Introductionto Financial

Accounting

(As per the Revised Syllabus 2014-15 of Mumbai University for

F.Y. BMS, Semester I)

Dr.NisikantJha

[Winner of “Best Commerce Author 2013-14” by Maharashtra Commerce Association]

Ph.D., ICWA, PGDBM (MBA), M.Com.,

International Executive MBA UBI, Brussels, Belgium; BEC Cambridge University,

Assistant Professor in Accounts & Coordinator

for

BAF, Thakur College of Science and Commerce,

UGC Recognised, University of Mumbai.

Visiting Faculty for: MBAin United Business Institutes, Brussels, Belgium, Europe,

CFA& CFP Professional Courses of USA, CIMAProfessional Courses of London,

CA & CS Professional Courses of India, M.Com. & M.Phil., Hinduja College,

Ph.D. Guide [Research Supervisor] & Professor for Research Methodology.

Prof.Nimesh Jotaniya Prof.Poonam Kakad

PGDFM, M. Com., UGC-NET Co-ordinaotor BAF, BMS

Assistant Professor in Accounts at Nirmala College of Commerce

Thakur College of Science & Commerce Kadivali, East

MUMBAI NEW DELHI NAGPUR BENGALURU HYDERABAD CHENNAI PUNE LUCKNOW

AHMEDABAD ERNAKULAM BHUBANESWAR INDORE KOLKATA GUWAHATI

© Authors

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying, recording and/or otherwise without

the prior written permission of the publishers.

First Edition: 2014

Published by : Mrs. Meena Pandey for Himalaya Publishing House Pvt. Ltd.,

“Ramdoot”, Dr. Bhalerao Marg, Girgaon, Mumbai - 400 004.

Phone: 022-23860170/23863863, Fax: 022-23877178

E-mail: himpub@vsnl.com; Website: www.himpub.com

Branch Offices :

New Delhi : “Pooja Apartments”, 4-B, Murari Lal Street, Ansari Road, Darya Ganj,

New Delhi - 110 002. Phone: 011-23270392, 23278631;

Fax: 011-23256286

Nagpur : Kundanlal Chandak Industrial Estate, Ghat Road, Nagpur - 440 018.

Phone: 0712-2738731, 3296733; Telefax: 0712-2721216

Bengaluru : No. 16/1 (Old 12/1), 1st Floor, Next to Hotel Highlands, Madhava Nagar,

Race Course Road, Bengaluru - 560 001.

Phone: 080-22286611, 22385461, 4113 8821, 22281541

Hyderabad : No. 3-4-184, Lingampally, Besides Raghavendra Swamy Matham,

Kachiguda, Hyderabad - 500 027. Phone: 040-27560041, 27550139

Chennai : 8/2 Madley 2nd street, T. Nagar, Chennai - 600 017. Mobile: 09320490962

Pune : First Floor, "Laksha" Apartment, No. 527, Mehunpura, Shaniwarpeth

(Near Prabhat Theatre), Pune - 411 030. Phone: 020-24496323/24496333;

Mobile: 09370579333

Lucknow : House No 731, Shekhupura Colony, Near B.D. Convent School, Aliganj,

Lucknow - 226 022. Phone: 0522-4012353; Mobile: 09307501549

Ahmedabad : 114, “SHAIL”, 1st Floor, Opp. Madhu Sudan House, C.G. Road,

Navrang Pura, Ahmedabad - 380 009. Phone: 079-26560126;

Mobile: 09377088847

Ernakulam : 39/176 (New No: 60/251) 1

st

Floor, Karikkamuri Road, Ernakulam,

Kochi – 682011. Phone: 0484-2378012, 2378016; Mobile: 09387122121

Bhubaneswar : 5 Station Square, Bhubaneswar - 751 001 (Odisha).

Phone: 0674-2532129, Mobile: 09338746007

Indore : Kesardeep Avenue Extension, 73, Narayan Bagh, Flat No. 302, IIIrd Floor,

Near Humpty Dumpty School, Indore - 452 007 (M.P.). Mobile: 09303399304

Kolkata : 108/4, Beliaghata Main Road, Near ID Hospital, Opp. SBI Bank,

Kolkata - 700 010, Phone: 033-32449649, Mobile: 7439040301

Guwahati : House No. 15, Behind Pragjyotish College, Near Sharma Printing Press,

P.O. Bharalumukh, Guwahati - 781009, (Assam).

Mobile: 09883055590, 08486355289, 7439040301

DTP by :

Printed at : Hyderabad. On behalf of HPH.

Preface

It is a matter of great pleasure to present this new edition of the book on Introduction to

Financial Accounting to the Students and Teachers of Bachelor of Management and studies started

by University of Mumbai. This book is written on lines of syllabus instituted by the university. The

book presents the subject matter in a simple and convincing language.

We owe a great many thanks to a great many people who helped and supported me during the

writing of this book which includes Principal, Co-coordinator, and Students of BMS Section.

The syllabus contains a list of the topics covered in each chapter which will avoid the

controversies regarding the exact scope of the syllabus. The text follows the termwise, chapter-topic

pattern as prescribed in the syllabus. We have preferred to give the text of the section and rules as it is

and thereafter added the comments with the intention of explaining the subject to the students in a

simplified language. While making an attempt to explain in a simplified language, any mistake of

interpretation might have crept in.

This book is an unique presentation of subject matter in an orderly manner. This is a

student-friendly book and tutor at home. We hope the teaching faculty and the student community

will find this book of great use.

We are extremely grateful to Mr. Pandey of Himalaya Publishing House Pvt. Ltd. for their

devoted and untiring personal attention accorded by them to this publication.

We gratefully acknowledge and express my sincere thanks to the following people without

whose inspiration, support, constructive suggestions of this book would not have been possible.

Mr. Jitendra Singh Thakur (Trustee, Thakur College)

Dr. Chaitaly Chakraborty (Principal, Thakur College)

Mrs. Janki Nishikhant Jha

Mrs. Anita Ninesh Jotaniya

Mr. Kalpesh Jotaniya & Mrs. Anita K. Jotaniya

Mr. Pritesh Gangar & Mr.Alpesh Gangar

Mr. Kalpesh Tank & Mr. Rahul Tank

Where we stand Today is because of our reverred parents whom we owe much.

We welcome suggestions from students and teachers for further improvement of quality of the

book.

Authors

Our Well-wishers .....

1. Prof. Monica Chandiwala (BMS/BAF/BBI Coordinator, Balbharti College)

2. Porf. Kavita Shah (BMS/BAF/BBI Coordinator, N. K. College)

3. Prof. Poonam Kakkad (BMS Coordinator, Nirmala College)

4. Dr.Anand Dharmadhikari (BAF Coordinator, Hinduja College)

5. Prof. Kuldeep Sharma (BAF Coordinator, Hinduja College)

6. Dr.A.C. Vanjani (Principal, MMK College)

7. Dr. Jayant Apte (Vice Principal, G.D. Saraf College)

8. Mr. Vinod D. Tibrewala (Trustee, SRSS College)

9. Mr. Rajubhai Desai (Trustee, St. Rock’s College)

10. Prof. S.B. Arya (Vice Principal, KGMittal College)

11. Dr. V.S. Kannan (Vice Principal, KES College)

12. Dr. Malini Johri (Principal, Chinai College)

13. Prof. Piyush Shah (Vice Principal Burhani College)

14. Prof. Prachi Kadam (BMS Coordinator, Gokhle College)

15. Dr. Sharda S.C. (Principal, L. N. College)

16. Prof. Anita Bobade & Prof. Sanjeev Thakur (Alkesh Dinesh Modi Institute)

17. Prof. Bysi Panikar (BMS Coordinator, Patuk College)

18. Prof. Shirley Pillai (BBI Coordinator, St. Andrew’s College)

19. Prof. Rupal Shah (N.M College)

20. Prof. Tiwari (BMS Coordinator, Birla College)

21. Prof. Nanda (BMS Coordinator, SRSS College)

22. Prof. Arvind Dhond (St Xevier College)

23. Prof. Leena Nair (Tolani College)

24. Dr. Vinita Pimple (Poddar College)

25. Prof. Darshan Pagdhre (Lala College)

Syllabus

The objectives of the course are:

To understand and apply the theoretical aspects of accounting methods used for collecting,

recording and reporting financial information.

To analyze and interpret the financial environment in which accounting information is used in

managing a business;

To apply accounting and financial management decision-making techniques to practical

situations that are likely to be encountered by a manager.

Unit – 1

Meaning and Scope of Accounting: Need and development, definition: Book-Keeping and

accounting, Persons interested in accounting, Branches of accounting, Objectives of accounting.

