DLSU Business & Economics Review 28(2) 2019, pp. 52–68

Copyright © 2019 by De La Salle University

RESEARCH ARTICLE

How Does the Thai Stock Market Respond to

Monetary and Fiscal Policy Shocks?

Suthawan Prukumpai

Kasetsart University, Bangkok, Thailand

fbusswp@ku.ac.th

Yuthana Sethapramote

National Institute of Development Administration, Bangkok, Thailand

Abstract: This study examines the impacts of monetary and scal policy on the Thai stock market using the structural vector

autoregressive (SVAR) model. In addition to the data on the market aggregate level, we also consider the response of stock

prices at the sectoral level. The empirical results show that the Thai stock market signicantly responds to both monetary

policy and scal policy. However, monetary policy has stronger effects on both real output and stock prices than those of

scal policy. Fiscal policy shocks affect the stock market only for the next two to three quarters. In addition, sector indices

were used in place of the overall stock market and the results revealed that different sectors appeared to react heterogeneously

to shocks in monetary policy and scal policy.

Keywords: Monetary policy, Fiscal policy, Thai stock market, Structural VAR

JEL Classications: E44, E52, E62

The linkages between nancial markets, the real

economy, and economic policy are important aspects

for the proper understanding of the macroeconomy.

In the context of the business cycle, monetary policy

and scal policy have an important role in stabilizing

ination and output gaps. Through monetary policy, the

central bank uses open market operations (e.g., buying

or selling government bonds; lending or borrowing in

money markets) to control money supply or short-term

interest rates. In terms of scal policy, the government

uses tax cuts or government spending to stimulate

aggregated demand using the multiplier effect.

Currently, the stock market is not only a crucial

part of the nancial market but it also plays important

roles in the macroeconomy since it enables the optimal

allocation of scarce capital resources. Moreover, any

mistakes will possibly lead to the disruption of nancial

markets, which eventually will link to the entire

economy. This explains why nancial market stability

and resilience are the ultimate goals in the economic

development of each nation. In the other direction, stock

prices are also sensitive to changes in the economic

fundamentals that affect a rm’ cash ows. Moreover,

according to Flannery and Protopapadakis (2002), risk-

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 53

adjusted discount rates in asset pricing are also related

to changes in macroeconomic conditions.

Hence, the associations between the stock market,

the macroeconomy, and economic policy are also

emphasized in the literature. At the early stage of

empirical work, most studies concentrated on the

long-term relationship between economic growth

and stock market development (e.g., Goldsmith,

1969; McKinnon, 1973). Specifically, economic

policy has been generally used to promote the long-

term sustainable growth of the real sector, which is

a fundamental of nancial markets. In addition, the

good functioning of nancial markets will enhance

economic growth by enabling rms to acquire capital

at a reasonable cost. Recently, several studies have

turned their focus to the short-term response of

stock markets to economic policy. Interestingly,

most of the empirical studies in this area have been

primarily concerned with monetary policy (e.g.,

Jensen & Johnson, 1995; Thorbecke, 1997; Conover,

Jensen, Johnson, & Mercer, 1999). However, only

a few studies (e.g., Darrat, 1988) have explored the

response of stock markets to scal policy. Besides

investigating the effect of monetary policy and

scal policy on stock markets individually, many

studies have been interested in the combined effect

of these policies on the stock markets, for example,

Chatziantoniou, Duffy, and Filis (2013), Hsing (2013),

and Thanh, Thuy, Anh, Thi, and Truong (2017).

In Thailand, the stock market was established in

1975. Since then, the Stock Exchange of Thailand

(SET) has become one of the most attractive

exchanges in ASEAN. However, compared with

developed markets such as the United States and the

United Kingdom, the SET is still relatively small and

has limited numbers of listed companies. In addition,

both the Thai economy and the SET are sensitive

to both internal and external shocks. Therefore, the

SET may react to economic policy shocks differently

to those of the developed markets. The objective of

this paper is then to examine the effects of monetary

and scal policy shocks on the stock markets. Using

data from the SET, both at the market aggregated

level and at the sectoral level, an intensive study

will not only enrich previous research in this eld

but also offer a reference for related research on

developing countries, which thus will present

possible valuable applications for both academia

and practitioners.

Literature Review

Linkages Between Financial Sector and Real

Economy

The linkages between the financial sector and

the real economy are emphasized in macroeconomic

theory. There are several studies on the relationship

between the real sector, economic policy, and the

stock market. At the early stage of empirical work,

most studies were concentrated on the long-term

relationship between economic growth and stock

market development, for example, Goldsmith (1969)

and McKinnon (1973). Specically, they showed a

strong positive empirical link between the degree of

nancial market development and the rate of economic

growth. However, that literature did not provide any

theoretical framework to explain the linkage between

the real economy and the nancial sector. Recently,

a formal linkage has been cited between nancial

intermediation and growth. Levine (1997), for example,

emphasized the role of financial institutions in

enhancing resource allocation efciency and eventually

promote economic growth. In addition, Luintel and

Khan (1999) reported the bi-directionally relationship

between nancial development and economic growth.

In addition to the linkage via financial

intermediation, the transmission mechanism of

monetary policy provides another transmission

channel between the nancial sector and the real

economy. Specifically, the central bank will use

open market operations (e.g., buy or sell government

bonds; lending or borrowing in money markets –

interbank or repurchase ones) to control money

supply or interest rates. This implies that there must

be some links between financial variables (e.g.,

quantities of money, interest, and exchange rates) and

macroeconomic variables (e.g., unemployment, GDP,

asset prices). Mishkin (1996) summarized that there

are ve channels of monetary policy transmission: the

interest rate channel, the credit channel, the exchange

rate channel, the asset price channel (wealth effect),

and the expectation channel (monetary channel).

In sum, there is bi-directional causality between the

nancial sector and the real economy. The nancial

sector contributes to economic growth by facilitating

savings and allocating those funds efciently to the

most productive users in the real economy. In turn, the

real economy, once it gets funding, generates nancial

activity by employing people (who will eventually have

54

S. Prukumpai, et al

the residual income to saving or investing in nancial

markets).

