, then the housing is not affordable. The difference is the

additional amount that an average target household needs in order for the housing to be considered

affordable.

Calculating the Affordability Gap

Example: Year 1

FMR $650

Area Median Income (AMI) $1,000

30% AMI $300

Affordability Gap $350

In Year 1, the average household paying no more than 30% of AMI should

pay $300 in housing costs. However, the local FMR is $650. The result is in

an affordability gap of $350. In other words, the average household would

need to pay $350 more per month to afford a unit at the FMR.

To overcome the affordability gap, the average household income would

need to increase substantially.

To close the $350 gap in Year 1, a household would need to earn $2,165

per month. With this income, 30%of the household’s income would equal

$650. That monthly income, however, is 116% higher than the AMI.

Calculating the Affordability Gap

Example: Year 2

FMR $675

Area Median Income (AMI) $1,000

30% AMI $300

Affordability Gap $375

In Year 2, the FMR increases, but the AMI does not. The affordability gap

thus increases by an additional $25.

In Year 2, the household would need to earn $2,225 per month. That

monthly income is 123% higher than the AMI.

As in the example, the affordability gap can be tracked for each area annually to develop affordability

trends. Additionally, the affordability gap among clients can be compared to the affordability gap of the

general population using available data from the U.S. Census Bureau (www.census.gov) or the National

Low Income Housing Coalition (www.nlihc.org). High affordability gaps can have an adverse impact on

persons living with HIV/AIDS, including a need to work more hours, moving away from services or

healthcare, and less contact with family or friends. As the affordability gap increases, households are

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 13

likely to face a choice—pay more than 30% of their income toward rent or live where they can afford,

which may be away from available services or healthcare.

Housing Stability of HOPWA-Eligible Individuals

Data collected from past and current clients or HOPWA-eligible individuals can also be examined in a

number of different ways to provide information about the present housing stability of HOPWA-eligible

individuals in the community. Possible sources for such data may include client case records, agency

databases, or client surveys developed to collect housing information from past or current clients or

HOPWA-eligible individuals. Some stability factors to consider include the following:

• Tenure in current housing. Indivi

duals, who have been in their current housing for a very

short time, such as six months or less, can be at a higher risk of housing instability. The initial

months in a new housing situation tend to be tenuous in terms of ability to pay rent, handle

stress, and other similar factors.

• History of homelessness. Episodes or a history of homelessness is a strong indication of

housing instability and inability to maintain housing. If individuals report spending one or more

nights without a place to live, this may also be an indicator of housing stability problems.

• Burden of rent cost. The percentage of individuals paying in excess of 30% of their income

for rent and utilities and the percentage paying 50% or more will provide a better picture of

how severe the housing burden is for individuals in the community.

• Perceived impact of rent increases. Responses to questions (most likely in a survey) about

the perceived impact of small monthly increases in rent or mortgage payments can provide

information about the relative stability of their current housing situation. If survey respondents

report that they would likely have to move if their monthly rent payment increased only

marginally ($1 - $25 or $25 - $50), that may be an indication of how tenuous their housing

situation really is.

STEP 3: DEVELOP A STRATEGIC PLAN

After identifying the existing resources within the community, examining the housing and supportive

servi

ce needs among people with HIV/AIDS, and determining the gaps that exist, grantees need to

engage in a strategic planning process to decide how best to meet those needs.

The strategic planning process is instrumental for making decisions on the allocation of resources. Based

on the needs of the HOPWA population, strategic plans define the long-term goals and objectives and

include actionable strategies the grantee plans to undertake in order to meet those goals and objectives.

Grantees should periodically re-evaluate their goals and objectives as needs change and programs and

services evolve to ensure that resources are allocated effectively and are well integrated with planning for

mainstream services.

Strategic planning can take many forms. Planning efforts such as the Consolidated Plan, Ryan White

Planning, and Homeless Continuum of Care are local planning mechanisms that can be adapted to

include a focus on housing for individuals with HIV/AIDS. Many communities have chosen to conduct

separate housing plans that look solely at the housing needs among persons living with HIV/AIDS. Such

HIV/AIDS housing plans more fully examine the housing and supportive service needs of persons living

with HIV/AIDS and can be integrated with other community-wide efforts.

