TEXAS

Private Passenger Automobile

Semi-Annual Program

Effective:

December 10, 2016 New Business

January 24, 2017 Renewals

TABLE OF CONTENTS

Company Contact Information

2

Agent Information

3-5

Binding Authority

3

Agent Duties

4

Commission

5

Product Information

6-11

Coverage & Limits

6

Non-Owner

7

Policy Term

7

Fees

7

Payment Plans

7

Drivers

8

Vehicles

9

Surcharges

10

Discounts Requiring Documentation

11

Additional Discounts and Surcharges

11

Policy Services

12-14

SR22 Filings

12

Endorsements

12

Cancellations

13

Renewals

13

Reinstatements

13

Rewrites

14

Premium Determination

14-15

Driver Classification

14

Physical Damage

14

Insurance Scoring

15

Claims

16

Material Misrepresentation

16

Appendix A – Unacceptable Vehicles

17

2

COMPANY CONTACT INFORMATION

Customer Service & Underwriting

Phone Number 866-GAINSCO (424-6726)

Fax Number 800-532-3522

Claims Department

Phone Number 1-800-699-1561

Fax Number 1-800-699-1560

Help Desk / Technical Support

Phone Number 1-800-699-1561

Agents Login: New Business, Supplies, etc.

GAINSCO Connect: Agents Login www.gainscoconnect.com

GAINSCO Auto Insurance Address

Mailing Address GAINSCO Auto Insurance

P.O. Box 199023 Dallas, TX 75219-9023

Texas Marketing

East Phone: 817-991-0965

Dallas Phone: 214-729-7935

Central Phone: 512-757-3292

North Houston Phone: 281-222-4509

South Houston Phone: 832-221-0482

North West North / Fort Worth North Phone: 817-538-0642

North West South / Fort Worth South Phone: 817-264-2256

South Central Phone: 210-542-4859

Business Development Team – Other Areas

Email: Businessdev@Gainsco.com Phone: 972-629-4974

Marketing/Agency Support Coordinator

Phone: 800-699-1561 x 4966

3

AGENT INFORMATION

It is virtually impossible to set forth our underwriting program in its entirety within this

manual. All applications will be reviewed and underwritten on their individual merits.

This manual addresses minimum requirements. If in doubt, please call customer service

before binding.

Binding Authority

Agents have immediate binding authority in accordance with all the rules and

procedures set forth in this manual. The agent must be a duly authorized agent of MGA

Agency, Inc. (“Company”).

Coverage will be bound at the exact date and time the application is completed,

signed and dated by both the applicant and agent if the following conditions are met:

All of the information entered into the New Quote screen on

GAINSCOconnect.com must be submitted to the Company using the

portal.gainscoconnect.com website. Paper applications are unacceptable.

The application process is completed in its entirety when all required

documentation is obtained from the applicant, including but not limited to: a

signed and completed application with exclusions and rejections as

appropriate, household driver discovery affidavit, documentation for any

discounts and vehicle inspection form(s) if applicable.

The risk is not defined as being unacceptable in this manual.

The appropriate down payment or full premium and any applicable fees are

collected from the applicant and submitted to the Company.

Coverage is not bound and is considered null and void if the applicant’s down

payment check is returned by the bank for insufficient funds. Please notify the

company immediately upon receipt of notice of NSF from the applicant’s bank. If an

application is submitted with an incorrect driver class, surcharge, discount, etc. or

without the required proof for a specific discount, the policy will be issued at the

appropriate rate level according to the rules set forth in the program manual.

Unless notified otherwise, all submissions for new business and endorsement on existing

policies that have an effect of increasing the company’s exposure are suspended from

the time the National Weather Service issues a severe weather advisory (i.e. hurricane,

tornado, or thunderstorm watch/warning) within 100 miles of the watch/warning area.

Normal submission activity will be reinstated unless otherwise notified 24 hours after the

watch/warning is lifted by the National Weather Service.

4

Agent Duties

The Agent must assure compliance with all our Company’s underwriting guidelines,

procedures and requirements. The Agent is responsible that the entire application

package, including exclusions and rejections as appropriate, are reviewed with the

Applicant and approved by the Applicant. The Agent is also required to verify the

Applicant is the named insured prior to submitting any documents.

All applications must be uploaded to the Company using the

portal.gainscoconnect.com website.

If you are unable to upload an application through GAINSCOconnect.com, please

contact Customer Service or the Help Desk for assistance.

If an applicant is adversely impacted by information contained in a consumer report, or

our inability to pull a consumer report, we will generate a letter pursuant to the

provisions of the Fair Credit Reporting Act (FCRA). A copy of the FCRA letter must be

printed and provided to the applicant.