Accounting Principles: Introductions to Concepts and conventions.

Introduction toAccounting Standards: (Meaning and Scope)

AS 1: Disclosure to Accounting Policies

AS 6: Depreciation Accounting.

AS 9: Revenue Recognition.

AS 10: Accounting For Fixed Assets.

International Financial Reporting Standards(IFRS):

Introduction to IFRS

IAS-1: Presentation of Financial Statements (Introductory Knowledge)

IAS-2: Inventories (Introductory Knowledge)

Accounting In Computerized Environment

(Introduction, Features and application in various areas of Accounting)

Unit – 2

Accounting Transactions: Accounting cycle, Journal, Journal proper, Opening and closing

entries, Relationship between journal & ledger: Rules regarding posting: Trial balance:

Subsidiary books (Purchase, Purchase Returns, Sales, Sales Returns & cash book –Triple

Column), Bank Reconciliation Statement.

Expenditure:

Classification of Expenditure-Capital, revenue and Deferred Revenue expenditure

Distinction between capital expenditure and revenue expenses

Unusual Expenses: Effects of error: Criteria test.

Receipts: Capital receipt, Revenue receipt, distinction between capital receipts and revenue

receipts.

Profit or Loss: Revenue profit or loss, capital profit or loss

Unit – 3

Depreciation Accounting: Practical problem based on depreciation using SLM and RBM

methods.(Where Provision for depreciation Account not maintained).

Preparation of Trial Balance:

Introduction and Preparation of Trial Balance

Unit – 4

Final Accounts of a Sole Proprietor

Introduction to Final Accounts of a Sole proprietor.

Rectification of errors.

Manufacturing Account, Trading Account, Profit and Loss Account and Balance Sheet.

Preparation and presentation of Final Accounts in horizontal format

Introduction to Schedule 6of Companies Act, 1956

Contents

Chapter 1: Meaning and Scope of Accounting 1 — 37

Chapter 2: Introduction to Accounting Standard 38 — 61

Chapter 3. Introduction to IFRS and Accounting in Computerised

Environment 62 — 84

Chapter 4. Accounting Procedure 85 — 156

Chapter 5. Reconciliation and Rectification 157 — 188

Chapter 6. Capital and Revenue 189 — 203

Chapter 7. Depreciation, Provisions and Reserves 204 — 231

Chapter 8. Final Accounts 232 — 289

Chapter 9. Final Accounts of Companies 290 — 309

INTRODUCTION

All of you at one point of time would have visited a grocery shop or a medical shop. You might

have wondered how the business person maintains the record of all the transactions done during a

particular period of time say a year. You might have also thought why he or she has to maintain a

record, how is it beneficial and whether it is mandatory or not? As against this, imagine the role of a

business organization. They provide goods that might range from simple safety pin to fighter air crafts.

Those who are in service industry provide various services such as transportation services, hospitality

services, developing complex software programmes etc.

To make sound decision, a business enterprise need accounting information. This information is

also needed by government agencies, regulatory bodies, analysts and individuals at various point of

time and at different levels.

Accounting is perhaps one of the oldest and structured management information system. It has

evolved in response to the social and economic needs of society. Accounting as an information system

is concerned with identification, measurement and communication of economic information of an

organization to its users who may need the information for rational decision making. The accounting

system is a means to provide relevant and reliable financial information to all the interested parties.

Each and every person of the society is required to keep some accounts. In the stream of social

and economic activities of today, each and every person or institution is accountable to someone or to

other for his or its economic activities or the wealth acquired, income earned and the expenditure

incurred. Different types of transactions occur in business. Without maintaining proper accounts, it is

neither possible to ascertain profit or loss of the business nor to know the financial position of the

business at any particular date. This chapter will describe meaning, evaluation, scope and objects of

financial accounting. It also discusses importance and uses of accounting in daily life. Let's go through

the entire chapter and know introduction to financial accounting.

Definition of Accounting

Accounting is both the science and art of correctly recording in books of accounts all those

business transactions that result in the transfer of money or money's worth. It may also be defined as

the art of recording merchantile transactions in a regular and systematic manner; the art of keeping

accounts in such a manner that a man may ascertain correct result of his business activities at the end

of a definite period and also can know the true state of affairs of his/her business and properties by an

inspection of his/her books.

Accounting has been defined as, "the art of recording, classifying and summarizing in a

significant manner in terms of money, transactions and events which are, in part at least, of financial

character, and interpreting the results thereof. " This definition has been given by the AICPA.

1

CHAPTER

Meaning and Scope of

Accounting

2 Introduction to Financial Accounting

More Definitions of Accounting

American Accounting Association (AAA): AAA defines "Accounting refers to the process of

identifying, measuring and communicating economic information to permit informed judgment and

decisions by users of the information."

A.W. Johnson: "Accounting may be defined as the collection, compilation and systematic

recording of business transactions in terms of money, the preparation of financial reports, the analysis

and interpretation of these reports and the use of these reports for the information and guidance of

management."

Weygandt, Kieso and Kimmel: "Accounting is an information system that identifies, records

and communicates the economic events of an organization to interested users."

This definition views accounting as an information system that identifies and records the

financial transactions, ascertains the results and provides information to the various interested users in

the desirable way or according to their needs. Basically, accounting is not a recording procedure. It is

an information device or a tool that works to provide information to interested users to rationalize their

decision making.

SCOPE OF ACCOUNTING

The scope of field of accounting is very wide. Accounting is needed not only by business class

but also by non-business class. Starting from the private life of a man, the financial activities of school,

college, club, society, hospitals and government institutions come within the purview of accounting.

The jurisdiction of accounting also includes the financial activities of professionals including doctors,

engineers and layers. The monetary transactions which take place in the private life of a man are

recorded properly in the books of accounts; it becomes possible to ascertain his receipts and

expenditure as well as personal assets and properly in the books of accounts, it becomes to ascertain

his receipts and expenditure as well as his personal assets and liabilities. When the financial

transactions of a business are prepared, it is essential to maintain accounts of non-profit organizations

like school, college, hospital, club, society etc. In the same way, it is necessary to keep accounts of

professionals like service-holders, doctors, lawyers, actors/actress etc. to ascertain their incomes and

calculation of income-tax on the basis of those incomes. Maintaining accounting is practiced to

determine the income and expenditure of different government offices and public bodies as well as to

run those offices and organizations properly. By preparing and evaluating national plan and budget

with the help of accounting, it is possible to know the development and deterioration of the country.

Hence, in a nutshell, we can say that the scope of accounting is wide enough to cover all the fields of

the society.

Objectives of Accounting

The principal object of accounting is to keep permanent record of all monetary transactions

effected by a person or enterprise during a definite period and ascertainment of results of those

transactions at the end of the period. The main objects of accounting are enumerated below:

1. Proper Recording of Transactions: The first and foremost object of accounting is to keep

record of monetary transactions in a systematic manner.

2. Determination of Results: Every person or institution is always interested to know the

results of his/its monetary transactions at the end of a definite period. So, ascertainment of

result of financial transactions is an important object of accounting.

3. Ascertainment of Financial Position: Another object of accounting is the ascertainment of

debtors and creditors, assets and liabilities and the overall financial position.

Meaning and Scope of Accounting 3

4. Supplying Financial Information: Another important object of accounting is to make

available all sorts of financial reports and statements to all parties interested in the affairs of

the concerned institution as soon as possible after preparing those reports and statements.

5. Defalcation Prevented: Another special object of accounting is the prevention of

defalcation of money made through fraud by the officials of the institution as well as control

of expenditure.

NEED, IMPORTANCE AND USES OF ACCOUNTING IN DAILY LIFE

Accounting has become part of our daily activities as it implicates monetary transactions of life.

People spend money, invest money for future; all these require proper accounting. Let's discuss the

matter in detail.

Necessity and Importance of Accounting

The necessity and importance of accounting is limitless or unbounded to men in their day-today

personal life, family life, and intuitional life. The necessity of accounting is described below:

Institutional Necessity

1. Accounting supplies numerical information to the institution relating to its management and

administration.

2. Exact results of the institution are disclosed through accounting.

3. The firm can ascertain the financial status of the business operation.

4. Firm can compare the financial position of two/more years.

5. Books accounts are very valuable documents.

6. Proper accounting makes the firm credible to other party.

7. Tax authority can assess taxes for the firm using the accounting information.

8. Firm can determine the actual assets and liabilities.

9. Using accounting data, a firm can formulate policy and take many decisions on future

operations.

Uses of Accounting in Day-to-day Life

1. Someone can ensure smooth financial management in his life.

2. He/she can bring financial solvency because financial plan helps to be economical.

3. Accounting helps in preparing personal budget.

4. Accounting promote saving habits.

5. Accounting helps to solve family and social disputes as it provides for authentic records.

ACCOUNTING: WHETHER SCIENCE OR ARTS?

