Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

2022 Long-Term

Renewable Resources

Procurement Plan

Final Plan

Prepared to conform with the Illinois Commerce Commission’s Final

Order in Docket No. 22-0231, dated July 14, 2022.

August 23, 2022

Prepared in accordance with the

Illinois Power Agency Act (20 ILCS 3855), and the Illinois Public Utilities Act (220 ILCS 5).

RENEWABLE RESOURCES

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

i

Table of Contents

1. Introduction ...................................................................................................................................................................... 1

1.1. Background ............................................................................................................................................................. 1

1.2. Evolution of Long-Term Plans ........................................................................................................................ 2

1.3. First Revised Plan Accomplishments ........................................................................................................... 3

1.4. Plan Organization ................................................................................................................................................. 4

1.5. Action Plan .............................................................................................................................................................. 5

2. Statutory Requirements of the Plan ........................................................................................................................ 6

2.1. Renewable Energy Resource Procurement Prior to Public Act 99-0906 ..................................... 6

2.1.1. Original RPS—Eligible Retail Customer Load ................................................................................. 6

2.1.2. Original RPS—Hourly Pricing Customers ........................................................................................ 7

2.1.3. Original RPS—ARES Compliance ......................................................................................................... 8

2.2. Public Act 99-0906 .............................................................................................................................................. 8

2.2.1. P.A. 99-0906—Overview ......................................................................................................................... 9

2.2.2. Changes to the RPS through P.A. 99-0906 ....................................................................................... 9

2.2.3. The Long-Term Renewable Resources Procurement Plan ...................................................... 14

2.3. RPS Implementation: 2017-2021 ................................................................................................................ 15

2.3.1. Successes and Challenges ...................................................................................................................... 15

2.3.2. Legislative Proposals .............................................................................................................................. 17

2.4. Public Act 102-0662: The Climate and Equitable Jobs Act ............................................................... 18

2.5. Long-Term Renewable Resources Procurement Plan ........................................................................ 20

2.5.1. Plan Requirements ................................................................................................................................... 20

2.5.2. Items Not Included in Long-Term Renewable Resource Procurement Plan ................... 28

2.5.3. 2022 Long-Term Plan Development and Approval.................................................................... 29

2.5.4. Plan Updates ............................................................................................................................................... 29

2.6. The RPS and Percentage-Based Goals of the RPS ................................................................................. 30

2.6.1. Load Applicable to RPS Goals .............................................................................................................. 30

2.6.2. Eligible Projects for the Illinois RPS ................................................................................................. 31

2.6.3. Compliance Mechanism: RECs vs. “Renewable Energy Resources” .................................... 35

2.6.4. RPS Funding and Rate Impact Cap .................................................................................................... 36

2.7. Quantitative New Build Targets of the RPS ............................................................................................. 37

2.7.1. Quantitative Procurement Requirements ...................................................................................... 37

2.7.2. “New wind project” and “new photovoltaic project” Definition ........................................... 37

2.7.3. Forward Procurements Conducted Outside of This Plan ........................................................ 38

2.7.4. Competitive Procurements Proposed Through This Plan ....................................................... 39

2.8. Adjustable Block Program & Community Renewable Generation ................................................. 41

2.8.1. Adjustable Block Program .................................................................................................................... 42

2.8.2. Community Renewable Generation Projects ................................................................................ 48

2.9. Illinois Solar for All Program ......................................................................................................................... 50

2.9.1. Illinois Solar for All—Overview .......................................................................................................... 50

2.9.2. Illinois Solar for All—Sub-programs ................................................................................................ 52

2.9.3. Illinois Solar for All—Additional Requirements .......................................................................... 55

2.9.4. Illinois Solar for All—Third-party Program Administrator .................................................... 58

2.9.5. Illinois Solar for All—Referrals ........................................................................................................... 58

2.10. Diversity, Equity, and Inclusion Requirements ..................................................................................... 59

2.11. Self-direct Renewable Portfolio Standard Compliance Program ................................................... 61

3. REC Portfolio, RPS Goals, Targets, and Budgets ............................................................................................... 63

3.1. Background ........................................................................................................................................................... 63

3.2. REC Portfolio ........................................................................................................................................................ 64

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

ii

3.2.1. Existing REC Portfolios – RECs Already Under Contract .......................................................... 64

3.3. RPS Goals and Targets ...................................................................................................................................... 66

3.3.1. RPS Goals ...................................................................................................................................................... 66

3.3.2. RPS Targets ................................................................................................................................................. 67

3.3.3. Applicable Retail Customer Load Used to Calculate RPS Goals ............................................. 68

3.3.4. Overall REC Procurement Targets and Goals – REC Gap ......................................................... 69

3.3.5. Procurement Targets to Meet Specific Wind-Solar Requirement and Overall RPS

Targets .......................................................................................................................................................... 72

3.4. RPS Budget ............................................................................................................................................................ 74

3.4.1. Statewide Goals and Allocation of Cost and RECs from RPS Procurements to Each

Utility............................................................................................................................................................. 74

3.4.2. Cost Cap and Cost Recovery Provisions .......................................................................................... 75

3.4.3. RPS Compliance Procurement Priorities ........................................................................................ 77

3.4.4. RPS Budget and Cost Cap ...................................................................................................................... 78

3.4.5. Other Expenses .......................................................................................................................................... 80

3.4.6. Expenses and Available RPS Budgets ............................................................................................... 80

3.4.7. Budget Uncertainty Due to Unknowns in Project Energization Timelines ....................... 84

3.4.8. Budget Uncertainty Due to Annual Load Variations .................................................................. 84

3.5. Alternative Compliance Payment Funds Held by the Utilities......................................................... 86

3.6. Section 1-75(c)(1)(H)(i) ARES Option to Supply RECs for their Retail Customers ................ 87

3.7. MidAmerican Volumes ..................................................................................................................................... 88

3.7.1.

Initial Change to MidAmerican’s Load Forecast Methodology .............................................. 89

3.7.2. Correcting for the Unintended Consequences of MidAmerican’s Forecast Approach . 91

4. Renewable Energy Credit Eligibility ..................................................................................................................... 93

4.1. Introduction ......................................................................................................................................................... 93

4.2. REC Eligibility ...................................................................................................................................................... 93

4.3. Adjacent State Requirement .......................................................................................................................... 93

4.4. Cost Recovery Requirement ....................................................................................................................... 102

4.5. High-Voltage Direct Current Transmission Lines and Converter Stations ............................. 104

4.6. Application Process ........................................................................................................................................ 105

5. Competitive Procurements .................................................................................................................................... 107

5.1. Background - Agency Approach in Past Procurements ................................................................... 107

5.2. Past REC Procurements conducted by the IPA ................................................................................... 109

5.3. Statutory Requirements ............................................................................................................................... 113

5.4. New Requirements under P.A. 102-0662 ............................................................................................. 114

5.4.1 RPS Budgets ............................................................................................................................................. 115

