NATIONAL FLOOD INSURANCE PROGRAM

FLOOD

INSURANCE

MANUAL

October 2021

Risk Rating 2.0: Equity in Action Edition

This page is intentionally left blank.

Message to National Flood Insurance Program

Agents and Insurers

Over the past several years, we at the Federal Emergency

Management Agency (FEMA) have emphasized our

commitment to our policyholders. This year, we are significantly

transforming the ways we manage the National Flood

Insurance Program (NFIP). This transformation will enable our

partners and stakeholders, Write Your Own (WYO) insurance

companies, the NFIP Direct, insurance company vendors,

and agents, as insurance professionals, to improve our

policyholders’ experience.

A key part of this transformation is Risk Rating 2.0: Equity in

Action, which will change the way FEMA fundamentally views

and evaluates flood risk. The current rating methodology

has not changed since the 1970s; since then, technology

has evolved and so has FEMA’s understanding of flood risk.

After three years and thousands of hours of staff time, we are delivering a 21st century system

capable of developing premiums that reflect a single property’s unique flood risk.

The goal of Risk Rating 2.0 is to deliver easy-to-understand premiums that are distributed

more equitably across all policyholders based on the replacement cost value of their home and

their property’s unique flood risk. By addressing the current inequities, Risk Rating 2.0 puts

the NFIP on the path towards sound financial footing by creating a more stable program that

is accountable to taxpayers, more accurately reflects flood risk to both policyholders and non-

policyholders, and helps disaster survivors recover faster after floods.

An added benefit of Risk Rating 2.0 is that it will make it easier for flood insurance agents to

sell policies and better communicate flood risk to current and prospective policyholders. We are

committed to making this transition to the new methodology as smooth as possible with the

creation of the Industry Transition Memo and the new Risk Rating 2.0: Equity in Action Flood

Insurance Manual, which will make rates and processes easier to understand from the agent,

insurer, and policyholder’s point of view. Our goal is to ensure the NFIP provides the information

and processes needed to support the policyholder, agent, and insurer.

One of FEMA’s strategic goals is to build a culture of preparedness by helping property owners

understand the proper amount of flood insurance coverage for each individual property’s level

of risk. Risk Rating 2.0 will better inform individuals and communities about flood risk, set

premiums to strongly signal those risks, and promote actions to mitigate against them.

As an insurance professional, you are the key to guiding policyholders through the entire NFIP

policy lifecycle — from completing the application to endorsing coverage as the property value

changes to helping them understand the new rates under Risk Rating 2.0.

Each of you represents the NFIP and our improved customer experience. Each agent will likely

be the first – and may be the only – NFIP representative policyholders engage with unless there

is a major flood event. FEMA depends on each agent’s expertise and continued commitment to

help policyholders protect their property and recover more quickly from potentially devastating

flood losses.

I would like to take a moment to acknowledge the hard work you do on our behalf, particularly

during this taxing year. We recognize your job is not easy. However, you can affect the flood

insurance policy experience positively for NFIP policyholders and help people prepare for the

Message to National Flood Insurance Program

Agents and Insurers

unknown. I appreciate that you go the extra mile to make sure we are treating our policyholders

with integrity and respect.

Risk Rating 2.0: Equity in Action will allow us to bring generational change to the NFIP as we

continue building a culture of preparedness, improving individual and community resilience, and

advancing our goal to reduce disaster suffering. Together we can help close the insurance gap

and build more resilient communities.

Sincerely,

David I. Maurstad

Deputy Associate Administrator

for Insurance and Mitigation

U.S. Department of Homeland Security

Washington, DC

20472

October 1, 2021

Dear N

ational Flood Insurance Program Flood Insurance Manual User:

FEMA is pleased to present this updated Risk Rating 2.0: Equity in Action (Risk Rating 2.0) edition

of the National Flood Insurance Program (NFIP) Flood Insurance Manual, which applies to all

new NFIP policies and to renewal policies (at the policyholder’s option) effective October 1, 2021

or later. The NFIP is on a multi-year, transformative journey to deliver excellent customer service,

support community resilience, and reduce disaster suffering for all NFIP policyholders. This edition

of the Flood Insurance Manual presents guidance for a new rating methodology that will provide an

improved customer experience for policyholders and streamline operations for industry partners.

To underpin this effort, FEMA is introducing a new pricing paradigm in which the cost of flood

insurance more accurately reflects the associated risk. The NFIP is moving away from pricing based

primarily on a building’s elevation and its location inside or outside of a high-risk flood zone. The

legacy rating methodology, at times, created disparities at the edge of flood zones, giving neighboring

property owners markedly different flood insurance costs. FEMA’s new rating methodology leverages

catastrophe modeling, geospatial technology, and NFIP mapping data to estimate risk and determine

the cost of flood insurance for each individual building.

The new NFIP rating methodology, referred to as Risk Rating 2.0, produces flood insurance pricing

that is more equitable and easier to understand. So that each building’s flood insurance cost reflects its

unique flood risk, Risk Rating 2.0 considers additional types of flooding as well as property-specific

rating variables such as the distance to a flooding source and the cost to rebuild. Property-specific

pricing will clearly signal risk, helping policyholders and communities become more resilient and

make risk-informed decisions to mitigate the effects of flooding.

This Flood Insurance Manual Risk Rating 2.0 edition updates existing NFIP underwriting policies

and processes to enable effective and consistent program implementation within the Risk Rating 2.0

framework. It applies to new NFIP policies effective October 1, 2021 or later, and it also applies to

existing NFIP policies following their renewal under the new pricing methodology. The Risk Rating

2.0 Industry Transition Memo complements this Flood Insurance Manual edition. It explains the

transition from the legacy rating methodology to the new pricing methodology. More specifically, it

provides business, data, and information technology guidance for NFIP insurers and vendors on how

to transition existing policyholders, with renewals dates of October 1, 2021 through March 31, 2022,

who choose to renew under the new pricing methodology.

This Risk Rating 2.0 edition of the Flood Insurance Manual also reflects revisions to NFIP

regulations that become effective October 1, 2021. FEMA published the final rule (“Conforming

Changes To Reflect the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12) and the

Homeowners Flood Insurance Affordability Act of 2014 (HFIAA), and Additional Clarifications for

Plain Language”) in the Federal Register in July 2020. 85 Fed. Reg. 43946. The rule codifies certain

www.fema.gov

October 2021 RR 2.0 edition of the National Flood Insurance Program Flood Insurance Manual

October 1, 2021

Page 2

provisions of previous NFIP legislation and makes additional substantive and non-substantive changes

to N

FIP regulations and the Standard Flood Insurance Policy forms. FEMA already implemented

most BW-12 and HFIAA legislative reforms in previous manuals and other NFIP guidance documents,

but this Flood Insurance Manual edition includes additional changes to a waiting period exception,

reformation procedures, deductible options, cancellation reason codes, and definitions.

While the basic structure of the Flood Insurance Manual remains the same, some material has been

reorganized, revised, expanded, or deleted to reflect the new rating paradigm and updated procedures.

For your reference and ease of use, the Change Record following this cover memo highlights

significant changes.

