Losing group health insurance coverage during the

COVID-19 outbreak

Due to the COVID-19 outbreak, many Oregonians are experiencing layoffs, drastically reduced

hours, and uncertainty in their jobs. For those with employer-based health insurance, this can

mean the loss of health coverage when it is most vital.

Help is available

There are different options depending on individual circumstances. An important resource for

navigating this process is a licensed health insurance agent.

An online tool to help Oregonians find licensed health insurance agents in their area is available

through the Oregon Health Insurance Marketplace. Enter your ZIP code and select the Health

Insurance Agents option to find a list of licensed agents who can help you navigate this process.

Seven ways workers with employer-based insurance can maintain coverage after a layoff or

reduction in hours

1. After a loss of employer-based coverage, a person can purchase insurance on the

Oregon Health Insurance Marketplace

The loss of employer-sponsored health coverage (e.g., from a job loss) triggers a special

enrollment period that allows you to get a private health plan and a subsidy through the Oregon

Health Insurance Marketplace and HealthCare.gov. You have up to 60 days after the date the

coverage is lost to get a health plan at HealthCare.gov. If you sign up before losing your

employer-based coverage, you can secure Marketplace coverage that begins the next month and

avoid a gap in coverage.

Details: You may be eligible for federal subsidies for insurance purchased on the

Marketplace if your expected household income for 2020 is less than four times the

federal poverty level. This is about $50,000 a year for a single person or about $103,000

a year for a family of four. In many cases, the children in these families are eligible for

coverage through the Oregon Health Plan. Open enrollment for anyone to purchase

insurance on the Marketplace is usually in November and December.

Learn more: Oregon Health Insurance Marketplace

2. Workers and their family members may be eligible for free coverage through the

Oregon Health Plan, the state’s Medicaid program

The Oregon Health Plan (OHP) provides physical, dental, and mental health care for households

with lower incomes. You can apply for OHP at any time. Enrollment is always open.

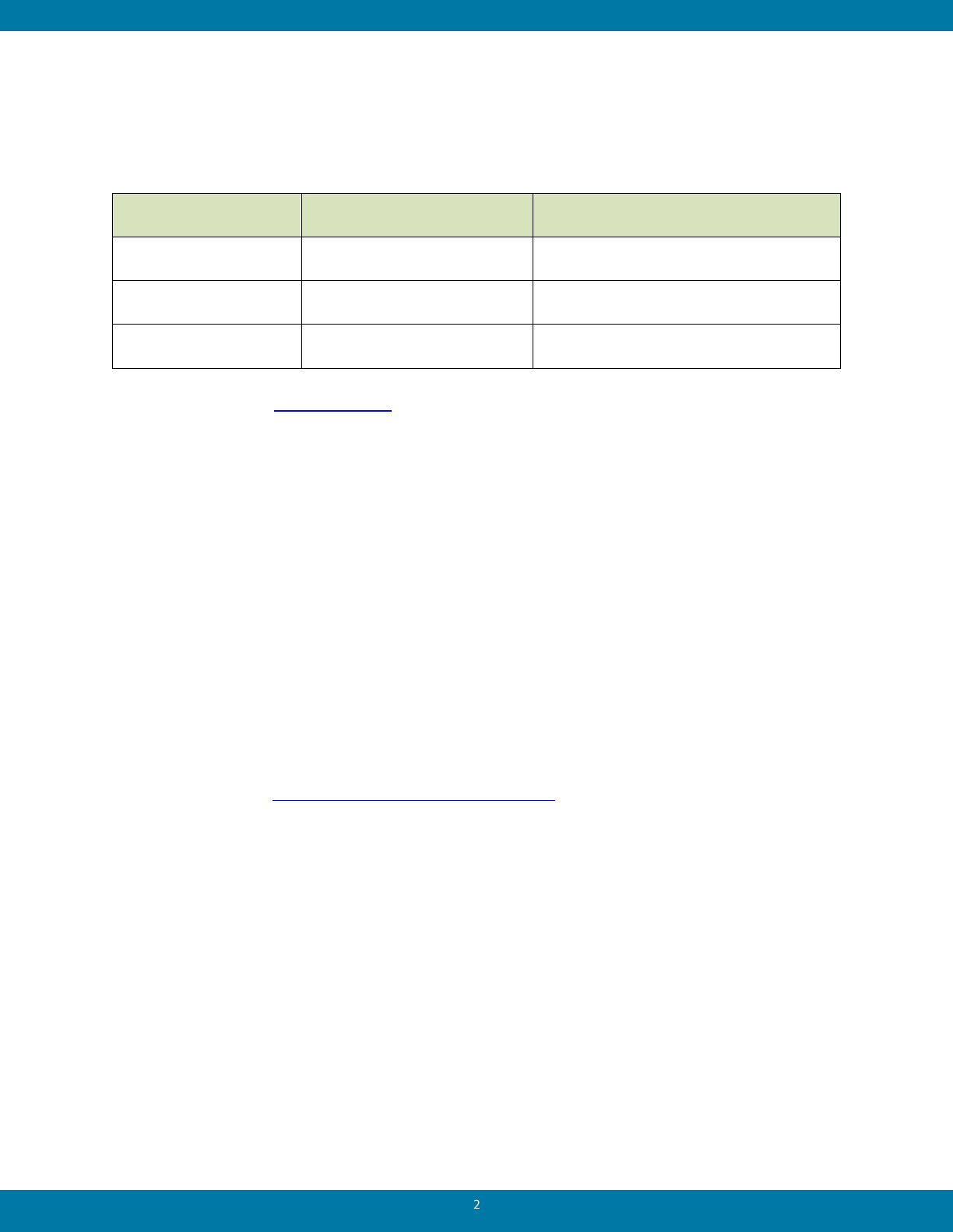

Details: You can have OHP, even if you still have a job. Eligibility is based on current

monthly income and varies by household size and other circumstances. Household

income is calculated from all taxable income sources, including any unemployment

insurance benefits. See the table below for income examples.

