A FIRM’S GUIDE TO THE

IMPLEMENTATION OF REGULATION

BEST INTEREST AND THE FORM CRS

RELATIONSHIP SUMMARY

September 27, 2019

1

SIFMA is the leading trade association for broker-dealers, investment banks and asset managers operating in the U.S. and global

capital markets. On behalf of our industry's nearly 1 million employees, we advocate for legislation, regulation and business

policy, affecting retail and institutional investors, equity and fixed income markets and related products and services. We serve as

an industry coordinating body to promote fair and orderly markets, informed regulatory compliance, and efficient market

operations and resiliency. We also provide a forum for industry policy and professional development. SIFMA, with offices in New

York and Washington, D.C., is the U.S. regional member of the Global Financial Markets Association (GFMA). For more

information, visit http://www.sifma.org.

This report is subject to the Terms of Use applicable to SIFMA’s website, available at http://www.sifma.org/legal.

Copyright © 2019

The information in this Guide was prepared by Deloitte & Touche LLP (Deloitte) as commissioned by

SIFMA.

The Guide is intended to communicate an awareness of Regulation Best Interest, the Form CRS

Relationship Summary, and an overview of the related implementation considerations.

SIFMA and/or Deloitte makes no representation or warranty to the accuracy of the information as this

Guide is not a complete representation of all the Reg BI requirements.

Deloitte is not, by means of this document, rendering accounting, business, financial, investment, legal,

tax, or other professional advice or services. The discussion and examples presented in this Guide are

for educational purposes. They are not to be viewed as an authoritative statement by SIFMA and/or

Deloitte on the quality and/or appropriateness of an individual organization’s practices. SIFMA and/or

Deloitte provides no assurance over the accuracy or completeness of the requirements for any specific

organization’s readiness for compliance with Reg BI. This Guide is meant to provide a framework to

assist organizations in performing their own implementation analysis. Before making any decision or

taking any action that may affect your organization, one should consult a professional advisor to assess

one’s specific facts and circumstances. SIFMA and/or Deloitte shall not be responsible for any loss

sustained by any person who relies on this Guide.

2

1

Deloitte also wishes to thank the following individuals for their contributions to the development of this Guide: Ajay Philip George, Trupthi P

Papanna Gorur, Marco Kim, Amitam Kumar, Neelima Mishra, Madhuri Munjuluri, Gitika Narang, and Aditya Rajagopalan.

Contributors

SIFMA and its members

Jillian Enoch

Vice President, Federal Government Affairs

Kevin Carroll

Managing Director and Associate General Counsel

Deloitte & Touche LLP

1

Maria Gattuso, Principal mgattuso@deloitte.com

George Hanley, Managing Director ghanl[email protected]

Bruce Treff, Managing Director btreff@deloitte.com

Bob Walley, Principal [email protected]

Gabriela Huaman, Managing Director ghuaman@deloitte.com

Karl Ehrsam, Principal kehrsam@deloitte.com

Craig Friedman, Senior Manager [email protected]

Josh Uhl, Senior Manager juhl@deloitte.com

Christopher Austin, Advisory Specialist Leader [email protected]

Robin Swope, Manager rswope@deloitte.com

Mira Vasani, Manager mira[email protected]

Cody Devine, Consultant codevine@deloitte.com

3

Contents

Contributors................................................................................................................................................... 2

Preface: How to use this Guide ...................................................................................................................... 6

1. Introduction............................................................................................................................................... 7

2. Program Governance ................................................................................................................................. 9

2.1. Identifying key stakeholders, business functions, roles, and responsibilities .................................... 9

2.1.1. Line of Business Leadership ........................................................................................................ 9

2.1.2. Legal .......................................................................................................................................... 10

2.1.3. Compliance ................................................................................................................................ 10

2.1.4. Human Resources ...................................................................................................................... 11

2.1.5. Product ...................................................................................................................................... 11

2.1.6. Marketing .................................................................................................................................. 11

2.1.7. Technology ................................................................................................................................ 12

2.1.8. Business Management .............................................................................................................. 12

2.1.9. Finance ...................................................................................................................................... 13

2.1.10. Risk .......................................................................................................................................... 13

2.2. Assessing organizational readiness for Reg BI Program implementation ........................................ 14

2.3. Developing a workforce and customer change management and communication strategy ........... 17

2.3.1. Change management strategy .................................................................................................. 17

2.3.2. Communication strategy ........................................................................................................... 19

2.4. Acknowledging other regulatory considerations in tandem with Reg BI implementation ............... 21

2.5. Providing an illustrative timeline for program implementation ....................................................... 22

2.6. Providing considerations for estimating program implementation costs ........................................ 22

3. Understanding the Rule and assessing impact ......................................................................................... 25

3.1. Understanding Reg BI ...................................................................................................................... 25

3.2. Business Impact ............................................................................................................................... 27

3.2.1. The Firm’s business structure ................................................................................................... 28

3.2.2. The products and services offered by a Firm and its respective revenue models .................... 28

3.2.3. Conflicts of interest by product and service type...................................................................... 29

3.2.4. Titles used to describe financial advisors .................................................................................. 29

3.2.5. Compensation and incentive models ........................................................................................ 30

3.3. Potential Business Changes .............................................................................................................. 30

4

3.4. Changes to Operations ..................................................................................................................... 32

3.5. Customer Life cycle .......................................................................................................................... 33

4. Disclosure Obligation ............................................................................................................................... 35

4.1 Reg BI Disclosure Obligation .............................................................................................................. 35

4.1.1. Disclosure Requirements of Reg BI ............................................................................................ 35

4.1.2 Oral disclosure ............................................................................................................................ 39

4.1.3 Disclosure after recommendation .............................................................................................. 39

4.1.4 Layering approach ...................................................................................................................... 40

4.1.5 Timing, frequency, and tracking of delivery ............................................................................... 41

4.1.6 Updating disclosure documents ................................................................................................. 41

4.2 Form CRS Relationship Summary and Amendments to Form ADV .................................................... 41

4.2.1 Disclosure Requirements of Form CRS ....................................................................................... 41

4.2.2 Amendments to Form ADV ......................................................................................................... 44

4.2.3 Delivery format and content ...................................................................................................... 44

4.2.4 Layering approach; using links .................................................................................................... 46

4.2.5 Timing, frequency, and tracking of delivery ............................................................................... 46

4.2.6 Updating disclosure documents ................................................................................................. 49

4.2.7 Key Implementation Considerations from Section 4 .................................................................. 51

5. Care Obligation ........................................................................................................................................ 52

5.1. Broker-Dealer’s understanding of particular security or investment strategy (reasonable basis) ... 52

5.1.1. Consideration for complex products ......................................................................................... 53

5.2. Customer-specific recommendation ................................................................................................ 53

5.2.1. Understanding of the retail customer’s investment profile ...................................................... 54

5.2.2. Factors to consider when making recommendations to a particular retail customer ............... 55

5.2.3. Consideration of reasonably available alternatives ................................................................... 55

5.3. Quantitative suitability (series of recommendations) ...................................................................... 56

5.4. Considerations for specific recommendation types ......................................................................... 56

5.4.1. Proprietary products and other limited menus of products and products with third-party

arrangements (e.g., revenue sharing) ................................................................................................. 56