5.4.2 Brownfield Site Photovoltaic Project Procurements .............................................................. 115

5.4.3 Labor, Diversity and Equity Requirements................................................................................. 116

5.4.4 Indexed REC Pricing Requirements ............................................................................................... 120

5.4.5 Indexed REC Settlement ..................................................................................................................... 120

5.4.6 Forward Price Curve ............................................................................................................................ 121

5.4.7 Application of the Price Curve .......................................................................................................... 122

5.5. Proposed Procurement Events .................................................................................................................. 122

5.5.1. Utility-Scale Solar and Utility-Scale Wind ................................................................................... 123

5.5.2. Brownfield Site Photovoltaic ............................................................................................................ 124

5.5.3. Non-Photovoltaic Community Renewable Generation .......................................................... 124

5.5.4. Procurement of RECs from Renewable Energy Resources other than New Wind and

Solar ............................................................................................................................................................ 125

5.6. Proposed Schedule for Competitive Procurements .......................................................................... 125

5.6.1. Proposed Schedule for Competitive Procurements ................................................................ 126

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

iii

5.7. Contracts ............................................................................................................................................................. 127

5.7.1. Credit Requirements ............................................................................................................................ 127

5.8. Benchmarks ....................................................................................................................................................... 128

6. Self-Direct Renewable Portfolio Standard Compliance Program .......................................................... 129

6.1. Introduction ...................................................................................................................................................... 129

6.1.1. Self-Direct Program Overview – What is a Self-Direct Program? ...................................... 129

6.1.2. Prior RPS Self-Direct Programs in Illinois ......................................................................................... 130

6.2. Self-Direct Customer Eligibility ................................................................................................................. 131

6.2.1. Common Parents.................................................................................................................................... 131

6.3. Project Eligibility ............................................................................................................................................. 133

6.3.1. “New” Projects ........................................................................................................................................ 133

6.3.2. Locational Requirements ................................................................................................................... 133

6.3.3. Labor and DEI Requirements ........................................................................................................... 134

6.4. REC Delivery Contract Eligibility .............................................................................................................. 135

6.4.1. Contract Term ......................................................................................................................................... 136

6.4.2. Delivery Quantity Requirement....................................................................................................... 136

6.5. Self-Direct Crediting and Accounting ...................................................................................................... 137

6.5.1. Self-Direct Bill Crediting ..................................................................................................................... 137

6.5.2. Procurement Target Adjustments .................................................................................................. 142

6.6. Self-Direct Program Size & Selection ...................................................................................................... 142

6.6.1. Current Publicly Available Analyses and Studies ..................................................................... 143

6.6.2. Establishing Program Size ................................................................................................................. 145

6.6.3. Selecting Between Competing Applications ............................................................................... 146

6.7. Self-Direct Program Application Process .............................................................................................. 147

6.8. Self-Direct Program Opening ..................................................................................................................... 148

6.9. Compliance Reporting ................................................................................................................................... 149

7. Adjustable Block Program...................................................................................................................................... 150

7.1. Background ........................................................................................................................................................ 150

7.1.1. Future Energy Jobs Act ........................................................................................................................ 150

7.1.2. 2021 Program Status and Lessons Learned ............................................................................... 151

7.1.3. Overview of Public Act 102-0662 Modifications ...................................................................... 152

7.1.4. Adjustable Block Program Reopening .......................................................................................... 153

7.2.

Program Administrator ................................................................................................................................ 155

7.3. Block Structure ................................................................................................................................................. 156

7.3.1. Background – Initial Program Design, Declining Price Blocks based on Capacity ..... 156

7.3.2. Transition to Annual Blocks .............................................................................................................. 158

7.3.3. Block Sizes ................................................................................................................................................ 161

7.3.4. Opening of 2022 Delivery Year Blocks & Subsequent Annual Block Openings ........... 161

7.3.5. Uncontracted Capacity at the Close of a Delivery Year .......................................................... 162

7.4. Adjustable Block Program Categories .................................................................................................... 164

7.4.1. Small Distributed Generation ........................................................................................................... 164

7.4.2. Large Distributed Generation ........................................................................................................... 164

7.4.3. Traditional Community Solar ........................................................................................................... 165

7.4.4.

Public Schools ......................................................................................................................................... 170

7.4.5. Community-Driven Community Solar........................................................................................... 171

7.4.6. Equity Eligible Contractor (“EEC”) ................................................................................................. 174

7.5. REC Pricing Model ........................................................................................................................................... 176

7.5.1. Background .............................................................................................................................................. 176

7.5.2. Modeling Update .................................................................................................................................... 178

7.5.3. Adjustments ............................................................................................................................................. 181

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

iv

7.5.4. Size Category Adjustments ................................................................................................................ 181

7.5.5. Co-location of Distributed Generation Systems ........................................................................ 181

7.5.6. Community Solar ................................................................................................................................... 182

7.5.7. Updating of REC Prices ........................................................................................................................ 183

7.6. Prevailing Wage ............................................................................................................................................... 184

7.7. Approved Vendors .......................................................................................................................................... 186

7.7.1. Supporting Stranded Distributed Generation Customers .................................................... 188

7.7.2. Approved Vendor Applications ....................................................................................................... 189

7.7.3. Equity Eligible Contractor Application Process ........................................................................ 190

7.8. Approved Vendor Designees ...................................................................................................................... 191

7.8.1.

Designee Registration .......................................................................................................................... 191

7.8.2. Equity Eligible Contractor Designees ............................................................................................ 192

7.9. Project Requirements .................................................................................................................................... 192

7.9.1. Technical System Requirements ..................................................................................................... 193

7.9.2. Metering Requirements ...................................................................................................................... 194

7.9.3. System Optimization ............................................................................................................................ 195

7.9.4. Co-location of Community Renewable Generation Projects ................................................ 196

7.9.5. Eligibility of Projects Located in Rural Electric Cooperatives and Municipal Utilities

...................................................................................................................................................................... 197

7.9.6. Specific Requirements for Community Solar ............................................................................. 200

7.10. Application Process ........................................................................................................................................ 202

7.10.1.

Batches ....................................................................................................................................................... 202

7.10.2. Systems below 25 kW .......................................................................................................................... 203

7.10.3. Application Fee ....................................................................................................................................... 204

7.10.4. Project Review ........................................................................................................................................ 204

7.10.5. Converting System Size into REC Quantities .............................................................................. 204

7.10.6. Batch Contract Approval .................................................................................................................... 205

7.10.7. Assignment of Projects ........................................................................................................................ 206

7.11. Project Development Timeline and Extensions .................................................................................. 207

7.11.1. Development Time Allowed .............................................................................................................. 207

7.11.2. Extensions ................................................................................................................................................ 208

7.11.3. Project Completion and Energization ........................................................................................... 208

7.11.4.