Recently, several studies have turned their focus

to the short-term response of the stock markets to

economic policy. According to the semi-strong form

market efciency hypothesis, asset prices must fully

reect all available relevant public information such as

rms’ announcements, nancial statements, and news,

including policy actions (Fama, 1970). Therefore, stock

prices should react to shocks in economic policy that

not only affect a rm’s cash ows but also inuences

time-varying discount factors. Even though signicant

literature has focused on the relationship between

the stock market and monetary policy (e.g., Jensen &

Johnson, 1995; Thorbecke, 1997; Conover et al., 1999),

only a few have studied the effects of scal policy on

stock markets. Darrat (1988) found that scal policy

plays an important role in determining stock returns. In

addition, many studies have demonstrated an interest in

the combined effect of these policies on stock markets,

for example, Chatziantoniou et al. (2013), Hsing (2013),

and Thanh et al. (2017). Therefore, the next section

will summarize the literature on the stock market and

economic policy: monetary policy and scal policy,

respectively.

Stock Market and Monetary Policy

The stock market is affected by innovations in

monetary policy through several channels. Via the

main channel—the interest rate channel—a change in the

interest rate has an impact of the cost of capital, which

eventually lowers the present value of a rm’s expected

cash ows or stock prices. This channel represents

the Keynesian view of interest rate transmission. The

changes in interest rate have an inuence on a rm’s

investment, which is called the credit channel. High

(low) investment activity leads to high (low) cash ows

for the rm in the future and in turn, higher (lower)

current stock prices. High interest rates also destroy the

value of long-lived assets, which is called the wealth

effect, through the asset price channel. In addition,

increases in the interest rate also lead to an appreciation

of the domestic currency, resulting in lower exports.

Production will eventually be cut due to lower exports,

hence, leading to lower asset prices. Lastly, higher

interest rates will lower stock prices since investors

will transfer funds from the stock market to the bond

market—assuming that only two asset markets exist, as

indicated by Tobin (1969).

Several studies have investigated the effects of

monetary policy on financial markets. Jensen and

Johnson (1995), using data from the US from 1962 to

1991, found that stock returns were higher after interest

rates decreased and were less volatile than returns

when interest rates increased. Similarly, Thorbecke

(1997) concluded that expansionary monetary policy

via decreased interest rates would increase the stock

returns. A study using international data by Conover et

al. (1999) also revealed that international stock market

returns are higher in the expansive US and local

monetary environments than they are in tight monetary

policy. In a more recent study, Chevapatrakul (2015)

investigated the relationship between international

stock market returns and monetary environments

by applying the quantile regression technique. He

found the asymmetric response of the stock market to

monetary policy. In addition, when returns are high,

stock markets signicantly respond to the US monetary

policy, while for some countries, local monetary policy

is effective only when returns are low.

The stock market condition can have a signicant

impact on the macroeconomy and is, therefore, likely

to be an input for policy actions. Because of the

simultaneous response from the stock market to policy

actions, Rigobon and Sack (2003) used an identication

technique based on the heteroskedasticity of stock

market returns to measure the reaction of monetary

policy to the stock market. They concluded that there as

a signicant monetary policy response to stock market

returns. Specically, there was the likelihood to increase

(decrease) the interest rate when the S&P500 index

increased (decreased). Bjornland and Leitemo (2009)

provided evidence of simultaneous interaction between

monetary policy and stock market returns. They found

that interest rate increases have a negative impact on

stock market returns, whereas increases in stock market

returns have a positive impact on interest rates.

Despite the vast empirical studies from developed

markets, the literature from developing countries

remains limited. In addition, many papers have

examined the effect of foreign (the U.S. and U.K.)

monetary policy rather than domestic monetary policy.

Wongswan (2009) found, for example, that the stock

markets of Indonesia, the Republic of Korea, and

Malaysia, not Thailand, responded to U.S. monetary

policy. Kim and Nguyen (2009) also found a negative

response of the 12 Asian stock markets to U.S. and E.U.

monetary policy shocks. Nevertheless, Vithessonthi

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 55

and Techarongrojwong (2013) applied an event study

approach to investigate the stock market’s reaction to

the Bank of Thailand’s monetary policy announcement.

Using rm-level stock prices, they found that stock

prices are affected by expected change rather than

an unexpected change in interest rates. Moreover, the

response of stock prices was found to be asymmetric,

depending on the direction of the changes in the

interest rate.

Stock Market and Fiscal Policy

In addition to monetary policy, the government can

use tax cuts and increased government spending to

stimulate the entire economy—aggregated demand in

particular. The effects of scal policy on the economy

are the subject of a long-lasting debate in economic

theory. Specically, such effects depend on whether

we take the Keynesian, classical, or Richardian views.

Keynesian theory states that the government can

stabilize the economy by inuencing the production

level by increasing or decreasing the tax level or public

spending. Contrary to Keynesian theory, the Richardian

view suggests that scal policy has no impact on the

economy as public borrowing will be offset by private

savings. In addition, according to the classical theory,

government spending will crowd out private sector

activity and, thus, its effects will be less important.

Turning to the empirical evidence on the relationship

between scal policy and stock markets, as mentioned

before, there is relatively less evidence on scal policy

than monetary policy. In an early study by Darrat

(1988), he found that the lag of scal policy, rather than

the lag of monetary policy, has a signicant effect on

Canadian stock returns. Using U.S. data, Laopodis and

Sawhney (2002) found a negative correlation between

scal decits and stock returns, and Ardagna (2009)

found that cutting government spending when there

is high level of government decit and lower public

debt will follow by a large decrease in interest rate and

an increase in stock market price. Employing a VAR

analysis, Afonso and Sousa (2011) examined the linkage

between scal policy and asset markets. They reported

that spending shocks have a negative impact on stock

prices while the government’s revenues have a small

and positive effect. Recently, Foresti and Napolitano

(2017) examined the effects of scal policy on 11

stock markets in the Eurozone. Their study revealed

that increases (decreases) in public decits would be

followed by decreases (increases) in stock markets.