5.4.2. Prospecting ............................................................................................................................... 57

5.4.3. IRA and IRA Rollovers ................................................................................................................ 57

5.4.4. Account Type ............................................................................................................................ 57

5.4.5. Explicit and Implicit “hold” recommendations .......................................................................... 58

5

5.5. Documentation of specific recommendations ................................................................................. 58

5.6. Key Implementation Considerations from Section 5 ........................................................................ 59

6. Conflict of Interest Obligation .................................................................................................................. 60

6.1. Conflicts of interest catalog (types) ................................................................................................. 60

6.1.1. Applicability of Conflict of Interest Obligation .......................................................................... 60

6.1.2. Conflicts of Interest under Reg BI

,

............................................................................................. 61

6.2. Conflict-related controls, policies and procedures .......................................................................... 62

6.2.1. Structure of Conflict of Interest Obligation

,

.............................................................................. 62

6.2.2. Considerations for adopting “reasonably designed” policies and procedures .......................... 63

6.2.3. Considerations for identification of conflicts of interest ........................................................... 64

6.3. Approach to disclosing, mitigating, or eliminating conflicts of interest .......................................... 65

6.3.1. Disclosure, mitigation, or elimination of Conflicts .................................................................... 65

6.3.2. Elimination or disclosure of Conflicts ........................................................................................ 67

6.3.3. Elimination of Conflicts ............................................................................................................. 72

6.4. Considerations for the adoption and implementation of Conflict of Interest Obligation ................ 73

6.5. Key Implementation Considerations from Section 6 ........................................................................ 75

7. Compliance Obligation ............................................................................................................................. 76

7.1. Compliance Obligation Requirements ............................................................................................. 76

7.2. Potential framework for satisfying the Compliance Obligation ....................................................... 79

7.2.1. Risk Assessment ........................................................................................................................ 79

7.2.2. Current-State Assessment and Gap Analysis............................................................................. 79

7.2.3. Target-State Design ................................................................................................................... 80

7.3. Key Implementation Considerations from Section 7 ........................................................................ 82

8. Recordkeeping Requirements .................................................................................................................. 83

8.1. Existing recordkeeping requirements .............................................................................................. 83

8.2. Reg BI and Form CRS recordkeeping requirements ........................................................................ 84

8.3. A proposed framework for recordkeeping implementation ............................................................ 85

8.4. Key Implementation Considerations from Section 8 ........................................................................ 86

6

Preface: How to use this Guide

This Guide provides an overview of Regulation Best Interest (“Reg BI”)

2

and the Form CRS Relationship

Summary (“Form CRS”)

3

, as adopted by the U.S. Securities and Exchange Commission (“SEC”), and provides

a summary of considerations for firms to satisfy compliance with the respective rule amendments.

4

The

Guide aims to assist firms in understanding the various Reg BI and Form CRS requirements and their

potential impacts. The Guide begins with recommendations for developing a Reg BI implementation

governance program and an outline for and their potential impact on firms.

The subsequent chapters of the Guide elaborate on specific Reg BI obligations and also address the

requirements for Form CRS filing and delivery. Considerations for implementation are embedded within

these chapters and are specific to the Reg BI obligation being addressed in the respective chapter. The

chapter on the Reg BI Compliance Obligation describes a potential framework for firms to achieve

compliance with the respective rules. The Guide closes with details on recordkeeping obligations for firms

under amendments made to industry recordkeeping rules.

5

This Guide provides an overview of Reg BI and Form CRS requirements as well as considerations for

implementation; however,

this Guide is not meant to serve as a replacement for the regulatory requirements

described in the SEC Final Rule releases as communicated on www.sec.gov. The final texts for Reg BI and

Form CRS contain a number of specific and detailed requirements along with related clarifications. Firms

are encouraged to read the two adopting releases to familiarize themselves with specific examples and

determine if, and how, such examples might apply to their businesses when preparing an implementation

plan.

6

The SEC has also recently published two compliance guides for small firms: Regulation Best Interest: A

Small Entity Compliance Guide

7

and Form CRS Relationship Summary; Amendments to Form ADV: A Small

Entity Compliance Guide

8

Firms are encouraged to read these compliance guides as well to familiarize

themselves with the SEC guidance provided therein.

Note: This Guide attempted to standardize terminology between the use of the terms “retail customer”,

“retail client”, and “retail investor” as the terms are defined and used differently between the Reg BI and

Form CRS adopting releases given their applicability and scope. In certain sections of this Guide, a

particular term may be used for alignment in terminology with the respective adopting release and for

this reason may appear to be inconsistent from section to section. Firms should defer to the SEC guidance

and rule language for clarity on definitions and usage in particular contexts.

2

Securities and Exchange Commission. 17 CFR Part 240. Release No. 34-86031; File No. S7-07-18. Regulation Best Interest: The Broker-Dealer

Standard of Conduct.

3

Securities and Exchange Commission. 17 CFR Parts 200, 240, 249, 275, and 279. Release Nos. 34-86032; IA-5247; File No. S7-08-18. Form CRS

Relationship Summary; Amendments to Form ADV.

4

Regulation Best Interest amended the Securities Exchange Act of 1934 and applies to registered Broker-Dealers (see CFR 17a-14). Form CRS

Relationship Summary amended both the Securities Exchange Act of 1934 and the Investment Adviser’s Act of 1940 and applies to both broker-

dealers and registered investment advisers (e.g., see CFR 204-5).

5

For Broker-Dealers, Rule 17a-3 and 17a-4 under the Securities Exchange Act of 1934. For registered investment advisers, Rule 204-2 under the

Investment Adviser’s Act of 1940.

6

The SEC also published interpretative guidance entitled, Commission Interpretation Regarding Standard of Conduct for Investment Advisers and

Commission Interpretation Regarding the Solely Incidental Prong of the Broker-Dealer Exclusion from the Definition of Investment Adviser. See SEC

website for access to these releases.

7

Securities and Exchange Commission. https://www.sec.gov/info/smallbus/secg/regulation-best-interest. 2019.

8

Securities and Exchange Commission. https://www.sec.gov/info/smallbus/secg/form-crs-relationship-summary. 2019.

7

1. Introduction

On June 5, 2019, the U.S. Securities and Exchange Commission (“SEC”) adopted new regulations governing

the conduct of broker-dealers (interchangeably, “Broker-Dealers” or “Firms”) and their natural persons

who are associated persons (“Associated Persons”), particularly with regard to the manner in which these

Firms provide investment recommendations to their customers.

9

Regulation Best Interest (“Reg BI”)

amends the Securities Exchange Act of 1934 (the “Exchange Act”) and imposes principles-based standards

on recommendations to retail customers, requiring that Broker-Dealers and their Associated Persons,

among other things, act in “the best interest of the retail customer at the time the recommendation is

made, without placing the financial or other interest of the Broker-Dealer ahead of the interests of the

retail customer.”

10

To meet their best interest obligations, Broker-Dealers that provide investment recommendations to their

retail customers must adhere to a number of requirements, including the above principles-based standard

(referred to also as the “General Obligation”), as well as specific disclosure, care, conflict of interest,

compliance obligations. Firms must also adhere to enhanced recordkeeping requirements. Reg BI aims to

provide retail customers with full and fair disclosure about the products and services offered by Broker-

Dealers, including relevant conflicts of interest, to allow these customers to make appropriate investment

decisions pertinent to their investment goals and needs while understanding the associated risks with such

decisions.