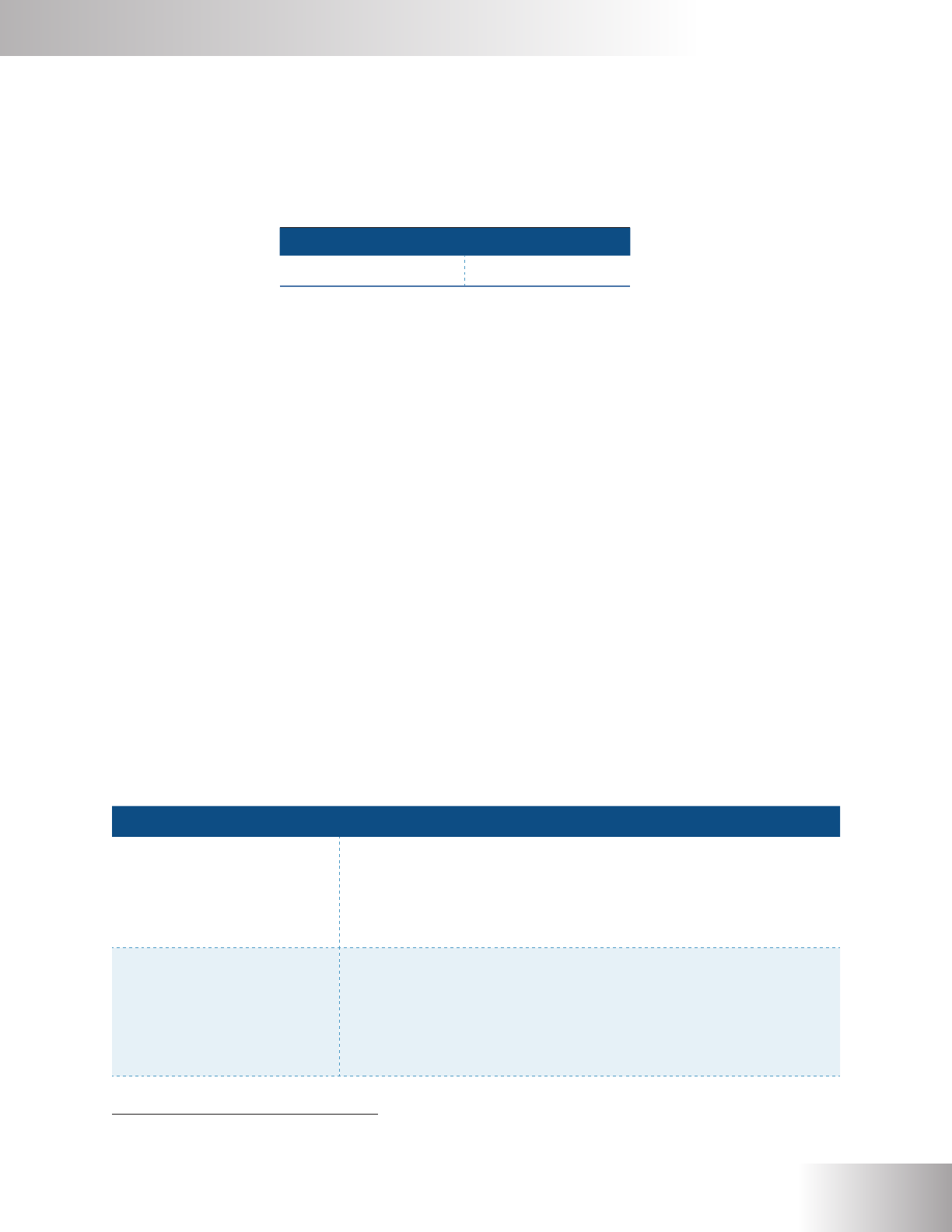

The table below summarizes aspects of the NFIP that are changing under Risk Rating 2.0 and

describes other aspects that are not.

What Is Not Changing What Is Changing

• Flood insurance coverage that

continues to align with the terms

and conditions of the Standard Flood

Insurance Policy.

• NFIP eligibility requirements.

• Statutory limits on annual premium

increases.

• Availability of statutory discounts,

including the Pre-FIRM and Newly

Mapped discounts.

• Availability of Community Rating

System discounts.

• Ability to transfer a policy and

applicable discounts to the buyer of

a property.

• Fundamentals of endorsements,

renewals, and cancellations.

• Use of Flood Insurance Rate Maps for

the mandatory purchase requirement

and floodplain management.

We are reducing complexity by:

• Eliminating the Elevation Certificate (EC)

requirement for rating purposes, while

allowing ECs optionally for all buildings.

• Simplifying guidance on premium discounts.

• Discontinuing the Preferred Risk Policy and

Mortgage Portfolio Protection Program.

• Minimizing the consideration of flood zones

in rating.

We are increasing investment in mitigation by:

• Expanding eligibility for mitigation discounts.

• Expanding applicability of Community Rating

System discounts.

We are addressing inequities by:

• Leveraging more information about building

characteristics and different types of flooding.

• Reflecting prior claims in premium costs,

while “forgiving” a single claim.

• Factoring in the cost to rebuild so that

policyholders with lower-valued homes no

longer pay more for their insurance coverage

than they should, nor policyholders with

higher-valued homes too little.

www.fema.gov

October 2021 RR 2.0 edition of the National Flood Insurance Program Flood Insurance Manual

October 1, 2021

Page 3

FEMA’s continued goal is to make NFIP products and processes easy to understand, enabling

insurance professionals to provide policyholders with an excellent customer experience. Thank you for

your continued support of the NFIP. Together we can make America more flood resilient and build a

culture of preparedness by closing the nation’s insurance gap.

Sincerely,

Jeffrey Jackson

Acting, Assistant Administrator for Federal Insurance

Federal Insurance and Mitigation Administration

www.fema.gov

This page is intentionally left blank.

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL 1

Change Record

October 1, 2021 Risk Rating 2.0 NFIP Flood Insurance Manual Edition

This change record presents significant highlights of the Risk Rating 2.0 Flood Insurance Manual (FIM)

sections and appendices. It also describes some changes from the April 1, 2021 FIM.

