Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … ions/P590B/2020/A/XML/Cycle06/source (Init. & Date) _______

Page 1 of 66 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Publication 590-B

Cat. No. 66303U

Distributions

from Individual

Retirement

Arrangements

(IRAs)

For use in preparing

2020 Returns

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (Tiếng Việt)

Contents

What’s New .............................. 1

Reminders ............................... 2

Introduction .............................. 3

Chapter 1. Traditional IRAs .................. 6

What if You Inherit an IRA? ................. 6

When Can You Withdraw or Use Assets? ....... 7

When Must You Withdraw Assets? (Required

Minimum Distributions) .................. 7

Are Distributions Taxable? ................ 14

What Acts Result in Penalties or Additional

Taxes? ............................ 22

Chapter 2. Roth IRAs ..................... 29

What Is a Roth IRA? ..................... 30

Are Distributions Taxable? ................ 30

Must You Withdraw or Use Assets? .......... 34

Chapter 3. Coronavirus Relief .............. 35

Qualified Coronavirus-Related Distributions .... 35

Taxation of Qualified

Coronavirus-Related Distributions ...... 35

Repayment and Inclusion in Income of

Qualified Coronavirus-Related

Distributions ...................... 36

Chapter 4. Disaster-Related Relief ........... 36

Qualified Disaster Distributions ............. 37

Repayment of Qualified Disaster

Distributions ...................... 38

Repayment of Qualified 2018, 2019, and

2020 Distributions for the Purchase or

Construction of a Main Home ......... 39

How To Get Tax Help ...................... 40

Appendices ............................. 44

Index .................................. 65

What’s New

Coronavirus-related distributions. Recent legislation

contains special rules that provide for tax-favored with-

drawals, income inclusion, and repayments for certain in-

dividuals who were impacted by the coronavirus in 2020.

See Coronavirus Relief, later.

Special rules for qualified disaster distributions and

repayments expanded. The special rules for qualified

disaster distributions and repayments are expanded to

apply to those disasters described in the Taxpayer Cer-

tainty and Disaster Tax Relief Act of 2020. A qualified dis-

aster is now expanded to include a major disaster that

was declared before February 26, 2021, by the President

under section 401 of the Stafford Act and that occurred on

or after December 28, 2019, and on or before December

27, 2020, and continued no later than January 26, 2021.

May 13, 2021

Page 2 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

However, this change does not include a major disaster

that has been declared only by reason of COVID-19.

See Disaster-Related Relief, later, for more informa-

tion.

RMDs not required in 2020. New legislation temporarily

waives the requirement to make required minimum distri-

butions (RMDs) in 2020 in response to the coronavirus

pandemic. Whether that distribution is one in a series of

RMDs or the initial RMD that would be required by April 1

for a taxpayer reaching age 70

1

/2 in tax year 2019, no

RMD is required. See When Must You Withdraw Assets?

(Required Minimum Distributions), later, for more informa-

tion.

Qualified birth or adoption distribution. Beginning in

tax years after December 31, 2019, you can take a distri-

bution from your IRA without it being subject to the 10%

additional tax for early distributions if that distribution is for

a qualified birth or adoption. For more information, see

Qualified birth or adoption distribution under Exceptions,

later.

Qualified plan loan offsets. A qualified plan loan offset

is a type of plan loan offset that meets certain require-

ments. In order to be a qualified plan loan offset, the loan,

at the time of the offset, must be a loan in good standing

and the offset must be solely by reason of (1) the termina-

tion of the qualified employer plan, or (2) the failure to

meet the repayment terms is because the employee has a

severance from employment. If you meet the require-

ments of a qualified plan loan offset, you have until the

due date, including extensions, to file your tax return for

the tax year in which the offset occurs to roll over the

qualified plan loan offset amount.

This revision is effective for tax years beginning Janu-

ary 1, 2018.

Modification of required distribution rules for desig-

nated beneficiaries. There are new required minimum

distribution rules for certain beneficiaries who are desig-

nated beneficiaries when the IRA owner dies in a tax year

beginning after December 31, 2019. All distributions must

be made by the end of the 10th year after death, except

for distributions made to certain eligible designated bene-

ficiaries. See 10-year rule, later, for more information.

Required minimum distributions (RMDs). For distribu-

tions required to be made after December 31, 2019, the

age for beginning mandatory distributions is changed to

age 72 for IRA owners reaching age 70

1

/2 after December

31, 2019. The required beginning date for IRA owners

who haven't reached age 70

1

/2 by the end of 2019 is April

1 of the year following the year of the owner’s 72nd birth-

day. See When Must You Withdraw Assets? (Required

Minimum Distributions), later, for more information.

Future Developments

For the latest information about developments related to

Pub. 590-B, such as legislation enacted after it was

published, go to IRS.gov/Pub590B.

Reminders

Tax relief for qualified disaster distributions and re-

payments. Special rules provide for tax-favored with-

drawals and repayments to certain retirement plans (in-

cluding IRAs) for taxpayers who suffered economic losses

as a result of certain major disasters that occurred in 2018

and 2019.

Special rules also provide for tax-favored withdrawals

and repayments from certain retirement plans (including

IRAs) for taxpayers who suffered economic losses as a

result of Hurricane Harvey or Tropical Storm Harvey, Hur-

ricane Irma, Hurricane Maria, or the 2017 California wild-

fires.

Disaster tax relief is also available for taxpayers who

suffered economic losses as a result of disasters declared

by the President under section 401 of the Robert T. Staf-

ford Disaster Relief and Emergency Assistance Act during

calendar year 2016.

See Disaster-Related Relief, later, for information on

these special rules.

Simplified employee pension (SEP). SEP IRAs aren't

covered in this publication. They are covered in Pub. 560,

Retirement Plans for Small Business.

Deemed IRAs. A qualified employer plan (retirement

plan) can maintain a separate account or annuity under

the plan (a deemed IRA) to receive voluntary employee

contributions. If the separate account or annuity otherwise

meets the requirements of an IRA, it will be subject only to

IRA rules. An employee's account can be treated as a tra-

ditional IRA or a Roth IRA.

For this purpose, a “qualified employer plan” includes:

•

A qualified pension, profit-sharing, or stock bonus

plan (section 401(a) plan);

•

A qualified employee annuity plan (section 403(a)

plan);

•

A tax-sheltered annuity plan (section 403(b) plan); and

•

A deferred compensation plan (section 457 plan)

maintained by a state, a political subdivision of a state,

or an agency or instrumentality of a state or political

subdivision of a state.

Statement of required minimum distribution (RMD).

If an RMD is required from your IRA, the trustee, custo-

dian, or issuer that held the IRA at the end of the preced-

ing year must either report the amount of the RMD to you,

or offer to calculate it for you. The report or offer must in-

clude the date by which the amount must be distributed.

The report is due January 31 of the year in which the mini-

mum distribution is required. It can be provided with the

year-end fair market value statement that you normally get

each year. No report is required for section 403(b) con-

tracts (generally tax-sheltered annuities) or for IRAs of

owners who have died.

IRA interest. Although interest earned from your IRA is

generally not taxed in the year earned, it isn't tax-exempt

interest. Tax on your traditional IRA is generally deferred

until you take a distribution. Don't report this interest on

Page 2 Publication 590-B (2020)

Page 3 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

your return as tax-exempt interest. For more information

on tax-exempt interest, see the instructions for your tax re-

turn.

Net Investment Income Tax (NIIT). For purposes of the

NIIT, net investment income doesn't include distributions

from a qualified retirement plan (for example, 401(a),

403(a), 403(b), or 457(b) plans, and IRAs). However,

these distributions are taken into account when determin-

ing the modified adjusted gross income threshold. Distri-

butions from a nonqualified retirement plan are included in

net investment income. See Form 8960, Net Investment

Income Tax—Individuals, Estates, and Trusts, and its in-

structions for more information.

Photographs of missing children. The IRS is a proud

partner with the National Center for Missing & Exploited

Children® (NCMEC). Photographs of missing children se-

lected by the Center may appear in this publication on pa-

ges that would otherwise be blank. You can help bring

these children home by looking at the photographs and

calling 1-800-THE-LOST (1-800-843-5678) if you recog-

nize a child.