11

Broker-Dealers and registered investment advisers (“RIAs”, and together with Broker-Dealers,

“Registrants”) are also required to file with the SEC and deliver to retail customers a Customer Relationship

Summary Form to meet the obligations imposed by the Form CRS Relationship Summary (“Form CRS”).

12

Under Form CRS, in no more than two pages, a Registrant is required to disclose information to its retail

customers about the Registrant’s business practices, including its registration status, its relationship and

services to the retail customer, the fees, costs, conflicts of interests, and standards of conduct as it relates

to those services, and the disciplinary history of the Registrant.

13

This disclosure requirement is intended

to provide retail customers with an understanding of a Registrant’s relationship and business practices to

allow them to make informed decisions when selecting a Registrant with which to conduct business.

The compliance date for Reg BI, the Form CRS rule amendments, and their associated recordkeeping

requirements (hereafter, referred to collectively as the “Reg BI Rule Package”) is June 30, 2020, and this

Guide is meant to provide Registrants with frameworks and considerations for designing, implementing,

and managing their obligations. This Guide is not meant to provide a prescriptive framework for

implementation or interpretative guidance under the Reg BI Rule Package. The below graphic illustrates

these differences:

9

See Securities and Exchange Commission Release Nos. 34-86031; 34-86032; IA-5247

10

See Executive Summary. Regulation Best Interest: The Broker-Dealer Standard of Conduct. SEC. 2019.

11

See page 213. Regulation Best Interest: The Broker-Dealer Standard of Conduct. SEC. 2019.

12

For registered investment advisers, the SEC also amended the Investment Adviser’s Act of 1940 for purpose of Form CRS (see CFR 204-5).

13

For registered investment advisers, the SEC also amended the Investment Adviser’s Act of 1940 for purposes of Form CRS (see CFR 204-5).

8

Figure 1: Purpose of this Guide

9

2. Program Governance

This section is intended to identify key design, implementation, and ongoing delivery considerations for

developing an implementation plan for a Reg BI Rule Package program (a “Reg BI Program”), specifically:

(1) Identifying key stakeholders, business functions, roles, and responsibilities;

(2) Assessing organizational readiness for Reg BI Program requirements;

(3) Developing a workforce and customer change management and communication strategy;

(4) Acknowledging other regulatory considerations in tandem with Reg BI Program implementation;

(5) Providing an illustrative timeline for program implementation; and

(6) Providing considerations for estimating program implementation costs

2.1. Identifying key stakeholders, business functions, roles, and responsibilities

Successful implementation of a Reg BI Program should consider the identification, engagement, and

management of multiple legal, compliance, business, and shared services stakeholders in order to design,

implement, and manage an effective rule implementation program with appropriate program governance.

Given the multiple and complex requirements within Reg BI, it is imperative that an appropriate stakeholder

analysis is conducted by Broker-Dealers implementing such an implementation program. Understandably,

Firms vary in size, organizational structure, and the degree of responsibility among different stakeholders

and functions. As such, the following list is not intended to prescribe all necessary stakeholders and their

required functions for a robust implementation program. Firms should assess their organizational structure

and identify such stakeholders as necessary and appropriate for their business model given differences in

roles and responsibilities across Firms.

Below are considerations for Broker-Dealers in conducting such stakeholder analysis.

2.1.1. Line of Business Leadership

Primary Role:

Serve as decision-maker for business or product strategy and operational impact questions as identified

and recommended by program management.

Primary Responsibilities:

(1) Approve and lead business strategy implicating products and services offered, customer acquisition

and management, and employee performance management;

(2) Approve financial or revenue drivers for the business, including sales strategy and practices

implicating product pricing, customer services and associated fees, marketing and distribution, and

employee or financial advisor compensation;

(3) Oversee the assessment and resolution of conflicts of interest, including compensation and

incentives

(4) Ensure program management meets continuous delivery milestones; and

(5) Approve program budgets and allocate resources as necessary to meet program deadlines.

10

2.1.2. Legal

Primary Role:

Advise compliance and business functions on interpretative questions throughout the Reg BI Program

implementation.

Primary Responsibilities:

(1) Advise on applicability of rule and scope of impact on business(es), subsidiaries, and contracted

third-party service providers in consideration of other applicable regulatory obligations;

(2) Review contractual and service agreement obligations for customers, employees, third-party

service providers, and other market participants;

(3) Review, amend, or advise Compliance on regulatory registrations, licensures, filings, disclosures,

and/or third-party or customer agreements;

(4) Perform legal responsibilities as necessary for ongoing purposes post-implementation; and

(5) Review, identify, and amend applicable disclosures.

2.1.3. Compliance

Primary Role:

Create or enhance existing compliance program to address Reg BI Rule Package requirements; Serve as

liaison between legal and business functions; Advise business function on compliance requirements

throughout the rule implementation program.

14

Primary Responsibilities:

(1) Develop and revise Firm compliance policies and procedures, in coordination with relevant

business and other stakeholders, to ensure compliance with rule requirements;

(2) Provide compliance advisory services to overall program management considering aspects of

change management on a Firm’s compliance program;

(3) Provide oversight for review of advertising, digital tools, marketing, and program development;

(4) Identify and ensure appropriate licensure and registration for all regulated work of the Broker-

Dealer and the individuals performing such work;

(5) Develop oversight, monitoring, testing, and inspections procedures for program implementation

procedures;

(6) Design, develop, and administer licensing, education, and training program for impacted

employees;

(7) Enhance the compliance testing plan to accommodate changes to controls, business activities, etc.;

(8) Conduct post-implementation compliance inspection, assessment, or review; and

(9) Manage appropriate compliance surveillance as necessary for ongoing purposes post-

implementation, including any necessary business reporting.

14

The roles and responsibilities of Compliance may vary at different firms.

11

2.1.4. Human Resources

Primary Role:

Serve as business function support and change management lead throughout the Reg BI Program

implementation related to changes to business strategy or practices, compensation or performance

management practices, talent acquisition strategy, and/or licensing, education, and training practices.

Primary Responsibilities:

(1) Review, and amend or revise if necessary, employee compensation, benefits, or performance

management statements, agreements, or plans

15

;

(2) Review, design, develop, and administer changes to talent acquisition or talent management

strategies; and

(3) Design and execute internal communications strategy.

2.1.5. Product

Primary Role:

Serve as subject matter expert for Firm investment philosophies, product analyses, investment

recommendations, and their associated risks.

Primary Responsibilities:

(1) Develop investment recommendation justifications for Firm’s product lineup, including

information about the target customers, the benefits of the investment product, the risks and costs

associated with the investment product, and other such information as necessary for marketing,

sales process, or training purposes;

(2) Create and develop investment content for marketing and sales distribution materials or other

such customer communications; and

(3) Ensure marketing and sales distribution materials are accurate, fair, and balanced regarding

investment products; conversely, ensure risks associated with such materials are appropriately

disclosed for initial implementation and for ongoing purposes post-implementation.