There is a great controversy whether accounting is science or arts. According to some scholars

accounting is science, someone is describing accounting as arts. But actually accounting is a

composition of both science and arts.

4 Introduction to Financial Accounting

Why Accounting is 'Science'?

Science refers to systematic process. In scientific activities, it follows certain rules —

observation, analysis, taking actions and then evaluation of activities. Like scientific activities before

taking any action, accounting observes the activities, analyses the various alternatives, chooses the

best alternatives and takes feedback to evaluate the performance. So, accounting is termed as science.

ACCOUNTING PROCESS

Accounting is the process of identifying the transactions and events, measuring the transactions

and events in terms of money, recording them in a systematic manner in the books of accounts,

classifying or grouping them and finally summarizing the transactions in a manner useful to the users

of accounting information.

1. Identifying the Transactions and Events: This is the first step of accounting process. It

identifies the transaction of financial character that is required to be recorded in the books of

accounts. Transaction is transfer of money or goods or services from one person or account

to another person or account. Events happen as a result of internal policies or external needs.

Events of non-financial character cannot be recorded even though such events may have an

impact on the operational results of the firm.

2. Measuring: This denotes expressing the value of business transactions and events in terms

of money (in terms of rupees in India).

3. Recording: It deals with recording of identifiable and measurable transactions and events in

a systematic manner in the books of original entry that are in accordance with the principles

of accountancy.

4. Classifying: It deals with periodic grouping of transactions of similar nature that appear in

the books of original entry into appropriate heads by posting or transfer entries. For example,

all purchases of goods made for cash or on credit on different dates are brought to purchase

account.

5. Summarizing: It deals with summarizing or condensing transactions in a manner useful to

the users. This function involves the preparation of financial statements such as income

statement, balance sheet, statement of changes in financial position and cash flow statement.

6. Analyzing: It deals with the establishment of relationship between the various items or

group of items taken from income statement or balance sheet or both. Its purpose is to

identify the financial strengths and weaknesses of the enterprise. The above six process in

the present-day scenario are generally performed using software packages.

7. Interpreting: It deals with explaining the significance of those data in a manner that the

end-users of the financial statement can make a meaningful judgment about the profitability

and financial position of the business. The accountants should interpret the statement in a

manner useful to the users, so as to enable the user to make reasoned decision out of the

alternative course of action. They should explain various factors on what has happened, why

it happened, and what is likely to happen under specific conditions.

8. Communicating: It deals with communicating the analyzed and interpreted data in the form

of financial reports/statements to the users of financial information, e.g., Profit and Loss

account, Balance Sheet, Cash Flow and Funds Flow statement, Auditors Report etc. The

Accounting Information system.

Meaning and Scope of Accounting 5

The Accounting Information System

Input Processing

1. Business transaction 1. Accounting concepts, conventions and

principles

2. External events measured in financial terms 2. Management plans and policies

3. Law and regulation

4. Classification and interpretation

Out put Users

1. Profit and Loss a/c 1. Shareholder

2. Balance sheet 2. Regulation

3. Cash flow statement 3. Lender

4. Explanatory notes 4. Employees

5. Audit report 5. Management

6. Regulatory filing 6. Rating agencies

LIMITATIONS OF ACCOUNTING

1. Though accounting system is the only source for extracting financial information of the firm,

it grossly lacks qualitative elements. Qualitative resources could include leadership of top

brass, highly talented human resource, highly motivated team, best products, the power of

resource and development, brand image etc.

2. Accounting is not free from bias. The accountants have some leeway or freedom on the

methods of depreciation charged, inventory valuation etc. Though the convention says

consistency has to be maintained on the policies adopted, there is considerable room for bias,

favourism and personal judgment.

3. Accounting reveals the estimated position and not the real position of the firm. Generally,

financial statements are prepared on separate entity concept, conservatism concept etc.

which are based on the estimates that may lead to overvaluation or undervaluation of assets

and liabilities. The exact picture of the financial situation can be ascertained only on the

liquidation of an enterprise.

4. Accounting ignores the price level changes when financial statements are prepared on

historical cost. Fixed assets are shown in the balance sheet at historical cost less accumulated

depreciation and not at their replacement value. Land value is shown at historical cost but

the replacement value could be far higher than the value stated in the balance sheet due to

appreciation of land value over the period of time.

5. The danger of window dressing arises when the management decides to incorporate wrong

figures to artificially inflate revenue or deflate losses or when there is a threat of hostile

takeover. In such a situation, the management fails to provide true and fair view of the

financial position to the various users of the financial statement. Satyam Computer Services,

the fourth largest software firm, went into bust when the information on inflated income to

the extent of ` 7,000 crore was revealed.

6 Introduction to Financial Accounting

MEANING OF ACCOUNTING PRINCIPLES, CONCEPTS AND POLICIES

Accounting information is used by various stakeholders. Since all the stakeholders should

understand the accounting language in the same sense, certain principles, concepts and policies of

accounting have been laid down.

1. Accounting Principles: Accounting Principles are basically the rules of action adopted by

the accountants universally while recording accounting transactions. The principles are

doctrines associated with theory and procedures and current practices of accounting. These

principles may be classified as concepts and conventions.

2. Concepts: Concepts take the form of assumptions or conditions, which guide the

accountants while preparing accounting statements.

Example: Business is started with an assumption that it shall be continued for a long period

of time and none wishes it to close down within a short period of time.

Based on this assumption, businessperson purchases fixed assets, uses long-term source to

fund the fixed assets etc. This strong assumption that the business will continue for a long

period of time is called a concept.

3. Conventions: Conventions are those customs and traditions which guide the accountants

while preparing the financial statements.

Example: Inventory (stock) in a business is valued at the end of an accounting period, at

cost or market price whichever is lower. This is an accepted convention or a practice in

accounting.

4. Accounting Policy: Accounting policy refers to the specific accounting principles and

methods of applying those principles adopted by the enterprise in the preparation and

presentation of financial statements.

Example: While depreciating an asset, the practice of adopting straight line method or

diminishing balance method or any other method is a convention.

The choice of selecting straight line method of depreciation or any other is the policy of the

management. No management can exercise discretion regarding fundamental presumptions of

accounting. But every management has a choice of making an accounting policy.

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

The double entry system of accounting is based on a set of principles which are called generally

accepted accounting principles. It incorporates the consensus at a particular time as to:

Customs and

Traditions

Accounting

Conventions

Accounting

Concepts

Assumptions or

Conditions

Accounting policy is one which is adopted by

management relevent to the situations

Accounting Principles

Meaning and Scope of Accounting 7

1. which economic resources and obligations should be recorded as assets and liabilities by

financial accounting,

2. which changes in assets and liabilities should be recorded,

3. when these changes are to be recorded,

4. how the assets and liabilities and changes in them should be measured,

5. what information should be disclosed and

6. which financial statement should be prepared.

For example, an entity having research and development department may follow the policy of

deducting all the R&D expenses incurred in a year as revenue expense while for the same situation

another entity may classify R&D expenses into projects and may write off only when the project is not

expected to offer any future benefits.