Introduction

This publication discusses distributions from individual re-

tirement arrangements (IRAs). An IRA is a personal sav-

ings plan that gives you tax advantages for setting aside

money for retirement. For information about contributions

to an IRA, see Pub. 590-A.

What are some tax advantages of an IRA? Two tax

advantages of an IRA are that:

•

Contributions you make to an IRA may be fully or par-

tially deductible, depending on which type of IRA you

have and on your circumstances; and

•

Generally, amounts in your IRA (including earnings

and gains) aren't taxed until distributed. In some ca-

ses, amounts aren't taxed at all if distributed according

to the rules.

What's in this publication? This publication discusses

traditional and Roth IRAs. It explains the rules for:

•

Handling an inherited IRA, and

•

Receiving distributions (making withdrawals) from an

IRA.

It also explains the penalties and additional taxes that

apply when the rules aren't followed. To assist you in com-

plying with the tax rules for IRAs, this publication contains

worksheets, sample forms, and tables, which can be

found throughout the publication and in the appendices at

the back of the publication.

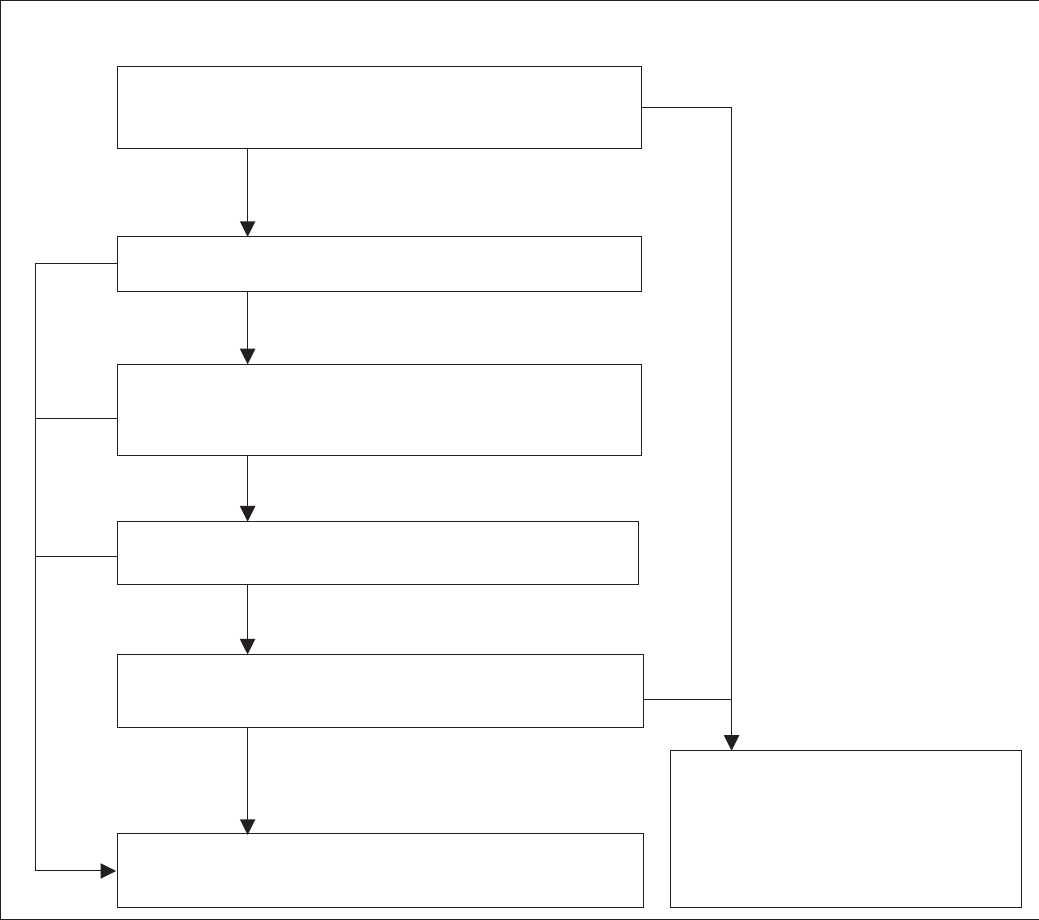

How to use this publication. The rules that you must

follow depend on which type of IRA you have. Use Table

I-1 to help you determine which parts of this publication to

read. Also use Table I-1 if you were referred to this publi-

cation from instructions to a form.

Comments and suggestions. We welcome your com-

ments about this publication and suggestions for future

editions.

You can send us comments through IRS.gov/

FormComments. Or, you can write to the Internal Reve-

nue Service, Tax Forms and Publications, 1111 Constitu-

tion Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each com-

ment received, we do appreciate your feedback and will

consider your comments and suggestions as we revise

our tax forms, instructions, and publications. Do not send

tax questions, tax returns, or payments to the above ad-

dress.

Getting answers to your tax questions. If you have

a tax question not answered by this publication or the How

To Get Tax Help section at the end of this publication, go

to the IRS Interactive Tax Assistant page at IRS.gov/

Help/ITA where you can find topics by using the search

feature or viewing the categories listed.

Getting tax forms, instructions, and publications.

Visit IRS.gov/Forms to download current and prior-year

forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instruc-

tions, and publications; call 800-829-3676 to order

prior-year forms and instructions. The IRS will process

your order for forms and publications as soon as possible.

Do not resubmit requests you’ve already sent us. You can

get forms and publications faster online.

Useful Items

You may want to see:

Publications

590-A Contributions to Individual Retirement

Accounts (IRAs)

560 Retirement Plans for Small Business (SEP,

SIMPLE, and Qualified Plans)

571 Tax-Sheltered Annuity Plans (403(b) Plans)

575 Pension and Annuity Income

939 General Rule for Pensions and Annuities

976 Disaster Relief

Forms (and Instructions)

W-4P Withholding Certificate for Pension or Annuity

Payments

1099-R Distributions From Pensions, Annuities,

Retirement or Profit-Sharing Plans, IRAs,

Insurance Contracts, etc.

5304-SIMPLE Savings Incentive Match Plan for

Employees of Small Employers (SIMPLE)—Not

for Use With a Designated Financial Institution

5305-S SIMPLE Individual Retirement Trust Account

5305-SA SIMPLE Individual Retirement Custodial

Account

590-A

560

571

575

939

976

W-4P

1099-R

5304-SIMPLE

5305-S

5305-SA

Publication 590-B (2020) Page 3

Page 4 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

5305-SIMPLE Savings Incentive Match Plan for

Employees of Small Employers (SIMPLE)—for

Use With a Designated Financial Institution

5329 Additional Taxes on Qualified Plans (Including

IRAs) and Other Tax-Favored Accounts

5498 IRA Contribution Information

8606 Nondeductible IRAs

8815 Exclusion of Interest From Series EE and I

U.S. Savings Bonds Issued After 1989

8839 Qualified Adoption Expenses

8880 Credit for Qualified Retirement Savings

Contributions

8915-A Qualified 2016 Disaster Retirement Plan

Distributions and Repayments

5305-SIMPLE

5329

5498

8606

8815

8839

8880

8915-A

8915-B Qualified 2017 Disaster Retirement Plan

Distributions and Repayments

8915-C Qualified 2018 Disaster Retirement Plan

Distributions and Repayments

8915-D Qualified 2019 Disaster Retirement Plan

Distributions and Repayments

8915-E Qualified 2020 Disaster Retirement Plan

Distributions and Repayments (Use for

Coronavirus-Related and Other Qualified 2020

Disaster Distributions)

See How To Get Tax Help, later, for information about

getting these publications and forms.

8915-B

8915-C

8915-D

8915-E

Page 4 Publication 590-B (2020)

Page 5 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Table I-1. Using This Publication

IF you need information on... THEN see...

Traditional IRAs chapter 1.

Roth IRAs chapter 2, and parts of chapter 1.

Coronavirus Relief chapter 3.

Disaster-Related Relief chapter 4.

SEP IRAs, SIMPLE IRAs, and 401(k) plans Pub. 560.

Coverdell education savings accounts (formerly called

education IRAs)

Pub. 970.