Additional Requirements for Community Solar Projects ..................................................... 210

7.12. REC Delivery ...................................................................................................................................................... 211

7.12.1. Ongoing Performance Requirements ............................................................................................ 211

7.12.2. Collateral Requirements ..................................................................................................................... 212

7.12.3. Options to Reduce REC Delivery Obligations ............................................................................. 213

7.13. Payment Terms ................................................................................................................................................ 214

7.14. Contracts ............................................................................................................................................................. 216

7.15. Annual Report ................................................................................................................................................... 218

8. Illinois Solar for All.................................................................................................................................................... 220

8.1. Overview ............................................................................................................................................................. 220

8.2. Existing and New Design Elements ......................................................................................................... 221

8.2.1.

Relationship with the Adjustable Block Program .................................................................... 221

8.2.2. Tangible Economic Benefits .............................................................................................................. 222

8.2.3. Small and Emerging Business Development .............................................................................. 225

8.2.4. Energy Sovereignty ............................................................................................................................... 226

8.3. Program Launch and Experience to Date .............................................................................................. 229

8.4. Funding and Budget ....................................................................................................................................... 232

8.4.1. Funding ...................................................................................................................................................... 232

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

v

8.4.2. Illinois Solar for All program design, structure, and budget ............................................... 233

8.4.3. Utilities Annual Funding Available ................................................................................................. 235

8.4.4. Section 16-108(k) Funding (Now Inoperable) .......................................................................... 236

8.4.5. Setting Budgets ....................................................................................................................................... 236

8.4.6. Payment Structure ................................................................................................................................ 237

8.5. Program Requirements and Incentives ................................................................................................. 238

8.5.1. Energy Sovereignty ............................................................................................................................... 239

8.5.2. Setting Incentive Levels ...................................................................................................................... 242

8.5.3. Low-Income Single-Family and Small Multifamily Solar ...................................................... 243

8.5.4. Low-Income Large Multifamily Solar ............................................................................................ 249

8.5.5.

Low-Income Community Solar Project Initiative ..................................................................... 251

8.5.6. Incentives for Non-Profits and Public Facilities ....................................................................... 256

8.5.7. Low-Income Community Solar Pilot Projects ............................................................................ 258

8.6. Illinois Solar for All Program Administrator........................................................................................ 258

8.7. Quality Assurance ........................................................................................................................................... 260

8.8. Coordination with Other Programs ......................................................................................................... 260

8.8.1. Job Training and Placement Programs ......................................................................................... 260

8.8.2. Equity and Environmental Justice programs ............................................................................. 263

8.8.3. Energy Efficiency Programs and Community Action Agencies .......................................... 263

8.8.4. Climate Bank and the Clean Energy Jobs and Justice Fund .................................................. 264

8.8.5. Equitable Energy Upgrade Program .............................................................................................. 265

8.8.6.

Coordination with programs that support building repairs and upgrades ................... 265

8.9. Additional Requirements for Illinois Solar for All Approved Vendors ..................................... 266

8.9.1. Job Training Requirements ............................................................................................................... 267

8.10. Application Process ........................................................................................................................................ 268

8.10.1. Project Submissions and Batches ................................................................................................... 268

8.10.2. Project Selection for Sub-programs with High Demand ....................................................... 269

8.10.3. Customer Eligibility .............................................................................................................................. 270

8.11. Consumer Protections ................................................................................................................................... 275

8.12. Environmental Justice Communities ....................................................................................................... 277

8.12.1. Definitions ................................................................................................................................................ 278

8.12.2. Approach for Defining Environmental Justice Communities .............................................. 280

8.12.3. Environmental Justice Community Designations ..................................................................... 283

8.12.4. Environmental Justice Communities 25% Goal ........................................................................ 283

8.13. Program Changes ............................................................................................................................................ 283

8.14. Evaluation........................................................................................................................................................... 284

8.15. Grassroots Education Funding .................................................................................................................. 286

8.16. Ongoing Research and Education ............................................................................................................. 289

8.17. Illinois Solar for All Advisory Group........................................................................................................ 289

9. Consumer Protection ............................................................................................................................................... 291

9.1. Consumer Protection Requirements under Prior Long-Term Plans ......................................... 291

9.2. Consumer Protection Provisions Arising from Public Act 102-0662 ........................................ 293

9.3. Registration for Program Participants ................................................................................................... 294

9.3.1. Registration Requirements ............................................................................................................... 295

9.3.2. Listing of Approved Entities.............................................................................................................. 295

9.3.3. Disciplinary Determinations ............................................................................................................. 296

9.4. Program Requirements and Contract Requirements ....................................................................... 298

9.4.1. Consumer Protection Handbook ..................................................................................................... 299

9.4.2. ABP Program Requirements ............................................................................................................. 301

9.4.3. ILSFA Program Requirements .......................................................................................................... 309

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

vi

9.5. Standard Disclosure Form Requirements ............................................................................................. 314

9.5.1. ABP Disclosure Forms ......................................................................................................................... 318

9.5.2. ILSFA Disclosure Forms ...................................................................................................................... 320

9.6. Consumer Complaint Center and Complaint Database ................................................................... 322

9.7. Annual Complaint Report ............................................................................................................................ 323

9.8. Consumer Protection Working Group .................................................................................................... 324

10. Diversity, Equity, and Inclusion ........................................................................................................................... 326

10.1. Equity Accountability System .................................................................................................................... 327

10.1.1. Minimum Equity Standards............................................................................................................... 327

10.1.2. Proposed Implementation Timeline .............................................................................................. 332

10.1.3.

Submittal and Reporting Process.................................................................................................... 332

10.1.4. Enforcement of Standards ................................................................................................................. 334

10.1.5. Program Recruitment for a Diverse Workforce ........................................................................ 335

10.1.6. Modifications to the Equity Accountability System................................................................. 335

10.2. Equity Accountability System Assessment and Racial Disparity Study.................................... 336

10.2.1. Timing of Equity Accountability System Assessment and Racial Disparity Study ..... 336

10.2.2. Scope of Equity Accountability System Assessment and Racial Disparity Study ........ 337

10.2.3. Coordination with Other Agencies ................................................................................................. 337

10.2.4. Entity Participation ............................................................................................................................... 337

10.3. Program Data Collection .............................................................................................................................. 337

10.4. Energy Workforce Equity Database ........................................................................................................ 338

