Taxpayer Advocate Service — 2013 Annual Report to Congress — Volume One 165

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

MSP

#15

EXEMPT ORGANIZATIONS: The IRS Continues to Struggle with

Revocation Processes and Erroneous Revocations of Exempt

Status

RESPONSIBLE OFFICIAL

Sunita B. Lough, Commissioner, Tax Exempt & Government Entities Division

DEFNITION OF PROBLEM

The IRS’s Exempt Organization (EO) unit receives about 60,000 applications for exempt status each

year.

1

In addition, EO receives applications for reinstatement from organizations whose exempt status was

automatically revoked. These applications added more than 50,000 cases to EO’s workload over the past

three years.

2

Already understaffed, EO did not allocate more resources to its Determinations Unit, which

processes both initial and reinstatement applications. Its inventory backlog now stands at about 66,000

cases, more than the number of initial applications it usually receives in an entire year, four times the

2010 level, and more than triple the 2011 level.

3

Organizations consulting the “Where is My Exemption

Application?” page on IRS.gov are informed that applications requiring review by an EO specialist take a

year and a half just to be assigned.

4

There is no procedure for administrative review of automatic revocations, yet EO uses automated systems

that erroneously identify thousands of organizations as no longer exempt.

5

Planned programming

changes will not avert future erroneous revocations. By erroneously listing an organization as having lost

its tax exempt status, the IRS may cause the organization to lose funding it needs to survive and the effect

may be community-wide.

In today’s difficult economy and in light of long-term cuts in projected spending known as sequestration,

exempt organizations are faced with a gap between an increasing need for their assistance and diminishing

1

Public Charity Organizational Issues, Unrelated Business Income Tax, and the Revised Form 990, Hearing before the H. Comm. on Ways and

Means, Subcomm. on Oversight, 112th Cong. 2nd Sess. (July 25, 2012) 2 (testimony of Steven T. Miller, Deputy Commissioner of Services and

Enforcement, Internal Revenue Service), available at http://waysandmeans.house.gov/UploadedFiles/Miller_Testimony_7.25.pdf (noting that “We

consistently receive about 60,000 applications for tax-exempt status each year. Most are requesting status under section 501(c)(3).”).

2

Total EO determinations case receipts were 66,038 for fiscal year (FY) 2011; 79,362 for FY 2012; and 79,740 for FY 2013. IRS response to TAS

fact check, referencing TE/GE’s fourth quarter 2013 Business Performance Review (BPR) (Dec. 16, 2013).

3

TE/GE response to TAS information request (Nov. 12, 2013). FY 2010 open inventory consisted of 15,570 determinations cases. For FY 2011,

the level was 20,603 cases. IRS response to TAS fact check, referencing TE/GE’s fourth quarter 2013 Business BPR (Dec. 16, 2013). TE/GE’s

most recent BPR posted on its webpage is for the second quarter of FY 2012. See TE/GE BPR FY 2012: Second Quarter (May 23, 2012), avail-

able at http://tege.web.irs.gov/support/planning/planning.asp.

4

Where Is My Exemption Application?, available at http://www.irs.gov/Charities-&-Non-Profits/Where-Is-My-Exemption-Application (informing tax-

pay as of Nov. 14, 2013, that EO was assigning applications it received in May of 2012). The web page was last updated on Sept. 23, 2013.

Organizations consulting the more recently updated “Where’s My Application?” page on IRS.gov are informed that the IRS might take up to six

months after acknowledgthe application to either inform the applicant that the application has been approved or to request additional information.

See Where’s My Application, available at http://www.irs.gov/Charities-&-Non-Profits/Charitable-Organizations/Where’s-My-Application%3F (last vis-

Dec. 17, 2013, showing the page had been updated Dec. 11, 2013). This new webpage was first available around Nov. 1, 2013. See Systemic

Advocacy Management System submission 28938. Because six months have not yet elapsed since then, TAS cannot verify the reliability of the

six-month estimate.

5

TE/GE estimates it erroneously treated about 9,000 organizations as having had their exempt status automatically revoked. TE/GE response to

TAS information request (Nov. 12, 2013).

