1

CORPORATE DATA

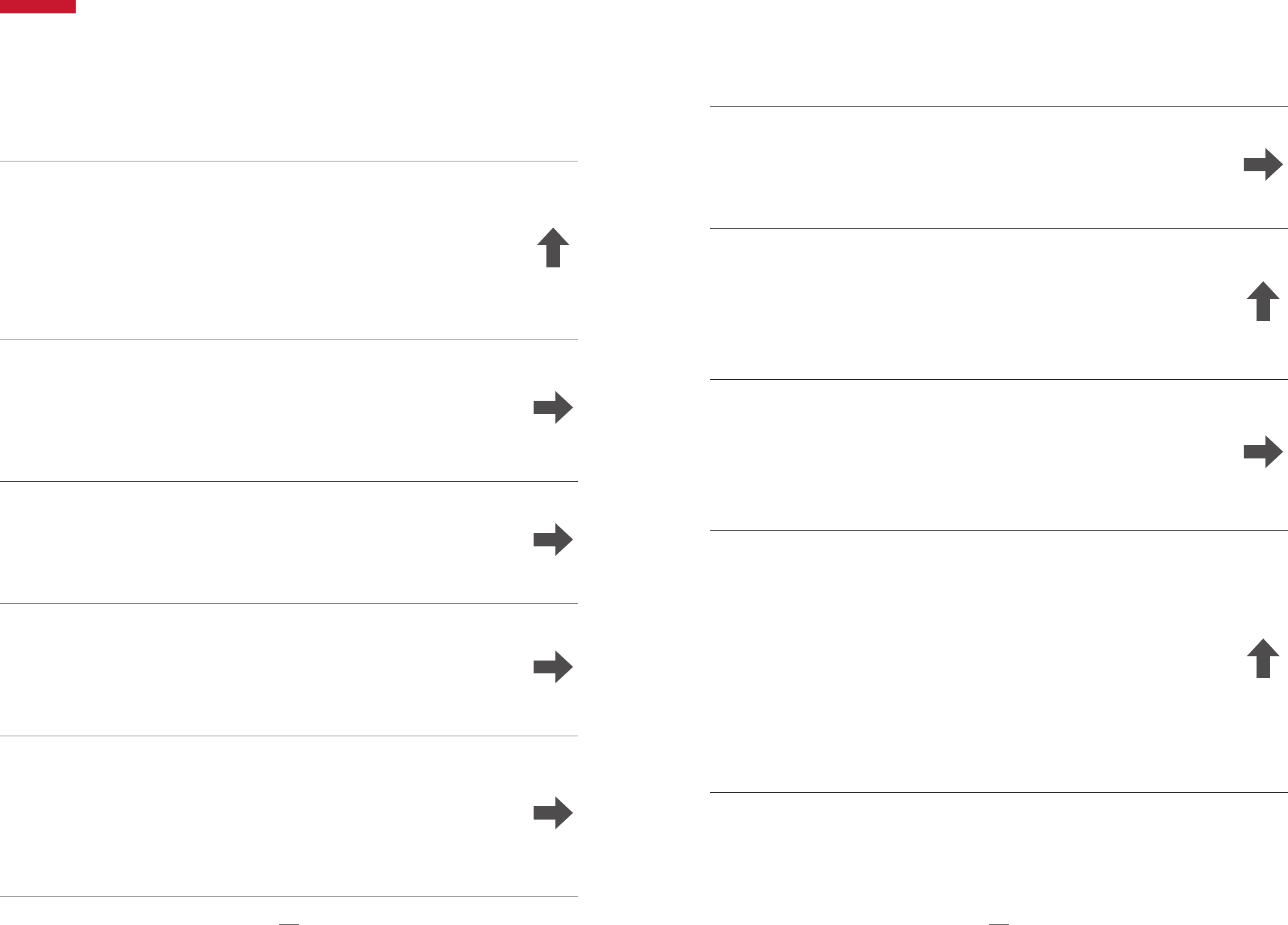

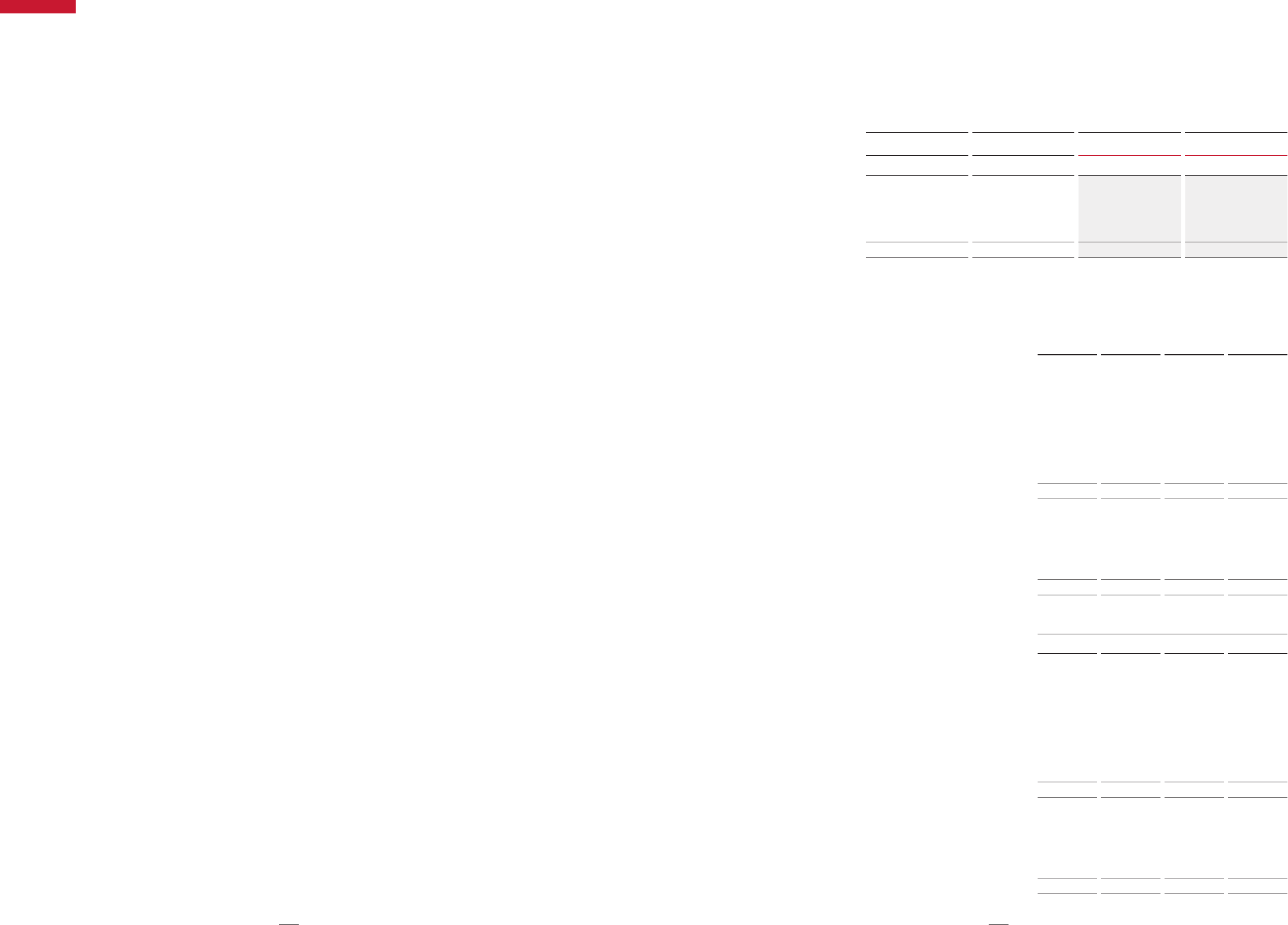

Historical Selected Financial Data

Shiseido Company, Limited and Subsidiaries

For the fiscal years ended March 31, 2014 to December 31, 2022

Notes: 1. The fiscal year ended December 31, 2015 is the 9 months from April 1, 2015 to December 31, 2015 for Shiseido and its consolidated subsidiaries in Japan and the 12 months from January 1,

2015 to December 31, 2015 for all other subsidiaries. In this report, it is referred to as “the year ended December 2015” in the text and as “2015/12” in tables, charts, and graphs.

2. Amounts of less than one million yen are omitted.

3. EBITDA (Earnings before interest, taxes, depreciation and amortization)* = Profit (loss) before Income Taxes + Interest expense + Depreciation and amortization expense + Impairment loss

* EBITDA includes depreciation and amortization and impairment loss included in the loss on COVID-19 recorded in extraordinary losses.

4. Net profit (loss) per share (primary) is based on the average number of shares outstanding during the fiscal year. Net assets per share is calculated using the number of shares

outstanding as of the balance sheet date. Net profit (loss) per share is calculated before dilution.

5. Return on invested capital = Operating profit × (1 – Tax rate*) / (Interest-bearing debt + Equity)**

* Tax rate = Total income tax / Profit (loss) before income tax ** (Interest-bearing debt + Equity) is the average of the beginning and the ending balances.

6. Interest-bearing debt to net EBITDA ratio = (Interest-bearing debt* – Cash and time deposits**) / EBITDA*

* Interest-bearing debt is the ending balance. ** Cash and time deposits are the term-end sum of cash and time deposits and short-term investment securities in current assets

7. Net debt-equity ratio = (Interest-bearing debt – Cash and time deposits) / Equity* *Equity = Total net assets – Stock acquisition rights – Non-controlling interests in consolidated subsidiaries

8. Days Sales of Inventory = Average Inventory ÷ (Cost of Goods Sold ÷ 365)

9. Cash Conversion Cycle (days) = Receivables turnover period (days) + Inventory turnover period (days) – Payables turnover period (days) (average of each indicator during the period)

10. Dividend on equity = Total dividends paid (full year) / Equity* *Equity is the average of the beginning and the ending balances.

11. The number of employees at year-end does not include temporary employees.

12. Shiseido has been recognizing payables associated with Dolce&Gabbana and Tory Burch from the fiscal years 2016 and 2020, respectively. For the fiscal year ended December 31, 2021,

the interest-bearing debt ratio including these payables was 26.4%, the net debt-equity ratio was 0.04, and interest-bearing debt was ¥195,722 million.

Japanese GAAP

Millions of yen

(Except per-share data)

IFRS

Millions of yen

(Except per-share data)

Thousands of U.S. dollars

(Except per-share data)

2014/3 2015/3 2015/12 2016/12 2017/12 2018/12

2019/12 2020/12 2021/12 2021/12 2022/12 2022/12

Operating Results:

Opereating Results:

Net sales 762,047 777,687 763,058 850,306 1,005,062 1,094,825

1,131,547 920,888 1,035,165 Net Sales 1,009,966 1,067,355 8,093,380

Cost of sales 189,559 196,433 196,009 207,553 231,327 231,928

254,844 238,401 262,959 Cost of sales 271,808 323,191 2,450,645

Selling, general and administrative expenses 522,843 553,640 529,388 605,972 693,298 754,545

762,871 667,523 730,619 Selling, general and administrative expenses 767,007 721,722 5,472,566

Operating profit 49,644 27,613 37,660 36,780 80,437 108,350

113,831 14,963 41,586 Core operating profit 42,553 51,340 389,293

EBITDA 91,285 90,703 80,635 90,078 154,741 150,318

169,348 71,393 172,556 EBITDA 94,516 102,371 776,244

Net profit (loss) attributable to owners of parent 26,149 33,668 23,210 32,101 22,749 61,403

73,562 (11,660) 42,439

Profit attributable to owners of parent

46,909 34,202 259,342

Financial Position:

Financial Position:

Total assets 801,346 823,636 808,547 934,590 949,425 1,009,618

1,218,795 1,204,229 1,179,360 Total assets 1,300,979 1,307,661 9,915,537

Short-term interest-bearing debt 64,054 75,615 18,996 16,557 10,662 15,202

144,949 75,565 25,394 Short-term interest-bearing debt 41,013 49,747 377,214

Long-term interest-bearing debt 91,864 31,281 67,617 104,022 70,801 60,574

103,159 248,733 165,588 Long-term interest-bearing debt 264,824 250,026 1,895,860

Interest-bearing debt 155,918 106,897 86,613 120,580 81,463 75,776

248,108 324,299 190,983 Interest-bearing debt 305,837 299,774 2,273,082

Equity 338,561 386,860 391,664 392,963 423,447 448,580

496,437 484,289 545,022 Equity attributable to owners of parent 540,695 604,259 4,581,885

