Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service132

Most Serious Problems

MOST SERIOUS PROBLEM #9: AMENDED RETURNS

The IRS Processes Most Amended Returns Timely But Some

Linger for Months, Generating Over a Million Calls That the IRS

Cannot Answer and Thousands of TAS Cases Each Year

RESPONSIBLE OFFICIALS

Kenneth Corbin, Commissioner, Wage and Investment Division

Eric Hylton, Commissioner, Small Business/Self-Employed Division

TAXPAYER RIGHTS IMPACTED

1

• e Right to Be Informed

• e Right to Quality Service

• e Right to Pay No More an the Correct Amount of Tax

• e Right to Finality

• e Right to a Fair and Just Tax System

EXPLANATION OF THE PROBLEM

e IRS leads taxpayers to expect that it will process their amended returns within 16 weeks. While this is

true for most amended returns, a subset takes longer to process or hits snags that the IRS does not explain

very well. e IRS does not disclose to taxpayers that if their amended returns are selected for audit,

processing will likely take several more months and sometimes the IRS will simply stop processing them. In

these situations, the Where’s My Amended Return tool, which is not available to business taxpayers, is of

little help because it has only three statuses (received, adjusted, or completed) and does not explain where an

amended return is in the processing pipeline or estimate when processing will be complete.

In fiscal year (FY) 2019, the IRS’s failure to set clear expectations and keep taxpayers informed of the status

of their amended returns generated over 2.2 million calls, 1.4 million of which it was able to answer, and

resulted in over 9,400 TAS cases.

2

Many taxpayers file an amended return to request a refund of a tax

overpayment, but the IRS also has the statutory authority to consider a taxpayer’s request to reduce an assessed

tax that remains unpaid, i.e., a request for abatement.

3

e IRS has exercised that authority and established

procedures for processing amended returns requesting an abatement.

4

However, it sometimes refuses to

consider the claim and issues a form letter without an adequate explanation to the taxpayer. e form letter

1

See

www.TaxpayerAdvocate.irs.gov/taxpayer-rights. The rights contained in the TBOR are also

codified in the IRC.

See

Most Serious Problem #9: Amended Returns

133

Most Serious Problems

simply states the law does not allow a claim to reduce tax owed and instructs the taxpayer to pay the tax

followed by another amended return.

ANALYSIS

An amended return is not defined in the IRC, and taxpayers are not required to file an amended return.

5

e

Supreme Court has held an amended return is a creature of administrative origin and grace.

6

In practice,

taxpayers regularly file amended returns to correct an error on a previously filed return, and the IRS has

adopted specific procedures for handling amended returns.

7

Most individual taxpayers receive a refund after

they file an amended return. e IRS’s announced timeframe for processing individuals’ amended returns is

16 weeks.

8

e IRS advises that it often takes three to four months to process corporations’ amended returns.

9

Taxpayers who file amended income tax returns include:

• Individuals filing Form 1040X, Amended U.S. Individual Income Tax Return;

10

• Corporations filing Form 1120X, Amended U.S. Corporation Income Tax Return, or other Form

1120-series amended returns such as Form 1120-S, U.S. Income Tax Return for an S Corporation, and

checking a box on the form to indicate that the return is an amended return;

• Partnerships filing Form 1065X, Amended Return or Administrative Adjustment Request (AAR), or

Form 1065, U.S. Return of Partnership Income, and checking a box on the form to indicate that the

return is an amended return; and

• Estates and trusts filing Form 1041, U.S. Income Tax Return for Estates and Trusts, and checking a box

on the form to indicate that the return is an amended return.

In distinguishing between a request for abatement (i.e., a request for a “decrease in the tax that was assessed”)

and a request for refund (i.e., “a request for the return of a paid assessment”), the IRS notes that “[a]lthough

IRC Section 6404(b) provides that taxpayers have no right to file a claim for abatement of income, estate, or

gift tax, the Service will consider a taxpayer’s request for an abatement of such taxes where the taxpayer files an

amended return with the IRS that shows a decrease in the tax that was assessed.”

11

Various codes on IRS computer systems show the receipt of an amended return and its movement through

different IRS functions as it is processed.

12

e codes do not show the correction the taxpayer sought on the

6

See

e.g

is filed electronically or not).

10

11

See

12

Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service134

Most Serious Problems

amended return, but they do show what adjustment was made to a taxpayer’s account after an amended return

was filed. e outcomes can be grouped into the following four categories:

• Category 1: e IRS agreed the taxpayer made an overpayment of tax and issued a refund to the taxpayer

(or offset the overpayment to the taxpayer’s tax liability for a different year);

• Category 2: e IRS abated some or all the tax, i.e., the IRS adjusted its records to show the taxpayer

owed less tax than the amount shown on the original return;

• Category 3: e IRS adjusted its records to show the taxpayer owed more tax than the amount shown on

the original return; or

• Category 4: e IRS did not make any change to its records to reflect information shown on the

amended return. is category includes cases in which the IRS rejected or declined to consider the

change proposed on the amended return, and where the IRS disallowed refunds requested on an

amended return.