Below are some other things to consider during the strategic planning process:

• Stakeholders. The most effective planning efforts are open processes that allow all

interested community stakeholders to take part. Grantees should involve a variety of

stakeholders when developing a team to participate in an HIV/AIDS housing planning

process. See Table 1.2 for stakeholders to include in the planning process.

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 14

Table 1.2: Suggested Stakeholders to Include

in an HIV/AIDS Housing Planning Process

• HIV/AIDS service providers

• Mental health/substance use

providers

• Housing developers

• Public Housing Authorities

• Homeless Continuums of Care

• Ryan White Planning agencies

• State or local government community

planning

• Mainstream supportive service

provi

ders

• Other Consolidated Plan program

providers

• Persons living with HIV/AIDS

• Leadership. Whether led by the grantee staff, a nonprofit organization, or an outside

consultant/organization, having a strong leader is critical to ensure that the planning process

stays on track and a team approach is in place to help build support for the process and

ensure energy to carry out the plan. An organization with the right leadership and credibility in

the community can also be an important conduit for attracting additional resources and

ensuring that efforts are well integrated with those of other mainstream and HIV/AIDS

supportive service providers as well as other homeless programs.

4

• Vision and Goal Setting. The vision of the planning group, consisting of relevant

stakeholders, should be the guiding focus for a housing strategy and articulate what goals the

grantee wants to achieve over a multi-year period and the specific plan to achieve those

goals. Goals developed as part of the housing plan should be measurable, time-limited, and

specific.

HUD’s HOPWA program has three national objectives for client outcomes:

o Increasing housing stability. Central to the HOPWA program’s success is finding and

maintaining stable housing for persons living with HIV/AIDS. Stable housing includes

private housing without known subsidy, housing obtained with HOPWA-funded housing

assistance, and housing subsidized from non-HOPWA sources, with greater support and

continued residence expected.

o Decreasing the risks of homelessness. The HOPWA program aims to reduce the risk

of homelessness among people living with HIV/AIDS. Through, for example, the provision

of short-term assistance to help pay for mortgage, rent, or utilities, the HOPWA program

can keep HOPWA clients who are already housed from losing that housing.

o Increasing access to care and non-medical supportive services. The HOPWA

program seeks to improve access and maintain connections to healthcare and other

supportive services for people living with HIV/AIDS. This could be achieved through

contact with case managers, housing plans, accessing medical insurance, visiting a

primary healthcare provider, and so on. A full range of services provided by HOPWA

grantees and project sponsors is identified in the HOPWA Consolidated Annual

4

HOPWA grantees and sponsors may find Building Effective Coalitions a useful resource. This guidebook discusses

the benefits of coalitions, how to build effective community-wide coalitions, how to collaborate with mainstream

agencies, how to expand a coalition's membership, and how to manage an effective continuum. See:

www.onecpd.info/resource/1117/building-effective-homeless-coalitions/.

Chapter 1: Strategic Planning for Rental Assistance

HOPWA Rental Assistance Guidebook 15

Performance and Evaluation Report (CAPER) Measuring Performance Outcomes and

the Annual Progress Report (APR).

5

One of HUD’s goals under the FY 2010–2015 HUD Strategic Plan is Goal 3: Utilize

Housing as a Platform for Improving Quality of Life. A HUD notice issued September 20,

2011, entitled Promoting Partnerships to Utilize Housing as a Platform for Improving Quality

of Life discusses how all HUD programs can contribute to good health outcomes for

beneficiaries by efforts to provide service coordination. See:

http://portal.hud.gov/huddoc/pih2011-51.pdf.

Grantees should consider these HUD and HOPWA objectives when they determine their

local program goals, but they are also strongly encouraged to develop additional local

program goals based on the needs of their HOPWA population.