Moreover, the impact of scal policy is time-varying

and depends on the macroeconomic scenario.

Stock Market and the Interaction of Monetary and

Fiscal Policies

There is substantial interest in understanding the

interaction between monetary and fiscal policies.

Specifically, many studies have focused on the

complementariness and substitutability of those

policies. Melitz (1997) analyzed the data in 19

countries of the OECD from 1960 to 1995 and found

that monetary policy moves in the opposite direction

to scal policy (mutual substitution effect). This is

reected in the fact that the expansion of scal policy

has led to a contraction in monetary policy in particular.

Interestingly, Muscatelli, Tirelli, and Trecroci (2004)

examined U.S. monetary and fiscal policies from

1970 to 2001 and concluded that the policies were

independent from 1970 to 1990, but after 1990, the

policies were complementary.

Afonso and Sousa (2011), together with

Chatziantoniou et al. (2013), emphasized the importance

of combining both monetary and scal policies into

one framework. Specifically, they found that the

interaction between those policies was very crucial

in explaining stock market development. Thanh et al.

(2017) concluded that monetary and scal policy not

only affects the Vietnam stock market individually but

also impacts the Vietnam stock market through their

interaction. In addition, Hu, Tirelli, and Trecroci (2018)

have pointed out that the interaction between monetary

and scal policies has played a signicant role in

explaining the development of Chinese stock markets.

In conclusion, the empirical studies on economic

policy and stock market returns have received a great

deal of attention in the literature. However, there have

been only a few studies on the impact of both policies,

especially scal policy, on the Thai stock market.

Therefore, in addition to evaluating the effect of

monetary policy and scal policy on the stock market

individually, this study incorporates both policies

into the VAR framework. The detailed econometric

methodology is provided in the next section.

Data and Methodology

Data

In this study, we set up the VAR model, which

included the following variables: world import volume

56

S. Prukumpai, et al

(IMW), real GDP (GDPR), real government spending

(GTR), short-term interest rate (INTS), long-term

government bond yield (INTL), and stock market

indices (SET). We used the real GDP and the SET

index to represent the real output and stock market,

respectively. In Thailand, increases in government

spending rather than tax cutting are typically used as a

scal policy mechanism. The short-term interest rate is

represented by the 1-day repurchase rate, which is used

as an instrument of monetary policy in Thailand. The

long-term interest rate (10-year government bond yield)

was included in the model to represent the transmission

channel of monetary policy and the crowding out effect

of scal policy. Finally, the world import value was

included to represent the external factor because the

international trade channel is important for ASEAN

economies. All data were collected from the CEIC

database at a quarterly frequency ranging from 1996

to 2017.

Econometric Methodology

Earlier, we discussed the complexity of the

interaction between the financial market, the real

economy, and economic policy. Therefore, the VAR

model is commonly employed to investigate the

dynamic relationships among real output, the stock

market, and monetary and scal policies. In the VAR

framework, the identication of shocks is crucial in

estimating the pattern of response of key variables to

shocks. Typically, the recursive method proposed by

Sims (1980) and the generalized method of Pesaran

and Shin (1998) are applied. However, in the case of

scal policy, a shock is dened as the changes in

government expenditures (or taxes) that are not due to

the business cycle.

While no consensus on the impact of scal policy

on economic activity has been concluded, researchers

generally agree on the linkage between scal and

economic activity. Besides the scal policy mechanism,

business cycle shocks also impact economic activity.

To handle these challenges, two main approaches are

applied: the narrative approach developed by Ramey

and Shapiro (1998) and the SVAR approach introduced

by Blanchard and Perotti (2002). The former assumes

that government spending is exogenous and orthogonal

to other information available at that time (Ramey &

Shapiro, 1998). The latter characterizes the dynamic

effects of shock in scal policy on economic activity

by using institutional features, that is, scal policy does

not respond to shocks that occur within the quarter

when using the quarterly data to achieve identication

(Blanchard & Perotti, 2002).

In this study, we followed the SVAR model. In

addition, the standard VAR models (reduced-form VAR)

with generalized impulse responses were also estimated

to check the robustness of the results. The details on

the econometric methodology are outlined as follows.

The structural VAR model. In this section, we

applied the structural VAR (SVAR) using the restrictions

suggested by Blanchard and Perotti (2002) and

Chatziantoniou et al. (2013). The representation of the

SVAR model of order has the following general form:

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

(1)

where

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

is a 6×1 vector of the endogenous variables,

that is,

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

= [IMW, GDPR, GTR, INTS, INTL, SET],

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

represents the 6×1 contemporaneous matrix,

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

is the 6×6 autoregressive coefcient matrix,

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

is

the 6×1 vector of structural disturbance, assumed

to have zero covariance. The covariance matrix of

the structural disturbances takes the following form:

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

. I n

order to estimate the SVAR model, the reduced form

was determined by multiplying both sides with

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

,

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

(2)

where

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

.

The reduced form has the covariance matrix of the

form

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

.

The structural disturbances can be derived by

imposing suitable restrictions on 0. In this study, the

short-run restrictions were set up as follows:

The structural VAR model. In this section, we applied the structural VAR (SVAR)

using the restrictions suggested by Blanchard and Perotti (2002) and Chatziantoniou et al.

(2013). The representation of the SVAR model of order has the following general form:

(1)

where

is a 6x1 vector of the endogenous variables, that is,

= [IMW, GDPR, GTR, INTS,

INTL, SET],

represents the 6x1 contemporaneous matrix,

is the 6x6 autoregressive

coefficient matrix,

is the 6x1 vector of structural disturbance, assumed to have zero

covariance. The covariance matrix of the structural disturbances takes the following form:

′

. In order toestimate the SVAR model, the

reduced form wasdetermined by multiplying both sides with

(2)

where

and

.The reduced form has the covariance matrix

of the form

′

The structural disturbances can be derived by imposing suitable restrictions on

In

this study, the short-run restrictions wereset up as follows:

(3)

The restrictions in the SVAR model wereimposed based on severalprinciples. First,

income contemporaneously reacts to external shocks but is not concurrently influenced by

other factors in the model. However, the GDP is the important factor that affectsthe long-term

(3)

The restrictions in the SVAR model were

imposed based on several principles. First, income

contemporaneously reacts to external shocks but is

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 57

not concurrently inuenced by other factors in the

model. However, the GDP is the important factor that

affects the long-term interest rate and the stock market.

