October 17, 2023

By Drs. Gillian Petit & Lindsay Tedds

Department of Economics

University of Calgary

Report prepared for the City of Calgary

A Detailed Portrait of

the Short-Term Rental

Market in Calgary

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

2

Contact Author:

Dr. Lindsay M. Tedds

Associate Professor, Economics

www.lindsaytedds.ca

This research paper was produced as part of the City of Calgary–Urban Alliance Agreement made effective on 12

January 2023 (Research Services File Number 1060024).The City of Calgary is collaborating with researchers at the

University of Calgary (UCalgary), under the Urban Alliance partnership, on a multi-year study of Calgary’s short-

term rental (STR) market. The goals of the study are to build a comprehensive evidence base on Calgary’s STR market

(including impacts, challenges, and opportunities), and to use this information to recommend a tailor-made STR policy

framework for Calgary that can be adapted as market conditions change. Engagement with Calgarians and interested

parties is an important component of the Short-Term Rental Study. The authors thank the City of Calgary for funding

this work.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

3

Executive Summary

In Calgary the expansion of the short-term rental (STR) market has produced wide-ranging implications

for individuals, communities, and various sectors. To address those implications, the City of Calgary (The

City) introduced an initial phase of STR regulations in February 2020. However, the disruption produced

by the SARS-CoV-2 (COVID-19) pandemic, coupled with continued market evolution and impact of the STR

regulations means that Calgary’s STR market is now different from that which existed when the

regulations were first designed. As Calgary looks to adopt a second comprehensive phase of STR

regulations a sophisticated evidence base is needed to ensure STR regulatory approaches and processes

manage negative community impacts, as well as enable The City to leverage STR activity to achieve

broader economic, social, and environmental goals. This underscores the need for a full review of the STR

market in Calgary that integrates recent knowledge and evidence along with stakeholder perspectives.

This report is one of several reports prepared for the City of Calgary on the STR market. In this report, we

compile a detailed portrait of the STR market in Calgary based on data on Airbnb and VRBO/HomeAway

listings. To ensure that we reflect the state of the market, we took several novel steps in the analysis. This

included the manual inspection of STR listings and hosts to ensure they were objectively and accurately

categorized. We also employ novel methodologies to differentiate between permanent versus non-

permanent rentals based on actual patterns of use instead of relying on a subjective definition. Finally,

we examine business license compliance, linking active listings to business administrative data, and then

inspecting those links for validity. This is a more accurate assessment of compliance than crude estimates

that divide the number of listings by the number of business licenses in a municipality. We end this report

by estimating the number of housing units STRs are removing from the housing market in Calgary.

The main take-aways of this paper are:

SIZE

The STR market has fully

recovered from the

COVID dip.

LOCATION

City Centre communities

and new developing

communities have more

STR activity.

COMPLIANCE

The majority of STR

listings are compliant

with business license

requirements.

LISTINGS

Most hosts operate 1 or

2 STRs.

PERMANANCY

Most listings are only

listed episodically or

temporarily.

HOUSING STOCK

It is possible that 25% of

listings could be returned

to the housing market

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

4

Overall, we strove to provide an accurate reflection of the STR market in Calgary, improving on the data

and methodologies that have been used in this literature. We find that Calgary has a vibrant STR market

that serves a critical role during events like Stampede and provides economic opportunities to those

operating STRs as well as the City. However, the STR market in Calgary is growing and there is a sizable

amount of commercialization. Calgary faces other related and critical policy issues such as a lack of

affordable housing and a lack of student housing. Now is an opportune time to examine the STR market

and grapple with what role it should play in the housing market and the accommodation market using

thoughtful and intentioned regulations.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

5

Table of Contents

Executive Summary................................................................................................ 1

Table of Contents ................................................................................................... 5

1. Introduction .................................................................................................. 7

2. Data .............................................................................................................. 9

3. Supply Side: A Detailed Portrait of Airbnb and VRBO/HomeAway Listings ... 11

3.1 Airbnb and VRBO/HomeAway Listings Over Time ...................................................................... 11

3.2 Listing Type ................................................................................................................................. 14

3.3 Spatial Analysis of Listings ........................................................................................................... 16

4. Demand Side: A Look at Airbnb and VRBO/HomeAway Bookings, Occupancy

Rate, and Community Impact ............................................................................... 23

4.1 Time Trends: Nightly Bookings ................................................................................................... 23

4.2 Year-Over-Year Change in Nightly Bookings ............................................................................... 24

4.3 Occupancy Rate .......................................................................................................................... 25

4.4 Nightly Bookings and Occupancy Rate by Community ............................................................... 27

4.5 Community Impacts: Complaints by Community ....................................................................... 29

5. Monetary Incentives: Revenues of Airbnb and VRBO Listings ..................... 31

5.1 Revenue Time Trends ................................................................................................................. 32

5.2 Revenue by Community .............................................................................................................. 32

6. Business License Compliance ...................................................................... 35

7. A Portrait of Short-Term Rental Hosts in Calgary ........................................ 37

7.1 Host Profile: Property Managers ................................................................................................ 39

7.2 Multi-Listing Hosts ...................................................................................................................... 40

7.3 Multi-Listing Hosts and Host Type .............................................................................................. 43

8. Full Time Listings: A New Approach ............................................................ 44

8.1 Method ....................................................................................................................................... 46

8.2 Results ......................................................................................................................................... 46

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

6

9. Impact on the Housing Market ................................................................... 51

9.1 Spatial Distribution ..................................................................................................................... 52

10. Conclusion .................................................................................................. 53

References ........................................................................................................... 54

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

7

1. Introduction

In Calgary, as is the case around the world, the expansion of the short-term rental (STR) market has

produced wide-ranging implications for individuals, communities, and various sectors. To address those

implications, the City of Calgary (The City) introduced an initial phase of STR regulations in February 2020.

However, the disruption produced by the SARS-CoV-2 (COVID-19) pandemic, coupled with continued

market evolution and impact of the STR regulations means that Calgary’s STR economy is now different

from that which existed when the regulations were first designed. As Calgary looks to implement revised

STR regulations in January 2024 as well as consider a comprehensive suite of flexible regulatory measures,

a sophisticated evidence base is necessary to ensure new approaches and processes both manage

negative community impacts, as well as enable The City to leverage STR activity to achieve broader

economic, social, and environmental goals. This underscores the need for a full review of the STR market

in Calgary that integrates recent knowledge and evidence along with stakeholder perspectives, including

those of STR hosts, housing advocates, the hotel industry, and residents.

In this report, we provide an extensive, evidence-based picture of the STR market in Calgary as of Summer

2023. This is the second report in a series of reports that assesses patterns and trends in the Calgary STR

market. In the first report, we reviewed the current STR regulations in Calgary, and, using Airbnb data

from June 2017 to June 2021, we assessed patterns and trends in the Calgary STR market to get a sense

of the size and trajectory of the market, as well as understand who the hosts are, and what guests are

looking for. In this report, we extend that data analysis up to and including July 2023. Future reports will

gather and consider stakeholder perspectives, look at the role of STRs withing Calgary’s regulatory

environment, and provide regulatory recommendations.

In 2018, an STR scoping review report was commissioned by The City and the initial regulations

(implemented in February 2020) were based on that report. However, recognizing that the landscape of

the STR market has changed and STRs continue to have an evolving impact on the hotel industry, local

communities, and city services—representing both an opportunity and cause for concern— in June 2022,

Council approved a Notice of Motion directing Administration to review and revise STR business license

requirements. In May 2023, Administration proposed changes to the STR bylaws that will increase

protection for guests, particularly fire safety. Fire safety became top of minds of municipalities across

Canada following the fatal fire in an Old Montreal building where a number of illegal Airbnbs were

operating. The proposed changes were accepted by council in June 2023 and will be effective in January

2024. These changes were proposed as interim measures as this in-depth review of the STR market is

ongoing.