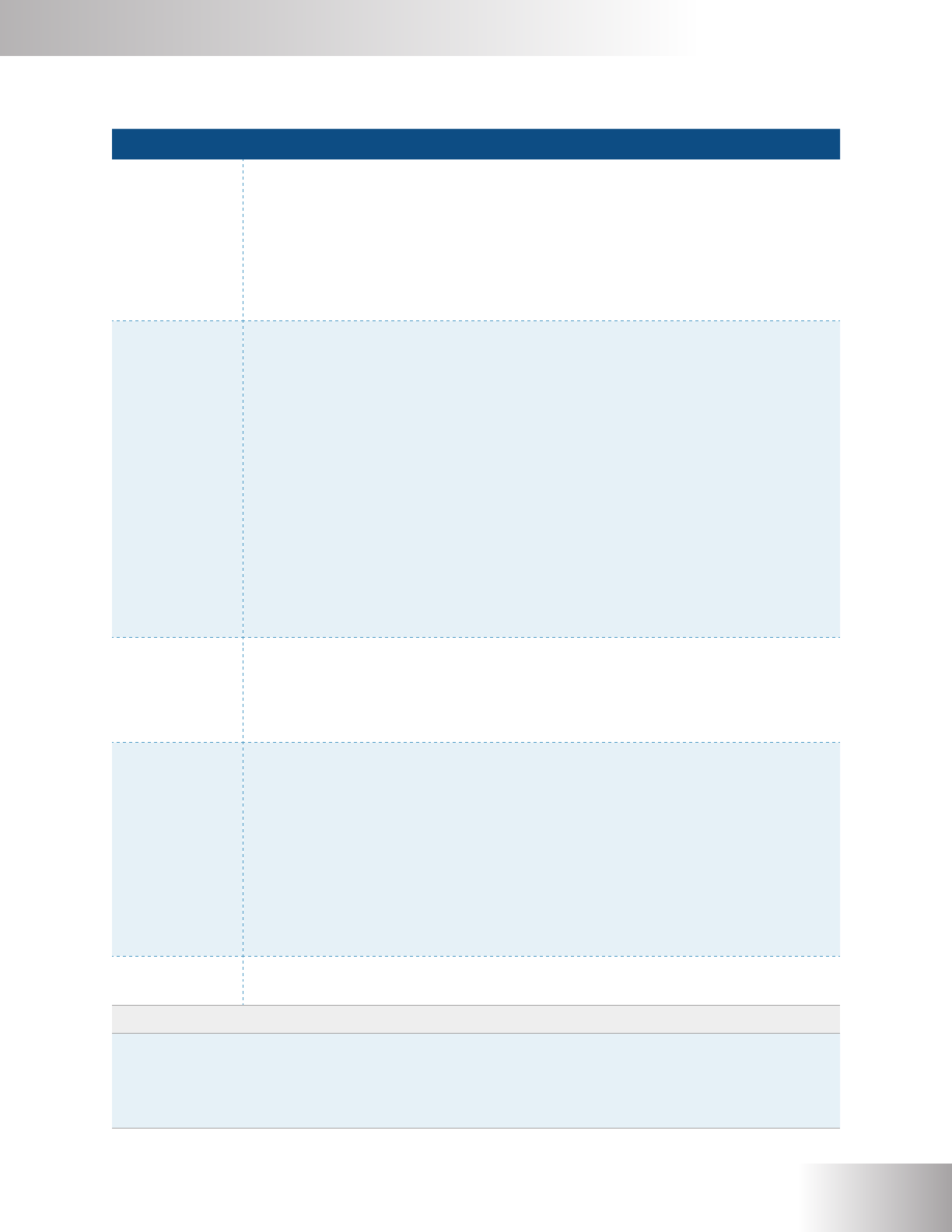

Section Changes

Section 1:

Introduction

• Provides an overview of the NFIP Flood Insurance Manual’s purpose

and contents.

• Describes the NFIP’s current operating model.

• Describes the contents of each section and appendix in the manual.

• Updates references and access information for NFIP resources.

Section 2:

Before You Start

• Explains the availability and use of the three Standard Flood

Insurance Policy (SFIP) forms.

• Clarifies guidance on insurable interest, tenant coverage, and

duplicate policies.

• Adds detailed guidance on multiple separate buildings located at a

single address.

• Describes distinctions between a Group Flood Insurance Policy

and an SFIP.

• Introduces a program change clarifying the flood-in-progress

coverage exclusion.

• Moves discussion of Increased Cost of Compliance (ICC) coverage to

Section 3: How to Write.

• Expands the effective date guidance to cover endorsements and

introduces program changes clarifying the loan exception and post-

wildfire exception.

• Clarifies guidance for policy assignments and transfers including the

specified timeframe for submitting the endorsement.

• Revises guidance for policy reformation due to insufficient premium

or insufficient rating information.

Section 3:

How to Write

• Revises much of the section to implement the Risk Rating 2.0

rating methodology.

• Summarizes the Risk Rating 2.0 rating methodology and the process

for writing new business.

• Provides guidance throughout for completing the Flood Insurance

Application Form as revised to reflect the new rating methodology.

• Presents general rating information divided into multiple

subsections: Policyholder and Mortgagee Information; Geographic

Location Variables; Structural Variables; Coverages and Deductibles;

Statutory Discounts; and Assessments, Fees, and Surcharges.

• Updates guidance on flood zones since zones no longer drive

NFIP rating.

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL 2

October 2021 RR 2.0 Change Record

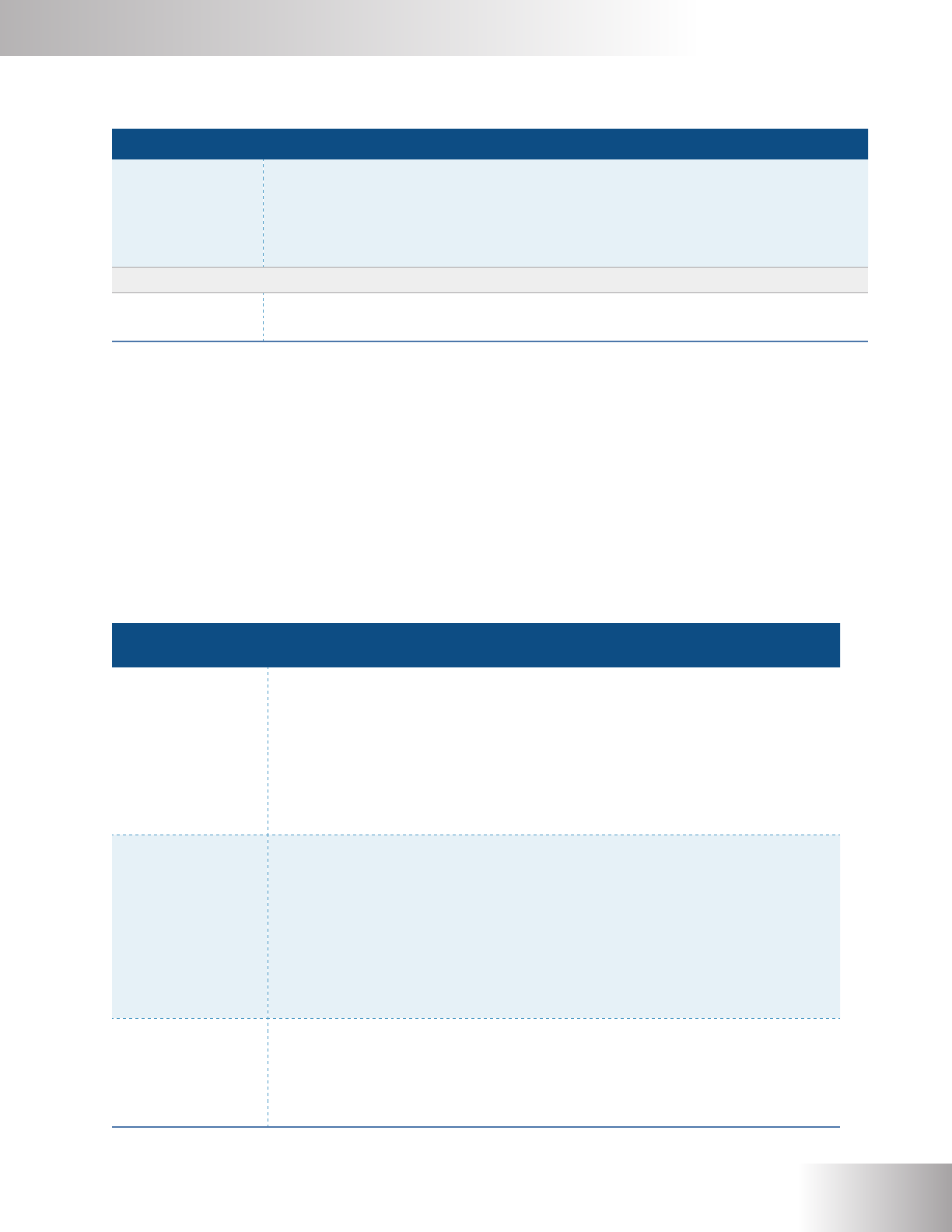

Section Changes

Section 3:

How to Write

continued

• Incorporates Community Rating System (CRS) guidance under

Geographic Location Variables, expanding the applicability of CRS

discounts to all flood zones.

• Expands and revises the lists of Building Occupancies and

Building Descriptions.

• Provides new guidance on Construction Type, Foundation Type, and

Floor of Unit.

• Introduces guidance on determining First Floor Height, eliminating

the EC requirement for rating purposes while allowing ECs with

accompanying photos optionally for all buildings.

• Provides detailed guidance on measures to earn mitigation discounts.

• Provides guidance on the new Building Replacement Cost Value and

Prior NFIP Claims rating factors.

• Revises deductible options and Federal Policy Fee amounts.

• Aligns tables for maximum coverage limits, deductibles, surcharges,

and fees, as applicable, with the revised Building Occupancies.

• Introduces and provides guidance on the application of statutory

discounts including the Pre-FIRM, Newly Mapped, and Emergency

Program discounts.

• Provides new guidance on a new policy after a real estate

transaction.

