EpidemiologySFI.tex

The Epidemiology of Macroeconomic Expectations

Christo pher D. Carroll

†

ccarroll@jhu.edu

April 15, 2003

Abstract

Macroeconomists have long emphasized the importance of expectations in deter-

mining macroeconomic outcomes, and an enormous theoretical literature has devel-

oped examining many models of exp ectations formation. This paper proposes a new

approach, based on epidemiological models, in which o nly a small set of agents (pro-

fessional forecasters) formulate their own expectations, which then spread through

the population via the news media in a manner analogous to the spread of a disease.

The paper shows that the very simplest epidemiological model, called the ‘common

source’ model, does a good job of explaining the dynamics of inflation and un-

employment expectations, and more complicated epidemiological models produce

dynamics similar to those that emerge from the common source model.

Keywords: inflation, expectations, unemployment, monetary policy, agent-based

modeling

JEL Classification Codes: D84, E31

This paper was written in connection with the conference “The Economy As an

Evolving Complex System III” at the Santa Fe Institute in November of 2001, in

honor of Kenneth Arrow’s contributions to the Santa Fe Institute and to economics.

A companion paper, “Macroeconomic Expectations of Households a nd Professional

For ecasters,” presents empirical work that was part of an earlier draft of this paper;

that paper was published in the Quarterly Journal of Economics, Vol. 118, Number

1 (February 2003) , pp. 269–298.

I am grateful to Jason Harburger, Jennifer Manning, Jirka Slacalek, and Johanna Francis

for excellent research assistance, to Robert Axtell, William Branch, Carl Christ, William

Dickens, Michael Dotsey, Joshua Epstein, Marvin Goo dfriend, Daniel Leigh, Bennett

McCallum, Yash Mehra, Serena Ng, Athanasios Orphanides, Adam Posen, John Roberts,

Martin Sommer, and Alexander Wolman for valuable feedback, and to Richard Kwok

for guidance to the r elevant epidemiology literature. Thanks also to seminar audiences

at Johns Hopkins University, Harvard University, the Center on Social and Economic

Dynamics at the Brookings Institution, the Federal Reserve Bank of Richmond , New

York University, and the University of Cyprus for valuable feedback.

The data, econometric programs, and simulation programs that gener-

ated all of the results in this paper are available on the author’s website,

http://www.econ.jhu.edu/people/carroll.

†

Department of Economics, Johns Hopkins University, Baltimore MD 21218-2685.

ff

1 Introduction

Economists have long understood that macroeconomic outcomes depend critically

upon agents’ expectations. Keynes (1936) believed that economies could experience

booms and busts that reflected movements in ‘animal spirits’ ( a view that has some

appeal a t the current moment of dot-com hangover), but the basis for most of

today’s macro models is the ratio nal expectations approach pioneered in the 1970s

by Lucas, Sargent, Barro, and others. This approach makes a set of assumptions

that are much stronger than rationality alone. In particular, the fra mework assumes

that all agents in the economy are not merely rational, but also share identical

(correct) beliefs about the structure of the economy, and have instantaneous and

costless access to all the latest economic data. Each agent combines these data

with the true macroeconomic model to obtain a forecast for the future path of

the economy, o n the a ssumption that all other agents have identical beliefs and

information (and therefore forecasts).

This set of assumptions has turned out to be a powerful vehicle for macroeco-

nomic modeling, but has never been free from the criticism that it does not resemble

the real world of conflicting opinions and forecasts, workers (and even some business

leaders) who may not pay much attention to macroeconomic matters, and informa-

tion that can sometimes be costly to obtain and process. Rational expectations

models also have problems explaining some robust stylized facts, such as the ap-

parent inexorability of the tradeo between inflation and unemployment rate (see

Ball (19 94)) or Mankiw (2001)). Partly in r esponse to these problems, an emerging

literature has been exploring models based on an assumption that agents engage in

some form of data-based learning process to form their expectations; for surveys,

see Sargent (1993) or Evans and Honkapohja (2001). But the rational expectations

framework remains the dominant approach, partly because it tends to be mathe-

matically more tractable than many proposed alternatives.

This paper proposes a tractable alternative framework for the formation of a

typical person’s expectations. Rather than having their own macroeconomic mo del

and constantly feeding it the la test statistics, typical people are assumed to obtain

their views about the future path of the economy fro m the news media, directly or

indirectly. Furthermore (and importantly), not every person pays close attention

to all macroeconomic news; instead, people are assumed to absorb the economic

content of news reports probabilistically, in a way that resembles the spread of

disease in a population, so that it may take quite some time for news of changed

macroeconomic circumstances to penetrate to all agents in the economy.

Roberts (1998) and Mankiw and Reis (2001, 2002) have recently proposed ag-

gregate expectations equations that are mathematically very similar to aggregate

implications of the baseline epidemiological model of expectations proposed derived

here. Roberts’s work was motivated by his separate findings in Roberts (1995, 19 97)

that empirical macro models perform better in a variety of dimensions when survey-

based inflation expectations are used in place of constructed model-consistent ra-

tional expectations. Mankiw and Reis (2001, 2002) obtain similar findings, and

ff

ff

ff

ff

ff

ff

particularly emphasize the point that these models can explain the inexorability

of an inflation-unemployment tradeo much better than the standard model with

rational expectations does.

However, neither Roberts (1998) nor Mankiw and Reis (2001, 2002) devote much

e ort to explaining why the dynamics of agg r ega te exp ectations should evolve as

they proposed (though Roberts does suggest that his equation might result f r om the

di usion of press rep orts). Mankiw and Reis motiva t e their model by suggesting

that there are costs either of obtaining or of processing inflation every time an agent

updates; however, they do not provide an explicit information-costs or processing-

costs microfoundation.

This paper provides an explicit microfoundation for a simple aggregate expec-

tations equation, based on simple models of the spread of disease. Rather than

tracking the spread of a disease through a population, the model tracks the spread

of a piece of information (specifically, the latest rational forecast of inflation).

A companion paper, Carroll (2003), estimates t he baseline model and finds that

it does a good job at capturing the dynamics of household survey expectations about

both inflation and unemployment. Furthermore, that paper shows that household

inflation expectations are closer to the expectations of professional forecasters during

perio ds when there is more news coverag e of inflation, and that the speed with which

household exp ectations adjust to professional expectations is faster when there is

more news coverage.

After providing the epidemiological foundation for the model estimated in Car-

roll (2003) and summarizing the basic empirical results from that paper, this paper

explores the implications of several extensions to the model, using the kinds of

‘agent-based’ simulation techniques pioneered at the Santa Fe Institute and at the

Center for Social and Economic Dynamics (CSED) at the Brookings Institution.

The first extension is to allow heterogeneity in the extent to which di erent

households pay attention to macroeconomic news. This version of the model is

capable of generating demographic di erences in macroeconomic expectations like

those documented in Souleles (forthcoming), which are very hard to rationalize in

a ratio na l exp ectations model. Bo th this extension and the baseline version of the

model are t hen simulated in order t o derive implications for the standard deviation

of inflation expectations across agents. When the simulated data are compared to

the empirical data, the results are mixed. On one hand, the patterns over time

of the empirical a nd the simulated standard deviations bear a strong resemblance,

rising sharply in the late 1970s and early 19 80s and then gradually falling o again.

On the other hand, the level of the standard deviation in the empirical data is much

higher than in the simulated data; however, I show that adding simple forms of

memory error can make the model and the data match up reasonably well.

The next extension examines what happens when the model is g eneralized to

a more standard epidemiological context: A ‘ra ndom mixing’ fra mework in which

people can be ‘infected’ with updated inflation expectations by conversations with

random other individuals in the population. It turns out that when the baseline

framework that assumes infection only fro m news sources is estimated on simulated

2

data from the random mixing model, the baseline framework does an excellent job

of capturing the dynamics of mean inflation expectations; this suggests that the

‘common source’ simplification is probably not too problematic.

