Consumer Financial

Protection Bureau

April 2015

YOUR MONEY, YOUR GOALS

A nancial empowerment

toolkit for Social Services

programs

Table of contents

MODULE 1: Introduction to the toolkit ..................................................................... 1

An introduction to the CFPB............................................................................. 2

Financial empowerment and your life .............................................................. 4

Financial empowerment: A way to improve client and program outcomes .... 4

Making referrals ................................................................................................ 6

The goal of Your Money, Your Goals................................................................ 7

MODULE 2: Assessing the situation ........................................................................9

Tool 1: Financial empowerment self-assessment ...........................................11

Tool 2: Client goal and financial situation assessment.................................. 21

MODULE 3: Starting the conversation ................................................................... 27

When should I bring up money topics? ..........................................................28

How should I bring up money topics? ............................................................ 29

MODULE 4: Emotional and cultural influences on financial decisions ...............39

Emotional influences on financial decisions .................................................. 39

Cultural influences on financial decisions ......................................................40

Cultural conflicts ............................................................................................. 41

How can this understanding help my clients?................................................ 41

MODULE 5: Using the toolkit ..................................................................................43

How does it work? ........................................................................................... 43

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS i

Tool 1: Client financial empowerment checklist ............................................ 45

MODULE 6: Setting goals ........................................................................................49

Setting SMART goals.......................................................................................50

Turning goals into savings targets .................................................................. 52

What about revising goals? ............................................................................. 54

Saving for education........................................................................................ 55

Tool 1: Goal setting tool.................................................................................. 57

MODULE 7: Saving for the unexpected, emergencies, and goals .......................61

What is savings? .............................................................................................. 61

How to save .....................................................................................................62

Savings and public benefits............................................................................. 63

Savings plan ..................................................................................................... 63

What are the benefits of a savings plan?......................................................... 65

A safe place to save .......................................................................................... 67

Direct deposit and savings ..............................................................................68

Tool 1: Savings plan .........................................................................................71

Tool 2: Benefits and asset limits .................................................................... 75

Tool 3: Finding a safe place for savings ......................................................... 79

Tool 4: Increasing your income through tax credits......................................83

MODULE 8: Managing income and benefits ..........................................................87

Income ............................................................................................................. 87

Benefits ............................................................................................................88

Getting income ................................................................................................89

Tool 1: Income and financial resource tracker ............................................... 93

Tool 2: Strategies for increasing sources of cash and financial resources .... 97

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS ii

Tool 3: Cash, paychecks, direct deposit, payroll cards, and EBT—

understanding the benefits and risks.............................................................101

MODULE 9: Paying bills and other expenses ......................................................107

Paying bills..................................................................................................... 108

When cash is short: Prioritizing bills ............................................................. 111

Tool 1: Spending tracker................................................................................ 115

Tool 2: Bill calendar.......................................................................................121

Tool 3: Strategies for cutting expenses ........................................................ 125

Tool 4: When cash is short—prioritizing bills and spending ....................... 129

MODULE 10: Managing cash flow......................................................................... 133

What is a cash flow budget? .......................................................................... 133

Making a cash flow budget ............................................................................ 134

Tool 1: Cash flow budget ............................................................................... 135

Tool 2: Cash flow calendar ........................................................................... 145

Tool 3: Improving cash flow checklist .......................................................... 149

MODULE 11: Dealing with debt .............................................................................157

What is debt? ..................................................................................................157

Good debt, bad debt?......................................................................................157

Tool 1: Debt management worksheet........................................................... 169

Tool 2: Debt-to-income worksheet ...............................................................173

Tool 3: Debt-reduction worksheet ................................................................177

Tool 4: Student loan debt ..............................................................................181

Tool 5: When debt collectors call ................................................................. 185

MODULE 12: Understanding credit reports and scores ..................................... 193

What are credit reports? ................................................................................ 193

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS iii

Why do credit reports and scores matter? .................................................... 193

What is in a credit report? ............................................................................. 194

Negative information .................................................................................... 196

Example credit report.....................................................................................197

Disputing errors on credit reports ................................................................204

What are credit scores? .................................................................................207

Tool 1: Getting your credit reports and scores ..............................................211

Tool 2: Credit report review checklist ...........................................................217

Tool 3: Improving credit reports and scores................................................223

MODULE 13: Evaluating financial service providers, products, and

services ............................................................................................................. 227

Financial service providers ........................................................................... 227

Choosing financial products..........................................................................228

Managing a bank account..............................................................................229

Tool 1: Selecting financial service products and providers.......................... 235

Tool 2: Evaluating financial service providers .............................................239

Tool 3: Types of financial services................................................................243

Tool 4: Opening account checklist ...............................................................249

MODULE 14: Protecting consumer rights ............................................................255

Consumer complaints.................................................................................... 256

It’s your money—be aware and take care...................................................... 257

Tool 1: Red flags............................................................................................ 261

Tool 2: Protecting your identity ...................................................................263

Tool 3: Submitting a complaint....................................................................269

Tool 4: Learning more about consumer protection..................................... 273

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS iv

MODULE 1:

Introduction to the toolkit

Welcome to the Consumer Financial Protection

Bureau’s Your Money, Your Goals: A financial

empowerment toolkit for social services

programs! If you’re reading this, you are

probably a case manager, or you work with case

managers.

Finances affect nearly every aspect of life in the

United States. But many people feel overwhelmed

by their financial situations, and they don’t know

where to go for help. As a case manager, you’re in

a unique position to provide that help. Clients

already know you and trust you, and in many

cases, they’re already sharing financial and other

personal information with you. The financial

stresses your clients face may interfere with their

progress toward other goals, and providing

financial empowerment information and tools is

a natural extension of what you are already doing.

What is “financial empowerment” and how is it

different from financial education or financial

literacy?

Financial education is a strategy that provides

people with financial knowledge, skills, and

resources so they can get, manage, and use their

money to achieve their goals. Financial education

Case manager

The term “case manager” is used

throughout this toolkit, and it refers

to anyone who works directly with

people with low or moderate income

in a wide range of organizations and

on a broad range of issues. Staff may

have different titles, but they

generally come from non-profit or

private sector organizations or city,

county, or tribal governmental

organizations, and they are generally

responsible for the following with

clients:

Conducting needs assessments

Developing action plans with

clients

Providing resources and referrals

needed to implement action plans

Monitoring progress and

evaluating results

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 1

Financial empowerment

Empowerment is the process of

increasing the capacity of people to

make choices and transform those

choices into actions and desired

results, according to the World Bank.

Financial empowerment is building

the knowledge and ability of

individuals to manage money and use

financial services products that work

for them.

is about building an individual’s knowledge,

skills, and capacity to use resources and tools,

including financial products and services.

Financial education leads to financial literacy.

Financial empowerment includes financial

education and financial literacy, but it is focused

both on building the ability of individuals to

manage money and use financial services and on

providing access to products that work for them.

Financially empowered individuals are informed

and skilled; they know where to get help with

their financial challenges. This sense of

empowerment can build confidence that they can

effectively use their financial knowledge, skills,

and resources to reach their goals.

We designed this toolkit to help you help your clients become financially empowered

consumers. This financial empowerment toolkit is different from a financial education

curriculum. With a curriculum, you are generally expected to work through most or all of the

material in the order presented to achieve a specific set of objectives. This toolkit is a collection

of important financial empowerment information and tools you can access as needed based on

the client’s goals. In other words, the aim is not to cover all of the information and tools in the

toolkit - it is to identify and use the information and tools that are best suited to help your

clients reach their goals.

An introduction to the CFPB

CFPB is the abbreviation for the Consumer Financial Protection Bureau. The CFPB’s mission is

to make markets for consumer financial products and services work for Americans—whether

they are applying for a mortgage, choosing among credit cards, or using any number of other

consumer financial products.

Above all, this means ensuring that consumers get the information they need to make the

financial decisions they believe are best for themselves and their families—that prices are clear

up front, that risks are visible, and that nothing is buried in fine print.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 2

We are working to give consumers the information they need to understand the terms of their

agreements with financial companies. We are working to make regulations and guidance as clear

and streamlined as possible so providers of consumer financial products and services can follow

the rules on their own.

Congress established the CFPB through the Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010 (Dodd-Frank Act). The Bureau:

Writes the rules for providers of financial products.

Oversees compliance with the rules.

Brings enforcement actions to stop violations.

Educates the public to help them navigate the market for financial services.

Answers consumers’ questions, handles their complaints, and shares data with the public

about the consumer financial experience.

Our primary strategies are:

Education—An informed consumer is the first line of defense against harmful

practices.

Enforcement—We supervise banks, credit unions, and other financial companies, and

we enforce Federal consumer financial laws.

Study—We gather and analyze available information to better understand consumers,

financial services providers, and consumer financial markets.

The Office of Financial Empowerment within the Division of Consumer Education and

Engagement developed this toolkit because case managers like you meet with thousands of

consumers that need high quality, unbiased financial information and tools to help them

address financial issues more effectively. This toolkit can help you help your clients reduce

financial stress as they become more financially empowered.