Most Serious Problems — Exempt Organizations166

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

resources available to meet that need.

6

The single largest category of public charities deliver human

services — they “provide networks of direct services to people in need. They feed our hungry, strengthen

our communities, shelter our homeless, care for our elderly, and nurture our young.”

7

When charities lose

funds because they cannot obtain timely recognition of their exempt status, or are erroneously treated as

no longer exempt, these vulnerable populations suffer the consequences.

ANALYSIS OF PROBLEM

Background

EO Has Struggled for the Past Decade to Process Its Inventory of

Applications for Exempt Status, and Automatic Revocations Made the

Problem Worse.

Since 2004, the National Taxpayer Advocate has reported on the increased number

of applications for exempt status and the decrease in the number of EO employees

who handle them.

8

Three of the past six Annual Reports to Congress identified

the delay in processing applications for exempt status as among the Most Serious

Problems.

9

EO’s workload grew substantially in 2010, when it began notifying

organizations their exempt status had been automatically revoked.

10

Many of

these organizations applied for reinstatement, and they have done so in increasing

numbers. EO, however, had projected a decrease in the number of applications

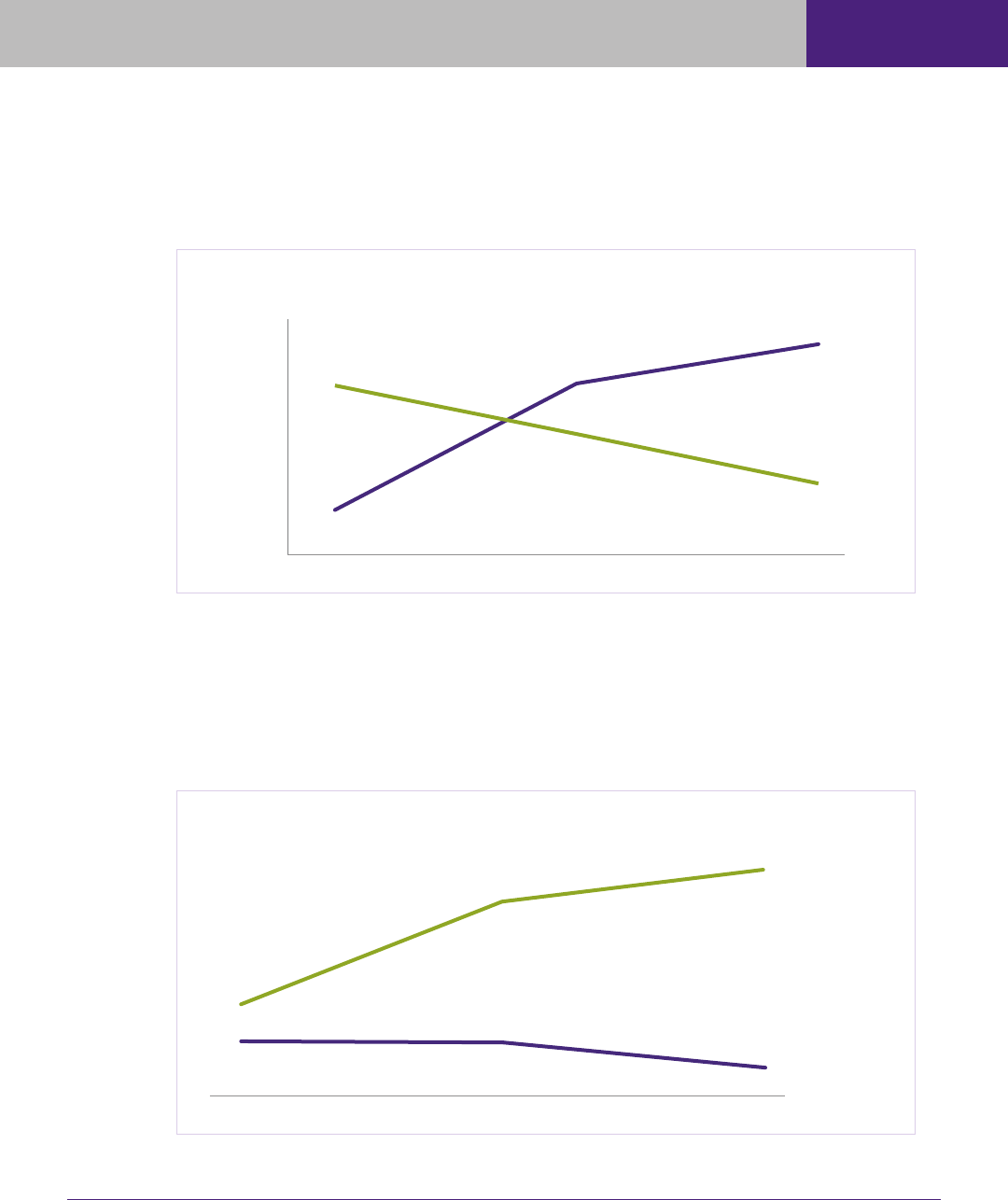

for reinstatement over time. Figure 1.15.1 shows the relationship between EO’s

projected and actual receipts of reinstatement applications.

6

Marcus Baram, Filling The Gap: As Government Shrinks, Community Groups Seek Local Solutions, The Huffington Post (May 2, 2012), available at

http://www.huffingtonpost.com/2012/05/02/filling-the-gap-crisis-assistance_n_1379761.html; Annie Lowrey, Government Giving Nonprofits Angst,

The New York Times (Nov. 7, 2013), available at http://www.nytimes.com/2013/11/08/giving/government-giving-nonprofits-angst.html?_r=0.