The final extension is to a context in which people communicate only with near

‘neighbors’ in some social sense, rather than with random other individuals in the

population. Simulation and estimation of the baseline model on this population

finds that the baseline model again does a good job of capturing expectational

dynamics; however, in one particular respect the results in this framework a re a

better match for the empirical results than is the baseline model.

The paper concludes with some general lessons and ideas for future research.

2 The Epidemiology of Expectations

2.1 The SIR M odel

Epidemiologists have developed a rich set of mo dels for the transmission of disease

in a population. The general framework consists of a set of assumptions about

who is susceptible to the disease, who among the susceptible becomes infected, and

whether and how individuals recover from the infection (leading to the framework’s

designation as the ‘SIR’ model).

The standard assumption is that a susceptible individual who is exposed to

the disease in a given period has a fixed probability p of catching the disease.

Designating the set of newly infected individuals in period t as N

t

and the set of

susceptible individuals as S

t

,

N

t

= pS

t

. (1)

The next step is to determine susceptibility. The usual assumption is that in

order to be susceptible, a healthy individual must have contact with an already-

infected person. In a population where each individual has an equal probability

of encountering any other person in the population (a ‘well-mixed’ population),

the growth rate of the disease will depend upon the fraction of the population

already infected; if very few individuals are currently infected, the small population

of diseased people can infect only a small absolute number of new victims.

However, there is a special case that is even simpler. This occurs when the

disease is not spread person-to-person, but through contact with a ‘common source’

of infection. The classic example is Legionnaire’s disease, which was transmitted to

a group of hotel guests via a contaminated air conditioning system (see Fraser et.

al. (1977) for a description fro m the epidemiological literature). Another application

is to illness caused by common exposure to an environmenta l factor such as air

pollution. In these cases, the transmission model is extremely simple: Any healthy

individual is simply assumed to have a constant probability per period of becoming

infected from the common source. This is the case we will examine, since below we

3

will assume that news reports represent a ‘common source’ of information ava ilable

to all memb ers of the population.

One further assumption is needed to complete the model: The probability that

someone who is infected will recover from the disease. The simplest possible a s-

sumption (which we will use) is that infected individuals never recover.

Under this set of assumptions, the dynamics of the disease are as follows. In

the first period, proportion p of the population catches the disease, leaving (1 − p)

uninfected. In period 2, proportion p of these people catch the disease, leading to a

new infection rate of p(1 − p) and to a fraction p + p(1 − p) of the population being

infected. Spinning this process out, it is easy to see that starting from period 0 at

the beginning of which nobody is infected, the tota l proportion infected at the end

of t perio ds is

Fra ction Ill = p + p(1 − p) + p(1 − p)

2

. . . + p(1 − p )

t

(2)

t

X

= p (1 − p)

s

(3)

s=0

whose limit as t ! 1 is p/p = 1, implying that (since there is no recovery) everyone

will eventually become infected. In the case where ‘infection’ is interpreted as

reflecting an agent’s knowledge of a piece of information, this simply says that

eventually everyone in the economy will learn a given piece of news.

2.2 The Epidemiology of Inflation Expectations

Now consider a world where most people form their expectations about future infla-

tion by reading newspaper articles. Imagine for the moment that every newspaper

inflation article contains a complete forecast of the inflation rate for all future quar-

ters, and suppose (again momentarily) that any p erson who reads such an article

can subsequently recall the entire forecast. Finally, suppose that at any point in

time t all newspaper articles print identical fo r ecasts.

1

Assume that not everybody r eads every newspaper article on inflation. Instead,

reading an article on inflation is like becoming infected with a common-source dis-

ease: In a ny given period each individual faces a constant probability λ of becoming

‘infected’ with the latest forecast by reading an article. Individuals who do not en-

counter an inflation article simply continue to believe the last forecast they read

about.

2

Call ˇ

t+1

the inflation rate between quarter t and quarter t + 1,

ˇ

t+1

= log(p

t+1

) − log(p

t

), (4)

1

This subsectio n is largely drawn from Carroll (2003); however, that paper does not discuss

the epidemiolo gical interpretation of the der ivations, as this derivation does.

2

This is mathematically very similar to the Calvo (1983) model in which firms change their

prices with probability p.

4

where p

t

is the aggregate price index in period t. If we define M

t

as the operator

that yields the population-mean value of inflation expectations at time t and denote

the Newspaper forecast printed in quarter t for inflation in quarter s ≥ t as N

t

[ˇ

s

],

by analogy with equation (2) we have that

M

t

[ˇ

t+1

] = λN

t

[ˇ

t+1

] + (1 − λ) {λN

t−1

[ˇ

t+1

] + (1 − λ) (λN

t−2

[ˇ

t+1

] + . . .)}

(5)

The derivation of t his equation is as follows. In period t a fraction λ of the

population will have been ‘infected’ with the current-period newspaper forecast of

the inflation rate next quarter, N

t

[ˇ

t+1

]. Fraction (1 − λ) of the population retains

the views that they held in period t−1 of period t+1’s inflation rate. Those period-

t − 1 views in turn can be decomposed into a fraction λ of people who encountered

an article in period t − 1 and obtained the newspaper forecast of period t + 1’s

forecast, N

t−1

[ˇ

t+1

], and a fraction (1 − λ) who retained their period-t − 2 views

about the inflation forecast in period t + 1. Recursion leads to the remainder of the

equation.

This expression for inflation expectations is identical to the one proposed by

Mankiw and Reis (2001, 2002 ) , except that in their model the updating agents

construct their own rational forecast of the future course of the macroeconomy

rather than learning about the experts’ fo recast from the news media. The equation

is also similar to a formulation estimated by Roberts (1997), except that Roberts

uses past realizations of the inflation rate on the right hand side rather than past

forecasts.

Mankiw and Reis loosely motivate the equation by arguing that developing a

full-blown inflation forecast is a costly activity, which people might therefore engage

in o nly occasionally. It is undoubtedly true that developing a reasonably rational

quarter-by-quarter forecast of the inflation rate arbitrarily far into the future would

be a very costly enterprise for a typical person. If this were really what people were

doing, one might expect them to make forecasts only very rarely indeed. However,

reading a newspaper article about inflation, or hearing a news story on television or

the radio, is not costly in either time or money. There is no reason to suppose that

people need to make forecasts themselves if news reports provide such forecasts

essentially for fr ee. Thus the epidemiological derivation of this equation seems

considerably more attractive than the loose calculation-costs motivation provided

by Mankiw and Reis, both because t his is a fully specified model and because it

delivers further testable implications (for example, if there is empirical evidence that

people with higher levels of education are more likely to pay attention to news, t he

model implies that their inflation forecasts will on average be closer to the rational

forecast; see below for more discussion of possible variation in λ across population

groups).

Of course, real newspaper articles do not cont ain a quarter-by-quarter forecast

of t he inflation rate into the infinite future as assumed in the derivation of (5), and

even if they did it is very unlikely that a typical person would be able to remember

5

ff

the detailed pattern of inflation rates far into the future. In order to relax these

unrealistic assumptions it turns out to be necessary to impose some structure on

households’ implicit views about the inflation process.

Suppose people believe that at any given time the economy ha s a n underly-

ing “fundamental” inflation rate. Furthermore, suppose people believe that future

changes in the fundamental rate are unforecastable; tha t is, after the next period

the fundamental rate follows a random walk. F inally, suppose the person believes

that the actual inflation rate in a given quarter is equal to that period’s fundamental

rate plus a n error term

t

which reflects unforecastable transitory inflation shocks

(reflected in t he ‘special factors’ that newspaper inflation stories o f t en emphasize).

Thus, the person believes that the inflation process is captured by

ˇ

f

ˇ

t

=

t

+

t

(6)

ˇ

f

ˇ

f

= + η

t+1

,

t+1

t

(7)

. .

. .