Cash Flows:

Cash Flows:

Cash flows from operating activities 84,320 32,134 60,529 59,129 95,392 92,577

75,562 64,045 122,887 Cash flows from operating activities 134,249 46,735 354,375

Cash flows from investing activities (16,799) 11,538 (23,137) (70,640) (1,061) (103,112)

(202,823) (70,084) 63,739 Cash flows from investing activities 66,733 (41,308) (313,224)

Cash flows from financing activities (47,462) (58,419) (30,151) 22,378 (53,117) (29,722)

113,678 46,880 (176,222) Cash flows from financing activities (190,575) (52,418) (397,467)

Free cash flow 67,521 43,673 37,392 (11,510) 94,331 (10,535)

(127,261) (6,039) 186,627 Free cash flow 200,983 5,427 41,151

Cash and cash equivalents at end of period 110,163 100,807 104,926 113,122 156,834 111,767

97,466 136,347 156,503 Cash and cash equivalents at end of period 156,503 119,036 902,608

Per-Share Data (in yen and U.S. dollars):

Per-Share Data (in yen and U.S. dollars):

Net profit (loss) 65.7 84.4 58.2 80.4 56.9 153.7

184.2 (29.2) 106.2 Basic earnings per share 117.4 85.6 0.65

Net assets 849.4 970.0 981.4 984.1 1,059.8 1,123.2

1,242.9 1,212.3 1,364.3 Equity attributable to owners of parent per share 1,353.5 1,512.4 11.47

Cash dividend 20.0 20.0 20.0 20.0 27.5 45.0

60.0 40.0 50.0 Cash dividend 50.0 100.0 0.76

Weighted average number of shares outstanding

during the period (thousands)

398,300 398,704 399,026 399,227 399,466 399,409

399,411 399,458 399,480

Weighted average number of shares outstanding

during the period (thousands)

399,480 399,538

Financial Ratios:

Financial Rations:

Operating margin (%) 6.5 3.6 4.9 4.3 8.0 9.9

10.1 1.6 4.0 Core Opereating margin (%) 4.2 4.8

Return on invested capital (%) 5.9 4.1 4.6 5.0 10.4 13.1

12.9 1.3 3.3 Return on invested capital (%) 2.9 5.2

Return on equity (%) 8.4 9.4 6.0 8.2 5.6 14.1

15.6 (2.4) 8.2

Return on equity attributable to owners of parent (%)

9.3 6.0

Equity ratio (%) 42.2 47.0 48.4 42.0 44.6 44.4

40.7 40.2 46.2 Ratio of equity attributable to owners of parent (%) 41.6 46.2

Net interest-bearing debt to EBITDA ratio (times) 0.3 (0.2) (0.5) (0.1) (0.6) (0.3)

0.8 2.4 0.1 Net Interest-bearing dect to EBITDA ratio (times) (0.1) 0.3

Net debt-equity ratio (times) 0.08 (0.04) (0.10) (0.02) (0.22) (0.11)

0.28 0.36 0.03 Net debt-equity ratio (times) (0.02) 0.05

Inventory Turnover (Days) 168.28 182.97 197.97 194.85 193.78 220.12

236.96 268.80 217.78 Inventory Turnover (Days) 199.51 149.69

CCC (Cash Conversion Cycle) (days) 139 143 146 123 114 126

149 199 169 CCC (Cash Conversion Cycle) (days) 155 128

Payout ratio (consolidated) (%) 30.5 23.7 34.4 24.9 48.3 29.3

32.6 — 47.1 Dividend Payout ratio (consolidated) (%) 42.6 116.8

Dividend yield (%) 1.1 0.9 0.8 0.7 0.5 0.7

0.8 0.6 0.8 Dividend yield (%) 0.8 1.5

Dividend on equity (%) 2.6 2.2 2.1 2.0 2.7 4.1

5.1 3.3 3.9

Dividends on equity attributable to owners of parent (%)

4.0 7.0

Number of employees at year-end 33,054 33,000 33,783 36,549 37,438 38,640

40,000 39,035 35,318 Number of employees at year-end 35,318 33,414

Net sales per employee 23.1 23.6 22.6 23.2 26.8 28.3

28.3 23.6 29.3 Net sales per employee 28.6 31.9 242

Operating profit per employee 1.5 0.8 1.1 1.0 2.1 2.8

2.8 0.4 1.2 Core operating profit per employee 1.2 1.5 12

010_0252087912303.indd 1010_0252087912303.indd 1 2023/04/12 20:09:372023/04/12 20:09:37

2

Shiseido | Integrated Report 2022

13. In November 2015, the Financial Accounting

Standards Board (“FASB”) issued Accounting

Standards Update (“ASU”) No. 2015-17, “Income

Taxes (Topic 740): Balance Sheet Classification of

Deferred Taxes” (“ASU 2015-17”). The standard

requires that deferred tax assets and liabilities be

classified as non-current on the balance sheet rather

than being separated into current and non-current.

Effective from the first quarter of 2017, affiliates in the

Americas have adopted ASU 2015-17 on a

retrospective basis. Accordingly, the Company

reclassified the current deferred taxes to non-current

in the consolidated balance sheet as of December 31,

2016.

Notes: 1. Amounts of less than one million yen are omitted.

2. U.S. dollar amounts are converted from yen, for convenience only, at the rate of ¥131.88 = US$1 prevailing on December

31, 2022 Fractions resulting from the translations are rounded.

3. EBITDA = Core operating profit + Depreciation and amortization

4. Basic Earnings per Share is based on the average number of shares outstanding during the fiscal year. Equity Attributable

to Owners of Parent per Share is calculated using the number of shares outstanding as of the balance sheet date. Basic

Earnings per Share is calculated before dilution.

5. ROIC = Core operating profit × (1 – tax rate) ÷ (Interest-bearing debt (average of the beginning and the ending balances,

excluding lease liabilities) + Equity attributable to owners of parent (average of the beginning and the ending balances))

6. Net interest-bearing debt to EBITDA ratio = (Outstanding interest-bearing debt (excluding lease liabilities) – Cash and

cash equivalents – Time deposits over three months) ÷ EBITDA*1 *1 EBITDA = Core operating profit + Depreciation and

amortization

7. Net debt-equity ratio = (Interest-bearing debt (excluding lease liabilities) – Cash and time deposits) / Equity attributable to

owners of parent

8. Days Sales of Inventory = Average Inventory ÷ (Cost of Goods Sold ÷ 365)

9. Cash Conversion Cycle (days) = Receivables turnover period (days) + Inventory turnover period (days) – Payables

turnover period (days) (average of each indicator during the period)

10. Dividends on Equity Attributable to Owners of Parent = Total dividends paid (full year) / Equity Attributable to Owners of

Parent* *Equity Attributable to Owners of Parent is the average of the beginning and the ending balances.

11. The number of employees at year-end does not include temporary employees.

Japanese GAAP

Millions of yen

(Except per-share data)

IFRS

Millions of yen

(Except per-share data)

Thousands of U.S. dollars

(Except per-share data)

2014/3 2015/3 2015/12 2016/12 2017/12 2018/12

2019/12 2020/12 2021/12 2021/12 2022/12 2022/12

Operating Results:

Opereating Results:

Net sales 762,047 777,687 763,058 850,306 1,005,062 1,094,825

1,131,547 920,888 1,035,165 Net Sales 1,009,966 1,067,355 8,093,380

Cost of sales 189,559 196,433 196,009 207,553 231,327 231,928

254,844 238,401 262,959 Cost of sales 271,808 323,191 2,450,645

Selling, general and administrative expenses 522,843 553,640 529,388 605,972 693,298 754,545

762,871 667,523 730,619 Selling, general and administrative expenses 767,007 721,722 5,472,566

Operating profit 49,644 27,613 37,660 36,780 80,437 108,350

113,831 14,963 41,586 Core operating profit 42,553 51,340 389,293

EBITDA 91,285 90,703 80,635 90,078 154,741 150,318

169,348 71,393 172,556 EBITDA 94,516 102,371 776,244

Net profit (loss) attributable to owners of parent 26,149 33,668 23,210 32,101 22,749 61,403

73,562 (11,660) 42,439

Profit attributable to owners of parent

46,909 34,202 259,342

Financial Position:

Financial Position:

Total assets 801,346 823,636 808,547 934,590 949,425 1,009,618

1,218,795 1,204,229 1,179,360 Total assets 1,300,979 1,307,661 9,915,537

Short-term interest-bearing debt 64,054 75,615 18,996 16,557 10,662 15,202

144,949 75,565 25,394 Short-term interest-bearing debt 41,013 49,747 377,214

Long-term interest-bearing debt 91,864 31,281 67,617 104,022 70,801 60,574

103,159 248,733 165,588 Long-term interest-bearing debt 264,824 250,026 1,895,860

Interest-bearing debt 155,918 106,897 86,613 120,580 81,463 75,776

248,108 324,299 190,983 Interest-bearing debt 305,837 299,774 2,273,082

Equity 338,561 386,860 391,664 392,963 423,447 448,580

496,437 484,289 545,022 Equity attributable to owners of parent 540,695 604,259 4,581,885

Cash Flows:

Cash Flows:

Cash flows from operating activities 84,320 32,134 60,529 59,129 95,392 92,577

75,562 64,045 122,887 Cash flows from operating activities 134,249 46,735 354,375

Cash flows from investing activities (16,799) 11,538 (23,137) (70,640) (1,061) (103,112)

(202,823) (70,084) 63,739 Cash flows from investing activities 66,733 (41,308) (313,224)

Cash flows from financing activities (47,462) (58,419) (30,151) 22,378 (53,117) (29,722)

113,678 46,880 (176,222) Cash flows from financing activities (190,575) (52,418) (397,467)

Free cash flow 67,521 43,673 37,392 (11,510) 94,331 (10,535)

(127,261) (6,039) 186,627 Free cash flow 200,983 5,427 41,151

Cash and cash equivalents at end of period 110,163 100,807 104,926 113,122 156,834 111,767

97,466 136,347 156,503 Cash and cash equivalents at end of period 156,503 119,036 902,608

Per-Share Data (in yen and U.S. dollars):

Per-Share Data (in yen and U.S. dollars):

Net profit (loss) 65.7 84.4 58.2 80.4 56.9 153.7

184.2 (29.2) 106.2 Basic earnings per share 117.4 85.6 0.65

Net assets 849.4 970.0 981.4 984.1 1,059.8 1,123.2

1,242.9 1,212.3 1,364.3 Equity attributable to owners of parent per share 1,353.5 1,512.4 11.47

Cash dividend 20.0 20.0 20.0 20.0 27.5 45.0

60.0 40.0 50.0 Cash dividend 50.0 100.0 0.76

Weighted average number of shares outstanding

during the period (thousands)

398,300 398,704 399,026 399,227 399,466 399,409

399,411 399,458 399,480

Weighted average number of shares outstanding

during the period (thousands)

399,480 399,538

Financial Ratios:

Financial Rations:

Operating margin (%) 6.5 3.6 4.9 4.3 8.0 9.9

10.1 1.6 4.0 Core Opereating margin (%) 4.2 4.8

Return on invested capital (%) 5.9 4.1 4.6 5.0 10.4 13.1

12.9 1.3 3.3 Return on invested capital (%) 2.9 5.2

Return on equity (%) 8.4 9.4 6.0 8.2 5.6 14.1

15.6 (2.4) 8.2

Return on equity attributable to owners of parent (%)

9.3 6.0

Equity ratio (%) 42.2 47.0 48.4 42.0 44.6 44.4

40.7 40.2 46.2 Ratio of equity attributable to owners of parent (%) 41.6 46.2

Net interest-bearing debt to EBITDA ratio (times) 0.3 (0.2) (0.5) (0.1) (0.6) (0.3)

0.8 2.4 0.1 Net Interest-bearing dect to EBITDA ratio (times) (0.1) 0.3

Net debt-equity ratio (times) 0.08 (0.04) (0.10) (0.02) (0.22) (0.11)

0.28 0.36 0.03 Net debt-equity ratio (times) (0.02) 0.05

Inventory Turnover (Days) 168.28 182.97 197.97 194.85 193.78 220.12

236.96 268.80 217.78 Inventory Turnover (Days) 199.51 149.69

CCC (Cash Conversion Cycle) (days) 139 143 146 123 114 126

149 199 169 CCC (Cash Conversion Cycle) (days) 155 128

Payout ratio (consolidated) (%) 30.5 23.7 34.4 24.9 48.3 29.3

32.6 — 47.1 Dividend Payout ratio (consolidated) (%) 42.6 116.8

Dividend yield (%) 1.1 0.9 0.8 0.7 0.5 0.7

0.8 0.6 0.8 Dividend yield (%) 0.8 1.5

Dividend on equity (%) 2.6 2.2 2.1 2.0 2.7 4.1

5.1 3.3 3.9

Dividends on equity attributable to owners of parent (%)

4.0 7.0

Number of employees at year-end 33,054 33,000 33,783 36,549 37,438 38,640

40,000 39,035 35,318 Number of employees at year-end 35,318 33,414

Net sales per employee 23.1 23.6 22.6 23.2 26.8 28.3

28.3 23.6 29.3 Net sales per employee 28.6 31.9 242

Operating profit per employee 1.5 0.8 1.1 1.0 2.1 2.8

2.8 0.4 1.2 Core operating profit per employee 1.2 1.5 12

010_0252087912303.indd 2010_0252087912303.indd 2 2023/04/12 20:09:382023/04/12 20:09:38

3

CORPORATE DATA

Operating Results and Financial Condition

OPERATING RESULTS

ANALYSIS OF OPERATING RESULTS

In the consolidated fiscal year 2022, the global economy as a whole

experienced a normalization of economic activities in line with the re-

laxation of COVID-19-related restrictions. Conversely, uncertain condi-

tions continued to persist due to intermittent lockdowns in China, the

prolonged conflict in Ukraine, surging resource and energy costs, and

the appreciation of the U.S. dollar.

