Frugal GRAD Budgeting 101:

Personal Budgeting for Graduate Students and Postdocs

UCHICAGO SEVEN

FACETS OF WELLNESS

Sponsored by:

Campus and Student Life and

UChicagoGRAD

University of Chicago

Personal Budgeting for Graduate Students

• What Is a Personal Budget?

• Elements of a Working Budget

• How to Set Realistic Budget Goals

• What’s In It for Me: Why Budget?

• Lessons Learned—Budgeting Basics from Cynthia Hillman, PhD ‘15

• Examples: Tracking Small Purchases, Especially Food

• Managing Food Costs

What Is a Personal Budget?

A way to make sure you will have the resources to do what you most want to do.

A budget should…..

Have a Purpose or defined goal that is achieved within a certain time period.

Myth: It is intended to identify each individual purchase ahead of time.

Be simple: The more complicated the budgeting process is, the less likely you are to keep up with it.

Myth: Your budget should include all detail of all income and expenses.

Be flexible: A budget will change from month to month and will require monthly review and alternation.

Myth: Your income and expenses should stay the same every month.

Elements of a Working Budget

4

Estimate Monthly

Income

• Take Your Stipend/

Loan Amount and

Divide by the Number

of Months You Need

It to Last (9-12)

• Pay Attention to

Timing of Irregular

Income

Estimate Monthly

Fixed Expenses

• Rent/Housing,

Transportation,

Insurance

(Renter’s/Auto),

Phone/Internet

• Debt Payments

• Factor in Quarterly

School Fees

Estimate Monthly

Variable Expenses

• Groceries and Other

Basics

• Going Out,

Entertainment

• Netflix, Hulu, Cable,

etc.

• Clothing

Savings/Financial

Goals

• Unplanned Expenses

(Illness,

Underemployment)

• Research/Conference

Travel

• Computer or Other

Research Tools

• Retirement

How to Set Realistic Budget Goals

• Define your priorities…budgeting is about decisions,

NOT money.

• Expenses should be about 5% or 10% below your estimated

income. Look to variable expenses to make and impact.

• Aim for a 90% success rate for your budget. Decision fatigue

will catch up with you at some point.

5

What’s In It for Me … Why Budget?

You have a statistically better chance of …

• Reaching your savings and financial goals

• Ensuring you are spending according to your priorities

• Creating peace of mind and ensuring you have money for

the things you need.

6

Lessons Learned - Budget Basics

• Eliminate Mindless Spending

Pay attention to your non-fixed/variable expenses.

Tip: These are food, entertainment, clothing.

• Allocate Funds Immediately

Fund various accounts as soon as you get your stipend/paycheck.

Tip: Savings is a monthly bill due each month.

• Plan Regularly

Review your budget at the beginning of the month or the beginning of each week.

Tip: Give yourself an allowance to spend cash on food & going out.

7

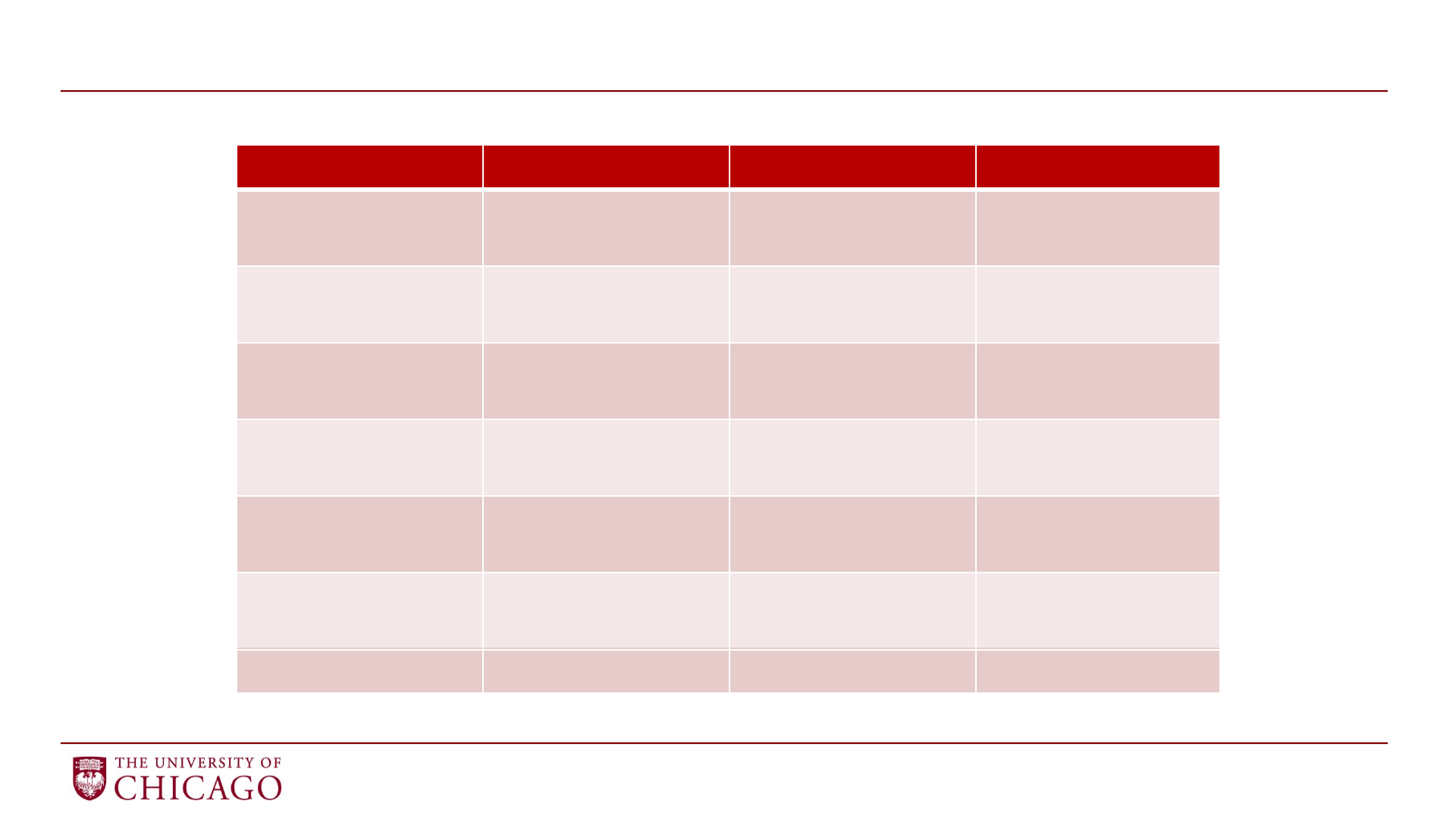

Examples: Tracking Small Purchases, Especially Food

Item

Cost per Item/Day

Cost

per Month

Cost per

Year

Morning Snack

(3x/week)

$2.25

$27

$324

Afternoon Coffee

(3x/week)

$2.25

$27

$324

Sunday Brunch w/

Friends (2x/month)

$20

$40

$480

ILL Library

Fines

(1x/month)

$6

$72

CVS

Runs

(2x/month)

$12

$24

$288

The

Pub after Class

(2x/week)

$6

$120 (per

quarter)

$360

8

Managing Food Costs

9

• PREPARE YOUR

OWN FOOD

• Set aside time on the

weekend to menu plan

• Eat perishable food

first

• Always have a freezer

meal

• KNOW YOUR FOOD

PRICES

• What does your favorite

bottle of wine cost?

• How much is a box of

cereal? One dozen eggs?

A pound of pasta?

• Note: EVERYTHING

goes on sale eventually.