. .

where

t

is a transitory shock to the inflation rate in period t while η

t

is the perma-

nent innovation in the fundamental inflation rate in period t. We further assume

that consumers believe that va lues of η beyond period t + 1, and va lues of beyond

perio d t, are unforecastable white noise variables; that is, future changes in the

fundamental inflation rate are unforecastable, and transitory shocks are expected

to go away.

3

Before proceeding it is worth considering whether this is a plausible view of

the inflation process; we would not want to build a model on an assumption that

people believe something patently absurd. Certainly, it would not be plausible

to suppose that people always and everywhere believe that the inflation rate is

characterized by (6)-(7); for example, Ball (2000) shows that in the US from 1879 -

1914 the inflation rate was not persistent in the US, while in other countries there

have been episodes of hyperinflation (and rapid disinflation) in which views like (6)-

(7) would have been nonsense.

However, the relevant question f or the purposes of this paper is whether this

view of the inflation process is plausible for the period for which I have inflation

expectations data . Perhaps the best way to examine this is to ask whether the

univariate statistical process for the inflation rate implied by (6) and (7) is strongly

at odds with the actual univariate inflation process. In other words, after allowing

for t ransitory shocks, does t he inflation rate approximately follow a random walk?

The appropriate statistical test is an augmented D ickey-Fuller test. Table 1

presents the results from such a test. The second row shows that even with more

than 160 quarters of data it is not possible to reject a t a 5 percent significance level

the proposition that the core inflation rate follows a random walk with a one-period

3

Note that we are allowing people to have some idea about how next quarter’s fundamental rate

may di er from the current quarter’s rate, because we did not impose tha t consumers’ expe c tations

of η

t+1

must equal zero.

6

ff

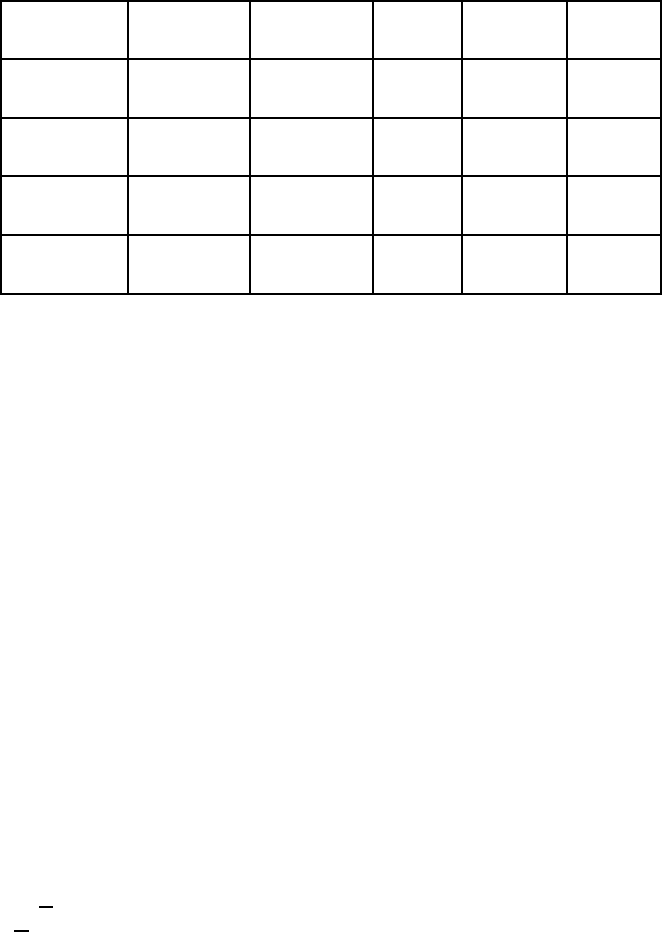

Lags Degrees of Freedom ADF Test Statistic

0

1

2

166

165

164

3.59

∗∗∗

2.84

∗

2.28

This table presents results o f standard Dickey-Fuller and Augmented Dickey-Fuller tes ts for the

presence of a unit root in the core rate of inflation (results are s imilar for CP I inflation). The

column labelled ‘Lags’ indicates how many lags of the change in the inflation rate are included

in the regression. With zero lags, the test is the original Dickey-Fuller test; with multiple lags,

the test is an Augmented Dickey Fuller test. In both cases a constant term is permitted in the

regress ion equation. The sample is from 1959q3 to 2001q2 (quarterly data from my DRI databa se

begin in 1959q1. In order to have the same sample for a ll three tes ts, the sample must be restricted

to 1959q3 and after.) One, two, and three stars indicate rejections of a unit root at the 10 percent,

5 percent, and one percent thresholds. RATS code generating these and all other empirical results

is available at the author’s website.

Table 1: Dickey-Fuller and Augmented Dickey-Fuller Tests for a Unit Root in In-

flation

transitory component - that is, it is not possible to reject the process defined by (6)-

(7).

4

When the transitory shock is a llowed to have e ects that last for two quarters

rather than one, it is not possible to reject a random walk in the fundamental

component even at the 10 percent level of significance (the last row in the table).

Note that the unit root (or near unit root) in inflation does not imply that f uture

inflation rates are totally unpredictable, only that the history of inflation by itself is

not very useful in forecasting future inflation changes (beyond the disappearance of

the transitory component of the current period’s shock). This does not exclude the

possibility that current and lagged values of other variables might have predictive

power. Thus, this view of the inflation rate is not necessarily in conflict with

the vast and venerable literature showing that other var ia bles (most notably the

unemployment r ate) do have considerable predictive power for the inflation rate

(see Staiger, Stock, and Watson (2001) for a recent treatment).

Suppose now that rather than containing a forecast for the entire quarter-by-

quarter future history of the inflation rate, newspaper articles simply contain a

forecast of the inflation rate over the next year. The next step is to figure out how

such a one-year forecast for inflation can be integrated into some modified version

of equation (5). To capture this, we must introduce a bit more notation. Define ˇ

s,t

as the inflation rate between periods s and t, converted to an annual rate. Thus,

for example, in quarterly data we can define the inflation rate for quarter t + 1 at

4

The near-unit-root feature of the inflation rate in the post-1959 period is well known to

inflation researchers; some authors find that a unit root can be rejected for some measures of

inflation over some time periods, but it seems fair to say that the conventional wisdom is that at

least since the late 1950s inflation is ‘close’ to a unit root process. See Barsky (1987) for a more

complete analysis, or Ball (2000) for a more recent treatment.

7

an annual ra t e as

ˇ

t,t+1

= 4(log p

t+1

− log p

t

) (8)

= 4ˇ

t+1

(9)

where the factor of four is required to convert the quarterly price change to an

annual rate.

Under this set of assumptions, Carroll (2003) shows that the process for inflation

expectations can be rewritten as

M

t

[ˇ

t,t+4

] = λN

t

[ˇ

t,t+4

] + (1 − λ)M

t−1

[ˇ

t−1,t+3

]. (10)

That is, mean measured inflation expectations for t he next year should be a

weighted average between the current newspaper forecast and last period’s mean

measured inflation expectations. This equation is therefore directly estimable, as-

suming an appropriate proxy for newspaper expectations can be constructed.

5

2.3 Estimates

Estimating (10) empirically requires the identification of empirical counterparts

for household-level inflation expectations and newspaper inflation forecasts. Con-

veniently, the University of Michigan’s Survey Research Center has been asking

households about their inflation expectations for well over thirty years. To be pre-

cise, households a re first a sked

“During the next 12 months, do you think that prices in general will go

up, or go down, or stay where they are right now?”

and then those who say “g o up” (the vast majority) are asked

“By about what percent do you expect prices to go up, on the average,

during the next 12 months?”

The Survey Research Center uses the answers to these questions to construct an

index o f mean inflation expectations, which is an a lmost exact counterpart to the

object required by the theory. (For details of index construction, see Curtin (1996)).

Measuring the forecasts that people ar e assumed to encounter in the news media

is a thornier problem. But typical newspaper articles on inflation tend to quote

professional forecasters, and so it seems reasonable to use the mean forecast from

the Survey of Professional Forecasters (SPF) as a proxy for what the news media

are reporting.