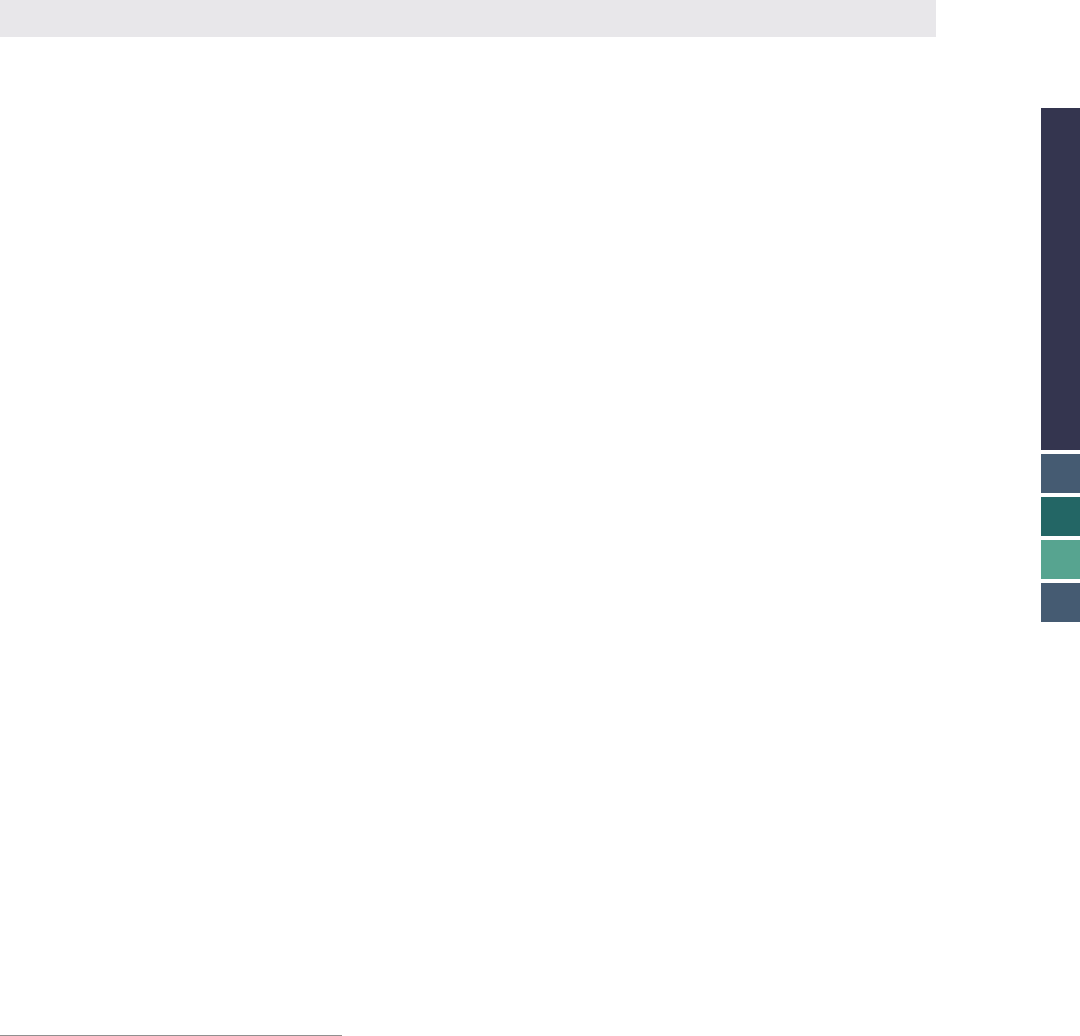

Figure 1.9.1 shows an estimate of the number of amended returns the IRS processed in FYs 2017-2019 by the

type of filer and the ensuing adjustment to the taxpayer’s account, according to the categories described above.

FIGURE 1.9.1, Estimated Number of Amended Returns Processed, FYs 2017-2019, by

Type of Form and Category of Outcome

13

Fiscal Year Form

Category 1

Refund

Category 2

Decrease in Tax

Category 3

Increase in Tax

Category 4

No Change

Total

FY 2017

Form 1040X 1,739,302 91,591 694,823 590,039 3,115,755

Form 1120X 18,352 1,637 3,836 161,470 185,295

Form 1065X 905 0 0 81,130 82,035

Form 1041 12,016 1,091 4,869 26,230 44,206

FY 2018

Form 1040X 1,889,628 98,922 712,322 678,877 3,379,749

Form 1120X 17,256 1,550 3,564 162,482 184,852

Form 1065X 566 0 0 82,889 83,455

Form 1041 11,281 1,056 4,368 28,210 44,915

FY 2019

Form 1040X 1,570,199 98,010 652,698 633,701 2,954,608

Form 1120X 15,291 1,426 3,464 170,366 190,547

Form 1065X 427 0 0 92,171 92,598

Form 1041 10,887 1,028 4,297 42,119 58,331

13

Most Serious Problem #9: Amended Returns

Most Serious Problems

As the “Total” column in Figure 1.9.1 shows, individual taxpayers file the most amended returns; corporations

file the next largest number of amended returns.

14

In terms of outcome, most individual taxpayers belong

to Category 1 (i.e., the taxpayer was issued a refund, or the overpayment was offset to a different year’s tax

liability). Most business taxpayers belong to Category 4 (i.e., no change). e Category 4 “no change”

outcome is the second most likely outcome for individual taxpayers. us, this discussion focuses on the two

largest groups of taxpayers — individuals and corporations — and Categories 1 and 4 outcomes.

15

Estimated median processing time of amended returns varied depending on whether the IRS examined, or

audited, the amended return, as discussed below.