7

Charity Navigator, available at http://www.charitynavigator.org/index.cfm?bay=search.categories&categoryid=6; Sarah L. Pettijohn, Urban Institute,

The Nonprofit Sector in Brief 4 (2013), available at www.urban.org/UploadedPDF/412923-The-Nonprofit-Sector-in-Brief.pdf, noting that of 335,037

public charities reporting to the IRS in 2011, 116,643 (35 percent) were classified as part of the human services subsector.

8

National Taxpayer Advocate 2004 Annual Report to Congress 193, 203 (Most Serious Problem: Application and Filing Burdens on Small Tax-Exempt

Organizations).

9

National Taxpayer Advocate 2012 Annual Report to Congress 192 (Most Serious Problem: Overextended IRS Resources and IRS Errors in the

Automatic Revocation and Reinstatement Process Are Burdening Tax-Exempt Organizations); National Taxpayer Advocate 2011 Annual Report

to Congress 442 (Most Serious Problem: The IRS Makes Reinstatement of an Organization’s Exempt Status Following Revocation Unnecessarily

Burdensome); National Taxpayer Advocate 2007 Annual Report to Congress 210 (Most Serious Problem: Determination Letter Process).

10

Section 1223 of the Pension Protection Act of 2006 (PPA) (Pub. L. No. 109-280, 120 Stat. 780 (2006)) imposed a new annual reporting require-

ment, Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt EOs Not Required to File Form 990 or 990-EZ, on small exempt organizations and

mandated automatic revocation of tax-exempt status of organizations that fail to file required returns or e-Postcards for three consecutive years.

The single largest category

of public charities deliver

human services… They

feed our hungry, strengthen

our communities, shelter

our homeless, care for our

elderly, and nurture our

young.

Taxpayer Advocate Service — 2013 Annual Report to Congress — Volume One 167

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

FIGURE 1.15.1, Projected and Actual Receipts of Applications for Reinstatement of