We hope you will use this information, the tools found within this toolkit, and the resources at

http://www.consumerfinance.gov with as many of your clients as possible. As you do, you’ll help

inform and empower the individuals in the community you serve to manage their finances in

ways that achieve their goals and dreams.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 3

Financial empowerment and your life

Case managers and financial

empowerment

As a case manager, you

are in a good

position to provide financial

empowerment services to your

clients. Case managers like you have

access to and the trust of millions of

individuals who are most in need of

financial empowerment services. You

may feel more equipped and

empowered to provide these services

when you read the content and use

the tools provided in the toolkit.

As a case manager, you may sometimes hesitate

to share information about financial

empowerment, because you feel like you don’t

know enough about it. Or you may feel like you

know the information but haven’t applied the

information and tools to your own life. In other

words, you might sometimes feel like you don’t

have the “right” to provide financial

empowerment information, because you may feel

your own financial house may not fully be in

order.

You can help your clients face money issues that

may be complicating their lives if you feel

knowledgeable about money and comfortable in

your own approach to money management,

credit, debt, and financial products. As you work

through each module of this toolkit, you will learn both the information and how the tools work.

As you try out the tools, you may also find ways to use your money to reach your own goals more

efficiently and effectively.

Financial empowerment: A way to improve

client and program outcomes

Sharing financial empowerment information and tools with clients may feel like a completely

different job—one more thing you’re being asked to add to your workload. But, once you become

familiar with the resources in this toolkit, we believe it can become natural to integrate its

contents into the work you do. That’s because its core functions relate to what you already do.

As a case manager, one of your job responsibilities is likely to be assessing client or client and

family needs. The toolkit starts you off with an assessment to help you understand your clients’

goals and the financial situations they may be facing.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 4

You then develop a plan to help your clients

receive your organization’s services. You often

have to gather and coordinate information, tools,

and other resources to share with them.

This is the exact function of the toolkit. It brings

together information, tools, and links to other

resources you can use to help your clients build

skills in managing money, credit, debt, and

financial products. Having all those resources in

one place can make it easier for you to integrate

financial empowerment into your meetings with

clients.

We developed the Your Money, Your Goals

toolkit because using the information and tools

Financial empowerment and

outcomes

Financial empowerment may help

your clients transition from the

services they receive from your

program. This won’t happen solely

because of the way that you use the

information and tools in the toolkit.

But sharing the information and tools

with your clients may help increase

their financial stability and reduce

their future need for services.

can improve outcomes for both your clients and your program or organization. As you share the

toolkit with them, your clients will have new understanding of financial concepts and financial

tools to apply to their own lives and to reaching their goals of financial stability and self-

sufficiency.

Depending on what your clients need, you may be able to help them:

Set goals and calculate how much money they need to save to reach these goals

Save money

Establish an emergency savings fund

Access and use tax refunds

Track the specific ways they are using their money

Bring their cash flow budgets into balance

Make a simple plan to pay down debt

Get and review their credit reports

Fix errors on their credit reports

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 5

Evaluate financial products and services

Recognize when their consumer rights may have been violated and know how to take

action

With these new skills and tools, you may be able to help your clients transition from the services

they receive from your organization, too. This won’t happen solely because of the way that you

use the information and tools in the Your Money, Your Goals toolkit. But when you provide

these services, they may play a role in helping your clients increase their financial stability and

reduce their future need for services.

Making referrals

Are you expected to provide all of the help clients need? The answer, of course, is “no.”

You can make a big difference in the lives of your clients by introducing them to financial

empowerment and providing them with some new information and tools to help them solve

specific financial challenges.

Because your clients trust you, they look to you for quality information and referrals on topics

such as the following:

“My credit report has information that’s not accurate. How can I fix it?”

“How can I know if the school loan I can get at the bank is better than one I can get at

school?”

“Should I borrow money from my credit card or take out a small loan to cover my bills

until my next paycheck?”

“My employer says I have to have direct deposit. Everywhere I go, the banks and credit

unions seem to charge fees. How can I find the right account for me?”

But some of your clients may need more help—help you may not feel comfortable providing

because it is technical, beyond what you feel comfortable addressing, or not available within

your organization. This is where your resource and referral network will be important.

Referral partners in your community may include certified, non-profit credit counselors,

independent loan specialists, free volunteer tax assistance sites sponsored by the IRS, and

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 6

financial education programs, among others.

Referral partners

When identi

fying referral partners,

make sure they:

Have expertise in the area for

which you are referring clients to

them

Have the time and interest to

meet with and assist your clients

Are objective, which means they

can show clients the potential

positive and negative

consequences of specific actions

And will not sell products or

services in the context of helping

your clients

These referral partners are often found at non-

profit agencies. It is important that your referral

base of experts does not try to sell products or

services to clients when they are seeking financial

empowerment assistance. It’s also important that

these partners are objective—able to show your

clients the upside and the downside of specific

actions they take and the impact these actions

have on their financial situations.

To get you started in making these types of

referrals, there are instructions and a template

for making a referral guide in the supplemental

module entitled Making a financial

empowerment resource and referral guide. If

you are working with a local financial

empowerment trainer, this person has or will

provide you with a list of websites and local

organizations you may find helpful in your work

with clients.

The goal of Your Money, Your Goals

The goal of the Your Money, Your Goals toolkit is to improve client outcomes by making it

easier for you as a case manager to help clients become more financially empowered.

The Your Money, Your Goals toolkit is divided into 14 modules:

Modules 1 through 5 are introductory modules.

Modules 6 through 14 include information on specific topics and tools clients can use to

put that information to work.

You should note that these modules are designed to be used as needed. Because the process is

designed to be client-driven, this isn’t a curriculum that requires you to start with

Module 6: Setting goals and work all the way through Module 14: Protecting consumer rights.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 7

Consider each module a specific set of tools to be

used as needed with each client.

For example, you may ha

ve a client who has just

lost her job. Starting with Module 6: Setting

goals would likely not be useful to this client. But

tips for managing cash flow and identifying new

resources if she doesn’t have enough cash to

cover basic living expenses (Module 10:

Managing cash flow and Module 8: Managing

income and benefits) could be useful for this

client at this particular time.

You may have a client who wants to get out of

debt. A focus on cash flow (Module 10:

Managing cash flow) may be useful, but you and

the client might decide to start by developing a

simple plan to lessen her debt (Module 11:

Dealing with debt).

If your work only allows you to meet with a client

infrequently—or even just once—this toolkit will

also help you identify ways to start a

conversation that opens the door for you to make referrals to others in your community who

may provide financial education or work with your client to build financial empowerment.

To make the best use of the toolkit, however, we advise not giving clients all of the tools at once.

Getting too many tools at one time would likely be overwhelming for most clients. A better

approach is to identify the topic and tool that will make the biggest difference for each client. If

you are going to send tools home with your client, limit it to one or two that you

have worked with them on how to use. If you give them too many tools at once, none of

the tools are likely to be used.

The Consumer Financial Protection Bureau (CFPB) has prepared this material as a resource for the public. This material is provided

for educational and information purposes only. It is not intended to be a replacement for the guidance or advice of an accountant,

certified financial advisor, or otherwise qualified professional. The CFPB is not responsible for the advice or actions of the

individuals or entities from which you received the CFPB educational materials. The CFPB’s educational efforts are limited to the

materials that the CFPB has prepared.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 8

Giving clients tools

Giving clients tools to take home to

work on can be helpful. At home, they

may have access to accurate

information to complete the tools.

But take care to not send too many

tools home with them at once.

Getting all of the tools at once or even

five tools at one time can be

overwhelming for most

clients. A

better approach is to identify the

topic and tools that will make the

biggest difference for each client at

that specific time.

And if you decide to send tools home

with your client, limit it to just one or

two that you have shown them how to

use.

MODULE 2:

Assessing the situation

Before you start providing financial empowerment services to clients, we want to be sure you

have some tools to help you figure out what your clients may need.

We also want to give you tools to understand your own knowledge and level of confidence about

money management, and the opportunities you have to provide financial empowerment services

to clients.