As stated in Tedds et al. (2021), the STR market is complex and the activity that unfolds within it is diverse

(p. 5). Unlike typical regulated markets, there are three actors in an STR market: hosts, guests, and the

platform, all with different motivations for participation. From a policy perspective, the differing

motivations of actors layered with various municipal polices—including zoning regulations, municipal

development plans, and affordable housing initiatives—pose challenges to regulating the STR market.

Applying standard regulatory responses in the face of these challenges can create “regulatory fractures”—

when existing regulatory frameworks apply to a new mode of activity in an incomplete fashion (Tedds et

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

8

al. 2021). The overall objective of this project is to assemble a thorough evidence base to create a flexible

regulatory framework that addresses regulatory fractures specifically for the City of Calgary, its unique

STR market, and considers the impact of the STR market on related markets and concerns (e.g., hotel

industry, LTR’s, community impact).

In this paper, we compiled a detailed portrait of the STR market in Calgary based on data on Airbnb and

VRBO/HomeAway listings. To ensure that we reflect the state of the market to the best of our ability, we

undertook several novel steps in the analysis. This included the manual inspection of STR listings and hosts

to ensure they were objectively and accurately categorized (e.g., as private rooms vs. entire

home/apartments), and we included new categories (e.g., basement suites) to ensure the data more

closely reflects what is actually happening in the market. We also employed novel methodologies, such

as a cluster analysis to find permanent rentals, which uses an algorithm to define permanent listings based

on actual patterns of use instead of relying on a subjective definition often employed in the literature.

Finally, to the best of our knowledge, we are the first jurisdictional report to examine business license

compliance in a careful and thorough manner, linking active listings to business administrative data, and

then inspecting those links for validity. This is a more accurate assessment of compliance than crude

estimates that divide the number of listings by the number of business licenses in a municipality. Overall,

we strove to provide an accurate reflection of the STR market in Calgary, improving on the data and

methodologies that have been used in this literature.

The main take-aways of this paper are:

• While the COVID-19 pandemic interrupted the STR market in Calgary, since late 2022 the STR

market has rebounded and is growing at pre-COVID rates.

• Some communities have more STR activity (e.g., active listings, nightly bookings, and market

growth) than other communities. These include centre communities such as the Beltline, Crescent

Heights, and Sunnyside, and developing communities such as Seton, Livingston, and Cornerstone.

• STR activity across communities differs. Centre communities are more likely to have apartment

listings and more STR-related complaints, while developing communities are more likely to have

basement suites and less STR-related complaints.

• The majority of STR listings in Calgary are compliant with business license requirements (70%)—

they have a valid business license number, it is posted in their STR listing, and it is not used across

multiple, unrelated STR listings.

• Most STR hosts in Calgary are individuals who operate fewer than two listings on average. A small

number of hosts are property managers, operating listings for property owners, and they control

a disproportionately large share of the market.

• There is also a small number of hosts who are multi-listing hosts (12%). They are the most likely

to be purchasing property for the sole purpose of operating it as an STR, and they control a

disproportionately large share of the Calgary STR market (52% of the total revenue).

• Most STR listings in Calgary are non-permanent listings (~79% in July 2022). A small number of

listings are permanent listings (~21% in July 2022) and are the least likely to be used as a

permanent residence, removing housing from the housing market.

• In total, we estimate that about 1,580 (27%) STR listings in July 2023 were listings that could

potentially to be returned to the housing market if STRs were hypothetically banned (i.e., they are

not used as a permanent residence but are dedicated STRs). This represents about 0.29% of

private dwellings. The Beltline had the highest number of these dedicated STRs by far.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

9

Overall, we find that Calgary has a vibrant STR market that serves a critical role during events like

Stampede and provides economic opportunities to those operating STRs as well as the City. However, the

STR market in Calgary is growing and there is a sizable amount of commercialization. Calgary faces other

related and critical policy issues such as a lack of affordable housing and a lack of student housing. Now is

an opportune time to examine the STR market and grapple with what role it should play in the housing

market and the accommodation market using thoughtful and intentioned regulations.

2. Data

As short-term rental platforms do not share their data, for this report, we use proprietary data purchased

from AirDNA. (AirDNA n.d.).

1

AirDNA scrapes data on STRs listed on Airbnb and VRBO/HomeAway. This

scraped data includes two linkable data sets: the “property” data set that contains information on the

characteristics of the listing itself (as reported by the host) such as the property type (e.g., apartment),

listing type (e.g., entire apartment or single room), the number of bedrooms, and the published nightly

fee. In the more recent data, (April 2023 – July 2023), the property data set also contains a business license

number if an STR listings includes on in its listing. The second data set is the “monthly” data set. It contains

monthly transaction data for each listing that includes the number of bookings per month, the number of

days available in a month, the occupancy rate, and the monthly revenue. Unlike the property data, the

transaction data has had to be estimated by AirDNA from 2015 onwards as Airbnb and VRBO/HomeAway

does not provide information on bookings. AirDNA uses machine learning algorithms based on an

enormous historical dataset to perform the estimations. This introduces uncertainty; however, Calgary’s

STR market is somewhat large so the number of observations in the historical dataset reduces the

uncertainty. Outside of data supplied directly from STR platforms, we believe that this is the best available

data set on the STR market.

2

We use AirDNA data spanning from January 2017 until July 2023—a period

of six years, spanning before, during, and after the COVID-19 pandemic. Finally, it should be noted that if

an Airbnb and VRBO/HomeAway listing share a calendar and are fundamentally the same listing, they are

combined into a single STR listing by AirDNA. This avoids double-counting of identical STR listings.

The data provided by AirDNA is raw data that must be reviewed and properly prepared for analysis. To

this end, we undertook several data cleaning steps which are novel in this space. That is, while other

research examines the data from AirDNA, they assume that what has been scraped is the “truth”.

However, when one begins manually inspecting the scraped data, it becomes clear that there are

deficiencies in the scraped data that require correcting for a more accurate picture of the STR market.

First, some listings are posted by traditional tourist accommodations such as hotels, motels, lodges, inns,

and hostels. While these may be listed on STR sites, they are not what we consider as STRs, which are

accommodations that are in or on a property that could otherwise be used for residential purposes. Thus,

we manually checked all hosts and listings in our data to ensure that traditional tourist accommodations

were excluded from the analysis.

1

The terms of the agreement with AirDNA are such that AirDNA retains intellectual property rights over the raw data transferred.

The raw data were provided to the authors for the purpose of statistical and research purposes and cannot be republished or

disclosed to a third party without the written consent of AirDNA.

2

This data is also widely used by other authors looking at STRs in Canada and/or the effects of STR regulation. See for examples:

Combs, Kerrigan, and Wachsmuth (2020); DiNatale, Lewis, and Parker (2018).

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

10

Second, to get a better understanding of hosts, we manually inspected every host in our data. We

categorized hosts into several categories including property managers, corporate hosts, and individual

hosts.

3

Third, since hosts personally choose how to describe their STR listing, this results in similar words being

used to describe dissimilar listings. For example, suppose a host has listed a bedroom, bathroom, and

living/rec room in their basement of a single detached house as their STR listing (where the host lives

upstairs). Some hosts may refer to this as a “private room” in a residential house while other hosts may

list it as an “entire house/apartment” in a residential house. To standardize listing characteristics, we

manually checked listings in our data for April 2023 – July 2023 and re-categorized the listing type (e.g.,

private room versus entire home/apartment) and property type (e.g., apartment, house, etc.).

4

Together,

these data cleaning steps allows us to provide a more accurate picture of the STR market.

Two other features of the AirDNA data of which to be aware. First, listings are more proliferate than then

number of private dwellings/properties used as an STR. Some hosts have multiple listings for the same

private dwelling. For example, a host may have one listing for an entire single detached house, plus

separate listings for separate rooms in the same house, plus separate listings for the upstairs and

downstairs. Another common example is one host separately listing various rooms in one private dwelling.

In both examples, there is only one private dwelling. This issue cannot be resolved with precision and

must be borne in mind in the interpretation of results.

Second, some hosts use Airbnb not to list STR’s but to list dwellings that they intend to rent for more than

28 days (an LTR). While it is unclear the proportion of listings that are used in this manner, it may be

problematic: it may allow landlords to avoid provisions under the Residential Tenancies Act.