5

This equa tion is basically the same as equatio n (5) in Roberts (19 98), exc ept that Rob e rts

proposes that the forecast toward which household expec tations are moving is the ‘mathematically

rational’ foreca st (and he simply proposes the equation without ex amining the underlying logic

that might produce it).

8

α α α

α α α

α

α α

α

α

α

α α

α

α

α

Carroll (2003) estimates equation (10 ) using the Michigan survey index for M

t

and t he SPF for N

t

. Results are reproduced in the upper panel of table 2 (where

N

t

changes to S

t

to indicate the use of the SPF).

Table 2:

Estimating and Testing the Baseline Model

Estimating Equation M

t

[•

t,t+4

] =

0

+

1

S

t

[•

t,t+4

] +

2

M

t−1

[•

t−1,t+3

] +

t

Eqn

0 1 2

¯

R

2

Durbin-

Watson StdErr

Test

p-value

Estimating Baseline Model on Inflation Expectations

Memo: 4.34

(0.19)

∗∗∗

0.00 0.29 0.88

0

= 0

0.000

1 0.36

(0.09)

∗∗∗

0.66

(0.08)

∗∗∗

0.76 1.97 0.43

1

+

2

= 1

0.178

2 0.27

(0.07)

∗∗∗

0.73

(0.07)

∗∗∗

0.76 2.12 0.43

1

= 0.25

0.724

3 1.22

(0.20)

∗∗∗

0.51

(0.08)

∗∗∗

0.26

(0.09)

∗∗∗

0.84 1.74 0.35

0

= 0

0.000

Estimating Baseline Model on Unemployment Expectations

Memo: 6.27

(0.31)

∗∗∗

0.00 0.07 1.25

0

= 0

0.000

1 0.30

(0.07)

∗∗∗

0.69

(0.07)

∗∗∗

0.95 1.59 0.28

1

+

2

= 1

0.036

2 0.30

(0.07)

∗∗∗

0.70

(0.07)

∗∗∗

0.94 1.50 0.29

1

= 0.25

0.476

3 −0.03

(0.19)

0.30

(0.08)

∗∗∗

0.69

(0.07)

∗∗∗

0.95 1.60 0.29

0

= 0

0.890

M

t

[•

t,t+4

] is the Michigan household survey measure of mean inflation exp e c tations or projected

unemployment expectations in quarter t, S

t

[•

t,t+4

] is the Survey of Professional Forecasters mean

inflation or unemployment forecast over the next year. Inflation equations are estimated over

the period 1981q3 to 2000q2 for which both Michigan and SPF inflation forecasts a re available;

Unemployment equations are estimated over the period 197 8q1 to 20 00q2 for which both Michigan

and SPF infla tion forecas ts are available. All standard errors are corrected for heteroskedasticity

and se rial cor relation using a Newey-West procedure (a Bartlett kernel) with four lags. Results

are not sensitive to the choice of lags.

The first line of the table (‘Memo:’) presents results for the simplest possible

model: that the value of the Michigan index o f inflation expectations M

t

[ˇ

t,t+4

] is

¯

equal to a constant,

0

. By definition the R

2

is equal to zero; the standard error of

the estimate is 0.88. The last column is reserved for reporting the results of various

tests; for example, the test performed in the ‘Memo:’ equation is for whether the

9

α

α α

α α

α α

α α

α

ff

ff

ff

average value of the expectations index is zero,

0

= 0, which is rejected at a very

high level of statistical significance, as indicated by a p-va lue of zero.

Equation 1 in the table reflects the estimation o f an equation of the form

M

t

[ˇ

t,t+4

] =

1

S

t

[ˇ

t,t+4

] +

2

M

t

[ˇ

t−1,t+3

] + ν

t

. (11)

Comparing this to (10) provides the testable restriction that

2

= 1 −

1

or,

equivalently,

1

+

2

= 1. (12)

The point estimates in equation 1 of

1

= 0.36 and

2

= 0.66 suggest that the

restriction (12) is very close to holding true, and the last column confirms that the

proposition is easily accepted by the data (the p -value is far above the usual critical

level of 0.05 which would signal a rejection).

Estimation results when the restriction (12) is imposed in estimation are pre-

sented in the next row o f the table, yielding our central estimate o f the model’s

main parameter: λ = 0.27. This point estimate is remarkably close to the value

of 0.25 assumed by Mankiw and Reis (2001, 2002) in their simulation experiments;

unsurprisingly, the test reported in the last column for equation 2 indicates that

the proposition

1

= λ = 0.25 is easily accepted by the data. Thus, the model

implies that in each quarter, only about one fourth of households have a completely

up-to-date forecast of the inflation rate over the coming year. On the other hand,

this estimate a lso indicates that only about 32 percent (= (1 −0.25)

4

) of households

have inflation expectations that are more than a year out of date.

Intutitively it might seem that if almost 70 percent of agents have inflation

expectations that are of a vintage of a year or less, the behavior of the macroeconomy

could not be all that di erent from what would be expected if all expectations were

completely up-to-date. The surprising message of Roberts (1 995, 19 97) and Mankiw

and Reis ( 2001, 2002) is that this intuition is wrong. Mankiw and Reis show that an

economy with λ = 0.25 behaves in ways tha t are sharply di erent from an economy

with fully rational expectations (λ = 1), and argue that in each case where behavior

is di erent the behavior of the λ = 0.25 economy corresponds better with empirical

evidence.

Equation 3 in the table reports some bad news for the model: When a constant

term is permitted in the regression equation, it turns out to be highly statistically

significant. The model (10) did not imply the presence of a constant term, so this is

somewhat disappointing. On the other hand, despite being statistically significant

the constant term does not improve the fit o f the equation much: The standard error

of the estimate only declines from 0.43 to 0.35. Furthermore, a version of the model

with a constant term cannot be plausibly interpreted as a true ‘structural’ model of

the expectations process, since it implies that even if the inflation rate were to go

to zero forever, and all forecasters were to begin forecasting zero inflation forever,

households would never catch on. A more plausible interpretation of the positive

constant term is t hat it may reflect some form of misspecification of the model.

Below, I will present simulation results showing t hat if expectations are transmitted

10

ff

ff

from person to person in addition to through the news media, and an equation of

the form of (10) is estimated on the data generated by the modified model, the

regression equation returns a positive and statistically significant constant term;

thus, the presence of the constant term can be interpreted as evidence that the

simple ‘common-source’ epidemiological model postulated here may be a bit too

simple.

The bottom panel of the table presents results for estimating an equation for

unemployment expectations that is pa rallel to the estimate for inflation expecta-

tions.

6

Equation 2 of this panel presents the version of the model that restricts the

coeÿcients to sum to 1; the point estimate of the fraction of updaters is λ = 0 .31,

but this estimate is not significantly di erent from the estimate of λ = 0.27 ob-

tained for inflation expectations or from the λ = 0.25 postulated by Mankiw and

Reis (2001, 2002). The last equation shows that the unemployment expectations

equation does not particularly want an intercept term, so the model actually fits

better for unemployment expectations than for inflation expectations.

In sum, it seems fair to say that the simple ‘common-source’ epidemiological

equation (10) does a remarkably good jo b of capturing much of the predictable

behavior of both the inflation and the unemployment expectations indexes.

3 Agent Based Models of Inflation Expectations

One of the most fruitful trends in empirical macroeconomics over the last fifteen

years has been the e ort to construct rigorous microfoundations for macroeconomic

models. Broadly speaking, the goal is to find empirically sensible models for the

behavior of t he individual agents (people, firms, banks), which can then be aggre-

gated to derive implications about macroeconomic dynamics. Separately, but in a

similar spirit, researchers a t the Santa Fe Institute, the CSED, and elsewhere have

been exploring ‘agent-based’ models that examine the complex behavior that can

sometimes emerge fr om the interactions between collections of simple agents.