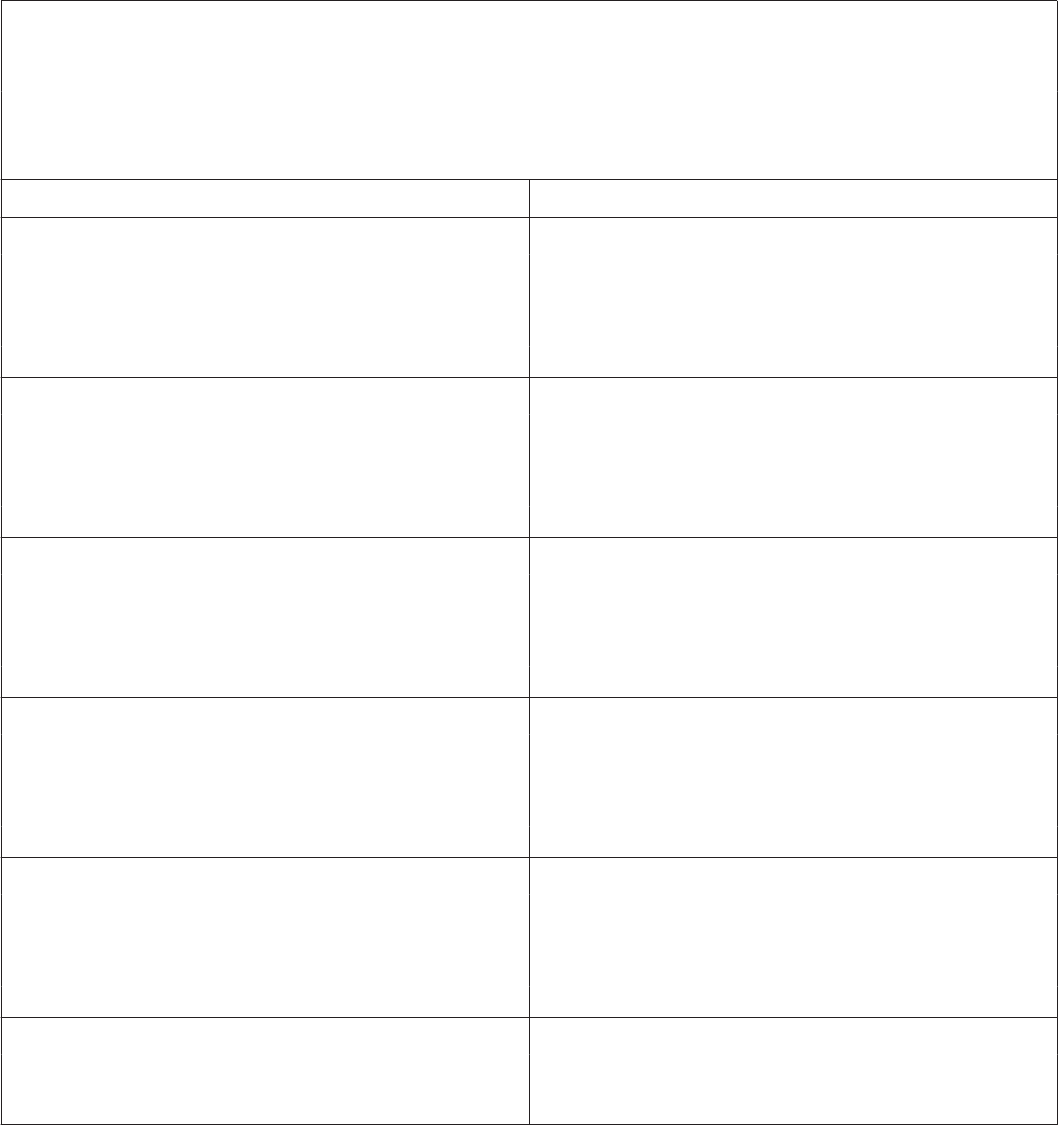

Table I-2. How Are a Traditional IRA and a

Roth IRA Different?

This table shows the differences between traditional and

Roth IRAs. Answers in the middle column apply to

traditional IRAs. Answers in the right column apply to Roth

IRAs.

Question Answer

Traditional IRA? Roth IRA?

Do I have to start taking distributions

when I reach a certain age from a

Yes. You must begin receiving required

minimum distributions by April 1 of the

year following the year you reach age

72. See When Must You Withdraw

Assets? (Required Minimum

Distributions) in chapter 1.

No. If you are the original owner of a

Roth IRA, you don't have to take

distributions regardless of your age.

See Are Distributions Taxable? in

chapter 2. However, if you are the

beneficiary of a Roth IRA, you may

have to take distributions. See

Distributions After Owner's Death in

chapter 2.

How are distributions taxed from a

Distributions from a traditional IRA are

taxed as ordinary income, but if you

made nondeductible contributions, not

all of the distribution is taxable. See Are

Distributions Taxable? in chapter 1.

Distributions from a Roth IRA aren't

taxed as long as you meet certain

criteria. See Are Distributions Taxable?

in chapter 2.

Do I have to file a form just because I

receive distributions from a

Not unless you have ever made a

nondeductible contribution to a

traditional IRA. If you have, file Form

8606. See Nondeductible Contributions

in Pub. 590-A.

Yes. File Form 8606 if you received

distributions from a Roth IRA (other

than a rollover, qualified charitable

distribution, one-time distribution to

fund an HSA, recharacterization,

certain qualified distributions, or a

return of certain contributions).

Publication 590-B (2020) Page 5

Page 6 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

1.

Traditional IRAs

Introduction

This chapter discusses distributions from an IRA. In this

publication, the original IRA (sometimes called an ordinary

or regular IRA) is referred to as a “traditional IRA.” A tradi-

tional IRA is any IRA that isn't a Roth IRA or a SIMPLE

IRA.

What if You Inherit an IRA?

If you inherit a traditional IRA, you are called a beneficiary.

A beneficiary can be any person or entity the owner choo-

ses to receive the benefits of the IRA after he or she dies.

Beneficiaries of a traditional IRA must include in their

gross income any taxable distributions they receive.

Inherited from spouse. If you inherit a traditional IRA

from your spouse, you generally have the following three

choices. You can:

1. Treat it as your own IRA by designating yourself as

the account owner;

2. Treat it as your own by rolling it over into your IRA, or

to the extent it is taxable, into a:

a. Qualified employer plan,

b. Qualified employee annuity plan (section 403(a)

plan),

c. Tax-sheltered annuity plan (section 403(b) plan),

d. Deferred compensation plan of a state or local

government (section 457 plan); or

3. Treat yourself as the beneficiary rather than treating

the IRA as your own.

Treating it as your own. You will be considered to

have chosen to treat the IRA as your own if:

•

Contributions (including rollover contributions) are

made to the inherited IRA, or

•

You don't take the required minimum distribution for a

year as a beneficiary of the IRA.

You will only be considered to have chosen to treat the

IRA as your own if:

•

You are the sole beneficiary of the IRA, and

•

You have an unlimited right to withdraw amounts from

it.

However, if you receive a distribution from your de-

ceased spouse's IRA, you can roll that distribution over

into your own IRA within the 60-day time limit, as long as

the distribution isn't a required distribution, even if you

aren't the sole beneficiary of your deceased spouse's IRA.

For more information, see When Must You Withdraw As-

sets? (Required Minimum Distributions), later.

Inherited from someone other than spouse. If you in-

herit a traditional IRA from anyone other than your de-

ceased spouse, you can't treat the inherited IRA as your

own. This means that you can't make any contributions to

the IRA. It also means you can't roll over any amounts into

or out of the inherited IRA. However, you can make a

trustee-to-trustee transfer as long as the IRA into which

amounts are being moved is set up and maintained in the

name of the deceased IRA owner for the benefit of you as

beneficiary.

Like the original owner, you generally won't owe tax on

the assets in the IRA until you receive distributions from it.

You must begin receiving distributions from the IRA under

the rules for distributions that apply to beneficiaries.

IRA with basis. If you inherit a traditional IRA from a per-

son who had a basis in the IRA because of nondeductible

contributions, that basis remains with the IRA. Unless you

are the decedent's spouse and choose to treat the IRA as

your own, you can't combine this basis with any basis you

have in your own traditional IRA(s) or any basis in tradi-

tional IRA(s) you inherited from other decedents. If you

take distributions from both an inherited IRA and your IRA,

and each has basis, you must complete separate Forms

8606 to determine the taxable and nontaxable portions of

those distributions.

