International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023

International Journal of Research Publication and Reviews

Journal homepage: www.ijrpr.com ISSN 2582-7421

A Study on Cash Flow Analysis of Top 5 Iron and Steel Industries in

India

Shruthi P. R

a

, Shivaraman T

b

a

Assistant Professor, Sri Krishna Adithya College of Arts and Science, Coimbatore-641042, India

b

Student, Sri Krishna Adithya College of Arts and Science, Coimbatore-641042,India

A B S T R A C T

Cash flow analysis helps you understand how much cash a business generated or used during a specific accounting period. The main objective of this paper is to

find the solvency position of top five iron and steel companies in India. The study uses Mean, Standard Deviation, Co efficient of Variation, Trend Analysis. The

study reveals the cash flow analysis of selected Iron and Steel companies in India.

Keywords: Cash flow, Iron and steel industries, Operating activities, Investing activities and Financing activities.

1. Introduction

Cash flow analysis helps you understand how much cash a business generated or used during a specific accounting period. This study makes complete

analysis of the profitability and solvency position of the Top five iron and steel companies in India. Tata steel, JSW steel, Jindal Steel and Power, SAIL,

APL Apollo.

1.1 Objectives of the study

• The main objective of this paper is to find the solvency position of top five iron and steel companies in India.

• To find the operational cash flows of top five iron and steel companies in India.

• To find the financial cash flows of top five iron and steel companies in India.

• To find the investing cash flows of top five iron and steel companies in India.

• To analyze the variation among the three activities i.e., Operating, Investing and Financing activity of the selected companies in the Iron and

steel Industry.

1.2 Statement of problem

Cash flow problems happen when a business does not have enough liquid cash to cover its liabilities. When cash outflows exceed cash inflows, businesses

may struggle to pay debts and other expenses.

Net cash outflows don’t necessarily indicate that a business has a cash flow problem. It’s common for businesses to experience a net cash outflow when

making large payments or experiencing seasonal business fluctuations. Cash flow only becomes a problem when outflows exceed inflows. At that point,

the business uses up its cash reserve and can no longer meet its liabilities.

Cash flow issues can arise from low-profit margins, problems invoicing and collecting payments, and over-investing in inventory or capacity. When cash

is short, it can impact businesses in several ways. Cash flow shortages can result in the following

• Late payments to suppliers, leading to strained relationships.

• Late or missed debt repayments, resulting in decreased credit ratings.

• Additional debt to cover business expenses.

• Missed opportunities to grow the business through investments.

• Negative impacts on marketing strategies and competitive advantages.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 537

• Covering business expenses with personal funds.

• Reduced employee morale and unpaid wages.

• Reduced customer satisfaction.

• Business closures due to insolvency

1.3 Scope of the Study

• The study limits its scope only to the 5 Iron and steel industries operating in India.

• To assess the ability of an enterprise to generate cash and cash equivalents of industry.

• It can use in checking the accuracy and performance of past assessments of future cash flows and in examining the relationship between

profitability and net cash flow and the impact of changing prices.

• It provides an extended view of the financial inflows and outflows by including both capital and revenue flows.

1.4 Limitations of the study

• The study is limited to only Top five iron and steel companies in India

• The study has been conducted for a very short duration of time

• The study is based on consolidated financial statements, which may or may not have some Errors.

2. Review of Literature

1. (Pinku Paul, 2018), “Analysis of the Effect of Working Capital Management on Profitability of the Firm: Evidence from Indian Steel Industry”. The

broad objective of the study was to identify the Effect of working capital management on firm’s profitability in steel industry, especially in the Indian

context. The study has taken into consideration four independent variables, that is, Current ratio, Quick ratio, Debtors Turnover ratio and Finished goods

turnover ratio which act as the indicators of working capital use in the industry. Return on total Assets represents the profitability of the industry and acts

as a dependent variable to develop an empirical model in order to establish Relationship between working capital management and profitability of the

steel industry in India by using panel data regression. The Period of study was 17 years, that is, 2000–2016. Hence, the study clearly asserted that Sample

companies of the steel industry have enough scope to enhance their profitability by the use of working capital in a more efficient way.

2. (R. Kogila, 2019), “A STUDY ON ANALYSING FINANCIAL POSITION OF SELECTED STEEL COMPANIES IN INDIA – USING ALTMAN

Z-SCORE MODEL”. The study had been undertaken to analyze the financial position of selected steel companies in India. The Researcher selected the

top five steel companies in India for analyzing financial performance during ten years of the study Period from 2007-08 to 2016-17. The researcher used

secondary data for analysis. The researcher applied the Altman Z-Score model for analysis using ratio analysis. The conclusion of the research was as

follows -the researcher selected the top five steel companies in India for analyzing financial performance during ten Years of the study period from 2007-

08 to 2016-17. The researcher applied the Altman Z-Score model for analysis using Ratio analysis.

3. (C. Geetha, 2019), “A Study on Investment in Shares of Steel Authority of India and Jindal Steel works”, To analyze the performance of selected

companies in industrial sector and to predict the future trends in the share prices through Technical Analysis. To assist the investors in making investment

decisions in Indian industrial Sector. The study concentrated on the growth profile of the industrial sector. The various possibilities of Investment and

their impact on the gain or loss resulting from such investment have been taken up. The study was carried on short-term analysis on investment for a

period of 2014 to 2018. , the researcher were selected the two iron and steel companies such as Steel Authority of India (SAIL) and Jindal Steel Work

(JSW).The Study concluded that the percentage of gain in the investment of SAIL share was fluctuated from 16.48 to 24.71 during 2014 –2018 the

percentage of gain in the investment of JSW share was fluctuated from 16.29 to 25.23 during 2014 –2018 .According to the World Steel Dynamics in

report in the year of 2017 Jindal steel works occupied 1St Rank in the share market; Steel Authority of India occupied 2nd rank in the share market.

4. (Ahmed Mahdi Abdulkareem, 2021), “Review of Cash Flow Statement of Selected Companies of Steel Industry (Tata Steel and Sail)”. The main

objective of the study was to assess the ability of the enterprise to generate cash and cash equivalents of the industry. For the study researcher has used

secondary data as a source of information and tools for the study were mean, trend analysis and pair “t” test. Data were collected by the researcher on the

basis of non-probability method in which judgemental. The study concluded that 12 variables were very similar and the data of both the industries were

available for the study period. From the analysis, it was concluded that both Industries have more similarities in the cash inflow and cash outflow of cash

flow statement. But in the profit, there is more difference due to the loss in SAIL for the last three years of the Study period. And there was a vast

difference in the interest received of both the industries Because there is a decreasing trend in SAIL which showed a huge difference between both the

Industries TATA Steel and SAIL. But the other variables were having similarities in cash inflows and outflows.