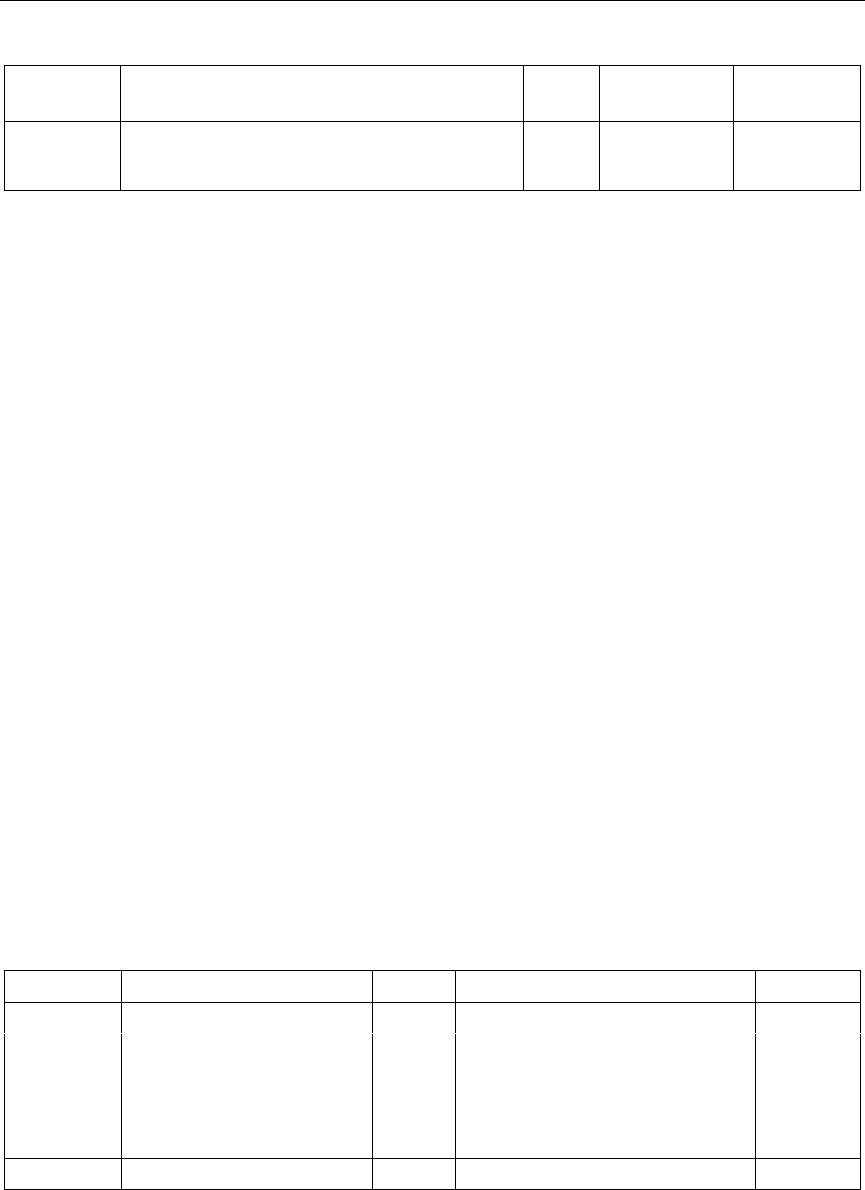

US GAAP Indian GAAP

It is established under FASB and AICPA It is established by ICAI

Balance sheet, Income statement and Fund flow

statement are alone mandatory

Statement are mandatory

Any change in foreign exchange fluctuations

cannot be capitalized but the difference can be

shown or debited to income statement

Any difference in foreign exchange can be

capitalized

Financial accounting, management accounting and

income tax accounting are prepared separately

Only financial accounting and income tax

accounting are prepared

The basic tenets is globalization of business The basic tenet is localization

Any long-term loan repayable in the current

financial year is shown separately

Long-term loan maturing in the current financial

year need not be disclosed separately

In lease contract, lease is more beneficiary

because he can claim depreciation allowance

In lease contract, lessor is eligible for depreciation

allowance and not the lease

It is more transparent and accepted worldwide.

More disclosure is required

It is comparatively less transparent. For listing the

securities in other country’s stock exchange US

GAAP is mandatory

INTRODUCTION TO BOOK-KEEPING

Every business involves exchange of goods or services. That means a businessman or business

concern deals with other parties in exchange of goods or services. Such dealings, in business, are

called business transactions. The business transactions include purchase of goods or services, sale of

goods or services, payments, receipts etc. In a business concern, the transactions are numerous. All the

details of these varied transactions cannot be remembered by the businessman.

So there was a need to record all business transaction in a systematic way and this job of

recording of transactions have been later on called as “Book-keeping”.

Meaning of Book-keeping

Book-keeping is a process of recording business transactions in the books of accounts in a

systematic manner.

Book-Keeping is the process of analysing, classifying and recording transactions in a systematic

manner to provide information about the financial affairs of the business concern.

8 Introduction to Financial Accounting

Book-Keeping may be defined as the science and the art of the recording monetary, business

transactions in a set of books.

‘Book’ means ‘Book of Accounts’ and ‘keeping’ means ‘maintaining’ the books of accounts.

Thus, the writing of business transactions in the books of accounts for future use is a simple meaning

of Book-Keeping.

All the transactions are recorded date wise. A person who records the same is called as an

Accountant who has to show the business results from such records at the end of financial year which

ends on 31

st

March every year. In India this system of book-keeping was in operation from 23

rd

centuries ago at the time of Chandragupta Maurya. Chanakya was recording the accounting

transactions. He wrote a famous book known as “Arthashashtra”. After some years this system was

called as “Deshi Nama”. The Double entry system of book-keeping was originated in Italy, developed

by Luca De Bergo Pacioli in the year 1494.

Definition of Book-keeping

R. N. Carter has defined, “Book-keeping is the science and art of correctly recording in the

books of accounts, all those business transactions that results in transfer of money’s worth.”

J. R. Batliboi has defined, “Book-keeping is the art of recording business dealings in a set of

books.”

Book-keeping is a Science or an Art:

Book-keeping is a science as well as an art. Book-keeping has some rules and principles as (like)

science. Book-keeping is a systematic body of knowledge governed by certain rules. Therefore, it is

called as science. However, it is not a physical, natural or pure science like chemistry, Biology or

Mathematics, but a social science evolved by man and society. Therefore answers provided by Book-

keeping are not always fixed or rigid, but largely dependent upon the needs of the business and the

society.

An art means an action of doing a thing with some skill and experience. Therefore, Book-keeping

is an art. An accountant (Book-keeper) can represent any typical transactions in an easy way with his

art. In book-keeping some transactions can be represented in alternate (different) ways.

Features of Book-keeping:

1. It is the process of recording business transactions

2. It is an art of recording business transactions scientifically.

3. It needs documentary support for each transaction.

4. Transactions are recorded in specific set of books only.

5. It records only monetary transactions. Non monetary transactions can not be recorded.

6. The system of recording should be universal.

7. The business organisation records its own transactions with others.

8. Record is prepared for a specific period but presented for future references.

Objectives of Book-keeping:

1. To know the profit or Loss of business during a particular (specific) period.

2. To know the financial position (Assets & liabilities) of the business on a particular date.

3. To know the amount of capital invested in the business.

4. To have a systematic, permanent record of business transactions.

Meaning and Scope of Accounting 9

5. To know the amount due to business from various debtors.

6. To know the amount due to creditors from business.

(To know what the businessman owes to others and what others owes to him)

7. To know the amount of various taxes payable to the Government.

8. To provide valuable information for legal purposes.

9. To compare his business with that of other concerns engaged in a similar line.

10. To find out the total incomes and total expenditures of the business.

11. To know the Goodwill of the business.

12. To know the progress of the business.

13. To know how the amount of profit or loss is made up.

14. To keep a check on the properties.

15. To review the progress of the business from year to year.

16. To prevent and minimise the accounting errors and frauds.

17. To know the total business purchases and sales.

18. To help in taking decisions on important business matters.

Importance of Book-Keeping:

Following points explain the Importance of Book-keeping.

1. Aid to Memory: Human memory has certain limitations. A businessman cannot remember

all the business transactions. Book-keeping helps the businessman in this regard also. Due to

Book-keeping, it is not necessary to remember the transactions.

2. Facilitates Planning: Proprietors have to plan their business operations for years to come.

Book-keeping generates valuable information about production, sales, expenses and incomes,

which helps planning.

3. Decision Making: Management has to take valuable decisions about business. Book-

keeping makes available necessary information, which facilitates decision-making.

4. Controlling: With the help of available financial information and figures the executives of

the business can control the business.

5. Comparison: A businessman can do yearly comparative study to understand the business

position over the years. He can also do the comparative study with other business units.

6. Helpful in Getting Discharge: In case of insolvency of a proprietor, he can get discharge

from the court on the basis of record of business transactions.

7. Settlement of Tax Liability: Book-keeping is useful to find out tax liability in case of Sales

Tax, Income Tax, Property Tax etc. Proper record of transactions would enable a

businessman to fix up the amount of his tax liability and discharge it.

8. Protection Against Theft and Dishonesty: A businessman can protect himself against theft

and dishonesty of employees by keeping books of accounts in a systematic manner. He can

exercise greater control on his finance through systematic recording only.

9. Evidence in Litigations: Court considers the record provided by businessman as an

evidence in case of any disputes.

10. Sale of Business: In case the business is sold out, the purchase consideration can be decided

on the basis of the accounts maintained.

10 Introduction to Financial Accounting

11. Helpful in Getting Loans: A businessman may require loans from banks for financing his

expansion scheme. Properly kept accounts can convince the banks about financial soundness

of business.

Utility of Book-keeping

1. To Owner: It helps to find out profit, losses, Assets, liabilities in the business at any time.

2. To Management: It helps the management in planning, decision making, controlling and

managing the overall business activities.

3. To Government: Book-keeping helps various department of government to decide how

much taxes are collected from business.

4. To Investors: Investors can decide whether to invest or not to invest their funds in the

business on the basis of information provided by the Book-keeping and Accountancy.