Federal estate tax deduction. A beneficiary may be

able to claim a deduction for estate tax resulting from cer-

tain distributions from a traditional IRA. The beneficiary

can deduct the estate tax paid on any part of a distribution

that is income in respect of a decedent. He or she can

take the deduction for the tax year the income is reported.

For information on claiming this deduction, see Estate Tax

Deduction under Other Tax Information in Pub. 559.

Any taxable part of a distribution that isn't income in re-

spect of a decedent is a payment the beneficiary must in-

clude in income. However, the beneficiary can't take any

estate tax deduction for this part.

A surviving spouse can roll over the distribution to an-

other traditional IRA and avoid including it in income for

the year received.

More information. For more information about rollovers,

required distributions, and inherited IRAs, see:

•

Rollovers under Can You Move Retirement Plan As-

sets? in chapter 1 of Pub. 590-A;

•

When Must You Withdraw Assets? (Required Mini-

mum Distributions), later; and

•

The discussion of IRA Beneficiaries, later, under

When Must You Withdraw Assets? (Required Mini-

mum Distributions).

Page 6 Chapter 1 Traditional IRAs

Page 7 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

When Can You Withdraw or

Use Assets?

You can withdraw or use your traditional IRA assets at any

time. However, a 10% additional tax generally applies if

you withdraw or use IRA assets before you reach age

59

1

/2. This is explained under Age 59

1

/2 Rule under Early

Distributions, later.

If you were affected by a qualified disaster, see chap-

ter 4.

You can generally make a tax-free withdrawal of contri-

butions if you do it before the due date for filing your tax

return for the year in which you made them. This means

that even if you are under age 59

1

/2, the 10% additional

tax may not apply. These distributions are explained in

Pub. 590-A.

When Must You Withdraw

Assets? (Required Minimum

Distributions)

You can't keep funds in a traditional IRA (including SEP

and SIMPLE IRAs) indefinitely. Eventually, they must be

distributed. If there are no distributions, or if the distribu-

tions aren't large enough, you may have to pay a 50% ex-

cise tax on the amount not distributed as required. See

Excess Accumulations (Insufficient Distributions), later,

under What Acts Result in Penalties or Additional Taxes.

The requirements for distributing IRA funds differ, de-

pending on whether you are the IRA owner or the benefi-

ciary of a decedent's IRA.

Required minimum distribution (RMD). The amount

that must be distributed each year is referred to as the re-

quired minimum distribution.

Note. A qualified charitable distribution will count to-

wards your required minimum distribution. See Qualified

charitable distributions under Are Distributions Taxable,

later.

Distributions not eligible for rollover. Amounts that

must be distributed (required minimum distributions) dur-

ing a particular year aren't normally eligible for rollover

treatment. But see Special rule for RMDs and rollovers in

2020, later.

IRA Owners

If you are the owner of a traditional IRA, you must gener-

ally start receiving distributions from your IRA by April 1 of

the year following the year in which you reach age 72.

April 1 of the year following the year in which you reach

age 72 is referred to as the “required beginning date.”

Distributions by the required beginning date. You

must receive at least a minimum amount for each year

starting with the year you reach age 72. If you don't re-

ceive that minimum distribution amount in the year you

become age 72, you must receive that distribution by April

1 of the year following the year you become age 72.

If an IRA owner dies after reaching age 72, but before

April 1 of the next year, no minimum distribution is re-

quired for that year because death occurred before the re-

quired beginning date.

RMDs not required in 2020. You are not required to

make RMDs in tax year 2020, whether that distribution is

one required after the initial RMD in a series of required

distributions or the distribution that would be required by

April 1 for a taxpayer reaching age 70

1

/2 in tax year 2019.

For tax years 2019 and earlier, you were required

to begin receiving distributions by April 1 of the

year following the year in which you reached age

70

1

/2. If you reach age 70

1

/2 in tax year 2020 or later, you

must generally begin receiving distributions from your IRA

by April 1 of the year following the year in which you reach

age 72.

If you have a RMD for 2020 due by April 1, 2021,

you are not required to take that distribution in

2021. You are only required to take the distribu-

tion due by December 31, 2021.

Special rule for RMDs and rollovers in 2020. If you re-

ceive a distribution in 2020, whether an RMD for the initial

required distribution or a distribution in a series of RMDs,

you can roll that distribution over and the 60-day rollover

period is extended in that the end of that 60-day period

cannot occur before August 31, 2020.

Permitted repayments of RMDs previously distrib-

uted from an IRA in 2020. If you received a distribution

from your IRA that would have normally counted as an

RMD in 2020, and that cannot be rolled over without vio-

lating the one-rollover-per-year rule, you can repay the

amount back to that IRA as long as the repayment is

made no later than August 31, 2020.

Even if you begin receiving distributions before

you reach age 72, you must begin calculating and

receiving RMDs by your required beginning date.

More than minimum received. If, in any year, you re-

ceive more than the required minimum distribution for that

year, you won't receive credit for the additional amount

when determining the required minimum distributions for

future years. This doesn't mean that you don't reduce your

IRA account balance. It means that if you receive more

than your required minimum distribution in one year, you

can't treat the excess (the amount that is more than the re-

quired minimum distribution) as part of your required mini-

mum distribution for any later year. However, any amount

distributed in the year you become age 72 will be credited

toward the amount that must be distributed by April 1 of

the following year.

TIP

TIP

CAUTION

!

Chapter 1 Traditional IRAs Page 7

Page 8 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Distributions after the required beginning date. The

required minimum distribution for any year after the year

you reach age 72 must be made by December 31 of that

later year.

Distributions from individual retirement accounts. If

you are the owner of a traditional IRA that is an individual

retirement account, you or your trustee must figure the re-

quired minimum distribution for each year. See Figuring

the Owner's Required Minimum Distribution below.

Distributions from individual retirement annuities. If

your traditional IRA is an individual retirement annuity,

special rules apply to figuring the required minimum distri-

bution. For more information on rules for annuities, see

Regulations section 1.401(a)(9)-6. These regulations can

be read in many libraries, and IRS offices, and online at

the IRS.gov.

Change in marital status. For purposes of figuring your

required minimum distribution, your marital status is deter-

mined as of January 1 of each year. If your spouse is a

beneficiary of your IRA on January 1, he or she remains a

beneficiary for the entire year even if you get divorced or

your spouse dies during the year. For purposes of deter-

mining your distribution period, a change in beneficiary is

effective in the year following the year of death or divorce.

Change of beneficiary. If your spouse is the sole

beneficiary of your IRA, and he or she dies before you,

your spouse won't fail to be your sole beneficiary for the

year that he or she died solely because someone other

than your spouse is named a beneficiary for the rest of

that year. However, if you get divorced during the year

and change the beneficiary designation on the IRA during

that same year, your former spouse won't be treated as

the sole beneficiary for that year.

Figuring the Owner's Required Minimum

Distribution

Figure your required minimum distribution for each year

by dividing the IRA account balance (defined next) as of

the close of business on December 31 of the preceding

year by the applicable distribution period or life expect-

ancy. Tables showing distribution periods and life expect-

ancies are found in Appendix B and are discussed later.

IRA account balance. The IRA account balance is the

amount in the IRA at the end of the year preceding the

year for which the required minimum distribution is being

figured.

Contributions. Contributions increase the account

balance in the year they are made. If a contribution for last

year isn't made until after December 31 of last year, it in-

creases the account balance for this year, but not for last

year. Disregard contributions made after December 31 of

last year in determining your required minimum distribu-

tion for this year.

Outstanding rollovers. The IRA account balance is

adjusted by outstanding rollovers that aren't in any ac-

count at the end of the preceding year.

For a rollover from a qualified plan or another IRA that

wasn't in any account at the end of the preceding year, in-

crease the account balance of the receiving IRA by the

rollover amount valued as of the date of receipt.

No recharacterizations of conversions made in

2018 or later. A conversion of a traditional IRA to a Roth

IRA, and a rollover from any other eligible retirement plan

to a Roth IRA, made in tax years beginning after Decem-

ber 31, 2017, cannot be recharacterized as having been

made to a traditional IRA.