One of the primary attractions of an agent-based or microfounded a pproa ch t o

modeling macroeconomic behavior is the prospect of being able to test a model

using large microeconomic datasets. This is an opportunity that has largely been

neglected so far in the area of expectations formation; I have found only three

existing research papers that have examined t he raw household-level expectations

data fr om the Michigan survey. Two are by Nicholas Souleles (2000, forthcoming).

For present purposes, the more interesting of these is Souleles (forthcoming), which

demonstrates (among other things) that there are highly statistically significant dif-

ferences across demographic groups in forecasts of several macroeconomic variables.

Clearly, in a world where everyone’s expectations were purely rational, t here should

6

Some data construction was necessary to do this, because the Michigan survey does not ask

people dire ctly what their expectations are for the level of the unemployment rate, but instead as ks

whether they think the unemployment rate will rise or fall over the next year. See Carroll (2003)

for details about how the unemployment ex pectations data are constructed.

11

ff

ff

ff

ff

ff

ff

ff

ff

ff

be no demographic di erences in such expectations.

An agent-based version of the epidemiological model above could in principle

account for such demographic di erences. The simplest approach would be to as-

sume that there a r e di erences across demographic groups in the propensity to pay

attention to economic news (di erent λ’s); it is even conceivable that one could cal-

ibrate these di erences using existing facts about the demographics of newspaper

readership ( or CNBC viewership).

Without access to the underlying micro data it is diÿcult to tell whether de-

mographic heterogeneity in λ would be enough to explain Souleles’s findings about

systematic demographic di erences in macro expectations. Even without the raw

micro dat a, however, an agent-based model has considerable utility. In particular,

an agent-based approach permits us to examine the consequences of relaxing some

of the model’s assumptions to see how robust its predictions are. Given our hypoth-

esis that Souleles’s results on demographic di erences in expectations might be due

to di erences in λ across groups, the most important a pplication of the agent-based

approach is to determining the consequences of heterogeneity in λ.

7

3.1 Heterogeneity in λ

Consider a model in which there are two categories of people, each of which makes

up half the population, but with di erent newspaper-reading propensities, λ

1

and

λ

2

.

For each group it will be possible to derive an equation like (10),

M

i,t

[ˇ

t,t+4

] = λ

i

N

t

[ˇ

t,t+4

] + (1 − λ

i

)M

i,t−1

[ˇ

t−1,t+3

]. (13)

But note that (dropping the ˇ arguments for simplicity) aggrega t e exp ectations

will just be the population-weighted sum of expectations for each group,

M

t

= (M

1,t

+ M

2,t

)/2 (14)

λ

1

+ λ

2

= N

t

+ ((1 − λ

1

)M

1,t−1

+ (1 − λ

2

)M

2,t−1

)/2 (15)

2

7

The final paper I know of that examines the micro data underlying the Michigan inflation

exp ectations index is by Branch (2001), who propos e s an interesting model in which individual

consumers dynamically choose between competing models for predicting inflation, but are subject

to idiosyncratic errors. He finds evidence that people tend to switch toward whichever model

has recently produced the lowest mean squared error in its forecasts. This interesting approach

deserves further study.

12

ff

Replace M

1,t−1

by M

t−1

+ (M

1,t−1

− M

t−1

) and similarly for M

2,t−1

to obta in

=0

z }| {

λ

1

+ λ

2

λ

1

+ λ

2

M

1,t−1

+ M

2,t−1

M

t

= N

t

+ 1 − M

t−1

+ − M

t−1

2 2 2

λ

1

(M

1,t−1

− M

t−1

) + λ

2

(M

2,t−1

− M

t−1

)

− (16)

2

λ

1

(M

1,t−1

− M

t−1

) + λ

2

(M

2,t−1

− M

t−1

)

ˆ

M

t

= λN

t

+ (1 − λ

ˆ

)M

t−1

− (17)

2

where λ

ˆ

= (λ

1

+ λ

2

)/2.

Thus, the dynamics of aggregat e inflation expectations with heterogeneity in λ

have a component

ˆ

λ)M

t−1

that behaves just like a version of the model λN

t

+ (1 −

ˆ

when everybody has the same λ equal to t he average value in the population, plus

a term (in big parentheses in (17)) that depends on the joint distribution of λ’s

and the deviation by group of the di erence between the previous period’s rational

forecast and the group’s forecast.

Now consider estimating the baseline equation

M

t

= λN

t

+ (1 − λ)M

t−1

(18)

on a population with heterogeneous λ’s. The coeÿcient estimates will be biased

in a way that depends on the correlations of N

t

, M

t−1

and M

t

with the last term

λ

1

(M

1,t−1

−M

t−1

)+λ

2

(M

2,t−1

−M

t−1

)

in equation (17),

2

. There is no analytical way to

determine the magnitude or nature of the bias without making a specific assumption

about the time series process for N

t

, and even with such an assumption all that could

be obtained is an expected asymptotic bias. The bias in any particular small sample

would depend on the specific history of N

t

in that sample.

The only sensible way to evaluate whether the bias problem is likely to be large

given the actual history of inflation and inflation forecasts in the US is to simulate

a model with households who have heterogeneous λ’s and to estimate the baseline

equation on aggregate statistics generated by that sample.

Specifically, the experiment is a s follows. A population of P a gents is cre-

ated, indexed by i; each of them begins by drawing a value of λ

i

from a uni-

form distribution on the interval (λ, λ). In an initial period 0, each agent is en-

dowed with an initial value of M

i,0

= 2 percent. Thus the population mean value

M

0

= (1/P )

P

i

P

=1

M

i,0

= 2. For period 1, each agent draws a random variable

distributed on the interval [0, 1]. If that draw is less than or equal to the agent’s

λ

i

, the agent updates M

i,1

= N

1

where N

1

is ta ken to be the ‘Newspaper’ forecast

of the next year’s inflation rate in period t; if the random draw is less than λ

i

the

agent’s M

i,1

= M

i,0

. The population-average value of M

1

is calculated, and the

simulation then proceeds to the next perio d.

For the simulations, the ‘news’ series N

t

is chosen as the concatenation of 1) the

actual inflation rate from 19 60q1 to 1981q2 and 2) the SPF forecast of inflation from

13

α α

α α

Estimating M

t

[ˇ

t,t+4

] =

1

S

t

[ˇ

t,t+4

] +

2

M

t−1

[ˇ

t−1,t+3

] +

t

λ

Range

1 2

¯

R

2

Durbin-

Watson StdErr

[0.25,0.25] 0.250

(0.001)

∗∗∗

0.750

(0.001)

∗∗∗

1.000 1.94 0.006

[0.00,0.50] 0.265

(0.010)

∗∗∗

0.743

(0.009)

∗∗∗

0.999 0.11 0.039

[0.20,0.30] 0.249

(0.001)

∗∗∗

0.751

(0.001)

∗∗∗

1.000 2.03 0.005

[0.15,0.35] 0.244

(0.002)

∗∗∗

0.756

(0.002)

∗∗∗

1.000 0.64 0.009

M

t

[ˇ

t,t+4

] is mean inflation expectations in quarter t, N

t

[ˇ

t,t+4

] is the news s ignal corres ponding

to the SPF mean inflation forecast after 1981q3 and the prev io us year inflation rate before 1981q3.

All equations are estimated over the period 1981q3 to 2001q2.

Table 3: Estimating the Baseline Model on Simulated D ata with Heterogeneous λs

1981q3 to 200 1q2. Then regression equations corresponding to (18) are estimated on

the subsample corresponding to the empirical subsample, 1981q3 to 2001q2. Thus,

the simulation results should indicate the dynamics of M

t

that would have been

observed if actual newspaper forecasts of inflation had been a random walk until

1981q2 and then had tracked the SPF once the SPF data began to be published.

The results of estimating (10) on the data generated by t his simulation when

the population is P = 250, 000 are presented in Table 3. For comparison, and

to verify that the simulation programs are working properly, equation (1) presents

results when all agents’ λ’s are exogenously set to 0.25. As expected, the simulation

returns an estimate of λ = 0.25, and the equation fits so precisely that there are

essentially no residuals.