Exempt Status, FY 2011–2013

11

FY 2011

FY 2012

FY 2013

25,000

20,000

15,000

10,000

5,000

Receipts of Applications for Reinstatement of Exempt Status

5,262

20,177

24,823

0

Actual Receipts

Projected Receipts

19,793

14,229

8,389

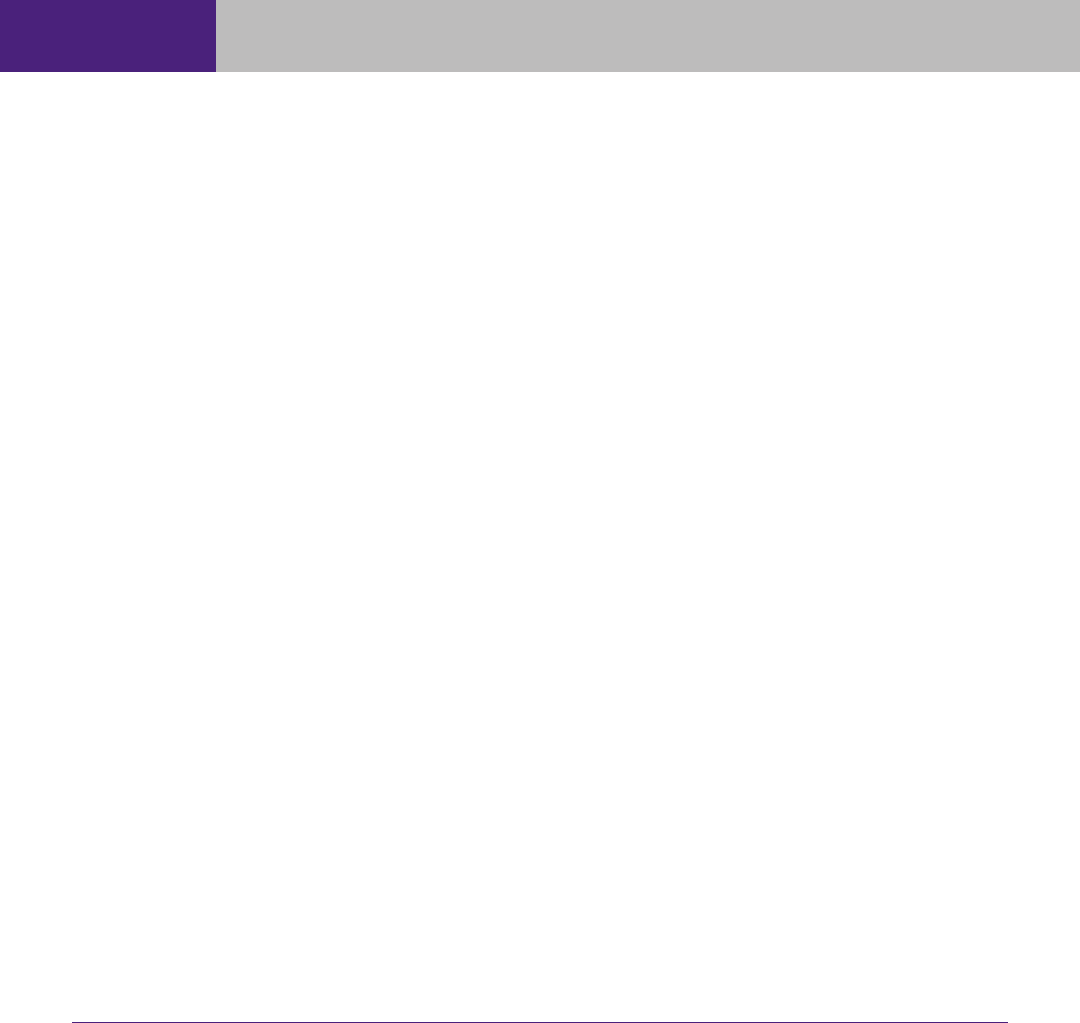

EO and the IRS also ignored TAS’s repeated warnings that EO was seriously understaffed to handle the

influx of applications, with the result that applications continue to outstrip EO resources, as shown by

Figure 1.15.2.

12

FIGURE 1.15.2, Applications for Reinstatement of Exempt Status and Full-time Cincinnati

Staff Handling the Applications FY 2011–2013

13

FY 2011

5,262

206

205

183

20,177

24,823

FY 2012

FY 2013

Staffing and Application Requests for Reinstatement of Exempt Status

Requests for

reinstatement

increased over

300% from FY

2011 to FY 2013

Full-time staff

handling

applications

decreased over

10% from FY

2011 to FY 2013

11

TE/GE response to TAS information request (Nov. 12, 2013). AWSS Employee Support Services, Payroll/Personnel Systems, HR Reporting

Section, Oct 5, 2013, available at https://persinfo.web.irs.gov/track/workorg.asp.