5

In our data

analysis we assume all listings are for STRs (less than 28 days), but this may not be the case (and should

be a consideration in STR regulations, a topic we will address in a future phases of this project).

3

For a more detailed explanation on host types, see the section on Hosts.

4

For a more detailed explanation of how we categorized property types and listing types, see the section on listing type.

5

While it is unknown whether this is an issue in Calgary, there is at least one Toronto case where it is being argued whether a

long-term Airbnb rental is protected by the Rental Tenancy Agreement (Arsenych 2023).

Data Summary

• Includes all Airbnb and VRBO/HomeAway listings in Calgary and Edmonton from January 2017 –

July 2023.

• Listings are scraped by AirDNA who then uses a machine learning algorithm to estimate bookings

and revenue per listing.

• We manually inspected all Airbnb and VRBO/HomeAway listings in Calgary present in the AirDNA

data to manually categorize host type (e.g., individual vs. property manager) and listing type (e.g.,

private room vs. entire home/apartment vs. entire suite) — a novel approach to the data.

• All traditional tourist accommodations (e.g., hotel room) have been removed.

• STR listings ≠ private dwellings used as an STR.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

11

3. Supply Side: A Detailed Portrait of Airbnb and VRBO/HomeAway

Listings

In this section, we look in-depth at the supply side of the STR market in Calgary (with comparison to

Edmonton as a reference). We look at: growth in Airbnb and VRBO/HomeAway listings over time and how

COVID has affected that growth, the breakdown of Airbnb and VRBO/HomeAway listings into various

listing types, and a spatial analysis of Airbnb and VRBO/HomeAway listings.

3.1 Airbnb and VRBO/HomeAway Listings Over Time

Since Calgary’s first STR regulations were introduced in February 2020, the STR market was altered by the

COVID-19 pandemic. While the COVID-19 pandemic interrupted the growth of Airbnb and

VRBO/HomeAway listings in Calgary, Airbnb and VRBO/HomeAway listings in Calgary have been growing

at a rate similar to pre-COVID, leading to a higher overall number of Airbnb and VRBO/HomeAway listings.

As of July 2023, there were 5,698 active Airbnb and VRBO/HomeAway listings

6

in the City of Calgary.

7

Figure 1 plots the number of active Airbnb and VRBO/HomeAway listings in Calgary (left panel) and

Edmonton (right panel) between January 2017 and June 2023.

8

The black line shows total active Airbnb

and VRBO/HomeAway listings, the blue line shows active Airbnb and VRBO/HomeAway listings that are

self-described by hosts as an “entire home/apartment”, and the red line shows active Airbnb and

VRBO/HomeAway listings that are self-described by hosts as “private rooms”.

9,10

Figure 1 shows that there are clear seasonal trends in Airbnb and VRBO/HomeAway active listings in

Calgary. Prior to the COVID-19 pandemic, large “spikes” in active listings in Calgary occur in the month of

July—the month when Calgary hosts the Calgary Stampede, a large outdoor rodeo and fair—with smaller

spikes occurring in December around the Christmas holidays. The Stampede spike persisted during the

COVID pandemic even when Stampede was cancelled (e.g., July 2020). Edmonton displays similar seasonal

trends, with spikes occurring in August during Capital Ex (previously called K-Days and Klondike Days) and

December holidays; however, the summer spike are less pronounced than in Calgary as Capital Ex is not

as large a tourist draw as Stampede.

6

Note that prior to June 2020, VRBO listings were called “HomeAway” listings. Both VRBO and HomeAway are owned by Expedia.

Expedia retired HomeAway in June 2020 and re-branded as VRBO to streamline their vacation rentals across countries.

7

“Active” listings refers to Airbnb and VRBO/HomeAway listings that are available to be booked for rental (whether or not they

were booked).

8

When additional data becomes available, we will update these results.

9

Note that active listings self-described as “shared rooms” are not shown as they make up less than 1% of active listings.

10

As we will show, these self-described listing types are not standardized. We standardize them based on manual inspections for

April 2023 – June 2023 and present the results below.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

12

Figure 1: Acve Airbnb and VRBO/HomeAway Lisngs, Calgary and Edmonton, January 2017 - July 2023

Figure 1 also shows that, over the time period examined, the number of active listings in both cities has

increased, but this increase has not been consistent. Active Airbnb and VRBO/HomeAway listings declined

in both cities beginning in early 2020 at the onset of the COVID-19 pandemic. Both began to recover in

winter 2021. Edmonton’s active Airbnb and VRBO/HomeAway listings recovered beyond pre-pandemic

numbers as of June 2022, while Calgary’s active Airbnb and VRBO/HomeAway listings surpassed pre-

pandemic active listings as of October 2022: Calgary’s STR active listings were four months slower to

recover than Edmonton’s.

Finally, Figure 1 shows the majority of active Airbnb and VRBO/HomeAway listings in Calgary (and

Edmonton) are self-described “entire home/apartments”. Self-described “entire home/apartments”

listings have grown at a much faster rate than self-described “private room” listings. Particularly, post-

COVID, private room listings have slowed their growth in Calgary and stagnated in Edmonton, and neither

city’s private room listings have reached pre-pandemic levels.

To get a better understanding of whether and how the COVID pandemic affected the STR market in

Calgary, in Figure 2 we plot the growth in active Airbnb and VRBO/HomeAway listings year-over-year. The

first panel of Figure 2 only includes pre-pandemic years, 2017 to 2019. Each additional panel introduces

one additional post-pandemic year until all years are shown (2017 to 2023). This allows us to examine the

number of active listings for each year in isolation.

In the top left panel, we see that from 2017 to 2019, active Airbnb and VRBO/HomeAway listings in

Calgary grew steadily from 2,183 listings in January 2017 to 3,946 listings in December 2019 — an 81%

increase in active listings. However, when the pandemic hit in March 2020, we see from the top right

figure, active Airbnb and VRBO/HomeAway listings in Calgary declined to below 2017 levels. They

remained below 2017 levels throughout all of 2021 (middle left panel) until January 2022 (middle right

panel). In October 2022, the number of active Airbnb and VRBO/HomeAway active listings finally

surpassed 2019 active listings. Since October 2022, active Airbnb and VRBO/HomeAway listings have

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

13

continued to grow. As the bottom right panel shows, the number of active listings in July 2023 was up

over 1,000 listings (24%) from the number of active listings in June 2019. This suggests that Airbnb and

VRBO/HomeAway listings are once again on a steadily increasing growth path in Calgary despite being

interrupted by the pandemic.

Figure 2: Acve Airbnb and VRBO/HomeAway Lisngs, Calgary, Year-Over-Year, January 2017 - July 2023

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

14

3.2 Listing Type

Airbnb and VRBO/HomeAway allows hosts to choose their own listing type. They must choose one of the

following: entire home/apartment, private room, hotel room, or shared room. While Airbnb does provide

a suggested definition of these (e.g., Airbnb 2023), allowing hosts to choose their own listing types results

in inconsistency across listings as hosts apply their own interpretations. For example, as we will see,

basement suites are a common STR type in Calgary. However, when the entrance to a basement suite STR

listing is shared, some hosts refer to such a listing as an entire home/apartment, while others label it a

private room. In Figure 1, we saw that self-described “entire home/apartment” listings have been driving

STR growth in Calgary. In this section, we nuance this result, and manually check and standardize listing

types. This provides a better understanding of the STR market in Calgary.

As suggested, to carry out this analysis, we manually re-categorized the listing type of all Airbnb and

VRBO/HomeAway listings in Calgary from April 2023 to July 2023.

11

We conceptualize “listing type” as a

description as to whether or not there is shared space in the STR with the host or other guests/tenants.

The listing types we defined are:

• Entire home/apartment: there are no shared spaces and no other tenants/hosts in the same

private dwelling. The entire private dwelling is entirely for the guest. This includes the

basement, if present. For example, a listing for a single detached home that includes the

basement, main floor, and upper floors or a 1-bedroom apartment that is entirely not shared

would both be an “entire home/apartment” listing.