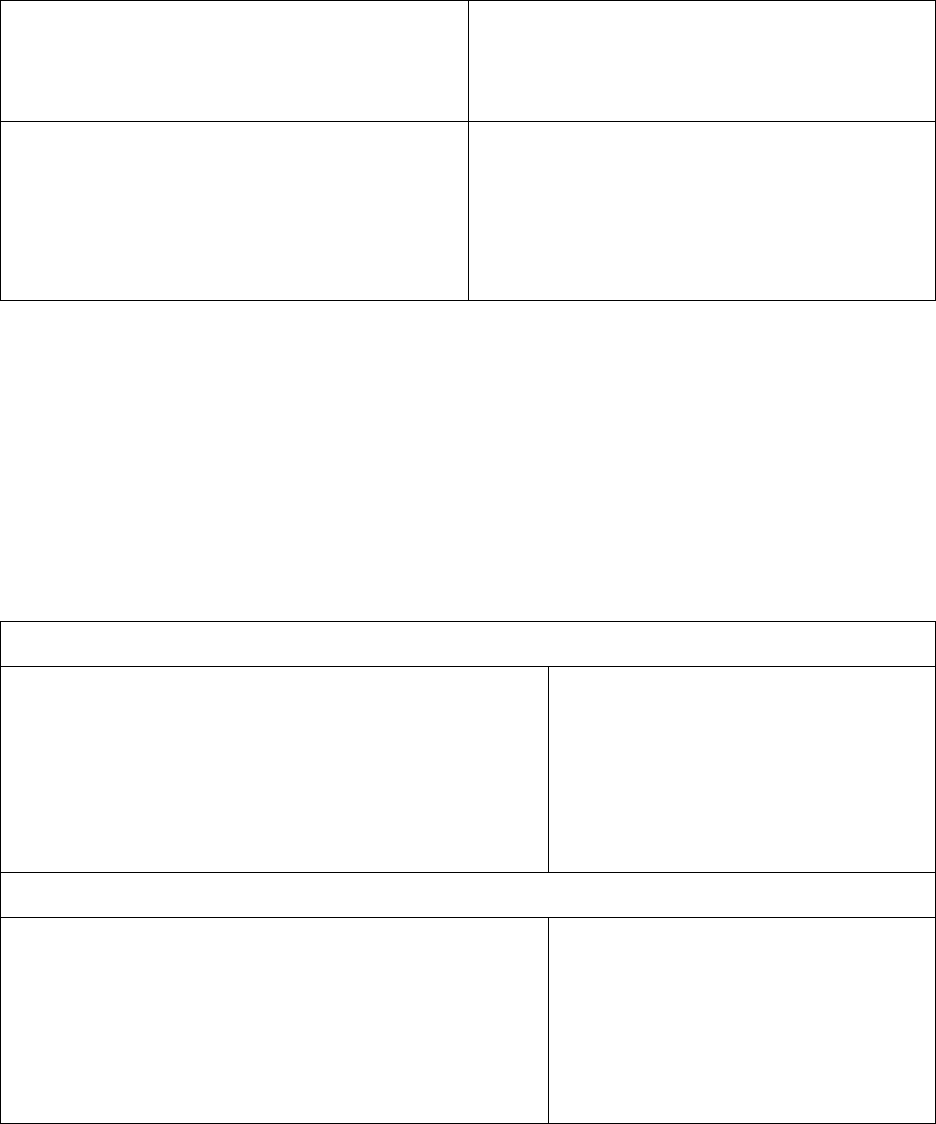

In this module of the Your Money, Your Goals toolkit, we provide two assessment tools to give

you a starting point. The assessment tools include the following:

Tool 1: Financial Empowerment Case Manager Self-Assessment is a three-part tool to help you

understand how much financial knowledge you already have. Learning more will not only

benefit your clients, but may also benefit you as you apply what you learn to your own life.

Tool 2: Client Goals and Financial Situation Assessment is designed to help you and your client

understand the client’s goals and financial situation. This information can help you target the

right module of the toolkit for each client. For example, if a client has a goal to buy a car or a

home, you can target Module 12: Understanding credit reports and scores because learning

how to improve his credit history may help him qualify for a lower cost loan. If you have a client

that is struggling to make ends meet every month, you can target Module 10: Managing cash

flow.

This tool will help you match each client’s goals and financial situation with specific modules

and tools within the toolkit.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 9

Tool 1:

Financial empowerment self-

assessment

Some case managers may find the idea of

providing financial empowerment information to

clients overwhelming. For some, it’s because they

feel like they just don’t know enough about it. But

the truth is that no one knows everything there is

to know about financial empowerment.

Since financial empowerment covers a wide range

of topics, it can be hard to know where to start.

Identifying what you know and don’t know may

be the best place to start. Using this approach, you may find that you know more than you think

you know. You may also find areas where you could benefit from a little more information or

know-how.

Use the following self-assessment to develop an understanding of your own level of financial

knowledge, skills, and confidence—your level of financial empowerment. Questions asked in this

assessment are related to topics in the Your Money, Your Goals toolkit.

Financial Empowerment

Financial empowerm

ent involves

building the ability to use financial

management knowledge, skills, and

tools to access resources, products,

and services to achieve your goals.

Case manager financial empowerment self-assessment

As someone who works with clients, it’s important for you to understand your own level of

financial empowerment. Use this three-part self-assessment to develop an

understanding of your financial knowledge, skill, and confidence. As you will see in

the answer keys, the questions asked in this assessment are directly related to modules in the

Your Money, Your Goals toolkit.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 11