For applicants with no prior insurance and no more than one accident or violation, if

the premium quoted for Personal Injury Protection or Uninsured Motorist Coverage

equals or exceeds the rate charged by TAIPA for these coverages, the agent must

notify the applicant. A sample notice is provided under the Printable Forms section of

www.GAINSCOconnect.com.

Agents may obtain the named insured signature on our Texas Automobile Insurance

Application, UM/UIM Bodily Injury, UM/UIM Property Damage, Personal Injury Protection

rejections, policy forms or statements, and any other documents utilizing electronic

signature (e.g. services offered by DocuSign, EchoSign or other electronic signature

service providers) . The Agent is responsible for providing the Applicant the opportunity

to consent to electronic signature. The Agent is responsible for complying with all

applicable state and federal e-signature laws.

Agents must keep all documentation, including the appropriate applicant

signatures, on file for the appropriate number of years. The Company reserves the

right at any time to inspect all applicant files and/or require agent to submit

copies of documentation to us for audit/review purposes.

The following documentation (if applicable to the policy) must be kept in your

Agency’s file for 3 years after the date of the transaction, or for the amount of

time prescribed by all applicable laws and regulations, whichever is greater, and,

as stated above, be available for Company review as requested:

Completed and signed Texas Automobile Insurance Application, including

signed UM/UIM Bodily Injury, UM/UIM Property Damage and Personal Injury

Protection rejections

A copy of the driver license, Matricula, and/or ID for the applicant, for each non-

excluded driver listed on the policy, and for any driver listed as an excluded

spouse

Signed driver exclusion form(s)

5

Signed household member affidavit

Proof of prior insurance coverage

Proof of home ownership

Any document proving accidents were not-at-fault

Signed and dated Vehicle Inspection Form(s) or photographs as specified below

Credit Card payment/Recurrent EFT authorization form

MGA Agency, Inc. reserves the right to inspect all applicant files and/or require

the agent to submit copies if requested by the company for audit and

compliance purposes.

Vehicle Inspection Requirement

Agents are required to complete a vehicle inspection for each vehicle with

Comprehensive, Collision, and/or Uninsured Motorist Property Damage coverage.

The Agent may either complete the vehicle inspection form or provide

photographs and must retain records of either in the agency’s file per guidelines

listed above. If the vehicle being insured is a new purchase from a dealership, the

Agent must obtain a copy of the purchase receipt and Vehicle Inspection Form

within 7 days of purchase and keep in your agency’s file per guidelines listed

above.

Photo Requirements

In lieu of a completed vehicle inspection form, the following photographs may be obtained and

retained with the application:

Four corner photos

A photograph should be taken of each corner of the vehicle which in total will

show the entire exterior of the vehicle.

VIN

One clear photograph of the VIN plate located on the dash or door.

Mileage

One clear, legible photograph of the vehicle odometer showing current mileage.

Damaged Areas

Clear photographs of any existing damage on the vehicle must be obtained.

Commission

Refer to the Agency Agreement for the exact commission schedule.

MGA Agency, Inc. reserves the right to alter commission schedules with notice to

agency per Agency Agreement.

6

PRODUCT INFORMATION

Coverages & Limits

Bodily Injury Liability $30,000/person $60,000/accident

Property Damage Liability $25,000/accident

Uninsured/Underinsured Motorist BI* $30,000/person $60,000/accident

Uninsured/Underinsured Motorist PD* $25,000/accident

Personal Injury Protection* $2,500/person

Medical Payments $500, $1000, $2000 or $5000/person

Comprehensive & Collision Deductible options: $250, $500, or $1000

Custom or Additional Equipment $2,500/vehicle

Towing & Labor $40, $75, or $100/disablement

Rental Reimbursement $20/day, $600/occurrence or

$30/day, $900/occurrence or

$40/day, $1200/per occurrence

*If rejection forms are not completed and signed, coverage will be added to policy

and the applicable premium charged.

Physical damage coverage cannot be selected without liability coverage.

Physical damage coverage cannot be selected on any vehicle over 20 years

old. Vehicles with physical damage and/or Uninsured/Underinsured Motorist

Property Damage coverage must be physically inspected by the agent and the

appropriate vehicle inspection form fully completed.

Comprehensive and Collision coverages are not available separately; these

coverages must be selected together.

Medical payments coverage cannot be selected on the same policy with

Personal Injury Protection coverage.

Custom or Additional Equipment coverage will only be available on

vehicles where Comprehensive and Collision coverage is selected.

Custom or Additional Equipment coverage on vehicles will only be covered

if the custom or additional equipment is listed on the application and

additional premium is paid on the cost new of the equipment.