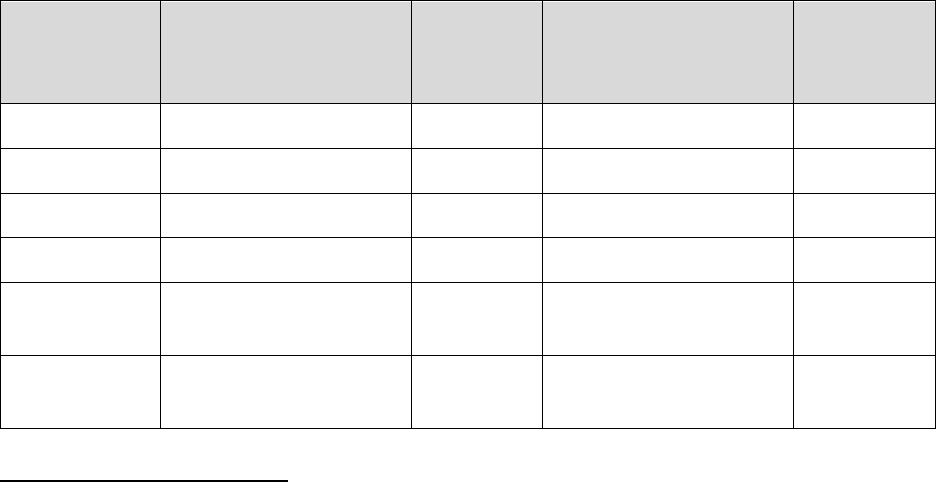

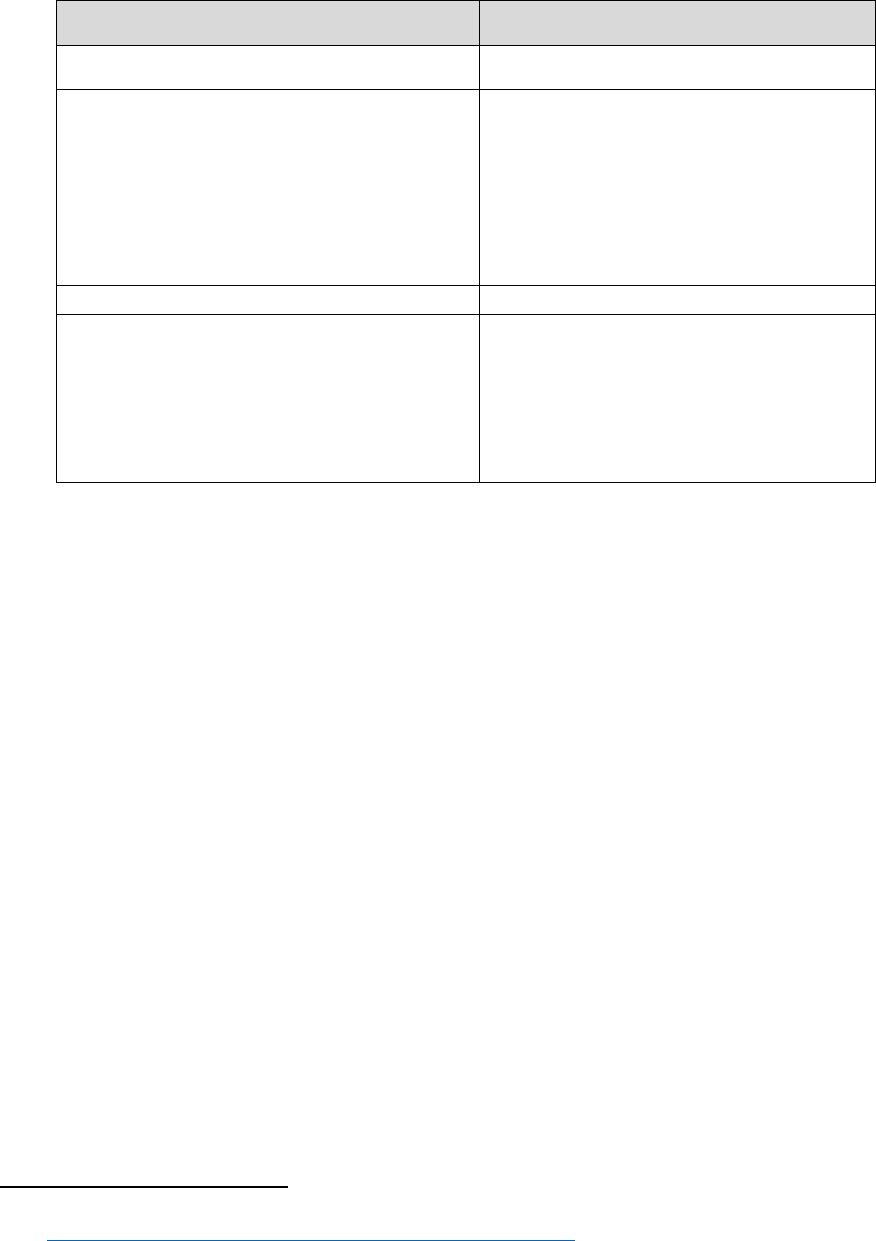

Tables

Table 3-1: Current REC Portfolio by Utility (By Expected Delivery Year) ..................................................... 65

Table 3-2: Annual RPS Goals ............................................................................................................................................. 67

Table 3-3: New Wind and Solar Targets ...................................................................................................................... 68

Table 3-4: Forecast Retail Customer Load Applicable to the Compliance Year (MWH) .......................... 68

Table 3-5: Statewide Overall Goal REC Gap

,

.............................................................................................................. 70

Table 3-6: Statewide RPS Goals ....................................................................................................................................... 72

Table 3-7: Projected Deliveries of Statewide Wind and Solar RECs in the Current Portfolio................ 73

Table 3-8: 2017-2019 Forward Procurement REC Portfolio Status ................................................................ 73

Table 3-9: Utility REC Cost Allocations ......................................................................................................................... 75

Table 3-10: Statewide RPS Budget Set Asides ........................................................................................................... 80

Table 3-11: Projected RPS Expenses ($ millions) .................................................................................................... 82

Table 3-12: RPS Funds and Expenditures ($ millions) .......................................................................................... 83

Table 3-13: Balance of HACP as of January 13, 2022 ($) ...................................................................................... 86

Table 3-14: Available ACPs ($)......................................................................................................................................... 86

Table 3-15: MidAmerican Applicable Load and RPS Budget before and after Change in Forecast

Approach ................................................................................................................................................................................... 89

Table 4-1: Natural Gas-Fired Combined-Cycle Generation Emissions Rates ............................................... 97

Table 4-2: Wind Duration/Direction Factors ............................................................................................................ 97

Table 5-1: 2017-2021 Competitive Procurements Summary .......................................................................... 112

Table 5-2: Spring 2022 Subsequent Forward Procurement Target Volumes ........................................... 114

Table 5-3: Bid Evaluation Price Adjustments ......................................................................................................... 119

Table 5-4: Utility-Scale REC Portfolio Status (Annual REC Volumes) ........................................................... 123

Table 5-5: Proposed Procurements ........................................................................................................................... 126

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

vii

Table 6-1: Representative Corporate Agreements with Utility-Scale Wind and Utility-Scale Solar

Projects in Illinois ............................................................................................................................................................... 144

Table 6-2: Major Corporate Renewable Energy Deals in Illinois Tracked by GreenBiz ........................ 145

Table 7-1: December 2021 ABP Block Sizes ............................................................................................................ 153

