Cataract Co-Management:

Coding & Billing Guide

Site of Care CPT

®

Code

Surgery for treatment

of cataract, physician

66982, 66984

Surgery for treatment

of cataract, facility

66982, 66984

About Co-Management

With today’s multidisciplinary care model, Ophthalmologists/

Cataract Surgeons and Optometrists are sharing

postoperative responsibilities of cataract patients.

1

Co-management is dened as the relationship between

an ophthalmologist/cataract surgeon and a non-operating

provider (e.g., an optometrist) for shared responsibility

in the postoperative care. There are various scenarios in

which co-management may be appropriate, such as the

patient is unable to return to the surgeon for follow-up,

the surgeon is unavailable for care, patient preference, or

the patient experiences another illness or complication

that requires intervention by another provider.

1

Transfer of care is dened as a transfer of responsibility

for a patient’s care from one qualied healthcare provider

operating within his/her scope of practice to another

who also operates within his/her scope of practice.

1

The

decision as to when it is medically appropriate for the

patient to be released to the care of the co-manager can

only be determined by the surgeon and the patient. The

specic date of the transfer of care cannot be made before

surgery. The surgeon must have the patient sign a written

agreement to be co-managed. Both the surgeon and the

co-managing provider managing the post-operative care

must retain a copy of the written transfer agreement in the

patient’s medical record.

2

A Transfer of Care Form from the surgeon to the co-

managing Provider should include the following

2

:

• Patient name

• Operative eye

• Nature of operation

• Date of surgery

• Clinical ndings

• Discharge instructions

• Transfer date

However, a transfer of care is not needed if the receiving

Provider is within the same group practice.

Type of Care

Provided

Modier and Notes

Surgical care only -54

• Surgeon must initiate the notication to

Medicare by using modier -54 when

billing for the surgery (e.g., 66984-54)

• The date of service is the date of the

surgical procedure

Post-operative

care

-55

•Co-managing provider bills the same

CPT

code with modier -55 (eg, 66984-

55) for the post-operative care

•Cannot bill for the co-managed care until

at least one service has been furnished

to the patient

Cataract Co-Management Billing and Coding

After surgery, the surgeon submits a claim for the procedure

citing the appropriate CPT

®

code and co-management

modier (-54) on the claim form. This modier is required

to identify the surgical procedure in a co-management

scenario. Once the co-managing provider has provided post-

operative care, he or she submits a claim form citing the

appropriate CPT

®

code and co-management modier (-55),

which indicates post-operative management only, as well as

the date he or she assumed the patient’s postoperative care

(refer to the charts below).

2,3

This information is provided for informational purposes only. It does not constitute legal or reimbursement advice or recommendations regarding

clinical practice. Alcon makes no guarantee that use of this information will result in coverage or payment or prevent disagreement by payers with

regard to billing, coverage, or amount of payment. Alcon encourages providers to submit accurate and appropriate claims for services. It is always the

provider’s responsibility to determine medical necessity, the proper site for delivery of any services, and to submit accurate information, codes, charges,

and modiers for services that are rendered. Coding, coverage, and payment policies are complex and are frequently updated. Alcon recommends that

you consult with your legal counsel, applicable payers’ policies, or reimbursement specialists regarding coding, coverage, and reimbursement.