Japan’s domestic cosmetics market, while price increases in a

wide range of areas weighed upon cosmetics purchases, achieved

gradual recovery thanks to the relaxation of restrictions and increased

opportunities to go out of home. In terms of overseas cosmetics mar-

kets, the market environment in China continued to be sluggish due

to restrictions on retail operations and supply chain disruptions

caused by lockdowns primarily in Shanghai and Hainan Island. Mean-

while, in the Europe and Americas regions, consumption continued to

recover steadily as economic activities resumed, and the cosmetics

market likewise showed strong growth across all categories.

Driven by its corporate mission, BEAUTY INNOVATIONS FOR A

BETTER WORLD, the Shiseido Group (the “Group”) actively promotes

innovations aimed at resolving environmental and social issues, such

as diversity and inclusion. We thus strive to realize our vision for 2030:

a sustainable world where people can enjoy happiness through the

power of beauty.

In 2021, we launched our medium- to long-term strategy “WIN

2023 and Beyond” in response to challenges caused by the

COVID-19 pandemic. Under this strategy, we have executed a global

transformation reform with an emphasis on profitability and cash flow,

through focusing on the skin beauty area, which is our competitive

advantage, restructuring our business portfolio, and improving profit-

ability particularly in the Americas and EMEA. We positioned 2022,

our second year of the strategy, as a “Back to Growth” year and have

worked to promote the growth of our global brands and to accelerate

digital transformation.

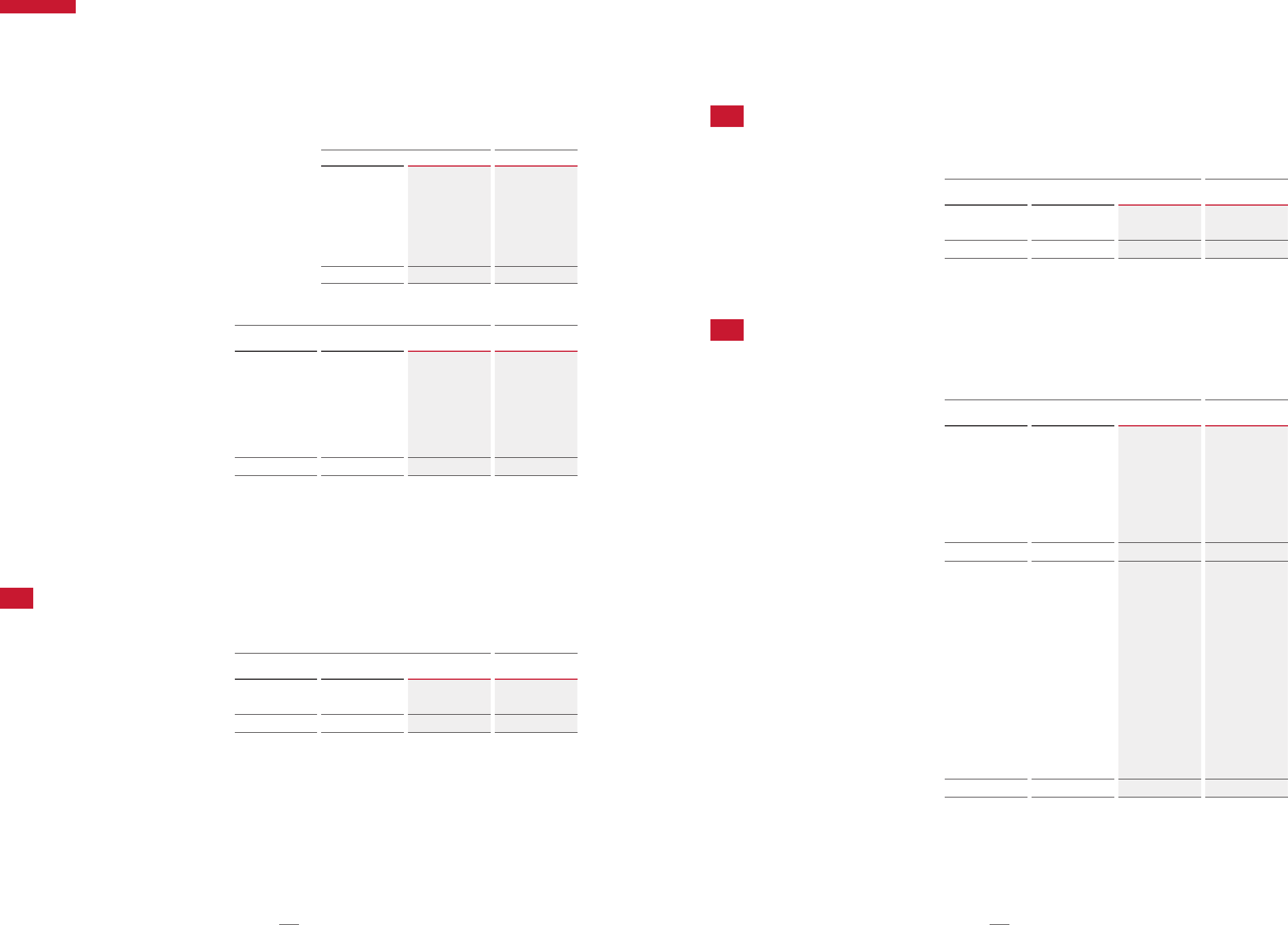

NET SALES

Net sales increased 5.7% year on year to ¥1,067.4 billion ($8,093.4 million) on reported figures, down 3.9% year on year on an FX-neutral basis, or

up 0.9% year on year on a like-for-like basis, which excludes the impacts of foreign exchange translation and business transfers. The result primarily

reflected the recovery in the EMEA, Americas, and Travel Retail Business, despite the continuing uncertain situation in China caused by the COVID-19

pandemic.

2021 2021

Excl. business

transfer impacts

2022

Excl. business

transfer impacts

2022

SHISEIDO

− 3%

IPSA

− 11%

ELIXIR

− 7%

Drunk

Elephant

− 1%

Clé de

Peau

Beauté

+6%

ANESSA

+2%

NARS

+22%

Fragrance

Other

Brands

Transferred

brands

FX, etc.

+12%

* YoY change (%) for each brand is calculated based on foreign exchange rate assumptions as of Feb 2022 and excludes exchange rate differences etc.

1,010.0 1,067.4

Trans-

ferred

brands

Like–for–like*

(Billion yen)

Net Sales by Brand

Clé de Peau Beauté, NARS and Fragrance Showed Strong Growth

While Most Skincare Brands Struggled amid Headwinds in Japan and China Markets

010_0252087912303.indd 3010_0252087912303.indd 3 2023/04/12 20:09:382023/04/12 20:09:38

4

Shiseido | Integrated Report 2022

COST OF SALES AND SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Cost of Sales

Cost of sales increased by 18.9% year on year to ¥323.2 billion ($2,450.6 million). The cost of sales ratio increased 3.4 percentage points year

on year to 30.3% mainly due to an increase in the cost of sales ratio caused by the supply of products during the transitional period for business

transfers and an impairment loss of factories resulting from the transfer of the personal care manufacturing business. The cost of sales ratio on a

like-for-like basis, excluding an increase in the cost of sales ratio due to the supply of products and the impairment loss resulting from the busi-

ness transfers, decreased 1.5 percentage points year on year to 23.6%, mainly due to a more favorable product mix resulting from the transfer of

business, improved productivity at factories in Japan, and a decrease in inventory write-off expenses.

Selling, General and Administrative Expenses

Selling, general and administrative (SG&A) expenses decreased 5.9% year on year to ¥721.7 billion ($5,472.6 million). The breakdown of this re-

sult on a core operating profit basis is as follows.

Marketing Costs

The ratio of marketing costs to net sales decreased 2.4 percentage points year on year to 24.9% due to lower expenses resulting from the busi-

ness transfers and agile cost management, despite higher investment expenses for enhancing brand equity.

Brand Development / R&D Expenses

The ratio of brand development and R&D expenses to net sales increased 1.3 percentage points year on year to 5.0%.

Personnel Expenses

The ratio of personnel expenses to net sales decreased 0.7 percentage points year on year to 21.5% as a result of initiatives to optimize personnel

expenses through such means as implementing structural reforms, which outweighed an increase in expenses resulting from strengthened in-

vestment in human capital.

Other SG&A Expenses

The ratio of other SG&A expenses to net sales decreased 0.8 percentage points year on year to 15.8% due to an increase in net sales outweighing

an increase in investment expenses for digital transformation.

R&D expenses, which are included in SG&A expenses, stood at ¥26.7 billion ($202.3 million), bringing the ratio of R&D expenses to net

sales to 2.5%.

Note: The ratio of marketing costs to net sales was 34.5% if expenses related to personal beauty partners are included. The ratio of personnel expenses to net sales was 12.0% if the same ex-

penses are not included.

010_0252087912303.indd 4010_0252087912303.indd 4 2023/04/12 20:09:382023/04/12 20:09:38

5

CORPORATE DATA

CORE OPERATING PROFIT

Core operating profit increased by ¥8.8 billion ($66.6 million) year on year to ¥51.3 billion ($389.3 million), thanks to agile cost management and

lower fixed costs that were achieved through structural reforms as well as the positive impact of foreign exchange rate translation, which outweighed

lower margins resulting from weaker sales in China and the impact of the transfer of the personal care business.

PROFIT ATTRIBUTABLE TO OWNERS OF PARENT

Profit attributable to owners of parent dropped by ¥12.7 billion ($96.4 million) year on year to ¥34.2 billion ($259.3 million), due to a decrease in

income tax expense from the fiscal year 2021 and an increase in non-controlling interests, in addition to profit before tax of ¥50.4 billion ($382.4

million), a year-on-year decrease of ¥48.7 billion ($369.1 million).

010_0252087912303.indd 5010_0252087912303.indd 5 2023/04/12 20:09:382023/04/12 20:09:38

6

Shiseido | Integrated Report 2022

REVIEW BY REPORTABLE SEGMENT

Results by reportable segment are as follows.