Regarding the policy variables, we assumed that both

scal policy and monetary policy are not inuenced

contemporaneously by the GDP. This assumption was

used to distinguish policy shocks from business cycle

shock. Next, monetary policy contemporaneously

reacts to scal policy. Finally, we assumed that the

stock market instantly responds to all macroeconomic,

nancial, and policy variables.

The reduced-form VAR model. Next, we estimated

the reduced-form VAR model and computed the

generalized impulse response function to check for

the sensitivity of the results from the SVAR model.

The reduced-form VAR model can be written as follow,

interest rate and the stock market. Regardingthe policy variables, we assumed that both fiscal

policy and monetary policy are not influenced contemporaneously by the GDP. This

assumption wasused to distinguish policy shocks from business cycle shock. Next,monetary

policy contemporaneously reacts to fiscal policy. Finally, we assumed that the stock market

instantly responds to all macroeconomic, financial, and policyvariables.

The reduced-form VAR model. Next, we estimated the reduced-form VAR model

and computed the generalized impulse response function to check for the sensitivity of the

results from the SVAR model. The reduced-form VAR model can be written as follow,

(4)

where Y = [IMW, GDPR, GTR, INTS, INTL,SET]. The number of lags included in the model

wasdetermined usingthe Schwartz information criteria (SIC).

To investigate the response of real output and the stock market to policy shocks, we

used two main methods. First, acausality test wasperformed to provide information on the

direction of the relationships among economic policies, real output, and the stock market.

Second, impulse response functions (IRFs) analysis wasapplied based on shocks in short-term

interest rates (INTS) and government spending (GTR). The comparison between the

generalized impulse response functions (GIRFs) from the reduced-form VAR model and the

IRFs from the SVAR model would provide information on the validity of the restrictions

imposed in the SVAR model.

Empirical Results

Unit Root Test

(4)

where Y = [IMW, GDPR, GTR, INTS, INTL, SET]. The

number of lags included in the model was determined

using the Schwartz information criteria (SIC).

To investigate the response of real output and the

stock market to policy shocks, we used two main

methods. First, a causality test was performed to provide

information on the direction of the relationships among

economic policies, real output, and the stock market.

Second, impulse response functions (IRFs) analysis

was applied based on shocks in short-term interest

rates (INTS) and government spending (GTR). The

comparison between the generalized impulse response

functions (GIRFs) from the reduced-form VAR model

and the IRFs from the SVAR model would provide

information on the validity of the restrictions imposed

in the SVAR model.

Empirical Results

Unit Root Test

Prior to checking for a causality relationship, it

is necessary to test the stationary property of the

data. The augmented Dickey-Fuller (ADF) test was

performed to test the null hypothesis of the unit root

with constant and time trend as well as the unit root

with constant without the time trend. As can be seen

in Table 1, all of the variables were non-stationary

(except for the long-term interest rate) at the level but

they were stationary at the rst difference. Therefore,

we then proceeded to estimate the VAR model based

on the rst difference variables in order to perform

the Granger causality test.

Table 1

Unit Root Tests

IMW GDPR GTR INTS INTL SET

At level

constant

-1.4931

(0.5329)

-0.8166

(0.8098)

-1.0746

(0.7234)

-1.4504

(0.5545)

-3.0915**

(0.0306)

-1.9191

(0.3222)

constant & trend

-1.2748

(0.8880)

-2.2209

(0.4726)

-1.6585

(0.7621)

-3.6925**

(0.0274)

-3.7881**

(0.0215)

-3.4233*

(0.0550)

At rst difference

constant

-5.412***

(0.0000)

-9.7353***

(0.0000)

-10.2185***

(0.0000)

-12.6986***

(0.0000)

-7.0969***

(0.0000)

-5.5959***

(0.0000)

constant & trend

-5.5495***

(0.0001)

-9.7051***

(0.0000)

-10.2792***

(0.0000)

-12.6598***

(0.0000)

-7.0581***

(0.0000)

-5.5677***

(0.0001)

Note: *, **, and *** represent signicance at 10%, 5%, and 1%, respectively as compared with the critical values tabulated by MacKinnon

(1990). The rst line presents the ADF t-statistics while the second line presents the corresponding p-value.

58

S. Prukumpai, et al

Granger Causality Test

As shown in Table 2, five main findings were

observed. First, the monetary policy variable (short-term

interest rate) had bi-directional causalities with real

output and a signicant effect on the SET. However, the

SET had no feedback causality in relation to monetary

policy. These results emphasize the complicated role

of monetary policy mentioned in previous studies.

Second, scal policy was seen to have no signicant

effect on either the real economy or the stock market.

We also found no evidence of a crowding out effect

since the long-term interest rate was not inuenced by

scal policy. Thirdly, the world import volume (IMW)

had no effect to either the real or nancial sectors.

Fourth, the interaction between monetary policy and

scal policy were found as the short-term interest rate

signicantly reacted to government spending. Lastly,

a causality relationship from the nancial sector to the

real sector was strongly signicant at 1%; however,

a feedback relationship from the real sector to the

nancial sector was not found.

Even though the results from the causality test

indicated that scal policy had no direct effect on either

real output or the stock market, scal policy may have

an effect to stock prices in short-run (1–3 quarters). In

addition, scal policy could provide effects via the

changes in interest rates. We then further investigated

the linkages between real output, stock market,

monetary policy, and scal policy using an impulse

response analysis.