Individual

Percentage of Federal

Poverty Level (FPL)

Monthly income examples

Adults

Up to 138%

$1,468 a month for a single person

or $3,013 for a family of four

Pregnant adults

Up to 190%

$2,730 for a single pregnant adult or

$4,149 for a family of four

Children and teens

Up to 305%

$4,382 for a family of two or $6,660

for a family of four.

Learn more: ohp.oregon.gov

3. People who lose employer-based coverage may be eligible for COBRA

COBRA (Consolidated Omnibus Budget Reconciliation Act of 1985) is a federal law that

requires businesses of at least 20 employees to continue any health benefit coverage for

individuals and their families who would otherwise lose their benefits due to termination of

employment, reduction in hours, or certain other events.

Details: With COBRA, your family can continue on the same employer-based health

insurance for up to 18 or 36 months, but you must pay the entire cost of the premium.

Your employer must contact you with information about COBRA coverage, and then you

have 60 days to decide on purchasing the COBRA coverage. COBRA is available only if

your employer is still offering coverage to its existing employees and would not be

available if your employer entirely canceled coverage for all employees. Once enrolled in

COBRA, you cannot cancel mid-year and enroll in a plan through the Marketplace

without another qualifying event.

Learn more: COBRA coverage on HealthCare.gov

4. State continuation

A worker who loses employer-based coverage may be eligible for state continuation. Oregon law

requires businesses of fewer than 20 employees to continue any health benefit coverage for

individuals and their families who would otherwise lose their benefits due to termination of

employment, reduction in hours, or certain other events.

State continuation applies to those who have had continuous health coverage (not necessarily

with the same employer) for at least three months before the date employment or coverage

ended.

Details: With state continuation, your family can continue on the same employer-based

health insurance for up to nine months, but you must pay the entire cost of the premium.

To continue coverage, you must notify the insurer in writing within 10 days after the date

you become eligible, or 10 days after the insurer notifies you of your eligibility. You

have to pay the full price of the coverage, and your employer can tell you the cost of the

insurance, the date by which you must pay, and the manner in which payment must be

provided. Once enrolled in state continuation, you cannot cancel mid-year and enroll in a

plan through the Marketplace without another qualifying event.

State continuation is only available if an employer is still offering coverage to its existing

employees and would not be available if the employer entirely canceled coverage for all

employees.

Learn more: State continuation

5. A worker 65 and older and some blind and disabled people younger than 65 can

enroll in Medicare

Medicare is for U.S. citizens 65 years old and older who meet residency requirements and some

disabled people younger than 65.

Details: Workers 65 years or older who lose their employer-based insurance can

immediately enroll in Medicare with no penalty.

Learn more: Medicare.gov. The Oregon Senior Health Insurance Benefits Assistance

(SHIBA) program provides free Medicare information and enrollment assistance at

SHIBA.Oregon.gov or call 800-722-4134.

6. The business decides to continue paying for employer-based coverage

Some employers may continue to offer health insurance for employees whose work hours have

been reduced, although in many cases, part-time workers may have different coverage options

and could face different cost-sharing for their coverage.

Details: If you remain on your same coverage, your health insurance would continue

with the same rules on deductibles and co-pays as before; however, you may have to pay

more in monthly premiums. A reduction in income and an increase in monthly premiums

may make you eligible for federal subsidies for individual insurance coverage through the

Marketplace. Check their eligibility by going to HealthCare.gov.

Learn more: Check with your employer.

7. Accessing coverage through a spouse’s employer-based insurance

If you lose your employer-based coverage, you may be able to obtain coverage through your

spouse or domestic partner’s employer-based coverage.

Details: Employee-paid premiums and other cost-sharing will vary, depending on the

rules of your partner’s employer.

Learn more: Your spouse or partner should check with their employer.

Other resources

For small business owners, contractors, and others who have their own individual insurance

plans at HealthCare.gov.

If you have purchased Marketplace insurance at HealthCare.gov, you may receive more federal

subsidies as your income declines. The actual subsidy is calculated based on annual income. You

can update your income information on HealthCare.gov to be sure you receive the correct

amount of subsidies.

Verify your health insurance agent’s license

It is always a good idea to make sure you are working with someone who is a licensed health

insurance agent. This is especially important if an agent contacts you whom you have not found

via the Oregon Health Insurance Marketplace’s online help tool or contacted initially. During

times of disaster and economic uncertainty, it is common for people to receive calls from

someone selling health insurance plans that do not provide important consumer protections,

including protections for people with pre-existing conditions. Seeking assistance from local

licensed agents will help reduce the risks of purchasing products not suitable for your needs.

You can verify the license of a health insurance agent online

COVID-19 information and resources:

Covid-19 Insurance and Information (Division of Financial Regulation)

COVID-19 Updates in Oregon (Oregon Health Authority)

National COVID-19 Information (Centers for Disease Control and Prevention)

Food assistance programs in Oregon:

o Women, Infants, and Children (WIC)

o Supplemental Nutrition and Assistance Program (SNAP)

For general information on COVID-19, call 211.

If you are having an emergency, call 911.