• Entire suite: there are no shared spaces within the suite although laundry rooms, backyards, and

the main entrance may be shared with the occupants of another (related) suite. There may be

other occupants in the same private dwelling in another (related) suite. The suite comprises only

a portion of the private dwelling. For example, a listing in a single detached house that has a

private basement suite available to the guest while the host/other tenant lives on the main floor

is an “entire suite”.

• Private room: the guest has private access to a bedroom (and possible a bathroom) within the

private dwelling unit. All other spaces are shared with the host or other tenants/guests, e.g.,

shared kitchen and living area.

• Shared room: the guest sleeps in a common room and all spaces are shared, e.g., the guest sleeps

on a couch or air mattress in the shared living room.

Similarly, hosts are allowed to choose their “property type”; however, the choice is subjective and not

standardized across hosts. To correct for this, we first conceptualize property type as referring to the

structure of the private dwelling in which the STR is located. We then manually checked all Airbnb and

VRBO/HomeAway listings in Calgary from April 2023 to July 2023 to determine their property type. In the

manual inspection, we only classified a listing’s property type if we could confirm their property type in a

photograph: we did not rely on a host’s self-described property type. The property types we used are:

• Single detached house (house): note that a STR listing in a legal secondary suite in an otherwise

single detached house is classified as a single detached house.

11

Note that we did not clean/manually verify the Edmonton data due to time constraints.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

15

• Apartment: high-rise apartments and condo buildings that are not townhouses, duplex’s,

triplexes, or fourplexes.

• Multi-family: multi-family dwellings including townhouses/row houses, duplex’s, triplexes, and

fourplexes.

• Guest house: STR listings in a structure that is not part of the main dwelling structure on the

property. For example, detached laneway houses, carriage houses, and units over top of a

detached garage all classify as a guest house.

• Camping: includes units one would camp in including trailers and tents.

Figure 3 plots the number of active Airbnb and VRBO/HomeAway listings by our re-categorized listing

types and property types for July 2023. There are 5,104 active Airbnb and VRBO/HomeAway listings that

we could manually categorize (e.g., the listing had not been removed at the time of manual inspection).

Of those, the most common listing type was entire home/apartments (2,507 or 49%) followed by entire

suites (1,609 or 32%). Breaking that down further, the most common listing + property type was entire

apartment units (1,326 or 26%) and the second most common type were basement suites (1,210 or 24%).

Entire single detached houses are less common, with only 581 (11%) of Airbnb and VRBO/HomeAway

listings appearing to be for an entire single detached house. Private rooms are not as common as either

entire home/apartments or entire suites, and, when private rooms are listed, they are more likely to be

in single detached houses: there are very few private room listings in apartments or multi-family units.

12

This re-enforces and extends the analysis from Figure 1. As with Figure 1, even after manually re-coding

listing types, entire home/apartment listings make up the majority of active Airbnb and VRBO/HomeAway

listings while private rooms make up significantly less listings. However, we now also see that of entire

home/apartment listings, it is more specifically entire apartment listings and entire basement suites that

are the most common, while entire home listings and entire multi-family listings are fewer. Further, with

respect to private room listings, private rooms in single detached houses make up the majority of private

room listings.

There are two other notes to make. First, the number of entire suites and private room listings suggests

many listings are located in dwellings where a portion of the dwelling is occupied by others (e.g., the hosts

or other STR/LTR tenants). Second, this pattern suggests that STRs may differ by community. Communities

with more apartments may have more entire apartment STR listings while communities with more single

detached homes may have more entire suites and private room STR listings. We examine this issue in

depth in the next section.

12

We examined this breakdown for April 2023, May 2023, and June 2023. While the number of listings per type

change, the relative percentages are the same regardless of month.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

16

Figure 3: Airbnb and VRO/HomeAway Acve Lisngs by Manually Categorized Lisng Type and Property Type, Calgary

3.3 Spatial Analysis of Listings

In this section, we examine where STR’s are located within Calgary. We allocate Airbnb and

VRBO/HomeAway listings to a community (with community boundaries as defined by the City of Calgary).

For most Airbnb and VRBO/HomeAway listings, the exact geographic location is not provided.

13

Rather, a

latitude and longitude that is up to 150 meters away from the exact location is provided. To ensure we

attribute the Airbnb and VRBO/HomeAway listing to the most likely community, we take the area that

listing could be in, and figure out which communities it overlaps. We assign Airbnb and VRBO/HomeAway

listings to the community with the most overlap.

In this section, we look at three different spatial patterns: general spatial distribution of STR listings across

communities, STR listing growth by community, and STR listing type and property type by community. The

purpose of this examination is to identify which communities have the most STR activity, and what that

activity looks like.

3.3.1 General Spatial Distribution Across Communities

As stated, to begin we examine the number of active Airbnb and VRBO/HomeAway listings by Calgary

community in April 2023 and July 2023 in Figure 4. Table 1 lists the top 10 communities by Airbnb and

13

There are some listings that provide an exact location. We take those as is.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

17

VRBO/HomeAway listings in July 2023. In Table 1, centre communities are highlighted in green and

developing communities are highlighted in orange.

Figure 4 and Table 1show that STR listings in Calgary are concentrated in centre communities. In particular,

the Beltline has a far greater number of active Airbnb and VRBO/HomeAway listings than any other

community regardless of the month examined. Outside of centre communities, developing communities

of Seton, Livingston, and Cornerstone also have a large number of active Airbnb and VRBO/HomeAway

listings (despite being located in different quadrants of the City).

Figure 4: Airbnb and VRBO Number of Lisngs by Community, April 2023 and July 2023

Table 1: Top 10 Communies by Number of Airbnb and VRBO/HomeAway Lisngs, July 2023

Community

Number of

Airbnb and

VRBO Listings

Sector

Community Status

(as of 2021)

BELTLINE

701

CENTRE

ESTABLISHED

LIVINGSTON

128

NORTH

DEVELOPING

SETON

118

SOUTHEAST

DEVELOPING

CRESCENT HEIGHTS

115

CENTRE

ESTABLISHED

SUNNYSIDE

98

CENTRE

ESTABLISHED

DOWNTOWN COMMERCIAL

CORE

88 CENTRE ESTABLISHED

CHINATOWN

79

CENTRE

ESTABLISHED

BRIDGELAND/RIVERSIDE

78

CENTRE

ESTABLISHED

CORNERSTONE

76

NORTHEAST

DEVELOPING

DOWNTOWN EAST VILLAGE

75

CENTRE

ESTABLISHED

*For April 2023, May 2023, and June 2023 the top 10 communities by STR listings were very similar as in July 2023; however, their order differed

somewhat (but Beltline was always the community with the most STR listings), and Panorama sometimes trades off with Downtown East Village.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

18

3.3.2 Airbnb and VRBO/HomeAway Listing Growth by Community

Digging into these trends further, we next examine which communities have seen the strongest growth

in active Airbnb and VRBO/HomeAway listings. Recalling from Figure 2 how the COVID-19 pandemic

interrupted active Airbnb and VRBO/HomeAway listings in Calgary, we omit examining COVID years, and

instead do a year-over-year comparison, comparing April 2019 to April 2023 and July 2019 to July 2023.

Further, because many Calgary communities had zero active Airbnb and VRBO/HomeAway listings in July

2019 (e.g., the developing communities of Seton and Livingston), we cannot examine percentage growth.

Instead, we examine absolute growth. Figure 5 provides a visual of the change in the number of Airbnb

and VRBO/HomeAway listings between April 2019 to April 2023 (left panel) and July 2019 to July 2023

(right panel) by community. Table 2 lists the top 10 communities by Airbnb and VRBO/HomeAway listing

growth between July 2019 and July 2023.