Table 7-2: Project Applications for Reopening Blocks ........................................................................................ 154

Table 7-3: Adjustable Block Program Annual Block Opening Schedule ...................................................... 159

Table 7-4: Proposed Annual ABP Block Capacity .................................................................................................. 161

Table 7-5: Proposed ABP REC Prices ($/REC) for Delivery Year 2022-23 ................................................. 180

Table 8-1: RERF Funding for Illinois Solar for All ................................................................................................ 234

Table 8-2: Total Illinois Solar for All Budgets ......................................................................................................... 237

Table 8-3: Incentives for the Low-Income Single and Small Multifamily Solar Program($/REC) .... 246

Table 8-3: Incentives for the Low-Income Large Multifamily Solar Program($/REC) .......................... 250

Table 8-5: Incentives for Low-Income Community Solar Projects ($/REC) .............................................. 255

Table 8-6: Incentives for Non-Profits and Public Facilities ($/REC) ............................................................ 257

Table 8-7: HUD Income Limits ...................................................................................................................................... 271

Table 8-8: Eligibility Guidelines for LIHEAP and IHWAP in Illinois .............................................................. 272

Table 8-9: Summary of CalEnviroScreen 3.0 Identification Methodology .................................................. 280

Table 9-1: Federal Statutes that Apply to Community Solar ............................................................................ 306

Table 9-2: Illinois Statutes that Apply to Community Solar.............................................................................. 307

Figures

Figure 3-1: Current Statewide REC Portfolio (By Expected Delivery Year) .................................................. 65

Figure 3-2: Statewide Annual RPS Goal, REC Portfolio and REC Gap .............................................................. 71

Figure 3-3: RPS Expenditures Compared to Annual Available Funds ............................................................. 83

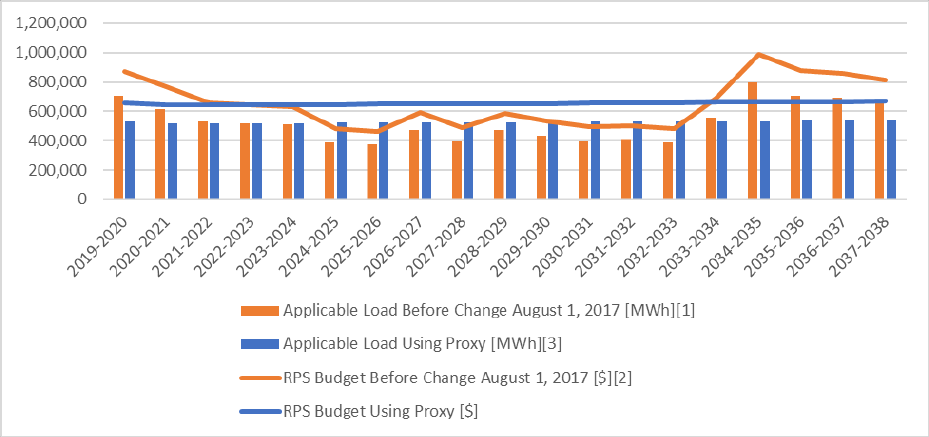

Figure 3-4: Effect on RPS Budget of Annual Load Variations to the Utilities’ Load Forecast................. 85

Figure 3-5: Comparison of MidAmerican’s Applicable Load Using the Generation Forecast before

Change and the Proposed Proxy for Determining Applicable Load and Budget ......................................... 92

Figure 4-1: Pollution Score Calculation ........................................................................................................................ 98

Figure 4-2: Fuel and Resource Diversity Score ......................................................................................................... 99

Figure 4-3: Reliability and Resiliency Score ............................................................................................................ 100

Figure 4-4: CO

2

Score Calculpation ............................................................................................................................. 101

Figure 8-1: ILSFA Program Years 1-3 Project Applications and Selections ............................................... 231

Figure 8-2: Springfield Qualified Census Tracts .................................................................................................... 273

Figure 8-3: CalEnviroScreen Formula ........................................................................................................................ 282

Figure 9-1: Disclosure Form Project Efficiency Graphic .................................................................................... 320

Appendices

Appendix A: Legislative Compliance Index

Appendix B-1: Summaries of Goals and Targets, RPS Portfolios, and Budgets

Appendix B-2: Full REC and Budget Portfolio Spreadsheet

Appendix C: Review of other State REC Pricing Approaches

Appendix D: Renewable Energy Credit Pricing Model Description

Appendix E: Renewable Energy Credit Pricing Model Spreadsheet

Appendix F: Income Eligibility Guidelines for Illinois Solar For All

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

viii

Appendix G: Review of Approaches to Energy Sovereignty

Appendix H: Illinois Solar for All Evaluation Report

Appendix I-1: Adjustable Block Program and Illinois Solar for All Program Consumer Protection

Handbook and Contract Requirements

Appendix I-2: Adjustable Block Program and Illinois Solar for All Program Disclosure Forms

Appendices are available separately at:

https://ipa.illinois.gov/energy-procurement/2022-ltrrpp-appendices.html

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

1

1. Introduction

This document constitutes the final version of the 2022 Revised Long-Term Renewable Resources

Procurement Plan (“2022 Long-Term Plan,” or “Plan”) of the Illinois Power Agency (“IPA” or

“Agency”) consistent with the Final Order of the Illinois Commerce Commission (“ICC” or

“Commission”) entered on July 14, 2022.

This Plan reflects substantial changes made to the Illinois Renewable Portfolio Standard (“Illinois

RPS” or “RPS”) through the enactment of Public Act 102-0662 (colloquially known as the “Climate

and Equitable Jobs Act”) on September 15, 2021. The Plan also presents certain updates that the

Agency had previously proposed in a draft Second Revised Long-Term Plan, which the Agency

withdrew from public comments after the enactment of Public Act 102-0662. This Plan will cover

the renewable energy procurement and programmatic activities conducted by the Agency over the

next two years.

1.1. Background

The Initial Long-Term Renewable Resources Procurement Plan (“Initial Plan”) was developed by the

IPA pursuant to the provisions of Sections 1-56(b) and 1-75(c) of the Illinois Power Agency Act (“Act”

or “IPA Act”), and Section 16-111.5 of the Public Utilities Act (“PUA”). That Initial Plan

1

was

developed under authority established through Public Act 99-0906 (“P.A. 99-0906”), enacted

December 7, 2016 (effective June 1, 2017), which substantially revised the Illinois Renewable

Portfolio Standard (“Illinois RPS” or “RPS”). The Initial Plan was approved by the Commission on

April 3, 2018 in Docket No. 17-0838 and covered the Agency’s renewable energy resources

procurement and programmatic activities for the following two years. The Agency published the

final Initial Plan on August 6, 2018.