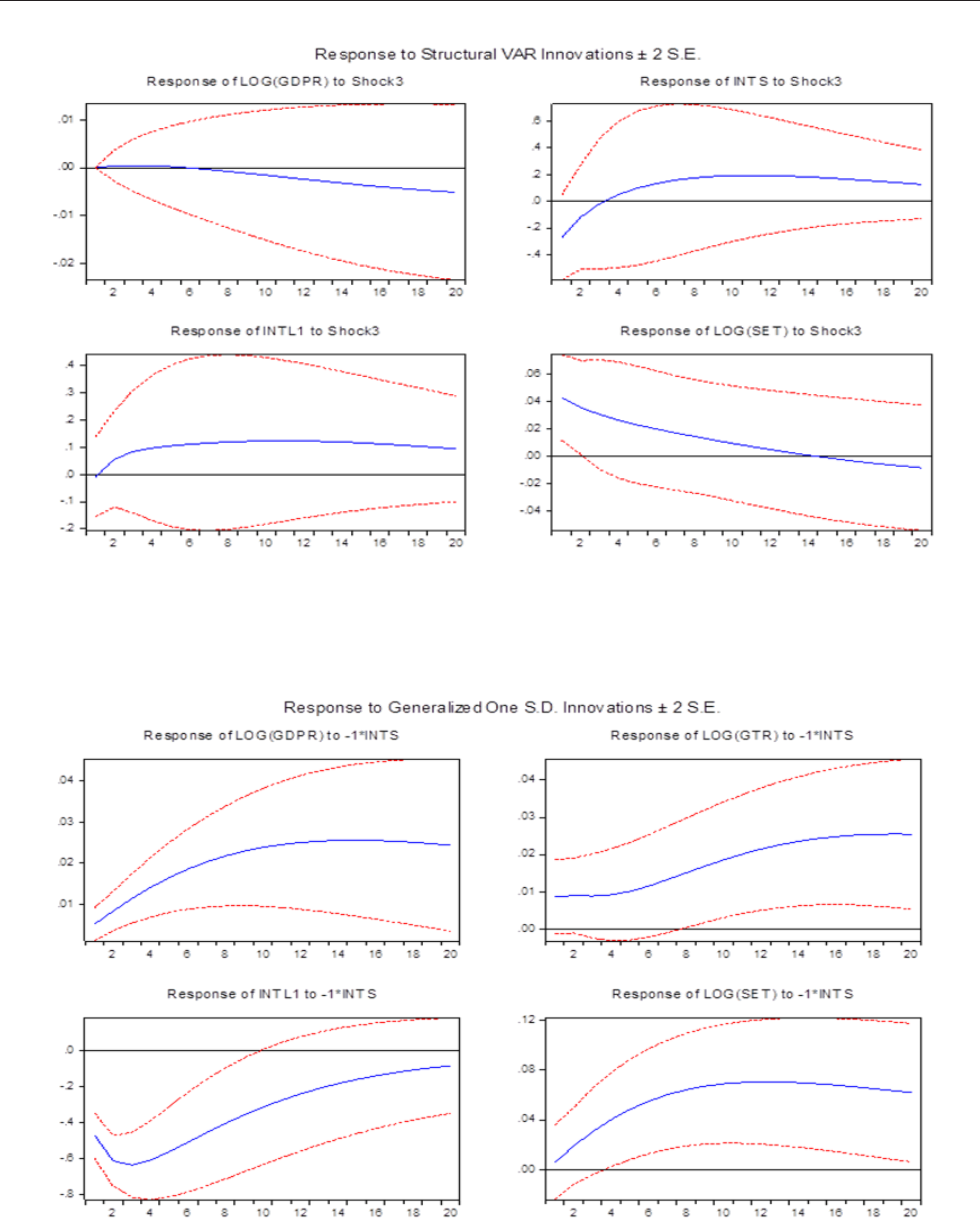

Structural VAR Model and Impulse Response

Analysis

The SVAR model with one lag based on minimized

SIC criteria was estimated using the data in level. To

reveal how the variable in question responded to the

shock over several periods of time, the IRF of the

expansionary shocks to monetary policy and scal

policy was calculated and shown in Figures 1 and 2,

respectively. Because the IRF is a conditional forecast,

it is necessary to report a condence interval, period by

period, to go with the IRF. The blue line represents the

response to one standard deviation shock while the red

line represents a 95% condence interval. The response

is signicantly different from zero when the condent

interval does not contain the zero-horizontal axis.

Table 2

Granger Causality Relationship Based on the VAR Model

Dependent

variable

Short-run causality, chi-squared statistics

IMW GDPR GTR INTS INTL SET

IMW

– 0.5408

(0.7631)

2.2394

(0.3264)

1.3681

(0.5046)

4.6951*

(0.0956)

7.6467**

(0.0219)

GDPR

0.4632

(0.7893)

– 1.1007

(0.5767)

7.8939**

(0.0193)

0.1395

(0.9326)

12.1364***

(0.0023)

GTR

1.3870

(0.4998)

6.01267**

(0.0495)

– 2.5674

(0.2770)

5.4544*

(0.0654)

3.0383

(0.2189)

INTS

2.9266

(0.2315)

6.0195**

(0.0493)

7.1934**

(0.0274)

– 6.9261**

(0.0313)

1.8403

(0.3985)

INTL

0.1807 5.2140* 3.0133 32.4136*** – 10.5312***

(0.9136) (0.0738) (0.2217) (0.0000) (0.0052)

SET

3.3734

(0.1851)

2.8808

(0.2368)

1.3629

(0.5059)

19.8397***

(0.0000)

4.6954*

(0.0956)

–

Note: *, **, and *** represent signicance at 10%, 5%, and 1%, respectively. The rst line presents the chi-squared statistics

while the second line presents the corresponding p-value. All of the variables were in natural logarithm.

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 59

Figure 1 presents the responses of four variables

(GDP, government spending, long-term interest rate,

and stock market) to a decrease in interest rate. As can

be seen, real GDP signicantly responds negatively to

monetary policy and the impacts reach the maximum

level within two to three years. In addition, the

expansionary monetary policy shock (decrease in

interest rate) not only stimulates real output but also

has a positive impact on the stock market. Unlike the

real GDP, the stock market signicantly responded

to monetary policy after six quarters and most of the

impacts were realized within two years. Moreover,

the long-term interest rate immediately moved in the

same direction as the shock in the monetary policy

interest rate. This result provides details on the interest

rate channel in the monetary policy transmission

mechanism.