Custom or Additional Equipment coverage is limited to $2,500 in total value

per vehicle.

Custom or Additional Equipment includes coverage for: custom paint,

custom wheels, phone equipment, stereo/sound equipment, video

equipment, and navigation/GPS.

7

Photos and receipts are required for Custom or Additional Equipment

coverage and should be maintained with the application.

Voluntary Coverage Endorsements

The applicant may select/purchase the following endorsements to increase coverage:

Custom or Additional Equipment Coverage Endorsement

The basic policy does not provide any coverage for Custom or Additional

Equipment installed on the insured vehicle, including items such as custom

wheels, camper shells, or navigational equipment. Purchase of this endorsement

allows an insured to specifically list any custom equipment items they may have

on the insured auto, and obtain coverage for its actual cash value.

Non-Owner Coverage Endorsement

Non-owner liability coverage is available for operators of private passenger vehicles who

do not own or have regular use of a vehicle. Of the coverages listed above, Bodily Injury

and Property Damage are included, Personal Injury Protection, Medical Payments,

Uninsured/underinsured Motorist BI, and Uninsured/underinsured Motorist PD are optional,

and the remaining coverages are not available on a Non-owner policy.

Policy Term

All policies are issued for a term of six months only.

Fees

Policy Fee: $66 per six month policy period

Anti-theft Prevention Fund (ATPF) fee: $1.00 per vehicle per six month policy term

SR22 Fee: $25.00 per filing

Standard Installment Fee: $3.00 for $500 annualized premium, $0.50 additional

for each $250 annualized premium

EFT Installment Fee: $3.00 (recurrent payment by insured checking account or

credit card)