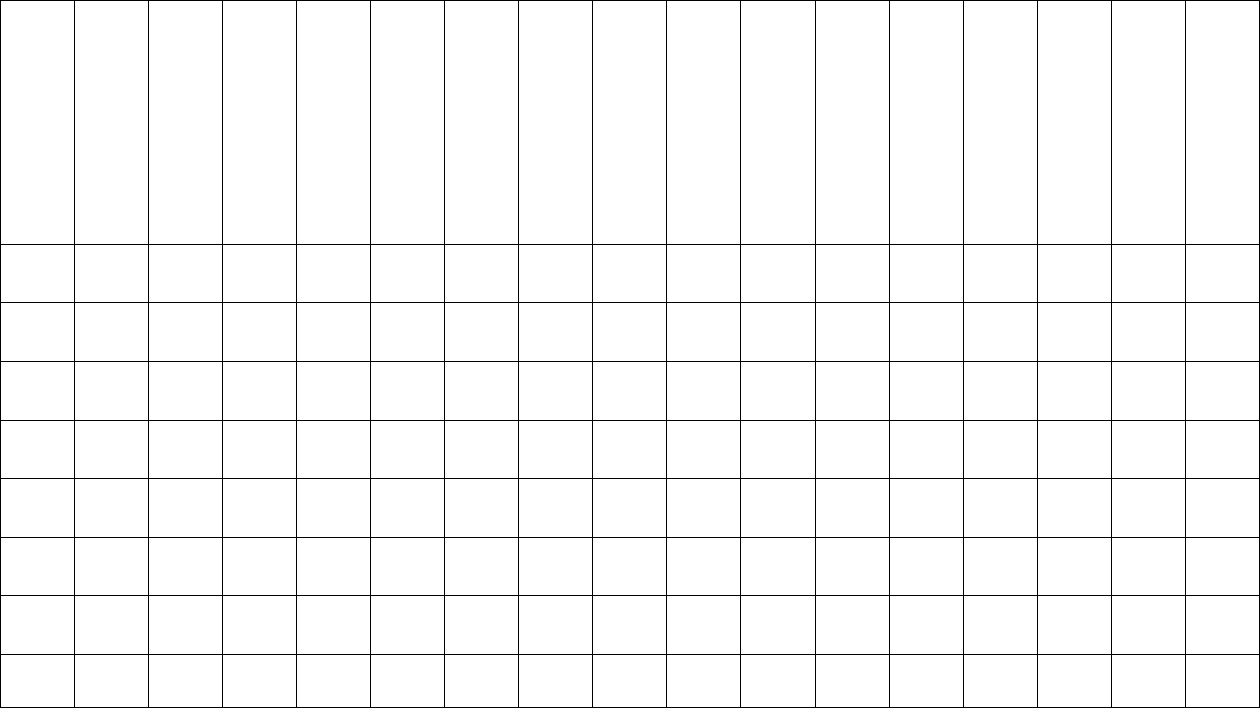

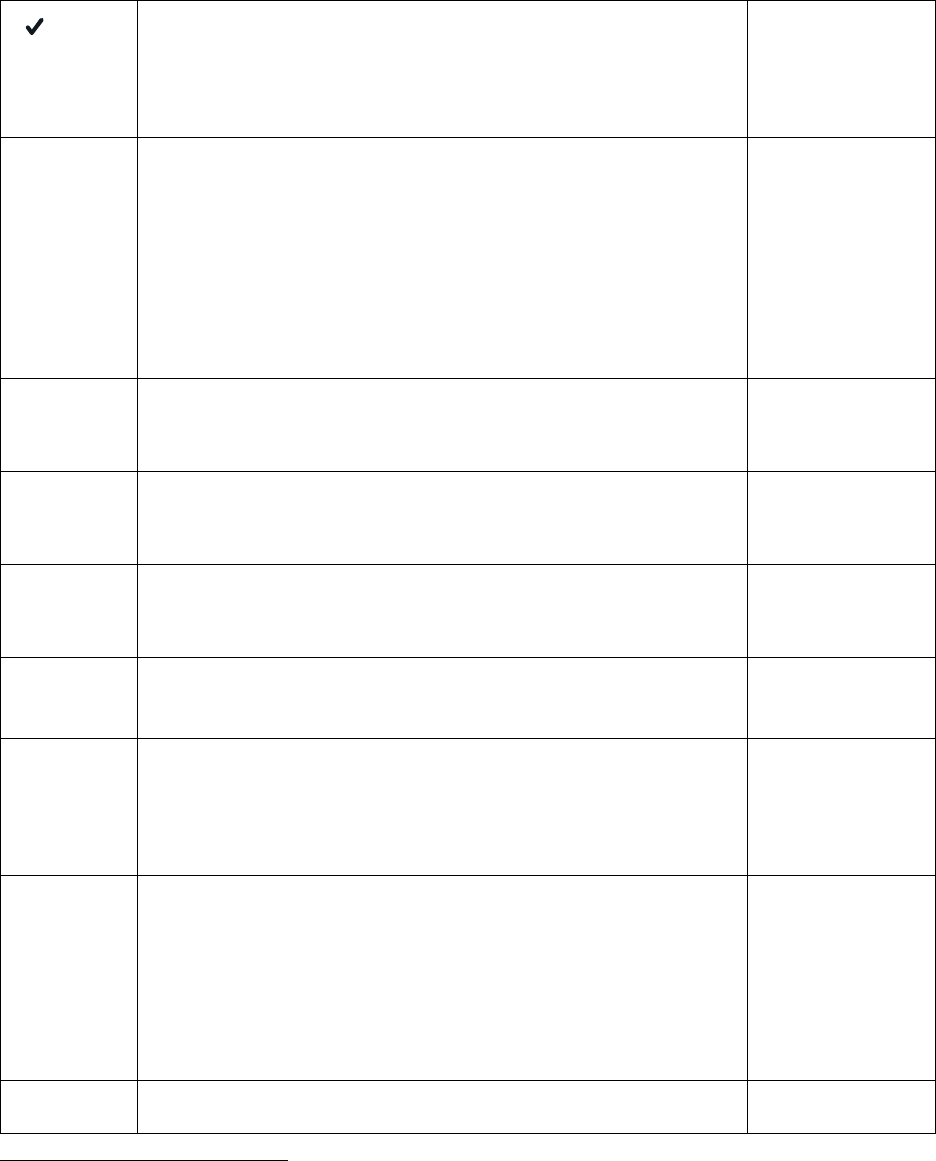

Case manager self-assessment: Part 1

Answer each of the following questions by checking either the “true” or “false” column.

Question True False

1. Goals are not important to financial planning or budgets.

2. To have enough money for emergencies you must save 3 to 6 months’

worth of living expenses.

3. A cash flow budget helps you track whether you will have enough cash to

cover your bills from week to week.

4. If you can’t pay all of your bills and collectors are calling, the “squeaky

wheel” that calls you the most should be paid first.

5. The only way to receive the income you’ve earned from working is by

receiving a paycheck.

6. Credit is when you owe someone money.

7. The amount of your monthly debt payments may impact your ability to pay

your other bills and living expenses and to access new credit.

8. A poor credit history may keep you from getting an apartment, insurance in

some states, or even a job.

9. There are no risks or additional costs associated with having a checking

account.

10. As a consumer, you have almost no rights when it comes to financial

products.

Financial empowerment self-assessment: Part 1 results

Number Correct: ________________ out of 10

Topics to Learn

More About:

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 12

Case Manager Self-Assessment: Part 2

Use check marks to show which word or phrase (rating) best describes how you feel today.

Statement Rating

Does

not

apply

Strongly

disagree

Disagree Agree Strongly

agree

1. I am satisfied with the amount

of money I save.

2. I know about state and federal

tax credits and how to claim

them.

3. I am not concerned about how

much money I owe.

4. I am confident about my credit

reports and scores.

5. I do not worry about being able

to pay my monthly living

expenses.

6. I understand how credit works.

7. I know how to fix incorrect

statements on my credit report.

8. I feel confident about helping

clients begin to manage some

of their financial challenges.

9. I know where the resources

are in my community for credit

and debt counseling and for

free tax filing assistance.

10. I know where to get help if I

have questions about financial

issues.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 13

Case manager self-assessment: Part 3

Use check marks to show whether your answer to each question is “yes,” “no,” or “I don’t know.”

Question Answer

Yes No I don’t

know

1. I have a savings or checking account at a bank or credit

union, and I use this account (make deposits and

withdrawals regularly).

2. I have applied for, received, and used a credit card.

3. I have applied for and received a loan for a car or a

home.

4. I have applied for and received a payday loan.

5. I have requested my own credit report and reviewed it.

6. I track my income and spending.

7. I have received a loan from a pawn shop.

8. I have used the services of a check cashing business.

9. I have had a car or other type of personal property

repossessed for nonpayment.

10. I have received calls from debt collection agencies.

11. I understand my rights and know what to do if I believe a

financial services provider has tried to take advantage of

me.

12. I receive my earnings from work via a method other than

a paycheck. (Payroll card, direct deposit, or cash, for

example.)

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 14

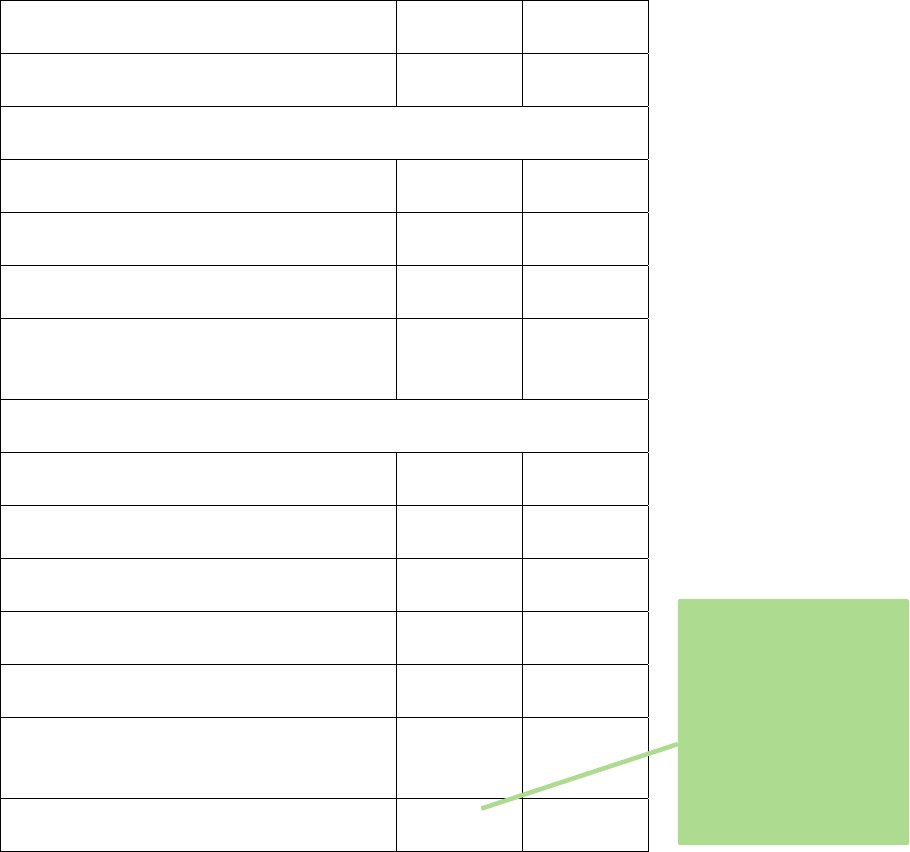

Case manager self-assessment: Part 1 answer key

Here are the correct answers for Part 1 of the “Financial Empowerment Self-Assessment.” If you

did not answer the question correctly, see the module in the toolkit listed next to the answer for

more information. Reading through the module indicated will help you understand the answer

to the question and build your financial empowerment knowledge and confidence.

Questions True False Module

1. Goals are not important to financial planning or budgets.

Module 6

2. To have enough money for emergencies you must save

3 to 6 months’ worth of living expenses.

Module 7

3. A cash flow budget helps you track whether you will

have enough cash to cover your bills from week to

week.

Module 10

4. If you can’t pay all of your bills and collectors are calling,

the “squeaky wheel” that calls you the most should be

paid first.

Module 9

5. The only way to get the income you earn from working

is receiving a paycheck.

Module 8

6. Credit is when you owe someone money.

Module 12

7. The amount of your monthly debt payments may impact

your ability to pay your other bills and living expenses

and to access new credit.

Module 11

8. A poor credit history may keep you from getting an

apartment, insurance in some states, or even a job.

Module 12

9. There are no risks or additional costs associated with

having a checking account.

Module 13

10. As a consumer, you have almost no rights when it

comes to financial products.

Module 14

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 15

Case manager self-assessment: Part 2 answer key

There are no right or wrong answers for Part 2 of the “Financial Empowerment

Self-Assessment.” That’s because the answers are your opinions about your own financial

knowledge, feelings, and situation. Use the following chart to count up how many of each answer

you had:

Rating Does not

apply

Strongly

disagree

Disagree Agree Strongly

agree

Total for

each

Total of strongly disagree +

disagree:

Total of agree + strongly

agree:

If the total of agree + strongly agree is greater than the total of strongly disagree +

disagree, you feel good about many aspects of your financial life.