Next, we considered the effect of scal policy

shock on the real and nancial sector. As presented

in Figure 2, the stock market responded signicantly

to expansionary scal policy shocks in a positive

direction; however, the effect lasted only a few quarters.

The scal policy insignicantly affected output growth.

These results show that scal policy has only a short-

term effect on the stock market. In sum, monetary

policy and scal policy provide a signicant impact

on the stock market.

The Reduced-Form VAR With Generalized Impulse

Response Function

Similar to the previous section, we used the data

in level to estimate the reduced-form VAR model with

one lag based on minimized SIC criteria. The GIRFs

to monetary and scal policy shocks are presented in

Figures 3 and 4, respectively. The interpretation of the

GIRFs is similar to that of the previous section.

Figure 3 presents the responses of the variables to a

decrease in interest rate. As can be seen, the results are

similar to those for the SVAR model, as the real GDP

Figure 1. Impulse-response function. Y-axis, percent response to 1 standard deviation monetary policy shock (shock 4,

particularly); X-axis, quarters after shock. Blue and red lines – response and 95% condence interval, respectively.

60

S. Prukumpai, et al

Figure 2. Impulse-response function. Note: Y-axis, percent response to 1 standard deviation scal policy

shock (shock 3, particularly); X-axis, quarters after shock. Blue and red lines – response and 95% condence

interval, respectively.

Figure 3. Impulse-response function. Note: Y-axis, percent response to 1 standard deviation monetary policy

shock (short-run interest rate shock, particularly); X-axis, quarters after shock. Blue and red lines – response

and 95% condence interval, respectively.

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 61

and stock market signicantly responded negatively

to monetary policy. In the case of scal policy, as

presented in Figure 4, scal policy shocks not only

affected the stock market but also had a signicant

effect on the output growth in the rst two quarters.

This result shows that scal policy has only a short-term

effect on real output and the stock market. \

In summary, based on the reduced-form VAR model

and the GIRFs, monetary policy and scal policy had

a signicant impact on both real GDP and the stock

market. Comparing the results based on the SVAR

model, the conclusion is similar—the real sector and

nancial sector responded positively to expansionary

monetary policy. In addition, the financial market

responded to the scal policy under both the SVAR

model and the reduced-form VAR model. This conrms

the signicant impact of scal and monetary policy on

the nancial sector.

How Do the Sector Indices Respond to Monetary

Policy and Fiscal Policy?

Several papers have examined the impact of

monetary and scal policy on stock markets, notably

Afonso and Sousa (2011), Chatziantoniou et al. (2013),

Thanh et al. (2017), and Hu et al. (2018). None of

these papers has addressed the issues examined here,

namely, the effects of monetary and scal policy on

stock markets at the sectoral level. The closest to our

study is that of Guerin and Leon (2017). However, they

investigated how changes in sectoral connectedness

will affect the response of the stock market to monetary

policy. Guerin and Leon (2017) found that highly

interconnected stock market is more likely to respond

to monetary policy. Additionally, the industry that is

more related to an aggregated market tends to react

relatively more to monetary policy shocks. Therefore,

in our study, we hypothesized that different sectors may

Figure 4. Impulse-response function. Note: Y-axis, percent response to 1 standard deviation scal policy

shock (spending shock, particularly); X-axis, quarters after shock. Blue and red lines – response and 95%

condence interval, respectively.

62

S. Prukumpai, et al

respond to monetary and scal policy differently. Due

to regularly adjusted components of sector indices by

the SET, only 18 sectors with completed data during

our study period (1996 to 2017) were included in our

analysis. The list of the sectors and their abbreviation

is shown in Table 3. All of the data were collected from

the CEIC database at a quarterly frequency.

The structural VAR model using the 18 sector

indices in place of the SET index was rst estimated.

The impulse responses of stock prices at the sectoral

level were calculated for the shocks in monetary policy

and scal policy. The results are shown in Figures 5 and

6, respectively. Figure 5 shows that all of the sectors

reacted negatively to monetary policy, similar to how

the overall market did. Unlike the monetary policy,

as presented in Figure 6, most sectors, except for the

professional service sector, positively responded to

scal policy.

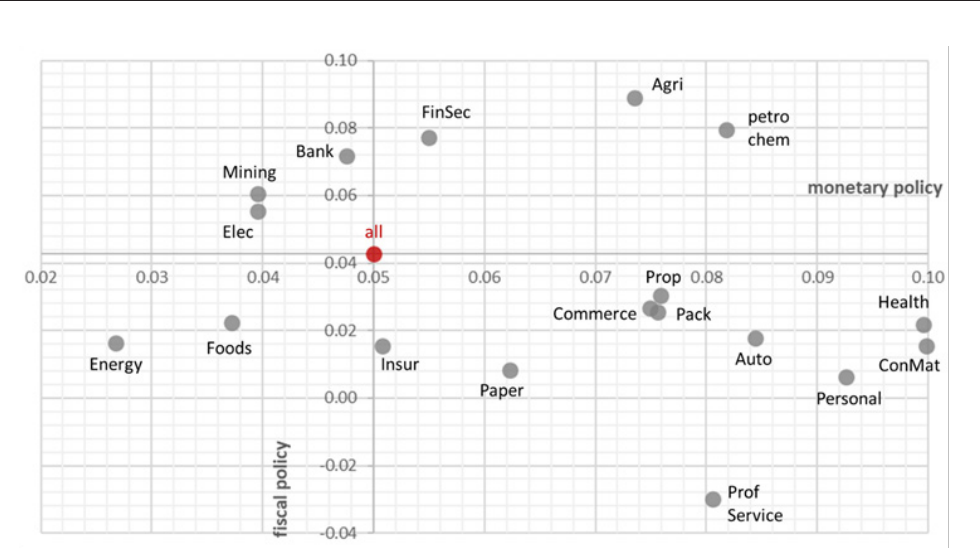

Next, we summarized the maximum response

value for each sector to policy shocks over the rst 20

quarters. The response value and response duration

for each sector are presented in Table 4. Additionally,

Figure 7 shows the sectoral response to both scal and

monetary policies.