Late Fee: $10.00 for each late installment payment

Payment Plans

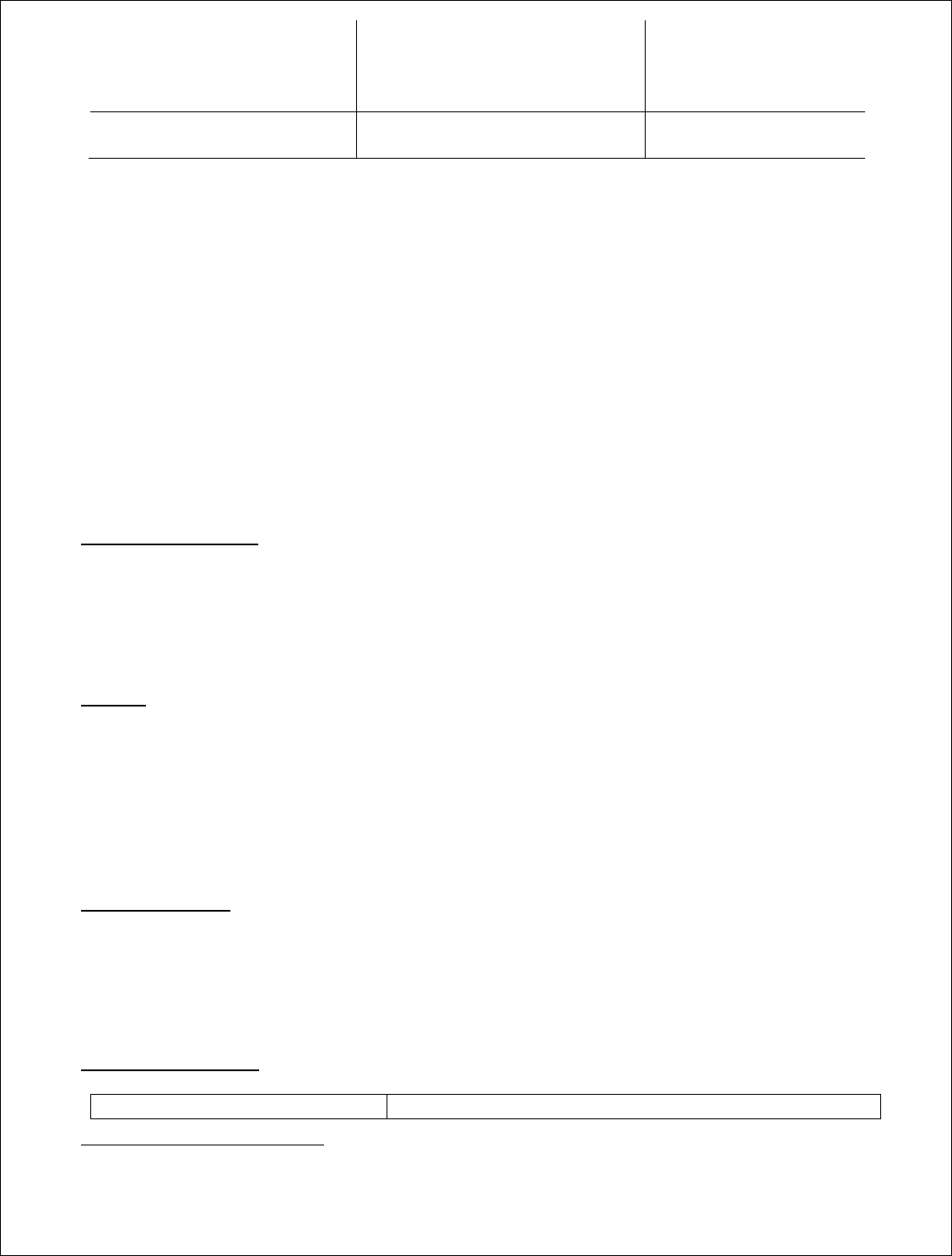

Payment Plan

Down Payment

1

st

Installment Due

6 Pay Plan

(Down + 5 Installments)

16.66% Down

+ ATPF fee + Policy Fee Split

20 Days

(30 thereafter)

6 Pay Plan

(Down + 5 Installments)

23% Down

+ ATPF fee + Policy Fee Split

30 Days

(30 thereafter)

8

6 Pay Plan

(Down + 5 Installments)

Amount no less than 16.67

calculated based on the

flexible date chose

+ ATPF fee + Policy Fee Split

Flexible date chosen

by the policy holder

1

Pay in Full

100% Down

+ ATPF fee + Policy Fee

N/A

All pay plans are available for Agency EFT, Insured EFT and credit card payments.

Auto-Pay is available for Insured checking account recurrent payments and credit

card recurrent payments, when selected an Auto-Pay discount will apply. With

Auto-Pay, the amount due will be swept on the due date.

The Company may introduce, vary and/or remove certain pay plans from the

product line as necessary. Only pay plans shown on our website rating system are

available for use in your area. We charge an installment fee for each payment

and renewal down payment. We do not accept premium financing.

For all pay plans with the exception of the Pay in Full option, the down payment will be

followed by five installments, each of which will include an installment fee. All pay plans

include a policy fee. All pay plans include an Anti-theft Prevention Fund (ATPF) fee per

vehicle per six month policy term will be included in the down payment.

Unacceptable Risks

The company reserves the right to make final underwriting decisions on all applications.

The following is a general list of unacceptable risks; however, a combination of factors

may cause some applications to be unacceptable even if not specifically mentioned in

the following information.

Drivers

All persons 15 years of age or older who are living in the named insured’s household

must be listed on the application. Individuals can be listed and rated as drivers or

specifically excluded. If an individual is to be excluded, the named driver exclusion

must be signed by the named insured. Unlicensed drivers and drivers with a suspended

or expired license are acceptable, but are expected to obtain a license consistent with

the requirements of the State of Texas.

Excluded Drivers

Any household members who are 15 or older and not listed on the policy must be

excluded on the Named Driver Exclusion and acknowledged by the signature of the

named insured. Policies can be written for an insured that is not the registered/titled

owner, but the registered/titled owner must be rated or excluded on the policy.

License State Matrix

License Status

Classification (Corresponds to option on Rater)

1

Policy holder may choose the 1

st

installment due date. The down payment amount of no less than 16.66% will be

calculated accordingly.

9

Texas

Texas

Other U.S. State

Applicable State

Mexico Driver’s License

Mexico

Mexico ID (Matricula)

Mexico

International

Non – USA

Licensed in another Country

Non – USA

Unlicensed or Never Licensed

Unverified License

License Expired

Applicable State with license status of Expired

Occupational

Unverified License

Suspended (with SR-22)

Texas license status of Suspended and with SR-22

Suspended (with no SR-22)

Applicable State with license status of Suspended

Revoked (with SR-22)

Unacceptable

Revoked (with no SR-22)

Unacceptable

Cancelled (with SR-22)

Unacceptable

Cancelled (with no SR-22)

Unacceptable

All other not listed above

Unacceptable

The following drivers are considered unacceptable:

More than 8 drivers per policy.

Any operator who is not a resident of the State of Texas.

Any operator under the age of 15.

Any named insured under the age of 18.

Any operator who lives or works in Mexico.

Migratory risks, including transient and seasonal workers.

All entertainers, athletes, and celebrities, or any professional individual who is

nationally or locally well known to a large segment of the population.

Operators with more than one minor violation in the 36 months immediately

preceding the effective date of the policy.