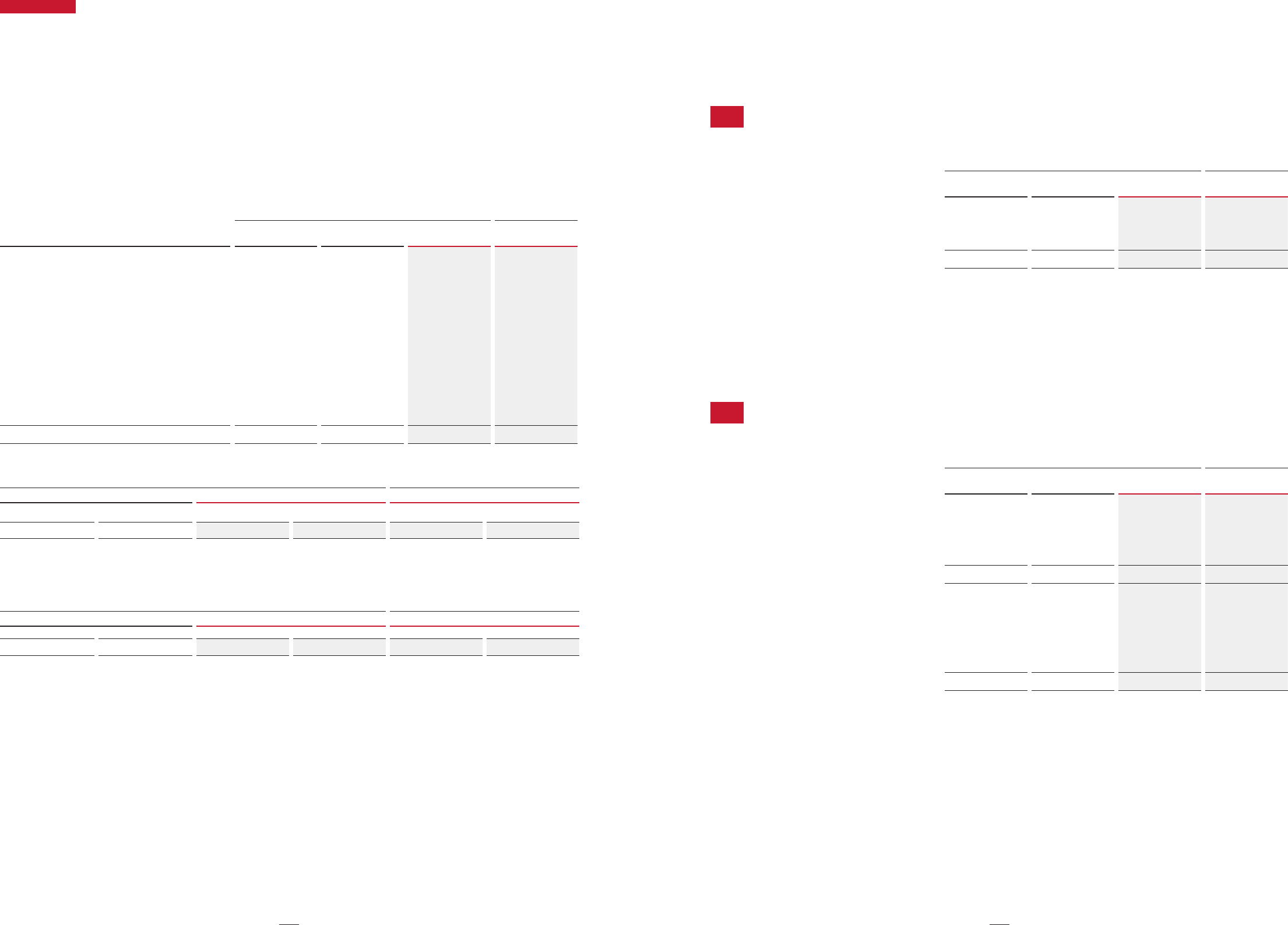

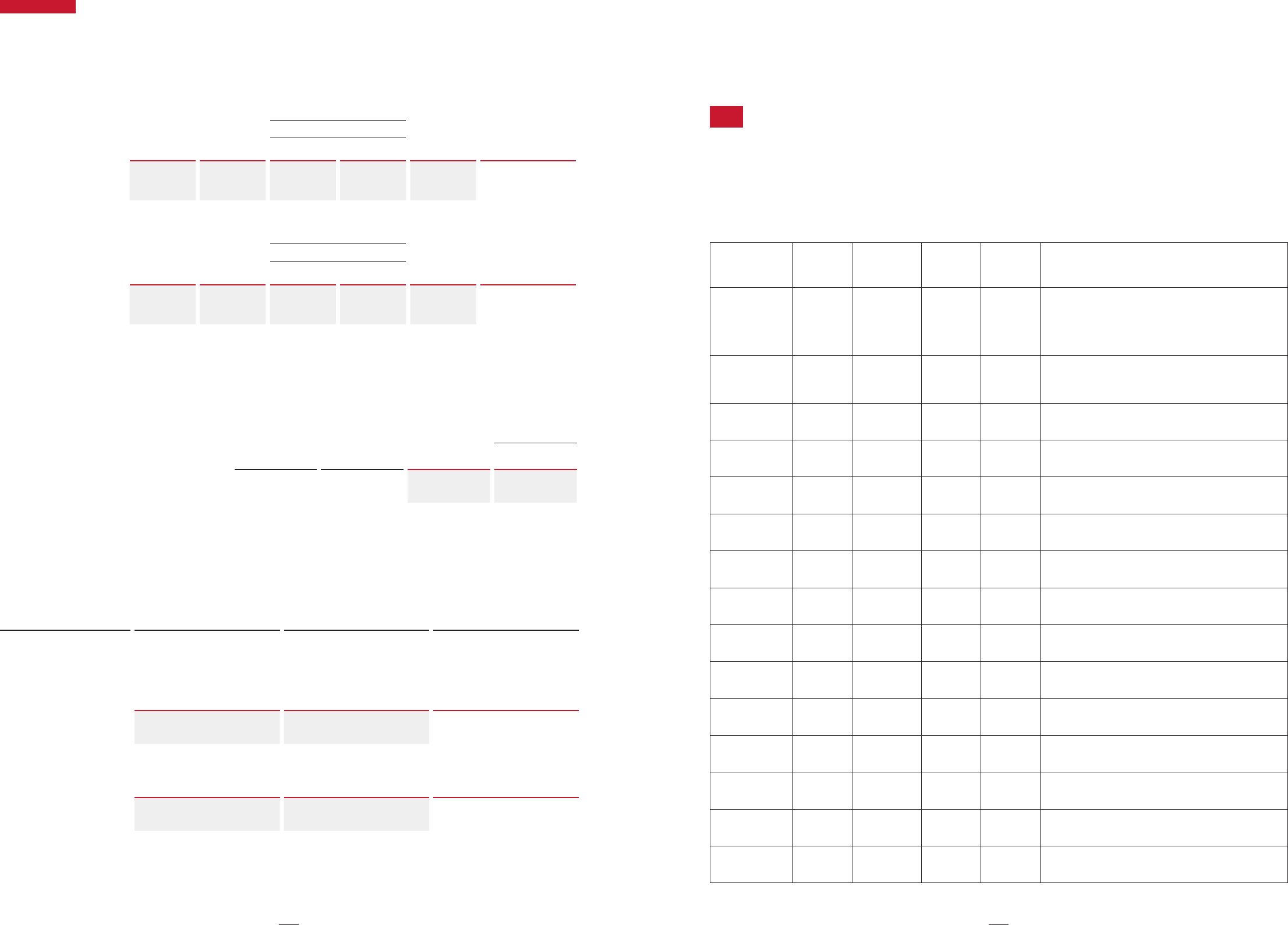

Net Sales by Reportable Segment

Segments

(Billions of yen) 2021/12 2022/12

Japan Business 258.8 237.6

China Business 274.7 258.2

Asia Pacific Business 63.6 68.0

Americas Business 121.4 137.9

EMEA Business 117.0 128.4

Travel Retail Business 120.6 163.7

Professional Business 15.3 9.3

Other 38.6 64.2

Core Operating Profit by Reportable Segment

Segments

(Billions of yen) 2021/12 2022/12

Japan Business 6.5 (13.1)

China Business 4.1 (3.9)

Asia Pacific Business 5.0 4.7

Americas Business 1.6 7.7

EMEA Business 2.7 6.9

Travel Retail Business 22.7 37.7

Professional Business 0.7 0.8

Other 14.1 6.1

Core Operating Margin by Reportable Segment

Segments

(%) 2021/12 2022/12

Japan Business 2.3 (5.4)

China Business 1.5 (1.5)

Asia Pacific Business 7.7 6.6

Americas Business 1.3 5.4

EMEA Business 2.1 5.0

Travel Retail Business 18.8 23.0

Professional Business 4.5 7.7

Other

5.2 2.0

Notes:

1. The Group has revised its reportable segment classifications from the fiscal year 2022. The

business results of Shiseido Beauty Salon Co., Ltd., previously included in the Other seg-

ment, are now included in the Japan Business. The business results related to the brand

holder functions of the NARS and Drunk Elephant brands, previously included in the

Americas Business, are now included in the Other segment. The segment information for

the fiscal year ended December 31, 2021 has been restated in line with the reclassifica-

tion.

2. Net sales from regional sales subsidiaries related to the Personal Care business, previously

recorded in the Japan, China, and Asia Pacific Businesses, are no longer recorded with

some exceptions from July 1, 2021 due to the transfer of the said business and resulting

changes in commercial distribution. Meanwhile, Personal Care products sales from the

Company and its manufacturing subsidiaries to FineToday Co., Ltd. (which has changed its

company name from “FineToday Shiseido Co., Ltd.” effective January 1, 2023) and its af-

filiates are recorded in the Other segment effective from the same date.

3. Net sales previously recorded by regional sales subsidiaries in Professional segment are no

longer recorded after July 1, 2022, with some exceptions, due to the transfer of the profes-

sional business.

4. The Other segment includes head office administration departments, IPSA Co., Ltd., man-

ufacturing operations, and the restaurant business, etc.

Japan Business

In the Japan Business, the mid price range market turned to a recov-

ery trend in the second half of the year coming from a sluggish mo-

mentum in the first half of the year. We continued to strengthen

strategic investments in skin beauty brands as well as the promotions

commemorating the 150th anniversary of our founding. In September,

we launched Elixir lotion and emulsion revamped with latest collagen

technologies. In the fourth quarter, we rolled out new and limited-edi-

tion products from SHISEIDO and Clé de Peau Beauté and enhanced

the value communication of the brand and the products. In addition,

we launched “Beauty Key,” a new membership service which consoli-

dates the different membership services offered by different sales

channels such as stores or e-commerce, or by brand. This allows for

counseling services tailored to each customer’s needs. We also

worked to strengthen digital communication.

As a result, net sales were ¥237.6 billion ($1,801.4 million), down

by 8.2% year on year, essentially the same level year on year on a

like-for-like basis excluding business transfer impacts. Core operating

loss was ¥13.1 billion ($99.2 million), lower by ¥19.6 billion ($148.4

million) year on year, primarily due to lower profit margins from the

transfer of the personal care business which outweighed cost man-

agement efforts.

China Business

In the China Business, we are shifting from a growth model driven pri-

marily by large-scale promotions to a more sustainable growth model

which focuses on value-based brand and product communication tai-

lored to consumer needs. While the market faced a significant year-

on-year decline during ‘Double 11,’ the largest e-commerce event in

China, our annual e-commerce sales achieved growth, on the back of

the expansion into major platforms and enhanced communication fo-

cusing on effect and efficacy. Meanwhile, on the offline front, despite

our efforts to enhance the unique experience at brick-and-mortar

stores and expand the loyal user base, sales decreased year on year

due to market headwinds such as traffic decline from lockdowns.

As a result, net sales were ¥258.2 billion ($1,958.0 million), down

6.0 % year on year on a reported basis, down 18.3% year on year on

an FX-neutral basis, or down 9.8% year on year on a like-for-like basis

excluding foreign exchange and business transfer impacts. Core oper-

ating loss was ¥3.9 billion ($29.8 million), lower by ¥8.0 billion ($60.9

million) year on year, primarily due to lower margins from a decline in

sales.

Asia Pacific Business

In the countries and regions of the Asia Pacific Business, along with

Taiwan’s return to growth from the fourth quarter, strong growth con-

tinued in South Korea, Southeast Asia, and other regions. In addition,

we continued to increase our sales in e-commerce across Asia by

continuing to accelerate key e-commerce platforms entry and to ex-

pand touch points with customers through digital engagement.

As a result, net sales were ¥ 68.0 billion ($515.7 million), up 7.0%

year on year on a reported basis, down 3.7% year on year on an

FX-neutral basis, or up 13.0% year on year on a like-for-like basis ex-

cluding foreign exchange and business transfer impacts. Core operat-

ing profit was down by ¥0.3 billion ($2.5 million) to ¥4.7 billion ($35.8

million), primarily due to higher personnel and other expenses out-

weighing the increase in sales and profit.