Examinations Add Months to Median Processing Time

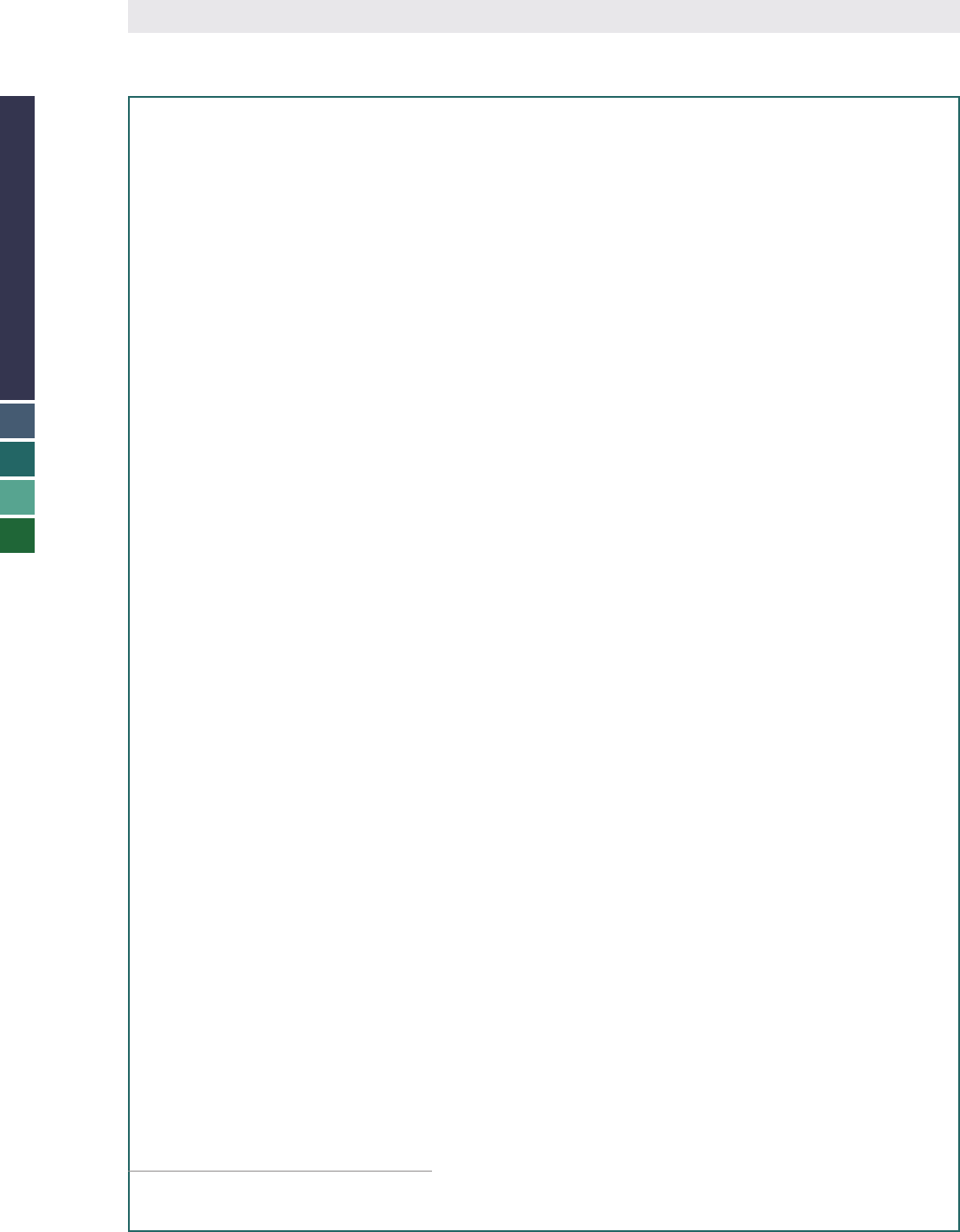

As Figure 1.9.2 shows, the estimated overall median processing time for individual amended returns

that resulted in a refund was never more than four weeks overall when the return was not audited.

(Estimated median processing time for these amended returns doubled from two weeks to four weeks from

FYs 2017-2019 but was well within the announced 16-week timeframe.) In FY 2017, estimated median

processing time for these audited returns stretched up to 35 weeks; by FY 2019, it had decreased to 20 weeks,

a significant improvement compared to FY 2017, but still 25 percent longer than taxpayers were told to

expect.

16

FIGURE 1.9.2

17

Estimated Median Process Time in Weeks of Individual Amended Returns

That Resulted in a Refund, by Whether the Return Was Audited, FYs 2017-2019

2017 2018

2019

2

1040X

Not Audited

1040X

Audited

4

20

32

2

35

14

16

i.e

17

Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service136

Most Serious Problems

For many individual taxpayers and most business taxpayers, amended returns result in no change to their

tax liability. Figure 1.9.3 shows the estimated median processing times for these amended returns filed

by individuals and by corporations according to whether the return was audited. While individuals’

unaudited returns in this category were processed in two to four weeks, estimated median processing time for

corporations’ unaudited amended returns increased from eight to 17 weeks in FYs 2017-2019.

For audited individual and corporate amended returns that resulted in no change, estimated median

processing time in FY 2017 was 32 weeks for individuals and 47 weeks for corporations. By FY 2019, these

estimated median processing times were 29 weeks for individuals and 37 weeks for corporations.

18

FIGURE 1.9.3

19

Estimated Median Processing Time in Weeks of Individual and Corporate Amended Returns

That Resulted in No Change, by Whether the Return Was Audited, FYs 2017-2019

2017 2018

2019

8

Form 1120X

Not Audited

Form 1120X

Audited

Form 1040X

Not Audited

Form 1040X

Audited

2

32

47

9

46

2

31

17

37

4

29

Whether a taxpayer files an amended return on paper or electronically, the IRS processes it manually.

20

In

terms of outcomes, most taxpayers belong to Category 1 or Category 4 (i.e., the taxpayer either received a

refund or no change resulted from the amended return). e processing steps generally followed by audited

amended returns filed by individuals and corporations with estimated processing timeframes for Category 1

and Category 4 cases in FYs 2017-2019 are summarized in Figure 1.9.4.