The remaining rows of the table present the results in the case where λ values

are heterogeneous in the population. The second row presents the most extreme

example, [λ, λ ] = [0.00, 0.50]. Fortunately, even in this case the regression yields

an estimate of the speed-of-adjustment parameter λ that, at around 0.26, is still

quite close to the true average value 0.25 in the population. Interestingly, however,

one consequence of the heterogeneity in λ is that there is now a very large amount

of serial correlation in the residuals of the equation; the Durbin-Watson statistic

indicates that this serial correlation is p ostive and a Q test shows it to be highly

statistically significant.

Heterogeneous λ’s induce serial correlation primarily because the views o f people

with λ’s below λ

¯

are slow to change. For example, if the ‘rational’ fo r ecast is highly

14

serially correlated, an agent with a λ close to zero will be expected to make errors

of the same size and direction for many periods in a row after a shock to the

fundamental inflation rate, until finally updating.

The comparison of the high serial correlation that emerges from this simulation

to the low serial correlation that emerged in the empirical estimation in Table 2

suggests that heterogeneity in λ is probably not as great a s the assumed uniform

distribution b etween 0.0 and 0.5. Results are therefore presented f or a third ex-

periment, in which λ’s are uniformly distributed between 0.2 and 0.3. Estimation

on the simulated data from this experiment yields an estimate of λ very close to

0.25 and a Durbin-Watson statistic that indicates much less serial correlation than

emerged with t he broad [0, 0.5] range of possible λ’s. Finally, the last row presents

results when λ is uniformly distributed over the interval [0.15,0.35]. This case is

intermediate: t he estimate of λ is still close to 0.25, but the Durbin-Watson statistic

now begins to indicate substantial serial correlation.

On the whole, the simulation results suggest that the serial correlation properties

of the empirical data are consistent with a moderate degree of heterogeneity in λ, but

not with extreme heterogeneity. It is important to point out, however, that empirical

data contain a degree of measurement and sampling error that is absent in the

simulated data. To the extent that these sources can be thought of as white noise,

they should bias the Durbin-Watson statistic up in comparison to the ‘true’ Durbin-

Watson, so the scope for heterogeneity in λ is probably considerably larger than

would be indicated by a simple comparison of the measured and simulated Durbin-

Watson statistics. Furthermore, since the error term is very tiny ( t he standard errors

are less than 4/100 of one percentage point), so any serial correlation properties it

has cannot be of much econometric consequence. Thus the serial correlation results

should not be taken as very serious evidence against substantial heterogeneity in λ.

A few last words on serial correlation. The imp ortant point in Mankiw and

Reis (2001, 200 2), as well as in work by Ball (2000) and others, is that t he presence

of some people whose expectations are not fully and instantaneously forward-looking

profoundly changes the behavior of macro models. Thus, the possibility of heter-

geneity in λ, and the resulting serial correlation in errors, has an importance here

beyond its usual econometric ramifications for standard errors and inference. If

there are some consumers whose exp ectations are very slow to update, they may

be primarily responsible for important deviations between the rational expectations

model and macroeconomic reality.

3.2 Matching the Standard Deviation of Inflation Expecta-

tions

Thus far all our tests of the model have been based on its predictions for behavior

of mean inflation expectations. Of course, the model also generates predictions for

other statistics like the standard deviation of expectations across households at a

point in time. Some households will have expectations that correspond to the most

15

Standard Deviation of Inflation Expectations

Simulations

3.0 11

2.5

10

2.0

9

1.5

8

7

1.0

6

0.5

5

0.0 4

Lambda = 0.25

Lambda in (0.0,0.5)

Michigan Data

1978 1980 1982 1984 1986 1988 1990 1992 1994

Figure 1: Standard Deviation of Inflation Expectations from Da t a and Simulations

recent inflation fo recast, while others will have expectations that are out of date

by varying amounts. One prediction of the model is that ( for a constant λ) if SPF

inflation forecasts have remained stable for a long time, the standard deviation of

expectations across households should be low, while if there have been substantial

recent changes in the rational forecast of inflation we should expect to see more

cross-section variability in households’ expectations.

This is testable. Curtin ( 1996) reports averag e values for the standard deviation

for the Michigan survey’s inflation exp ectations over the period fro m 1978 to 1995;

results are plotted as the solid line in figure 1. It is true that the empirical standard

deviation was higher in the early 1980s, a time when inflation rates and SPF inflation

expectations changed rapidly over the course of a few years, than later when the

inflation rate was lower and more stable.

Michigan Data

16

ff

ff

The short and long dashed loci in the figure depict the predictions of the ho-

mogeneous λ = 0.25 and heterogeneous λ 2 [0.0, 0.5] versions of the agent-based

model. There is considerable similarity between the time paths of the actual and

simulated standard deviations: The standard deviation is greatest for both simu-

lated and actual data in the late 1970s and early 19 80s, because that is the period

when the levels of both actual and expected inflation changed the most. In both

simulated and real data the standard deviation falls gradually over time, but shows

an uptick around the 1990 recession and recovery before returning to its downward

path.

However, the levels of the standard deviations are very di erent between the

simulations and the data; the scale for the Michigan data on the right axis ranges

from 4 to 11, while the scale for the simulated standard deviations on the left

axis ranges from 0 to 3. Over the entire sample period, the standard deviation of

household inflation expectations is about 6.5 in the real data, compared to only

about 0.5 in the simulated data.

Curtin (1996) a nalyzes the sources of the large standard deviation in inflation

expectations across households. He finds that part of the high variability is at-

tributable to small numb ers of households with very extreme views of inflation.

Curtin’s interpretation is that these households are probably just ill-informed, and

he pro poses a variety of other ways to extract the data’s central tendency that are

intended to be robust to the presence of these outlying households. However, even

Curtin’s preferred measure of dispersion in inflation expectations, the size o f the

range from t he 25th to the 75th percentile in expectations, has an average span of

almost 5 percentage points over the 81q3-95q4 period, much greater than would be

produced by any of the simulation models considered above.

8

The first observatio n to make about the excessive cross-section variability of

household inflation exp ectations is that such varia bility calls into question almost

all standard mo dels of wage setting in which well-informed workers demand nom-

inal wage increases in line with a rational expectation about the future inflation

rate.

9

If a large fraction of workers have views about the future inflation rate that

are a long way from rational, it is hard to believe that those views have much im-

pact on the wage-setting process. Perhaps it is possible to construct a model in

which equilibrium is determined by average inflation expectations, with individual

variatio ns making little or no no di erence to individual wages. Constructing such

8

Curtin advocates use of the median rather than the mean as the summary s tatistic for ‘typical’

inflation expectations. However, the epidemiological model has simple analy tical predictions for

the mean but not the median of household expectations, so the empirical work in this paper uses

the mean.

9

The only prominent exception I am aware of is the two papers by Akerlof, Dickens, a nd

Perry (1996, 2000) mentioned briefly above. In these models workers do not bother to learn about

the inflation rate unless it is suÿciently high to make the research worthwhile. However s uch a

model would presumably imply a modest upper bound to inflation expectation errors, since people

who suspected the inflation rate was very high would have the incentive to learn the truth. In fact,

Curtin (1996) finds that the most problematic feature of the empirical data is the sma ll number

of households with wildly implausibly high forecasts.

17

a model is beyo nd the scope of this paper; but whether or not such a model is

proposed, it seems likely that any tho rough understanding of the relation between

inflation expectations in the aggregat e and actual inflation will need a model of how

individuals’ inflation expectations are determined.

The simplest method of generating extra individual variability in expectations

is to assume that when people encounter a news report on inflation, the process of

committing the associated inflation forecast to memory is error-prone.