5. (Bhavani K Sirasgi, 2021), “A Study on Working Capital Management and Profitability of Steel Industries in India”. The main objective of the article

was to examine the impact of working capital on the profitability of Indian companies. The study selected a Sample of 5 Indian companies listed on the

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 538

National Stock Exchange (NSE) over a 5-year period from 2017-2021.The data which was collected were analysed and used as per the requirement of

the analysis. The Sample size for the study was five firms. The samples were chosen on convenience sampling method, and the data collected for 2015-

2019 period. The Study used descriptive statistics, Mean, Standard Deviation, Minimum, Maximum, Correlation, regression. Findings explain model,

relationship between working capital management and profitability and working capital management and its impact on Profitability. The result concluded

that’s a firm is needed to take care of a balance between liquidity and gain whereas conducting its every day operations.

6. (Dr. S. Ranjithkumar, 2021), “Evaluating Financial Strengths of Selected PSU Steel Companies”. To analyse the fiscal performance of the selected

PSU steel companies in India. The data collected from the past five years annual reports published by the selected Companies in their websites,

government websites, journals and internet sources. The Study mainly aimed at measuring the performance of seven steel producers under public Sector

in India. Z-score was applied as model to interpret the result. Out of seven public sector companies, 5 Companies RINL, MSTC, MECON, KIOCL &EIL

had a threat of financial distress during the study period. Two companies had the immune to bankruptcy as its score had between 1.81 and 2.99. In general,

the possibility of financial strength was remote. Among the five Variables contributed to the Z score to assess the bankruptcy measurement in forth

coming Period, Gross current assets after paying liabilities have been the main cause for the low Level of Z score. Companies which were found to be in

financial distress don’t have Sufficient accumulated profits to plough back during the times of need. The management Can apply Altman Z model on its

financial details regularly and check if the company had any risk of financial distress, which will enhance the financial health of under-performing

Companies and will boost up the companies which were already performing better, Resulting in an important mark in the industry map.

7. (Dr. M. Anandan, 2021), “Analysis of Long-Term Financial Position of Selected Steel Companies in India”, To study about the long-term financial

strength of selected steel companies in India. All data collected for the study was secondary in nature. It was collected from C.M.I.E, for a period of 5

years ranging from 2015–2016 to 2019–2020. Tools used for analysis Statistical Tools, Mean, Standard Deviation, Coefficient of variation, AJSW Steel

has been in Sound position in proprietary level from other selected steel companies. Debt equity ratio of Bhushan was more than 2:1 ratio it shows that

restriction to borrowing funds and total debt ratio of SAIL, TATA, BHUSHAN and JSP is much lower than the accepted standard norm 1:1 so it clearly

indicated that claims of the Owners were higher than those of outside owners.

8. (Dr. Ashok Kumar, 2022), The study “A comparative study of Financial Performance with Special Reference to JSW Steel Ltd., Jindal Steel & Power

Ltd. (JSPL) And SAIL”. The Study covered a period of five years from 2014-15 to 2018-19. The ratio analysis tools being utilized to analyses the

performance of steel industry in India and can be Utilized to find out the strength and weakness of the selected companies and their position in the market.

The research used, current Ratio., Quick Ratio, Inventory Turnover Ratio, Fixed Assets Turnover Ratio, Gross Profit Ratio, Debt Equity Ratio, Return

on Capital Employed., Dividend Payout Ratio. Dividend Payout Ratio. Efficient management of finance was very Important for the success of an

enterprise. The study attempted to compare the financial performance of the selected units i.e., JSW Steel Ltd., Jindal Steel & Power Ltd. (JSPL) and

SAIL while analyzing the financial performance of the selected units, it can be concluded that JSW Steel Ltd is performing good in terms of better

inventory Management, Gross Profit Ratio, return on capital Employed and Dividend Payout Ratio when Compared with JSPL and SAIL. These factors

play important role in forming company’s strategic and Operational thinking. Efforts should constantly be made to improve the financial position up to

next level of performance in order to make benchmark.

9. (Ms Sayesha Lakhina, 2022), “Performance of Selected Companies of Iron and Steel Industry in India: In Special Reference to Profitability and

Liquidity”. To analyse the profitability of the Selected iron and steel industry of India. To analyse the liquidity of the selected iron and steel industry of

India. To explore the statistical relationship Amongst the determinants of profitability and Liquidity with the profit of the iron and steel Industry of India.

The research used Descriptive Analysis, Mean and Standard Deviation, Descriptive Analysis, Skewness & Kurtosis tests. The conclusion of the study

highlighted the importance and direct impact of operating Profit on the net profit of the iron and steel Companies of India and the importance of a good

debtor turnover period i.e., the collection period of debtors to maintain the liquidity of the company. The study provided useful insights of the iron and

steel industry of India which would help government and investors for making informed decisions, this would also help the company to formulate and

reframe their corporate and functional policies and lastly would also be a useful addition to the treasure of literature on the subject matter.

10. (Charmy R. Gandhia, 2022), “An Analysis of Financial Health of Selected Steel Companies Listed In BSE”, The study’s objective was to examine a

company’s financial health using the Altman Z score methodology. Data collected for Five-year period from 2016-17 to 2020-21. The Altman Z Score

approach was used to analyse data. The Altman Z score was determined by five financial ratios: profitability, leverage, liquidity solvency, and activity

ratio. In the study, the Z score model for manufacturing enterprises was applied. According to the findings of the investigation, each firm, namely Jindal

stainless, Usha Martin Ltd, and Technocraft, was in a state of difficulty. The result disclosed that a financially unhealthy situation and predicted that these

firms would go bankrupt in the near future. Companies must enhance their liquidity and profitability positions, as well as endeavoured to raise their Sales

and stock market value.

3. Research Methodology

Research methodology is a way of explaining how a researcher intends to carry out their research. It's a logical, systematic plan to resolve a research

problem. A methodology details a researcher's approach to the research to ensure reliable, valid results that address their aims and objectives. It

encompasses what data they're going to collect and where from, as well as how it's being collected and analyzed.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 539

3.1. Data Collection

Secondary data:

Secondary data is the data which is already in exist. The study uses the secondary data for analysis purposes. The cash flow details from the balance sheet

of the selected companies are taken from the Money control.com.

3.2. Period of Study

The period of the study is between 2018 and 2022.