• Revises the Condominium Rating Information guidance to reflect the

revised Building Occupancies.

• Provides guidance on the revised concept of provisional rating,

addressing situations when FEMA’s system is unavailable to provide

premium quotes.

• Replaces rating examples with application scenarios in new

Appendix J: Sample Scenarios.

• Discontinues the Preferred Risk Policy and Mortgage Portfolio

Protection Program.

Section 4:

How to Endorse

• Revises much of the section to implement the Risk Rating 2.0

rating methodology.

• Provides guidance throughout for completing the revised General

Change Endorsement Form in conjunction with an updated version of

the Application Form to identify policy changes.

• Summarizes the process for premium-bearing changes.

• Expands the guidance on insufficient premium when processing

premium-bearing changes.

• Streamlines guidance on endorsement effective dates, referencing

details in Section 2: Before You Start.

• Expands discussion of premium-bearing changes during the renewal

cycle, adding new instructions on reducing coverage on a future

renewal date.

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL 3

October 2021 RR 2.0 Change Record

Section Changes

Section 4:

How to Endorse

continued

• Clarifies the difference between rating adjustments and

rating corrections.

• Clarifies types of endorsements that are exempt from the annual

increase cap discount.

• Provides guidance on adding an EC to determine a building’s First

Floor Height.

• Incorporates guidance on endorsing (or canceling and rewriting)

policies to the correct policy form and property address.

• Provides guidance on endorsing a policy from a provisional rate to a

rating engine rate.

• Adds a new table with examples of premium-bearing changes.

• Updates guidance on policy assignment.

• Discontinues Alternative Rating.

Section 5:

How to Renew

• Reorganizes information on starting the renewal process.

• Updates guidance on invalid payments and insufficient payments.

• Revises the guidance for determining the renewal effective date,

introducing a program change around policy lapses.

• Expands guidance on renewal by Application Form or Recertification

Questionnaire and revises guidance on nonrenewal.

• Removes previous guidance related to the Newly Mapped discount.

• Expands discussion of premium-bearing changes during the renewal

cycle, adding new instructions on reducing coverage on a future

renewal effective date.

• Streamlines guidance on transfers of business at renewal,

referencing details in Section 2: Before You Start.

Section 6:

How to Cancel

• Updates overall guidance on cancellation requests under the

General Information heading.

• Groups cancellation reason codes by topic.

• Removes the following reason codes:

– Reason Code 18 “Mortgage Paid Off on an MPPP Policy”

– Reason Code 24 “Cancel/Rewrite Due to a Map Revision,

LOMA, or LOMR”

– Reason Code 25 “HFIAA Section 28”

• Adds the following reason codes:

– Reason Code 27 “Building Becomes Ineligible During the

Policy Term”

– Reason Code 28 “No Longer Required by Lender,” consolidating

all reason codes for situations when flood insurance is no longer

required by the lender because the building is no longer in a

SFHA or the mortgage has been paid off (Reason Codes 08, 09,

12, 15, 19)

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL 4

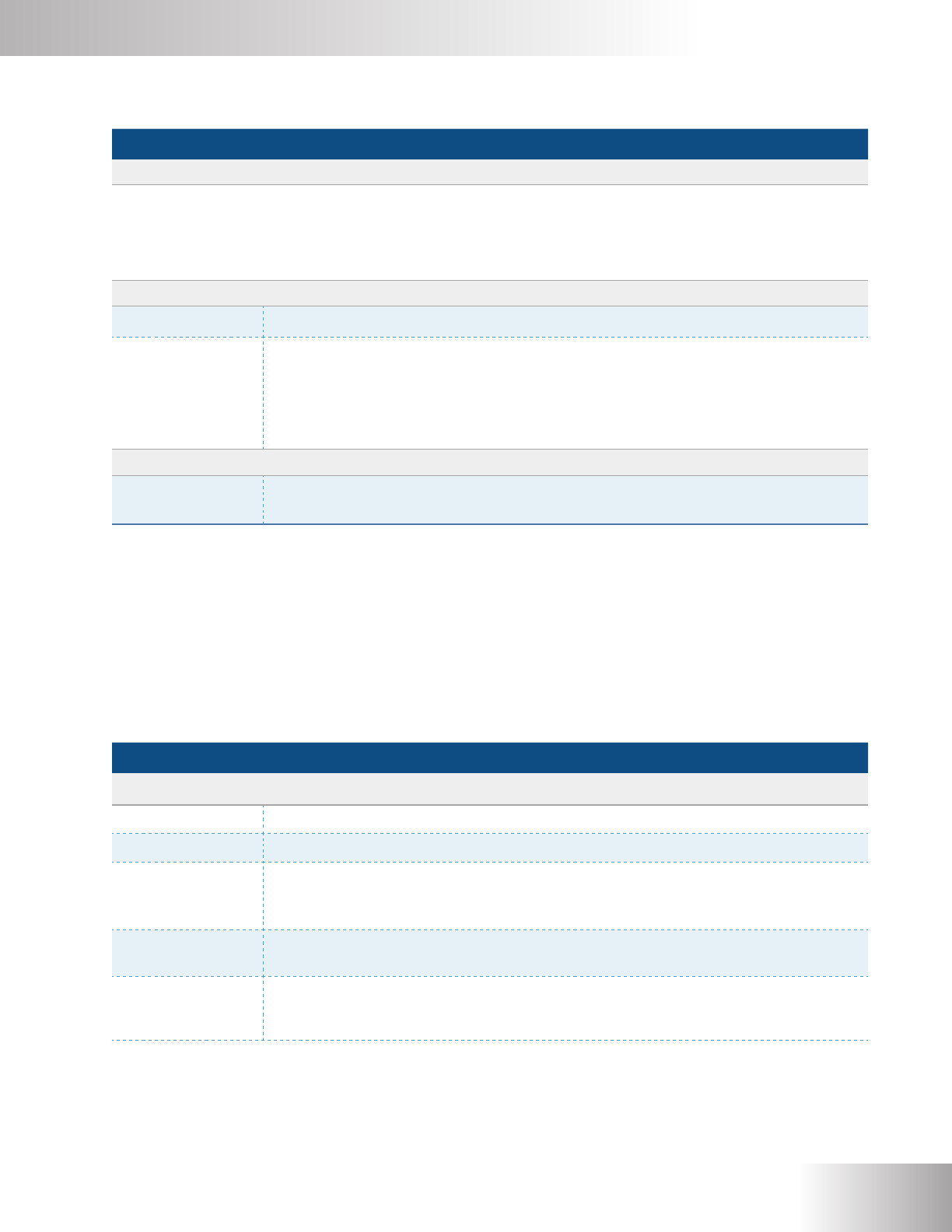

October 2021 RR 2.0 Change Record

Section Changes

Section 6:

How to Cancel

continued

– Reason Code 29 “Building Physically Altered and No Longer

Eligible for NFIP Coverage”

– Reason Code 30 “Insufficient Premium to Retain Coverage”

• Changed certain receipt date requirements.

• Updated refund rules in accordance with the July 2020 Final Rule.

Appendix A: Policy

• Updates the SFIP forms to reflect the July 2020 Final Rule. See the

Flood Insurance Manual cover memo for additional information.

Appendix B: Forms

• Incorporates new versions of the NFIP Flood Insurance Application,

General Change Endorsement, and Cancellation/Nullification

Request forms. Includes links to the current approved versions of

these forms on FEMA.gov.

• Incorporates the proposed version of the NFIP Residential Basement

Floodproofing Form (no changes to the form).

Appendix C: Quick

Start Guide

• A new appendix containing quick reference instructions for

completing the Flood Insurance Application Form when writing a

new policy.

Appendix D:

Flood Maps

• New lettering designation for this appendix.

• Revises and reorganizes the entire appendix.