As can be seen in Figure 7, three sectors in the rst

quadrant, namely PETROCHEM, AGRI, and FINSEC,

tended to respond to both monetary and scal policy

more than the overall market. While two sectors in

the third quadrant—ENERGY and FOODS—were less

likely to respond to either monetary or scal policy

than the market average.

Table 3

Abbreviation of Sector Indices

Sector index Abbreviation Sector index Abbreviation

Commerce COMMERCE Petrochemicals& Chemicals PETROCHEM

Banking BANK Electronic Components ELECTRONICS

Finance & Securities FINSEC Energy & Utilities ENERGY

Insurance INSUR Property Development PROP

Construction materials CONMAT Mining MINING

Agribusiness AGRI Paper & Printing Materials PAPER

Personal Products &

Pharmaceuticals

PERSONAL Packaging PACKAGING

Food and beverage FOODS Health Care Services HEALTH

Automotive AUTO Professional Services PROFSERVICE

Source: Retrieved from https://www.set.or.th/en/products/index/setindex_p2.html

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 63

Figure 5. . Impulse-response function by sector. Note: Y-axis, percent response to 1 standard deviation monetary policy shock (shock 4, particularly); X-axis,

quarters after shock. Blue and red lines – response and 95% condence interval, respectively. Sector indices’ abbreviations are shown in Table 3.

64

S. Prukumpai, et al

Figure 6. . Impulse-response function by sector. Note: Y-axis, percent response to 1 standard deviation scal policy shock (shock 3, particularly); X-axis, quarters

after shock. Blue and red lines – response and 95% condence interval, respectively. Sector indices’ abbreviations are shown in Table 3.

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 65

Table 4

Sectoral response value and response duration

Sector

Response to monetary policy Response to scal policy

Max value Duration Max value Duration

Overall 0.0500 8 0.0426 1

AGRI 0.0735 8 0.0888 4

FOODS 0.0372 8 0.0223 2

BANK 0.0476 8 0.0718 3

COMMERCE 0.0749 8 0.0268 4

CONMAT 0.0998 8 0.0156 1

AUTO 0.0844 8 0.0177 1

ELEC 0.0395 8 0.0553 4

ENERGY 0.0268 8 0.0162 1

FINSEC 0.0550 8 0.0771 1

INSUR 0.0508 8 0.0154 1

MINING 0.0395 8 0.0605 1

PACK 0.0756 8 0.0255 1

PAPER 0.0623 8 0.0082 1

PERSONAL 0.0926 8 0.0063 1

PROFSERVICE 0.0806 8 -0.0298 1

HEALTH 0.0995 8 0.0219 1

PETROCHEM 0.0818 8 0.0795 1

PROP 0.0759 8 0.0304 1

Note: The max value represents the maximum percent response to 1 standard deviation of policy shock while duration refers to the quarter

in which the percent response reached the maximum value.

66

S. Prukumpai, et al

When the government decided to implement

monetary policy by increasing the short-term interest

rate, the largest impact was on HEALTH, CONMAT,

and PERSONAL. One possible reason was that the

price-to-earnings (P/E) ratio of these sectors was higher

than the overall market—HEALTH’s P/E was 36.02 and

PERSONAL’s P/E was 19.39—compared to the overall

market P/E at 19.33.

1

Specically, when prices are

high, they are more sensitive to interest rate changes.

ELECTRONICS, FOODS, ENERGY, and MINING

were less affected by monetary policy. These sectors’

P/E were lower than the overall market, and the P/E

ranged from 7.69 to 20.24.

AGRI and PETROCHEM responded to fiscal

policy, changes in government spending in particular,

more than the others did. This was not surprising

because most Thai government spending programs

were related to agricultural products and infrastructure

construction and maintenance.

Conclusion

Comparing the empirical evidence on the effects

of monetary policy on the real and nancial economy,

Figure 7. Sector index response to policies shocks. Note: Y-axis, percent response to 1 standard deviation scal

policy shock (spending shock, particularly); X-axis, percent response to 1 standard deviation

monetary policy shock (short-run interest rate shock, particularly).

that of scal policy has received less attention. With

the recent economic downturn, scal policy has been

implemented more since it was expected to be effective

in terms of economic recovery. This is not the rst paper

to study the effects of monetary and scal policies;

however, most of the existing literature uses data from

developed countries. The biggest contribution of this

study is in analyzing the impact of Thai monetary and

scal policies on the stock market, both at the market

aggregate level and at the sectoral level. The ndings

can provide a reference point for research in this eld

using developing country data.

This study used quarterly data from 1996 to 2017 to

study how the Thai Stock Market responds to monetary

and scal policy. The structural VAR model with six

variables—world import volume (IMW), real GDP

(GDPR), real government spending (GTR), short-term

interest rate (INTS), long-term government bond yield

(INTL), and stock market indices (SET)—was estimated

and the following conclusions were drawn. First, based

on the causality test, monetary policy was seen to have

a bi-directional causal relationship with the real sector

but not with the stock market. No signicant causal

relationship between scal policy and either the real

How Does the Thai Stock Market Respond to Monetary and Fiscal Policy Shocks? 67

sector or the stock market was found. In addition, we

found no evidence of the crowding out effect but we

did nd a causal relationship from scal policy to

monetary policy.

Second, according to the impulse response analysis,

when comparing the results based on the SVAR model

and the reduced-form VAR model, the conclusion

was similar where the real sector and nancial sector

responded positively to expansionary monetary policy.

The impact of the scal policy was faster but lasted a

shorter length of time than that of monetary policy.

Our results reveal that the nancial market responds

to scal policy under both the SVAR model and the

reduced-form VAR model. This implies that investors

should consider both monetary and scal policy when

making investment decisions.