5. To Customers: Customers can judge the financial capacity of the business and can remain

assured about smooth supply of goods.

6. To Lenders: Lenders can study the creditworthiness of the business firm with the help of

books of accounts which assures continuous supply of funds.

7. To Purchaser: Book-Keeping helps the purchaser to find out the true value of the business.

8. To Trade Union: Book-keeping helps the trade union to know that wages, salaries or bonus

given to employees are fair or not. A Trade union is able to demand high wage (Wage hike)

on the basis of book-keeping.

9. To Partner: In case of partnership firm, partners are able to get information about

admission, retirement or death of a partner from book-keeping.

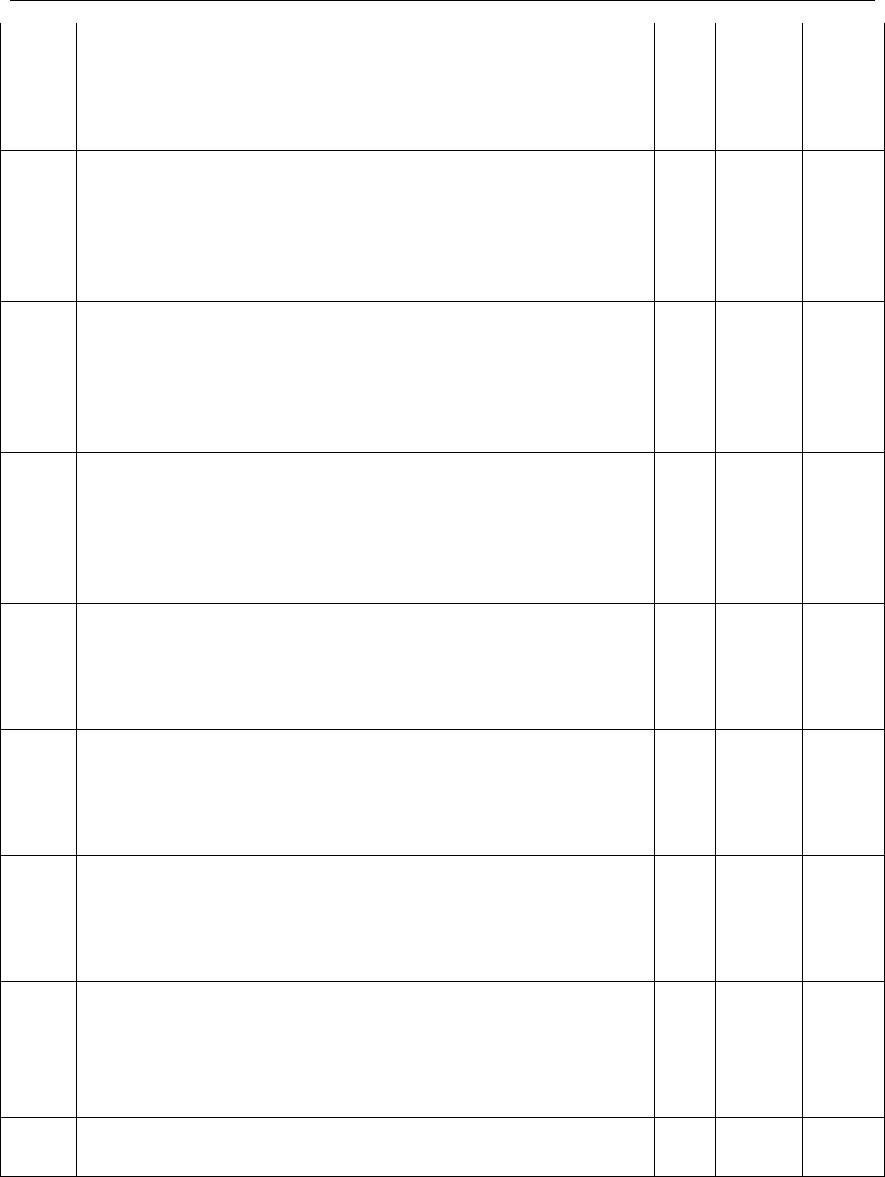

Distinction between Book-keeping & Accountancy

Book-keeping Accountancy

1

Meaning

Book-keeping is a process of recording business

transactions in the books of accounts in a

systematic mannermeans of collecting,

summarizz.

Accountancy is concerned with the processes of

recording, sorting & summarising data resulting

from Business operations & events. Accountancy

also refers to systematic analysis of the recorded

data.

2

Stage

Book-keeping is the first stage and it comes

immediately after transaction.

Accountancy comes after recording and

classification. Accountancy is the next stage after

Book-keeping.

3

Objectives

Book-keeping aims at keeping the record and

provides primary information.

Accountancy aims at finding the profits or losses

and gives financial position.

4

Level of work

In book-keeping, the level of work is less. It is

done by junior staff.

In accountancy, the level of work is high. It is done

by senior staff.

5

Results

Meaning and Scope of Accounting 11

Book-keeping basically results in Journal and

Ledger.

The results of Accountancy is Profit and Loss A/c

and Balance sheet.

6

Period

Book-keeping gives day to day details. Accountancy gives details of entire year.

7

Scope

Book-keeping has a limited scope. Accountancy has a wider scope.

8

Procedure

Book-keeping includes recording the entries of

day-to-day transactions by following basic rules of

double entry Book-keeping system.

Accountancy includes processing of Primary

information available from books of accounts and

preparation of financial statements.

9

Principles

Book-keeping requires principles of elementary

knowledge of Journalising and Posting.

Accountancy requires all the Accounting

Principles.

10

User

Book-keeping records are used by accountant as it

provides the basis for accountancy.

Accounting records are used by owners,

managements, Government and other stock holders.

Basis of Accountancy/Accounting

1. Cash Basis: Under this system only cash transactions are recorded. Under cash basis an

income is recorded only when cash is actually received and expenses are recorded when cash in

actually paid. The business records every cash that comes in business and every cash that goes from

business.

2. Accrual Basis: An income is recorded when it is earned (whether cash received or not) and

expenses is recorded when they become payable. Both cash as well as credit transactions are recorded.

This is also called Mercantile Basis of Accounting.

Branches of Accounting

In order to satisfy the needs of different people interested in the accounting information, different

branches of accounting have been developed. The changing business scenario has given birth to the

specialized branches of accounting which are:

1. Financial Accounting: Financial Accounting is concerned with recording of financial

transactions, summarizing and interpreting them and communicating the results. It is original form of

accounting that ascertains profits earned or loss suffered during a specific period (generally a year)

and ascertains the financial position on the date when the accounting period ends.

2. Cost Accounting: It is the process of accounting and controlling the cost of product, operation

or function. The purpose of this branch of accounting is to ascertain the cost, to control the cost and to

communicate information for decision.

3. Management Accounting: It is an accounting for the management i.e. accounting which

provides necessary information to the top level management for discharging its functions.

Management accounting covers various areas such as cost accounting, budgetary control, inventory

control, statistical methods, internal auditing etc. The purpose of this branch of accounting is to supply

all information that management may need in taking decisions and to evaluate the impact of its

decisions and actions.

12 Introduction to Financial Accounting

ACCOUNTING PRINCIPLES

Meaning of Accounting Principles

The literal (dictionary) meaning of the term Principle is that it is a basic fundamental truth or

treaty, which is uniformly accepted and followed by everyone and everywhere. Development of

accounting principle took place from time to time based on experience, usage and necessity.

Accounting principles are those rules of action or conduct, which are accepted universally by all

accountants in recording transactions in the books of accounts. (Accounting principles are those rules

which are to be adopted by Accountants) These principles are usually developed by professional

accounting bodies.

Accounting principles can be broadly classified into two main categories

(a) Accounting Concepts

(b) Accounting Conventions

ACCOUNTING CONCEPT OR ASSUMPTIONS

Meaning of Accounting Concept

Accounting is the language of business. In the absence of systematic approach, accountants may

use their own language and it may not be understood in the same sense by all concerned parties. With

a view to make accounting language a standard language, certain accounting concepts have been

developed over a course of period. Accounting concepts are general guidelines for sound accounting

practices.

Accounting concepts are assumptions and conditions on which the whole accounting structure

stands. They are the predetermined condition which a book - keeper must keep in mind, while

recording transactions in the books of accounts.