Distributions. Distributions reduce the account bal-

ance in the year they are made. A distribution for last year

made after December 31 of last year reduces the account

balance for this year, but not for last year. Disregard distri-

butions made after December 31 of last year in determin-

ing your required minimum distribution for this year.

Distribution period. This is the maximum number of

years over which you are allowed to take distributions

from the IRA. The period to use for 2021 is listed next to

your age as of your birthday in 2021 in Table III in Appen-

dix B.

Life expectancy. If you must use Table I, your life ex-

pectancy for 2021 is listed in the table next to your age as

of your birthday in 2021. If you use Table II, your life ex-

pectancy is listed where the row or column containing

your age as of your birthday in 2021 intersects with the

row or column containing your spouse's age as of his or

her birthday in 2021. Both Table I and Table II are in Ap-

pendix B.

Distributions during your lifetime. Required minimum

distributions during your lifetime are based on a distribu-

tion period that is generally determined using Table III

(Uniform Lifetime) in Appendix B. However, if the sole

beneficiary of your IRA is your spouse who is more than

10 years younger than you, see Sole beneficiary spouse

who is more than 10 years younger below.

To figure the required minimum distribution for 2021, di-

vide your account balance at the end of 2020 by the distri-

bution period from the table. This is the distribution period

listed next to your age (as of your birthday in 2021) in Ta-

ble III in Appendix B, unless the sole beneficiary of your

IRA is your spouse who is more than 10 years younger

than you.

Example. You own a traditional IRA. Your account bal-

ance at the end of 2020 was $100,000. You are married

and your spouse, who is the sole beneficiary of your IRA,

is 6 years younger than you. You turn 75 years old in

2021. You use Table III. Your distribution period is 22.9.

Your required minimum distribution for 2021 would be

$4,367 ($100,000 ÷ 22.9).

Sole beneficiary spouse who is more than 10

years younger. If the sole beneficiary of your IRA is your

spouse and your spouse is more than 10 years younger

Page 8 Chapter 1 Traditional IRAs

Page 9 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

than you, use the life expectancy from Table II (Joint Life

and Last Survivor Expectancy) in Appendix B.

The life expectancy to use is the joint life and last survi-

vor expectancy listed where the row or column containing

your age as of your birthday in 2021 intersects with the

row or column containing your spouse's age as of his or

her birthday in 2021.

You figure your required minimum distribution for 2021

by dividing your account balance at the end of 2020 by the

life expectancy from Table II (Joint Life and Last Survivor

Expectancy) in Appendix B.

Example. You own a traditional IRA. Your account bal-

ance at the end of 2020 was $100,000. You are married

and your spouse, who is the sole beneficiary of your IRA,

is 11 years younger than you. You turn 75 in 2021 and

your spouse turns 64. You use Table II. Your joint life and

last survivor expectancy is 23.6. Your required minimum

distribution for 2021 would be $4,237 ($100,000 ÷ 23.6).

Distributions in the year of the owner's death. The re-

quired minimum distribution for the year of the owner's

death depends on whether the owner died before the re-

quired beginning date, defined earlier.

If the owner died before the required beginning date,

there is no required minimum distribution in the year of the

owner's death. For years after the year of the owner's

death, see Owner Died Before Required Beginning Date,

later, under IRA Beneficiaries.

If the owner died on or after the required beginning

date, the IRA beneficiaries are responsible for figuring and

distributing the owner's required minimum distribution in

the year of death. The owner's required minimum distribu-

tion for the year of death is generally based on Table III

(Uniform Lifetime) in Appendix B. However, if the sole

beneficiary of the IRA is the owner's spouse who is more

than 10 years younger than the owner, use the life expect-

ancy from Table II (Joint Life and Last Survivor Expect-

ancy).

Note. You figure the required minimum distribution for

the year in which an IRA owner dies as if the owner lived

for the entire year.

IRA Beneficiaries

The rules for determining required minimum distributions

for beneficiaries depend on the following.

•

The beneficiary is the surviving spouse.

•

The beneficiary is an individual (other than the surviv-

ing spouse).

•

The beneficiary isn't an individual (for example, the

beneficiary is the owner's estate). (But see Trust as

beneficiary, later, for a discussion about treating trust

beneficiaries as designated beneficiaries.)

•

The IRA owner died before the required beginning

date, or died on or after the required beginning date.

The following paragraphs explain the rules for required

minimum distributions and beneficiaries.

If distributions to the beneficiary from an inherited

traditional IRA are less than the required minimum

distribution for the year, discussed in this chapter

under When Must You Withdraw Assets? (Required Mini-

mum Distributions), you may have to pay a 50% excise

tax for that year on the amount not distributed as required.

For details, see Excess Accumulations (Insufficient Distri-

butions) under What Acts Result in Penalties or Additional

Taxes, later in this chapter.

Surviving spouse. If you are the surviving spouse who is

the sole beneficiary of your deceased spouse's IRA, you

may elect to be treated as the owner and not as the bene-

ficiary. If you elect to be treated as the owner, you deter-

mine the required minimum distribution (if any) as if you

were the owner beginning with the year you elect or are

deemed to be the owner. For details, see Inherited from

spouse under What if You Inherit an IRA, earlier in this

chapter.

Note. If you become the owner in the year your de-

ceased spouse died, don't determine the required mini-

mum distribution for that year using your life; rather, you

must take the deceased owner's required minimum distri-

bution for that year (to the extent it wasn't already distrib-

uted to the owner before his or her death).

You can never make a rollover contribution of an

RMD; however, RMDs are waived for 2020 and

you can roll over an RMD for 2020. The rollover

must be completed within 60 days after the distribution,

except that for distributions made before July 2, 2020, the

60-day rollover period was extended to August 31, 2020.

Normally, any rollover contribution of an RMD is subject to

the 6% tax on excess contributions. See chapter 1 of Pub.

590-A for more information on the tax on excess contribu-

tions.

For any year after the owner’s death, where a sur-

viving spouse is the sole designated beneficiary

of the account and he or she fails to take a re-

quired minimum distribution (if one is required) by Decem-

ber 31 under the rules discussed below for beneficiaries,

he or she will be deemed the owner of the IRA. For de-

tails, see Inherited from spouse under What if You Inherit

an IRA, earlier in this chapter.

Date the designated beneficiary is determined. Gen-

erally, the designated beneficiary is determined on Sep-

tember 30 of the calendar year following the calendar year

of the IRA owner's death. In order to be a designated ben-

eficiary, an individual must be a beneficiary as of the date

of death. Any person who was a beneficiary on the date of

the owner's death, but isn't a beneficiary on September 30

of the calendar year following the calendar year of the

owner's death (because, for example, he or she dis-

claimed entitlement or received his or her entire benefit),

won't be taken into account in determining the designated

beneficiary. An individual may be designated as a benefi-

ciary either by the terms of the plan or, if the plan permits,

by affirmative election by the employee specifying the

beneficiary.

CAUTION

!

CAUTION

!

TIP

Chapter 1 Traditional IRAs Page 9

Page 10 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Note. If a person who is a beneficiary as of the owner's

date of death dies before September 30 of the year follow-

ing the year of the owner's death without disclaiming enti-

tlement to benefits, that individual, rather than his or her

successor beneficiary, continues to be treated as a bene-

ficiary for determining the distribution period.

For the exception to this rule, see Death of surviving

spouse prior to date distributions begin, later.

Death of a beneficiary. In general, the beneficiaries of a

deceased beneficiary must continue to take the required

minimum distributions after the deceased beneficiary's

death. However, the beneficiaries of a deceased benefi-

ciary don't calculate required minimum distributions using

their own life expectancies. Instead, the deceased benefi-

ciary's remaining interest must be distributed within 10

years after the beneficiary's death, or in some cases

within 10 years after the owner's death. See 10-year rule,

later.

More than one beneficiary. If an IRA has more than one

beneficiary or a trust is named as beneficiary, see Miscel-

laneous Rules for Required Minimum Distributions, later.

Eligible designated beneficiaries. An IRA beneficiary

is an eligible designated beneficiary if the beneficiary is

the owner's surviving spouse, the owner's minor child, a

disabled individual, a chronically ill individual, or any other

individual who is not more than 10 years younger than the

IRA owner.