21

18

i.e

20

e.g

21

Most Serious Problem #9: Amended Returns

137

Most Serious Problems

FIGURE 1.9.4, Processing Steps for Audited Amended Returns, FYs 2017-2019

22

22

1. Amended Returns Routed to Accounts Management

The IRS Submission Processing (SP) function receives individual taxpayers’ amended returns. SP either (1) evaluates the

requested adjustment and makes (or declines to make) the requested changes or (2) routes the amended return to the

AM function, a process that took an estimated two to four weeks.

1

Corporations’ amended returns are routed directly to AM

for processing (SP records the receipt of amended returns but does not process them further).

2

2. Amended Returns Selected for Audit

AM evaluates some amended returns but is required to refer some amended returns, known as

CAT-A returns, to the Examination function (Exam).

3

Exam then selects some of these amended

returns for examination. This process, which applied to about three percent of the individual

amended returns and about 1.3 percent of corporations’ amended returns AM received in Step 1,

took an estimated median of five to six weeks for individual amended returns and less than a

week for corporate amended returns.

3. Amended Return Assigned to Auditor and Audit Opened

Some amended returns selected for audit are assigned to an examiner (who contacts the

taxpayer), and an audit is opened. This step, which applied to between 27 percent and 56 percent

of individual amended returns and between 8.5 and 44 percent for corporations’ amended returns

selected for audit in Step 2, took an estimated median of three to nine weeks for individual amended

returns, and 14 to 16 weeks for corporate amended returns.

4. Amended Return Audit Closed

The examiner concludes the audit and closes the case, which took an

estimated median of 17 to 20 weeks for individual amended returns, and

35 to 41 weeks for corporate amended returns.

4

Thus, the median exam

time alone took just as long or longer than all the preceding steps 1-3.

1 The applicable IRM during FYs 2017-2019 provided for a timeframe of 12 calendar days (20 days during the March-June peak filing

season) to route amended returns from SP to AM. See, e.g., IRM 3.11.6.2(8), General Form 1040-X Information (Nov. 21, 2019). The

decision to route the individual’s amended return to AM is “based on the issue, the dollar tolerance, computer program capabilities

(e.g., Blocking Series), and other various reasons.” IRM 3.11.6.4.15 (1), Accounts Management Cases (Jan. 2, 2019). This processing

step is automated for electronically filed Forms 1040X, which is expected to reduce delays. IRS response to fact check

(Nov. 24, 2020). Due to the COVID-19 pandemic, as of September 26, 2020, there were over a million Forms 1040X in SP inventory,

of which about 974,000 were more than 21 days old. IRS, JOC, Customer Account Services Form 1040X Consolidated Inventory

Report, Submission Processing (Sept. 26, 2020).

2

IRM 21.7.4.4.4.11.13, Form 1120-X, Amended U.S. Corporation Income Tax Return (Oct. 1, 2020). As of Sept. 26, 2020, there were more

than 230,000 Forms 1120X in AM inventory, of which about 89,000 were more than 120 days old. IRS, JOC, AMIR National Inventory

Age Report (Sept. 26, 2020). The 120 days begins on the date the IRS received the amended return, as recorded by SP; thus, the

delays in SP processing described above overflowed into AM.

3 IRM 21.5.3-2, Examination Criteria (CAT-A) – General (Aug. 7, 2020). CAT-A criteria were established based on past examinations that

identified characteristics indicating a high degree of noncompliance.

4 The maximum time it took to close a case in FYs 2017-2019 was 99 weeks for an individual amended return case and 101 weeks for a

corporate amended return case, i.e., once opened, these audits alone took almost two years to conclude.

Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service138

Most Serious Problems

DELAYED REFUNDS CAUSE THE GOVERNMENT TO INCUR INTEREST CHARGES

e government is required to pay interest on the overpayments taxpayers claim, and the interest generally

begins to accrue 45 days after the taxpayer requests a refund from the IRS.

23

us, delays in processing

amended returns on which taxpayers seek refunds contribute to overpayment interest.

24

Millions of Taxpayers Call the IRS Seeking Information About Their Amended Returns

Since 2013, the IRS has provided a “Where’s My Amended Return” tool.

25

e tool is accessible online at

IRS.gov or by calling a toll-free number for an automated phone system, referred to as the amended return

hotline. e tool allows taxpayers to ascertain whether the IRS received their amended return, whether the

IRS made any adjustment to their accounts, and whether processing of the amended return is complete.

However, beyond these three statuses (received, adjusted, or completed), the tool does not explain where an

amended return is in the processing pipeline or estimate when processing will be complete.

26

Moreover, the

application is not available for business taxpayers or for taxpayers who file an amended return with a foreign

address, among others.

27

In FY 2019, taxpayers accessed the tool online through IRS.gov more than five

million times and called the amended return hotline more than 2.2 million times; 1.4 million of these calls

were answered.

28

Taxpayers Seek Assistance From TAS in Resolving Amended Return Issues

In each of FYs 2017-2019, the fourth most common reason taxpayers came to TAS was for assistance in

resolving problems caused by amended return processing.

29

Past analysis of TAS cases with this issue showed

that the underlying factor in these cases is that the processing period greatly exceeded the IRS’s announced

23 IRC §

24

See

intervening years.

26

27

e.g

28

to taxpayers.

Code

Most Serious Problem #9: Amended Returns

Most Serious Problems

timeframe.

30

As discussed above, processing time is considerably lengthened when taxpayers’ amended returns

are audited. A review of TAS cases that were closed in FY 2019, discussed below, suggests that taxpayers

encounter an additional difficulty: the IRS may refuse to consider their amended returns on which they

request an abatement of tax.