Figure 5: Airbnb and VRBO/HomeAway Lisng Growth by Community Year-Over-Year, April and July

We make several observations from Figure 5 and Table 2. First, the majority of communities have had

negative, zero, or small (e.g., less than 30 listings) Airbnb/VRBO/HomeAway listing growth between 2019

and 2023. Second, the majority of Airbnb/VRBO/HomeAway listing growth has been concentrated in

developing communities. Some of these same developing communities, as of July 2023, had the most

active Airbnb and VRBO/HomeAway listings by community (Table 1). In particular, Seton, Livingston, and

Cornerstone all were part of the top 10 communities by number of active Airbnb and VRBO/HomeAway

listings in July 2023. Third, outside of the Beltline, centre communities saw very little active Airbnb and

VRBO/HomeAway listing growth. In fact, Downtown East Village lost 57 STR listings between July 2019

and July 2023, the largest decline of any community. This suggests that, despite the higher number of

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

19

Table 2: Top 10 Communies by Airbnb and VRBO/HomeAway Lisng Growth, July 2019 to July 2023

Community

Change in the Number

of active Airbnb and

VRBO Listings

Sector

Community Status

(2021)

BELTLINE

145

CENTRE

ESTABLISHED

LIVINGSTON

117

NORTH

DEVELOPING

SETON

94

SOUTHEAST

DEVELOPING

CORNERSTONE

73

NORTHEAST

DEVELOPING

CARRINGTON

57

NORTH

DEVELOPING

SUNNYSIDE

54

CENTRE

ESTABLISHED

CITYSCAPE

41

NORTHEAST

DEVELOPING

REDSTONE

39

NORTHEAST

DEVELOPING

SAGE HILL

38

NORTH

DEVELOPING

MAHOGANY

36

SOUTHEAST

DEVELOPING

active Airbnb and VRBO/HomeAway listings, listings in centre communities are not seeing large growth

outside of the Beltline. Finally, the Beltline was the community with both the most active Airbnb and

VRBO/HomeAway listings in July 2023 and saw the largest growth in active Airbnb and VRBO/HomeAway

listings from July 2019 to July 2023. This suggests that the Beltline is the top community for STR activity.

3.3.3 Airbnb and VRBO/HomeAway Listing Type by Community

In our final spatial analysis of listings, we examine the different listing types in each community. Drawing

from Figure 3, we look at July 2023 listings and break down Airbnb and VRBO/HomeAway listings in each

community into basement suites, upper suites, entire apartments, entire single detached homes, entire

multi-family homes, and private rooms in a house. Further, we retain only those communities with 35 or

more listings in July 2023. For each community, we find the percentage of active Airbnb and

VRBO/HomeAway listings by listing type and plot it in Figure 6 for centre communities, Figure 7 for

developing communities, and Figure 8 for “other” communities (i.e., not a centre community nor a

developing community).

From these figures, we see that Airbnb and VRBO/HomeAway listings in centre communities are more

likely to be entire apartments. Of the 24 centre communities with 35+ listings, entire apartment listings

make up the largest type of listing in 15 of them. Further, some centre communities with the highest

number of Airbnb and VRBO/HomeAway listings have nearly 100% entire apartment listings. This includes:

the Beltline, Chinatown, Downtown Commercial Core, and Downtown East Village. Likewise, Cliff

Bungalow, Sunnyside, and Mission—also centre communities but with not as many Airbnb and

VRBO/HomeAway listings—also have a higher percentage of entire apartment STR listings (between 60%

and 90%). The remaining Centre communities examined have a wider variety of STR types. Of note, Banff

Trail has a high percentage of Airbnb and VRBO/HomeAway listings that are private rooms in a single

detached house. This is likely due to its location near the University and the LRT, making it a popular

location for students.

Second, Airbnb and VRBO/HomeAway listings in developing communities are more likely to be basement

suites. Except for Redstone, all the developing communities with 35+ Airbnb and VRBO/HomeAway

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

20

listings have 20% of greater of their Airbnb and VRBO/HomeAway listings being basement suites. Entire

apartment listings are much less prominent; however, they do make up a mid-percentage of listings in

Skyview, Seton, Redstone, and Cornerstone.

Finally, active Airbnb and VRBO/HomeAway listings in “other” communities are more varied than in

developing or centre communities. Entire houses, entire multi-family units, basement suites, upper suites

and private rooms in detached houses all have a significant presence in these communities. The least likely

listing type in there “other” communities are entire apartments.

Figure 6: Airbnb and VRBO/HomeAway Lisngs by Lisng Type and Community, Centre Communies, July 2023

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

21

Figure 7: Airbnb and VRBO/HomeAway Lisngs by Lisng Type and Community, Developing Communies, July 2023

Figure 8: Airbnb and VRBO/HomeAway Lisngs by Lisng Type and Community, Other Communies, July 2023

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

22

To conclude: Figure 3 told us that entire apartments were the main Airbnb and VRBO/HomeAway listing

type in Calgary in July 2023 followed by basement suites. Breaking this down by community provides a

more nuanced view and shows us that listing type varies by community. Centre communities are the most

likely to have entire apartment listings whereas developing communities are the most likely to have

basement suites. This variation is most likely due to housing type in each community. While we do not

have data to confirm, it is intuitively likely that centre communities in the downtown core, have more

apartments/condos and less multi-family (townhouses, duplex, triplex) and single detached houses, while

the opposite is true in developing communities.

14

Another explanation for the increased presence of basement suites in developing communities is changes

to the process for approval of secondary suites combined with zoning changes. Prior to March 2018,

homeowners that wanted to renovate their home and include a legal secondary suite had to appear in

from of City council to request a land use re-designation. As of March 2018, this requirement was

abolished and homeowners were required, instead, to register their secondary suite and prove they met

certain safety and legal requirements. With respect to zoning, as of April 2016, the Residential Low Density

Mixed Housing (R-G)(R-Gm) District was introduced. Under the RG zoning, more flexible forms of housing

were allowed and, in particular, secondary suites are a permitted use: approval before City council for a

secondary suite (prior to March 2018) was not required. After April 2016, developing communities sought

the RG zoning designation, and were able to include secondary suites as an additional (optional) feature

to those looking to build a house in the community.

15

In sum, newer homes in developing communities

are more likely to have basement suites due to RG zoning compared to established communities (e.g.,

centre communities) who were established before RG zoning and were not initially built with basement

suites.

14

Note that Census 2021 data that would allow us to confirm this is not available by community. And, while Census 2016 data is

available, it does not encompass the developing communities.

15

See for example https://app.tricohomes.com/communities/seton

Calgary STR Listing Summary

• Despite the reduction in STR listings during the COVID-19 pandemic, STR listings in Calgary are

higher than ever and appear to be growing at the pre-COVID rates.

• The communities with the greatest number of STR listings are centre communities and developing

communities, while STR listing growth is primarily driven by developing communities such as Seton

Livingston, and Cornerstone, as well as the Beltline. These are the communities that likely

experience the greatest STR activity.

• The most frequent listing type in Calgary are entire apartment listings followed by basement

suites; however, this differs by community. Centre communities (e.g., the Beltline East Village,

Commercial Core) are more likely to have entire apartment listings, while developing communities

(e.g., Seton, Livingston, Cornerstone) are more likely to have basement suite listings, and “other”

communities have a more varied mix of listings. These differences are likely driven by the different

choice of housing in different communities and zoning.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

23

4. Demand Side: A Look at Airbnb and VRBO/HomeAway Bookings,

Occupancy Rate, and Community Impact

STR listings are only one side of the STR market – the supply side. In this section, we examine the demand

side of the STR market in Calgary. In particular, we examine the number of nightly bookings per month in

active Airbnb and VRBO/HomeAway listings, their occupancy rate, and STR-related complaints. We further

beak these down by communities. This will give us a sense of not just how many listings there are, but

how frequently they are visited by guests, particularly post-pandemic, and the impact on the peace of the

community.

4.1 Time Trends: Nightly Bookings

We begin by examining the number of nightly bookings in active Airbnb and VRBO/HomeAway per month

to determine whether and how the COVID-19 pandemic affected STR bookings in Calgary. In July 2023,

there were 96,723 nightly bookings in Calgary Airbnb’s and VRBOs/HomeAway’s—the highest number of

nightly bookings per month recorded. Figure 9 shows a time trend of the number of nightly bookings per

month in active Airbnb and VRBO listings for Calgary (left graph) and Edmonton (right graph) between

January 2017 and July 2023. The black line shows total bookings in an active listing, the blue line shows

bookings in active listings that are self-described by hosts as an “entire home/apartment”, and the red

line shows bookings in active listings that are self-described by hosts as “private rooms”.