Owner Died On or After Required Beginning

Date

If the owner died on or after his or her required beginning

date (defined earlier), and you are an eligible designated

beneficiary, you must base required minimum distribu-

tions for years after the year of the owner's death on the

longer of:

•

Your single life expectancy shown in Table I in Appen-

dix B, as determined under Beneficiary an individual

later; or

•

The owner's life expectancy as determined under

Death on or after required beginning date under Bene-

ficiary not an individual later.

Surviving spouse is sole designated beneficiary. If

the owner died on or after his or her required beginning

date and his or her spouse is the sole designated benefi-

ciary, the life expectancy the spouse must use to figure

his or her required minimum distribution may change in a

future distribution year. This change will apply where the

spouse is older than the deceased owner or the spouse

treats the IRA as his or her own.

Designated beneficiary who is not an eligible desig-

nated beneficiary. Distributions to a designated benefi-

ciary who is not an eligible designated beneficiary must be

completed within 10 years of the death of the owner. See

10-year rule, later.

Owner Died Before Required Beginning

Date

If the owner died before his or her required beginning date

(defined earlier), and you are an eligible designated bene-

ficiary, you must generally base required minimum distri-

butions for years after the year of the owner's death using

your single life expectancy shown in Table I in Appendix

B, as determined under Beneficiary an individual, later.

However, there are situations where an individual des-

ignated beneficiary may be required to take the entire ac-

count by the end of the 10th year following the year of the

owner's death. See 10-year rule, later.

If the owner’s beneficiary isn’t an individual (for exam-

ple, if the beneficiary is the owner’s estate), the 5-year

rule, discussed later, applies.

Special rules for surviving spouse. If the owner died

before his or her required beginning date and the surviv-

ing spouse is the sole designated beneficiary, the follow-

ing rules apply.

Year of first required distribution. If the owner died

before the year in which he or she reached age 72 (age

70½ if the owner was born before July 1, 1949), distribu-

tions to the spouse don't need to begin until the year in

which the owner would have reached age 72 (or age 70½,

if applicable).

Death of surviving spouse prior to date distribu-

tions begin. If the surviving spouse dies before Decem-

ber 31 of the year he or she must begin receiving required

minimum distributions, the surviving spouse will be treated

as if he or she were the owner of the IRA.

This rule doesn't apply to the surviving spouse of a sur-

viving spouse.

Example 1. Your spouse died in 2017, at age 65. You

are the sole designated beneficiary of your spouse’s tradi-

tional IRA. You don't need to take any required minimum

distribution until December 31 of 2024, the year your

spouse would have reached age 72. If you die prior to that

date, you will be treated as the owner of the IRA for purpo-

ses of determining the required distributions to your bene-

ficiaries. For example, if you die in 2020, your beneficia-

ries won't have any required minimum distribution for

2020 (because you, treated as the owner, died prior to

your required beginning date). They must start taking dis-

tributions under the general rules for an owner who died

prior to the required beginning date.

Example 2. Same as Example 1, except your sole

beneficiary upon your death in 2020 is your surviving

spouse. Your surviving spouse can't wait until the year

you would have turned 72 to take distributions using his or

her life expectancy. Also, if your surviving spouse dies

prior to the date he or she is required to take a distribution,

he or she isn't treated as the owner of the account. Just

like any other individual beneficiary of an owner who dies

before the required beginning date, your surviving spouse

must start taking distributions in 2021 based on his or her

Page 10 Chapter 1 Traditional IRAs

Page 11 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

life expectancy (or elect to fully distribute the account un-

der the 10-year rule by the end of 2030).

The second surviving spouse from Example 2

above can still elect to treat the IRA as his or her

own IRA or roll over any distributions that aren't

required minimum distributions into his or her own IRA.

See Inherited from spouse under What if You Inherit an

IRA, earlier in this chapter.

5-year rule. The 5-year rule requires the IRA benefi-

ciaries who are not taking life expectancy payments to

withdraw the entire balance of the IRA by December 31 of

the year containing the fifth anniversary of the owner’s

death. For example, if the owner died in 2019, the benefi-

ciary would have to fully distribute the plan by December

31, 2024. The beneficiary is allowed, but not required, to

take distributions prior to that date. The 5-year rule never

applies if the owner died on or after his or her required be-

ginning date.

The 5-year rule generally applies to all beneficia-

ries if the owner died in a year ending before

2020. It also applies to beneficiaries who are not

individuals (such as a trust) if the owner died in a year

ending after 2019. If the owner died in a year ending after

2019 and the beneficiary is an individual, see 10-year rule

next.

10-year rule. The 10-year rule requires the IRA bene-

ficiaries who are not taking life expectancy payments to

withdraw the entire balance of the IRA by December 31 of

the year containing the 10th anniversary of the owner’s

death. For example, if the owner died in 2020, the benefi-

ciary would have to fully distribute the plan by December

31, 2030. The beneficiary is allowed, but not required, to

take distributions prior to that date.

The 10-year rule applies if (1) the beneficiary is an eligi-

ble designated beneficiary who elects the 10-year rule, if

the owner died before reaching his or her required begin-

ning date; or (2) the beneficiary is a designated benefi-

ciary who is not an eligible designated beneficiary, regard-

less of whether the owner died before reaching his or her

required beginning date.

For a beneficiary receiving life expectancy payments

who is either an eligible designated beneficiary or a minor

child, the 10-year rule also applies to the remaining

amounts in the IRA upon the death of the eligible designa-

ted beneficiary or upon the minor child beneficiary reach-

ing the age of majority, but in either of those cases, the

10-year period ends on the 10th anniversary of the benefi-

ciary's death or the child's attainment of majority.

Individual designated beneficiaries. The terms of

most IRA plans require individual designated beneficia-

ries, who are eligible designated beneficiaries, to take re-

quired minimum distributions using the life expectancy

rules (explained later) unless such beneficiaries elect to

take distributions using the 5-year rule or the 10-year rule,

whichever rule applies. The deadline for making this elec-

tion is December 31 of the year the beneficiary must take

the first required distribution using his or her life expect-

ancy (or December 31 of the year containing the 5th

TIP

CAUTION

!

anniversary (or 10th anniversary for the 10-year rule) of

the owner’s death, if earlier).

If the individual designated beneficiary is not an eligible

designated beneficiary, the beneficiary is required to fully

distribute the IRA by the 10th anniversary of the owner's

death under the 10-year rule.

Beneficiary not an individual. The 5-year rule applies

in all cases where there is no individual designated bene-

ficiary by September 30 of the year following the year of

the owner’s death or where any beneficiary isn't an indi-

vidual (for example, the owner named his or her estate as

the beneficiary).

Review the IRA plan documents or consult with

the IRA custodian or trustee for specifics on the 5-

or 10-year rule provisions, where applicable, of

any particular plan.

If the 5-year rule applies, the amount remaining in

the IRA, if any, after December 31 of the year

containing the 5th anniversary of the owner's

death is subject to the 50% excise tax detailed in Excess

Accumulations (Insufficient Distributions), later.

If the 10-year rule applies, the amount remaining

in the IRA, if any, after December 31 of the year

containing the 10th anniversary of the owner's

death is subject to the 50% excise tax detailed in Excess

Accumulations (Insufficient Distributions), later.

Figuring the Beneficiary's Required

Minimum Distribution

How you figure the required minimum distribution de-

pends on whether the beneficiary is an individual or some

other entity, such as a trust or estate.

Beneficiary an individual. If the beneficiary is an indi-

vidual, figure the required minimum distribution for 2021

as follows.

Death on or after required beginning date. Divide

the account balance at the end of 2020 by the appropriate

life expectancy from Table I (Single Life Expectancy) in

Appendix B. Determine the appropriate life expectancy as

follows.

Spouse as sole designated beneficiary. Use the life

expectancy listed in the table next to the spouse's age (as

of the spouse's birthday in 2021). Use this life expectancy

even if the spouse died in 2021. If the spouse died in 2020

or a prior year, use the life expectancy listed in the table

next to the spouse’s age as of his or her birthday in the

year he or she died. Reduce the life expectancy by 1 for

each year since the year following the spouse’s death.