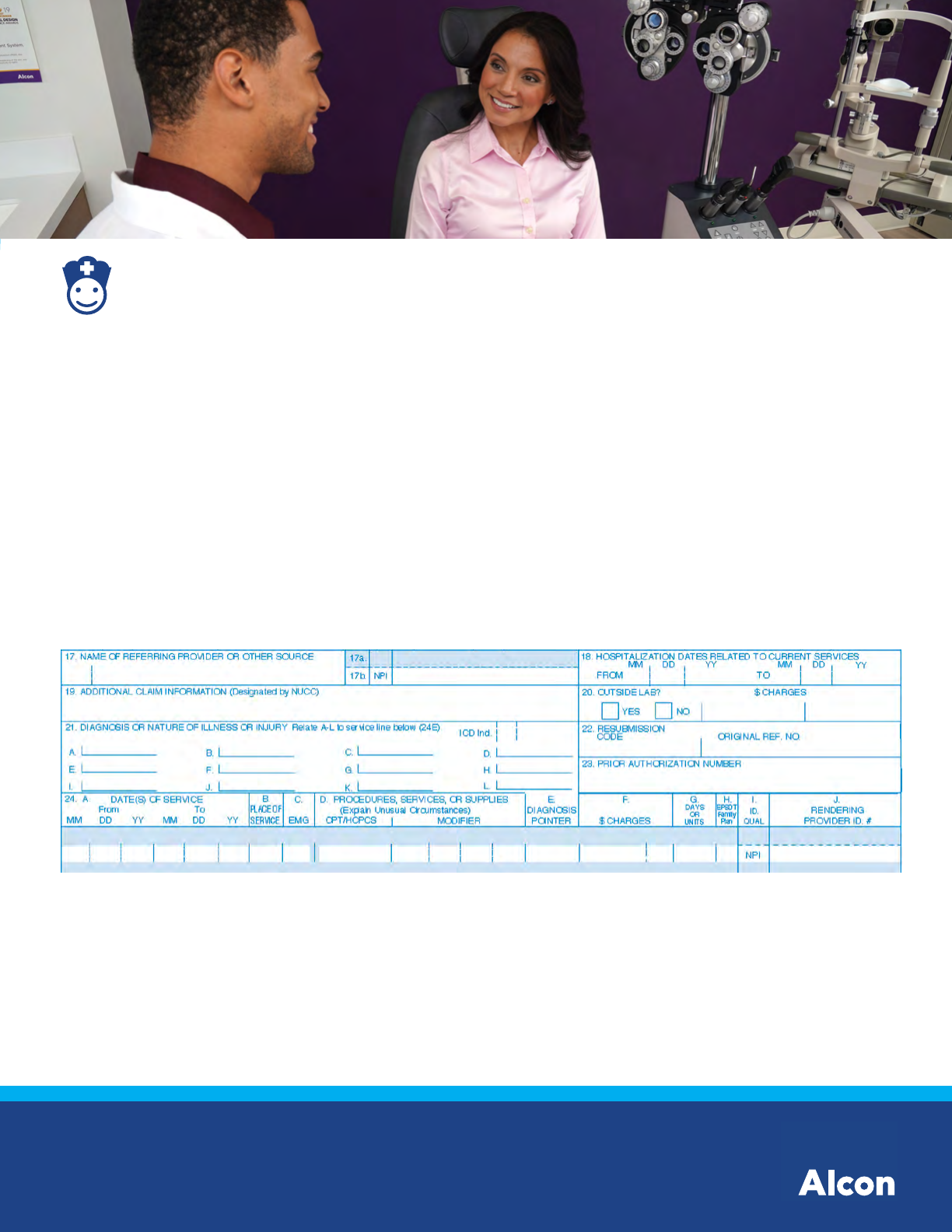

CMS-1500 Claim Form Completion

for Cataract Co-Management

For surgeons who will provide part of the

post-operative care (refer to example surgical claim

form below)

2,3

:

Example Surgeon’s Claim for Post-operative Care

This information is provided for informational purposes only. It does not constitute legal or reimbursement advice or recommendations regarding

clinical practice. Alcon makes no guarantee that use of this information will result in coverage or payment or prevent disagreement by payers with

regard to billing, coverage, or amount of payment. Alcon encourages providers to submit accurate and appropriate claims for services. It is always the

provider’s responsibility to determine medical necessity, the proper site for delivery of any services, and to submit accurate information, codes, charges,

and modiers for services that are rendered. Coding, coverage, and payment policies are complex and are frequently updated. Alcon recommends that

you consult with your legal counsel, applicable payers’ policies, or reimbursement specialists regarding coding, coverage, and reimbursement.

XXX XXX, MD

H25.11

Assumed Post-Operative Care XX/XX/XXXX relinquished XX/XX/XXXX

XXXXXXXXXX

XX XX XX XX XX XX 11 66984 55 RT A XXX XX 1 XXXXXXXXXX

r Submit a claim for with the CPT

®

surgery code 66984 and co-management modier -54 (e.g., 66984-54)

r Submit a claim for your portion of the post-operative care by submitting a second line item entry on the form for

the same surgery procedure code with the modier -55. Note: For the claim to be accurate, the surgeon needs

to know the date the optometrist assumed responsibility for the remaining post-operative care (transfer date)

r Report the range of dates that post-op care was provided in Item 19 (or EMC equivalent of the CMS-1500 claim

form). Only the range of dates is needed (e.g., 1-11-2020 thru 3-11-2020)

r Indicate a “1” in Item 24G of the claim form (or number of post-op days if required by your Medicare carrier/

contractor)

Example Surgeon’s Claim for Surgical Procedure

XXX XXX, MD

H25.11

XXXXXXXXXX

XX XX XX XX XX XX 24 66984 54 RT A XXX XX 1 XXXXXXXXXX

Surgeons submit 2 claim forms:

• One claim form for surgical procedure

• One claim form for the surgeons portion of the

post-operative care

r Submit a claim to Medicare with the CPT

®

cataract

surgery code (e.g., 66984) and modier -55 (e.g.,

66984-55)

r Date of service is the date of surgery (or the date care

was assumed if indicated by your Medicare carrier/

contractor)

• The date care is assumed must be indicated in

Item 19 (or EMC equivalent of the CMS-1500

claim form)

r Enter a “1” in Item 24G of the CMS-1500 claim form

(or the number of post-op days if indicated by your

Medicare carrier/contractor)

Reimbursement for Post-Operative Services

Medicare

The total post-operative care percentage for ophthalmic

procedures has been set at 20% of the surgical fee

allowance. In cases where more than one provider

furnishes post-operative services, the payment will be

divided between the providers based on the number of

days for which each provider is responsible for furnishing

post-operative care.

1,2

Example Claim for Co-management Post-Operative Care

Commercial or Medicare Advantage

Commercial or Medicare Advantage payers may have

dierent guidelines with regard to co-management, and

some payers may not permit co-management at all.