Operators with more than two at fault accidents in the 36 months immediately

preceding the effective date of the policy.

Operators with more than one alcohol or drug related charge in the 36 months

immediately preceding the effective date of the policy.

Operators with more than one major violation in the 36 months immediately

preceding the effective date of the policy.

Operators with more than two intermediate violations in the 36 months immediately

preceding the effective date of the policy.

Total number of minor violations for all operators listed on a policy cannot exceed

six in the 36 months immediately preceding the effective date of the policy.

Total number of at fault accidents for all operators listed on a policy cannot

exceed two in the 36 months immediately preceding the effective date of the

policy.

Total number of major violations for all operators listed on a policy cannot exceed

two in the 36 months immediately preceding the effective date of the policy.

Total number of intermediate violations for all operators listed on the policy cannot

exceed three in the 36 months immediately preceding the effective date of the

policy.

Students residing and/or attending school in a state other than Texas.

Vehicles

10

All vehicles must be registered/titled to the named insured, his/her spouse, a listed

driver, or an excluded driver. Motor vehicles including private passenger, station

wagon, utility, pickup or van which do not exceed one ton load capacity are eligible

for this program.

The following vehicles are considered unacceptable. See Appendix A for additional

details.

MGA Insurance Company, Inc. does not allow more than 6 vehicles per policy

and does not allow more than 2 extra vehicles, for example 1 driver with 4

vehicles is unacceptable, but 1 driver with 3 vehicles is acceptable.

Vehicle Types

Conversion vans/pickups (for physical damage), and 1-ton vans

Dune buggies, Baja bugs and/or any other type of ATV or off-road vehicle or any

vehicle not licensed for road use

Motorcycles

Hearses and limousines

Rare, antique, classic, vintage, custom, electric, kit, low production, limited

edition, race replica, or show vehicles

Motor Homes, RVs, Campers, Travel Trailers, or any vehicles with plumbing,

cooking, or refrigerator packages

Vehicles built/designed for, or used in, speed contests

Flatbed vehicles

Vehicles having a Gross Vehicle Weight (GVW) of more than 10,000 pounds or

more than 1 ton of load capacity

Open air vehicles, including those with detachable roofs (except convertibles)

not otherwise listed

Saleen Models

Value, Age and Condition

For Liability, any vehicle with a base price greater than $80,000

For Physical Damage, any vehicle with a base price greater than $50,000

Vehicles over 20 years old are not acceptable for Physical Damage coverages

Any vehicle which has been substantially modified in appearance or

performance, or mechanically altered; i.e. high suspension or lift kits

Any pickup, van or utility vehicle that does not have bumpers

Vehicles with pre-existing damage (other than cosmetic), where physical

damage or uninsured/underinsured motorist property damage coverage is

being requested

Salvaged, restored or reconstructed vehicles. Restored salvage may be issued

for liability only

Vehicles not inspected by the agent where physical damage coverage has

been requested

Ownership and Usage

Vehicles titled to a legal entity or DBA

11

Any vehicle not garaged in the zip code for which the policy is written, unless the

vehicle is away at school in the state of Texas.

Any vehicle used for service with a transportation network company, such as

Uber or Lyft.

Any vehicle used for service with a delivery network company, such as UberEATS,

UberRUSH, or Postmates.

Surcharges

Driver points are based on all occurrences and/or violations that have occurred in the

thirty-six months immediately preceding the policy or the renewal date. Any accidents

listed on a motor vehicle, application or other underwriting report will be considered at

fault unless a police report or written explanation is provided stating one of the

following:

The insured vehicle was legally parked.

The insured or a listed driver was struck in the rear while legally stopped for traffic

or a traffic device.

The insured or a listed driver was involved in an accident with a hit & run driver

and reported to the police within 24 hours after the occurrence.

The insured or a listed driver on the policy received a judgment or reimbursement

from a third party and no liability payment was made on behalf of the insured.

All one vehicle accidents are considered at-fault. If an at-fault accident and a

violation arise out of the same incident, the one resulting in the largest surcharge will

apply. If an at-fault accident occurs in conjunction with a major violation, both

incidents will be surcharged.

Discounts Requiring Documentation

If the proof of eligibility for a discount is received after the policy is issued, the discount

will be applied on a pro-rata basis.

Prior Coverage Discount - a prior coverage discount will apply to the policy when

the named insured can provide proof of prior insurance coverage from a

company other than GAINSCO for the six months immediately preceding the

effective date of the policy and has not had a lapse in coverage of more than

30 days. Proof of the prior insurance coverage is required with the application

and the binding of coverage. Acceptable proof of prior insurance includes a

letter of experience on prior carrier letter head, company issued Declaration

page, applicable renewal offer or ID card with an expiration date within 30 days

of the effective date of the GAINSCO policy.