Americas Business

In the Americas Business, the cosmetics market continued to grow

in all categories with the normalization of economic activities due to

010_0252087912303.indd 6010_0252087912303.indd 6 2023/04/12 20:09:382023/04/12 20:09:38

7

CORPORATE DATA

the relaxation of COVID-19 restrictions. NARS in particular saw share

gains, driven by successful new product launches and growth in

e-commerce supported by digital marketing enhancements. Sales of

SHISEIDO remained steady on the back of strengthened promotions.

As a result, net sales were ¥137.9 billion ($1,045.8 million), up

13.6% year on year on a reported basis, down 4.7% year on year on

an FX-neutral basis, or up 8.8% year on year on a like-for-like basis

excluding foreign exchange and business transfer impacts. Core op-

erating profit improved by ¥6.0 billion ($45.7 million) year on year to

¥7.7 billion ($58.1 million), primarily due to higher margins associat-

ed with an increase in sales and lower fixed costs due to structural

reforms, etc.

EMEA Business

In the EMEA Business, the cosmetics market continued to prosper in

all categories with the normalization of economic activities due to the

relaxation of COVID-19 restrictions. We held promotions capturing the

recovery trend in consumer consumption, and NARS and narciso ro-

driguez achieved strong growth and increased shares. We also steadi-

ly increased the number of stores for Drunk Elephant, which

contributed to the growth in sales.

As a result, net sales were ¥128.4 billion ($973.9 million), up 9.8%

year on year on a reported basis, up 3.3% year on year on an FX-neu-

tral basis, or up 4.0% year on year on a like-for-like basis excluding

foreign exchange and business transfer impacts. Core operating profit

improved by ¥4.2 billion ($32.0 million) year on year to ¥6.9 billion

($52.5 million), primarily due to higher margins associated with an in-

crease in sales and lower fixed costs due to structural reforms, etc.

Travel Retail Business

In the Travel Retail Business (sales of cosmetics and fragrances pri-

marily through airport and downtown duty-free stores), tourist traffic

resumed with the relaxation of COVID-19 restrictions and we saw rap-

id recovery particularly in the Americas and Europe. In Hainan Island

in China, although affected by the lockdowns, we achieved strong

growth through new store opening in the world’s biggest duty-free

shopping mall in Haikou City and through the expansion of e-com-

merce.

As a result, net sales were ¥163.7 billion ($1,240.9 million), up

35.7% year on year on a reported basis, up 15.3% year on year on an

FX-neutral basis, or up 14.2% year on year on a like-for-like basis ex-

cluding foreign exchange and business transfer impacts. Core operat-

ing profit increased by ¥14.9 billion ($113.3 million) year on year to

¥37.7 billion ($285.7 million), mainly due to higher margins from in-

creased sales.

Professional Business

In the Professional Business, we used to roll out professional products

such as hair care, styling, color, and perm solutions to hair salons in

Japan, China, and Asia Pacific. However, we transferred the said

business in July 2022, with some exceptions.

Net sales were ¥9.3 billion ($70.8 million), down 38.9% year on

year on a reported basis, or down 43.1% year on year on an FX-neu-

tral basis. Core operating profit stayed flat year on year at ¥0.8 billion

($5.7 million).

[Reference]

Period-on-Period Growth in Sales (Local Currency Basis)

Japanese GAAP IFRS

(%) 2019/12 2020/12 2021/12 2021/12 2022/12

Net Sales 5.7 (17.8) 7.8 — (3.9)

Note: The above period-on-period growth in sales on a local currency basis is a period-on-

period comparison before translation into yen. Exchange rates for each fiscal period are

presented below.

(Yen) 2019/12 2020/12 2021/12 2022/12

USD 109.1 106.8 110.0 131.4

EUR 122.1 121.8 129.9 138.0

CNY 15.8 15.5 17.0 19.5

Sales by geographical area

Japanese GAAP IFRS

(Billions of yen) 2019/12 2020/12 2021/12 2021/12 2022/12

Japan 491.1 333.3 321.2 297.5 298.6

China 248.4 289.0 343.7 343.7 348.5

Asia (excl.China) 128.6 104.1 117.7 116.2 132.1

Americas 130.4 93.1 127.5 127.5 146.5

Europe 133.1 101.3 125.1 125.1 141.7

Total 1,131.5 920.9 1,035.2 1,010.0 1,067.4

Note: Sales are categorized by country or region based on customer location.

010_0252087912303.indd 7010_0252087912303.indd 7 2023/04/12 20:09:382023/04/12 20:09:38

8

Shiseido | Integrated Report 2022

LIQUIDITY AND CAPITAL RESOURCES

FINANCING AND LIQUIDITY MANAGEMENT

The Group strives to generate stable operating cash flows and secure

a wide range of financing sources, while always seeking to appropriately

secure adequate funds for its business activities, maintain liquidity,

and achieve a sound financial position. We fund the working capital,

capital expenditures, and investments and loans needed to maintain

growth primarily with cash on hand and operating cash flow,

supplemented by bank borrowings and bond issues. In terms of

fundraising, we aim for a net debt-to-equity ratio of 0.2 and a net

interest-bearing debt to EBITDA ratio of 0.5 for maintaining an A-level

credit rating, which enables access to capital on favorable terms. At

the same time, we raise funds using optimal, timely methods giving

consideration to such factors as the market environment. However,

taking into account future profitability and the potential to generate

cash flows, we may revise the policies stated above, as well as our

shareholder return policy, in an appropriate fashion so that we can

establish an optimal capital structure that contributes to further

improvements in capital efficiency.

One of our targets for short-term liquidity is to maintain liquidity on

hand at a level of approximately 1.5 months of consolidated net sales.

As of December 31, 2022, cash and deposits totaled ¥134.5 billion

($1,019.8 million) and liquidity on hand amounted to 1.5 months of

consolidated net sales for the fiscal year 2022.

Meanwhile, interest-bearing debt as of December 31, 2022 totaled

¥299.8 billion ($2,273.1 million). The Group uses diversified funding

methods, which include ¥100 billion ($758.3 million) in unused

committed lines of credit with financial institutions and ¥280 billion

($2,123.1 million) in authorized but unissued straight bonds in Japan.

In addition, the Group and its two subsidiaries in Europe and the

United States have established a syndicated loan program with

authorized but unused commitments totaling $300 million.

As of December 31, 2022, as the Shiseido Group maintained a

sufficient level of liquidity and the funding methods are diversified, we

consider that the financial flexibility is high.

CREDIT RATINGS

The Group recognizes the need to maintain its credit rating at a certain level to secure financial flexibility consistent with its capital and liquidity

policies and to ensure access to sufficient capital resources through capital markets. The Group has acquired ratings from Moody’s Japan K.K.

(Moody’s) to facilitate fund procurement through corporate bonds.

Moody’s

Long-term A3 (Outlook: stable)

(As of February 28, 2023)

010_0252087912303.indd 8010_0252087912303.indd 8 2023/04/12 20:09:382023/04/12 20:09:38

9

CORPORATE DATA

ASSETS, LIABILITIES, AND NET ASSETS

Assets

Total assets increased by ¥6.7 billion ($50.7 million) from the end of

the previous fiscal year to ¥1,307.7 billion ($9,915.5 million), primari-

ly from an increase in exchange differences on translation of foreign

operations due to the yen depreciation, which outweighed a decrease

in cash and cash equivalents due to income taxes paid on business

transfers executed in the previous fiscal year and cash dividend pay-

ments, as well as a decrease in property, plant and equipment due to

the recording of impairment losses associated with the transfer of the

manufacturing business of personal care products and a decrease in

inventories due to the business transfers as well as tightened invento-

ry management.

Liabilities

Liabilities decreased by ¥56.9 billion ($431.4 million) to ¥681.9 billion

($5,170.7 million), primarily due to a decrease in current liabilities as-

sociated with a decrease in income taxes payable and a decrease in

non-current liabilities associated with a decrease in retirement benefit

liability.

Equity

Equity increased by ¥63.6 billion ($482.1 million) to ¥625.8 billion

($4,744.9 million), chiefly due to the recording of profit attributable to

owners of parent and exchange differences on translation of foreign

operations.