You can't make a rollover contribution of your re-

quired minimum distributions in years after the

owner's death. Such contribution is subject to the

6% tax on excess contributions. See chapter 1 of Pub.

590-A for more information on the tax on excess contribu-

tions.

TIP

CAUTION

!

CAUTION

!

CAUTION

!

Chapter 1 Traditional IRAs Page 11

Page 12 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Other designated beneficiary. Use the life expect-

ancy listed in the table next to the beneficiary’s age as of

his or her birthday in the year following the year of the

owner’s death. Reduce the life expectancy by 1 for each

year since the year following the owner’s death.

As discussed in Death of a beneficiary, earlier, if the

designated beneficiary dies before his or her portion of the

account is fully distributed, continue to use the designated

beneficiary’s remaining life expectancy to determine the

amount of distributions. However, any remaining balance

in the account must be distributed within 10 years of the

beneficiary's death.

Example. Your brother died in 2020 at age 74. You

are the designated beneficiary of your brother’s traditional

IRA. You are 65 years old in 2021, which is the year fol-

lowing your brother's death. You use Table I and see that

your life expectancy in 2021 is 21.0. If the IRA was worth

$100,000 at the end of 2020, your required minimum dis-

tribution for 2021 would be $4,762 ($100,000 ÷ 21.0).

Death before required beginning date. If the IRA

owner dies before the required beginning date and the

10-year rule applies, no distribution is required for any

year before the 10th year.

Beneficiary not an individual. If the beneficiary isn't an

individual, determine the required minimum distribution for

2021 as follows.

Death on or after required beginning date. Divide

the account balance at the end of 2020 by the appropriate

life expectancy from Table I (Single Life Expectancy) in

Appendix B. Use the life expectancy listed next to the

owner's age as of his or her birthday in the year of death.

Reduce the life expectancy by 1 for each year after the

year of death.

Death before required beginning date. If the IRA

owner dies before the required beginning date and the

beneficiary isn't an individual (for example, the owner

named his or her estate as the beneficiary), the 5-year

rule applies. No distribution is required for any year before

the fifth year. See 5-year rule, earlier.

Note. The required beginning date was defined earlier

under Distributions by the required beginning date.

Example. The owner died in 2020 at the age of 80,

and the owner's traditional IRA went to his estate. The ac-

count balance at the end of 2020 was $100,000. In 2021,

the required minimum distribution would be $10,870

($100,000 ÷ 9.2 (the owner's life expectancy in the year of

death, 10.2, reduced by 1)).

If the owner had died in 2020 at the age of 68 (before

their required beginning date), the entire account would

have to be distributed by the end of 2025. See Death on

or after required beginning date and Death before re-

quired beginning date, earlier, for more information.

Which Table Do You Use

To Determine Your

Required Minimum Distribution?

There are three different life expectancy tables. The ta-

bles are found in Appendix B of this publication. You use

only one of them to determine your required minimum dis-

tribution for each traditional IRA. Determine which one to

use as follows.

Reminder. In using the tables for lifetime distributions,

marital status is determined as of January 1 each year. Di-

vorce or death after January 1 is generally disregarded

until the next year. However, if you divorce and change

the beneficiary designation in the same year, your former

spouse can't be considered your sole beneficiary for that

year.

Table I (Single Life Expectancy). Use Table I for years

after the year of the owner's death if either of the following

applies.

•

You are an individual and a designated beneficiary,

but not the owner's surviving spouse and sole desig-

nated beneficiary.

•

The beneficiary isn't an individual and the owner died

on or after the required beginning date, defined ear-

lier.

Surviving spouse. If you are the owner's surviving

spouse and sole designated beneficiary, you will also use

Table I for your required minimum distributions. However,

if the owner hadn't reached age 72 when he or she died,

and you don't elect to be treated as the owner of the IRA,

you don't have to take distributions until the year in which

the owner would have reached age 72.

Table II (Joint Life and Last Survivor Expectancy).

Use Table II if you are the IRA owner and your spouse is

both your sole designated beneficiary and more than 10

years younger than you.

Note. Use this table in the year of the owner's death if

the owner died after the required beginning date and this

is the table that would have been used had he or she not

died.

Table III (Uniform Lifetime). Use Table III if you are the

IRA owner and your spouse isn't both the sole designated

beneficiary of your IRA and more than 10 years younger

than you.

Note. Use this table in the year of the owner's death if

the owner died after the required beginning date and this

is the table that would have been used had he or she not

died.

No table. Don't use any of the tables if either the 5-year

rule or the 10-year rule (discussed earlier) applies.

Page 12 Chapter 1 Traditional IRAs

Page 13 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

What Age(s) Do You Use With the

Table(s)?

The age or ages to use with each table are explained be-

low.

Table I (Single Life Expectancy). If you are a designa-

ted beneficiary figuring your first distribution, use your age

as of your birthday in the year distributions must begin.

This is usually the calendar year immediately following the

calendar year of the owner's death. After the first distribu-

tion year, reduce your life expectancy by 1 for each sub-

sequent year. If you are the owner's surviving spouse and

the sole designated beneficiary, this is generally the year

in which the owner would have reached age 72. After the

first distribution year, use your age as of your birthday in

each subsequent year.

Example 1. You are an eligible designated beneficiary

figuring your first required minimum distribution. Distribu-

tions must begin in 2021. You become age 57 years old in

2021. You use Table I.

Example 2. You are the owner's surviving spouse and

the sole designated beneficiary. The owner would have

turned age 72 in 2021. Distributions begin in 2021. You

become 69 years old in 2021. You use Table I. Your distri-

bution period for 2021 is 17.8.

Owner's life expectancy. You use the owner’s life ex-

pectancy to calculate required minimum distributions

when the owner dies on or after the required beginning

date and there is no designated beneficiary as of Septem-

ber 30 of the year following the year of the owner’s death.

In this case, use the owner’s life expectancy for his or her

age as of the owner’s birthday in the year of death and re-

duce it by 1 for each subsequent year.

Or use the owner’s life expectancy in the year of death

(reduced by 1 for each subsequent year) if the owner is

younger than you.

Table II (Joint Life and Last Survivor Expectancy).

For your first distribution by the required beginning date,

use your age and the age of your designated beneficiary

as of your birthdays in the year you become age 72. Your

combined life expectancy is at the intersection of your

ages.

If you are figuring your required minimum distribution

for 2021, use your ages as of your birthdays in 2021. For

each subsequent year, use your and your spouse's ages

as of your birthdays in the subsequent year.

Table III (Uniform Lifetime). For your first distribution by

your required beginning date, use your age as of your

birthday in the year you become age 72.

If you are figuring your required minimum distribution

for 2021, use your age as of your birthday in 2021. For

each subsequent year, use your age as of your birthday in

the subsequent year.

Miscellaneous Rules for

Required Minimum Distributions

The following rules may apply to you.

Installments allowed. The yearly required minimum dis-

tribution can be taken in a series of installments (monthly,

quarterly, etc.) as long as the total distributions for the

year are at least as much as the minimum required

amount.

More than one IRA. If you have more than one tradi-

tional IRA, you must determine a separate required mini-

mum distribution for each IRA. However, you can total

these minimum amounts and take the total from any one

or more of the IRAs.

More than minimum received. If, in any year, you re-

ceive more than the required minimum amount for that

year, you won't receive credit for the additional amount

when determining the minimum required amounts for fu-

ture years. This doesn't mean that you don't reduce your

IRA account balance. It means that if you receive more

than your required minimum distribution in one year, you

can't treat the excess (the amount that is more than the re-

quired minimum distribution) as part of your required mini-

mum distribution for any later year. However, any amount

distributed in your age 72 year will be credited toward the

amount that must be distributed by April 1 of the following

year.

Multiple individual beneficiaries. If, as of September

30 of the year following the year in which the owner dies,

there is more than one beneficiary, the beneficiary with

the shortest life expectancy will be the designated benefi-

ciary if both of the following apply.

•

All of the beneficiaries are individuals.

•

The account or benefit hasn't been divided into sepa-

rate accounts or shares for each beneficiary.