Importance of Accounting Concepts/Principles

1. Ensure uniformity in presentation of financial statements. (Uniformity in presentation)

2. Serve the purpose of providing proper information to the stakeholders. (Proper information

to all)

3. All the stakeholders believe that assumptions on which financial statements are based are

valid and appropriate. (Valid & appropriate assumptions)

4. Make financial statements reliable. (Reliable financial statements)

5. Provide a basis for measurement that is generally acceptable. (Generally acceptable basis of

measurement)

Some of the Important Concepts are as follows

1. Entity Concept/Business Entity Concept

Entity means something that has real separate existence. In other words, entity refers to status or

personality. The business has separate existence from its owner or proprietor. For instance Mr. X has

been conducting business under the title Ganesh Medicals for last so many years. Here in this case Mr.

X and Ganesh Medicals are different from each other.

The business unit is separate from its owner is the basic meaning of entity. Under this concept

sole trading concern and sole proprietor are treated as two different entities. According to this concept

Meaning and Scope of Accounting 13

only business transactions are recorded in the business book of accounts. Proprietor’s personal

transactions are not recorded in the books of accounts

e.g.: Half of the building is used for business office and other half of the building is used for the

residence of the proprietor. If the total rent of the building is ` 50,000 then only ` 25,000 will be

deducted as drawings from proprietor’s capital.

2. Money Measurement Concept

There is a need to express transactions in common unit of measurement, Every transaction is

recorded in terms of money. In India all the accountants use only Indian currency i.e., ‘Rupee’ (`)

Because of this concept only monetary items are recorded.

In accounting, everything is recorded in terms of money. Events or transactions, which can not be

expressed in terms of money, are not recorded in the books of accounts, even if they are very

important or useful for the business. Purchase and sale of goods, payment of expenses and receipt of

income are monetary transactions which find place in accounting. Death of executive, resignation of a

manager are the events which can not be expressed in money. Thus, they are not recorded in the books

of accounts.

E.g., A businessman owns following properties;

Land 2000 Sq. Mtrs. Cost ` 5,00,000, Building 40 Rooms, Cost ` 9,00,000,

Raw Material 8 Tonnes, Cost ` 4,00,000

Here total assets will be recorded by common unit of money measurement and will be valued at

` 18,00,000 in the books of accounts.

3. Cost Concept

This concept does not recognise the realisable value, the replacement value or the real worth of

an asset. Thus, as per cost concept.

(a) An asset is ordinarily recorded at the price paid to acquired (got/purchased) it i.e. At its

cost, and

(b) This cost is the basis for all subsequent accounting for the asset.

For Example: If a plot of land is purchased for ` 1,00,000 & It is recorded in the books at

` 1,00,000. In case market value goes to ` 2,00,000 or ` 60,000 it will not be considered.

4. Going Concern Concept

It is the basic assumption that business will continue for a quite long time, it will go on and on

and will not be closed down or stopped for a quite long time. Business is not to be closed at its early

stage but should give a long life. This principle helps may investors to invest, many suppliers to give

credit, many workers or employees to give services.

e.g. A stall for marketing of any product or introduction of new product of any business has to be

closed immediately after the exhibition is over. But once the business is set up, it continues for a long

time.

5. Realisation Concept

Income is recorded only when it is realized i.e. either it is received or earned. Revenues are

recorded only when sale are affected or the services are rendered. Sales revenues are considered as

recognized when sales are effected during the accounting period irrespective of the fact whether cash

is received or not.

14 Introduction to Financial Accounting

e.g.

(i) A company gets an order for sale of goods ` 1,00,000/- in May 2014 goods of only

` 60,000/- are sold and delivered in June 2014. Cash is received for ` 60,000/- in Sept., 2014.

As per the principle of realisation, sale is to be recorded in June 2014.

(ii) A businessman purchased 2 washing machines from manufacturers for ` 15,000/- each. One

out of two is sold for ` 17,000/- and earned a profit of ` 2000/-. The other one is not sold out

then he can’t anticipate and record a profit of ` 2000/- on the second machine unless and

until a sale is realised.

(iii) Money received in advance along with an order is not treated as revenue until the goods are

dispatched & sold or services are rendered.

(iv) Similarly, until the asset is sold, appreciation in value of the asset is not to be considered.

E.g. land is purchased for ` 50,000 in 2010 and after one year if the market price increases to

` 70,000, then ` 20,000 which is appreciation on land should not be considered.

6. Accrual Concept Dual Concept

It implies recording of revenues (Incomes) and expenses of a particular accounting period,

whether they are received or paid in cash or not. Income is recorded when it accrues (earned) and

expenses are recorded when they accrue (become payable) All expenses and revenues related to the

accounting period are to be considered irrespective of the fact, the revenues (Incomes) are received in

cash or not or expenses are paid in cash or not. Outstanding expenses & outstanding incomes are

entered in the books of Account due to accrual concept.

e.g. A company invested ` 2,00,000 with a bank for one year on 1st July, 2009, Bank has to pay

interest at 10% p.a. on it maturity i.e. 30th June, 2010. As per principal of accrual Interest of 6 months

is ` 10,000 to be shown in income statement as Interest receivable during financial year 1/1/2009 to

31/12/2009.

7. Dual Aspect Concept

Every business transaction has two effects and involves exchange of benefits. Benefit received

and benefit given both the aspects should be recorded in the books. The system which records such

dual aspects in the books is known as Double Entry System.

This principle also considered as the concept of debit & credit. The account where the benefit

comes in is debited and the account where benefit goes out is credited.

e.g.: A proprietor invested ` 1,00,000 into the business. At one side business gets asset (Cash)

` 1,00,000/- and the other side business owes ` 1,00,000/- as capital to the proprietor. Thus all the

debit in the ledger will be equal to all the credits.

8. Revenue Recognition Principle

This principle is mainly concerned with the revenue, being recognised in the Income Statement

of an organization. Revenue is the gross inflow of cash receivables or other considerations arising in

the course of ordinary activities.

e.g. Sale of goods, rendering of services and use of resources by other, yielding interest, royalties

and dividends. It excludes the amount collected on behalf of third parties such as certain taxes. In an

agency relationship the revenue is the amount of commission and not the gross inflow of cash

receivable or other consideration. Revenue is recognized in the period in which it is earned

irrespective of the fact whether it is received or not received during that period.

Meaning and Scope of Accounting 15

9. Matching Concept

This concept is very important for determination of profit or loss correctly. According to this

concept, the profit of the business is calculated by matching total revenue earned during the year with

total expenses incurred during the same period. The difference between the two represents profit or

loss. Excess of revenue over expenses is profit while Excess of expenses over revenue is a loss.

Following points should be considered

(i) Any expenses payable for the period should be considered & added to expense.

(ii) Any prepaid expenses should be deducted from expenses paid.

(iii) Income receivable should be added to the revenue (Income).

(iv) Income received in advance should be deducted from the revenue.

For example:

If a broker has received commission of ` 10,000. Here, ` 10,000 can not be considered as his

profit. He must deduct expenses incurred by him to earn this commission. If he has spent ` 200 on

travelling, ` 300 on stationery and ` 500 on advertisement then his real profit will be as shown below:

`

Commission Received (Income/Revenue) 10,000

Less: Expenses

1 Travelling 200

2 Stationery 300

3 Advertisement 500

Real Profit 9,000

In the above case his revenue ` 10,000 are matched with his expenses of ` 1,000.

10. Accounting Period Concept

A business organisation is a going concern. It has continuous life. The correct results cannot be

ascertained unless the business is closed down. The proprietor cannot wait indefinitely till the closure

of business to know the financial results. Hence, the life span of an organisation is divided into the

periods of 12 months which is known as accounting year or accounting period. It is also known as

fiscal or financial year. It is essential to measure financial health of an organisation periodically to

enable the stakeholders to take right decision. Hence, financial results are ascertained every year. All

the organisations therefore, prepare financial statements every year.

11. Objective Evidence Concept

According to this concept all accounting transactions must be supported by proper documentary

(paper) evidence. This document includes bills, contracts, pass book, copy of receipt, vouchers etc.

This documentary evidence helps the auditor (C.A.) to check the entries in the books of account with

their supporting papers. Thus, for each and every entry in the books of account there should be

documentary evidence. Similarly, for each and every documentary evidence of monetary nature there

should be entry in the books of account.

16 Introduction to Financial Accounting

ACCOUNTING CONVENTIONS

Meaning of Accounting Conventions

Dictionary meaning of convention is behaviour and attitudes that most people in a society

considered to be normal and right. Accordingly, accounting conventions refer to rules which have

common acceptance and agreement in accountancy. In other words, customs or traditions which guide

or direct the preparation of accounts are called accounting conventions. In this sense, accounting

conventions and accounting concept are synonymous. In short, accounting conventions means customs

or traditions which are followed years together to prepare accounts of the business concern.

An accounting convention may be defined as a custom or generally accepted practice which is

adopted either by general agreement or common consent among accountants.