16,17

Figure 9 shows that nightly bookings per month display a seasonal trend. In Calgary, bookings are always

highest during Stampede months (July) with another smaller peak in December. In Edmonton, bookings

are highest in July or August during Capital Ex with smaller peaks in December. This is consistent with

seasonal trends seen with active listings in Figure 1.

Further, while nightly bookings in Airbnb and VRBO/HomeAway’s have increased over the time period

examined, this increase has not been consistent. Airbnb and VRBO/HomeAway nightly bookings declined

in both cities beginning in early 2020 at the onset of the COVID-19 pandemic. Nightly bookings in both

cities began to recover in summer 2021. Calgary nightly bookings surpassed pre-pandemic levels in

October 2022, the same month the number of active listings surpassed pre-pandemic levels. Edmonton

nightly bookings surpassed pre-pandemic levels in March 2022, seven months before Calgary and three

months before their number of active listings surpassed pre-pandemic levels. This suggests a faster re-

bounding of demand in Edmonton compared to Calgary and compared to supply (e.g., listings).

As with listings, the majority of Airbnb and VRBO/HomeAway nightly bookings in Calgary and Edmonton

are in self-described “entire home/apartments” listings: around 82% of all Airbnb and VRBO/HomeAway

nightly bookings in July 2023 were in self-described “entire home/apartments” listings in both cities.

Nightly bookings in self-described private rooms are growing in both Calgary and Edmonton post-COVID;

however, as with listings, they have not yet reached pre-pandemic levels. This growth of nightly bookings

16

Note that active listings self-described as “shared rooms” are not shown as they make up less than 1% of active listings.

17

As we will show, these self-described listing types are not standardized. We standardize them based on manual inspections for

April 2023 – July 2023 and present the results below.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

24

in self-described private rooms appears to be somewhat stronger than the growth in active listings;

however, this will be examined in the section on occupancy rate.

Figure 9: Acve Airbnb and VRBO/HomeAway Nightly Bookings per Month, Calgary and Edmonton, January 2017 - July 2023

4.2 Year-Over-Year Change in Nightly Bookings

To examine the effect of the COVID-19 pandemic on the STR market in Calgary in closer detail, Figure 10

plots the number of Airbnb and VRBO/HomeAway nightly bookings per month year-over-year. The first

panel of Figure 10 only includes pre-pandemic years, 2017 to 2019. Each additional panel introduces one

additional post-pandemic year until all years are shown (2017 to 2023). This allows us to examine the

number of nightly bookings per month for each year in isolation.

In the top left panel of Figure 10, we see that from 2017 to 2019, Airbnb and VRBO/HomeAway nightly

bookings in Calgary grew steadily from 10,136 bookings in January 2017 to 41,455 bookings in December

2019 — a 309% increase in bookings. However, when the pandemic hit in March 2020, we see from the

top right figure, Airbnb and VRBO/HomeAway nightly bookings in Calgary declined to below 2017 levels.

They remained below 2017 levels until August 2021 (middle left panel). In October 2022, the number of

Airbnb and VRBO/HomeAway nightly bookings surpassed 2019 nightly bookings (at the same time as

listings shown in Figure 2). This growth trend has continued and increased into 2023. As the bottom right

panel shows, the number of nightly bookings in July 2023 was up 20,996 bookings (28%) from the number

of bookings in July 2019. As with active Airbnb and VRBO/HomeAway listings, this suggests that Airbnb

and VRBO/HomeAway nightly bookings are once again on a steadily increasing growth path in Calgary

despite being interrupted by the pandemic.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

25

Figure 10: Airbnb and VRBO/HomeAway Nightly Bookings per Month, Year-Over-Year, Calgary, January 2017 - July 2023

4.3 Occupancy Rate

So far, we have documented that for both Airbnb and VRBO/HomeAway active listings and nightly

bookings they have been back on pre-COVID growth paths. The question for this section is: what are the

relative growth rates? Have active listings and nightly bookings grown at the same rate or has one

outpaced the other? This is important because if there are more active listings than nightly bookings,

Airbnb and VRBO/HomeAway listings may be quiet and have very little impact on the peace of a

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

26

community. However, if Airbnb and VRBO/HomeAway nightly bookings are outpacing active listings, there

may be a higher level of traffic and turn-around that may be more disruptive to the peace of a community.

As suggested, we examine the occupancy rate. Occupancy rate is calculated by taking, for each individual

active Airbnb and VRBO/HomeAway listing, the number of nightly bookings in a month divided by the

number of nights available in a month. For example, if an active listing is available 30 nights of a month

and is booked for 15 nights in the same month, the occupancy rate is 50%.

18

The “average occupancy rate”

is the average of the occupancy rate across all active Airbnb’s and VRBO’s/HomeAway’s in a month. Figure

11 shows the average occupancy rate of active Airbnb and VRBO/HomeAway listings for Calgary (left

graph) and Edmonton (right graph) between January 2017 and June 2023. The black line shows average

occupancy rate across all listing types. The blue line shows the average occupancy rate in active listings

that are self-described by hosts as an “entire home/apartment”, and the red line shows the average

occupancy rate in active listings that are self-described by hosts as “private rooms”. In general, if active

listings have grown at a faster rate than nightly bookings, we expect to see a drop in the average

occupancy rate and vice versa.

Figure 11 shows the similar seasonal trends seen with active listings and nightly bookings. The average

occupancy rate is always highest in Stampede months (July) for Calgary and in July/August for Edmonton

(Capital Ex). Interestingly, there is no peak in occupancy rate in December suggesting there may be more

active listings available compared to nightly bookings.

Figure 11: Airbnb and VRBO/HomeAway Average Occupancy Rate, Calgary and Edmonton, January 2017 - July 2023

Also, in recent months another interesting pattern has emerged. The average occupancy rate in Calgary

grew steadily pre-pandemic, and then, as with active listings and nightly bookings, it was interrupted by

the pandemic. The occupancy rate increased again between summer 2021 and summer 2022 in Calgary;

18

A host may “block” nights. If a night is blocked, that listing is not available for that blocked night.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

27

however, as of summer 2023, the occupancy rate has slowed and declined. In summer 2023, the

occupancy rate was lower than the occupancy rate in summer 2022 in Calgary. Likewise, for Edmonton,

the occupancy rate initially increased post-pandemic from 2020 to 2021; however, it has stagnated and

declined since then. This suggests that in Calgary as of summer 2023 and in Edmonton as of 2021/2022,

the growth in the number of active listings has outpaced the growth in nightly bookings per month: the

supply side has grown faster than the demand side. This same trend is observed for both self-described

entire home/apartment listings and for self-described private rooms.

4.4 Nightly Bookings and Occupancy Rate by Community

As seen with STR listings, these time trends that aggregate across Calgary hide community-level patterns

that are important to understanding the STR market. In this section, we examine Airbnb and

VRBO/HomeAway nightly bookings and occupancy rate by community. We examine both April 2023 and

July 2023. As seen in the time trend graphs, April tends to be a quieter month for the STR market while

July tends to be a busier month. Further, both April 2023 and July 2023 are post-COVID.

Figure 12 shows the number of bookings (left) and the occupancy rate (right) in April 2023 in Calgary by

community. Likewise, Figure 13 shows the number of bookings (left) and the occupancy rate (right) for

July 2023 in Calgary by community. Note that for occupancy rate, we have limited our examination to

those communities with more than five Airbnb’s and/or VRBO/HomeAway’s.

19

Table 3 shows the top 10

communities by bookings while Table 4 shows the top 10 communities occupancy rate, both for July 2023.

From these figures and graphs, we make several observations. First, unsurprisingly, the communities with

the most nightly bookings largely mirror the communities with the most active Airbnb and

VRBO/HomeAway listings. These communities are all either in the centre or a developing community.