Agency Internal Transfer Discount - a prior coverage discount will apply to the

policy when the named insured is eligible for the prior coverage discount as

defined above and the prior coverage was written by the same agency

submitting the application to GAINSCO. Proof of the prior insurance coverage

and proof that the prior coverage was written by the agency are required with

the application and the binding of coverage. Acceptable proof includes those

forms of proof available for the prior coverage discount when the agency’s

name is shown on the document, and will need to be supplemented with

additional documentation when the agency’s name is not shown. Acceptable

12

proof of prior insurance includes a letter of experience on prior carrier letter

head, company issued Declaration page, applicable renewal offer or ID card

with an expiration date on or after the effective date of the GAINSCO policy.

Prior GAINSCO policies do not qualify for the Agency Internal Transfer Discount.

Homeowner Discount - a discount will apply to the policy when the named

insured submits acceptable proof of homeownership. The individual identified as

the named insured on the auto application must also appear as the owner on

the homeowner’s proof. The homeowner discount is not available to a minor

whose parent(s) are not listed on the policy. Acceptable forms of proof include

a homeowner’s insurance policy declaration page, mortgage statement,

property tax records or property deed. Mobile homeowners are eligible for the

homeowner discount.

Additional Discounts and Surcharges

Any driver added to the policy in term (after the 60

th

day following the effective

date of coverage) that is defined as being unacceptable in the underwriting

rules/guidelines will be surcharged in addition to any other surcharges that may

apply.

If the garaging address or primary area of operation of any listed vehicle on the

policy is moved outside of Texas (after the 60

th

day following the effective date

of coverage) or if the insured moves their residence outside of Texas a surcharge

will apply.

Any vehicle or coverage added in term (after the 60

th

day following the

effective date of coverage) that is defined as being unacceptable in the

underwriting rules/guidelines will be surcharged in addition to any other

surcharges that may apply.

Business use (Class 3) should be assigned to any listed vehicle that is used in the

occupation, profession or business of the insured. A surcharge will apply.

Business use coverage is only available on “private passenger” type vehicles and

pickups with a gross vehicle weight under 10,000 lbs. An insured vehicle assigned

a business class use cannot be registered or titled to a business, corporation,

partnership or DBA.

If a driver possesses a Driver’s License classified as “Unverifiable” (see page 7)

there will be a surcharge applied to the risk.

An advanced purchase discount will be applied when the policy is purchased at

least 3 days prior to the new business effective date. The discount will not be

applied when the Agency Transfer discount or Prior Gainsco discount is also

applied or when proof of prior insurance is not provided.

NOTE: Within the first 60 days following the effective date of coverage, the addition of

any driver, vehicle, or coverage, or a change that otherwise results in a risk that is

unacceptable under our underwriting guidelines, may result in cancellation of the

policy in lieu of the application of an Additional Surcharge.

POLICY SERVICES

SR22 Filings

13

If an SR22 filing is needed by the insured or a member of the household living with the

named insured, it may be done at point of sale if the new application is uploaded

through the company website portal.gainscoconnect.com by following the prompts

that are provided as part of the web upload process. Forms are available upon

request for the issuance of SR22 filings in the agent’s office; please contact your Territory

Manager. If the SR22 filing is needed after the policy is effective, contact Customer

Service for assistance. There is a fee for the processing of the SR22 filing. SR22 filings will

only be processed in the state of Texas for the name insured and for members of the

household living with the named insured.

Endorsements

Endorsements can be processed online at portal.gainscoconnect.com or by phone,

fax, or mail.

Endorsements processed online will detail any additional premium and any amount to

collect. Once the endorsement is submitted online, a confirmation page will generate

and it must be printed, signed by the insured, and maintained in the agency’s file, per

the documentation requirements under the Agent Duties section =of this Rule Guide.

If an endorsement results in a return premium, the insured’s account will be credited

and remaining payments will be lowered.

Agents have 72 hours binding authority (3 calendar days) from the time that the

applicant notifies the producer. After this, the endorsement becomes effective the

date and time of the phone call or fax, or day after postmark. DO NOT BACK DATE

COVERAGE.

Cancellations

Flat cancellation is not permitted by the insured or producer once the policy is in force,

unless there is duplicate coverage for the same risk. If a flat cancellation is being

requested due to duplicate coverage, a copy of the declaration page from the other

insurer indicating the policy dates is required. The company may flat cancel for down

payments which are returned by the bank for non-sufficient funds. Agents are to notify

the company immediately upon receiving notice of the NSF from the bank. A copy of

the front and back of the returned check along with the request to cancel must be

faxed to MGA Insurance Agency, Inc.

