05/29/2024

1

GROUP-TERM LIFE INSURANCE FAQs

In accordance with the Internal Revenue Code Section 79, the Internal Revenue Service (IRS) considers

employer-provided term life insurance for employees a benefit that is taxable as imputed income.

Imputed income is the addition of the value of fringe benefits to an employee’s taxable wages to

properly withhold income and employment taxes from the wages.

Although group-term life insurance under the State of Georgia Flexible Benefits Program (Flex Program)

is a contributory plan, it is subject to the Section 79 tax rules. There are four separate group-term life

insurance plan options under the Flex plan: Employee Life, Spouse Life, Child Life and Accidental Death

and Dismemberment (AD&D). The imputed income calculation is slightly different depending on the

specific option. For Employee Life insurance, imputed income is the taxable value of group life coverage

over $50,000. For Spouse Life insurance coverage, if the spouse coverage is greater than $50,000,

imputed income must be calculated and included in employee’s taxable wages for amounts that exceed

$50,000. Based on current plan provisions, Child Life insurance coverage and AD&D do not trigger any

imputed income calculations.

1. How is the taxable value of Group-Term Life Insurance (GTL) determined? The taxable value of

GTL is determined using the IRS Uniform Premium Cost Table, commonly referred to as Table 2-

2. The table quotes a value per $1000 of coverage based on the employee’s age as of December

31 of the current calendar year. For employee life coverage, the cost or taxable value of

employer-provided group term life insurance that exceeds $50,000, less any amount the

employee pays for coverage in any year with after-tax dollars, must be included in the

employee’s taxable compensation for the year.

2. Does the monthly administrative fee impact the imputed income calculation? Yes. There is a

monthly administrative fee of $.70 that is added to each plan option’s (e.g., Employee Life,

Spouse Life, etc.) rate. The monthly administrative fee is considered part of the amount the

employee pays for monthly coverage and serves to reduce the overall imputed income amount,

if calculated on an after-tax basis.

3. How is imputed income treated for payroll tax purposes? GTL imputed income is subject to

withholding for social security and Medicare taxes (commonly referred to as FICA taxes).

Although federal and state income taxes are not withheld, imputed income is reported as

taxable federal and state income on Form W-2. GTL insurance is not subject to FUTA tax.

4. Where will imputed income appear on my paycheck? For PeopleSoft entities, the Employee

Life and Spouse Life imputed income will appear in the “Hours and Earnings” section of the

employee paycheck. For all other entities, it would depend on the payroll system.

05/29/2024

2

5. What are the W-2 reporting requirements for imputed income? The imputed income must be

included in Boxes 1 and 16 of the employee’s Form W-2 and in Box 12 with Code C. In addition,

the value must be included in Box 3 - Social Security wages and Box 5 - Medicare wages and tips.

6. How is the amount of the employee’s taxable compensation calculated? The amount of

taxable income on coverage in excess of $50,000 is referred to as “imputed income.” The

annual imputed income calculation is figured for each employee using the following formula:

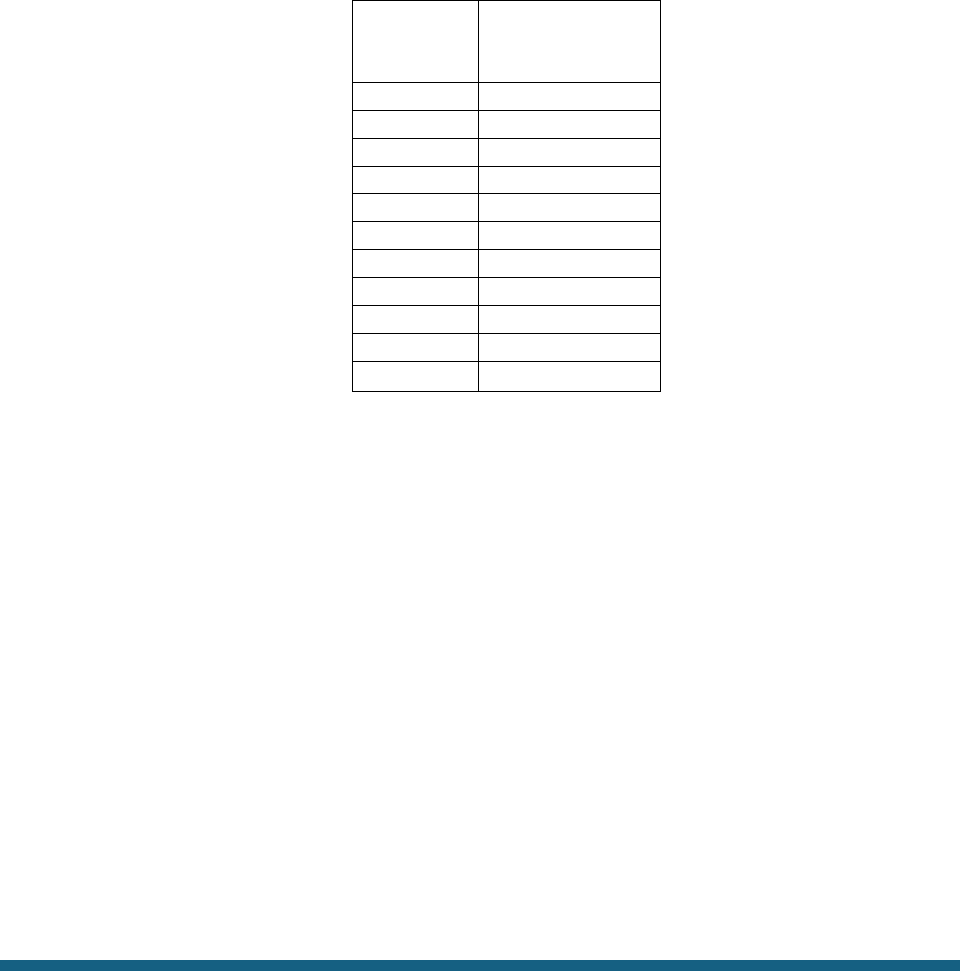

IRS Uniform Premium Cost (Table 2-2)

Age

Bracket

Cost Per $1,000

of Coverage Per

Month

Under 25

$0.05

25-29

0.06

30-34

0.08

35-39

0.09

40-44

0.10

45-49

0.15

50-54

0.23

55-59

0.43

60-64

0 66

65-69

1.27

70 & above

2.06

(Total group-term life insurance coverage - $50,000)/1,000 (rates are per thousand) x Table 2-2

rate for employee’s age x 12 months] minus employee after-tax life insurance rates for the

calendar year. Note that the cost of the coverage for the imputed income calculation is based

on the Table 2-2 rate, not the rate the employee is actually paying to the insurer. Also, use the

employee’s age on the last day of the employee’s tax year.

Example: Assume that an employee is 56 years old, earns $65,000 per year. Assume the

employee’s plan is 2x salary. The employee pays $.80 per month toward the cost of life

insurance, plus $.70 administrative fee for a total monthly rate of $1.50.

The employee’s life insurance benefit is $130,000 ($65,000 x 2) minus $50,000 = $80,000, the

amount on which the employee must pay imputed income taxes.

To calculate how much imputed income will apply to the employee, divide $80,000 by $1,000

(rates are per thousand), then multiply by .43 (from Table 2-2 costs) = $34.40 per month.

$34.40 per month/$412.80 per year is the imputed income for this employee. Since the

employee life rates are defaulted to pre-tax unless the employee elects as after-tax, there will

be no employee rates subtracted from the calculated imputed income amount of $34.40.

05/29/2024

3

SPOUSE LIFE INSURANCE

Is the spouse’s age considered in the imputed income calculation for the spouse’s life

insurance?

Yes. The taxable value of the benefit using Table 2-2 costs is based on the spouse’s birth date as

of December 31 of the tax year. The spouse rate that is used to offset the taxable benefit

amount is based on the spouse’s age in October prior to the plan year.

For examples of spouse life imputed income calculations please refer to the Examples of

Imputed Income for Spouse Life.

7. Where can I locate additional information regarding imputed income? Please access the

following link for additional information on imputed income.

https://www.irs.gov/pub/irs-pdf/p15b.pdf