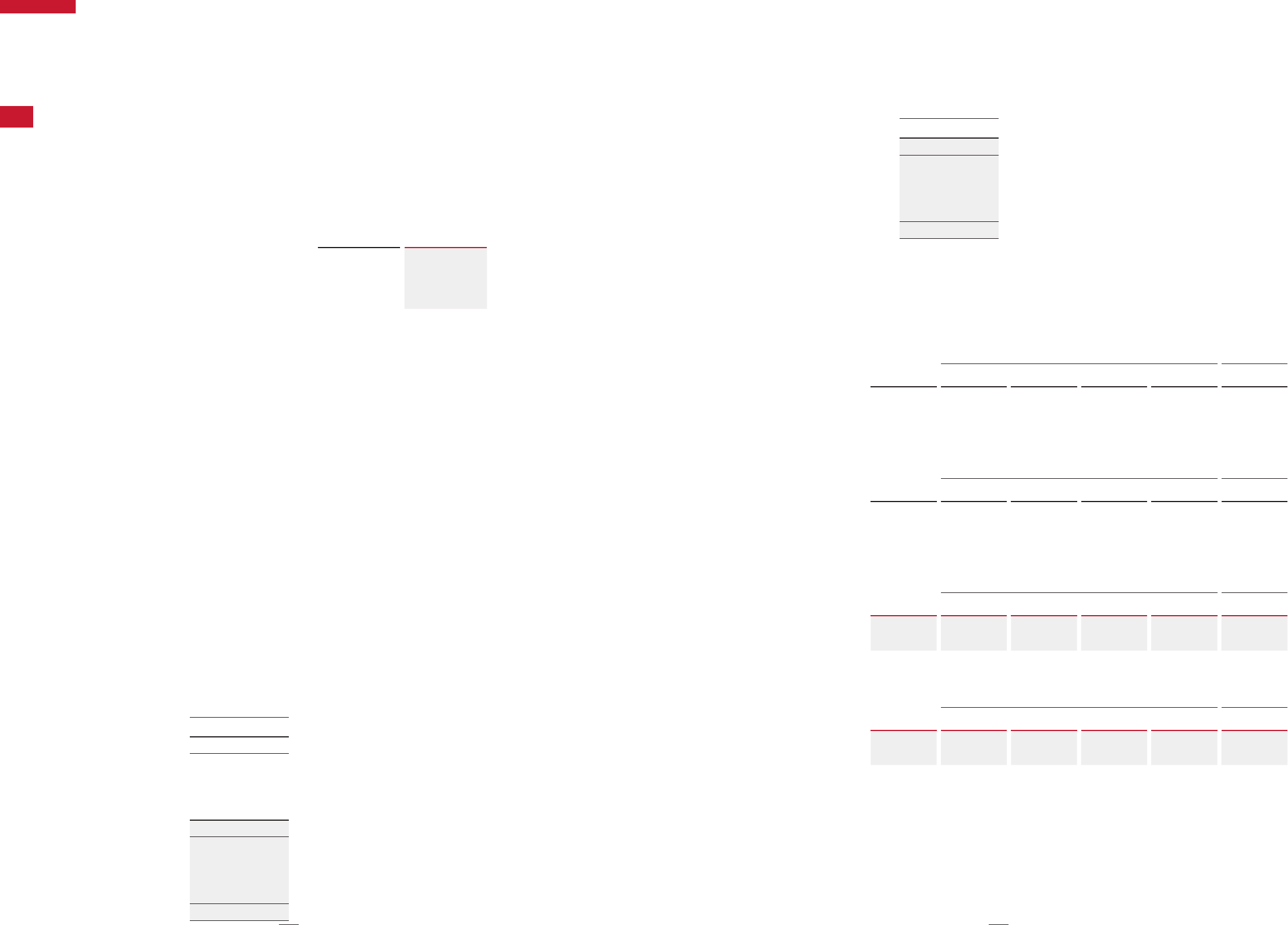

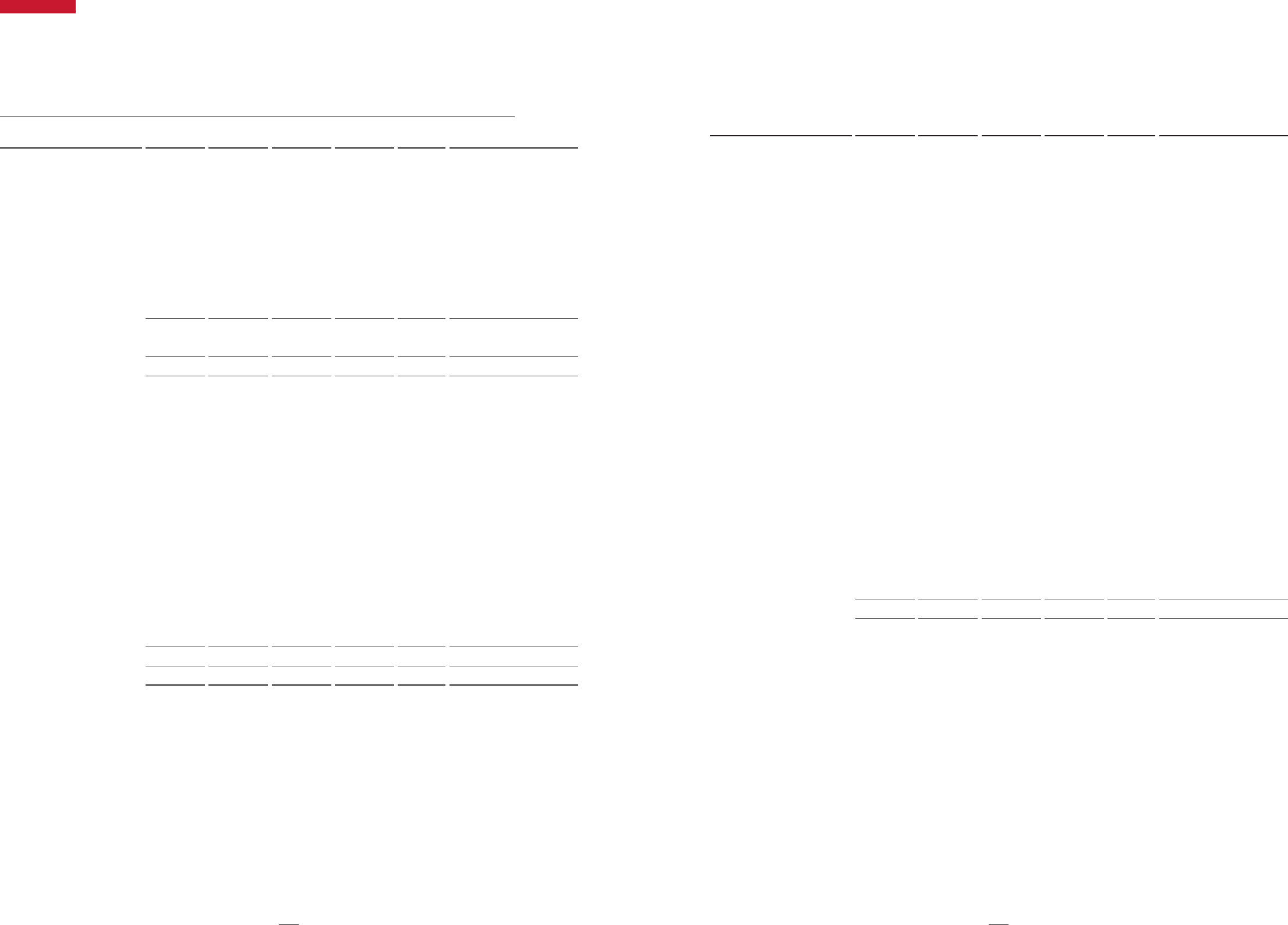

CASH FLOWS

Cash Flow Summary

The balance of cash and cash equivalents as of December 31, 2022

stood at ¥119.0 billion ($902.6 million), ¥37.5 billion ($284.1 million)

less than at the end of the previous consolidated fiscal year.

Cash Flows from Operating Activities

Net cash provided by operating activities decreased ¥87.5 billion

($663.6 million) year on year to ¥46.7 billion ($354.4 million). The

result is attributable to cash outflow factors of income taxes paid of

¥67.5 billion ($512.0 million), gain on transfer of business of ¥15.3

billion ($116.0 million), a decrease in trade payables of ¥12.5 billion

($94.9 million), an increase in trade receivables of ¥6.3 billion ($48.0

million), and an increase in inventories of ¥3.3 billion ($25.4 million),

which outweighed cash inflow factors of profit before tax of ¥50.4

billion ($382.4 million) and non-cash expenses including depreciation

and amortization of ¥75.7 billion ($574.1 million).

Cash Flows from Investing Activities

Net cash used in investing activities decreased ¥108.0 billion ($819.2

million) year on year to ¥41.3 billion ($313.2 million). The result is

attributable to cash outflow factors of purchase of property, plant and

equipment of ¥36.3 billion ($275.2 million) and purchase of

intangible assets of ¥29.9 billion ($226.8 million), which outweighed

cash inflow factors of proceeds from transfer of business of ¥13.8

billion ($104.5 million) and proceeds from sale of property, plant and

equipment and intangible assets of ¥5.3 billion ($40.1 million).

Cash Flows from Financing Activities

Net cash used in financing activities decreased ¥138.2 billion

($1,047.6 million) year on year to ¥52.4 billion ($397.5 million). The

result is attributable to cash outflow factors of repayments of lease

liabilities of ¥29.7 billion ($225.2 million), dividends paid of ¥22.0

billion ($166.6 million), and redemption of bonds of ¥15.0 billion

($113.7 million), which outweighed a cash inflow factor of proceeds

from issuance of bonds of ¥20.0 billion ($151.7 million).

2021 Q4 2022 Q4

Profit

before

income

taxes

+50.4

Depreciation,

amortization

+91.8

Other CF

from

operating

activities

+9.5

Proceeds

from

transfer

of

business

+13.8

Other CF

from

investing

activities

+11.1

CF from

financing

activities,

etc.

−17.5

CAPEX

−66.2

Interest-

bearing

debt

−25.4

Increase in

inventories

−3.3

Gain on

transfer

of

business

−15.3

Working

capital

less

inventories

−18.9

Income

taxes

paid

−67.5

156.5

119.0

(Billion yen)

Operating CF: + 46.7

Free Cash Flow: + 5.4

Investing CF: − 41.3

Cash Flow Management:

Continued CAPEX for Future Growth while Maintaining Sound Financial Position

010_0252087912303.indd 9010_0252087912303.indd 9 2023/04/12 20:09:382023/04/12 20:09:38

10

Shiseido | Integrated Report 2022

BUSINESS AND OTHER RISKS

Our Annual Securities Report pertaining to our business performance

and financial condition includes risks that may potentially impact on

our business performance and financial positions as listed below. We

believe that these risks could have a major impact on our investors’

decisions.

Such items associated with future events are based on our judg-

ment as of the Annual Securities Reports dated March 24, 2023.

Please note that the potential risks are not limited to those listed be-

low.

The risk management of the Group is primarily focused on “building

trust with multiple stakeholders and achieving our corporate strategy.”

We thus consider risks as “uncertainties” that may impact the

achievement, both potential threats to business as well as potential

opportunities. Based on this approach, we have established a risk

management structure and place measures proactively and expedi-

tiously.

The “Global Risk Management & Compliance Committee,” chaired

by the CEO and composed of Regional CEOs and HQ Executive Offi-

cers as well as Global Strategy Committee regularly identify Group

risks and deliberate measures toward them.

Risk-related information of the Group is gathered by the Risk Man-

agement Department at Global Headquarters (HQ), which reports into

the Office of the Chief Legal Officer of the Group.

In 2022, material risks were identified through a holistic approach

combining multiple and comprehensive methods. Specifically, HQ

Risk Management Department interviewed HQ Executive Officers, Re-

gional CEOs, and External Directors for their view on Group risks. Re-

gional risk assessments and input from relevant functions were also

taken into consideration as HQ Risk Management Department identi-

fied material risks affecting the key areas of our medium-term strate-

gy, SHIFT 2025 and Beyond, with the input from external advisors.

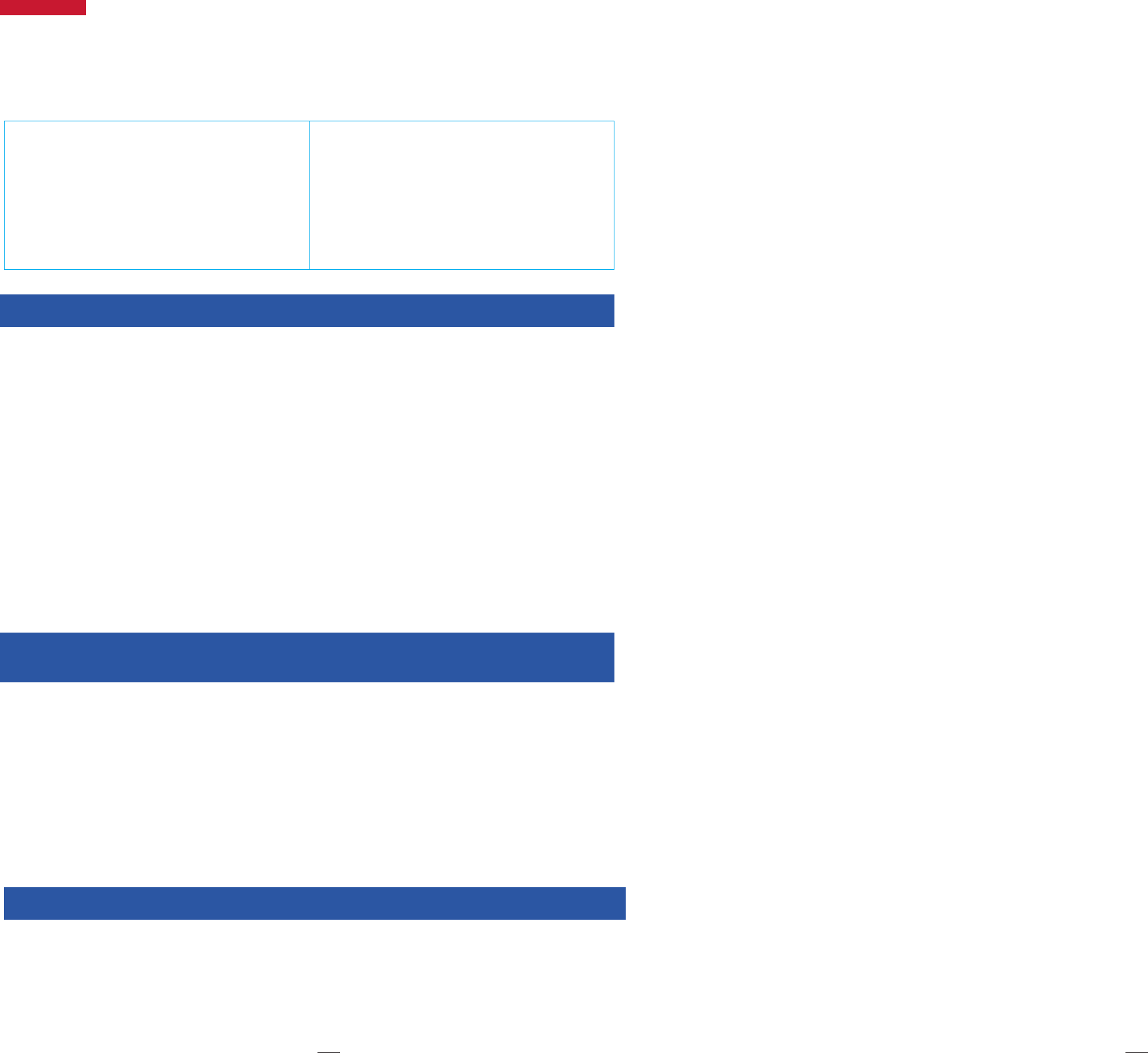

As shown in Table 1 below, the identified material risks were evalu-

ated with three measurements of “Impact on business,” “Likelihood,”

“Vulnerability,” followed by confirmation of prioritization and counter-

measures through the above committee meetings and other individual

meetings.

Table 1 <Risk evaluation methodology>

Impact on business

•

Quantitative impact on business performance

(e.g. topline sales) in case of manifestation

•

Qualitative impact on our corporate/brand

image and culture

Likelihood

•

Likelihood and timing of risk manifestation

Vulnerability

•

Preparedness to the risk

•

Controllability of the manifestation of the risk

due to external factors

Total 21 material risks identified through our risk assessment have

been organized into three risk categories: “Consumer and Social-relat-

ed Risks,” “Operation & Fundamental Risks,” and “Other Risks,” as

shown in Table 2 below.