Appendix E: Coastal

Barrier Resources

System

• New lettering designation for this appendix.

• Updates links to external references.

• Expands guidance on locating a property in the CBRS Buffer Zone.

Appendix G: Leased

Federal Properties

• Removes references to “full-risk rating,” clarifying that Leased

Federal Properties are ineligible for statutory discounts.

• Removes the “Settling a Claim” topic.

Appendix F: Severe

Repetitive Loss

Properties

• New lettering designation for this appendix.

• Updates the links to external references.

Appendix H: Claims

• New lettering designation for this appendix.

• Updates links to external references.

Appendix I:

Policyholder

Communications

• A new appendix that provides samples and requirements for

documents used to communicate with policyholders and other

interested parties.

• Consolidates in this appendix all the sample letters that used to

appear in various FIM sections.

Appendix J: Sample

Scenarios

• A new appendix that provides Flood Insurance Application

sample scenarios.

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL 5

October 2021 RR 2.0 Change Record

Section Changes

Appendix K:

Definitions and

Acronyms

• New lettering designation for this appendix.

• Adds new definitions, deletes old definitions, and revises existing

definitions as appropriate.

• Updates the list of acronyms.

Former Appendix C:

Lowest Floor Guide

• Removes this appendix because it is largely obsolete under the new

rating methodology. See the new Foundation Type and First Floor

Height guidance in Section 3: How to Write.

Former Appendix F:

Community Rating

System

• Removes this appendix because the revised CRS guidance is now

included in Section 3: How to Write.

• A list of all current CRS eligible communities and their status can be

found at: https://www.fema.gov/floodplain-management/community-

rating-system.

Former Appendix J:

Rate Tables

• Removes this appendix because the new rating methodology does

not use rate tables; instead FEMA’s system uses the submitted

policy information to generate a premium quote. Other topics that

remain relevant like ICC coverage; deductible options; statutory

discounts; assessments, fees, and surcharges; condominium rating;

and provisional rating now appear in Section 3: How to Write.

Former Appendix

K: Residential

Basement

Floodproofing

Premium Discount

• Removes this appendix because the floodproofing guidance in

Section 3: How to Write now links directly to the list of communities

approved for the residential basement floodproofing premium

discount.

This page is intentionally left blank.

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • i

Table of Contents

Message to National Flood Insurance Program Agents and Insurers

Cover Memo

Change Record

1. Introduction

I.

Purpose and Audience .................................................................................................................. 1-1

II.

NFIP Program and Operational Model ........................................................................................ 1-1

A. Program Overview ................................................................................................. 1-1

B. NFIP Operational Model ......................................................................................... 1-1

C. Legislative Reforms ............................................................................................... 1-2

III.

Organization of the Document ..................................................................................................... 1-3

IV.

NFIP Resources .............................................................................................................................. 1-6

A. Policy-Specic Inquiries ......................................................................................... 1-6

B. General Assistance and Inquiries ........................................................................... 1-6

C. NFIP Topics and Contact Information ...................................................................... 1-6

2. Before You Start

I.

Policy Forms ....................................................................................................................................2-1

A. General Information .............................................................................................. 2-1

B. Insurable Interest .................................................................................................. 2-2

C. Duplicate Policies .................................................................................................. 2-3

D. Group Flood Insurance Policy ................................................................................. 2-4

II.

Eligibility for NFIP Coverage ..........................................................................................................2-4

A. Eligibility of Property Locations ............................................................................... 2-5

1. Where the NFIP Offers Insurance ....................................................................... 2-5

2. Where the NFIP Does Not Offer Insurance .......................................................... 2-5

B. Building Eligibility .................................................................................................. 2-6

1. General Information .......................................................................................... 2-6

2. Single and Multiple Buildings ............................................................................. 2-7

3. Eligible Types of Buildings ................................................................................. 2-7

4. Ineligible Types of Buildings ............................................................................... 2-10

C. Contents Eligibility ................................................................................................. 2-11

D. NFIP Coverage Exclusions and Limitations .............................................................. 2-12

III.

Effective Dates for New Policies and Endorsements ................................................................2-13

A. Standard 30-day Waiting Period ............................................................................. 2-14

1. General Information .......................................................................................... 2-14

2. Insufcient Payment ......................................................................................... 2-15

3. Invalid Payment ................................................................................................ 2-15

B. Map Revision Exception (1-Day Waiting Period) ........................................................ 2-15

C. Loan Exception (No Waiting Period) ........................................................................ 2-16

D. Post-Wildre Exception (1-Day Waiting Period) ......................................................... 2-18

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • ii

Table of Contents

2. Before You Start continued

IV.

Administrative Topics .....................................................................................................................2-18

A. Electronic Signatures............................................................................................. 2-18

B. Delivery of the Policy ............................................................................................. 2-19

C. Evidence of Insurance ........................................................................................... 2-19

V.

Assignment and Transfer of Business .........................................................................................2-19

A. Assignment of a Policy to a New Building Owner ...................................................... 2-19

B. Transfer of Any or All of a Policyholder’s or Agent’s Business to Another Insurer ........ 2-20

C. Transfer of an Insurer’s Entire Book to Another Insurer ............................................ 2-20

VI.

Reformation Due to Insufcient Premium or Rating Information ...........................................2-20

A. General Information .............................................................................................. 2-20

B. General Reformation Procedures ............................................................................ 2-21

C. Exception When Reforming a Policy Due to an Incorrect Geolocation

or Flood Zone ....................................................................................................... 2-24

3. How to Write

I.

Introduction ..................................................................................................................................... 3-1

A. Snapshot of the Risk Rating 2.0 Methodology: Equity in Action ................................ 3-1

B. Process for Writing New Business .......................................................................... 3-3

II.

General Rating Information ..........................................................................................................3-4

A. Policyholder and Mortgagee Information ................................................................. 3-4

1. Policyholder Information .................................................................................... 3-4

2. Mortgagee Information ..................................................................................... 3-4

B. Geographic Location Variables ............................................................................... 3-4

1. Building Location .............................................................................................. 3-4

a. Property Address ........................................................................................ 3-5

b. Geolocation ................................................................................................ 3-5

c. Multiple Buildings at the Same Address .......................................................3-6

2. Community Map Information and Flood Zone ...................................................... 3-6

3. Community Rating System (CRS) Discount ......................................................... 3-7

a. General Information ....................................................................................3-7

b. Policies Ineligible for CRS Discounts ............................................................ 3-7

c. CRS Classes and Discounts ........................................................................3-8

d. CRS Community Status Information ............................................................. 3-8

C. Structural Variables ............................................................................................... 3-9

1. Building Occupancy & Description ...................................................................... 3-9

a. Building Occupancy .....................................................................................3-9

b. Building Description .................................................................................... 3-12

c. Manufactured/Mobile Homes ...................................................................... 3-14

2. Construction Type ............................................................................................. 3-14

3. Foundation Type ............................................................................................... 3-15

a. Non-Elevated Building .................................................................................3-15

b. Elevated Building ........................................................................................3-17

c. Elevated Building with an Enclosure .............................................................3-19

i. Denition of an Enclosure ....................................................................... 3-19

ii. Enclosure Wall Types .............................................................................. 3-19

d. Crawlspace – Elevated and Non-Elevated .....................................................3-20

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • iii

Table of Contents

3. How to Write continued

4. First Floor Height .............................................................................................. 3-21

a. General Information ....................................................................................3-21

b. FEMA Determined First Floor Height .............................................................3-23

c. Elevation Certicate/Land Survey ................................................................3-23

d. Additional Information on Elevation Certicates or Land Surveys ....................3-25

i. Documentation required .........................................................................3-25

ii. Other Elevation Information ....................................................................3-26

iii. Troubleshooting .....................................................................................3-26

e. First Floor Height Used................................................................................3-26