Section 16-111.5(b)(5)(ii)(B) of the PUA provides that “[the Agency] shall review, and may revise,

the plan at least every 2 years thereafter.” That subparagraph further provides that “[t]o the extent

practicable, the Agency shall review and propose any revisions to the long-term renewable energy

resources procurement plan in conjunction with the Agency's other planning and approval processes

conducted under this Section.” The first Long-Term Plan update process was undertaken by the

Agency in 2019 starting with stakeholder feedback opportunities, and on August 15, 2019, a draft

Revised Plan was released for public comment concurrently with the IPA’s release of its draft 2020

Electricity Procurement Plan. The Revised Plan was filed for Commission approval on October 21,

2019 and reflected the Agency’s consideration of comments received.

Under Section 16-111.5(b)(5)(ii)(C) of the PUA, the Commission then had 120 days to review the

Revised Plan and enter its Order confirming or modifying the Plan. The Commission approved that

Plan on February 18, 2020 and the Agency published a final version (“First Revised Plan”) on April

20, 2020. The Agency subsequently petitioned the Commission to reopen the First Revised Plan to

provide modifications addressing pressing RPS budget issues on March 3, 2021. The Commission

1

The Initial Plan is available at

https://www2.illinois.gov/sites/ipa/Documents/2019ProcurementPlan/Long%20Term%20Renewable%20Resources%20Procuremen

t%20Plan%20%288-6-18%29.pdf.

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

2

approved those modifications on May 27, 2021 and the Agency filed a First Revised Plan on

Reopening in conformance with that Order on June 7, 2021.

Following that two-year plan updating cycle, the Agency then again conducted stakeholder feedback

opportunities and released a draft Second Revised Long-Term Plan on August 16, 2021 for public

comment (concurrent with the release of the draft 2022 Electricity Procurement Plan). However,

before comments on that Plan were due, in early September of 2021 the General Assembly passed

comprehensive energy legislation in the form of amendments to Senate Bill 2408. That legislation

was signed by the Governor, and became effective, on September 15, 2021 as Public Act 102-0662.

That Act contained a provision that within 120 days, after its effective date, “the Agency shall release

for comment a revision to the long-term renewable resources procurement plan, updating elements

of the most recently approved plan as needed to comply with this amendatory Act of the 102nd

General Assembly, and any long-term renewable resources procurement plan update published by

the Agency but not yet approved by the Illinois Commerce Commission shall be withdrawn for public

comment.” As a result, the Agency withdrew the draft Second Revised Plan and began the process of

preparing a draft 2022 Long-Term Plan.

For this new 2022 Long-Term Plan, the Agency issued requests for stakeholder feedback in

November 2021 and released a draft 2022 Long-Term Plan on January 13, 2022. After the receipt of

public comments on that draft Plan, the Agency updated the Plan and filed the 2022 Long-Term Plan

for approval by the Illinois Commerce Commission on March 21, 2022 in Docket No. 22-0231 and the

Commission approved that Plan with modification on July 14, 2022.

This Final Plan reflects changes arising from the Commission’s Order confirming and modifying the

filed Plan. The Plan as filed has been amended consistent with the IPA’s understanding of the Final

Order issued by the Commission in Docket No. 22-0231. While the Agency has strived to fully and

accurately reflect the Commission’s Order in this update, in the case of any unintended

inconsistencies between this Final Plan and the Commission’s Order, the Final Order issued by the

Commission shall govern.

See Chapter 2 for additional information on the Plan approval process.

1.2. Evolution of Long-Term Plans

The Initial Plan addressed the Agency’s proposed set of programs and competitive procurements to

acquire renewable energy credits (“RECs”) for RPS compliance obligations applicable to three Illinois

electric utilities: Ameren Illinois Company (“Ameren Illinois”), Commonwealth Edison Company

(“ComEd”), and MidAmerican Energy Company (“MidAmerican”). The Initial Plan also described how

the Agency would develop and implement the Illinois Solar for All (“ILSFA”) Program, which utilizes

a combination of funds held by the Agency in the Renewable Energy Resources Fund (“RERF”) and

funds supplied by the utilities from ratepayer collections, to support the development of photovoltaic

(“PV”) resources, along with job training opportunities (supported separately) to benefit low-income

households and environmental justice communities across the State of Illinois. The First Revised Plan

updated those programs and procurements where applicable.

The First Revised Plan covered the Agency’s proposals for procurements and program activity to be

conducted during calendar years 2020 and 2021. As discussed throughout that Plan, absent

legislative changes, RPS budget limitations would constrain the ability of the Agency to conduct

additional procurements or expand program capacity for its Adjustable Block Program. That concern

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

3

proved accurate, and the Agency was unable to open additional blocks of capacity for the Adjustable

Block Program beyond those envisioned through the Initial Plan. However, Public Act 102-0662

required opening new blocks of Adjustable Block Program capacity prior to the approval of a new

Long-Term Plan by December 14, 2021. P.A. 102-0662 also mandated that the Agency hold

procurements for RECs from new utility-scale wind, solar, and brownfield site photovoltaic projects

prior to this Plan’s approval; those procurements occurred in May 2022.

Public Act 102-0662 contains significant changes to the RPS. Key changes include:

• New “40% by 2030” and “50% by 2040” RPS goals, including a new target of 45 million RECs

from new wind and solar projects delivered annually by 2030.

• An increase of the rate used for collections from ratepayers of funding, and changes to

accounting procedures to provide more flexibility for the timing of expenditures.

• Changes to REC procurements conducted to support new utility-scale wind and solar projects

through incorporating Indexed REC pricing.

• A large customer self-direct program that allows very large electric customer to directly

procure REC from new utility-scale wind and solar projects and reduce their RPS compliance

costs.

• Changes to the Adjustable Block Program to create three new categories of projects for

projects located at public schools, community-driven community solar, and projects from

equity eligible contractors.

• Changes to the Illinois Solar for All Program including dedicated support for projects that

promote energy sovereignty.

• Expansion, reinforcement, and codification of consumer protection standards applicable to

transactions under IPA programs.

• New diversity, equity, and inclusion requirements on the renewable energy industry,

including the implementation of an Equity Accountability System for Agency’s renewable

energy programs and procurements.

• Labor requirements, including prevailing wage requirements, applicable to the Agency’s

renewable energy programs and procurements.

This 2022 Long-Term Plan describes how the Agency will implement these and other new provisions.

The Plan also includes incorporates certain proposals previously contained in the withdrawn Second

Revised Plan that the Agency believed would improve programs and procurements.

The Agency has restructured this Plan compared to previous versions. This includes new chapters

and reorganized sections within chapters. Therefore, section references to previous plans are likely

not applicable to this 2022 Long-Term Plan.

With the finalization of the 2022 Long-Term Plan, the Agency will next update the Long-Term Plan

starting in 2023 for approval in 2024 to cover activities for 2024 and 2025.

1.3. First Revised Plan Accomplishments

Subsequent to the approval of the First Revised Plan by the Commission on February 21, 2020, the

programs and procurements discussed in this Plan met the following milestones:

• Block capacity for the Adjustable Block Program filled (by March 2020 for Large Distributed

Generation; December 2020 for Small Distributed Generation).