In Letter 916C, the IRS Declines to Consider Amended Returns Requesting Abatement

of Tax

e IRS has the statutory authority to abate income taxes; it has exercised that authority and has adopted

procedures for processing amended returns that request abatement.

31

As Figure 1.9.1 shows, the IRS abated

taxes in about 100,000 cases each year in FYs 2017-2019 (Category 2 cases). Yet, in some situations the IRS

refuses to consider these claims.

For some amended returns requesting an abatement of tax the IRS sends the taxpayer Letter 916C, Claim

Incomplete for Processing; No Consideration.

32

Letter 916C is a blank template, with the IRS employee

developing the content of the letter by selecting among pre-written paragraphs including Paragraph M.

33

Paragraph M of Letter 916C says:

e law allows you to file a claim for a refund of taxes you have paid. However, the law doesn’t

allow you to file a claim to reduce the tax you owe. If you disagree with the amount of tax you

owe, you can appeal our decision. To appeal our decision, you must:

• Pay the tax you owe.

• File an amended return with documentation that supports a reduction in the tax you owe.

• File your claim for refund within 3 years from the date you filed your return or 2 years from the

date you paid your tax, whichever is later.

34

e reference to the option to “appeal our decision” in paragraph M does not refer to the right to an

administrative appeal, which is not available in tax abatement cases, but rather to the right to pay the assessed

tax, request a refund from the IRS (which may include an administrative appeal), and if unsuccessful, bring a

refund suit in a U.S. district court or the U.S. Court of Federal Claims.

35

While taxpayers are required to pay

the assessed tax before they may bring a refund suit in federal court, there is no requirement that they pay an

assessed tax before they seek abatement of some or all of the tax from the IRS.

36

30

31

See also

32 Letter must advise the taxpayer why the claim is not

being considered

33

34

36

Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service140

Most Serious Problems

e IRS justifies including Paragraph M in Letter 916C when requests for abatement do not contain adequate

explanation or documentation by affirming that:

is procedure was established to provide a courtesy to the taxpayers, to allow AM CSR’s

[Customer Service Representatives] to consider a claim, even though the taxpayer may not

have paid the tax they owe. Instead of outright denying the claim, AM CSR’s will review the

claim in full and determine if it is fully processable and contains all the necessary supporting

documentation.

37

e IRS also notes: “[t]hat is why in IRM 21.5.3.4.6(3), we advise our CSR’s not to deny claims based solely

on the nonpayment of tax, rather to consider the claims if they contain all of the necessary documentation.”

It appears the IRS considers requests for tax abatement, but only if the request is submitted with adequate

explanation and documentation. When the request is incomplete, rather than asking taxpayers to provide the

missing information, taxpayers are told that “the law doesn’t allow you to file a claim to reduce the tax you

owe.”

38

is practice is unacceptable. e IRS should contact the taxpayer and provide a reasonable period of

time to submit documentation in support of the request for abatement.

Each Year, TAS’s Inventory Includes Abatement Requests the IRS Did Not Consider

In FY 2019, TAS closed 9,602 cases in which the primary issue was IRS delays in processing amended

returns.

39

Of these, there were 240 “no consideration” cases in which the taxpayer, after filing an amended

income tax return, was issued Letter 916C that was viewable on IRS databases.

40

Even though these cases

comprise a small portion (three percent) of TAS cases involving delays in processing amended returns, they

demonstrate inconsistencies in the IRS’s treatment of amended returns.

Of the 240 cases, in 52 cases the taxpayer sought an abatement of tax rather than a refund. In 22 of these

52 cases (42 percent), Letter 916C informed the taxpayer that the law does not allow claims for abatements.

Either Paragraph M was selected (18 cases) or a fill-in paragraph contained the same information (four

cases).

41

In all 22 cases except one, this was the only reason given for not considering the claim (i.e., in only

one case was the taxpayer advised that the supporting information was not complete).

CONCLUSION AND RECOMMENDATIONS

Most amended returns filed by individuals result in a refund, and the IRS usually processes these amended

returns within its announced timeframe of 16 weeks, although auditing these returns increased processing

time to a median of 20 weeks in FY 2019. Amended returns filed by individuals and corporations often do

37

38

40

41

Most Serious Problem #9: Amended Returns

141

Most Serious Problems

not result in any change in liability. When they are not audited, these amended returns are usually processed

timely (within a median time of four weeks for individuals and 17 weeks for corporations in FY 2019). When

these amended returns are audited, processing times increase significantly, reaching an estimated median

of 29 weeks for individuals and 37 weeks for corporations in FY 2019; these taxpayers wait seven or eight

months to learn, e.g., that their claimed refund or request for tax abatement was denied. e main driver of

increased processing times for audited amended returns is the time it takes to conduct the audit.

e IRS has the authority to abate income taxes. It has exercised that authority and adopted procedures for

considering requests for tax abatement submitted on an amended return. About 100,000 amended returns

result in tax abatement each year. However, a review of TAS cases shows that when the IRS refuses to consider

requests for tax abatement, it frequently cites as the reason for its refusal that the law doesn’t allow taxpayers

to file a claim to reduce the tax they owe. at response is misleading and undermines taxpayers’ rights to be

informed and to pay no more than the correct amount of tax.