5. Mitigation Discounts ......................................................................................... 3-27

a. Machinery and Equipment Above First Floor ..................................................3-27

b. Proper Flood Openings ................................................................................ 3-28

i. Proper Flood Openings Discount Requirements ........................................3-28

ii. Engineered Openings Certied by a Design Professional ........................... 3-29

iii. Engineered Openings Certied by the International Code Council

Evaluation Service ..................................................................................3-30

6. Floodproong ................................................................................................... 3-30

a. General Information ....................................................................................3-30

b. Application Form .........................................................................................3-30

c. Documentation Requirements for Non-Residential Floodproong ....................3-31

7. Replacement Cost Value ................................................................................... 3-32

a. Square Footage .......................................................................................... 3-32

b. Building Replacement Cost Value.................................................................3-33

i. Occupancy Type: Single-Family Home, Residential Manufactured/

Mobile Home, Residential Unit, and Two-to-Four Family Building ................3-33

ii. Occupancy Type: Other Residential Building, Residential Condominium

Building, Non-Residential Building, Non-Residential Manufactured/

Mobile Building, Non-Residential Unit ......................................................3-33

8. Claims History .................................................................................................. 3-34

a. Prior NFIP Claims ........................................................................................ 3-34

i. General Information ...............................................................................3-34

ii. Correcting or Updating NFIP Claims History .............................................. 3-35

b. Severe Repetitive Loss Property ..................................................................3-35

9. Other Building Factors ....................................................................................... 3-36

a. Date of Construction ................................................................................... 3-36

i. General Information ...............................................................................3-36

ii. Substantial Improvement Date ................................................................ 3-36

iii. Date of Construction for Manufactured/Mobile Homes and

Travel Trailers ........................................................................................3-37

iv. Building Under Construction ....................................................................3-37

b. Number of Detached Structures on Property ................................................ 3-38

c. Number of Elevators ...................................................................................3-38

d. Number of Floors in Building ........................................................................3-38

e. Floor of Unit ...............................................................................................3-38

f. Total Number of Units in the Building ...........................................................3-38

g. Rental Property .......................................................................................... 3-38

h. Building Over Water ....................................................................................3-38

i. Primary Residence Status ...........................................................................3-38

i. General Information ...............................................................................3-38

ii. Documentation of Primary Residence ......................................................3-39

iii. Primary Residence and Trusts ................................................................. 3-39

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • iv

Table of Contents

3. How to Write continued

D. Coverage and Deductibles ..................................................................................... 3-40

1. Maximum Coverage Limits ................................................................................ 3-40

2. Increased Cost of Compliance (ICC) Coverage .................................................... 3-41

3. Deductibles ...................................................................................................... 3-42

E. Statutory Discounts .............................................................................................. 3-44

1. Pre-FIRM Discount ............................................................................................ 3-44

a. Eligibility ....................................................................................................3-44

b. Lapse in Coverage ...................................................................................... 3-45

c. Application ................................................................................................. 3-45

2. Newly Mapped Discount .................................................................................... 3-46

a. Eligibility ....................................................................................................3-47

b. Documentation ...........................................................................................3-47

c. Lapse in Coverage ...................................................................................... 3-47

d. Application Form .........................................................................................3-48

3. Other Statutory Discounts ................................................................................. 3-49

4. New Policy After a Real Estate Transaction ......................................................... 3-49

F. Assessments, Fees, and Surcharges...................................................................... 3-50

1. Reserve Fund Assessment ................................................................................ 3-50

2. HFIAA Surcharge............................................................................................... 3-50

3. Federal Policy Fee ............................................................................................. 3-51

4. Probation Surcharge ......................................................................................... 3-52

G. Premium Considerations ........................................................................................ 3-52

III.

Condominium Rating Information ...............................................................................................3-52

A. Condominium Rating Scenarios.............................................................................. 3-52

1. Overview .......................................................................................................... 3-52

2. Condominium Association Coverage for Residential Condominium

Building (Scenario #1) ....................................................................................... 3-53

3. Residential Unit Owner Coverage in Residential Condominium

Building (Scenario #2) ....................................................................................... 3-58

a. General Information ....................................................................................3-58

b. Assessment Coverage ................................................................................3-61

4. Residential Unit Owner Coverage in Non-Residential Condominium

Building (Scenario #3) ....................................................................................... 3-62

5. Condominium Association Coverage for Non-Residential Condominium

Building (Scenario #4) ....................................................................................... 3-64

6. Non-Residential Unit Owner Coverage in Residential or Non-Residential

Condominium Building (Scenario #5).................................................................. 3-67

B. Applying the Condominium Rating Scenarios ........................................................... 3-70

IV.

Provisional Rating Information ..................................................................................................... 3 -74

A. General Information .............................................................................................. 3 -74

B. Eligibility ............................................................................................................... 3 -74

C. Rates ................................................................................................................... 3-75

D. Premium Adjustments ........................................................................................... 3-76

E. Notication ........................................................................................................... 3-76

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • v

Table of Contents

4. How to Endorse

I.

Endorsement Process ....................................................................................................................4-1

A. General Change Endorsement Form ....................................................................... 4-1

B. Signatures ............................................................................................................ 4-1

C. Non-Premium and Premium-Bearing Changes ......................................................... 4-1

1. Non-Premium Changes ..................................................................................... 4-1

a. Process for Submitting a Non-Premium Change. ...........................................4-2

2. Premium-Bearing Changes ................................................................................ 4-2

a. Process for Submitting a Premium Change ................................................... 4-2

b. Statutory Annual Increase Cap ....................................................................4-2

D. Refund ................................................................................................................. 4-3

1. Prior Term Refunds (PTRs) ................................................................................. 4-3

E. Insufcient Premium .............................................................................................. 4-3

II.

Coverage and Deductible Changes .............................................................................................. 4-4

A. Adding or Increasing Coverage ............................................................................... 4-4

1. Effective Dates for Endorsements Adding or Increasing Coverage ........................ 4-4

B. Reducing Coverage ................................................................................................ 4-5

1. Reduction in Building Coverage ......................................................................... 4-5

2. Reduction in Contents Coverage ........................................................................ 4-5

3. Effective Dates for Endorsements Reducing Coverage ........................................ 4-5

C. Removing Coverage ............................................................................................... 4-5

1. Duplicate Coverage ........................................................................................... 4-6

2. Condominium Coverage .................................................................................... 4-7

D. Changing Deductibles ............................................................................................ 4-7

1. Deductible Increases ........................................................................................ 4-7

2. Deductible Decreases ....................................................................................... 4-7

E. Coverage Changes During the Renewal Cycle .......................................................... 4-8

1. Adding or Increasing Coverage at Renewal ......................................................... 4-8

2. Reducing Coverage on a Future Renewal Effective Date ...................................... 4-8

III.

Other Premium-Bearing Changes ................................................................................................4-8

A. Rating Adjustment ................................................................................................. 4-8

B. Rating Correction .................................................................................................. 4-9

C. Adding an Elevation Certicate ............................................................................... 4-9

D. Community Information ......................................................................................... 4-10

1. Change in Program Status ................................................................................. 4-10

2. Change in Community Rating System (CRS) Status ............................................. 4-10

E. Construction Completed ........................................................................................ 4-10

F. Incorrect Policy Form ............................................................................................. 4-10

G. Property Address Corrections................................................................................. 4-11

H. Rate Category Change ........................................................................................... 4-11

I. Examples of Other Premium-Bearing Changes ......................................................... 4-12

IV.

Assignment of a Policy .................................................................................................................. 4-13

A. Assignment with Building Purchase ........................................................................ 4-14

B. Assignment without Building Purchase ................................................................... 4-14

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • vi

Table of Contents

5. How to Renew

I.

General Information ....................................................................................................................... 5-1

II.