We have identified “Risk Owners” for each risk category in an effort

to clarify responsibility for countermeasures. Moreover, we have im-

plemented a transparent monitoring and communicative framework

within the Global Risk Management & Compliance Committee and the

Board of Directors to regularly discuss and assess our progress in ad-

dressing these risks.

Table 2 <Summary of Shiseido Group material risks>

Consumer and

Social-related Risks

•

Changes in Consumer Values

•

Speed of Digital Acceleration

•

Pace of Cutting-Edge Innovation

•

Corporate and Brand Reputation

•

Environment and Climate Change

•

Diversity& Inclusion

•

Natural and Human-Made Disasters

•

Infectious Disease

•

Geopolitical Tensions

Operation &

Fundamental Risks

•

Corporate Culture and Acquisition/Securing

Outstanding Talent

•

Business Structure Transformation

•

Operating Infrastructure

•

Supply Network

•

Compliance

•

Regulatory

•

Quality Assurance

•

Governance Structure

•

Information Security and Privacy

Other Risks

•

Exchange Rate Fluctuations

•

Business Investment

•

Material Litigation

As a noteworthy point of the risk assessment results mentioned above,

the individual risks identified are more interlinked than in the past and

interdependency of the countermeasures is increasing. In addition to

that, we have identified five key risks that have significantly increased

their risk levels compared to the previous fiscal year: “Changes in

Consumer Values,” “Geopolitical Tensions,” “Corporate Culture and

Acquisition/Securing Outstanding Talent,” “Quality Assurance,” and

“Information Security and Privacy.” We have also added “Regulatory”

as a new material risk, which is becoming increasingly important as

we cultivate brands with unique value and develop new businesses

such as beauty devices and the inner beauty category.

The following outlines our key strategic initiatives, expected uncer-

tainties (threats and opportunities), countermeasures and change in

risk level, for each material risk. Please note that the following is

based on our assumptions as of March 24, 2023.

010_0252087912303.indd 10010_0252087912303.indd 10 2023/04/12 20:09:382023/04/12 20:09:38

11

CORPORATE DATA

<Consumer/Social-related Risks>

Risk Important efforts for realizing our Strategies/Uncertainties (Threats and Opportunities) that could impact such efforts and countermeasures re-

garding these uncertainties

Change in risk

level

(Compared to

the previous

fiscal year)

Changes in

Consumer Values

[Key Strategic Initiatives]

• Focus on the Premium Skin Beauty segment.

• Strengthen business portfolio combining the Company’s R&D with open innovation and strategic M&A.

• Develop the inner beauty category.

• Develop cross-border marketing.

[Uncertainties]

• Loss of competitiveness due to delayed or inadequate response to changing consumer values relating to “beauty,” changing tastes related to

cosmetics or inner beauty, price acceptability, and diversifying purchasing behavior including touchpoints. (Threat)

• Successful marketing strategies addressing changing consumer values may lead to higher-than-expected sales and profits. (Opportunity)

[Countermeasures]

• Strengthen the delivery of compelling, tailor-made experiences in the offline store and in online e-commerce with a focus on the consumer.

• Strengthen brand portfolio to respond to diversifying consumer values.

• Accelerate diversity of human resources, especially at HQ.

• Accelerate value creation and business development through open innovation with other companies.

• Set up Consumer and Market Intelligence Department to gather consumer information in an accurate and timely manner.

Speed of Digital

Acceleration

[Key Strategic Initiatives]

• Orchestrate foundational Group-wide shifts in strategy, people, technology and processes, focused on delivering benefits for the larger enter-

prise.

• Drive Global Standardizations (platforms, tools, process and aligned KPIs) for focused and effective activations and measurement in order to

help reach Global targets and create cost efficiencies and decrease compliance risks.

• Obtain and analyze consumer data in compliant manner to develop more personalized marketing through digital CRM. Strengthen retention

and loyalty.

[Uncertainties]

• Possibility of decline in market share due to lack of data and process standardization may lead to compliance risk and cost increases. (Threat)

• Offer unique value through combination of online and offline (i.e., store counter) experiences. (Opportunity)

[Countermeasures]

• Quarterly regional meetings between Chief Digital Officer (CDO) and digital leadership team in the HQ and Regional HQs established for audit

and track global delivery based on standardized KPIs.

• Introduction of the digital workforce planning to reinforce team building, hiring, retention, and development of digital experts.

• Enhance development of beauty technology to reinforce personalized engagement with customers and improve unique digital content to ana-

lyze skin condition.

• Accelerate first-party data acquisition through service and technology offered to consumers online and at store counters.

• Promote governance by creating stage gate process, investment management model with collaboration with R&D, Corporate Strategy and Glob-

al IT companies.

• Establishment of Global and Regional Metaverse and Web 3.0 Steering Committee to pilot innovations and test, learn and stay competitive.

Pace of Cutting-

Edge Innovation

[Key Strategic Initiatives]

• Selection and concentration of R&D through introduction of unique R&D philosophy “DYNAMIC HARMONY.”

• Strengthen R&D in the Premium Skin Beauty segment.

• Invest in R&D with ca.3% of net sales ratio target.

• Strengthen R&D and regulatory compliance activities at each Regional HQ.

[Uncertainties]

• New and competing technologies may make existing technologies obsolete. Cosmetics and other regulations of certain countries could result in

restriction of our technologies, making it difficult to provide new value to consumers. (Threat)

• Short-term delay such as launch of new technologies, medium-to long term slowdown in basic research or formula development/alternative in-

gredients to boost sustainability, or delay in M&A progress and partnerships with third parties could prevent us from achieving planned syner-

gies. This would limit our overall competitiveness and ability to meet the needs of consumers. (Threat)

• Establishing competitive superiority through the creation of new value via innovation in fields such as services, processes, and organization.

(Opportunity)

[Countermeasures]

• Continue to expand investment and resources in R&D of cosmetics.

• Identified core technology areas for R&D and clarified short-to long-term strategies for each to achieve resource allocation with high return on

investment.

• To maximize the value of innovative research results, identify the seeds for commercialization across brands, which are effectively communicat-

ed to consumers through strategic communications.

• Establishment of an Innovation Center to drive innovation in collaboration with other companies.

• Operate Nasu Factory, Osaka Ibaraki Factory and Fukuoka Kurume Factory leveraging the latest technologies.

• Conduct joint research with external organizations. Harness expertise of startup ventures. Focus on consumer trends.

• Collaborate for innovation with external parties through initiatives such as “fibona” (open innovation program involving startup companies).

• Define KPIs for measuring the return on R&D (such as R&D expenses to net sales ratio, number of researchers, sites, patent applications, aca-

demic papers, and seeds created and utilized etc.) for monitoring.

• Expanding the strategic dispatch of talents to external organizations for the development of innovative human resources.

Corporate and

Brand Reputation

[Key Strategic Initiatives]

• Aggressive marketing activities including digital marketing to increase brand value.

• Proactive marketing activities to create both corporate brand and each brand images using ambassadors and social media influencers.

[Uncertainties]

• Rumors, whether true or unfounded, regarding our official communications or comments and actions by ambassadors and social media influ-

encers associated with Shiseido could result in public criticism of the Group and damage our reputation. (Threat)

• Sale of counterfeit products can damage our ability to share our values with consumers, resulting in damage to our brand. (Threat)

[Countermeasures]

• Formulate and implement a strict social media policy and ensure familiarization among employees.

• Provide in-house training on maintaining and enhancing brand image for brand holder marketing and communications staff.

• Introduced a review system for language used in advertising and promotional materials, as well as selection of ambassadors and social media

influencers, to avoid behavior/messaging leading to criticism on the grounds of ethical or social norms.

• Perform website and social media monitoring to discover and respond to negative information in an accurate and timely manner.

• Coordinate with local government authorities to combat counterfeit products.

010_0252087912303.indd 11010_0252087912303.indd 11 2023/04/12 20:09:382023/04/12 20:09:38

12

Shiseido | Integrated Report 2022

Risk Important efforts for realizing our Strategies/Uncertainties (Threats and Opportunities) that could impact such efforts and countermeasures re-

garding these uncertainties

Change in risk

level

(Compared to

the previous

fiscal year)

Environment and

Climate Change

[Key Strategic Initiatives]

• As part of initiatives to realize a better world, execute actions while working toward greater sustainability, and enriching people’s lives through an

approach unique to a beauty company.

• Promote activities to achieve three commitments: “Reducing Our Environmental Footprint,” “Developing Sustainable Products,” and “Promoting

Sustainable and Responsible procurement.”

[Uncertainties]

• Lack of environmental measures may lead to loss of trust of consumers/society at large and a decline in shopping motivation. (Threat)

• Inadequate responses to environmental issues, particularly climate change risks, would negatively affect business, finance, and corporate val-

ue. (Threat)

• Efforts such as development of sustainable products could establish greater trust with consumers and society at large, create new social value

in beauty, and rapidly increase corporate value. (Opportunity)

[Countermeasures]

• Regular meetings held by the Sustainability Committee for medium-to-long-term strategy development/KPI setting, deliberation/resolution on

sustainability issues, and monitoring of the strategy implementation progress involving related departments of HQ and Regional HQs with re-

sponsibility for execution.

• Sustainability/SDGs-related activities by each brand.

• Promote ISO14001 certification at all factories and distribution centers by end of 2024.

• Issue Sustainability Report reflecting corporate policies, initiatives, and KPIs.

• Promote efforts to contribute to the reduction of environmental impact together with customers through adopting eco-friendly packaging.

• Promote switch to certified palm oil and paper.

• Set and disclose medium-term targets for major environmental load reduction items (CO2, palm oil, paper, water, waste) and work toward

achieving them.

• Support the Task Force on Climate-related Financial Disclosures (TCFD). Prepare and disclose a scenario based on quantitative/qualitative analy-

sis of climate change impact on business, estimated financial impact and specific actions to be taken, in line with TCFD recommendations.

Diversity& Inclusion [Key Strategic Initiative]

• To achieve the three commitments of “Advancing Gender Equality,” “Empowering people through the Power of Beauty,” and “Promoting Re-

spect for Human Rights,” actions taken by HQ/Regional HQs/brands in collaboration with external international organizations and NGOs.

• Particularly in Japan, where empowerment of women lags behind, Shiseido to provide information to employees as well as external companies,

thereby driving transformation of Japanese companies and Japanese society as a whole.

[Uncertainties]

• Possibility of losing the trust of society at large and consumers due to insufficient efforts in Diversity & Inclusion effort, which is a strength of

Shiseido. (Threat)

• Our efforts to promote Diversity & Inclusion may create new social values, building trust with consumers and society at large. (Opportunity)

• Organizational culture rooted in diversity and inclusion may lead to recruitment/retainment of diverse and talented people, promoting innovation

and dramatically increasing our corporate value. (Opportunity)

[Countermeasures]

• Medium-to-long-term strategy development, setting KPIs, and monitoring of the strategy implementation progress, involving related depart-

ments of HQ and Regional HQs.

• Activities by each brand for sustainability and SDGs realization.

• Issuance of sustainability report containing corporate policy, initiatives, and KPIs.

• Participation in “30% Club Japan” which aims to raise the percentage of women officers in Japanese companies, with our CEO acting as chair

to lead the activities of TOPIX Presidents’ Association.

• Expand opportunities to experience “power of makeup” through “SLQM(Shiseido Life Quality Makeup)”and “Lavender Ring Makeup & Photos

with Smiles” programs, supporting QOL improvement of cancer survivors.

Natural and

Human-Made

Disasters

[Key Strategic Initiative]

• Reinforce human resources and management infrastructure to rebuild our foundation for growth on a global scale.

[Uncertainties]

• Recent natural disasters (such as earthquakes, flood damages, and tornadoes) and other events around the world (such as terrorism and riots)

threatening employee safety and/or causing property damage, resulting in negative impact on supply network and business. (Threat)

[Countermeasures]

• Execute employee safety training and formulate business continuity plans (BCPs) for HQ and major regional sites. Hold regular and consistent

training at each site.

• Strengthen and leverage our global supply network to allow flexible and continuous supply during a crisis, such as establishment of a new factory.

Infectious Disease [Key Strategic Initiatives]

• Reinforce human resources and management infrastructure to rebuild our foundation for growth on a global scale.

• Build a digitally driven business model and organization.