List any that you rated as disagree or strongly disagree below and read the modules

that relate to these areas in the Your Money, Your Goals toolkit to learn more.

If the total of agree + strongly agree is less than the total of strongly disagree +

disagree, you may be feeling stress about many aspects of your financial life.

Consider reviewing the entire toolkit and working through the worksheets on your

own before you using them with the clients you serve.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 16

Statement

If your rating is disagree or strongly disagree,

check out . . .

1. I am satisfied with the amount of

money I save.

Modules 6 and 7

2. I know about state and federal tax

credits and how to claim them.

Modules 7 and 8

3. I am not concerned about how

much money I owe.

Modules 10 and 11

4. I am confident about my credit

reports and scores.

Module 12

5. I do not worry about being able to

pay my monthly living expenses.

Module 9 and 10

6. I understand how credit works. Module 12

7. I know how to fix incorrect

statements on my credit report.

Module 12

8. I feel confident about helping

clients begin to manage some of

their financial challenges.

Consider reviewing all of the content modules.

9. I know where the resources are in

my community for credit and debt

counseling and for free tax filing

assistance.

Supplemental Your Money, Your Goals information on

making a financial empowerment resource and referral

guide

10. I know where to get help if I have

questions about financial issues.

Supplemental Your Money, Your Goals information on

making a financial empowerment resource and referral

guide

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 17

Case manager self-assessment: Part 3 answer key

There are no right or wrong answers for Part 3 of the “Financial Empowerment

Self-Assessment” because it helps you identify the financial products or services with which you

have had experience. If you have not used some of these products or services that your clients

may use, you may need to learn more about them. Use the materials in Modules 7, 8, and 9 to

learn more about products, services, and financial service providers. You may also find it

beneficial to review those modules even if you have experience with the products, services, and

financial service providers.

Question Modules of interest

1. I have a savings or checking account at a

bank or credit union, and I use this

account (make deposits and withdrawals

regularly).

If no or I don’t know, see Module 13.

2. I have applied for, received, and used a

credit card.

If no or I don’t know, see Modules 12, and 13.

3. I have applied for and received a loan for

a car or a home.

If no or I don’t know, see Modules 11, 12, and

13.

4. I have applied for and received a payday

loan.

If yes or I don’t know, see Modules 10, 11, and

13.

5. I have requested my own credit report and

reviewed it.

If no or I don’t know, see Module 12.

6. I track my income and spending. If no or I don’t know, see Module 8.

7. I have received a loan from a pawn shop.

If yes or I don’t know, see Modules 10, 11, and

13.

8. I have used the services of a check

cashing business.

If yes or I don’t know, see Modules 8 and 13.

9. I have had a car or other type of personal

property repossessed for nonpayment.

If yes or I don’t know, see Modules 10 and 11.

10. I have received calls from debt collection

agencies.

If yes or I don’t know, see Module 11.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 18

11. I understand my rights and know what to

do if I believe a financial services provider

has tried to take advantage of me.

If no or I don’t know, see Module 14.

12. I receive my earnings from work via a

method other than a paycheck. (Payroll

card, direct deposit, or cash, for example.)

For any response, see Module 7.

This Tool is included in the Consumer Financial Protection Bureau’s toolkit. The CFPB has prepared this material as a resource for

the public. This material is provided for educational and information purposes only. It is not a replacement for the guidance or

advice of an accountant, certified financial advisor, or otherwise qualified professional. The CFPB is not responsible for the advice or

actions of the individuals or entities from which you received the CFPB educational materials. The CFPB’s educational efforts are

limited to the materials that CFPB has prepared.

This Tool may ask you to provide sensitive personal and financial information. The CFPB does not collect any information from you

or the organization using this Tool. The CFPB is not responsible and has no control over how others may use the information that

you provide to them about your personal or financial situation. Be cautious how you use this Tool. CFPB recommends that you do

not include names, account numbers; that you lock up completed hard copies and encrypt completed soft copies of the Tool that

contain sensitive personal and financial information; and shred hard copies that contain sensitive personal and financial

information when no longer needed.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 19

Tool 2:

Client goal and financial

situation assessment

Situation Assessment

A picture of conditions today used to

create a plan for actions to change

conditions in the future.

You may be wondering where you should start

with a clie

nt. The Client Goal and Financial

Situation Assessment may help you figure out a

beginning point with a client.

Use of this assessment is optional. It can help you

efficiently and effectively determine where to

start in the toolkit, but you may find that you

already ask similar questions in your existing assessment protocol.

If you do use this assessment, consider using it when:

Clients fill out intake paperwork for your organization or program

You meet with clients for an initial assessment

Clients are waiting for other services (such as waiting to have their tax returns prepared

at a Volunteer Income Tax Assistance site)

You may also choose to:

Send this home with clients to fill out privately

Use it as a guide to ask questions in a conversational style to better understand the

financial concerns and goals of your clients

Ask the questions over several sessions with your client

How does it work? When you feel the time is right, you can simply ask a client to complete the

assessment. You can match her answers with modules in the Your Money, Your Goals toolkit as

a starting point for assistance.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 21

Because the assessment is simple and only has a few key questions, you might often be able to

gather the information in a conversation. Reading the assessment and recording the answers for

her may be useful if you are working with a client that has limited literacy levels, is an English

language learner, or with whom a question and answer format would be more productive.

Introducing the assessment may be uncomfortable if you’re not used to asking these types of

questions. Module 3 of the Your Money, Your Goals toolkit provides tips on starting the

conversation. With the assessment, you can use a statement like the following as an

introduction:

We know that many issues in running a household involve money. One thing we would like

to do is provide you with information and tools to help you use your money to reach your

goals. To get us started, we have this questionnaire, which you’ll see covers several topics.

You know where you are and where you’d like to go, and your answers will help us build a

plan to get you the information and tools that are going to be most useful to you right now.

We will not use the information you provide in any other way.

Remember, financial empowerment is a big topic. Knowing where to start can be hard, but using

this assessment will help you identify what is going on with your client and provide her with the

right information, tools, or referrals.

Finally, be sure you have a system for keeping your clients’ assessments completely confidential.

When discussing this assessment with your clients, be sure you can provide assurance of

confidentiality and describe your system for keeping this information secure (e.g., a locked

drawer in a file cabinet). As you proceed, be sure to follow your organization’s data policy

guidelines and retention policy.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 22

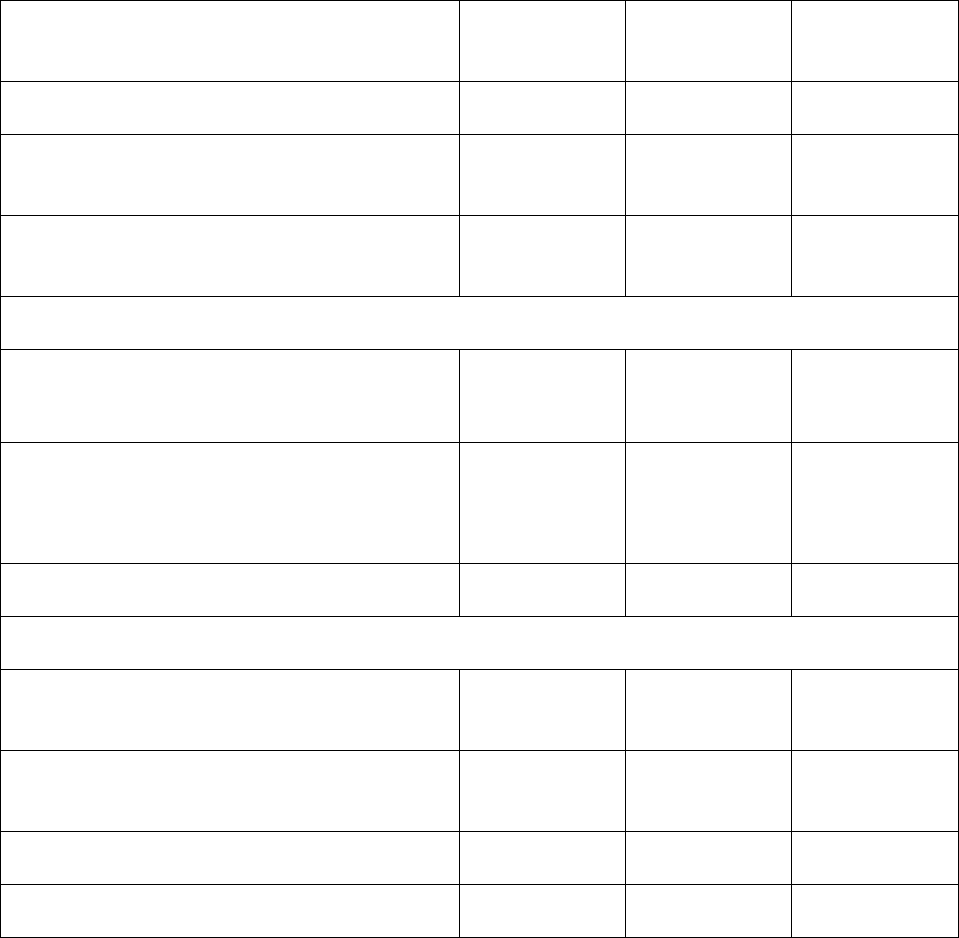

Your goals and financial situation

Please answer the following questions based on where you are today. There are no right or

wrong answers. The purpose of this questionnaire to ensure the right financial information and

resources are provided to you to help you reach your goals.