Renewal Process ............................................................................................................................5-1

A. Starting the Renewal Process ................................................................................ 5-1

1. Renewal Notice ................................................................................................ 5-1

2. Amounts of Insurance on the Renewal Notice ..................................................... 5-2

3. Final Notice ...................................................................................................... 5-2

B. Renewal Notication Requirements ........................................................................ 5-2

C. Premium Payment ................................................................................................. 5-3

1. Invalid Payment ................................................................................................ 5-3

2. Insufcient Payment ......................................................................................... 5-4

D. Determine the Renewal Effective Date .................................................................... 5-4

III.

Additional Information ................................................................................................................... 5-4

A. Renewal by Application Form or Recertication Questionnaire .................................. 5-4

B. Nonrenewal .......................................................................................................... 5-5

C. Coverage Changes During the Renewal Cycle .......................................................... 5-5

1. Adding or Increasing Coverage at Renewal ......................................................... 5-5

2. Reducing Coverage on a Future Renewal Effective Date ...................................... 5-6

3. Other Premium-Bearing Endorsements at Renewal ............................................. 5-6

D. Transfer of Business at Renewal ............................................................................ 5-6

6. How to Cancel

I.

General Information ....................................................................................................................... 6-1

II.

Valid Cancellation Reason Codes ................................................................................................6-1

A. No Insurable Interest ............................................................................................. 6-2

B. Establish a Common Expiration Date ...................................................................... 6-4

C. Duplicate Coverage ............................................................................................... 6-5

D. Not Eligible for Coverage ........................................................................................ 6-7

E. Lender No Longer Requires Insurance .................................................................... 6-10

F. Invalid Payment or Fraud ........................................................................................ 6-10

G. Other Reason Codes ............................................................................................. 6-12

III.

Processing a Cancellation or Nullication Request ..................................................................6-14

A. Signatures ............................................................................................................ 6-14

1. Policyholder’s Signature .................................................................................... 6-14

2. Agent Signature ................................................................................................ 6-14

B. Premium Refunds .................................................................................................. 6-14

C. Cancellation Processing Outcomes ........................................................................ 6-15

Appendix A: Policy

Dwelling Form ........................................................................................................................................A-3

General Property Form .........................................................................................................................A-34

Residential Condominium Building Association Policy Form..........................................................A-62

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • vii

Table of Contents

Appendix B: Forms

I.

NFIP Flood Insurance Application Form ......................................................................................B-1

II.

NFIP Flood Insurance General Change Endorsement Form ..................................................... B-4

III.

NFIP Flood Insurance Cancellation/Nullication Request Form .............................................B-6

IV.

NFIP Residential Basement Floodproong Certicate .............................................................B-8

V.

NFIP Floodproong Certicate for Non-Residential Structures ...............................................B-12

VI.

NFIP Elevation Certicate and Instructions ................................................................................B-16

Appendix C: Quick Start Guide

I.

Agency Number/Agent Number ...................................................................................................C-1

II.

Property Address ............................................................................................................................ C-1

III.

Building Occupancy, Policy Form, and Coverage Amounts ......................................................C-1

IV.

Building Description ....................................................................................................................... C-2

V.

Foundation Type .............................................................................................................................C-2

VI.

Proper Flood Openings ..................................................................................................................C-3

VII.

First Floor Height Determination ..................................................................................................C-3

VIII.

Building Characteristics .................................................................................................................C-4

A. Building Under Construction ................................................................................... C-4

B. Date of Construction ............................................................................................. C-4

C. Has the Building Been Substantially Improved? ....................................................... C-4

D. Construction Type ................................................................................................. C-4

E. Is Building Properly Floodproofed? .......................................................................... C-5

F. Is the Building Eligible for the Machinery and Equipment Mitigation Discount? .......... C-5

G. Building Square Footage ........................................................................................ C-5

H. Number of Floors in Building .................................................................................. C-6

I. Floor of Unit .......................................................................................................... C-6

J. Total Number of Units in a Building ......................................................................... C-6

K. Building Replacement Cost (Including Foundation) ................................................... C-6

Appendix D: Flood Maps

I.

Flood Map Service Center ............................................................................................................. D-1

II.

Flood Hazard Maps ........................................................................................................................D-1

III.

Map Zones ....................................................................................................................................... D-2

A. Special Flood Hazard Areas ................................................................................... D-2

1. Zone A ............................................................................................................. D-2

2. Zone AE and Zones A1–A30 .............................................................................. D-3

3. Zone AH ........................................................................................................... D-3

4. Zone AO ........................................................................................................... D-3

5. Zone A99 ......................................................................................................... D-3

6. Zone AR ........................................................................................................... D-3

7. Zones AR/AE, AR/AH, AR/AO, AR/A1– A30, AR/A ................................................ D-3

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • viii

Table of Contents

Appendix D: Flood Maps continued

8. Zone V ............................................................................................................. D-3

9. Zone VE and Zones V1–V30 .............................................................................. D-3

B. Moderate or Minimal Hazard Areas ........................................................................ D-4

1. Zones B and X (Shaded) .................................................................................... D-4

2. Zones C and X (Unshaded) ................................................................................ D-4

3. Zone D ............................................................................................................. D-4

IV.

Locating a Property on a Map ......................................................................................................D-4

V.

Changing or Correcting a Flood Map by a Letter of Map Change (LOMC) .............................D-5

A. Letter of Map Amendment ..................................................................................... D-5

B. Letter of Map Revision........................................................................................... D-6

C. Physical Map Revision ........................................................................................... D-6

Appendix E: Coastal Barrier Resources System

I.

General Information ....................................................................................................................... E-1

II.

Determining Eligibility ....................................................................................................................E-1

A. Determine If Community Has a System Unit or OPA ................................................. E-1

B. Determine If the Property is Located in a System Unit or OPA .................................. E-2

1. Building Located in the CBRS Buffer Zone .......................................................... E-2

C. Determine Building Eligibility .................................................................................. E-2

D. Documentation of Eligibility .................................................................................... E-3

1. Buildings Not Located in a System Unit or OPA ................................................... E-3

2. Buildings Located in a System Unit or OPA ......................................................... E-4

a. Proof of building permit date, as evidenced by either: ...................................E-4

b. Proof of building construction date, as evidenced by a written statement

from the community building permit ofcial that: ..........................................E-4

c. Proof of building location in a System Unit or OPA: ....................................... E-4

3. Buildings Eligible Based on Use ......................................................................... E-4

Appendix F: Severe Repetitive Loss Properties

I.

General Information ....................................................................................................................... F-1

II.

New Business .................................................................................................................................F-1

III.

Notication Requirements for Transfer to SDF ..........................................................................F-1

IV.

Underwriting Requirements ..........................................................................................................F-2

V.

Process for Correcting or Updating a Property’s SRL Status ...................................................F-2

A. Required Documentation ....................................................................................... F-2

B. SDF Process After FEMA Determination .................................................................. F-3

VI.

Flood Mitigation Assistance (FMA) Program .............................................................................. F-3

Appendix G: Leased Federal Properties

I.

General Information ....................................................................................................................... G-1

II.

Requirements .................................................................................................................................G-1

III.

Correcting an LFP Designation ..................................................................................................... G-2

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • ix

Table of Contents

Appendix H: Claims

I.

Information for Policyholders After a Flood ...............................................................................H-1

II.

Claims Process ...............................................................................................................................H-1

A. Damage Estimate.................................................................................................. H-1

B. Claim Payment ...................................................................................................... H-2

III.

Disputed Claims .............................................................................................................................H-2

IV.

Appealing a Claim .......................................................................................................................... H-2

A. Filing an Appeal..................................................................................................... H-2

B. Appeals Process ................................................................................................... H-3

V.

Litigation .......................................................................................................................................... H-4

VI.

Increased Cost of Compliance (ICC) Claims ............................................................................... H-4

Appendix I: Policyholder Communications

I.