12

EO does not assign specific employees to work only on applications for reinstatement. TE/GE response to TAS information request (Nov. 12,

2013).

13

TE/GE response to TAS information request (Nov. 12, 2013) noting that “all Exempt Organizations, Determinations (EOD) and Exempt

Organizations, Technical (EOT) employees who work on applications may work on reinstatement requests” and “[t]he approximate number of

employees in EOD working applications is 150. The approximate number of employees in EOT working applications is 30.” TAS found that as

of Oct. 5, 2013, there were 183 full-time Cincinnati Determinations staff. AWSS Employee Support Services, Payroll/Personnel Systems, HR

Reporting Section, available at https://persinfo.web.irs.gov/track/workorg.asp.

Most Serious Problems — Exempt Organizations168

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

EO’s budget as a portion of TE/GE’s budget hovered between 35 and 38 percent for FYs 2011-2013 and

remained relatively stable in dollar terms, but EO’s volume of open inventory (i.e., total unresolved cases)

more than tripled.

14

According to the “Where is My Exemption Application?” page on IRS.gov, applica-

tions that need development take 18 months to be assigned to a reviewer, up from the nine months cited

in last year’s Annual Report and the seven months cited in the 2011 Annual Report.

15

Organizations affected by delays in obtaining recognition of exempt status include those that deliver

human services such as food and shelter. Of public charities that report to the IRS, there are more in this

category than in any other.

16

Increased need for their assistance coincides with reductions in the amount

of government funds to meet the need, especially at the state and local levels. For example, according to a

2012 survey by the U.S. Conference of Mayors:

17

Over 80 percent of the survey cities reported an increase in requests for emergency food assistance

over the past year and three fourths expect such requests to increase in the future.

18

Nearly half of the survey cities expect that resources to provide emergency food assistance will

decrease over the next year.

19

More than half the survey cities reported an increase in the total number of persons experiencing

homelessness and expect the number of homeless families to increase in the future.

20

More than half of the survey cities expect resources to provide emergency shelter to decrease over

the next year.

21

The difficulties organizations encounter in obtaining timely recognition of their exempt status directly

affects the members of their communities most in need of assistance.

EO Erroneously Notified Thousands of Organizations Their Exempt Status Had Been Revoked.

Since the first automatic revocations became effective in 2010, EO has notified about 550,000 organiza-

tions they are no longer exempt, with about 9,000 of these notifications being in error.

22

The IRS notes

the loss of exempt status on an electronic list of organizations whose exempt status was automatically

14

EO’s budget equaled $98,759,800 or 35.6 percent of TE/GE’s budget in FY 2011; $100,547,400 or 37.2 percent in FY 2012; and $97,154,000

or 38.1 percent in FY 2013; TE/GE response to TAS information request (Nov. 12, 2013). For FY 2011, the level of open inventory was 20,603

cases compared to the FY 2013 level projected to be 66,000 cases. IRS response to TAS fact check, referencing TE/GE’s fourth quarter 2013

Business BPR (Dec. 16, 2013).

15

See National Taxpayer Advocate 2012 Annual Report to Congress 196 (Most Serious Problem: Overextended IRS Resources and IRS Errors in the

Automatic Revocation and Reinstatement Process Are Burdening Tax-Exempt Organizations); National Taxpayer Advocate 2011 Annual Report to

Congress 449; Where Is My Exemption Application?, available at http://www.irs.gov/Charities-&-Non-Profits/Where-Is-My-Exemption-Application

(informing taxpayers that, as of Nov. 14, 2013, EO was assigning applications it received in May of 2012). The web page was last updated on

Sept. 23, 2013.

16

Sarah L. Pettijohn, Urban Institute, The Nonprofit Sector in Brief 4 (2013), available at www.urban.org/UploadedPDF/412923-The-Nonprofit-Sector-

in-Brief.pdf. Of the 335,037 public charities reporting to the IRS in 2011, 116,643 (35 percent) were classified as part of the human services

subsector. The next largest category included the 58,568 educational organizations (17.5 percent of the total), followed by the 41,619 health

organizations (12.4 percent of the total). All other classifications (arts, culture and humanities; environment and animals; international and for-

eign affairs; public and social benefit; and religion related) each accounted for less than 12 percent of the total.