Question Response

1. Do you have financial goals and know how

much money you need to reach them?

Yes No

I don’t

know

2. Are you in danger of losing your housing or

car because you cannot make payments?

Yes No

I don’t

know

3. Are you in danger of having any of your

utilities shut off because of nonpayment?

Yes No

I don’t

know

4. Do you have a regular and reliable source of

income?

Yes No

I don’t

know

5. Do you have money set aside to cover

emergencies or unexpected expenses?

Yes No

I don’t

know

6. Are you able to cover all of your bills and

monthly living expenses each month?

Yes No

I don’t

know

7. Do you owe a person or business money? Yes No

I don’t

know

8. Do you have student loans or other debts you

can’t pay?

Yes No

I don’t

know

9. Have you been unable to get a job, cell

phone plan, insurance, apartment, credit

card, or car due to a bad credit record?

Yes No

I don’t

know

10. Do you have an account at a bank or credit

union?

Yes No

I don’t

know

11. Have you been denied a savings or checking

account?

Yes No

I don’t

know

12. Do you feel like the financial services you use

cost you too much?

Yes No

I don’t

know

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 23

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

13. Do you know who to call with a complaint

about a financial product or service?

Yes No

I don’t

know

14. If you answered that you have financial goals, what are they?

15. If you could change one thing about your financial situation, what would that be?

This Tool is included in the Consumer Financial Protection Bureau’s toolkit. The CFPB has prepared this material as a resource for

the public. This material is provided for educational and information purposes only. It is not a replacement for the guidance or

advice of an accountant, certified financial advisor, or otherwise qualified professional. The CFPB is not responsible for the advice or

actions of the individuals or entities from which you received the CFPB educational materials. The CFPB’s educational efforts are

limited to the materials that CFPB has prepared.

This Tool may ask you to provide sensitive personal and financial information. The CFPB does not collect any information from you

or the organization using this Tool. The CFPB is not responsible and has no control over how others may use the information that

you provide to them about your personal or financial situation. Be cautious how you use this Tool. CFPB recommends that you do

not include names, account numbers; that you lock up completed hard copies and encrypt completed soft copies of the Tool that

contain sensitive personal and financial information; and shred hard copies that contain sensitive personal and financial

information when no longer needed.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 24

Client goals and financial situation assessment key

Use the following chart to help you analyze the “Client Goals and Financial Situation

Assessment.” This analysis will help you determine where to start financial empowerment work

with your client. If your client seems to have several high-priority areas, you can list them and

ask the client to prioritize them with you.

Question Response

1. Do you have financial goals and know how

much money you need to reach them?

If no or I don’t know, see Module 6.

2. Are you in danger of losing your housing or

car because you cannot make payments?

If yes, call 211 or local emergency assistance

center. For homeowners, call (888) 995-

HOPE.

3. Are you in danger of having any of your

utilities shut off because of nonpayment?

If yes, call 211 or local emergency assistance

center.

4. Do you have a regular and reliable source of

income?

If no, call 211, workforce opportunity center, or

local emergency assistance center and see

Module 8.

5. Do you have money set aside to cover

emergencies or unexpected expenses?

If no or I don’t know, see Modules 7 and 13.

6. Are you able to cover all of your bills and

monthly living expenses each month?

If no or I don’t know, see Module 10.

7. Do you owe a person or business money?

If yes or I don’t know, see Modules 10, 11, and

12.

8. Do you have student loans or other debts you

can’t pay?

If yes or I don’t know, see Modules 9 and 11.

9. Have you been unable to get a job, cell phone

plan, insurance, apartment, credit card, or car

due to a bad credit record?

If yes or I don’t know, see Module 12.

10. Do you have an account at a bank or credit

union?

If no or I don’t know, see Module 9.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 25

11. Have you been denied a savings or checking

account?

If yes or I don’t know, see Module 13.

12. Do you feel like the financial services you use

cost you too much?

If yes or I don’t know, see Module 13.

13. Do you know who to call with a complaint

about a financial product or service?

If no or I don’t know, see Module 14.

Answers to Questions 14 and 15 will vary. Use the answers to these two questions as additional

information to help you pinpoint the module and tool that will be most useful for your client

right now.

The Consumer Financial Protection Bureau (CFPB) has prepared this material as a resource for the public. This material is provided

for educational and information purposes only. It is not intended to be a replacement for the guidance or advice of an accountant,

certified financial advisor, or otherwise qualified professional. The CFPB is not responsible for the advice or actions of the

individuals or entities from which you received the CFPB educational materials. The CFPB’s educational efforts are limited to the

materials that the CFPB has prepared.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 26

MODULE 3:

Starting the conversation

Starting the conversation

If financial empowerment is not a

part of your regular work with clients,

knowing when to bring up the topic

can be a challenge at first. Ways to

start the conversation include:

Using the existing assessment

tool in intake or assessment

meetings with clients

Making the most of shorter

discussions

you have with

clients to introduce a tool or

make a referral

Integrating financial

empowerment into

organizational programs or

procedures

Following up with clients

when they bring up financial

issues directly or indirectly

Everyone has questions about money. Even the

wealthiest people in the world may turn to

someone when they have financial questions.

It can be difficult, though, to talk about money,

even with people that you know well. It can feel

uncomfortable to raise the topic of personal

finance because it’s so personal. Because the

subject of money is deeply personal, it can seem

even more difficult to talk about it with clients

that you don’t know well.

But you talk with clients all the time about other

personal issues. Talking about money can get

easier if you start the conversation with

your clients at the right time in a way that

acknowledges their desire to have control

over their own lives. By approaching financial

issues in a non-judgmental way, you will build

trust that allows you to work with clients to

address their financial challenges.

Most people are working to get their financial

houses in order. But even if you are among the

few who have never had money struggles

yourself, chances are that you’ve seen someone

you care about struggle with financial issues.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 27

Use the experiences that you’ve had in your own life to help you empathize with your clients and

understand where they’re coming from. When they feel that you respect them and that they can

trust you, they will be more willing to open up and discuss financial topics that might otherwise

make them feel uncomfortable.

When should I bring up money topics?

The right time to bring up money topics will depend on the people that you work with and your

relationship with them. For example, the needs of people transitioning from a shelter into

permanent housing are very different from the needs of people who own their own homes and

are at risk of foreclosure. Likewise, discussing money topics will vary depending on how much

contact you have with your clients. A conversation about financial topics with a client you see

once a year will be very different than the discussion you’ll have if you see him or her weekly or

monthly. Like every other intervention, you need to balance meeting clients where they are with

the expectations of your program.

If you are screening someone for benefits, follow your organization’s protocol closely when it

comes to financial questions so that clients don’t feel like you are trying to find out more

information than is required for screening them. In this case, talking about financial

empowerment at the wrong time could undermine their trust in you. Instead, you may use this

opportunity to build trust by suggesting resources they may qualify for such as free tax filing

assistance or claiming the Earned Income Tax Credit as a way to bring more money into the

household.

Clients may also share problems they’re having with a financial product or service provider. As

you listen to the challenges they’re facing and how they have tried to resolve the problem, if

appropriate, you can offer to help them submit a complaint to the CFPB.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 28

How should I bring up money topics?

Use the assessment tool

If you have a lot of contact with a client, one of the easiest ways to bring up money is to use the

Client Goal and Financial Situation Assessment from Module 2. By going over this series of

questions with your client, you will have a clear picture of where he or she stands and what

information might be most useful. Remember, you can:

Ask your client to complete the assessment individually either in your office or at home

Cover the questions in the assessment orally or in conversation format

Ask your clients to complete or answer only a few of the questions

Make the most of short-term contacts

While it’s great to be able to build trust and discuss financial issues with your clients over the

long term, sometimes you just don’t have that kind of time. But that doesn’t mean that you can’t

work on empowering your clients financially during short-contact meetings, such as when a

client applies for public benefits or comes in for job skills training. For example, if you had a

brief meeting with a new client, George, who came in to apply for an energy assistance program,

you could say:

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 29

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 30

Build it into existing program procedures

Take a look at your existing organizational purpose, program procedures, and protocols. Often,

you may find that introducing financial topics, such as credit, debt, savings, and cash flow, help

clients to become more economically self-sufficient. If economic self-sufficiency or a similarly

stated purpose is part of your organization’s mission or is required by your funders, can you add

these topics into your existing protocols, procedures or program offerings to help empower your

clients financially?