STEP 4: IMPLEMENTATION PLANNING

At this point, the grantee and its partners must consider how they will turn their Strategic Plan into on-the-

ground reality. As discussed more fully in Chapters 2 and 3, there are critical decisions to be made about

the following:

• The most appropriate model or mix of models for providing rental assistance that meets the

needs of the targeted population(s)

• The amount of funding to be provided from HOPWA and other public and private sources

• The specific support services needed, existing availability of those services, and potential

resources for addressing identified service gaps

• The range of policies, procedures, and formats (e.g., client intake and exit, selecting and

leasing acceptable housing units, financial procedures, reporting, etc.) to be developed and

used by project sponsors

• Performance criteria, performance measures, and oversight plans to be built into operational

plans

Most communities develop a “Request for Proposals” or “Request for Qualifications” that describes the

desired characteristics of the proposed HOPWA rental assistance program and seek responses from

potential project sponsors. The grantee also indicates how it will decide which proposals it accepts and

funds. Typically grantees employ existing procedures for carrying out this process. The specific contents

will vary to reflect the specifics of the local strategic plan and implementation decisions.

As emphasized in this guidebook, HOPWA rental assistance is not a stand-alone program; rather, it is the

housing component of a more comprehensive support program for low-income persons living with

HIV/AIDS that includes an integrated and individualized array of support services. The HOPWA program

is emphasizing enhanced, coordinated delivery of services to clients through a process referred to as

“braided” funding, by which multiple funding streams, such as mainstream resources for employment,

income support, and education, are utilized to provide for the range of services needed by a given

population. This approach is in contrast with one where a client is simply referred to separate service

providers for each type of service required by the client.

5

The CAPER is required by HOPWA formula grantees, and the APR is required by HOPWA competitive grantees.

To access the CAPER, see: www.onecpd.info/resource/1011/hopwa-caper-form-hud-40110-d/. To access the APR,

see: www.onecpd.info/resource/1012/hopwa-annual-progress-report-apr-form-hud-40110-c/.

HOPWA Rental Assistance Guidebook 16

CHAPTER 2: HOPWA RENTAL ASSISTANCE PROGRAM

DESIGN

WHAT THIS CHAPTER IS ABOUT

The HOPWA program is flexible, allowing communities to use their HOPWA funds for a wide array of

housing and supportive services, as well as program planning and development costs. However, as HUD

seeks to emphasize housing as the primary HOPWA activity, a significant portion of HOPWA funds is

used for housing programs, including rental assistance programs. For grantees seeking to start new

rental assistance programs or for those refining existing programs, this chapter provides an overview of

the elements to consider when designing a program.

The first consideration clearly is the population to be served. In order to receive HOPWA assistance, the

client must meet two basic program requirements:

• HIV/AIDS Diagnosis. A memb

er of the household must have a medical diagnosis of

HIV/AIDS.

• Income Eligibility. Households must be at or below 80% of Area Median Income (AMI) to be

eligible for all forms of HOPWA assistance, with the exception of Housing Information

Services (24 CFR 574.3). Information on Area Median Income as determined by HUD is

available at: www.huduser.org/portal/datasets/il.html.

Depending on the needs of this population, HOPWA rental assistance programs may be designed as

transitional or permanent housing. Grantees and project sponsors should clearly define the length of time

clients may continue receiving rental assistance and reflect any limitations in the program policies and in

the client participation agreements.

Whether the housing is designed as transitional or permanent, provided on a scattered site basis or in a

housing facility, HOPWA rental assistance programs should include an emphasis on moving clients

toward other, non-HOPWA-funded permanent housing as much as is practical. Programs that help clients

to become self-sufficient, qualify for other mainstream rental assistance, or enter and maintain market

rate housing will enable HOPWA funds to be used to assist additional clients in need of assistance and

not eligible for assistance under other programs.

The chapter covers the following topics:

• Types of rental assistance. Tenant-Based Rental Assistance (TBRA), Project-Based Rental

Assis

tance (PBRA), and Master Leasing, as well as the advantages and disadvantages of

each approach

• Three critical components of rental assistance program design. Program management,

property management, and supportive service delivery, including housing related activities

It should be noted that this chapter is not meant to be a step-by-step guide in designing a program, but

instead it highlights the primary considerations when designing a new program or refining an existing one.