17

The U.S. Conference of Mayors, Hunger and Homelessness Survey (Dec. 2012), available at http://usmayors.org/publications/.

18

Id., at 1-2, reporting that 82 percent of the cities reported an increase in requests for emergency food assistance and three fourths of the survey

cities expect requests for emergency food assistance to increase over the next year.

19

Id., at 2, reporting that 48 percent expect that resources to provide emergency food assistance will decrease over the next year.

20

Id., at 2-3, reporting that 60 percent of the cities reported an increase in homelessness and 60 percent expect the number of homeless families

to increase over the next year.

21

Id,. at 3, reporting that 58.5 percent of the cities expect resources to provide emergency shelter to decrease over the next year.

22

TE/GE response to TAS information request (Nov. 12, 2013); IRS response to TAS fact check (Dec. 16, 2013).

Taxpayer Advocate Service — 2013 Annual Report to Congress — Volume One 169

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

revoked and removes the organization from the list of organizations to which deductible contributions

may be made. An organization will likely immediately suffer the consequences of being taken off the

“right” list and placed on the “wrong” list, while it faces potentially lengthy timeframes in the reinstate-

ment process. EO refuses to implement a review procedure that would avert these drastic consequences

long enough to allow it to consider the possibility that the revocation might have been erroneous.

23

In

the meantime, an organization may become ineligible for grants and may lose donor funding it needs to

survive.

As described in last year’s Annual Report, after the Treasury Inspector General for Tax Administration

found a programming problem existed, EO identified more than 2,270 cases in which an organiza-

tion was erroneously listed as having had its exempt status revoked, and 300 to 400 additional entities

identified themselves as erroneously listed as revoked. The most common reason

for the erroneous revocations was that IRS systems did not recognize subordinate

organizations as part of a group return when the subordinates and the parent

organizations had different accounting periods.

24

This year, EO reported to TAS additional programming conditions that caused

erroneous revocations. As reported in the National Taxpayer Advocate’s Fiscal

Year 2014 Objectives Report to Congress, one programming change caused IRS

computers to calculate the three-year nonfiling period that triggers automatic

revocation only with reference to the date the organization obtained its Employer

Identification Number (EIN).

25

An organization obtaining its EIN in 2007, for

example, would be treated as having had reporting obligations since 2007, even if

the organization commenced operations and obtained recognition of its exempt

status only in 2011. Systemic review of filing activity would show three or more

consecutive years of nonfiling (2007-2010) and EO would notify the organization

that it was no longer exempt. EO does not track the number of organizations it

treated as automatically revoked because of this issue.

26

EO relies on affected organizations to come forward and seek relief, then rectifies an error by restoring

the organization’s exempt status on its databases and issuing a letter attesting to its exempt status.

27

In an

effort to minimize erroneous revocations, EO plans to change its procedures by identifying taxpayers who,

in the process of obtaining an EIN, indicate they are nonprofit organizations.

28

The IRS will then send

these organizations that do not file returns Notice 259A. The notice does not actually remind (or inform)

23

See National Taxpayer Advocate 2012 Annual Report to Congress 192, 202 (IRS Response: Most Serious Problem: Overextended IRS Resources

and IRS Errors in the Automatic Revocation and Reinstatement Process Are Burdening Tax-Exempt Organizations).

24

Id. at 199.

25

National Taxpayer Advocate Fiscal Year 2014 Objectives Report to Congress 33 (June 30, 2013). An EIN is a nine-digit number assigned by

the IRS to sole proprietors, corporations, partnerships, estates, trusts, and other entities for tax filing and reporting purposes. An organization

requests an EIN by submitting IRS Form SS-4, Application for Employer Identification Number (EIN). The form does not require that the organization

already be operational. For example, the applicant may select “banking purpose” as the reason for applying for the EIN. Thus, a new organization

might obtain an EIN, set up a business bank account, and then use a check or credit card from the business bank account to pay the incorpora-

tion fee imposed by the state in which the organization is created. The EIN application asks what type of entity the applicant is, and contains a

box for “other nonprofit organization.”