Exploring the response of the stock market to

policy shocks at the sectoral level, we found that

different sectors appear to react heterogeneously

to monetary and scal policy. Particularly, the high

P/E ratio sectors, such as healthcare and personal

service, were seen to be more sensitive to changes

in interest rates and vice versa. Moreover, changes

in government expenditure had the largest impact on

the agribusiness and petrochemical sectors. This is

because most monetary policy programs are related

to the promotion of agricultural product prices and

the investment in infrastructure construction and

maintenance. The heterogeneity responses of each

sector to economic policy imply that policymakers

need to customize their policies to meet the specic

needs of the sectors.

Endnote

1

The P/E ratio was retrieved from http://siamchart.

com/stock/SECTOR. October 27, 2018.

References

Afonso, A., & Sousa, R. M. (2011). What are the effects of

scal policy on asset markets? Economics Modelling,

28, 1871–1890.

Ardagna, S. (2009). Financial markets’ behavior around

episodes of large changes in the scal stance. European

Economic Review, 53, 37–55.

Bjornland, H., & Leitemo, K. (2009). Identifying the

interdependence between US monetary policy and

the stock market. Journal of Monetary Economics, 56,

275–282.

Blanchard, O., & Perotti, R. (2002). An empirical

characterization of the dynamic effects of changes in

government spending and taxes on output. Quarterly

Journal of Economics, 117, 1329-1368.

Chatziantoniou, I., Duffy, D., & Filis, G. (2013). Stock market

response to monetary and scal policy shocks: Multi-

country evidence. Economic Modelling, 30, 754–769.

Chevapatrakul, T. (2015). Monetary environments and stock

returns: International evidence based on the quantile

regression technique. International Review of Financial

Analysis, 38, 83–108.

Conover, C. M., Jensen, G. R., Johnson, R. R., & Mercer, J. M.

(1999). Monetary environments and international stock

returns. Journal of Banking and Finance, 23, 1357–1381.

Darrat, A. (1988). On scal policy and the stock market.

Journal of Money Credit and Banking, 20, 353–363.

Fama, E. F. (1970). Efcient capital markets: A review of

theory and empirical work. Journal of Finance, 25,

383–417.

Flannery, M. J., & Protopapadakis, A. A. (2002).

Macroeconomic factors do inuence aggregate stock

returns, Review of Financial Studies, 15, 751–782.

Foresti, P., & Napolitano, O. (2017). On the stock market

reactions to scal policies. International Journal of

Finance and Economics, 22, 296–303.

Goldsmith, R. (1969). Financial structure and development.

New Haven: Yale University Press.

Guerin, P., & Leon, D. L. (2017). Monetary policy, stock

market and sectoral comovement (Documentos de

Trabajo No. 1731). Madrid: Banco de Espana.

Hsing, Y. (2013). Effects of scal policy and monetary policy

on the stock market in Poland. Economies, 1, 19–25.

Hu, L., Han, J., & Zhang, Q. (2018). The impact of monetary

and scal policy shocks on stock markets: Evidence

from China. Emerging Markets Finance and Trade, 54,

1856–1871.

Jensen, G. R., & Johnson, R. R. (1995). Discount rate changes

and security return in the U.S., 1962–1991. Journal of

Banking and Finance, 19, 79–95.

Kim, S.-J., & Nguyen, T. (2009). The spillover effects of target

interest rate news from the U.S. Fed and the European

Central Bank on the Asia-Pacic stock markets. Journal

of International Financial Markets, Institutions and

Money, 19, 415–431.

Levine, R. (1997). Financial development and economic

growth: Views and agenda. Journal of Economic

Literature, 35, 688–726.

Laopodis, N. T., & Sawhney, B. L. (2002). Dynamic interactions

between Main Street and Wall Street. Quarterly Review

of Economics and Finance, 42, 803–815.

Luintel, B. K., & Khan, M. (1999). A quantitative re-

assessment of the nance-growth nexus: Evidence from

a multivariate VAR. Journal of Development Economics,

60, 381–405.

68

S. Prukumpai, et al

MacKinnon, J. G. (1990). Critical values for cointegration

tests (Queen’s Economics Department Working Paper

No. 1227) Ontario: Queen’s University.

McKinnon, R. I. (1973). Money and capital in economic

development. Washington, D.C.: Brookings Institution.

Melitz, J. (1997). Some cross-country evidence about

debt, decits and the behavior of monetary and scal

authorities (CEPR Discussion Paper No. 1653). London:

CEPR.

Mishkin, F. S. (1996). The channels of monetary transmission:

Lessons for monetary policy (NBER Working Paper No.

5464). Massachusetts: National Bureau of Economic

Research.

Muscatelli, V. A., Tirelli, P., & Trecroci, C. (2004). Fiscal and

monetary policy interactions: Empirical evidence and

optimal policy using a structural New-Keynesian model.

Journal of Macroeconomics, 26, 257–280.

Pesaran, M. H., & Shin, Y. (1998). Generalized impulse

response analysis in linear multivariate models.

Economics Letters, 58, 17–29.

Ramey, V. A., & Shapiro, M. D. (1998). Costly capital

reallocation and the effects of government spending.

Carnegie-Rochester Conference Series on Public Policy,

48, 145–194.

Rigobon, R., & Sack, B. (2003). Measuring the reaction of

monetary policy to the stock market. Quarterly Journal

of Economics, 118, 639–669.

Sims, C. A. (1980). Macroeconomics and reality. Econometrica:

Journal of the Econometric Society, 48, 1–48.

Thanh, T. T., Thuy, L. P., Anh, T. N., Thi, T. D., & Truong, T.

H. (2017). Empirical test on impact of monetary policy

and scal policy on Vietnam stock market. International

Journal of Financial Research, 8, 135–144.

Thorbecke, W. (1997). On stock market returns and monetary

policy. Journal of Finance, 52, 635–654.

Tobin, J. (1969). A general equilibrium approach to monetary

theory. Journal of Money Credit and Banking, 1,

15–29.

Vithessonthi, C., & Techarongrojwong, Y. (2013). Do

monetary policy announcements affect stock prices

in emerging market countries? The case of Thailand.

Journal of Multinational Financial Management, 23,

446–469.

Wongswan, J. (2009). The response of global equity indexes

to U.S. monetary policy announcements. Journal of

International Money and Finance, 28, 344–365.