2.1.6. Marketing

Primary Role:

Serve as liaison between investment management, legal, compliance, and business functions to create,

coordinate, and deliver marketing materials, communications, and required disclosures to customers

throughout program implementation and thereafter.

15

Such action may be required if the firm participates in a pay-for-referral, pay-for-enrollment, stock incentive compensation plan, or other

compensation-based or commission-based compensation program for sales or trading employees. See Conflicts Obligation for more information.

12

Primary Responsibilities:

(1) Create, coordinate, and deliver marketing materials, strategic communications, and required

disclosures to customers throughout rule implementation program and thereafter;

(2) Assess and inform business functions on strategic messaging, customer and competitive responses,

and market participant dynamics throughout rule implementation program; and

(3) Ensure consistency across new and dated marketing materials for ongoing purposes.

2.1.7. Technology

Primary Role:

Serve as business function support and technical lead for technology enhancements, upgrades, or

onboarding of systems or third-party service provider integration throughout rule implementation

program.

Primary Responsibilities:

(1) Serve as technical subject matter expert on technology enhancements, versioning, upgrades, or

vendor procurement as necessary for Reg BI Program implementation;

(2) Design, build, and test systems integration and/or third-party service provider integration

necessary for Reg BI Program implementation;

(3) Ensure system access, change control, supervision, and oversight are appropriately designed and

built for compliance obligations; and

(4) Ensure information security, data privacy, and technology risk and control requirements to meet

applicable Firm policies, industry standards, and regulatory compliance requirements.

2.1.8. Business Management

Primary Role:

Lead business strategy and operational transformation as necessary for the Reg BI Program

implementation.

Primary Responsibilities:

(1) Ensure ongoing execution of operational functions of the Broker-Dealer, including all applicable

regulatory requirements for front-, middle-, and back-office business functions;

(2) Design, develop, and administer appropriate supervision and oversight of obligations imposed by

Reg BI for both operational and employee purposes;

(3) Design, develop, and administer an appropriate business and systems control environment to

ensure compliance with obligations imposed by Reg BI and other associated regulatory

requirements; and

(4) Manage and inform appropriate shared services stakeholders for ongoing purposes as business

strategy or operational changes occur.

13

2.1.9. Finance

Primary Role:

Serve as liaison between business and shared services functions in assessing and modeling financial impact

on implementation costs and changes to business strategy.

Primary Responsibilities:

(1) Assess and model the financial impact of changes to pricing, fees, commissions, or other financial

changes to products, services, and employee or financial advisor compensation;

(2) Assess and plan for costs associated with Reg BI Rule Package compliance; and

(3) Manage ongoing financial modeling as new products are launched, and business strategies and

product and service offerings are developed.

2.1.10. Risk

Primary Role:

Serve as liaison between or in tandem with compliance and business functions in the design,

implementation, and testing of the business control environment; Advise business function on its risk

profile and associated mitigation strategies throughout the Reg BI Program implementation.

Primary Responsibilities:

(1) Conduct initial-state risk assessments to understand business’s overall risk profile with regard to

products and services offered, potential conflicts of interest (e.g., business line, compensation),

and third-party service provider vulnerabilities;

(2) Engage business, technology, and shared services stakeholders throughout rule implementation

program to ensure risks are appropriately identified and mitigated given proposed changes to

people, process, technology, and business strategy;

(3) Design, develop, and implement necessary controls as changes to people, process, technology, and

business strategy are developed as a result of Reg BI Program; and

(4) Conduct post-implementation risk assessments and ongoing control testing to ensure business is

appropriately managing its risk profile.

Below is a representative program governance framework with identified stakeholders and suggested

primary roles throughout rule implementation as roles and responsibilities vary across Firms.

14

2.2. Assessing organizational readiness for Reg BI Program implementation

Many considerations for assessing a Firm’s organizational readiness depend on an initial-state business

model. This initial-state model accounts for the size, scope, and complexity of the Firm’s business model,

including the products and services it offers its customers. Firms with more uniform product and service

offerings, centralized supervision structures, and simplified or model investment philosophies will likely

find lower organizational readiness barriers to adopting Reg BI Rule Package requirements. Conversely,

Firms offering more complex products and service offerings, decentralized supervision structures, and

more nuanced or competing investment philosophies across business lines will likely find higher

organizational readiness barriers given the change management necessary to meet the various

requirements of the Reg BI Rule Package.

The framework below seeks to assist program management in assessing its Firm’s organizational readiness

to adopting Reg BI Rule Package requirements. This framework is neither comprehensive nor exhaustive;

rather, it identifies key questions involving people, process, technology, and business strategy that Firms

may consider in determining the organizational readiness for a program governance structure. Answers to

such questions will likely implicate the degree to which implementation efforts impact a Firm’s operations,

strategy, and people.

Figure 2: Reg BI Program governance framework

15

Table 1: Potential framework for organizational readiness

Category

Topic

Change Management Considerations

People

Employee Management

(Talent Acquisition,

Retention, Management)

• Does the Firm retain the technical talent necessary to

meet its obligations imposed by the Reg BI Rule

Package, including administration, enforcement, and

interpretation?

• Does the Firm appropriately manage the technical

talent necessary to meet its obligations imposed by

the Reg BI Rule Package?

• Does the Firm anticipate additional resources are, or

will be, required for implementation of obligations

imposed by the Reg BI Package?

Customer Management

(Customer, Vendor,

Market Participant

Management)

•

Does the Firm understand the applicability of the Reg

BI Rule Package on its customer populations?

• Does the Firm understand and appropriately manage

its customer population demographics? For example,

does the firm appropriately provide products and

services that are suitable for its customer

demographics?

• Does the Firm effectively and appropriately manage its

customer acquisition strategy?

• Does the Firm appropriately manage its customer

relationships to ensure it is acting in the best interest

of such?

• Does the Firm adequately understand the components

of the customer life cycle and the individual customer

needs at each stage of the cycle?

Financial Advisors

•

Does the Firm appropriately manage financial advisors’

understanding of the differences between risks and

costs across products?

• Does the Firm provide financial advisors the tools

necessary to facilitate client management and

investment recommendation processes?

Process

Compliance Program

•

Are the appropriate people positioned to assist with

the development of policies and procedures for Reg BI

Rule Package compliance and conflict mitigation? Are

individuals appropriately identified as Associated

Persons for purposes of Broker-Dealer oversight and

surveillance?

• Are individuals appropriately registered to conduct

securities and supervisory activities on behalf of the

Broker-Dealer (e.g., Series 24, Series 65)?

Supervision

•

Does the Firm employ an appropriate number of

supervisory principals to reasonably conduct

16

Category

Topic

Change Management Considerations

supervision of registered persons on behalf of the

Broker-Dealer?

• Does the supervisory structure exist as a centralized or

decentralized model? Does this supervisory structure

meet the compliance requirements of the Reg BI Rule

Package?

• Does the Firm appropriately manage the risk profile of

branch offices?

• Does the Firm have appropriately-designed policy

escalation and exception procedures?

• Does the Firm have an aggregated view of its data to

identify trends and high-risk behavior?

Sales / Compensation

Practices

• Does the Firm employ sales practices or compensation

practices that conflict with the obligations imposed by

the Reg BI Rule Package?