26

TE/GE response to TAS information request (Nov. 12, 2013).

27

TE/GE response to TAS information request (Nov. 12, 2013).

28

Id. This capability is expected to be available beginning in January of 2014.

The inventory backlog of

applications for exempt

status now stands at

about 66,000 cases, more

than the number of initial

applications the IRS usually

receives in an entire year,

four times the 2010 level,

and more than triple the

2011 level.

Most Serious Problems — Exempt Organizations170

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

the organization of its filing obligation, but is captioned simply “You didn’t file a

Form 990/990-EZ or Form 990-N.” The recipient is told that if it did not file, it

should respond to the letter, and EO believes that this may prompt organizations

that do not have a filing requirement to contact the IRS.

29

However, the portion

of the notice “If We Don’t Hear From You” begins, “[b]ecause you have tax-

exempt status, you must file Form 990/990-EZ or Form 990-N.” An organization

that does not (yet) have exempt status would likely conclude that the notice simply

doesn’t apply to it. Nothing in the notice or any other IRS communication alerts

the taxpayer that as far as the IRS is concerned, the three-year nonfiling period for

automatic revocations has begun.

EO’s decision to continue to measure the three-year nonfiling period with refer-

ence to issuance of the EIN is essentially a business decision. EO reasons that

because an organization generally has an annual filing requirement from the time

it forms and generally obtains an EIN in conjunction with its legal formation, “the EIN establishment

date is an appropriate, and the best available, metric from which to begin looking for filings.”

30

We agree

that this may be an accurate description of how events generally unfold, and we recognize the convenience

of using the EIN establishment date as a point of reference. However, the National Taxpayer Advocate

takes issue with the imposition of this general rule because it is coupled with EO’s refusal to provide

administrative review of automatic revocations. By computing the three-year nonfiling period with

reference to the EIN date, EO is perpetuating erroneous revocations. Some taxpayers may obtain EINs

without actually forming a legal entity or conducting any activity. These taxpayers would not, as a matter

of law, have a filing obligation. Other taxpayers, as generic organizations, may obtain EINs, have no filing

requirements, and only later become nonprofit organizations, yet the nonfiling period would start on the

date the EIN was obtained. Because the best available metric also ensures continued error, EO should

allow administrative review of automatic revocations that result from this business decision.

A related procedure unfairly penalizes organizations that do file for exempt status as soon as they obtain

their EINs, namely EO’s inclusion in the three-year nonfiling period the time an e-Postcard filer was wait-

ing for EO to process its application for exempt status. It is impossible to submit an e-Postcard in that

period without assistance from the IRS.

31

TAS’s position, with which the IRS has not agreed, is that it is

unfair to “count” any failure to file during this period as one of the three periods that triggers automatic

revocation, when the Internal Revenue Code requires electronic filing of the postcard and the IRS has

designed a system that makes it physically impossible for the EO to make such an e-filing on its own.

EO expects to partially address this problem with the same change in its procedures described above.

Taxpayers that indicate on their applications for an EIN that they are nonprofit organizations will be

29

TE/GE response to TAS information request (Nov. 12, 2013).

30

Id.

31

One of the Frequently Asked Questions about exempt organizations’ annual filing requirements is “Does an organization whose gross receipts are

normally $25,000* or less have to file the e-Postcard if its application for tax exemption is pending?” The answer is “Yes, but to do so an officer

of the organization must first call Customer Account Services at 1-877-829-5500 (a toll-free number) and ask that the organization be set up to

allow filing of the e-Postcard.” Exempt Organizations Annual Reporting Requirements — Annual Electronic Notice (Form 990-N): Frequently Asked

Questions and Answers, available at http://www.irs.gov/Charities-&-Non-Profits/Exempt-Organizations-Annual-Reporting-Requirements-Annual-

Electronic-Notice-(Form-990-N):-Organization-With-Application-Pending-Must-File. Taxpayers who call the number cited above can expect to wait 17

minutes to speak to an IRS employee. The level of service (the percentage of callers requesting a customer service representative who received

assistance) is 68.58 percent. TE/GE response to TAS information request (Nov. 12, 2013).