Chapter 2: HOPWA Rental Assistance Program Design

HOPWA Rental Assistance Guidebook 17

Short-Term Assistance

In addition to the three types of rental assistance just mentioned, HOPWA

funds may also be provided as short-term rent and utility payments (STRMU)

aimed at persons and households that are in a precarious living situation

and, without immediate short-term relief, are likely to become homeless. This

type of short-term assistance is not described in this guidebook, but grantees

can find information about the eligibility requirements and details of when and

how to provide short-term rental assistance in the following:

• Attachment 2-1: STRMU Fact Sheet at t

he end of this chapter

• Frequently Asked Questions for Short-Term Rent, Mortgage, and

Utility (STRMU) on the OneCPD Resource Exchange at:

www.onecpd.info/resource/1031/hopwa-strmu-frequently-asked-

questions/

• STRMU Notice CPD 06-07 at:

http://portal.hud.gov/hudportal/documents/huddoc?id=DOC_15245.

pdf

The ESG program provides funding for homeless prevention as well as rapid-

rehousing for individuals and families experiencing homelessness. For more

information on the ESG Program, see the Emergency Solutions Grants

(ESG) Program Fact Sheet at: www.onecpd.info/resource/2015/emergency-

solutions-grants-esg-program-fact-sheet/.

PROVIDING RENTAL ASSISTANCE

One fundamental design decision involves the type(s) of HOPWA rental assistance the program will offer:

• Tenant-Based Rental Assistance (TBRA)

• Project-Based Rental Assistance (PBRA)

• Master Leasing

o Scatte

red Site

o Facility-Based

This section describes each type of rental assistance and discusses the advantages and disadvantages

of each.

Tenant-Based Rental Assistance

Under TBRA, funding is provided to an eligible client and the client selects a housing unit of his or her

choice. If the client moves out of the unit, the contract with the owner ends and the client can move with

continued assistance to another unit. In other words, TBRA is portable and moves with the client.

Chapter 2: HOPWA Rental Assistance Program Design

HOPWA Rental Assistance Guidebook 18

Table 2.1 summarizes the advantages and disadvantages of TBRA.