Preliminary Administrative Recommendations to the IRS

e National Taxpayer Advocate preliminarily recommends that the IRS:

1. Change its procedures by:

a. Revising the IRM to provide that if a request for tax abatement is incomplete, the employee

should solicit the necessary documentation from the taxpayer, and if the documentation is not

forthcoming or is insufficient, the employee should deny the request, explain the reason for the

denial, and explain the different procedures that apply to requests for tax abatement and requests

for refund;

b. If the IRS determines the taxpayer is not entitled to an abatement, issuing a 30-day letter

providing taxpayers the right to file a protest with the Independent Office of Appeals

42

for

abatement of tax and updating and clarifying the IRM’s No Immediate Tax Consequence

provisions by referencing abatement cases;

c. Removing any selectable paragraph in Letter 916C that states the law does not allow taxpayers

to file a claim to reduce the tax they owe or appears to advise taxpayers that they cannot seek an

abatement of tax without first paying the amount of tax already assessed (Paragraph N in the

current version of Letter 916C); and

d. Revising the IRM to instruct employees not to use a fill-in paragraph in Letter 916C to state the

law does not allow taxpayers to file a claim to reduce the tax they owe or to inform taxpayers they

cannot seek an abatement of tax without first paying the amount of tax already assessed.

2. Identify and address the cause of lengthy examination times for amended returns.

3. Identify and address the cause of the increase in processing time for corporations’ unaudited amended

returns.

4. Add additional status updates to the “Where’s My Amended Return” tool to allow taxpayers to see

when the IRS selects their amended return for audit, when it assigns the audit to an examiner, and

what an estimated completed processing time is based on the return’s current status.

42

See

Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service142

Most Serious Problems

IRS COMMENTS

e IRS is committed to processing amended returns accurately and efficiently. On August 17, 2020,

the IRS began receiving electronic Forms 1040X, Amended U.S. Individual Income Tax Return,

which has been an important goal for the IRS and our industry partners for many years. Electronically

filing a Form 1040X will reduce errors and decrease processing time. As of November 21, 2020, over

144,000 electronically filed amended returns have been accepted from 18 industry partners. Future

upgrades will allow taxpayers to file an electronic amended return for the current and two prior years.

And, although the IRS has been converting more complex paper amended returns into electronic

Correspondence Imaging System (CIS) cases for years, we initiated a pilot process in October 2020 to

convert less complex paper amended returns to CIS cases. If the pilot is successful streamlining our

ability to work and resolve these cases, we plan to implement the process Servicewide.

We are making progress in reducing the Business Masterfile (BMF) amended return inventory that

has increased due to the lapse in appropriations in 2019 and office closures due to COVID-19 in

2020. As of November 2020, the current BMF inventory is about 670,000 cases, down 20 percent

from a peak of 840,000 cases one year prior. We anticipate BMF amended return processing will

increase once new employees are trained and are focused on this inventory.

Our efforts to ensure compliance with the tax laws extend to amended returns. Before determining

whether to survey or examine an assigned claim for refund, examiners thoroughly review the return to

identify large, unusual, or questionable items per IRM 4.10.2.3, In-Depth Pre-Contact Analysis, and

evaluate the audit potential of the entire return, and possibly, for related returns for the same or other

tax years. e examination is not limited to the issues raised in the claim for refund if there are other

issues that warrant further consideration (IRM 4.10.11.2.4 and 4.10.11.3.3). erefore, the effort

and time required to examine an amended return can rise to the same level as in other examinations,

although current data shows the cycle time for examinations on amended returns is lower than other

examinations both in Field and Campus operations (269 days in fiscal year 2020 compared to 319

days for all examinations). e length of any audit is based on the unique facts and circumstances

of each case, the timeliness of taxpayer responses to IRS letters, and may be affected by the need

to balance competing priorities or extenuating circumstances such as disasters. To help expedite

examinations, campuses began forwarding claims and assigning cases to the field electronically in

July 2020.

We are always seeking to improve how we communicate with taxpayers and will consider how the

“Where’s My Amended Return” tool could be improved in this regard, taking into account cost and

competing IT priorities. We will also review and consider other recommendations provided by the

National Taxpayer Advocate.

Some amended returns include requests for abatement of tax owed, before the tax is paid. Currently,

we consider these requests where sufficient documentation is provided. We do so as a courtesy to

taxpayers, to allow the Service to consider a claim even though the taxpayer has not paid the assessed

Most Serious Problem #9: Amended Returns

143

Most Serious Problems

tax that is due. We are working with the IRS Office of Chief Counsel to determine how best to

address the concerns raised by the Advocate with our procedures in addressing requests for abatement

that are incomplete.

TAXPAYER ADVOCATE SERVICE COMMENTS

TAS understands that there are good reasons why amended returns may take almost as much time to

audit as other returns. TAS looks forward to the improved processing times expected to result from

electronic filing, electronic assignment of some cases that are assigned for exam, and scanning some

paper returns so they are accessible in the CIS database. In any event, taxpayers should be given

more realistic estimates of what the expected processing time will be; the IRM should be adjusted if

the current 16 week expected processing time is no longer accurate, and the Where’s My Amended

Return tool should be improved accordingly. e Form 1120X instructions should likewise be

adjusted if the referenced processing time of three to four weeks is not accurate.

However, the IRS’s explanation for lengthy processing times for amended returns filed by businesses

is not supported by the data in this report, which is based on operations for FYs 2017-2019. ere

was indeed a government shutdown due to a lapse of appropriations in FY 2019, as the IRS notes,

but amended return processing times improved in FY 2019 compared to FYs 2017 and 2018. e

COVID-19 pandemic affected IRS operations, but not until FY 2020.

e National Taxpayer Advocate appreciates the IRS’s willingness to work with the IRS Office of

Chief Counsel to better address requests for abatement. As with any other taxpayer request, the IRS

should advise taxpayers when they need to submit additional information in order for their request

to be considered. e blanket statement currently in use (that the law doesn’t allow taxpayers to file

a claim to reduce the tax owed) without further explanation is not appropriate and often confusing

for taxpayers. Providing the taxpayer an administrative review or initiating a specific request for

documentation prior to rejection should be standard procedures. e IRS should also consider

permitting these taxpayers to appeal their cases to the Independent Office of Appeals rather than

having to pay the tax the taxpayer believes is not due, then file another claim of refund, or bring a

refund suit in order for the IRS to review their documentation. Taxpayers have the right to pay no

more than the correct amount of tax, and the IRS should assist them with that determination.

Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service144

Most Serious Problems

RECOMMENDATIONS

Administrative Recommendations to the IRS

e National Taxpayer Advocate recommends that the IRS:

1. Revise the IRM to provide that if a request for tax abatement is incomplete, the employee

should solicit the necessary documentation from the taxpayer, and if the documentation is not

forthcoming or is insufficient, the employee should deny the request, explain the reason for

the denial, and explain the different procedures that apply to requests for tax abatement and

requests for refund.

2. If the IRS determines the taxpayer is not entitled to an abatement, issue a 30-day letter

providing taxpayers the right to file a protest with the Independent Office of Appeals

43

for

abatement of tax and updating and clarifying the IRM’s No Immediate Tax Consequence

provisions by referencing abatement cases.

3. Remove any selectable paragraph in Letter 916C that states the law does not allow taxpayers

to file a claim to reduce the tax they owe or appears to advise taxpayers that they cannot seek

an abatement of tax without first paying the amount of tax already assessed (Paragraph N in

the current version of Letter 916C).

4. Revise the IRM to instruct employees not to use a fill-in paragraph in Letter 916C to state the

law does not allow taxpayers to file a claim to reduce the tax they owe or to inform taxpayers

they cannot seek an abatement of tax without first paying the amount of tax already assessed.

5. Identify and address the cause of lengthy examination times for amended returns.

6. Identify and address the cause of the increase in processing time for corporations’ unaudited

amended returns.

7. Add additional status updates to the “Where’s My Amended Return” tool to allow taxpayers

to see when the IRS selects their amended return for audit, when it assigns the audit to an

examiner, and what an estimated completed processing time is based on the return’s current

status.

8. Revise the IRM and Form 1120X instructions to more accurately reflect the expected

processing time for amended returns.

43

See

Most Serious Problem #9: Amended Returns

Most Serious Problems

Appendix A

METHODOLOGY

Traditional amended return data found on IRS databases includes items such as IRS received dates,

transaction codes, action codes, and transaction dates. For example, we identified individual amended returns

by searching taxpayer accounts for a transaction code of 971 and an action code of 120. e data in this

report was gathered according to the following methodology:

1. Only one amended return per taxpayer per fiscal year was taken into account. If a taxpayer filed more

than one amended return in the same fiscal year, whether or not it was with respect to the same tax

year, only the earliest amended return was included, and processing times were computed with respect

to that amended return. If a taxpayer filed more than one amended return with respect to the same

tax year, the amended returns were all included in the analysis to the extent they were filed in different

fiscal years.

2. Also not included in the analysis are individual amended returns that were filed after an audit was

opened and amended returns that were filed with a function other than Submission Processing (e.g.,

IRS Appeals, IRS Exam, Automated Underreporter Unit).

3. e analysis of individual amended returns is limited to individual amended returns filed on Form

1040X, although the IRS also processes as amended returns some filings taxpayers submit on another

IRS form, such as Form 1040, U.S. Individual Income Tax Return, that indicate the filing is intended

to be an amended return.

4. Other Business Master File returns not included in Figure 1.9.1 include, e.g., employment tax, estate

tax, gift tax, excise tax, and tax-exempt organization returns.

Processing Times of Audited Amended Returns in Categories 1 or 4

Step 1: SP routes amended returns to AM: In FYs 2017-2019, SP received 2,152,508; 2,383,472; and

1,998,609 Category 1 and 4 Forms 1040X, respectively. SP routed 909,464 (42 percent); 929,902 (39

percent); and 791,716 (40 percent) of these returns to AM in FYs 2017-2019, respectively.

44

is step took

an estimated median of two weeks, three weeks, and four weeks in FYs 2017-2019, respectively. In addition,

SP routed 183,817; 184,605; and 194,508 Forms 1120X in Categories 1 and 4 to AM in FYs 2017-2019,

respectively.

Step 2: AM refers CAT-A returns to Exam, and Exam selects some of them for audit: is process, which

affected a small portion of amended returns, took an estimated median of five to six weeks for individual

amended returns, and less than a week for corporate amended returns, as shown in Figure 1.9.A1.