3.3. Tools and Techniques

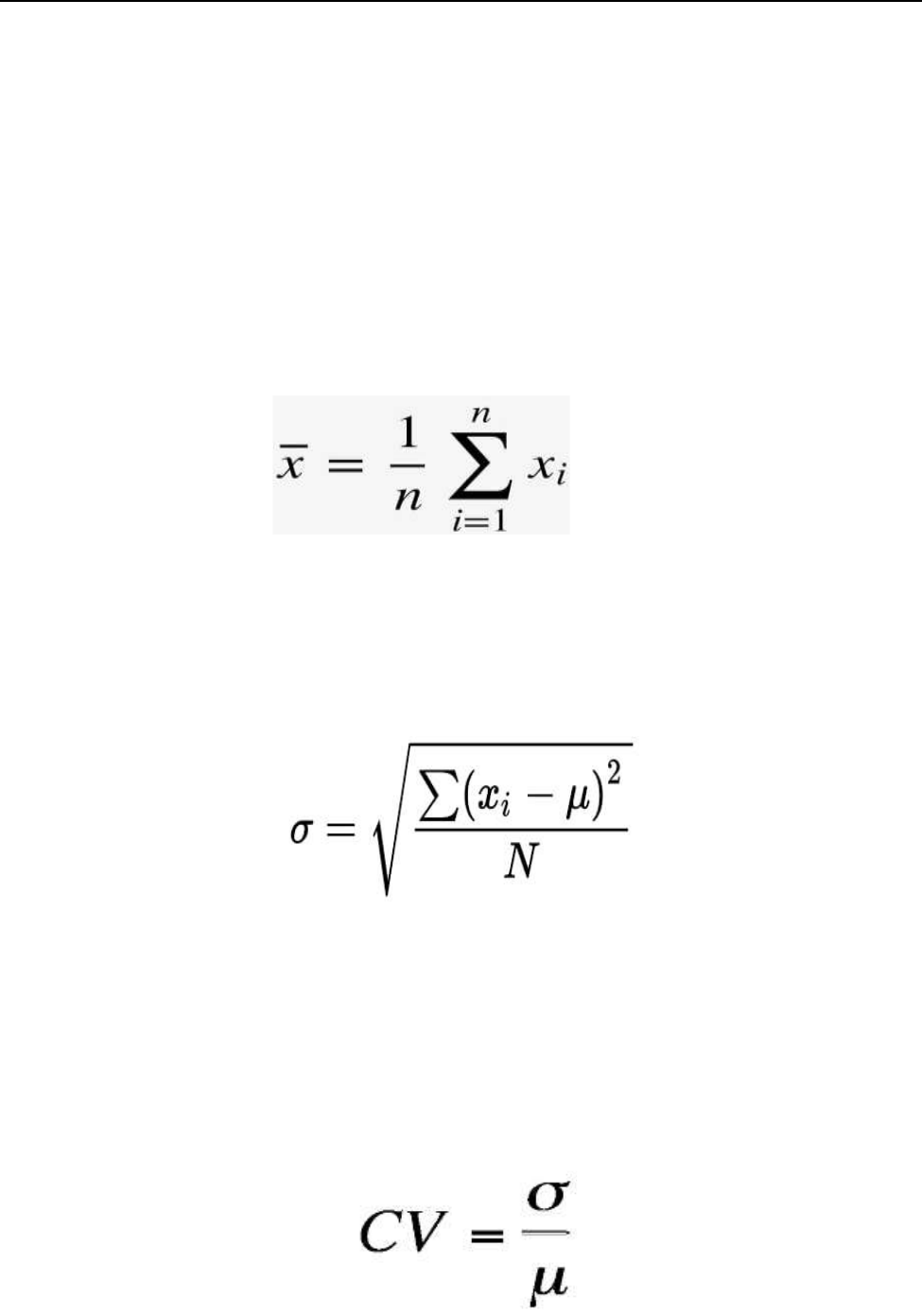

MEAN

The arithmetic mean is the simplest and most widely used measure of a mean, or average. It simply involves taking the sum of a group of numbers, then

dividing that sum by the count of the numbers used in the series.

X

̄

= ARITHMETIC MEAN

n = No of values

Xi = Cash flow from activities

STANDARD DEVIATION:

Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. The

standard deviation is calculated as the square root of variance by determining each data point's deviation relative to the mean.

σ = STANDARD DEVIATION

Xi = Cash flow from different activities

µ = Mean

N = No of years

CO EFFICIENT OF VARIATION:

The co-efficient of variation (CV) is a statistical measure of the dispersion of data points in a data series around the mean. The co-efficient of variation

represents the ratio of the standard deviation to the mean, and it is a useful statistic for comparing the degree of variation from one data series to another,

even if the means are drastically different from one another.

CV = CO EFFICIENT OF VARIATION

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 540

σ = STANDARD DEVIATION

µ = MEAN

TREND ANALYSIS

Trend analysis is a technique used in technical analysis that attempts to predict future stock price movements based on recently observed trend data. Trend

analysis uses historical data, such as price movements and trade volume, to forecast the long-term direction of market sentiment.

TYPES OF TRENDS:

Upward trend

An upward trend, also known as a bull market, is a sustained period of rising prices in a particular security or market. Upward trends are generally seen

as a sign of economic strength and can be driven by factors such as strong demand, rising profits, and favorable economic conditions.

Downward trend

A downward trend, also known as a bear market, is a sustained period of falling prices in a particular security or market. Downward trends are generally

seen as a sign of economic weakness and can be driven by factors such as weak demand, declining profits, and unfavorable economic conditions.

Sideways trend

A sideways trend, also known as a rangebound market, is a period of relatively stable prices in a particular security or market. Sideways trends can be

characterized by a lack of clear direction, with prices fluctuating within a relatively narrow range.

4. Analysis and Interpretation

4.1 Operating Activities

Table 4.1.1 – Table showing Operating Activities of Iron and steel industries

INDUSTRY/YEAR

17-18

18-19

19-20

20-21

21-22

MEAN

SD

COV

TATA STEEL

11791.45

15193.11

13453.66

37554.77

41986.12

23995.822

13,000.52

184.58

JSW STEEL

12174

15578

14110

17733

23335

16586

3,833.46

432.66

JINDAL STEEL

4860.19

6987.51

7060.98

9760.12

14185.27

8570.814

3,209.10

267.08

SAIL

6157.81

7301.57

-650.57

23395.88

30963.6

13433.658

11,793.65

113.91

APL APOLLO

-59.93

267.55

304.93

617.88

160.28

258.142

220.20

117.23

INTERPRETATION:

From the above Table 4.1.1 it is inferred that the Operating Activities for the selected Companies‟ ranges minimum of -650.57 for Steel Authority of

India Limited during the year 2019 and maximum of 41986.12 for TATA Steel Limited during the year 22-21. The minimum average of Operating

Activity of 258.142 for APL Apollo Tubes Limited and maximum average Operating Activity of 23995.822 for TATA Steel Limited.

The minimum Operating Activity of APL Apollo Tubes Limited indicates that the Company has the lowest average operating expenses compared to other

selected companies. The TATA Steel Limited has the highest average Operating Activity indicates that it has got more resources to carry out the Operating

Activities. But the consistency is more only for Steel Authority of India Limited because of the lowest Coefficient of Variation (COV) 113.90%. The

JSW Steel Limited has got more volatility as far as Operating Activity is concerned, because of highest Coefficient of Variation (COV) of 432.66%.

