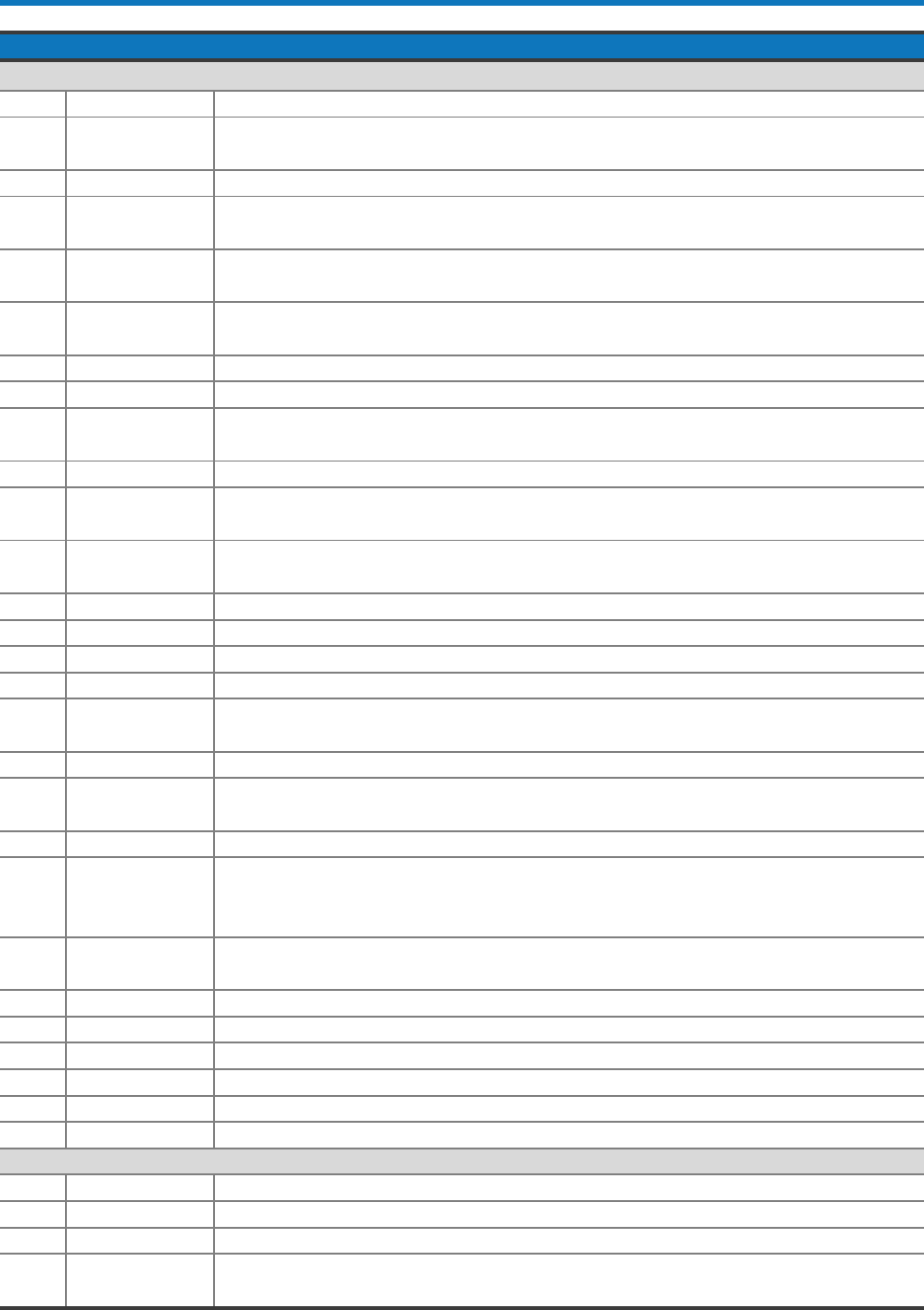

European Insurance Premium Tax (IPT) comparison table

Rank Country Rate

1 FINLAND 24% (Motor and Fire)

2 ITALY 21.5% (Liability, Fire, Theft, Other),

12.5%

(

Motor

,

A

g

ricultural liabilit

y

and fire

)

3 NETHERLANDS 21% (Most – Marine, Travel, Health, Goods in transit = Exem

p

t)

4 GERMANY 22% (Fire, Business interruption),

19%

(

Home/Buildin

g

s

,

Livestock

,

Goods in German transit

,

Other

)

5 GREECE 20% (Fire, Motor fire)

15%

(

Liabilit

y,

Motor

,

Marine/aviation

,

Health

,

Accident

,

Goods in transit

)

6 UK 12% Most UK risk

20% Travel

,

Hire car insurance

,

extended warrant

y

7 MALTA 11% (Most)

8 AUSTRIA 11% (Most)

9 HUNGARY 10%

(

exce

p

t Motor at 30%

)

10 BELGIUM 9.25%

11 FRANCE 9.0% (except Motor 33%, Fire 30%, Marine (Sport, pleasure) 19%, Motor (Accidental

dama

g

e

)

18%

,

Le

g

al Protection 12.5%

)

12 PORTUGAL 9.0% (except Marine and aviation, goods in transit, Agriculture, Personal accident all

5%

)

13 SLOVENIA 8.5%

14 SLOVAKIA 8.0%

15 SPAIN 6.0%

16 CROATIA 5% (exce

p

t Motor liabilit

y

15%, motor dama

g

e 10%)

17 IRELAND 5% (non-life)

1%

(

life

)

18 LUXEMBOURG 4.0%

19 ROMANIA 2% Motor

1% Non-Life

20 BULGARIA 2.0%

21 CYPRUS 1.5% Life

(BUT 5% Motor (Guarantee Fund))

Mostl

y

stam

p

dut

y

22 DENMARK 1.5%

(

Exce

p

t Motor 42.9%

)

23 SWEDEN EXEMPT (but 32% for Motor)

24 POLAND EXEMPT (but 10% fire bri

g

ade tax on Fire)

ESTONIA No IPT

LATVIA No IPT

LITHUANIA No IPT

CZECH REPUBLIC No IPT

LIECHTENSTEIN 5.0%

NORWAY No IPT

SWITZERLAND 5% (but Accident, A

g

ricultural, Marine exem

p

t)

ICELAND 0.0045% Fees

0.03%

p

revention tax (avalanches)

EU Countries

Non-EU Countries