Insured’s checks for installment payments that are returned for non-sufficient funds will

be cancelled giving the appropriate notice.

With the exception of flat cancellations, all cancellations will be calculated on a pro

rata basis. A request by the insured to cancel the policy must be in writing and signed

by the named insured; the effective date of the insured requested cancellation cannot

be earlier than the date the agent or company was notified by the named insured.

Renewals

A renewal policy will be issued after the inception of the new policy period if all

premiums owed on the current policy have been paid and the first payment of the

14

renewal policy has been received prior to the expiration of the current policy term.

Renewal offers and non-renewals will be sent at least 30 days prior to the annual policy

anniversary date.

If the appropriate renewal payment is not paid and mailed (U.S. Postal Postmark) by the

expiration date of the six-month policy term, coverage will expire on the final day

(expiration date) of the current policy term (there is no grace period). If the

appropriate annual renewal payment is not mailed/postmarked (U.S. Postal Postmark)

by the actual annual anniversary date, coverage will expire effective that date (there is

no grace period).

The renewal policy can be paid in full or will be billed in six installments to include the

appropriate down payment. The gross premium plus a policy fee will be equally

divided over the installments. The first installment on a renewed policy will include an

ATPF fee for each listed vehicle, plus the SR22 fee if applicable.

Reinstatements

Reinstatements are permitted for up to 30 days. Reinstatements can be processed

online at portal.gainscoconnect.com for up to 7 days from the cancellation date, after

the 7th day reinstatements can be processed by phone or fax to Customer Service.

If a policy is cancelled for underwriting reasons, and the reasons for cancellation have

been corrected prior to the cancellation date, the policy will remain in force without a

lapse.

If the reason for cancellation was for non-payment and payment is

postmarked/received by the agent or company within the cancellation notification

period as required by the insurance code (10 days from the date of the cancellation

notice), the company will reinstate with no lapse in coverage.

If payment is postmarked/received by the agent or company after the cancellation

has taken effect, a reinstatement without a lapse in coverage may be considered at

the company’s discretion (company approval required), only after collection of any

owed premium is paid and a no loss statement is executed and signed by the named

insured for the period of time between the actual cancellation date and the signing of

the no loss statement. An inspection form may also be requested at the underwriter’s

discretion.

Rewrites

Rewrites can be processed online at portal.gainscoconnect.com. A policy that

cancels for non-payment is eligible for the rewrite option. Policies that are ineligible for

the rewrite option include polices that are cancelled for underwriting reasons,

cancelled for insured NSF, had a non-renewal posted or if there is an open claim.

PREMIUM DETERMINATION

15

If an application is submitted with an improper driver class, discount, surcharge, etc. the

policy will be issued at the appropriate rate level according to the rules as set forth in

this manual.

Driver Classification

Age refers to the driver’s age at policy inception (effective date). A marital status of

“single” refers to an unmarried, widowed, divorced or legally separated driver. A

marital status of “married” means a legally married person residing in the same

household as his/her spouse. If a married driver does not have his/her spouse listed or

excluded on the policy, the driver must be rated as “single”.

Physical Damage

A pre-insurance vehicle inspection form must be completed at the time of application

for all vehicles insured with physical damage and/or Uninsured/Underinsured Motorist

Property Damage coverage.

Vehicles should be inspected as follows:

Verify that the VIN number on the dashboard matches the VIN number of the

registration and application.

Walk around the vehicle to check for existing damage. If there is existing

damage, the damage must be clearly described on the inspection form and

photos must be taken and maintained with the application paperwork.

Odometer reading must be completed.

This same procedure applies when endorsing vehicles with physical damage.

A vehicle inspection form is required for each vehicle insured with physical damage

and/or uninsured/underinsured motorist property damage coverage. If a loss occurs

and it is determined that the producer did not actually inspect the vehicle and prior

damages are paid for by the company, the company reserves the right to make a

claim for these previous damages from the producer.

Exception: Vehicle inspections are not required for new vehicles if a copy of a licensed

dealer’s bill of sale, invoice or window sticker is submitted with application.

Insurance Scoring

An Insurance Score based upon credit history information may be ordered for the

named insured as part of the quote process.

To order the Insurance Score, select “Scored” and follow the instructions on the

www.gainscoconnect.com website. Please read the disclosure on the website to

the customer and verify their permission to obtain the score. Select “Agree” only

if the applicant gives permission to obtain the score.

