Tax Information

Form 1099G

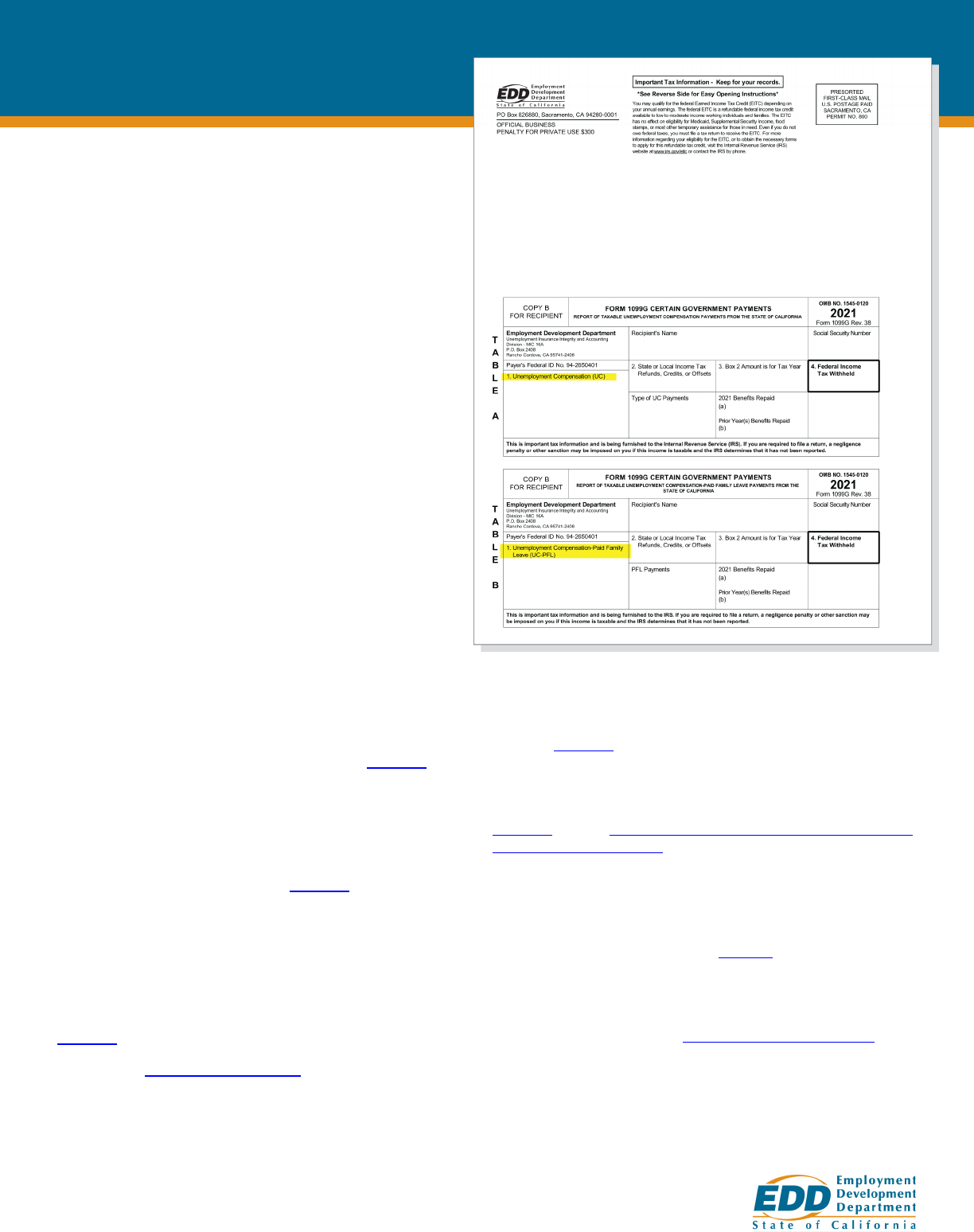

What is a 1099G form?

Form 1099G is a record of the total taxable income the

California Employment Development Department (EDD)

issued you in a calendar year, and is reported to the IRS.

You will receive a Form 1099G if you collected

unemployment compensation from us and must report

it on your federal tax return as income. This income is

exempt from California state income tax.

Taxable unemployment compensation includes:

● Unemployment Insurance (UI) benets including:

- Federal Extensions (FED-ED)

- Lost Wages Assistance (LWA)

- Pandemic Additional Compensation (PAC)

- Pandemic Emergency Unemployment

Compensation (PEUC)

- Mixed Earner Unemployment

Compensation(MEUC)

● Pandemic Unemployment

Assistance (PUA) benets

● Disability Insurance (DI) benets received as a

substitute for UI benets

● Disaster Unemployment

Assistance (DUA) benets

● Paid Family Leave (PFL) benets

When do I get a Form 1099G?

We will provide a 2021 Form 1099G to you by January 31,

2022. We will mail it unless you opt out of paper copies by

December 27, 2021. To opt out, select Prole in

UI Online and

update your Form 1099G Preferences.

Call 1-866-401-2849 if:

● If you see a $0 amount on your form.

● You have a new mailing address. You can also change

your contact information in your UI Online account or

create an account with the correct information.

● An adjustment was made to your Form 1099G, it will not be

available online.

How do I request a copy of my Form 1099G?

Form 1099G tax information is available for up to ve years in

UI Online. To access a copy or request a paper copy online:

1. Log in to Benet Programs Online.

2. Select UI Online.

3. Select Form 1099G > View next to the desired year

> Print or Request Paper Copy.

To request a copy by phone, call 1-866-333-4606.*

My 1099G form is incorrect...

First, conrm the amount on your 1099G by viewing your payment

history in UI Online or by calling 1-866-333-4606.* If you don’t

agree with the amount on your Form 1099G, call 1-866-401-2849

and provide your current address and phone number.**

To learn how to get detailed unemployment payment information in

UI Online, refer to UI Online: Access Tax Information/Form 1099G

Using UI Online (YouTube).

I did not collect unemployment but received

a Form 1099G...

You might be a victim of fraud. Visit AskEDD and select

Form 1099G to report fraud, or call 1-866-401-2849.** If we nd

you were a victim of fraud, we will remove the claim from your

Social Security number and send you an updated Form 1099G.

For additional resources, visit Tax Information (Form 1099G).

If you received a Form 1099G that does not belong to you, please

write “Return to Sender” on the envelope and mail it back to us. It

does not need new postage.

*Self-service phone line available 24 hours a day, 7 days a week.

**Phone line available Monday through Friday, from 8 a.m. to 5 p.m. (Pacic time), except on state holidays.

Rev. 4 (12-21)