10

To be specific, suppose that whenever an ag ent encounters a news report and

updates his expectations, the actual expectation stored in memory is given by the

expectation printed in the news report times a mean-one lognormally distributed

storage error. Since the errors average out in the population as a whole, this as-

sumption generates dynamics of aggregate inflation expectations that are identical

to those of the baseline model. Figure 2 plots the predictions for the standard de-

viation o f inflation expectations across households of the baseline λ = 0 .2 5 model

with a lognormally distributed error with a standard error of 0.5. The figure shows

that the change in the standard deviation of inflation residuals over time is very

similar in the model and in the data, but the level of the standard deviation is still

considerably smaller in the model. This could of course be rectified by including an

additive error in addition to the multiplicative error. Such a proposed solution could

be tested by examining more detailed information on the structure of expectations

at the household level like that examined by Souleles (forthcoming).

3.3 So cial Transmission of Inflation Expectations

As noted above, the standard model of disease transmission is one in which illness

is transmitted by person-to-person contact. Analog ously, it is likely that some peo-

ple’s views about inflation are formed by conversations with others rather than by

direct contact with news reports. For the purposes of this paper the most impor-

tant question is whether the simple formula (10) would do a reasonably g ood job

in capturing the dynamics of inflation expectations even when social transmission

occurs.

Simulation of an agent-based model with both modes of transmission is straight-

forward. The extended model works as follows. In each period, every person has

a probability λ of obtaining t he latest forecast by reading a news story. Among

the ( 1 − λ) who do not encounter the news source, the algorithm is as follows. For

each person i, there is some probability p that he will have a conversation about

inflation with a randomly-selected other person j in the population. If j has an

inflation forecast that is of more recent vintage than i’s forecast, then i adopts j’s

forecast, and vice-versa.

11

10

Alternatively, one could assume that retrieval from memory is error-prone. The implications

are very similar but no t identical.

11

This rules out the possibility that the less-recent foreca st would be a dopted by the person with

a more- recent information. The reason to rule this out is that if there were no directional bias

(more recent forecasts push out older ones), the swapping of information would not change the

18

Cross-Household Standard Deviation

0

2

4

6

8

10

12

Michigan Data

Lambda = 0.25, Multiplicative Error

1978 1980 1982 1984 1986 1988 1990 1992 1994

Figure 2: Standard Deviation of Inflation Exp ectations from Simulation with Mem-

ory Errors

19

α α α

α α α

α α

α

α α

α

ff

ff

ff

Estimating M

t

=

0

+

1

S

t

+

2

M

t−1

+

t

Prob. of Durbin- Test

Social Exchange

0 1 2

¯

R

2

Watson StdErr p-value

p = 0.25 0.311

(0.003)

∗∗∗

0.689

(0.003)

∗∗∗

1.000 2.26 0.020

1

+

2

= 1

0.1357

0.009 0.303 0.694 1.000 2.15 0.020

0

= 0

(0.009) (0.006 )

∗∗∗

(0.006)

∗∗∗

0.2939

p = 0.10 0.276

(0.001)

∗∗∗

0.724

(0.001)

∗∗∗

1.000 1.69 0.009

1

+

2

= 1

0.2172

0.000 0.274 0.725 1.000 1.66 0.009

0

= 0

(0.004) (0.003 )

∗∗∗

(0.003)

∗∗∗

0.9006

M

t

is the mean value of inflation expectations across all agents in the simulated population; S

t

is

the actual annual inflation rate from 1960q1 to 1981q2, and the SPF inflation forecast fro m 1981q3

to 2000q2. Es timatio n is restricted to the simulation periods corre sponding to 1981q3 to 2000q2

for which actual SPF data are available. All standard errors are c orrected for heter oskedasticity

and se rial cor relation using a Newey-West procedure (a Bartlett kernel) with four lags. Results

are not sensitive to the choice of lags.

Table 4: Estimating Baseline Model on Random Mixing Simulations

Table 4 presents results of estimating equation ( 10) on the aggregate inflation

expectations data that result from this agent-based simulation under a uniform

fixed λ = 0.25 probability of news-reading. The first two rows present results when

the probability of a social transmission event is p = 0.25. The primary e ect of

social transmission is to bias upward the estimated speed of adjustment term. The

point estimate is about 0.31, or about 6 percentage points too high. However,

R

¯

2

the of the equation is virtually 100 percent, indicating that even when there

is social t r ansmission of information, the common-source model does an excellent

job of explaining the dynamics of aggregate expectations. The next row shows t he

results when the rate of social transmission is p = 0.10. Unsurprisingly, the size of

the bias in the estimate of λ is substantially smaller in this case, and the model

¯

continues to perform well in an R

2

sense.

A potential objection to these simulations is that they assume ‘random mixing.’

That is, every member of the population is equally likely to encounter any other

member. Much of the literature on agent-based models has examined the behavior

of populations that are distributed over a la ndscape in which most interactions

occur between adjacent locations on the landscape. Often models with local but no

global interaction yield quite di erent outcomes from ‘random mixing’ models.

To explore a model in which social communication occurs locally but not glob-

ally, I constructed a population distributed over a two dimensional lattice, of size

500x500, with one agent at each lattice point. I assumed that a fraction η of agents

distribution of forecasts in the population and therefor e would not result in aggregate dynamics

any di erent from those when no social c ommunication is allowed.

20

α α α

α α α

α α

α

α α

α

α

α α

are ‘well informed’ - that is, as soon as a new inflation forecast is released, these

agents learn the new forecast with zero lag. Other agents in the population obtain

their views of inflation solely through interaction with neighbors.

12

Thus, in this

model, news travels out in concentric patterns (one step on the landscape per pe-

riod) from its geographical origination po ints (the news agents, who are scattered

randomly across the landscape). As in the random mixing model, I assume that

new news drives out old news.

Estimating M

t

=

0

+

1

S

t

+

2

M

t−1

+

t

Up-to-date Durbin- Test

Agents

0 1 2

¯

R

2

Watson StdErr p-value

η = 0.25 0.234

(0.025)

∗∗∗

0.696

(0.034)

∗∗∗

0.992 0.10 0.135

1

+

2

= 1

0.0000

0.386 0.315 0.499 1.000 1.03 0.007

0

= 0

(0.003)

∗∗∗

(0.001)

∗∗∗

(0.001)

∗∗∗

0.0000

η = 0.15 0.098

(0.017)

∗∗∗

0.853

(0.027)

∗∗∗

0.988 0.13 0.117

1

+

2

= 1

0.0000

0.475 0.185 0.587 1.000 1.15 0.008

0

= 0

(0.004)

∗∗∗

(0.001)

∗∗∗

(0.001)

∗∗∗

0.0000

M

t

is the mean value of inflation expectations across all agents in the simulated population; S

t

is

the actual annual inflation rate from 1960q1 to 1981q2, and the SPF inflation forecast fro m 1981q3

to 2000q2. Es timatio n is restricted to the simulation periods corre sponding to 1981q3 to 2000q2

for which actual SPF data are available. All standard errors are c orrected for heter oskedasticity

and se rial cor relation using a Newey-West procedure (a Bartlett kernel) with four lags. Results

are not sensitive to the choice of lags.

Table 5: Estimating Baseline Model on Local Interactions Simulations

Results f rom estimating the baseline model on data produced by the ‘local in-

teractions’ simulations are presented in table 5. For comparability with the baseline

estimate of λ = 0 .2 5 in the common-source model, I have assumed that proportion

η = 0.25 of the agents in the new model are the well-informed types whose infla-

tionary expectations are always up to date. Interestingly, estimating the baseline

model yields a coeÿcient of about

1

= 0.22 on the SPF forecast, even though

25 percent of agents always have expectations exactly equal to the SPF forecast.

The coeÿcient o n lagged expectations gets a value of about 0.71, and the last col-

umn indicates that a test of the proposition tha t

1

+

2

= 1 now rejects strongly.

¯

However, the regression still has an R

2

of around 0.99, so the basic common-source

model still does an excellent job of capturing the dynamics of aggregate inflation

expectations.