• Does the Firm employ an appropriately-designed

compensation model for sales personnel, relationship

managers, registered representatives (“RR”), and/or

Associated Persons?

• Does the Firm appropriately monitor or mitigate risk in

its employee compensation programs?

• Does the Firm understand the risks associated with

pay-for-referral, stock compensation plan, pay-for-

enrollment, or similar sales-based compensation

programs? Are these risks appropriately identified,

documented, controlled, and/or mitigated?

Performance

Management

• Does the Firm have an appropriate incentive and

disincentive program structure to manage the

performance of its registered persons?

• Are the consequences for performance management

or policy violations appropriately designed to mitigate

their associated risks and/or disincentivize their

occurrence?

Technology

System Integration

•

Does the Firm require new or updated systems,

technology, technology governance, or third-party

service providers to implement requirements imposed

by the Reg BI Rule Program?

• Does the Firm employ document digitalization

technologies or electronic delivery technologies that

would aid in the delivery of Reg BI Program

requirements?

Information Technology

(“IT”) Risk and Controls

•

Does the Firm employ an appropriately-designed and

adequately performing governance program for

systems and their associated risks?

17

Category

Topic

Change Management Considerations

• Does the Firm have the appropriately-established

controls to mitigate operational risks pertinent to its

business model?

• Does the Firm properly educate and train IT personnel

on the regulatory responsibilities imposed by Reg BI in

its development of software and technology on behalf

of the Firm?

Oversight and Monitoring

• Does the Firm adequately understand its compliance

obligations for onboarding or employing third-party

service providers for Reg BI Program purposes?

• Does the Firm have appropriately-designed and

adequately performing due diligence oversight of new

or existing third-party service providers?

• Does the Firm have identified and documented points

of contact for new and existing third-party service

providers for crisis management, business

contingency, and operational excellence purposes?

• Does the Firm appropriately manage its third-party

service providers in order to ensure it is meeting its

obligations imposed by the Reg BI Rule Package?

Strategy

Products Offered

•

Does the Firm promote certain products over others

across business lines that potentially present a conflict

of interest? For example, does the Firm give

preferential treatment to new product offerings that

are equally suitable for customers?

Services Offered

•

Does the Firm understand its obligations imposed by

the Reg BI Rule Package as a result of these service

offerings?

2.3. Developing a workforce and customer change management and communication

strategy

2.3.1.

Change management strategy

Based on a Firm’s business model, the scope and complexity of its products and services, its customers,

and its sales and compensation practices, the degree to which change management considerations affect

its program governance could vary significantly. While not intended to provide a prescriptive change

management strategy, the following framework provides considerations for Firms as they develop a change

management strategy for Reg BI Program implementation that is appropriate in scope and design for the

Firm’s specific needs.

The change management strategy framework assesses key questions involving people, process,

technology, and business strategy which Firms may consider as part of a program governance structure.

Answers to such questions will likely implicate the degree to which implementation efforts impact a Firm’s

operations, strategy, and people.

18

In general, the following table outlines high-level change management tasks that Firms may wish to

consider as part of their rule implementation program. With all topics, a Firm may need to consider if a

particular topic applies to the Firm’s implementation efforts, and if so, what degree of effort the Firm will

need to dedicate to such topic. Answers to these topics will implicate overall program implementation costs

and implementation timelines.

Table 2: Potential framework for change management strategy

Category

Topic

Change Management Considerations

People

Education and

Training

• Annual Compliance Meeting

• Job-specific trainings

•

Policy and procedure trainings

Human

Resources

•

Employee and financial advisor compensation practices (e.g.,

incentive compensation)

• Talent acquisition and retention practices

•

Performance management changes

Licensing and

Registration

•

For non-dually registered Firms, a review of the use of the terms

“financial advisor” or “advisor” in marketing materials, customer

communications, and registered persons representations

• Registration of persons (e.g., Series 65 requirements)

Process

Policies and

Procedures

• Written Supervisory Procedures

• Registered principal responsible

• Escalation procedures (for policy questions)

• Exception procedures (for Firm policies and procedures)

• Complaint handling (identification and remediation)

• Books and records

• Conflict of Interest policies and procedures

•

Reg BI Program policies & procedures

Regulated

Work

•

Regulatory filings (e.g., Form CRS, Form BD changes if applicable)

• Books and records (e.g., Form U4, U5 changes)

• Outside business activities

• Code of Ethics

• Political contributions

• Gifts and entertainment

Oversight

• Control testing

• Control and operational oversight

•

Surveillance changes

Supervision

•

Associated Persons

• Financial operations

• Front-office operations

• Middle/Back-office operations

• Books and records

• Communications

• Marketing (forward and backward looking)

• Trading (oversight/surveillance of RR or financial advisor trades;

market participants)

19

Category

Topic

Change Management Considerations

• AML/FinCEN

•

Powers of attorney or authorized agents on accounts

Technology

System

Integration

•

Ownership and decision-making structure for implementation

•

Ongoing management and oversight

Process

Automation

• Opportunities to automate or consolidate processes

• Implement automated, preventative system controls

•

Enhance data analytics and reporting technologies

Vendor

Management

• Vendor identification and due diligence

•

Vendor procurement

Books &

Records

•

Contract requirements

• Data privacy

• Service agreements

• Control documentation

Strategy

Sales Practice

• Product offerings (i.e., self-directed vs. recommended)

• Digital vs. face-to-face recommendations

• Model portfolios (vs. managed accounts)

• Share classes (particularly, as investment recommendations)

• Business lines (e.g., conflicts of interest, sales strategy)

• Customer acquisitions (e.g., cold-calling, etc.)

•

Financial advisors’ compensation

Compensation

•

Employee compensation

• Product fees (e.g., share class pricing)

• Trading commissions (self-directed, online vs. call)

• Administrative fees (e.g., 12b-1 fees)

Sales and

Service

Offerings

• Account administration (e.g., managed, discretionary)

• Solicited vs. unsolicited trades (e.g., individual, RIA, Investment

Adviser Representative (“IAR”), RR)

• Account monitoring (initial and ongoing)

• Account type (e.g., managed, brokerage v. advisory, 401k rollovers)

• Account trading (solicited vs. unsolicited)

• IRA account services (e.g., terms and conditions)

Products

• Suitability recommendations (e.g., share class, similar investment

objectives, pricing)

• Trade aggregation (and its associated fees)

• Product shelf considerations (e.g., open or proprietary)

2.3.2. Communication strategy

An appropriately designed communication strategy may be required, given the degree to which a Firm

chooses to modify its product and services marketing, business strategy, and operations as a result of Reg

BI Program implementation. A well-planned and organized communication strategy will consider both

internal and external stakeholders as part of its communications. Internal stakeholders could include

employees, business and operational management, marketing, and other specialized functions within Firms

as necessary. External communications could include Firm customers, the public, third-party service

providers, other market participants and utilities, and regulators. The framework below offers suggestions

20

that a Firm may consider in an overall communication strategy as part of Reg BI Program implementation.

Firms may wish to consider how such communications take into account important factors in terms of

audience, timing, messaging, and impact or reaction.