Difference between Concepts and Conventions

Following is the difference between concepts and conventions:

1

.

Concepts

are

established

by

law

whereas

conventions

are

guidelines

based

upon

customs

or

usage.

2

.

In

adoption

of

concepts,

there

is

no

role

of

personal

judgment

where

as

conventions

adoption

is

affected

by

personal

Judgment.

3

.

Accounting

concepts

are

adopted

in

different

enterprises

to

bring

uniformity.

There

cannot

be uniformity in adoption of accounting conventions by different enterprises.

Different Accounting Conventions are as follows

1. Convention of Disclosure/full Disclosure

The accounts must disclose all material (important) information. The accounting reports should

disclose full and fair information to the related parties. The financial position and performance should

be disclosed very honestly to all the users. The financial position means the Balance Sheet of the

business and financial performance means business results in terms of profits or losses and income

and expenses in profit and loss account.

All the information disclosed should be relevant, reliable, comparable and understood by all the

concerned authorities.

This accounting convention is more relevant or made applicable to a joint stock company where

there is separation of ownership and management. As per the provisions of companies act, 1956,

financial statement and report prepared by the company must give a true and fair view of the state of

affairs of the company.

Note: Full disclosure does not mean all small points which should be discussed and mentioned

like purchase of motor car, its number, colour, which company, with or without carrier, etc.

2. Convention of Materiality

Material means important. The accountant should attach importance to material (important)

details and ignore insignificant (unimportant) details. If this is not done accounts will be overburdened

with minute (small) details. As per the American Accounting Association, “an item should be

regarded as material, if there is a reason to believe that knowledge of it would influence the decision

of informed investor.” Therefore, keeping the convention of materiality in view, unimportant items are

either left out or merged with other items or shown as foot notes.

Note: However, an item may be material for one purpose but immaterial for another, material for

one concern but immaterial for another, or material for one year but immaterial for next year.

Meaning and Scope of Accounting 17

3. Convention of Consistency/Consistency Concept

Any policy adopted for accounting should be continuous or consistent throughout the business

and it need not be changed generally unless and until circumstances demand. However it does not stop

any improvement of new techniques. But that should be disclosed with a note.

For instance, there are several methods of depreciation, to charge depreciation on fixed assets.

Once particular method of depreciation is adopted to charge depreciation on fixed assets, it should be

followed consistently for years together.

The convention of consistency has the following advantages:

(i) It ensures comparability of financial statements of different years.

(ii) It eliminates an element of uncertainty regarding the accounting procedure to be followed.

(iii) It also eliminates the element of any personal bias regarding preparation of accounts and

accounting reports.

4. Convention of Conservatism

It refers to the policy of ‘playing safe’. As per this convention all prospective (possible &

expected) losses are taken into consideration but not all prospective (possible & expected) profits. In

other words anticipate no profit but provide for all possible losses.

Under this convention if there are two figures representing losses or liabilities, then the higher

one must be selected and on the other side, if there are two figures representing profit or assets, then

the lower one should be selected. In short conservatism means to follow the safe side.

However, this convention is being criticised on the ground that it goes not only against the

convention of full disclosure but also against the concept of matching costs and revenues. It

encourages creation of secret reserves by making excess provision for depreciation, bad and doubtful

debts etc. The Income statement shows a lower net income and the Balance sheet overstates the

liabilities and understates the assets.

Following are the examples of application of conservatism

(i) Making provision for doubtful debts and discount on debtors.

(ii) Not providing for discount on creditors.

(iii) Valuing stock in trade at cost or market price whichever is less.

(iv) Creating provision against fluctuations in the price of Investments.

(v) Showing Joint Life Policy at surrender value and not at the paid up value.

Accounting Principles

Accounting Concepts Accounting Convention

1. Entity concept 1. Convention of Disclosure

2. Money measurement concept 2. Convention of Materiality

3. Cost concept 3. Convention of consistency

4. Going concern concept 4. Convention of Conservatism

5. Realisation concept

6. Accrual concept

7. Dual aspect concept

8. Revenue recognition concept

9. Matching concept

10. Accounting period concept

11. Objective evidence concept

18 Introduction to Financial Accounting

INTRODUCTION TO DOUBLE ENTRY SYSTEM

There are different methods of recording accounting information. They are as follows:

1. Indian system

2. English system

(a) Single Entry system

(b) Double Entry system

3. Conventional Accounting System

INDIAN SYSTEM

It is the most conventional (traditional) system of accounting. It is also called Mahajani\

Marwadi\Deshi Nama system. Under this system records are maintained in Indian Language, such as

Marathi, Hindi, Marwadi, Urdu etc. Transactions are recorded in long books known as kird and Bahi

Khata. This system of accounting is not based on Double Entry system. Though this system is not

scientific, it is still being used in India in small sized business.

ENGLISH SYSTEM

In English system, business transactions are recorded systematically in a separate set of books

such as journal and ledger, in the English language as per modern style. English system is more

advanced and extensively used now-a-days all over the world. Even in India, English system is more

preferred and extensively used in almost all types of business organisations. English Book-keeping

system is broadly reclassified as (A) Single entry book-keeping system and (B) Double entry book-

keeping system.

Single Entry Book-keeping System

Under this system only Cash Book (Cash A/c) and Personal Accounts, are maintained. This

system is known as incomplete system of recording because it changes with the convenience of

businessman. Therefore it is not a scientific and complete method of recording. It cannot provide

accurate information about the financial position of business. It is unscientific method having number

of defects. It is suitable to small traders.

Due to many limitations (defects/drawbacks) now single entry system is rarely used is modern

business.

Double Entry Book-keeping System

Origin of Double Entry System

Double Entry System of Book-keeping has emerged in process of evolution of various

accounting techniques.

The credit of evolving the present Double Entry Book Keeping system goes to a philosopher

turned mathematician Italian merchant “Luca D. Bargo Pacioli” in 1494.

Meaning of Double Entry System

Every business transaction involves an exchange of money or money’s worth (i.e. goods or

services or anything). An exchange involves two parts i.e. receiving and giving. The system of book-

keeping which records both the aspects of transactions is known as double entry system of book-

keeping. There cannot be business transactions without two effects. When a businessman gives

Meaning and Scope of Accounting 19

something, he gets something else in return. These two aspects affect two accounts - one account

receives the benefit and the other account gives the benefit. A business transaction is comparable with

a coin with two sides. As a coin has two sides, a transaction affects two accounts.

Double entry book-keeping does not mean the transaction is to be recorded two times. It is a

complete record of business transactions, that is, recording both the aspects of a transaction i.e. debit

and credit. Amount of benefit received by one account is equal to the amount of benefit given by the

other account. In other words, amount of debit is always equal to the amount of credit. Today, most of

the business concerns have adopted this system.

Recording dual (double) aspects of business transactions in the books of accounts in terms of

Debit & credit is known as ‘Double Entry System of Book-keeping’.

Definition of Double Entry System

“Every business transaction has a two fold effect and that it affects two accounts in opposite

directions and if a complete record is to be made of each such transaction it would been necessary to

debit one account and credit another account. It is this recording of two fold effect of every

transaction that has given rise to the term Double Entry”

– J. R. Batliboi

“The Double Entry System seeks to record every transaction in Money or Money’s worth in its

double aspect- the receipt of a benefit by one account and the surrender of a like benefit by another

account, the former entry being to the debit of the account receiving and the later to the credit of the

account surrendering.”

– William Pickles

Principles/Features of Double Entry System

Following are the main principles/features of Double Entry System of Book-keeping.

1. Every transaction has minimum two aspects.

2. These two aspects involve two accounts i.e. every transaction affects two accounts.

3. One account receives the benefit and the other account gives the benefit.

4. One account is debited and the other account is credited with equal amount.

Main Principle of Double Entry System

“Every debit has corresponding credit and every credit has corresponding debit with equal

amount.”

Examples:

(a) Furniture is purchased for ` 2,000 for which cash is paid.

Here, furniture comes in and cash goes out.

Two accounts are affected i.e. Furniture and Cash.

(b) Cash paid to Mr. Rakesh ` 3,000.

Here, two accounts are affected. One is Mr. Rakesh A/c. (who is receiver) and second is

Cash A/c. (goes out)

20 Introduction to Financial Accounting

Advantages of Double Entry System of Book-keeping

1. Complete Record: Since both the debit and credit aspects of every transaction are fully

recorded, a complete record of all transactions is obtained.

2. Accuracy: As every debit has a corresponding credit, and every credit has a corresponding

debit, the arithmetical accuracy of the books of account on any given date can be easily

verified.

3. Item Wise Details: The detail information with respect to different types of expenses,

incomes, losses, gains, assets, liabilities, debtors, creditors, etc. is easily made available

under double entry system of book-keeping. This is because under this system all ledger

accounts are prepared separately.