[Uncertainties]

• Re-emergence of COVID-19 or outbreak of similar pandemics may lead to decline in consumption, sales, and profits. (Threat)

• Possibility to secure a competitive advantage in the market by quickly and flexibly addressing the changes in consumer values and needs. (Op-

portunity)

[Countermeasures]

• Putting the safety and security of employees first, taskforce established at HQ and Regional HQs in response to COVID-19.

• BCP for infectious diseases established and response system continuously strengthened.

Geopolitical

Tensions

[Key Strategic Initiatives]

• Focus investments on the areas of growth drivers.

• Rebuild the business foundation to boost profitability.

[Uncertainties]

• Possibility of boycott on our products due to increased anti-Japan sentiments in markets where we operate. (Threat)

• Deterioration of business environment due to political instability in markets where we operate. (Threat)

• Our profitability may deteriorate if the increased cost of raw materials caused by global price inflation leads to an increase in the price of goods/

services, as consumers may be less motivated to purchase our products. (Threat)

• Unstable political conditions and strained diplomatic relationships of countries and conflicts where we operate could deteriorate our business

environment and lead to negative impacts on production, supply, and sales of our products. (Threat)

[Countermeasures]

• Further develop our Premium Skin Beauty business.

• Balance sales portfolio across Regions. Strengthen and leverage the scale of our global supply network to be able to be flexible at a time of cri-

sis, without interrupting supply.

• Identification and consideration of Group-wide response points in the event of a crisis.

010_0252087912303.indd 12010_0252087912303.indd 12 2023/04/12 20:09:382023/04/12 20:09:38

13

CORPORATE DATA

<Operation & Fundamental Risks>

Risk Important efforts for realizing our Strategies/Uncertainties (Threats and Opportunities) that could impact such efforts and countermeasures re-

garding these uncertainties

Change in risk

level

(Compared to

the previous

fiscal year)

Corporate Culture

and Acquisition/

Securing

Outstanding

Human

Talent

[Key Strategic Initiatives]

• Under the “PEOPLE FIRST” Principle, acquire/develop human resources that realize innovation and create new value.

• Established eight working principles for all Shiseido employees to follow, as OUR PRINCIPLES (TRUST 8).

[Uncertainties]

• Inability to attract and retain the best talent may lead to talent shortages in realizing our business objectives. (Threat)

• Possibility of securing a competitive advantage by hiring and retaining the best talent. (Opportunity)

• Possible increase in productivity of the entire Group through work style reforms tailored to each task. (Opportunity)

[Countermeasures]

• Continue to reinforce a strong culture of transparent leadership and governance globally and reinforce the culture through employee communi-

cations and town halls.

• Promote workplace with flexibility and diversity, such as a workstyle combining office and remote work to achieve maximum results (Shiseido

hybrid work style) and permitting part-time jobs. Improve employee wellbeing.

• Introduce the global HR database and unify employee performance management to appoint talented people right time in the right jobs at the

right time.

• Introduce the Job Grade HR System and a remuneration system commensurate with individual contributions to ensure transparency in person-

nel evaluation and improve employee motivation.

• Accelerate a shift to digitally driven business model and reinforce IT/digital capability through Shiseido Interactive Beauty (SIB).

• Strengthen retention of human resources by offering total rewards, including global leadership programs, women’s leadership development pro-

grams, global mobility and competitive compensation systems.

Business Structure

Transformation

[Key Strategic Initiative]

• Promote structural reforms by divesting or withdrawing from unprofitable and non-core businesses and improve profitability through reduction

of COGs and SG&A expenses.

[Uncertainties]

• Business plan achievement may be negatively affected if regional/divisional business restructuring does not progress as targeted and profitabili-

ty and cash flow is not improved. (Threat)

• Possibility that the timing of market recovery may be delayed beyond expectations due to the impact of the Covid-19 and other factors may re-

sult in changed in consumer purchasing behavior, negatively affecting the management plans. (Threat)

• Growth in the cosmetics market may fall below expectations with slowdown of economic growth in China or the Americas, affecting manage-

ment plans. (Threat)

• Possibility of competitive advantage in the global market by improving profitability in EMEA and the Americas, rebuilding the foundation around

local business in Japan, and establishing a strong growth foundation in China. (Opportunity)

[Countermeasures]

• Establish and promote the Global Transformation Committee led by the CEO to establish, implement, manage, and expedite decision-making

for corporate strategy and to formulate/implement reform proposals for each regional structure or division.

Operating

Infrastructure

[Key Strategic Initiative]

• Globally improve effectiveness of information systems, business management systems, and core business processes related to procurement/

production/sales.

[Uncertainties]

• If IT system reconstruction/transition at our local offices do not proceed as planned, or faces issues hindering smooth operation after introduc-

tion, the initiative to improve global business base may be hindered and management plans negatively affected. (Threat)

• Updating global IT systems contributes to a stronger business foundation and improved competitiveness. (Opportunity)

[Countermeasures]

• Establishment of the specialized department at HQ and dedication to standardizing and updating IT systems and business processes globally,

in line with the overall objectives of the FOCUS project.

• Proceed the system implementation based upon the robust methodology to ensure business, system, and people readiness.

• Implement a high-availability global Cloud IT infrastructure to ensure resilience.

• Activate the Business Contingency Plan, when required, to avoid any operational impact.

Supply Network [Key Strategic Initiatives]

• Establishment of domestic factories and a supply chain base to enable stable production over the medium-to-long-term.

• Improve our global supply chain management.

• Continuous process improvement and state of the art technology investments in manufacturing and distribution.

• Focus on safety and sustainability.

[Uncertainties]

• Possible delays and inability to produce stable products due to price hikes, increased demand for raw materials, business withdrawals, natural

disasters, cyber damage to suppliers, and other factors caused by economic factors such as yen depreciation and international inflation affect-

ing the supply chain. (Threat)

• Leverage Japan’s high-quality manufacturing strengths to increase consumer value, at our factories in Japan. (Opportunity)

[Countermeasures]

• Reinforce supply structure of important ingredients by using multiple suppliers, securing emergency stocks, and creating strategic alliances

with suppliers.

• Strengthen our monitoring capabilities to ensure compliance with the Shiseido Group Supplier Code of Conduct.

Compliance [Key Strategic Initiative]

• Strengthen global legal compliance structure as we rebuild business foundation through new business models such as digital and beauty tech,

wellness, new M&A, etc.

[Uncertainty]

• Shiseido is subject to laws and regulations in countries in which we operate around the world relating to product safety, ingredients and label-

ing, employee health and safety, intellectual property, antitrust and competition, data privacy, environment, employment and labor, taxes, prod-

uct claims, corporate governance, Tokyo Stock Exchange (TSE) listing and disclosure. Unexpected changes to these laws and regulations could

have a material impact on the cost of doing business. Failure to comply with these laws and regulations could expose the Company to civil and/

or criminal fines, penalties and sanctions impacting our corporate reputation. (Threat)

[Countermeasures]

• Appointed a Chief Legal Officer (CLO) who works in conjunction with regional legal leaders to reinforce global compliance with the Standards

and with laws and regulations. Response teams are activated in any affected Regions or markets to ensure timely and effective actions in pro-

tecting the safety of our consumers and our employees.

• Foster an ethical culture and a framework of our ways of working that set out our non-negotiable standards embodied in our Shiseido Code of

Conduct and Ethics expected from all employees. We also provide training and awareness of compliance areas such as anti-corruption, an-

ti-trust, anti-harassment and anti-discrimination and privacy, in addition to developing areas concerning the use of consumer data.

• Provide an anonymous employee reporting system via phone or online, to report and respond to alleged violations of standards.

010_0252087912303.indd 13010_0252087912303.indd 13 2023/04/12 20:09:382023/04/12 20:09:38

14

Shiseido | Integrated Report 2022

Regulatory [Key strategic Initiative]

• HQ leads in collecting information and analyzing risks related to new environmental laws, product regulations and social trends, sharing infor-

mation with related departments, and including overseas regions, and strengthening the system for the smooth launch of innovative products

and services.

[Uncertainties]

• If we are unable to appropriately formulate our corporate strategy to respond to changes in consumer’s sense of value regarding beauty and

health to develop cosmetics and services that match demand, it may have a significant impact on our business, causing us to lose the trust of

society and consumers.

[Countermeasures]

• Established a dedicated department within HQ to monitor regulatory trends and formulate strategies for cosmetics and other regulations in each

country.

• Conduct compliance assessments of environmental and other regulations based on the ISO14001 to ensure strict compliance with laws and

regulations.

Quality Assurance [Key strategic Initiative]

• Offering safe products is a core Shiseido value and the foundation of our business strategies and competitive advantage; thorough measures

are taken to ensure high quality throughout product design, production, and sales.

[Uncertainties]

• Group-wide challenges to the thorough implementation of the Group’s high standard of quality assurance at various stages of product lifecycles

and providing safe products to consumers. (Threat)

• Globally provide Japan-standard quality, leading to improved brand image and increase in consumers, especially outside Japan. (Opportunity)

[Countermeasures]

• Developed Basic Guidelines on Quality Assurance and Global Quality Policy and Guidance and established Shiseido’s own quality and safety

assurance standards. Confirm adherence to such guidelines and standards at all stages, including new product design and development, man-

agement of raw materials, production, and delivery. Established a dedicated quality assurance department.

• Launched Global Quality Transformation Project, directly led by Global CEO, to improve global quality standards by strengthening governance/

risk assessment/operating protocols.

• Implementation of Global Quality System, a system allowing global sharing of voice of consumers collected at consumer centers.

• Set up a consumer service desk and a dedicated internal system for reporting and responding to potential quality risks, in addition to conduct-

ing regular simulation training.

Governance

Structure

[Key Strategic Initiative]

• Creation of a matrix organization structure composed of six Regions and brand categories to allow HQ to manage the entire Group business,

whilst also transferring greater authority to Regional HQs overseeing Japan, China, APAC, the Americas, EMEA, and Travel Retail. We will pro-

mote the localization of responsibilities and authority.

[Uncertainties]

• If Regional HQs push through decisions that do not align with the Group’s overall policies, or, conversely, if authority is not appropriately dele-

gated to Regional HQs and they are unable to effectively fulfill their responsibilities, it may become increasingly challenging to maintain efficient

and legally compliant operations and damage the organization’s sustainability. (Threat)

• Possibility of increased consumer loyalty in Regional HQs area of responsibility and make speedy decisions or successfully execute marketing

strategies to address local market needs. (Opportunity)

[Countermeasures]

• Significant decisions relating to the Company’s business are regularly reviewed by the Company’s Executive Officers and presented to the Board

of Directors.

• We create rules for responsibility and authority of HQ/ Regional HQs for each function and brand to ensure corporate governance through regu-

lar reporting and on-going global leadership meetings.

• Strengthen governance structure by establishing internal controls globally, including a Group-wide risk management system.

Information

Security and

Privacy

[Key Strategic Initiative]

• Strengthen digital marketing globally by utilizing data and enhancing e-commerce to match consumer needs and fierce competitive environ-

ment.

• Acquire via consumer consents personal data to provide new curated experience/services to customers and co-creation.

• Shift to Shiseido Hybrid Work Style, a way of working where productivity is high regardless of place or time.

• Further collaboration and co-creation with external partners such as startups to generate innovation.

[Uncertainties]

• Stagnation of production and sales and liability for damages to consumers and customers and loss of trust in the Company due to system fail-

ures caused by cyberattacks and leakage of consumer data. (Threat)

• With the increase in access points to important data accompanying working styles regardless of location and time, and further collaboration/

co-creation with external partners, information leakage risks may be heightened if management or operation is inadequate. (Threats)

• Violation of laws and regulations, fine payments, and loss of trust in the Company due to delayed or inappropriate response to data privacy-re-

lated laws and regulations in each country/region. (Threat)

• Loss of trust in the Company and business opportunity due to failure to understand the sensitivity of society regarding data privacy and appro-

priately understand the concerns/ expectations of consumers regarding data privacy. (Threat)

• By taking appropriate countermeasures to the above threats, possibility of contributing to the achievement of business goals; for example, con-

sumers feel safe to entrust their personal data to the Company. (Opportunity)

[Countermeasures]

The following measures are implemented, referencing the ISO and National Institute of Standards and Technology (NIST) frameworks.

• Dedicated information security department leading global collaboration, governance, and control.

• Appoint a person responsible for data privacy to reestablish and strengthen global collaboration system.