Definitions for Communication Strategy Framework:

o Business strategy – communications describing changes to business strategy that could implicate

inbound vs. outbound sales, customer and product prospecting, etc.

o Education – communications detailing or administering educational or awareness materials

o Change management – general communications describing implications to employee or business

practices, including employee compensation, compliance, performance management, job

description changes, etc.

o Operations – communications describing operational or infrastructure changes, including vendor

procurement, technology enhancements, etc.

o Product / service – communications describing changes to discretionary trading practices,

securities recommendation practices, account services offered, etc.

o Fees / commissions – communications describing changes to customer or customer billing, fees,

commissions, or other associated costs borne by such individuals

o Required customer notice – communications describing changes to Firm registrations, licensures,

marketing materials, or service agreements or contracts for customers and/or third-party service

providers which require customer notice, including account service agreements, data privacy

sharing agreements, etc. Retail customers can also be notified to expect the delivery of Form CRS

starting from June 30, 2020.

o Required regulatory notice – communications to regulators describing changes to Firm

registrations, licensures, or marketing materials as required by applicable regulatory requirements

(e.g., Form BD, Form CRS, Form ADV changes) or account service agreement changes (e.g., IRA

service agreement), etc.

The following framework proposes internal and external stakeholders that Firms may consider in

implementing a robust and effective communication strategy as part of its Reg BI Program

implementation:

Table 3: Potential framework for communication strategy

Category

Group

Topic of Communication

Internal

Stakeholders

Employees (e.g.,

financial advisors,

registered

principals)

• Business strategy

• Education

• Change management

• Product / service

•

Operations

Management

• Business strategy

• Education

• Change management

• Product / service

•

Operations

21

Category

Group

Topic of Communication

Marketing

•

Business strategy

• Education

• Change management

• Product / service

Specialized business

functions

• Business strategy

• Education

• Change management

• Product / service

• Operations

• Additionally, Firms may consider: Enterprise risk

management, data privacy, financial crimes oversight

changes

External

Stakeholders

Customers

•

Business strategy

• Product / service

• Fees / commissions

• Required customer notice

The Public

• Business strategy

•

Product / service

Third-Party Service

Providers

•

Business strategy

• Product / service

• Operations

Market

Utilities/Participants

• Business strategy

• Product / service

• Operations

Regulators

• Business strategy

• Product / service

• Fees / commissions

• Operations

• Required customer notice

•

Required regulatory notice

2.4. Acknowledging other regulatory considerations in tandem with Reg BI implementation

As with any rule implementation program, Firms should holistically consider the universe of potential

impacts on their other regulatory obligations given their registration status, their business and operational

models, the products and services offered, their geographical location, and the jurisdiction of their

regulators. While this Guide does not discuss in detail other regulatory obligations, as Firms implement

changes to their business strategies, operations, products and services, or human capital management as

a result of the Reg BI Program, they may wish to consider impacts on other, applicable regulatory

obligations, including:

22

o SEC regulations;

o Financial Industry Regulatory Authority (“FINRA”) rules;

o Individual state laws and regulations;

o Municipal Securities Rulemaking Board requirements;

o Department of Treasury requirements;

o Department of Labor (“DOL”) requirements;

o Office of the Comptroller of the Currency requirements; and/or

o Emerging and existing state fiduciary requirements.

In addition, other voluntary best practices, such as the Certified Financial Planner Board of Standards, Inc.

fiduciary requirements, may be considered for individuals.

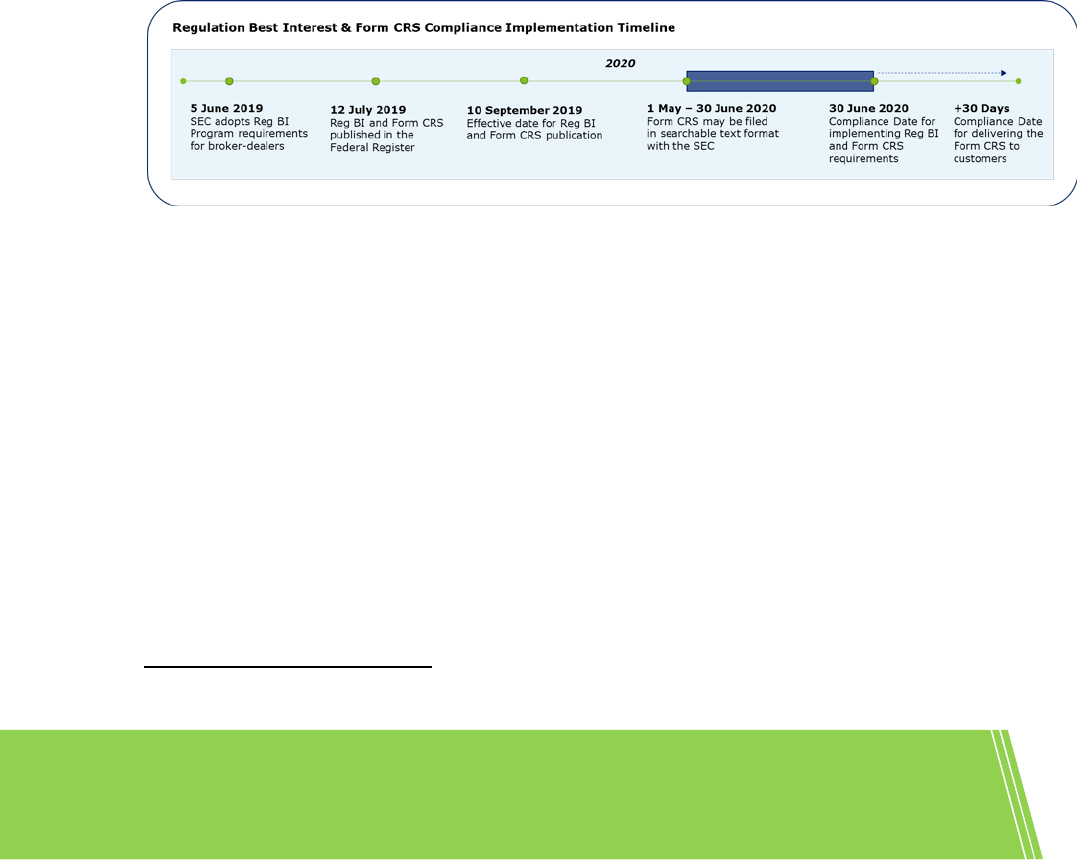

2.5. Providing an illustrative timeline for program implementation

Critical to the success of effective program governance is the understanding of the various program

milestones and compliance dates for Reg BI Rule Package implementation. Below is a depiction of the

compliance dates as set forth by the SEC in publishing the Reg BI Rule Package adopting releases.

16

Figure 3: Reg BI Program compliance implementation timeline

In consideration of the approaching compliance dates in June 2020, Firms should maintain perspective of

how these dates align with other operational considerations and budget priorities. For example, the

compliance date marks the end of the second business quarter, and Broker-Dealers often execute a number

of functions at quarter-end, including sending customer account statements, filing quarterly regulatory

reports, or finalizing and closing financial books. These competing priorities may pose operational or

budgetary constraints may need to be considered by Firms as part of Reg BI Program implementation.