4.4.2 Investing Activities

Table 4.2.1 – Table showing Investing Activities of Iron and steel industries

INDUSTRY/YEAR

17-18

18-19

19-20

20-21

21-22

MEAN

SD

COV

TATA STEEL

-

12273.35

- 16349.98

-

17634.66

-

13665.22

-34167.79

-18818.2

7,905.58

-238.04

JSW STEEL

-6134

-11432

-19092

-2609

-17652

-11383.8

6,375.99

-178.54

JINDAL STEEL

-869.68

-1346.56

-1366.33

-3508.73

-9406.63

-

3299.586

3,187.35

-103.52

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 541

SAIL

-6468.71

-3755.66

-4236.12

-3390.79

-3974.66

-

4365.188

1,087.65

-401.34

APL Apollo

-132.02

-123.07

-163.7

-545.08

21.28

-188.518

189.34

-99.57

INTERPRETATION:

From the above Table 4.2.1 it is inferred that the Investing Activities for the selected Companies‟ ranges minimum of -34167.79

for TATA Steel Limited during the year 21-22 and maximum of 21.28 for APL Apollo Tubes Limited during the year 21-22. The minimum average of

Investing Activity of -18818.2 for TATA Steel Limited and maximum average Investing Activity of -188.518 for APL Apollo Tubes Limited. The

minimum Investing Activity of TATA Steel Limited indicates that the Company has the lowest average investing expenses compared to other selected

companies. The APL Apollo Tubes Limited has the highest average Investing Activity indicates that it has got more resources to carry out the Investing

Activities. But the consistency is more only for Steel Authority of India Limited because of the lowest Coefficient of Variation (COV) -401.34%. The

APL Apollo Tubes Limited has got more volatility as far as Investing Activity is concerned, because of highest Coefficient of Variation (COV) of -

99.57%.

4.3 Financing Activities

Table 4.3.1- Table showing Financing Activities of Iron and steel industries

INDUSTRY/YEAR

17-18

18-19

19-20

20-21

21-22

MEAN

SD

Cov

TATA STEEL

4165.58

-2887.17

4629.79

-

23385.49

-7368.05

-4969.068

10,245.33

-48.50

JSW STEEL

-6301

725

3054

-7441

-9134

-3819.4

4,804.47

-79.50

JINDAL

-4027.22

-5675.58

-5380.22

-1080.01

-7427.72

-4718.15

2,117.08

-222.86

SAIL

269.42

-3590.77

5005.53

-

19690.12

-

27397.58

-9080.704

12,361.67

-73.46

APL Apollo

192.48

-120.87

-126.66

-108.46

-130.02

-58.706

125.81

-46.66

INTERPRETATION:

From the above Table 4.3.1 it is inferred that the Financing Activities for the selected Companies‟ ranges minimum of -27397.58

for Steel Authority of India Limited during the year 21-22 and maximum of 5005.53 for Steel Authority of India Limited during the year 19-20. The

minimum average of Financing Activity of 9080.704 for Steel Authority of India Limited and maximum average Financing Activity of -58.706 for APL

Apollo Tubes Limited. The minimum Financing Activity of Steel Authority of India Limited indicates that the Company has the lowest average financing

expenses compared to other selected companies. The APL Apollo Tubes Limited has the highest average Financing Activity indicates that it has got more

resources to carry out the Financing Activities. But the consistency is more only for Jindal Steel and Power Limited because of the lowest Coefficient of

Variation (COV) -222.86%. The APL Apollo Tubes Limited has got more volatility as far as Financing Activity is concerned, because of highest

Coefficient of Variation (COV) of -46.66%.

4.4 Trend Analysis of Operating Activities

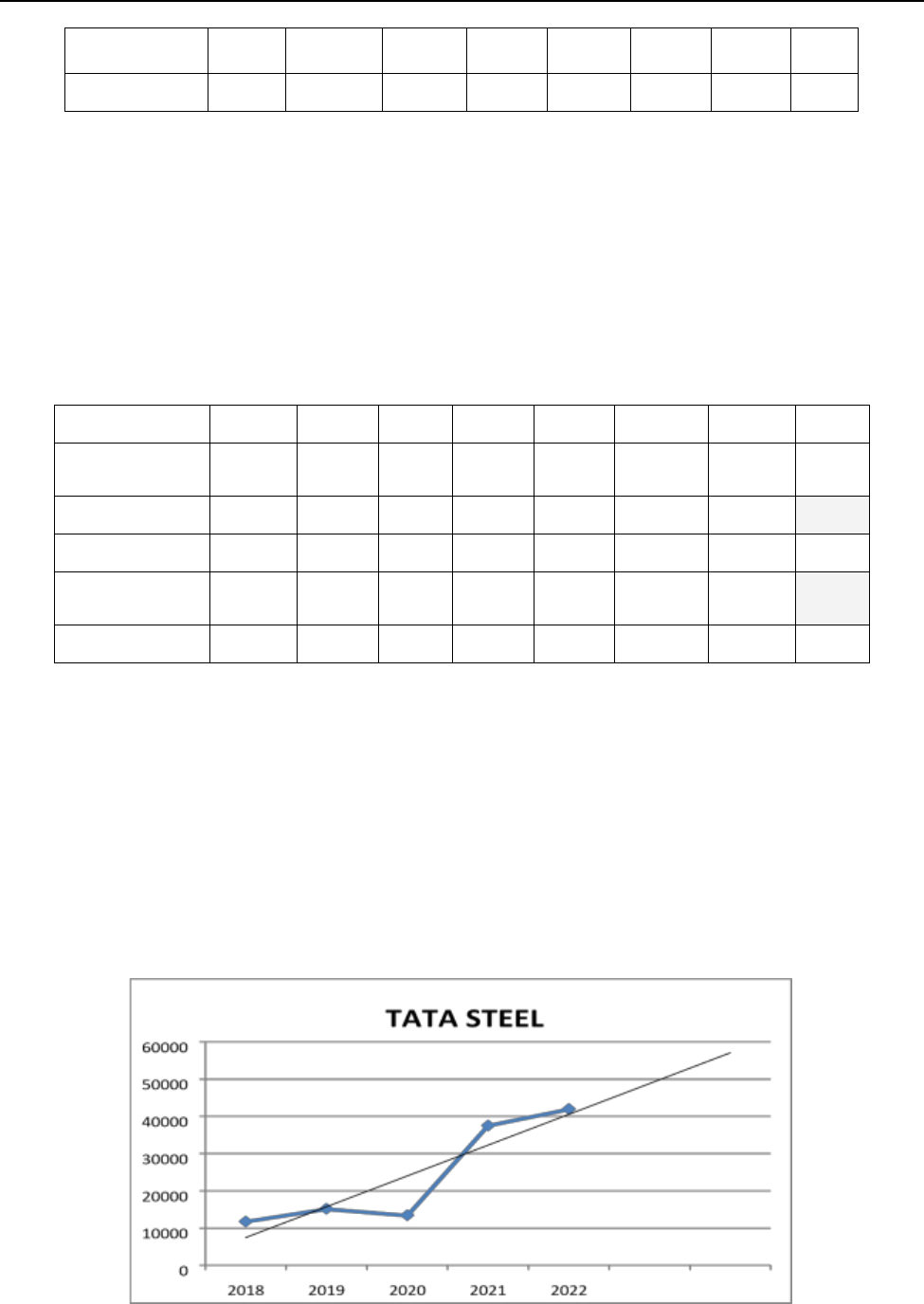

Chart 4.4.1 – Trend analysis of Operating activities of Tata steel limited

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 542

INTERPRETATION:

From the above chart 4.4.1 the trend analysis shows that the net operating cash flow of TATA Steel was increasing during study period. The net operating

cash flow was ₹ 11791.45 Cr in 2018 and it is increased to ₹ 41986.12 Cr in 2022. The above chart shows the upward trend line and the company will

reach the net operating cash flow value of ₹ 50000 Cr in next 2 to 3 years approximately. TATA Steel plans to double its capacity to 40 million tonnes

(MT) is entitled an investment around ₹1 lakh crore.