12

For the purposes of the simulation, an agent’s neighbors are the agents in the eight cells

surrounding him. For agents at the borders of the grid, neighborhoods are assumed to wrap

around to the opposite side of the grid; implicitly this assumes the agents live on a torus.

21

α

α

ff

The most interesting result, however, is shown in the next row: The estimation

now finds a highly statistically significant role for a nonnegligible constant term.

Recall that the only real empirical problem with the common-source model was

that the estimation found a statistically significant role for a constant term.

Results in the next rows show what happens when the pro portion of news agents

is r educed to η = 0.15. As expected, the estimate o f

1

falls; indeed, the downward

bias is now even more pronounced than with 25 percent well-informed. However,

when a constant is allowed into the equation, the constant term itself is highly

significant and the estimate of

1

jumps to about 0.18, not far from the fraction of

always-up-to-date agents in the population.

What these simulation results suggest is that the empirical constant term may

somehow b e reflecting the fact that some transmission of inflation expectations is

through social exchange rather than directly through the news media. Furthermore,

and happily, it is clear from the structure of the local interactions model that this

population would eventually learn the true correct expectation of inflation if the

SPF forecasts permanently settled down to a nonstochastic steady-state. Thus it is

considerably more appealing to argue that the constant term reflects misspecifica-

tion of the model (by leaving out social interactions) than to accept the presence of

a true constant term (and its associated implication of permanent bias).

A final caveat is in order. The central lesson of Mankiw and Reis (2001, 2002)

and others is that the extent t o which inflation can be reduced without increasing

unemployment depends upon the speed with which a new view of inflation can be

communicated to the entire population. It is not at all clear that the predictions

about t he medium-term inflation/unemployment tradeo of a model with social

transmission of expectations, or even of the common-source model with heteroge-

neous λ’s, are similar to the predictions of the homogeneous λ model examined by

Mankiw and Reis (2001, 2002). Investigating this question should be an interesting

project for future research.

4 Conclus i ons

This paper was written to provide a specific example of a more general proposi-

tion: That many of the puzzles confronting standard macroeconomic models today

could be resolved by abandoning the mathematically elegant but patently false as-

sumptions of rational expectations models and replacing them with more realistic

and explicit models of how people obtain their ideas about economic topics, in-

volving some form of learning or social transmission of knowledge and information.

While the paper confines itself to presenting results from agent-based simulations

of such a model of inflation expectaitons, the closely related work by Mankiw and

Reis (2001, 2002) shows that macroeconomic dynamics are much more plausible

when expectations are governed by a model like the ones explored here.

Other puzzles that might yield to such an approach are legion. For example,

excess smoothness in aggregate consumption (releative to the rational expectations

22

ff

benchmark) may reflect precisely the same kind of inattention posited for inflation

expectations here (I am actively pursuing this possibility in ongoing work). A plau-

sible explanation for the equity premium puzzle might be to suppose that it has

taken a long time for news of the favora ble risk/return tr adeo of stocks to spread

from experts like Mehra a nd Prescott (1985) to the general population. The strong

systematic relationship of productivity growth and the natural rate of unemploy-

ment documented, for example, by Staiger, Stock, and Watson (200 1) and Ball

and Moÿtt (2001) may reflect workers’ imperfect knowledge about productivity

growth (and the slow social transmission of such information). The detailed dy-

namics of productivity itself can surely be captured better by models in which new

technologies spread gradually in a population t han by models in which new tech-

nologies instantaneously boost productivity upon the date of invention (which is t he

conventional ‘technology shock’ approach in rational expectations models). And a

substantial literature now exists arguing that social transmission of information in

a population of investing agents may be able to explain the excess volatility of asset

prices compared to the rational expectations benchmark (see LeBaron (forthcom-

ing) for a summary).

23

References

Akerlof, George, William Dickens, and George Perry: “The Macroeconomics of Low

Inflation,” Brookings Papers in Economic Activity, (1996:1), 1–76.

Akerlof, Georg e, William Dickens,

and George Perry “ Near-Rational Wage and Price

Setting and the Long-Run Phillips Curve,” Brookings Papers in Economic Activ-

ity, (2 000:1), 1–60.

Ball, Laurence “What Determines the Sacrifice Ratio?,” in Monetary Policy, N. Gre-

gory Mankiw, ed., chap. 5. (Chicago:, University of Chicago Press 1994) .

(2000): “Near-Rationality and Inflation in Two Monetary Regimes,” NBER

Working Paper No. W7988.

Ball, Laurence,

and R obert Moÿtt (2001): “Productivity Growth and the Phillips

Curve,” Johns Hopkins University Department of Economics Working Paper

Number 450.

Barsky, Robert B. (1987): “The Fisher Hypothesis and the Forecastability and

Persistence of Inflation,” Journal of Monetary Economics, 19, 3–24.

Branch, William A. (2001): “The Theory of Rationally Heterogeneous Expectations:

Evidence from Survey Data on Inflation Expectations,” Manuscript, Department

of Economics, College of William and Mary.

Calvo, Guillermo A. (1983): “Staggered Contracts in a Utility-Maximizing Frame-

work,” Journal of Monetary Economics, 12, 383–98.

Carroll, Christopher D. (2 003): “ Macroeconomic Expectations of Households a nd

Professional Forecasters,” Quarterly Journal of Economics, 118(1), 269–298,

http://www.econ.jhu.edu/people/ccarroll/epidemiologyQJE.p df.

Curtin, Richard T. (1996): “Procedure to Estimate Price Expectations,”

Manuscript, University of Michigan Survey Research Cen ter.

Evans, George W.,

and Seppo Honkapohja (20 01): Learning and Expectations in

Macroeconomics. Princeton University Press, Princeton.

Fra ser, DW et. al. (1977): “Legionnaires’ disease: description of a n epidemic of

pneumonia,” New Engl and Journal of Medicine, 297(22) , 1189–97.

Keynes, John Maynard (1936): The General Theory of Employment, In terest, and

Money. Harcourt, Brace.

LeBaron, Blake (forthcoming): “Agent Based Computational Finance: Suggested

Readings a nd Early Research,” Journal of Economic Dynamics and Control.

24

ffMankiw, N. Gregory (2001) : “The Inexorable and Mysterious Tradeo Between

Inflation and Unemployment,” Economic Journal, 111(4 71), C45–C61.

Mankiw, N. Gregory,

and Ricardo Reis (2001): “Sticky Information: A Mo del of

Monetary Nonneutrality and Structural Slumps,” NBER Working Paper Number

8614.

(2002): “Sticky Information Versus Sticky Prices: A Proposal to Replace

the New Keynesian Phillips Curve,” Quarterly Journal of Economics, 117(4),

1295–1328.

Mehra, Rajnish,

and Edward C. Prescott (1985): “The Equity Premium: A Puzzle,”

Journal of Monetary Economics, 15, 145–61.

Roberts, John M. (1995): “New Keynesian Economics and the Phillips Curve,”

Journal of Money, Credit, and Banking , 27(4), 975–984 .

(1997): “Is Inflation Sticky?,” Journal of Monetary Economics, pp. 173–

196.

(1998): “Inflation Expectations and the Transmission o f Monetary Policy,”

Federal Reserve Board FEDS working paper Number 1 998-43.

Sargent, Thomas J. (1 993): Bounded Rationality in Macroeconomics. Oxford Uni-

versity Press, Oxford.

Souleles, Nicholas (forthcoming): “Consumer Sentiment: Its Rationality and Use-

fulness in Forecasting Expenditure; Evidence from the Michigan Micro Data,”

Journal of Money, Credit, and Banking .

Souleles, Nicholas S. (2000): “Household Securities Purchases, Transactions Costs,

and Hedging Motives,” Manuscript, University of Pennsylvania.

Staiger, Douglas, Ja mes H. Stock,

and Mark W. Watson (2001): “Prices, Wages,

and the U.S. NAIRU in the 1990s,” NBER Working Paper Number 8320.

25