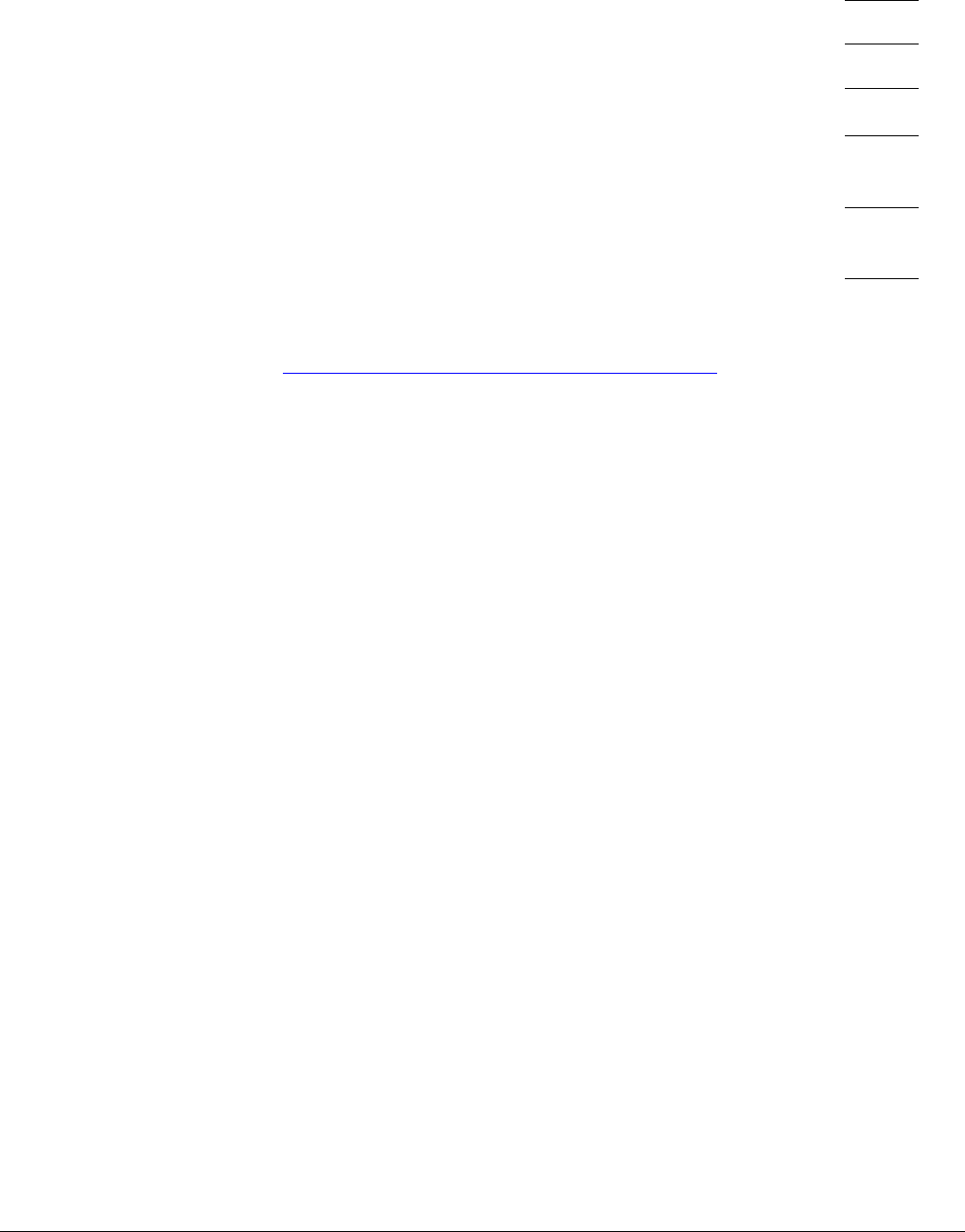

Table 2.1: Advantages and Disadvantages of TBRA

Advantages Disadvantages

• Maximizes choice by allowing clients to

search for and make their own housing

choice

• Maximizes independence and anonymity

• Enhances integration with the local

commu

nity

• Provides flexibility to communities to easily

increase the number of assisted units year

to year

• May be difficult for more physically limited

clien

ts in need of more medical care and

assistance

• Can be difficult to deliver in areas where

the n

umber of vacant rental housing units is

low because clients are less likely to find

appropriate housing (i.e., if the only

available housing for a client with drug

abuse issues is an area known for high

drug crime, then this would not be an

appropriate housing arrangement for that

client)

Project-Based Rental Assistance

Whereas TBRA follows the tenant regardless of the unit in which they live, assistance under PBRA is tied

to the unit. HOPWA funds provide subsidy to the unit specifically reserved for HOPWA clients by paying

for the operating costs of the unit. Because assistance is tied to the unit, clients may receive assistance

only so long as they are eligible and reside at the project-based unit. The assistance does not go with the

client when they move, although clients may be eligible for TBRA after leaving a project-based unit.

Table 2.2 summarizes the advantages and disadvantages of PBRA.

Table 2.2: Advantages and Disadvantages of PBRA

Advantages Disadvantages

• Often better for serving the needs of clients

with complex needs because clients with

similar needs are housed together

• Provides a more permanent supply of

housing for people with HIV/AIDS since

project-based units remain designated for

HOPWA clients

• Allows grantees to leverage other

government resources and capital funds to

develop or rehabilitate housing and stretch

HOPWA dollars further

• Can be used with new construction or with

existing structures

• Longer lead time required for development

projects and therefore it takes longer for

affordable housing to become available

• More complex than TBRA and requires

greater expertise and capacity

• Clients living in project-based units do not

have as much anonymity as they do under

the TBRA program

While this guidebook discusses general design considerations, operating procedures, and program and

grant management within the framework of HOPWA requirements, the Corporation for Supportive

Housing has a Toolkit for Developing and Operating Supportive Housing that provides a wealth of

information on the many tasks involved in developing a PBRA program. To access the Corporation for

Supportive Housing’s Toolkit for Developing and Operating Supportive Housing, please visit:

www.csh.org and look under “Resources.”

Chapter 2: HOPWA Rental Assistance Program Design

HOPWA Rental Assistance Guidebook 19

Master Leasing

Master Leasing is a model in which an organization directly leases individual units, blocks of units, or an

entire structure from a private owner. Unlike TBRA, the lease is between the private owner and the