Chart 4.4.2 – Trend analysis of Operating activities of JSW steel limited

INTERPRETATION:

From the above chart 4.4.2 the trend analysis shows that the net operating cash flow of JSW Steel was increasing during study period. The net operating

cash flow was ₹ 12174 Cr in 2018 and it is increased to ₹ 23335 Cr in 2022. The above chart shows the upward trend line and the company will reach

the net operating cash flow value of ₹ 30000 Cr in next 2 to 3 years approximately. JSW Steel is planning to invest ₹ 47,457 crores (US$ 6.36 billion) to

increase Vijayanagar's steel plant capacity by 5 MTPA and establish a mining infrastructure in Odisha, in the next three years, starting from June 2021-

Dec-2022.

Chart 4.4.3 – Trend analysis of Operating activities of Jindal steel and power limited

INTERPRETATION:

From the above chart 4.4.3 the trend analysis shows that the net operating cash flow of JINDAL STEEL AND POWER was increasing during study

period. The net operating cash flow was ₹ 4860.19 Cr in 2018 and it is increased to ₹ 14185.27 Cr in 2022. The above chart shows the upward trend line

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 543

and the company will reach the net operating cash flow value of ₹ 20000 Cr in next 2 to 3 years approximately. The High-Level Clearance Authority of

Odisha, headed by Chief Minister Naveen Patnaik, had approved JSPL's proposal to expand the capacity of its steel plant to 25.2 MTPA at Angul by

2030. This would be the world largest and greenest single-location steel plant, thus pitching Odisha's USP on the global steel map.

Chart 4.4.4 – Trend analysis of Operating activities of Steel authority of India limited

INTERPRETATION:

From the above chart 4.4.4 the trend analysis shows that the net operating cash flow of SAIL was increasing during study period. The net operating cash

flow was ₹ 6157.81 Cr in 2018 and it is increased to ₹ 30963.6 Cr in 2022. The above chart shows the upward trend line and the company will reach the

net operating cash flow value of ₹ 40000 Cr in next 2 to 3 years approximately. SAIL intends to raise its crude steel production capacity to 35 million

tonnes per year by 20302031, in line with the expected rise in crude steel production to 300 million tonnes.

Chart 4.4.5 – Trend analysis of Operating activities of APL Apollo tubes limited

INTERPRETATION:

From the above chart 4.4.5 the trend analysis shows that the net operating cash flow of APL APOLLO was increasing during study period. The net

operating cash flow was ₹ -59.93 Cr in 2018 and it is increased to ₹ 160.28 Cr in 2022. The above chart shows the upward trend line and the company

will reach the net operating cash flow value of ₹ 600 Cr in next 2 to 3 years approximately. By 2030-31, 300 million tonnes of production capacity will

be available, according to the 2017 National Steel Policy. Steel tube usage per capita has risen from 57.6 kg to 74.1 kg over the last five years.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 544

4.5 Trend Analysis of Investing Activities

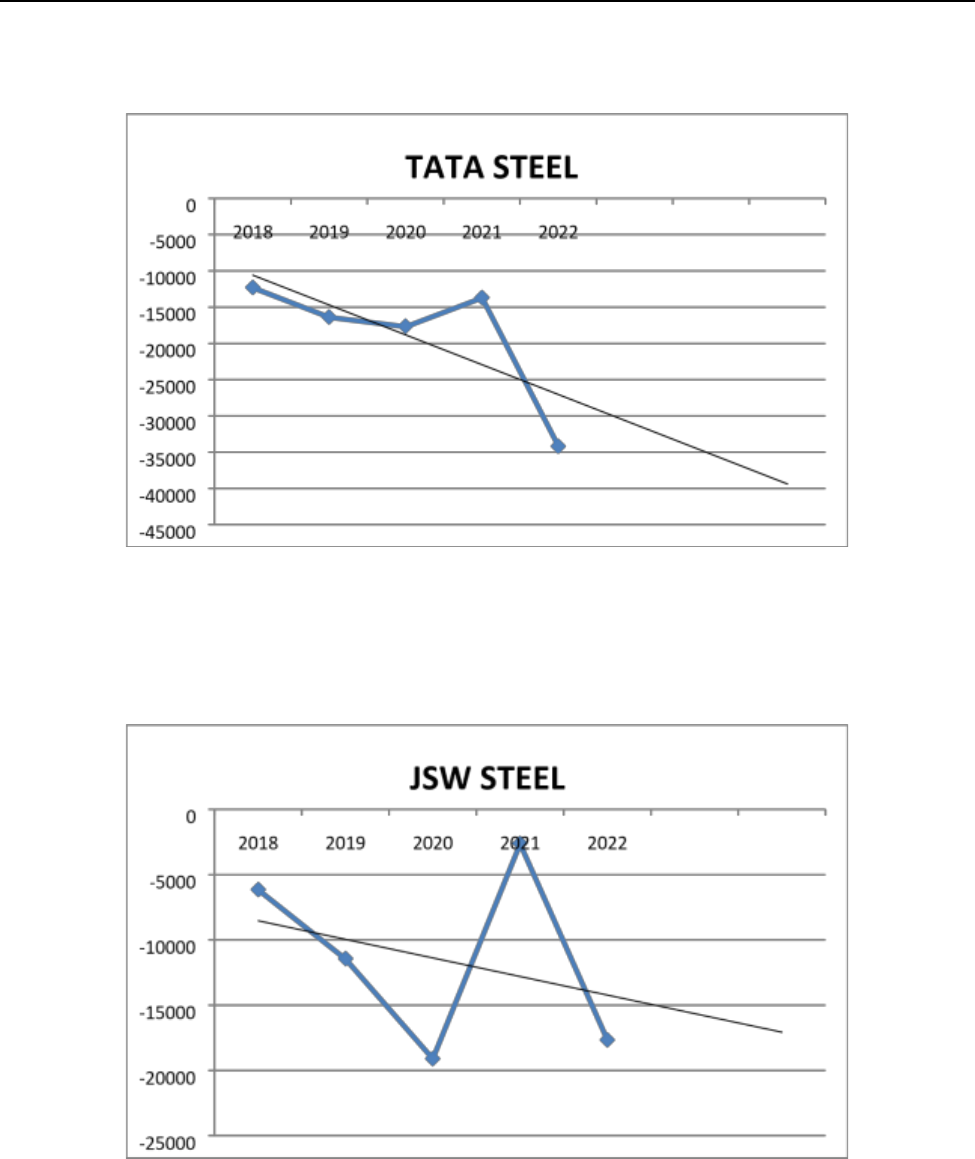

Chart 4.5.1 – Trend analysis of Investing activities of Tata steel limited

INTERPRETATION:

From the above chart 4.5.1 the trend analysis shows that the net investing cash flow of TATA STEEL was decreasing during the study period. The net

investing cash flow was ₹ -12273.35 Cr in 2018 and it is decreased to ₹ -34167.79 Cr in 2022. The above chart shows the downward trend line and the

trend line indicates that the net investing cash flow value will tumble to ₹ -40000 Cr in next 2 to 3 years approximately.