However, despite the fact that these communities have the most active listings and nightly bookings, they

do not necessarily have the highest occupancy rate. For example, the Beltline, which has the most active

Airbnb and VRBO/HomeAway listings and nightly bookings, is only ranked 107

th

of 166 communities with

an occupancy rate of 74%. Regardless, the top 10 communities by nightly bookings in Table 3 all have an

occupancy rate of 67% or greater, indicating they were relatively busy STR communities in July 2023.

Second, the top 10 communities by occupancy rate are not in the top 10 lists for active listings nor nightly

bookings. Further, they have very few Airbnb or VRBO/HomeAway listings (25 or less), and none of them

are in centre communities. This suggests that, on the one hand, Airbnb and VRBO/HomeAway listings in

centre communities have more competition and thus may not have as high an occupancy rate as active

listings in less competitive communities. Furthermore, it suggests that Airbnb and VRBO/HomeAway

listings in competitive STR communities are sought after by guests. This may be because of their location,

e.g., away from busier Stampede grounds, closer to family/friends, etc., or easier access, e.g., less parking

restrictions/more free parking.

19

There are some communities with only 1 or 2 STR listings with very high occupancy rates. This results in an irregularly high

occupancy rate, obscuring the general pattern.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

28

Figure 12: Bookings and Occupancy Rate by Community, April 2023

Figure 13: Bookings and Occupancy Rate by Community, July 2023

Finally, how much STR activity is in a community differs by time period. We present here data for July

2023 which is a snapshot in time. July is a very busy month for STRs due to stampede. Other months are

less busy. In looking at other months, the top 10 communities by nightly bookings only changes marginally.

For average occupancy rate, the change in the ranking of communities across time periods is more

substantial. For example, of the top 10 communities by occupancy rate in July 2023, zero of those are in

the top 10 communities by occupancy rate in April 2023, and they also have very few active listings and

nightly bookings. These temporal changes need to be kept in mind when considering the data.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

29

Table 3: Top 10 Communies by Nightly Bookings, July 2023

Community

Number of

Nightly

Bookings

Occupancy

Rate

Sector

Community

Status

(2021)

BELTLINE

12,408

.74

CENTRE

ESTABLISHED

LIVINGSTON

2,246

.76

NORTH

DEVELOPING

SETON

2,008

.77

SOUTHEAST

DEVELOPING

CRESCENT HEIGHTS

1,898

.75

CENTRE

ESTABLISHED

SUNNYSIDE

1,838

.78

CENTRE

ESTABLISHED

DOWNTOWN EAST VILLAGE

1,572

.85

CENTRE

ESTABLISHED

CORNERSTONE

1,493

.86

NORTHEAST

DEVELOPING

CHINATOWN

1,326

.67

CENTRE

ESTABLISHED

BRIDGELAND/RIVERSIDE

1,273

.69

CENTRE

ESTABLISHED

BOWNESS

1,204

.75

NORTHWEST

ESTABLISHED

Table 4: Top 10 Communies by Occupancy Rate, July 2023

Community

Average

Occupancy

Rate

Number

of

Listings

Number of

Bookings

Sector

Community

Status

(2021)

VISTA HEIGHTS

.94

7

145

NORTHEAST

ESTABLISHED

CEDARBRAE

.93

10

233

SOUTH

ESTABLISHED

RUNDLE

.93

10

157

NORTHEAST

ESTABLISHED

SILVERADO

.92

22

368

SOUTH

DEVELOPING

MIDNAPORE

.91

9

106

SOUTH

ESTABLISHED

SCENIC ACRES

.91

19

349

NORTHWEST

ESTABLISHED

MILLRISE

.90

6

127

SOUTH

ESTABLISHED

COUNTRY HILLS

VILLAGE

.89

7

153

NORTH

ESTABLISHED

MACEWAN GLEN

.89

8

93

NORTH

ESTABLISHED

HASKAYNE

.88

25

557

NORTHWEST

DEVELOPING

4.5 Community Impacts: Complaints by Community

In this section, we examine whether and how the busier STR communities identified above affect their

communities. In particular, we look at complaints by community.

20

To do this, we count the total number

of complaints to by-law that are STR related from May 2022 to April 2023. We use a year’s worth of

complaints as there are very few complaints in any given month. We focus on the total number of

complaints as we are concerned here with community impact: the number of complaints indicates the

total level of community disruption. Complaints range from noise-related to untidy private/public

20

This data was provided to us from the City Calgary and covers the period from January 2018 to April 2023 by community. It

includes all complaints made to the City of Calgary 311 line (e.g., non-emergency by-law services) that includes the mention of

an STR or related phrasing (e.g., Airbnb, VRBO, etc.).

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

30

property, to ice/snow on sidewalk and unkept lawn and weeds. Overall, over this time frame, there were

1,031 complaints, with 175 (17%) of those being noise complaints.

Figure 14 shows the total number of complaints over May 2022 to April 2023 by community while Table

5 lists the top 10 communities by number of STR-related complaints. The Beltline has the most complaints

by far, with 77 complaints from May 2022 to April 2023 (and 58 (75%) of those are noise complaints). The

community with the second most number of complaints was Crescent Heights with a total of 62

complaints from May 2022 to April 2023.

Surprisingly, other communities with a large number of listings have relatively fewer complaints. For

example, Seton and Livingston—which both had a high number of STR listings and were some of the

fastest growing communities with respect to STR listings—had few complaints. Seton had six STR-related

complaints and Livingston had 15 STR-related complaints from May 2022 to April 2023.

Figure 14: Number of STR-Related Complaints by Community, May 2022 – April 2023

Table 5: Top 10 Communies by Number of Complaints, May 2022 - April 2023

Community

Number of

Complaints

Sector

Community

Status (2021)

BELTLINE

77

CENTRE

ESTABLISHED

CRESCENT HEIGHTS

62

CENTRE

ESTABLISHED

HILLHURST

30

CENTRE

ESTABLISHED

BANKVIEW

28

CENTRE

ESTABLISHED

CITADEL

27

NORTHWEST

ESTABLISHED

BOWNESS

21

NORTHWEST

ESTABLISHED

BANFF TRAIL

20

CENTRE

ESTABLISHED

ACADIA

18

SOUTH

ESTABLISHED

SUNALTA

17

CENTRE

ESTABLISHED

HIDDEN VALLEY

16

NORTH

ESTABLISHED

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

31

We hypothesize that this difference across communities is associated with listing type. That is, we

hypothesize that communities with a higher percentage of entire apartment and entre multi-family unit

STRs will have more complaints than communities with a higher percentage of entire basement suites,

entire upper suites, and entire single detached house STRs.

21

This is because entire apartment and entre

multi-family unit STRs are potentially in closer contact with non-STR related residents whereas entire

basement suites, upper suites, and entire single detached house STRs are somewhat removed from

interactions with non-STR related residents. To verify this, we examine the correlation between the

percentage of listings in a community by listing type (as re-categorized by us and shown in Figure 3) and

the total number of STR-related complaints in a community. We find that the sign of the correlation

coefficient verifies this hypothesis: a higher percentage of entire apartment and entre multi-family unit

STRs is associated with an increase in STR-related complaints whereas a higher percentage of entire

basement suites, upper suites, and entire single detached house STRs is correlated with a decline in the

number of STR-related complaints. It should be noted that these correlations were not statistically

significant except for the correlation between total complaints and the percentage of entire apartments.

Together, this information leads to the following observations. Communities with a higher number of

complaints tend to be located in the centre and have a relatively high number of active Airbnb and

VRBO/HomeAway listings. The number of active listings is only partially contributing to this result as not

all communities with a large number of active listings have a large number of STR-related complaints,

particularly in developing communities. These results may be correlated with the type of listings that are

more prevalent in communities. Particularly, an increase in the percentage of listings that are suites or

entire single detached houses are correlated with less complaints while an increase in the percentage of

listings that are entire apartments or entire multi-family units are correlated with more complaints.