When charities lose funds

because they cannot

obtain timely recognition

of their exempt status, or

are erroneously treated as

no longer exempt, these

vulnerable populations

suffer the consequences.

Taxpayer Advocate Service — 2013 Annual Report to Congress — Volume One 171

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case AdvocacyAppendices

able to file a return or e-Postcard without assistance from the IRS.

32

This solution will not help taxpayers

whose EIN applications do not show they are nonprofits. As noted above, it also does not help taxpayers

who, although they have an EIN, have not commenced operations or do not respond to the IRS’s notice

because they do not believe it applies to them.

A separate programming change affected reinstated organizations. IRS databases did not show that

organizations whose exempt status had been reinstated had a new three-year automatic revocation period.

This caused the IRS to revoke exempt status a second time shortly after granting reinstatement.

33

The

IRS does not know how many organizations it treated as automatically revoked because of this change.

34

While the IRS has resolved the problem for many of these organizations, it does not know how many it

may have overlooked.

35

EO requested programming changes that will essentially suspend the three-year

nonfiling period while the organization’s exempt status remains automatically revoked. If approved, the

changes will be implemented in January of 2015.

36

As the National Taxpayer Advocate has repeatedly

pointed out, administrative review of all proposed automatic revocations (rather than the current ad hoc

and nonpublic approach) would likely have averted many errors.

37

CONCLUSION

EO’s inventory backlog, which now exceeds the number of initial applications it usually receives in an

entire year, burdens taxpayers who must wait for 18 months for their applications to be assigned to an

analyst. Thousands of organizations were forced to cope with EO’s troubled inventory management only

because EO erroneously treated them as having had their exempt status automatically revoked and they

were required to apply for reinstatement. EO is aware that measuring the three-year nonfiling period with

reference to the EIN date causes erroneous revocations, yet it intends to retain that practice. It does not

adequately inform organizations how the practice may affect them or provide organizations any way to

seek administrative review of automatic revocations.

32

TE/GE response to TAS information request (Nov. 12, 2013). In fact, as described above, the IRS will issue these taxpayers notice CP 259A to

notify them they did not file a return.

33

Upon learning that EO programming was causing erroneous revocations, TAS issued guidance to its employees explaining how to identify and

advocate for taxpayers who come to TAS with these problems.

34

TE/GE response to TAS information request (Nov. 12, 2013).

35

Id.

36

Id.

37

National Taxpayer Advocate 2012 Annual Report to Congress 192 (Most Serious Problem: Overextended IRS Resources and IRS Errors in the

Automatic Revocation and Reinstatement Process Are Burdening Tax-Exempt Organizations); National Taxpayer Advocate 2011 Annual Report

to Congress 442 (Most Serious Problem: The IRS Makes Reinstatement of an Organization’s Exempt Status Following Revocation Unnecessarily

Burdensome); National Taxpayer Advocate 2011 Annual Report to Congress 562 (Legislative Recommendation: Provide Administrative Review of

Automatic Revocations of Exempt Status, Develop a Form 1023-EZ, and Reduce Costs to Taxpayers and the IRS by Implementing Cyber Assistant).

Most Serious Problems — Exempt Organizations172

Legislative

Recommendations

Most Serious

Problems

Most Litigated

Issues

Case Advocacy Appendices

RECOMMENDATIONS

The National Taxpayer Advocate recommends the IRS:

1. Issue a letter informing the organization when the IRS proposes to treat it as having had its

exempt status automatically revoked and providing an opportunity to correct the condition that

caused the proposed automatic revocation within 30 days. The letter should specify the availabil-

ity of administrative review for organizations raising concerns that the IRS is proceeding in error.

2. When notifying organizations that they did not submit a required return or e-Postcard, inform

them that EO calculates the three-year nonfiling period using the date the organization ob-

tained its EIN. Advise them to contact EO if its use of the EIN date may result in an erroneous

revocation.

3. Do not include in the three-year nonfiling period for purposes of automatic revocations any

period for which an organization could not submit an e-Postcard without contacting the IRS.