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

4

• The third program year of the Illinois Solar for All Program opened in June 2020. Project

applications filled the available funding for the non-profit/public facilities and low-income

community solar sub-programs, while project applications in the distributed generation sub-

program continued to not meet program goals. The fourth year of the program opened in June

2021.

• A new-wind forward procurement (1 million RECs annually from new utility-scale wind

projects) was conducted in March 2021. No projects were selected.

Additionally, many program materials were updated (including Marketing Guidelines, Disclosure

Forms, the Adjustable Block Program Guidebook, and individual program websites) and the Agency

has conducted numerous stakeholder feedback and comment processes.

The ongoing COVID-19 global pandemic significantly contributed to delays in project completions in

2020 and 2021. Nonetheless, as of the finalization of this 2022 Long-Term Plan, 98% of Distributed

Generation projects and 84% of Community Solar projects from initial Adjustable Block Program

blocks have been energized and processed for REC payments.

1.4. Plan Organization

This 2022 Long-Term Plan contains 10 chapters.

Chapter 1 is the Introduction, which contains a brief overview of the Plan and a set of action items

the Agency requested the Commission expressly adopt as part of its approval of this Plan.

Chapter 2 provides an overview of the statutory requirements governing this Plan contained in the

Illinois Power Agency Act and the Public Utilities Act, including a historical overview of the Illinois

RPS’s development and evolution and an outline of the significant changes in Illinois law resulting

from the enactment of Public Act 102-0662.

Chapter 3 contains calculations of RPS targets, summaries of RPS portfolios, and summaries of RPS

budgets.

Chapter 4 discusses the eligibility of RECs for use in the Illinois RPS. Specifically, it addresses two

requirements of the RPS: eligibility of RECs from facilities in adjacent states, and the requirement

that RECs cannot be procured from facilities that recover their costs through regulated rates.

Chapter 5 describes the competitive procurement process and the procurements the Agency plans to

conduct for the delivery of RECs from new utility-scale wind and solar projects and brownfield site

photovoltaic projects.

Chapter 6 describes the new large customer self-direct program to be implemented by the Agency.

This program does not feature the procurement of RECs by the Agency on behalf of the utilities, but

instead authorizes a credit for certain qualifying REC purchases through long-term contracts by large

electric customers.

Chapter 7 describes the Adjustable Block Program, which includes details on the following: the

structure of the blocks; program categories; REC prices; the application process; payment terms; the

process for approving vendors and designees; project specifications; delivery requirements; and

more. This chapter consolidates chapters 6 and 7 in the previous plans, which separately considered

provisions related to distributed generation and community solar. Considerations related to

consumer protections are now contained in a new Chapter 9.

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

5

Chapter 8 describes the Illinois Solar for All Program including the program funding and design,

customer terms, conditions, and eligibility, and the approach for designating environmental justice

communities.

Chapter 9 describes how the Agency implements consumer protection standards. Public Act 102-

0662 created new statutory provisions related to consumer protections in IPA programs, and this

chapter codifies the Agency’s approach to implementing those requirements.

Chapter 10 describes the Agency’s commitment to diversity, equity, and inclusion in the renewable

energy industry through the implementation of the Equity Accountability System, conducting a racial

disparity study, and development of an Energy Workforce Equity Database.

1.5. Action Plan

For this 2022 Long-Term Plan, the IPA recommended that the ICC expressly approve the following

items as part of the Plan’s approval:

1. Approve the RPS targets, and budget estimates for Ameren Illinois, ComEd, and MidAmerican

for the delivery years 2022-2023 through 2023-2024 contained in Chapter 3, including the

forecast used for this Plan, and additionally stipulate that Ameren Illinois, ComEd, and

MidAmerican will provide updated load forecasts and budget data to the Agency on a

biannual basis (each spring and fall) to allow the Agency to update those numbers.

2. Approve the continuation of the Agency’s approach for considering and weighting the public

interest criteria related to facilities located in adjacent states that is contained in Chapter 4.

3. Approve the procurements contained in Chapter 5 including the changes to the procurement

process to incorporate the Indexed REC approach.

4. Approve the design of the large customer self-direct program contained in Chapter 6

including the process for determining the program size, application process, bill crediting

methodology.

5. Approve the continuation of the basic design of the Adjustable Block Program contained in

Chapter 7, and approve updates to block design, program categories, schedule of REC prices,

and program terms and conditions.

6. Approve the process for the submission, review, and approval of the proposed contracts to

procure renewable energy credits or implement the programs authorized by the Commission

as primarily outlined in Chapters 5, 7, and 8.

7. Approve the continuation of the basic design and terms and conditions of the Illinois Solar

for All Program contained in Chapter 8, as well as the updates proposed in this 2022 Long-

Term Plan.

8. Approve the consumer protection standards contained in Chapter 9.

9. Approve the Agency’s approach to minimum equity standards contained in Chapter 10.

The Illinois Power Agency respectfully files this Final 2022 Long-Term Renewable Resources

Procurement Plan, which reflects the Commission’s Final Order in Docket No 22-0231 approving and

modifying this Plan consistent with Section 16-111.5 of the PUA.

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

6

2. Statutory Requirements of the Plan

This Chapter of the IPA’s Long-Term Renewable Resources Procurement Plan (“Long-Term

Renewables Plan” or “Plan”) describes the statutory requirements applicable to the Long-Term

Renewables Plan, with a particular focus on changes made through Public Act 102-0662 (colloquially

known as the “Climate & Equitable Jobs Act”), which took effect on September 15, 2021 beginning

the 120-day deadline for the initial publication of this Plan. While not inclusive of all such

requirements, this Chapter attempts to outline primary requirements while directing readers to

individual Sections and Chapters in which the Agency’s implementation approach to satisfying those

requirements is explained in detail.

A Statutory Compliance Index, Appendix A, provides a complete cross-index of statutory

requirements and the specific sections of this Plan that address each requirement identified.

2.1. Renewable Energy Resource Procurement Prior to Public Act 99-0906

The Agency has been producing procurement plans addressing renewable energy resource

procurements since 2008 and conducting renewable energy resource procurements since 2009, and

it is helpful to understand the background of the Illinois Renewable Portfolio Standard’s (“RPS”)

RPS’s original structure and implementation challenges in understanding the changes made through

Public Acts 99-0906 and now 102-0662.

Prior to P.A. 99-0906 (colloquially known as the “Future Energy Jobs Act”), the Illinois RPS effectively

had three compliance mechanisms depending on a customer’s supply source: eligible retail customer

procurements, Alternative Retail Electric Supplier (“ARES”) compliance, and hourly pricing customer

compliance payments. Below is an outline of the pre-P.A. 99-0906 RPS, provided for background;

please note that the structure outlined in Section 2.1 below no longer governs RPS implementation

and compliance in Illinois.