21

Note that we look at the percentage of listing type as opposed to the number by listing type. What we want to know is how

the composition of STR listings (not the number) affects the total number of complaints.

Calgary Nightly Bookings and Occupancy Rate: Summary

• While the COVID-19 pandemic interrupted the growth of nightly bookings, growth has resumed

post-COVID, particularly for self-described entire home/apartment listings.

• However, this growth in nightly bookings has been slightly slower in recent months than the

growth in active listings as indicated by the recent decline in the occupancy rate. This suggests that

the supply of STR’s is outstripping demand somewhat.

• Unsurprisingly, by community, nightly bookings are concentrated in communities with more active

listings. Communities with the most nightly bookings are located in centre communities and

developing communities, and, while they do not have the highest occupancy rates, they do have

high (69%+) occupancy rates, indicating significant STR traffic in these communities.

• Communities with more STR-related complaints tend to be located in centre communities, have a

higher number of active listings and nightly bookings, and have a higher percentage of listings that

are entire apartment or entire multi-family unit listings. The overall business of the STR and the

proximity to non-STR related neighbors both appear to matter.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

32

5. Monetary Incentives: Revenues of

Airbnb and VRBO Listings

In this section, we examine revenues made by Airbnb and VRBO/HomeAway hosts in Calgary. Along with

being another indicator of market size, STR revenues have also been found in the STR literature to vary by

community, potentially indicating communities with higher STR potential. Thus, we examine both the

general revenue time trend followed by a spatial analysis of revenues.

5.1 Revenue Time Trends

In July 2023 alone, Calgary Airbnb and VRBO/HomeAway active listings earned collectively $22.1 million

CAD. While this is a large number, it should be remembered that this is revenue, not profit. Out of this

revenue, hosts cover fees such as cleaning fees and utilities, as well as various government taxes and

levies, including GST (if applicable), property taxes, income taxes, and the Alberta Tourism Levy.

22

Since January 2017, the revenue earned by Airbnb and VRBO/HomeAway hosts has increased. Figure 15

shows this increase in revenue for all Airbnb and VRBO/HomeAway listings (black line), self-described

entire home/apartments (blue line), and self-described private rooms (red line) in both Calgary (right

panel) and Edmonton (left panel). In Calgary, total revenue grew from $0.9 million in January 2017 to

$22.1 million in July 2023: an increase of over 2,000%. As with active listings and nightly bookings, Figure

15 shows that while the COVID-19 pandemic interrupted the growth of revenues, since about summer

2021, total revenues have continued their upward trend and are higher than ever before. However, this

should be interrupted with caution. Given the high inflation in 2023 and the increasing government taxes

(including the introduction of the Alberta Tourism Levy effective in April 2021), the cost of operating an

STR are also higher than ever before.

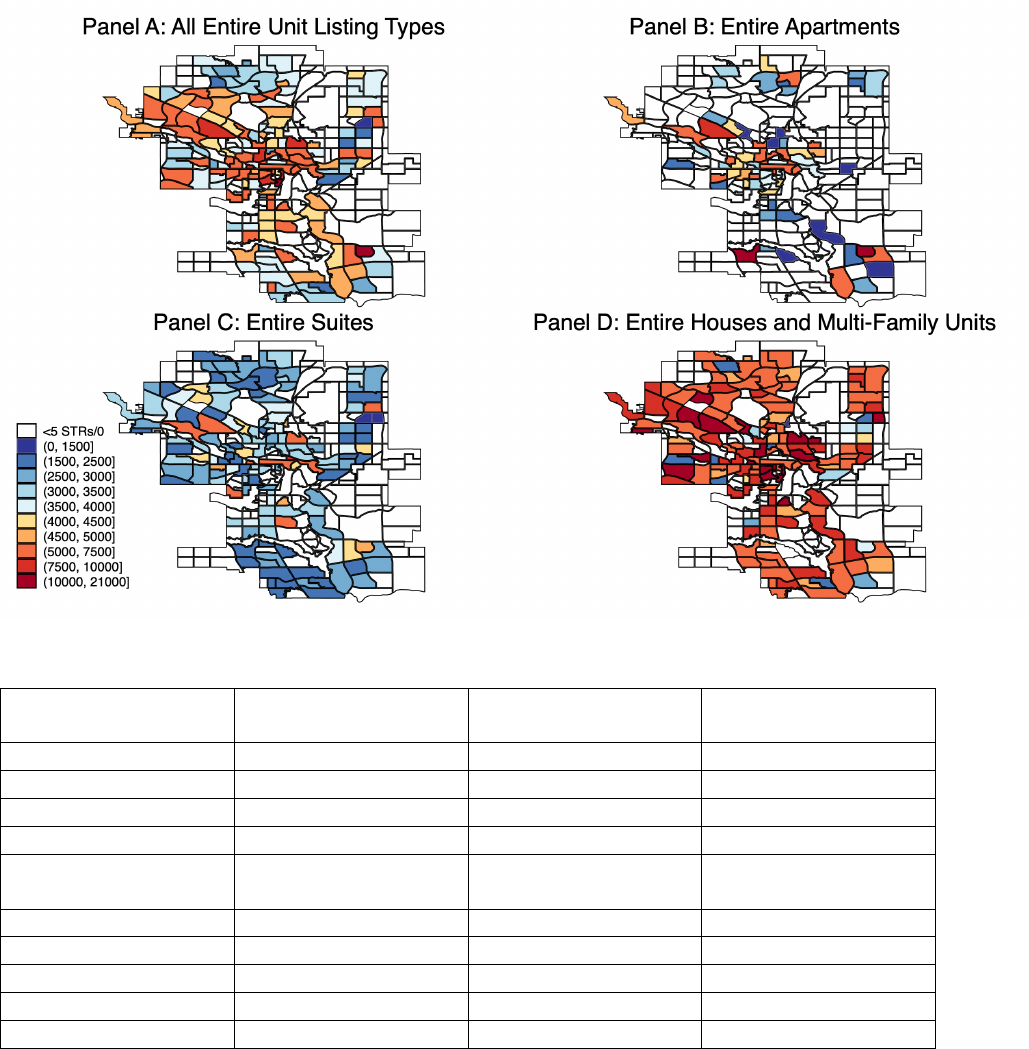

1.1 Revenue by Community

In July 2023, Airbnb and VRBO/HomeAway active listings made an average revenue of $4,047/month in

Calgary (after removing listings which made zero revenue). However, average listing revenue varies by

community

23

and by listing type. To examine average listing revenue by community, we again show a heat

graph of average revenue by community for July 2023 in Figure 16. In Panel A, we include only entire

home/apartments (as manually verified by us). In Panel B, we include only entire apartments, Panel C

includes only entire suites (upper or basement), and Panel D includes only entire detached houses or

entire multi-family units (townhouses, duplexes, and triplexes). Table 6 shows the top 10 communities by

average revenue per active entire unit listing. For all, we only show communities where there are five or

more of the listing type in the community.

22

Our data does not include information on the costs of operating an STR.

23

Note that we do not show total STR revenue by community here. Usurpingly, it largely follows the same pattern seen in the

listings and nightly bookings analysis previously with centre communities like the Beltline and developing communities such as

Seton and Livingston, being top earners.

Short-Term Rentals in Calgary | UNIVERSITY OF CALGARY

33

Figure 15: Acve Airbnb and VRBO/HomeAway Revenues, Calgary and Edmonton, January 2017 - July 2023

The first observation to make is that communities with more active listings and more nightly bookings do

not necessarily have a higher average revenue per listings. For example, entire unit listings in the Beltline

earned on average $5,577/month—less than half the average revenue earned by entire unit listings in

New Brighton ($12,761/month). Active listings in Seton and Livingston earned even less on average

($2,872/month and $3,771/month, respectively).

Second, of the top 10 communities by average revenue per entire unit listing, centre communities make

up six of them. However, this is weighted by the disproportionately high average revenue per entire suite

listings and per entire detached house listing in those same centre communities. Entire apartment listings

in centre communities do not earn as much on average as entire apartment listings outside of centre