Chart 4.5.2 – Trend analysis of Investing activities of JSW steel limited

INTERPRETATION:

From the above chart 4.5.2 the trend analysis shows that the net investing cash flow of JSW STEEL was decreasing during the study period. The net

investing cash flow was ₹ -6134 Cr in 2018 and it is decreased to ₹ -17652 Cr in 2022. The above chart shows the downward trend line and the trend line

indicates that the net investing cash flow value will tumble to ₹ -25000 Cr in next 2 to 3 years approximately.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 545

Chart 4.5.3 – Trend analysis of Investing activities of Jindal steel and power limited

INTERPRETATION:

From the above chart 4.5.3 the trend analysis shows that the net investing cash flow of JINDAL STEEL AND POWER was decreasing during the study

period. The net investing cash flow was ₹ -869.68 Cr in 2018 and it is decreased to ₹ -9406.63 Cr in 2022. The above chart shows the downward trend

line and the trend line indicates that the net investing cash flow value will tumble to ₹ -12000 Cr in next 2 to 3 years approximately.

Chart 4.5.4 – Trend analysis of Investing activities of Steel authority of India limited

INTERPRETATION:

From the above chart 4.5.4 the trend analysis shows that the net investing cash flow of SAIL was decreasing during the study period. The net investing

cash flow was ₹ -6468.71 Cr in 2018 and it is decreased to ₹ -3974.66 Cr in 2022. The above chart shows the upward trend line and the trend line indicates

that the net investing cash flow value will tumble to ₹ -2000 Cr in next 2 to 3 years approximately.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 546

Chart 4.5.5 – Trend analysis of Investing activities of APL Apollo tubes limited

INTERPRETATION:

From the above chart 4.5.5 the trend analysis shows that the net investing cash flow of APL APLLO was decreasing during the study period. The net

investing cash flow was ₹ -132.02 Cr in 2018 and it is decreased to ₹ 21.28 Cr in 2022. The above chart shows the downward trend line and the trend

line indicates that the net investing cash flow value will tumble to ₹ -300 Cr in next 2 to 3 years approximately.

4.6 Trend Analysis of Financing Activities

Chart 4.6.1 – Trend analysis of Financing activities of Tata steel limited

INTERPRETATION:

From the above chart 4.6.1 the trend analysis shows that the net financing cash flow of TATA STEEL was decreasing during the study period. The net

financing cash flow was ₹ 4165.58 Cr in 2018 and it is decreased to ₹ -7368.05 Cr in 2022. The above chart shows the downward trend line and the trend

line indicates that the net financing cash flow value will tumble to ₹ -25000 Cr in next 2 to 3 years approximately.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 547

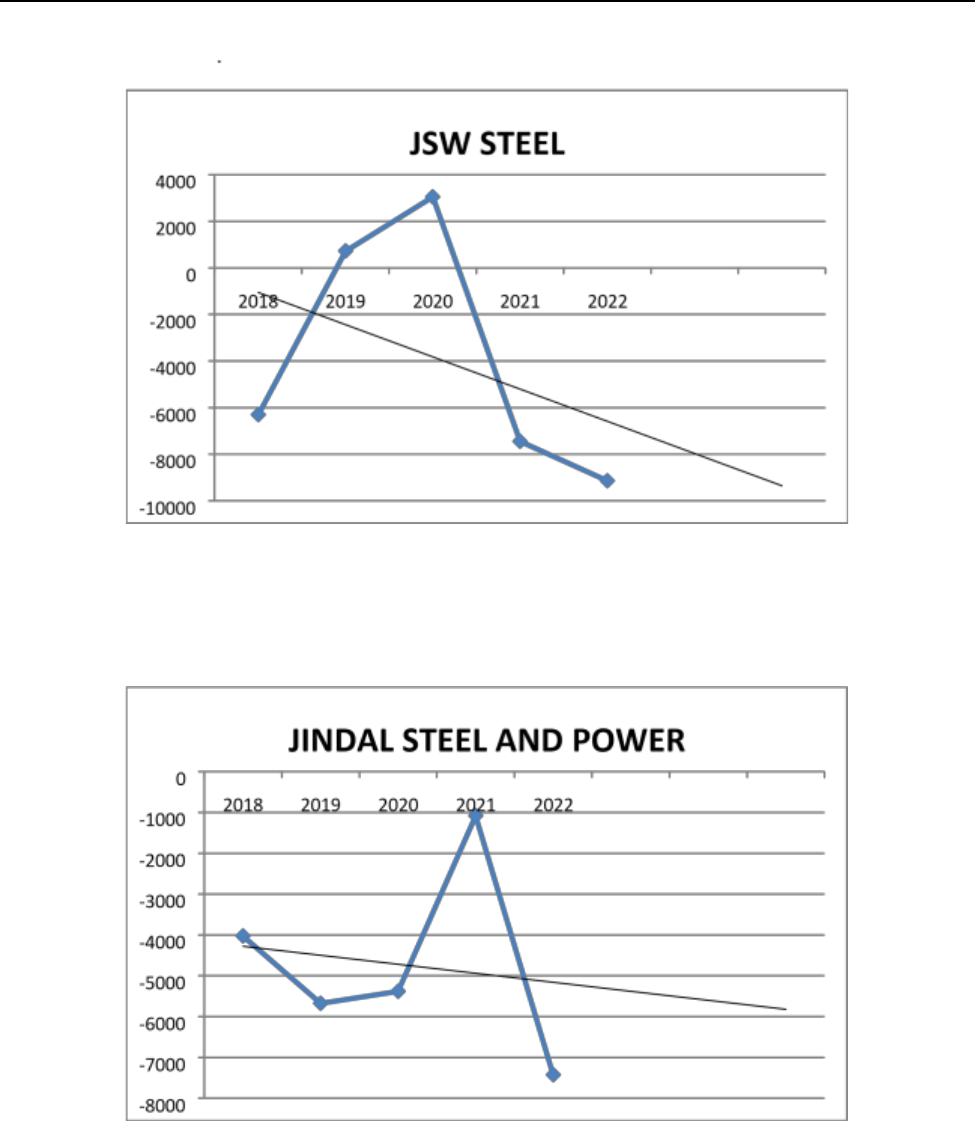

Chart 4.6.2 – Trend analysis of Financing activities of JSW steel limited

INTERPRETATION:

From the above chart 4.6.2 the trend analysis shows that the net financing cash flow of JSW STEEL was decreasing during the study period. The net

financing cash flow was ₹ -6301 Cr in 2018 and it is decreased to ₹ -9134 Cr in 2022. The above chart shows the downward trend line and the trend line

indicates that the net financing cash flow value will tumble to ₹ -10000 Cr in next 2 to 3 years approximately.