Separate accounts. A single IRA can be split into

separate accounts or shares for each beneficiary. These

separate accounts or shares can be established at any

time, either before or after the owner's required beginning

date. Generally, these separate accounts or shares are

combined for purposes of determining the minimum re-

quired distribution. However, these separate accounts or

shares won't be combined for required minimum distribu-

tion purposes after the death of the IRA owner if the sepa-

rate accounts or shares are established by the end of the

year following the year of the IRA owner's death.

The separate account rules can't be used by beneficia-

ries of a trust.

Trust as beneficiary. A trust can't be a designated ben-

eficiary even if it is a named beneficiary. However, the

beneficiaries of a trust will be treated as having been des-

ignated beneficiaries for purposes of determining required

minimum distributions after the owner’s death (or after the

death of the owner’s surviving spouse described in Death

Chapter 1 Traditional IRAs Page 13

Page 14 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

of surviving spouse prior to date distributions begin, ear-

lier) if all of the following are true.

1. The trust is a valid trust under state law, or would be

but for the fact that there is no corpus.

2. The trust is irrevocable or became, by its terms, irrev-

ocable upon the owner's death.

3. The beneficiaries of the trust who are beneficiaries

with respect to the trust's interest in the owner's bene-

fit are identifiable from the trust instrument.

4. The trustee of the trust provides the IRA custodian or

trustee with the documentation required by that custo-

dian or trustee. The trustee of the trust should contact

the IRA custodian or trustee for details on the docu-

mentation required for a specific plan.

The deadline for the trustee to provide the beneficiary

documentation to the IRA custodian or trustee is October

31 of the year following the year of the owner's death.

Trust beneficiary is another trust. If the beneficiary

of the trust (which is the beneficiary of the IRA) is another

trust and both trusts meet the above requirements, the

beneficiaries of the other trust will be treated as having

been designated as beneficiaries for purposes of deter-

mining the distribution period.

Note. The separate account rules, discussed earlier,

can't be used by beneficiaries of a trust.

You may want to contact a tax advisor to comply

with this complicated area of the tax law.

Annuity distributions from an insurance company.

Special rules apply if you receive distributions from your

traditional IRA as an annuity purchased from an insurance

company. See Regulations sections 1.401(a)(9)-6 and

54.4974-2. These regulations can be found in many libra-

ries, and IRS offices, and online at IRS.gov.

Are Distributions Taxable?

In general, distributions from a traditional IRA are taxable

in the year you receive them.

Failed financial institutions. Distributions from a tradi-

tional IRA are taxable in the year you receive them even if

they are made without your consent by a state agency as

receiver of an insolvent savings institution. This means

you must include such distributions in your gross income

unless you roll them over.

Exceptions. Exceptions to distributions from traditional

IRAs being taxable in the year you receive them are:

•

Rollovers (see chapter 1 of Pub. 590-A);

•

Qualified charitable distributions, discussed later;

•

Tax-free withdrawals of contributions (see chapter 1 of

Pub. 590-A); and

TIP

•

The return of nondeductible contributions, discussed

later under Distributions Fully or Partly Taxable.

Although a conversion of a traditional IRA is con-

sidered a rollover for Roth IRA purposes, it isn't

an exception to the rule that distributions from a

traditional IRA are taxable in the year you receive them.

Conversion distributions are includible in your gross in-

come subject to this rule and the special rules for conver-

sions explained in chapter 1 of Pub. 590-A.

Qualified charitable distributions. A qualified charita-

ble distribution (QCD) is generally a nontaxable distribu-

tion made directly by the trustee of your IRA (other than a

SEP or SIMPLE IRA) to an organization eligible to receive

tax-deductible contributions. You must be at least age

70

1

/2 when the distribution was made. Also, you must

have the same type of acknowledgment of your contribu-

tion that you would need to claim a deduction for a chari-

table contribution. See Substantiation Requirements in

Pub. 526.

The maximum annual exclusion for QCDs is $100,000.

Any QCD in excess of the $100,000 exclusion limit is in-

cluded in income as any other distribution. If you file a joint

return, your spouse can also have a QCD and exclude up

to $100,000. The amount of the QCD is limited to the

amount of the distribution that would otherwise be inclu-

ded in income. If your IRA includes nondeductible contri-

butions, the distribution is first considered to be paid out of

otherwise taxable income.

A QCD will count towards your required minimum

distribution, discussed earlier.

You can't claim a charitable contribution deduc-

tion for any QCD not included in your income.

Example. On December 23, 2020, Jeff, age 75, direc-

ted the trustee of his IRA to make a distribution of $25,000

directly to a qualified 501(c)(3) organization (a charitable

organization eligible to receive tax-deductible contribu-

tions). The total value of Jeff's IRA is $30,000 and con-

sists of $20,000 of deductible contributions and earnings

and $10,000 of nondeductible contributions (basis). Since

Jeff is at least age 70

1

/2 and the distribution is made di-

rectly by the trustee to a qualified organization, the part of

the distribution that would otherwise be includible in Jeff's

income ($20,000) is a QCD.

In this case, Jeff has made a QCD of $20,000 (his de-

ductible contributions and earnings). Because Jeff made a

distribution of nondeductible contributions from his IRA,

he must file Form 8606 with his return. Jeff includes the

total distribution ($25,000) on line 4a of Form 1040-SR.

He completes Form 8606 to determine the amount to en-

ter on line 4b of Form 1040-SR and the remaining basis in

his IRA. Jeff enters -0- on line 4b. This is Jeff's only IRA

and he took no other distributions in 2020. He also enters

“QCD” next to line 4b to indicate a qualified charitable dis-

tribution.

After the distribution, his basis in his IRA is $5,000. If

Jeff itemizes deductions and files Schedule A (Form

CAUTION

!

TIP

CAUTION

!

Page 14 Chapter 1 Traditional IRAs

Page 15 of 66 Fileid: … ions/P590B/2020/A/XML/Cycle06/source 11:04 - 13-May-2021

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

1040) with Form 1040-SR, the $5,000 portion of the distri-

bution attributable to the nondeductible contributions can

be deducted as a charitable contribution, subject to AGI

limits. He can't take the charitable contribution deduction

for the $20,000 portion of the distribution that wasn't inclu-

ded in his income.

One-time qualified Health Savings Account (HSA)

funding distribution. You may be able to make a quali-

fied HSA funding distribution from your traditional IRA or

Roth IRA to your HSA. You can't make this distribution

from an ongoing SEP IRA or SIMPLE IRA. For this pur-

pose, a SEP IRA or SIMPLE IRA is ongoing if an employer

contribution is made for the plan year ending with or within

your tax year in which the distribution would be made. The

distribution must be less than or equal to your maximum

annual HSA contribution.

This distribution must be made directly by the trustee of

the IRA to the trustee of the HSA. The distribution isn't in-

cluded in your income, isn't deductible, and reduces the

amount that can be contributed to your HSA. You must

make the distribution by the end of the year; the special

rule allowing contributions to your HSA for the previous

year if made by your tax return filing deadline doesn't ap-

ply. The qualified HSA funding distribution is reported on

Form 8889 for the year in which the distribution is made.

One-time transfer. Generally, only one qualified HSA

funding distribution is allowed during your lifetime. If you

own two or more IRAs, and want to use amounts in multi-

ple IRAs to make a qualified HSA funding distribution, you

must first make an IRA-to-IRA transfer of the amounts to

be distributed into a single IRA, and then make the

one-time qualified HSA funding distribution from that IRA.

Testing period rules apply. If at any time during the

testing period you cease to meet all requirements to be an

eligible individual, the amount of the qualified HSA funding

distribution is included in your gross income. The qualified

HSA funding distribution is included in gross income in the

tax year you first fail to be an eligible individual. This

amount is subject to the 10% additional tax (unless the

failure is due to disability or death).

More information. See Pub. 969 for additional infor-

mation about this distribution.

Ordinary income. Distributions from traditional IRAs that

you include in income are taxed as ordinary income.

No special treatment. In figuring your tax, you can't use

the 10-year tax option or capital gain treatment that ap-

plies to lump-sum distributions from qualified retirement

plans.

If you were affected by a qualified disaster, see

chapter 4.

Distributions Fully or Partly Taxable

Distributions from your traditional IRA may be fully or

partly taxable, depending on whether your IRA includes