In the next sections, we’ll offer you specific suggestions, tools, and tips for broadening and

improving existing financial conversations that you have with your clients. For example, if you

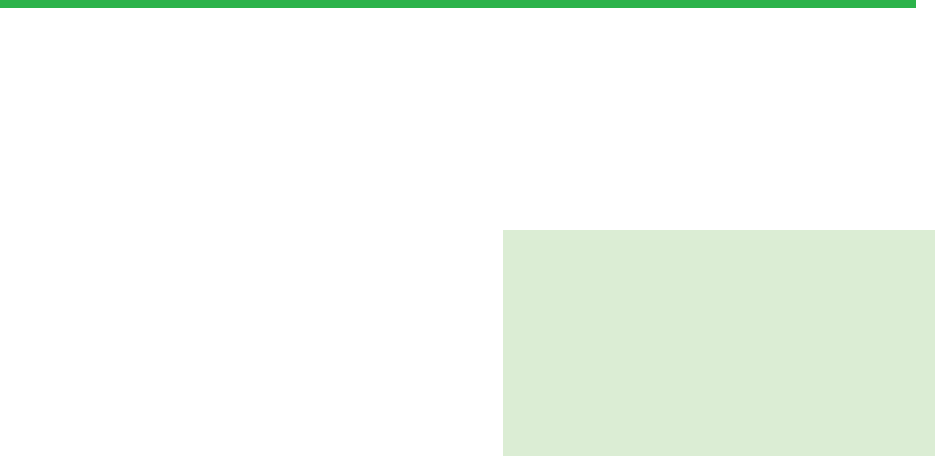

are working on obtaining employment and building job skills with your client, Javier, you can

talk with him about banking and savings after he gets a job in order to help him effectively

manage his income.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 31

Respond when clients initiate

Sometimes an opportunity to talk with a client about financial issues will arise outside of a

formal assessment or procedure. This happens when a client brings up a financial issue directly

or indirectly.

Here’s an example of how it could sound if a client brings up a financial issue directly. For

example, your client, Aaliyah, with whom you have regular and focused contact, says in one of

your early meetings:

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 32

Here’s an example of how it could sound if a client brings up a financial issue indirectly. For

example, during a meeting you ask Aaliyah how her kids are doing, and she says:

Discussing difficulties or problems with financial products with

your clients

Many people have difficulty with credit or other financial services, but your clients may feel a

sense of shame or embarrassment because of their situation. When discussing what has

happened with your clients, be sure to explain in clear terms how to avoid a similar situation in

the future and how to get help from the CFPB and other federal, state, or local agencies if they

can’t resolve problems with the financial services provider. See Module 14: Protecting consumer

rights for information on submitting a complaint to the CFPB and other authorities.

Alternatively, you can submit a complaint on behalf of your client.

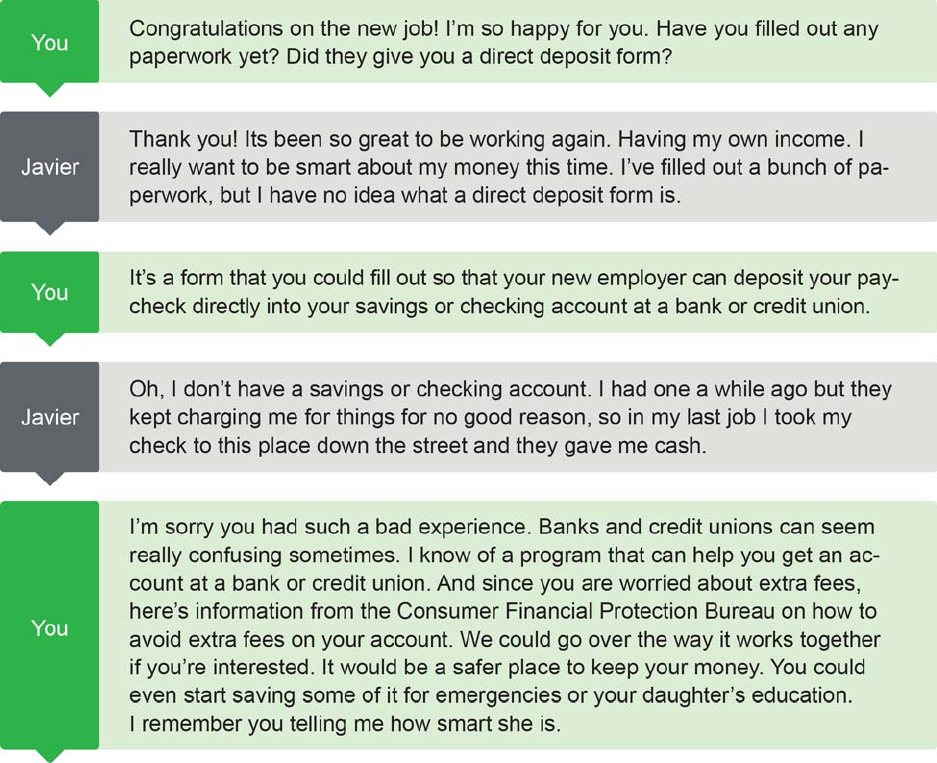

Submitting a complaint on behalf of another person

CFPB’s online complaint system allows you to submit a complaint on behalf of another person

but the forms and the way in which you submit may vary depending on the type of complaint. To

submit on behalf of someone else, go to the complaint area of the website. Fill out the first two

sections—“What happened?” and “Desired Resolution”—and then you will arrive at the “My

information” section. At the top of the “My information” section in some intake forms, you will

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 33

be asked whether you are submitting a complaint on behalf of “myself” or “someone else.”

Choose the “someone else” option and you will be prompted to another section where you can

fill out the consumer’s contact information. In other forms, you may be able to enter

information about the contact person that is different from the information provided about the

consumer. You should upload a copy of the Representation Agreement as an attachment when

provided an opportunity on the last page of the form.

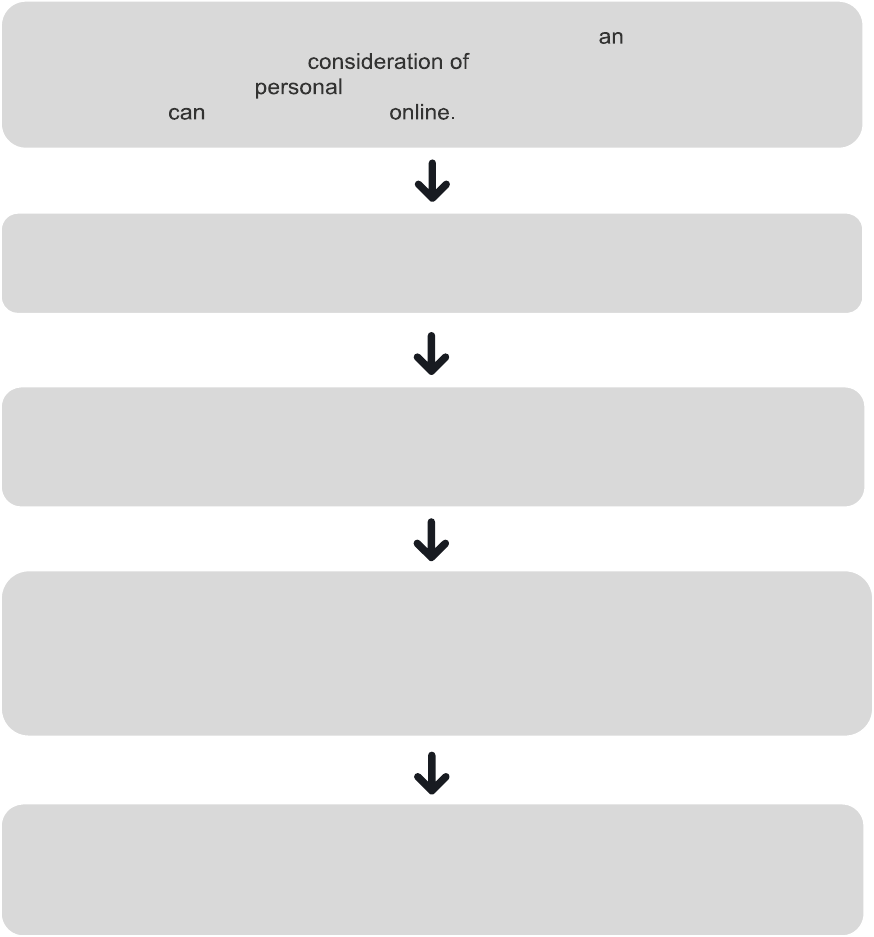

This is what one of the online forms looks like with notes for how to complete it for a client:

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 34

Here is what will happen to the complaint:

Complaint Submitted: The CFPB will screen you complaint based on several criteria.