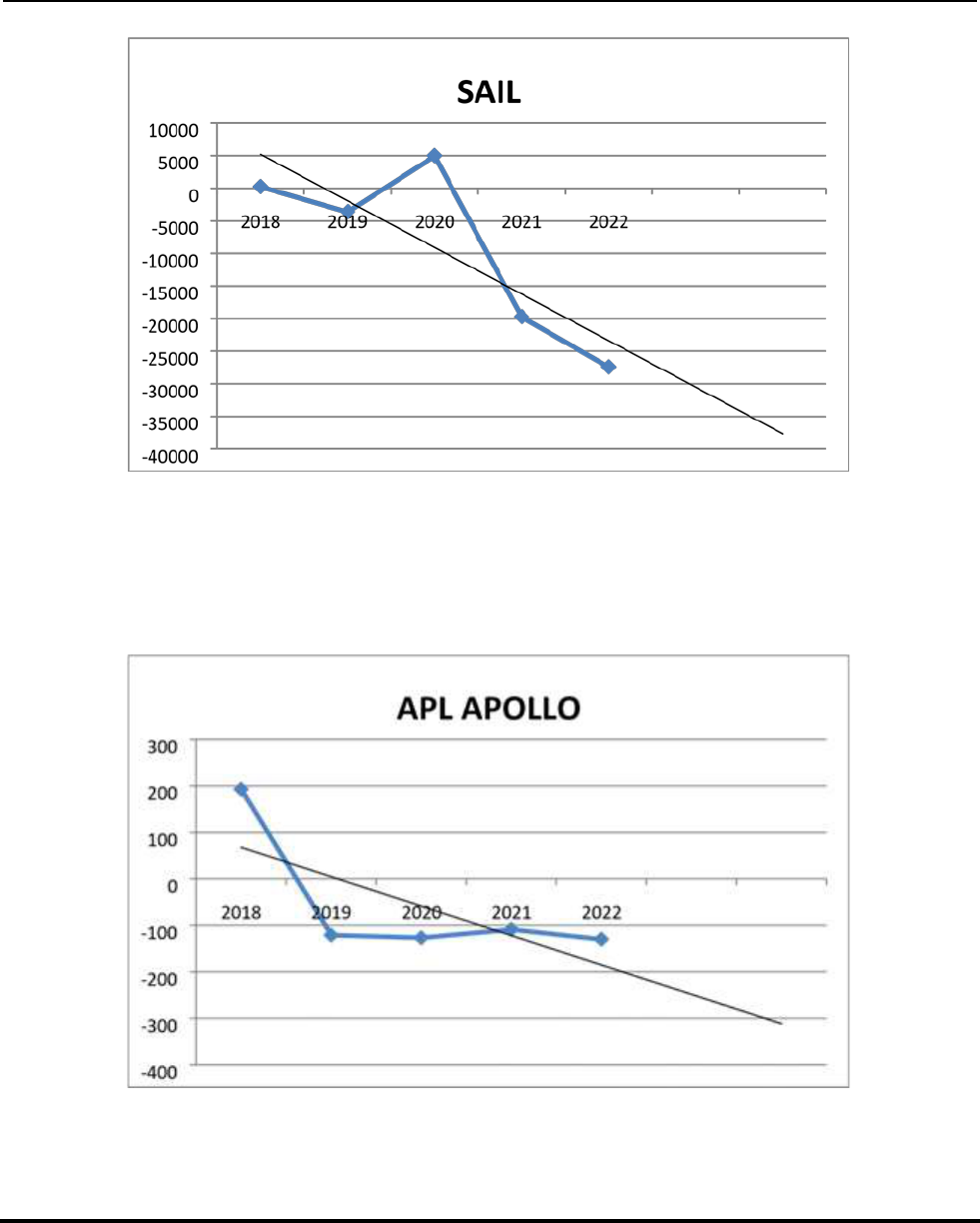

Chart 4.6.3 – Trend analysis of Financing activities of Jindal steel and power limited

INTERPRETATION:

From the above chart 4.6.3 the trend analysis shows that the net financing cash flow of JINDAL STEEL AND POWER was decreasing during the study

period. The net financing cash flow was ₹ -4027.22 Cr in 2018 and it is decreased to ₹ -7427.72 Cr in 2022. The above chart shows the downward trend

line and the trend line indicates that the net financing cash flow value will tumble to ₹ -10000 Cr in next 2 to 3 years approximately.

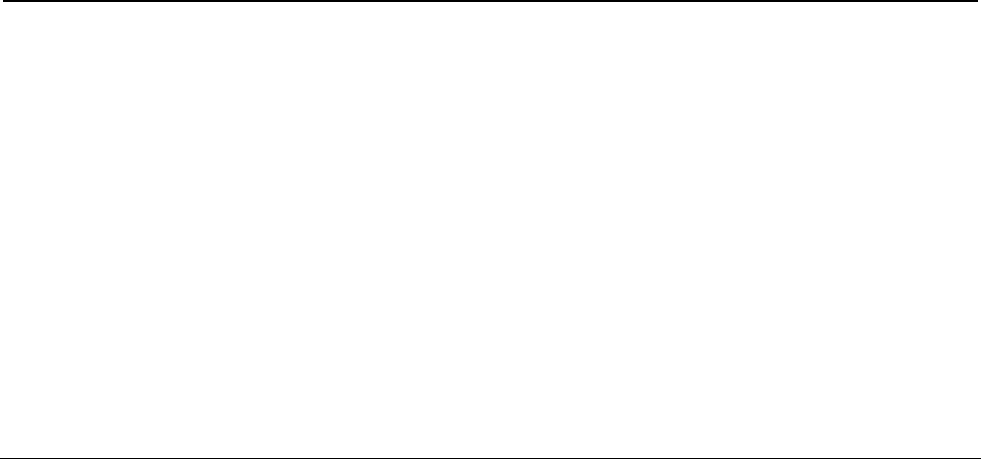

Chart 4.6.4 – Trend analysis of Financing activities of Steel authority of India limited

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 548

INTERPRETATION:

From the above chart 4.6.4 the trend analysis shows that the net financing cash flow of SAIL was decreasing during the study period. The net financing

cash flow was ₹ -4027.22 Cr in 2018 and it is decreased to ₹ -27397.58 Cr in 2022. The above chart shows the downward trend line and the trend line

indicates that the net financing cash flow value will tumble to ₹ -10000 Cr in next 2 to 3 years approximately.

Chart 4.6.5 – Trend analysis of Financing activities of APL Apollo tubes limited

INTERPRETATION:

From the above chart 4.6.5 the trend analysis shows that the net financing cash flow of APL APOLLO was decreasing during the study period. The net

financing cash flow was ₹ 192.48 Cr in 2018 and it is decreased to ₹ -130.02 Cr in 2022. The above chart shows the downward trend line and the trend

line indicates that the net financing cash flow value will tumble to ₹ -10000 Cr in next 2 to 3 years approximately.