2.6. Providing considerations for estimating program implementation costs

Firms may wish to consider a number of factors when determining an appropriate cost estimate for their

rule implementation program. While these factors will vary largely in degree from Firm to Firm given

variances in business model and organizational readiness, Firms may want to consider undergoing a formal

budget review process for Reg BI Program implementation. Such a review could include considerations of

both front-end and ongoing implementation costs as well as opportunities to consolidate or converge

16

Reg BI and Form CRS adopting releases were published in the Federal Register with an effective date of September 9, 2019. See footnote 2 and

3, respectively.

23

collective business efforts (e.g., technology enhancements or process automation) to maximize cost-

reduction potential.

Possible cost considerations for Reg BI Program implementation and ongoing expenditures could include

the following:

Table 4: Possible cost considerations for program implementation

Category

Potential Implementation Costs

Human Capital

•

Additional full-time employees (e.g., ongoing surveillance, oversight,

supervision, and reporting)

• Reallocated full-time employees (e.g., ongoing surveillance, oversight,

supervision, and reporting)

• Third-party resources (e.g., contractors, vendors, outside counsel spends)

• Ongoing surveillance and reporting activities

• Ongoing supervision and monitoring of employees

• Ongoing compliance considerations

Operational

Impacts

• Program evaluations (e.g., compensation structure, product due diligence,

account type recommendations, conflicts of interest, service offerings,

customer service-level impacts)

• Performance management changes

• Education and training programs

• Disclosures and communications delivery

• Marketing materials review (i.e., current-state and future materials)

• New or enhanced business processes

• New or enhanced business controls

•

Opportunity deferrals and business plan disruption impacts

Technology

Investments

•

Process automation or enhancements

• Data analytics and reporting

• Vendor procurement or system integration

• Supervisory controls

• Software or product licensing fees

In considering program implementation costs and expected ongoing expenditures, many Firms undertook

a similar exercise when considering the DOL fiduciary rule proposal in 2017. While not an exact comparison,

Firms may find it efficient to benchmark against prior DOL fiduciary rule program cost estimates when

assessing the impact of Reg BI Program requirements. As a comparison, the following industry data was

published by Deloitte in August 2017 following input from industry participants.

17

From the DOL fiduciary

rule’s issuance in April 2016 to the publication of the report in August 2017, financial institutions reported

a total spend to-date (i.e., “start-up costs”) of $595 million with an anticipated $200 million spend for the

remainder of 2017.

18

Additionally, the table below illustrates the average spend (based on size) of these

financial institutions:

17

The DOL Fiduciary Rule: A study of how financial institutions have responded and the resulting impacts on retirement investors. Deloitte &

Touche LLP. August 2017. All references below in the remainder of this section refer to this publication.

18

The DOL Fiduciary Rule: A study of how financial institutions have responded and the resulting impacts on retirement investors. Deloitte &

Touche LLP. August 2017. Page 17.

24

Figure 4: Average spend (based on size) for financial institutions

From the same study, Deloitte multiplied the average cost estimate of each financial institution size

category by the number of institutions in their respective size category.

19

This calculation yielded the

following cost estimates for both Broker-Dealer “start-up costs” to implementation and ongoing annual

costs for compliance.

Figure 5: Estimated total Broker-Dealer start-up costs

Figure 6: Estimated total ongoing annual costs

It is expected that each Firm will approach its rule implementation governance program independently

with particular consideration and attention given to its interpretation of the Reg BI Program, its business

model and objectives, its product and service offerings, and its risk appetite for compliance.

19

^Ibid. Number of Broker-Dealers in industry, per DOL: Large, n = 42; Medium, n = 147; Small, n = 2,320. Deloitte Whitepaper (2017); page 18.

25

3. Understanding the Rule and assessing impact

This section provides a framework for Firms to understand the Reg BI Rule Package requirements and its

impact on their business and operations. This includes identifying key stakeholders and decision makers,

establishing subject matter expertise, agreeing on the meaning of rule requirements, and making business

decisions associated with the requirements.

This section is intended to identify key elements for consideration when developing an approach to

compliance with a Reg BI Program, specifically:

o Conducting an impact assessment to develop a clear understanding of how the Firm is currently

addressing the elements of the Reg BI Rule Package and assessing how Reg BI Program

requirements will impact the current state

o Making business decisions on how to respond to Reg BI Program impacts

o Designing changes to current-state operations intended to support the business decisions taken

and address compliance gaps in the current-state model

This section will also identify various points in the customer life cycle where the Reg BI Program should be

considered.

3.1. Understanding Reg BI

Reg BI is a significant regulatory change with components and elements that directly or indirectly affect

various units and divisions of a Firm. Hence, it is recommended that the Reg BI Rule Package and its core

requirements are understood by impacted functions within the Firm, including product, operations,

compliance, legal, technology, and finance. Without a consistent understanding of the regulation, Firms

may be challenged to assess the impact of the Reg BI Program and identify, escalate, and resolve items

supporting rule compliance and business decisions. At the same time, these functions need to have a

consistent understanding of the Reg BI Program, so that they are synchronized and coordinated, leading to

cohesive efforts across the Firm.

There are opportunities for differences in understanding the requirements by different functions, as Reg

BI, itself, is not definitive or prescriptive in various instances (e.g., the definition of “best interest” and

“reasonably designed” policies and procedures). Firms may wish to consider conducting workshops with

participants from each of the impacted functions. These workshops might serve as the foundation for

further impact analysis across various divisions and businesses. They may also be a platform for the

stakeholders to come together to identify and plan the future course of action as it pertains to Reg BI

Program compliance.

Firms should consider establishing a core Reg BI Program team with representation from multiple functions

(e.g., operations, compliance, legal, technology, risk, product), to undertake the various activities needed

to comply with Reg BI Rule Package requirements. This team may consist of internal and/or external

resources. Below are the pros and cons of involving internal resources vs. external resources for a Reg BI

Program team:

26

Table 5: Pros and cons of involving internal resources vs. external resources for a Reg BI Program team

Option/

Parameter

Internal Resources

External Resources

Both Internal and External

Resources

Pros

Identifying a core group of

internal resources enables

Firms to leverage groups and

individuals who already have

a strong understanding of

the Firm, its business and

product line, e.g., resources

previously involved with the

DOL fiduciary rule may be

leveraged to support this

effort.

Engaging external

resources to support the

Firm in understanding Reg

BI may provide additional

marketplace perspective

and reduce the demand

on internal resources who

may not have bandwidth

to support Reg BI efforts in

addition to business as

usual (“BAU”).

This has the potential to take

the best of both options;

internal resources will

provide Firm-level insights

while external resources will

bring expertise and industry

insights. Internal resources

may have capacity to focus

on BAU while available to

provide Firm-level

information.

Cons

The time and opportunity

cost of engaging these

resources may be relatively

high as BAU may be

impacted and other

initiatives may be delayed.

Firms may be challenged to

identify industry leading

practices as it relates to the

questions they are seeking

to answer.

The direct cost is higher

but the demand on

internal resources is lower

as they are able to focus

on the issues requiring

decisions rather than

understanding rule

requirements.

It may require a strong

Program Management

Office (“PMO”) to ensure

efficient team coordination

and management of

associated costs;

communication is critical so

the information between

internal and external

resources need be

exchanged in a timely

manner.