4. Comparative Study/Facilitates Planning: Under double entry book-keeping system

comparison between the results of current year with the previous year can be done easily

which in turn helps to prepare planning for the future activities.

5. Common Acceptance: The records prepared and maintained under double entry book-

keeping system have common approval and acceptance from financial institutions,

government authorities and others.

6. Provides Useful Financial Information: Financial position of the business and yearly

performance of the business activities i.e. profit or loss can be known easily if double entry

book-keeping system is followed. On the basis of such financial information management

can easily provide useful information to various users.

7. Helpful for Management: Under this system accountants can easily provide periodical

financial information to the management on various aspects of the business. On the basis of

these data and information, management can take corrective steps to develop and control

business activities.

8 Control Errors and Frauds: Because of the counter-checks provided by the equality of

debits and credits, it is difficult to commit errors and frauds, and easy to detect them if at all

they are committed. Thus, double entry book-keeping system is useful to control errors and

frauds.

INTRODUCTION TO ACCOUNTS

As per the concept of Double entry system, every business transactions has a two effects, i.e.,

Debit and Credit.

An account as we understand it, as a systematic record of transaction related to a person, property,

expenses, or income. Every account has a two sides. The left hand side known as the Debit side and

the right hand side is known as Credit side. To debit an account means to record the transaction on

debit side and credit an account means to record the transaction on credit side.

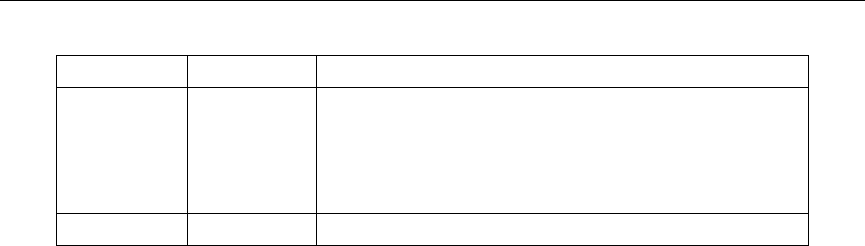

Dr ____________A/c Cr.

Date Particulars J.F.

`

Date Particulars J.F.

`

Meaning and Scope of Accounting 21

For complete record of business transaction, the firm has to record all the business transactions

that it has deal with. For this purpose, accounts are classified as follow.

TYPES OF ACCOUNTS

Accounts are classified as follows:

(I) Personal Account

(II) Impersonal Account

(a) Real Account

(b) Nominal Account

ACCOUNTS

Personal A/c Impersonal A/c

1. Natural or Living Person Real A/c Nominal A/c

2. Artificial or Legal Person 1. Tangible 1. Expenses & Losses

3. Representative or Groups 2. Intangible 2. Incomes & Gains

(I) Personal A/c

Personal Accounts includes the accounts of persons or parties with whom the business deals.

Personal Accounts can be classified into three categories.

(a) Natural or Living Personal A/cs

These accounts are related to natural or living persons. Natural persons means persons who are

creation of God. In other words human beings are natural persons. These are the accounts of persons

created by nature.

e.g. Meena’s A/c, Mr. Raj’s A/c, Miss Reshma’s A/c, Ram’s A/c, Rahim’s A/c etc.

(b) Artificial or Legal Personal A/cs

These persons do not have life, body or soul but transactions are done by it in its own name and

exist in the eyes of law or recognized by law. These are the accounts of person created by provisions

of law.

These accounts are related to non-living persons, artificial persons or legal persons. These

accounts include accounts of corporate (registered) bodies or institutions. e.g. Partnership Firms, Co-

Operative Societies, Companies, Clubs, Associations, Municipality, Central or State Government,

Insurance Companies, Charitable Trust, Legal Authorities etc.

(c) Representative or Groups Personal A/cs

These accounts represents certain person or Groups.

e.g. Capital, Drawing, Debtors, Creditors, Outstanding rent, Interest payable, Prepaid Insurance,

Salary paid in advance, Interest receivable, Pre-received commission, rent received in advance,

Unexpired Insurance.

22 Introduction to Financial Accounting

PERSONAL A/C

Natural or living Artificial or legal Representative or Group

1. Mr. Ramesh’s A/c. 1. N.L. College A/c 1. Capital A/c

2. Miss Rati’s A/c 2. Bank of India A/c 2. Drawings A/c

3. Mrs. Kapoor’s A/c 3. Bank A/c 3. Debtors A/c

4. Mr. Ravi’s A/c 4. Paras Classes A/c 4. Creditors A/c

5. Raj’s A/c 5. Suchak Hospital A/c 5. Outstanding Rent A/c

6. Clubs A/c 6. Interest Payable A/c

7. Tata Ltd A/c 7. Prepaid Insurance A/c

8. Asian Paints Ltd A/c 8. Salary paid in advance

A/c

9. Nutan School A/c 9. Interest Receivable A/c.

10. Western Railway A/c 10. Pre-received

commission A/c

11. Government 11. Rent received in adv.

of India’s A/c A/c

12. Unexpired Insurance A/c

13. Unpaid wages A/c

Examples:

1. Mr. A paid ` 500 to Mr. B on our behalf.

Soln: B’s A/c - Personal A/c - Receiver - Debit

A’s A/c - Personal A/c - Giver - Credit

2. Mr. X received ` 1,000 from Mr. Y on our behalf.

Soln: X’s A/c - Personal A/c - Receiver - Debit

Y’s A/c - Personal A/c - Giver - Credit

3. Laxmi Medical paid ` 5,000 to Ganesh medical on our behalf.

Soln: Laxmi Medical A/c - Personal A/c - Giver - Credit

Ganesh medical A/c - Personal A/c - Receiver - Debit

4. Raj received ` 7,000 from XYZ General Stores on our behalf.

Soln: Raj’s A/c - Personal A/c - Receiver - Debit

XYZ General Stores’s A/c - Personal A/c - Giver - Credit

Note: Outstanding (O/s) (accrued)/ Receivable/

Payable/Pre-received/prepaid/received in

advance paid in advance/unexpired (pre-paid)

/unpaid.

Rule of Personal

Account

Debit the Receiver

Credit the Giver

Meaning and Scope of Accounting 23

(II) Impersonal A/c

All accounts other than personal accounts are called impersonal account. There are two types of

impersonal accounts.

(a) Real A/c

(b) Nominal A/c

(a) Real Account

It is also known as Property A/c. These accounts relate to all kinds of properties and assets

possessed by business. The assets may be tangible or intangible.

(i) Tangible Real A/cs: These accounts consists of assets and properties which can be seen,

touched, felt & measured.

e.g. Cash A/c, Building A/c, Stock A/c, Machinery A/c, Furniture A/c etc.

(ii) Intangible real accounts: These accounts consists of assets and properties which cannot be

seen, touched but they are capable of measurement in terms of money.

e.g. Goodwill, Copyright, Trade Marks, Patent Right etc.

REAL OR PROPERTIES A/C

Tangible real A/c Intangible real A/c

1. Cash A/c 1. Goodwill A/c

2. Goods A/c 2. Patent Right A/c

3. Machinery A/c 3. Trade Marks A/c

4. Stock A/c 4. Copy right A/c

5. Building A/c

6. Furniture A/c

7. Motor Car A/c

Rule of Real A/c

Debit what comes in

Credit what goes out

Examples:

1. Goods purchase for cash ` 5,000

Soln: Goods A/c - Real A/c - Comes in - Debit

Cash A/c - Real A/c - Goes out - Credit

2. Goods sold for Cash ` 8,000.

Soln: Cash A/c - Real A/c - Comes in - Debit

Goods A/c - Real A/c - Goes out - Credit

3. Goods purchase of ` 3,000 from Raj on credit.

Soln: Goods A/c - Real A/c - Comes in - Debit

Raj’s A/c - Personal A/c - Giver - Credit

4. Goods sold of ` 6,000 to Pankaj Stores on credit.

Soln: Goods A/c - Real A/c - Goes out - Credit

Pankaj Stores’ s A/c - Personal A/c - Receiver - Debit

24 Introduction to Financial Accounting

5. Goods purchase of ` 2,000 and amount paid by cheque.

Soln: Goods A/c - Real A/c - Comes in - Debit

Bank A/c - Personal A/c - Giver - Credit

6. Paid ` 12,000 to Rajnikant by Cash.

Soln: Rajnikant’s A/c - Personal A/c - Receiver - Debit

Cash A/c - Real A/c - Goes out - Credit

(b) Nominal Account

These are the accounts of expenses or losses and incomes or gains. These accounts are called