5. Findings, Suggestions and Conclusion

5.1 Findings:

➢ With reference to the range of the Operating, Investing and Financing Activity from the year 2017 -2018 to 2021-2022, TATA Steel Limited

has maximum range of Operating Activity in the year 2021-2022, APL Apollo Tubes Limited has maximum range of Investing Activity in

the year 2021-2022, Steel Authority of India Limited has maximum range of Financing Activity in the year 2019-2020.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 549

➢ Steel Authority of India Limited has got minimum range of Operating Activity in the year 2019-2020, TATA Steel Limited has got minimum

range of Investing Activity in the year 2021-2022, Steel Authority of India Limited has got minimum range of Financing Activity in the year

2021-2022.

➢ TATA Steel Limited has got maximum average Operating Activity and minimum Investing Activity.

➢ APL Apollo Tubes Limited has got maximum average Investing and Financing Activity and minimum Operating Activity.

➢ Steel Authority of India Limited has got minimum average Financing Activity.

➢ With reference to the Co-efficient of variation of the Operating, Investing, and Financing Activity, the Steel Authority of India Limited, has

got lowest Co-efficient of Variation in Operating Activity respectively stating that it has got more consistency in operating activity.

➢ Steel Authority of India Limited has got lowest Co-efficient of Variation in Investing Activity shows that its level of cash flow maintained by

the company is more consistent for the selected period.

➢ Jindal Steel and Power Limited has got lowest Co-efficient of Variation in Financing Activity stating that it has got more consistency in these

operations.

➢ The JSW Steel Limited has got highest Co-efficient of Variation in Operating Activity stating that it is more volatile in operating activity.

➢ APL Apollo Tubes Limited has got highest Co-efficient of Variation in both Investing and Financing activity stating that it is more volatile in

these operations.

➢ With reference to the chart 4.4.1 the trendline analysis predicted that the Net Operating Cash Flow from the operating activities of TATA

Steel Limited will show upward trend in upcoming three years.

➢ With reference to the chart 4.4.2 the trendline analysis predicted that the Net Operating Cash Flow from the operating activities of JSW Steel

Limited will show upward trend in upcoming three years.

➢ With reference to the chart 4.4.3 the trendline analysis predicted that the Net Operating Cash Flow from the operating activities of Jindal Steel

and Power limited will show upward trend in upcoming three years.

➢ With reference to the chart 4.4.4 the trendline analysis predicted that the Net Operating Cash Flow from the operating activities of Steel

Authority of India Limited will show upward trend in upcoming three years.

➢ With reference to the chart 4.4.5 the trendline analysis predicted that the Net Operating Cash Flow from the operating activities of APL Apollo

Tubes Limited will show upward trend in upcoming three years.

➢ With reference to the chart 4.5.1 the trendline analysis predicted that the Net Investing Cash Flow from the investing activities of TATA Steel

Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.5.2 the trendline analysis predicted that the Net Investing Cash Flow from the investing activities of JSW Steel

Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.5.3 the trendline analysis predicted that the Net Investing Cash Flow from the investing activities of Jindal Steel

and Power Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.5.4 the trendline analysis predicted that the Net Investing Cash Flow from the investing activities of Steel

Authority of India Limited will show upward trend in upcoming three years.

➢ With reference to the chart 4.5.5 the trendline analysis predicted that the Net Investing Cash Flow from the investing activities of APL Apollo

Tubes Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.6.1 the trendline analysis predicted that the Net Financing Cash Flow from the financing activities of TATA

Steel Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.6.2 the trendline analysis predicted that the Net Financing Cash Flow from the financing activities of JSW Steel

Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.6.3 the trendline analysis predicted that the Net Financing Cash Flow from the financing activities of Jindal Steel

and Power Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.6.4 the trendline analysis predicted that the Net Financing Cash Flow from the financing activities of Steel

Authority of India Limited will show downward trend in upcoming three years.

➢ With reference to the chart 4.6.5 the trendline analysis predicted that the Net Financing Cash Flow from the financing activities of APL Apollo

Tubes Limited will show downward trend in upcoming three years.

International Journal of Research Publication and Reviews, Vol 4, no 5, pp 536-550 May 2023 550

5.2 Suggestions

➢ The companies have to improve their inventories in order to prevent the huge cash outwards at a single time.

➢ Leasing of assets and equipment will incur a small payment i.e., installments.

➢ The companies have to offer some incentives in the name of discount for early payments in order to improve the cash flows.

➢ The companies will have to maintain a friendly relationship with the suppliers to pay in small installments which will improve the cash flow.

5.3 Conclusion

It is concluded that the study reveals the cash flow analysis of selected Iron and Steel companies in India. With reference to range, it is considered that

TATA Steel Limited, APL Apollo Tubes Limited and Steel Authority of India Limited is good. With reference to average, TATA Steel Limited and APL

Apollo Limited have got maximum average, shows that these companies have invested huge capital in all these three activities for their business

development. With reference to Coefficient of variation, JSW Steel Limited APL Apollo’s performance in all the activities shows more consistent growth

than other companies. The other companies have to improve its cash flow activates to regulate its consistent growth. The trend analysis predicted upward

and downward trend of cash flow from operating, investing and financing activity of the selected Iron and Steel companies for the upcoming three years.

References

1. Pinku Paul, P. M. (2018). Analysis of the Effect of Working Capital Management on Profitability of the Firm : Evidence From Indian Steel Industry.

Asia-Pacific Journal of Management Research and Innovation.

2. R.Kogila, G. (2019, February). A Study on Analysing Financial Position of Selected Steel Companies in India- Using Altman Z-Score Model.

International Journal of Research in Business Management, 7(2).

3. C.Geetha, D. M. (2019, February). A Study on Investment in Shares of Steel Authority of India and Jindal Steel Works. International Journal of

Research and Analytical Reviews, 6(1).

4. Ahmed Mahdi Abdulkareem, V. S. (2021). Review of Cash Flow Statement of Selected Companies of Steel Industry ( Tata Steel and Sail). Journal

La Bisecoman, 02(05).

5. Bhavani K Sirasgi, R. K. (2021, November). A Study on Working Capital Management and Profitability of Steel Industries in India. International

Journal of Research Publication of Steel Industries in India, 2.

6. Dr. S. Ranjithkumar and Dr. R. Mahesh, April 2021, Evaluating Financial Strengths of

Selected PSU Steel Companies, Webology, Volume 18

7. Dr.M.Anandan, D. (2021, September). Analysis of Long Term Financial Position of Selected Steel Companies in India. International Journal of

Management and Development Studies, 10.

8. Kumar, D. (2022, June). A Comparative Study of Financial Performance with Special Reference to JSW Steel Ltd,JSPL and SAIL. Aayushi

International Interdisciplinary Research Journal, ix(vi).

9. Ms Sayesha Lakhina, D. M. (2022). Performance of Selected Companies of Iron and Steel Industry in India: In Special Reference to Profitability and

liquidity. Journal of Positive School Psychology.

10. Charmy R.Gandhia, D. (2022). An Analysis of Financial Health of Selected Steel Companies Listed in BSE. Journal of Engineering and Technology,

14.