44

total

(

i.e

Most Serious Problem #9: Amended Returns

Taxpayer Advocate Service146

Most Serious Problems

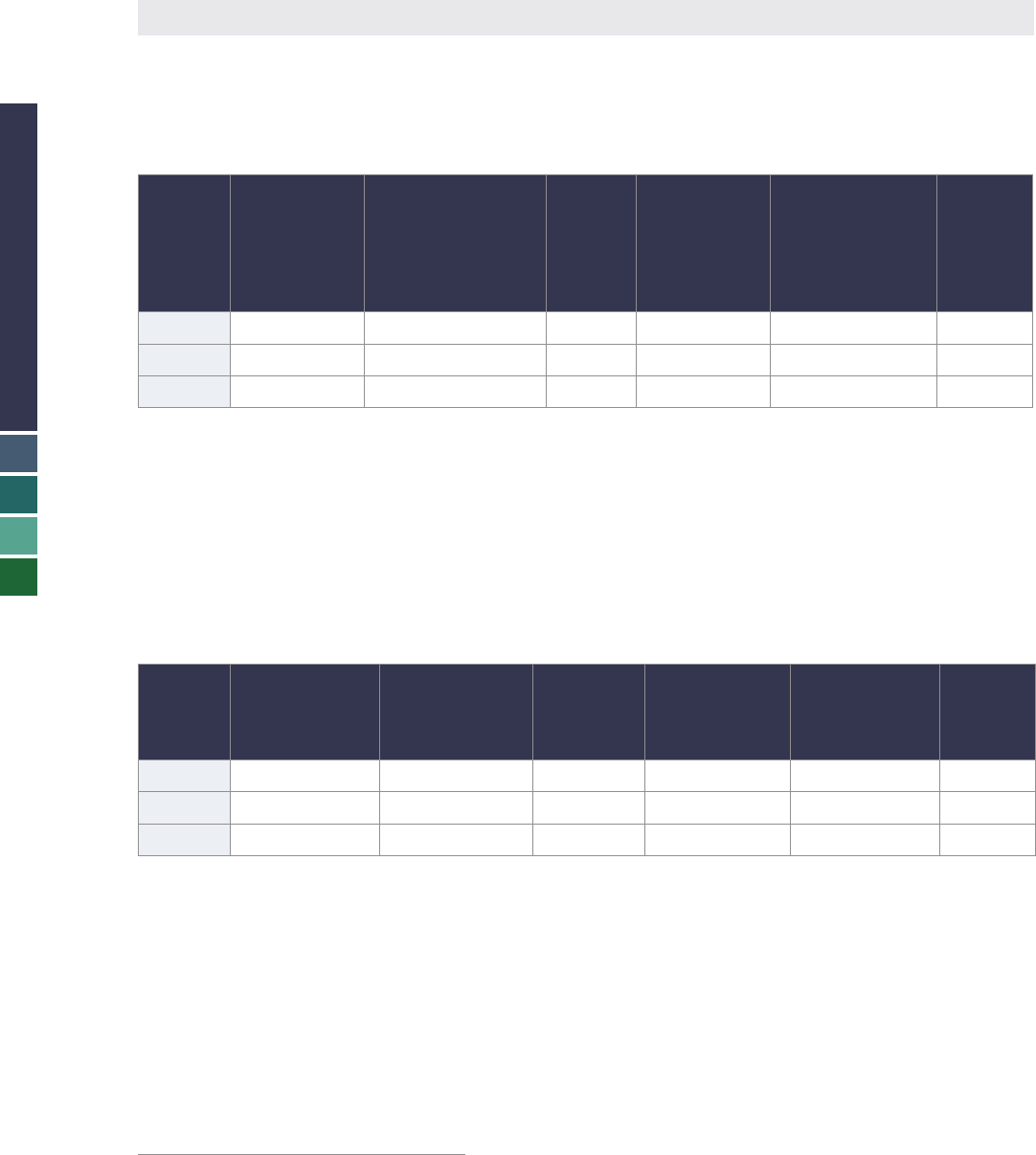

FIGURE 1.9.A1, Estimated Number of Amended Returns in Categories 1 and 4 Referred

From AM to Exam and Selected for Audit, and Processing Time

45

Fiscal

Year

1040X

Returns

Referred to

Exam by AM

and Selected

for Audit

1040X Returns

Transferred From

SP to AM That

Were Referred

to Exam and

Selected for Audit

Median

Number

of

Weeks

1120X

Returns

Referred to

Exam by AM

and Selected

for Audit

1120X Returns

Received by

AM That Were

Referred to Exam

and Selected for

Audit

Median

Number

of

Weeks

FY 2017

30,405 3.3% 6 2,410 1.3% 0

FY 2018

26,571 2.9% 5 2,218 1.2% 0

FY 2019

24,007 3.0% 6 2,488 1.3% 0

Step 3: Some amended returns that were selected for audit are assigned to an examiner, who contacts the

taxpayer and opens an audit: is process, which affected only a portion of the amended returns that were

selected for audit, took an estimated three to eight weeks for individual amended returns and 14 to 16 weeks

for corporate amended returns, as shown in Figure 1.9.A2.

46

FIGURE 1.9.A2, Estimated Number of Amended Returns in Categories 1 and 4 Selected

for Audit That Were Assigned and an Audit Opened, and Processing Times

47

Fiscal

Year

1040X Returns

for Which an

Audit Was

Opened

1040X Returns

Selected for

Audit That

Were Audited

Median

Number of

Weeks

1120X Returns

for Which an

Audit Was

Opened

1120X Returns

Selected for

Audit That

Were Audited

Median

Number

of

Weeks

FY 2017

16,910 56% 4 1,059 44% 16

FY 2018

12,735 48% 9 583 26% 16

FY 2019

6,440 27% 3 211 8.5% 14

Step 4: e examiner concludes the audit and closes the case: is process took an estimated median of 16

to 21 weeks for individual amended returns, and 30 to 40 weeks for corporate amended returns, as shown in

Figure 1.9.A3.

46

47

Most Serious Problem #9: Amended Returns

147

Most Serious Problems

FIGURE 1.9.A3, Estimated Number of Amended Returns in Categories 1 and 4 for Which

an Open Audit Was Concluded, and Processing Times

48

Fiscal

Year

1040X Returns for

Which an Audit Was

Begun and Completed

Median Number of

Weeks

1120X Returns for

Which an Audit Was

Begun and Completed

Median Number of

Weeks

FY 2017

16,760 21 973 41

FY 2018

12,606 18 541 39

FY 2019

6,328 16 200 35

48