These criteria include whether your complaint falls within the CFPB’s primary

enforcement authority, whether the complaint is complete, and whether it is a duplicate

of another complaint you have submitted.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 35

Review and Route: If a particular complaint does not involve a product or market that

is within the Bureau’s jurisdiction or that is not currently being handled by the Bureau,

the CFPB refers it to the appropriate regulator. Screened complaints are sent via a secure

web portal to the appropriate company—the business you have the complaint with.

Company Response: The company reviews the information, communicates with you

as needed. It then determines what action to take in response. The company reports back

to you and the CFPB via the secure “company portal.” After your complaint is sent to the

company, the company has 15 days to provide a substantive response to you and the

CFPB. Companies are expected to close all but the most complicated complaints within

60 days.

Consumer Review: CFPB then invites you to review the response and provide

feedback. Consumer Tracking: You can log onto the secure “consumer portal” available

on the CFPB’s website or call a toll-free number to receive status updates, provide

additional information, and review responses provided to the you by the company.

Review and Investigate: The CFPB reviews your feedback about company responses,

using this information along with other information such as the timeliness of the

company’s response, for example, to help prioritize complaints for investigation.

Analyze and report: Complaints help with the CFPB’s work to supervise companies,

enforce federal consumer financial laws, and write better rules and regulations. The

CFPB also reports to Congress about the complaints we receive and makes anonymized

consumer complaint data available to the public on the website:

www.consumerfinance.gov/complaintdatabase/.

Contact information

Online: consumerfinance.gov/complaint

Toll‐free phone: (855) 411‐CFPB (2372), 8am‐8pm EST, Monday ‐ Friday

TTY/TDD phone: (855) 729‐CFPB (2372)

Fax: (855) 237‐2392

Mail:

Consumer Financial Protection Bureau

PO Box 4503, Iowa City, IA 52244

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 36

The Consumer Financial Protection Bureau (CFPB) has prepared this material as a resource for the public. This material is provided

for educational and information purposes only. It is not intended to be a replacement for the guidance or advice of an accountant,

certified financial advisor, or otherwise qualified professional. The CFPB is not responsible for the advice or actions of the

individuals or entities from which you received the CFPB educational materials. The CFPB’s educational efforts are limited to the

materials that the CFPB has prepared.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 37

MODULE 4:

Emotional and cultural

influences on financial

decisions

Everyone has situations where they know what they think they “should” do, but find themselves

doing something else instead – especially when it comes to money. For example, you may have

decided to save part of your tax refund to build an emergency fund. Instead, you use it to help a

family member pay down his medical debt, because not helping a family member pay off a debt

would go against the cultural norms you were raised with. Or, you may use it to splurge on

something you have wanted because you’ve been working hard and making this splurge for

yourself or family feels good.

Financial decisions, no matter how well intended, are never made in a vacuum. Many things

influence both our short- and long-term financial decisions. This module focuses on two

influences on financial decision-making: emotions and culture.

Emotional influences on financial decisions

When people talk about money, it’s not just about the numbers—what they are really discussing

is what money means to them. Attitudes and behaviors around money are wrapped up in

feelings around security, failure, family, love, and status. It’s important to observe your clients to

try to determine their emotional reactions to money and its meaning, and integrate their

emotions and feelings into your discussions about their finances. If someone is “upset or rattled

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 39

about money, they tend to swing too far in one direction or the other. The best approach takes a

middle path – talk to both head and heart.”

1

Instead of just asking your clients to provide you with the basic numbers, try asking your clients

questions about how they feel when you’re discussing their finances. You could try questions

such as:

“What does money mean to you?”

“What is your first memory involving money?”

“What is the most difficult thing about money for you? For your family?”

Helping clients become aware that financial decisions are influenced by emotions and past

experiences may help them understand what drives some of their financial practices. It can also

help you better understand their unique strengths and challenges.

Cultural influences on financial decisions

No decisions, including financial ones, are made in a vacuum. People make all of their decisions

within the very powerful context of culture, including family, ethnicity, region, community,

socio-economic status, generation, and religion. Each of these factors influences beliefs, values,

and experiences about money and the way financial decisions are handled.

Cultural influences are heavily rooted in values. Consider how common American values—such

as individualism, practicality, honesty, and hard work

2

—might influence the financial choices

people make. Values around money are also influenced by businesses, governments, changes in

financial markets, and the media.

1

Mellan, Olivia and Christie, Sherrie, Second Thoughts: Making Better Decisions, ThinkAdvisor, February 25, 2013.

See http://www.thinkadvisor.com/2013/02/25/second-thoughts-making-better-decisions.

2

Kohl, L. Robert, Values Americans Live By, 1984. See

http://www.claremontmckenna.edu/pages/faculty/alee/extra/American_values.html.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 40

Cultural conflicts

Sometimes, you will find that clients are caught in the middle of cultural conflicts around

money. Their family culture may emphasize saving and avoiding debt, while their broader

community may ascribe status to material things like new cars or expensive clothes, which could

require taking on debt to purchase. Or the culture in which they were raised might emphasize

caring financially for parents as they age, while their peers at work are not expected to take on

the same level of responsibility.

Sometimes, these conflicts aren’t just internal, but take place within a family: one spouse may

have cultural influences or a family background that encourage them to save for their children’s

education, while the other may feel that children should be responsible for their own

educational expenses. Consequently, one parent may want to save the family’s tax refund; the

other will think that money should go towards things the family needs or simply wants now.

These conflicts can lead to emotional decisions that may not look rational on the outside but

make perfect sense given their background, values, and culture.

How can this understanding help my

clients?

Discover your clients’ cultural and emotional context

When discussing clients’ financial behavior, don’t just accept their expressed wants at face

value; probe gently to discover their underlying attitudes, needs, goals, and roadblocks. Ask

them questions like:

“Who handles the finances in your family?”

“How does your community of faith view money?”

“How did your family handle finances when you were growing up? Did you discuss

money openly?”

“How do your friends view money? How do you think this may influence you?”

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 41

“What do you want your children to learn about money? What do you think they are

learning from you now?”

It’s often difficult for people to open up about money, but taking the time to really understand

and connect with your clients’ cultural and emotional values and needs around money will build

empathy, making you more successful in achieving both client and program outcomes.

Recognize emotional and cultural influences

An example of how a difference in cultural values might affect financial behavior is that Western

culture values individuality and personal well-being, which means it’s generally considered

appropriate for each person to support themselves financially. In some other cultures, family

members support each other financially throughout their lives—if they save money, it may go to

a family member they believe needs it. If a client chooses to spend his disposable income on his

extended family instead of saving it in an emergency fund, this doesn’t mean that he has bad

financial habits, just that he is making financial choices in a different cultural context than you

may be familiar with.

Helping to bridge cultural and emotional roadblocks

It’s important to understand these cultural influences without being judgmental. In discussing

financial goals and choices with clients, seek to understand their values and cultural influences,

so that you can help them reach their true goals in a way that makes them feel understood and

respected. Though they might agree to a financial plan that makes rational sense, and know that

it’s what they have agreed to do, this is often not enough to override their feelings or cultural

context in the moment when decisions are made. Remember that while their priorities may

seem counterproductive to you, within their own culture, they may feel completely appropriate.

Once you understand the cultural factors that are guiding your clients’ behavior, you can coach

them toward financial choices that help them effectively manage their obligations and line up

with their true values and desires. This might mean that you help them figure out a compromise:

for example, how to ensure that they take responsibility for their own financial needs and

obligations without asking them to abandon their commitment to help their extended family.

The Consumer Financial Protection Bureau (CFPB) has prepared this material as a resource for the public. This material is provided

for educational and information purposes only. It is not intended to be a replacement for the guidance or advice of an accountant,

certified financial advisor, or otherwise qualified professional. The CFPB is not responsible for the advice or actions of the

individuals or entities from which you received the CFPB educational materials. The CFPB’s educational efforts are limited to the

materials that the CFPB has prepared.

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 42

MODULE 5:

Using the toolkit

How does it work?

At this point you may be wondering: How am I ever going to find the time to add financial

empowerment into my already packed schedule? One way to think about this financial

empowerment work is that it is not an “add-on” service, but rather something to be integrated

into the work you are already doing with clients.

Does this mean that it doesn’t require time on your part? Of course not. But that time will be

front-loaded. In order to integrate financial empowerment into the case management or other

supportive services you provide, you will have to invest time into:

Learning the toolkit content

Becoming comfortable with the topics and the tools in the toolkit

Thinking about ways to introduce financial empowerment in the context of the case

management you provide

Potentially capturing the outcomes of financial empowerment in the work you do

YOUR MONEY, YOUR GOALS: A FINANCIAL EMPOWERMENT TOOLKIT FOR SOCIAL SERVICES PROGRAMS 43

Integration

Integration of financial empowerment means identifying where and how you can weave

financial empowerment information and tools into the work you are already doing.

Why is integration of financial empowerment such a promising strategy? Here are a few

reasons:

It builds on established relationships you may have with clients.