Contact your commercial payers on how to handle billing

co-management services.

1,2

This information is provided for informational purposes only. It does not constitute legal or reimbursement advice or recommendations regarding

clinical practice. Alcon makes no guarantee that use of this information will result in coverage or payment or prevent disagreement by payers with

regard to billing, coverage, or amount of payment. Alcon encourages providers to submit accurate and appropriate claims for services. It is always the

provider’s responsibility to determine medical necessity, the proper site for delivery of any services, and to submit accurate information, codes, charges,

and modiers for services that are rendered. Coding, coverage, and payment policies are complex and are frequently updated. Alcon recommends that

you consult with your legal counsel, applicable payers’ policies, or reimbursement specialists regarding coding, coverage, and reimbursement.

XXX XXX, OD

H25.11

Assumed Post-Operative Care XX/XX/XXXX relinquished XX/XX/XXXX

XXXXXXXXXX

XX XX XX XX XX XX 11 66984 55 RT A XXX XX 1 XXXXXXXXXX

r Do not use visit codes, ophthalmic, or

evaluation and management for this post-

operative care, as this is the most common billing

error for co-managed services

r Note: If the surgeon provides the entire post-

operative care and directs the patient to their

optometrist for post-operative refraction and

glasses, this does not constitute co-management.

Only the refraction can be billed to the patient.

No ophthalmological examination is medically

necessary, medically justied, or medically

reasonable

For co-managing providers who will provide post-operative care

(refer to example post-operative claim form below)

2,3

:

1. American Academy of Ophthalmology. Comprehensive Guidelines for the Comanagement of Ophthalmic Postoperative Care. September. 7, 2016. https://www.aao.org/ethics-detail/guidelines-co-

management-postoperative-care. Accessed March 30, 2020. 2. Richman H and Wartman R. Cataract Co-Management Billing for Medicare. American Optometric Association. https://www.aoa.org/

Documents/optometric-sta/Articles/Cataract%20Co-Management.pdf. Accessed March 30, 2020. 3. Edgar JD, Vicchrilli SJ. Coding Complex Cataract Surgery With Condence. American Academy of

Ophthalmology website. March 26, 2016. https://www.aao.org/young-ophthalmologists/yo-info/article/coding-complex-cataract-surgery-with-condence. Accessed March 30, 2020. 4. Centers for

Medicare & Medicaid Services. CMS Ruling 05-01. May 3, 2005. https://www.cms.gov/Regulations-and-Guidance/Guidance/Rulings/Downloads/CMSR0501.pdf. Accessed March 30, 2020. 5. Centers for

Medicare & Medicaid Services. CMS Ruling 1536-R. January 22, 2007. https://www.cms.gov/Regulations-and-Guidance/Guidance/Rulings/Downloads/CMS1536R.pdf. Accessed March 30, 2020.

Co-Management of Advanced

Technology Intraocular Lenses

(AT-IOLs)

The Centers for Medicare & Medicaid Services (CMS)

permits providers to bill Medicare beneciaries a

separate charge for refractive non-covered services,

including AT-IOLs for astigmatism-correction or

presbyopia-correction (refer to the table below). As with

conventional cataract surgery, some patients who are

referred by their optometrist or ophthalmologist may

wish to return to their referring provider for some of their

post-operative care for an AT-IOL.

1,4,5

In this instance, both the surgeon and the co-managing

providers may participate in providing the non-covered

services associated with post-operative follow-up care

for AT-IOLs. Both the surgeon and co-managing provider

are encouraged to obtain a signed advance notice of

non-covered services and extra fees associated with AT-

IOL use.

1,4,5

Checklist for Co-Management of Patients

Undergoing Cataract Surgery

1,2,4,5

r For Commercial or Medicare Advantage payers,

conrm policy and reimbursement for co-

management services

r Complete written co-management agreement

between the surgeon and the co-managing provider

to share patient care

r Obtain patient’s written consent and archive

patient’s completed transfer of care agreement

(both providers)

r Cite appropriate co-management modiers on the

claim forms (both providers)

r Conrm accuracy of dates of surgery/follow up care

and date of transfer of care

r For AT-IOL patients, explain to the patient noncovered

services and his/her payment responsibilities

CMS Coverage Guidelines for AT-IOLs

4,5

Site of Care What’s Not Covered Patient’s Responsibility

Physician • Physician’s services attributable to the noncovered

functionality of the AC-IOL and PC-IOL

• Additional physician work and resources required for

insertion, tting, and vision acuity testing

• Payment of charges for the physician services

that exceed the physician charge for insertion

of a conventional IOL

Facility • Astigmatism-correcting or presbyopia-correcting

function of an IOL and any additional resources

required for insertion, tting, and vision acuity testing

• Payment of charges for the facility charges that

exceed the facility charge for insertion of a

conventional IOL, including costs of the IOL and

modest charge for handling

© 2020 Alcon Inc. | 5/20 | US-SG-2000039

(866) 457- 0277 | [email protected] | ars.alcon.com