Include the full name, address, date of birth, and last 4 digits of the applicant’s

Social Security Number in order to obtain the Insurance Score. An applicant has

the right to not provide the last 4 digits of their Social Security Number, but this may

result in a No Hit result.

If a score is ordered and results in an applicant not receiving the maximum rate

benefit, or a No Hit or “thin file” result is returned, provide the applicant with the

16

FCRA notification that is generated by the website. If a customer suspects

inaccuracies in their credit information, they may request a copy of their report by

contacting the vendor as instructed in the notice provided.

The insurance score will be automatically re-evaluated every thirty-six months. In

addition, at the request of the named insured, we will re-order the score up to

once annually. Should the score result in a more favorable rate for the insured we

will use it during the renewal pricing process. Otherwise, we will continue to use

the score from the prior policy term.

If the applicant believes their credit information has been directly influenced by

a catastrophic illness or injury, the death of a spouse, child, or parent, by

temporary loss of employment, by divorce, or by identity theft, they may submit

to us in writing a request that we provide an exception to our rates, rating

classification, or underwriting rules related to that information. If an exception is

granted, we will consider only the credit information not affected by the event or

we shall assign them a neutral score. We may require reasonable written and

independently verifiable documentation of the event and the effect of the

event on their credit information before granting an exception. We will not

consider repeated events or events which have previously been reconsidered as

an extraordinary event.

If a score is ordered and returns a result of subject deceased, then the

application is unacceptable. The applicant will have the option to verify/modify

their information and have the Company re-order to obtain a new result.

The Company will not use an insurance score developed using factors that are

prohibited by law or applicable regulation.

CLAIMS

All claims should be reported as promptly as possible. Accidents involving injuries or that

render the insured vehicle not drivable should be reported to MGA Agency, Inc. by

telephone as soon as possible. All other losses should be reported by fax or

correspondence on the appropriate form as soon as possible to the Company.

Claims phone number: 800-669-1561

Claims fax number: 800-699-1560

MATERIAL MISREPRESENTATION

It is important that agents ask all questions directly to the applicant and clearly explain

the consequences of providing false information. Complete and accurate information

on the application is required in order to bind coverage. Material misrepresentation may

result in the policy being declared null and void from inception and will impact the

insured’s rights to policy benefits. It is important that agents explain that a claim may

not be paid if false or misleading information is provided to us. Misrepresentation

includes, but is not limited to the following:

Failure to disclose all household members aged 15 or older.

Use of an incorrect garaging address

Failure to report all prior accidents or violations on the application.

Failure to accurately report vehicle usage or vehicles available for use.

17

APPENDIX A – UNACCEPTABLE VEHICLES

MAKE

MODEL

Acura

NSX

AM General

Hummer H1

Aston Martin

All Models

Audi

R8, RS models, S models

Avanti

All Models

Bentley

All Models

Bertone

All Models

Bluebird

All Models

BMW

8-series, M6, Z8

Bricklin

All Models

Bugatti

All Models

Cadillac

Allante, XLR

Chevrolet

Tracker, Volt, Spark, Captiva, Orlando, Corvette

Chrysler

Prowler

Coda

All Models

Daewoo

All Models

Daihatsu

All Models

DeLorean

All Models

Dinan

All Models

Dodge

Raider, Viper

Eagle

2000 GTX

Ferrari

All Models

Fisker

All Models

Ford

Cobra Models, GT, Saleen Models, Mustang Shelby GT500, F150 SVT,

Transit

GEM

All Models

Geo

Tracker

GMC

Tracker

Isuzu

Amigo

Jaguar

XK Series, F-Type

Jeep

CJ Series, Scrambler

Jensen

All Models

Lada

All Models

Laforza

All Models

Lamborghini

All Models

Lexus

LFA

Lotus

All Models

18

Maserati

All Models

Maybach

All Models

Mazda

SPEED Models

McLaren

All Models

Mercedes-

Benz

AMG Models, CL class, G class, SL class, SLR, Sprinter, 600 Class

Morgan

All Models

Nissan

GT-R

Pantera

All Models

Pinanfarina

All Models

Plymouth

Prowler

Porsche

All Models

Renault

All Models

Rolls-Royce

All Models

Ruf

All Models

Shelby

All Models

Smart

All Models

Sterling

All Models

Subaru

Brat, STI models

Suzuki

Samurai, Sidekick, X90, JIMNY, VITARA

Tesla

Electric

Think

All Models

Triumph

All Models

TVR

All Models

VPG

All Models

Volkswagen

Thing

Wheego

All Models

Yugo

All Models

All Other

Electric Vehicles, Fuel Cell Vehicles, Pickup Trucks Over 1-Ton And All Other

Vehicles 1-Ton Or Greater.