2.1.1. Original RPS—Eligible Retail Customer Load

Of the three former RPS compliance mechanisms, the compliance pathway that looked most like the

present RPS was that which applied to “eligible retail customers,” or those customers still taking

default supply service from their electric utility (ComEd and Ameren Illinois, and starting in 2015,

MidAmerican). The Agency’s annual procurement plans (developed primarily to propose

procurements intended to meet the energy, capacity, and other standard wholesale product

requirements of eligible retail customers) were required to also include procurement proposals

intended to meet annually-climbing, percentage-based renewable energy resource targets. As with

block energy procured by the Agency, the applicable utility served as the counterparty to resulting

contracts.

Sub-targets were also introduced to the overall procurement volumes: of the renewable energy

resources procured, 75% were required to come from wind, 6% from photovoltaics, and 1% from

distributed generation. Prior to June 1, 2011, resources from Illinois were expressly prioritized

(looking to adjoining states if none were available in-state, and then elsewhere); after June 1, 2011,

the RPS required looking to Illinois and adjoining states together as a first priority, and then

elsewhere. Funds available for use under RPS contracts were subject to a rate impact cap—a fixed

bill impact cap percentage (2.015% of 2007 rates), which was then applied to eligible retail customer

load to produce a renewable resources procurement budget.

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

7

This system may have worked more effectively had Illinois not experienced significant volatility in

the size of its eligible retail customer load. Upon the establishment of the IPA in 2007, however, the

General Assembly required that electric utilities execute relatively long-term energy supply contracts

(known as the “swap contracts”) to serve eligible retail customer load. In the years that followed,

energy prices plummeted in the wholesale market, yet these swap agreements served to inflate the

default supply rate well above that which could be offered by a competitive supplier. From 2011 to

2013, significant populations of default supply customers switched to ARES service, often through

opt-out municipal aggregation,

2

and eligible retail customer load dwindled, causing a corresponding

decline in the annual available renewable resources budget.

As part of its 2009 Annual Procurement Plan, the Agency proposed, and the Commission approved, a

procurement for “bundled” (energy and REC) long-term contracts from renewable energy suppliers

(known as the Long-Term Power Purchase Agreements, or “LTPPAs”). The LTPPA contracts were

executed through a 2010 procurement event, with winning suppliers receiving 20-year bundled

contracts to help meet future years’ RPS targets. While this procurement helped facilitate significant

new renewable energy development in Illinois (especially in the form of wind projects), it also

provided a floor of annual payment obligations under the renewable resources budget for future

years.

As the annual renewable resources budget declined due to customer load moving to ARES supply,

not only was funding unavailable to conduct additional renewable energy resource procurements,

but funding was also no longer available to meet the full commitments of the LTPPAs described

above. As a result, for two years ComEd’s LTPPAs were “curtailed” (payment was not made through

the renewable resources budget for the full expected output). Due to the unpredictability of available

budgets in future years, the Agency’s annual procurement plans after the 2010 LTPPAs proposed

only

3

the procurement of one-year contracts to meet each upcoming delivery year’s renewable

energy resource obligations. As obtaining financing for developing new facilities generally required

revenue certainty over a long period, this short-term focus left the prior RPS as an ineffective (or

“broken”) tool for facilitating the development of new renewable energy generation.

2.1.2. Original RPS—Hourly Pricing Customers

Beginning with the 2010 delivery year through June 1, 2017, Section 1-75(c)(5) of the Act required

that the applicable electric utility apply “the lesser of the maximum alternative compliance payment

rate or the most recent estimated alternative compliance payment rate for its service territory for

the corresponding compliance period” to hourly pricing customers. Those funds were held by the

electric utility and utilized to supplement to the Agency’s annual procurement planning process.

Because contracts with distributed generation systems required contracts of at least 5 years, the IPA

used these hourly Alternative Compliance Payments (“ACPs”) to serve as the funding source for

procurements supporting DG development, including DG procurements approved in the IPA’s 2017

Annual Procurement Plan.

2

Under Section 1-92 of the Act, municipalities, whether individually or in a coalition with others, may aggregate residential and small

commercial electric loads and leverage economies of scale to negotiate favorable electric supply rates for those customers.

3

The lone exception to this was the procurement of statutorily mandated five-year distributed generation procurements using alternative

compliance payments.

Illinois Power Agency 2022 Long-Term Plan (Final) August 23, 2022

8

As discussed in detail in Chapter 3, even accounting for payments still to be made under those DG

procurements, some balance of prior-collected hourly ACPs remains for REC procurements.

2.1.3. Original RPS—ARES Compliance

Lastly, the ARES RPS compliance mechanism, adopted in 2009, was more complex. Under Section

16-115D of the Public Utilities Act, each ARES carried a percentage-based renewable portfolio

standard requirement similar to the Section 1-75(c) requirement as a percentage of its sales, but

could satisfy its obligation by making alternative compliance payments at a rate reflecting that rate

paid by eligible retail customers for no less than 50% of its obligation. For the remaining 50% of its

obligation, the ARES could either make additional alternative compliance payments and/or self-

procure RECs from a broad geographic footprint.

With ARES competing with one another for customers (and against default supply service), this

paradigm created an incentive for an ARES to comply at the lowest cost possible.

4

Thus, alternative

compliance payments were generally made for the minimum 50% amount, and the self-procurement

obligation was not structured to lead to the development of new renewable energy generation.

Alternative compliance payments were deposited into the IPA-administered Renewable Energy

Resources Fund. Due to statutory constraints, leveraging this fund for procurements carried

significant challenges, as the IPA outlined in detail its 2015 Supplemental Photovoltaic Procurement

Plan. In addition, as a special state fund, the RERF could always be—and indeed was—subject to the

risks of borrowing and transfers. Given these risks, and given the State’s inability to enact a budget

from July 1, 2015 until August 31, 2017 (thereby leaving the IPA without appropriation authority to

make payments under contracts regardless of actual funds available), the State of Illinois was an

unattractive counterparty for REC delivery contracts.

With the majority of Illinois electric load being served by ARES,

5

this stood as no small problem—

while the RPS technically covered most of the electricity delivered in the state, very little new

renewable generation was able to be developed through it. Significant amounts were being paid into

the RERF each year to support renewable energy development, yet the money was unable to be

effectively leveraged for that purpose. While ARES were procuring millions of RECs in aggregate each

year, the incentive structure facing those suppliers made it highly unlikely that those RECs would be

sourced from anything other than the lowest-priced seller: generally, facilities already built and

financed, and potentially from projects in vertically integrated states with costs already being fully

recovered through rates. Hence, parties seeking changes to this system often characterized the

Illinois RPS as a “broken RPS,” and one that would require a comprehensive legislative overhaul to

be properly fixed.

2.2. Public Act 99-0906

The Agency’s initial obligation to develop a Long-Term Renewable Resources Procurement Plan for