Underwriting-Related Policyholder Communications ................................................................ I-1

II.

Declarations Page and Summary of Coverage ..........................................................................I-3

A. Overview ............................................................................................................... I-3

B. Summary of Coverage ........................................................................................... I-3

C. Templates ............................................................................................................. I-4

1. Declarations Page Template (New Business or Renewal), Page 1 ......................... I-4

2. Declarations Page Template (New Business or Renewal), Page 2 ......................... I-5

3. Declarations Page Template (Endorsement), Page 1 ........................................... I-6

4. Declarations Page Template (Endorsement), Page 2 ........................................... I-7

D. Sample Documents ............................................................................................... I-8

1. Declarations Page Sample (New Business or Renewal), Page 1 ........................... I-8

2. Declarations Page Sample (New Business or Renewal), Page 2 ........................... I-9

3. Declarations Page Sample (Endorsement), Page 1.............................................. I-10

4. Declarations Page Sample (Endorsement), Page 2.............................................. I-11

E. Requirements ....................................................................................................... I-12

III.

Replacement Cost Value Update Notice .....................................................................................I-24

A. Overview ............................................................................................................... I-24

B. Sample Building Replacement Cost Value Notication ............................................. I-25

IV.

Severe Repetitive Loss Property Notice ...................................................................................... I-26

A. Overview ............................................................................................................... I-26

B. Sample Notications ............................................................................................. I-27

1. Policyholder SRL Notication, Page 1 ................................................................. I-27

2. Policyholder SRL Notication, Page 2 ................................................................. I-28

3. Agent SRL Notication, Page 1 .......................................................................... I-29

4. Agent SRL Notication, Page 2 .......................................................................... I-30

5. Lender SRL Notication, Page 1 ........................................................................ I-31

6. Lender SRL Notication, Page 2 ........................................................................ I-32

V.

FIRA Notice .....................................................................................................................................I-33

A. Overview ............................................................................................................... I-33

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • x

Table of Contents

Appendix I: Policyholder Communications continued

B. Sample Documents ............................................................................................... I-34

1. FIRA Introduction Letter .................................................................................... I-34

2. NFIP FIRA Property Claims History, Page 1 ......................................................... I-35

3. NFIP FIRA Property Claims History, Page 2 ......................................................... I-36

4. FIRA Acknowledgment Form, Page 1 .................................................................. I-37

5. FIRA Acknowledgment Form, Page 2 .................................................................. I-38

VI.

Leased Federal Property Notice ................................................................................................... I-39

A. Overview ............................................................................................................... I-39

B. Sample LFP Notications ....................................................................................... I-40

1. Policyholder LFP Notication .............................................................................. I-40

2. Agent LFP Notication ....................................................................................... I-41

3. Lender LFP Notication ..................................................................................... I-42

VII.

Provisional Rating Notice ..............................................................................................................I-43

A. Overview ............................................................................................................... I-43

B. Sample Documents ............................................................................................... I-43

1. Policyholder Provisional Rating Notication ......................................................... I-43

VIII.

Renewal Notice, Renewal Notice (This Is Not A Bill), and Final Notice ..................................I-44

A. Overview ............................................................................................................... I-44

B. Sample Notications (WYO Versions) ...................................................................... I-45

1. Renewal Notice (WYO Version), Page 1 .............................................................. I-45

2. Renewal Notice (WYO Version), Page 2 .............................................................. I-46

3. Renewal Notice (WYO Version), Page 3 .............................................................. I-47

4. Renewal Notice (This Is Not A Bill) (WYO Version), Page 1 ................................... I-48

5. Renewal Notice (This Is Not A Bill) (WYO Version), Page 2 ................................... I-49

6. Renewal Notice (This Is Not A Bill) (WYO Version), Page 3 ................................... I-50

7. Final Notice (WYO Version), Page 1 .................................................................... I-51

8. Final Notice (WYO Version), Page 2 .................................................................... I-52

9. Final Notice (WYO Version), Page 3 .................................................................... I-53

C. Sample Notications (NFIP Direct Versions) ............................................................ I-54

1. Renewal Notice (NFIP Direct Version), Page 1 ..................................................... I-54

2. Renewal Notice (NFIP Direct Version), Page 2 ..................................................... I-55

3. Renewal Notice (NFIP Direct Version), Page 3 ..................................................... I-56

4. Renewal Notice (This Is Not A Bill) (NFIP Direct Version), Page 1 .......................... I-57

5. Renewal Notice (This Is Not A Bill) (NFIP Direct Version), Page 2 .......................... I-58

6. Renewal Notice (This Is Not A Bill) (NFIP Direct Version), Page 3 .......................... I-59

7. Final Notice (NFIP Direct Version), Page 1........................................................... I-60

8. Final Notice (NFIP Direct Version), Page 2........................................................... I-61

9. Final Notice (NFIP Direct Version), Page 3........................................................... I-62

D. Requirements ....................................................................................................... I-63

IX.

Cancellation Verication Letter ....................................................................................................I-73

A. Overview ............................................................................................................... I-73

B. Sample Document ................................................................................................ I-73

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • xi

Table of Contents

Appendix J: Sample Scenarios

I.

Sample Scenarios ..........................................................................................................................J-1

Scenario 1. Post-FIRM, Single-Family Home with Basement .......................................... J-2

Scenario 2. Pre-FIRM, Single-Family Home, Elevated .................................................. J-3

Scenario 3. Post-FIRM, Single-Family Home, Elevated ................................................. J-4

Scenario 4. Post-FIRM, Residential Condo Unit Within a Residential

Condominium Building, Elevated ................................................................................. J-5

Scenario 5. Post-FIRM, Residential Condominium Building Association

Policy, Non-Elevated .................................................................................................. J-6

Appendix K: Denitions and Acronyms

I.

Denitions .......................................................................................................................................K-1

II.

Acronyms ......................................................................................................................................... K-12

Tables

1. Introduction

Table 1. Major NFIP Reform Legislation ...........................................................................1-2

Table 2. Organization of the NFIP Flood Insurance Manual ................................................1-4

Table 3. NFIP Topics and Contact Information .................................................................1-7

2. Before You Start

Table 1. Standard Flood Insurance Policy Forms ..............................................................2-1

Table 2. Where the NFIP Offers Insurance .......................................................................2-5

Table 3. Where the NFIP Does Not Offer Insurance ..........................................................2-5

Table 4. Buildings the NFIP Insures ................................................................................2-7

Table 5. Buildings the NFIP Does Not Insure ...................................................................2-11

Table 6. Contents Eligibility Examples .............................................................................2-11

Table 7. NFIP Coverage Exclusions and Limitations ..........................................................2-12

Table 8. Effective Date with a 30-Day Waiting Period .......................................................2-14

Table 9. Effective Date When Eligible for the Map Revision Exception ...............................2-16

Table 10. Effective Date When Potentially Eligible for the Loan Exception ..........................2-17

Table 11. General Procedures to Reform a Policy ............................................................2-22

Table 12. Reformation Timeframes and Effective Dates ...................................................2-23

Table 13. How to Handle a Claim Involving Policy Reformation ..........................................2-24

Table 14. Reformation Timeframes and Effective Dates When the Geolocation

or Flood Zone Is Incorrect ...............................................................................2-25

Table 15. How to Handle a Claim Involving Policy Reformation When the Geolocation

or Flood Zone is Incorrect ...............................................................................2-25

OCTOBER 2021 RISK RATING 2.0 NFIP FLOOD INSURANCE MANUAL TOC • xii

Table of Contents

3. How to Write

Table 1. NFIP Rating Information ....................................................................................3-2

Table 2. Requirements for Latitude and Longitude Coordinates ........................................3-5

Table 3. CRS Premium Discounts By Class .....................................................................3-8