Broker-Dealers may choose one option over others depending on their history of undertaking such large

compliance and transformation efforts, comfort with and understanding of the subject matter, and capacity

to manage this effort in addition to BAU.

As many of the rule requirements are principles-based, this team should identify clarification points and

questions and develop Firm-specific interpretations and definitions to share with the relevant parties. This

team may want to conduct workshops and regular meetings for stakeholders to share the analysis, clarify

questions, and ensure involvement of appropriate resources and escalation of questions and issues.

While an understanding of Reg BI Rule Package requirements is critical, the Reg BI Program team may also

benefit from a robust communications framework to share Reg BI Program requirements and decisions

with stakeholders impacted by rules. A framework should consider who should be communicated to, when,

how and in what capacity; for example, the Firm may want to communicate updates to its field force about

the product portfolio as and when a decision is made or wait until formal training is administered. The

timing and medium of communication are important to consider. Firms may choose different media for

27

different communications to different stakeholders, and the manner and content of which they choose will

be unique to each. The team may also engage external parties for communication design and delivery.

Overall, a cohesive and consistent understanding of the Reg BI Rule Package requirements will lay the

foundation for understanding the potential impact of the Reg BI Program on a Firm’s current-state business

and help the Firm undertake decisions and changes it may want to implement in response to the rule

requirements.

3.2. Business Impact

Once a working understanding of the Reg BI Rule Package has been established, Firms should consider

developing an understanding of its impact on the existing business structure followed by a consideration

of changes that may need to be made as a result. It is suggested that the groups responsible for

understanding Reg BI Rule Package requirements engage with appropriate business owners who can

provide context regarding the impact of potential changes. Particular attention should be paid to business

areas that are considered critical or core to the Firm’s business operations, and it is important to recognize

many of these elements are interrelated and should not be considered in isolation. Areas of consideration

may include:

(1) The Firm’s business structure (e.g., a Broker-Dealer, an RIA), a dual Registrant or a financial

institution that has both a registered broker-dealer and a registered investment adviser as separate

and distinct legal entities (a “Hybrid Firm”);

(2) The products and services offered by the Firm and its respective revenue models, including any

specific limitations imposed by the Reg BI Program;

(3) Conflicts of interest at the Firm (including its affiliates) and at the registered representative level;

(4) Titles used to describe financial advisors (e.g., the terms “advisor” or “adviser”, in marketing

materials, legal entities’ documents, customer agreements, and financial advisor licenses); and/or

(5) Compensation and incentive models, including compensation differences by:

o Product (e.g., affiliated vs. nonaffiliated, security type, Firm, share class);

o Account type (e.g., brokerage, advisory, annuity, retail vs. retirement);

o Source (e.g., IRA rollover); and/or

o Incentive programs and their criteria for qualification.

A suggested approach when reviewing each of the elements mentioned above is to determine potential

change(s) that the Firm may decide to make in response to the Reg BI Program and the level of impact that

these change(s) may have on the business model and operations.

Illustrative Example:

Impact of Reg BI on the products and services offered under the Broker-Dealer (for dually-registered Firms)

o Is a change under Reg BI required or optional? Optional

o What are potential changes that may need to be made? Potentially move certain services – financial

planning, portfolio monitoring -- out from the Broker-Dealer and to the RIA

o Is the area of impact critical to business, important to business or ancillary? Critical to business

28

o Could impact to the current model cause Financial Advisors or customers to leave or stay?

Potentially leave - will require a communications program and implications for the customer and

representative experience

o Might it present a competitive advantage? Potentially – by enabling the Broker-Dealer to have a

more transaction focused business model

o Is the financial impact of the change negligible, minor, or significant? Potentially significant

3.2.1. The Firm’s business structure

Firms may operate under a variety of business structures and be registered as a Broker-Dealer, an RIA, or

a dual Registrant or Hybrid Firm. The business structures drive how RRs and financial advisors engage with

customers and the types of products and services they provide. Firms should consider leveraging their

understanding of Reg BI Program requirements to evaluate how these different structures are impacted by

rules, which may facilitate discussions among stakeholders regarding future state and potential changes.

3.2.2. The products and services offered by a Firm and its respective revenue models

It is important to understand how Reg BI Program requirements may impact a Firm’s decision to continue

to offer certain products, while possibly adding others to the product shelf. Firms may want to consider

developing an inventory of all products and services currently offered, which would support additional

discussion and evaluation of compensation practices, revenue models, and conflicts of interest. Suggested

elements may include:

o The product type (e.g., ETF, mutual fund, individual security, annuity);

o The service type (e.g., a managed account, self-directed account or advisory, brokerage, or digital

educational tools vs. providing investment advice); and

o The firm type offering a product or service (e.g., a Broker-Dealer, an RIA, a dual Registrant or Hybrid

Firm).

For each product type and service, the Firm should consider undertaking a revenue analysis. This analysis

might include a breakdown of the various revenue streams associated with each product type and service,

as well as a breakdown of the business structures and account types under which the product types and

services are offered. The Firm should also consider analyzing for each product and service type:

o The level of due diligence that is performed at the Firm and RR or financial advisor level;

o The costs to the retail customer and how such costs benchmark the cost and performance to

alternatives, including alternative share classes (this would also include evaluation of how

proprietary products are evaluated vs. non-proprietary alternatives);

o The level of understanding that customers, RRs, or financial advisors have of the products’ or

services’ complexities and risks;

o The customer segment(s) to which the product or service is offered and the investing goals that it

helps to address; and/or

o How the product or service is sold and the level of supervision, surveillance, and testing of sales

practices.

29

3.2.3. Conflicts of interest by product and service type

Firms may want to consider developing a conflict of interest register if one does not already exist. A

comprehensive catalog could include all conflicts of interest of which the Firm is aware and answer the

following questions:

o To which products or services does the conflict apply?

o What is the type of conflict (e.g., client vs. client, Firm vs. client, financial consultant vs. client,

financial consultant vs. Firm)?

o Is the conflict at the Firm- or RR or financial advisor-level, and how does the Firm categorize such

conflicts?

o Is the conflict considered material or immaterial? Might this vary depending on the product?

o What Firm-level (including its affiliates) revenue streams and RR or financial advisor-level

compensation and incentives are associated with the conflict?

o Is the conflict being mitigated? What controls and testing are in place to mitigate such a conflict?

If the conflict is not currently being mitigated, is it possible to mitigate or eliminate the conflict?

o If the conflict cannot be mitigated or eliminated, is it an acceptable conflict for the Firm?

o How complex is the conflict, and how well do impacted customer segment(s) understand the

conflict?

o What is the description of the conflict, including the related incentive or disincentive and other

material facts?

o What is the driver of the conflict and how is it appropriately managed?

o Is the conflict appropriately disclosed?

Policies and procedures regarding conflicts of interest may also be considered, including:

o The frequency of review of existing conflicts of interest;

o A method of review of existing conflicts of interest;

o A process for reviewing and adding conflicts of interest to new products and services;

o A process for reviewing cross-functional conflicts between business functions or business lines;

o A process for evaluating conflicts of interest when a product or service is changed, or there is a

business event (e.g., the Firm acquires another Firm or enters a new market); and/or

o How internal and external audiences are notified/updated when conflicts of interest are updated

or modified.